Published

Mexico: the Missing Piece in the EU’s Transatlantic Outlook

By: Renata Zilli

Subjects: European Union Latin America North-America Regions

Mexico elected a new President in June and, on October 1st,, the country’s first female president, Dr Claudia Sheinbaum, will take office. There are plenty of challenges in her inbox: Mexico’s relation to the EU is one of them. With the modernisation of the EU-Mexico Global Agreement (GA) stalled, it will be Sheinbaum’s task to fashion the future of Mexico’s diplomatic and economic relationship with the EU.

What is the state of play? Negotiations to modernise the EU-Mexico GA were completed in 2020, but ratification was halted due to political setbacks. Although Sheinbaum represents the continuity of her predecessor, Andrés Manuel López Obrador (AMLO), it is not clear whether she will follow his approach. They share a nationalist economic ideology, but it may be that Sheinbaum’s commitment to a green transition will open up new avenues of dialogue. It’s an open secret that the energy chapter is one of the stumbling blocks in the modernisation process of the GA.

The EU needs to make more friends to become a more autonomous and strategic geopolitical actor. But when it thinks about strengthening its Transatlantic ties, it hardly sees Mexico as part of that equation. A key motivation for the EU to sign an FTA with Mexico in the late 1990s was Mexico joining NAFTA. European companies and investors were dissatisfied with receiving less favourable treatment than American companies and, therefore, sought to engage in reciprocal trade with Mexico. In 2020, Mexico, the US, and Canada modernised their trade and economic relations and signed a new agreement – the USMCA – which aims to restructure the future of North America’s economic relations with the world. At a time of rising trade barriers and mounting geopolitical turmoil, there’s a real risk that the EU and Mexico will fail to adapt their relationship to remain competitive.

Debunking misconceptions about Mexico

With few exceptions, there is little awareness of Mexico in the Brussels bubble. Lack of familiarity leads to false perspectives: for example, only assessing Mexico as a Latin American country misses the dual role that the country plays as a bridge between North and South America. Unlike Europe, North America’s geographical boundaries do not define a collective regional identity. Raymond Aron, the French thinker, would say that Europeans become Europeans unconsciously through their collective experience of a shared existence. But in North America, this is not the case. Very few Mexicans would consider themselves “North Americans,” and even fewer Americans would consider Mexicans as such. Luckily, Mexicans are versatile. In addition to their domestic causes of patriotism and cultural heritage, they also share sources of identity with other countries in Latin America based on a shared history, language, and religion. And, just like in Europe, one of the most significant differences stems not only from economics or politics but from football.

This collective identity between Mexico and its Central and South American peers makes it possible for Latin American countries to present a common agenda in multilateral fora. Last year, after an eight-year hiatus, the EU-CELAC meeting took place in Brussels, where all countries in Latin America and the Caribbean (except Nicaragua) and the EU Member States signed a joint declaration. Notwithstanding this apparent sense of shared purpose, there are profound differences between Latin American countries. For example, in the multilateral arena, spaces are very limited for developing economies, and in Latin America, there’s always a regional struggle over which country should be the region’s leading voice for the Global South. In fact, international analysts often overlook that Mexico and Brazil are diplomatic and trade adversaries rather than allies.

One observation that Europeans often make about regional integration in Latin America is why it hasn’t been possible to create a common market, especially when there aren’t greater language barriers. And while it’s true that language is a predictor of international trade, it is not always the most significant variable. And here lies the paradox within the Latin American context. It is the economic similarities – and not the differences – that pull Latin American countries apart. Most southern cone countries are commodity exporters, which makes it challenging to integrate productive value chains.

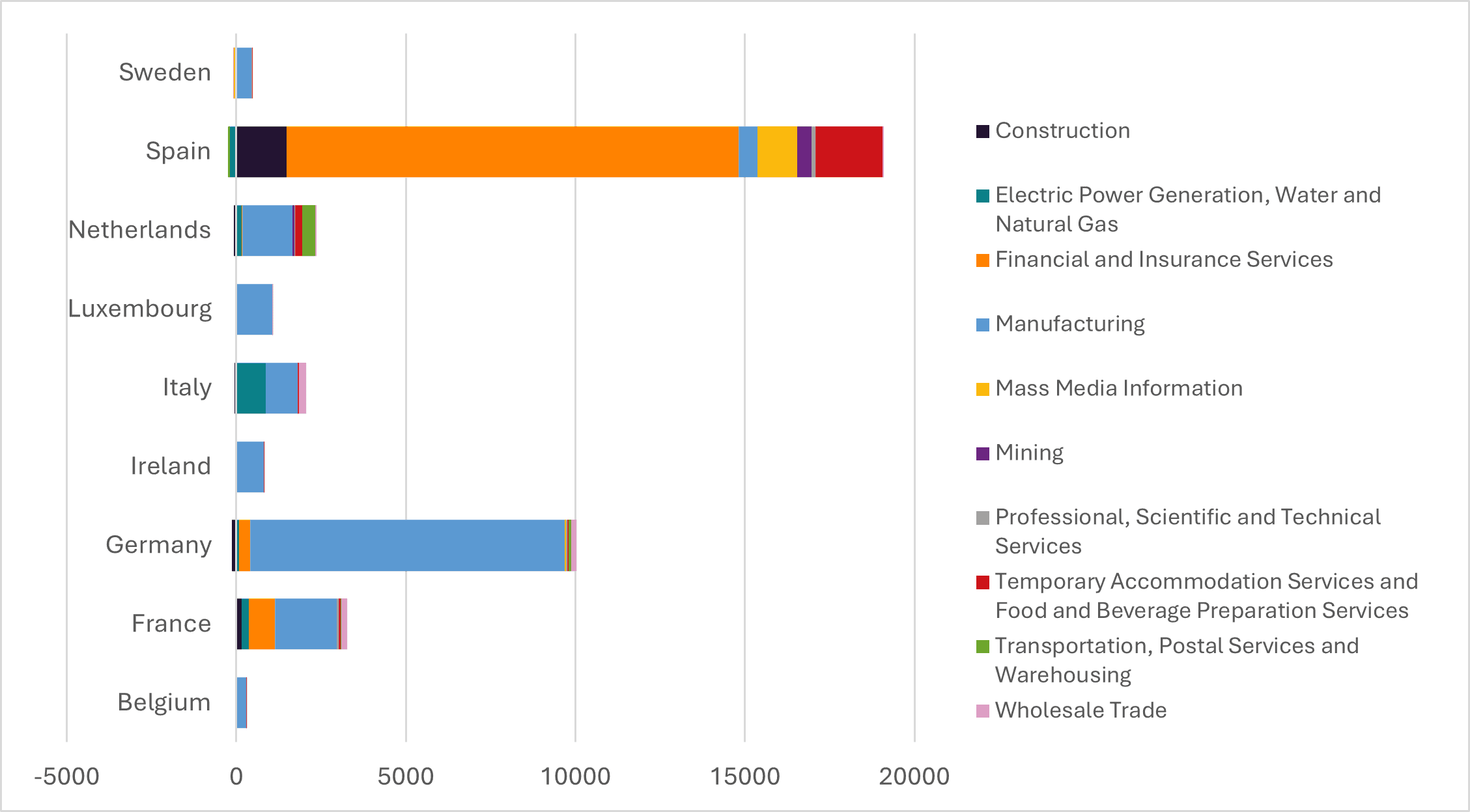

Mexico, however, is different. Its export is oriented towards manufacturing, resulting from decades of supply chain integration with the US and Canada. This economic profile makes the country attractive to FDI in higher value-added sectors, i.e. 50% of the FDI in Mexico goes to the manufacturing sector. The EU is Mexico’s second-largest investor after the US, and in 2023, most of the EU outward investment in Mexico was concentrated in financial services and manufacturing (see Figure 1).

Figure 1: Top FDI Investors in Mexico from the EU per Sector (2019-2023)

Source: DataMexico, Secretaría de Economía, Author’s calculations.

Note: Values are in millions USD; negative numbers refer to disinvestment trends.

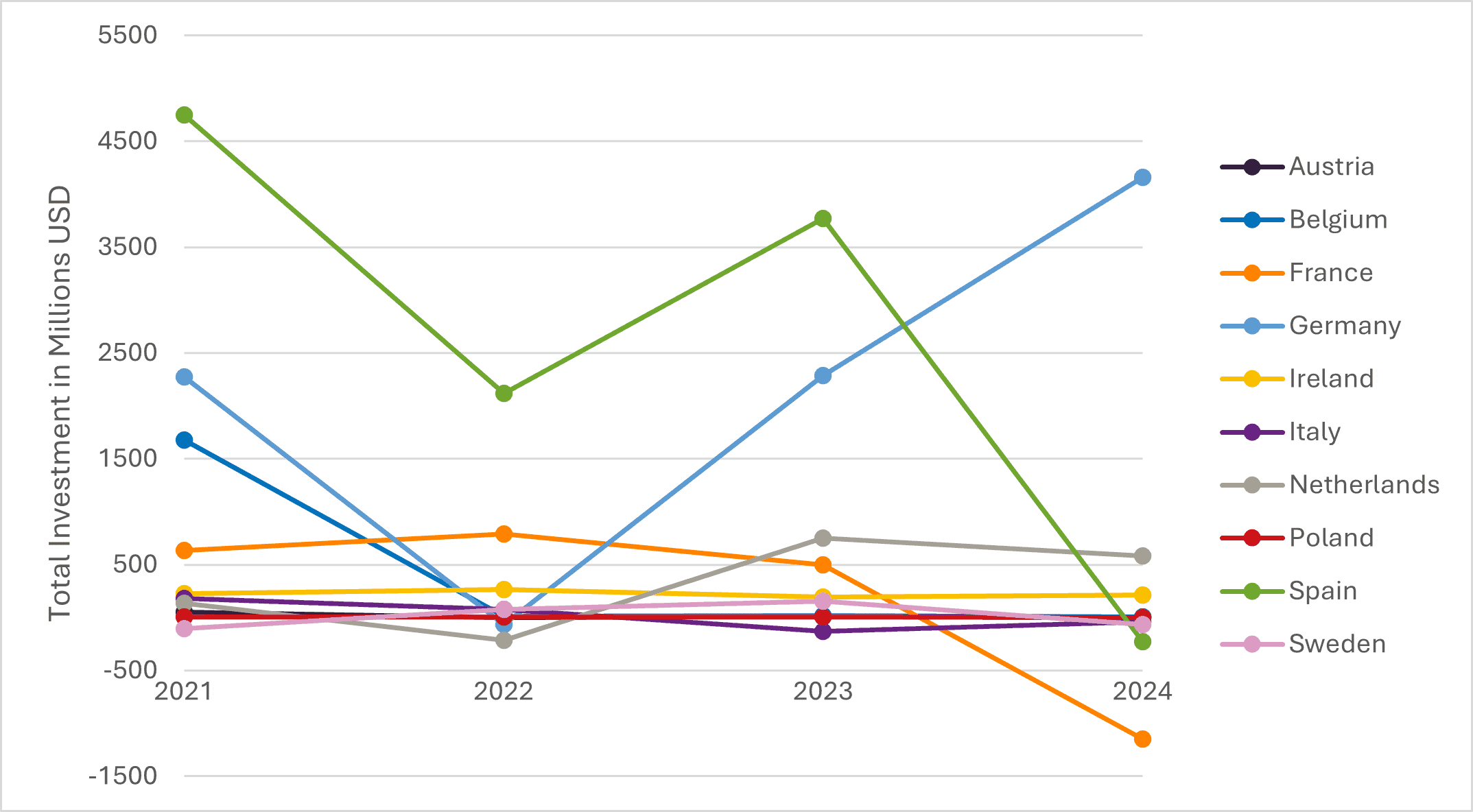

Historically, Spain has been Mexico’s largest source of FDI in the EU. However, this trend seems to be changing (see Figure 2). In 2023, Germany overtook Spain as the top investor, which reveals the growing attractiveness of Mexico as a manufacturing hub for European car makers. But, Germany aside, preliminary figures for the state of FDI flows in Mexico in 2024 are concerning, with countries like France, Italy, and Spain showing negative trends. This may be due to election years on both continents, but it’s a worrying sign as these countries need to strengthen their international alliances to improve growth prospects for their citizens.

Figure 2: FDI from EU to Mexico – Top 10 Investors

Source: DataMexico, Secretaría de Economía

Note: Values are until the second quarter of 2024; negative numbers refer to disinvestment trends.

Mexico as a partner for improved EU competitiveness

Mexico and the European Union have a long-standing political and economic relationship. Since the late ’60s, when Mexico formalised its diplomatic relations with the European Community, they have updated their relations in light of new economic realities. The EU’s decision to sign an Free Trade Agreement (FTA) with Mexico, its first agreement with a country in the Americas, was largely motivated by the changes in trade dynamics that followed on the end of the Cold War and the rearrangements of economic blocs. There was also a “development dimension” in the FTA: the EU sought to advance greater prosperity in emerging and developing economies with its FTAs.

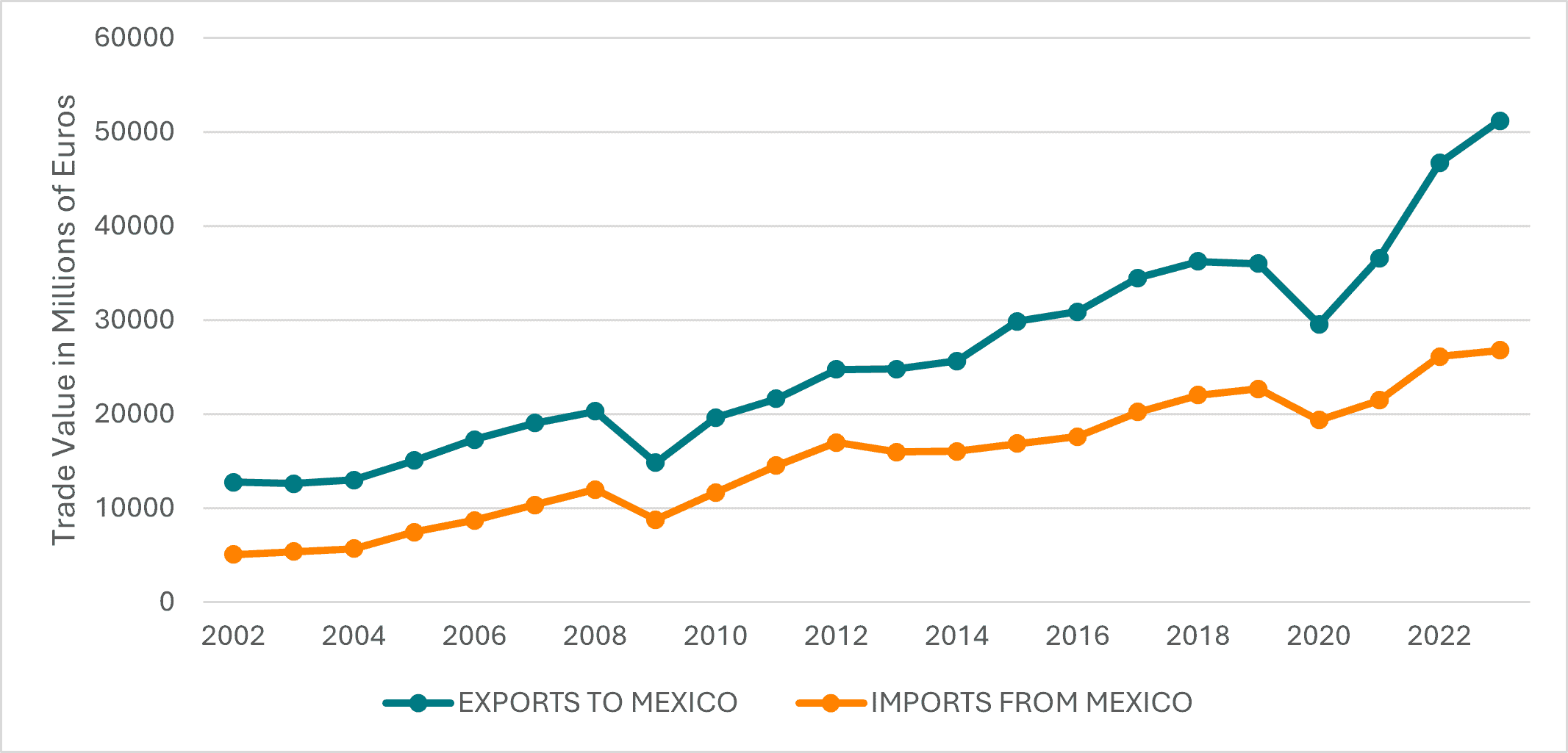

Since the EU-Mexico GA entered into force, trade between partners has grown at an average annual rate of 7%. Between 2013 and 2023, exports from the EU to Mexico increased by 107%, compared to a 68% increase in EU imports from Mexico (see Figure 3). The EU’s trade surplus has thus grown bigger. Notably, at least 50% are intra-trade flows within the manufacturing sector, particularly the automotive industry. As a result of NAFTA and the transfer of technology within the North American region, Mexico has become one of the most important automotive hubs for European brands. The growing presence of European companies in Mexico not only ensures a diversified supply chain and increases their global competitiveness but also strengthens the EU’s position in the transatlantic alliance. Mexico is a key partner which reinforces Europe’s interests vis-à-vis Washington.

Figure 3: EU-Mexico International Trade (Merchandise)

Source: Eurostat, Autor’s calculations

Mexico as a node in the Transatlantic Alliance

Mexico’s importance in the global economy is often neglected. Old sepia-toned films and big sombreros give a limited picture of where Mexico stands today and its transition from a single-commodity exporter in the 80s to the 12th largest economy in 2024. Last year, Mexico overtook China as the US’ top trading partner, being slightly ahead of Canada. Investors are also paying attention. In a recent interview, Jamie Diamon, CEO of JP Morgan, said that “If you had to pick one country to invest in, Mexico would be the number one opportunity.”

In Mexico, nearshoring has become the buzzword in the public debate. However, the evidence for it remains mixed. Part of the confusion is due to different measurement methods and the overriding fact that structural processes take time to unfold – and show up in data. Consider investment. Most investment projects announced as evidence of nearshoring are predominantly intentions. A flagship FDI project publicised with much fanfare was the opening of a new Tesla Gigafactory in the northern state of Nuevo Leon. In recent days, however, Elon Musk announced that he was suspending construction until the results of the US presidential election. Tesla’s example points both to the pitfalls of trusting announcements and that politics is a key factor in the nearshoring development. Mexico is clearly at risk of being too confident that its proximity to the US alone will drive investments and trade.

Looking at the trade side, one of Mexico’s most prominent economists argues that nearshoring can be better understood by looking at the growth in Mexican exports to the US. In the first quarter of 2024, Mexico’s share of total US imports accounted for 15.9%, 2.5 percentage points higher than in 2017. In line with this view, a recent study published by the Georgetown Americas Institute found that due to the ongoing strategic competition between the US and China, Mexico has been able to substitute for certain Chinese export goods in the US market. As the US-China trade war has unfolded, Mexico has gradually gained ground by specialising in more skill-intensive industries, while China’s average export skill intensity is declining.

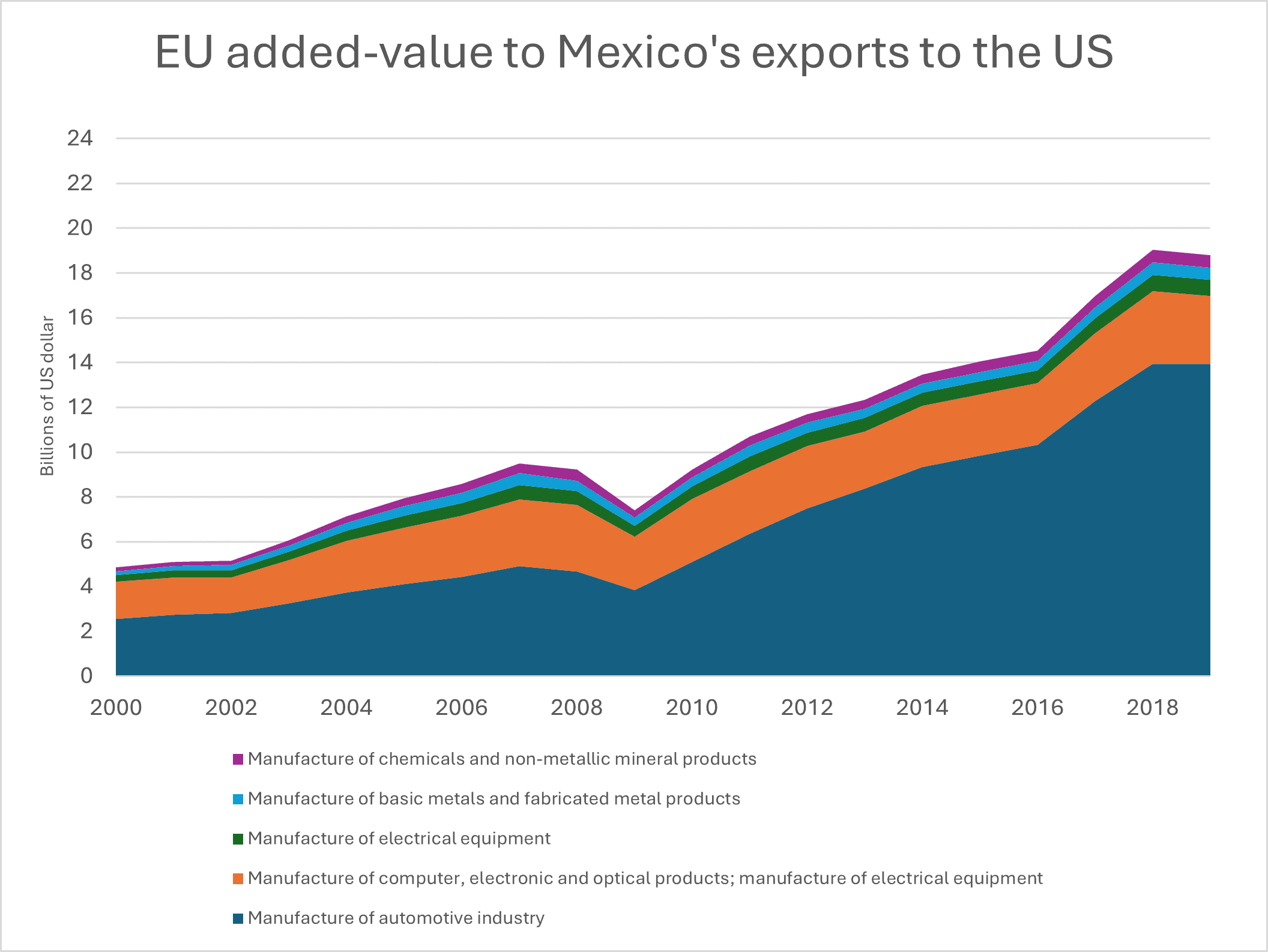

The EU also bolsters Mexico’s manufacturing competitiveness. Only in the automotive sector, the EU-embedded value-added in Mexico’s exports to the US reach a net value of USD 13.9 billion in 2023 (see Figure 4). The EU’s contribution to the value of goods exported by Mexico highlights the interconnected nature of the global supply chain and the fact that incorporating European technology and know-how in the production processes boosts the economic capacities and economic growth of both Europe and its partners. Moreover, Mexico has become a top exporter in the defence manufacturing industry, which could have substantial implications for Europe’s security strategy based on supply chains from reliable allies.

Figure 4

Source: OECD TiVA, Author’s calculations.

Conclusion: Mexico as a bridge to the future

While geographic distance has made Europe to pay little attention to Mexican affairs, it is paramount that the EU now takes a closer look at Mexico’s transformation. This far-away country has a great deal to tell the world about the future of globalization. In Europe, there’s plenty of awareness of the benefits of strengthening transatlantic relations. However, few think of Mexico as part of that relation.

The global economy is undergoing a profound structural change, and there’s a window of opportunity to shape and design the economic and trade relations for market economies to remain competitive. The modernisation of the USMCA marked a new era of trade and economic relations in North America. And while history does not repeat, it certainly rhymes. Once again, European companies could miss their chance to integrate into a Western and market-oriented supply chain if the agreement with Mexico fails to be updated.

The recently appointed female heads of the EU institutions have the chance to meet with the first female President of Mexico, with whom they share not only their gender but also a common vision for a green, prosperous and democratic future. Under these foundations, the relationship between the EU and Mexico could be modernised. Next year will mark the 10th anniversary of the last summit between the leaders of the EU and Mexico. Relaunching the relationship at the highest level could signal the road forward.