The Impact of Increased Mass Litigation in Europe

Published By: Fredrik Erixon Oscar Guinea Dyuti Pandya Vanika Sharma Elena Sisto Oscar du Roy Renata Zilli Philipp Lamprecht

Subjects: European Union

Summary

The purpose of this study is to better understand the growth of mass litigation in the European Union (EU) and its economic consequences. European authorities have long encouraged consumers to seek redress through private litigation in European competition law and, more recently, they have shifted their focus towards collective actions in a broad range of areas, including data privacy and product liability.

Facilitating access to justice through collective actions is not a cost-free option. Unfortunately, there is a lack of economic analysis on the consequences of an increase in collective action cases in the EU. It is crucial to understand the economic consequences of a “mixed regime” – that is, a regime based on both ex-ante public enforcement through regulation and ex-post enforcement through private litigation. The combination of these two enforcement models raises questions about how the system is intended to work together and what the consequences might be for the economy.

This study examines the economic implications of these developments in the EU.

Chapter 2 outlines the two models of enforcement: public and private enforcement of regulation. Private enforcement enables individuals or groups to pursue court-based legal action to enforce regulations. In contrast, public enforcement is conducted by government agencies and public institutions responsible for ensuring compliance with laws and regulations.

The public and private enforcement regimes each influence the economy in distinct ways. Private enforcement entails lower ex-ante compliance costs, as businesses face reduced regulatory oversight by public authorities. However, although the higher compliance costs associated with public enforcement are readily apparent, private enforcement entails additional costs, such as settlement payments or increased insurance premiums to cover potential litigation risks.

These costs affect companies’ behaviour and ultimately the broader economy. For example, private enforcement systems generally provide greater flexibility for businesses, offering them more opportunities to innovate. However, this flexibility comes at the cost of increased uncertainty. Companies may face ambiguity regarding the compliance standards to follow, as these are largely shaped by court rulings resulting from private litigation, which may hinder innovation.

Two features distinguish the EU’s enforcement system from other regions: the integration of national and EU legislation, and the prominent role of Ombuds Bodies.

Regarding the first feature, the EU adopted the Representative Actions Directive (RAD) to establish a unified framework with minimum standards for collective redress, aiming to prevent fragmentation and ensure equal procedural rights for consumers across the EU. However, while minimum standards have been implemented, the Directive’s flexibility allows non-harmonised rules to persist, and the potential for forum shopping remains, as some EU countries adopt a more permissive approach to mass litigation than others.

Regarding the second feature, Ombuds Bodies provide a middle ground between purely private and purely public enforcement, offering faster consumer redress and at a lower cost than collective actions. For instance, the enforcement powers available to the Swedish Ombuds Body may be linked to the low volume of collective actions in Sweden, as citizens are empowered to uphold their rights through the mechanisms offered by the Ombuds Body.

Chapter 3 presents the results of a database on collective actions, revealing a significant increase in the number of cases. The analysis identifies a two-phase trend: an initial peak around 2015, followed by a renewed surge in filings starting in 2020. This trend suggests a growing use of collective actions across the EU. Notably, the Netherlands, Portugal, Germany, and Slovenia report a higher volume of collective action lawsuits.

Across economic areas, consumer protection remains the primary driver of collective actions. However, as the volume of cases has increased, so has the scope of economic sectors affected. Notably, there has been a significant rise in cases related to data privacy, digital services, as well as the environment, energy, and climate.

The analysis of collective actions at the country level reveals significant variations. However, this variation cannot be fully explained by variables such as GDP, population, GDP per capita, or product quality. Other factors may contribute to the different levels of growth in collective action cases across EU countries.

Case studies from the Netherlands, Portugal, and Germany provide valuable qualitative insights.

In the Netherlands, the prevalence of collective actions can be attributed to the Dutch legal system’s low threshold for initiating such cases compared to other countries. Dutch collective actions operate under an opt-out system, and ad hoc entities can be formed quickly to pursue specific claims. Additionally, the admissibility criteria for collective actions in Dutch courts are less stringent than in other EU countries, and cost-shifting risks are minimal. Likely for these reasons, a thriving ecosystem of law firms and funders actively pursuing collective actions has developed in the Netherlands.

The legal system in Portugal is similarly favourable to collective actions. Alongside the opt-out system, there are no caps on the damages that can be claimed and no restrictions on forum shopping. These features make collective action in Portugal an appealing and comparatively low-cost option for litigants and funders.

The German system of collective actions can be characterised as a dual framework comprising the assignment model and the Redress Action Act. The assignment model’s popularity, supported by the emergence of digital platforms facilitating the aggregation of mass claims, has been a major driver of the increase in collective actions in Germany.

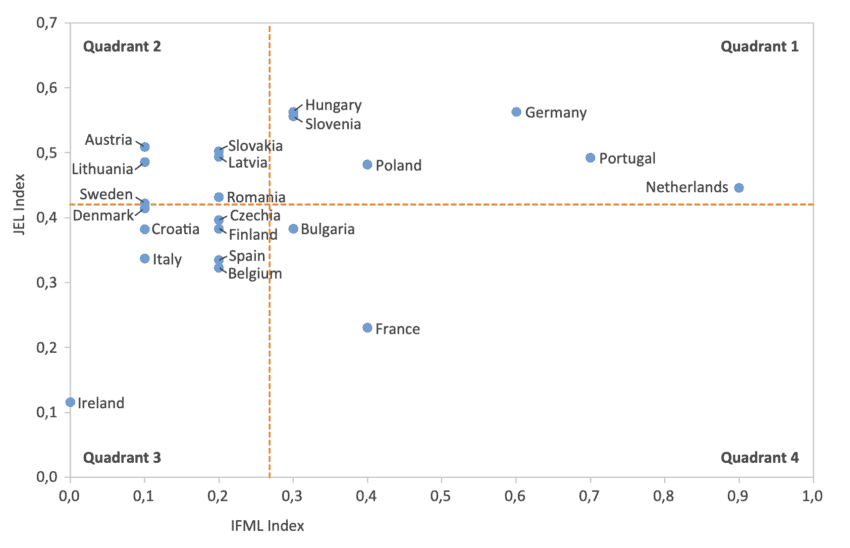

Chapter 4 builds on these insights by developing two quantitative indices. The first is the Institutional Framework for Mass Litigation (IFML) Index, based on three variables: (1) existing collective action mechanisms; (2) characteristics of the legal system governing collective actions (e.g., opt-out systems, no requirement to disclose funding sources, no loser-pays principle, admission of ad hoc qualified entities (QEs)); and (3) institutional factors external to the legal system (e.g., number of funders). The second is the Judicial Efficiency for Litigation (JEL) Index, based on seven variables: (1) number of judges; (2) number of prosecutors; (3) number of lawyers; (4) judicial budget; (5) clearance rates; (6) cost of contract enforcement; and (7) disposition times.

The IFML and JEL indices can be combined to position each EU country within a quadrant framework based on their scores. The following figure illustrates EU countries positioned above or below the IFML and JEL averages.

Figure: IFML and JEL Indices across EU Member States The figure suggests that countries such as the Netherlands, Portugal, and Germany, all located in Quadrant 1 (High JEL, High IFML), may be more susceptible to an increase in mass litigation in the future. These countries exhibit above-average institutional factors supporting collective action, along with relatively efficient judicial systems, making them appealing venues for increased mass litigation activity.

The figure suggests that countries such as the Netherlands, Portugal, and Germany, all located in Quadrant 1 (High JEL, High IFML), may be more susceptible to an increase in mass litigation in the future. These countries exhibit above-average institutional factors supporting collective action, along with relatively efficient judicial systems, making them appealing venues for increased mass litigation activity.

Countries located in Quadrant 2 (High JEL, Low IFML), such as Austria, Lithuania, and Sweden, may be less susceptible to an increase in collective actions. Despite their efficient legal systems, these countries have implemented legal guardrails that constrain mass litigation.

Countries positioned in Quadrant 3 (Low JEL, Low IFML), such as Ireland, Italy, and Spain, have institutional frameworks that are less supportive of collective action, combined with relatively less efficient legal systems. This suggests that these countries may experience slower growth in the volume of collective actions.

Finally, countries located in Quadrant 4 (Low JEL, High IFML), such as France and Bulgaria, present an intriguing case. Although they possess above-average institutional frameworks that support collective action, these factors might be offset by less efficient judicial systems, as evidenced by their low scores on the JEL Index.

The increase in the volume of collective action cases will have significant economic consequences.

Several studies have sought to estimate the costs of private enforcement on companies operating in the US. These estimates serve as the basis for assessing the potential impact of a higher volume of collective actions in the EU. However, it remains uncertain how closely the EU system of mass litigation aligns with its US counterpart. To address this uncertainty, a scenario-based analysis has been employed to capture a range of potential outcomes. The study outlines three scenarios (Low, Medium, and High Growth) which assume that as the number of collective actions in the EU rises, the economic effects of mass litigation observed in US empirical studies can be proportionally applied to the EU economy.

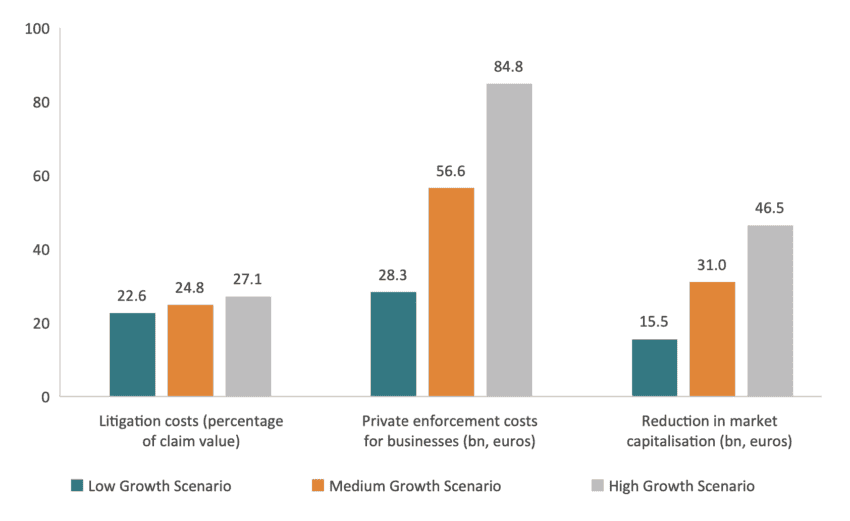

The Low Growth Scenario assumes that the economic impact of mass litigation growth in the EU will correspond to 10 percent of the effects observed in empirical studies in the US. The Medium Growth Scenario projects a 20 percent correspondence, while the High Growth Scenario estimates a 30 percent equivalence.

The scenario-based analysis highlights the potentially significant economic impact of a growing number of collective actions. Private enforcement costs for businesses are projected to range from €28.3 billion under the Low Growth Scenario, €56.5 billion under the Medium Growth Scenario, to €84.8 billion under the High Growth Scenario. Similarly, if these scenarios are applied to litigation costs as a share of claim value, such costs could increase from the current level of 20.3 percent to 22.6 percent (Low Growth), 24.8 percent (Medium Growth), or 27.1 percent (High Growth) of claim value. For the EU’s most innovative companies, market capitalisation losses are estimated at €15.5 billion (Low Growth), €31.0 billion (Medium Growth), and €46.5 billion (High Growth).

Figure: Economic effects of collective actions in the EU Another way to interpret the results of the scenario-based analysis is to assess the benefits of avoiding a shift to the High Growth Scenario. The differences between the High and Low Growth Scenarios include a 20 percent reduction in litigation costs, savings of €56.6 billion for businesses, and a €31 billion reduction in the potential decline in the market capitalisation of innovative companies in the EU.

Another way to interpret the results of the scenario-based analysis is to assess the benefits of avoiding a shift to the High Growth Scenario. The differences between the High and Low Growth Scenarios include a 20 percent reduction in litigation costs, savings of €56.6 billion for businesses, and a €31 billion reduction in the potential decline in the market capitalisation of innovative companies in the EU.

The EU and its Member States should carefully consider the implications of the economic modelling as they refine their institutional frameworks regulating mass litigation. The IFML Index demonstrates a strong correlation between the total number of collective action cases and the institutional framework that regulates them. EU countries can adopt measures to mitigate the adverse economic effects of increased mass litigation on the European economy. For instance, based on the IFML Index, EU Member States can:

- amend class participation rules by adopting an opt-in process instead of opt-out to prevent exaggerated claims,

- adopt or reinforce existing transparency rules to ensure disclosure of funding sources,

- ensure that the loser pays principle is reinforced and consistently applied,

- apply stricter criteria for forming a qualified entity to file collective action cases,

- exclude ad hoc entities and private persons as claimants, and

- mitigate the negative economic effects of private third-party funders in collective actions to ensure a larger share of the defendant’s payments reaches consumers.

This report was commissioned by the European Justice Forum, a coalition of businesses, individuals and organisations that are working to build fair, balanced, transparent and efficient civil justice laws and systems for both consumers and businesses in Europe.