Published

Calling on the EU-US Trade and Technology Council: How to Deliver for the Planet and the Economy

By: Oscar Guinea Vanika Sharma

Subjects: EU Trade Agreements European Union North-America Regions

In recent years, there has been a shift in the EU-US relationship. Historically, these regions were leading advocates for trade liberalization, but now their policymakers are increasingly focused on preventing a regression towards protectionism. As the next meeting of the EU-US Trade and Technology Council (TTC) approaches, the time is ripe for this situation to change. One way to lead this change is for both regions to embark on a joint initiative that significantly enhances economic integration between the EU and the US. In our forthcoming ECIPE Policy Brief, we propose an EU-US Mutual Recognition Agreement (MRA) on conformity assessment for machinery and electrical equipment as a pioneering initiative.

The EU and the US are already bound by a MRA covering various sectors, including telecommunications equipment, pharmaceutical products, and medical devices. This agreement has evolved over the years, incorporating new Conformity Assessment Bodies (CABs), products, and procedures. We propose an expansion of this MRA to include machinery and electrical equipment. This extension will allow EU and US firms to utilize both EU and US CABs to certify compliance with each other’s regulatory frameworks in these sectors.

There are compelling economic reasons for adopting this policy. Currently, most third-party conformity assessments for machinery and electrical equipment must occur in the country where the products are sold. This requirement leads to increased costs and delays in market entry for EU and US exporters. Implementing an MRA on conformity assessment would expand the available market for these services and reduce their cost. This cost reduction is significant when compared to traditional import tariffs: in 2019, the trade-weighted average tariff was only 2.4 percent for the US and 2.9 percent for the EU.

Although the total cost reduction from an MRA on conformity assessment might also be relatively modest, it becomes substantial when considering the scale of EU and US trade in machinery and electrical equipment, which amounted to 192 billion USD in 2022. In that context, any decrease in trade costs could have profound effects. To illustrate this idea, it is important to remember that the transatlantic market for machinery and electrical equipment in 2022 was nearly three times larger than that for vehicles.

It is also important to recognize that while an MRA on conformity assessment is anticipated to lower the costs associated with these processes, it will not eliminate the need for them. The primary objective of the agreement is to facilitate compliance for EU and US firms with the regulatory requirements in their respective export markets. This is achieved by recognizing the validity of product conformity assessments conducted in either the EU or the US.

Historically, EU-US relations have encountered challenges, often due to the attempts by each party to impose their regulatory frameworks on the other, hindering the development of trade-enhancing agreements. In contrast, the proposed MRA on conformity assessment is designed to reduce regulatory compliance costs without prescribing “the optimal policy solution”. Crucially, it does this without changing product regulations on either side of the Atlantic.

More importantly, the rationale of an EU-US MRA on machinery and electrical equipment extends beyond purely economic reasons. This agreement plays a pivotal role in supporting both the EU and US’s objectives related to economic security and climate goals.

The EU and the US have been actively formulating policies to identify and reduce their respective dependencies on imports from China, particularly concerning certain goods and strategic technologies. For example, the EU has identified dependencies in technologies such as wind generators, photovoltaics, and robotics, all of which require components from machinery and electrical equipment. Notably, in 2022, Chinese firms accounted for a substantial share (49 percent) of the EU’s imports of electrical equipment, surpassing sectors where Chinese imports have been traditionally predominant such as furniture, footwear, or textiles.

Reshoring production has been a priority for EU and US policymakers. However, there are physical and budgetary constraints to this policy. An MRA on conformity assessment offers an alternative to reshoring. It will enable both regions to diversify their supply chains and give a competitive advantage to each other’s companies, facilitating exports to each other’s markets. This approach not only addresses dependencies but also promotes mutual economic growth and specialization in critical technological areas.

Existing research, including studies by Berden et al (2013), Johnson & Danielle (1998), and Schmidt & Steingress (2019), suggests that an MRA on conformity assessment could lead to a reduction in trade costs ranging from 2 to 6 percent. In our upcoming study, we applied the GTAP Computable General Equilibrium (CGE) model, a widely used tool for assessing the economic impact of trade policies, to model the effects of this reduction in trade costs.

Our modeling results indicate that an MRA on conformity assessment in the sectors of machinery and electrical equipment between the EU and the US would result in increased production and exports for both economies. Moreover, this reduction in trade costs, being exclusive to EU and US exporters, is projected to lead to a shift away from imports of similar goods from China. These findings highlight the potential of the MRA not only to enhance EU-US trade but also to strategically diversify supply chains away from over-reliance on a single external source.

An MRA on conformity assessment is also in direct alignment with the goals of the Transatlantic Initiative for Sustainable Trade, which aims to “create a resilient and integrated transatlantic market that accelerates the transition to a climate-neutral and circular economy.” Both the EU and the US are grappling with the challenge of decarbonizing their economies and implementing policies to support the energy transition. In this context, policies that reduce the costs associated with green investments are not just beneficial, but essential.

A transatlantic market for green goods and technologies, facilitated by an MRA on conformity assessment for machinery and electrical equipment, directly supports these objectives. From a list of goods elaborated by Knudson et al. (2015), 75 percent of the EU-US trade in environmentally classified goods falls within the machinery and electrical equipment categories. Given that many items in these categories are vital inputs for the decarbonization of the energy system, the positive environmental impact of an MRA focused on Clean Technologies and Green Goods will be significantly bigger by including a broader range of goods from the machinery and electrical equipment sectors.

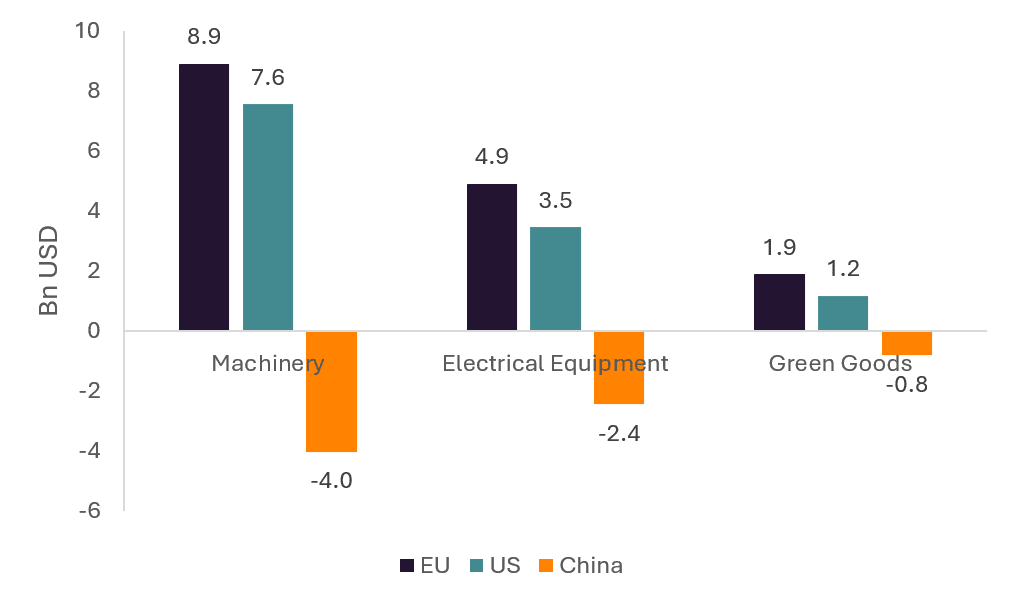

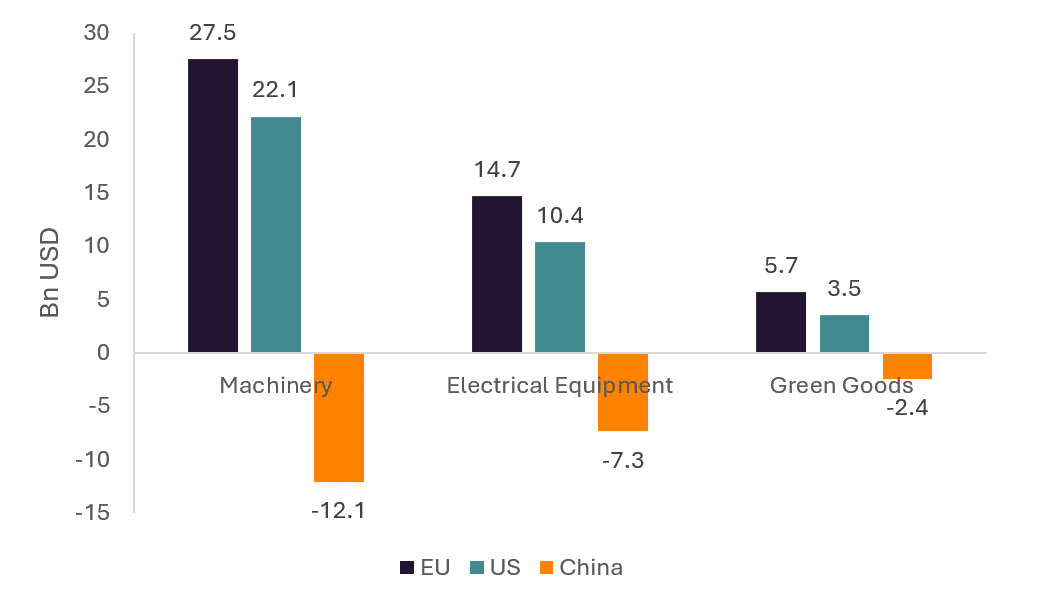

The next two figures present the increase in EU and US exports to each other’s markets and the fall in Chinese exports to the EU and the US for machinery, electrical equipment and a set of environmental goods belonging to machinery and electrical equipment. These changes are modeled assuming that the agreed MRA leads to a 2 percent (Figure 1) and a 6 percent (Figure 2) decrease in trade costs for EU and US firms when exporting to the US and the EU respectively.

Figure 1: Change in EU, US and Chinese trade as a result of EU-US MRA on conformity assessment for machinery and electrical equipment resulting in a 2 percent reduction in EU-US bilateral trade costs

Source: Authors’ calculations.

Figure 2: Change in EU, US and Chinese trade as a result of EU-US MRA on conformity assessment for machinery and electrical equipment resulting in a 6 percent reduction in EU-US bilateral trade costs

Source: Authors’ calculations.

In the scenario where the EU-US MRA on conformity assessment leads to a 2 percent decrease in trade costs, our analysis estimates a substantial increase in exports. Specifically, exports of machinery and electrical equipment from the EU to the US are projected to rise by US$ 13.8 billion, while US exports to the EU are expected to increase by US$ 11 billion. At the same time, this scenario predicts a decrease in Chinese exports of these goods to both the EU and the US equal to US$ 6.5 billion.

In a more ambitious scenario, assuming a 6 percent reduction in trade costs, the projected increases in exports are even more pronounced. In this case, EU exports to the US in the same categories could grow by US$ 42.2 billion, and US exports to the EU could increase by US$ 32.5 billion. This larger decrease in trade costs is also expected to lead to a more significant reduction in Chinese exports to the EU and US, estimated at US$ 19.4 billion.

The potential benefits of a more narrowly focused MRA, specifically targeting machinery and electrical equipment pivotal in fighting climate change, are also substantial. Such an MRA, encompassing Clean Technologies and Green Goods, is projected to boost EU and US exports by amounts ranging from US$ 3.1 billion to US$ 9.2 billion. This increase in trade is directly linked to the breadth of goods classified under the Clean Technologies and Green Goods MRA and the degree to which trade costs are reduced.

As the range of included goods expands and trade costs decrease further, we anticipate not only a significant rise in bilateral exports between the EU and the US but also a corresponding decline in Chinese exports of these environmental goods. This highlights the dual effect of the proposed MRA: it not only fosters transatlantic trade in key sectors for climate action but also shifts the EU and US supply of green goods and technologies away from China.

An important aspect of the proposed MRA on conformity assessment is its fiscal prudence. Unlike many policy interventions, this agreement does not entail any direct financial burden on taxpayers. It is fundamentally a pro-competitive policy that enhances economic security and resilience, and does so through fostering market-driven competition. This approach stands in contrast to other policies that often rely on public subsidies to achieve similar objectives.

So, if it is such a non-brainer, why it has not happened yet?

There has been an understanding that an MRA on conformity assessment for machinery and electrical equipment would disproportionately favor European firms over their American counterparts. This belief is founded on two main arguments. First, the US has historically preferred third-party conformity assessments, while the EU has leaned towards self-assessment practices. Consequently, an MRA facilitating third-party conformity assessments would likely benefit EU firms more significantly. These firms would have the option to conduct their third-party conformity assessments either within the EU or the US, thus facilitating easier access to the US market. In contrast, US firms, which are not required to undergo third-party assessments before exporting to the EU, might not gain as much from this agreement. Second, the EU maintains a positive trade balance with the US in the sectors of machinery and electrical equipment. Therefore, any policy that enhances the competitive position of EU firms in the US market could potentially lead to a reduction in the domestic market share of US firms.

However, these arguments do not fully consider recent policy developments and current market realities. Addressing the first argument, it is important to note that the EU is progressively implementing regulations that require third-party conformity assessments. Notable examples include the EU Machinery Regulation, the AI Act, and the Cyber Resilience Act. This shift suggests that, while initially EU firms may benefit more from an MRA on machinery and electrical equipment, US firms are likely to increasingly utilize this agreement for exports to the EU as these regulations take effect.

Moreover, the potential economic impact for US companies is significant. Even if the MRA results in a modest 2 percent reduction in trade costs for US firms exporting to the EU, US exports of machinery and electrical equipment to the EU will increase by US$ 11 billion. This agreement could also contribute to a decrease in US dependency on Chinese imports by approximately US$ 5.3 billion.

In relation to the second argument, it is crucial to understand which is the current landscape of global trade in machinery and electrical equipment. Contrary to the assumption that EU or US firms dominate, Chinese companies are the largest exporters to both the EU and the US. In 2022, Chinese exports accounted for 30 percent of US imports in these industries, while EU firms contributed to only 7 percent of US imports. Similarly, 44 percent of the EU’s imports of machinery and electrical equipment originated from China.

This market dynamic marks a significant shift from earlier years. For instance, in 2002, US firms were the leading suppliers to the EU in machinery and electrical equipment. However, by 2022, they constituted only 11 percent of the EU’s imports in these two sectors. Globally, the market share of Chinese firms in machinery and electrical equipment has expanded impressively, from 10 percent in 2002 to 27 percent in 2022. Concurrently, the EU’s share of world imports in this sector decreased from 19 to 13 percent, and the US’s share halved from 14 to 7 percent.

The EU and the US are at a pivotal juncture where they must move beyond their traditional mercantilist approaches to trade. The focus now should shift towards facilitating bilateral trade that enhances transatlantic economic integration. In this context, it is incumbent upon policymakers in both regions to deliver an agreement that offers substantial economic, geopolitical, and environmental advantages.

An MRA on conformity assessment specifically targeting machinery and electrical equipment is precisely the kind of agreement that aligns with these objectives. It not only promises to bolster economic growth and competitiveness but also plays a crucial role in advancing environmental sustainability and reinforcing geopolitical alliances. Such an agreement represents a strategic convergence of interests and values, making it a critical step forward for transatlantic economic integration.

One response to “Calling on the EU-US Trade and Technology Council: How to Deliver for the Planet and the Economy”