Strengthening the Supply-Side Innovation in EU Telecommunications

Published By: Fredrik Erixon Oscar Guinea Dyuti Pandya

Subjects: Digital Economy European Union Services

Summary

The telecommunications sector is central to the EU’s competitiveness, not only providing the infrastructure that underpins digital connectivity but also serving as a key driver of innovation. Recent EU reports already highlight the persistent structural challenges faced by the EU telecommunication sector: market fragmentation, low investment levels, divergent spectrum policies, and an urgent need to bolster digital sovereignty.

However, a critical dimension in this discussion often receives far less attention: the supply of the underlying technologies that power telecommunications infrastructure. In this domain, EU companies remain competitive. In 2023, 27 EU-headquartered firms were among the world’s top 2,000 R&D spenders in telecommunications, accounting for 16 percent of global sectoral investment. These figures underscore that, while Europe may lag in investment and infrastructure, it still holds strategic leadership in telecom innovation and technology development.

Central to Europe’s success are standard development organisations (SDOs), technical standards, and Standard Essential Patents (SEPs). SDOs provide collaborative forums where companies jointly develop technical standards that ensure interoperability, reduce fragmentation and foster innovation. Complementing this, SEPs protect the innovations embedded within these standards, granting European companies vital licensing revenues that sustain their research efforts. This system is particularly important for EU firms, which tend to be smaller than their global competitors; it enables them to specialise in cutting-edge technology development and commercialise their innovations globally without needing to dominate manufacturing or end-user markets.

As competitiveness in telecommunications increasingly depends on the pace and adoption of innovation, the EU faces both a challenge and an opportunity. European firms have the potential not only to supply critical technologies but to drive breakthroughs in connectivity which are linked to the development of other technologies such as artificial intelligence (AI) or quantum technologies. However, to stay competitive, the EU must reinforce its position on the supply side, where its companies still operate at the technological frontier.

This Policy Brief sets out five strategic priorities:

- Recommit to open, market-driven standards: market-led, industry-driven standards have enabled European companies to specialise and grow, supporting a diverse ecosystem of firms. This approach also aligns with the structure of the European economy, which is not dominated by vertically integrated tech giants, as in the US, but instead consists of a dynamic network of small and large firms operating across different parts of the value chain.

- Strengthen intellectual property protection: The recent withdrawal of a proposal to reduce SEP royalty payments is a welcome step in this direction. As the boundaries between the telecom and digital sectors blur, and with much of cellular technology’s production now occurring outside Europe, the EU’s comparative advantage lies increasingly in the upstream segment: the development and licensing of advanced technologies.

- Mobilise resources to support R&D: Europe’s leadership in telecom standards stems from long-term investment in research and development, which has allowed firms to build deep expertise and maintain technological edge. To build on this strength, the EU should increase public research funding and focus on encouraging private sector innovation, supporting SMEs, improving university quality, and attracting top global talent.

- Invest in telecom infrastructure: Weak domestic demand for new telecom infrastructure is quietly holding back Europe’s competitiveness. It limits innovation by suppliers and reduces the EU’s standing in global markets. To reverse this, the EU must tackle persistent underinvestment caused by market fragmentation and poor incentives.

- Get regulation right: Europe’s telecom sector underpins the wider economy and its digital ambitions, delivering returns far beyond the costs of network deployment. But the sector’s success depends heavily on the broader economic and regulatory environment. Overregulation has created a complex and costly landscape that stifles innovation and adds uncertainty. If Europe remains an unfriendly place for digital innovation, demand for advanced telecom services will weaken, discouraging investment in next-generation telecommunication infrastructure and technologies.

1. Introduction

The telecommunications sector is a fundamental driver of economic growth.[1] Therefore, it is no surprise that the sector plays a central role in discussions about the EU’s competitiveness. The Letta Report[2] on the EU single market refers to telecommunications and networks 30 times, while the Draghi Report[3] makes 64 references to these terms. Before these two documents were published, the European Commission presented a White Paper[4] setting out policy directions to strengthen the EU’s digital infrastructure. This surge in policy proposals on the future of the EU’s telecommunications sector is justified as the European Commission plans to publish its Digital Networks Act before the end of 2025[5].

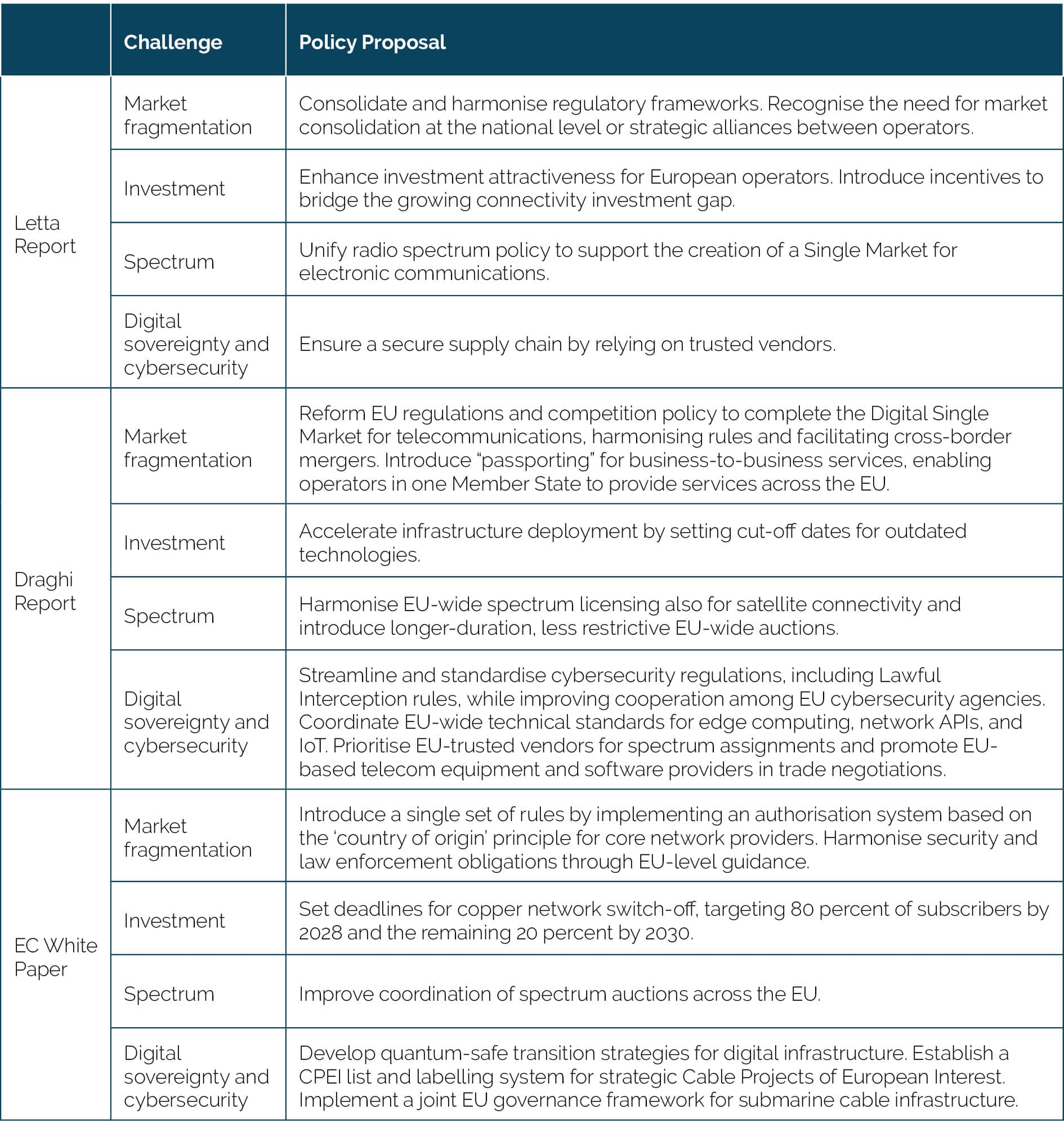

There is a degree of convergence among these reports with regards to the main challenges facing the EU telecommunications sector: (1) increasing investment; (2) market fragmentation and the need to establish a fully integrated single market for electronic communications; (3) harmonising rules on spectrum allocation; and (4) reinforcing digital sovereignty in the telecommunications sector. Annex 1 outlines these challenges and the corresponding policies proposed in the Letta Report, the Draghi Report and the European Commission White Paper.

Across these four areas of concern, infrastructure investment emerges as a goal in itself and as a policy closely related and impacted by the other challenges. For example, there is a general agreement that regulatory fragmentation has discouraged market consolidation, negatively impacting the profitability of the European telecom sector and, in turn, reducing operators’ ability to invest in infrastructure. Similarly, the absence of harmonised spectrum policies is often cited as a barrier to creating a single spectrum market and pan-European operators with the size to pay the large sum required for investing in telecommunication networks. Finally, investments in telecommunication infrastructure are key for achieving digital sovereignty, not just on land, but also in space and at sea with calls for these investments to prioritise EU companies.

The focus on infrastructure is completely understandable. Comparisons with other countries highlight that Europe is falling behind in telecommunications infrastructure investment, with consequences for service quality. For example, South Korea has deployed more than five times as many 5G base stations – crucial for high reliability and low latency – per 100,000 inhabitants as the EU, while China has deployed nearly three times as many.[6] Moreover, EU telecommunications companies invest less per customer in capital expenditure, and have lower market capitalisation than their counterparts in the US, Japan, and South Korea.[7]

Partly because of these obvious shortcomings, the policies outlined in the Letta Report, the Draghi Report and the European Commission White Paper focus exclusively on the demand for telecommunications infrastructure. Yet, as in any market, there is also a supply side, covering telecommunications equipment and the underlying technology – namely, standards for advanced mobile communication. Naturally, supply and demand are closely linked. Weak demand for new telecommunications infrastructure or slow deployments of the newest technologies hampers suppliers’ ability to innovate and diminishes the EU market’s significance, potentially driving EU companies to relocate their R&D or even their headquarters abroad.[8]

However, while infrastructure investment dominates much of the policy debate and its importance is now broadly recognised, the equally vital role of EU leadership in the development of telecommunication technologies remains underappreciated. Yet, the benefits of having EU firms actively engaged in setting global technology standards are tangible. First, successful contributions to standards often embed proprietary technologies that generate licensing revenues through standard essential patents (SEPs), creating a stream of income that supports further R&D. For instance, Ericsson earned EUR 1 billion in IPR licensing revenue in 2023.[9] Second, firms at the forefront of standardisation tend to be among the most innovative in the sector, shaping not only technical specifications but also future market dynamics. Their leadership sustains an ecosystem of upstream innovation that anchors the EU’s competitive position in telecommunications, even as manufacturing is based elsewhere.[10]

A positive sign for the European supply of telecommunication technology is that some EU firms operate at the cutting edge of this technology. In 2023, out of the 2,000 companies with the highest R&D spending in the world, 95 companies belonged in the telecommunications sector[11]. Of these, 27 were headquartered in the EU, accounting for 16 percent of total R&D investment in telecommunication. Among them, Nokia spent EUR 4.3 billion and Ericsson EUR 4.4 billion on R&D in 2023 alone, much of which has been directed toward the development of 5G technologies.[12]

However, being at the technological frontier today does not guarantee future leadership, particularly in a sector defined by rapid technological change and the rise of Chinese telecommunication companies. Moreover, the boundaries between telecommunications and digital technologies are becoming increasingly blurred. This presents both an opportunity of expansion and a challenge for EU companies, which will face growing competition from digital giants with deep R&D pockets. Therefore, it is crucial for Europe to focus on the supply-side of a sector where its companies remain at the forefront, and with the potential to drive future innovations in connectivity, AI, and quantum technologies across the economy.

This Policy Brief seeks to provide a balanced discussion on the competitiveness of the EU telecommunications sector by examining the supply-side of technology. The next chapter evaluates Europe’s competitive position in telecommunications equipment and technology. The third chapter examines the ecosystem in which European companies operate for the development of telecommunications-related technology. This ecosystem works through an open, consensus-driven, industry-led voluntary process within standardisation bodies which produce innovation protected by SEPs. The analysis of Chapter 2 and 3 informs the final chapter, which sets out policy recommendations for the EU to support the competitiveness of its suppliers of telecommunications technology.

[1] Minges, M. (2015). Exploring the relationship between broadband and economic growth (World Development Report 2016 Background Paper). World Bank. https://documents1.worldbank.org/curated/en/178701467988875888/pdf/102955-WPBox394845B-PUBLIC-WDR16-BP-Exploring-the-Relationship-between-Broadbandand-Economic-Growth-Minges.pdf

[2] Letta, E. (2024). Much more than a market: Speed, security, solidarity. European Council. https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf

[3] Draghi, M. (2024). The future of European competitiveness: In-depth analysis and recommendations (Part B). European Commission. https://commission.europa.eu/document/download/ec1409c1-d4b4-4882-8bdd-3519f86bbb92_en

[4] European Commission. (2024). How to master Europe’s digital infrastructure needs? (COM(2024) 81 final).

[5] European Commission. (2025). Commission work programme 2025: Moving forward together – A bolder, simpler, faster Union (Annexes 1 to 5) (COM(2025) 45 final). European Commission.

[6] Erixon, F., Guinea, G., and Pandya, D. (2024). Securing Europe’s Future: Strengthening ICT Competitiveness for Economic and National Security. Report, ECIPE, Brussels, Policy Brief 04/2023, 15 p.

[7] European Commission. (2024). How to master Europe’s digital infrastructure needs? (COM(2024) 81 final).

[8] Deutsch (2024) “Ericsson CEO Says Weak Europe Market Forces Firm to Grow Abroad.” Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-11-18/ericsson-chief-looks-for-growth-in-us-as-europe-falls-behind

[9] Ringstrom, A. (2023, August 25). Ericsson sees IPR licensing revenues of $1 billion this year. Reuters. Available at: https://www.reuters.com/markets/deals/ericsson-huawei-renew-patent-cross-licensing-deal-2023-08-25/#:~:text=%22With%20the%20current%20portfolio%20of,company%20said%20in%20a%20statement

[10] Erixon, F., and Guinea, O. (2023). Reforming Standard Essential Patents: Trade, Specialisation, and International Jurisprudence. Report, ECIPE, Brussels, Policy Brief 04/2023, 15 p.

[11] ICB4 codes selected: Fixed line telecommunications, mobile telecommunications and telecommunications equipment

[12] Nindl, E., Confraria, H., Rentocchini, F., Napolitano, L., Georgakaki, A., Ince, E., Fako, P., Hernández Guevara, H., Gavigan, J., Tübke, A., Pinero-Mira, P., Rueda-Cantuche, J.M., Banacloche-Sánchez, S., de Prato, G., and Calza, E. Scoreboard Panel 2003-2022. JRC. Available at: https://iri.jrc.ec.europa.eu/scoreboard/2023-eu-industrial-rd-investment-scoreboard

2. The Competitiveness of the European Supply of Telecommunication Technology

The objective of this chapter is to assess the competitiveness of the EU telecommunication sector from the perspective of technology development. To ground this analysis, the chapter begins with a broader assessment of the overall competitiveness of the EU telecommunication sector, not limited to technology supply but encompassing its performance across the value chain. As highlighted in the introduction, demand for advanced telecom services, encourages firms to invest in research, develop new capabilities, and bring innovations to market. Understanding the general state of the sector, therefore, offers critical context for interpreting the performance and prospects of its technological base.

The chapter then turns to the development of technology in the EU’s telecommunication sector, focusing on two key indicators: R&D expenditure and patenting activity. By examining Europe’s position in these areas – both in absolute terms and relative to global peers – Chapter 2 shed lights into the competitiveness of the EU’s supply-side in the telecommunication sector.

2.1 The Competitiveness of the EU’s Telecommunication Sector

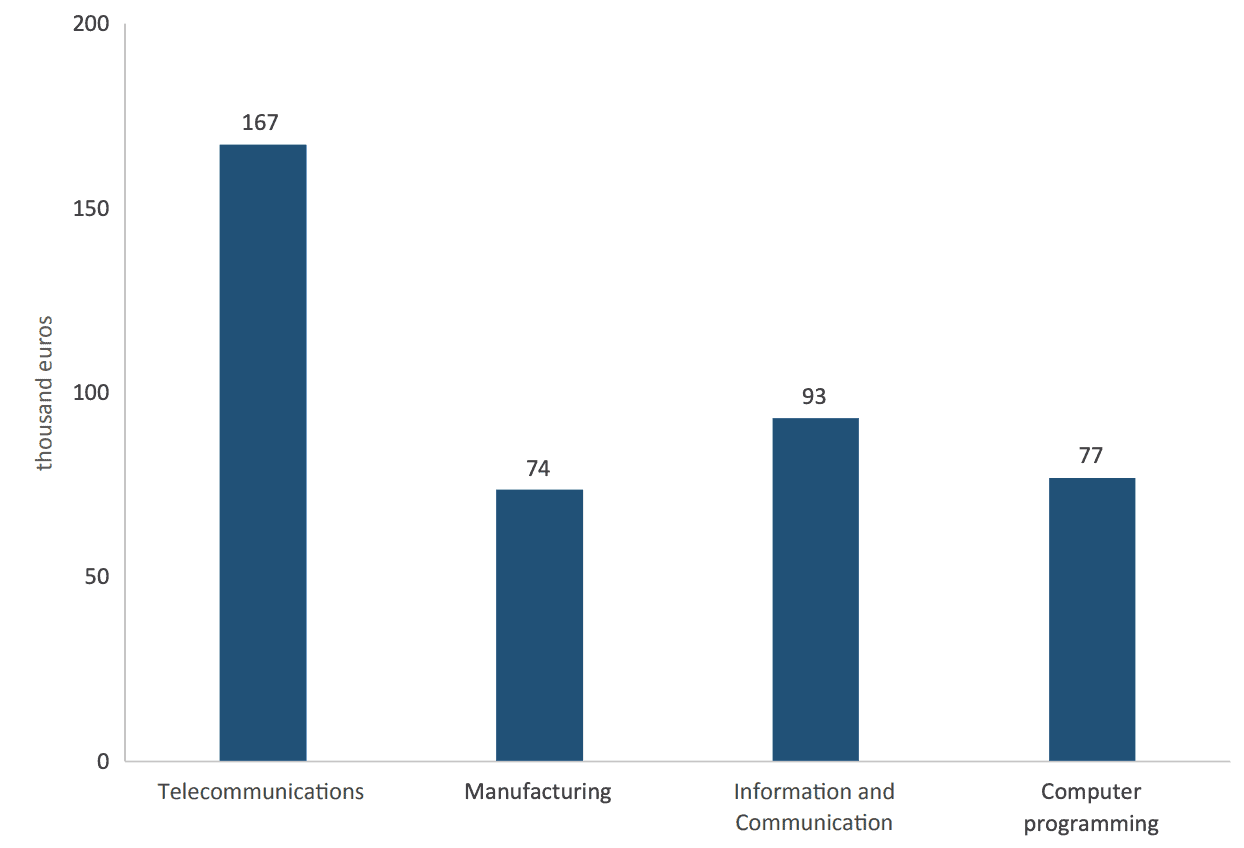

The EU telecommunications sector is one of the most productive in the EU economy.[1] Out of 65 sectors[2], it ranks eighth in productivity, outperforming the overall manufacturing sector, information and communication, and even computer programming. The next figure illustrates this advantage.

Figure 1: Labour productivity in the EU manufacturing, information and communication, telecommunication and computer programming sector (2021) Source: Eurostat, Apparent labour productivity – thousand euro. Sectors and NACE codes: Manufacturing (C); Information and Communication (J); Telecommunications (J61); Computer programming, consultancy and related activities (J62). Author’s calculations.

Source: Eurostat, Apparent labour productivity – thousand euro. Sectors and NACE codes: Manufacturing (C); Information and Communication (J); Telecommunications (J61); Computer programming, consultancy and related activities (J62). Author’s calculations.

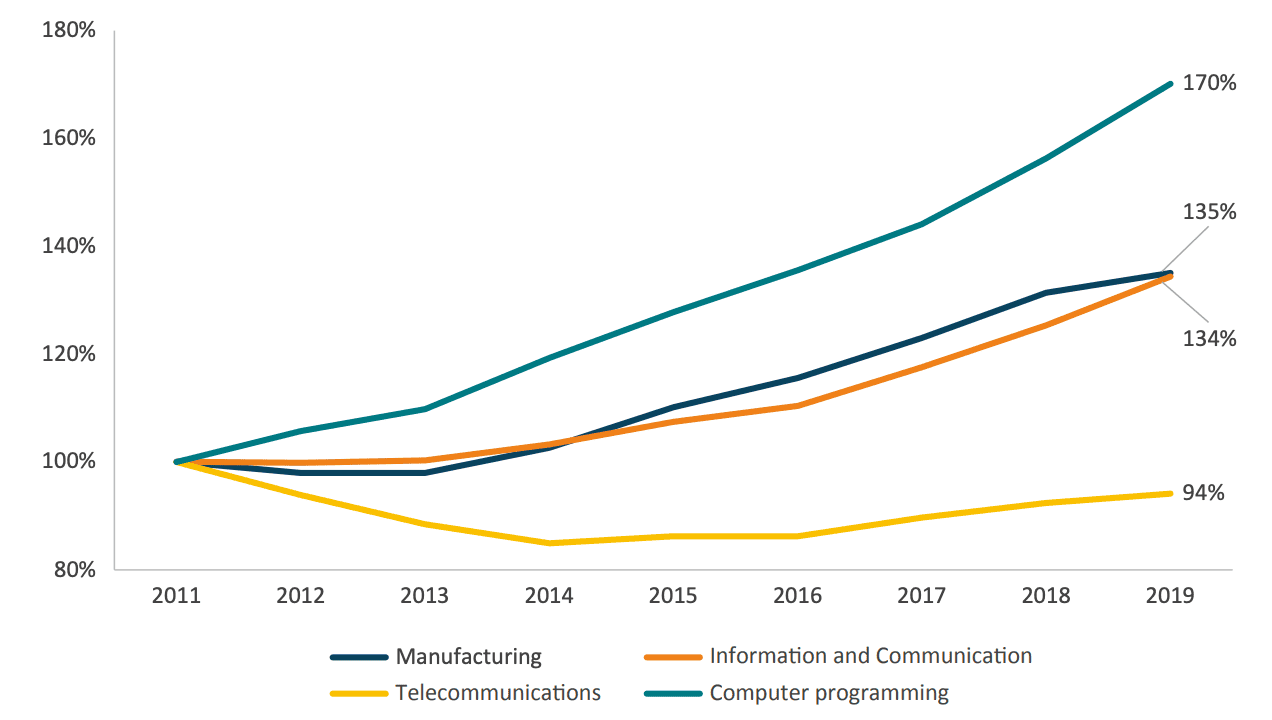

However, despite being one of the most productive sectors, the EU telecommunications sector has had a mixed track record over the years.[3] The next figure shows value-added in million euros since 2011 for telecommunications, manufacturing, information and communication, and computer programming, which together with telecommunication is part of the broader information and communication sector. While the other sectors have expanded, telecommunications has struggled, with its nominal value in 2019 falling below its 2011 level.[4]

Figure 2: Change in value-added in the EU manufacturing, information and communication, telecommunication and computer programming sector (2011 = 100) Source: Eurostat. Author’s calculations.

Source: Eurostat. Author’s calculations.

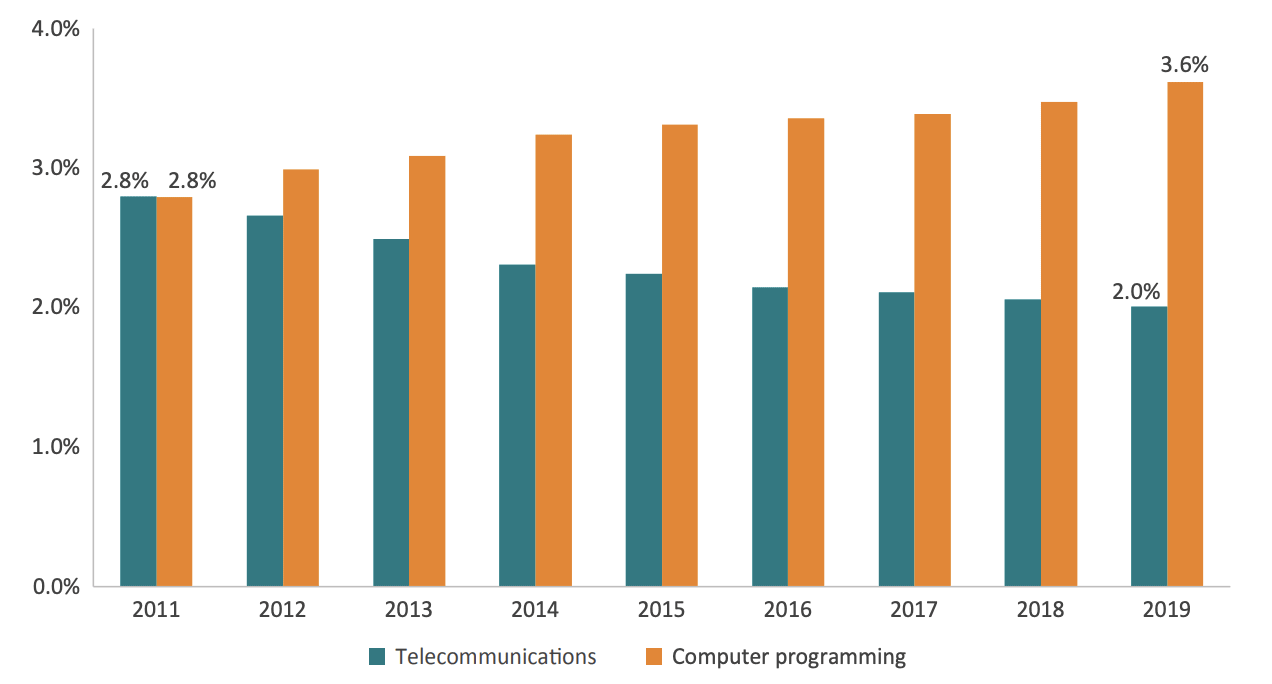

The decline in value-added means that Europe’s telecommunications sector has become less relevant within the broader business economy. The next figure illustrates value-added as a percentage of the private economy for telecommunications and computer programming between 2011 and 2019. In line with the findings presented in Figure 2, the telecommunication sector has steadily lost ground, while computer services has grown in importance.

Figure 3: Value-added in the EU telecommunication and computer programming sector as a share of value-added in the business economy (2011-2019)  Source: Eurostat. Author’s calculations.

Source: Eurostat. Author’s calculations.

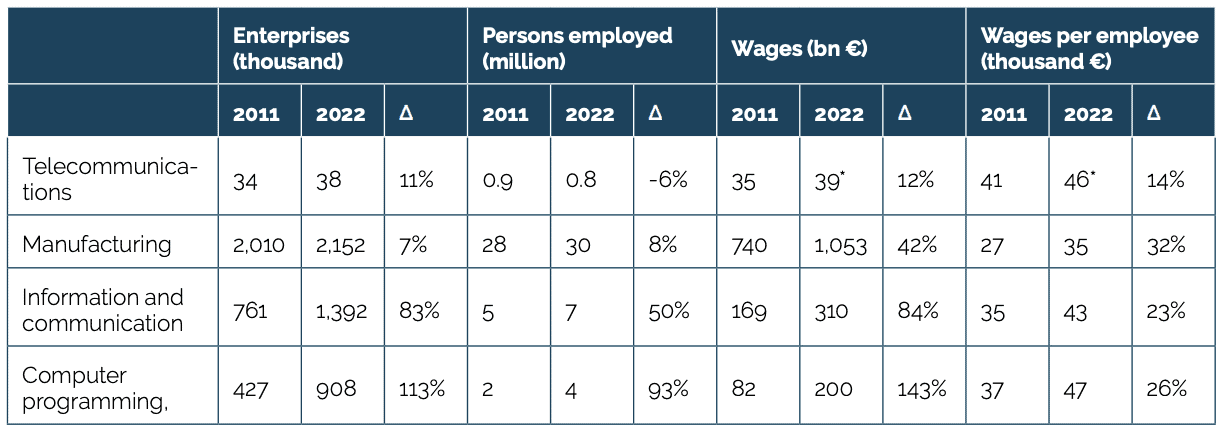

The table below paints a similar picture. While the telecommunications sector has seen growth in the number of firms and wages, it lags behind the broader information and communication sector and computer programming across number of firms, employment, and wages. Interestingly, in terms of wage growth, the telecommunications sector has performed worse than manufacturing, and in relation to employment, the sector had fewer employees in 2022 than in 2011.

Table 1: Number of enterprises, persons employed, and wages in the EU manufacturing, information and communication, telecommunication and computer programming sector (2011-2022) Note: *Wages and Salaries – million euros for Telecomm 2021; Wages and Salaries / Person employed – number for Telecomm 2021. Source: Eurostat. Author’s calculations.

Note: *Wages and Salaries – million euros for Telecomm 2021; Wages and Salaries / Person employed – number for Telecomm 2021. Source: Eurostat. Author’s calculations.

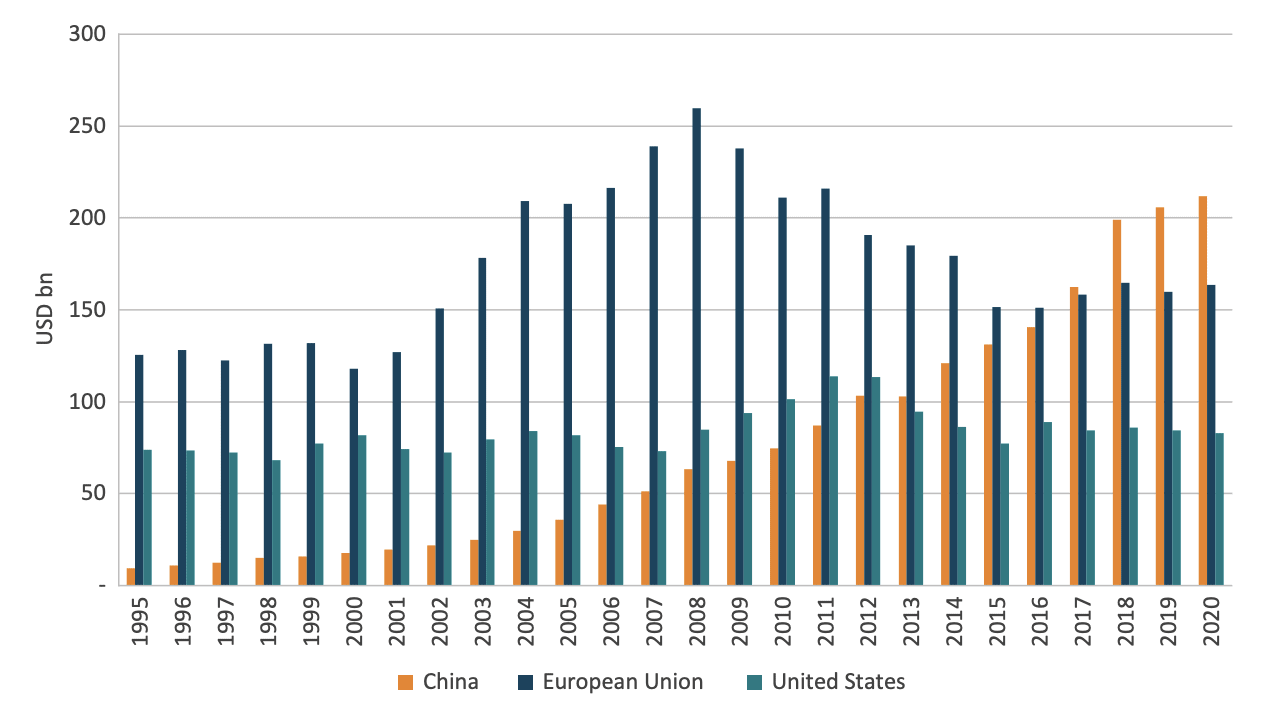

The next step in assessing the competitiveness of the overall EU telecommunications sector is to compare it with other major economies. The US and China serve as relevant benchmarks. Figure 4 illustrates the value-added generated by the telecommunications sector in the EU, the US, and China from 1995 to 2020. The data shows Europe’s steady growth until 2008, after which it plateaued and then declined. Meanwhile, China saw consistent growth, overtaking the EU by the mid-2010s. The US, despite some fluctuations, maintained a relatively stable trajectory. This comparison highlights that the EU’s telecommunication sector, despite producing significantly higher value-added than the US telecommunication sector has suffered from a relative decline, particularly in contrast to China’s rapid expansion.

Figure 4: Value-added in the telecommunications sector for EU, China and the US between 1995 and 2020.  Source: OECD. Author’s calculations.

Source: OECD. Author’s calculations.

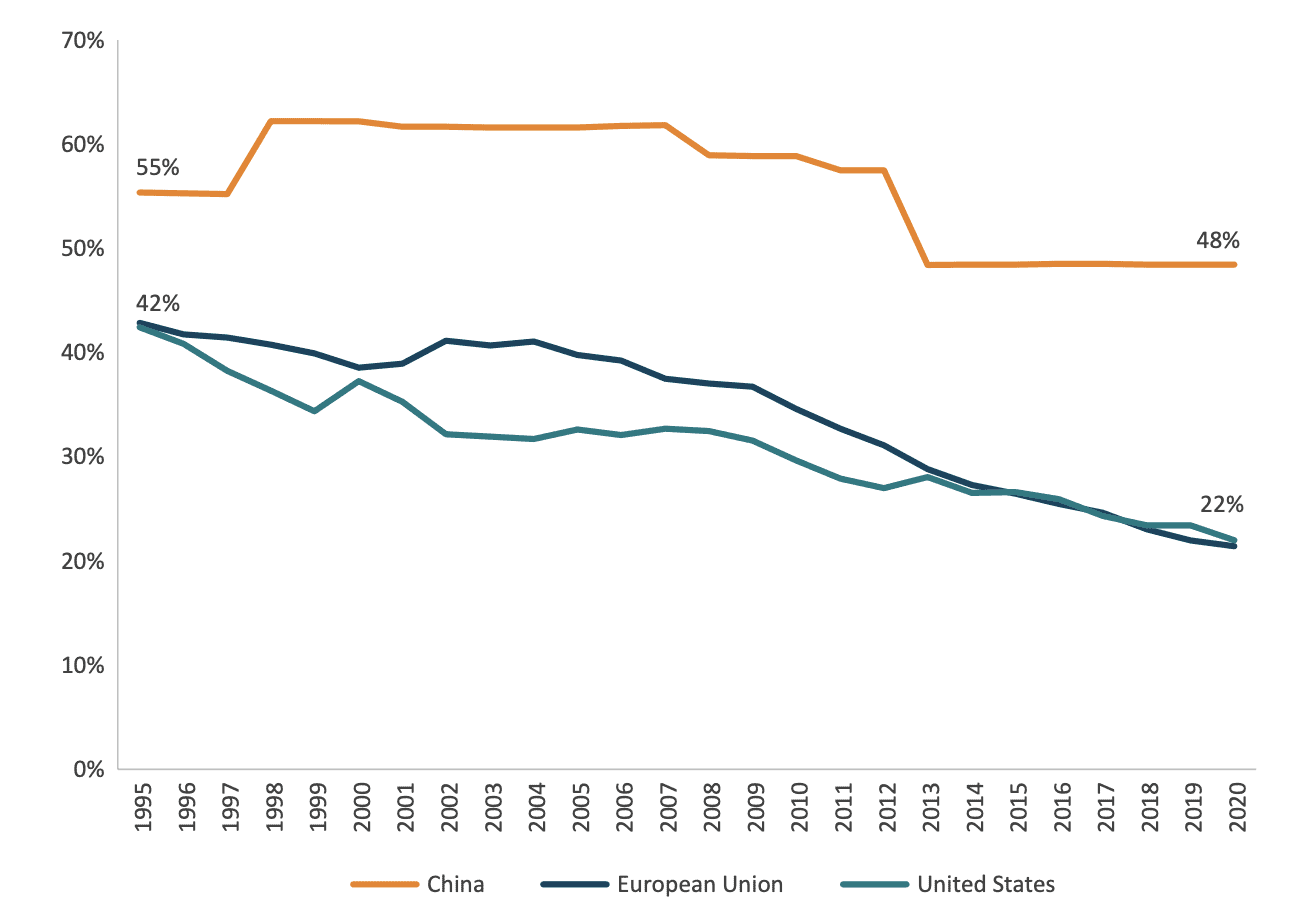

Finally, as a percentage of value-added in the Information and Communications Technology (ICT) sector, the telecommunications sector has seen a decline, although this decline has been markedly different across the three countries. In 1995, telecommunications accounted for 42 percent of ICT value-added in the EU, but this share steadily declined to 22 percent by 2020. The US followed a similar downward trend, with its share also falling to around 22 percent. In contrast, Chinese’s telecommunication share of China’s ICT has remained relatively high for years, starting at 55 percent and dropping to 48 percent by 2020.

Figure 5: Telecommunication sector share of value-added over ICT for the EU, China and the US between 1995 and 2020. Source: OECD. Author’s calculations.

Source: OECD. Author’s calculations.

2.2 EU’s Competitiveness in the Supply of Telecommunication Technology

There are two main ways to measure the competitiveness in the supply-side of telecommunication technology. First, by examining inputs, specifically, how much firms invest in R&D. Second, by assessing the outputs of these investments, such as new inventions. A common approach to measure R&D output, is through the number of patents.

The EU is a major player in telecom R&D investment. As explained in the Introduction, among the 95 largest telecom companies identified by the EU Joint Research Centre as top R&D spenders in 2023[5], 27 were headquartered in the EU. That year, these companies collectively spent €81 billion on R&D, with EU firms accounting for 16 percent of the total. Leading EU companies like Ericsson, Nokia, Telecom Italia, Telefonica, Deutsche Telekom, and Orange ranked among the sector’s top global R&D investors.

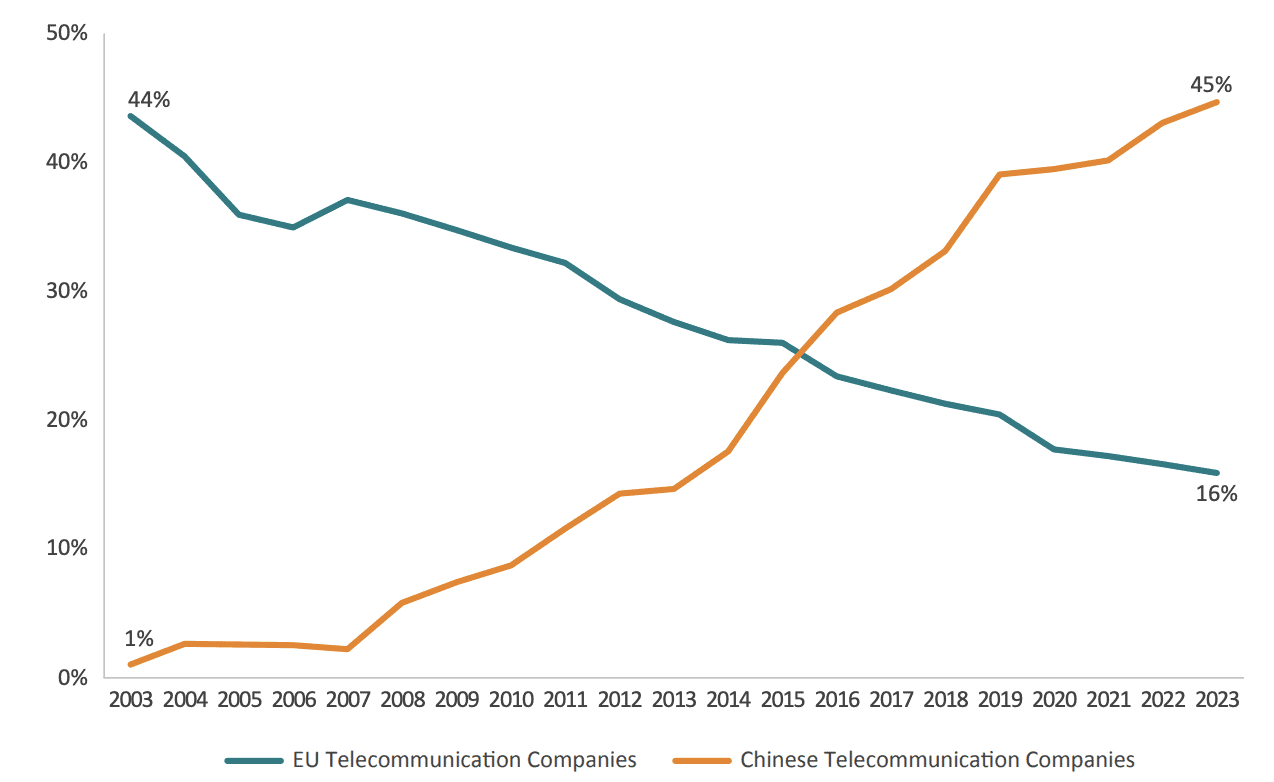

However, Europe’s relative contribution to global R&D spending in telecommunications used to be significantly higher than it is now. Their share of global spending in the sector has dropped sharply, falling from 44 percent in 2003 to just 16 percent in 2023.

Figure 6 below shows that EU’s relative decline in telecom innovation is largely due to the rise of Chinese companies. In 2003, Chinese firms accounted for just 1 percent of global R&D spending in telecommunications, but by 2023, their share had surged to 45 percent. Essentially, Chinese companies now play the same role in telecom innovation that EU firms did two decades ago. Among the top 10 telecom R&D spenders, six were Chinese, contributing 40 percent of total R&D investment in the sector from the sample of 96 leading companies mentioned previously.

Figure 6: R&D spending by EU and Chinese companies and as a share of telecommunication (2003-2023) Source: JRC panel data. Author’s calculations.

Source: JRC panel data. Author’s calculations.

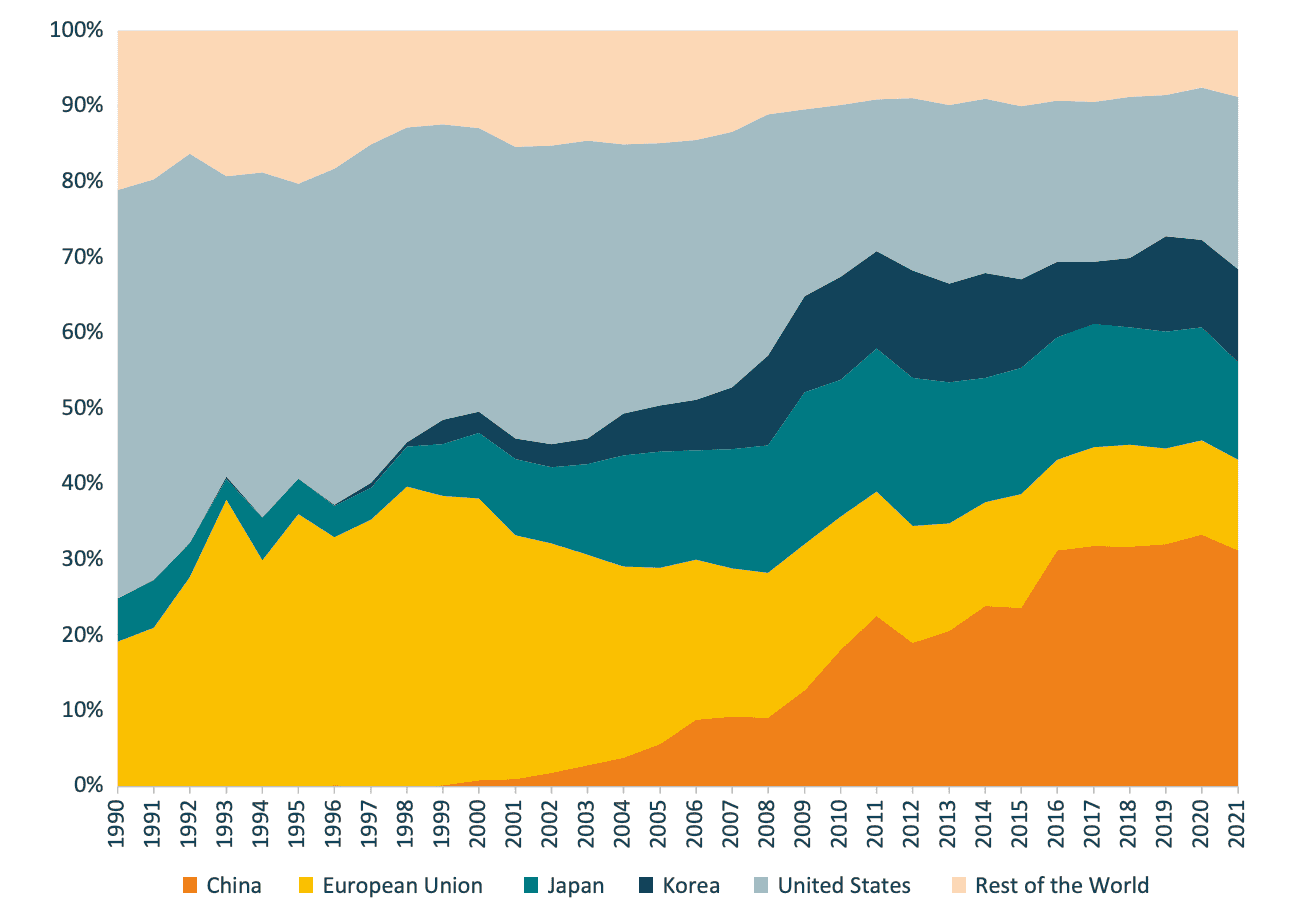

The shift in R&D spending by Chinese companies has been accompanied by a surge in telecommunications patents. Figure 7 illustrates how the EU and China have effectively swapped places as the largest holders of telecom patents between 2000 and 2021. True, not all patents have the same value or impact technological progress in the same way, which is particularly relevant when assessing China’s contribution to worldwide patents. However, the overall trend is clear.[6] In the early 2000s, the EU dominated global telecom patents, holding the largest share among major economies. However, its position steadily declined as China’s share grew rapidly. By the early 2010s, China had overtaken the EU, and by 2021, it had established itself as the clear leader in telecom patent filings. The EU has even fallen behind the US, which has maintained a more stable share of telecom patents, further highlighting Europe’s relative decline in telecom innovation.

Figure 7: Share of patents in telecommunication in the EU, US, Korea, Japan, China, and the Rest of the World, 1990-2021 Source: OECD-REGPAT. Author’s calculations.

Source: OECD-REGPAT. Author’s calculations.

Patents in the telecommunications sector alone do not fully capture the evolving competitiveness of the industry. As digitalisation accelerates, the boundaries between telecommunications, computing, and digital communications are becoming increasingly fluid. Many cutting-edge technologies now integrate multiple domains. For example, quantum communication combines telecom infrastructure with quantum computing, while AI-driven systems are transforming network operations by optimising bandwidth and anticipating usage patterns.

This technological convergence presents both an opportunity and a challenge for European firms. As connectivity becomes a foundational component not only of the digital economy but also of sectors such as manufacturing, transport, and healthcare, EU telecom companies have the chance to expand into new, higher-value areas like industrial automation, cybersecurity, and cloud-based services. However, this broader playing field also attracts powerful competitors, particularly large US-based digital companies with deep R&D budgets and established dominance in adjacent markets.

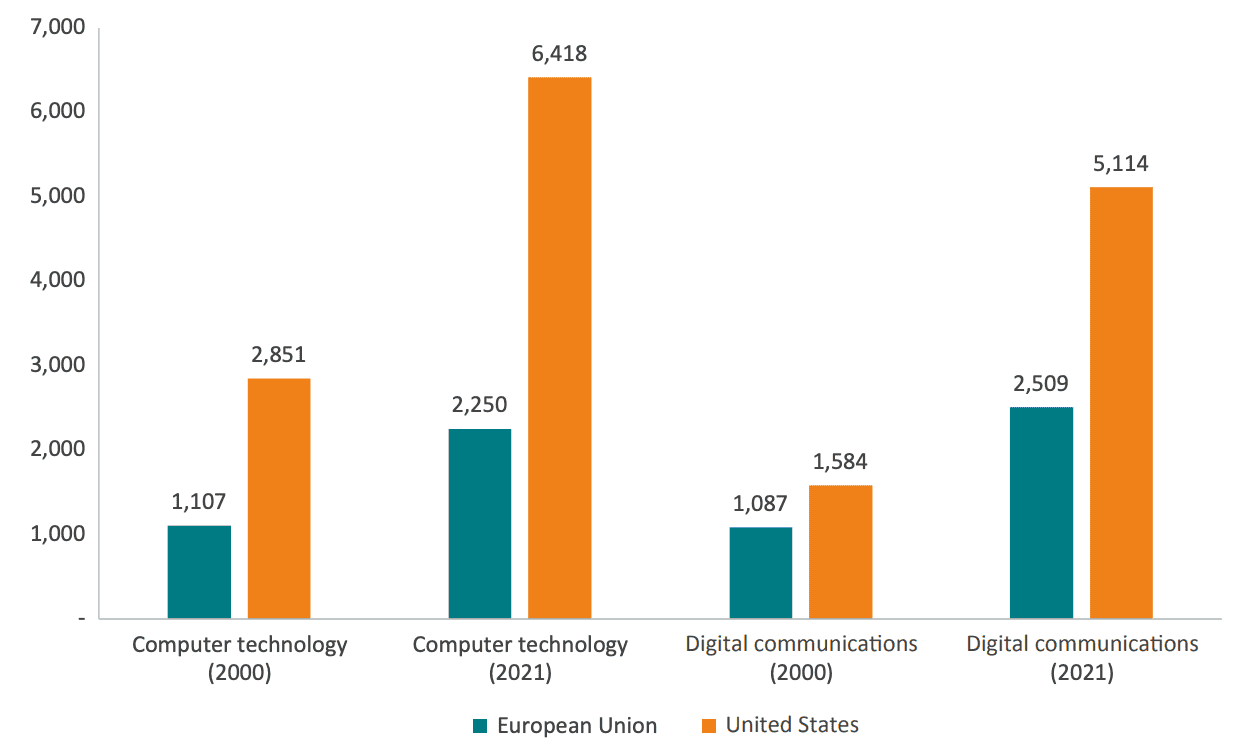

The next figure shows how far the EU with respect to the US in the development of patents across computer technology and digital communications. The data clearly illustrates that the EU has fallen behind the US in these key areas, with the gap widening over time. In 2000, the US already held an advantage, but by 2021, this difference had grown significantly. In that year, the US had 142 percent more patent applications in these technologies compared to the EU, a sharp increase from the 102 percent difference observed in 2000.

Figure 8: Total number of patent applications in computer technology and digital communication in the EU and the US (2000-2021) Source: OECD-REGPAT and Di Girolamo et al., 2023. Author’s calculations.

Source: OECD-REGPAT and Di Girolamo et al., 2023. Author’s calculations.

In summary, the performance of the EU telecommunications sector reveals a mixed picture. The overall sector has struggled to keep pace with other technology sectors, and in some areas, such as employment, it has even contracted over time. This erosion in the domestic market affects the wider ecosystem, including firms at the forefront of telecommunication technology development, which are increasingly reliant on foreign demand to grow.[7] Yet, Europe still hosts companies that are among the global leaders in the field. However, their position is no longer unchallenged: Chinese players are rapidly catching up. At the same time, the convergence between telecommunications and digital technologies creates a window of opportunity for EU telecommunication technology companies. But doing so will require confronting not just rising Asian competitors, but also US-based digital companies with deep R&D budgets.

[1] The measure productivity, the study uses labour productivity from Eurostat which is defined as value added at factor costs divided by the number of persons employed.

[2] In 2021, the ten most productive sectors in the EU economy (and their corresponding NACE code) were: Insurance, reinsurance and pension funding, except compulsory social security (K65); Extraction of crude petroleum and natural gas (B06); Manufacture of coke and refined petroleum products (C19); Manufacture of tobacco products (C12); Electricity, gas, steam and air conditioning supply (D35); Rental and leasing activities (N77); Financial service activities, except insurance and pension funding (K64); Telecommunications (J61); Programming and broadcasting activities (J60); and Real estate activities (L68). Eurostat LABPRY_TEUR: Apparent labour productivity – thousand euro.

[3] Eurostat labour productivity data for the telecommunications sector were only available for the years 2019, 2020, and 2021. As a result, a time series analysis comparing telecommunications with manufacturing, information and communication, and computer programming was not conducted.

[4] The period selected for Figures 2 and 3 covers 2011-2019 and does not extend beyond due to Eurostat discontinuing the statistics following changes in the business survey. However, the latest values, which include 2020, while not directly comparable, show a similar trend.

[5] ICB4 codes selected: Fixed line telecommunications, mobile telecommunications and telecommunications equipment.

[6] While China plays a significant role in the global innovation ecosystem, relying solely on the volume of its patent applications risks overstating its actual innovative output. A report by the USPTO observed that government subsidies have incentivised entities to file patents primarily to access financial rewards, rather than to protect genuine innovations. The report also highlighted that non-market factors, such as state-imposed patent filing targets and associated countermeasures, further inflate application numbers. These practices form part of China’s broader industrial policy, which underpins its narrative of having “won” the global innovation race in critical areas like 5G and artificial intelligence. Nevertheless, these cautionary findings do not undermine the broader concern that the EU is gradually losing its competitive edge in patents application. See: United States Patent and Trademark Office. (2021). Trademarks and Patents in China: The Impact of Non-market Factors on Filing https://s3.amazonaws.com/media.hudson.org/Putnam%20Luu%20Ngo_Impact%20of%20China’s%20Subsidized%20Patent%20Application%20System.pdfand IP Systems. Available at: https://www.uspto.gov/sites/default/files/documents/ USPTO-TrademarkPatentsInChina.pdf, as referenced and studied further in Putnam, J., Luu, H., Ngo, N., (2021). Does China Really Dominate Global Innovation? The Impact of China’s Subsidized Patent Application System. Hudson Institute Policy Memo. Available at: https://s3.amazonaws.com/media.hudson.org/Putnam%20Luu%20Ngo_Impact%20of%20China’s%20Subsidized%20Patent%20Application%20System.pdf. Also see: National Security Commission on Artificial Intelligence, Final Report (Washington, DC: NSCAI, January 2021), https://www.nscai.gov/wp-content/ uploads/2021/01/NSCAI-Draft-Final-Report-1.19.21.pdf referenced in Putnam, J, et al. (2021).

[7] Deutsch (2024). “Ericsson CEO Says Weak Europe Market Forces Firm to Grow Abroad.” Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-11-18/ericsson-chief-looks-for-growth-in-us-as-europe-falls-behind

3. Technology-Development Framework for EU Telecoms Companies

The competitiveness of the EU’s supply side in telecommunication technology cannot be understood by R&D spending and the number of patents alone. Chapter 3 explains how standard development organisations (SDOs), technical standards, and standard essential patents (SEPs) form a mutually reinforcing system that enables European firms to commercialise their innovations in telecommunication technology.

Focusing on these three elements is essential to understanding the competitiveness of the EU’s supply side in telecommunication technology. Standards shape the technical foundations of mobile networks like 4G and 5G, and subsequently now towards 6G. Firms that contribute to these standards at SDOs often sit at the cutting edge of innovation, and their involvement generates valuable licensing income through SEPs. Examining this process offers a clearer view of where Europe excels, which is not in mass production, but in the development of the telecommunication technology that underpins the latest advances.

3.1 The Standardisation Process

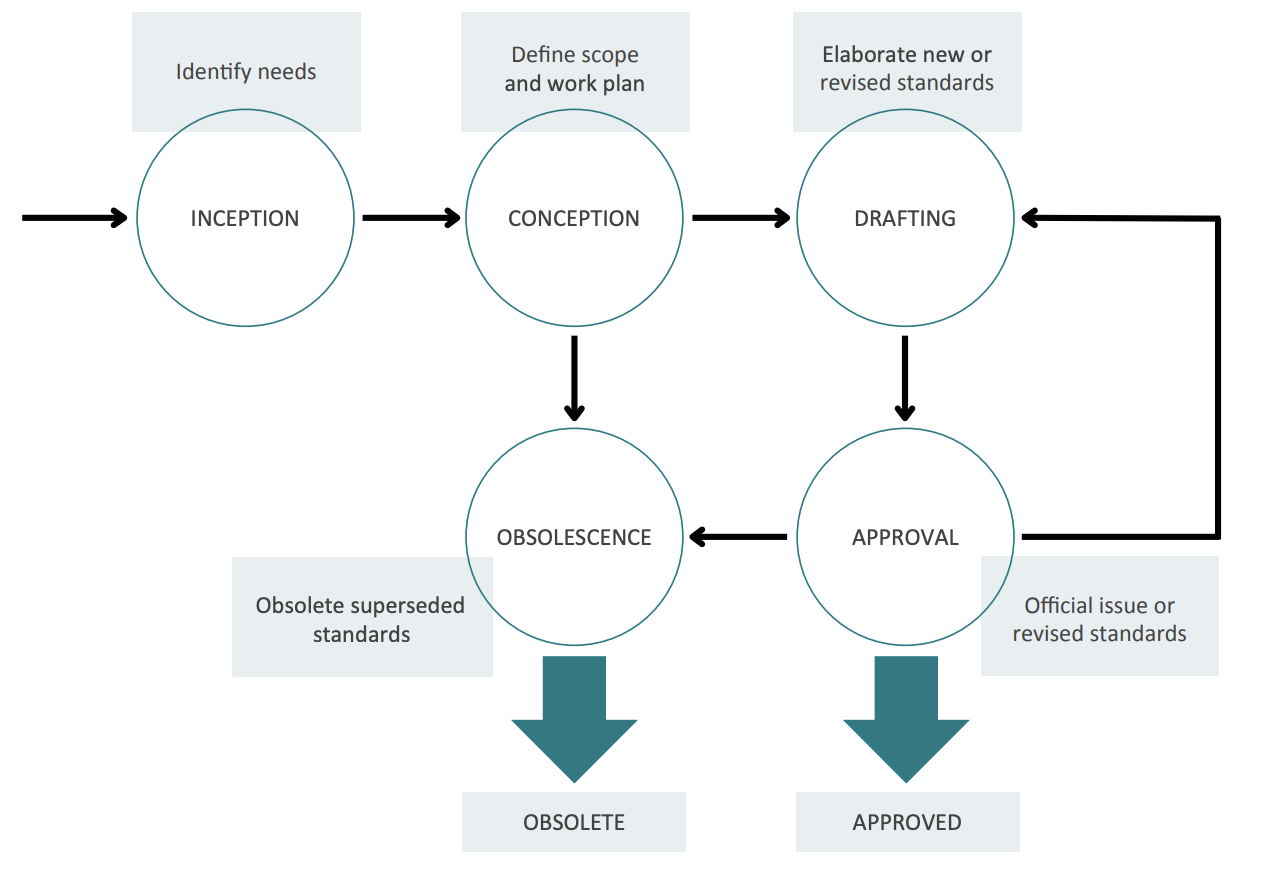

The development of a standard typically unfolds through several structured stages, as described in Figure 9.[1] The inception phase starts with identifying the need for a new standard and submitting a proposal to the SDO. Once a proposal is accepted, the SDO begins the conception phase, where it establishes internal teams and procedures to manage the lifecycle of the standard.

At the beginning of the process, participants submit technical documents, known as “contributions”, to propose solutions or technologies for the standard under discussion. A relatively small group of contributors plays a key role in developing the core technologies that underpin these standards. This phase of the process effectively functions as the research and development arm of standardisation. For instance, Ericsson, Huawei, Nokia, Qualcomm, Samsung, and ZTE are responsible for over half of the contributions in the 3rd Generation Partnership Project (3GPP) – a standardisation organisation that develops protocols for mobile telecommunications.[2]

Upon finalising the technical details, a draft standard is created. This draft undergoes extensive technical and editorial review, in line with the internal workflow rules of the SDO. If the draft is deemed mature and stable, it advances to the approval phase for official release. However, if it fails to meet the required criteria, it may undergo revisions and resubmissions multiple times until it meets the necessary criteria for adoption.

Once published, a standard remains a living document, subject to ongoing modifications and updates as technologies evolve. This is evident in 5G standardisation, where each new release introduces enhancements and refinements to address emerging industry needs.[3] Over time, as newer technologies emerge, older standards are phased out. For example, a key feature of 5G standardisation was its ability to work seamlessly with 4G (LTE), making the transition smoother and making it adaptable to future demands, laying the groundwork for 6G

Figure 9: Standardisation Process  Source: ETSI.

Source: ETSI.

3.2 The SEP Licencing Process

Patents protect technological innovation, and when such patents are essential to a standard, they become SEPs. As described previously, standards are developed at SDOs through collaborative processes involving many companies, often the most innovative in the industry. These companies are incentivised to have their technologies included in a standard, as this grants them valuable SEP rights. In other words, innovators will contribute their technologies to a standard only if they are assured of a fair return on investment through licensing revenues. On the other hand, implementers will adopt the standard only if they can access licences at reasonable and predictable costs.

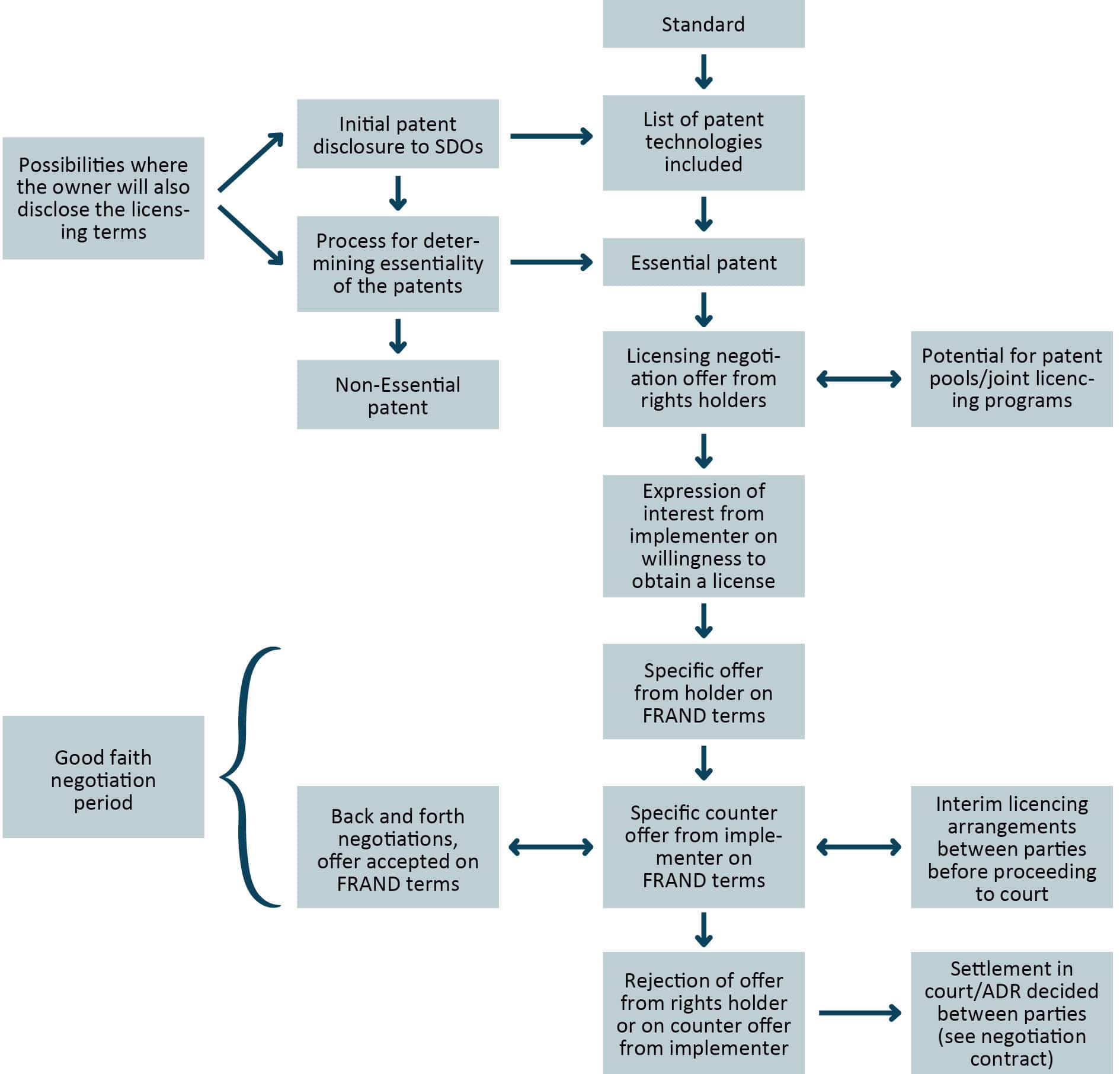

Figure 10 outlines the key stages involved in the licensing process for SEPs. The process begins with the patent holder’s initial disclosure to SDOs, which may include licensing terms. A determination is then made as to whether the disclosed patents are essential to the standard in question. Non-essential patents exit the process at this stage, while essential ones are included in the standard’s patent list and may be subject to joint licensing arrangements, such as patent pools.

For essential patents, the rights holder initiates licensing negotiations by making an offer to implementers. Interested implementers respond with an expression of willingness to obtain a licence, triggering the core negotiation phase. This includes a good-faith exchange of offers and counter-offers based on Fair, Reasonable, and Non-Discriminatory (FRAND) terms. If an agreement is reached, licensing proceeds. If not, the parties may agree to interim arrangements or, ultimately, pursue settlement through court proceedings or alternative dispute resolution.

SEPs have been crucial for the development of telecommunication technology. When standards were created for 4G or 5G, they built upon existing patented innovations that are essential their implementation. These SEPs enable companies across the ecosystem to manufacture infrastructure and devices that are fully compliant with the standard. In this way, SEPs ensure that cutting-edge innovations in the telecommunication sector are not only protected but also widely adopted.

Figure 10: SEP Licencing Process Source: ECIPE.

Source: ECIPE.

3.3 SDOs, Technical Standards and SEPs are EU’s Advantages

SDOs, technical standards, and SEPs have enabled the emergence of a market for telecommunication technology in which EU companies have thrived. First, standards and SDOs have allowed EU firms to specialise in what they do best, while relying on a broader ecosystem of compatible technologies protected by intellectual property rights, including SEPs. Second, SEPs have provided EU innovators with an alternative pathway for commercialising innovation, enabling firms to reap rewards for their R&D. Third, these SEP licensing revenues, amounting to billions annually, sustain the ecosystem of EU companies working in the upstream segment of the telecommunication sector. These revenues are reinvested into R&D, helping maintain Europe’s know-how and leadership in SDOs, standards development, and telecommunication technologies.[4]

The system has delivered positive results for EU companies of all sizes. As explained in Chapter 2, many of the companies making these R&D investments in the global telecommunication sector are European. While this includes major corporations such as Nokia, Ericsson, Siemens, and Philips, it also encompasses a vibrant ecosystem of SMEs, such as Fractus in Spain, Transatel in France, and TICRA in Denmark. In fact, half of the European Telecommunications Standards Institute’s (ETSI) membership consists of European firms. In contrast, only 16 Chinese companies are members of ETSI, representing just 2 percent of its total membership. France and Germany alone have more ETSI members than the US.[5]

This is crucial, especially considering that European firms have transitioned from Original Equipment Manufacturers (OEMs) in the cellular handset business to technology developers. Their exit from end-user markets coincided with the rapid global rise of South Korean and Chinese smartphone OEMs. However, these companies had a limited portfolio of SEPs, while EU companies were among the most significant holders and licensors of cellular SEPs. The system of SDOs, technical standards, and SEPs helped large EU companies to restructure their business models by focusing on the supply side of technology. Without this system in place, they would have found it far more difficult to continue their operations.

[1] ETSI. Understand ICT Standardisation. Available at: https://www.etsi.org/images/files/Education/Textbook_Understanding_ICT_Standardization.pdf

[2] Casaccia, L., Petrovcic, U. and Vuong, K. (2024, February 21). Understanding the Difference Between Participants and Contributors in a Standard-Development Process. Competition Policy International. Available at: https://www.pymnts.com/cpi-posts/understanding-the-difference-between-participants-and-contributors-in-a-standard-development-process/

[3] Minor editorial changes, such as clarifications or corrections, are handled routinely within working groups, while major revisions, such as introducing new technical capabilities follow the same rigorous process as creating an entirely new standard.

[4] Mallinson, K. (2022). How Europe can build on strengths in SEPs to reclaim leadership in cellular with 5G and 6G. 4iPCouncil. Available at: https://www.4ipcouncil.com/features/how-europe-can-build-strengths-seps-reclaim-leadership-cellular-5g-and-6g

[5] Guinea, O. (2023). The Economic Value of Standard Essential Patents and the Costs of the Commission’s SEPs proposal. Available at: https://ecipe.org/blog/economic-value-sep-commissions-proposal/

4. Policy Recommendations

Chapter 4 sets out the policy recommendations that emerge from the analysis presented in this study. Building on the evidence laid out in previous chapters, this chapter outlines five policy recommendations for strengthening Europe’s position in telecommunication technology.

Recommit to Open, Market-Driven Standards to Sustain EU Competitiveness

The EU has long played a leading role in shaping global standards in telecommunications, thanks to the strength of its standardisation bodies and the active participation of its firms. As explained, organisations like the ETSI and the 3GPP have benefited from strong European representation, with EU companies accounting for 52 per cent of ETSI participants and 28 per cent in 3GPP in 2023. This is well ahead of their American and Chinese counterparts.[1]

However, this leadership cannot be taken for granted. In recent years, the EU’s attitude towards standard-setting has become more defensive and politicised. There is a growing tendency to treat standards as an instrument of industrial policy, used to favour national champions and reduce the role of foreign participants. This shift risks undermining the very foundation of Europe’s success in this area: openness.

Standards in the telecommunication sector are powerful because they are global. Their value lies in enabling companies to scale innovations, reduce costs, and operate across borders. Standards are what allow a smartphone or a 5G antenna to work seamlessly in Paris, New York, or Seoul. If the EU turns its standard-setting into a politically driven process, it may succeed in excluding some competitors but it will almost certainly exclude itself from global relevance in the process.

Instead, the EU should recommit to a model that has served it well: market-driven standards that are open and industry-led. Such a system has encouraged participation and fosters innovation, enabling the European companies to specialise and grow.

This approach also reflects the structure of European economy, which is not dominated by vertically integrated giants like in the US, but rather consists of a broad ecosystem of firms, large and small, that specialise in particular segments of the value chain. These firms rely on licensing and intellectual property rights to commercialise their innovations, often supplying downstream companies around the world.

Europe has a lot to lose if it closes in on itself and it also has a lot to gain if it stays globally engaged. By keeping its standard-setting process open, the EU can continue to punch above its weight in telecom technology: shaping global rules, supporting home-grown innovators, and preserving its competitiveness.

Strengthen Intellectual Property Protection to Support Upstream Innovation

In addition to technical standards and the participation in SDOs, the second pillar sustaining the EU’s success in telecommunications are SEPs. As explained in Chapter 3, these patents are vital to ensure that companies investing in telecom innovation are rewarded for their efforts.

A recent proposal by the European Commission sought to reform the SEP system. Had it been implemented, it would have lowered royalty payments for SEP holders, many of them European firms. Fortunately, the proposal has now been withdrawn. That decision should be welcomed. Reducing returns from intellectual property would have harmed European telecom innovators, discouraged investment in R&D, and potentially weakened the EU’s standing in a fiercely competitive market.

European policymakers should recognise that the telecom sector has changed. Cellular technology has gone global, and its implementation, assembly, production, and final delivery, has largely moved outside Europe. What remains, and what Europe excels at, is the upstream segment of the value chain: the development of advanced technology and the licensing of critical innovations. Firms like Ericsson, Nokia, and a host of specialised European R&D players drive this upstream strength. They may no longer produce devices, but their technologies power much of the world’s connectivity infrastructure.

Therefore, SEP policy needs to reflect this international and market-based reality. Rules for licensing and protecting SEPs should not be crafted as if Europe still dominates end-product manufacturing. They must be outward-looking, aligned with global practices, and designed to maintain strong incentives for upstream innovation. The EU should treat SEPs not as a burden, but as a strategic asset.

Moreover, as the telecom sector continues to evolve, each new generation of telecom standards will give rise to fresh SEPs, potentially increasing the value of existing telecommunication companies within the EU ecosystem. This underscores the importance of encouraging active participation in the early stages of standard development, and more importantly during the creation of entirely new standards. If Europe wants to remain competitive in telecommunications, it must ensure that its innovation engine is well-oiled. That starts by keeping SEPs strong, fair, and globally attuned.

Mobilise Resources to Support R&D in Europe’s Telecom Ecosystem

Europe’s leadership in telecommunication standards has not happened by accident. It is the product of long-term investments in research and development, which have enabled European firms to maintain technological leadership. These firms may not top today’s global R&D spending tables, but they have accumulated deep reserves of knowledge and expertise, which continue to power innovation in the upstream parts of the value chain. Between 2003 and 2023, the stock of R&D investment in the telecommunication sector by the EU companies with the highest investment in R&D was €323 billion.[2] Nokia and Ericsson invest almost 20 percent of their revenues on R&D activities, a higher percentage than US companies such as Alphabet or Apple.

To build on this strength, the EU must actively stimulate new R&D. This starts with increasing public spending on research, but it cannot stop there. There are four key steps to getting this right:

- Focus on private sector R&D. Two-thirds of Europe’s R&D already comes from businesses, and there is room for more. Tax incentives should be sharpened to reward high-impact innovation.

- Support SMEs more directly. Unlike large companies, SMEs are more responsive to targeted support, and more likely to translate public incentives into measurable gains.

- Improve the quality of European universities. The EU has a good number of average universities by not so many world-class ones. The EU should follow the example of countries such as Switzerland which host a significant number of top research universities with tight links with industry.[3]

- Attract global talent. A shrinking working-age population and global competition for skilled labour mean the EU must do more to welcome top researchers and engineers. That means faster, simpler visa processes and a renewed effort to make European innovation hubs attractive to international talent.

Invest in Telecom Infrastructure to Strengthen Europe’s Technology Base

Weak demand for new telecommunications infrastructure is quietly undermining Europe’s competitiveness. It constrains the ability of telecom suppliers to innovate and diminishes the EU’s relevance in global markets. When domestic demand falters, firms are more likely to relocate research, scale back investment, or shift their focus to more dynamic regions.

To stimulate the supply side of Europe’s telecommunications market, the EU must tackle one crucial issue: underinvestment in infrastructure. This is not a new problem. As pointed in Chapter 1, reports by Letta, Draghi, and the European Commission have all flagged the same challenges pointing at market fragmentation, weak investment incentives, and disjointed spectrum policy as reasons for this underinvestment.

These are not rhetorical argument. The reality is that Europe is falling behind in telecommunication infrastructure. Deployment of next-generation networks such as 5G has been slow, patchy, and fragmented. The result is not just a connectivity gap, but a missed opportunity to boost demand for cutting-edge telecom equipment and drive innovation from within.

To revert this situation, the EU should take the following action:

- Accelerate investment in fibre and 5G. This is not just important for the telecommunication sector. Digital infrastructure raises productivity across the board and opens up new possibilities in everything from industrial automation to healthcare.

- Market fragmentation must be addressed. Europe’s telecom market is still a patchwork of national markets, governed by different rules and spectrum regimes. This prevents operators from reaching scale and reduces profitability, which in turn limits their ability to invest in infrastructure. A more integrated single market, with a unified framework for licensing and spectrum management, would help spread the cost of investment across a broader customer base and stimulate demand in the upstream segment of the value chain, where EU companies excel.

Telecom Competitiveness is Central to Europe’s Economic Future, So Is Getting Regulation Right

As explained previously, the competitiveness of Europe’s telecom sector is not an isolated concern. It is foundational to the performance of the broader EU economy, and especially to Europe’s digital ambitions. The total economic and social return dwarfs the cost of deploying new networks or the revenue received by telecom firms. Put simply, the value of telecommunications technology to society far exceeds the sum of its parts.

However, this relationship cuts both ways. Just as a strong telecom sector supports the wider economy, the broader economic and regulatory environment shapes the future of Europe’s telecom suppliers.

Europe’s digital economy remains heavily overregulated. The past decade has seen a steady accumulation of rules. While many of these regulations are well-intentioned, their combined effect is a complex, often contradictory regulatory environment that discourages experimentation, raises compliance costs, and increases uncertainty.

For the telecom sector, this overregulation has significant ripple effects. If Europe becomes a less attractive place to build and scale digital technologies, demand for advanced telecom services will stagnate. When fewer companies are building smart factories, launching digital platforms, or rolling out cloud-based applications, there is less need for cutting-edge connectivity and less incentive for telecom firms to invest in the next generation of infrastructure and technology.

The policy recommendation is clear: Europe must improve its overall regulatory environment for digital innovation. A more innovation-friendly digital economy will stimulate demand for telecom services and encourage investment in infrastructure and R&D.

[1] Guinea, O. (2023). The Economic Value of Standard Essential Patents and the Costs of the Commission’s SEPs proposal. Available at: https://ecipe.org/blog/economic-value-sep-commissions-proposal/

[2] Nindl, E., Confraria, H., Rentocchini, F., Napolitano, L., Georgakaki, A., Ince, E., Fako, P., Hernández Guevara, H., Gavigan, J., Tübke, A., Pinero-Mira, P., Rueda-Cantuche, J.M., Banacloche-Sánchez, S., de Prato, G., and Calza, E. Scoreboard Panel 2003-2022. JRC. Available at: https://iri.jrc.ec.europa.eu/scoreboard/2023-eu-industrial-rd-investment-scoreboard

[3] Dugo, A., Erixon, F., and Guinea, O. (2025). Models of Industrial Policy: Driving Innovation and Economic growth. Report, ECIPE, Brussels, occ. paper 05/2025, 38 p.

References

Bauer, M., Erixon, F. Guinea, O. and Sharma, V. (2023). In support of market driven standards. ECIPE. Report, ECIPE, Brussels, occ. paper 01/2023, 30 p.

Colangelo, G. (2023) FRAND Determinations Under the EU SEP Proposal: Discarding the Huawei Framework. Available at: https://laweconcenter.org/wp-content/uploads/2023/11/SEP-wp-28.9.pdf

Deutsch, Jillian. Ericsson CEO Says Weak Europe Market Forces Firm to Grow Abroad. Bloomberg. 18 November 2024. Available at: https://www.bloomberg.com/news/articles/2024-11-18/ericsson-chieflooks-for-growth-in-us-as-europe-falls-behind

Directorate-General for Research and Innovation (European Commission), Di Girolamo, V., Mitra, A., Ravet, J., Peiffer-Smadja, O., & Balland, P.-A. (2023). The global position of the EU in complex technologies. Publications Office of the European Union. https://data.europa.eu/doi/10.2777/454786

Draghi, M. (2024). The future of European competitiveness: In-depth analysis and recommendations (Part B). European Commission. https://commission.europa.eu/document/download/ec1409c1-d4b4-4882-8bdd-3519f86bbb92_en

Dugo, A., Erixon, F., and Guinea, O. (2025). Models of Industrial Policy: Driving Innovation and Economic growth. Report, ECIPE, Brussels, occ. paper 05/2025, 38 p.

Ehnts, D., & De Masi, F. (2024). The Elephant in the Room: ICT, Productivity, and Economic Competitiveness. Fabio-de-masi.de.

Ericsson. Release 14 – the start of 5G standardization. Available at: https://www.ericsson.com/en/blog/2015/6/release-14–the-start-of-5g-standardization

Erixon, F., and Guinea, O. (2023). Reforming Standard Essential Patents: Trade, Specialisation, and International Jurisprudence. Report, ECIPE, Brussels, Policy Brief 22/2024, 16 p.

Erixon, F., Guinea, G., and Pandya, D. (2024). Securing Europe’s Future: Strengthening ICT Competitiveness for Economic and National Security. Report, ECIPE, Brussels, Policy Brief 04/2023, 15 p.

ETNO. (2024). State Of Digital Communications. Available at: https://connecteurope.org/sites/default/files/2024-09/downloads/reports/etno%2520state%2520of%2520digital%2520communications%2520-%25202024.pdf

ETSI. Understand ICT Standardisation. Available at: https://www.etsi.org/images/files/Education/Textbook_Understanding_ICT_Standardization.pdf

European Commission. (2022). An EU Strategy on Standardisation – Setting Global Standards in Support of a Resilient, Green and Digital EU Single Market. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. COM (2022) 31 Final. Brussels: European Commission.

European Commission. (2024). How to master Europe’s digital infrastructure needs? (COM(2024) 81 final)

European Commission. (2025). Commission work programme 2025: Moving forward together – A bolder, simpler, faster Union (Annexes 1 to 5) (COM(2025) 45 final). European Commission

Guinea, O. (2023). The Economic Value of Standard Essential Patents and the Costs of the Commission’s SEPs proposal. Available at: https://ecipe.org/blog/economic-value-sep-commissions-proposal/

Gupta, K. L. (2000). The Effects of Telecommunications Infrastructure on Economic Growth: Evidence from Developing Countries. Contemporary Economic Policy.

Letta, E. (2024). Much more than a market: Speed, security, solidarity. European Council. https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf

Mallinson, K. (2022). How Europe can build on strengths in SEPs to reclaim leadership in cellular with 5G and 6G. 4iPCouncil. Available at: https://www.4ipcouncil.com/features/how-europe-can-build-strengths-seps-reclaim-leadership-cellular-5g-and-6g

National Security Commission on Artificial Intelligence. (2021). Final Report. Available at: https://www.nscai.gov/wp-content/uploads/2021/01/NSCAI-Draft-Final-Report-1.19.21.pdf

Nikolic, I. (2022). Licensing standard essential patents: FRAND and the internet of things. Bloomsbury Publishing.

Nindl, E., Confraria, H., Rentocchini, F., Napolitano, L., Georgakaki, A., Ince, E., Fako, P., Hernández Guevara, H., Gavigan, J., Tübke, A., Pinero-Mira, P., Rueda-Cantuche, J.M., Banacloche-Sánchez, S., de Prato, G., and Calza, E. Scoreboard Panel 2003-2022. JRC. Available at: https://iri.jrc.ec.europa.eu/scoreboard/2023-eu-industrial-rd-investment-scoreboard

Putnam, J., Luu, H., Ngo, N., (2021). Does China Really Dominate Global Innovation? The Impact of China’s Subsidized Patent Application System. Hudson Institute Policy Memo. Available at: https://s3.amazonaws.com/media.hudson.org/Putnam%20Luu%20Ngo_Impact%20of%20China’s%20Subsidized%20Patent%20Application%20System.pdf

Renaud, M., et al (2024) In With the New? Not So Fast: The UPC’s First SEP Ruling Aligns With German Precedent. Mintz. Available at: https://www.mintz.com/insights-center/viewpoints/2231/2024-05-08-new-not-so-fast-upcs-first-sep-ruling-aligns-german

Ringstrom, A. (2023, August 25). Ericsson sees IPR licensing revenues of $1 billion this year. Reuters. Available at: https://www.reuters.com/markets/deals/ericsson-huawei-renew-patent-cross-licensing-deal-2023-08-25/#:~:text=%22With%20the%20current%20portfolio%20of,company%20said%20in%20a%20statement.

Roller, L.-H., & Waverman, L. (2001). Telecommunications Infrastructure and Economic Development: A Simultaneous Approach. American Economic Review.

United States Patent and Trademark Office, Trademarks and Patents in China: The Impact of Non-market Factors on Filing Trends and IP Systems (Washington, DC: USPTO, January 2021), https://www.uspto.gov/sites/default/files/documents/ USPTO-TrademarkPatentsInChina.pdf

Yang, W., & Zhang, Y. (2025). Standardization catch-up strategy of latecomer enterprises: a longitudinal case of Huawei. Humanities and Social Sciences Communications, 12(1), 1-16.

Annex 1

Table 1: Challenges and policy proposals for the EU telecommunication sector in the Letta Report, the Draghi Report and the European Commission White Paper Authors from Letta, Draghi and European Commission white paper.

Authors from Letta, Draghi and European Commission white paper.