Published

Spain, Split and Talk: Quantifying Regional Independence

By: Guest Author

Subjects: European Union

This piece is co-authored by Hanna Adam (University of Bayreuth), Mario Larch (University of Bayreuth), and Jordi Paniagua (University of Valencia and University of Notre Dame).

In December 2019, during one of the most followed sporting events (the classic football match “El Clásico” between FC Barcelona and Real Madrid), a huge banner was unfurled at Camp Nou with a strong message: #SpainSitAndTalk. This message urged the Spanish government to sit around the negotiating table and talk about the possible secession of Catalonia from Spain, demonstrating the political stalemate since the 2017 referendum.

Four years later, it appears that the banner has had an effect, as representatives of the Spanish central and regional Catalan governments sit down for the first time for dialogue. Although the issues discussed are being kept somewhat under wraps, one particularly interesting question is the economic impact of an eventual Catalan independence. It may appear surprising how few academic papers there are on this topic compared to other fields such as law or political science. The few existing papers (Comerford et al., 2014, 2019) reflect substantial losses for Catalonia and do not expose the consequences for the remaining Spanish Autonomous Regions, nor take into account the uncertainty regarding the integration of an independent Catalan state in Europe.

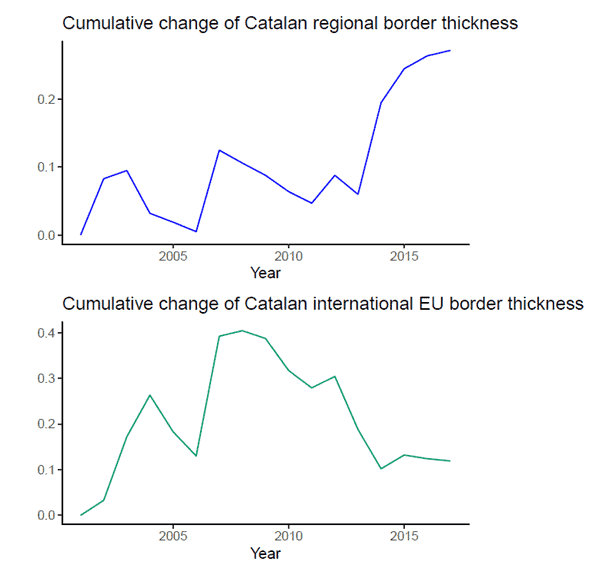

Our recent working paper (available here), seeks to answer the following question: What would be the economic consequences for the rest of Spain and Catalonia if the region were to become independent? This column proceeds in two directions. First, it investigates the border effect of international trade, that is, the observed difference in international trade compared to domestic trade within a country. Using a novel dataset covering all 17 Spanish Autonomous Communities (ACs) and 142 countries over the years 2001 to 2017, it reveals that Catalonia has intensified its trade integration with the rest of the world to the detriment of trade with the rest of the Spanish regions. One way to analyze this change is to study the thickness of the Catalan trade border, which represents the trade intensity of Catalonia with its trading partners relative to domestic trade. The upper panel of Figure 1 shows the cumulative change in the thickness of the Catalan trade border with the rest of the Autonomous Communities and the lower panel with the EU. It shows that its integration with the EU (a lower thickness in the trade border) intensified and its trade relationship with the rest of the ACs deteriorated following the economic collapse of Spain after the Great Recession.

It is a process like what Almunia et al. (2021) documented as “venting out”. Facing a loss of Spanish domestic demand during the Great Recession, companies adjust their costs to sell their products in a more competitive international market. Catalonia became less integrated commercially with the rest of Spanish regions than in the previous decades and shifted its exports to towards Europe. All this happens between 2011 and 2012, just when austerity policies were being deployed all over Europe. It is well documented that the austerity wave fostered economic dislocation and disintegration, as in the case of Brexit (see Fetzer, 2019).

Figure 1: Change in the thickness of Catalonia’s trade border with the rest of the Autonomous Communities (top) and EU countries (bottom).

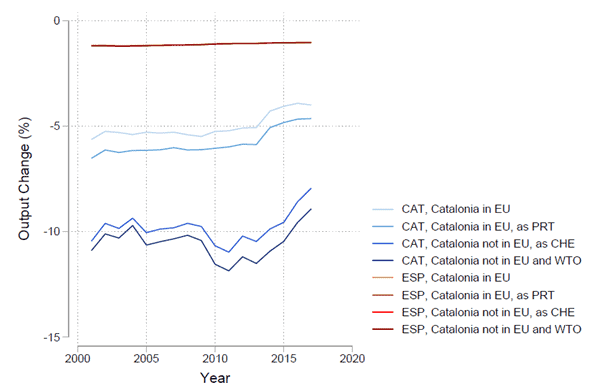

The second contribution of the study is to quantify the potential economic impact of a hypothetical Catalan secession through a general equilibrium analysis. Specifically, we use a structural model of inter- and intra-national trade to investigate how a Catalan secession would affect consumer prices, producer prices, and welfare. Political uncertainty regarding Catalonia’s status inside or outside the EU after the break-up remains a crucial factor, determining the region’s economic and political dynamics. Therefore, various border scenarios (regional, international or EU) and how they could evolve if Catalonia were to become an independent state are simulated.

The findings, summarized in Figure 2, suggest, on the one hand, increasing losses for Catalonia in scenarios of declining integration. Specifically, Catalonia would lose about 5% of its GDP if it were to remain in the EU under conditions similar to today and 11% of its GDP if it found itself outside the EU with a preferential status similar to Switzerland. On the other hand, the results suggest a decrease in the welfare loss associated with independence from 2011 onwards due to less integration with the rest of the ACs, as suggested by the results of the thickness of the trade border. The losses for Spain are lower and very similar in all scenarios (around 1%). In any of the scenarios the independence of Catalonia translates into slight and constant losses for the remaining Autonomous Communities. In other words, the Spanish Central Government may play with an advantage in the negotiations, and could, for example, veto Catalonia’s access to the European Union with hardly any consequences for the welfare of the rest of Spain, according to the model.

Figure 2: Welfare losses for Catalonia and the rest of the Autonomous Regions under different scenarios for the independence of Catalonia.

In relative terms, Catalan companies would suffer the most from independence. In the most favorable scenario, Catalan producers would see a decrease of their prices of around 3%, while Catalan consumers would pay 2.3% more for their products. In the remaining Autonomous Regions, producers would see their selling prices fall by 0.4% and consumers would pay 0.8% more for their products. This distribution of losses perhaps helps to understand why companies tend to be less enthusiastic than consumers when it comes to advocating independence.

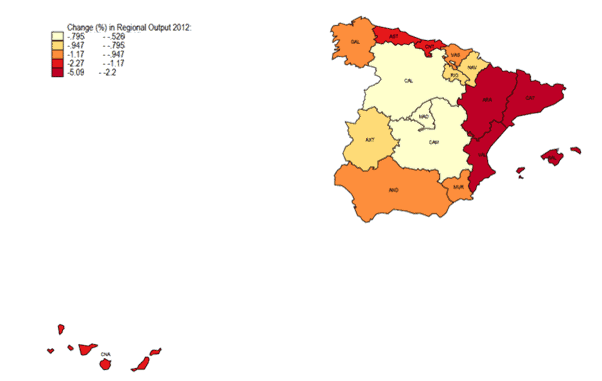

The losses by region are quite heterogeneous. The Community of Madrid, which is curiously less commercially integrated with the rest of Spain than Catalonia, and the two Castillas, as integrated with Madrid as they are, are the ones that would lose the least in each scenario (see Figure 3).

Figure 3: Losses by Autonomous Communities due to the independence of Catalonia.

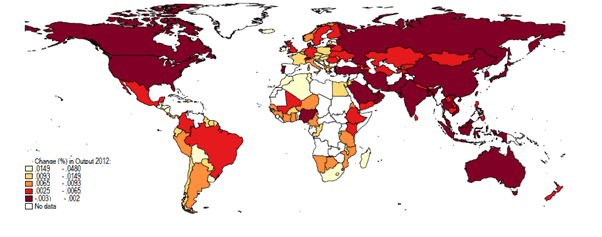

Finally, the welfare implications of Catalan independence in the 142 countries in the sample are reported in Figure 4. While the effects are overall relatively small, the effects are heterogenous, specifically across bordering regions. Although many countries would suffer a moderate negative effect (less than 0.01%), some countries would benefit from a new independent Catalan state. Countries such as Morocco, Algeria, Tunisia, or South Africa would benefit from a Catalan secession due to new trading patterns and these countries would have incentives to legally recognize an independent Catalonia.

Figure 4: Losses for the rest of the countries due to the independence of Catalonia.

To summarize, taking into account the uncertainty of whether and under which conditions an independent Catalonia would be a member of the EU or the WTO, a Catalan secession is predicted to decrease welfare by 5 to 11% for Catalonia and by about 1% for the rest of Spain. These predicted costs reflect the fact that the Catalan response to the Great Recession was to internationalize, so that independence costs less now than it did years ago. Finally, the potential losses for Catalan consumers, although significant, are not predicted to be much larger than those they suffered following the adjustment policies after the 2008-2013 financial crisis in Spain. Hopefully, this column helps to assess the trade-offs within the political economy in possible future negotiations more accurately and less heatedly.

You can read the authors’ full Working Paper that inspired this blog here.

Confusing (without reading the full WP). More clarity required on the expected mechanisms. e.g. if independent Catalunya retained EU membership (i.e. no change in tariff and NTB situation for internal or external trade), why would there be any negative impact on output?

Also how are fiscal transfers accounted for? Catalunya is a net contributor to Spain right?