When the State Becomes the Only Buyer: Monopsony in China’s Public Procurement of Medical Technology

Published By: Fredrik Erixon Oscar Guinea Anna Guildea

Research Areas: Far-East Healthcare

Summary

China’s centralised state procurement policies are moving the Chinese market of medical technologies in a monopsonistic direction. A monopsony means that a single buyer exerts strong power to move the market to its favour by gradually cutting prices and setting terms for producers that are extortionary. It is equivalent to a monopoly – with the only difference being that in a monopsony, it is the single buyer that acts in a market-predatory manner. Ultimately, a monopsonistic market empowers the buyer to capture most of the financial rewards from a contract. Competition gets undermined because a vibrant market also requires competition between buyers and, over time, fewer firms will be able to supply the procured goods at terms that are set by the single buyer.

This shift towards monopsony does not happen overnight, it is a process that builds on a number of steps that tilts the balance of power in favour of the buyer. First, there is a concentration of buyers, sometimes down to a single buyer – such as the state. This concentration of buyers acts to extract value from sellers by creating pressure to reduce and converge prices. Buyers in monopsonistic conditions may also add other objectives to their agenda, using their monopsonistic position to abuse the market. For example, political objectives may be in place, which can include discrimination against foreign companies or corruption. Finally, there is a consolidation of the market, with fewer suppliers overall, and a focus on price rather than innovation.

Several characteristics of a market could be indicative of a monopsony. One of these indicators is the price. In the case of the Chinese market for medical technology, price reductions have been sustained across medical devices, with price cuts exceeding 90 percent in some medical products. When the buyer’s primary focus is to reduce prices, the risk is that low-quality products will drive out high-quality products. Another indicator is price convergence: the idea that one price should apply to the whole market. Price convergence can be observed as the distance between the average and maximum price reduction offered by companies. The small differences seen in the Chinese procurement of medical technologies for these two indicators indicates that prices are converging downwards. Forcing a convergence of prices breaks with natural market behaviour and overall leads to a market with fewer participants. In a monopsony, the buyer tends to capture the dominant part of the market value of the product, which squeezes the margins of sellers. Over time, this leads to fewer competitors as only a few companies can survive under such conditions. These dynamics have real consequences: the number of winning companies in the procurement of medical technology per one million people in China is substantially lower than in the EU. In addition to a reduced reliance on multiple suppliers, the Chinese centralised state procurement reinforces China’s industrial policy to support Chinese firms growing their domestic market shares to the detriment of non-Chinese companies. These are the consequences of a market that is increasingly taking a monopsonistic form.

Public procurement does not have to follow the Chinese recipe of centralised state procurement. There is a substantial body of evidence, research, and studies that recommend specific procurement policies that tackle the monopsonistic tendencies embedded in public procurement markets. These recommendations emphasize the importance of competition without lowering the number of firms in the market, underlining the need for a long-term view on how the market delivers continuous innovation. The danger for China is that monopsony will collapse the future market by making it less attractive for companies to innovate and compete.

Chinese centralised state procurement and the move towards monopsony will not go unnoticed. These policies clearly breach basic principles and norms of international exchange, and how governments should behave to avoid a distortion of competition. First, Chinese centralised state procurement favours the Chinese medical technology industry to the detriment of non-Chinese companies. Second, given the low prices achieved in Chinese centralised state procurements, there is a risk that firm’s margins are severely cut, putting a lid on global spending on R&D. The EU and the US should coordinate their policies to counter the monopsonistic tendencies of the Chinese market of medical technologies. Their markets for medical technologies are significantly larger than the Chinese market and Chinese companies rely on the US and the European market to maintain their growth. The EU-US Trade and Technology Council (TTC) offers a setting to take these discussions forward and agree on policies to counter Chinese market distortions.

1. Introduction

China’s market for medical technology is going through a period of profound change. The market is growing fast as the average age of the Chinese population is increasing and people demand more healthcare. Its rapid economic growth in the past 30 years has also created the economic space for growing expenditures in healthcare – leading to better opportunities to increase innovation and competition by attracting more companies to supply critical medical technologies like stents, pacemakers, and orthopaedics. However, Beijing and provincial governments are also engineering the market to benefit Chinese manufacturers of medical technology, and the conditions for open and transparent competition have deteriorated sharply in recent years. Foreign companies are finding that their chances to compete freely and fairly are shrinking.

A previous paper documented China’s new policies for the medical technology sector, and what those policies entail for foreign sales in China[1]. In the last decades, China’s imports of medical devices have grown robustly. On the back of vibrant innovation, firms from America, Europe[2] and elsewhere have not just followed the growth of Chinese demand for medical devices – they have also increased their share of Chinese imports. Now, however, this market is at risk of being gradually closed off for them as Beijing has embraced several types of policies that advantage local firms at the expense of foreign firms, innovation, and patient outcomes.

China’s ambition to grow its own medical technology sector encompasses many different policies. The country’s long-term ‘made-in-China’ ambition is to have local firms take up the lion’s share of the market for medical devices by 2030, and this ambition is supported by a programme of policies that amount to import-substitution policy. Accessing the Chinese market for medical devices has never been easy but it has become increasingly challenging in recent years. Direct financial support, tax benefits, R&D support, local content requirements, opaque approval systems, and other forms of advantages to domestic MedTech producers are now becoming major drivers for the behaviour and development of the Chinese medical device market. China’s Fourteenth Five-Year Plan and the country’s new economic model of ‘dual circulation’ reinforces this trend. Last year, a memo from the central government called for a sharp move towards local content requirements for 137 MedTech goods, which in the future should have 100 percent local content[3].

China has also changed its procurement of medical technologies with a policy that makes the market centralised and state-oriented. Launched in 2019, centralised state procurement has distorted the procurement market by mandating extreme price cuts – going up to 90 percent – and reducing the scope for fair competition. It started with local procurements of certain medical technologies, with policy then escalating to the central level. This procurement policy is gradually squeezing foreign firms out of the Chinese market. As a result, China’s new procurement policy has also had a significant impact on China’s imports of medical devices: a 1.3 billion euro trade deficit for China in medical technology products in 2019 turned into a 5.2 billion euro surplus in 2020. The change has been even more stark for products that have been subject to centralised state procurement. Moreover, in Africa, Asia and Latin America, competitive American and European manufacturers are now confronted with competition from Chinese MedTech companies that have the backing of the Chinese state. The competitive distortions in the Chinese market are now spilling over to the global market: China is exporting market distortions.

In this paper, we will take a closer look at how China’s overall ambitions and policies for the medical-technology sector will have an impact on competition. There is already a clear trend towards monopsony in China’s procurement market for MedTech goods. The risk is that this trend will accelerate in the next couple of years as new industrial, procurement and localisation policies in China are introduced and take effect.

A monopsony means that a single buyer exerts strong power to move the market to its favour by gradually cutting prices and setting terms for producers that are extortionary. It is equivalent to a monopoly – with the only difference being that in a monopsony, it is the single buyer that acts in a market-predatory manner. Ultimately, a monopsonistic market empowers the buyer to capture most of the financial rewards from a contract: the suppliers will not be able to make much of a profit. Competition gets undermined because a vibrant market also requires competition between buyers. Furthermore, over time competition will be diminished even more because few firms can supply the procured goods at terms that are set by a single buyer – unless they have other financial backing from the procuring government. Therefore, innovation will be damaged because the profits that companies make from their current sales are used to support investment in new and better medical technologies in the future. Without profits from its current stock of products, manufacturers will not invest in new products.

This paper tracks the monopsonistic trend of the Chinese market in the procurement of medical technology. It also points to policies in other regions that China could take inspiration from to avoid that centralised state procurement becomes a race to the bottom. Other countries also rely on systems of medical-technology procurement that have concentration on the buyer side. However, many of these countries acknowledge that buyer concentration can limit competition and ultimately deprive patients of better healthcare, and therefore they organise procurement in such a way that allows for dynamic competition.

Chinese centralised state procurement and the move towards monopsony will not go unnoticed. These policies clearly breach basic principles and norms of international exchange, and how governments should behave to avoid a distortion of competition. Previously, we presented policy recommendations for EU policymakers to address these practices, as well as engage with China to resolve them[4]. Among these policies we highlighted the EU International Procurement Initiative (IPI). The EU IPI has been agreed between the European Parliament and the Council, and the regulation is expected to be approved in 2022[5]. Once approved, the European Commission can use the IPI to pressure Beijing to agree on free and fair terms of competition in the procurement of medical devices. If China does not accept that, it will lose market access in the EU.

European action against Chinese discriminatory procurement practices will carry a higher chance of success if it is discussed and agreed with the US. The EU-US Trade and Technology Council (TTC) offers a setting for these discussions. The MedTech industry is an important sector in the EU and the US, and companies on both sides of the Atlantic are similarly affected by the deteriorating policy environment in China. Although still at its inception, the TTC has organised ten working groups on trade and technology related subjects that include the goal to “address non-market, trade-distortive policies and practices […] and explore ways to combat the negative effects of such policies and practices in third countries”[6]. Including Chinese centralised state procurement and the country’s move towards monopsony in the procurement of medical devices in China in the TTC would be benefit both sides. It would align EU and US policies, offering a stronger counterweight to Chinese discriminatory procurement and industrial policies.

Size matters in the procurement of medical technology. The combined value of the EU and US markets is substantially higher than the value of the Chinese market. In 2020, the Chinese market for medical technology was equal to $29 billion while the combined EU and US market was almost ten times larger at around $278 billion[7]. Market size is important because the Chinese MedTech industry still relies on the rest of the world for its continuous growth. Chinese exports of medical devices have skyrocketed, partly, but not only, as a result of Chinese exports of COVID-19 medical goods. In 2020, the EU and the US represented 45 percent of Chinese exports of medical technology. On the other hand, for European and US companies, China represented 7 percent of their exports. In medical technologies, EU and US markets are more important for Chinese companies than vice-versa.

Putting a break on Chinese discriminatory practices in the procurement of medical devices will not stop the market distortions brought by monopsony. With or without discrimination against foreign firms, the aim of the monopsonistic buyer is to extract the largest surplus of every transaction. When the monopsonistic buyer wants to achieve the lowest possible price, margins are reduced, and the market is drained of resources needed to pay for R&D and innovation. This has consequences for the market and ultimately for the quality of healthcare. In part, due to the size of its market, foreign companies rely on their sales in China to support their R&D spending in some measure. If resources for R&D are reduced, overall spending on R&D in the MedTech sector will decrease and foreign companies may stop selling their latest products in China. This will have negative consequences for global innovation in medical technologies and Chinese healthcare. Therefore, the Chinese state has a direct responsibility to maintain a vibrant market that promotes competition and innovation.

In chapter two, we will take a closer look at monopsonies and how such markets evolve. We define what monopsony is and we set the conditions that underpin the movement towards monopsony. This chapter also presents examples of markets around the world which are increasingly showing monopsonistic features. Chapter three applies the framework developed in chapter two to the market of medical technologies in China. It starts by describing the main features of this market and the extent to which centralised procurement and Chinese industrial policy have shaped the way this market operates. Having demonstrated how the Chinese market of medical technology is moving towards monopsony, chapter four explains that such a policy is neither inevitable nor desirable. This chapter presents good procurement practices in the medical technology sector developed by international organisations and the European Union, and how their recommendations stand in stark contrast with current Chinese policies. Finally, Chapter five concludes with a summary of the main findings of the study.

[1] Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology (No. 12/2021). ECIPE Policy Brief.

[2] Unless specified, Europe refers to the European Union

[3] Ministry of Finance and Ministry of Industry and Information Technology (2021, May 14), “Notice regarding the publication of Auditing Guidelines for Government Procurement of Imported Products”. Memorandum No. 551.

[4] Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology (No. 12/2021). ECIPE Policy Brief.

[5] European Parliament Press Release (2022). French Presidency briefs the European Parliament’s committees on its priorities. Accessed at: https://www.europarl.europa.eu/news/pt/press-room/20220119IPR21311/french-presidency-briefs-the-european-parliament-s-committees-on-its-priorities

[6] EU-US Trade and Technology Council Inaugural Joint Statement (the Pittsburgh Statement), Brussels, 29 September 2021. Available at: https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_21_4951

[7] Fitch Solutions, 2021, Worldwide Medical Devices Market Factbook, Medical devices total sales. Sales for the in vitro diagnostic sector were not included.

2. Monopsonistic markets

2.1 What is monopsony?

While the term ‘monopoly’ is widely used and understood, not many people are familiar with the concept of ‘monopsony’. While monopolies describe a market with a single supplier, monopsonistic conditions arise when a body, such as the state, makes itself the only buyer in a sector and uses that position to rig the market in its favour, for instance by demanding extreme price reductions. In a monopsony, the buyer can easily set the terms for the market so that it could capture the dominant part of the market value of the purchased goods.

In recent times, we have witnessed a new wave in the rise of markets that are moving towards monopsonies. Some governments have had successful experiences with concentrating their buying power, such as vaccine purchasing by the EU. These positive experiences have encouraged other initiatives such as the proposal to buy gas in bulk at the EU level to build EU strategic reserves and lower energy prices[1]. This new trend has been occurring within wider changes that we are seeing at the moment, as many states implement policies that move away from open-economy rules toward geopolitical or strategic trade protection. Overall, there has been an increasing role of state power in international trade, with many governments hesitating about being dependent on the supply from other countries.

However, as this paper will show, government strategies to pursue monopsony are neither cost-free nor risk-free. While we have established and upheld rules against monopolies, we also have rules against monopsony that are of equal importance. Many countries run policies that tilt in the direction of monopsony – particularly in public procurement – but often acknowledge that strong market power for the buyer comes with costs and risks that should be addressed. For instance, procurement agencies in Europe for medical technologies have the political space to negotiate about prices that reflect the value of the product. They have the mandate to pay for innovation and the desire to ensure dynamic competition. By contrast, the danger of monopsonistic behaviour is that it will collapse the future market by making it less attractive for companies to innovate and compete.

2.2 Examples of monopsony across markets and countries

An example of a monopsonistic market would be the retail sector, which has witnessed increasing consolidation among supermarkets[2]. Supermarkets buy from food producers and sell those products to consumers. To get better prices from their suppliers, supermarkets organise themselves in buying groups. These buying groups are national and international alliances of retailers that centralise their procurement to get better deals out of their providers. The four largest buying groups control 82 percent of the market in the Netherlands, 85 percent in Austria, 86 percent in Spain, 90 percent in Germany, and 100 percent in Finland[3].

The monopsonistic power of these buying groups has not gone unnoticed. Regulators and lawmakers acknowledged the negative impacts that this concentration of buying power – the first step towards monopsony – could have on the functioning of the market. Competition authorities in the UK, Germany, the Netherlands, Austria, Spain, and Finland started several investigations while the European Parliament adopted a declaration in 2008 requesting the European Commission to address “the abuse of power by large supermarkets operating in the European Union.”[4]

In 2019, the European Union adopted the Unfair Trading Practice Directive in business-to-business relationships in the agricultural and food supply chain.[5] The clue of the Directive is in the name as it came with the recognition that there was a problem in the sector arising from the imbalance of power between few and large buying groups and the numerous smaller suppliers. The abuse of monopsonistic power from supermarkets on their suppliers was such that the practices banned by the Directive would be inconceivable in any healthy business relationship. For instance, the Directive banned buyers from unilaterally changing terms of a supply agreement; requiring payments from suppliers that are not related to the sale of the agricultural and food products of the supplier; requiring suppliers to pay for the deterioration or loss of agricultural and food products that occurs on the buyer’s premises; or the prohibition that the buyer threatens to carry commercial retaliation against the supplier if the supplier exercises its contractual or legal rights.

The growing monopsonistic power of these buying groups on their suppliers meant that only large food producers could withstand the conditions imposed by supermarkets, which incentivised market concentration in food production. Consumers may benefit at the beginning from this haggling between food producers and supermarkets but, in the long-term, market concentration from food suppliers and supermarkets will harm them. For instance, monopsony and monopoly power in the retail sector can have a negative effect on innovation[6].

There are other examples of monopsony across countries and markets. We have already mentioned the proposal for joint-purchase of gas by EU countries to build EU strategic reserves and lower energy prices. The bookselling market[7] [8] have shown monopsonistic features and certain practices in the US labour market[9] that stem from the monopsony power enjoyed by some employers have been widely observed.[10] Moreover, the raise in market concentration and market power across sectors in the US[11][12] and the EU[13] has implications not just on the monopoly but also on the monopsony power of many multinationals that have become the most important sellers of a product and the main buyer of the inputs needed to produce it. But this shift towards monopsony does not happen overnight, it is a process that builds on a number of steps that tilts the balance of power in favour of the buyer.

2.3 The path towards monopsony

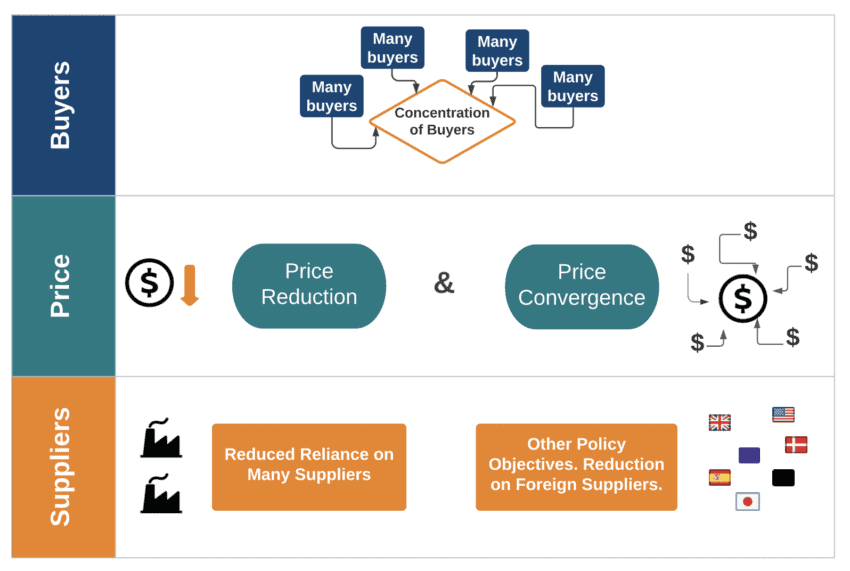

In this section, we present the overall process and several indicators that can be used in identifying whether a market is on a path towards monopsony and already showing monopsonistic features. The process of leaning towards a monopsonistic market can be described in the following steps:

- There is a concentration of buyers, sometimes down to a single buyer – such as the state.

- This concentration of buyers acts to extract value from sellers by creating pressure to reduce and converge prices.

- Buyers in monopsonistic conditions may also add other objectives to their agenda, using their monopsonistic position to abuse the market. For example, political objectives may be in place, which can include discrimination against foreign companies or corruption.

- Finally, there is a consolidation of the market, with fewer suppliers overall, and a focus on price rather than innovation.

The following figure presents these steps in a diagram.

Figure 1: Path to monopsony

It follows from this process that several characteristics of a market could be indicative of a monopsony. One of these indicators is the price: often the rationale for monopsonistic buyers is the control over price – and to drive it down. By doing so, monopsonistic buyers can save money by reducing their expenditure on supplies. However, when the buyer’s primary focus is to reduce prices, which is often the case, it is impossible for companies to participate without making a loss or without reducing the quality of its associated services. The risk then is that low-quality products will drive out high-quality products from the market.

Another indicator is price convergence: the idea and practice that one price should apply to the whole market, independently of the nature of the product or the submarkets where the product is delivered. In most markets, prices naturally vary over time and across geographies depending on several factors – the product, its quality, demand, size of orders, customer loyalty, competition, price elasticities, and more. Forcing a convergence of prices breaks with natural market behaviour and overall leads to a market with fewer participants. Other negative consequences are triggered: there will be less responsiveness in the market to supply and demand factors, as the market is constrained and cannot move smoothly when competition is not working. Hence, having just one price applied for a large tender sets a path for the market that gradually will shrink the number of tender participating companies.

Yet another indicator of a market that is taking monopsonistic features is a reduced reliance on many suppliers, along with a reduction in the number and volume of suppliers from abroad. The fall in the number of market participants is an outcome of monopsonistic behaviour. In such markets, the buyer tends to capture the dominant part of the market value of the product, which squeezes the margins of sellers. Over time, this leads to fewer competitors as only a few companies can survive under such conditions – and those few survivors need to be able to produce in bulk to afford the price conditions. Thus, monopsony and monopoly trends reinforce each other as the market becomes a game of power and size. A summary of these indicators is presented in Table 1.

Table 1: Indicators of a monopsonistic market

[1] Reuters (2021, September 23rd) ‘Factbox: European grapples with surging power and gas prices.’ Reuters. Accessed at: https://www.reuters.com/business/energy/europe-tries-soften-blow-surging-power-gas-prices-2021-09-22/

[2] Other examples of monopsonistic markets across different countries include the US aerospace industry throughout the 1970s, the power generation market in the US prior to the passing of the ‘Energy Policy Act’ in 1992, which opened up and organised regulated wholesale power markets.

[3] European Central Bank (2014). Retail market structure and consumer prices in the euro are. See Table 4. Market share by country and buying group.

[4] Declaration tabled by Caroline Lucas (Verts/ALE/UK), Gyula Hegyi (PSE/HU), Janusz Wojciechowski (UEN/PL), Harlem Désir (PSE/FR) and Hélène Flautre (Verts/ALE/FR) pursuant to Rule 116 of the European Parliament’s Rules of Procedure, EP reference number : DCL-0088/2007 / P6-TA-PROV(2008)0054.

[5] Directive (EU) 2019/633 of the European Parliament and of the Council of 17 April 2019 on unfair trading practices in business-to-business relationships in the agricultural and food supply chain

[6] EY, Cambridge Econometrics, Arcadia International (2014). The Economic impact of modern retail on choice and innovation in the EU food sector. European Commission.

[7] Krugman, Paul. (2014) ‘Amazon’s Monopsony is Not Okay.’ The New York Times. Accessed at: https://www.nytimes.com/2014/10/20/opinion/paul-krugman-amazons-monopsony-is-not-ok.html

[8] Lennon, Connor (2014, October 24th) ‘Amazon and Monopsony.’ Sound Economics. Accessed at: https://blogs.pugetsound.edu/econ/2014/10/23/amazon-and-monopsony/

[9] As large firms hire more people, becoming the dominant employer in some cities, economists have expressed concern that they could be using their monopsonistic power to supress wages. 60 percent of US labour markets have “high labour market concentrations” as defined using the ‘Herfindahl-Hirschman Index’ (HHI), which is the most common measure of market concentration. That is to say, most areas have relatively few employers. Azar, Jose (2020) ‘Why are wages so low in so many markets?’ https://www.ieseinsight.com/doc.aspx?id=2452&ar=6

[10] Manning, Alan (n.d) ‘Why we need to do something about the monopsony power of employers.’ London School of Economics. Accessed at: https://blogs.lse.ac.uk/usappblog/2020/09/05/why-we-need-to-do-something-about-the-monopsony-power-of-employers/

[11] Tepper, J. (2018). The myth of capitalism: monopolies and the death of competition. John Wiley & Sons.

[12] Philippon, T. (2019). The great reversal. Harvard University Press.

[13] Guinea, O., & Erixon, F. (2019). Standing up for competition: Market concentration, regulation, and Europe’s quest for a new industrial policy (No. 01/2019). ECIPE Occasional Paper.

3. Monopsony in China’s market for medical technology

3.1 The Chinese market of medical technology: moving from a competitive towards a monopsonistic market

There has been a clear shift in China’s market for medical technology in the past years. In 2019, China started to pilot a new policy for centralised state procurement of medical devices – sometimes referred to as volume-based procurement. The first test cases were done in Jiangsu and Anhui and after a brief pause in early 2020 as China battled its COVID-19 outbreak many other provinces followed suit in April 2020. In November of the same year, China conducted its first nationwide tender for a medical device, namely coronary stents.

The logic behind centralised state procurement is straightforward: buy in bulk to lower the price of each individual medical device. In this case, the price that hospitals and other procuring entities would pay for a coronary stent, pacemaker or other medical technology can be reduced if they contract on a high volume of products as a group. In most sectors, suppliers will often be prepared to reduce the price if the contracted volume is higher because a guaranteed high-volume allows a manufacturer to arrange production and distribution in a way that lowers production costs.

Inspiration for changing the procurement policy for medical technology came from the pharmaceutical sector and previous procurement projects in China to bulk purchase generic medicines[1]. But this is not a model that works well for advanced, patient-centred, and technology-intensive products like medical devices. A sophisticated medical device requires constant training, education, instrument availability, and other post-sales services. This is costly and substantially reduces the potential for cutting expenditures by contracting on a high volume.

Companies with winning bids under centralised state procurement are shortlisted to supply their medical technology to Chinese hospitals. Companies that are not successful in these procurement rounds are out of a significant part of the national market until the next procurement round, which usually happens between one and two years later. This prospect is dire. With minimal opportunities to sell their products in the immediate future, unsuccessful companies may leave the market altogether as the cost of keeping their after-sales services becomes impossible to justify. Faced with such a decision, some foreign companies prefer to bid at a price that barely covers production and servicing costs, rather than losing their sales networks, training infrastructure, and brand reputation.

However, there are obvious problems and dangers when governments organise their procurement in a such a highly centralised fashion. One problem – evident in the centralised state tenders that we have seen in recent years in China – is that the procurement authority engineers the tender with the primary focus of driving down the price. As mentioned, when this happens, it is often impossible for companies to participate in the tender without making a loss or without reducing the overall quality of the product and its associated services (e.g. training and education in using the product). When centralised state tenders take little or no account of value, low prices become the only outcome. Obviously, the risk then becomes low-quality products with no ancillary services eventually driving out high-quality products that include the necessary post-sale services. Another problem of centralised state procurement is that the process can be captured by those who want to use procurement to support domestic manufacturers. In contrast to a decentralised system, centralised state purchasing – nationwide or in big provinces and cities – makes it easy and often attractive to pursue such industrial policy goals.

In the past, most medical devices produced by Chinese manufacturers were low-cost, high-volume items and international manufacturers supplied Chinese hospitals and other health care facilities with high-end equipment and devices. This dynamic is now rapidly changing and some of this change is a natural reflection of the improved innovation capacity by Chinese firms. In line with its goal of propelling the Chinese economy up the value chain – by creating national champions and lowering the dependence on foreign imports – Beijing has made the development of the country’s biomedical and high-end medical device manufacturing sector a key priority. Already in 2014 President Xi Jinping declared that it “is necessary to accelerate localization of high-end medical devices, to decrease production costs and to promote the continuous development of national enterprises”.[2] Now the country is accelerating that ambition. In 2020, President Xi Jinping vowed that the government would be doing more to support strategically important sectors – specifically robotics, biomedicine, and medical technology[3].

As recently as April 2021, the Chinese government published its new medical technology five-year plan (2021-2025), outlining the goal to make at least six Chinese companies to be among the leading 50 medical device companies globally (currently there are four Chinese companies in the top 100, and only a handful are in the top 50).[4] The plan also calls for developing higher-value medical devices, encouraging Chinese manufacturers to step into fields such as radiotherapy and ultrasound, magnetic resonance, dialysis machines or pacemakers and cardio-vascular stents. To achieve these goals, the central government expects Chinese local governments to set favourable fiscal, financial, and taxation policies[5]. As we explained in our previous paper[6], the price cuts achieved in the rounds or centralised state procurement have been extraordinarily high and cannot be explained on market terms alone. Chinese industrial and procurement policy work in tandem not just to lower prices for Chinese consumers but to support Chinese producers in the medical technology industry.

Public procurement therefore became another tool to achieve China’s industrial ambitions in medical technology. The language used throughout documents and plans pertaining to the Chinese government procurement is clearly suggestive of preferential support for domestic firms in public purchases as a tool for industrial policy. For example, “through comprehensive use of fiscal, taxation, financial and other means, guide local governments, social resources, etc. to support the medicine-industry collaboration on tackling key obstacles in developing high-end medical equipment, key parts and components”.[7] Premier Li Keqiang, speaking at a State Council meeting on centralised state procurement in medical devices and pharmaceuticals, called in early 2021 for a “concentration” of the market – or to “use centralized procurement to make the consumables industry more concentrated as it relates to competition”.[8]

The ‘Made in China 2025’ initiative itself calls for more than half of Chinese hospitals to be using 50 percent more domestically produced medical devices by 2020 and 95 percent more by 2030. Several Chinese provinces and municipalities have gone so far as to redirect medical device purchasing to national manufacturers. Provinces such as Sichuan, Zhejiang, and Jiangxi – representing a combined population of 184 million, which equals the combined population of Germany, Italy and Spain – have now passed legislation that compels middle and higher-tier health care institutions to purchase certain types of equipment from domestic manufacturers.[9]

The Guangdong Provincial Healthcare Security Administration admitted as much in a letter to the Guangdong Provincial People’s Congress. It said: “in formulating the rules for the centralised procurement of medical consumables in our province, [we will] implement the same group bidding policy for domestic medical consumables and imported medical consumables to enhance the price advantage of domestic medical consumables and increase the chance of domestic medical consumables being selected.”[10]

Shanghai is also expanding its ambition to become a global hub for the development and manufacturing of medical technologies. Following the five-year plan for emergent industries by the Shanghai Municipal People’s Government, this ambition is directly connected to the general ambition to substitute imports of foreign medical technologies by Chinese products. This plan “calls for developing a number of local innovative enterprises to achieve indigenous control of core technologies and new biomedical products by 2025, focusing on developing high-end medical device and equipment including surgical robots and biomedical materials.”[11]

Similar ambitions have been established in the five-year plans of other provincial governments. The Guangdong provincial government has said in its plan that it aims to “leverage on preferential government policies” to reinforce the strength of its MedTech industry.[12] Hainan and Shandong have similar plans. The Beijing municipal government has also laid out its plan for cultivating a group of medical equipment manufacturers and build up new industrial parks.[13] This state support, in the form of direct financial backing, tax benefits, R&D support, or local content requirements, allowed Chinese companies to continue moving up the value-chain in medical devices, producing more sophisticated devices, while competing aggressively to gain a larger market share in each procurement round.

Centralised state procurement has charged monopsonistic behaviour. These abusive practices are already at display in China’s MedTech market and examples of it include the extreme price reductions effectively demanding that manufacturers of medical technologies should price their products in such a way that the margin gets captured by the buyer. Other political objectives have taken a hold in procurement practices. As described in strategies and policies by both the central government and the provincial leadership mentioned before, centralised state procurement has been explicitly referenced as a mechanism to gradually squeeze out foreign MedTech manufacturers to make space for domestic producers. These are the consequences of a market that is increasingly taking a monopsonistic form. In Chapter two we presented the overall process and some indicators that can be used in identifying whether a market is on a path towards monopsony. We will now examine how these indicators can be observed in the Chinese market of medical technology, and reveal how the market is on the path towards monopsony

3.2 Price reduction

Obviously, one rationale for centralised state procurement in the medical technology market is that China wants to have a policy for purchasing medical technologies that leads to an efficient use of scarce resources. Beijing’s strategy is designed to help authorities to save money by reducing the expenditure on various medical supplies.

However, considerable problems and dangers arise when governments organise procurement in such a highly centralised fashion. As explained, one problem – obvious in the centralised state tenders that we have seen in recent years in China – is that when procurement authorities engineer the tender with the primary focus of driving down the price, the risk is then posed that low-quality products will drive out high-quality products. Price reductions, going up over 90 percent of the market price as shown in figure two, have been extreme and are unsustainable for companies in the long term and undermine innovation in China. Moreover, the price reductions that have been achieved would likely not have been as deep without all the various policy instruments in China that have advantaged domestic firms.

The pressure to meet these price cuts may lead to lower product availability and ultimately have negative impacts on patients. For example, after the national coronary stent tender, 93 percent of Chinese doctors experienced difficulties due to lack of product variety when treating their patients. The pool of 10 stent types procured in the centralised procurement was not suitable for all patients, such as those with complex medical problems. Moreover, given the aggressive price cuts achieved in the stent tender, some manufacturers were unable to deliver the stents that they promised to sell, which resulted in 70 percent of doctors experiencing shortages of this medical product between January and June 2021. As a result, some procedures were delayed due to inability to obtain the required stents[14].

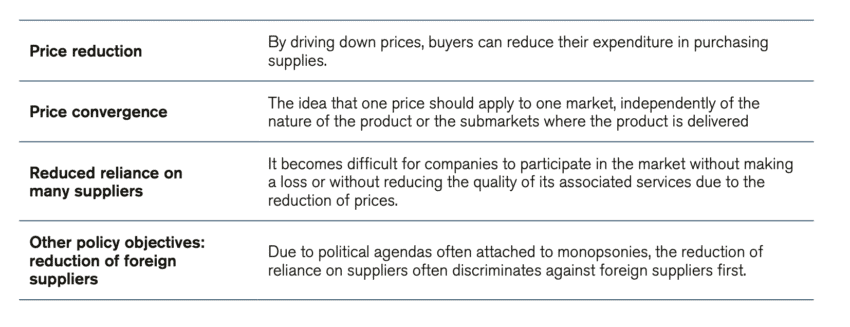

To understand the extent of price reductions emerging as a result of centralised state procurement, we analysed the outputs of 41 Chinese procurement exercises in medical technologies run between 2019 and 2021. The figure below presents the average price reduction coming from these tenders across six categories of medical technology products: pacemakers, coronary stents and balloons catheters, knee and hip joints, intraocular lenses and various other medical technology products including hemodialyzers, ultrasonic scalpels, and infusion ports.

From our sample, the average price reduction was 58 percent. The average fall in prices was particularly dramatic in coronary stents and balloons (72 percent on average) and less pronounced in intraocular lenses (34 percent on average). However, the figure below also shows that there were price reductions of at least 70 percent in tenders across all categories except for intraocular lenses, in which the largest price fall was of 54 percent. These price reductions have been sustained consistently throughout the years with the average price reduction in 2021, 2020, and 2019 being 79 percent, 64 percent, and 50 percent respectively. Our sample includes procurement at the city and provincial levels, as well as several Chinese provinces that undertook joint procurement. The data shows that the larger the procurement exercise, the larger the fall in average prices. For example, the average price reduction for coronary stents and balloons across procurements in provincial alliances was equal to 80 percent while the average price reduction for the same medical products procured by a single province was equal to 65 percent.

Figure 2: Price reduction in Chinese tenders of medical technologies between 2021 and 2019 Source: IQVIA

Source: IQVIA

As described in chapter four, other countries, too, have medical technology policies that tilt in the direction of monopsony, but they often acknowledge that a monopsonistic buyer can have negative impacts on the market ability to innovate and ultimately on health outcomes. Therefore, they strive to establish a price that is fair and reflects the desire to promote innovation, competition, and dynamism – or, at least, a price that is not based on forcing it to be as low as possible. EU countries are a good example of this. In 2020, there were 78 procurement award notices for pacemakers, artificial joints, and intraocular lenses,[15] and 40 percent of these notices include quality award criteria to select the winning bidder in addition to price. This percentage can always increase but it is considerable when compared with Chinese procurement of medical technology, where considerations about quality do not feature at all.

3.3 Price convergence

The evolution towards buyer centralisation reduces the responsiveness in the market to supply and demand factors, thus the market becomes constrained and cannot move as well as when competition is working. The main factor behind this problem is the concept of price convergence – the idea that one price should apply to one market – independently of the nature of the product or the submarkets where the product is delivered. As mentioned, medical technologies are patient-centred and have ancillary costs such as education, training, etc. which make these goods relatively heterogeneous. Moreover, there are different patient needs and health demands, and the convergence towards one price risks leading to serious reductions in product variety.

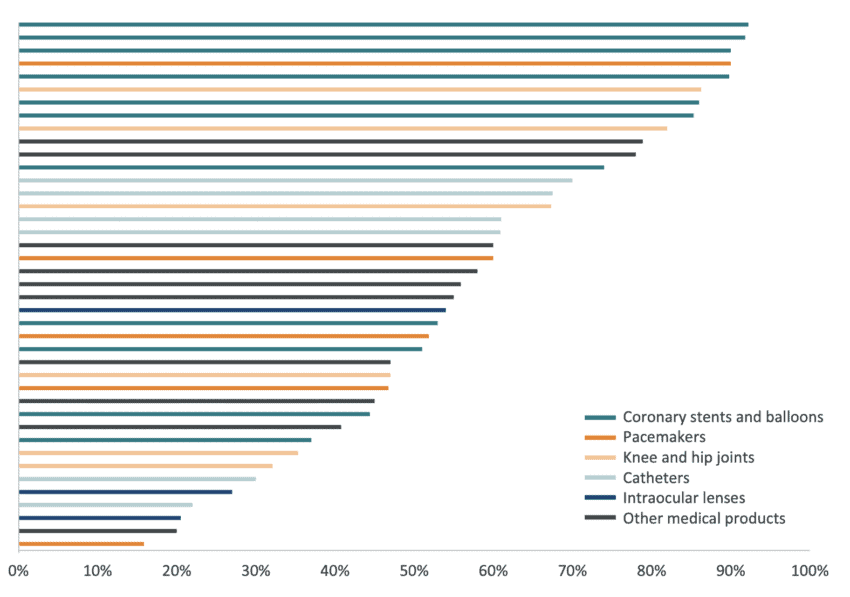

Price convergence can be observed within Chinese medical procurement rounds as the distance between average prices and maximum prices of tenders gets smaller: an indication of convergence and the known pressure from suppliers to offer significant price cuts. Given the significant average price reduction shown before, the small gap between the average price and the maximum price reduction shown in Figure 3 suggests a market where bidders tend to converge towards the highest price reduction. This is also indicative of a market where price, not quality, is the only criteria to win a bid. The figure presents 24 procurement rounds of Chinese medical technologies where average and maximum price reductions were recorded. In general, the higher the average price reduction the smaller the difference between the average and the maximum price reduction which indicates that companies are putting forward offers closer to the most aggressive bidder.

Figure 3: Average price reduction and maximum price reduction in Chinese tenders of medical technologies between 2021 and 2019 Source: IQVIA

Source: IQVIA

This price convergence among suppliers is a process designed by the Chinese government at the outset. For example, for the state-wide procurement of coronary stents, the tender documents include two pre-selecting criteria. The first one is that bids should be no bigger than 1.8 times the amount of the lowest priced bid. The second criterion is that if greater than 1.8 times the amount of the lowest priced bid, the bid must be less than US$ 426. These conditions nudge companies towards a downward convergence in prices. In our dataset, 23 of the 26 individual tenders had an average price lower than 1.8 times the lowest priced bid.

3.4. Reduction in suppliers

As monopsonistic markets move towards a single buyer, there is also a responding development towards fewer manufacturers or suppliers. As prices are driven down and converge, it becomes difficult for some companies to participate without making a loss or without reducing the quality of the accompanying services, thus leading to a market with fewer participants over time. Therefore, a steady fall in the number of market participants is a logical consequence when monopsonistic behaviour takes a stronger hold over a market. Beijing has already signalled its intention to bring about consolidation in the market for medical technologies. Even if some of the results from centralised state procurement have also encouraged the participation of smaller Chinese manufacturers, the vision behind a stronger drive for centralised state procurement seems to be one where the state captures a growing share of all the value of a product and the Chinese supply side consolidates to the point where China has its own national champions.

Yet, at the same time as Chinese and non-Chinese companies significantly lower their prices to win public tenders, a growing number of new Chinese companies are entering the market. Between 2019 and 2020, the number of Chinese MedTech manufacturers jumped by 46 percent[16]. Although part of this growth came as a result of growing worldwide demand for medical technology products due to COVID-19, other Chinese companies have entered the MedTech market to produce medical goods unrelated to COVID-19. All in all, Chinese exports of medical technology have surged from 18 billion euro in 2019 to 23 billion euro in 2020[17],

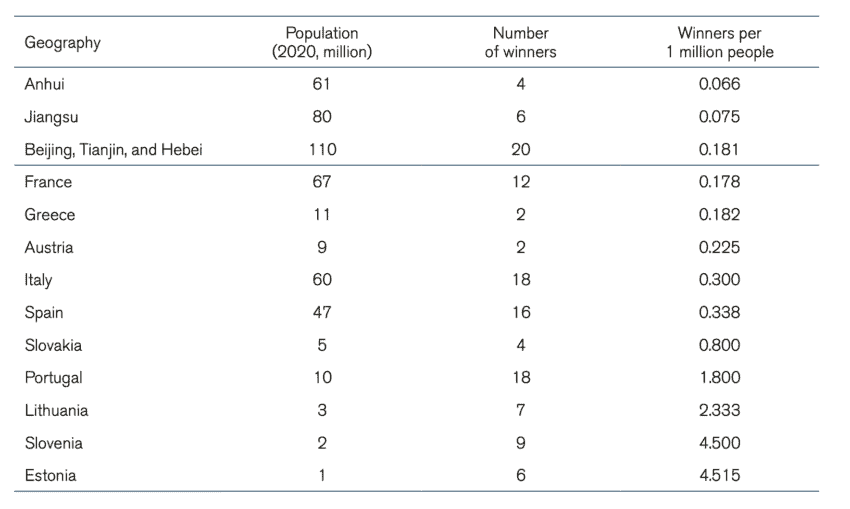

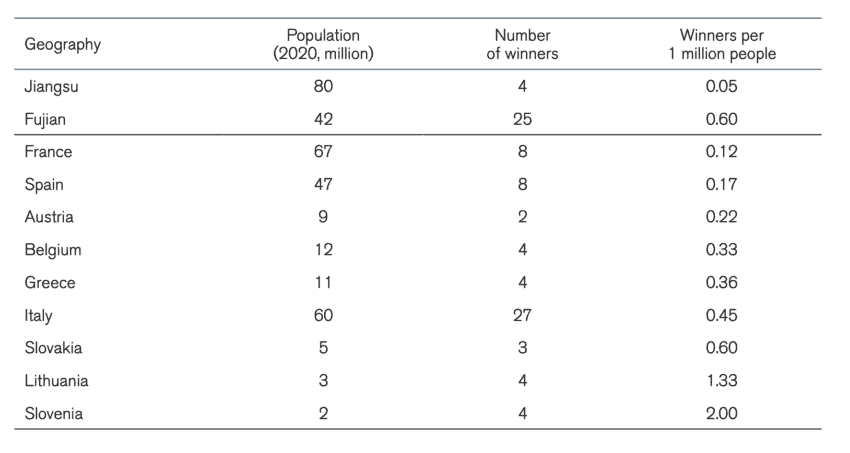

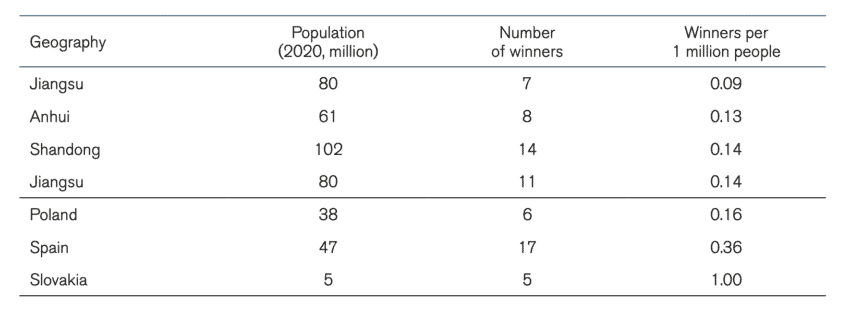

The competing forces of new businesses entering the market and the monopsonistic power of centralised state procurement makes it difficult to assess whether the number of suppliers of medical technologies in China is actually shrinking. A comparison of the number of companies presenting offers for public tenders of medical technologies over time would provide some answers. Unfortunately, data limitations make these calculations imprecise. However, we can compare the Chinese market for medical technologies with another market. Table 2 compares the number of winning suppliers per 1 million people in intraocular lenses, pacemakers, and artificial joints, and knee and hip joints between Chinese provinces and EU member states. The selection of these specific medical products is because these products appear in our sample of Chinese procurement and the EU TED database of public procurement[18].

In contrast with Chinese procurement, where there is one large procurement exercise, procurement in EU member states is organised regionally and even at hospital level. This means that to calculate the number of winning companies in each EU member state, we have put together several regional procurements for each EU country. Then we have identified which companies won those tenders and we have counted the number of unique companies in each EU country that won a tender. Therefore, when one company won more than one tender, we counted that company only once.

Table 2: Procurement of intraocular lenses in China and the EU Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

Table 3: Procurement of pacemakers in China and the EU Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

Table 4: Procurement of knee and hip joints (China) and Artificial joints (EU) Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

Note: EU member states procurement for 2020. Chinese provinces between 2019, 2020, and 2021

The first thing that comes out of these tables is the size of the Chinese centralised state procurement. Many Chinese provinces and province alliances are significantly more populated than European countries. Moreover, even for provinces that have the population size of EU countries, there is only one procurement exercise for a particular medical product while in EU countries there were several procurements within the year. This has implications for the market as companies may feel less pressured to bid for a particular tender knowing that other opportunities will arise in the future. As explained before, this is not the case in China, and therefore companies may feel that they must bid, or they will be out of the market for a long time.

A second conclusion that can be drawn from the tables is that in most cases, the number of winning companies in the procurement of medical technology per one million people in China is lower than in EU countries. Although we should not come to a definitive conclusion given that we only have a sample of procurement exercises, it is telling that the cases with the lowest number of winners per 1 million people are in centralised Chinese procurement and the largest number of winners per 1 million people are in EU member states. The number of winners per one million people for the procurement of intraocular lenses in Anhui more than halved the same number in France, the EU member states with the lowest number of bidders per one million people for that medical product. For pacemakers, the number of bidders per one million people in Fujian was in the same region as in other EU member states but for Jiangsu this number was considerably smaller. In the procurement of knee and hip joints, all Chinese provinces in our dataset had a lower number of winning bidders per one million people than the EU member states.

As we will discuss in chapter four, the EU follows an active policy and practice to avoid monopsonistic behaviour, as there is an awareness that monopsonistic tendencies harm the long-term sustainability of the market. Thus, active steps are taken to maintain a higher number of suppliers such as the inclusion of quality criteria in procurement described before or setting several procurement rounds within the year. These policies have the objective of maintaining a healthy ecosystem of large and small companies. From the 33,000 medical technology companies in Europe, 95 percent were SMEs[19].

3.5 Reduction of foreign suppliers

As explained in section 3.1., centralised state procurement – which is the first step towards a monopsonistic market – can be easily captured by those who want to use it to support domestic manufacturers. In contrast to a decentralised system, centralised state purchasing – nationwide or in big provinces and cities – makes it easy and often attractive to pursue such industrial policy goals. One of the indicators of a market with monopsonistic features is that the buyer acquires so much power that it is able to add other objectives in addition to securing a lower price. In the case of China’s market of medical technology, Chinese centralised state procurement directly reinforces China’s industrial policy and allows for a development where state tenders increasingly form part of the goal to have Chinese firms rapidly grow their domestic market shares to the detriment of non-Chinese companies. Hence, China’s monopsonistic strategy is not just a way to save healthcare costs but to drive the market to a particular shape.

Therefore, many non-Chinese medical technology companies are in a position where they are pushed to consider leaving the Chinese market altogether. Chinese imports of medical technology goods from the EU, the US, and Switzerland have declined in the past year. Moreover, the fall in Chinese imports of medical technology can especially be observed in the medical technologies that went through centralised state procurement. Products like syringes, needles, catheters, artificial joints, and pacemakers have experienced a steady fall in their annual growth of imports since 2015, and in 2020 it turned negative[20]. In relation to some of the products discussed in this paper, EU exports of catheters[21] to China went down by 3 percent while orthopaedic appliances[22] were reduced by 7 percent between 2020 and 2019. At the same time, Chinese exports of medical goods to the EU have exploded, mostly driven by the increase in EU imports of reagents for COVID-19 testing[23], and respirators and ventilators[24] made in China, but also Chinese-made scans[25] or X-rays machines[26] bought by EU hospitals.

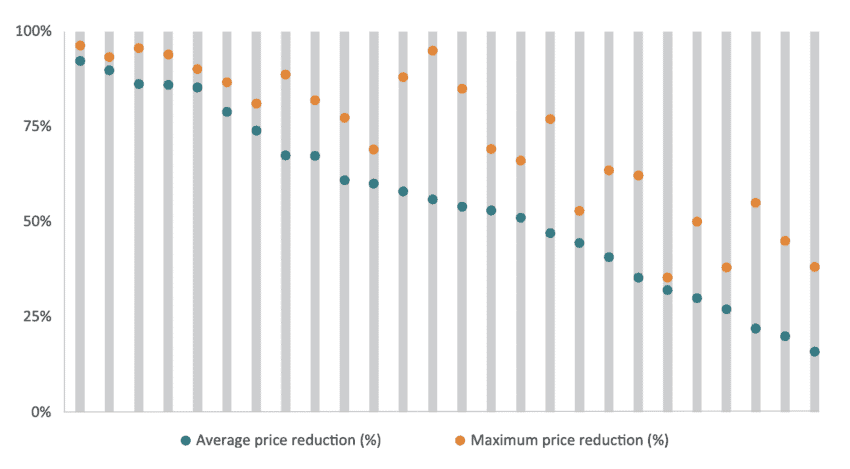

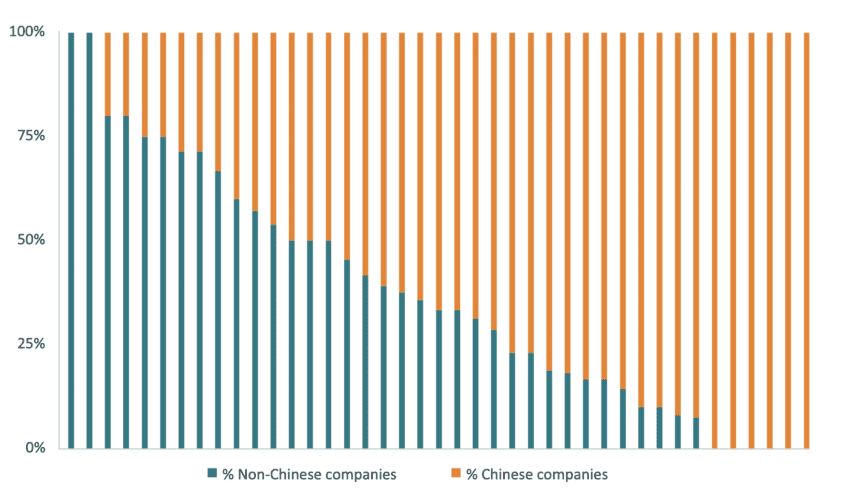

Figure 4 presents the share of Chinese and non-Chinese companies winning tenders in the Chinese procurement of medical technology. We gather data from 41 individual tenders that include 449 winning bidders, out of which 32 percent were non-Chinese companies and 68 percent were Chinese companies. The figure shows that Chinese companies represented more than half of the winning bidders in 26 out of the 41 individual tenders. The underrepresentation of non-Chinese companies was particularly relevant in coronary stents and balloons, knee and hip joints, and catheters, and this underrepresentation appeared in procurements run by cities, individual provinces, and provincial alliances.

Figure 4: Percentage of Chinese and non-Chinese winning companies in in Chinese tenders of medical technologies between 2021 and 2019 Source: IQVIA

Source: IQVIA

The percentage of winning bidders is not the same as the percentage of actual sales. While some procurements may produce an even outcome in terms of the number of Chinese and non-Chinese winning bidders, the actual sales may be skewed in favour of the suppliers who promise to deliver more units at the most affordable price. In the case of the national stent tender procurement, non-Chinese companies represented 37 percent of the winning bidders but only 20 percent of the actual sales[27].

[1] Centralised state procurement of generic medicines led to a price reduction of around 50 percent on average. As we will see in the next section this is much less drastic than centralised state procurement of medical technologies.

[2] China’s Central Government (2014, May 26), “Xi Jinping: People can’t afford high-end medical equipment and we need to speed up localization”. http://www.nhc.gov.cn/xcs/wzbd/201405/4fb04cb812c243bc9befdfa8bfaf56c7.shtml

[3] Xinhua News (2020, March 23rd), Xi stresses Covid-19 scientific research during Beijing inspection. https://www.tsinghua.edu.cn/en/info/1399/9816.htm

[4] Chinese Department of Equipment Industry (2021, February 9th) Public Consultation on the Development Plan for the Medical Equipment Industry.

[5] Ye, S. (2021, May 26), China Releases Its 2025 Vision For The Medtech Sector – May 2021 Update. Pharma Intelligence. Accessed at: https://medtech.

pharmaintelligence.informa.com/MT143977/China-Releases-Its-2025-Vision-For-The-Medtech-Sector–May-2021-Update

[6] Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology (No. 12/2021). ECIPE Policy Brief.

[7] Chinese Department of Equipment Industry (2021, February 9th) Public Consultation on the Development Plan for the Medical Equipment Industry.

[8] Zhou Chencheng (2021, January 16), “State Council: To promote the normalization and institutionalization of centralized drug procurement, public medical institutions should participate in centralized procurement to promote the concentration of the drug and consumable industries in competition”. http://www.gov.cn/zhengce/2021-01/16/content_5580457.htm

[9] Wang, W. et al (2021, July) The Healthcare Market in China. EUSME Centre in partnership with China-Britain Business Council. Accessed at: https://www.eusmecentre.org.cn/report/healthcare-market-china-2021-update

[10] Healthcare Security Administration of Guangdong Province (2021, April 26), “Letter from the Guangdong Provincial Medical Security Bureau on the suggestion of co-organization by the representative No. 1116 of the Fourth Session of the Thirteenth People’s Congress of Guangdong Province”. http://hsa.gd.gov.cn/ygzwpt/jggk/content/post_3278501.html

[11] General Office of the Shanghai Municipal People’s Government (2021, June 24), “Fourteenth Five-Year Plan for the Development of Strategic Emerging Industries and Leading Industries in Shanghai”. https://www.shanghai.gov.cn/nw12344/20210721/d684ff525ead40d8a2dfa51e541a14e4.html

[12] The People’s Government of the Guangdong Province (2021, July 30), “Notice of the 14th Five-Year Plan for high-quality development”. http://www.gd.gov.cn/zwgk/wjk/qbwj/yf/content/post_3458462.html

[13] The People’s Government of the Beijing Municipality (2021, August 18), “Notice of the Beijing Municipal People’s Government on Printing and Distributing the Beijing’s Fourteenth Five-Year Plan, High-precision Industry Development Plan”. http://www.beijing.gov.cn/zhengce/zhengcefagui/202108/t20210818_2471375.html

[14] IQVIA (need reference)

[15] Source TED. CPV Product categories: 33182210 Pacemakers; 33141750 Artificial joints; 33731110 Intraocular lenses.

[16] China’s Department of Comprehensive and Planning Finance (2020) National Medical Products Administration State Drug Administration Information Document. Accessed at: http://www.gov.cn/xinwen/2021-05/14/5606276/files/4b0aa9334e8d42b985e0672dbf633ad9.pdf

[17] The trade data in this section was sourced from the Trade Map Database of the International Trade Centre.

[18] Source TED. CPV Product categories: 33182210 Pacemakers; 33141750 Artificial joints; 33731110 Intraocular lenses.

[19] The European Medical Technology Industry in figures. 2021. MedTech Europe. Available at: https://www.medtecheurope.org/wp-content/uploads/2021/06/medtech-europe-facts-and-figures-2021.pdf

[20] Erixon, F., Guildea, A., Guinea, O., & Lamprecht, P. (2021). China’s public procurement protectionism and Europe’s response: The case of medical technology (No. 12/2021). ECIPE Policy Brief.

[21] Product code 901839 “Needles, catheters, cannulae and the like, used in medical, surgical, dental or veterinary sciences (excl. syringes, tubular metal needles and needles for sutures)”. Source: Eurostat.

[22] Product code 902110 “Orthopaedic or fracture appliances”. Source: Eurostat.

[23] Product code 382200 “Diagnostic or laboratory reagents on a backing, prepared diagnostic or laboratory reagents whether or not on a backing, other than those of heading 3002 or 3006; certified reference materials”. Source: Eurostat.

[24] Product code 901920 “Ozone therapy, oxygen therapy, aerosol therapy, artificial respiration or other therapeutic respiration apparatus, incl. parts and accessories”. Source: Eurostat.

[25] Product code 901819. “Electro-diagnostic apparatus, incl. apparatus for functional exploratory examination or for checking physiological parameters (excl. electro-cardiographs, ultrasonic scanning apparatus, magnetic resonance imaging apparatus and scintigraphic apparatus)”. Source: Eurostat.

[26] Product code 902290 “Apparatus based on the use of X-rays, for medical, surgical or veterinary uses (excl. for dental purposes and computer tomography apparatus)”. Source: Eurostat.

[27] IQVIA (2021). China National VBP Impact Assessment in 2021.

4. Policies to tackle the power of monopsony in public procurement

Public procurement does not have to follow the Chinese recipe of centralised state procurement. In fact, the system of centralised state procurement is not what experts advise. There is a substantial body of evidence, research, and studies from international organisations, the EU, and research projects that recommend specific procurement policies that tackle the monopsonistic tendencies embedded in public procurement markets. The policy recommendations presented below stand in stark contrast to Chinese procurement practices in medical technologies. In the view of international organisations, as well as the European Commission and research projects like Euriphi[1], a healthy procurement market makes appropriate specifications for the medical technology sector, and does not focus solely on prices but on competition and innovation in order to improve patient outcomes and manage the total costs of care.

4.1 Policy recommendations from international organisations

The World Bank’s good practices in public procurement go well-beyond cutting the price. In its recommendations, the Bank emphasises the importance of efficiency and quality for goods and services that are procured by the public sector[2]. It stresses the relevance of strong and transparent procurement programmes that build viable partnerships and collaboration between the private and public sector, which are open to firms of all sizes.[3] The World Bank also highlights the role of competition without lowering the number of firms in the market, and points to the need for a long-term view on how the market delivers continuous innovation.

Primarily, the World Bank promotes public procurement systems that encourage value rather than volume. By design, a value-for-money approach to public procurement should entice the right suppliers to participate, with better bids received. Value-for-money does not mean the outcome of the public procurement bid should be the lowest possible price.[4] As the Bank’s own definition of value-for-money goes: “Price alone may not necessarily represent value for money”[5].

The World Bank acknowledges that centralised procurement can offer potential advantages in lowering the cost of the goods. However, their experts also highlight that traditional procurement approaches, based on lowest price conforming bids, have led to failure in the past in managing risks associated with buying and operating medical equipment. The World Bank cites feedback from the market stating that manufacturers and suppliers are unable to offer the most innovative solutions where the buyer’s focus is on the lowest cost conforming bid.[6] This precludes them from offering valued-added features to their bids as these are not recognised or credited. With a focus on lowest capital cost, suppliers are disadvantaged if their innovation involves necessary investments to deploy their medical technologies.

In the medical technology sector, the Bank has released material on procuring Medical Diagnostic Imaging (MDI) equipment.[7] The procurement of MDI equipment is moving rapidly towards value-based purchasing, which brings the focus on equipment that achieves the best healthcare outcomes, rather than equipment that simply satisfies technical requirements at the lowest possible price. The World Bank report emphasises the link between value-for-money in MDI equipment and innovation, which often improves the quality and efficiency of health services, thereby contributing to improved population health. The authors of the report also highlight the benefits of innovation such as decreasing waiting times, length of hospital stays, morbidity and mortality rates.

The Asian Development Bank (ADB) has set out guidelines for best practice in public procurement that largely endorse and adhere to the World Bank’s recommendations. According to the ADB, “good procurement follows the principles of economy (best value for money), efficiency (does not delay the project), fairness (does not discriminate against bidders on the basis of nationality, for example) and transparency (what is involved, how it is done, and the results are public).” The ADB emphasises the importance of a “system that encourages as many qualified firms as possible can compete on the basis of price, while ensuring quality objectives are met.” The ADB also discusses how procurement systems are sometimes used to address other commercial and social policy objectives, that measures are commonly incorporated in public procurement regulations to promote local business, develop small enterprises, further labour, and environmental standards, and assist disadvantaged groups. In principle, the ADB discourages these measures as it is felt they are best dealt with outside of the procurement system. Within the procurement system, collateral objectives are difficult to quantify, sometimes contradictory, and often contrary to the principles of fairness and obtaining best value for money.[8]

4.2 Policy recommendations from the EU

The European Commission, in its public procurement strategy for the healthcare sector, explicitly notes the need to address imbalances of power between providers and procurers because of limited competition due to barriers to entry and the monopsony power of the buyer. To avoid these power imbalances, the EU stresses the need for competency and detailed understanding of current and upcoming medical technologies from procurement authorities. According to the European Commission, successful procurement depends on several essential pre-conditions, such as strong political commitment, clear rules, trust between collaborating parties, and price transparency.[9]

The EU is also in favour of adding additional policy goals to public procurement that go beyond medical care. For the European Commission, procurement is a “strategic instrument providing policy levers for achieving government policy goals, such as innovation, the development of SMEs and objectives like public health and greater inclusiveness.” But in contrast to Chinese practices where public procurement has become a tool for industrial policy, the additional policy goals presented by the EU do not discriminate between domestic and foreign providers of medical technologies. In any case, the EU strategy acknowledges the risk of public procurement being captured by politics, and domestic companies’ bids being judged more favourably than the rest of the competition. For that reason, the European Commission has invested in anti-corruption and governance tools focused on transparency, oversight, and accountability.

The EU Public Procurement Directive acknowledges the trend towards “aggregation of demand by public purchasers with a view to obtaining economies of scale, including lower prices and transaction costs”. However, it recognises that “the aggregation and centralisation of purchases should be carefully monitored in order to avoid excessive concentration of purchasing power and collusion, and to preserve transparency and competition, as well as market access opportunities for SMEs” [10]. To that end, quality considerations are explicitly considered as an award criterion in many public tenders, as we saw in section 3.2, and contracting authorities are encouraged to “divide large contracts into lots” rather than aggregate demand in order to “better correspond to the capacity of SMEs”[11]. The policy outcome that is being pursued in Europe is one where the uptake of innovation – not just price – leads to a more resilient and sustainable healthcare.

European buyers and sellers of medical technologies share similar views with regards to the best procurement strategies in the health sectors. According to the Euriphi, a coordinating and supporting action funded under the EU’s Horizon 2020 programme that gathered the views of European public procurement organisations and health and social care providers, contracting authorities should stimulate competition in order to reduce the dependency on a small number of suppliers and offer opportunities to smaller or new market players, who may be responsible for placing new technology on the market, to complete. [12]

[1] European wide Innovation Procurement in Health and Care. European Union’s Horizon 2020 research and innovation programme. Accessed at: https://www.euriphi.eu

[2] The World Bank (2020, March 23rd) Global Public Procurement Database: Share, Compare, Improve! Accessed at: https://www.worldbank.org/en/news/feature/2020/03/23/global-public-procurement-database-share-compare-improve

[3] The World Bank (2020, April 14th) Procurement for Development Accessed at: https://www.worldbank.org/en/topic/procurement-for-development#1

[4] The World Bank (2017, February) Project Procurement Strategy for Development: Short Form Guidance. Accessed at: https://thedocs.worldbank.org/en/doc/123601488224013672-0290022017/original/ProcurementPPSDShortFormFeb2017.pdf

[5] Procurement Guidance. Value for Money. Achieving VfM in Investment Projects Financed by the World Bank”, page 1, World Bank, 2016

[6] Ibid.

[7] World Bank (2019, February) Medical Diagnostic Imaging (MDI) Equipment: Understanding how to procure medical diagnostic imaging equipment. Accessed at: https://thedocs.worldbank.org/en/doc/494021551733716736-0290022019/original/ProcurementGuidanceHowcontractMedicalDiagnosticlmagingspecialist.pdf

[8] Robert Rothery (n.d.) The Governance Brief: A Quarterly Publication, Governance and Regional Cooperation Division, Regional and Sustainable Development Department. Issue 3. Asian Development Bank.

[9] European Commission (2021) Public Procurement in Healthcare Systems: Fact Sheet Accompanying the Opinion of the Expert Panel on Effective Ways of Investing in Health. European Union.

[10] Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on public procurement. Recital 59.

[11] Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on public procurement. Recital 78.

[12] Euriphi (2020) European Cross-border Innovation procurement in health and social care: Legal Guidance. CMS.

5. Conclusion

The Chinese public procurement market in medical technology is becoming a monopsonistic market. A monopsony is equivalent to a monopoly, with the only difference being that in a monopsony, it is the single buyer who captures all the financial rewards of a contract.

The shift towards monopsony in the Chinese procurement of medical technology started in 2019 with its first centralised state procurement. Since then, this procurement policy has accelerated, and now includes several more medical technologies and centralised tenders on the national level. This procurement policy has led to price reductions, price convergence, a reduced reliance on many suppliers, and a reduction in the number of foreign suppliers.

- Price reductions have been sustained across medical technologies, with price cuts exceeding 90 percent in some medical products. Since centralised procurement began in China, the average price reduction in our sample of medical technologies in 2019, 2020, and 2021 has been 50 percent, 64 percent, and 79 percent respectively.

- Price convergence can be observed as the distance between the average and maximum price reduction offered by sellers. Our analysis shows that the small differences between the average and the maximum price reduction indicates that prices are converging towards the price offered by the most aggressive bidder.

- Reduction in suppliers is a natural development in a monopsonistic market. As prices are driven down and converge, it becomes difficult for some companies to participate without making a loss or without reducing the quality of the complementary services, leading to a market with fewer participants. We have compared the number of winning companies per one million people across medical technologies in China and the EU, and showed that in most cases the number of winning companies in the procurement of medical technology per one million people in China was substantially lower than in EU countries.

- Reduction in foreign suppliers is not necessarily an outcome of falling and converging prices but the result of a deliberate policy choice by the Chinese government to favour its domestic industry. Beijing has clearly expressed its desire for sector consolidation and several provinces are outspoken about their policies to advance Chinese manufacturers through public procurement. There is a target for the share of the medical technology market for tier 2 hospitals that should be represented by Chinese suppliers in 2030[1]. Industrial policy moves in the same direction of concentrating the market upon Chinese suppliers. Hence, monopsony is a feature – not a bug – in China’s industrial and procurement strategies. The analysis of the procurement data shows that Chinese companies represent more than half of the winning bidders in 26 of the 41 individual tenders of medical devices gathered in our dataset – a remarkable achievement considering that only a handful of Chinese companies belong to the group of the 50 largest manufacturers of medical technology in the world.

China’s policies towards monopsony in the public procurement market of medical technology goes against the policy recommendations and best practice guidelines for procurement put forward by international organisations such as the World Bank, the Asian Development Bank, and the European Union. These recommendations heavily emphasize the importance of competition without lowering the number of firms in the market, underlining the need for a long-term view on how the market delivers continuous innovation. Therefore, they strive to establish a price that is fair and reflects the desire to promote innovation, competition, and dynamism. These recommendations stand in stark contrast with current Chinese policies that are driving the Chinese market of medical technology towards monopsony. In a monopsonistic market, competition gets undermined because a vibrant market also requires competition between buyers. In the long-term, the danger for China is that monopsony will collapse the future market by making it less attractive for companies to innovate and compete.

Policymakers outside China are watching closely. Chinese centralised state procurement and the move towards monopsony have negative effects on other countries. First, Chinese direct financial backing, tax benefits, R&D support, and local content requirements favour the Chinese MedTech industry to the detriment of non-Chinese companies. Secondly, given the low prices achieved in Chinese centralised state procurements, there is a risk that firm’s margins are severely cut, putting a lid on global spending on R&D. The EU and the US should coordinate their policies to counter the monopsonistic tendencies of the Chinese market of medical technologies. Their markets for medical technologies are significantly larger than the Chinese market and Chinese companies rely on the US and the European market to maintain their growth. A sectoral dialogue on medical technologies in the context of the EU-US Trade and Technology Council (TTC) offers a setting to take these discussions forward and agree on policies to counter Chinese market distortions.

[1] U.S. Chamber of Commerce (2021). Understanding U.S.-China Decoupling: Macro Trends and Industry Impacts.