Published

The Buyer’s Market: How Vendor Exclusions and OPEN RAN Actually Affect Market Concentration

Subjects: Digital Economy European Union Far-East

Our forthcoming policy brief on Open RAN explores the increasing politicisation of the 5G rollout around the world. In particular, the radio access networks (RAN) that make up the radio installations in the field (and the majority of the hardware costs) are the centre of a political discussion. Exclusions of foreign vendors in China, Europe, the US, Japan and many other places, raises concerns about higher costs due to an increasing market concentration amongst equipment vendors.

While the policy brief carefully examines the technology and the logic behind Open RAN, the question of market concentration warrants a separate conversation. Despite what is commonly argued in Europe and elsewhere, the economic evidence clearly shows how the equipment market is a buyers’ market due to a higher concentration amongst operators.

It is indeed true how the equipment market has consolidated into just five global players – namely Huawei, Ericsson, Nokia, Samsung and ZTE. Notably, the North American suppliers of RAN – like Nortel, Motorola or Lucent – have all merged into the remaining European players.

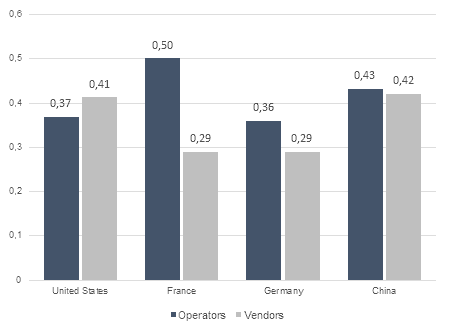

But consolidation is not the same as concentration. Antitrust investigations typically illustrate market concentration through the Herfindahl-Hirschman index, which measures the market concentration on a continuous scale between 0 and 1, where 0.5 indicates a duopoly, and 1.0 indicates a full monopoly with just one seller – and where the European network equipment market score less than 0.3.

In Europe, operators demonstrate a higher concentration than the equipment market, indicating the monopsonic relationship. The relative strength of the buyers is even more pronounced in reality, as the data on operators do not capture joint ventures or pooled procurement. In particular, the EU national telecom markets are far more concentrated when they act like buyers (against vendors), with rarely more than two buyers per country. Similarly, all Chinese telecom companies are state-owned and purchase their equipment jointly through a joint procurement agency.

Today’s baseline

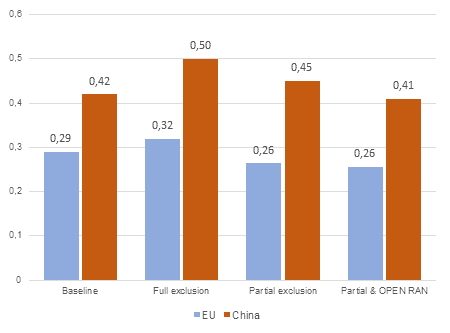

Let’s now play with a few of scenarios where certain vendors are excluded. We try the following formulas on the EU and Chinese markets where:

- Two principal foreign vendors are declared high-risk vendors in Europe and China and entirely excluded from the market. Three principal vendor remains in Europe, and two in China. Their market shares are distributed equally amongst the remaining players.

- Two principal foreign vendors are declared high-risk vendors in Europe and China, and their market shares are halved. Their market shares are distributed amongst the remaining players equally

- In addition to the previous scenario, other (non-established) vendors gather approximately 10% of the market thanks to new technology like Open RAN.

Three scenarios

In conclusion, we see that:

- Full exclusion of two foreign vendors from the RAN market leads to a marginal increase in Europe (0.03 points) in market concentration while slightly more in China which becomes a duopoly (0.50).

- Halving the market shares of the foreign vendors leads to actually less market concentration in Europe, as the market shares are now more diversified amongst the vendors. In China, market concentration is just marginally higher than today.

- However, in the final scenario where “other” non-established players gather 10% of the market (thanks to Open RAN), the degree of concentration is unchanged in Europe. The market concentration in China returns to today’s levels.

In conclusion, the debate overly focuses on the number of sellers on the market. A more significant determinant on market power is how their market shares are distributed, and how concentrated the sellers are relative to the buyers.

In the case of Europe, the market remains a buyers’ market for all scenarios as the operator concentration is higher than every outcome. The buyers would even strengthen their leverage in some cases. For China, the foreign vendor exclusion leads to a classic duopoly where the sellers get the upper hand. Hence further diversification is required by either strengthening the minor indigenous players or allowing new market entrants.

One response to “The Buyer’s Market: How Vendor Exclusions and OPEN RAN Actually Affect Market Concentration”