The Trade Effects of AI Provisions in PTAs: Does Non-Binding Matter?

Published By: Elena Sisto Erik van der Marel

Subjects: Digital Economy WTO and Globalisation

Summary

This paper examines whether non-binding (“soft”) AI-related provisions in preferential trade agreements (PTAs) move trade and how their effects compare with binding (“hard”) provisions. The motivation is straightforward: digital rules are spreading quickly, but legal enforceability is uneven. We ask whether non-binding instruments (standards work, data-innovation clauses, interoperability programmes) can deliver trade gains in AI-intensive sectors even without hard obligations.

Drawing from TAPED AI-related provisions in PTAs, we construct a measure of AI-related depth, distinguishing binding from non-binding provisions. To identify where these rules should matter most, we interact agreement depth with a sectoral proxy for AI intensity based on firm adoption. We estimate a structural gravity model using PPML with exporter-year, importer-year, pair, and pair-trend fixed effects, and run extensive robustness checks including pooled sector interactions and leads/lags.

Key results:

- Around 40% of AI-related provisions in PTAs are non-binding.

- Binding AI-related depth is associated with ~13% higher trade in AI-intensive sectors.

- Non-binding AI-related depth delivers nearly comparable gains (~12%).

- Binding provisions bite most on customs-duty/digital goods and data-protection items.

- Non-binding provisions are especially effective for cross-border data flows and new AI/data issues (interoperability, standards, data-innovation).

- Pooled sector tests confirm positive, significant effects when depth is interacted with AI intensity.

Interpretation and implications: In fast-moving, regulation-heavy domains such as AI, credible soft-law cooperation can reduce coordination frictions and facilitate trade, often approaching the impact of binding rules. Policymakers can sequence: use structured non-binding tools to unlock near-term gains where consensus is still forming, while locking in binding disciplines where norms are mature.

Policy directions: (i) deploy cooperation chapters, interoperability work programmes, and open-data initiatives to target data-flow frictions; (ii) consolidate binding disciplines on established areas (digital-goods duties, core data-protection principles) to amplify effects; and (iii) invest in standards and translational mechanisms that support firms in AI-intensive sectors.

We thank Daniel Trefler for serving as a discussant at the OECD Conference on Trade in Services and for helpful comments and suggestions. We also thank Hildegunn Nordås and Bernard Hoekman for comments. In addition, we would like to thank Lars Vandelaar for excellent research assistance.

1. Introduction

During the rapid growth of Preferential Trade Agreements (PTAs) in recent years, these agreements have become increasingly comprehensive. The average depth of legally enforceable provisions in PTAs globally increased by 247 percent between 2000 and 2020. Surprisingly, the corresponding depth of non-legally enforceable provisions, or those that are weakly enforceable, grew even faster, by about 274 percent. Together, these provisions have a combined effect on trade in goods of approximately 18.4 percent.[1] This is puzzling since trade theory generally suggests that only legally binding provisions in deep trade agreements should have a positive impact on trade.[2]

Digital trade is an area where both legally and non-legally enforceable provisions in deep trade agreements have grown significantly in recent years. In 2000, only one trade agreement included digital trade provisions, but by 2020, this number rose to 203 (see annex Figure A1). Between 2000 and 2020, the average depth of digital provisions in these PTAs grew by approximately 157 percent. Interestingly, similar to the overall trend, non-legally enforceable provisions in these agreements have been rising at a faster rate during this period. This paper examines how both legally and non-legally enforceable provisions in PTAs influence digital trade, focusing on where non-legally enforceable provisions have the greatest impact.

Specifically, we examine AI-related provisions and their impact on digital trade, distinguishing between legally enforceable (hard) and non-legally enforceable (soft) provisions. AI is expected to significantly influence the global economy, affecting both goods and services, and is likely to shape international trade in various ways.[3] Additionally, the policies governing the relationship between AI and trade often involve deep, non-trade-related regulations, such as privacy policies. Despite being behind-border regulations, many of these are included in PTAs as part of digital trade provisions. Notably, we observe that almost half of these provisions are framed in soft language, making them non-legally enforceable. This paper explores where these soft provisions have the most impact, aiming to uncover their role in digital trade.

This paper builds on two distinct streams of research: one exploring the positive trade effects of the depth of PTAs, and the other examining the link between digital trade and AI. First, Mattoo et al. (2022) demonstrate that deep, legally enforceable provisions within PTAs lead to greater trade creation and less trade diversion, compared to agreements with fewer such provisions. Similarly, Laget et al. (2020) show that deep trade agreements positively impact trade within global value chains (GVCs), particularly through value-added trade in intermediate goods.[4] Neri-Lainé et al. (2023) confirm this effect at the firm level, especially in developing countries.[5] Research in this area often draws on the World Bank Deep Trade Agreements (DTA) database, which tracks deep trade provisions across various trade areas.[6]

However, the DTA database lacks a comprehensive record of digital trade provisions. Instead, the recently developed Trade Agreement Provisions on Electronic-commerce and Data (TAPED) provides an extensive history of all digital trade provisions in PTAs, categorising them by legally and non-legally enforceable provisions.[7] This dataset offers a detailed analysis of provisions in PTAs worldwide, covering chapters, provisions, annexes, and side documents that regulate digital trade, including AI. The authors highlight that PTAs with digital trade provisions have significantly increased in recent years, with a broader scope that goes beyond traditional trade topics, underscored by provisions with weak legal enforceability. We use this database to perform our analysis of AI-related provisions on digital trade.

Second, while various works in recent years have assessed the potential economic impact of AI[8], as well as the impact of AI on labour markets[9], few works have explored the implications of AI on trade. One exception is Goldfarb and Trefler (2018), which describes the various channels through which AI is likely to affect trade from a conceptual perspective.[10] Additionally, the authors discuss the policy implications of AI and trade, emphasising the role of behind-the-border (i.e. deep) regulations. Other works have analysed the linkages of AI and trade, similarly emphasising the key role that regulatory policies play to reinforce this relationship.[11]

However, none of these studies provides an empirical analysis of AI-related policies affecting international trade.[12] Similarly, they do not assess the impact of legal provisions in PTAs within the context of AI and digital trade. We aim to fill this gap by examining this issue, with a particular focus on the distinction between legally binding and non-legally enforceable provisions, following the literature.[13]

Specifically, we use an identification strategy that focuses on AI-related provisions in PTAs following Goldfarb and Trefler (2018).[14] First, we chose AI over broader digital-related provisions because AI provisions allow us to zero in on a specific, emerging technology that demands deep regulatory negotiations within a PTA. Our second contribution involves developing an AI-specific intensity indicator, based on firm-level information, to measure the extent to which various industries and sectors utilise AI technologies. This approach helps us more accurately determine if industries and sectors dependent on AI technologies are particularly sensitive to changes in AI-related policies between countries negotiating a PTA.

Our third contribution is to differentiate between hard and soft AI-related provisions in PTAs and evaluate their impact on AI-related trade, a novel approach in the literature. Two key reasons drive our interest in both types of provisions.

First, while legally enforceable provisions are typically expected to have the most direct impact on trade, non-binding or weakly enforceable provisions in PTAs have surged in recent years. It seems unlikely that these provisions serve only non-trade purposes, particularly for a digital technology like AI, which is presumed to have a substantial impact on trade. Second, previous research shows that both hard and soft provisions in PTAs can have a significant combined effect on trade when they are deep.[15] However, the authors did not further explore this finding, which we aim to do in this paper. Many AI-related provisions are “behind-the-border” regulations that, despite not always being legally enforceable, are deep and may still significantly impact trade.

We find that approximately 40 percent of the analysed PTAs include non-binding AI-related provisions, reflecting their strong global increase in recent years. This high share of non-legally enforceable provisions is noteworthy, especially given the traditionally unclear trade effects of such “soft” provisions. Using our firm-level proxy to identify AI-intensive industries and sectors within a structural gravity model, we find that the economic impact of non-binding AI-related provisions nearly matches that of legally enforceable ones. Moreover, this trade effect is particularly strong in so-called new areas of AI. One possible explanation for this substantial effect is that AI, as a recent technology, requires regulatory cooperation among countries through deep provisions that are challenging to enforce legally. Our findings indicate that these non-binding provisions still significantly influence trade.

This paper is structured as follows. The next section covers the data used for our variables on AI provisions in PTAs, firm-level use of AI technologies, and trade. Section 3 outlines our empirical gravity model, divided into two parts: one for hard provisions and one for soft provisions. Section 4 presents our baseline results and additional robustness checks. The final section concludes with some policy implications.

[1] Mattoo, A., Mulabdic, A., & Ruta, M. (2022). Trade creation and trade diversion in deep agreements. Canadian Journal of Economics/Revue canadienne d’économique, 55(3), 1598-1637.

[2] Maggi, G. (2016). Issue linkage. In Handbook of commercial policy (Vol. 1, pp. 513-564). North-Holland.

[3] Goldfarb, A., & Trefler, D. (2018). Artificial intelligence and international trade. In The economics of artificial intelligence: an agenda (pp. 463-492). University of Chicago Press.

[4] Laget, E., Osnago, A., Rocha, N., & Ruta, M. (2020). Deep trade agreements and global value chains. Review of Industrial Organization, 57(2), 379-410.

[5] Neri-Lainé, M., Orefice, G., & Ruta, M. (2023). Deep trade agreements and heterogeneous firms exports (No. 10436). CESifo Working Paper.

[6] Hofmann, C., Osnago, A., & Ruta, M. (2017). Horizontal depth: a new database on the content of preferential trade agreements. World Bank Policy Research Working Paper, (7981).

[7] Burri, M., Callo-Müller, M. V., & Kugler, K. (2024). The evolution of digital trade law: Insights from TAPED. World Trade Review, 23(2), 190-207.

[8] See Acemoglu, D. (2025). The simple macroeconomics of AI. Economic Policy, 40(121), 13-58; Agrawal, A., Gans, J., & Goldfarb, A. (Eds.). (2019). The economics of artificial intelligence: An agenda. University of Chicago Press; see also Agrawal, A., Gans, J. S., & Goldfarb, A. (2024). Artificial intelligence adoption and system‐wide change. Journal of Economics & Management Strategy, 33(2), 327-337.

[9] Acemoglu, D., & Restrepo, P. (2018). Artificial intelligence, automation, and work. In The economics of artificial intelligence: An agenda (pp. 197-236). University of Chicago Press; Autor, D. (2024). Applying AI to rebuild middle class jobs (No. w32140). National Bureau of Economic Research.

[10] Goldfarb, A., & Trefler, D. (2018). Artificial intelligence and international trade. In The economics of artificial intelligence: an agenda (pp. 463-492). University of Chicago Press.

[11] Ferencz, J., González, J. L., & García, I. O. (2022). Artificial Intelligence and international trade: Some preliminary implications; Meltzer, J. P. (2018). The impact of artificial intelligence on international trade. Center for technology Innovation at Brookings, 9.

[12] An exception is Sun and Trefler (2023) which assesses unilateral AI-related policies and their impact on trade in digital services. The authors, however, do not analyse any AI-related policies nor provisions with respect to PTAs. From a non-policy perspective, Brynjolfsson et al. (2019) examined the effect of a specific AI sub-field, machine translation, on international trade in goods. They discovered that implementing a machine translation system on a selected platform increased export quantities by about 17.5 percent, as it helped reduce search costs by overcoming language barriers.

[13] The literature that differentiates between legally enforceable and non-legally enforceable provisions, whether shallow or deep, builds on the initial work by Horn et al. (2009). The authors provide an analysis of so-called deep provisions which are under the mandate of the WTO (referred to as “WTO+”) and those which fall outside the scope the WTO mandate (referred to as “WTO-X”). Examples of WTO+ provisions include tariffs and subsidies, while WTO-X provisions cover areas like investment and competition policy. For digital-related policies, data policies serve as an example of WTO-X provisions.

[14] Goldfarb, A., & Trefler, D. (2018). Artificial intelligence and international trade. In The economics of artificial intelligence: an agenda (pp. 463-492). University of Chicago Press.

[15] Mattoo, A., Mulabdic, A., & Ruta, M. (2022). Trade creation and trade diversion in deep agreements. Canadian Journal of Economics/Revue canadienne d’économique, 55(3), 1598-1637.

2. Data

Our identification strategy relies on three sets of data, namely AI-related provisions in PTAs, an indicator assessing the intensity of industries and sectors using AI-technologies, and trade in goods and services.

2.1 TAPED PTA Provisions

Our first set of data on AI-related provisions in PTAs is sourced from the TAPED database.[1] TAPED is a comprehensive repository of digital trade provisions in PTAs worldwide, addressing a gap not covered by the World Bank’s DTA. The database includes chapters, provisions, annexes, and side documents that directly or indirectly regulate a broad range of digital trade items, such as intellectual property, key service sectors, government procurement, trade in goods, general and specific exceptions, and emerging data economy issues like paperless trade, data protection and encryption, and AI.

More specifically, TAPED covers over 430 PTAs concluded since 2000 until 2022, encompassing 116 digital trade items. These items are organised into five distinct categories: e-commerce and digital trade, data-dedicated provisions, new data economy issues, cross-cutting issues related to e-commerce, and intellectual property. TAPED documents several types of provisions, including market access commitments and deeper regulatory items that are non-discriminatory or serve as general and specific exceptions in sectors like services. All provisions are recorded, whether they are found in a dedicated digital chapter of a PTA or scattered across other chapters, sections, or other texts.

Additionally, TAPED categorises all provisions by their legal nature, distinguishing between “hard” and “soft” commitments. Hard commitments are binding and legally enforceable by the trade parties involved, typically worded in a way that allows them to be enforced by another party. Failure to comply with these commitments can lead to the issue being addressed through the agreement’s dispute settlement mechanism. Soft commitments, on the other hand, are non-binding and either not legally enforceable or only weakly so. As a result, they cannot be enforced through dispute resolution mechanism if not complied with. In TAPED, cooperation provisions are generally classified as non-binding unless the treaty explicitly specifies an obligation to cooperate in certain areas within a defined framework and timeframe.[2]

2.2 AI-Related PTA Provisions

For our identification strategy, we need to extract the AI-related provisions from TAPED. To achieve this, we follow the methodology established by Goldfarb and Trefler (2018) and Meltzer (2018), who categorise various areas of AI-related policies.[3] Based on their work, we break down the AI-related policy provisions into five thematic groups: (1) customs duties on commodities essential for AI development; (2) data protection provisions; (3) general data issues; (4) emerging data issues and specific AI-related provisions; and (5) intellectual property.

The first group on custom duties covers two provisions: whether there is a commitment for the non-imposition of custom duties on electronic transmissions and whether the agreement include a provision on the custom value of carrier mediums. The second group involves several provisions related data privacy such as whether the agreement include provisions on data protection recognising certain international standards and whether they are as a least restrictive measure. The third group covers specific data-related policies, such as an obligation for the free movement of data and a ban on data localisation.

The next two groups delve into items that are relatively new and not typically discussed under the WTO’s mandate, making them part of the WTO-X category. The fourth group encompasses a broad array of areas relevant to AI, such as competition policy and provisions related to data innovation, including the sharing and reuse of data. This group also addresses provisions on standardisation, interoperability, and mutual recognition in the context of digital technologies. Lastly, the fifth group focuses on intellectual property provisions, covering areas such as trade secrets, source codes, algorithms, and more. Table A1 in the annex provides a detailed list of the 22 types of AI-related provisions as defined in TAPED across the five groups, along with their corresponding numbers in the database.

After selecting the AI-related commitments, cleaning the data, and removing expired PTAs, we identified 137 PTAs containing a total of 537 AI-related provisions. Of these, 60 percent are classified as hard commitments, while the remaining 40 percent are soft commitments. Most hard commitments are found in the first group related to custom duties (with no soft commitments present) and the final group concerning intellectual property. Provisions on data protection also have a high share of hard commitments. However, the other two groups, data issues and new data/AI issues, have a much lower percentage of hard commitments, with a higher number of soft commitments negotiated in their PTAs. Table A2 in the annex provides a detailed overview of the shares for each group.[4]

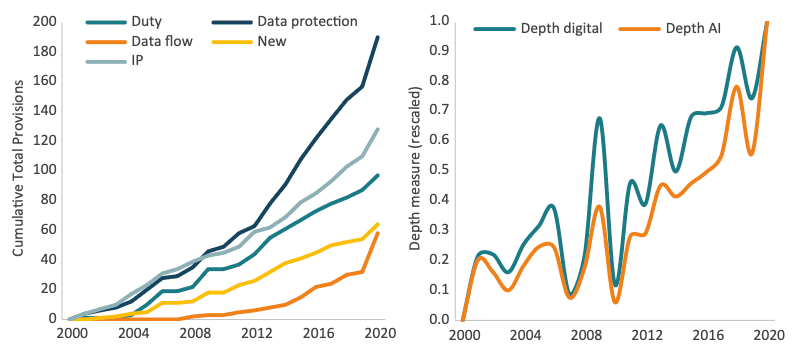

Interestingly, provisions on data protection have experienced the fastest growth in recent years, as illustrated in Figure 1 below (left panel), followed by provisions related to intellectual property. A significant increase in commitments is also observed in the area of custom duties. The two data chapters have shown the slowest growth over time, with data-related policies only beginning to accelerate around 2014 and continuing to rise in recent years.

Using these sets of commitments, we develop a measure of the depth of AI-related provisions. To do this, we construct a simple depth measure, following the approach of Mattoo et al. (2022), by calculating the average count of provisions per year, rescaled between 0 and 1.[5] We apply this method to both hard and soft provisions. As shown in Figure 1 (right panel), the average depth of AI-related provisions, encompassing all five groups, has been increasing over the years. Although there are some fluctuations, the depth of AI-related provisions, including soft ones, has grown in tandem with the rise of depth of all other digital provisions as found in the TAPED database, which we also computed and displayed in the panel for comparison.

Figure 1: Depth of digital/AI-related provisions & AI-related provisions by type (2000-2020) Source: authors using TAPED. Note: see text how average depth is computed.

Source: authors using TAPED. Note: see text how average depth is computed.

2.3 AI-Intensive Sectors

Our second set of data on AI-reliant industries and sectors are sourced from Eurostat. To select sectors that are intensive in the adoption of AI technologies, we apply a novel approach.

Whereas previous works have selected AI-intensive industries based on R&D[6] or intellectual property rights, as well as AI-related scientific publications,[7] for our purposes these intensity measures are either too broad or potentially suffer from methodological issues. Instead, we use data from the Eurostat’s EU Survey on ICT usage and e-commerce in enterprises. This dataset provides the most comprehensive and up-to-date source of information on the cross-country adoption of AI technologies released by a statistical agency. To the best of our knowledge the rich set of information provided by this dataset has not yet been utilised in academic research to assess the AI-intensity by sector, apart from Brey and van der Marel (2024).[8]

The newly released Eurostat dataset provides the most comprehensive coverage of AI adoption across 34 European countries, including the European region as a whole, and 2-digit NACE industries for 2021.[9] The dataset measures the share of firms that adopt a variety of digital technologies, including AI. Our measure of AI adoption includes: (i) text mining, (ii) speech recognition, (iii) natural language generation, (iv) image recognition, (v) deep/machine learning, (vi) automating decision making, and (vii) autonomous physical movements of machines. For more detailed information on each of these AI technologies, see Table A3 in the annex.

The Eurostat database provides several variables that measure the extent to which enterprises use AI technologies. These variables include whether enterprises use at least one, two, or three out of seven AI-related technologies, or whether they use AI for specific purposes, such as logistics, marketing, or management. Since our focus is on the overall adoption of AI rather than specific uses, we prefer to use the non-purpose indicator and select the measure of whether firms use at least one AI technology, labelled “e_ai_tany” in the database. This approach captures the most variation in the data, as using higher thresholds (such as two or three technologies) risks capturing only those sectors considered as AI-producing industries, like IT and information sectors.

As noted earlier, the Eurostat survey provides data for many European countries individually, as well as for the entire region. To avoid endogeneity issues, we opt to use the region-wide indicator of AI adoption by each 2-digit sector. This approach is warranted given that firms in countries that already trade high levels of AI-related goods and services might be more likely to adopt AI technologies, potentially leading to reverse causality. Unfortunately, our AI-intensity data comes from the end of our time frame, so we cannot fully eliminate the possibility of endogeneity. However, our extremely demanding set of fixed effects will hopefully take out any endogeneity trend (see more below).

In selecting our set of industries and sectors which are most AI-intensive, we take those which show a share of firms using AI technologies that lies above the median across the full range of industries and sectors. Typically, the mean instead of the median is used in such selection approach. However, in our case the data is highly skewed: there are many more sectors in which a very low share of firms that use an AI-technology, as shown by the density plot in Figure A2 in the annex. A simple test of normality of our selected variable of AI-adoption shows that the Chi(2) is 0.0041, which is lower than 0.05 implying the null hypothesis of normality rejected, which is shown in annex Table A3. Thus, in this case, the median is preferred over the mean as a measure of central tendency.[10]

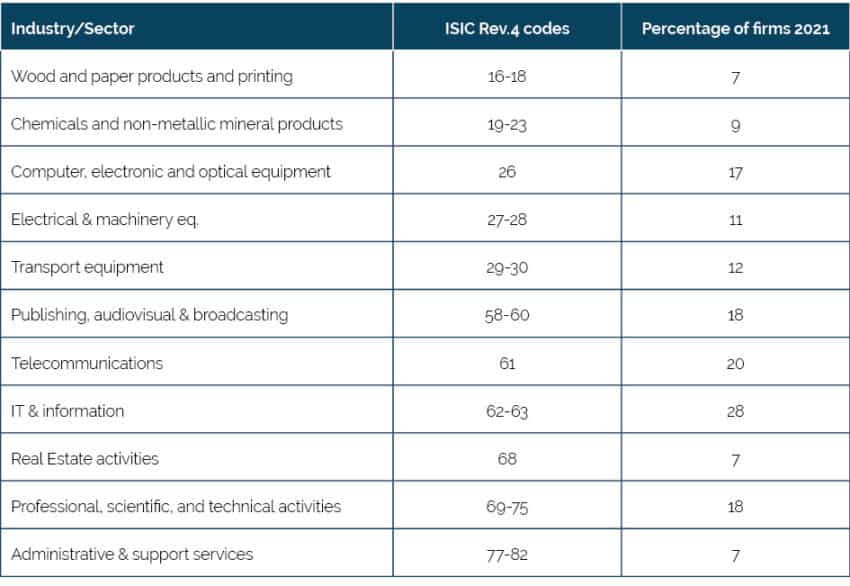

Table 1: Percentage of firms using AI technology, by industry/sector Source: authors using Eurostat.

Source: authors using Eurostat.

As a result, we focus only on the sectors in Table 1, indicating they are at or above the median. Only these sectors are included in our analysis to evaluate whether AI-related provisions in PTAs affect trade in these AI-dependent industries and sectors. They are comprised of both goods industries and services sectors.

2.4 Trade

Our third data set covers trade in both goods and services. To ensure a unified set of trade data across goods industries and services sectors, we use the OECD TiVA data.

The advantage of TiVA is that, unlike many other sources, it consistently records trade data for both goods and services from 1995 to 2020.[11] Additionally, its sector classification aligns well with our independent variables of AI intensity by sector from Eurostat, which is based on ISIC Rev 4 (see Table 1, column 2). This alignment allows for a perfect match between sectors in our initial regressions. Later, we also use the full range of sectors from TiVA and match them with all sectors reporting AI intensity, which is harder to achieve with other data sources that include both goods and services trade.

[1] Mira Burri and María Vásquez Callo-Müller, TAPED: Trade Agreement Provisions on Electronic Commerce and Data Version November 2022, available at: https://unilu.ch/taped; Burri, M., Callo-Müller, M. V., & Kugler, K. (2024). The evolution of digital trade law: Insights from TAPED. World Trade Review, 23(2), 190-207.

[2] Textual examples of binding commitments are “shall,” “must,” “shall take appropriate measures,” whereas examples of non-binding commitments are “recognize the importance,” “shall work towards,” “promote.” Note that TAPED takes into account the fact that some treaties use language that initially can be considered as binding (for instance, when “shall” is used) but after which another verb is added so as to the commitments becomes hortatory (for instance “shall endeavour”), it is considered as non-binding.

[3] Goldfarb, A., & Trefler, D. (2018). Artificial intelligence and international trade. In The economics of artificial intelligence: an agenda (pp. 463-492). University of Chicago Press; Meltzer, J. P. (2018). The impact of artificial intelligence on international trade. Center for technology Innovation at Brookings, 9.

[4] Note that the shares of each category are influenced by number of provisions within each category, which is somewhat corrected when computing our depth measure as discussed below.

[5] Mattoo, A., Mulabdic, A., & Ruta, M. (2022). Trade creation and trade diversion in deep agreements. Canadian Journal of Economics/Revue canadienne d’économique, 55(3), 1598-1637.

[6] Aghion, P., Jones, B. F., & Jones, C. I. (2017). Artificial intelligence and economic growth (No. w23928). National Bureau of Economic Research.

[7] Ferencz, J., González, J. L., & García, I. O. (2022). Artificial Intelligence and international trade: Some preliminary implications.

[8] Brey, B., & van der Marel, E. (2024). The role of human-capital in artificial intelligence adoption. Economics Letters, 244, 111949. McElheran et al (2023) provide similar measures of AI-technology adoption by sector for the U.S., which is in line with the data reported in Eurostat. Unfortunately, this data is not available and not consistent with the Eurostat and our trade data, which both uses ISIC Rev. 4 classification.

[9] Eurostat. (2023). EU survey on ICT usage and e-commerce in enterprises [Data set]. Eurostat.

[10] Moreover, result of the Chi(2) in the normality test considers both the skewness and kurtosis and adjusts for our small sample size. Note that the result of the normality test holds even after dropping sectors such as real estate and utilities, which are non-market driven sectors.

[11] Another data source that reports both goods and services is the USITC ITPD-E database (Borchert et al., 2021). However, we prefer TiVA for the following reasons. First, the services sectors covered in ITPD-E are more aggregate than TiVA and therefore does not perfectly match with the classification by Eurostat. Second, even though the ITPD-E d databases record services trade data as of 2000, which is in line with the time frame of our dependent variable of the depth of AI-related provisions, early years in this data source comes with gaps. Finally, ITPD-E report trade data till 2019, unlike TiVA which is till 2020.

3. Empirical Strategy

We use a structural gravity approach for our empirical strategy. The gravity model of trade is a widely used method to evaluate the impact of bilateral trade policy variables, such as trade agreements.[1] In our study, the focus is on deep binding and non-binding AI-related provisions in PTAs as the key bilateral trade policy variables.

We carry out our simple empirical strategy in two steps. We first regress trade in the selected AI-technology intensive sectors on our variable measuring depth of binding AI-related provisions. In a second step we perform similar regressions separately for non-binding AI-related provisions. After that, we perform a series of robustness checks in which we also combine the two indicators. Standard practice using the gravity model prescribes that the trade data in the econometric specification follows a Poisson distribution which is estimated by PPML as recommended by Santos Silva & Tenreyro (2006, 2011).[2]

Using this approach, we estimate equations (1) and (2) as part of our baseline gravity model using PPML. These equations measure the trade impact of binding and non-binding AI-related provisions, respectively:

Xijt= exp{α0+α1PTAijtbin+α2depthijtbin+δit+ γjt+θij+CONTijt}*εijt (1)

Xijt= exp{α0+α1PTAijtnon+α2depthijtnon+δit+ γjt+θij+CONTijt}*εijt (2)

In both equations, Xijt denotes aggregate exports between origin country i and destination country j as the sum over AI-intensive industries and sectors for year t. The first term to estimate in both equations is PTAijtbin and PTAijtnon . These two terms measure the presence of an PTA that contains binding or non-binding provisions, respectively. These two dummy variables must be seen as a control variable which measures the presence of a shallow PTA, which is a trade agreement without any depth. This indicator could be seen as set of trade agreement fixed effect and controls for the timing of the agreement containing AI-related provisions comes into force between member countries, aside from any depth of these provisions themselves.[3]

Our variable of interest is epthijtbin and epthijtnon, which capture the depth of AI-related provisions in PTAs over time between partner countries. This depth measure changes by the extent to which the five groups of AI-related policies are covered for each year by any country pair that shares a PTA. A positive and significant coefficient result on either variable indicates that deep AI-related binding and non-binding provisions as part of an PTA is associated with greater levels of trade between member countries of the agreement, compared to those that shallower PTAs. It would mean that in addition to the sheer presence of a PTA containing any AI-related agreement, measured by our previous two variables, depth of AI-related agreements matters too.

Both equations also employ three sets of fixed effects, namely αij, γjt and δit, which is standard practise in the gravity literature. The first two terms are defined by origin country-time and destination country-time, respectively. They control any exporter-year and importer-year specific shocks, which theoretically are defined as the multilateral resistance terms and which prevents us from biasing our results.[4] The third term captures the country pair-specific effects, which also largely controls for any endogeneity concerns that may cause our results to bias upwards,[5] following Baier and Bergstrand (2007).[6] By doing so, this means that many other standard gravity variables such as distance are collinear with these set of fixed effects and are therefore dropped from our regressions.

In addition to these country-pair fixed effects, we also incorporate a linear time trend specific to each country pair. This is done to account for the possibility that countries are negotiating deeper AI-related provisions within PTAs while global data flows between countries are increasing. AI technologies are known to be highly dependent on cross-border data flows,[7] which have seen significant growth in recent years. By including this trend effect, we capture any potential (average) movements specific to a country pair due to this rise. Failing to do so could result in the trade effect of AI provisions being less likely to be exogenous. This approach helps control for any higher-than-average changes in the trend of bilateral AI-intensive trade between countries during the sample period compared to countries without any deeper AI-related provisions in PTAs.

In summary, using these fixed effects ensures that our coefficient results reflect the trade impacts in AI-intensive goods and services of the depth of binding and non-binding AI-related provisions in PTAs over time within each country pair involved in the agreement, as well as the effects of these provisions across other country pairs. Standard errors are initially two-way clustered by country-pair and time, as recommended by Egger and Tarlea (2015).[8]

Finally, we also incorporate various control variables in the extended baseline regression as part of our robustness checks. For now, however, we include only one additional control variable for PTAs, in line with previous research, namely RTA. We use the RTA dummy from the ITPD-E database, which is sourced from the Mario Larch’s Regional Trade Agreements Database and which is corrected and cleaned.[9] This RTA variable accounts for all PTAs that country pairs have agreed upon, excluding those with AI-related provisions. Note that these PTAs may still contain binding and non-binding digital provisions listed in TAPED, but their commitments do not fall within the scope of the AI-related provisions we selected, as shown in Table A1.

Note, furthermore, that we also preform regressions for each of the five groups of AI-related provisions as previously discussed and shown in Table A1. We do that for both the binding and non-binding provisions separately for reasons explained below.

[1] See Head, K., & Mayer, T. (2014). Gravity equations: Workhorse, toolkit, and cookbook. In Handbook of international economics (Vol. 4, pp. 131-195). Elsevier.

[2] Silva, J. S., & Tenreyro, S. (2006). The log of gravity. The Review of Economics and statistics, 641-658; Silva, J. S., & Tenreyro, S. (2011). Further simulation evidence on the performance of the Poisson pseudo-maximum likelihood estimator. Economics Letters, 112(2), 220-222.

[3] Mattoo et al. (2022) state that this term could be interpreted either as a trade agreement fixed effect, which captures country-pair confounding factors determining the timing of trade agreements being signed and changes in trade flows, or as an interaction variable that captures the effect of an agreement with zero depth—i.e., a shallow PTA.

[4] Baldwin, R., & Taglioni, D. (2006). Gravity for dummies and dummies for gravity equations.

[5] Countries are more inclined to accord trade agreements with each other that already trade intensively due to structural reasons, such as geography or language, or which are so-called “natural” trading partners. See Krugman, P. (1991). The move toward free trade zones. Economic Review, 76(6), 5. See also Trefler (1993) which discusses the endogeneity problem of trade policy in empirical analysis. Trefler, D. (1993). Trade liberalization and the theory of endogenous protection: an econometric study of US import policy. Journal of political Economy, 101(1), 138-160.

[6] Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade?. Journal of international Economics, 71(1), 72-95.

[7] McAfee, A., & Brynjolfsson, E. (2017). Machine, platform, crowd: Harnessing our digital future. WW Norton & Company.

[8] Egger, P. H., & Tarlea, F. (2015). Multi-way clustering estimation of standard errors in gravity models. Economics Letters, 134, 144-147.

[9] Egger, P., & Larch, M. (2008). Interdependent preferential trade agreement memberships: An empirical analysis. Journal of international Economics, 76(2), 384-399.

4. Results and Robustness Checks

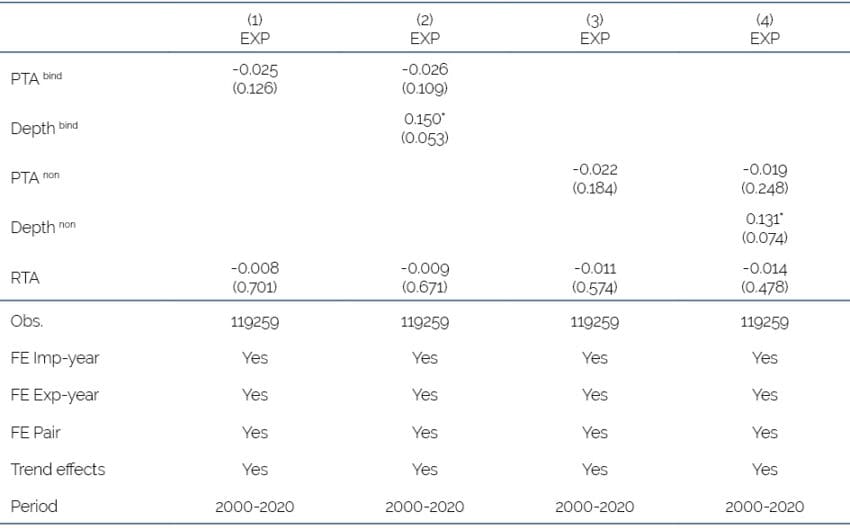

Table 2 reports the baseline regression results. The first two columns report the coefficient results for digital PTAs with binding provisions, as per equation (1). The last two columns present the results for PTAs with non-binding provisions, as per equation (2). Although we run separate regressions for the two types of provisions to avoid potential collinearity, we later include them together to ensure the consistency of the results. The results indicate that binding AI-related provisions (i.e. Depth bind) have a positive and significant effect on trade in AI-related sectors and industries, with an estimated economic impact of around 13.2 percent.[1] Non-binding AI-related provisions (i.e. Depth non) also show a positive and significant effect, with an economic impact of approximately 11.8 percent.[2]

Table 2: Baseline regression results Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

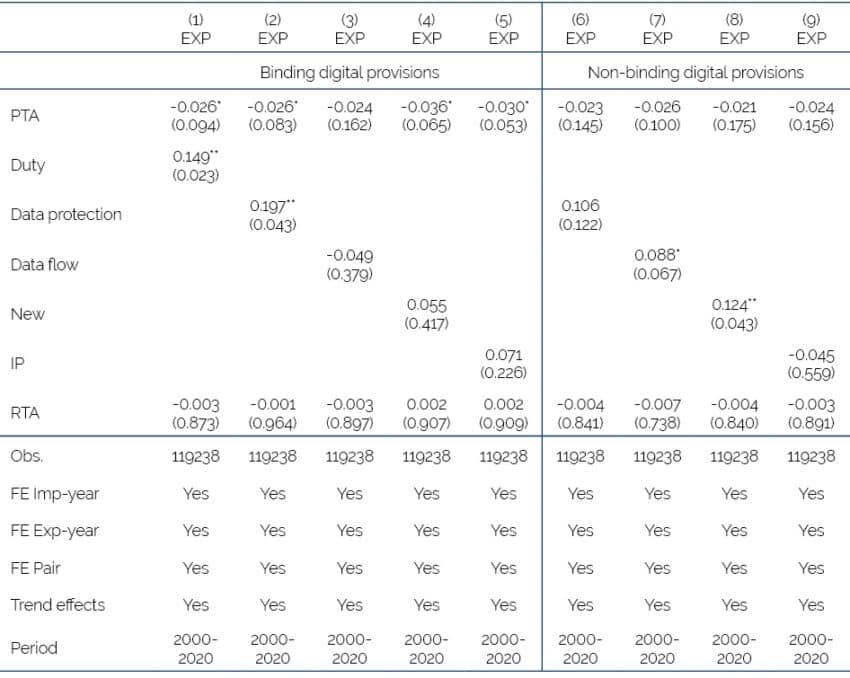

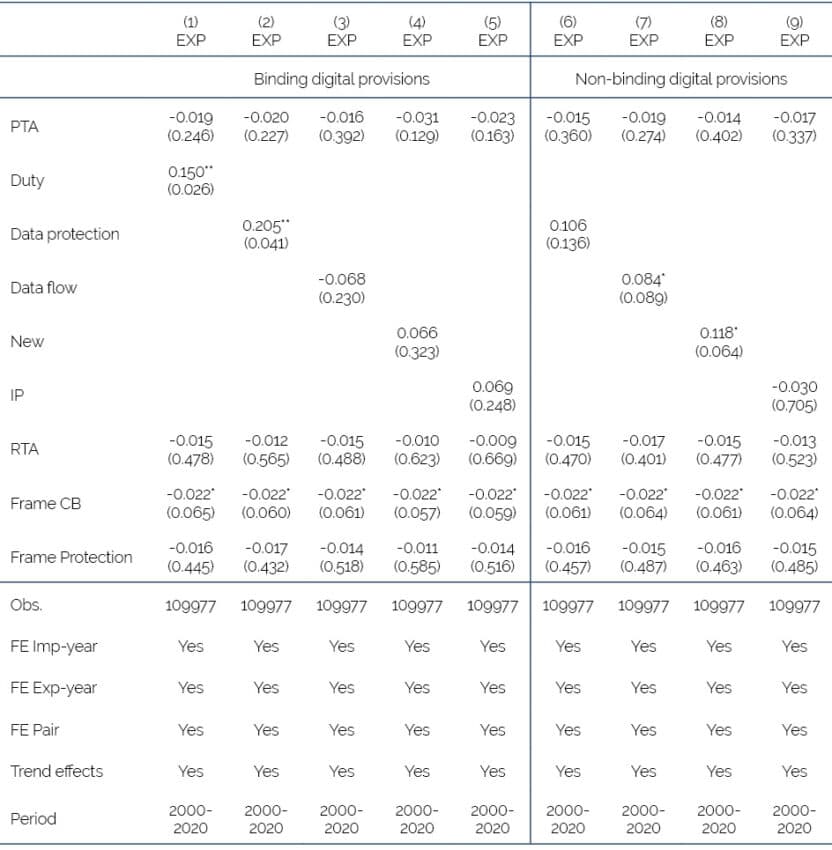

Both results are only significant at the 10 percent level, likely because of the extremely strict pair trend effects. Additionally, combining the five groups may obscure important differences in what drives the overall positive effect of both types of provisions. To address this, our next step is to separately regress each of the five groups of AI-related provisions, as outlined in Table A1. We do this for both binding and non-binding provisions. The results are presented in Table 4.

The table indicates that binding provisions on custom duties for digital goods and data protection have a positive and significant effect. However, no significant effect is observed for binding provisions related to data flows, new data and AI-related issues, or intellectual property (IP). On the other hand, non-binding provisions show a positive and significant effect for data-related regulations, both the ones related to the free flow of data and new data issue. Finally, IP-related provisions show no significant impact for either binding or non-binding provisions. Despite the high correlation between binding and non-binding provisions for some groups, as can be seen in Annex Table A5, results remain largely similar when entering both binding and non-binding provisions for each group together, as shown in Annex Table A6.

4.1 Robustness Checks

We conduct several robustness checks to ensure the results remain significant. First, we add control variables related to globalisation effects, data regulation, and protection governance. Second, we introduce intervals, leads, and lags in line with the empirical gravity literature. Lastly, we use an alternative gravity model, namely by pooling over all industries and sectors, where we interact our key variable with the AI-intensity measure.

To ensure the robustness of our estimates and avoid bias in the effects of bilateral trade policies, we follow the methodology suggested by Yotov et al. (2016) and Yotov (2022), which includes both international and intranational trade flows in the dependent variable.[3] This approach accounts for potential biases arising from the omission of domestic trade flows. Following Bergstrand et al. (2015), we control for common globalisation trends by including a vector of time-varying border dummy variables.[4] These dummies take the value of 1 for international trade flows (i≠j) and 0 for domestic trade flows (i=j) in each year. This allows us to isolate the effects of globalisation from the specific impacts of bilateral trade policies and other regulatory factors, ensuring that our estimates are not overstated due to broader global trends.

Table 3: Baseline regression results by group Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

In Table 4, we include two control variables that measure the extent to which unilateral regulations on data have been implemented between any country pair, alongside the globalisation dummies discussed above. In recent years, many countries have started regulating cross-border data flows and personal data privacy. These rules generally follow three regulatory models, each with distinct characteristics: the open transfer model, the conditional transfer model with safeguards, and the government-controlled transfer model. The open model is characterised by the absence of restrictions on cross-border data flows, whereas the conditional transfer model features certain conditions for the transfers of personal data. The controlled model is characterised by extensive restrictions on cross-border data transfers and by systematic control of personal data by national authorities.[5]

These three data governance models have become a key reference for countries worldwide when establishing rules for cross-border data transfers and domestic processing of personal data.[6] Additionally, many countries have begun developing and implementing their own comprehensive regulatory frameworks for personal data protection. Such a framework includes the consent of the data subject for data collection, extensive rights including the right to access, modify and delete data, and in most cases the establishment of data protection authorities. While these regulations may raise business costs, primarily due to compliance, they are also expected to build consumer trust in the digital economy in the long term.

Ferracane and van der Marel (2025) show that having similar data models between country pairs affects their digital trade performance, with varying impacts based on the specific data model and whether a data protection regime is in place.[7] Building on their data and approach, we construct two dummy variables to evaluate whether any country pair in our dataset follows the same regulatory data model and if they share a data protection regime. The first dummy measures whether a country pair follows any of the three data models, open, conditional, or closed, while the second dummy indicates whether the pair has implemented a comprehensive data protection regime.

The results of incorporating the two data-related control variables and domestic flows are presented in Table 4. We directly run the regressions by group of AI-related provisions and compare these findings with those from Table 3. The results in Table 4 remain largely consistent with those in Table 3, except that the significance for new data and AI-related provisions is weaker. Both control variables show a negative outcome and shows a weak significance for countries sharing a similar regulatory data model. One possible explanation for these negative results is that two out of the three data models, as well as a comprehensive data protection regime, introduce significant compliance costs in the form of fixed costs, as noted by Frey and Presidente (2024).[8]

Table 4: Baseline regression results by group, including control variables of regulatory data policies Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

Our next robustness check is to perform regressions using intervals for our trade data, in addition to applying the lags and leads, following work by Cheng and Wall (2005).[9] This approach is widely used in works assessing the impact of regional trade agreements.[10]

Interval data. To address potential timing issues in trade flow adjustments and account for the gradual shifts in trade patterns due to implementation of bilateral trade agreements, the gravity literature suggests using multi-year intervals instead of annual data. Since many AI-related provisions in PTAs involve complex regulatory rules, firms may take time to adjust to these new conditions, which could delay trade pattern changes. Following this standard approach, we modify our analysis using 4-year intervals. The results, shown in columns (1)-(2) of Table A8, indicate that both depth variables for binding and non-binding provisions remain statistically significant with similar coefficient sizes. Additionally, the coefficient results for the two FTA variables now also become significant.

Lagged variables. Second, to further address the possibility of gradual adjustments in trade patterns due to new AI-related provisions, we include lagged explanatory variables in our regression models, following Baier and Bergstrand (2007).[11] This method captures potential phased-in effects of trade policies, as sectors and industries may take time to adapt to new regulatory environments. Adding lagged variables alongside the intervals helps account for these slow adjustments. The results, presented in columns (3)-(4) of Table A7, show that the two lagged depth variables become insignificant, indicating no additional phased-in effects beyond the interval method. Moreover, the main depth variables without the lag also lose significance.

Lead variables. The third check involves applying a lead to the explanatory variables. As explained by Larch et al. (2019), this can be seen as a placebo test, where the expected outcome is no significant effect, as the provisions shouldn’t impact trade before they are implemented.[12] If significant results appear, it may suggest that anticipatory effects are at play, potentially due to unobserved factors related to AI-related provisions and possibly indicating potential endogeneity. The results, presented in columns (5) and (6) of Table A7, show no such effects, suggesting this is not a concern in our data. However, the main depth variables without the leads also remain insignificant.

Additionally, we have also performed regressions using the log of our AI-intensity taking a threshold of selection AI-intensive measures using the mean instead the median. Doing so excludes three sectors, which are real estate, administrative services, and wood and paper products and printing. However, results remain largely consistent as reported in Annex Table A9 when regressing the baseline specification by the groups of AI-related provisions.

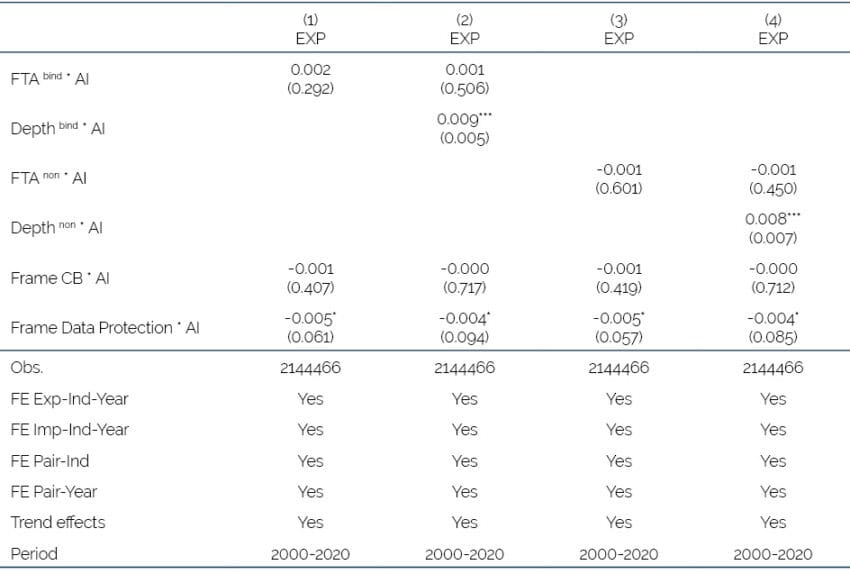

4.2 Pooled Gravity

Our final robustness check consists of applying an alternative gravity model which is comprised of interaction terms. In particular, we extend our baseline gravity by pooling across all industries and sectors instead of using aggregate trade data by only selecting the most AI-intensive industries. This alternative strategy follows French (2019),[13] French and Zylkin (2024),[14] and Brunei and Zylkin (2022)[15] who similarly perform analysis using sector-level trade data.[16] As discussed in these works, doing so corrects for any potential aggregation bias. Moreover, this strategy also enables us to control for any time-variant unobserved factors that determine bilateral trade as it enables to apply more stringent fixed effects. Typically, this method replaced a sector-by-sector estimation and offers an average treatment effect.

As a result, we estimate the trade effects of AI-related provisions on bilateral trade flows as follows:

Xijt= exp{α0+α1PTAijtbin+AIk+α2depthijtbin * AIk + δit+ γjt+θij++σijt+α3CONTijt}*εijt (3)

Xijt= exp{α0+α1PTAijtnon+AIk+α2depthijtnon * AIk + δit+ γjt+θij++σijt+α3CONTijt}*εijt (4)

where Xijt in both equations represent exports pooled over all industries and sectors k between origin country i and destination country j for year t. The terms PTAijtbin and PTAijtnon are dummy variables for PTAs between partner countries containing binding and non-binding AI-related provisions, respectively, in equation (3) and (4). Similarly, both depthijtbin and depthijtnon are the depth of AI-related provisions in FTAs over time between partner countries.

This approach uses specific proxies of sectoral intensities, referred to as sectoral weights, which represent our measure of AI-intensity, AIk. These proxies are interacted with all four terms in both equations. The rationale behind this is that the two key variables of interest vary by country-pair over time. By interacting them with intensity measures, we base our identification strategy on the fact that certain sectors are more affected by AI-related provisions in digital PTAs than others, which the baseline gravity model cannot capture. We also do this for our two data-related control variables. Rather than using a dummy indicator above a certain threshold, we directly use the sectoral share of firms adopting at least one AI technology and interact this with the digital PTA and depth variables.

Further, as mentioned earlier, the fixed effects must be expanded and adjusted using pooled gravity. Specifically, the terms αikt, γjkt, δijk and δijt denote the set of applied fixed effects that incorporate a sector-level dimension. In respectively order, they correspond to the exporter-sector-time, importer-sector-time, exporter-importer-sector, and finally the exporter-importer-year fixed effects. The final term of fixed effects substitutes for pair-time varying variables in equations (1) and (2) when conducting an aggregate gravity model. These fixed effects therefore subsume our dummy variable of PTAijtbin and PTAijtnon and all other non-digital PTAs. Moreover, like above, pair-trend effects are applied. Finally, εodkt is the error term. All regressions apply two-way clustering by exporter-importer, as before.

Table 5 presents the results of these pooled gravity regressions. It shows that the depth variables for both binding and non-binding AI-related provisions are positive and highly significant. In comparison to Table 2, the coefficient signs for shallow digital PTA variables are positive (though insignificant) for binding provisions in columns (1)-(2), while they remain negative (and also insignificant) for non-binding provisions in columns (3)-(4). The coefficient sizes for the two depth variables are considerably lower than in Table 3, suggesting an economic impact of around 1 percent.

However, since the interaction terms involve two continuous variables, the method for calculating the economic marginal effects changes. These effects must be multiplied by the unit of measurement for a digital PTA. Using the average number of digital PTAs for each reporter country across all its partner countries over the entire sample of years in our dataset, which is 12.17, the average economic impact for a country with a digital PTA containing deep binding provisions ranges between 12.5-13.5 percent, while for deep non-binding provisions the trade effect is around 8.5 percent. These results are consistent with the results found in Table 3, albeit slightly lower.

Table 5: Regressions with interaction term using AI intensity  Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

Note: * p < 0.10, ** p < 0.05, *** p < 0.01. Robust standard errors in parentheses clustered by country-pair and year.

[1] This impact is computed by taking the expected value and correcting for the shallow digital PTA bind effect: exp((0.150)+(-0.026))*100-100=13.2 percent.

[2] Note that the negative results on the shallow digital FTA variables for both binding and non-binding provisions are in line with previous research in Mattoo et al. (2022).

[3] Yotov, Y. V., Piermartini, R., & Larch, M. (2016). An advanced guide to trade policy analysis: The structural gravity model. WTO iLibrary; Yotov, Y. V. (2022). On the role of domestic trade flows for estimating the gravity model of trade. Contemporary Economic Policy, 40(3), 526-540.

[4] Bergstrand, J. H., Larch, M., & Yotov, Y. V. (2015). Economic integration agreements, border effects, and distance elasticities in the gravity equation. European Economic Review, 78, 307-327.

[5] See Table A7 for the specific characteristics of each data model, as outlined by Ferracane and van der Marel (2025).

[6] The open model, commonly associated with the U.S., is dominant in North America, while the closed model used by China is prevalent in East Asia. The conditional model, largely driven by the EU, has become widely adopted in Latin America, Oceania, and parts of Africa.

[7] Ferracane, M. F., & van Der Marel, E. (2025). Governing personal data and trade in digital services. Review of International Economics, 33(1), 243-264.

[8] Frey, C. B., & Presidente, G. (2024). Privacy regulation and firm performance: Estimating the GDPR effect globally. Economic Inquiry, 62(3), 1074-1089. The authors found that the GDPR, being a conditional model personal data, incurred new fixed costs, indicating a significant increase of compliance costs for forms dealing with European personal data. Additionally, the authors found that companies in third countries exposed to digital imports from Europe experienced a negative impact on profitability. This suggests that, beyond compliance costs, trade costs also increased for these companies due to the GDPR. Other works assessing economic impacts of the GDPR focus on online outcomes rather than trade, such as Goldberg et al. (2023), Aridor et al. (2023), Congiu et al. (2022), Janssen et al. (2022) Johnson et al. (2023).

[9] Cheng, I.-H., & Wall, H. J. (2005). Controlling for heterogeneity in gravity models of trade and integration. Federal Reserve Bank of St. Louis Review, 87(1), 49–63.

[10] Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade?. Journal of international Economics, 71(1), 72-95; Bergstrand, J. H., Larch, M., & Yotov, Y. V. (2015). Economic integration agreements, border effects, and distance elasticities in the gravity equation. European Economic Review, 78, 307-327; Larch, M., Wanner, J., Yotov, Y. V., & Zylkin, T. (2019). Currency unions and trade: A PPML re‐assessment with high‐dimensional fixed effects. Oxford Bulletin of Economics and Statistics, 81(3), 487-510.

[11] Ibid.

[12] Ibid.

[13] French, S. (2017). Comparative advantage and biased gravity. UNSW Business School Research Paper, (2017-03).

[14] French, S., & Zylkin, T. (2024). The effects of free trade agreements on product-level trade. European Economic Review, 162, 104673.

[15] Brunel, C., & Zylkin, T. (2022). Do cross‐border patents promote trade?. Canadian Journal of Economics/Revue canadienne d’économique, 55(1), 379-418.

[16] Baier and Bergstrand (2007) use these three-way fixed effects to estimate the impact of trade agreements on trade, whereas Brunel and Zylkin (2022) use this structure to assess the impact of cross-border patent fillings on trade. See French (2017) for further discussion on this topic.

5. Conclusion and Discussion

In recent years, the number of non-binding digital provisions in PTAs has grown significantly, alongside a notable increase in binding digital provisions. While binding provisions are legally enforceable, non-binding provisions are not, leading to expectations that the latter would have less economic impact on trade. However, non-legally enforceable digital provisions in PTAs have been rising at a faster rate than legally enforceable ones. Additionally, their economic impact remains uncertain: previous research on goods trade suggests that non-binding provisions may still have significant trade effects.[1]

This paper has explored the impact of both digital legally binding and non-binding provisions in Preferential Trade Agreements (PTAs) on digital trade, with a focus on the significant influence of non-binding provisions. For our identification strategy, we specifically examine AI-related provisions, distinguishing between legally binding (hard) and non-binding (soft) types, and assess their impact on AI-intensive industries and sectors. We follow the classification framework from Goldfarb and Trefler (2018) and Meltzer (2018), organising AI-related provisions into five categories: (1) customs duties on essential AI commodities, (2) data protection, (3) general data issues, (4) emerging data and specific AI provisions, and (5) intellectual property rights.[2]

Our findings show that both binding and non-binding AI-related provisions significantly influence trade in AI-intensive industries. Binding provisions, particularly those related to customs duties and data protection, have a strong impact on AI-related trade. On the other hand, non-binding provisions mainly affect trade through issues related to cross-border data flows and emerging data areas, such as data innovation and competition policy. These results hold under various robustness tests commonly found in gravity literature, including using time intervals, leads, lags, and pooled gravity regressions.

The difference in outcomes among AI-related provisions could be traced back to regulatory practices. For example, customs duties on AI and other digital goods have long been a focus for policymakers and are key aspects in multilateral trade negotiations under the WTO. The Information Technology Agreement (ITA), which eliminates tariffs on high-tech products used in AI, is one such example. This agreement extends benefits even to non-members through the most-favoured nation (MFN) principle. Therefore, the risk for policymakers in committing to these provisions in PTAs is relatively low, even for countries that are not part of the agreement.

Similarly, rules related to data protection are now well-established worldwide. By 2022, over 80 percent of the 160 countries analysed had adopted comprehensive data protection laws, as illustrated in Annex Figure A3. Most of these countries have developed their data protection regulations based on a common model of conditional transfer, requiring certain conditions for the transfers of personal data.[3] Although the WTO does not cover this data protection regulations, the widespread adoption of a unified regulatory framework could encourage countries to make further binding commitments in PTAs.

However, the readiness to make binding commitments may not extend to less developed regulatory areas globally. Although many PTAs include rules for data flows, there are significant differences among the countries involved. Over the past decade, regulatory measures affecting cross-border data flows have become more restrictive, with some rules even prohibiting the free movement of personal data.[4] This potentially elevates the regulatory challenges for policymakers, which may lead to a preference for non-binding provisions. Even so, our findings indicate that non-binding provisions can still exert an influence on trade, particularly in evolving areas like data innovation and AI regulations.

Similarly, emerging data issues like data innovation and AI regulations are also relatively new and remain underdeveloped in many countries. For example, only a few countries have set up specific rules for AI, such as mutual recognition of AI systems and regulations on automated decision-making. Likewise, policies on competition, open government data, and data sharing are relatively new to governments. This uncertainty may lead policymakers to make non-binding commitments in these areas within in PTAs, which, as our finding suggests, can still influence trade.

[1] Mattoo, A., Mulabdic, A., & Ruta, M. (2022). Trade creation and trade diversion in deep agreements. Canadian Journal of Economics/Revue canadienne d’économique, 55(3), 1598-1637.

[2] Goldfarb, A., & Trefler, D. (2018). AI and international trade (No. w24254). National Bureau of Economic Research; Meltzer, J. P. (2018). The impact of artificial intelligence on international trade. Center for technology Innovation at Brookings, 9.

[3] Ferracane, M. F., & van Der Marel, E. (2025). Governing personal data and trade in digital services. Review of International Economics, 33(1), 243-264.

[4] González, J. L., Casalini, F., & Porras, J. (2022). A preliminary mapping of data localisation measures.

References

Acemoglu, D. (2025). The simple macroeconomics of AI. Economic Policy, 40(121), 13-58.

Acemoglu, D., & Restrepo, P. (2018). Artificial intelligence, automation, and work. In The economics of artificial intelligence: An agenda (pp. 197-236). University of Chicago Press.

Aghion, P., Jones, B. F., & Jones, C. I. (2017). Artificial intelligence and economic growth (No. w23928). National Bureau of Economic Research.

Agrawal, A., Gans, J., & Goldfarb, A. (Eds.). (2019). The economics of artificial intelligence: An agenda. University of Chicago Press.

Agrawal, A., Gans, J. S., & Goldfarb, A. (2024). Artificial intelligence adoption and system‐wide change. Journal of Economics & Management Strategy, 33(2), 327-337.

Autor, D. (2024). Applying AI to rebuild middle class jobs (No. w32140). National Bureau of Economic Research.

Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade?. Journal of International Economics, 71(1), 72-95.

Baldwin, R., & Taglioni, D. (2006). Gravity for dummies and dummies for gravity equations.

Bergstrand, J. H., Larch, M., & Yotov, Y. V. (2015). Economic integration agreements, border effects, and distance elasticities in the gravity equation. European Economic Review, 78, 307-327.

Brey, B., & van der Marel, E. (2024). The role of human-capital in artificial intelligence adoption. Economics Letters, 244, 111949.

Brunel, C., & Zylkin, T. (2022). Do cross‐border patents promote trade?. Canadian Journal of Economics/Revue canadienne d’économique, 55(1), 379-418.

Burri, M., Callo-Müller, M. V., & Kugler, K. (2024). The evolution of digital trade law: Insights from TAPED. World Trade Review, 23(2), 190-207.

Cheng, I.-H., & Wall, H. J. (2005). Controlling for heterogeneity in gravity models of trade and integration. Federal Reserve Bank of St. Louis Review, 87(1), 49–63.

Egger, P., & Larch, M. (2008). Interdependent preferential trade agreement memberships: An empirical analysis. Journal of international Economics, 76(2), 384-399.

Egger, P. H., & Tarlea, F. (2015). Multi-way clustering estimation of standard errors in gravity models. Economics Letters, 134, 144-147.

Ferencz, J., González, J. L., & García, I. O. (2022). Artificial Intelligence and international trade: Some preliminary implications.

Ferracane, M. F., & van Der Marel, E. (2025). Governing personal data and trade in digital services. Review of International Economics, 33(1), 243-264.

French, S. (2017). Comparative advantage and biased gravity. UNSW Business School Research Paper, (2017-03).

French, S., & Zylkin, T. (2024). The effects of free trade agreements on product-level trade. European Economic Review, 162, 104673.

Frey, C. B., & Presidente, G. (2024). Privacy regulation and firm performance: Estimating the GDPR effect globally. Economic Inquiry, 62(3), 1074-1089.

Goldfarb, A., & Trefler, D. (2018). Artificial intelligence and international trade. In The economics of artificial intelligence: an agenda (pp. 463-492). University of Chicago Press.

González, J. L., Casalini, F., & Porras, J. (2022). A preliminary mapping of data localisation measures.

Head, K., & Mayer, T. (2014). Gravity equations: Workhorse, toolkit, and cookbook. In Handbook of international economics (Vol. 4, pp. 131-195). Elsevier.

Hofmann, C., Osnago, A., & Ruta, M. (2017). Horizontal depth: a new database on the content of preferential trade agreements. World Bank Policy Research Working Paper, (7981).

Laget, E., Osnago, A., Rocha, N., & Ruta, M. (2020). Deep trade agreements and global value chains. Review of Industrial Organization, 57(2), 379-410.

Larch, M., Wanner, J., Yotov, Y. V., & Zylkin, T. (2019). Currency unions and trade: A PPML re‐assessment with high‐dimensional fixed effects. Oxford Bulletin of Economics and Statistics, 81(3), 487-510.

Maggi, G. (2016). Issue linkage. In Handbook of commercial policy (Vol. 1, pp. 513-564). North-Holland.

Mattoo, A., Mulabdic, A., & Ruta, M. (2022). Trade creation and trade diversion in deep agreements. Canadian Journal of Economics/Revue canadienne d’économique, 55(3), 1598-1637.

McAfee, A., & Brynjolfsson, E. (2017). Machine, platform, crowd: Harnessing our digital future. WW Norton & Company.

Meltzer, J. P. (2018). The impact of artificial intelligence on international trade. Center for technology Innovation at Brookings, 9.

Neri-Lainé, M., Orefice, G., & Ruta, M. (2023). Deep trade agreements and heterogeneous firms exports (No. 10436). CESifo Working Paper.

Silva, J. S., & Tenreyro, S. (2006). The log of gravity. The Review of Economics and statistics, 641-658.

Silva, J. S., & Tenreyro, S. (2011). Further simulation evidence on the performance of the Poisson pseudo-maximum likelihood estimator. Economics Letters, 112(2), 220-222.

Yotov, Y. V. (2022). On the role of domestic trade flows for estimating the gravity model of trade. Contemporary Economic Policy, 40(3), 526-540.

Yotov, Y. V., Piermartini, R., & Larch, M. (2016). An advanced guide to trade policy analysis: The structural gravity model. WTO iLibrary.