China’s Public Procurement Protectionism and Europe’s Response: The Case of Medical Technology

Published By: Fredrik Erixon Anna Guildea Oscar Guinea Philipp Lamprecht

Subjects: European Union Healthcare Sectors

Summary

This paper concerns China’s market for medical technologies and how the Chinese state is assisting its own companies to gain greater sales at the expense of producers from Europe and other advanced manufacturing economies. The medical technology sector captures a variety of products, services and solutions which are essential to the provision of healthcare to citizens. Examples range from fairly simple technologies such as sticking platers, to complex ones, such as coronary stents, orthopaedics and pacemakers. In the last decades, Europe’s exports of medical devices to China have grown robustly. On the back of vibrant innovation, firms from Europe and elsewhere have not just followed the growth of Chinese demand for medical devices – they have also increased their share of Chinese imports. Now, however, this market is at risk of being gradually closed off for European firms as China doubles down on various policies that advantage local firms, while ultimately harming innovation and Chinese patients.

China has recently introduced a new element in its industrial policy for its medical technology sector – a policy that builds on its long-term ‘made-in-China’ ambition to have local firms taking up the lion’s share of the market for medical devices by 2030. Beijing and provincial governments are using many different policies to provide support to the domestic industry and are in effect pursuing a policy for import substitution. Accessing the Chinese market for medical devices has never been easy but it has become increasingly challenging in recent years. Direct financial support, tax benefits, R&D support, local content requirements, opaque approval systems and other forms of advantages to domestic MedTech producers are now becoming major sources for the behaviour and development of the Chinese medical device market. China’s Fourteenth Five-Year Plan and the country’s new economic model of ‘dual circulation’ reinforces this trend. The Chinese market is becoming less open.

Added to that is centralised state procurement – a new public procurement policy in China that was launched in 2019 for medical devices which has led to a grossly distorted procurement market. While this policy has reduced the price of medical devices in a drastic way, it has also paved the way for Chinese firms to take up a larger market share. This procurement policy is gradually squeezing European firms out of the Chinese market. Competition in China is becoming less fair.

These policies follow a pattern. In several sectors, Chinese firms have grown their domestic market share through industrial subsidies and policies that restrict market access for foreign firms – or make it more difficult for foreign firms to compete in China. From their domestic market, these firms have then expanded abroad and taken a more prominent role outside of China. Backed by the Chinese state, these firms can squeeze market opportunities even more for otherwise-competitive European producers. Now this development is happening in the MedTech sector.

It is urgent for Europe to respond to China’s procurement protectionism. MedTech manufacturers in Europe are often small and medium-sized enterprises, and they already struggle with getting into the Chinese market. China’s new procurement policy has also had a significant impact on Chinese imports of medical devices: a 1.3 billion euro trade deficit for China in medical technology products in 2019 turned into a 5.2 billion euro surplus in 2020. In Africa, Asia and Latin America, competitive European manufacturers are now confronted with competition from Chinese MedTech companies that have the backing of the Chinese state. The competitive distortions in the Chinese market now spill over to the global market – making European MedTech manufacturers even more disadvantaged.

Europe should consider a case at the World Trade Organisation (WTO) against China’s policies which reduce European market presence for medical devices. Once agreed, a new International Procurement Initiative might be a useful instrument to wield pressure against the Chinese government to agree to free and fair competition. Europe can also negotiate with China – for instance in the framework of the Comprehensive Agreement on Investment (CAI) or through the new initiative on trade and health that Europe proposed to the Ottawa Group in 2020. These responses should focus both on remedying China’s current policy for growing its domestic medical technology industry by distorting its market and setting out the core policies and rules that should guide the future market for medical technologies.

Fredrik Erixon and Anna Guildea are Director and Research Associate, respectively, at ECIPE. Oscar Guinea and Philipp Lamprecht are Senior Economists at ECIPE. The authors are grateful to a number of experts in the private sector and from the European Commission, the Federal Ministry for Economic Affairs and Energy in Germany, China’s Ministry of Industry and Information Technology that have taken their time to share their knowledge with us.

1. Introduction

There is now a familiar pattern in China’s industrial policy. It begins with policymakers in Beijing identifying sectors and technologies that they believe are important to the country’s economic development and security. Leaders then initiate policies – in Beijing and filtering down to provincial governments – to groom a domestic industry that can climb the value chain and challenge globally leading firms. These policies combine subsidies to domestic firms with strategic market restrictions against foreign firms with a large presence in China. Some of these restrictions are overt and explicit. Most of them, however, are opaque and evolve over time.

As a consequence of these distortions, the foreign firms that sell in China gradually see their sales and market shares being reduced and substituted by Chinese firms. Soon these foreign companies also face competition from the same Chinese firms in other countries – and what started as a gradual erosion of market shares in China now leads to a shrinking market share globally. In essence, Chinese firms can grow powerful in the domestic market by competing on terms that are not free and fair. They have access to support that companies from other countries simply do not have. Over time, competition, innovation, and general market dynamism recede.

This process is now happening in the Chinese market for medical technologies. The European Union Chamber of Commerce in China has recently reported that almost two-thirds of European firms that sell medical devices in China are missing out on business because of market restrictions and regulatory barriers.[1] At the centre of current developments in China is an ambitious industrial policy and new policies for centralised state procurement of medical technologies that support Chinese medical technology producers. It is becoming urgent for the European Union to act to avoid lasting damages to European medical technology manufacturers.

Just like other countries, China wants to have a policy for purchasing medical technologies that leads to an efficient use of scarce resources. This is also a central part of Chinese procurement policies and the drive by Beijing to centralise state procurement of medical devices. The strategy is designed to help authorities to save money by reducing the expenditure on various medical supplies. As China continues its economic rise, there will increasingly be competitive and innovative firms from China that are at the frontier of global competition. Moreover, as the country and its state organisations continue their modernisation, there will be changes to practices in government purchasing that will drive price reductions and that will better tailor procurement processes to the needs of the procurer and the ultimate beneficiaries – citizens, users, and patients. This is a natural and positive development.

However, China’s centralised state procurement – sometimes referred to as volume-based procurement – is not just about pursuing legitimate social welfare goals. In the first place, it is notable that some provinces and the State Council have tied savings from centralised state procurement to increases in salary for staff. In June 2021, for instance, the State Council explicitly made the connection between the saved funds from centralised state procurement and salary reform in public hospitals.[2] More importantly, this new policy is indirectly reinforcing China’s industrial policy and allows for a development where state tenders increasingly form part of the goal to have Chinese firms rapidly growing their domestic market shares and use that base to expand abroad. This is particularly the case in the procurement of medical technology goods. Two years ago, China started to pilot a new policy for centralised state procurement of medical devices. After China’s State Council had issued the content of this reform in July 2019, a few test cases were done in Jiangsu and Anhui. After a brief pause in early 2020 as China battled its Covid-19 outbreak, many other provinces followed suit in April 2020. In November of the same year, China conducted its first nationwide tender for a medical device, namely coronary stents. More nationwide tenders for medical devices will come in 2021 and 2022, for instance of orthopaedic joints.

The logic behind centralised state procurement is rather straightforward: buy in bulk to lower the price of each individual medical device. In this case, the price that hospitals and other procuring entities would pay for a coronary stent, pacemaker or other medical technology can be reduced if they contract on a high volume of products as a group. In most sectors, suppliers will often be prepared to reduce the price if the contracted volume is higher because a guaranteed and high volume allow a manufacturer to arrange production and distribution in a way that lowers production costs.

Companies with winning bids under centralised state procurement are shortlisted to supply their medical technology to Chinese hospitals. Companies that are not successful in these procurement rounds are out of a significant part of the national market until the next procurement round, which usually happens between one and two years later. This prospect is dire. With minimal opportunities to sell their products in the immediate future, unsuccessful companies may leave the market segment all together as the cost of keeping their after-sales services becomes impossible to justify. Faced with such a decision, some foreign companies prefer to bid at a price that barely covers production and servicing costs, rather than losing their sales networks, training infrastructure, and brand reputation.

However, there are obvious problems and dangers when governments organise its procurement in a such highly centralised fashion. One problem – evident in the centralised state tenders that we have seen in recent years in China – is that the procurement authority engineers the tender with the primary focus of driving down the price. When this happens, it is often impossible for companies to participate in the tender without making a loss or without reducing the overall quality of the product and its associated services (e.g. training and education in using the product). When centralised state tenders take little or no account of value, low prices become the only outcome. Obviously, the risk then becomes low-quality products eventually driving out high-quality products. Another problem of centralised state procurement is that the process can be captured by those who want to use procurement to support domestic manufacturers. In contrast to a decentralised system, centralised state purchasing – nationwide or in big provinces and cities – makes it easy and often attractive to pursue such industrial policy goals.

Both of these problems are real in China’s centralised state procurement of medical devices. Chinese authorities have achieved the goal of reducing the price – a goal that is legitimate and that China shares with other governments. But the price reductions, going up over 90 percent of the market price, have been extreme and are unsustainable for companies in the long term and undermine innovation in China. Obviously, other motivations than reducing the price have been at play.

This new procurement policy builds on decades of healthcare policy developments in China, and it is a central plank of the Healthy China 2030 blueprint to enhance livelihoods and optimise healthcare systems. It serves as an integrating link between the healthcare ambitions of the government and its equally important plan to move the country’s model of economic growth from exports to domestic consumption. In Beijing, the shift to a new model is seen as critical for the country’s national security.

In a China that is ageing fast and where the rise in healthcare costs outpace economic growth by a good margin[3], China has made the crucial decision to position its own industrial development in the slipstream of domestic expenditure growth. Logically, the procurement of medical technology is increasingly seen as an exclusive reserve for Chinese MedTech producers. There has therefore been a constant stream of new announcements and policies in the last years that gradually have made it clear that China intends to reduce its dependence on foreign MedTech manufacturers.

Inspiration for changing the procurement policy for medical technology came from the pharmaceutical sector and previous procurement projects in China to bulk purchase generic medicines.[4] But this is not a model that works well for advanced, patient-centred, and technology-intensive products like medical devices. A sophisticated medical device requires training, education, instrument availability and cleanliness, and other post-sales services. Doctors often select a particular type of product to meet the specific needs of the patient and to obtain the best outcome for that patient. To ensure the quality and safety of healthcare, it is important that the procurement process considers the cost of care and outcomes, and integrates the quality criteria specific to a given product category. If the terms of a centralised state tender leads to a narrow focus on the price of the actual device – and not the services that are required to safely and effectively use a complex device – there will be negative consequences. Significant price reductions might seem like a win in the short term. However, procuring at the lower cost might have a high price tag in the longer term for the healthcare system, especially when it leads to longer hospitalisation, higher readmission rate and longer rehabilitation time – i.e., lower-value medical devices.

The price outcomes of the centralised state tenders point to distortions in the procurement process. In this paper, we will highlight two problems. First, the price reductions that have been achieved would likely not have been as deep without all the various policy instruments in China that have advantaged domestic firms. There is a vibrant industrial policy for China’s medical technology sector – and it has grown stronger over time. This year, medical technologies (along with biotechnologies) have received a new embrace by Xi Jinping, Beijing and provincial governments as the Fourteenth Five-year Plan has been outlined in greater detail. Moreover, new resources have been added to the industrial policy for the medical technology sector – not least by Chinese provinces that aim to make themselves central hubs for the development and manufacturing of medical technology goods.

Second, the tenders – suffering in the first place from poor transparency – have not just favoured Chinese suppliers but generally confused the market for medical technology. The nationwide centralised state tender for coronary stents is an instructive example. The tender led to a reduction of the price of stents by over 90 percent.[5] Out of the 20 participating bids, eight companies got chosen. Remarkably, six of them were Chinese. Moreover, only one company, a Chinese company, received a guaranteed commitment – despite the fact that the model of centralised state procurement is designed to get companies reducing their price in return for a committed volume of sales. The other winning bids received no sales commitment. In the process to get hospitals to actually purchase their medical technology, it has been common that companies have had to include services like education and training that they had cut from the tender bid in order to sufficiently reduce the price to the level indicated by the tender proposal. This is not a policy based on free and fair competition: it is a highly distorted procurement process that sometimes borders on extortion.

China’s new policy merits a European response. The result of these policies is that European manufacturers of medical devices are deprived of opportunities to compete and win customers in China – sometimes on a national basis. Many of the MedTech manufacturers in Europe are small and medium-sized enterprises with little capacity to fend for themselves in China.

Furthermore, the market distortions in China do not stay in China. The obvious risk is that the loss of sales and market shares in China will be followed by more competition from state-backed Chinese manufacturers in third markets – something that already has started to happen in regions like Africa, Asia and Latin America. This is also clear in trade data: Chinese exports of medical devices have taken an extraordinary jump during the Covid-19 pandemic, and China’s MedTech industry is now in a position to grow its global market share radically as hospitals and healthcare systems in many parts of the world will have to increase expenditures to replace their medical technology. The number of Chinese MedTech companies have grown rapidly since 2019. Notably, China’s export growth during the pandemic has not been the strongest in segments that many have read about in media: facemasks and other personal protective equipment (PPE). Exports of medical devices have been booming and the improvement in China’s trade balance has been the strongest in some medical devices that also have been subjected to centralised state tenders in the past years (see chapter 2.4). Consequently, it is not surprising that European medical technology companies are fearing an existential threat – similar to the one witnessed in other sectors where Chinese manufacturers, supported by Beijing and provincial governments, have steamrolled foreign competitors at home and abroad. For Beijing, the MedTech sector is now in the bullseye.

In Europe, there are substantial economic interests at risk. Europe’s medical technology sector is a high value-added sector that is globally competitive and that generates good economic outcomes for Europe. The sector employs approximately 760,000 people directly in Europe – with 210,000 employees in Germany, 103,000 in the United Kingdom, 94,000 in Italy and 89,000 in France. There are 33,000 MedTech companies in Europe and 95 percent of those are small- and medium sized firms. There is also vibrant innovation in the sector. In 2020, firms in the MedTech sector were responsible for nearly 14,300 patent applications to the European Patent Office – 38 percent of which came from European firms. Trade with the rest of the world in medical technologies in 2020 generated a trade surplus for Europe of 8.7 billion euros.[6]

There are several actions that the European Commission can take to address the growing concerns that European manufacturers are increasingly squeezed out of China’s MedTech procurement market. There are direct actions that can be taken – some remedial, other focused on dialogue and negotiation with China about the future development of the medical technology market. They are the focus of this report. Europe should consider filing a complaint at the World Trade Organisation (WTO) over China’s distortive procurement policy and the impairment of previous market access. While there is no obvious instrument that directly could help to remedy the problem, a combination of measures – including both contingent policies, notably the evolving International Procurement Instrument (IPI), and negotiations – would be necessary to achieve two outcomes. First, it is required that actions are employed rapidly to avoid the continued deterioration of market access of European manufacturers arising from distorted procurement policies. Secondly, it is desirable for all sides that the long-term development of the market for medical technology goods continues to be competitive, rewards innovation, and provides patients with access to high-quality medical devices that meet their individual needs.

[1] European Chamber of Commerce in China (2021) European Business in China, Business Confidence Survey 2021. European Chamber.

[2] State Council (2021, June), “Notification on Key Tasks for Deepening Healthcare Reform in 2021”.

[3] Fitch Solutions, Medical Devices Factbook 2021, Healthcare Expenditure.

[4] Centralised state procurement of generic medicines led to a price reduction – around 50 percent on average that is much less drastic than centralised state procurement of medical technologies.

[5] Xinhua Net (2020, November 5) China’s centralized purchasing leads to a 90 pct drop in price of coronary stents. Accessed at: http://www.xinhuanet.com/english/2020-11/05/c_139493620.htm

[6] MedTech Europe (2021, June 21st). The European Medical Technology Industry in figures, 2021. Accessed at: https://www.medtecheurope.org/wp-content/uploads/2021/06/the-european-medical-technology-industry-in-figures-2021.pdf

2. Industrial and Procurement Policies in China

Industrial policy can be broadly defined as a policy agenda that attempts to improve the business environment and alters the industrial structure of a region, with the view of making production more efficient, either through promoting or restricting specific sectors and technologies. In China, the government has considerable influence over its industries and over the past two decades the state has played a significant role in helping some Chinese firms to become globally successful in industries such as pharmaceuticals, solar panels, and machine tools (See Box 1: Chinese Exports and Industrial Policy). As previously discussed, a centralised system of purchasing in China, nationwide or in provinces, helps the government to achieve its industrial policy goals. While this system allows domestic companies to get a head start against other competitors, it could also lead to a distortion of the procurement market.

Box 1: Chinese Exports and Industrial Policy

China’s ‘Made in China 2025’ initiative, launched in 2015, aims to turn Chinese firms in high value-added manufacturing into world leaders. In 2020, president Xi Jinping vowed that the government would be doing more to support strategically important sectors – specifically robotics, biomedicine and medical technology.[1] Implied by the name ‘Made in China’, this initiative puts an emphasis on industrial policy that is preferential to Chinese domestic producers, while often discriminating against foreign manufacturers. China’s industrial policy has already been widely criticised for distorting free and fair competition, and the impacts of it can be seen in the shrinking role of the EU in global value chains. While EU trade integration with China is increasing, the EU’s external competitiveness has been undermined in several sectors.[2]

In this chapter, we will be examining China’s industrial policy for the medical technology sector, which has become central for Beijing in the wake of the Covid-19 pandemic. China’s Ministry of Industry and Information Technology (MIIT), as part of China’s central government, has for the first time issued strategic ambitions for the medical technology sector[3] [4]. We outline in our analysis how Chinese industrial policy in the medical technology sector is increasingly discriminatory, showing a clear preference for domestic firms at the expense of foreign firms. While centralised state procurement is first and foremost a policy to reduce expenditures on medical devices, it is equally obvious that it spills over to industrial policy and becomes one part of a broader package of strategies and policy instruments advancing the domestic Chinese industry. This section illustrates how the tools used to implement this industrial policy by the Chinese government distort pricing and competition, and lead to unfair results for European competitors and exporters.

2.2 MedTech Industrial Policy in China

As a result of its rapid economic development and the large size of its economy, the Chinese market of medical technologies doubled its market revenue in 2020 from its value in 2015. With an annual growth rate of nearly 20 percent since the implementation of the ‘Made in China 2025’ initiative, the industry has constantly outpaced GDP growth. From 2015 to 2020, Chinese imports of medical devices grew at nearly 9 percent a year, outpacing global growth and making the country an increasingly key medical technologies market. In 2019, the Chinese medical equipment market reached 25 billion euro[5]. China is thus increasingly becoming a market that foreign manufacturers and governments cannot afford to ignore. However, as was outlined above, the medical technology sector, like most sectors of the Chinese economy, is subject to a distinctive regulatory and competitive environment that is crucial for the evolution of this sector.

In the past decades, European manufacturers have been successful in reaching Chinese customers and maintaining a substantial market share in the country. However, frequent changes to the regulations governing China’s medical device market have impacted foreign brands: new policies that have been rolled out by national and local authorities have routinely favoured domestic manufacturers. As mentioned in the introduction, a recent survey by the European Union Chamber of Commerce in China of European companies operating in China showed that 78 percent of respondents in the pharmaceutical sector and 64 percent in the medical devices sector report that they missed out on business opportunities due to market access restrictions or regulatory barriers in 2020. Together with Legal Services, Transportation and Civil Engineering, Medical Devices and Pharmaceuticals belong to the group of worst-affected sectors.[6] Full localisation of the medical device market is still impractical for China as domestic producers are not capable of providing competitive products in many sectors. Moreover, imports from foreign manufacturers play an important role in disseminating new innovations and technology in the industry. However, China’s industrial policy already sets a pathway for the country to substitute over time European and other foreign manufacturers to a substantial degree.

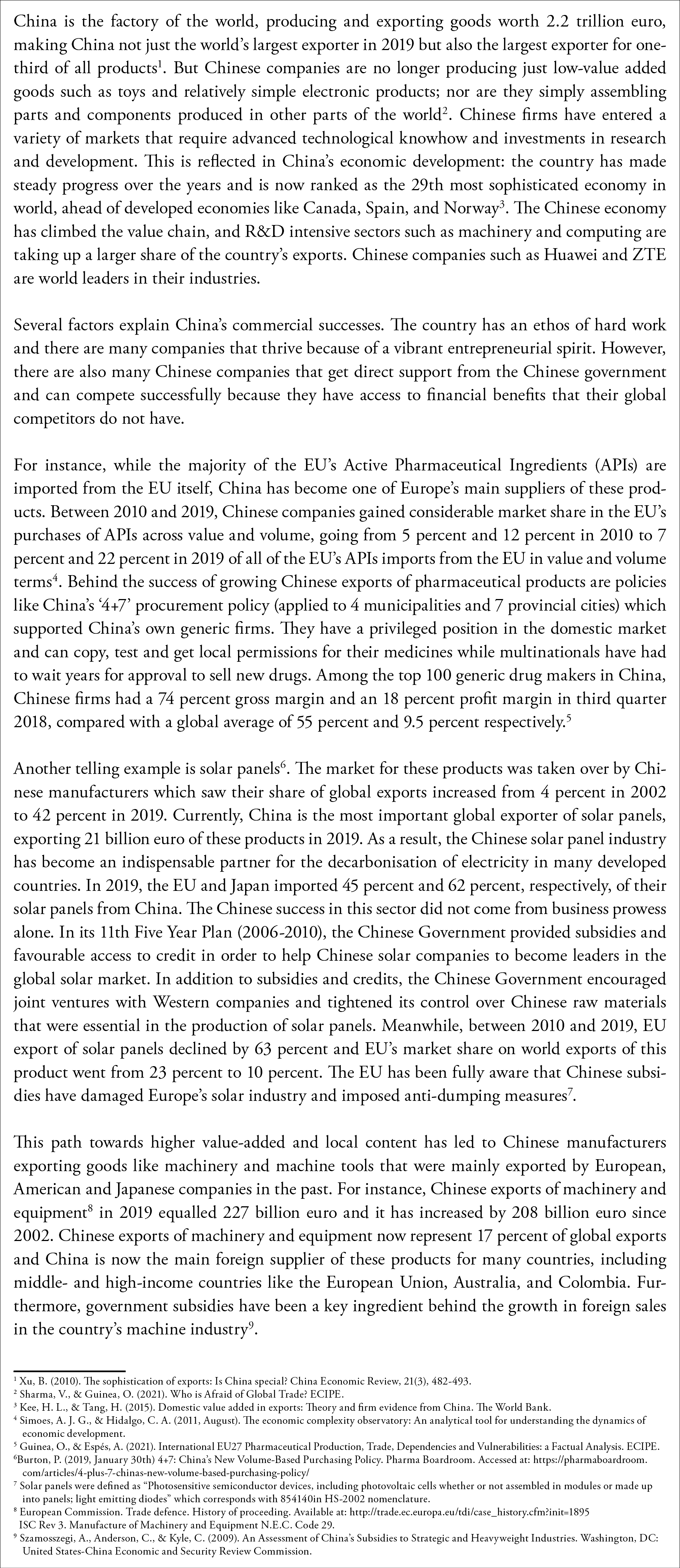

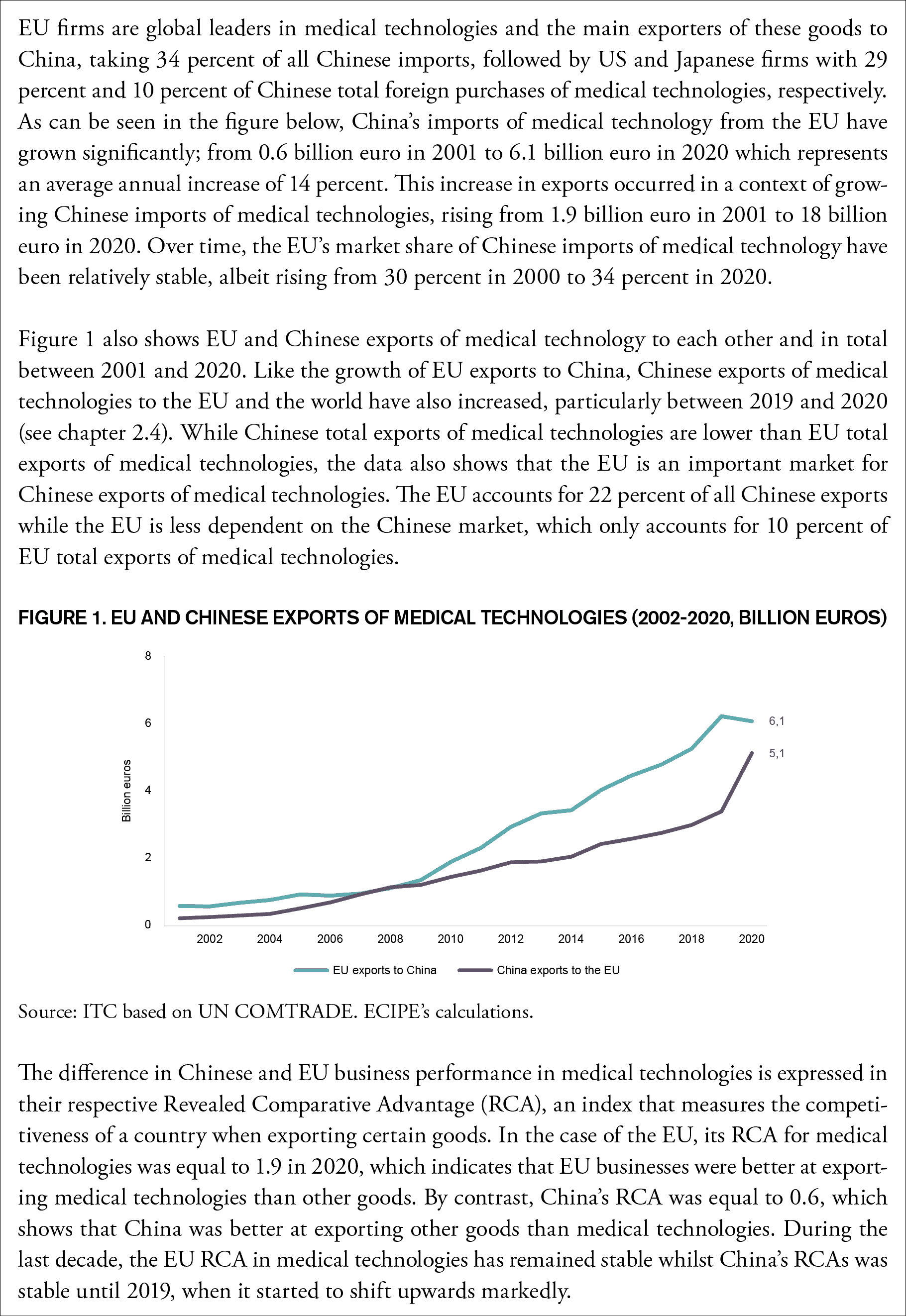

Box 2: EU and Chinese Exports of Medical Technologies

In the past, most medical devices produced by Chinese manufacturers were low-cost, high-volume items and international manufacturers supplied Chinese hospitals and other health care facilities with high-end equipment and devices. This dynamic is now rapidly changing and some of this change is a natural reflection of the improved innovation capacity by Chinese firms. In line with its goal of propelling the Chinese economy up the value chain – creating ‘national champions’ and lowering dependence on foreign imports – Beijing has made the development of the country’s biomedical and high-end medical device manufacturing sector a key priority. Already in 2014 President Xi declared that it “is necessary to accelerate localization of high-end medical devices, to decrease production costs and to promote the continuous development of national enterprises”.[7] Now the country is accelerating that ambition.

Several policy areas have been identified by the central government in China to be important for its MedTech industrial policy[8]. Capital equipment appeared to be the initial focus of the country’s strategy. The Chinese government has strengthened support for so-called ‘first of its kind’ devices, which include several types of medical technology. As part of the scheme, provincial governments are to design subsidies to incentivise the development of their local medical device producers and encourage the listing of local companies that can supply medical technology products. Notably, developing manufacturing capacity for key components also emerges as a central plank of the scheme (for instance, components for MRI, CT, life support machines, medical robots, implantation and intervention equipment, among other high-value consumables).

Moreover, the Chinese government has expanded tax benefits for R&D expenses, removing previous restrictions on expenses from overseas R&D activities. Companies can now deduct 100 percent of their R&D expenditures from their tax bill. The government will also refund incrementally retained value-added tax credits for the advanced manufacturing industry in an effort to encourage equipment updates and technology investment. Moreover, to reduce borrowing costs, the People’s Bank of China has focussed its lending activity into high-tech manufacturing[9]. The overall aim of these policies is to support innovation by domestic manufacturers.

As recently as April 2021, the Chinese government published its new medical technology five-year plan (2021-2025), outlining the goal to make at least six Chinese companies to be among the leading 50 medical device companies globally (currently there are four Chinese companies in the top 100, none of which are in the top 50).[10] The plan also calls for developing higher-value medical devices, encouraging Chinese manufacturers to step into fields such as radiotherapy and ultrasound, magnetic resonance, dialysis machines or pacemakers and cardio-vascular stents. To achieve these goals, the central government expects Chinese local governments to set favourable fiscal, financial, and taxation policies[11].

There are also other strategies and policies being used by the Chinese government that have the effect of promoting the domestic MedTech industry. Importantly, in May 2021 the Chinese Ministry of Finance and the Ministry for Industry and Information Technology issued a joint notice that establishes local content requirements for 315 specific products.[12] 178 of these products are medical technology goods – and 137 goods of these are required to have 100 percent local content. Even if it remains somewhat unclear what these requirements mean in practice, this is a remarkable ambition that can knock out all imports of certain categories of medical devices, such as x-ray machines, MRI equipment and products for renal replacement therapies. The notice does not include specific instructions for implementation, but it has been distributed as reference to province-level governments. Moreover, it follows on some previous province-level ‘buy China’ policies and is a harbinger of China’s direction in MedTech procurement policy.

Yet another stream of strategies that seems to favour domestic producers at the expense of international manufacturers is the ‘dual circulation’ model of China – an attempt to make the country more dependent on the domestic circulation of goods and less dependent on the international circulation of products. Medical equipment is part and parcel of that strategy. In the five-year plan for the MedTech sector from the Ministry of Industry and Information Technology, the Chinese government lays out its ambition for a “new development pattern marked by the domestic cycle as the main body and the mutual reinforcing of both the domestic and international cycles thus built” and says that the government “must promote the high‐quality development of the medical equipment industry”.[13] President Xi echoed these ambitions in a speech in the Great Hall of the People in May 2021, saying that the government must “accelerate the breakthrough of a number (i.e., batch) of key core technologies in the fields of medicines, medical devices, medical equipment, vaccines, etc”.[14] Figure 2 highlights the Chinese strategies and policies which are currently at play to build up and promote the Chinese medical technology sector.

Figure 2: Strategies and Policies for State Intervention in China’s Medical Technology Sector

There is also a strong focus on using public procurement to achieve industrial ambitions in medical technology. McKinsey, the consultancy,[15] highlights the increasing prevalence of aggressive volume-based procurement, or centralised state procurement, in China’s medical technology strategy. In the lead-up to 2020, public procurement had made it to the top of the agenda of China’s policy leaders – and the consequences of new procurement policies led many to wonder if established business models were still sustainable (See Box 4: Outcomes of the Recent Chinese Procurement in Medical Technologies). Nine regions had piloted tenders — implemented at both city and province level — while 16 had ongoing or announced tenders. The average price cuts brought about by the tenders were steep, with many product categories having price cuts between 50 and 60 percent (and some up to 80 percent). A host of products were affected, from orthopaedic implants and cardiovascular stents – the latter experiencing a dramatic 90 percent reduction in prices on a national basis[16] – to infusion sets and intravascular catheters. Furthermore, throughout 2020 several official institutions within the central government announced intentions for more comprehensive implementation of centralised procurement.

The language used throughout documents and plans pertaining to the Chinese government procurement is clearly suggestive of preferential support for domestic firms in public purchases as a tool for industrial policy. For example, “through comprehensive use of fiscal, taxation, financial and other means, guide local governments, social resources, etc. to support the medicine‐industry collaboration on tackling key obstacles in developing high‐end medical equipment, key parts and components”.[17] Premier Li Keqiang, speaking at a State Council meeting on centralised state procurement in medical devices and pharmaceuticals, called in early 2021 for a “concentration” of the market – or to “use centralized procurement to make the consumables industry more concentrated as it relates to competition”.[18]

The ‘Made in China 2025’ initiative itself calls for top Chinese hospitals to be using 50 percent more domestically produced medical devices by 2020 and 95 percent more by 2030. There are well over 30,000 hospitals in China, the vast majority of which are owned by the state. A number of Chinese provinces and municipalities have gone so far as to redirect medical device purchasing to national manufacturers. Provinces such as Sichuan, Zhejiang and Jiangxi – representing a combined population of 184 million, which equals the combined population of Germany, Italy and Spain – have now passed legislation that compels middle and higher-tier health care institutions to purchase certain types of equipment from domestic manufacturers.[19] Multinationals in the medical technology sector have reported that even when their products are listed for use, their domestic counterparts eventually win contracts because of cheaper prices and stronger government connections.

The Guangdong Provincial Healthcare Security Administration admitted as much in a letter to the Guangdong Provincial People’s Congress. It said: “in formulating the rules for the centralised procurement of medical consumables in our province, [we will] implement the same group bidding policy for domestic medical consumables and imported medical consumables to enhance the price advantage of domestic medical consumables and increase the chance of domestic medical consumables being selected.”[20]

Shanghai is also expanding its ambition to become a global hub for the development and manufacturing of medical technologies. Following the five-year plan for emergent industries by the Shanghai Municipal People’s Government, this ambition is directly connected to the general ambition to substitute imports of foreign medical technologies by Chinese products. This plan “calls for developing a number of local innovative enterprises to achieve indigenous control of core technologies and new biomedical products by 2025, focusing on developing high-end medical device and equipment including surgical robots and biomedical materials.”[21]

Similar ambitions have been established in the five-year plans of other provincial governments. The Guangdong provincial government has said in its plan that it aims to “leverage on preferential government policies” to reinforce the strength of its MedTech industry.[22] Hainan and Shandong have similar plans. The Beijing municipal government has also laid out its plan for cultivating a group of medical equipment manufacturers and build up new industrial parks.[23]

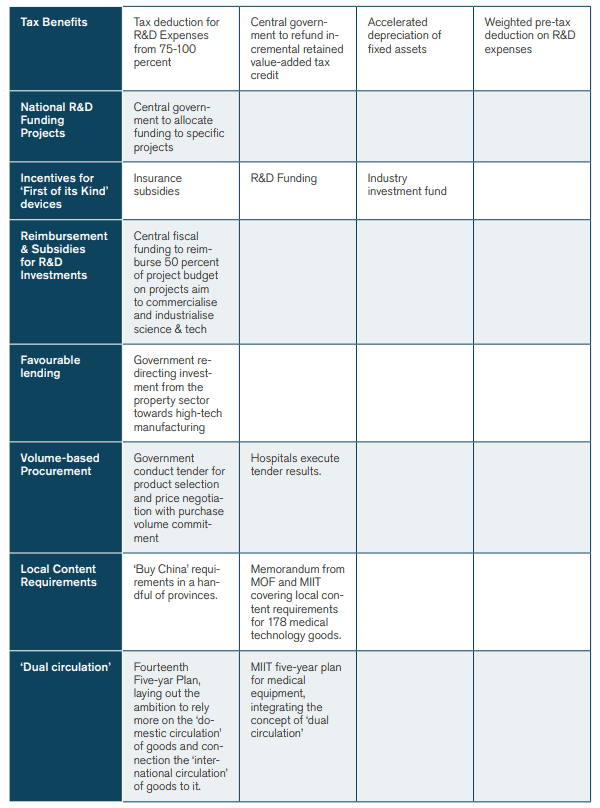

Box 3: Chinese Discriminatory Regulations in Medical Technologies

2.3 MedTech Procurement – Policies and Centralised State Procurement

Before the outbreak of Covid-19, several Chinese provinces had taken the first steps toward realizing Beijing’s ambitions through procurement policies that preference domestic manufacturers over foreign imports. In 2018, state hospitals in the Sichuan province, with a population almost as big as Germany, were required to procure domestically produced devices in 15 product categories or risk losing out on lucrative state-insurance reimbursements. In 2019, provinces and major cities across China released a series of increasingly restrictive procurement policies. The Ningxia province was first to release a notice requiring state hospitals to justify any foreign medical device imports with a lengthy audit. Suzhou and Tianjin, major economic hubs with a combined population of 26.34 million, soon followed suit with identical notices. The Shandong province, with a GDP almost as large as Spain, limited all device imports to only 488 items, mainly high-tech diagnostic devices not produced in China. The Zhejiang province soon after limited state hospital imports to 232 items. These restrictive policies are a double-edged sword. They benefit China’s medical device industry by insulating it from foreign competition while also forcing hospitals to expend resources searching for products which, in some cases, may be of lesser quality than foreign alternatives.[24]

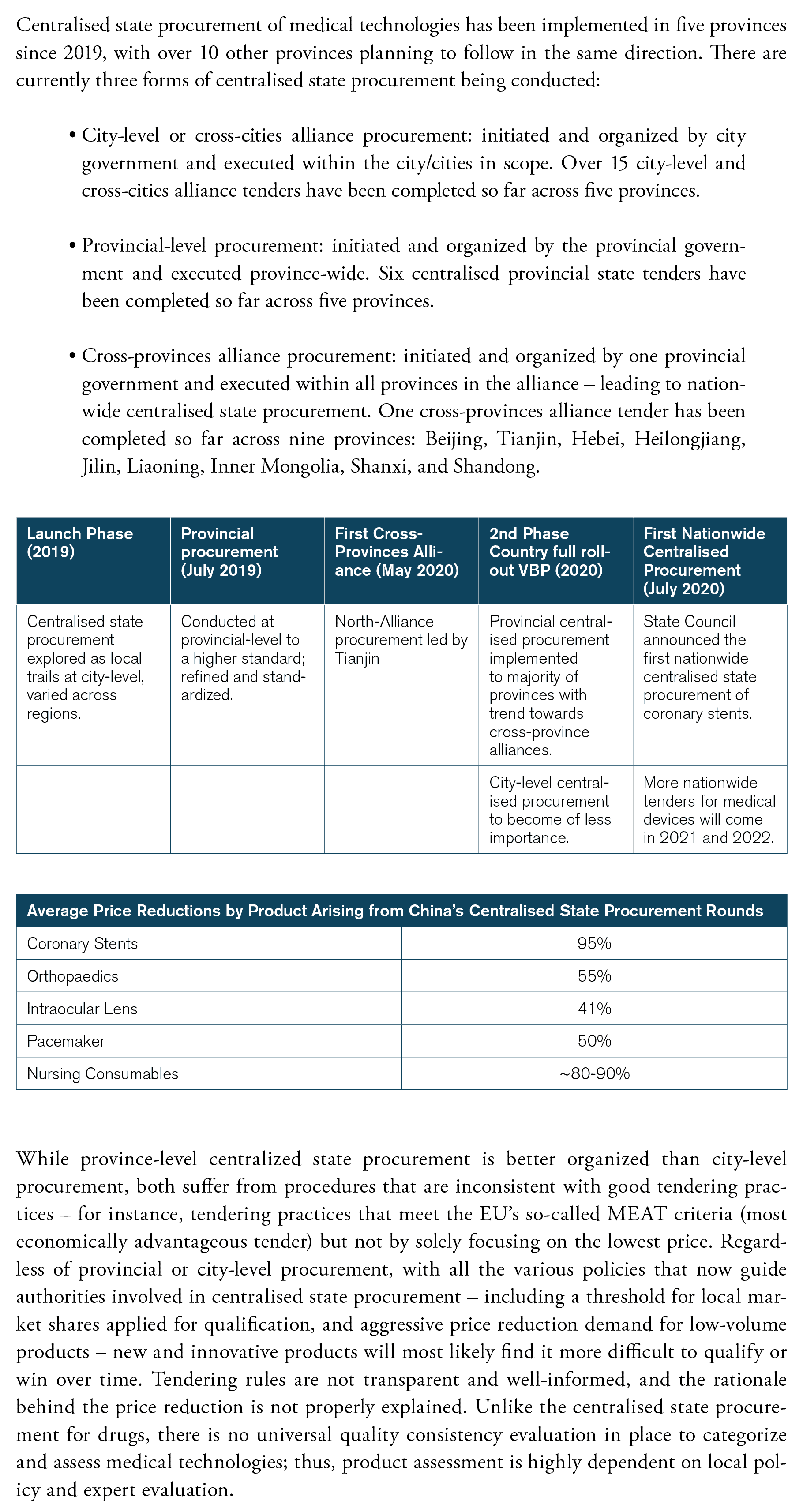

Box 4: Outcomes of the Recent Chinese Procurement in Medical Technologies

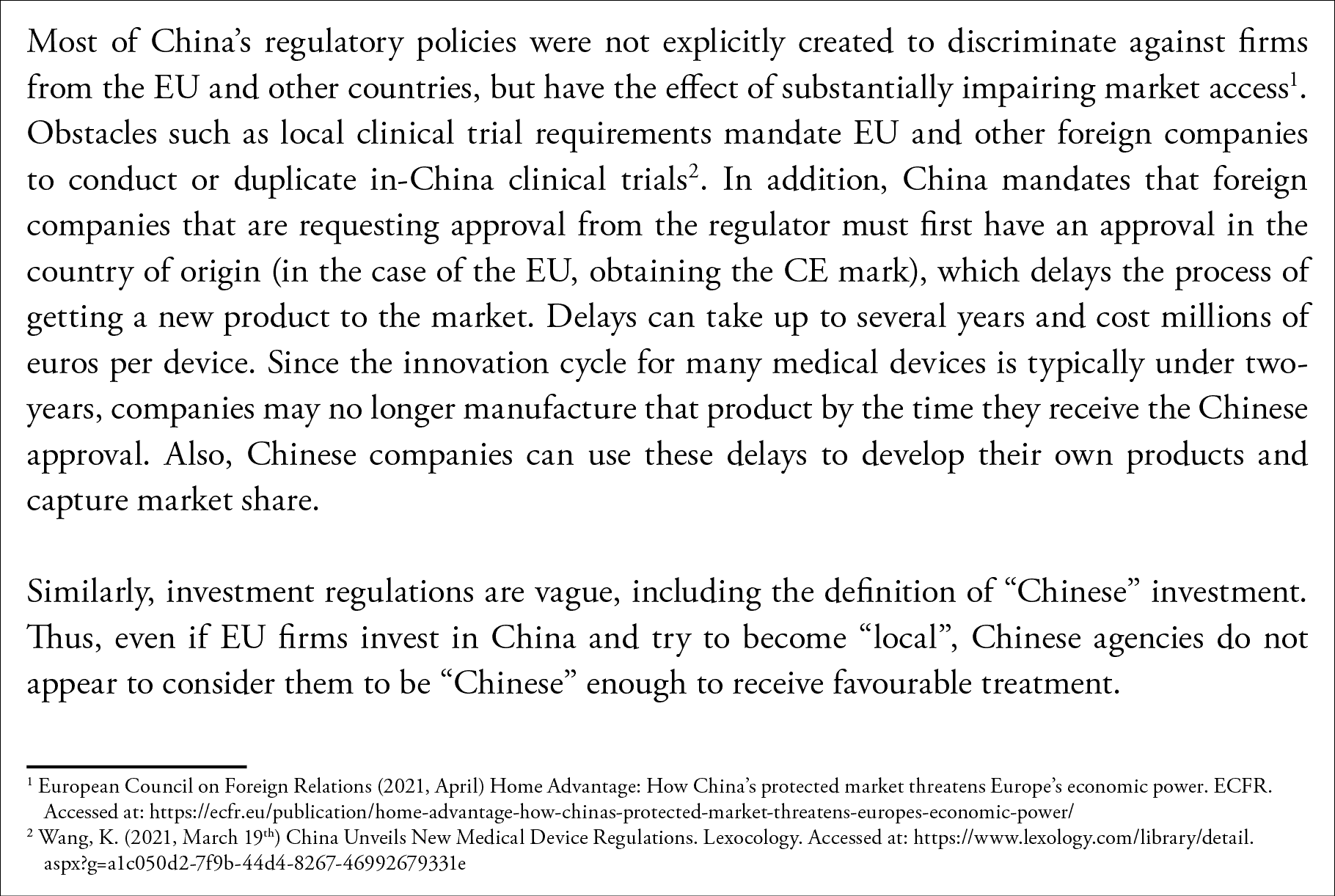

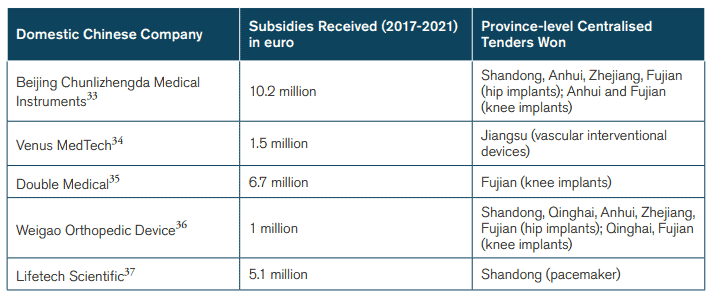

The use of public procurement as an industrial strategy by the Chinese government is likely to present the medical technology industry with significant challenges. Obviously, there are risks of considerable reallocations of market shares just because of changes in procurement policy, and in some market segments this is already under way. Take cardiac stents: Chinese companies already have over 80 percent of its domestic market. It was a Chinese company – MicroPort – that was the largest winner in the 2020 nationwide state tender. These domestic companies also get financial support from various levels of governments in China. For instance, MicroPort received at least 2.75 million euros (21 million renminbi) in subsidies from the Shanghai city government in 2019 alone.[25] Other Chinese MedTech companies also receive various forms of government support – only a fraction of which is known to the public. These companies are, as a result, growing and becoming better positioned to compete with multinational corporations. They are also winning Chinese tenders (see Figure 3).

Figure 3: Subsidies to Selected Chinese Companies*

*These are just examples of subsidies to Chinese firms that have won tenders.

Questions have been raised in China about the aggressive pursuit of price reductions. In some cases, it has been unclear if smaller companies that have won tenders actually could supply the demanded volumes, and if their product quality and product services could meet clinical needs. As a result, the central government has asked bidders in some recent tenders to supply letters guaranteeing that they will be able to supply the volume they potentially could win.

However, this problem also comes from the actual policy design and cannot easily be addressed by letters. Unlike centralised state procurement in the pharmaceutical sector[31], where winners have been guaranteed a promised procurement quantity, there is no guaranteed sales for the winning bidders in the centralised state procurement for medical technologies. It has been the case in some tenders that the winning bidder with the lowest price was guaranteed a volume of sales, but the fact that most bidders will not know what volumes they are bidding for seriously affects their capacity to provide price and supply plans that are fully reliable.

Another complicating factor is that medical technologies – unlike generic pharmaceuticals – are not just a good. After-sales services, regular product testing and education for medical staff are central and indispensable services that need to accompany the actual medical technology good. This is costly and substantially reduces the potential for cutting expenditures by contracting on a high volume. The risk is rather that aggressive price cuts will ultimately affect the quality of the good and the service, and that – over time – it will make it harder for Chinese patients to get access to innovative medical technologies[32].

Obviously, there is significant international concern that centralised state procurement by the Chinese government of medical technology will distort pricing and competition, and gradually will make it harder for non-Chinese manufacturers to access the Chinese market. The price pressures in the achieved rounds of centralised state procurement have been extraordinarily high, leading to price cuts that were far bigger than expected – and that cannot be supported or encouraged on market terms[33] (See Box 4: Outcomes of the Recent Chinese Procurement in Medical Technologies). It does not require much imagination to see how procurement processes get distorted to encourage higher take-ups by local firms. In other words, an important unwritten objective of Chinese procurement practices such as the programme for centralised state procurement is not about lowering prices for Chinese consumers but to support Chinese producers in the medical technology industry.

By design, these procurement practices hurt the chances of European manufacturers to access China’s procurement market. China’s market for medical technology and consumables is growing fast and Chinese manufacturers accounted for 6 percent of the global market in medical technology in 2020. Moreover, the Chinese medical sector is expanding rapidly abroad, supplying countries not just with the medical goods needed during the outbreaks of Covid-19 but also other medical technologies. Using government procurement as an industrial policy tool is a well-known routine in the Chinese policy-tool kit. The Chinese government has followed a similar path in other industries (See Box 1: Chinese Exports and Industrial Policy).

2.4 Covid-19 and China’s Rise in Medical Technology

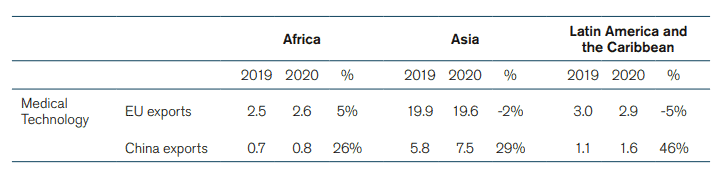

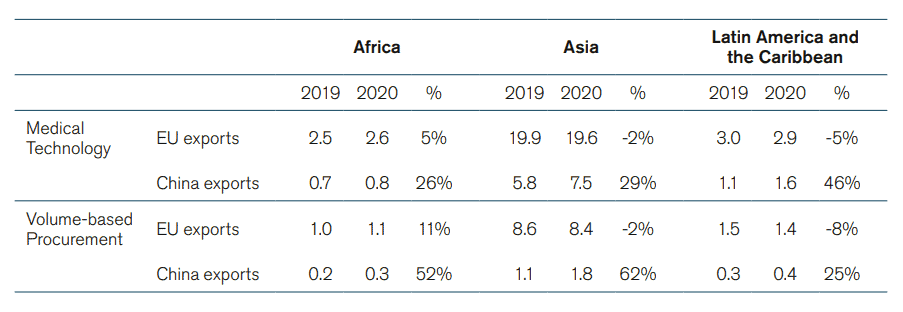

There has been a significant growth in China’s medical technology activity during the Covid-19 pandemic – an indication about the development of the market that is to come after the pandemic. Between 2019 and 2020, the number of Chinese MedTech manufacturers jumped by 46 percent.[34] Chinese exports of medical goods also increased dramatically in 2020.[35] This increase was not only due to larger sales of personal protective equipment like gowns, facemasks, and gloves but also because of an increase in exports of other medical technologies, which went from 18 billion euro in 2019 to 23 billion euro in 2020. The growth in Chinese exports of medical technology happened worldwide. Africa, Asia, and Latin America and the Caribbean saw their imports of Chinese medical technology between 2019 and 2020 grow by 26 percent, 29 percent and 46 percent respectively. China’s growing exports of medical technology was also visible in the US and the EU where Chinese imports grew by 16 percent and 51 percent, respectively. Meanwhile, EU exports of medical technologies to these countries in 2020 grew at a much slower pace than Chinese exports; EU exports to Asia and Latin America in 2020 were even lower than in 2019 (See Annex, Table 1 for full data).

Table 1: Chinese and EU exports of Medical Technologies to Africa, Asia, and Latin America and the Caribbean (2019 and 2020 in Billion Euros, and Annual Change in Percentage)

Source: ITC based on UN COMTRADE. ECIPE’s calculations.

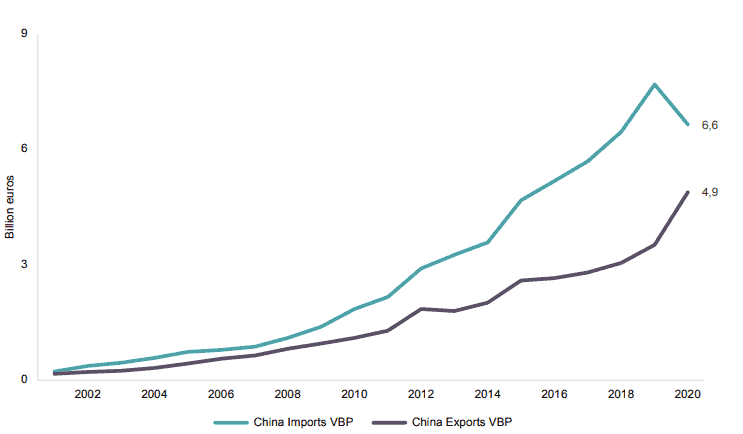

Part of this export success was due to the Covid-19 pandemic: China’s medical technology sector has increased its production of medical goods substantially in 2020. Among the products that boosted China’s exports of medical technology were oxygen therapy equipment such as artificial respiration and ventilators whose exports grew by a factor of three and five between 2019 and 2020. Astonishingly, China’s global market share for oxygen therapy equipment went from 10 percent in 2019 to 22 percent in 2020. There were several other products that showed remarkable growth in exports and that lead China to take a substantial part of the global trade, like electro-diagnostic tools, radiation apparatus and dental implants. For example, in 2020 the Chinese medical technology industry provided close to one-third of all dental equipment like drills, rotating chairs, and X-rays machines imported by Latin America and the Caribbean countries, more than one of every four electro-diagnostic tools like electro-cardiographs and resonance machines in Africa, and one-tenth of CT scanners in Asia. China is of course also a large importer of medical technology. However, China’s trade balance in medical technology – the difference between exports and imports of medical technology goods – has changed very fast. It went from a deficit of 1.3 billion euro in 2019 to a surplus of 5.2 billion euro in 2020.

It is important to pay closer attention to what has happened in Chinese imports. As previously noted in Figure 1, Chinese imports of medical technology goods from the EU have declined in the past year. Chinese imports from some other countries such as the United States or Switzerland show a similar trend. What is equally remarkable, if not more, is that the fall in Chinese imports of medical technology can especially be observed in the medical technologies that went through centralised state procurement. Products like syringes, needles, and catheters, artificial joints, and pacemakers have experienced a steady fall in their annual growth of imports since 2015. In 2020, it turned negative (see Figure 4). At the same time, Chinese total exports of these products between 2015 and 2020 showed positive growth. These figures indicate that Chinese companies are not only substituting foreign goods for domestic production but they are also gaining market shares abroad (as it can be seen in Table 1 when comparing Chinese and EU exports of medical technologies between 2019 and 2020). This is, for instance, the case of Chinese manufacturers of pacemakers that, whilst representing a small share of global sales, saw their global exports between 2015 and 2020 grow by 110 percent while sales of foreign manufacturers of pacemakers to China increased by just 2 percent during the same period.

Figure 4: Chinese Global Trade Balance for Medical Technology Goods Subject to Centralised State Procurement (2001-2020, Billion Euros)

Source: ITC based on UN COMTRADE. ECIPE’s calculations.

MedTech companies in other parts of the world have faced a different reality. Like many sectors, the Covid-19 pandemic hit the medical devices sector hard. However, the restrictions and challenges raised by the pandemic have forced medical device manufacturers to think in new ways, creating growth opportunities for the sector. In Western Europe, the medical device market is on track to recover from the COVID-19 pandemic by 2023, when it will return to its pre-pandemic path of growth.[36] In China, however, it is not just the recovery that has been faster: its market for medical devices is predicted to continue to grow significantly faster than in Europe, the United States and other major economies. The compound annual growth of Chinese expenditure on healthcare between 2015 and 2020 was close to 10 percent while the same figures for the EU and the US were significantly lower at 3.4 percent and 4.5 percent respectively[37] Meanwhile, according to Deloitte, China now accounts for 20 percent of the global medical device market, and this fast-growing industry is expected to continue on an upward trajectory, supported by multiple drivers such as an aging population, rising incomes, and Chinese procurement practices in medical device tender.[38]

Even if it is difficult to find reliable figures for China’s share of the global medical device market, it is clear that Chinese medical technology manufacturers have expanded considerably during the pandemic and that they have been growing rapidly in sectors that are not related to the treatment of Covid-19. This expansion builds on increasing efforts over several years by the Chinese government to build healthcare partnerships with countries in Africa, Asia and Latin America – often with components of Chinese bilateral development aid. China’s development support is anchored in key initiatives like the Health Silk Road, the Belt and Road Initiative and Forum on China-Africa Cooperation and includes the donation of medicines and medical equipment. In recent years, China has also made investments in healthcare education and training, and supported new healthcare facilities such as the Kenyatta University Teaching, Research and Referral Hospital in Kenya. Gradually, the Chinese government has raised its presence in foreign healthcare markets. It has also been successful in making use of healthcare contracts through international organisations like the World Bank. While the World Bank prioritises to give contracts to local suppliers, Chinese suppliers have supplied and fulfilled 989 contracts in recent years – despite the number of contracts in China only being 444.[39]

While it is to be expected that the global market for medical technology will increasingly feature Chinese firms, it is notable that Chinese industrial policy and procurement policies have depressed Chinese imports from Europe and other countries. But it is not surprising. China’s advances in its own medical technology market – and in the global market – have been advertised in central industrial strategies by Beijing. The government has put financial resources behind these strategies, and if the country continues on its current path of centralised state tenders, Chinese firms will be given an even stronger basis to compete globally in the post-pandemic healthcare technology market.

2.5 Concluding Comments

Since the launch of centralised state procurement in China’s market for medical devices, some important lessons have been learned about the practical and real consequences of this model of government purchasing.

The first lesson, already discussed above, is that the price reductions have been extreme. There is a reason for this. Technically, these unprecedented price reductions have been achieved through bids from Chinese and foreign manufacturers that have offered a price vastly below past procurement prices. Some Chinese manufacturers have participated in previous procurements by hospitals but something has changed over recent times that has allowed them to now set the tone for the procurement results. A key change is of course the efforts made by Beijing to roll out centralised state procurement. The methodology of this new procurement policy entails that bidders can offer a lower price if they can sell more goods. While there is a limit to the price reduction that can be achieved in medical technologies by contracting on high volumes, the theory is that the price will be a factor of the quantity sold. There is some truth in this, but it cannot – by far – explain the levels of price reductions announced in the procurement results. It is obvious that other factors are at play. One such factor is favouritism of Chinese companies in the tenders – the outlined policy that Chinese firms should increase their combined market share by 95 percent until 2030.[40] Another factor is the acceleration in China’s industrial policy for the medical technology sector, which allows Chinese firms to compete by dropping prices below levels that is sustainable by market terms.

A second lesson, drawn from province-level tenders, is that winning companies rarely will be guaranteed sales at a certain volume – despite the fact that volume commitment is the philosophy that guides this procurement policy. This is highly problematic since the price that bidders have agreed to sell at is based on the notion that they are guaranteed substantial sales and thus can arrange production and cost accordingly. If they cannot sell the expected quantity – or not even near the expected quantity – the procurement process has created not just an artificial price but also an artificial market. Companies have been asked to bid for a market that in reality does not exist.

Such practices violate basic norms of good procurement policy. Participating companies are forced into a situation where it is profoundly unclear what product and services that should be offered and on what terms. Chinese procurement authorities know that foreign manufacturers will have to make a tender bid if they are to have significant sales in China – a process reinforced by recent indications by Chinese authorities that the centralised state procurement in the future also could include the private hospitals market. But the market they tender for changes when they have to include additional services to hospitals.

A third lesson is that, while there are differences between the tenders by provincial governments and the central government in Beijing, the expansion from provincial to nationwide procurement impairs the medical technology market. The process is coordinated: after the initial provincial tender, there has been a stream of other provincial tenders – finally, in the case of coronary stents, leading to a nationwide tender. The price changed during the progression from provinces to nationwide tenders: the biggest price reduction in the various procurements of coronary stents was achieved in the final nationwide tender. The same evolution is expected for other medical technologies, including pacemakers and orthopaedic implants that are due to be subject to new nationwide tenders.

The development from provincial to national tenders makes it imperative for companies to participate from day one in the first provincial tenders. If not, they risk getting cut out of the market. Companies that do not bid for a first provincial tender because the indicated price reduction is too big will find that the next province-level tenders, and the national tender, will ask for even bigger price reductions. Getting into the list of winning bidders for the first provincial tender, even if it means selling at an unsustainably low price, is the only way to take part in the market.

Moreover, since the design of centralised state procurement rounds may require bidding products to exceed a threshold of market share to even be considered, any product that is new or out of the market for any appreciable time may be disqualified by design. This renders formerly existing products (and manufacturers, if they had only a single product in the market) unable to compete for future business, further strengthening the position of manufacturers that have won previous bids, which are often Chinese.

Additionally, because nationwide tenders have primacy over the provincial tenders, this can cause problems even for those companies that win provincial tenders. Companies that win provincial tenders rely on those committed volumes to set production levels and, to some extent, product cost. Therefore, the volumes and prices around which companies have planned production schedules are further upset when the terms of a national tender supplant the provincial tender. This puts companies in an even more precarious position.

The result of all this is, firstly, a highly unpredictable market. It is legitimate that the Chinese government and procuring provincial entities want to establish a procurement procedure that allows for strong price competition. After all, that will lead to better-value-for-money for the Chinese state. But for the process to be transparent and fair, the procuring entity needs to offer predictable terms and not actively reduce market-based competition in which companies can offer their goods and services in accordance with the market. In every competitive sector and market, there is not one price for an item that can apply for every buyer. Not only is there natural price variation – the actual cost for producing and delivering a service depends crucially on when, how, where and exactly what should be delivered.

But there is a more fundamental concern. The way that the new policy for centralised state procurement has been designed and has evolved over time, points clearly to a type of market that is taking on a monopsonic character. Unlike a monopoly, where the seller has dominant market power, a monopsonic market means that the buyer has so much power that it can dictate the market terms. When the state – and, in this case, the central state – practically makes itself the only buyer or only price setter and pursues extreme price reductions, it can easily set the conditions of price and quantity for sellers’ participation in the market.

A monopsonic market easily lead to abusive behaviour by the buyer. Such abuse is already at display in China’s MedTech market and examples of it include exactly the concerns that have been covered in this chapter. Procuring authorities in China have pursued extreme price reductions – effectively demanding that manufacturers of medical technologies should price their products in such a way that the margin gets captured by the buyer. Other political objectives have taken a hold in procurement practices. For instance, price reductions in medical technologies have been tied to increases in hospital staff salaries and thus become part of a strategy to improve job satisfaction. In strategies and policies by both the central government and the provincial leadership, centralised state procurement has been explicitly referenced as a mechanism to gradually squeeze out foreign MedTech manufacturers to make space for domestic producers. These are the consequences of a market that is increasingly taking a monopsonic form.

Other countries, too, have MedTech policies that tilt in the direction of monopsony, but they are often alert to the fact that a monopsonic buyer can destroy the market and take away incentives for innovation and improving value for patients. Therefore, they strive to establish a price that is fair and reflects the desire to promote innovation, competition and dynamism – or, at least, a price that is not based on forcing it as low as possible. They make sure that manufacturers have an interest to stay in the market. The danger with monopsony is that it will collapse the future market by making it less attractive for companies to innovate and compete.

[1] Xinhua News (2020, March 23rd), Xi stresses Covid-19 scientific research during Beijing inspection. https://www.tsinghua.edu.cn/en/info/1399/9816.htm

[2] Garcia-Herrero, A. and Martinez Turegano, D. (2020, November 27th) Europe is losing competitiveness in global value chains while China surges. Bruegel. Accessed at: https://www.bruegel.org/2020/11/europe-is-losing-competitiveness-in-global-value-chains-while-china-surges/

[3] Chinese Department of Equipment Industry (2021, February 9th) Public Consultation on the Development Plan for the Medical Equipment Industry.

[4] Guo Ban Fa (2019, July 19th) Notice of the General Office of the State Council on Issuing Reform Plan on Management of High Value Medical Consumables. The General Office of the State Council

[5] Fitch Solutions, Medical Devices Factbook 2021, Healthcare Expenditure.

[6] European Chamber of Commerce in China (2021) European Business in China, Business Confidence Survey 2021. European Chamber.

[7] China’s Central Government (2014, May 26), “Xi Jinping: People can’t afford high-end medical equipment and we need to speed up localization”. http://www.nhc.gov.cn/xcs/wzbd/201405/4fb04cb812c243bc9befdfa8bfaf56c7.shtml

[8] Guo Ban Fa (2019, July 19th) “Notice of the General Office of the State Council on Issuing Reform Plan on Management of High Value Medical Consumables. The General Office of the State Council.”

[9] Chinese lending data shows shift toward high-tech manufacturing. August 23, 2021. Inside Washington Publishers.

[10] Chinese Department of Equipment Industry (2021, February 9th) Public Consultation on the Development Plan for the Medical Equipment Industry.

[11] Ye, S. (2021, May 26), China Releases Its 2025 Vision For The Medtech Sector – May 2021 Update. Pharma Intelligence. Accessed at: https://medtech.pharmaintelligence.informa.com/MT143977/China-Releases-Its-2025-Vision-For-The-Medtech-Sector–May-2021-Update

[12] Ministry of Finance and Ministry of Industry and Information Technology (2021, May 14), “Notice regarding the publication of Auditing Guidelines for Government Procurement of Imported Products”. Memorandum No. 551.

[13] China’s Ministry of Industry and Information Technology (2021, February 9) Public Consultation on the Development Plan for the Medical Equipment Industry 2021-2025.

[14] Zichen Wang (2021, June 8), “Xi Jinping’s Speech on Science and Technology June 8”, Pekingnology. https://pekingnology.substack.com/p/xi-jinpings-speech-on-science-and

[15] Chen, S et al. (2020, May 7th) How COVID-19 is reshaping China’s MedTech industry. McKinsey and Company. Accessed at: https://www.mckinsey.com/featured-insights/china/how-covid-19-is-reshaping-chinas-medtech-industry

[16] Deloitte (2021, March 1st) China’s fast-growing medical device market presents huge opportunities for foreign firms. Deloitte. Accessed at: https://www2.deloitte.com/cn/en/pages/life-sciences-and-healthcare/articles/pr-chinese-medical-device-industry-whitepaper.html

[17] Chinese Department of Equipment Industry (2021, February 9th) Public Consultation on the Development Plan for the Medical Equipment Industry.

[18] Zhou Chencheng (2021, January 16), “State Council: To promote the normalization and institutionalization of centralized drug procurement, public medical institutions should participate in centralized procurement to promote the concentration of the drug and consumable industries in competition”. http://www.gov.cn/zhengce/2021-01/16/content_5580457.htm

[19] Wang, W. et al (2021, July) The Healthcare Market in China. EUSME Centre in partnership with China-Britain Business Council. Accessed at: https://www.eusmecentre.org.cn/report/healthcare-market-china-2021-update

[20] Healthcare Security Administration of Guangdong Province (2021, April 26), “Letter from the Guangdong Provincial Medical Security Bureau on the suggestion of co-organization by the representative No. 1116 of the Fourth Session of the Thirteenth People’s Congress of Guangdong Province”. http://hsa.gd.gov.cn/ygzwpt/jggk/content/post_3278501.html

[21] General Office of the Shanghai Municipal People’s Government (2021, June 24), “Fourteenth Five-Year Plan for the Development of Strategic Emerging Industries and Leading Industries in Shanghai”. https://www.shanghai.gov.cn/nw12344/20210721/d684ff525ead40d8a2dfa51e541a14e4.html

[22] The People’s Government of the Guangdong Province (2021, July 30), “Notice of the 14th Five-Year Plan for high-quality development”. http://www.gd.gov.cn/zwgk/wjk/qbwj/yf/content/post_3458462.html

[23] The People’s Government of the Beijing Municipality (2021, August 18), “Notice of the Beijing Municipal People’s Government on Printing and Distributing the Beijing’s Fourteenth Five-Year Plan, High-precision Industry Development Plan”. http://www.beijing.gov.cn/zhengce/zhengcefagui/202108/t20210818_2471375.html

[24] Asia Unbound (2019, December 3rd) Protected at Home, China’s Medical Device Industry Looks Abroad. Council on Foreign Relations. Accessed at: https://www.cfr.org/blog/protected-home-chinas-medical-device-industry-looks-abroad

[25] MicroPort (2019, February 19) Three Subsidiaries of MicroPort Awarded the Title of 2018 Shanghai Municipality Specialised, Refined, Characteristic and Novel Small and Medium-Size Enterprise. MicroPort. Accessed at: https://microport.com/news/three-subsidiaries-microport-awarded-the-title-shanghai-municipality-specialized-refined-characteristic-and-novel-small-and-medium-size-enterprise

[26] For extensive documentation on subsidies received, please consult WUYIGE Certified Public Accountants LLP, Beijing Chunlizhengda Medical Instruments Co., Ltd. Audit Report, https://pdf.dfcfw.com/pdf/H2_AN202012221442694901_1.pdf; Beijing Chunlizhengda Medical Instruments Co., Ltd., 2017 Annual Report, https://files.services/files/339/2018/0430/20180430170405_11426618_tc.pdf

[27] For extensive documentation of subsidies received, please consult Venus MedTech, Global Sales, http://www.venusmedtech.com/documents/files/prospectus/c101.pdf

[28] Extensive documentation on subsidies received can be found here: Double Medical, 2019 Announcement on Obtaining Government Subsidies, http://www.szse.cn/disclosure/listed/bulletinDetail/index.html?bfad1002-2ed6-4d68-a818-adb25055278c; Double Medical, 2018 Announcement on Obtaining Government Subsidies, http://www.szse.cn/disclosure/listed/bulletinDetail/index.html?70f91b8f-cb39-42cf-9553-1feb4064d10b

[29] See for instance Weihai Huancui District Government, Decision on Amending the “Huancui District Supporting Opinions on Encouraging the Development of Leading Enterprises, http://www.huancui.gov.cn/art/2020/5/25/art_64242_2482906.html. For an extensive list of subsidies received, see Prospectus of Shandong Weigao Orthopaedic Device Co., Ltd., Initial Public Offering of Shares and Listing on the Science and Technology Innovation Board, http://pdf.dfcfw.com/pdf/H2_AN202009301418437247_1.pdf

[30] See Sciping, Summary of the National Key Research and Development Plan projects as of November 13 2019, https://www.sciping.com/22501.html; Lifetech Scientific, Independent Innovation Demonstrates Value: Lifetech is Approved for Two National Key R&D Projects, http://www.lifetechmed.com/news/n1/20190102/2225.aspx; Lifetech Scientific, Lifetech Scientific company history, http://www.lifetechmed.com/r_d/187.aspx; Sina Finance, Lifetech Receives a Subsidy of 42 Million RMB for New Production Line, http://finance.sina.com.cn/stock/hkstock/ggscyd/20140717/083419728364.shtml?from=wap; Shenzhen Municipal Bureau of Industry and Information Technology, Notice of the Municipal Bureau of Industry and Information Technology on Issuing the 2021 Industrial Internet Development Support Plan Funding Projects, http://www.sz.gov.cn/cn/xxgk/zfxxgj/tzgg/content/post_8614726.html; Xueqiu, Report of Shenzhen Longhua District Science and Technology Innovation Bureau subsidy for Biotyx Medical, https://xueqiu.com/7732429874/154767015

[31] Eversana (2021, March 10th) China Lays Out Path Forward for Volume-Based Procurement, Tendering. Eversana. Accessed at: https://www.eversana.com/2021/03/10/china-lays-out-path-forward-for-volume-based-procurement-tendering/

[32] IQVIA (September 2020) Presentation for the Virtual MedTech Conference: Overview of Volume Based Procurement in China

[33] Boston Healthcare (2019, September) Medical Disposables and Consumables Players Face Challenge of Government-Initiated Price Cuts in China. Boston Healthcare. Accessed at: https://www.bostonhealthcare.com/medical-disposables-consumables-players-face-challenge-of-government-initiated-price-cuts-in-china/

[34] China’s Department of Comprehensive and Planning Finance (2020) National Medical Products Administration State Drug Administration Information Document. Accessed at: http://www.gov.cn/xinwen/2021-05/14/5606276/files/4b0aa9334e8d42b985e0672dbf633ad9.pdf

[35] The trade data in this section coms from the Trade Map Database of the International Trade Centre.

[36] Daniel, B. (2021, March 31st) Impact of COVID-19 on Elective Procedures in Western Europe, 2020-2023. ReportLinker. Accessed at: https://www.globenewswire.com/fi/news-release/2021/03/31/2202632/0/en/Impact-of-COVID-19-on-Elective-Procedures-in-Western-Europe-2020-2023.html

[37] Fitch Solutions, Medical Devices Factbook 2021, Healthcare Expenditure.

[38] Deloitte (2021, March 1st) China’s fast-growing medical device market presents huge opportunities for foreign firms. Deloitte. Accessed at: https://www2.deloitte.com/cn/en/pages/life-sciences-and-healthcare/articles/pr-chinese-medical-device-industry-whitepaper.html

[39] Data retrieved from https://finances.worldbank.org/Procurement/Major-Contract-Awards/kdui-wcs3

[40] Medical Product Outsourcing (2020, August 28) Localisation Strategy Key to Competing in Chinese MedTech Market. Medical Product Outsourcing Magazine. Accessed at: https://www.mpo-mag.com/contents/view_breaking-news/2020-02-28/localization-strategy-key-to-competing-in-chinese-medtech-market/

3. What can Europe do? Policy Options Going Forward

It is urgent for the European Union to respond to the discrimination and mistreatment of European medical technology firms in China. China’s industrial policy for the sector and the practices used in the country’s centralised state procurement clearly breach basic principles and norms of international exchange, and how governments should behave to avoid a distortion of competition. It is equally obvious that these procurement practices – along with domestic support schemes – have been tailored to encourage a larger market share for Chinese firms. European firms are clearly damaged by these practices: they are pushed to cut prices artificially low and end up in contractual situations that are unfair and highly unpredictable. On current trend, they are at risk of losing significant market shares in China only because they are not allowed to compete fairly. The consequences of these practices are also spilling over the border: European firms now face competition from state-backed Chinese companies in third markets.

A first step is obviously to consider bringing a case to the World Trade Organisation (WTO). China is not a member of the plurilateral Government Procurement Agreement (GPA) – and, so far, its market access offers to join the GPA have not been satisfactory. However, the GPA is not the only possible basis for a legal complaint over China’s procurement policy in medical technology. A complaint would start from the observation that China’s policy violates core WTO principles such as national treatment and non-discrimination: it is obvious that these principles are not adequately applied in China’s policy for centralised state procurement. Moreover, since they have applied in the past – leading to significant growth in China’s imports of medical technology goods from Europe – the European Union can build up a case that can show that market access opportunities provided by China in its accession to the WTO have been impaired and are at risk of getting nullified. Through the WTO, the EU has negotiated with China and has expectations that market access will remain. When market access has been substantially impaired, trade-restrictive measures can be actionable even if they are consistent with WTO commitments.

Europe can also act more directly – using new policy instruments and current frameworks of negotiations to improve the terms of market access for European exporters of medical technology goods. In this chapter, we will present a menu of actions that the European Commission can take to – in the first place – protect the norms of free and fair competition in government procurement and, more generally, encourage the development of better procurement practices in China. These actions are not mutually exclusive. On the contrary, they could – and should – be pursued simultaneously.

3.1 Foreign Subsidy Instrument and Countervailing Duties

Generally, European policymakers are already aware that Chinese commercial practices are a significant problem to free and fair competition, and have decided to act on multiple fronts. In May 2021, the Commission proposed a new instrument to address potential distortive effects of foreign subsidies in the single market. Under the proposed regulation, the Commission will have the power to investigate financial contributions granted by public authorities of a non-EU country which benefit companies engaging in an economic activity in the EU and redress their distortive effects. The regulation proposes the introduction of three tools: two notification-based and one general market investigation tool. It also includes a range of structural and behavioural remedies, such as the divestment of certain assets or the prohibition of a certain market behaviour. In case of notified transactions, the Commission will also have the power to prohibit the subsidised acquisition or the award of the public procurement contract to the subsidised bidder.[1]

The new tool is designed to effectively tackle foreign subsidies that cause distortions and harm the level playing field in the single market. It is also a key element to deliver on the updated EU Industrial Strategy, also adopted in May 2021, by promoting a fair and competitive single market.[2] As outlined in the updated Industrial Strategy, the European Commission has conducted an analysis identifying 137 products in sensitive ecosystems where the EU is “highly dependent”. Many of these products are in the health ecosystem and the list includes several healthcare goods. The analysis also shows that more than half of the imports of these highly dependent products come from China.[3]

Furthermore, the Commission published the Implementing Regulation 2020/776 in June 2020, which imposes definitive countervailing duties (CVD) on imports of certain woven and/or stitched glass fibre fabrics originating in China and Egypt. In recent years the Commission has conducted a number of anti-subsidy investigations concerning imports from China. The new countervailing duties extend the boundaries of the EU anti-subsidy regime, as this is the first time that the Commission has imposed countervailing duties on imports from the country that provided the subsidy (China), and also on imports from another country where the subsidies in question were put in place (Egypt).[4]

While the specifics of the new Foreign Subsidy Instrument remain unclear (the measure is currently discussed in the Council and the Parliament with the view of making this instrument effective by 2023), it is important that the EU can defend its market from distortive competition – in this case from Chinese manufacturers of medical technology goods that have improved their competitiveness by accessing support from the Chinese government.

3.2 International Procurement Instrument

Another basis for action for the European Union starts with the proposed International Procurement Instrument (IPI), designed to level the playing field in government procurement. The IPI was originally proposed by the Commission in 2012. After several rounds of revisions, and in June 2021, EU ambassadors agreed on a mandate for negotiations with the European Parliament on a regulation to create the IPI. The next step is now for the European Parliament to adopt its position and start trialogue negotiations with the Commission and the Council.[5] The treatment of European firms in China’s medical technology sector is exactly the type of problem that the IPI aims to remedy.

The basic mechanism of the IPI is that the EU could restrict access to its procurement market for companies, goods or services coming from countries where EU companies face restrictive or discriminatory measures. This action would depend on whether Chinese purchasing practices are strictly government procurement, as the WTO or the IPI would define it. It would not directly remedy the problems that European companies face in China. However, by threatening to restrict access for China’s medical technology sales in Europe – which are already substantial – the IPI could motivate China to play by the rules in its domestic market.

European manufacturers need that assistance. Even large multinationals in the sector do not have the capacity to influence a foreign government that distorts market access. And in Europe’s MedTech sector, the vast majority of companies are small and medium-sized enterprise with even less capacity to present their cases and defend their rights with a foreign government. They rarely have political access and do not know how to navigate the opaque systems of public procurement in China. Equally important, the medical technology sector in Europe is internationally competitive and falling market shares in China will affect output, revenues and jobs in Europe.

The EU public procurement market represents 2.4 trillion euro and is one of the largest and most accessible in the world.[6] The EU has opened its public procurement markets to a significant degree to competitors from third countries. However, access to procurement markets in some other large economies is often a challenge for EU companies, which only win a small fraction (10 billion euro) of the global 8 trillion euro procurement market per year.[7] The restrictions preventing more exports affect competitive EU sectors such as construction, public transport, medical devices, power generation and pharmaceuticals.

Obviously, China is a particular concern. There is no transparent and comprehensive information on the procurement market in China. Nor is China bound by the Government Procurement Agreement in the World Trade Organisation. Most of the procurement in China is conducted by State Owned Enterprises.[8] In fact, European companies are often prohibited from participating in public tenders in China.