The Economic Dividend of Competitiveness

Published By: Fredrik Erixon Oscar Guinea Philipp Lamprecht Elena Sisto Erik van der Marel

Subjects: European Union

Summary

In a world of technological and economic rivalry, the EU must devote increased attention to its competitiveness. Higher levels of competitiveness will help the EU build a more prosperous economy which will in turn produce innovation and resources to address the great challenges of our time.

ECIPE published a study presenting a competitiveness compass with concrete policy recommendations that will improve EU’s competitiveness. These policy recommendations, once implemented, will bring tangible benefits to the EU economy in the form of higher levels of trade and productivity. This report presents five scenarios in which the EU pursues competitiveness policies that lead to higher economic growth.

- Dynamic markets: markets with a significant number of competitors and low market barriers are more likely to deliver new innovation and ultimately productivity growth. Achieving the policies set out in this scenario would increase EU GDP by 1.2 percent.

- A thriving services industry: a growing number of technologies will be developed outside the EU and will be transferred through services, making trade in services a crucial input for EU competitiveness. Achieving the policies set out in this scenario would increase EU GDP by 0.3 percent.

- Openness to digital trade: many of the latest and most promising technologies will have digital inputs or will be delivered through the Internet. Therefore, the growth of the digital economy will be a prime force for new patterns of productivity and trade. Achieving the policies set out in this scenario would increase EU GDP by 0.1 percent.

- A globally integrated economy: supporting global free trade is essential for raising competitiveness. Access to cheaper inputs and more customers abroad make firms more competitive and economies more specialised. Achieving the policies set out in this scenario would increase EU GDP by 1.1 percent.

- A knowledge-based economy: innovation is at the heart of productivity growth and competitiveness. It creates new markets and increases economic efficiency while it supports knowledge spillovers that lead to higher economic growth. Achieving the policies set out in this scenario would increase EU GDP by 0.1 percent in the short-term and 0.3 percent in the long-term.

The combined effect of these five scenarios, which are not mutually exclusive, would lead to 2.95 percent increase in EU GDP, which is equivalent to 428 billion euros, comparable to half of the total funds allocated to the next generation EU recovery instrument and more than twice as much as what the EU currently spends on defence. Moreover, none of the benefits of pursuing these policy recommendations will come as a result of losses from non-EU countries. Increasing EU competitiveness will lead to higher levels of economic prosperity in the EU and the world.

This study was commissioned by the Confederation of Swedish Enterprise.

1. Introduction

The guiding principle and main contribution of this report can be summarised in the following quip: we can’t fix what we don’t measure. The compass to guide EU policy in support of business competitiveness (hereby referred to as the competitiveness compass), presented in a previous report[1], contained seven focus areas and 28 policy recommendations[2] to improve EU’s competitiveness. Acting on these recommendations will deliver economic dividends to the EU member states, which are estimated in this report.

The estimates of these economic benefits follow from actions taken under five of the seven focus areas presented in the competitiveness compass. These are:

- Enabling Resilient and Dynamic Markets: harnessing the growth potential in deepening the Single Market and fostering competition and flexibility in European markets, leading to good framework conditions for bottom-up firm growth.

- Supporting Global Free Trade: with many regions of the world growing faster than the EU, trade policy has an important role to open new markets and expand global trading opportunities for EU firms.

- Developing Innovation Capacity: harnessing European policy to boost innovation and making sure that the EU will be at the global frontier of current technological shifts.

- Accelerating the Digital Development: creating the conditions for faster digitalisation of the economy, better use of existing digital capacities and the development of new ones.

- Ensuring better regulation: improving the quality and predictability of regulation, and better transparency in the regulatory process.

Pursuing the policies described in the other focus areas of the competitiveness compass: addressing climate change and the energy transition; and improving infrastructure conditions will also have positive impacts on European competitiveness. However, due to data and methodological limitations, this report does not quantify the positive effects of the policy recommendations in these two focus areas.

Societies that enjoy a high degree of competitiveness show continuous innovation and a strong entrepreneurial spirit, flexible markets and substantial investments in education and knowledge. Given this mix of ingredients, competitiveness can feel like an ambiguous concept. However, it is a concept that has shaped much of EU policies over the years. Competitiveness can be measured using two proxy indicators: productivity and trade.

First, improving competitiveness means growing the level of productivity in the economy. Productivity growth is a fundamental prerequisite for increasing prosperity and it is based on a dynamic economy – an economy with good firm and labour churn, that adapts to new technologies and is quick to seize new business opportunities.

Second, competitiveness is about how firms and economies perform in an international context – or vis-à-vis other economies and firms in other regions. This is not a zero-sum game in which a country performs better by blackballing other countries. In fact, one country’s level of competitiveness is based on open conditions for cross-border exchange, technology, and competition. The ability of an economy to cooperate deeply with other economies has proven to be a remarkable good way of building up an autonomous potential for growth and prosperity.[3] Therefore, competitive economies thrive on the success in other regions: they imitate or learn from countries that are at the frontier of technological change, business development, and productivity growth so as to receive positive spill-overs that in turn translate in higher productivity growth.

This report uses productivity and trade as proxies for competitiveness. Therefore it measures the economic impact arising from progress in the policy recommendations set out in the competitiveness compass in these two variables. Progress in the policy recommendations is measured using indicators of policy reform. For example, the OECD Product Market Regulation (PMR) index, which measures regulatory barriers to firm entry and competition is used to track economic dynamism which features under the competitiveness compass focus area of Enabling dynamic and resilient markets.

This report offers a guide to policymakers in relation to the future economic gains that can be obtained from improving Europe’s competitiveness. The economic modelling estimates the relationship between changes in reforms of the policy recommendations as set out in the competitiveness compass and changes in competitiveness. The outcome of this relationship is used in an economy-wide model that measure the future economic benefits of pursuing these policies in EU’s Gross Domestic Product (GDP) and employment.

The next chapter describes the methodology used to quantify the impact. Appendixes I and II describe the methodology in more detail and provide additional outputs of the econometric and general equilibrium analysis. The final chapter presents the main findings of the economic modelling.

[1] Erixon, F., Guinea, O., Lamprecht, P., Sharma, V., Sisto, E., van der Marel, E. (2022). A Compass to Guide EU Policy in Support of Business Competitiveness. Report, ECIPE. Brussels, occ. Paper 6/2022, 82p.

[2] A summary of all the policy recommendations can be found in Annex III.

[3] See Jones, E. (2003). The European Miracle. Cambridge University Press; Angus Maddison, 1991, Dynamic Forces in Capitalist Development: A Long-Run Comparative View. Oxford University Press; Acemoglu, D., Johnson, S., & Robinson, J. (2005). The rise of Europe: Atlantic trade, institutional change, and economic growth. American economic review, 95(3), 546-579.

2. Methodology

The central hypothesis of our empirical work is that progress on the policy recommendations of the competitiveness compass will lead to higher competitiveness. To test and measure this hypothesis, the study follows a three-step methodology.

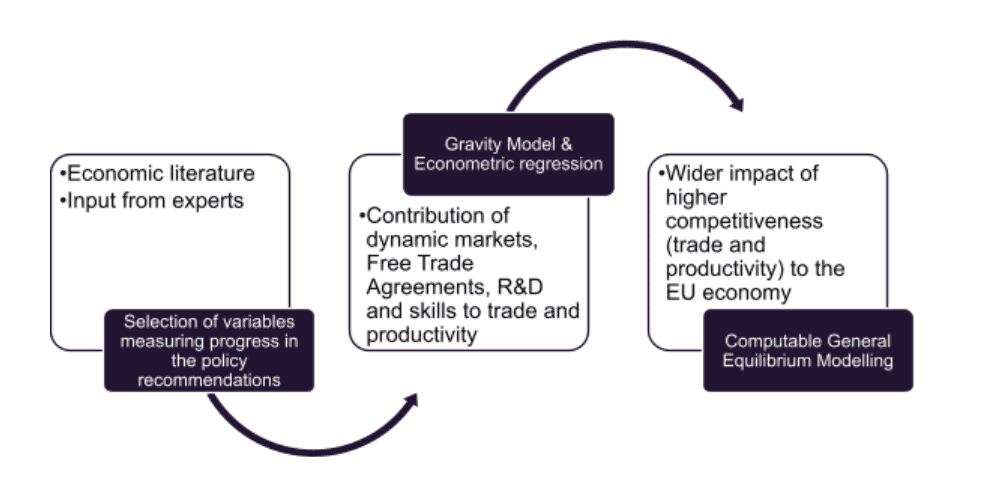

First, a selection of the indicators that measure progress in the policy recommendations is done following a revision of the economic literature and input from experts. Second, the gravity model – fully described in section 2.2 and in the Annex I – is used in an econometric regressions analysis to measure the extent to which these reform indicators explain changes in trade and productivity. Finally, a Computable General Equilibrium (CGE) model – also described in section 2.3 and in Annex II – translates the changes in trade and productivity from the gravity model into economy-wide impacts such as GDP and employment to predict the wider macro-economic implications arising from the policy reforms. Figure 1 summarises the methodology.

Figure 1: Summary of the Methodology Source: ECIPE.

Source: ECIPE.

2.1 Selection of Variables Measuring Progress in the Policy Recommendations

The first step of the methodology is to select the indicators that measure progress in the policy recommendations. These are:

- Product Market Regulation (PMR): index measuring regulatory barriers to firm entry and competition in a broad range of key policy areas produced by the OECD. It relates to focus areas enabling dynamic and resilient markets; and ensuring better regulation. It impacts competitiveness through trade.

- Service Trade Restrictiveness Index (STRI): index measuring regulatory barriers that restrict trade in services produced by the OECD. It relates to focus areas enabling dynamic and resilient markets; supporting global free trade; and developing innovation capacity. It impacts competitiveness through trade.

- Digital Services Trade Restrictiveness Index (DSTRI): index measuring cross-cutting barriers that affect services traded digitally produced by the OECD. It relates to focus areas enabling dynamic and resilient markets; supporting global free trade; and accelerating digital development. It impacts competitiveness through trade.

- Economic Integration Agreements (EIAs): a variable measuring the number of Economic Integration Agreements signed by countries published in the Regional Trade Agreements Database from Egger and Larch (2008). It relates to the focus area supporting global free trade. It impacts competitiveness through trade.

- R&D intensity: a variable measuring business expenditure in R&D over gross-value-added produced by the OECD. It relates to the focus area developing innovation capacity. It impacts competitiveness through productivity.

- Human capital: a variable measuring total number of researchers per thousand labour force produced by the OECD. It relates to the focus area developing innovation capacity. It impacts competitiveness through productivity.

2.2 Gravity Model and Economic Regression

The second step of the methodology is to calculate the relationship between the selected indicators and our proxy variables for competitiveness, which are productivity and trade. Gravity models and other economic regressions were used to estimate these relationships. A more detailed description of the estimation method is included in Annex I.

Gravity model

The gravity model provides a framework to econometrically test the impact of regulatory reform of the PMR, STRI, DSTRI and EIA on exports. The gravity model is one of the most widely used empirical models in the economic trade literature. It has been used to estimate the impact of economic size, distance, common language, geography and institutions on international trade. The gravity model is also suitable to measure the trade impacts resulting from policy reforms.

The OECD Trade in Value Added (TiVA) database, which includes international and intra-national trade, is used to populate the gravity model. The estimations are done following the most recent advancement in the trade literature on how to apply a structural gravity model and is performed using the PPML with fixed effects as recommended by Santos Silva and Tenreyro (2006) and Fally (2015). In addition, the estimates include pair-specific time-trend fixed effects in line with the recent literature on how to consistently estimate the effects of trade policy reforms on trade (see Piermartini and Yotov, 2016; Anderson and Yotov, 2016; Dai et al. 2014; Baier & Bergstrand, 2007).

Econometric regression

The relationship between R&D intensity, human capital and labour productivity is measured using a standard econometric regression. Through an interaction term, this empirical model estimates the effect of changes in R&D intensity at industry level and human capital endowments at country level, and the interaction between both variables on productivity. In addition, the model includes country, time, and industry fixed effects.

2.3 Computable General Equilibrium (CGE) Modelling

CGE models combine economic theory with real economic data to estimate the wider economic impacts of policy measures or external shocks in the economy. These models are regularly used by governments and research institutes around the world to understand ex-ante the impact and magnitude of economic events or policy changes. The economic impact of the policy shocks being modelled is estimated by comparing the economy before and after the shock. The model starts from an equilibrium to which the shock is applied. After the policy change is introduced, the economy adapts to the new circumstances until it reaches a new equilibrium.

The general equilibrium model simulation is conducted with a static comparative model: the standard GTAP Model built by the Global Trade Analysis Project (GTAP) at the University of Purdue. This model is widely applied in studies about impacts of trade policy. However, like any applied economic model, the model is based on a number of assumptions which simplify the complex policy framework governing the economy in reality. The results of the estimations therefore only have indicative character as should not be interpreted as economic forecast. A more detailed description of the CGE is included in Annex II.

Scenarios

The CGE model does not include the same variables that were used in the gravity model and the economic regressions. Therefore, it is necessary to translate the significant coefficients estimated in the second step of the methodology into variables that can be readily changed and compared in the CGE model. In the case of the PMR, STRI, DSTRI and EIA, this is done using ad valorem tariff equivalents (AVEs). AVEs can be interpreted as the change in trade barriers that will lead to the same change in trade as measured with the associated coefficients found for PMR, STRI, DSTRI, and EIA. These changes in trade barriers can be used in CGE modelling because the model contains a variable denoting such AVEs. A full explanation of the methodology used to calculate AVEs, including how the elasticities of substitutions are set, is included in Appendix I.

The calculation of AVEs requires to build a scenario. Each scenario is associated to a policy change which is described by a change on the indicator of policy reform that measures progress in the policy recommendations of the competitiveness compass. Table 1 presents an overview of each scenario. For simplicity, our scenarios assume a 30 percent fall in the PMR, STRI, and the DSTRI. These are realistic scenarios. For example, in 2021, the difference between the best performing OECD economy – i.e., with the lowest PMR – and the EU27 average was 40 percent. For the STRI, the EU27 average was 25 percent above the score of the leading economy. Finally, for the DSTRI, the EU DSTRI was more 50 percent higher than the US score. In the case of the EIA, the scenario assumes the signing of an additional economic integration agreement. The scenarios for PMR and EIA are applied to all EU trade. However, the scenarios for the STRI and the DSTRI are applied to the services and the digital services sectors respectively.

In the case of R&D intensity and human capital, our scenario assumes a goal of 5 percent of EU global R&D spending by the end of the decade, i.e., 2030. This is in line with the policy recommendation Mobilise resources on European R&D of the competitiveness compass. Increasing innovation capacity also aligns with policy priorities that place an emphasis on attracting individuals to participate in R&D. The 5 percent target represents an increase of 2.73 percentage points with respect to the current level of EU’s R&D spending relative to GDP. The results of the econometric regression indicate that a 10 percentage points increase in R&D investment and the ability to attract highly skilled workers leads to a 4.27 percent increase in productivity in the EU’s R&D-intensive industries compared to non-R&D-intensive sectors[1]. Therefore, our scenario assumes that a 2.73 percent increase in R&D spending or human capital will lead to 1.16 percent higher level of productivity in R&D-intensive industries only.

The 1.16 percent increase in productivity is translated into the CGE modelling following Gat et al (2019). The authors of this paper estimate the effect of changes in productivity into changes in productive technologies or technical output which are captured in the CGE model. As a result, the 1.16 percent increase in productivity translates into changes in technical output of 0.1 and 0.41 in the short- and long-term respectively.

Table 1: Overview of Policy Changes Source: Authors’ calculations.

Source: Authors’ calculations.

[1] As shown in Table 6 in Appendix I, a 10 percentage point change serves as a depiction of a small change in the independent variable.

3. Findings and Interpretation of Results

This chapter presents the findings of the econometric and macroeconomic modelling results for each scenario. Each scenario captures a theme of the competitiveness compass which relates to the variables used to measure progress in the policy recommendations of the competitiveness compass. The results of the quantitative analysis – the gravity model, the econometric regression, and the CGE modelling – are presented for each scenario.

3.1 Dynamic Markets

Enabling dynamic markets is crucial for competitiveness. Markets with a significant number of competitors and low market barriers that allow for companies to enter and exit the market are more likely to deliver new innovation, resource efficiency and – ultimately – growth in productivity and the economy.

The OECD Product Market Regulation (PMR) measures the economy-wide regulatory barriers to firm entry and competition that impede economic dynamism. The index is based on information on the regulatory framework in a broad range of cross-sector policy areas, ranging from the governance of state-owned enterprises, and administrative burdens on firms, to public procurement regulations. This information is scored against internationally accepted best practice and aggregated. The result is a composite indicator whose value ranges between 0 and 6, from most to least competition-friendly regulatory regimes.

Changes in the PMR index are associated with the first policy recommendation of the competitiveness compass: An open industrial policy, entrepreneurship, scale-up companies, and growth. An open industrial policy puts the emphasis on supporting market dynamism and competition rather than being an incumbent-oriented policy. This policy recommendation calls for greater competition in the market and removing regulations that inhibit the growth of productive companies. The PMR index measures these regulatory barriers.

The gravity model shows the significant negative relationship between the PMR index and trade. For instance, a 10 percentage point increase in the PMR is associated with 8 percent less trade. The full results of the gravity model can be found in Table 1 of Appendix I. Based on the gravity model, it can be computed that a 30 percent fall in the PMR is equivalent to a 10.56 percent fall in trade barriers.

This fall in EU trade barriers will lead to higher economic growth and employment in the EU. EU GDP is estimated to increase by 1.2 percent which is equivalent to 170 bn euros. This increase in economic activity would support close to 2.5 million jobs.

3.2 A Thriving Services Industry

A growing number of technologies and innovations will be developed outside the EU and many of these technologies will be transferred through services sectors like Information and Communication Technologies (ICT) or business services, making trade in services a crucial input for EU competitiveness. Moreover, various service sectors nowadays show higher levels of productivity than manufacturing, and the potential for growth in services by making lower-productivity firms more alike higher-productivity firms is very substantial.

The OECD Service Trade Restrictiveness Index (STRI) measures the obstacles to global services trade in 22 services sectors, including, among others, transport, banking, telecommunication or professional services. The index measures services trade restrictions on foreign entry, movement of people, discriminatory measures, competition, and transparency. It takes the value from 0 to 1, where 0 is completely open and 1 is completely closed.

A fall in the STRI is associated with higher levels of competitiveness since it leads to higher levels of competition and better technological diffusion arising from positive spill-overs. Therefore, improvements in the STRI are linked to progress on several policy recommendations of the competitiveness compass, including: An open industrial policy, entrepreneurship, scale-up companies, and growth; Focus on market access and re-build a free trade strategy; Make the EU market resilient; and Address the productivity gap of European businesses. By measuring the barriers to trade in services, the STRI measures the degree of openness and competition in services sectors. The higher the level of openness and competition in services, the easier for EU companies to access foreign innovations through services.

The gravity model shows the significant negative relationship between the STRI and services trade. For instance, a 10 percentage point increase in the STRI is associated with 15 percent less services trade. The full results of the gravity model can be found in Table 2 of Appendix I. Based on the gravity model, it can be computed that a 30 percent fall in the STRI is equivalent to a 5.2 percent fall in trade barriers for the service economy.

This fall in EU trade barriers will lead to higher economic growth and employment in the EU. EU GDP is estimated to increase by 0.3 percent which is equivalent to 42 bn euros. This increase in economic activity would support 0.6 million jobs.

3.3 Openness to Digital Trade

The COVID-19 pandemic demonstrated that the use of digital technologies affects a nation’s ability to prosper. When used effectively, digital technologies not only make it possible for work and education to move online, but they also offer effective ways to coordinate business operations and governmental procedures. Many of the latest and most promising technologies, including AI, 6G, quantum computing, virtual worlds like the Metaverse, 3D printing or robotics will have digital inputs or will be delivered through the Internet. Therefore, the growth of the digital economy, and its interplay with new technologies, is the prime force for new patterns of productivity and trade.

In this context, digital trade becomes a key determinant of competitiveness, providing faster and more opportunities for growth, innovation, and increased trade to companies of all sizes. The EU has already taken some steps in embracing the growing importance of digital trade. This is reflected in the EU’s trade policy communication, ‘An Open, Sustainable and Assertive Trade Policy’, where supporting Europe’s digital agenda is made a priority for EU trade policy.

However, a parallel policy trend is that most countries have introduced new digital restrictions. The EU has been one of the first major economies to regulate the digital economy and digital technologies, and compared to many other Western economies, it has adopted regulations that are more restrictive and less predictable than elsewhere. Adding more regulatory uncertainty and confusion in the rules for the digital economy could stifle innovation and make European companies that compete in the global market less capable to work with frontier technological changes.

The OECD Digital Services Trade Restrictiveness Index (DSTRI) measures cross-cutting barriers that inhibit or prohibit firms’ ability to supply services using electronic networks. It includes five measures: infrastructure and connectivity; electronic transactions; e-payment systems; intellectual property rights; and other barriers to trade in digitally enabled services. It takes the values between 0 and 1, where 0 indicates an open regulatory environment for digitally enabled trade and 1 indicates a completely closed regime.

A reduction in the DSTRI is associated with an EU environment for digital regulations that is more growth friendly. Moreover, the DSTRI can be used to benchmark Europe’s digital regulatory environment against global frontrunners. For example, progress in the eighth policy recommendation of the competitiveness compass, embrace digital trade, can be tracked by changes in the DSTRI.

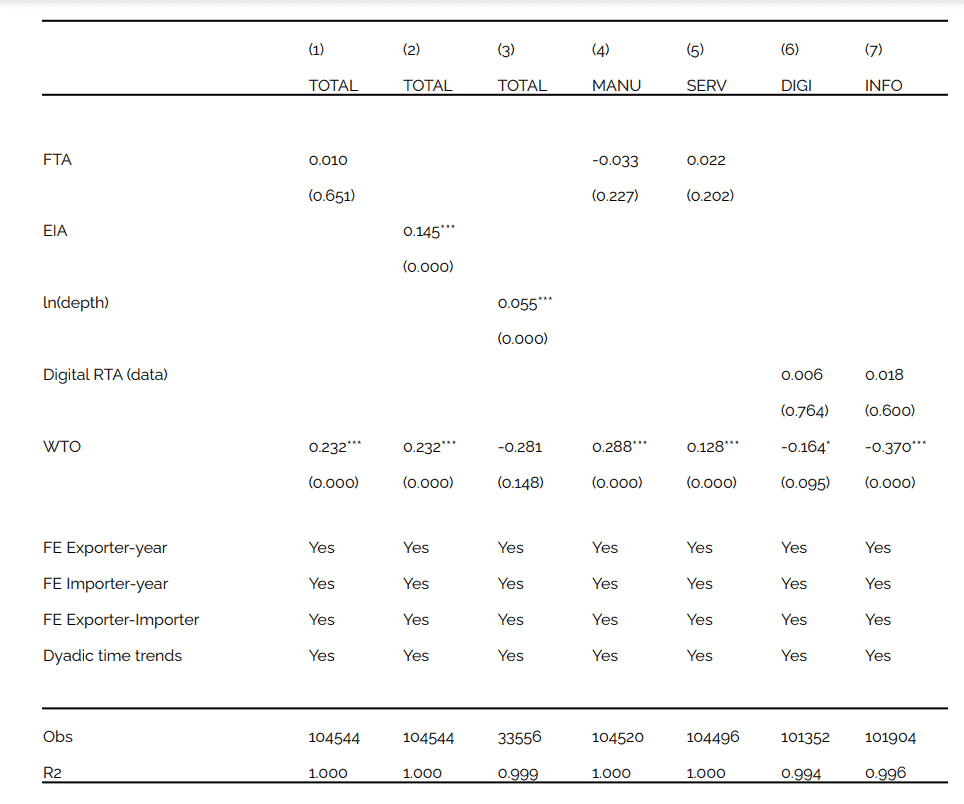

The gravity model shows the significant negative relationship between the DSTRI and digital services trade. For instance, a 10 percentage point increase in the DSTRI is associated with 6.6 percent less services trade. This result is mostly driven by barriers related to infrastructure and connectivity, which measures in particular the data-related restrictions. The full results of the gravity model can be found in Table 3 of Appendix I. Based on the gravity model, it can be computed that a 30 percent fall in the DSTRI is equivalent to a 3.39 percent fall in trade barriers in digital services.

This fall in EU trade barriers will lead to higher economic growth and employment in the EU. EU GDP is estimated to increase by 0.1 percent which is equivalent to 16 bn euros. This increase in economic activity would support 0.2 million jobs..

3.4 A Globally Integrated Economy

Supporting global free trade is essential for raising competitiveness. Access to cheaper inputs and more customers abroad make firms more competitive and economies more specialised. When a growing part of world growth happens outside of Europe, free trade is key to access expertise, technology and important value chains – without which European competitiveness will fall markedly. Moreover, international trade also exposes domestic firms to foreign competition, requiring constant innovation and productivity from companies in order for them to succeed in the market.

In addition, openness also contributes to lowering trade vulnerabilities arising from the shocks and disruptions afflicting the international market. It provides an avenue for diversification of suppliers, making countries more resilient by increasing the number of suppliers available to producers. Diversification is also cheaper than alternate options of tackling trade vulnerabilities and disruptions such as, re-shoring, and ensures that competition gains from trade remain.

The EU is active in some trade negotiations. There are on-going talks about a new bilateral trade agreement with Australia while negotiations on the EU-New Zealand trade agreement concluded successfully in June 2022, and the old bilateral Free Trade Agreements with Chile and Mexico are due to be modernised. Negotiations with India have re-started, although the potential for the conclusion of an ambitious agreement is limited. An agreement has been signed with Mercosur, but it has so far failed to get the approval of Member States. However, despite these advances, progress in finalising agreements has been slow compared to the release of the defensive trade policy.

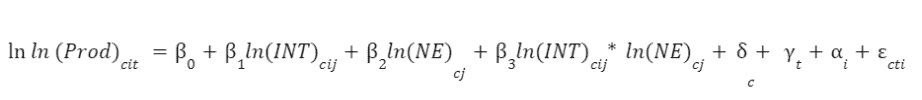

Economic Integration Agreements (EIA) measures the number of international trade agreements that include provisions that allow for deeper economic integration. The impact of signing Economic Integration Agreements relates to progress under the focus area of Supporting global free trade and the four policy recommendations included there: Focus on market access and re-build a free trade strategy; Make the EU market resilient; Build partnerships and make new friends; and Embrace digital trade. These policy recommendations will enable the EU to become more competitive through global free trade, while making its economy more resilient to trade shocks and disruptions.

The gravity model shows the significant positive effect of signing Economic Integration Agreements and trade. These Economic Integration Agreements are associated with 16 percent more total trade, with an additional 0.5 percent with 10 percent higher number of deep provisions. The full results of the gravity model can be found in Table 4 of Appendix I. Based on the gravity model, it can be computed that an additional Economic Integration Agreement is equivalent to a 4.95 fall in trade barriers.

This fall in EU trade barriers will lead to higher economic growth and employment in the EU. EU GDP is estimated to increase by 1.1 percent which is equivalent to 158 bn euros. This increase in economic activity would support 2.3 million jobs.

3.5 A Knowledge-Based Economy

Innovation is at the heart of productivity growth and competitiveness. At the firm level, it creates new markets and increases economic efficiency while at the aggregate level it supports knowledge spillovers that lead to higher economic growth.

The EU has renewed its goal of boosting investment in R&D to 3 percent of GDP by the end of the current decade. However, in 2020 the EU spent €311 billion on research and development, equal to 2.3 percent of its GDP. To revert this situation, the EU needs to allocate a bigger part of its budget for R&D and leverage its own funds and policies to mobilise more R&D from the private sector. Moreover, the EU’s target to reach 3 percent of GDP on R&D – which the EU has not reached yet – is far too unambitious for the 21st century. That may have suited the economy in the 1980s, but an adequate target for R&D in the modern economy is closer to 5 percent.

Given that private R&D represents two thirds of the EU’s total R&D spending, a significant part of that increase should come from private R&D spending in industries. R&D spending and how big is that spending over companies’ gross value added can be measured using the ratio between the Business R&D Expenditure (BERD) and the gross value added (GVA). Both variables are measured at industry level and are sourced from the OECD. Between 2015 and 2019, the economic sectors with the highest levels of R&D intensity were pharmaceuticals; other transport equipment; computer, electronic and optical products; motor vehicles; electrical equipment; and machinery in manufacturing and IT and other information services; and professional, scientific and technical activities in services.

In addition to R&D, investments in human capital are necessary to build a knowledge-based economy. Higher human capital improves labour quality in a country by providing workers with knowledge and skills to perform their jobs more effectively, and a skilled labour force is also more likely to develop new ideas and techniques that improve productivity. Investments in human capital can be proxied using the number of researchers per labour force for each country published in the OECD Main science and technology indicators (MS&TI) database.

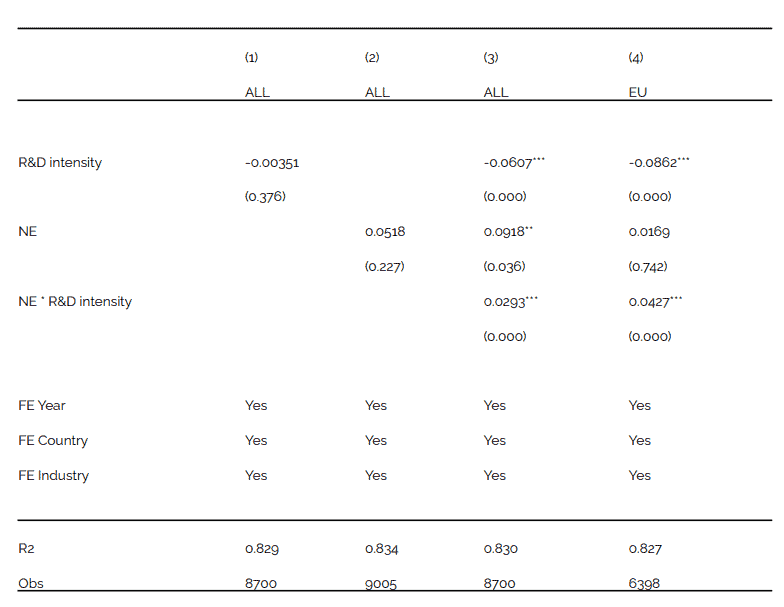

The interplay between R&D intensity at industry level and human capital involved in R&D at country level supports higher levels of productivity and therefore competitiveness, which is associated with the focus area of More innovation capacity and progress in the following policy recommendations: Mobilise resources on European R&D; Support global success in research and universities; and Urgent need to attract talent.

The econometric regression shows the significant positive relationship between the R&D intensity, human capital and productivity. A 10 percentage point increase in the ability to attract higher levels of human capital or invest in R&D is associated with a 4.3 percent higher level of productivity in R&D intensive industries, compared to non-R&D intensive industries. The full results of the regression analysis can be found in Table 6 of Appendix I. Based on the econometric regression, it can be computed that reaching 5 percent of GDP on R&D would lead to a 1.16 percent higher productivity in R&D-intensive industries. For the short-term and long-term scenario, productivity shocks are then estimated on the basis of percentage increases in output of productive technologies following Gal et al. (2019) (see Annex II).

This rise in productivity will lead to higher economic growth and employment in the EU. In the short-term, EU GDP is estimated to increase by 0.1 percent which is equivalent to 10 bn euros. Higher economic activity would support 0.1 million jobs. In the long-term, EU GDP is estimated to increase by 0.3 percent, which is equivalent to 42 bn euros, supporting 0.6 million jobs.

3.6 Summary of the Results

The economic modelling clearly shows that the policy recommendations described in the competitiveness compass lead to further economic growth and employment. The force of competition pushes the least competitive companies out of the market and provides a larger market for the most successful companies to grow. In the CGE modelling exercise, this process leads to a reallocation of resources – capital and labour – from the least to the most productive sectors which increases the overall competitiveness in the EU.

In the same way, the increase of productivity in R&D intensive sectors triggers a reallocation of resources away from the more inefficient sectors towards the more efficient R&D intensive manufacturing and services sectors. Following Gal et al. (2019), the short-term scenario can be expected to lead to higher levels of productivity within the first year, while the effects of the long-term scenario are expected to occur after 5 years.

Moreover, the four scenarios that lower trade barriers between the EU and the world – Dynamic markets; A thriving services industry; Openness to digital trade; A globally integrated economy – will have a positive impact on consumers’ choices. Firms abroad would face less barriers to enter the EU economy and domestic users i.e., final consumers and business consumers (as well as public sector institutions), would have increased access to global supply. The effects of these scenarios are likely to emerge over time (see Annex II).

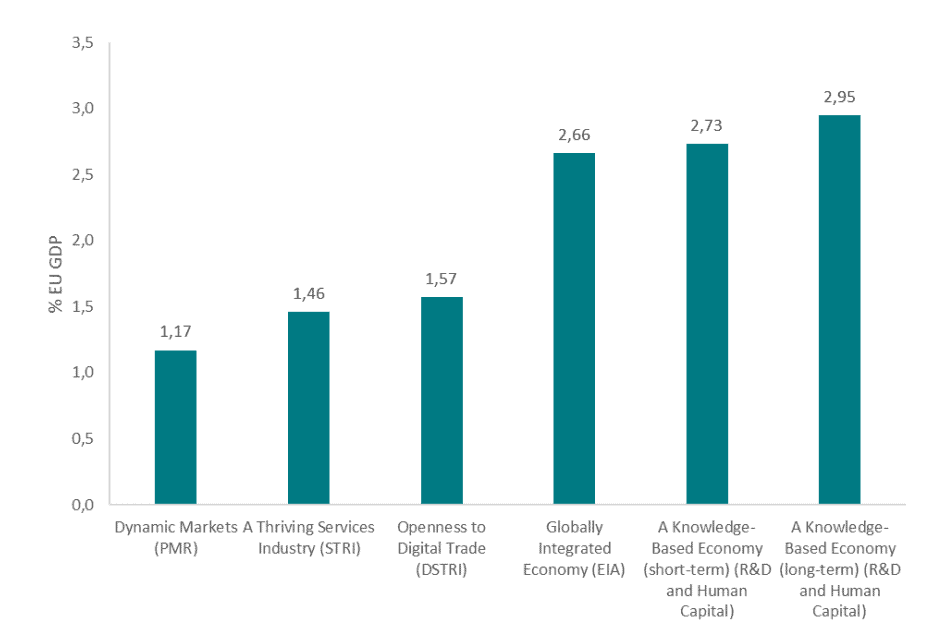

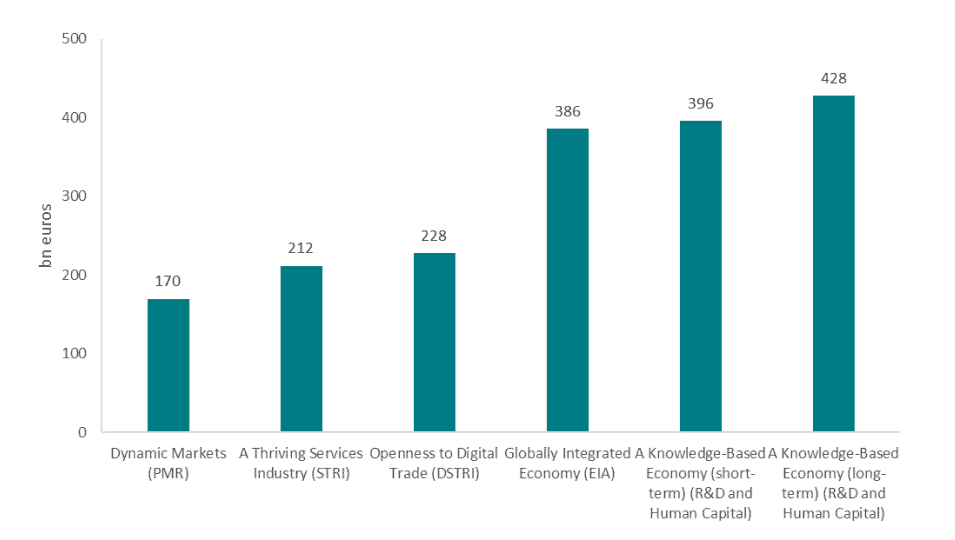

The five scenarios are not mutually exclusive. The EU can pursue these scenarios in parallel which would lead to a cumulative GDP increase of up to 2.95 percent of EU GDP. Figure 2 presents the cumulative effect of implementing the five scenarios, including the fifth scenario – A knowledge-based economy – unfolding over the long-term. The monetary effect of these four scenarios would result in total gains of close to 428 billion euros (Figure 3). This is a higher value than the total allocation for the common agricultural policy (CAP) amounting to 387 billion euros; more than half of the total funds allocated to the next generation EU recovery instrument (808 billion euros); or twice the value of total European defence spending in 2021 (214 billion euros).

None of these policies will have negative effects on EU’s main trading partners. Quite the contrary: increasing competitiveness in the EU is a policy that leads to higher levels of prosperity in the EU and the world. This is important because as the major world exporter of goods and services, economic growth, and therefore demand, in non-EU countries supports growth in EU exports. This is in clear contrast to other policies. For instance, re-shoring production could reallocate resources from sectors where the EU is competitive to less competitive output. An increase in state-aid could lead to public resources, capital and labour staying in low productivity companies. Moreover, there is a real risk that EU’s trade partners retaliate or even imitate EU’s re-shoring and state-aid policies which will hurt the EU’s most competitive sectors.

Figure 2: Estimated Cumulated Increase of Europe’s GDP in Percent Source: Authors’ calculations.

Source: Authors’ calculations.

Figure 3: Estimated Cumulated Increase of Europe’s GDP in Billion Euros

Source: Authors’ calculations.

Source: Authors’ calculations.

References

Acemoglu, D., Johnson, S., & Robinson, J. (2005). The rise of Europe: Atlantic trade, institutional change, and economic growth. American economic review, 95(3), 546-579.

Anderson, J. (1979) “A theoretical foundation for the gravity equation”, American Economic Review, Vol. 69, No. 1, pages 106-116.

Anderson, J. and E. van Wincoop, 2003, “Gravity with Gravitas: A solution to the Border Puzzle”, The American Economic Review, Vol. 93, No. 1, pages 170-192.

Anderson, J.E., and Y.V. Yotov (2016) “Terms of Trade and Global Efficiency Effects of Free Trade Agreements, 1990-2002”, Journal of International Economic, Vol. 99(C), pages 279-298.

Arrow, K. J. (1971). The economic implications of learning by doing (pp. 131-149). Palgrave Macmillan UK.

Baier, S.L. and J.H. Bergstrand (2007) “Do Free Trade Agreements Actually Increase Members’ International Trade?”, Journal of International Economics, Vol. 71, pages 2-95.

Becker, G. S. (1962). Investment in human capital: A theoretical analysis. Journal of political economy, 70(5, Part 2), 9-49.

Benz, S. (2017) “Services Trade Costs: Tariff Equivalents of Services Trade Restrictions Using Gravity Estimation”, OECD Trade Policy Papers, No. 200, OECD Publishing, Paris.

Bergstrand, J.H., M. Larch and Y.V. Yotov (2015) “Economic Integration Agreements, Border Effects, and Distance Elasticities in the Gravity Equation, European Economic Review, Vol 78, pages 307-327.

Borchert, I., M. Larch, S. Shikher and Y. Yotov (2021) “The International Trade and Production Database for Estimation (ITPD-E)”, International Economics, Vol. 166, pages 140–166.

Bughin, J., Windhagen, E., Smit, S., Mischke, J., Sjatil, P. E., & Gürich, B. (2019). Innovation in Europe. Changing the game to regain a competitive edge.

Castellani, D., Piva, M., Schubert, T., & Vivarelli, M. (2019). R&D and productivity in the US and the EU: Sectoral specificities and differences in the crisis. Technological Forecasting and Social Change, 138, 279-291.

Chaney, T. (2008) Distorted Gravity: The intensive and Extensive Margins of International Trade”, American Economic Review, Vol. 98, No. 4, pages 1707-1721.

Egger, P. and M. Larch (2008) “Interdependent Preferential Trade Agreement Memberships: An Empirical Analysis”, Journal of International Economics, Vol. 76, No. 2, pages 384-399.

Erixon, F. et al. (2022). After the DMA, the DSA and the New AI regulation: Mapping the Economic Consequences of and Responses to New Digital Regulations in Europe. ECIPE Occasional Papers, No. 3/2022.

Erixon, F., Guinea, O., Lamprecht, P., Sharma, V., Sisto, E., van der Marel, E. (2022). A Compass to Guide EU Policy in Support of Business Competitiveness. Report, ECIPE. Brussels, occ. Paper 6/2022, 82p.

European Commission (2023). Common Agricultural Policy Funds. Available at: https://agriculture.ec.europa.eu/common-agricultural-policy/financing-cap/cap-funds_en

European Commission (2023). Recovery Plan for Europe. Available at: https://commission.europa.eu/strategy-and-policy/recovery-plan-europe_en#nextgenerationeu

European Defence Agency (2022). European defence spending surpasses €200 billion for first time. Available at: https://eda.europa.eu/news-and-events/news/2022/12/08/european-defence-spending-surpasses-200-billion-for-first-time-driven-by-record-defence-investments-in-2021

Gal, P., et al (2019). Digitalisation and Productivity: In Search of the Holy Grail – Firm-level Empirical Evidence from EU Countries. OECD Economics Department Working Papers No. 1533, https://www.oecd-ilibrary.org/economics/digitalisation-and-productivity-in-search-of-the-holy-grail-firm-level-empirical-evidence-from-eu-countries_5080f4b6-en

Galindo-Rueda, F., & Verger, F. (2016). OECD taxonomy of economic activities based on R&D intensity.

Jones, E. (2003). The European Miracle. Cambridge University Press; Angus Maddison,

1991, Dynamic Forces in Capitalist Development: A Long-Run Comparative View. Oxford University Press.

Larch, M., J. Wanner, Y.V. Yotov and T. Zylkin (2019) “Currency Unions and Trade: A PPML Re-assessment with High-dimensional Fixed Effects”, Oxford Bulletin of Economics and Statistics, Vol. 81, pages 487-510.

Lucas Jr, R. E. (1988). On the mechanics of economic development. Journal of monetary economics, 22(1), 3-42.

McKinsey & Company (2022). Securing Europe’s competitiveness: Addressing its technology gap. Retrieved from https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/securing-europescompetitiveness-addressing-its-technology-gap

Moncada-Paternò-Castello, P. (2016). EU corporate R&D intensity gap: Structural features calls for a better understanding of industrial dynamics (No. JRC103361). Joint Research Centre (Seville site).

Moncada-Paternò-Castello, P. (2022). Top R&D investors, structural change and the R&D growth performance of young and old firms. Eurasian Business Review, 12(1), 1-33.

OECD (2015a). The Innovation Imperative: Contributing to Productivity, Growth and Well-Being, OECD Publishing, Paris. DOI: http://dx.doi.org/10.1787/9789264239814-en

OECD (2018). Decoupling of wages from productivity. OECD Economic Outlook, Volume 2018 Issue 2.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of political economy, 94(5), 1002-1037.

Schumpeter, J. (1911). The theory of economic development. Harvard economic studies. vol. xlvi. The theory of economic development. Harvard Economic Studies. Vol. XLVI.

Shepherd, B., M. Decosterd, C. Castillo Comabella, and D. Stivas. (2019) “EU Exit and Impacts on Northern Ireland’s Services Trade”, Report prepared for the Department for the Economy, Northern Ireland.

Solow, R. M. (1956). A contribution to the theory of economic growth. The quarterly journal of economics, 70(1), 65-94.

Van der Marel, E. et al (2020). Are Services Sick? How Going Digital Can Cure Services Performance. Bertelsmann Stiftung.

Van Der Marel, E., & Shepherd, B. (2020). Trade facilitation in services concepts and empirical importance (No. 9234) Policy Research Working Paper. World Bank.

Veugelers, R. (2017). Missing convergence in innovation capacity in the EU: facts and policy implications (No. 066). Directorate General Economic and Financial Affairs (DG ECFIN), European Commission.

Annex

Annex I: Gravity Model and Econometrics Regression

Gravity Model

The gravity model is used as the main empirical approach to identify the importance of regulatory indexes and economic integration on competitiveness. In the end, the results arising from the gravity model are used to compute the tariff equivalent, which in turn are used for the wider macro-economic general equilibrium analysis.

There are three regulatory indexes used, each measuring a different aspect of competitiveness: (1) the OECD Product Market Regulations (PMR) which captures state regulations currently applied across the economy; (2) the OECD Services Trade Restrictiveness Index (STRI) which covers restrictions applied in services sectors specifically, and (3) the OECD Digital STRI, which captures the country-wide regulations related to digital services trade only. Finally, the gravity model is also used to measure the effect of Economic Integration Agreements (EIA), also called Deep and Comprehensive Free Trade Agreements (DCFTAs), on competitiveness.

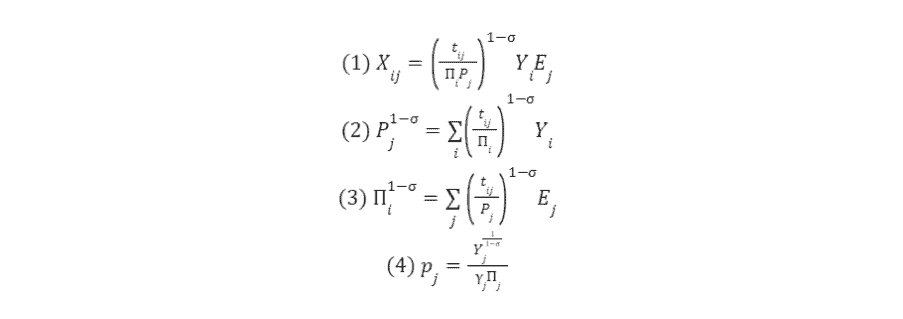

The gravity model is the most commonly used setup for empirical international trade analysis. Current best practice in the literature is Anderson et al. (2018), where the authors develop a simple method for both estimating parameters econometrically and conducting counterfactual simulations, all perfectly consistent with the constraints imposed by standard trade theory. Their starting point is the familiar structural gravity model derived from CES preferences across countries for national varieties differentiated by origin (the Armington assumption). The model takes the following form:

Where: X is exports in value terms from country i to country j; E is expenditure in country j; Y is production in country i; t captures bilateral trade costs; sigma is the elasticity of substitution across varieties; P is inward multilateral resistance, which captures the dependence of bilateral shipments into j on trade costs across all inward routes; is outward multilateral resistance, which captures the dependence of bilateral shipments out of i on trade costs across all outward routes; p is the exporter’s supply price of country i; and gamma is a positive distribution parameter of the CES function. Full details of the model’s solution and characteristics are provided by Anderson et al. (2018), and Yotov et al. (2017).

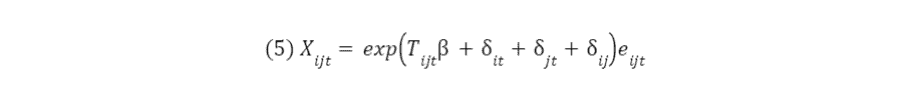

Most commonly, the model represented by (1) through (4) is estimated by fixed effects, which collapses it into the following empirical setup:

Where: T is a vector of observables capturing different elements of trade costs; is a set of exporter fixed effects; is a set of importer fixed effects; and e is a standard error term. For simplicity, it is assumed that the model is estimated using data for a single year, although in practise we apply a panel there where possible and where the data permits.

If the above model is estimated by PPML with fixed effects as recommended by Santos Silva and Tenreyro (2006), then Fally (2015) shows that the estimated fixed effects correspond exactly to the terms required by the structural model. In other words, if (5) is estimated correctly, then it follows that:

Where: E0 corresponds to the expenditure of the country corresponding to the omitted fixed effect (typically an importer fixed effect) in the empirical model, and the normalization of the corresponding price terms in the structural model.

For the above approach to work in a consistent way, it is important for the dependent variable, bilateral trade, to include all directions of trade. That is, it also must include intra-national trade (or domestic trade), which is production that is both produced and consumed in each country. Through this way the estimated fixed effects can in fact relate to the output and expenditure terms implied by the theory.

As a result, we use trade data sourced from the TiVA dataset. Given that this dataset is the only one that covers domestic trade consistently across industries and sectors, it is the most relevant one to use in our analysis. This database is a squared data set for which values of trade are reported as trade in gross shipments terms, not in value-added terms. The advantage of this source is that it contains harmonized trade and production data across goods and services sectors so that total trade in goods and services (including digital services) can be computed including its domestic trade, which is calculated as production less total world exports. We take the year available as provided by our indexes, which typically restricts us to the time span of 2014-2020.

In order to identify the impact of the regulatory restrictiveness indexes, it is important to understand that these indicators are multiplied with a dummy variable indicating the trade flow is international trade as opposed to intra-national trade, following Heid et al. (2021). This is because the three regulatory indexes mentioned above are non-discriminatory in nature, they do not vary by partner country because the indexes only pick up so-called MFN policies for trade; they are applied unilaterally. Without this interaction, the three regulatory indexes would be entirely absorbed by our applied fixed effects given the sample is a panel series. Note that this interaction terms of the indexes will be set at the importer side which captures the effect of trade restrictions on trade for the importer, which in turn would affect the ability of a reporter country to export to the country that applies the restriction.

All other observables, as part of the vector T capturing the different elements of the so-called gravity controls, are sourced from the associated data set which forms part of the ITPD-E that is called the dynamic gravity data set from Gurevich and Herman (2018). We use the latest version from 2021. Because of the application of dyadic fixed effect in the empirical model () we are only left to include time-varying gravity controls which are the standard RTA measure and WTO membership. Note, that for the fourth competitiveness factor of having applied an EIA, data is sourced from Mario Larch’s Regional Trade Agreements Database from Egger and Larch (2008) and not from the ITPD-E dynamic gravity data set given that the former is more complete.

Note as well that in addition to the inclusion of these three sets of fixed effect, the recent empirical literature also points out that pair-specific time-trend fixed effects on top of the dyadic fixed effects should be applied. As such, altogether our estimates are in line with the recent literature on how to consistently estimate the effects of trade policy (see Piermartini and Yotov, 2016; Anderson and Yotov, 2016; Dai et al. 2014; Baier & Bergstrand, 2007). To execute our estimations, we follow the commands as developed by Dai et al. (2014), which addresses the large number of dyadic fixed effects in combination with the trend effects needed to consistently identify the effects of time-varying (trade) policies, which in our case are changes in the regulatory restrictiveness indexes and signing an Economic Integration Agreement.

Gravity Model Regressions

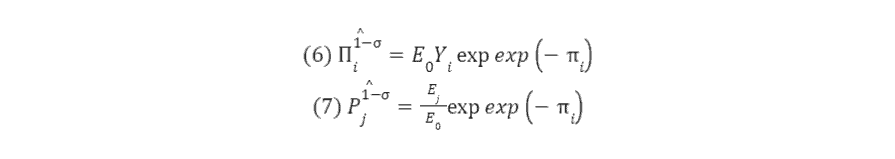

Table 1: Product Market Regulation Source: Authors’ calculations. Notes: Agri = Agriculture; MItUT = Mining and Utilities; MANU = Manufacturing; SERV = Services; TOTAL = all sectors; on which regressions are applied. PMR = OECD Product Market Regulation Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

Source: Authors’ calculations. Notes: Agri = Agriculture; MItUT = Mining and Utilities; MANU = Manufacturing; SERV = Services; TOTAL = all sectors; on which regressions are applied. PMR = OECD Product Market Regulation Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

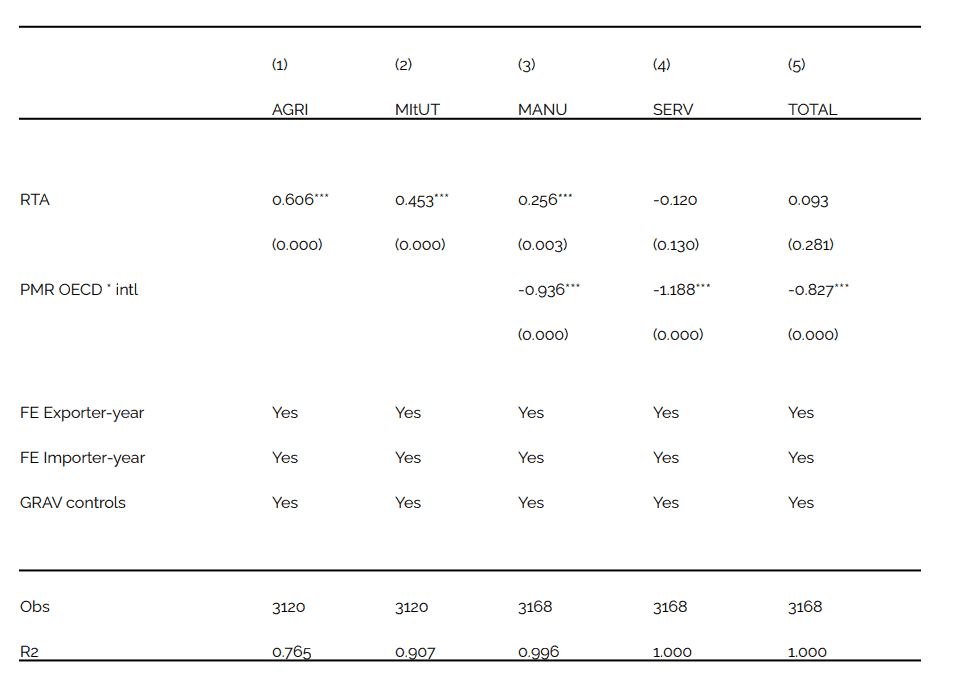

Table 2: Services Trade Restrictiveness Index Source: Authors’ calculations. Notes: SERV = Services ; EXCL. CO&PU = Services excluding construction and public utilities; BUSS = Business services; MANU = Manufacturing; TOTAL = all sectors; on which regressions are applied. STRI = OECD Services Trade Restrictiveness Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

Source: Authors’ calculations. Notes: SERV = Services ; EXCL. CO&PU = Services excluding construction and public utilities; BUSS = Business services; MANU = Manufacturing; TOTAL = all sectors; on which regressions are applied. STRI = OECD Services Trade Restrictiveness Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

Table 3: Digital Services Trade Restrictiveness Index Source: Authors’ calculations. Notes: TOTAL = all sectors; MANU = Manufacturing; SERV = Services; DIGI = Digital services (telecom, computer and information services); INFO = Information services; on which regressions are applied. DSTRI = OECD Digital Services Trade Restrictiveness Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

Source: Authors’ calculations. Notes: TOTAL = all sectors; MANU = Manufacturing; SERV = Services; DIGI = Digital services (telecom, computer and information services); INFO = Information services; on which regressions are applied. DSTRI = OECD Digital Services Trade Restrictiveness Index; intl = dummy denoting unity for inter-national trade; RTA = Regional Trade Agreement. Aggregation of sectors can be found in Table 5

Table 4: Economic Integration Agreements Source: Authors’ calculations. TOTAL = all sectors; MANU = Manufacturing; SERV = Services; DIGI = Digital services (telecom, computer and information services); INFO = Information services; on which regressions are applied. FTA = Free Trade Agreements; EIA = Economic Integration Agreements; depth = number (in logs) of provisions per agreement = Digital RTA (data) = Regional Trade Agreements with data provisions; WTO = World Trade Organization membership. Aggregation of sectors can be found in Table 5

Source: Authors’ calculations. TOTAL = all sectors; MANU = Manufacturing; SERV = Services; DIGI = Digital services (telecom, computer and information services); INFO = Information services; on which regressions are applied. FTA = Free Trade Agreements; EIA = Economic Integration Agreements; depth = number (in logs) of provisions per agreement = Digital RTA (data) = Regional Trade Agreements with data provisions; WTO = World Trade Organization membership. Aggregation of sectors can be found in Table 5

Methodology to Calculate the Ad Valorem Tariff Equivalents

The obtained coefficient results from this empirical exercise are used to compute the so-called tariff equivalents. This is because parameter estimates are not easily comparable across the four competitiveness measures, due to differences in scale from one indicator to another. We therefore convert statistically significant estimates to ad valorem tariff equivalents (AVEs), by making use of the relationship in the theoretical model between individual factors and overall bilateral trade costs.

To make the conversion, we follow Benz (2017) but adapt his method slightly as per Shepherd et al. (2019). In this framework, the AVE in percentage terms is calculated as follows, using the STRI as an example (where beta is its estimated coefficient from the regression model):

Given the elasticity parameter is not observed, we follow the OECD in setting it equal to 5 for when regressing manufacturing trade, 3 for regressing services trade, 2 for regression digital services trade, and finally 4 when regressing total trade.

Productivity Regressions

Innovation and human capital are widely recognized as key drivers of productivity and economic growth. This has already been studied and acknowledged by economists such as Schumpeter (1911), Solow (1956), Romer (1986), Lucas (1988), Gary Becker (1962), and Kenneth Arrow (1971).

There are various measures to capture the level of innovation and human capital in different countries or industries. The ratio of R&D investment to an output measure, typically gross value added (GVA) or gross output (GO) is how R&D intensity is characterised. When measuring an economy’s overall (general) R&D effort (GERD over GDP) or business sector (BERD over GVA for the business sector) this statistic is frequently used. This study used R&D intensity at the industry level, defined as Business R&D expenditure over gross value added, as a proxy for innovation. Similarly, the amount of researchers per labour force, including scientists, engineers, and technicians, is used as a proxy for human capital. Note that the human capital measure is taken at the country level to stand as a country endowment in highly educated personnel.

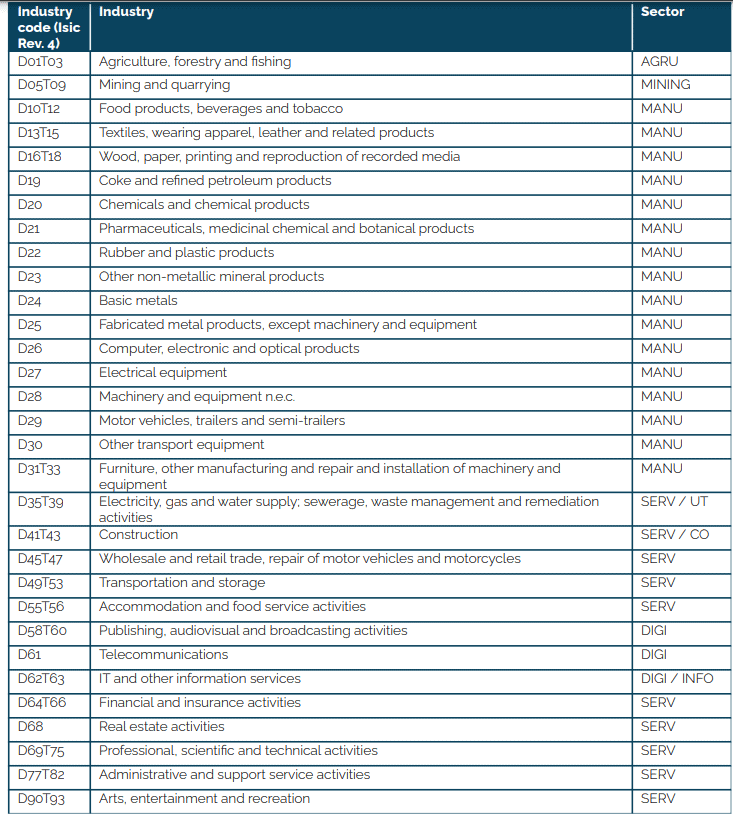

Following Galindo-Rueda & Verger (2016), R&D intensity are computed at the industry level as the ratio between the Business R&D Expenditure (BERD) and the gross value added (GVA). The BERD is taken from the OECD ANBERD database, and GVA from the OECD STAN database. The amount of researchers per labour force is taken from the OECD Main science and technology indicators (MS&TI) database. Labour productivity data comes from the OECD iSTAN database, which provides a number of indicators calculated after STAN estimation procedures to ensure consistency. The productivity measure, which compares the value added over total employment for each sector, was chosen above productivity per hour because it offers a better coverage of the country in our sample. As a result, our panel is composed of 29 countries, of which 20 are EU member states[1], along 31 industries[2] found in Table 5 from 2007 to 2019. Note that the level of aggregation of the industries was chosen accordingly to the data availability to ensure the highest range of countries and years in our panel data. This results in the following empirical setup:

Where ln ln (Prod)cit is the labor productivity for country c, industry i, at time t. We take the natural logarithm of the variables as it transforms the distribution of the features to a more normally-shaped bell curve and to have a model in which marginal changes in the explanatory variables are interpreted in terms of multiplicative (percentage) changes in the dependent variable. is the R&D intensity for country c and industry i. is the national endowment in human capital, here number of researchers per thousand labour force. is a set of country fixed effects, a set of time fixed effects, a set of industry fixed effects, and is a standard error term. is the coefficient of interest in this study and is the interaction term between an industry R&D intensity and a country endowment in human capital.

Table 5: Industries used in the Gravity and Econometric Estimations

Table 6: R&D Intensity and Human Capital Source: Authors’ calculations. ALL = All countries; EU = European Union member states.

Source: Authors’ calculations. ALL = All countries; EU = European Union member states.

Annex II: Computable General Equilibrium Model

Description of the CGE Model

In this study, CGE model simulations are conducted on the basis of the standard model by the Global Trade Analysis Project (GTAP) at the University of Purdue. CGE models are frequently used in economic impact assessments to estimate the magnitude of economic feedback effects, including structural changes in countries’ international trade profiles for goods and services.

The model applied in this analysis is static-comparative and has been used frequently in studies to measure the impacts of various trade policy measures such as tariffs and non-tariff trade barriers (NTBs). We apply a multi-regional and multi-sector model, characterised by perfect competition, constant returns to scale and a set of fixed Armington elasticities. The modelling is conducted on the basis of the default macro-closure, which applies a savings-driven model, i.e., the savings rate is exogenous, and the investment rate will adjust.

As concerns the economic base data on which we run the simulations, we apply the most up-to-date GTAP 10 database released in 2019. The database contains global trade data for 2004, 2007, 2011 and 2014 as reference years based on input output tables and recorded trade protection data[3]. The database covers 121 countries and 20 aggregate regions of the world for each reference year. The sectoral coverage includes a total of 65 sectors. The GTAP 10 dataset on the global economy was extrapolated to reflect the “best estimate” of the global economy today.

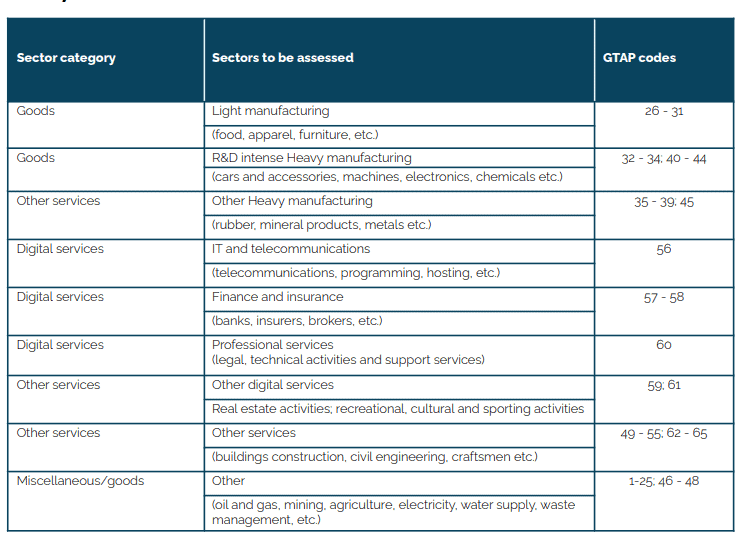

With regard to the regional set-up, we distinguish between the EU27 and major trading partners in goods and services trade. These are: UK, U.S., China, and the “Rest of the World” (RoW). The CGE model setup employs 9 sectors and sector groups which differentiate between R&D intense and R&D non-intense sectors as well as between goods and services sector categories. The model’s sector aggregation is outlined in Table 7.

The applied model is comparative-static, i.e., the simulation results reflect two equilibria at different points in time. As concerns the timeframe, the results of the modelling do not have a preset time dimension indicating how long it would take the economy to adjust to a new equilibrium. For the economic impacts to evolve, the time horizon generally depends on the nature of the simulated policy shock and a reasonable assessment of agents’ behavioral responses, e.g., adjustments in consumption, production trade. The timeframe also depends on the nature of the policy change and is generally sensitive to industry characteristics. For the productivity effects, following Gal et al. (2019) the productivity effects of the short-term scenario are considered to be an instantaneous increase, while the long-term effects are estimated to occur after a timeframe of 5 years.

Table 7: GTAP Sector Aggregation Source: GTAP, authors’ calculations.

Source: GTAP, authors’ calculations.

Key Assumptions of the CGE Model

CGE simulation results are sensitive to various features of the model and assumptions underlying the modelling approach, incl. the quality of the underlying trade and production data, the underlying closure (the parameterisation of casual economic relationships), and the actual quantification of economic shocks (e.g. the level of numerical tariff equivalents of non-tariff trade barriers). The outcomes in terms of changes in economic variables also depend on the set-up of the model and the assumptions underlying the modelling approach which translates real world legal obligations to quantitative inputs for the model. These include assumptions about the nature of competition, substitutability of goods and services, trade elasticities, scale economies, firm heterogeneity and productivity, which are frequently subject to criticism in academic and policy circles.

Like any applied economic model, the model used in this analysis is based on a number of assumptions which simplify complex behavioural economic relationships and the policy framework governing the reality of domestic production and international commerce. The results of the estimations therefore only have indicative character as it is not possible to forecast the precise economic impacts of regulatory changes on macro-economic variables, mainly due to lack of empirical data, the influence of a many different policy and non-policy factors and causal relationships that change over time (Lucas critique)[4]. In the following, we outline key assumptions and their implications for the modelling of the scenarios and the interpretation of the modelling results.

The applied model is comparative-static, i.e. the simulation results reflect two equilibria at different points in time[5]. As concerns the timeframe for the economic impacts to evolve, the time horizon generally depends on the nature of the simulated policy shock and a reasonable assessment of agents’ behavioural responses, i.e., adjustments in consumption, production, trade and investment. The timeframe also depends on the nature of the policy change and is generally sensitive to industry characteristics. Therefore, the timeframe for economic impacts to unfold needs to be assessed and discussed on a sector-by-sector basis. In addition, the assumption of full factor mobility and full employment of factors of production, i.e. all factors of production including labour will adjust until they are fully absorbed by other sectors after the policy changes, has critical implications for the modelling and the assessment of the time horizon within which policy-induced economic impacts will unfold.

Effects on Cross-Sector Productivity

Effects on cross-sector productivity are studied in addition to the impacts that result from the other scenarios. Due to the comparative-static nature of the applied CGE model, the results derived from data-induced AVEs do not include any effects on total factor productivity over time in the EU’s economy. However, productivity gains would likely accrue after the imposition of the new policies as a result of higher quantities available or better access to productive technologies and innovation at the technology frontier. To varying extents, productivity gains are likely to prevail over the medium to longer term. For each of the two productivity simulation sets, productivity gains are estimated on the basis of percentage increases in output of productive technologies and total factor productivity estimates derived by Gal et al. (2019). Gal et al. assess how the adoption of a variety of technologies impacts on firm-level productivity. Based on varying specifications of econometric models, it is estimated for a set of EU countries that increases in the adoption of certain technologies (and respective business models) by firms translate into total factor productivity (TFP) changes. For example, the estimations indicate that a 10-percentage point increase in adoption of productive technologies such as high-speed broadband or cloud computing would translate into an instantaneous increase in MFP growth by 0.9 percentage points. After 5 years, this would imply a 3.5 percentage points higher TFP level for the average firm[6]. In order to arrive at our productivity shocks, we multiply the coefficient gains of 1.16 by 0.9 percentage points for the short-term productivity scenario, and by 3.5 percentage points for the long-term productivity scenario.

Annex III: List of Policy Recommendations Included in the Competitive Compass

Enabling Dynamic and Resilient Markets

- An open industrial policy that boosts entrepreneurship, scale-up companies, and growth: industrial policy should be preoccupied with productivity but not target in advance which activities – let alone firms – should become more productive than others. An open industrial policy promotes competition and removes regulation that inhibits the growth of productive companies.

- Future-proof and deepen the EU Single Market: there should be no barriers to the EU Single Market, and in particular to those industries that drive economic modernisation and technological progress which are in many cases service sectors. Actions to support a future-proof and deepen the EU Single Market include a radical push for liberalisation in services – similar in ambition to what the Delors’s Commission did for the Single Market in goods.

- A strong competition policy: EU competition policy has delivered a framework for market competition which boosted Member States confidence that the rules of the game are fair. Further erosion to EU state aid rules will have a negative impact on competitiveness and productivity since young and productive companies may have to leave the market in favour of less productive ones receiving government support.

- An open and global attitude to standards: the EU should commit to market-driven standards which do not favour some companies over others according to their nationality. A more political European standard setting process risks taking away what makes it attractive to foreign companies, its broad participation. European standards that are accepted at global level are crucial for EU competitiveness in, for example, the circular economy, where the EU wants to be a leader.

Supporting Global Free Trade

- Focus on market access and re-build a free trade strategy: most global growth in the next few years will take place outside the EU. To remain competitive, the EU should focus on increasing trade opportunities. Moreover, the EU should strive to implement the new EU trade defensive instruments in a way that causes as little red tape and costs as possible for trading firms and reduces the risks of retaliation from partner countries.

- Make the EU market resilient: to diversify its suppliers, the EU needs to look for trade partners with the needed products which will not exploit EU dependencies for political gains. If properly designed, EU policies on the circular economy will also support the EU’s goal to reduce its trade dependencies.

- Build partnerships and make new friends: given the increasing importance of forming strategic alliances in the new global order, the EU needs to ratify the Free Trade Agreements (FTAs) that have been finalised or that are under negotiation, and continue engaging with the World Trade Organization.

- Embrace digital trade: there are many opportunities in digital trade. The EU should include ambitious digital chapters in its FTAs; continue its trade and technology dialogues with the US and India; and participating or forging Digital Economy Agreements with other countries.

Developing Innovation Capacity

- Mobilise resources on European R&D: The EU should prioritise R&D in its own budget even if that means reducing its budgetary spending in other policy areas. Moreover, given that two thirds of EU R&D is invested by companies, the EU should focus on incentivising European businesses to increase their R&D spending.

- Support global success in research and universities: the EU spending on higher education should support European Universities and research institutions at the global frontier. The EU should increase mobility for European researchers inside and outside Europe to be able to join international networks.

- Urgent need to attract talent: Knowledge is a key force behind technological change and defines the ability of an economy to absorb new technology and new ways of doing business. The EU should work with Member States to facilitate international labour migration into the EU, make the EU an attractive destination for foreign workers with skills that are needed in the European labour market, and support and encourage human capital flows between Member States and sectors so that labour finds the place where it can be more productive.

- Harmonise and strengthen innovation protection: the EU needs to provide legal certainty and harmonisation of IPRs in the EU’s Single Market especially on copyright as many innovations are produced in the digital economy.

- Address the productivity gap of European businesses: low productivity firms struggle with obtaining access to knowledge and skills, data, and technologies, similar to those of high productivity firms. EU regulation, particularly in the digital economy, that includes experimentation clauses and sandboxes as well as investments in open infrastructure for testing and demonstration are two actions that the EU can take to shrink the productivity gap.

Accelerating Digital Development

- Digital regulations should support competitiveness and growth: digital rules should not be cumbersome for businesses to follow or impede the development of new digital technologies. The EU needs to simplify and streamline digital regulation before the amount of regulation hurts competitiveness.

- Improve infrastructure and connectivity: digital infrastructure can raise the productivity of all factors of production, broadening the productive capacity of the economy as a whole. The EU should put its attention into fibre, 5G, spectrum access and satellites.

- Encourage venture capital in digital technology: for technological start-ups to scale up and realise their ideas, access to capital is essential. The EU should change its financial regulation to encourage investment by pension funds into venture capital funds. These funds will support the growth of European technology companies in Artificial Intelligence (AI) development where access to finance is insufficient.

Addressing Climate Change and the Energy Transition

- Develop a global carbon price: The EU is not alone in its efforts to establish a market to price carbon. The EU should make the EU ETS more attractive to non-EU countries, build links between the EU ETS and other carbon markets and work on initiatives to set a global carbon price for industries where the leading countries have similar policies and objectives on emissions reduction.

- More research into and deployment of fossil-free technology: investments in R&D to address climate change will make the EU more sustainable and competitive. The EU can channel more of its own resources to R&D activities and design regulatory frameworks that support the creation and adoption of new fossil-free technologies.

- Produce more fossil-free energy: the energy transition requires a significant investment in fossil-free energy. These investments are not necessarily a detriment to competitiveness, but the energy transition will require a bigger role for tools that ensure stability of the system such as investments in energy storage and baseload capacity.

- Upgrade the infrastructure for an Energy Union: connecting the energy infrastructure across EU Member States will make the EU more resilient to sudden changes in energy imports and will ease the management of renewable energy. The EU should provide funding, planning and coordination for additional cross-border energy infrastructure projects.

Improving Infrastructure Conditions

- Deregulate transport services to make road and rail transport more attractive: the EU needs to further open up its transport market. Further deregulation in European road and rail markets will result in lower prices and create new business opportunities.

- Fix the bottlenecks in European transport infrastructure: the EU should continue providing planning and financing to support a Trans-European Transport Network that addresses bottlenecks and facilitates cross-border transport. Moreover, EU-funded research should be channelled to decarbonise the transport sector before 2050.

- Foster fair competition in international aviation and the maritime sector: the EU should play a leading role in extending open skies agreements with third countries and establishing a global level-playing field in aviation and the maritime sector. In addition, the EU should increase its efforts to cooperate with the International Civil Aviation Organization (ICAO) and the International Maritime Organization (IMO) on an international regulatory framework to further strengthen fair competition, high safety standards, and environmental protection.

Ensuring Better Regulation

- Increase scrutiny and transparency in EU regulation: the EU should be serious about competitiveness. It has the tools and guidelines, but they are not always implemented to the required depth. The quality of EU impact assessments, consultations, and evaluation must improve.

- Expand the space for experimentation: instead of being prescriptive about how to use a specific technology, the EU should focus on outcomes and provide space for experimentation to demonstrate how these outcomes are achieved.

- Empower the Regulatory Scrutiny Board: given the growing number, complexity and importance of EU regulation, the Regulatory Scrutiny Board should receive additional human and economic resources as well as become fully independent from the European Commission.

- Reduce the regulatory burden: the EU should assess the regulatory burden of its regulation and the cumulative effect of regulation in each industry.

- Make the better regulation agenda central in EU decision making: the EU could include EU competitiveness as part of the discussion of EU rules on fiscal sustainability in the Economic and Financial Affairs Council (ECOFIN); integrate competitiveness within the EU Next Generation Funds; or assign DG COMPETITION with a standing mission to produce sectoral reviews that include an assessment of how regulation impacts firms and competition within a given sector.

[1] EU countries (20): Austria, Belgium, Czech Republic, Germany, Denmark, Spain, Estonia, Finland, France, Greece, Hungary, Ireland, Italy Lithuania, the Netherlands, Poland, Portugal, Slovakia, Slovenia, and Sweden. Non-Eu countries (9): Australia, Canada, Japan, South Korea, Mexico, Norway, Turkey, United States of America, and the United Kingdom.

[2] Industries D84T85 and D86T88 were removed following Galindo-Rueda, F., & Verger, F. (2016). Since most of the R&D investment in these industries is performed by other sectors than government and higher education business enterprises.

[3] It is built on the most reliable international data sources (including Eurostat data for EU countries) and undergoes constant scrutiny by the different stakeholders and users such as the European Commission, the World Bank, OECD, IMF, WTO, United Nations, FAO, etc.

[4] The Lucas critique is a criticism of econometric policy assessment approaches that fail to recognize that optimal decision rules of economic agents vary systematically with changes in regulation. It criticizes using estimated statistical relationships from past data to forecast the effects of adopting a new policy, because the estimated regression coefficients are not invariant but will change along with agents’ decision rules in response to a new policy context.

[5] Most CGE models are “comparative-static” by default, i.e., the results of the modelling do not have a preset time dimension indicating how long it would take the economy to adjust to a new equilibrium.

[6] The effect after 5 years results from accumulated annual increases in MFP growth combined with weaker catch-up due to progressively higher MFP levels.