Trade and Competitiveness: Putting the Firm at the Centre of the Analysis

Published By: Lucian Cernat Oscar Guinea

Subjects: European Union

Summary

The European Commission published its communication for the long-term competitiveness of the EU. Trade and Open Strategic Autonomy were among the selected policy areas that will drive EU competitiveness in the future and trade with the rest of the world as a share of EU Gross Domestic Product (GDP) was the selected indicator to measure progress. This Policy Brief proposes a new set of indicators that complement this and similar indicators that focus on the value of trade. Using the Trade by Enterprise Characteristics (TEC) database, this paper produces indicators that measure the number of exporters, non-EU suppliers, non-EU customers, and foreign companies. By putting the firm at the centre of the analysis, these indicators offer insights that complement policy-makers’ views on trade and competitiveness.

1. Introduction

Higher competitiveness is necessary to boost living standards, give more economic opportunities to citizens and support the technological change necessary to decarbonise the economy. It is also central in an age of increasing geopolitical frictions and war. The European Commission published a communication on EU long-term competitiveness that proposes actions to boost EU competitiveness and indicators to measure the effectiveness of these actions[1]. The 17 Key Performance Indicators (KPI), accompanied by their respective targets, measure progress in nine policy areas which are critical for competitiveness. One of these policy areas is Trade and Open Strategic Autonomy.

Trade and competitiveness are not a zero-sum game in which a country’s gain is another’s country’s loss. In fact, one country’s level of competitiveness is based on open conditions for cross-border exchange and competition. Access to high-quality inputs and more customers make firms more competitive and economies more specialised, whilst international trade exposes domestic firms to competition, requiring constant innovation and productivity improvements to succeed in the market[2].

However, the traditional analytical framework for trade and competitiveness is prone to focus policymakers’ minds on trade as a zero-sum game. Indicators such as relative trade performance, export market share, and comparative advantage – widely used when measuring competitiveness – focus primarily on export values. Inadvertently, these indicators connect competitiveness with a mercantilist notion of trade, in which success is measured only as a result of growing exports. The risk of such an approach is that competitiveness is expressed as a race, with winners and losers, and a positive trade balance becomes the be-all and end-all of economic policy. The corollaries that follow are import restrictions and export promotion policies, which distort global markets and harm productivity.

This Policy Brief proposes a complementary approach to the traditional indicators that measure competitiveness using trade statistics. Our focus is on the participation in international trade rather than the value of trade. This approach has several advantages. First, by using firm-level data, it puts firms at the centre of the analysis[3]. In the same way as firms, rather than countries, are the entities that trade, the competitiveness of firms is what makes a country competitive. Second, trade values can be distorted by the role of a few firms in total trade. Our indicators of participation weigh all firms equally and can be disaggregated by firm size. Third, more productive companies are more likely to export[4] and therefore a growing number of companies participating in international trade can also reflect an increase in firm productivity.

The indicators proposed in this paper are based on data retrieved from the Eurostat Trade by Enterprise Characteristics (TEC) database[5]. This database contains trade data by economic activity, type of enterprise, and the geographical diversification of the traded products. This Policy Brief is not conceived as an exhaustive analysis of each possible metric but as a demonstration of new firm-level indicators produced with trade statistics that policy-makers can use to understand and make decisions in relation to competitiveness.

[1] European Commission (2023). Long-term competitiveness of the EU: looking beyond 2030. European Commission.

[2] The EU can also follow other policies to support its competitiveness in addition to trade openness. See Erixon et al. (2022) and Erixon et al. (2023).

[3] Cernat, L. (2014).

[4] Ricci, M. L. A., & Trionfetti, M. F. (2011).

[5] Eurostat (2023). Focus on enterprise characteristics (TEC). European Commission, Retrieved from: https://ec.europa.eu/eurostat/web/international-trade-in-goods/data/focus-on-enterprise-characteristics-tec

2. Why the Number of Exporters Matter

The number of companies exporting to foreign markets can be used as a proxy to measure competitiveness. Economic theory points to a positive relationship between trade and productivity[1]: more productive firms are more likely to sell to foreign countries than less productive companies and, in some cases, exposure to foreign markets has positive effects on a firm’s productivity, an effect known as learning-by-exporting[2]. In the case of the EU, the number of exporters to non-EU countries went from 301,000 in 2012 to 717,000 in 2020. The EU member states with the largest number of exporting companies outside the EU are also the largest ones i.e., Italy, Germany, France, and Spain; while, as a percentage of all enterprises, small open economies like Estonia, Denmark, and Sweden come on top.

Given that the majority of EU companies are SMEs, an increase in the number of SMEs selling their products and services into foreign markets would reflect a more productive and therefore competitive EU economy. At the moment, only the most productive companies can export because they need higher levels of productivity to jump over trade barriers and remain competitive in foreign markets. As a proportion of all SMEs belonging to the manufacturing industry, 10 percent of them export to another non-EU country. This proportion, while significant, is substantially lower than for large enterprises in that sector, for which 85 percent of them export outside the EU.

Across economic sectors, the majority of EU companies that export to non-EU countries are intermediary services providers, not the actual producers of the exported goods. The services sector of wholesale and retail trade represents 44 percent of all EU exporters while manufacturing companies represent 34 percent of EU exporters. However, between 2016 and 2020, professional services and information and communication services experienced a faster growth in the number of exporters than manufacturing and wholesale and retail trade. Somewhat surprisingly, and although starting from a low base, the sharpest increase was recorded in the number of EU companies exporting agricultural products.

These findings complement the traditional trade statistics used to measure competitiveness that focus on the value of exports. An increase in exports is likely to reflect higher levels of productivity, but such an increase becomes more valuable for the competitiveness of the economy when a large number of exporters is behind it since that means that the productivity growth associated with higher exports is shared more widely across firms. Moreover, the number of exporters across different economic sectors provides valuable information about the areas of the economy which are becoming more open and competitive.

[1] Melitz, M. J. (2003). The impact of trade on intra‐industry reallocations and aggregate industry productivity. econometrica, 71(6), 1695-1725. Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. The review of economic studies, 75(1), 295-316.

[2] Atkin, D., Khandelwal, A. K., & Osman, A. (2014).

3. Trading Firms: the Importance of Import and Export Concentration

Until recently, trade concentration (and in particular import concentration) has not been a topic of much interest in EU trade policy debates. A lesson of the COVID-19 pandemic and the subsequent shortages of products is that competitive economies are those which can rely on multiple trade partners for the provisions of goods and services. International trade provides an avenue for diversification of suppliers, making countries more resilient by increasing the number of available suppliers.[1] In the face of adversity, dependencies on a limited number of suppliers for the import of inputs can prove harmful to EU competitiveness.

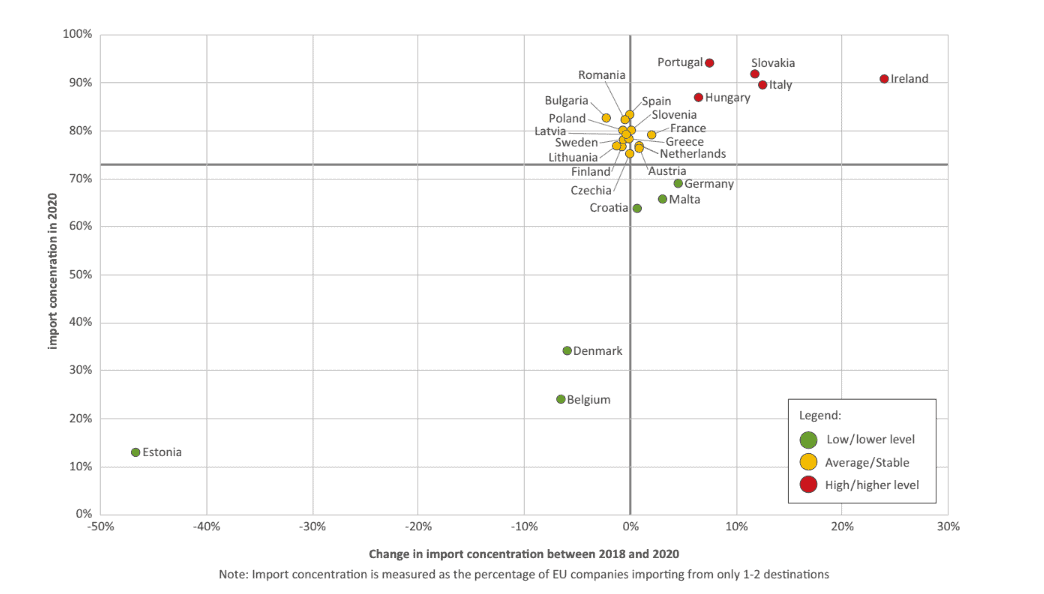

With this new focus in mind, it is important to assess the import concentration at firm-level, i.e., the exposure of EU importers to single or dual sources of supply, as a measure of possible supply chain vulnerabilities. At the EU level, the percentage of EU firms that only import from one or two non-EU countries has increased, between 2018 and 2020, going from 73 to 77 percent. Across Member States, one can distinguish three distinct clusters of countries (see Figure 1). The first cluster is composed of those with high and growing import concentration ratios (Ireland, Slovakia, Italy, Portugal, Hungary). A second cluster is formed by those Member States whose import concentration is close to the EU average and remained stable in recent years. This represents the majority of EU Member States. A third group of countries are those whose importing firms have lower than average import concentration ratios and/or continued to diversify their import sources recently (Germany, Malta, Croatia, Denmark, Belgium, Estonia). As one can see, there is no single, obvious reason behind this distribution. All clusters contain small and large Member States, Southern and Northern countries, newer and older EU members. Interestingly, the variation in import concentration ratios is fairly high, ranging from 94 percent of importing firms in Portugal having their suppliers in only one or two non-EU countries to Estonia, where only 13 percent of Estonian importers rely on single country or dual sourcing strategies.

Figure 1: EU Member States Import Concentration Levels Source: Eurostat, authors’ calculations.

Source: Eurostat, authors’ calculations.

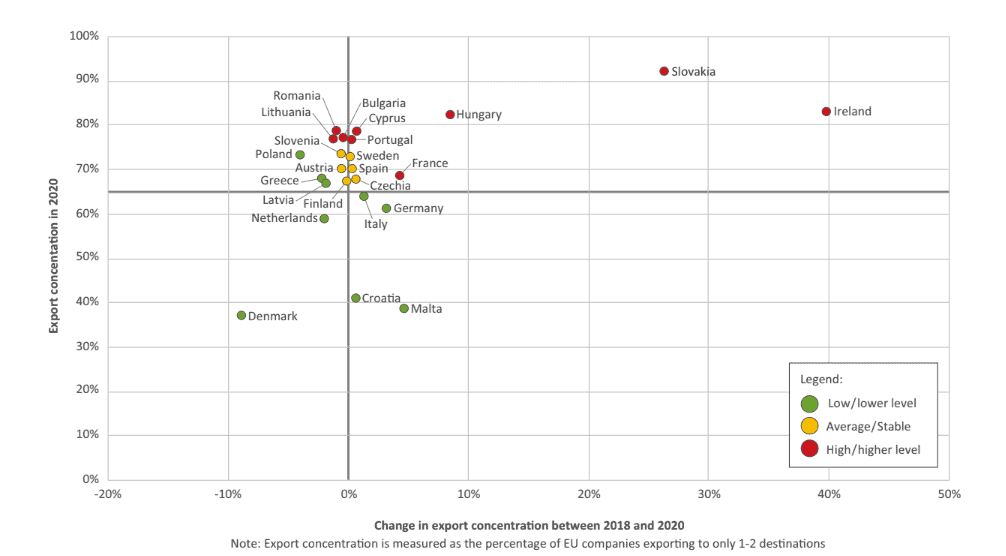

In contrast to import concentration as a metric for resilient supply chains, export concentration has traditionally been one of the main indicators to measure competitiveness. For years, the World Bank has advised developing countries to diversify their exports in order to become less vulnerable to sudden changes in commodity prices[2] . At the EU level, the percentage of EU firms that only exports to one or two non-EU countries has remained stable between 2018 and 2020, at 65 percent. Across member states, however, the picture is more nuanced (see Figure 2)

Figure 2: EU Member States Export Concentration Levels Source: Eurostat, authors’ calculations.

Source: Eurostat, authors’ calculations.

As in the case of import concentration, one can distinguish three distinct clusters of EU Member States. A first group is composed of countries with a good performance in terms of low and/or declining export concentration (Denmark, Croatia, Malta, Netherlands, Germany, Italy, Latvia, Greece, Poland). A second cluster is formed by countries that have a close to the EU average and stable export concentration ratios (Finland, Czechia, Austria, Spain, Sweden, and Slovenia). A third group of countries has exporters that are highly dependent on one or two destinations (Romania, Bulgaria, Cyprus, Portugal, and Lithuania) or high and growing export concentration ratios (Ireland, Slovakia, Hungary, France). Slovakia and Ireland are two outliers in this regard, having very high export concentration ratios that have increased significantly recently. For instance, over 90 percent of all Slovakian exporters have clients in only one or two non-EU countries. Similarly, 83 percent of Irish exporters depend on clients located in one or two countries outside the EU.

As in the case of import concentration, no obvious, single parameter stands out as an explanatory factor for this distribution. While the reasons behind different trade concentration ratios across EU Member States are hard to pin down, one thing is certain: the companies that were most successful in managing disruptions during the COVID-19 pandemic were those that had access to a diversity of suppliers and a diversified client base – both geographically and in numbers. To diversify its suppliers, the EU needs to look for countries that can ensure a wider supply base for EU importing firms. This is particularly the case for certain raw materials and critical components, where deeper international cooperation is needed to ensure resilient supply chains. The European Commission has recently put forward a series of legislative proposals (e.g., the Critical Raw Materials Act[3], the Net Zero Industry Act[4]) which contain, inter alia, provisions aimed at reinforcing the security and resilience of supply chains in several strategic sectors. A monitoring tool to scan and anticipate potential bottlenecks in EU supply chains has also been recently launched.[5] Stronger regulatory cooperation is also pursued via the recently announced Critical Raw Materials Club. All these new initiatives will reinforce the positive effects expected from various Free Trade Agreements (FTAs) negotiations, e.g., with regions and countries like Mercosur, Chile, India, Australia, New Zealand, and Mexico.

[1] Guinea, O., & Forsthuber, F. (2020). Globalisation comes to the rescue: How dependency makes us more resilient (No. 06/2020). ECIPE Occasional Paper.

[2] Hesse, H. (2009). Export diversification and economic growth. Breaking into new markets: emerging lessons for export diversification, 2009, 55-80.

[3] European Commission (2023, 16 March). Critical Raw Materials: ensuring secure and sustainable supply chains for EU’s green and digital future. Press Release, European Commission.

[4] European Commission (2023). Proposal for a regulation on establishing a framework of measures for strengthening Europe’s net-zero technology products manufacturing ecosystem (Net Zero Industry Act). European Commission.

[5] European Commission (2022). “SCAN” (Supply Chain Alert Notification) monitoring system. European Commission.

4. From Trade and FDI to Global Competitiveness: How to Avoid a Zero-Sum Game

Contrary to earlier findings in the literature based on aggregate metrics, recent firm-level analyses find a positive effect of Foreign Direct Investment (FDI) on productivity, including on the productivity of domestic firms that do business with foreign companies[1]. Moreover, there is a positive-sum game between trade (both exports and imports), on the one hand, and FDI, on the other. This positive-sum game from FDI to overall trade performance takes place via two distinct channels: firstly, as a result of FDI, domestic firms extend their trade performance and participation in global supply chains and, secondly, foreign affiliates are major drivers behind exporting activities.

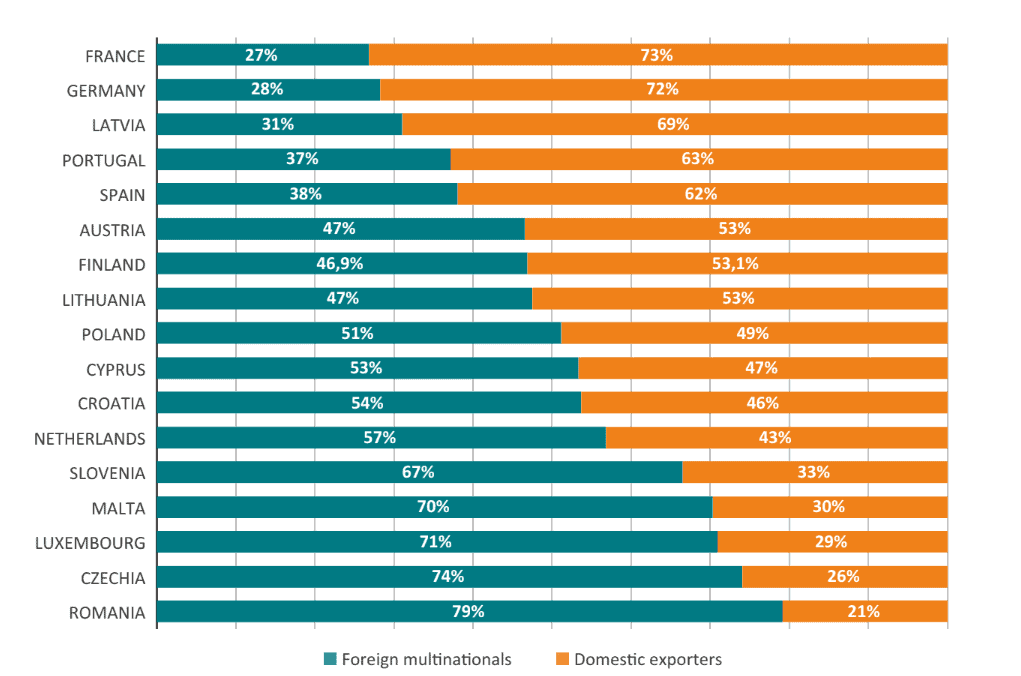

The first channel has been documented in several country studies, using detailed firm-level data.[2] The second channel can be illustrated directly based on the firm-level trade statistics from the Eurostat TEC database. As seen in Figure 3, for many EU Member States a large share – and in some cases, the majority – of their exports are generated by foreign multinationals. In the case of Romania, almost 80 percent of total exports are generated by foreign affiliates.

Figure 3: Share of Exports by Foreign Multinational and Domestic Exporters Source: Eurostat, authors’ calculations.

Source: Eurostat, authors’ calculations.

Based on this combined evidence, it becomes clear that attracting inward FDI remains a key driver for Europe’s productivity, particularly for medium and small member states whose domestic market is not large enough to allow domestic companies to scale up. Inward FDI is therefore a strong factor behind Europe’s competitiveness, acting as a powerful conveyor belt connecting smaller firms to global supply chains.

[1] Javorcik, B. S. (2004).

[2] Alfaro-Urena, A., Manelici, I., & Vasquez, J. P. (2022). The effects of joining multinational supply chains: New evidence from firm-to-firm linkages. The Quarterly Journal of Economics, 137(3), 1495-1552.

5. Conclusion

The European Commission identified Trade and Open Strategic Autonomy as one of the nine key policy areas that supports long-term EU competitiveness. Progress in this policy area, which includes actions to diversify trade and reduce dependencies, will be measured by tracking EU trade with the rest of the world as a share of EU GDP. This Policy Brief takes advantage of the Eurostat Trade by Enterprise Characteristics (TEC) database to offer additional firm-level trade metrics and insights that can support policy-makers when assessing the competitiveness of the EU and its Member States.

- The number of EU companies exporting outside the EU has been growing over time. The likelihood to be one of them is much higher for large companies than for the smaller ones. Across economic activities, manufacturing and retail are the most relevant sectors in terms of the number of exporting companies. However, information and communication, professional services and agriculture were the areas of the EU economy with the highest growth rate of exporting companies.

- The degree of import concentration, measured as the percentage of EU firms that only import from one or two non-EU countries, has increased over time, going from 73 to 77 percent between 2018 and 2020. The level of import concentration differs across EU Member States with Ireland, Slovakia, Italy, Portugal and Hungary experiencing the highest and more persistent levels of import concentration. The percentage of EU firms that only export to one or two non-EU countries has remained stable between 2018 and 2020 at 65 percent. Companies based in Romania, Bulgaria, Cyprus, Portugal, and Lithuania are highly dependent on one or two destinations and businesses in Ireland, Slovakia, Hungary, and France present growing levels of export concentration.

- EU competitiveness is supported by Foreign Direct Investment (FDI), which has positive effects on productivity and trade. A large proportion of EU Member States exports is generated by foreign multinationals.

When using such firm-level trade metrics, certain policy priorities in relation to EU competitiveness and trade become more apparent. As President Von der Leyen argued, EU policy-makers should focus their attention on the competitiveness of SMEs, by introducing a standard competitiveness check in EU regulations[1]. This would allow policy makers to become aware of excessive market concentration, either from an import or export perspective, use EU trade policy to support trade diversification, and consider the positive role of FDI as an engine for improving trade performance and participation in global supply chains

[1] von der Leyen, U. (2022). Speech by President von der Leyen at the European Parliament Plenary on the preparation of the European Council meeting of 20-21 October 2022. European Commission.

References

Alfaro-Urena, A., Manelici, I., & Vasquez, J. P. (2022). The effects of joining multinational supply chains: New evidence from firm-to-firm linkages. The Quarterly Journal of Economics, 137(3), 1495-1552.

Atkin, D., Khandelwal, A. K., & Osman, A. (2014). Exporting and firm performance: Evidence from a randomized trial (No. w20690). National bureau of economic research.

Cernat, L. (2014). Towards Trade Policy Analysis 2.0. From National Comparative Advantage To Firm-Level Trade Data. European Commission, DG Trade, Chief Economist Note.

European Commission (2021). Better regulation toolbox. European Commission, Retrieved from https://commission.europa.eu/system/files/2023-02/br_toolbox-nov_2021_en.pdf

European Commission (2022). “SCAN” (Supply Chain Alert Notification) monitoring system. European Commission, Retrieved from

European Commission (2023, 16 March). Critical Raw Materials: ensuring secure and sustainable supply chains for EU’s green and digital future. Press Release, European Commission, Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/IP_23_1661

European Commission (2023). Long-term competitiveness of the EU: looking beyond 2030. European Commission, Retrieved from https://commission.europa.eu/system/files/2023-03/Communication_Long-term-competitiveness.pdf

European Commission (2023). Proposal for a regulation on establishing a framework of measures for strengthening Europe’s net-zero technology products manufacturing ecosystem (Net Zero Industry Act). European Commission, Retrieved from https://single-market-economy.ec.europa.eu/publications/net-zero-industry-act_en

European Council (2022). European Council conclusions, 15 December 2022. European Council, Retrieved from https://www.consilium.europa.eu/media/60872/2022-12-15-euco-conclusions-en.pdf

Eurostat (2020). Small and Medium-size enterprises: an overview, Retrieved from: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20200514-1

Eurostat (2023). Focus on enterprise characteristics (TEC). European Commission, Retrieved from: https://ec.europa.eu/eurostat/web/international-trade-in-goods/data/focus-on-enterprise-characteristics-tec

Erixon, F., Guinea, O., Lamprecht, P., Sharma, V., Sisto, E., and van der Marel, E. (2022). A Compass to Guide EU Policy in Support of Business Competitiveness. Report, ECIPE. Brussels, occ. Paper 6/2022, 82p.

Erixon, F., Guinea, O., Lamprecht, P., Sisto, E., and van der Marel, E. (2023). The Economic Dividend of Competitiveness. Report, ECIPE. Brussels, Policy Brief 2/2023, 36p.

Guinea, O., & Forsthuber, F. (2020). Globalisation comes to the rescue: How dependency makes us more resilient (No. 06/2020). ECIPE Occasional Paper.

Hesse, H. (2009). Export diversification and economic growth. Breaking into new markets: emerging lessons for export diversification, 2009, 55-80.

Javorcik, B. S. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American economic review, 94(3), 605-627.

Melitz, M. J. (2003). The impact of trade on intra‐industry reallocations and aggregate industry productivity. econometrica, 71(6), 1695-1725.

Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. The review of economic studies, 75(1), 295-316.

Ricci, M. L. A., & Trionfetti, M. F. (2011). Evidence on productivity, comparative advantage, and networks in the export performance of firms. International Monetary Fund.

von der Leyen, U. (2022). Speech by President von der Leyen at the European Parliament Plenary on the preparation of the European Council meeting of 20-21 October 2022. European Commission, Retrieved from https://ec.europa.eu/commission/presscorner/detail/da/speech_22_6262