Strategic Autonomy and the Competitiveness of Europe’s Innovative Pharmaceutical Sector: A Wake-up Call

Published By: Fredrik Erixon Oscar Guinea

Research Areas: European Union Healthcare Trade and IP

Summary

It is high time for Europe to break its relative decline in the pharmaceutical sector. Europe used to be the preeminent region in the world for Research and Development and innovation in the sector – being the location for a majority of R&D and the development of new medicines. However, its competitiveness has been going down for several decades – and, in more recent time, the pace of the decline is now accelerating. Europe is not just outpaced by the United States. Unless there is a new direction, China will soon be ahead of Europe too.

Europe is behind the global frontier in innovation and new product development in medicines. It is not just Europe’s share of global R&D that is going down. Of all the new chemical and biological entities that are developed, Europe is contributing a falling share. There is a similar development in the drug pipeline – medicines that are in the regulatory approval process. The location of clinical trials for Advanced Therapy Medicinal Products – an area of new frontline drug development – is moving out of Europe.

If Europe is to improve its strategic autonomy and restore competitiveness in the pharmaceutical sector, better policies are needed to incentivise innovation and attract R&D investment. A new strategy for the pharmaceutical industry should include – among other things – better protection of intellectual property, more and focused R&D expenditures, and streamlined regulatory and reimbursement processes.

1. Introduction

There is a paradox at the heart of the European Union’s drive for strategic autonomy. The European Commission and member states are releasing record amounts of resources to support industries and boost their competitiveness. However, one of Europe’s premier sectors for modern and innovation-driven growth, the pharmaceutical industry, is largely absent in the new policies.

Batteries feature prominently in Europe’s drive to become more competitive in the global economy and build industrial resilience. A new space strategy, coupled with new state funding streams, is emerging. Of course, older manufacturing sectors like automotives and chips remain cherished targets for support, too. New green technologies, such as hydrogen,are on the cusp of getting the very warm embrace of industrial policy. However, the pharmaceutical sector, which invests more in Research and Development (R&D) and innovation than most other sectors – and is the largest contributor to the EU’s trade surplus with Intellectual Property (IP) intensive and high-value added exports – has been excluded.

Obviously, industrial policy does not equal state funding to individual companies or alliances of firms. In its general orientation, industrial policy is about providing good conditions for investment, development, and growth. It includes the capacity of capital and labour markets to provide necessary resources to sectors and firms. Importantly, the regulatory conditions that apply for development, production, and sales – through the entire value chain – can support or deter firms and industries. In essence, general industrial policy is about the broad policy and institutional factors for improving competitiveness.

On these scores, too, it is difficult to find a determined EU approach to the pharmaceutical industry. Nor does the long-awaited EU pharmaceutical strategy seem intent to give a boost to the competitiveness of the sector.[1] Various iterations of this strategy have surfaced previously, and their focus has not exactly been the health of the pharmaceutical industry.[2] Rather, most policies and strategies over the last years in the pharmaceutical space have put affordable medicines front and centre and complemented it with the pursuit of more elusive objectives like “a strong EU voice globally”. Securing affordable medicines is a perfectly legitimate policy goal, but it is not industrial policy and does not say much about the competitiveness of the European pharmaceutical sector.

Hopefully the new strategy will be different. However, there are reasons for concern. It comes on the heels of a COVID-19 pandemic which has pushed several EU policymakers to think about manufacturing resilience – not innovation and growth – as the overarching objective. Previous efforts have included ideas about restricting the imports of pharmaceutical inputs – for instance, active pharmaceutical ingredients (APIs) – to reduce “strategic vulnerabilities” or “strategic dependencies”. A new idea that has been kicking around for a while is to mandate all companies to launch their new medicines in all EU countries. While this seems like an equitable policy at face value it ignores countries’ capacities to pay and the fact that, while companies can decide whether or not to file for the registration of a medicine, it is not up to them to decide whether a new medicine or treatment can be launched in a member state market or not. This misguided objective will therefore challenge a system of differential pricing in Europe (richer EU countries pay more for their medicines, less developed ones pay less) but is unlikely to create more equitable access as this remains a member state competence.

To the extent there is a signal about an industrial policy ambition for the pharmaceutical sector, it seems to build on the idea of spurring manufacturing. While important, manufacturing alone does not equal a competitive sector, and a single-minded focus on the manufacturing of medicines can lead Europe to bad outcomes. For example, the effect of many other policies in the recent past – for instance lowering the effective protection of supplementary protection certificates (SPCs) – has been to change the balance of the pharmaceutical sector away from the innovation-driven sector to the generics manufacturing sector.[3] Intentional or not, one effect of Europe’s broad industrial policy for the pharmaceutical sector has been to reallocate resources from high value-added to low value-added production (while the opposite is occurring, for example, in China). The result has been the opposite of what should be expected from judicious industrial policy.

The absence of policy also has an effect. Pharmaceutical trade policy is a case in point. Generally, a stronger focus on IP intensive sectors in EU trade agreements would significantly boost trade and EU output.[4] The EU is the biggest trader in pharmaceutical products but there has been a worrying development over time with underperforming exports in IP intensive sectors, including pharmaceuticals. This is especially true for trade with big emerging markets like Brazil, India, and South Africa.[5] The deterioration in pharmaceutical export performance is partly a consequence of worsening policy conditions in these markets and EU neglect in trade policy to address them. The EU has ample opportunity to support its IP-intensive sectors – for example in the ongoing EU-India Free Trade Agreement (FTA) and Investment Protection Agreement (IPA) negotiations – but, again, signals that any meaningful conclusion on IP can be reached are absent.

In this Policy Brief, we will take a closer look at the competitiveness of the pharmaceutical sector in Europe. It remains one of the most important sectors in the European economy – in its contribution to R&D and investment and value-added. Building on a long history of commercial prominence, the industry is obviously also important for member state healthcare systems and patients.[6] Europe was in many ways the birthplace of modern and commercial development of new medicines, and some of the companies that were part of shaping this new market in the late 19th century and the 20th century are still important operators in the global market.

However, their development over the years, and Europe’s capacity to create competitive conditions for innovation-led investments, are increasingly causes of concern. Today, there is only one pharmaceutical company headquartered in the EU that ranks in the top-10 list of the market capitalisation of pharmaceutical companies. The gap between the big ones and the rest has also grown as the pharmaceutical market has become more global and capital intensive. Biotech breakthroughs have also helped to change the nature of the sector – pushing, together with other factors, it towards higher R&D intensity and more investment-led growth with less focus on blockbuster drugs and pricing power. Europe should have been a central hub for that development, but it is obvious that it increasingly has been losing its commercial clout – vis-à-vis its main global competitors the United States (US) and China.

The focus of European policymakers should be to help restore the competitiveness of Europe’s pharmaceutical sector, full stop. A good way to think about strategic autonomy is to improve the conditions for being a leading region in innovation and to operate at the frontier of technological change. There is no real autonomy in a model of economic policy that puts the emphasis on manufacturing alone, or one that reduces the economic significance of those who build their business models on high R&D intensity. The economic strength of Europe’s pharmaceutical sector is mainly about its capacity to lead with innovation to develop the medicines and treatments of tomorrow, not produce those of yesterday.

[1] The Commission had announced the release of this strategy by the end of March, 2023.

[2] See, for instance, European Commission (2020) Pharmaceutical Strategy for Europe. COM (2020) 761 final.

[3] Bauer, M. (2017) Unintended and Unattended Consequences: The Opportunity Costs of Reducing the Exclusivity Rights for Intellectual Property. ECIPE Policy Brief No. 4/2017.

[4] Erixon, F., Guinea, O., Lamprecht, P., & van der Marel, E., (2022) The Benefits of Intellectual Property Rights in EU Free Trade Agreements. ECIPE Occasional paper, No. 1/2022.

[5] Bauer, M. and Erixon, F. (2016) The EU’s Trade with Emerging Markets: Climbing the Value-added Chain and Growing IP Intensity? ECIPE Occasional Paper No. 1/2016.

[6] For economy wide data about the significance of the pharmaceutical sector, see Erixon, F., Guinea, O., Lamprecht, P., & van der Marel, E., (2022) The Benefits of Intellectual Property Rights in EU Free Trade Agreements. ECIPE Occasional paper, No. 1/2022.

2. The Slow Decline of Europe’s Innovative Pharmaceutical Sector

Like in other sectors of frontier technological change, innovation is the most powerful engine for competitiveness in the pharmaceutical industry. The EU has considerable advantages that have underpinned its position as one of the global pharmaceutical hubs: democratic market economy, the rule-of-law, protection of intellectual property, science-based education, good universities, and strong medicines regulatory agencies. Moreover, its trade performance has also been good – and it remains a top trader in medicines. In fact, the EU is the number one exporter in the world of pharmaceutical products[1].

However, Europe is far from the only region with such characteristics. The competition between countries and regions is getting harder. Unfortunately, some of the factors that helped to support a competitive pharmaceutical industry in the EU have been deteriorating over time. Moreover, some very fundamental issues have also emerged. For instance, some of the claims by national governments that have been unwilling to pay for the vaccines they ordered have been farcical to the point of prompting doubts about the integrity of contracts and the rule of law.

In fact, it is becoming obviously clear that Europe is losing its edge as a region of frontline innovation in the pharmaceutical sector. This trend has been going on for several decades: Europe was for many decades the preeminent region for new drug innovation. In 1960, almost two thirds of all new medicines came from Europe. In 1990, European firms in the pharmaceutical industry still contributed with more than half of the global R&D expenditure, a percentage that has declined steadily over the decades reaching 35 percent in 2020.[2] Such positions would be difficult to maintain in a world economy with rising competition and new centres of innovation. However, Europe’s decline should have been arrested and a new drive to raise its competitiveness should have started 30 years ago. It did not – and, since then, Europe has been outpaced by the United States. Unless there is a change, China will soon be ahead of Europe too

This chapter presents Europe’s performance in many of these dimensions. Together, these indicators are a cautionary tale for the future competitiveness of the EU’s pharmaceutical industry. The pharmaceutical industry is one of the most important industries in Europe[3]: it contributes with over €200 billion in Gross Value Added (GVA) and 2.5 million jobs,[4] has one of the largest R&D intensities,[5] and delivers the strongest trade balance across all EU manufacturing sectors.[6] For anyone thinking about competitiveness and strategic autonomy, it should be a priority sector.

2.1 Value Added and Investment

The EU’s pharmaceutical sector[7] is a critical industry for the EU economy and its importance has continued to grow over time, although at a modest pace. As a share of EU’s manufacturing value-added, the pharmaceutical sector went from 5 percent in 2013 to 6 percent in 2019. During the same period, the EU pharmaceutical production over total manufacturing production went from 3.4 percent to 4.5 percent and as a percentage of manufacturing investment went from 4.3 percent to 4 percent.

Comparing these statistics across countries is complicated due to inconsistent metrics, data incompleteness, and different sectoral definitions. Therefore, in order to compare between regions, the analysis is limited to comparing trends rather than aggregate statistics. In the EU, investment in pharmaceutical production has increased at an annual average rate of 6 percent during the period between 2011 and 2020.[8] As a comparison, manufacturing investment of medicines in China has grown at an annual average rate of 15 percent between 2011 and 2019.[9] This is consistent with evidence that China has become a major producer of generics and Active Pharmaceutical Ingredients (API). For example, China supplied 7.2 percent of EU’s total imports (including intra-EU imports) of API by value and 22.6 percent by volume.[10]

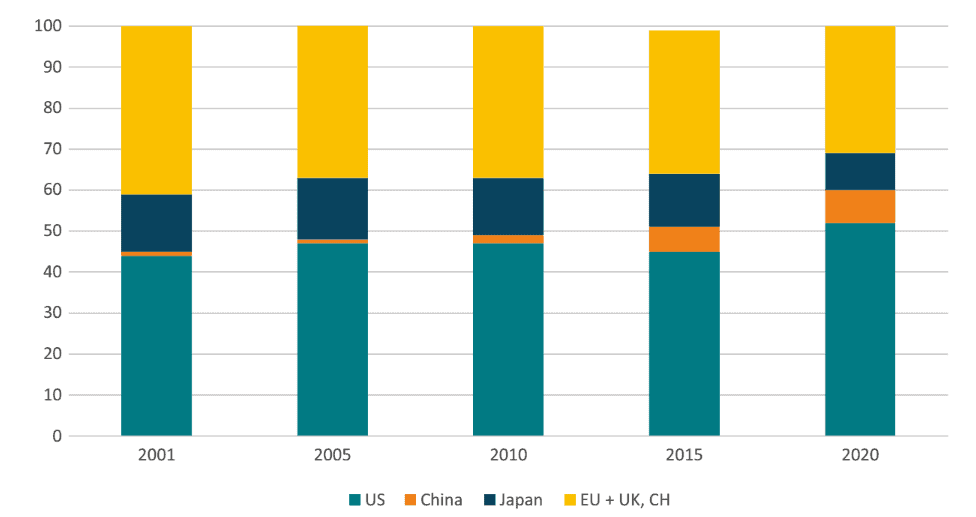

Despite growth in Europe’s investment and R&D in the sector, it is important to observe that the growth has been outpaced by other regions – especially the US and China. Figure 1 considers biopharmaceutical R&D investments in the major markets, and the trend is one of a shrinking relative performance for Europe and Japan. China has obviously grown its market share. However, a better comparator is the US, which interestingly, has also grown its market share between 2001 and 2020 – going from 44 percent to 52 percent. In the same period, Europe’s share of biopharmaceutical investment fell from 41 percent to 31 percent.

Figure 1: Market shares in biopharmaceutical R&D investments Source: Charles River Associates

Source: Charles River Associates

In relation to Foreign Direct Investment (FDI), Europe was the region that attracted the highest number of FDI projects in pharmaceuticals.[11] However, 22 percent of these projects went to the UK rather than the EU (and Switzerland represent a significant part, too) – and Brexit has led to a significant deterioration in the EU’s relative performance. This is understandable since the UK is a strong player in the pharmaceutical industry and it holds an advantage when attracting FDI due to its world-class universities, ecosystem of companies, and language, which helps labour mobility from US based firms. However, the UK has also put in place a regulatory framework that supports innovation and foreign investment in the pharmaceutical industry. This regulatory framework was a reason cited by BioNTech to invest in the UK on a research facility to develop new cancer treatments.[12]

2.2 Trade Performance

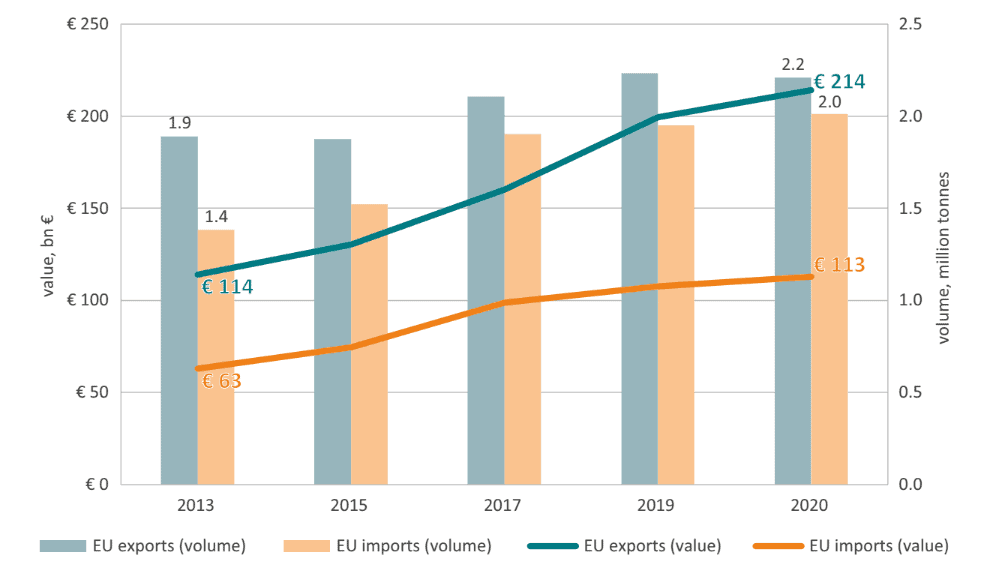

The EU is a leader in trade in pharmaceuticals. As shown in Figure 2, EU exports of pharmaceuticals in value terms went from €114 bn in 2013 to €214 bn in 2020.[13] As a percentage of EU total exports in goods, pharmaceutical products went from 6 to 11 percent during the same period.

Figure 2: EU Pharmaceutical Exports and Imports in Value and Volume terms (2013-2020) Source: Eurostat, author’s calculations.

Source: Eurostat, author’s calculations.

Similarly, in volume terms EU exports of pharmaceuticals went from 1.9 in 2013 to 2.2 million tonnes in 2022. The main market for EU pharmaceutical exports, outside the EU itself, was the US, followed by China at a distance. EU imports of pharmaceutical products also followed an upward trend, in value and volume, but their growth rates were slower than exports which resulted in a positive trade balance.

The EU’s strong trade performance is also apparent when compared to other countries. The EU enjoys a comparative advantage in the export of pharmaceutical products[14], with an index of Revealed Comparative Advantage (RCA) equal to 1.9 on average between 2013 and 2021. The US also showed a strong performance in the export of pharmaceutical products but its average RCA during that period was 1.1 while China RCA – although increasing from 0.21 to 0.38 between 2020 and 2021 – was lower than 1.

However, the EU should not be complacent. Past performances are no guarantee for future ones, particularly given the EU’s relative decline in R&D spending. There is no question that the EU remains the undisputed leader in the export of pharmaceuticals for the time being, but while EU exports of pharmaceuticals[15] increased by 16 percent between 2021 and 2022, Chinese exports went up by 121 percent, doubling its market share of global pharmaceutical exports from 3 to 6 percent. This is not an isolated event but part of a broader trend in the health sector in which the EU lead in research and production is being challenged by other countries.[16]

2.3 R&D Spending

The increase in global R&D spending in the pharmaceutical industry has been dramatic.[17] The 15 largest pharmaceutical companies invested a record €113 billion in 2021 in R&D, an increase of 44 percent since 2016.[18] The EU played a role in this increase. The EU pharmaceutical sector is also the EU industry with the highest level of R&D per employee and net sales.[19]

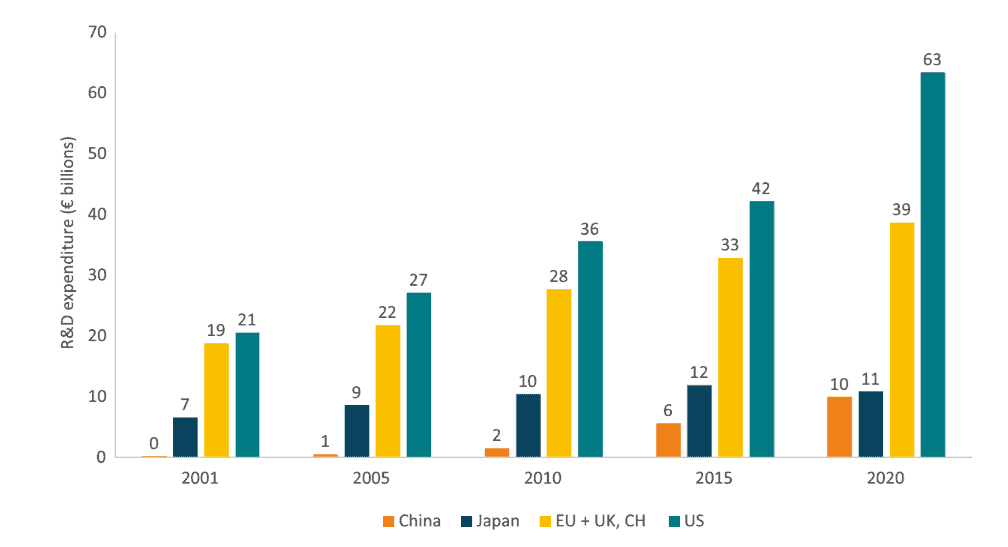

However, the relative importance of the EU pharmaceutical industry in global R&D spending has been declining and the gap between the EU and US – the leading economy in terms of R&D spending in the pharmaceutical sector – has been widening over the years. Twenty years ago, the amount of R&D investments made by US and European pharmaceutical companies differed by only €2 billion; in 2020, the difference had increased to almost €25 billion.[20]

Figure 3 presents R&D expenditure collected by the major pharmaceutical industry associations. The graph shows the US leading in aggregate terms and showing a strong growth rate. China, although with much lower absolute numbers, shows a continuous increase in R&D spending. Europe’s R&D spending – which includes the EU, the UK and Switzerland – has been growing over time but at a slower rate, resulting in a widening gap with the US and a diminishing share of total global pharmaceutical R&D expenditure.

Figure 3: Pharmaceutical Companies’ R&D Expenditure Across Countries (2001-2020) Source: Charles River Associates (2022).

Source: Charles River Associates (2022).

Other data sources also point towards Europe’s relative decline in the pharmaceutical industry. Data from IQVIA, a market-research company, indicates that during the period of 2016-2021 the Brazilian, Chinese, and Indian pharmaceutical markets grew by 11.7, 6.7, and 11.8 percent respectively compared to an average market growth of 5.8 percent for the top five EU countries.[21] Similarly, the R&D growth of the US biotechnology companies outperformed their EU counterparts in terms of R&D investment (11 times larger) and number of companies (166 vs 20) and, to a lesser extent, with higher R&D intensity (30.6 vs 26.5 percent).[22]

One of America’s main advantages is their world class innovation hubs, located close to world-class academic institutions. In contrast, EU funds in R&D are more uniformly distributed and the countries receiving the highest share per person are not the ones where the innovation centres are located. For instance, as a percentage of their Gross Domestic Product (GDP), the countries with the highest levels of Horizon 2020 research spending were Cyprus, Luxembourg, and the Netherlands – neither of which has the best pharmaceutical research clusters.[23] This is not a good strategy when it comes to supporting world class research, which is what the EU pharmaceutical industry needs in order to push the technological frontier and compete with other centres of excellence. As a comparison, the US invested heavily in its leading clusters, with Massachusetts, Maryland and the District of Columbia getting the larger amount of funding from the US National Institute of Health.[24]

These public policy choices impact on the creation and establishment of pharmaceutical companies, which later have long-term consequences in the competitiveness of the EU pharmaceutical industry.

2.4 Innovation

Innovation is not a monolith. R&D spending in the pharmaceutical sector is done in each stage of the R&D and production processes. Therefore, understanding the EU’s relative performance across these stages helps us gauge the future competitiveness of the EU pharmaceutical industry.

Companies at the early stage of the process play a crucial role in innovation. The headquarters of emerging pharmaceutical companies is important because the new pharmaceutical companies of today will be the future main players of tomorrow. Moderna and BioNTech – two pharmaceutical companies that played a major role in the invention of COVID-19 vaccines – were founded in 2008 and 2010 respectively. Unfortunately, the share of European-headquartered emerging biopharma companies has been declining over the last ten years, with the US dominating in terms of the number of companies and their contribution to the global pipeline of new drugs, and China growing rapidly at a rate of 456 percent between 2016 and 2021.[25]

This is important because a weaker performance in the number of emerging companies in the EU pharmaceutical industry today will lead to fewer top European pharmaceutical companies in the future. Furthermore, it will dampen future R&D spending and investment since most companies tend to invest in the regions where they already have R&D or manufacturing sites. For instance, all of the top 20 global pharmaceutical companies have a strong R&D centre in their home country.[26]

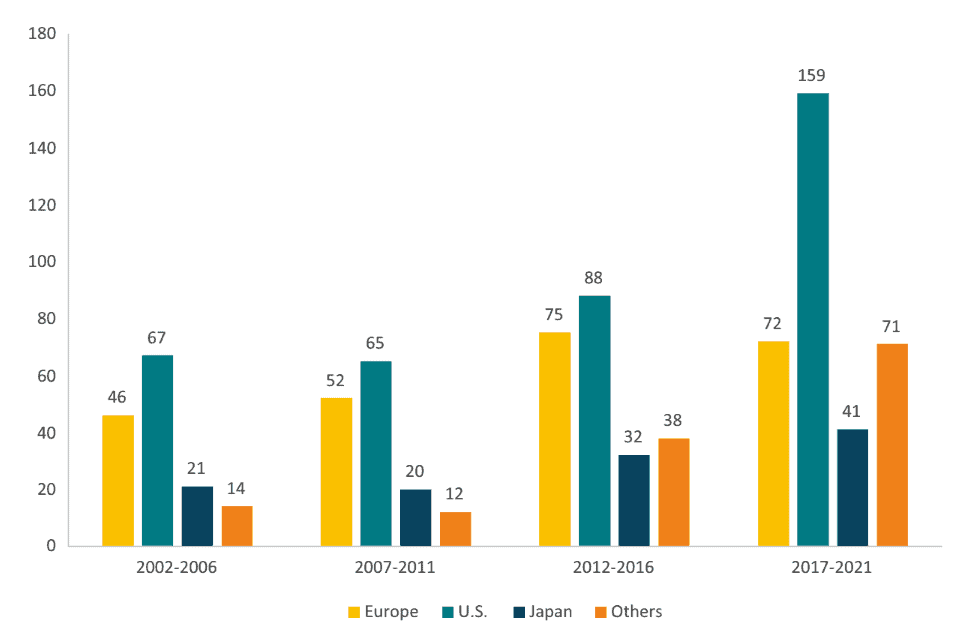

While the EU continues to benefit from being the birthplace of modern and commercial development of new medicines, the slow relative decline in Europe’s innovation capacity is increasingly visible. The corollary of relatively lower R&D spending (Figure 2) is relatively lower R&D output. Figure 4 shows the number of chemical and biological entities discovered by the pharmaceutical industry in the EU, the US, Japan and the rest of the world. The data shows not only that the EU is lagging behind the US but also the rise of the rest of the world supported by China.

Figure 4: Number of New Chemical and Biological Entities (2002-2021) Source: EFPIA (2022). The Pharmaceutical Industry in Figures.

Source: EFPIA (2022). The Pharmaceutical Industry in Figures.

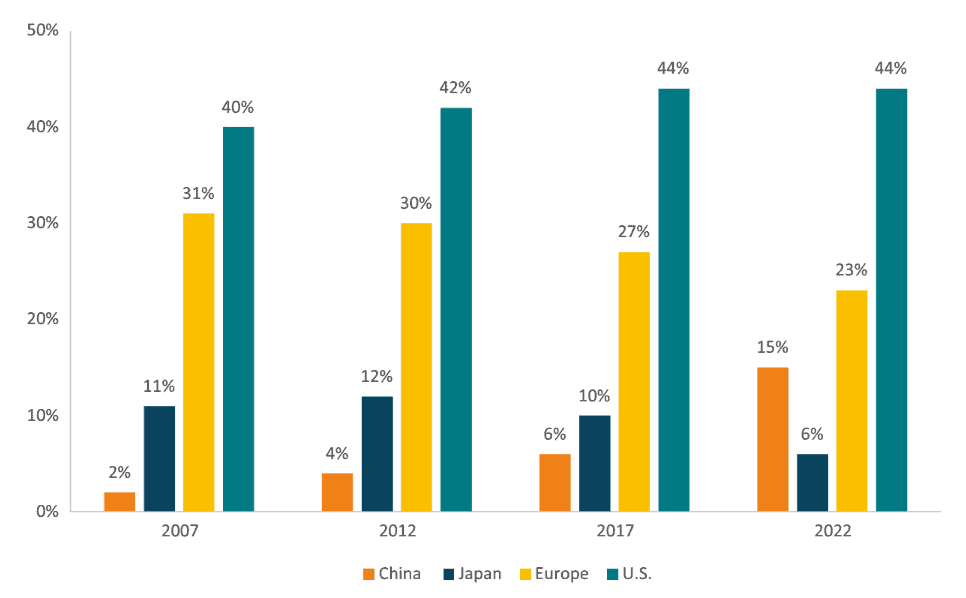

The same can be said about the number of new drugs submitted to regulators. Figure 5 shows the country share of pipeline Phase I regulatory submissions, based on the location of company headquarters. Like the findings on new chemical and biological entities, the data shows a widening gap between the US and Europe and a strong growth in China, whose proportion of the global pipeline rose from 4 percent in 2012 to 15 percent in 2022.

Figure 5: Share of Pipeline Phase I to Regulatory Submission Based on Company Headquarters (2007-2022) Source: IQVIA Pipeline Intelligence (2022).

Source: IQVIA Pipeline Intelligence (2022).

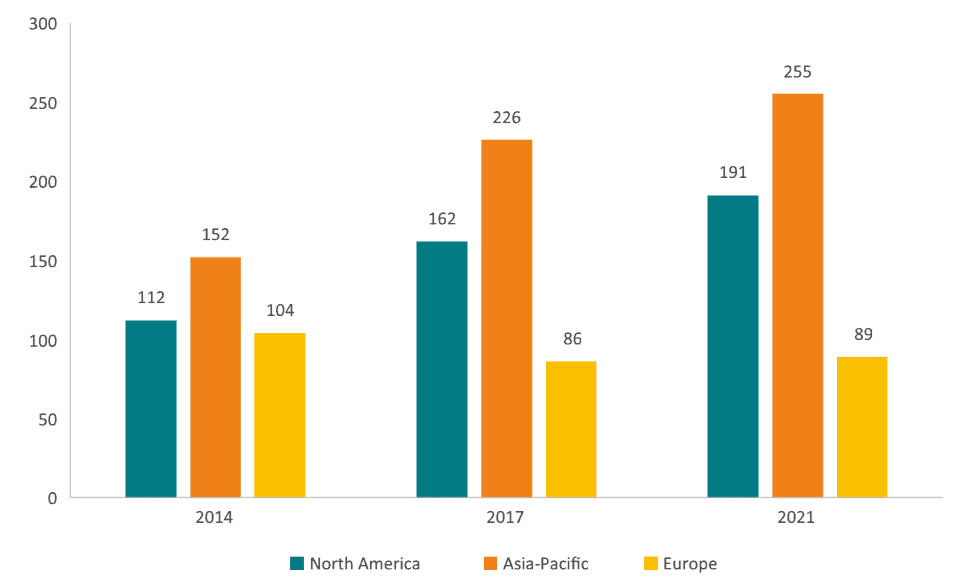

Another example of Europe’s relative decline in innovation can be found in the development of Advanced Therapy Medicinal Products (ATMP). The Asia-Pacific region (used as a proxy for China due to data limitations) has been the most competitive region in attracting ATMP clinical trials for the last seven years, and the number of trials conducted in Europe has fallen despite overall growth of the global clinical development pipeline.[27] This pattern sits at odds with the fact that, between 2017 and 2019, the lead authors of around 120,000 papers published about ATMP were affiliated with a European institution, while in the US and China, equivalent figures were 72,000 and 100,000 respectively.[28] Europe seems to be involved in the academic research, but the R&D investments go elsewhere. Again, the performance of the US shows that the forces of relative economic decline do not have to lead to falling competitiveness in a prioritised sector. The US has in fact grown the number of ATMP clinical trials – just as it has grown its market share of the Phase I drug pipeline.

Figure 6: Location of Advanced Therapy Medicinal Products (ATMP) Clinical Trials (2014-2021) Source: Charles River Associates (2022).

Source: Charles River Associates (2022).

While Europe continues to be an attractive location to conduct clinical trials for more traditional medicinal technologies, the fact that this is not the case for new therapeutic solutions like ATMPs is a red flag for EU pharmaceutical competitiveness. For ATMP, there is a stronger interconnectivity between research, innovation, clinical trials, and commercial manufacturing. This is different from the previous paradigm, which was more allowing to policies and developments that separate innovation, manufacturing and health care into siloed stages of the value chain. The new model, substantially driven by the biotechnology revolution, is far more integrated. Therefore, the Asia-Pacific lead in clinical trials of ATMP could result in a larger share of the pharmaceutical business moving out of Europe and a future where new medicines and treatments are first introduced in Asia.

Another critical factor that will impact on the future competitiveness of the EU pharmaceutical industry is the digital transformation. This is because the pharmaceutical industry relies more and more on ICT for its competitiveness. Digitalisation will be key for the automation of value-chains, virtual clinical trials, and the ICT-supported discovery of new drugs. However, the wave of new regulations that will govern data, artificial intelligence and the digital economy generally will increase the cost and constrain the ability of the EU pharmaceutical industry to access the most up-to-date ICT services, including Artificial Intelligence applications that are crucial for the speed of the discovery of new drugs.[29] There are good initiatives, like the European Health Data Space, but regulations like the GDPR has created “widespread uncertainty” in the industry.[30] These limitations impact on the industry’s competitiveness in absolute and relative terms since companies in some other regions outside the EU do not face the same levels of restrictiveness in the use of digital technologies.

[1] UN COMTRADE. Pharmaceutical products were defined using SITC Revision 3 54 Pharmaceutical products.

[2] EFPIA (2022). The Pharmaceutical Industry in Figures. EFPIA.

[3] European Commission (2018). R&D and innovation activities in companies across Global Value Chains. European Commission.

[4] PwC (2019). The economic and societal footprint of the pharmaceutical industry in Europe. PricewaterhouseCoopers.

[5] European Commission (2021). EU Industrial R&D Investment Scoreboard. European Commission, Joint Research Centre.

[6] Eurostat (Easy Comext Database, 2023).

[7]Eurostat. Structural Business Statistics. The pharmaceutical sector is defined as C21 of NACE Rev 2.

[8] Eurostat. Structural Business Statistics. The pharmaceutical sector is defined as C21 of NACE Rev 2.

[9] CRA (2022). Factors affecting the location of biopharmaceutical investments and implications for European policy priorities. Charles River Associates. China Statistical Yearbooks 2003-2019. Investments in Fixed for manufacturing medicines for China

[10] Guinea, O. and Espés, E. (2021). International EU27 pharmaceutical production, trade, dependencies and vulnerabilities: a factual analysis. Report, ECIPE, Brussels, 82 p.

[11] Karadima, S. (2022, June 9). FDI in pharmaceuticals: The state of play. Pharmaceutical Technology, Retrieved from https://www.pharmaceutical-technology.com/analysis/fdi-pharmaceuticals-state-of-play-investment/

[12] BioNTech (2023, January 5). Press Release. BioNTech Announces Strategic Partnership with UK Government to Provide up to 10,000 Patients with Personalized mRNA Cancer Immunotherapies by 2030, BioNTech, Retrieved from https://investors.biontech.de/news-releases/news-release-details/biontech-announces-strategic-partnership-uk-government-provide

[13] The CN codes selected to account for the pharmaceutical industry can be found in Guinea and Espés (2021). International EU27 pharmaceutical production, trade, dependencies and vulnerabilities: a factual analysis. Report, ECIPE, Brussels, 82 p.

[14] UN COMTRADE. Pharmaceutical products were defined using SITC Revision 3 54 Pharmaceutical products.

[15] UN COMTRADE. Pharmaceutical products were defined using SITC Revision 3 54 Pharmaceutical products.

[16] For example, in Medical Technologies, Chinese companies experienced a surge in their exports to third countries between 2019 and 2020. Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology (No. 12/2021). ECIPE Policy Brief.

[17] Evaluate Pharma (2021). World Preview 2021, Outlook to 2026 report. Evaluate Pharma.

[18] IQVIA (2022). Global Trends in R&D 2022. IQVIA.

[19] European Commission (2021). EU Industrial R&D Investment Scoreboard. European Commission, Joint Research Centre.

[20] CRA (2022). Factors affecting the location of biopharmaceutical investments and implications for European policy priorities. Charles River Associates.

[21] CRA (2022). Factors affecting the location of biopharmaceutical investments and implications for European policy priorities. Charles River Associates.

[22] European Commission (2021). EU Industrial R&D Investment Scoreboard. European Commission, Joint Research Centre.

[23] European Commission. Horizon 2020 dashboard, Retrieved from https://ec.europa.eu/info/funding-tenders/opportunities/portal/screen/opportunities/horizon-dashboard

[24] US Department of Health & Human Services. NIH Awards by Location & Organization, Retrieved from https://report.nih.gov/award/index.cfm#tab1

[25] IQVIA (2022). Emerging Biopharma’s Contribution to Innovation. IQVIA.

[26] CRA (2022). Factors affecting the location of biopharmaceutical investments and implications for European policy priorities. Charles River Associates.

[27] ASGCT (2021). Gene, Cell, & RNA Therapy Landscape. ASGCT.

[28] Loche, A. et al (2021) A call to action: Opportunities and challenges for CGTs in Europe. McKinsey & Company.

[29] For example, Moderna relies on AI and robotic automation in R&D and production processes. These were used to help them move from manually producing around 30 mRNA molecules per month to around 1,000 per month to accelerate development of their COVID-19 vaccine. Gast, A. (2022, 14 May). AI helped Moderna speed up Covid vaccine development. Now it can help climate too. ThePrint, Retrieved from https://theprint.in/tech/ai-helped-moderna-speed-up-covid-vaccine-development-now-it-can-help-climate-too/955061/

[30] CIPL, EFPIA and FPF (2019) Can GDPR Work for Health Scientific Research? Workshop report, retrieved from https://fpf.org/wp-content/uploads/2018/12/Can-GDPR-Work-for-Health-Scientific-Research-Report.pdf

3. A New Policy for Competitiveness in Europe’s Pharmaceutical Sector

It is high time for EU policymakers to think hard about what policy reforms the EU should pursue to make the region a more attractive place for pharmaceutical R&D and innovation. Manufacturing resilience is not something that policymakers can command: it depends on the willingness of inventors, innovators, and investors to allocate more activity in Europe. Obviously, they respond to incentives and the overall policy environment for the pharmaceutical sector – and they can be attracted to place more of their activities in Europe if conditions improve.

Over the years, much ink has been spilled on the affordability of medicines and the pricing of new medicines. This is an important discussion and there should be improvements in the frameworks used to establish prices, for example through value-based pricing. However, Europe is not going to become like America, where pricing is freer. Also, the cost-containment policies applied in many EU countries are likely to persist, and the EU market will remain more fragmented than in the US and China. In such an environment, it becomes even more important for policymakers in Europe to consider what other policies could make up for these disadvantages and make the region more attractive. Taking a standard portfolio view on policy, weaker or riskier baseline conditions or policies need to be balanced by stronger and more stable policies. What matters is not the relative advantage in just one policy: it is the portfolio of policies, or the total effect, that matters.

There are some obvious areas for Europe to start. First, public R&D spending needs to expand, be used more efficiently and become clustered in the most competitive pharmaceutical regions in Europe. EU research spending on the broad biopharmaceutical sector needs to double. Second, incentives for private R&D investment – unlike public R&D spending the true driver of commercial and applied innovation – should become stronger and ideally surpass or at least become comparable to the US. For example EU Regulatory Data Protection should not go down as is envisaged in a leaked version of the pharmaceutical strategy, but increase to offset other EU competitive disadvantages. Third, the effective duration of patent protection should be restored: it has declined for years because of a longer approval process and the erosion of patent-term extension policy – the latter should be reversed. Fourth, while marketing approvals can be sped up, it is equally important that the pricing and reimbursement decisions are made much faster. Fifth, to remain attractive for clinical trials – especially for ATMPs and gene therapies – the EU should reform, streamline and future-proof its regulatory system. Sixth, EU trade policy should give top priority to improving IP standards generally and especially for those intellectual property rights that deliver most economic value – patents and trademarks.

These policy suggestions are just a start and are meant as a first step to reverse Europe’s relative decline: much more can be done and needs to be done to arrest the trend of falling competitiveness in the pharmaceutical sector in Europe.

References

ASGCT (2021). Gene, Cell, & RNA Therapy Landscape. ASGCT.

Bauer, M. and Erixon, F. (2016) The EU’s Trade with Emerging Markets: Climbing the Value-added Chain and Growing IP Intensity? ECIPE Occasional Paper No. 1/2016.

Bauer, M. (2017) Unintended and Unattended Consequences: The Opportunity Costs of Reducing the Exclusivity Rights for Intellectual Property. ECIPE Policy Brief No. 4/2017.

BioNTech (2023, January 5). Press Release. BioNTech Announces Strategic Partnership with UK Government to Provide up to 10,000 Patients with Personalized mRNA Cancer Immunotherapies by 2030, BioNTech, Retrieved from https://investors.biontech.de/news-releases/news-release-details/biontech-announces-strategic-partnership-uk-government-provide

CIPL, EFPIA and FPF (2019) Can GDPR Work for Health Scientific Research? Workshop report, retrieved from https://fpf.org/wp-content/uploads/2018/12/Can-GDPR-Work-for-Health-Scientific-Research-Report.pdf

CRA (2022). Factors affecting the location of biopharmaceutical investments and implications for European policy priorities. Charles River Associates.

EFPIA (2022). The Pharmaceutical Industry in Figures. EFPIA.

Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology. ECIPE Policy Brief No. 12/2021.

Erixon, F., Guinea, O., Lamprecht, P., & van der Marel, E., (2022) The Benefits of Intellectual Property Rights in EU Free Trade Agreements. ECIPE Occasional paper, No. 1/2022.

European Commission (2018). R&D and innovation activities in companies across Global Value Chains. European Commission.

European Commission (2020). Pharmaceutical Strategy for Europe. European Commission.

European Commission (2021). EU Industrial R&D Investment Scoreboard. European Commission, Joint Research Centre.

European Commission. Horizon 2020 dashboard, Retrieved from https://ec.europa.eu/info/funding-tenders/opportunities/portal/screen/opportunities/horizon-dashboard

Evaluate Pharma (2021). World Preview 2021, Outlook to 2026 report. Evaluate Pharma.

Gast, A. (2022, 14 May). AI helped Moderna speed up Covid vaccine development. Now it can help climate too. ThePrint, Retrieved from https://theprint.in/tech/ai-helped-moderna-speed-up-covid-vaccine-development-now-it-can-help-climate-too/955061/

Guinea and Espés (2021). International EU27 pharmaceutical production, trade, dependencies and vulnerabilities: a factual analysis. Report, ECIPE, Brussels, 82 p.

IQVIA (2022). Emerging Biopharma’s Contribution to Innovation. IQVIA.

IQVIA (2022). Global Trends in R&D 2022. IQVIA.

IQVIA (2022). IQVIA Pipeline Intelligence. IQVIA.

Karadima, S. (2022, June 9). FDI in pharmaceuticals: The state of play. Pharmaceutical Technology, Retrieved from https://www.pharmaceutical-technology.com/analysis/fdi-pharmaceuticals-state-of-play-investment/

Loche, A. et al (2021) A call to action: Opportunities and challenges for CGTs in Europe. McKinsey & Company.

McKinsey & Company (2021). Can European biotechs achieve greater scale in a fragmented landscape? McKinsey & Company.

McKinsey & Company (2021). Infographic: Capital landscape for European biotechs is maturing, but it continues to trail the United States. McKinsey & Company.

PwC (2019). The economic and societal footprint of the pharmaceutical industry in Europe. PricewaterhouseCoopers.

Turner, N. (1999, April 29). What’s gone wrong with the European pharmaceutical industry. The Pharma Letter, Retrieved from https://www.thepharmaletter.com/article/what-s-gone-wrong-with-the-european-pharmaceutical-industry-by-neil-turner

U.S. Department of Health & Human Services. NIH Awards by Location & Organization, Retrieved from https://report.nih.gov/award/index.cfm#tab1