Trade, Jobs and Technological Change: What to Expect in the Next Five Years?

Published By: Lucian Cernat

Research Areas: Digital Economy New Globalisation Services WTO and Globalisation

Summary

This Policy Brief explores the intertwined effects of trade and technological change (notably robotics and AI) on employment, highlighting a growing divergence between the number of jobs supported by exports and the declining labour intensity of exports in recent years. The decline in labour intensity may be sharply accelerated by the rise of robotics and the automation of routine tasks, displacing workers in manufacturing and logistics while enhancing productivity. For many countries that have a strong dependence on the trade-jobs nexus, the historically declining labour intensity of exports combined with the rapid adoption of robotics in key economic sectors, will mean that industries could now rely on fewer workers for their exporting activities. This dual shock suggests that, in the future, the number of jobs that depend on trade may decline. The convergence of these forces may lead to certain sectors or regions bearing the brunt of such potential labour disruptions. To address these challenges, supporting policies will be required to mitigate these adverse effects.

The views expressed herein are those of the author and do not reflect an official position by the European Commission.

1. Trade and Jobs: Still a Political Priority?

The impact of trade on jobs remains a front-page newspaper issue, especially in heated political debates such as the US presidential campaign. While politicians and experts may disagree on the impact of various trade policies on jobs, most would likely agree that trade flows, including both imports and exports, have a significant effect on jobs.

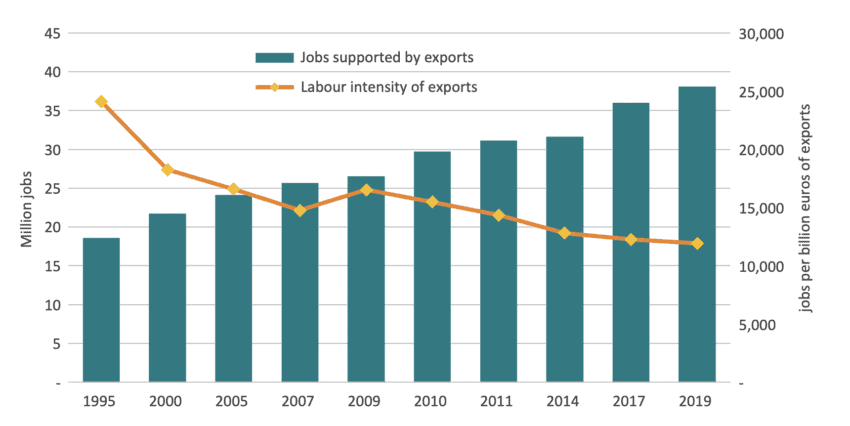

Trying to settle the big “trade and jobs” debate would be a futile attempt for a Policy Brief. Instead, we can focus our attention on some interesting facts and trends. In the case of the EU, for instance, when it comes to trade and jobs, we have so far been capable of doing more with less. Figure 1 plots two key indicators for the trade-and-jobs nexus. The first indicator is the number of jobs supported by extra-EU exports of goods and services, based on several reports produced by the European Commission Joint Research Centre and DG TRADE. The second indicator is the labour intensity of exports, measured as the ratio of embodied employment in exports over the total value of EU goods and services exports (expressed in jobs per billion of EU exports). The evolution of these two variables over time shows a stark contrast: as EU exports increased over time, the total number of jobs supported by EU exports also steadily increased over the last few decades. At the same time, the labour intensity of EU exports has been in constant decline.

Figure 1. Trade and jobs: more jobs, but lower labour intensity Source: Author’s compilation based on various issues of the series “EU exports to the EU: Effects on employment” published by the EU Joint Research Centre and DG TRADE.

Source: Author’s compilation based on various issues of the series “EU exports to the EU: Effects on employment” published by the EU Joint Research Centre and DG TRADE.

Between 1995 and 2019, the value of extra-EU exports increased fourfold, from less than 1 billion EUR in 1995 to almost 4 billion EUR in 2019. However, the number of jobs supported by extra-EU exports only doubled from 18.5 million in 1995 to over 38 million jobs in 2019. These trends indicate that the labour intensity of EU exports basically halved during that period, from over 24,000 jobs per billion of EU exports in 1995 to only 12,000 jobs per billion of EU exports in 2019. The EU is not unique in this respect. A similar downward trend has been documented in the United States (US). Data from the US International Trade Administration (ITA) shows that the labour intensity of US exports declined by more than 62 percent between 1999 and 2022 (USITA, 2024).

Even though the labour intensity of exports has been declining over time, the EU’s participation in global trade remains a powerful force for economic prosperity at home. In 2019, roughly one out of five jobs in Europe depended on EU exports. EU- supported jobs also have a wage premium. Export-related jobs in the EU are, on average, 12 percent better paid than other jobs. The export wage premium ranges from 5 to 14 percent, depending on workers’ skill levels and occupational profile (Kutlina-Dimitrova and Rueda-Cantuche, 2021).

But will these trends continue in the future, given the continuous decline in the labour intensity of EU exports? How will technology, notably robotics and AI, affect the trade-and-jobs nexus?

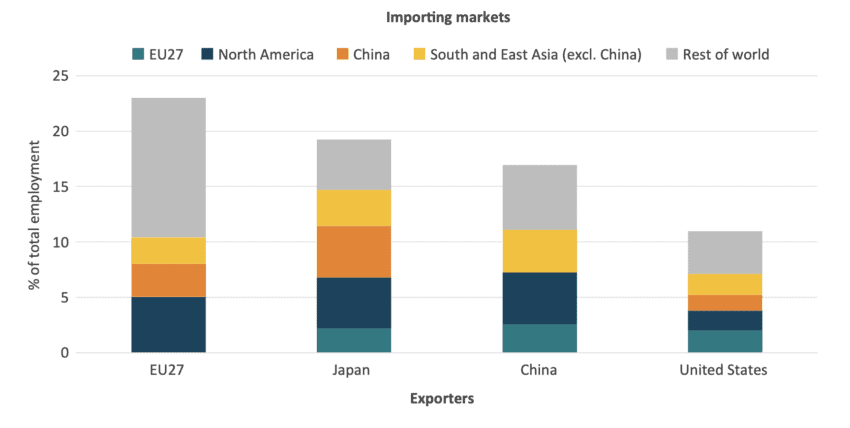

These are important questions given the fact that, compared to other major trading partners, the EU is relatively more dependent for its jobs and economic prosperity on its strong participation in global trade (Figure 2). The OECD Trade in Employment (TIM) database indicates that more than 20 percent of EU employment is sustained by customers abroad that buy EU exported goods and services, either directly or indirectly along global supply chains. In comparison, other partners like the US, China, or Japan are significantly less reliant on global trade, in terms of domestic jobs. The US, in particular, has the lowest share of employment sustained by exports compared to other major economies. This may reflect various policies adopted by the US in recent years, but data from the US ITA indicates that the US has had such a relative low share of jobs supported by exports for much longer.

Figure 2. Share of employment sustained by exports Source: Authors’ calculations based on OECD Trade in Employment (TIM) database – share of employment sustained by foreign demand. Data for 2020.

Source: Authors’ calculations based on OECD Trade in Employment (TIM) database – share of employment sustained by foreign demand. Data for 2020.

Apart from the overall level of job exposure to international trade, the relative structure of this trade-and-jobs nexus is also interesting. The EU seems to be more reliant on trade with the US than vice versa. The EU is also more dependent on the Chinese market than the US is, a feature already pointed out by other researchers (Lovely and Yan, 2024). China is also more dependent on US consumers than EU ones for the domestic job creation effect derived from its exports. Last but not least, among major trading partners, the EU is the most reliant on the “rest of the world”. This is good news for those who favour economic resilience and export diversification as top policy priorities nowadays.

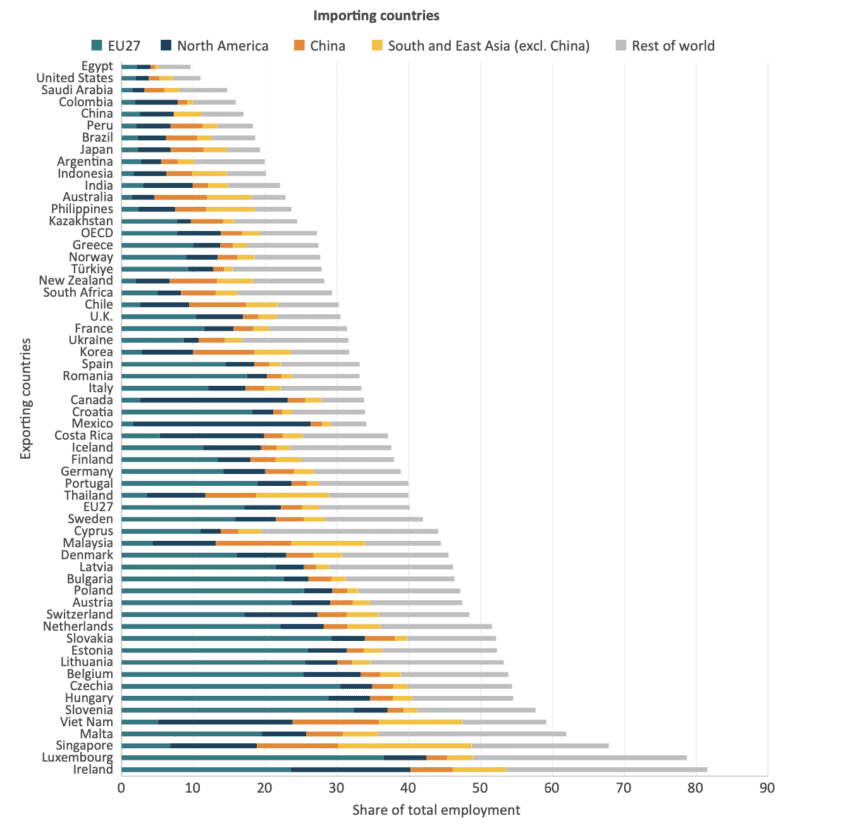

Figure 3. Share of domestic employment in the business sector sustained by foreign trade Source: Authors’ calculations based on OECD data for 2020. Business sector is defined as non-agriculture business sector excluding real estate.

Source: Authors’ calculations based on OECD data for 2020. Business sector is defined as non-agriculture business sector excluding real estate.

Expanding the analysis to a broader set of trading partners, the picture becomes even more nuanced (see Figure 3). The OECD TIM database suggests that countries are placed on a wide spectrum of trade-and-job dependencies. At the lowest end of the trade-and-job nexus, we find countries like Egypt, US, and Saudi Arabia. At the opposite end, the highest trade and jobs dependencies are found for countries like Ireland, Luxembourg, and Singapore, but also Malta or Vietnam.

For instance, in Ireland, more than 80 percent of jobs depend on trade, either with other EU countries that are part of the Single Market or with the rest of the world. As expected, for most EU countries, the trade linkages within the Single Market represent a major job-creation factor. In relative terms, for many EU member states in Central and Eastern Europe (notably Slovakia, Slovenia, Hungary, and Czechia), the job-creation effect of the Single Market is significantly larger than the jobs supported by trade links with the rest of the world. Access to the EU Single Market is also critical for several close trading partners. In Switzerland, almost half of all domestic jobs depend on exports and one in six jobs depend on Swiss exports to the EU. In the UK and Türkiye, roughly one in ten jobs depend on exports to the EU Single Market.

As described, the exposure of domestic labour markets to trade patterns is partly explained by economic size and geography: smaller countries, especially those closer to large markets, tend to be heavily job-dependent on their exports. However, trade policy also has a role to play. Having a large share of export-dependent jobs in Europe scattered across a large and diverse set of trading partners reduces the risk of overdependencies on specific markets. This correlates well with the fact that the EU is the trading bloc with the largest number of bilateral trade agreements in the world. The EU has 44 “big” trade agreements with 76 partners, covering almost 50 percent of extra-EU trade (European Commission, 2024). At the same time, the EU has signed more than 2,000 trade “mini-deals” on a wide range of trade issues with other countries around the world (Cernat, 2024).

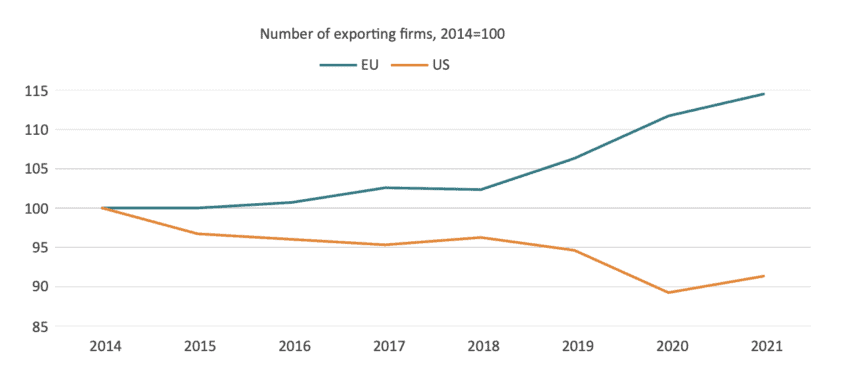

This network of big and small trade deals facilitates exports and the jobs attached to those economic activities. The stark contrast between the EU and the US in terms of export-related jobs can also be explained by the much larger number of extra-EU exporters compared to US exporting firms (Figure 4). Over the last decade, the number of EU exporting firms increased by 15 percent, whereas in the US the total number of exporters declined by almost 10 percent. The end result is that nowadays there are twice as many exporting firms in the EU as in the US.

Figure 4. The evolution of EU and US exporting firms Source: Author’s calculations based on the OECD Trade by Enterprise Characteristics database (TEC).

Source: Author’s calculations based on the OECD Trade by Enterprise Characteristics database (TEC).

2. Trade and Declining Labour Intensity: Can We Blame Robots and AI Already?

The previous section clearly demonstrated that, regardless of recent political priorities, trade is still a powerful driver for job creation in Europe. At the same time, the data indicates that there is a steady decline in the labour intensity of exports. What triggered this trend and what should we expect in the near future? Among the many factors that led to this outcome, the adoption of labour-saving technologies in many economic sectors is clearly an important driver. As with the trade and jobs debate, do not expect a consensus on how important technological change will be in the future for the overall labour trends.

However, one thing is sure: the robots are coming! There is growing consensus that technological advancements and demographics have created a very dynamic environment for the large-scale deployment of robots and automation across the full spectrum of economic activities, from agriculture and mining to manufacturing and services sectors. For globalisation and tech enthusiasts, there is even a new concept – globotics, a combination of globalisation and robotics – to describe the current trends (Baldwin, 2019). In his book, “Globotics Upheaval”, Richard Baldwin argues that the new digital technologies will fundamentally reshape the trade and employment patterns we see today. Essentially, he argues that the future globalisation will no longer be about shipping containers around the world, although that still remains a massively important part of our economies.

Of course, we will still live in a material world, and we still need to import pineapples and bananas into Belgium or Sweden from countries with comparative advantages in those products. Millions of jobs around the world will still depend on those trade flows, and many developing countries will still remain dependent on labour-intensive, export-oriented activities. At the same time, many jobs, both skilled and unskilled, can be replaced by robots across the entire spectrum of economic activities. Agricultural robots can pick apples, gather strawberries, harvest lettuce, and strip away weeds (Gossett and Whitfield, 2024). Such robots can be particularly useful in countries and sectors where there are seasonal labour shortages. Robots do not have to look like creatures from sci-fi movies. In the mining sector, more mundane applications, like autonomous heavy-duty vehicles, are particularly valuable for mining operations, doing away with the need for human intervention in dangerous environments.

One of the most spectacular deployments of robots is found in the automotive industry. In the current “Industry 4.0” era, the days when thousands of workers performed repetitive tasks along a conveyor line carrying various car parts are long gone. Car factories now rely to a large extent on robots working autonomously, or in tandem with a declining number of employees. According to the International Federation of Robotics, the automotive sector introduced more than 300,000 robots worldwide during the 2020-2022 period. In 2023, there were more than half a million robots deployed worldwide, with the automotive, electronics and machinery sectors accounting for the largest shares (Rogers, 2025). The fact that the automotive sector faces significant technological changes is also evident in the recent restructuring announcements by various car manufacturers, leading to potential job losses in the sector.

The services sector is not immune to major globotics disruptions. Robots can replace workers in a wide range of services jobs, from crane operators in ports, to logistics workers in a distribution centre, or chefs and bartenders in the hospitality sector (Rogers, 2025). A second powerful technology affecting the trade-and-jobs nexus is digital technologies. Digitalisation will increase trade in services, and, in some cases, it can bring labour intensive services activities into the international market. This powerful technological force will push up the labour intensity of exports, especially for developing countries. The large-scale adoption of teleworking after the COVID-19 pandemic created favourable conditions for certain services jobs to be delocalised abroad, thus increasing the number of trade-dependent jobs of countries involved in such services trade. At the same time, some of these new digital services may also be affected by other emerging, labour-saving technologies such as artificial intelligence (AI). Whether AI will replace accountants, doctors, or teachers is still not very clear. However, what is clear is that the nature of services trade is being reshaped by digital technologies (Cernat, 2024). The significant increase in digital services trade may happen at the expense of certain domestic activities, and the combined effect resulting from labour substitution effects and delocalisation effects may lead to an overall increase in the share of services jobs that depend on trade.

3. What to Expect in the Next Five Years?

The future was never easy to predict, and it is even less so when faced with unparalleled disruptive technologies. Throwing trade, technology, and jobs into the crystal ball blurs the image of our future even more. This complex picture only leaves room for some speculative remarks.

On the trade front, expect globalisation forces to be resilient. Faced with simultaneous challenges such as a global pandemic, regional wars, and other disruptions, global supply chains proved strong. If you believe in globotics, also expect a growing importance of services trade and the jobs associated with such activities that can be performed remotely or virtually. And if you believe in robotics, expect perhaps more pressure on the types of jobs that robots can do better than humans. Expect some pressure on domestic jobs even from remote robots, not just those replacing jobs at home. There are significant disparities in the deployment of robots around the world, with countries in Asia (China, South Korea, Singapore) being in the lead.

According to the latest “Future of Jobs Report”, robotics and autonomous systems are expected to be the largest net job displacer, with a net decline of 5 million jobs (World Economic Forum, 2025). Robotisation tends to increase both productivity and the quality of manufacturing activities, hence a domestic worker competing against a foreign robot may be at a disadvantage both in terms of costs and quality. Certain empirical studies find that the extensive use of industrial robots tends to suppress employment growth, confirming the labour-substituting effect of industrial robots, especially for low-skilled labour (Acemoglu and Restrepo, 2020; Jung and Lim, 2020). Large cross-country disparities in robotics may lead to an additional effect on jobs from increased trade flows generated by robotic comparative advantages. Other studies, however, found that robotisation does not always reduce employment or wages (Adachi, Kawaguchi, Saito 2024). If such a combination of trade and technological forces were to lead to an increase in unemployment in certain sectors, the EU has several instruments at its disposal to deal with potential negative labour effects. One such instrument is the European Globalisation Fund (EGF). Despite having a relatively small budget, low political visibility, and somewhat complex procedures, the EGF has delivered tangible results for tens of thousands of workers across the EU (Cernat and Mustilli, 2018).

When these technological disruptions are added to the secular declining trend in labour intensity of exports in many countries, there is a possibility for a dual labour effect from trade and technology: some services jobs may become considerably more trade dependent, whereas the large-scale adoption of robotics in manufacturing activities could lead to both job destruction and job creation effects. Overall, if we look at some of our factories today, there is a likelihood that the future manufacturing activities will be less labour intensive overall, more high-skilled, and possibly less trade dependent.

How will these conflicting tendencies affect the overall trade-and-jobs nexus in Europe? I wish I knew. What is clear, though, is that the interplay between trade and technology will have significant job implications that will continue to attract political attention. Ensuring that trade remains a driver for prosperity in Europe requires an optimal policy mix that aligns with the current concerns and future priorities of EU citizens.

References

Acemoglu, D. and Restrepo, P. (2020). Robots and Jobs: Evidence from US Labor Markets. Journal of Political Economy, 128 (6): 2188–2244.

Adachi, D., Kawaguchi, D. and Saito, Y.U. (2024). Robots and Employment: evidence from Japan. Journal of Labor Economics, 42(2): 1978–2017.

Baldwin, R. (2019). The Globotics Upheaval: Globalization, Robotics and the Future of Work. Oxford University Press.

Cernat, L. and Mustilli, F. (2018) Trade and Labour Market Adjustments: What Role for the European Globalisation Adjustment Fund?, Intereconomics, Vol. 53(2):79-86.

Cernat, L. (2024, May 30) The big shift in global trade in services: a tale of five modes of supply. ECIPE Blog.. Available online at: https://ecipe.org/blog/the-big-shift-in-global-trade-in-services-a-tale-of-five-modes-of-supply/

European Commission (2024). 2023 Implementation and Enforcement Report by DG TRADE. Available online at: https://ec.europa.eu/newsroom/trade/redirection/document/108903.

Gossett, S. and Whitfield, B. (2024). 15 Agricultural Robots and Farm Robots You Should Know. Builtin. Available online at: https://builtin.com/robotics/farming-agricultural-robots.

Jung, J. H. and Lim, D.G. (2020). Industrial robots, employment growth, and labor cost: A simultaneous equation analysis. Technological Forecasting and Social Change 159.

Kutlina-Dimitrova, Z. and Rueda-Cantuche, J. (2021). More crucial than ever: employment content in extra-EU exports. European Commission JRC126043.

Lovely, M. and Yan, J. (2024). While the US and China decouple, the EU and China deepen trade dependencies. Peterson Institute for International Economics. 27 August. Available online at: https://www.piie.com/blogs/realtime-economics/2024/while-us-and-china-decouple-eu-and-china-deepen-trade-dependencies

Rogers, T. N. (2025, January 8). The fight over robots threatening American jobs. Financial Times. Available online at: https://www.ft.com/content/eb11f69c-e45c-4f23-8793-0ca5866b4b67

US International Trade Administration. (2024). Jobs Supported by Exports. Available online at: https://www.trade.gov/jobs-supported-exports-home-page.

World Economic Forum. (2025). Future of Jobs Report. Available online at: https://www.weforum.org/publications/the-future-of-jobs-report-2025/