Published

‘Urgent Need to Review the Mobility Package 1 Proposals’ Says EU Transport Sector

By: Natalia Macyra

Subjects: EU Single Market European Union Five Freedoms Sectors Services

The European Parliament Transport Committee continues working on the Mobility Package 1 despite the ongoing coronavirus crisis that led to confinement measures introduced by many European governments. Many of these measures affected Europe’s freight transport sector. Truck and light vehicle operators suffered major disruptions caused by the erection of internal borders and additional sanitary controls between member states. Only after the European Commission’s has called for special ‘green lanes’ to facilitate the movement of goods and suspend some of the restrictions – including the controversial EU cabotage limitations – governments began to allow drivers and companies operate freely again.

Yet at the same time, the European Council adopted its position on Mobility Package regulations on 7 April 2020, which allows the European Parliament to proceed with the final adoption scheduled for July 2020. In the most likely scenario, we will see the new rules implemented in 2022.

Stakeholders from industry and government are now calling to for another review of the proposals, admonishing that policymakers may eventually take decisions without having looked at the implications for the Single Market and CO2 emissions. The legislative train proceeded without an appropriate economic, social and environmental impact assessment, which stands in clear opposition to the EU’s commitment to evidence-based policymaking. Stakeholders are deeply concerned that the Package’s cabotage regulations will continue to discriminate against EU citizens who hold the wrong EU passport.

As Europe needs a strong economic recovery plan, also for the transport sector, the Lithuanian National Road Carriers Association admits the need for ‘a Mobility Package that maximises social, environmental and economic benefits for all companies, drivers and regions across the EU. Unfortunately, today many of its provisions are to introduce severe market restrictions, discriminate EU’s periphery against its centre, and run counter to our joined efforts to implement ambitious climate and competitiveness policies.’

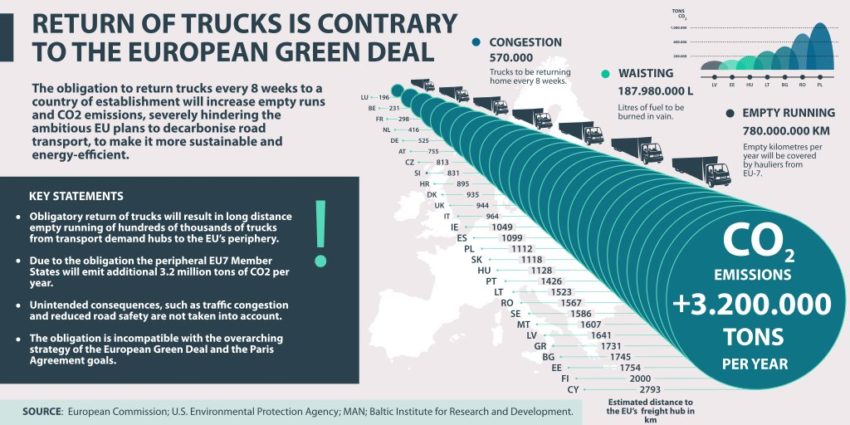

Estimations show that only 7 peripheral EU Member States – Lithuania, Latvia, Estonia, Poland, Hungary, Romania, Bulgaria – will alone emit additional 3.2 million tons of CO2 per year. All of 570,000 trucks will be returning home every 8 weeks navigating 780 million suboptimal or empty kilometres annually. As a result, the European transport system and businesses will face inefficiencies, higher fuel consumption and lack of transport capacity, while EU citizens will encounter more pollution and congestion.

Similarly, the Lithuania’s International Transport and Logistics Alliance (TTLA) pointed out that ‘in particular, the obligatory home return of trucks every 8 weeks contradicts the goals of the European Green Deal and the Paris Agreement. It would also significantly limit the freedom to provide services while distorting competition and functioning of the Single Market.’

The National Union of Road Hauliers in Romania also fears that ‘such regulations will significantly increase the business cost for peripheral Member State and could cut them off from the international value chains’.

CLECAT Director-General, Nicolette van der Jagt agrees and adds: ‘the cabotage restriction on combined transport will diminish its effectiveness to support multi-model freight operations. These measures, together with the introduction of a ‘cooling-off’ period, are in stark contrast to the transport decarbonisation objectives of the European Green Deal. They will create inefficiencies in the operational processes of road hauliers, and lead to an enormous increase in CO2 emissions due to vehicles running at suboptimal or even empty loads.’ She also calls on the European Commission to ‘live up to its promises made last December and come forward with a proper impact assessment on both the revised rules for cabotage and the obligation to return trucks home every 8 weeks.’

Furthermore, failing to achieve a level playing field among the EU Member States and to ensure appropriate enforcement capacities, the current proposals in the Mobility Package risk seriously aggravating competition vis-à-vis non-EU hauliers.

‘For Romanian carriers who already operate with extremely low margins, it means an increase in their prices by 10% to 14% to cover the losses caused by the Mobility Package. It will also most likely decrease the fright market by 15-20%, which will have immediate effects on the economy, including foreign trade balance’ says National Union of Road Hauliers in Romania. They also stressed that ‘this particular European legislation in the field of road transport goes beyond any acceptable level of protectionism [within the Single Market]’.

‘There is a feeling of certain disconnection between the policymakers in Brussels and the reality of transport sector companies on the market and at the borders’ says Joanna Jasiewicz, from the Transport i Logistyka Polska. She also pointed to the surprise among the transport sector when the European Parliament decided to continue the discussion on the proposed Mobility Package regulations. ‘Transport companies were, and are expecting more support in terms of improving working conditions and mobility of the drivers during Covid-19 outbreak, rather than pursuing legislation, which will increase legal uncertainty, cost and create new protectionist measures in the long term.’

Therefore, ‘the European Commission, European Parliament and the Member States must focus on finding a well-balanced, realistic and carefully assessed decisions. Only this way, the Mobility Package could embody a bold and future-proof policy response, minimise harmful impacts and enabling the European road transport sector’s sustainable transformation’ stresses the Lithuanian National Road Carriers Association.

Listen to the podcast with Joanna Jasiewicz from TLP on how the current crisis impacted the transport sector in Poland.