Globalisation Comes to the Rescue: How Dependency Makes Us More Resilient

Published By: Oscar Guinea Florian Forsthuber

Subjects: European Union Healthcare New Globalisation Regions WTO and Globalisation

Summary

A new consensus is growing across the European Union – and other parts of the world too: that globalisation has gone too far. The argument goes as follows: as an exchange for higher efficiency and lower prices, Europe has sacrificed its ability to take care of itself and protect its own citizens. The Covid-19 crisis has revealed how much Europe depends on the rest of the world for products like medical goods and medicines. Therefore, if Europe does not want to live through another shortage of essential supplies, the lesson of the Covid-19 crisis is that the EU has to produce these products itself.

This conclusion may sound intuitive but it is fundamentally wrong. Europe is not overly dependent on the rest of the world because most trade in the EU is done within its own borders. New evidence presented in this paper shows that there were only 112 products, making just 1.2% of the value of EU total imports, for which the four largest suppliers were non-EU countries as compared to more than two thousand products for which the four largest suppliers were from EU member states. And while not every product is equally important in the face of a global pandemic, there is not a single Covid-19 related good for which all EU imports only came from non-EU countries.

This paper debunks the idea that the EU is too reliant on other countries. Instead, our analysis shows that imports from the rest of the world make every EU member state more resilient by diversifying its sources of supply.

Because of their geographical location and economic integration, if there was to be a shock like a pandemic, a plague, or a nuclear disaster, groups of EU countries are likely to be hit simultaneously. Having sources of supply outside the EU is therefore critical to reduce Europe’s vulnerability to these shocks. Europe’s recent experience has shown that international trade is a strength, not a weakness, and the EU was blessed to be able to tap into the manufacturing capacity of the rest of the world to buy urgently needed medical goods from abroad during the hardest months of the pandemic.

Preparing for future crisis like Covid-19 is extremely complex. Nobody knows which type of shock will come after Covid-19, which economic activities will be impacted, or what kind of goods will be needed to protect our citizens. Yet, any debate about the merits of re-shoring should be based on figures and not on narratives. This paper analyzes EU imports on more than 9,000 products and concludes that Europe should not build its resilience by the mandatory re-shoring of economic activities. That is the opposite of diversification. Besides, re-shoring will increase costs and hit citizens in the poorest countries the hardest.

An economy that is served by multiple firms across multiple locations is more resilient to random shocks than one where goods are produced by fewer firms in the same location. While re-shoring may bring the illusion of control, in reality, the EU will be more vulnerable and dependent on fewer and larger companies. This is why globalisation and the EU’s reliance on the rest of the world is what makes the EU more resilient.

This paper is co-authored with Florian Forsthuber, former research assistant at ECIPE and currently European Central Bank trainee; the views expressed in this paper are those of the author and do not necessarily reflect those of the European Central Bank.

1. In Defense of Globalisation

Politicians in Brussels and many European capitals are calling for the re-shoring of value chains. Addressing France in a televised speech, President Emmanuel Macron denounced the risk of over-reliance on global value chains saying that “the only answer is to build a new, stronger economic model, to work and produce more, so as not to rely on others”[1]. The French European Commissioner for the Internal Market, Thierry Breton, openly stated that “globalisation has gone too far”[2]. But it is not just French policymakers who are concerned about globalisation. In Berlin, Angela Merkel called for “strategic capabilities for Europe” [3] and the need to identify sectors where production has to be based in the EU. The prevailing view was summarized by European Commissioner for Health, Stella Kyriakides when she said that “we need to ensure that we reduce our dependency on other countries.”[4] As a reaction to this new call to pull up the drawbridge, the European Commission is developing the concept of open strategic autonomy[5] that includes the stockpiling of medicines[6] and has been used to justify a more active approach in EU industrial policy[7].

The debate about whether globalisation has gone too far is not just happening in Europe but across the world. Only subtle differences exist between what some European policymakers call sovereignty and what the Trump administration calls re-shoring. For example, while Peter Navarro, director of the White House Office of Trade and Manufacturing Policy, stated that “For far too long, we’ve relied on foreign manufacturing and supply chains for our most important medicines”[8], France’s Finance Minister Bruno Le Maire asked “Do we want to still depend at the level of 90% or 95% on the supply chain of China for the automobile industry, for the drug industry, for the aeronautical industry, […] or be more independent and sovereign?”[9]. It is difficult to distinguish one from the other.

But how did we get into a situation where European political leaders are openly calling for the retreat of globalisation? In the first quarter of 2020, as policymakers struggled to find the medical supplies needed to protect their doctors and nurses from Covid-19, EU leaders realized that Europe did not have the means to produce vital products like face masks, goggles or medical gowns by itself. Urgency quickly turned into panic and EU countries rushed to nationalize medical supplies and to stop any medical goods from leaving their national borders. Suddenly, the EU internal market of medical goods came into a halt as EU companies were not allowed to ship their own goods within the EU. It took a few weeks to sort out but a compromise was found and the ban to sell medical supplies within the EU was turned into an export restriction for some medical products. Nonetheless, to equip hospitals with the much-needed medical supplies, the EU had to rely on imports to get the medical goods that were so urgently required. In the view of many European leaders, Covid-19 demonstrated the degree of European dependency on the rest of the world. And this dependency was blamed for the shortage of medical supplies.

However, blaming globalisation is a mistake. First, it is based on the idea that facing the same crisis, a country with all the production facilities on its national soil would have done better. In reality, the surge in demand for medical goods was such, that no country could have ramped up production to meet their own demand. Even China, who was the main producer of face masks at the start of the crisis, could not meet its own demand related to Covid-19, and had to import a large number of face masks[10]. Similarly, the OECD quantified that for every euro of German exports of Covid-19 goods, Germany imports EUR 0.72 of Covid-19 goods; in the United States, for every dollar of Covid-19 good imports, the US exports USD 0.75 of Covid-19 goods, exposing the myth of a one-sided autonomy for medical goods[11].

Second, any expectation of self-sufficiency is simply unrealistic. It cannot happen because goods need inputs from abroad. For example, Philips, one of the largest manufacturers of ventilators, identified that in one machine there are 621 crucial components which were designed, produced, and assembled in facilities scattered across the world[12]. If a country wanted to replicate the whole value chain behind a ventilator, it would have to build factories to produce all these 621 components. This would be expensive and inefficient. Even relatively simpler products like hand sanitizer need ingredients from outside the EU[13].

Third, if a country managed to produce a good that it was not producing before, the cost is likely to be higher than importing it from abroad. The OECD[14] calculated that a world where local production substitutes global value chains would be poorer and more vulnerable to shocks. And it is not just the higher cost of domestic production which matters, it is the opportunity cost as well. It is ludicrous to argue that Europe’s future competitiveness lays on the production of face masks[15]. Besides, if governments want firms to produce certain products, they are going to influence a pattern of economic specialization, which can have tremendous negative consequences.

For example, in the light of the disruption brought by Covid-19, some policymakers have called for the production of basic medicines, like paracetamol, to be done within Europe. In reality, more than 70% of EU imports of active pharmaceutical ingredients already come from Europe[16]. Moreover, when resources are scarce – and most of the time they are – trade allows EU industry to focus on high value-added activities. It would be strange to argue that the EU pharmaceutical industry should produce low value-added medicines rather than investing in innovative and high value-added products. The consultation note of the EU Trade Policy Review makes this very point when it says that “Here in Europe we need imports to supply our companies with essential raw materials and intermediate inputs, to maintain our competitive and technological edge, helping us to provide high-quality jobs, develop and manufacture cutting-edge products, and satisfy consumer needs.”[17] As we are seeing with the production of a Covid-19 vaccine, economic specialization, international trade, and imports are what allow firms to focus on the activities that they do best to the benefit of all.

Unfortunately, these arguments have been mostly ignored. Yet, the hard truth is that any steps towards self-sufficiency will have a cost attached to it. Moreover, re-localization, re-shoring, or building strategic capabilities is not simply going to happen because governments say so. Governments do not produce stuff, companies do. And if EU governments are willing to impose any restructuring on value chains, companies may decide to stop selling those goods or to do it at a premium – an extra cost that EU public budgets can hardly afford.

More importantly, if there is a lesson that we have learned from this crisis it is that, despite all the difficulties, global value chains have delivered. For example, businesses – European and non-European – have been successful at increasing production of personal protective equipment in a very short timeframe and only some occasional grocery products have run out despite heavy restrictions. Globalisation has been a great help to EU countries as they could count on the industrial capacity of the rest of the world. The EU bought 40% of its Covid-19 test kits and diagnostic reagents from outside the EU, imports of gloves from non-EU countries between January and April of 2020 increased by 14%, imports of thermometers grew by 42%, and imports of protective garments surged by 81% compared to the same period of 2019.

European policymakers do not need to choose between resilience and global value chains. That’s a false choice based on a made-up dichotomy. Yet, the wheels of EU policymaking are already in motion and they are not moving in the right direction. Josep Borrell, the High Representative of the Union for Foreign Affairs and Thierry Breton stated that “we clearly need to diversify and reduce our economic and industrial dependencies”[18]. The consultation note of the EU Trade Policy Review states that “Immediate concerns arose with regard to the supply of medical and protective equipment: the crisis exposed the risks of being too dependent on one or a limited number of suppliers of critical goods and services in these sectors”.[19] Similarly, the public consultation on the new EU Pharmaceutical strategy calls for a “thorough examination of how the supply chain can be made more secure and reliable” as the EU is “increasingly dependent on active ingredients originating from outside the EU”[20]. In the view of many EU decision-makers “faced with a symmetrical shock affecting all of Europe, the answer could only be European”[21]. This is not just short-sighted but also untrue.

Meanwhile Italy has already announced plans to offer tax incentives to those companies willing to repatriate their activities[22] while France has allocated one billion euros to helping companies start producing medical equipment at home along with other items such as electronics, food products and industrial inputs[23].

This paper dispels two powerful myths underpinning the narrative in support of re-shoring. The first myth is that the world has become more protectionist. The reality is more subtle. Section two of this paper shows that, confronted with the unprecedented crisis of Covid-19, countries around the world – including the EU – have on balance turned outwards rather than inwards. While there are worrying trends of protectionism – in Europe and other parts of the world – the Covid-19 experience also suggests that the wheels of economic globalisation are moving faster. The second myth is that to protect its citizens, the EU needs to concentrate more production within Europe. Section three of this paper dispels this myth with evidence. If diversification is the tool to lower Europe’s dependency from its largest suppliers, the data shows that EU imports become more diverse when the EU opens up to trade with the rest of the world. This is because EU member states are the largest suppliers of each other’s imports. Therefore, any re-shoring that leads to further concentration of production within Europe will make the EU more fragile to symmetric shocks like Covid-19 which impact all EU countries simultaneously. Moreover, new evidence presented in this paper puts the claim of Europe’s perceived dependency on the rest of the world into the right context. There were only 112 products, out of 9,700 products, for which the largest four importers were non-EU countries and none of these products were medical goods required to treat Covid-19.

[1] Rose, M., & Kar-Gupta, S. (2020, June 14). France must seek greater economic independence after virus, says Macron. Reuters, Retrieved from https://www.reuters.com

[2] Hanke Vela, J. (2020, July 4). Coronavirus won’t kill globalisation, but will clip its wings. Politico, Retrieved from https://www.politico.eu

[3] Hanke Vela, J. (2020, July 4). Coronavirus won’t kill globalisation, but will clip its wings. Politico, Retrieved from https://www.politico.eu

[4] Brunsden, J., & Peel, M. (2020, April 20). Covid-19 exposes EU’s reliance on drug imports. Financial Times, Retrieved from https://www.ft.com

[5] European Commission (2020, May 14). Intro remarks by Commissioner Phil Hogan at Second G20 Extraordinary Trade and Investment Ministers Meeting on COVID-19, 14 May 2020. European Commission, Retrieved from https://ec.europa.eu

[6] European Commission (2020, September 16). State of the Union Address by President von der Leyen at the European Parliament Plenary, 16 September 2020. European Commission, Retrieved from https://ec.europa.eu

[7] European Commission (2020, June 12). Commissioner Breton introductory remarks at Competitiveness Council on the Recovery Plan, 12 June 2020. European Commission, Retrieved from https://ec.europa.eu

[8] Erman, M., & Banerjee, A. (2020, May 19). Trump administration signs up new company to make COVID-19 drugs in U.S. Reuters, Retrieved from https://www.reuters.com

[9] Horobin, W., & Fujikoa, T. (2020, February 22). Globalisation Comes Under Fire Amid Coronavirus ‘Stress Test’. Bloomberg, Retrieved from https://www.bloomberg.com

[10] Bradsher, K. (2020, April 11). China Delays Mask and Ventilator Exports After Quality Complaints. The New York Times, Retrieved from https://www.nytimes.com

[11] OECD (2020). Trade interdependencies in Covid-19 goods. OECD, Paris.

[12] Berden K., & Guinea O. (2020). Trade policy and COVID-19: Openness and cooperation in times of a pandemic. ECIPE, Brussels.

[13] Pooler M., Evans J. (2020, March 15). Stocks of hand sanitiser ingredient run low in Europe.

Financial Times, Retrieve from https://www.ft.com

[14] OECD (2020). Shocks, risks, and global value chains: insights from the OECD METRO model. OECD, Paris.

[15] Le Figaro (2020, April 12). Thierry Breton promet «une autosuffisance en masque» pour l’Union européenne. Le Figaro, Retrieved from https://video.lefigaro.fr

[16] In 2019, 70.9% of EU27 imports of Active Pharmaceutical Ingredients (APIs) came from Europe (51.1% EU27, 17.2% Switzerland, 2.6% United Kingdom). China and India constituted 8.0% and 3.4% of EU27 imports of APIs respectively. In volumes terms, however, China and India supplied 22.5% and 3.2% of EU27 imports of APIs (Erixon, F., & Guinea, O. 2020)

[17] DG Trade, European Commission (2020). A renewed trade policy for a stronger Europe. Consultation Note, European Commission, Brussels, p.2.

[18] European Commission (2020, June 10). For a united, resilient and sovereign Europe. European Commission, Retrieved from https://ec.europa.eu

[19] DG Trade, European Commission (2020). A renewed trade policy for a stronger Europe. Consultation Note, European Commission, Brussels, p.3.

[20] European Commission (2020). Survey on the Pharmaceutical Strategy – Timely patient access to affordable medicines.

[21] European Commission (2020, June 12). Commissioner Breton introductory remarks at Competitiveness Council on the Recovery Plan, 12 June 2020. European Commission, Retrieved from https://ec.europa.eu

[22] Benedito, I. (2020, June 14). Así es el plan de Vittorio Colao para reactivar la economía italiana. Expansión, Retrieved from https://www.expansion.com

[23] Mallet, V. (2020, September 9). French trade minister warns UK on Brexit level playing field. Financial Times, Retrieved from https://www.ft.com

2. Globalisation and COVID-19

Globalisation has been a blessing for countries facing the challenge of Covid-19. And despite prevailing views, most countries have actively opened their markets. Not just by lowering tariffs but also by amending their national regulations to facilitate imports. For example, to speed up access to personal protective equipment, Brazil eased its authorization requirements, while Canada loosened its bilingual labelling rules. The United Arab Emirates allowed visual technology programs instead of onsite visits, and Ecuador developed online tools for verification of certificates[1]. The EU made exceptions to the conformity assessment rules for personal protective equipment[2] and the US published emergency use authorizations that allowed medical products produced and approved in the EU, Japan, South Korea, and China to be sold to US hospitals[3]. Overall, the WTO reported that a total of 27 countries made 77 changes to their regulations to facilitate trade[4].

It’s also true that many countries made exports of medical goods more difficult. At the height of the crisis, the objective was to gather as many medical supplies as possible to meet the surge in demand. To do that countries followed a dual strategy of restricting exports and attracting imports. However, export restrictions backfired and many countries – including the EU[5] and the US[6] – had to roll back measures that limited exports of Covid-19 related products. This is because export restrictions have an impact on value chains preventing companies from exporting goods which are later imported as finished products. Moreover, as other countries retaliated, those countries imposing export restrictions in the first place did not receive the inputs needed to produce ventilators, hydroalcoholic gel and personal protective equipment. By restricting exports, countries were harming their own industrial capacity to produce these goods, while simultaneously disincentivizing companies from scaling up production.

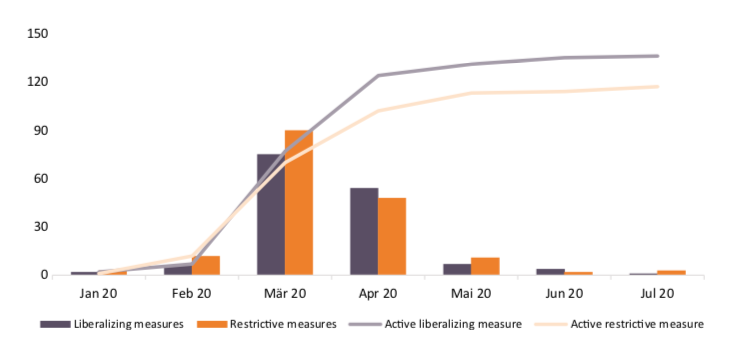

The figure below shows the evolution of trade protectionist and trade liberalizing measures from January to July 2020, mostly on medical and food products. The figure shows that, while the initial impulse was to stop exports of domestic production by imposing trade restrictions, liberalizing measures became more prominent as the crisis unfolded. Restrictive trade measures were not sustainable and therefore were not sustained. Even if the number of total adopted trade protectionist measures was higher than trade liberalizing ones, the number of trade liberalizing measures that stayed in place during the period exceeded the total number of restrictive measures. The reason for this was that 28% of trade restrictive measures between March and April 2020 were cancelled.

Figure 2.1: Number of Trade Measures Adopted from January to July 2020 Source: Authors’ calculation based on data published by the Global Trade Alert.

Source: Authors’ calculation based on data published by the Global Trade Alert.

When facing a crisis like Covid-19, turning inwards was not the right strategy and was not what most countries did. This is because no country is too big or too developed to produce all the medical goods necessary to face a pandemic. For instance, the EU sourced 32% of its imports of medical supplies needed to fight Covid-19 from outside the EU[7].

This is a good thing. As the pandemic spread across Europe, and factories had to close, access to imports meant that the EU could buy essential goods from other countries. Covid-19 was a symmetric crisis – impacting all EU countries more or less at the same time – and as such, all EU countries dramatically increased their imports from non-EU countries. For example, intra-EU imports – imports into an EU member state from another EU member state – of face masks and hydroalcoholic gel increased by 45% and 14% while extra-EU imports – imports into an EU member state from a non-EU country – of these products surged by 769% and 45% respectively. These figures show that the answer to the crises was not to concentrate more production within the EU but to tap into the industrial capacity of the rest of the world. Therefore, the answer to future crisis is not necessarily to concentrate more production within Europe, as EU member states are already the main suppliers of many products consumed within the EU.

The next section assesses Europe’s dependency on imports in detail. Our analysis demonstrates that by opening up to trade with non-EU countries, EU imports become more diversified which in turn strengthen EU member states’ ability to face unexpected shocks like Covid-19.

[1] WTO (2020). Standards, Regulation and COVID-19. What Actions Taken by WTO members? WTO, Geneva.

[2] European Safety Federation (2020, July 14). Exceptions to the conformity assessment rules for PPE. European Safety Federation, Retrieved from https://eu-esf.org

[3] FDA (2020). Emergency Use Authorizations for Medical Devices. FDA, Retrieved from https://www.fda.gov

[4] WTO (2020). Standards, Regulation and COVID-19. What Actions Taken by WTO members? WTO, Geneva.

[5] European Commission (2020, May 26). Coronavirus: Requirement for export authorisation for personal protective equipment comes to its end. European Commission, Retrieved from https://trade.ec.europa.eu

[6] The US Administration considered to ban exports to Canada and Mexico of respirators made by 3M but finally decided not to impose those measures (Bollyky, T., & Bown, C. 2020).

[7] Guinea, O., & Monterosa, I. (2020). A Global Effort to Win the War Against COVID-19. ECIPE, Brussels.

3. Openness, Trade, and Economic Resilience

The technological revolution that underpinned global value chains led to goods being produced in the most efficient location. This also meant that some vital medical products are no longer produced within national borders. This process achieved a spectacular growth in living standards, lifting millions of people out of poverty. Yet, it has made economies more reliant on each other. In this context, the Covid-19 crisis and the shortage of some medical products has been interpreted as a wake-up call for those who argue that Europe must have the strategic capabilities to produce some of these goods within its borders.

But did globalisation go too far by making the EU too reliant on other countries? And is the re-shoring of production the right strategy to reduce Europe’s vulnerability to future pandemics? The analysis presented in this paper answers these two questions with a definitive no.

Our analysis looks at EU dependency across imports from non-EU countries and imports from EU member states. This distinction is important when discussing a symmetric shock like Covid-19. If import diversification is the tool to prepare for an unexpected shock, EU countries should assess internal and external dependencies alike. While trade within the EU single market is protected from political interference by EU law and therefore might be seen as more reliable than trading with a non-EU country, EU member states share the same geographical location and their economies are highly integrated. Therefore, an unpredictable event like a pandemic is more likely to hit EU countries simultaneously, and the economic consequences of such a shock are more likely to be quickly transmitted across EU economies. The answer to a symmetric shock, therefore, is not necessarily to concentrate more production within the EU itself. That is the opposite of diversification.

While it is true that Europe relies on non-EU countries for some goods, re-shoring is not necessarily the right answer to any perceived vulnerability on foreign imports. There are other ways to prepare for any future pandemic that would be less harmful to Europe’s economy such as stockpiling medical products, or by implementing measures which can have a positive impact on Europe’s economy such as the adoption of global standards[1], eliminating import tariffs[2], accepting other countries’ regulations to swiftly buy medical products from abroad[3], and diversifying Europe’s sources of supply[4].

This section presents new evidence showing how imports from abroad make Europe more resilient. First, the analysis shows that the market share of EU imports enjoyed by EU member states is significantly larger than for non-EU countries. The importance of EU internal trade is a sign of the positive role played by the EU single market in the construction of Europe’s value chains but it can also be a source of weakness in the case of symmetric shock. The analysis highlights how imports from outside the EU help EU member states to diversify their sources of imports and, as a result, be better prepared to face any unexpected shock. This section also presents evidence showing that, for some goods, non-EU countries capture a market share which is larger than 80% of EU total imports. Yet, our analysis shows that none of these goods are essential goods needed to manage Covid-19. In fact, the EU already imports Covid-19 related goods from a large number of countries.

3.1 The EU Single Market as the Main Provider of Goods for EU Countries

To evaluate the EU’s economic vulnerability to an external shock, we need to assess the number of imported products supplied by a particular country and its market share. If an imported product is supplied by one country and this country captures a large share of the buyers’ market, any external shock that impacts the producing country will have severe consequences not just on the producing country but also on the countries importing these goods, as they lack an alternative supplier.

In this analysis, we gather data from Eurostat Comext on EU imports. The data includes intra-EU imports – imports into an EU member state from another EU member state – and extra-EU imports – imports into an EU member state from a non-EU country. The compiled dataset contains more than 5 million observations of more than 9,000 products. Supplementary tables and figures that complement the analysis below are available in the appendix accompanying the publication of this paper. In addition, we published the code to compute and replicate all the statistics presented here and a link to our dataset.

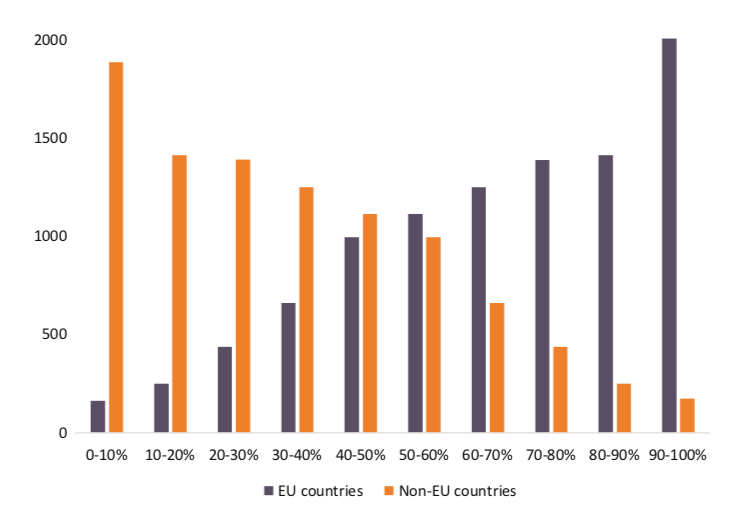

Figure 3.1. presents the market share of EU and non-EU countries on products imported into the EU in 2019. The figure shows that EU countries are the most important suppliers of goods within the EU as they capture more than 50% of the EU’s imports market share in 74% of all the imported goods. Moreover, there were 3,323 (35 %) products for which the market share of EU countries was larger than 80%.

Furthermore, there were 125 products that the EU imports exclusively from within the EU. Still, the EU average masks considerable cross-country differences. For example, Luxembourg relies solely on the EU internal market for 4,117 (48%)[5] of the imported products, followed by Slovakia (34%), Croatia (34%) and Slovenia (32%). On the other end of the spectrum, the Netherlands sources just 489 (5%) products solely from the single market, closely followed by Germany (8%) and France (8%). The results presented at the EU member state level may be impacted by re-exports or quasi-transit[6] within the EU. For instance, the Netherlands is a large re-exporter of goods due to the role of Rotterdam as a distribution hub[7]. The fact that some goods arriving to the port of Rotterdam from a non-EU country are later re-exported to another EU member state, may lead to some non-EU imports to be recorded as EU imports. This would lead to an overestimation of the share of non-EU goods on total imports for countries like the Netherlands or Belgium where these distribution hubs are located and an underestimation of the share of non-EU imports on total imports in the EU member states receiving these re-exports. The figures presented at the EU level, however, are not impacted by re-exports.

The analysis also shows that there were 424 (4.4%) products for which the market share of non-EU countries was higher than 80%[8]. These 424 products accounted for 4% of all the imported products and 7% of the total value of EU imports. The countries supplying these products that featured more prominently were China, US, and UK. The degree of market concentration of imports from non-EU countries, however, varies across member states. The EU member states with the highest number of products where non-EU countries supply more than 80% of the value of imports were Ireland with 4,379 products, the Netherlands with 1,792 products, and Malta with 1,481 products. The countries that capture the highest market share of these products were UK for Ireland, China for Netherlands, and UK for Malta.

One of the issues exposed by Covid-19 and which has worried EU policymakers is the perceived dependency on Chinese imports. Our analysis shows that China supplies 40% of these 424 products where non-EU countries capture a large share of EU total imports. The EU countries that were more exposed to Chinese imports were the Netherlands, Hungary, and Slovenia where China supplies 27%, 23% and 18% respectively of the products where non-EU countries enjoyed a market share on total imports larger than 80%. Yet, Chinese imports only represent 2% of the value of these 424 products imported into the EU. In comparison, the value of imports from these 424 products coming from the US and the UK was 11% and 5% respectively. This indicates that relationships with the US or a no-deal Brexit may be a bigger issue with regards to vulnerability on foreign partners than the dependency on Chinese imports. Moreover, for some EU member states, the country which captures the largest value of these 424 products was not China but Russia. This is because some EU member states import much of their energy from Russia. For 73% of the products, however, the market share of non-EU countries was lower than 50%.

Figure 3.1: Number of Imported Products into the EU by Market Share of EU and Non-EU Countries (2019) Source: COMEXT Eurostat, authors’ calculations.

Source: COMEXT Eurostat, authors’ calculations.

Finally, there were 112 products where all the four largest sources of imports were non-EU countries. Again, the non-EU countries that feature more prominently are China, the UK, and the US, and the kind of products included in this list were goods like agricultural products which do not grow in Europe like coffee beans, raw materials[9] such as natural gas or cotton, as well as some specific manufacturing products like bicycle parts.

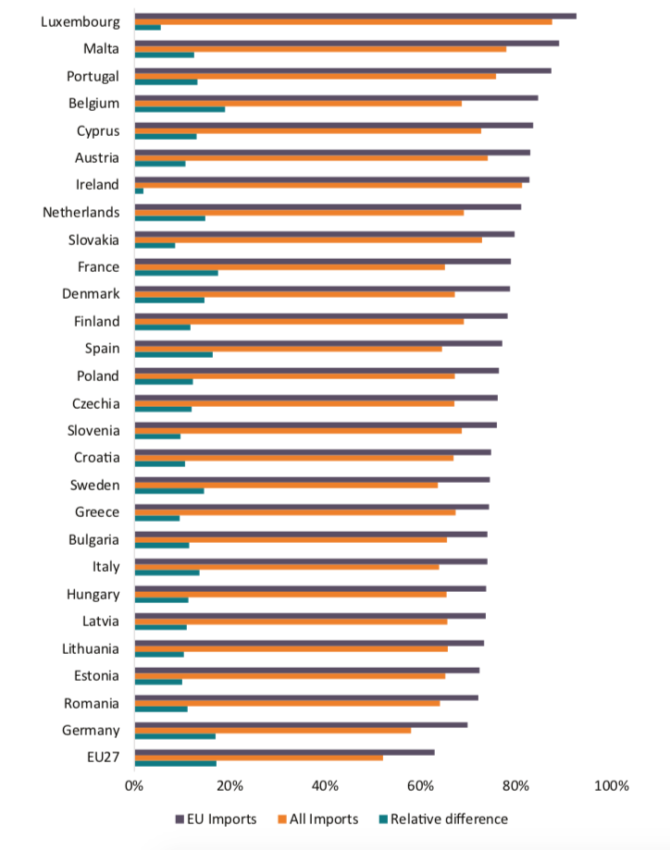

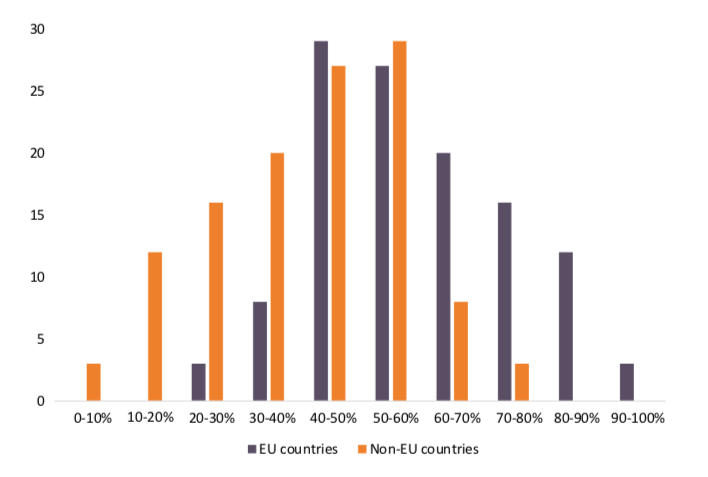

Figure 3.2. shows the market share of the four largest EU suppliers of intra-EU imports and the four largest suppliers – EU and non-EU countries – of total imports in each EU member state. Those countries where the four largest importers supply the highest market share are also the ones which are more exposed to shocks impacting their largest suppliers of imports. The purple bar shows the market share of the four largest EU suppliers of intra-EU imports. Luxembourg, Malta, and Portugal are the EU countries where the market share of the four largest EU suppliers on their EU imports is the highest, while Germany, Romania and the Baltic states are the EU member states where this market share is the lowest[10]. The yellow bar shows the market share of the top four suppliers – EU and non-EU countries – of imports when intra and extra-EU imports are taken into account. The figure shows that the market share of the top four suppliers of imports goes down once imports from outside the EU are taken into account. In other words, opening up to trade with the rest of the world lowers the market share of the top four suppliers making EU countries less reliant on the largest producers. These results are consistent across a number of market concentration indicators[11].

Therefore, imports from outside the EU lowers the degree of market concentration that EU countries have on each other, increasing the diversification of imports and making the EU less vulnerable to symmetric shocks. For example, in France, the share of the top four EU suppliers of imports sourced within the single market was equal to 79%, whilst after accounting for imports coming from outside the EU, the market share of the top four suppliers fell to 65%. The gains on imports diversification are represented by the grey bar which shows the relative fall in the market share of the four largest suppliers once imports from non-EU countries are taken into account. Belgium, France, and Germany are the EU countries who gained the most in terms of diversification while Luxembourg, Slovakia, and Greece are the EU countries in which sources of imports are more dependent on the four largest EU suppliers.

Figure 3.2: Market Share of the Four Largest Suppliers of Imports by EU Member State (2019) Source: COMEXT Eurostat, authors’ calculations.

Source: COMEXT Eurostat, authors’ calculations.

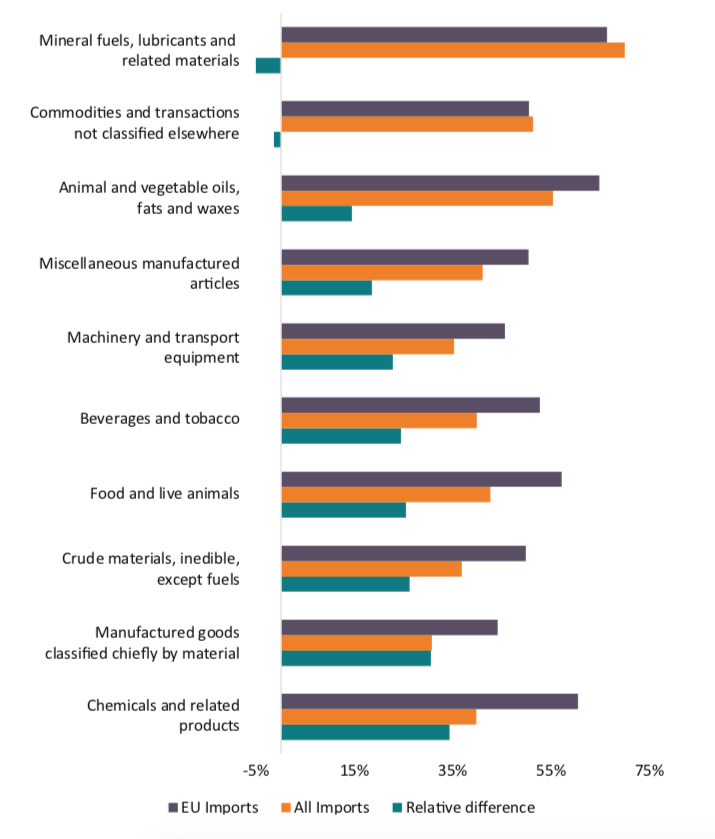

At the level of specific products, Figure 3.3. shows that, mineral fuels, agricultural products, and chemicals were the economic sectors where four EU member states capture a larger share of intra-EU imports. On the other hand, machinery and transport equipment, and manufactured goods show the lowest level of market concentration of intra-EU imports. Similar to Figure 3.2., import diversification is indicated by the grey bar. Chemicals, manufactured goods, and crude materials are the economic sectors where diversification increased the most after opening up to trade with the rest of the world. In contrast, mineral fuels, and commodities gained the least in terms of diversification. In commodities, and mineral fuels, the EU trading with the rest of the world actually increases the market share of the top four suppliers. This is because the top suppliers of total imports of these kinds of products, such as Russia or the US, have a higher share of EU total imports than the top EU suppliers of intra-EU imports on these products. This is expected as these products are supplied by a handful of countries and most EU countries simply lack these raw materials.

Figure 3.3: Market Share of the Four Largest Suppliers of Imports by Economic Sector (2019) Source: COMEXT Eurostat, authors’ calculations. SITC nomenclature.

Source: COMEXT Eurostat, authors’ calculations. SITC nomenclature.

3.2. Europe’s Vulnerability on Essential Products

Not all products are equally important when there is a crisis. It may be acceptable to EU policy-makers concerned about EU’s dependency on foreign producers that China and the UK capture 19% and 10% respectively of extra-EU imports if there is sufficient domestic production within the EU or in certain agricultural products or low-value manufacturing goods which can be substituted by other products relatively easily.

In the case of essential products, however, there is space for additional discussion. But this discussion should be anchored in facts and figures. Our analysis of the EU’s vulnerability on essential products is based on a list of 118 Covid-19 medical supplies published by Eurostat[12] and the corresponding data on intra and extra-EU trade.

Following the same logic as before, if the EU wants to diversify its sources of supply for vital goods, it should not concentrate too much production within the EU as, in the case of a pandemic, EU member states are likely to close their factories at the same time. Fortunately, the market concentration of the four largest suppliers fell from 70% to 60% when imports of Covid-19 related goods from the rest of the world were taken into account. It is important to note that one of the main drivers for this fall in market share after opening up to trade comes from trading with the UK rather than China or India. With regard to protective garments – one of the product categories for which shortages were more acute – intra-EU trade represents 42% of all EU imports whilst the largest non-EU importers were China, UK, and US accounting for 19%, 4%, 3% of EU total imports of these products respectively.

There was not a single Covid-19 related product that was solely imported from one EU or non-EU country. Moreover, Figure 3.4. shows that there were no Covid-19 related products from which a non-EU country captured more than 80% of all EU imports. Furthermore, there was not a single product for which the EU has a market share lower than 20%. This is important as it indicates that the EU has the know-how to produce all Covid-19 related medical products. This know-how can be used to ramp up production if foreign suppliers decide to stop trading these goods. Moreover, EU imports of Covid-19 medical goods were well-diversified. On average, Covid-19 goods were supplied from 46 countries – EU and non-EU countries – and the Covid-19 product supplied from the fewer number of countries was imported from 32 different countries.

Figure 3.4: Market Share of EU and Non-EU countries of COVID-19 Imports of Medical Supplies into the EU (2019) Source: COMEXT Eurostat, authors’ calculations.

Source: COMEXT Eurostat, authors’ calculations.

[1] For a more detailed discussion on standards as a policy tool to fight a pandemic see Guinea, O. (2020). The Right Kind of Standard to Fight a Pandemic. ECIPE, Brussels.

[2] For a more detailed discussion on import tariffs of medical products see Guinea, O., & Monterosa, I. (2020). Trade Policy and the Fight Against Coronavirus. ECIPE, Brussels.

[3] For a more detailed discussion on an international agreement to encourage the liberalisation of tariffs and non-tariff barriers in medical products see Guinea, O. (2020). A Global Agreement on Medical Equipment and Supplies to fight COVID-19. ECIPE, Brussels.

[4] For a more detailed discussion on the diversification of EU value chains and the role of SMEs see Cernat L., & Guinea, O. (2020). On ants, dinosaurs, and how to survive a trade apocalypse. ECIPE, Brussels.

[5] The large number of products that Luxembourg only imports from the EU can be explained by the extensive share that intra-EU trade represents over Luxembourg’s total trade. As a small economy surrounded by EU countries, intra-EU trade was equal to 80% of Luxembourg’s total trade. The highest share across the EU. Retrieved from https://ec.europa.eu/eurostat/statistics-explained/index.php?oldid=452727

[6] Quasi-transit is defined by Eurostat as the operation when goods are imported by non-residents into the reporting economy from outside the EU and subsequently dispatched to another Member State.

[7] Lemmers, O., & Wong, K. F. (2019). Distinguishing between imports for domestic use and for re-exports: A novel method illustrated for the Netherlands. ESCoE Conference on Economic Measurement.

[8] These products, however, represent just 3% of the value of EU total imports.

[9] The EU published an action plan on critical raw materials on the 3rd of September 2020. The plan points out a number of tools – from recycling to diversifying sources of supply – to increase the number of available suppliers of critical raw materials.

[10] The calculations do not include domestic production. If we were to include domestic production, e.g. the value of goods that French companies sell within France as part of our calculation of market concentration, the market share captured by EU member states in each EU country would have been significantly higher.

[11] These market concentration indexes are the Herfindahl-Hirschman Index (HHI) and the market share of the two (C2), four (C4), and ten (C10) largest suppliers. The appendix accompanying this publication includes the market concentration indexes on intra-EU imports and total imports for each EU member state.

[12] The list of Covid-19 medical supplies produced by Eurostat can be found at https://ec.europa.eu/eurostat/documents/6842948/11003521/Corona+related+products+by+categories.pdf.

4. Conclusion

Covid-19 has shaken the long-held belief that globalisation is a force for good. Some EU leaders – shocked by Europe’s perceived inability to produce the medical goods needed during the pandemic – want to reduce Europe’s dependency on the rest of the world and are actively arguing in favor of the re-shoring of certain economic activities.

These arguments are not supported by the evidence:

1. Faced with the challenge of Covid-19, most countries have actively opened their markets. Not just by lowering tariffs but also by amending their national regulations to facilitate imports. Although some countries – including within the EU – made exports of medical goods more restrictive, many of these restrictions backfired and were reversed. Between January and July 2020, there were more active trade liberalization measures than restrictive ones.

2. Despite all the difficulties, global value chains have delivered. Globalisation has been a great help for EU countries as they could count on the industrial capacity of the rest of the world. For example, the EU bought 40% of its Covid-19 test kits and diagnostic reagents from outside the EU. External imports of medical goods, from gloves, and face masks to hydroalcoholic gel and thermometers, increased dramatically. These imports from non-EU countries complemented the EU internal market. For instance, while intra-EU imports of hydroalcoholic gel increased by 14%, extra-EU imports of the same product grew by 45%.

3. Extra-EU imports are a source of strength as they support the diversification of EU imports. This diversification is fundamental when facing a symmetric shock. Events like pandemics, plagues, or a nuclear disaster are more likely to hit EU countries simultaneously because EU member states share the same geographical location and their economies are highly integrated. The answer to a symmetric shock, therefore, should not be to concentrate more production within Europe. That’s the opposite of diversification.

4. All EU member states saw an increase in import diversification once imports from outside the EU were taken into account. Even though there were 112 products for which the four largest suppliers were non-EU countries, these products represent 1.2% of the value of EU total imports and do not belong to any product category related to essential medical goods needed to treat Covid-19. In fact, the EU already imports Covid-19 related goods from 46 different countries. Therefore, the re-shoring of economic activities cannot be justified on the grounds of improving resilience.

References

Benedito, I. (2020, June 14). Así es el plan de Vittorio Colao para reactivar la economía italiana. Expansión, Retrieved from https://www.expansion.com

Berden, K., & Guinea, O. (2020). Trade policy and COVID-19: Openness and cooperation in times of a pandemic. ECIPE, Brussels.

Bollyky, T., & Bown, C. (2020, September/October). The Tragedy of Vaccine Nationalism. Only Cooperation Can End the Pandemic. Foreign Affairs, Retrieved from https://www.foreignaffairs.com

Bradsher, K. (2020, April 11). China Delays Mask and Ventilator Exports After Quality Complaints. The New York Times, Retrieved from https://www.nytimes.com

Brunsden, J., & Peel, M. (2020, April 20). Covid-19 exposes EU’s reliance on drug imports. Financial Times, Retrieved from https://www.ft.com

Cernat, L., & Guinea, O. (2020). On ants, dinosaurs, and how to survive a trade apocalypse. ECIPE, Brussels.

DG Trade, European Commission (2020). A renewed trade policy for a stronger Europe. Consultation Note, European Commission, Brussels.

Erixon, F., & Guinea, O. (2020). Key Trade Data Points on the EU27 Pharmaceutical Supply Chain. ECIPE, Brussels.

Erman, M., & Banerjee, A. (2020, May 19). Trump administration signs up new company to make COVID-19 drugs in U.S. Reuters, Retrieved from https://www.reuters.com

European Commission (2020). Survey on the Pharmaceutical Strategy – Timely patient access to affordable medicines.

European Commission (2020, September 16). State of the Union Address by President von der Leyen at the European Parliament Plenary, 16 September 2020. European Commission, Retrieved from https://ec.europa.eu

European Commission (2020, June 10). For a united, resilient and sovereign Europe. European Commission, Retrieved from https://ec.europa.eu

European Commission (2020, June 12). Commissioner Breton introductory remarks at Competitiveness Council on the Recovery Plan, 12 June 2020. European Commission, Retrieved from https://ec.europa.eu

European Commission (2020, May 14). Intro remarks by Commissioner Phil Hogan at Second G20 Extraordinary Trade and Investment Ministers Meeting on COVID-19, 14 May 2020. European Commission, Retrieved from https://ec.europa.eu

European Commission (2020, May 26). Coronavirus: Requirement for export authorisation for personal protective equipment comes to its end. European Commission, Retrieved from https://trade.ec.europa.eu

European Safety Federation (2020, July 14). Exceptions to the conformity assessment rules for PPE. European Safety Federation, Retrieved from https://eu-esf.org

Eurostat (2020). HS/CN8 classification reference list for dataset EU trade since 2015 of COVID-19 medical supplies. Eurostat.

FDA (2020). Emergency Use Authorizations for Medical Devices. FDA, Retrieved from https://www.fda.gov

Guinea, O. (2020). A Global Agreement on Medical Equipment and Supplies to fight COVID-19. ECIPE, Brussels.

Guinea, O. (2020). The Right Kind of Standard to Fight a Pandemic. ECIPE, Brussels.

Guinea, O., & Monterosa, I. (2020). A Global Effort to Win the War Against COVID-19. ECIPE, Brussels.

Guinea, O., & Monterosa, I. (2020). Trade Policy and the Fight Against Coronavirus. ECIPE, Brussels.

Hanke Vela, J. (2020, July 4). Coronavirus won’t kill globalisation, but will clip its wings. Politico, Retrieved from https://www.politico.eu

Horobin, W., & Fujikoa, T. (2020, February 22). Globalisation Comes Under Fire Amid Coronavirus ‘Stress Test’. Bloomberg, Retrieved from https://www.bloomberg.com

Lemmers, O., & Wong, K. F. (2019). Distinguishing between imports for domestic use and for re-exports: A novel method illustrated for the Netherlands. ESCoE Conference on Economic Measurement.

Mallet, V. (2020, September 9). French trade minister warns UK on Brexit level playing field. Financial Times, Retrieved from https://www.ft.com

OECD (2020). Shocks, risks, and global value chains: insights from the OECD METRO model. OECD, Paris.

OECD (2020). Trade interdependencies in Covid-19 goods. OECD, Paris.

Rose, M., & Kar-Gupta, S. (2020, June 14). France must seek greater economic independence after virus, says Macron. Reuters, Retrieved from https://www.reuters.com

WTO (2020). Standards, Regulation and COVID-19. What Actions Taken by WTO members? WTO, Geneva.