The External Side of Europe’s Great Economic Transformation: International Trade in Services

Published By: Lucian Cernat Carmen Díaz Mora Oscar Guinea

Research Areas: European Union Services

Summary

Europe’s digital transition is starting to bear fruits. Europe’s economic landscape is becoming increasingly digital, with sectors like information and communication technology (ICT) capturing a growing share of EU GDP. This Policy Brief examines the impact of these economic shifts on Europe’s trade profile and the policies that the EU can pursue to support this transformation.

Disclaimer: the views expressed herein are those of the author and do not represent an official position of the European Commission.

1. Introduction

Once upon a time the service sector was perceived as a burden on economic growth. Policymakers viewed it with scepticism, and some economists even labelled services as a disease to be fought[1]. Service sector jobs were associated with lower wages and productivity compared to those in manufacturing, which was seen as the engine of technological advancement and well-paid employment. However, this perspective began to shift with the emergence of digital technologies.

Nowadays, the service sector has become a key driver of innovation, fostering the development of new technologies that propel productivity growth and economic prosperity. These digital innovations, delivered as software, apps, or dedicated websites, are experiencing unprecedented rates of adoption. For instance, ChatGPT achieved 100 million users in just three months[2], faster than any previous technology.

Digital technologies have also enhanced the productivity of the service sector itself. Evidence from some EU countries demonstrates that productivity in sectors like information services, business services, and distribution now surpasses that of manufacturing[3]. Another sign of the growing importance of services is the increasing role of intangible capital such as software, data, intellectual property rights, or business models. In 2022, investment in intangible capital in Austria, Germany, Spain, Finland, France, Italy, Luxembourg, Netherlands, and Portugal accounted for 17 percent of Gross Value Added (GVA), exceeding the 13 percent invested in tangible assets[4].

This Policy Brief explores an understudied aspect of the EU’s economic transformation: the evolving pattern of international trade towards services. As digital services become a more important part of the EU economy, the pattern of EU’s international trade is changing as well, becoming more digital and service oriented too. This presents a two-fold opportunity: international markets offer a growing demand for EU service providers, while also expanding the pool of potential suppliers for services.

The following section of this Policy Brief provides evidence that underscores Europe’s evolving comparative advantage in services trade. Section 3 delves deeper, examining the EU’s information and communication technology (ICT) sector as a case study that exemplifies Europe’s transformation towards service trade. The concluding section explores policy options for the EU to further support this development.

[1] William Baumol and William Bowen pioneered the concept that service industries are inherently less productive than manufacturing. This stems from the limited capacity of many service activities to leverage new technologies for significant productivity gains. Consequently, as economies transition to post-industrial structures with a growing service sector, overall productivity growth was bound to decline. This phenomenon is known as Baumol’s disease.

[2] Wodecki, B. (2023, February 3). UBS: ChatGPT May Be the Fastest Growing App of All Time. AI Business, Retrieved from https://aibusiness.com/

[3] van der Marel, E., Erixon, F., Guinea, O., & Lamprecht, P. (2020). Are Services Sick. How Going Digital Can Cure Services Performance. Global Economic Dynamics, Bertelsmann Stiftung Report.

[4] Erixon, F., Guinea, O. & du Roy, O. (2024). Keeping Up with the US: Why Europe’s Productivity Is Falling Behind. Report, ECIPE, Brussels, Policy Brief 9/2024.

2. Europe’s Changing Comparative Advantage

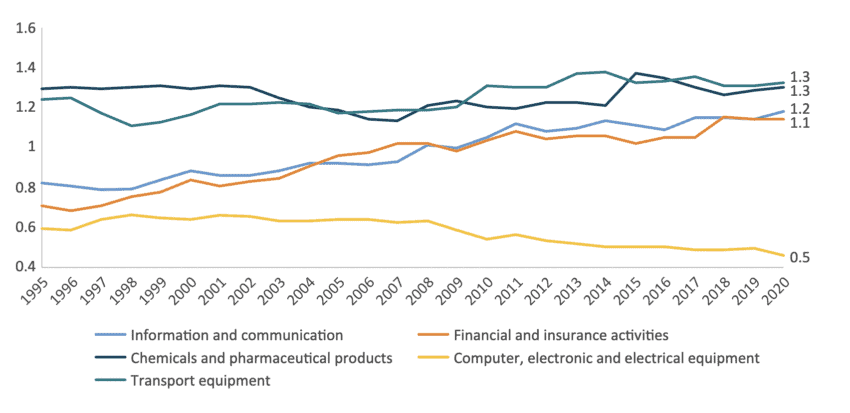

EU’s Revealed Comparative Advantage (RCA)[1] for a selection of sectors. This index, which assesses a country’s export performance relative to the global average, provides a measure of competitive strength. The figure reveals that EU services such as the ICT sector and the financial and insurance sector have moved from a position of comparative disadvantage to one of comparative advantage.

Figure 1: Shifts in the EU’s revealed comparative advantage across economic sectors (1995-2020) Source: Erixon et al. 2024

Source: Erixon et al. 2024

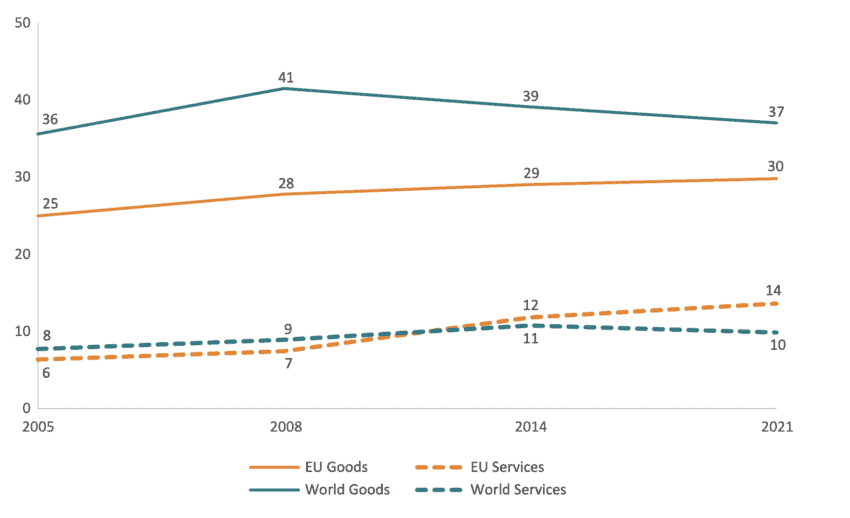

These developments represent positive news for the EU, as its export portfolio is shifting towards the most dynamic part of the global economy. While discussions regarding the potential decline of globalisation have been ongoing, the Figure below offers some key additional insights. It reveals that the ratio of trade in goods to GDP has stagnated since 2008. In contrast, the ratio of trade in services to GDP has exhibited continued growth, particularly for the EU, where it has increased from 6 percent in 2005 to 14 percent in 2021. This suggests that globalisation is becoming more immaterial, less physical and more digital (van der Marel, 2020; Blázquez et al., 2023); a new scenario where competitiveness in digital trade in services is crucial for global competitiveness.

Figure 2: World and EU trade openness in goods and services (2005-2021) Source: Author’s calculations based on data from Eurostat, WTO and IMF.

Source: Author’s calculations based on data from Eurostat, WTO and IMF.

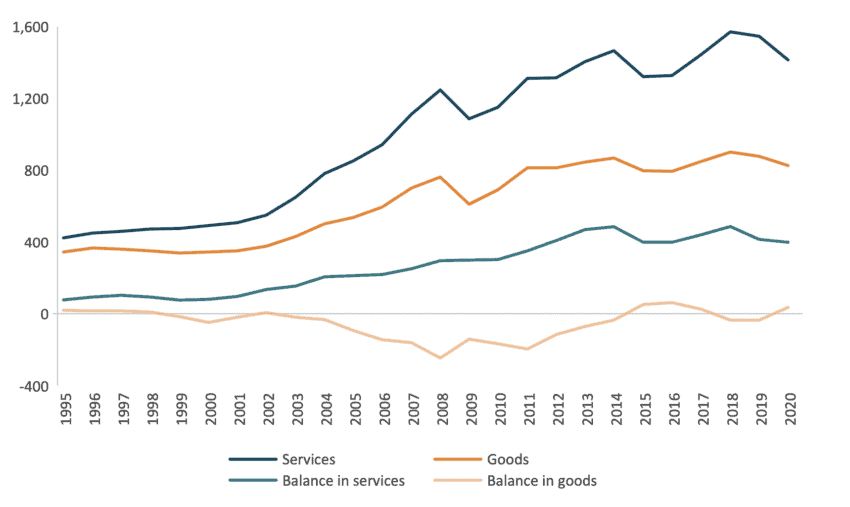

Trade in services includes not only final services but also intermediate services. Similar to the trend observed in manufacturing, these intermediate services are becoming increasingly integrated into larger supply chains. Figure 3 presents the OECD’s Trade in Value Added (TIVA) indicator “domestic value added embodied in foreign final demand.” This indicator quantifies the value-added that European companies export directly through their final goods and services, as well as indirectly through exports of intermediate services that are ultimately incorporated into final products consumed abroad[2].

Figure 3 underscores two key findings. First, when measured in terms of value-added, the EU’s exports of services now surpass those of goods[3]. Notably, while both categories exhibited similar value in 1995, EU services exports have grown by a factor of 3.3 over the past 25 years, compared to a 2.4-fold increase for EU goods exports during the same period. Second, the value-added trade balance, calculated as the difference between domestic value-added embodied in foreign final demand (value-added exports) and foreign value-added in domestic final demand (value-added imports), shows a positive and increasing trend for services.

Figure 3: EU value-added exports and trade balance in goods and services (1995-2020, billion USD) Source: Author’s calculations based on data from OECD TiVA. Current prices.

Source: Author’s calculations based on data from OECD TiVA. Current prices.

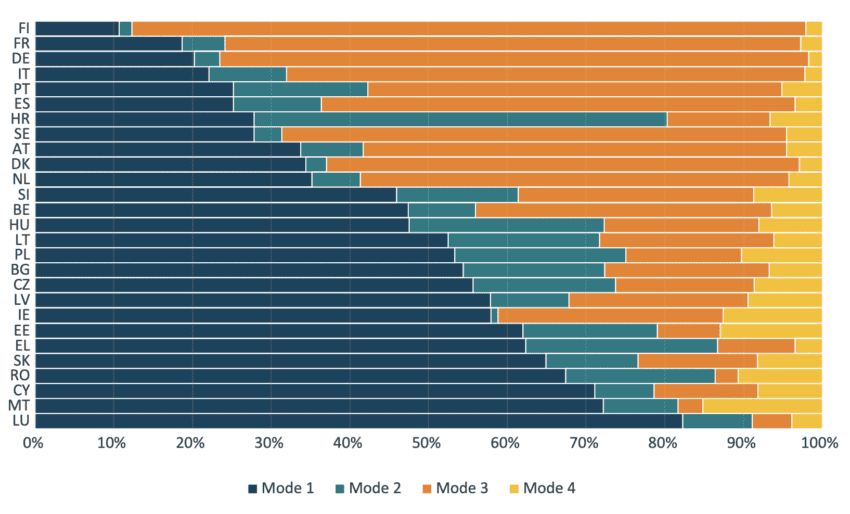

While services trade is crucial for all EU Member States, behind these EU aggregate trade figures, there are major differences with regard to how these services are delivered. In international trade jargon, services can be traded in four modes of supply. Mode 1 refers to cross-border supply of services. This mode typically covers digital services trade and international transport such as shipping or air transport. Mode 2 captures consumption abroad which primarily includes international tourism activities. Mode 3 refers to the delivery of services to foreign customers through the presence of a business office or a subsidiary, abroad. Finally, Mode 4 refers to the temporary movement of people into a foreign country to deliver a specific service.

Figure 4 reveals that Mode 1, cross-border supply, is the dominant mode of service delivery in most EU countries. This trend has been significantly accelerated by the COVID-19 pandemic. Between 2019 and 2022, digital trade in services (Mode 1) surged by 40 percent. Conversely, services reliant on physical movement (Modes 2 and 4) saw a substantial decline[4]. Mode 4, temporary movement of service providers, experienced a particularly sharp 60 percent decrease during this period. This shift is largely driven by a technological transformation, as the internet facilitates the delivery of various service categories through Mode 1 rather than through the movement of people (Mode 2 and 4).

Figure 4: Services exports by modes of supply across EU member states Source: Author’s calculations based on data from Eurostat.

Source: Author’s calculations based on data from Eurostat.

[1] An RCA value greater than 1 indicates that the country is relatively more efficient or competitive in producing a particular sector compared to the average world performance. Conversely, a value less than 1 indicates a comparative disadvantage in that specific sector.

[2] This indicator computes the value-added that originates within the EU services or good sector and that is later consumed outside the EU by consumers and firms independently on whether the product is exported as a service or as a good.

[3] The value of EU services embedded into EU goods exported abroad, also known as Mode 5, was computed as part of EU total services exports.

[4] Cernat, L. (2024). The big shift in global trade in services: a tale of five modes of supply. ECIPE Blog. May 2024. Retrieved from https://ecipe.org/blog/the-big-shift-in-global-trade-in-services-a-tale-of-five-modes-of-supply/

3. A Case Study of EU’s Changing Comparative Advantage: ICT

If there is a European service sector that has shown a robust export performance, that is ICT. Between 2010 and 2020, EU exports of ICT services achieved a remarkable average annual growth rate of 8.5 percent. This increase significantly outpaced the growth rates observed in other EU export sectors, such as chemicals (2 percent), machinery (1.4 percent), and transport equipment (1.4 percent)[1].

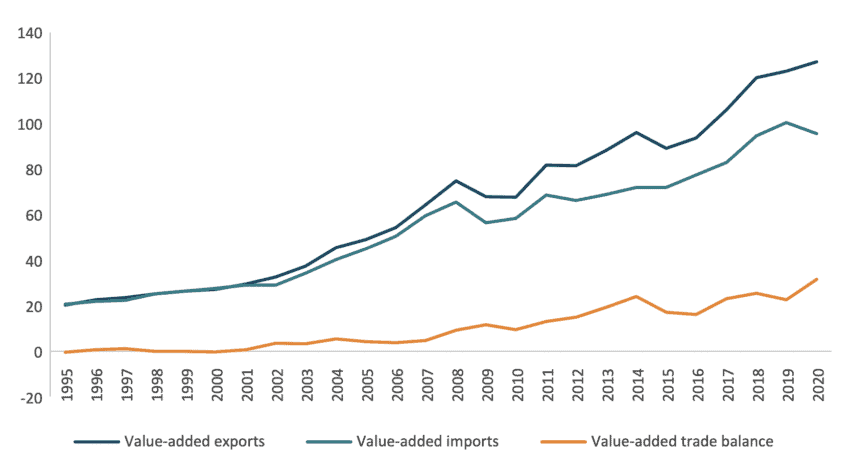

The EU has achieved a consistent and growing value-added trade surplus in ICT since the turn of the century. In 2020, EU ICT value-added exports surpassed imports by a significant margin, exceeding them by 33 percent. This statistic may be surprising given the perception of the EU as a net importer of ICT services. However, the absence of a globally recognised European ICT company does not diminish the success of the EU’s ICT industry. The ICT sector encompasses a broad range of sub-sectors, and European companies are leaders in multiple areas such as cellular technology or industry software.

Figure 5: EU value-added exports, imports and trade balance in ICT services (1995-2020, billion USD) Source: Author’s calculations based on data from OECD TiVA. Current prices.

Source: Author’s calculations based on data from OECD TiVA. Current prices.

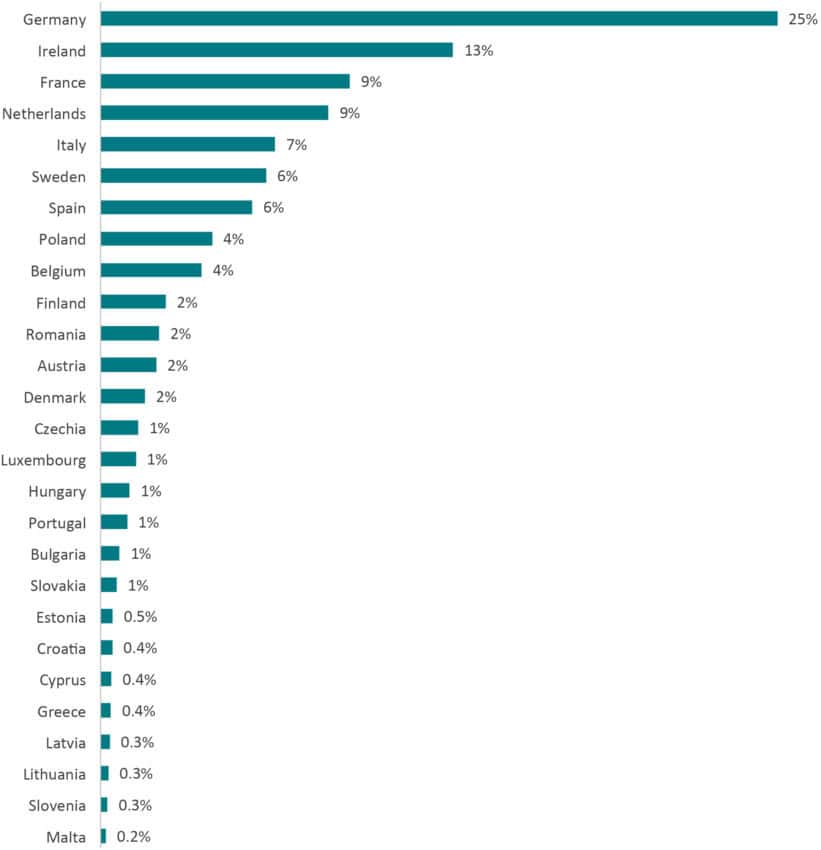

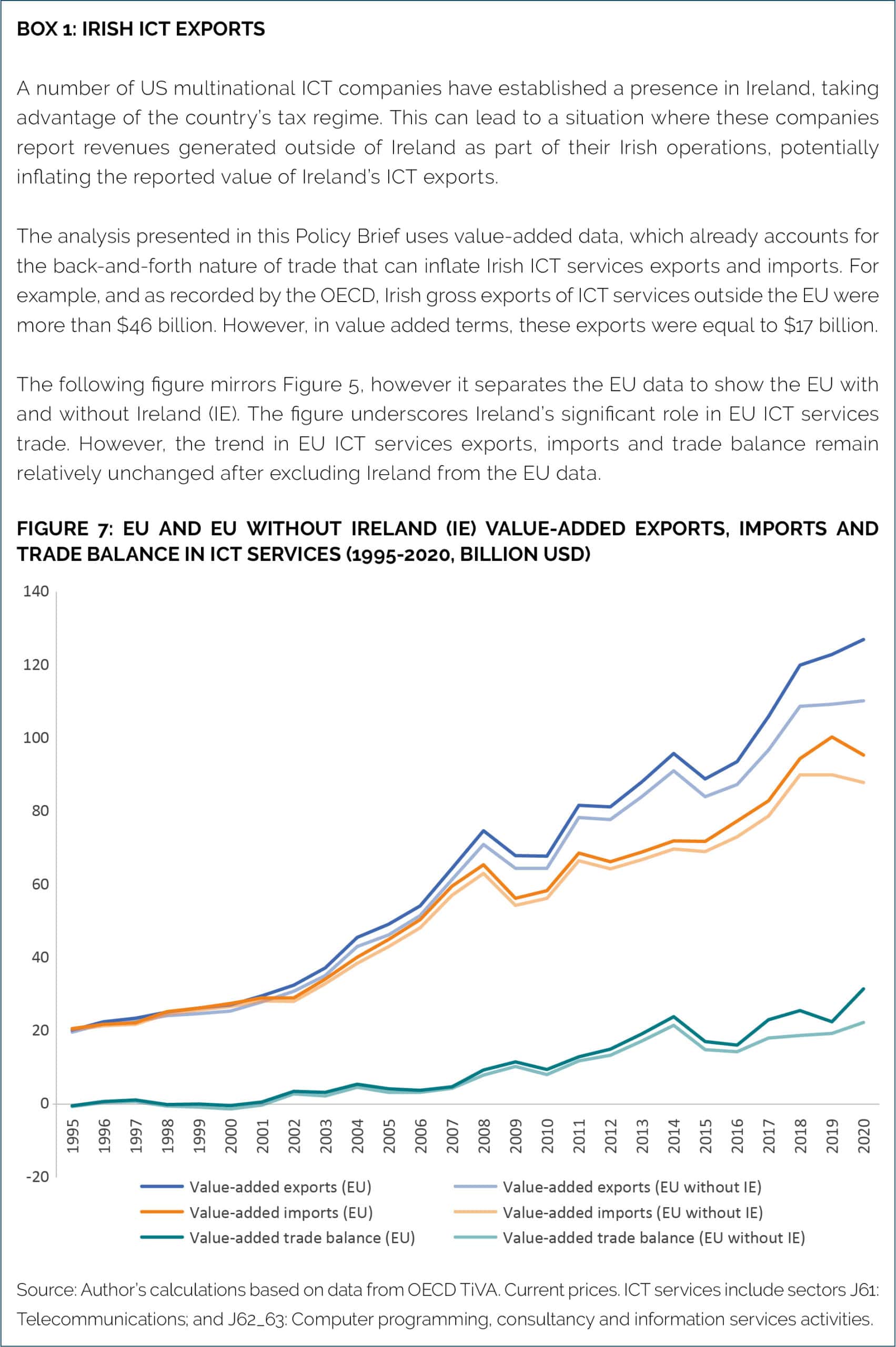

Four EU member states – Germany, Ireland, France, and the Netherlands – collectively account for more than half of the EU’s value-added exports in ICT services. Despite this concentration, a positive trade balance in ICT value-added trade is a common feature for most EU countries. The Netherlands, Germany, and Ireland boast the highest surpluses, at $4.6 billion, $8.7 billion, and $9.2 billion, respectively, while Austria, Denmark, France, Greece and Slovenia present trade deficits. It is worth noting that Ireland’s case is unique due to the presence of a significant number of large US ICT companies headquartered there. However, even excluding Ireland’s data, the EU maintains a substantial ICT services trade surplus of $22 billion (See Box 1).

Figure 6: Share in EU ICT services value-added exports by EU member state (2020) Source: Author’s calculations based on data from OECD TiVA.

Source: Author’s calculations based on data from OECD TiVA.

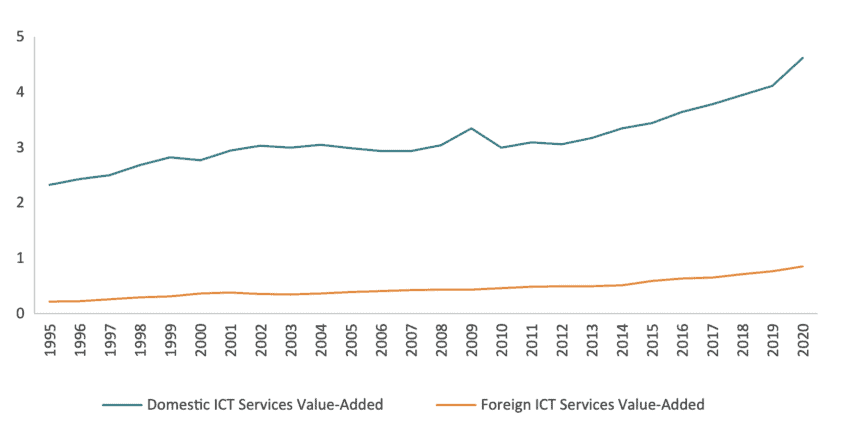

Finally, a thriving trade in ICT services is critical for Europe’s competitiveness. Research suggests that a doubling of foreign ICT services within manufacturing exports can lead to a significant increase in manufacturing competitiveness, measured by a revealed comparative advantage index using trade in value-added, by around 15 percent[2]. Figure 8 illustrates the rising contribution of both EU and foreign value-added from ICT services to the EU’s total exports of goods and services. In 2020, EU and foreign ICT services accounted for 4.6 and 0.9 percent, respectively, of the EU’s gross exports.

Figure 8: Share of domestic and foreign ICT services value-added in EU gross exports (1995-2020, %) Source: own elaboration from TiVA database

Source: own elaboration from TiVA database

[1] Erixon, F., Guinea, O., Lamprecht, P., du Roy, O., Sisto, E., & Zilli, R. (2024). Trading Up: An EU Trade Policy for Better Market Access and Resilient Sourcing. Report, ECIPE, Brussels, Policy Brief 8/2024.

[2] Blázquez, L., Díaz-Mora, C., & González-Díaz, B. (2020). The role of services content for manufacturing competitiveness: A network analysis. Plos one, 15(1), e0226411. https://doi.org/10.1371/journal.pone.0226411

4. Policy Recommendations to Support EU Trade in Services

Trade rules can be shaped in several ways to promote trade in services. The main trade policy instruments used to promote services trade were bilateral free trade agreements and plurilateral trade negotiations, combined with trade facilitation measures in the WTO context (such as the e-commerce moratorium). This approach will continue to remain part of the mainstream trade policymaking. However, more could be done.

One approach involves unilateral reform, where countries independently implement changes that benefit service providers. Recognising the increasing interconnectedness between services and goods, rather than focussing almost exclusively on manufacturing, would be an important element in any policy mix involving trade and industrial policies. Many countries are undertaking domestic reforms that establish trade rules that promote technological progress via domestic reforms. These reforms often target areas like customs regulations and indirect taxation. For example, some developing countries are considering adopting duty drawback mechanisms for services. The European Union already offers various options under the European Union Customs Code (EUCC) to address the treatment of embedded services within exported goods. Article 259 of the EUCC, for instance, outlines the outward processing regime, which allows EU-embedded software to be exempt from import duties when incorporated into processed products traded under this specific customs procedure.

A second option is to bolster bilateral cooperation on trade and technology with key partners. The rapid pace of technological development consistently outpaces the process of trade rule making. However, national regulators in critical areas like cybersecurity, artificial intelligence, data protection, product standardisation, or consumer safety will inevitably establish new regulations. Proactive regulatory cooperation with key partners offers a promising avenue to prevent future trade barriers by establishing common ground before domestic regulations are implemented. This is particularly crucial for the services sector, where entrenched regulations make dismantling trade barriers inherently more challenging compared to goods.

A promising policy priority, with the potential for concrete outcomes, is to ensure that trade “mini-deals” (Mutual Recognition Agreements, Memoranda of Understanding, etc.) adequately address potential regulatory fragmentation. Recent surveys support the case for mini-deals in areas where disparate domestic regulations emerge across the globe. The digital arena, which includes standards, cybersecurity, 5G, e-invoice interoperability, and other facets of the digital transformation, is witnessing significant regulatory developments not only within the EU, but also amongst many of its key trading partners. If regulators around the world think in isolation, this new regulations will create a new set of trade challenges for new non-tariff barriers affecting services trade. At the same time, these new developments clearly illustrate the need for stronger global regulatory cooperation, that is best framed by the kind of formal arrangements offered by mini-deals.

The third option is regulatory cooperation on trade and technology in a multilateral setting that breaks the legal silos of various WTO treaties and adopts good practices from one trade area to another. The WTO’s well-established system for addressing technical barriers to trade in goods serves as a successful model. A similar dialogue and cooperation between WTO members can be further promoted in the area of services. Identifying such good practices, improving transparency as part of the work in the regular WTO councils and committees could reinforce the effectiveness of WTO rules. WTO members could also try to modernise certain specific trade provisions at the interface between various treaties (GATT, GATS, the Customs Valuation Agreement, etc) that potentially hamper the adoption of such new technologies along global supply chains.

References

Antimiani, A., & Cernat, L. (2018). Liberalizing global trade in mode 5 services: How much is it worth?. Journal of World Trade, 52(1).

Bauer, M., Pandya, D. and du Roy, O. (2024): Openness as Strength: The Win-Win in EU-US Digital Services Trade, ECIPE Policy Brief 05/2024.

Baumol, W. J. (1967). Macroeconomics of unbalanced growth: the anatomy of urban crisis. The American economic review, 415-426.

Baumol, W. J., & Bowen, W. G. (1965). On the performing arts: The anatomy of their economic problems. The American economic review, 55(1/2), 495-502.

Blázquez, L., Díaz-Mora, C., & González-Díaz, B. (2020). The role of services content for manufacturing competitiveness: A network analysis. Plos one, 15(1), e0226411. https://doi.org/10.1371/journal.pone.0226411

Blázquez, L., Díaz-Mora, C., & González-Díaz, B. (2023). Slowbalisation or a “New” type of GVC participation? The role of digital services. Journal of Industrial and Business Economics, 50(1), 121-147. https://doi.org/10.1007/s40812-022-00245-x.

Cernat, L. (2020). Trade policy reflections beyond the covid-19 outbreak. Chief Economist Notes Series, DG TRADE, (2).

Cernat, L. (2021). We Need to Talk Trade and Technology!. ECIPE Policy Brief 08/2021.

Cernat, L. (2023a) The Art of the Mini-Deals: The Invisible Part of EU Trade Policy. ECIPE Policy Brief 11/2023.

Cernat, L. (2023b) How valuable is WTO transparency: the 15 trillion dollar question. ECIPE Blog. June 2023.

Cernat, L. (2024). The big shift in global trade in services: a tale of five modes of supply. ECIPE Blog. May 2024.

Cernat, L. and Kutlina- Dimitrova, Z. (2014). Thinking in a box: A ‘mode 5’ approach to service trade. DG TRADE Chief Economist Notes 2014- 1, Directorate General for Trade, European Commission.

Erixon, F., Guinea, O. & du Roy, O. (2024). Keeping Up with the US: Why Europe’s Productivity Is Falling Behind. Report, ECIPE, Brussels, Policy Brief 9/2024.

Erixon, F., Guinea, O., Lamprecht, P., du Roy, O., Sisto, E., & Zilli, R. (2024). Trading Up: An EU Trade Policy for Better Market Access and Resilient Sourcing. Report, ECIPE, Brussels, Policy Brief 8/2024.

Van der Marel, E. (2020). Globalization isn’t in decline: It’s changing. Report, ECIPE, Brussels, Policy Brief 6/2020.

van der Marel, E., Erixon, F., Guinea, O., & Lamprecht, P. (2020). Are Services Sick. How Going Digital Can Cure Services Performance. Global Economic Dynamics, Bertelsmann Stiftung Report.

Wodecki, B. (2023, February 3). UBS: ChatGPT May Be the Fastest Growing App of All Time. AI Business, Retrieved from https://aibusiness.com/