Open RAN: The Technology, its Politics and Europe’s Response

Published By: Hosuk Lee-Makiyama Florian Forsthuber

Subjects: Digital Economy Far-East

Summary

This policy brief explores the implications of Open RAN concept and its technical and political developments in the mobile network industry.

- Open RAN is not necessarily a new technology in itself, but represents a combination of existing technologies, e.g. virtualisation, AI, commercial off-the-shelf parts and open interfaces.

- Its proponents promise more secure networks without ‘high-risk vendors’ but Open RAN could introduce new systemic risks that must be addressed due to its reliance on open source software.

- While the proponents also promise significantly reduced costs, it is still inconclusive whether Open RAN in itself reduces the total costs of deploying a 5G network. Economic evidence shows that the equipment market is a buyers’ market due to a higher concentration amongst operators. The number of vendors is less critical for prices than the relative power between buyers and sellers.

- The network equipment market is the only ICT segment where the EU manufacturers are still global leaders. If various industry consortiums call for subsidies, the EU has the commercial policy instruments to countervail against them.

- Some industry voices suggest that a certain Open RAN specification could replace existing global specifications under 3GPP. However, as today’s market condition is not caused by the 3GPP standardisation, a solution is not to be found through developing alternative technical specifications. 3GPP is also more comprehensive than RAN.

- Thus, the question is whether Europe should try to sustain one common global umbrella of standards – or see the world balkanise into national or regional standards from 6G and onward. For better or worse, there will be regional fragmentation.

- The EU industrial policy could be facing a reality where network standards are politicised for commercial reasons – to pave way for an indigenous industry – which is unrelated to national security objectives. Also, EU operators may not react well if Open RAN open the door for cloud services to encroach into the telecom market.

In conclusion, Open RAN has a raison d’etre as a promising new concept, even if it does not solve any geopolitical gambits. However, the EU have little to gain from government interventions in the RAN segment, which is just one element of the mobile network market.

The author thanks Badri Narayanan for data research and Claudia Lozano for her assistance in the final editing stage.

1. Introduction: What does Open RAN imply for the EU?

The realities of geopolitics affect no industry as much as the 5G network equipment market. As mobile networks become the critical infrastructure that underpins all other infrastructures upon which societal functions depend, 5G networks serve as the backbone of societal or technological concepts like smart cities and autonomous cars that will radically change the future.

Several jurisdictions – including the US, EU Member States, Japan, Korea, Vietnam, and other Asian countries, and not least China – have taken steps to limit the participation (de facto or de jure) of vendors associated with elevated levels of risks. In particular, the radio access networks (RAN) or 5G New-Radio (5G NR) that make up the radio installations ‘in the field’ have become at the centre of a political discussion. 5G raises new security issues and vulnerabilities through the RAN that were not deemed critical under previous generations of mobile networks.[1]

RAN also accounts for the majority of equipment investments in a mobile network, as operators deploy thousands of base stations across vast areas. It is in this particular network segment where Chinese vendors like Huawei and ZTE have thrived. Thanks to their ability to export by leveraging on the economy of scale thanks to the protected market in China, vendors like Huawei and ZTE are exporting competitive RAN equipment that has challenged established suppliers like Ericsson of Sweden and Nokia of Finland.

The current US-China economic decoupling and technological bifurcation in the network equipment industry raises concerns about long-term market prospects and future supply. European operators also are concerned about rising costs, if fewer equipment suppliers may serve them. Strangely, this worry about supplier diversity has not a been prominent in Australia, Japan, outside of Europe. There are also new market entrants like Samsung, NEC and Fujitsu.[2] In other markets, like the US, UK or India, the debate emphasises the need for indigenous (i.e. non-European or Chinese) producers rather than diversity of suppliers.[3]

It is within this context which Open RAN technology has emerged in the debate: Open RAN is not a new technology in itself but a concept that leverages on recent developments that allow for disaggregation of hardware and software components into smaller parts, and virtualisation and AI that allows RAN functions to be performed in the cloud. Advocates of Open RAN promise lower costs and new suppliers coming into the unattractive RAN market, which has been plagued by massive R&D costs and low profit margins.

The many industry groups and consortia are turning into a plethora of acronyms: O-RAN Alliance a merger between xRAN Forum (formed by US tech industry) and C-RAN Alliance, consisting of mainly Chinese telecom operators. Telecom Infra Project (TIP) OpenRAN Project is led by Facebook.

Several US industry coalitions promise to further reduce costs by replacing the base stations that are today typically built by a single vendor (using customised code and high-performance chipsets). Their idea is to replace them with commercial off-the-shelf PC components and open-source software. The O-RAN Alliance aims to define new standards, and specifications for the Open RAN concept using Intel chipsets, but its members also include Chinese telecom operators. Meanwhile, the OpenRAN Policy Coalition group is lobbying the US and other governments for preferential treatment for Open RAN, where some O-RAN Alliance specifications could be adopted as national standards.[4]

This paper argues that the Open RAN concept combines several technologies and features that have been around for a few years already in 3G and 4G. Despite some teething troubles and inherent commercial limitations, a full-scale 5G RAN could be just a few test iterations away. Nonetheless, its commercial impact is limited in the short term –[5] Open RAN may only hold a sliver of the market, around ten per cent.[6]

Also, Open RAN is not a silver bullet for any policy issues as it advertises itself to be. If it solves the security issue, or the market concentration arising from vendor exclusion policy, Open RAN introduces similar problems too. Nevertheless, the increasing government interventions in the RAN segment is a challenge for both telecom operators and equipment vendors, that are typically from Europe: In addition to the promotion of indigenous innovations in China, the US and India, cloud services are tempted to enter the operator market. Thus, it is somewhat unsurprising that the EU industries feel besieged by not one, but two Trojan horses.

By politicising Open RAN, the standard-setting in the RAN becomes a catalyst for a bifurcation that could end the global interoperability between the US, Europe and China that prevailed since 3G.

[1] Lee-Makiyama, H. (2018), Stealing Thunder, ECIPE, accessed at: http://ecipe.org//app/uploads/2018/02/ECIPE_ Occasional0218_HLM_V7.pdf.

[2] Koh, E. (2020), Samsung, Verizon Sign $6.65 Billion 5G Contract, The Wall Street Journal, September 7, 2020, accessed at: https://www.wsj.com/articles/samsung-verizon-sign-6-65-billion-5g-contract-11599469883

[3] See inter alia Katoch, P. (2019), India’s 5G Network, Indian Defence Review, June 9, 2019, accessed at: http://www.indiandefencereview.com/news/indias-5g-network/ ; Schoff, J. and Kamijima-Tsunoda, R. (2020) The United States and Japan Should Team Up on 5G, Carnegie Endowment for International Peace, July 23, 2020, accessed at: https://carnegieendowment.org/2020/07/23/united-states-and-japan-should-team-up-on-5g-pub-82354 ; Reuters (2020), UK Seeks Alliance to Avoid Reliance on Chinese Tech: The Times, Reuters, May 28, 2020, accessed at: https://www.reuters.com/article/us-britain-tech-coalition-idUSKBN2343JW ; Khan, D. (2020), Inside Reliance Jio’s Make in India Strategy for 5G, IoT to Cut Dependence on Foreign Gear, The Economic Times Telecom, July 31, 2020, accessed at: https://telecom.economictimes.indiatimes.com/news/reliance-jio-builds-in-house-5g-iot-tech-to-reduce-dependence-on-foreign-gear-replaces-nokia-oracle-tech-with-own-tech/74534777

[4] Bill to use proceeds from spectrum auctions to support supply chain innovation

and multilateral security by Senators Warner, Burr, Rubio, Menendez, Cornyn, Bennet in the 116th Congress 2nd Session in the United States Senate (2020), accessed at: https://www.warner.senate.gov/public/_cache/files/2/3/2365fc6a-422c-4df2-837b-f297bb293ad2/E8131EF8149D5D0E1411683ABC3DECCD.oll20034.pdf

[5] Dano, M. (2020), If Dish is America’s Rakuten, it Might be in Trouble, LightReading, October 5, 2020, accessed at: https://www.lightreading.com/aiautomation/if-dish-is-americas-rakuten-it-might-be-in-trouble—analysts-/d/d-id/764411?_mc=RSS_LR_EDT

[6] Kapko, M. (2020), Open RAN Set to Capture 10% of Market by 2025, SDxCentral, September 2, 2020, accessed at: https://www.sdxcentral.com/articles/news/open-ran-set-to-capture-10-of-market-by-2025/2020/09/

2. Does the 5G cybersecurity toolbox really necessitate Open RAN?

As 5G changes the way our society uses and relies on mobile data, it also increases the scope and potency of cyber espionage. The commercial or public value of the information carried in a 5G network will increase multi-fold compared to today,[1] with large-scale and critical machine communication containing more corporate information, trade secrets and critical applications. 5G will be essential to government functions, corporations, individuals and society as a whole.

The supplier restrictions on 5G infrastructure of recent months are rooted in how 5G architecture operates differently from previous generations. The wireless telecommunication network consists of several parts. But it is the RAN and its radio antennas and base stations (that connects individual devices to other parts of the network), which is at the centre of today’s discussions. The 5G RAN (also called 5G New Radio) will also account for the majority of a mobile operators’ capital expenditure on equipment.

Previous security measures often involved restricting non-EU vendors from core networks (where key functions are performed) while they were allowed to supply the less sensitive RAN. However, the new 5G architecture will blur the distinction between RAN from other parts of the network through virtualisation and mobile edge computing.

In response, the new updated 5G restrictions have led to de facto or de jure exclusion of non-trusted vendors. Since the first 5G vendor-restriction – Australia’s Telecom Sector Security Review (TSSR) in 2019 –[2] the United States, Japan, Korea, Vietnam and the UK have excluded vendors from China. The EU Member States are developing a common regulatory tool with mitigating measures where at least twenty countries are pending to take restrictive measures. China has also limited the participation of European vendors to approximately ten per cent, excluding one vendor entirely.

Whether Chinese 5G equipment is competitively priced thanks to non-market factors is more or less disputed by analysts. However, it is undeniable that Chinese vendors benefit from economies of scale achieved in their home markets. After all, China continues to represent more than half the global 5G RAN market, and the four Chinese state-owned telecom operators promote local vendors. Thus, Chinese vendors achieve the scale to export into overseas markets in Europe and many developing countries.

Open RAN and security

It is not the purpose of this paper to discuss the merits of recent vendor restrictions in the US, Europe, China and elsewhere. However, if one of the objectives of Open RAN is to provide an alternative to vendors alleged to have legal and extrajudicial obligations to the foreign governments, then the new Open RAN technology must be more secure than today’s vendors.

However, an open-source based Open RAN would present several security complications in addition to the pre-existing risks of virtual network functions. One of the inherent security risks of open-source code is its public availability, including information on vulnerabilities available through resources like the National Vulnerability Database (NVD).[3] Hackers and advanced persistent threat groups (APTs) could exploit such vulnerabilities and target carriers that are known to be slow to patch their applications. This inherent weakness of open-source, with the vast number of strategic applications on servers running Linux (which is open-source based), have made them a common target for APT groups,[4] with number of incidents 430 percent.[5]

Also, Open RAN technology disaggregates and atomise a base station into different parts, e.g. radio, central and distributed units, where different vendors supply each part and yet fit together thanks to open front-haul interfaces. The continuous integration of highly specialised and discrete solutions will inevitably offer APT groups new opportunities to exploit vulnerabilities in widely disseminated niche solutions.

As the US government ‘discouraged’ its mobile operators from using Chinese vendors even prior to the 2019 Entity List,[6] the US networks were already ‘secure’ and built exclusively by European and Korean suppliers. For Europe, Open RAN replaces today’s risks that are situation-specific – i.e. limited to certain suppliers in some countries – for a systemic risk stemming from open source software and integration vulnerabilities of open-source that is still exploited by state-sponsored APT groups.

Therefore, it is essential that Open RAN adequately addresses security risks (in its standards, as well as in its implementation), through a risk-based approach and not deal with security as a problem that will be solved ex-post. The O-RAN Alliance is already addressing the new security risks through a recently formed security task force (within ORAN WG1 on architecture).[7] As the O-RAN Alliance introduces additional open interfaces and functions that are not part of the 3GPP standard. Therefore, O-RAN specifications will require additional security measures in addition to the 3GPP SA3 security standards.

In conclusion, there are two critical questions to be raised on security. Firstly, Open RAN only diversify vendors within a base station, while mitigating the risks on national RAN and data-intensive core networks must be achieved by traditional means.

Secondly, Open RAN will inevitably introduce a new range of security issues, rather than solving those of the past. EU policymakers need to ask whether the legal risks of foreign-made base stations overshadows the omnipresent threat of software and integration vulnerabilities in Open RAN, many developed by small (yet dominant) firms whose ownership are yet to be clarified.

Hence, Open RAN on its own does not mitigate the supplier-specific risk identified by 5G EU Toolbox.[8] Also, the need to meet security objectives will inevitably limit the number of actual Open RAN suppliers to ‘trusted stacks’ for software and hardware. Similarly, only a small group of companies will be able to comply with the common security requirement compliant under the O-RAN Alliance specifications.

[1] Supra 1.

[2] Lee-Makiyama, H. (2018), 5G and National Security, ECIPE, accessed at: https://ecipe.org/wp-content/uploads/2018/10/TSSR-final.pdf

[3] Cypress Data Defence (2020), 3 Open Source Security Risk and how to Address Them, Medium, August 4, 2020, accessed at: https://towardsdatascience.com/3-open-source-security-risks-and-how-to-address-them-82f5cc776bd1

[4] GReAT (2020), An overview of targeted attacks and APTs on Linux, September 10, accessed at: https://securelist.com/an-overview-of-targeted-attacks-and-apts-on-linux/98440/

[5] Chickowski, E. (2020), Next-gen supply chain attacks surge 430%, Dark Reading, August 21, accessed at: https://www.darkreading.com/application-security/next-gen-supply-chain-attacks-surge-430-/d/d-id/1338717?_mc=rss_x_drr_edt_aud_dr_x_x-rss-simple

[6] Department of Commerce Bureau of Industry and Security (2019) Federal Register, 84(162), August 21, 2019, accessed at: https://www.govinfo.gov/content/pkg/FR-2019-08-21/pdf/2019-17921.pdf

[7] O-RAN Alliance (2019), O-RAN Alliance WG1 Operations and Maintenance Architecture v02.00, accessed at: https://static1.squarespace.com/static/5ad774cce74940d7115044b0/t/5de7af78639be22007fa8158/1575464839778/O-RAN-WG1.OAM-Architecture-v02.00.pdf

[8] European Commission (2019), Member States publish a report on EU coordinated risk assessment of 5G networks security, October 9, 2019, accessed at: https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6049

3. Implications of Open RAN on 5G investments

The telecom carriers depend on their ability to scale revenues from users while driving down both variable costs (e.g. the cost of servicing the customers, device subsidies, and the cost of energy and leasing cost of towers) and fixed costs (i.e. investments). Due to the modest average revenue per user (ARPU) in Europe (compared to other, more technology-embracing, regions), with the higher cost of associated with building stand-alone 5G networks (Release 16) despite their shorter range, 5G networks is not always a lucrative investment for European network operators. Bruno Jacobfeuerborn – Deutsche Telekom’s Head of Tower Business – believes that RAN costs must drop by at least 50% to make 5G roll-out economically viable in Europe, claiming that RAN hardware accounts for up to 70% of these costs.[1] The question is whether the Open RAN technology achieve such cuts.

European operators are understandably concerned about costs if some principal players are declared ‘high-risk vendors’ (HRVs) and how it may lead to higher prices for RAN equipment. However, such discussions seem to be limited to Europe. The cost question is surprisingly absent in other markets where RAN vendors have been excluded on markets such as the US, China, Japan, Korea where at least one or two foreign vendors have been de facto absent. Even in smaller developing countries like Vietnam, much smaller and less resourceful operators have decided to replace some vendors.

There are also new market entrants like Samsung (also followed by Japanese competitors like NEC or Fujitsu) who have already made inroads into the US market, [2] and could increase their market presence in Europe. In China, minor Chinese companies such as Datang Telecom Group always held a corner of the local market.

How the O-RAN Alliance aims to drive costs down

If virtualisation and other vital features of Open RAN centralise the workload away from the ‘edge’ of the network, it allows for base stations that use cheaper low-performance chipsets. Here is where Open RAN technology does not just promise new vendors – but also to significantly drives costs down through the use of commercial off-the-shelf (COTS) parts made for the PC industry.

Open RAN-based COTS hardware yields high economies of scale as it is less costly than customised hardware R&D and could reduce costs significantly for the roll-out of 5G networks. Especially the members of the O-RAN Alliance aim to replace as much proprietary hardware as possible in favour of COTS to make widespread 5G roll-outs financially viable. The specifications of the O-RAN Alliance uses ‘Lego parts’ made by its US-based consortium members, including the world’s largest vendor of PC-processors, Intel, with its software reference platform to run virtual RAN workloads with cloud virtualisation platforms provided by VMware and Dell.[3]

However, COTS may not yet replace customised chipsets in critical low-latency applications. The setup is currently rolled out for LTE (4G), but yet not ready for 5G NR. So far, Intel-based are unable to compete performance-wise with customised chipsets and other electronics in the proprietary baseband units by Ericsson, Huawei, Nokia and Samsung with processors that are designed specifically for their tasks. Meanwhile, high-end suppliers like Apple have abandoned Intel (x86) chipsets that have failed to deliver efficiencies it needs for its high-end devices.

But a full-scale 5G Open RAN using only hardware and software by the O-RAN Alliance is perhaps just a matter of time. Results seem impressive so far, with promises of up to 50% savings on RAN hardware,[4] although a breakdown of operator costs shows that savings does not lead to lower overall costs, if they lead to increased costs elsewhere, e.g. higher integration cost or energy consumption.[5] As a result, early Open RAN deployments indicate that they have not yet delivered lower costs.[6]

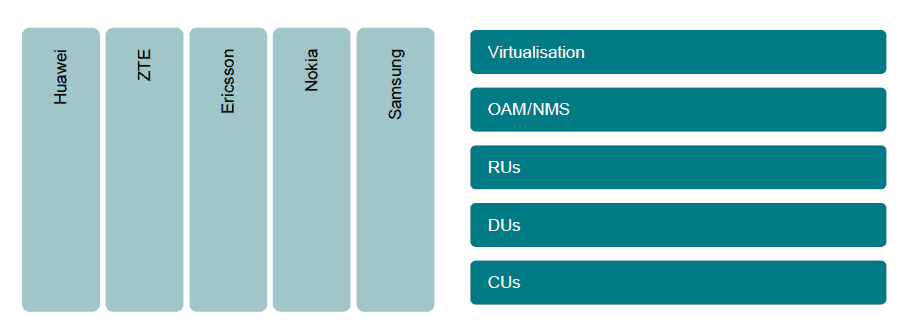

Figure 1: Simplified schematics of traditional vs ORAN value-chain

There are, however, several outstanding questions. Firstly, it is unclear how much a European network operator will save on the bottom line and total cost of ownership (TCO) of a network. The operators must either build up inhouse engineering capabilities or contract a system integrator who will do it for them.

From the perspective of corporate finance, it is a transformation of hardware investments (i.e. capital expenditure that says on the balance sheet) into additional staff or consulting fees, i.e. operational expenditure that hits the income statement and cuts dividend payments.

As of today, EU operators already find it too costly to comply with monoculture bans that require them to diversify into just two RAN equipment vendors (in addition to all other vendors. If maintaining two traditional RAN suppliers within a country is too costly and complicated for them, it is difficult to see EU operators embrace Open RAN with dozens of suppliers per site. Some consolidation is unavoidable, even with O-RAN Alliance specifications. As Open RAN matures over time, O-RAN Alliance may turn into just another vertically integrated vendor (like Nokia, Ericsson, Huawei or Samsung), albeit originating from the US, India or elsewhere.

[1] Morris, I. (2018), Major Telcos Pool Efforts to Slash 5G RAN Costs, LightReading, February 27, 2018. Accessed at: https://www.lightreading.com/mobile/fronthaul-c-ran/major-telcos-pool-efforts-to-slash-5g-ran-costs/d/d-id/740913

[2] Wood, N. (2020), Samsung Joins the 5G RAN Big Leagues With $6.6bn Verizon Deal, Telecoms.com, September 7, 2020, accessed at: https://telecoms.com/506368/samsung-joins-the-5g-ran-big-leagues-with-6-6bn-verizon-deal/

[3] Hardesty, L. (2020). VMware and Intel help Deutsche Telekom with O-RAN, Fierce Wireless, February 28, 2020, accessed at: https://www.fiercewireless.com/wireless/vmware-and-intel-help-deutsche-telekom-o-ran

[4] See inter alia Hardesty, L. (2019). Mavenir wants to replace the proprietary baseband unit with x86 and software, Fierce Wireless, April 17, 2019, accessed at: https://www.fiercewireless.com/wireless/mavenir-wants-to-replace-proprietary-baseband-unit-x86-and-software ; Supra 5.

[5] GSMA Connected Society (2019), Closing the Coverage Gap, GSMA Association, July 2019, accessed at: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/07/GSMA-Closing-The-Coverage-Gap-How-Innovation-Can-Drive-Rural-Connectivity-Report-2019.pdf

[6] Supra 5.

4. Market concentration on the 5G RAN market

Previous two sections draw on the concern amongst EU carriers that the supplier market evolves into a duopoly if new national security rules exclude high-risk vendors from the market. Similar conditions apply for the Chinese market, where one European vendor has qualified for the 5G ‘pilot’ roll-outs organised in 2019. But are there real concerns for market concentration and dominant behaviour by the remaining vendors on the equipment market?

It is indeed true that the mobile network equipment market has been characterised by market consolidation – which often (but not always) translate into more concentration. Duty-free trade and the absence of regulatory barriers have unleashed unprecedented economies of scale. With the extraordinarily high R&D costs, the world has just four or five global players left in business – namely Huawei, Ericsson, Nokia, Samsung and ZTE. Notably, the North American suppliers of RAN – like Nortel, Motorola or Lucent – have all merged into the remaining European players.

Surprisingly, despite a complete absence of market entry barriers and close synergies with adjacent segments, only a couple of suppliers have decided to enter the RAN market, post-Huawei. Profit margins are typically lower than ten per cent and just half of the R&D spending. Network equipment does seem like not an industry for rational people with other, alternative investment opportunities.

While some exclusively blame China’s entry into the market, there are also other factors at play. The telecom equipment market, given its high concentration of buyers amongst operators, is a market characterised by monopsonistic competition. In other words, there is a higher market concentration amongst the buyers than sellers.

In all of the EU markets, there is a market dominance exercised by an incumbent player that is usually a former monopolist. Operators are also allowed to engage in different models of collusion. In the EU Member States, they form joint ventures with competitors to pool their procurement and management of their network infrastructure. In China, state-owned operators buy all their equipment jointly through a state-owned contracting agency to exercise price pressure.

A buyers’ market

Evidence from European markets overwhelming shows that buyers, rather than sellers, set the market prices. Network equipment is a buyers’ market. The number of vendors plays a lesser role in market prices compared to the relative power between buyers and sellers. As long as the market entry barriers stay low, there will be enough pressure on hardware suppliers to offer competitive prices, which is also evident from the low profit margins that plague the industry.

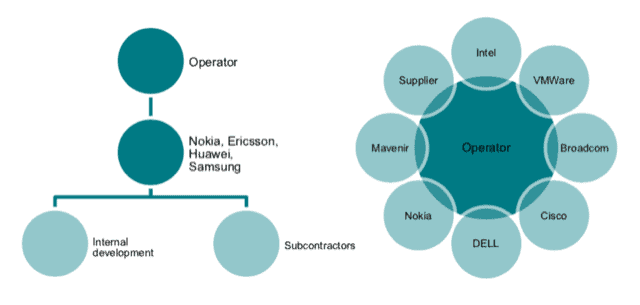

Antitrust investigations typically illustrate market concentration through the Herfindahl-Hirschman index (HHI),[1] which measures the market concentration on a continuous scale between 0 and 1, where 0.5 indicates a duopoly, and 1.0 indicates a full monopoly with just one seller – and where the European network equipment market score less than 0.3.

Figure 2: Market concentration: Operators vs RAN vendors (2019)

Across all major world markets, telecom operators are either equally or more concentrated than the equipment vendors, indicating the monopsonic relationship. The relative strength of the buyers is even more pronounced in reality, as the data on operators do not capture joint ventures or pooled procurement. In particular, the EU national telecom markets are far more concentrated when they act like buyers (against vendors) rather than as service suppliers.

Also, market concentration is distinctively higher for operators compared to equipment manufacturers in Europe than elsewhere. In France, for example, the market concentration on the operator market is equivalent to the level of a duopoly, nearly twice the levels of the vendor market. In the US and China, the buyers and sellers are on an equal footing as one large vendor – Huawei and Ericsson respectively – holds nearly half the market.[2]

Impact of vendor exclusion and ORAN entry in Europe

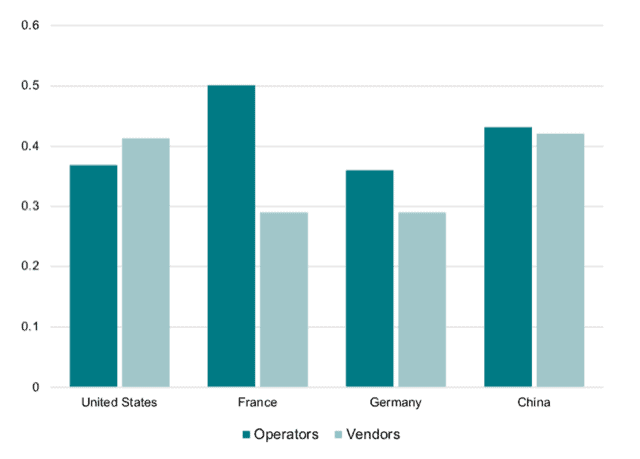

Whereas the debate overly focus on the number of sellers on a market, a more significant determinant on market power is how their market shares are distributed. A scenario experiment where all Chinese vendor leave the European market entirely proves the point.

In the following scenario, two vendors are assumed to be designed as high-risk vendors and leave the RAN market, including LTE and other legacy products. Their market shares are then distributed proportionately amongst the remaining RAN vendors.

Such a scenario results in a marginal increase in market power for the suppliers, a negligible increase of just 0.03 index points. Exclusion could even result in lower concentration than today, depending on the distribution of these market shares amongst the remaining players.

Figure 3: Market concentration after vendor exclusion (2020)

Recent tenders in China, Belgium, Australia and Canada seem to prove that the relative concentration amongst buyers is more important to force prices down.[3] Similarly, the entry of a consortium like the O-RAN Alliance could lead to a very marginal or higher or lower market concentration, depending on whose market shares it displaces. In addition, if a telecom operator becomes its own supplier through Open RAN (by putting together its own solution using subcontractors, it is technically speaking no longer a buyer. As there are then fewer buyers left on the market, it strengthens the leverage of the remaining buyers even further.

What a single RAN multi-vendor implementation allows is first and foremost an alternative industrial organisation where the nature of concentration changes from vertically integrated suppliers to a horizontal and layered market concentration where one dominant supplier controls each step of the value-chain. This structure is similar to the previous organisation of the PC industry with one dominant processor manufacturer, one dominant operating system, one business software suite, etc.

Figure 4: Industry concentration of traditional RAN vs ORAN

In conclusion, the buyers (i.e. EU operators) retain their powerful negotiation position by being more concentrated than the sellers in every outcome, and Europe stays a buyers’ market for a foreseeable future. Whether the market concentration changes thanks to Open RAN is yet inconclusive. But the impact is in any case bound to be marginal, given that analysts project Open RAN technology holding less than ten per cent of the 5G NR market.[4]

While Open RAN technology may not lead to change market concentration amongst 5G NR vendors significantly, it may more significantly alter the competitive landscape of telecom operators. Under 4G and prior generations, market entry into the EU telecom market required a prohibitively costly and politically sensitive acquisition of an existing European operator.

With Open RAN, a market entrant can build a network from scratch, as Rakuten has proven by becoming a 4G LTE network provider with its own Open RAN solution supplemented roaming contracts with existing telecom operators outside their own coverage.[5] In late 2020, it has also launched a trial 5G network based on its proprietary virtualisation technology.[6] Given that the technology favours know-how in virtualisation and cloud development, non-telecom actors like AWS, Alphabet, Facebook, or Microsoft are also uniquely placed to become telecom operators, unburdened by any legacy costs from investments in fixed-line, GSM/PDC/PCS (2G) or WCDMA (3G). Such evolution where platforms make inroads into the telecom market is already on the way, as proven by AWS entry into ‘edge computing’.[7]

Cloud suppliers with a global consumer footprint, strong brand recognition and experience in physical fulfilment are particularly well placed. For instance – what if Rakuten or Amazon shipped a miniaturised, easy-to-use BBUs, included free with every book purchase? Consumer-facing internet platforms could build 5G networks, and easily turn iCloud, Gmail, or Office365 accounts into a phone line.

Such scenarios require an OTT player either competitively bidding for a 5G spectrum license and sign roaming or MVNO agreements with existing operators with existing operators. However, Rakuten’s conversion from platform to telecom operator shows how the line between OTTs and traditional telecoms is blurred. OTT players are ‘descending from the top’ – down to the networks, and vertically integrate across the entire value-chain: from apps, operating systems, cloud stack and down to the physical RAN.

[1] See Herfindahl and Hirschman, (1993), National Power and the Structure of Foreign Trade, Berkley Univ. of California Press, 1945; Rhoades, Stephen A. “The Herfindahl-Hirschman Index.” Federal Research Bulletin. 79 (1993): 188

[2] Pongratz, S. (2020), Huawei and ZTE Increased their Revenue Shares While Nokia and Cisco’s Revenue Shares Declined for the Full Year 2019, Telecom Equipment Market, Dell’Oro Group, March 2, 2020, accessed at: https://www.delloro.com/the-telecom-equipment-market-2019/

[3] See inter alia Proximus (2020), Proximus Selects Nokia and Ericsson as Partners to Roll Out its Mobile Network of the Future, Proximus, Press release, October 9, 2020, accessed at: https://www.proximus.com/news/2020/20201009_mobile-network-equipment-renewal.html# ; Gmelich, K. and Wingrove, J. (2019), BCE says Potential Huawei Ban won’t Affect Pending or Delay 5G Launch, Financial Post, February 7, 2019, accessed at: https://financialpost.com/telecom/media/bce-says-potential-huawei-ban-wont-delay-launch-of-5g-network ; Supra 15.

[4] Supra 6.

[5] Tomás, J. (2020), Rakuten Mobile Launches 4G Services in Japan Through Virtualized Network, RCR Wireless News, April 8, 2020, accessed at: https://www.rcrwireless.com/20200408/5g/rakuten-mobile-launches-4g-services-japan-through-virtualized-network

[6] Hardesty, L. (2020), Rakuten Mobile Launches 5G Service, But Only in a Few Areas, Fierce Wireless, September 30, 2020, accessed at: https://www.fiercewireless.com/5g/rakuten-mobile-launches-5g-service-but-only-a-few-areas

[7] Garman, M. and Erwin, T. (2020) Verizon and AWS deliver mobile edge computing to customers in Boston and the Bay Area, AWS, August 6 2020, accessed at: https://aws.amazon.com/blogs/industries/verizon-and-aws-deliver-mobile-edge-computing-to-customers-in-boston-and-the-bay-area/

5. The future role of standardisation

The previous section concluded how open source, virtualisation and software-driven functionality are not unique to Open RAN. They are already integral to 3GPP that also provide the full scope of standards needed to realise a functional 3G, 4G and 5G network and RAN interfaces – and not just some aspects of RAN, as with the case of TIP or O-RAN Alliance specifications. In other words, the global 3GPP consortium and private consortiums, such as O-RAN Alliance, will co-exist for the foreseeable future.

There are some long-term and strategic questions at hand with Open RAN and standardisation. Indeed – as a global standard-setting consortium, 3GPP has its drawbacks and challenges. For instance, the US is keen to point out that Chinese vendors are deeply involved in the development of 3GPP standards – but Chinese state-owned operators are also members of the O-RAN Alliance, although Chinese operators are not very likely to adopt O-RAN Alliance specifications based on US chipsets as their national 5G standards.

Meanwhile, sharing mobile standards with China is a two-way street. While it is true that Chinese entities participate in ‘western’ standard setting but conversely, it also allows for EU vendors to participate in the standard-setting in the ‘east’. 3GPP is quintessential for EU suppliers’ access to the Chinese market, which accounts for half of the global market of telecom equipment.

By reducing regional regulatory divergences and national standard-setting – the industry and consumers have benefitted from free trade increasingly void of any standards-related regulatory barriers. The liberalisation has also unleashed the global competition and consolidation that has taken place since. Thus, the network equipment market has practically little or no market entry barriers. Even the payments for standard-essential patents (SEPs) are deferred during the development stage. The patent fees are not accrued until the first sale and paid per unit sold. As a result, mobile communication is one of the most adopted technical inventions of the past century,[1] enjoying a wider dissemination than toothbrushes.

As the current market conditions are not caused by the 3GPP standardisation, a solution cannot be found through developing alternative technical specifications. Meanwhile, the ability to recoup R&D investments and supporting standards development is an essential prerequisite for sustainable market participation, or to develop future mobile communication systems even after 5G. In private, some O-RAN Alliance members are not shy about challenging the existing international standard-setting under 3GPP. But market actors must inevitably continue 3GPP for the non-RAN portion after 5G.

In essence, whether Europe should try to sustain one common global umbrella of standards under 3GPP – or see the world balkanise into national or regional standards from 6G and onward – is a dilemma for EU industrial policy.

Lobbying for subsidies and government mandates

Despite the transformative potential of Open RAN technology, some proponents are calling for subsidies and mandatory national standards where one particular Open RAN specification is declared a winner. Otherwise, the technology is too costly and risky to invest in.

This is perhaps the most policy-relevant consequences of Open RAN for the EU, as there is now a bipartisan effort in the US Senate under the leadership of Senators Burr and Warner – the Chair and Vice-Chair respectively of the Senate Intelligence Committee. The latter is also a telecom entrepreneur.

The group proposes more than $1 billion of US Federal funding into Open RAN, to ‘invest in Western-based alternatives to Chinese equipment providers Huawei and ZTE. The proposed new legislation – Utilising Strategic Allied (USA) Telecommunications Act – would let the Federal Communications Commission (FCC) to earmark $750 million into Open RAN development.[2] Furthermore, the US would also set up a $500 million Multilateral Communications Security Fund to ‘the adoption of trusted and secure equipment globally’.

The proposed subsidies are substantial. Just for comparison, the European operators spent just over $4 billion per year on purchasing RAN equipment.[3] There is an unprecedented amount of discretionary power for the FCC and other federal US agencies to promote one particular Open RAN specification while discriminating others.

In addition to US domestic discussions, several strategic alliances – including the Quad (of the US, India, Japan and Australia),[4] as well as ‘D10’ (currently proposed by the UK that would augment G7 with Australia, Korea and India) – are pondering whether Open RAN is a possible solution to exclude Chinese vendors.[5]

The natural stance for the EU is that all Open RAN specifications must be allowed to compete on a level-playing field, without distorting interventions like discriminatory subsidies or government technology mandates. Open competition between technologies has been the case in the past. For instance, there was an open competition between WiMax and LTE to become the prevalent standard for 4G, where the US, Chinese and EU governments remained technology-neutral and did not promote either standard. This is how the telecom markets have always picked the winning standards – with EU operators choosing the winning standard, solely on their commercial and technological merits.

[1] Statista (2020), A Mobile Connected World, accessed at: https://www.statista.com/study/74670/a-mobile-connected-world/

[2] US Congress (2020), USA Telecommunications Act, accessed at: https://www.congress.gov/bill/116th-congress/house-bill/6624

[3] Strand Consult, accessed at: https://strandconsult.dk/understanding-the-market-for-4g-ran-in-europe-share-of-chinese-and-non-chinese-vendors-in-102-mobile-networks/

[4] The Times of India, (2020), Quad Countries Deliberating on Common Approach on 5G Technology, The Times of India, September 26 2020, accessed at: https://timesofindia.indiatimes.com/business/india-business/quad-countries-deliberating-on-common-approach-on-5g-technology/articleshow/78337483.cms

[5] Warrell, Beattie, Sevastopulo (2020), UK turns to Five Eyes to help alternatives to Huawei, Financial Times, July 13 2020, accessed at: https://www.ft.com/content/795a85b1-621f-4144-bee0-153eb5235943

6. Conclusions for EU industrial policy

By all accounts, Open RAN will have a limited impact on EU deployment of 5G. While the short-term effect may be limited, there are still many arguments for how the underlying technologies that enables Open RAN will reshape the telecom equipment industry, once all security and performance issues are resolved.

There is already a natural evolution from today’s hardware-centric solution towards a software-centric one. Whether the industry calls it Open RAN or ‘business as usual’, software-centric innovation will capture faster upgrade cycles and further drive economies of scale associated with simpler and standardised hardware. Ability to leverage on cloud automation will also enable new ways of exploiting AI and related technologies. But it is innovation and market demand that drives these developments, not government intervention.

Although Open RAN is advertised as the solution to many of the policy questions currently plaguing the network equipment industry, it falls short of many of its promises. The technology merely swaps a geopolitical risk (stemming from high-risk vendors) to a systemic problem of software vulnerabilities we recognise well from the PC industry.

Secondly, Open RAN could not significantly change the financial burden on the EU operators. Today’s low market prices are primarily a function of the buyers’ monopoly power – a so-called monopsonistic competition. This power is further increased in Europe and China by pooled procurements.

Thirdly, any cost savings in RAN may be offset by increased energy consumption, or incremental staff costs of putting together the COTS-Lego. A third-party system integrator could take on that role, but we are then only back to where we started – with another vertically integrated supplier like Ericsson, Huawei or Nokia.

But Open RAN does not fulfil these promises. Virtualisation, multi-vendor implementation and other underlying technologies have a raison d’être without solving any geopolitical gambits. What is most critical for the European industrial policy how these technologies are packaged and presented on the market.

As it stands, the EU is the global leader on the both sides of the mobile network industry. To begin with, EU operators have the largest global footprint by far. They are the principal investor overseas – while the US, Chinese and Japanese operators have remained national players. The European telecom industry will not react well if Open RAN allows US platforms to encroach into their markets by cherry-picking high revenue clusters. Telecom operators may – once again – call for regulatory protectionism.

Furthermore, network equipment is the only ICT market segment where the EU suppliers are still global leaders. Majority of the R&D, standards, and turnover is in possession of the two major European vendors – Nokia and Ericsson. Current market developments reward suppliers who are competitive in areas like virtualisation, AI and cloud technologies. These are areas where Silicon Valley has its competitive advantages that allow the US industry to re-enter into the network equipment market.

These market realities are limiting the policy space for the EU. The EU Common Commercial Policy is equipped with trade policy instruments that are able to offset government-induced market distortions in third countries, whether it is the US or China. However, countervailing duties against foreign subsidies are rather unattractive options for diplomatic reasons. Retaliatory action is also highly likely. The EU itself maintains subsidies for telecom R&D – albeit on the basis of non-discrimination and technology-neutral.

The telecom market has opted for open competition where the market determines the winning specification based on performance and reliability – rather by government decrees or based on how much subsidies each consortium manages to attract. In sum, the EU industrial policy could be facing a reality where network standards are politicised for commercial reasons, namely to pave way for an indigenous industry, which is separate from national security objectives.