What Mode of Supply Will Matter the Most for the Future of Services Trade?

Published By: Lucian Cernat

Subjects: Sectors Services WTO and Globalisation

Summary

This Policy Brief looks at the latest trends in services trade and tries to show their importance, in its various manifestations, for virtually all countries in the world. The paper starts with a short history of trade in services across centuries. Fast forward to today’s realities, the paper uses the most comprehensive datasets documenting the latest trends in global trade in services by modes of supply, trying to fill a gap in trade policy analysis and providing new insights on the importance of different modes of supply for various countries. The paper concludes with some recommendations aimed at creating a bridge between the various policy priorities shaping the future of globalisation in coming years.

Disclaimer: the views expressed herein are those of the author and do not represent an official position of the European Commission.

1. Introduction

While politicians are nowadays focussed on a revival of industrial policies, often with a side effect of a growing trend in protectionist interventions, economists tend to follow the money and are excited about the potential offered by trade in services, as the most dynamic engine of the “new globalisation”. Richard Baldwin, for instance, argues that services are not only the future of globalisation but also a more promising path for developing countries interested in export-led growth than old-fashioned industrialisation (Baldwin et al., 2024). The Economist recently ran an article also exploring the development potential of services sectors (The Economist, 2024). So far, the focus of political attention and economic evidence do not always dovetail well. The relative neglect of services in policy debates is not that new. In the past, services used to be called “non-tradables”. For more than a decade, there has been a growing literature referring to the growing importance of services, and the servicification of manufacturing was already identified as a powerful transformative change (National Board of Trade 2012, Cernat and Kutlina-Dimitrova, 2014). Yet, few of the recommendations were followed up with concrete policy initiatives.

Despite their relative neglect, services were always key to globalisation. This paper looks at the latest trends in services trade and tries to show their importance, in its various manifestations, for virtually all countries in the world. The paper starts with a short history of trade in services across centuries. Then we fast forward to today’s realities, based on the most comprehensive datasets documenting the latest trends in global trade in services. The paper concludes with some recommendations aimed at creating a bridge between the various policy priorities shaping the future of globalisation in coming years.

2. A short history of trade in services: we have always traded services!

It is hard to imagine our world without services trade. We tend to ignore the crucial importance of maritime transport services, one of the earliest manifestations of globalisation. From early stages of our evolutionary journey, we engaged in trade across seas. International maritime transport, a service classified nowadays under GATS mode 1, was the backbone of our civilisation.

But maritime transport was not the only transformative service in our societies. Education services were another powerful driver of economic dynamism. As early as 12th and 13th century, a few universities in Europe became major exporters of education services. The Coimbra University in Portugal, one of the oldest in Europe, became the source of knowledge not only in the Iberian Peninsula but for the whole world. At some point, the so-called “Conimbricense Course” was the most popular university textbook, exported from Portugal by European missionaries to many other countries around the world, all the way to China. Exporting and importing knowledge took place not only by selling textbooks but also by student exchanges. In the 12th century, Sorbonne University in Paris was a major destination for English scholars. But in 1167, the King Henri II banned English scholars from going to Sorbonne. This ban on what we nowadays call mode 2 services, forced many scholars to study in England and contributed to the rapid development of Oxford University as one of the most prestigious academic centres.

Not only scholars but artists too travelled internationally, delivering their services. In 1515, French King Francis I hired Leonardo da Vinci as ‘The King´s First Painter, Engineer and Architect’. Da Vinci relocated to France and offered his unparalleled services to the French king, under what nowadays would be called cross-border public procurement via mode 4 services exports. With the same occasion, da Vinci also exported probably the most famous mode 5 services: some of his sketches and artworks, including the unfinished Mona Lisa!

Many centuries later, another famous artist, Constantin Brancusi, also tried to export his genius mode 5 services to the United States. However, unlike 16th century French authorities who did not stop da Vinci at the Franco-Italian border, the U.S. customs considered the Brancusi’s bronze sculpture not as duty-free artwork but as a metallic object subject to 40 percent custom duties (Pellen, 2023). Brancusi appealed the decision and the dispute led to one of the first art vs trade law litigation cases. The final ruling allowed the duty-free importation of the sculpture and essentially admitted that the difference between a piece of metal and a masterpiece is made by artistic genius and by the embedded mode 5 services.

3. Services trade in the 21st century: a tale of five modes

With the adoption of the General Agreement on Trade in Services (GATS) at the WTO, combined with a myriad of free trade agreements (FTAs) containing services provisions, global trade in services is nowadays governed by a comprehensive set of trade rules affecting the nature and the modalities in which companies engage in trade in services across borders. The fundamental logic of services trade rules relies on the so-called “modes of supply”, the idea being that the same type of service can be supplied internationally under different modes. The GATS, and pretty much all the existing bilateral FTAs, define four modes of supply for services trade:

- Mode 1: Cross-border supply – This mode typically covers digital services trade and international transport (shipping, air transport).

- Mode 2: Consumption abroad – This mode of supply primarily captures international tourism activities.

- Mode 3: Commercial Presence – Under this mode, companies establish a physical presence abroad, such as an office or subsidiary, to deliver services to foreign customers.

- Mode 4: Temporary Movement of Natural Persons – This mode refers to the temporary movement of service suppliers, or natural persons, into a foreign country to deliver a specific service. Companies utilise this mode by sending their workers abroad to perform and deliver the service in person.

Despite clearly defined modes of supply concepts, getting the trade statistics for all of them is harder than it seems. Particularly problematic is the mode 3 services, which are not usually captured in Balance of Payments (BoP) services trade statistics. That leads to one of the most misleading gaps in trade statistics: mode 3, the biggest mode of supply for services, bigger than all the other GATS modes taken together, is systematically missing from official trade statistics. This omission significantly undervalues global trade in services and leads most trade experts to wrongly conclude that world trade in services is much smaller than trade in goods. One typical example is found in the regular WTO statistical reports, where world trade in goods is estimated at $21 trillion in 2021, compared to $5.8 trillion for commercial services (WTO, 2022). Based on these incomplete services trade statistics, the prevailing but erroneous view both among policymakers and economists is that trade in goods is several times higher than trade in services.

To fill the mode 3 gap (FDI-driven services) in official trade statistics, the WTO (in collaboration with several WTO members and other international agencies) launched the Trade in Services by Modes of Supply (TISMOS) database, where mode 3 estimates are included. Once mode 3 services are taken into account, global services trade reached over $17 trillion in 2021, which is almost on par with total trade in goods and becomes bigger than world trade in manufacturing, valued at $14 trillion.[1]

The role of services trade becomes even more important when considering mode 5 services trade. Apart from “direct” GATS services trade, services can be traded internationally also in an “indirect” way, as part of exported goods. Think, for instance, of the software incorporated in the device (a laptop or mobile phone) you use to read this policy brief. Or think of the value of the design services incorporated in the last pair of shoes you bought, in case they were imported. Such “services in boxes” are subject to GATT rules and are captured under the so-called “Mode 5” services trade (Cernat and Kutlina-Dimitrova, 2014).[2]

While the TISMOS database only covers the four GATS modes of supply, mode 5 services can be derived from the OECD Trade in Value-Added (TiVA) database (OECD, 2024). Combining the TISMOS and the TiVA databases allow us to compare the relative importance of all five modes of supply in world total services trade (Figure 1). Taking the share of embedded services from the TiVA database and applying to the value goods trade allows us to estimate the value of mode 5 services exports for all the individual countries contained in the TiVA database. For the missing countries, the share of embedded services in goods exports for the “rest of the world” was used for such estimates. If we extract the value of mode 5 services from global trade in goods, then world trade in service is no longer a small fraction of goods trade but skyrockets to around $22 trillion and becomes actually larger than trade in “real” goods.

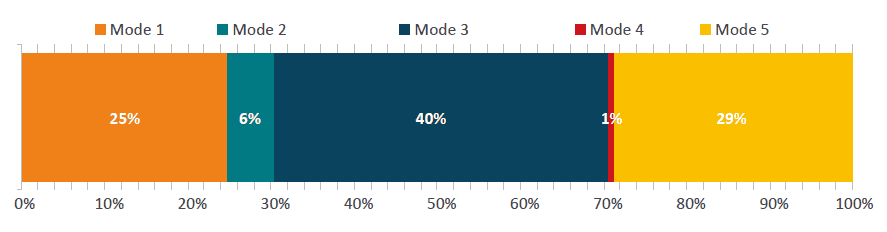

Figure 1. World trade in services by modes of supply, as a percentage of total

Source: Author’s calculations based on the TISMOS and TiVA databases. Data for 2021. Mode 5 estimates are based on the value of embedded services in goods exports.

From Figure 1 we notice that mode 3 is the largest mode of supply in world trade in services. At the same time, we also observe that mode 1 and mode 5 combined represent more than half of total service trade. Interestingly, mode 5 services are the second most important mode of supply and represents almost a third of the total value of global trade in service. Given current technological trends, it is expected that both mode 1 and mode 5 will continue to remain the most dynamic modes of supply and continue to capture a large share of world trade in services.

[1] The WTO TISMOS services statistics are still experimental. In February 2023 Eurostat also published experimental national data on mode of supply. In 2024, EU countries are expected to transmit to Eurostat, for the first time, official services statistics by mode of supply.

[2] With the exception of certain specific provisions on customs valuation and processing trade rules, existing trade rules and agreements do not contain dedicated provisions for mode 5 services, i.e., embedded services in exported goods.

4. Going beyond world averages: a detailed country-level assessment

When considering all five modes of supply, the overall picture of world trade in services provides a powerful message: global trade in services is far more important than most people think. This conclusion essentially hinges on the crucial contribution of mode 3 services, that are generally missing from official trade statistics. Yet, world shares can be misleading. Are mode 3 services the dominant mode of supply for all countries in the world? The TISMOS and TIVA databases offer the possibility to analyse the relative importance of all five modes of supply at detailed country level.

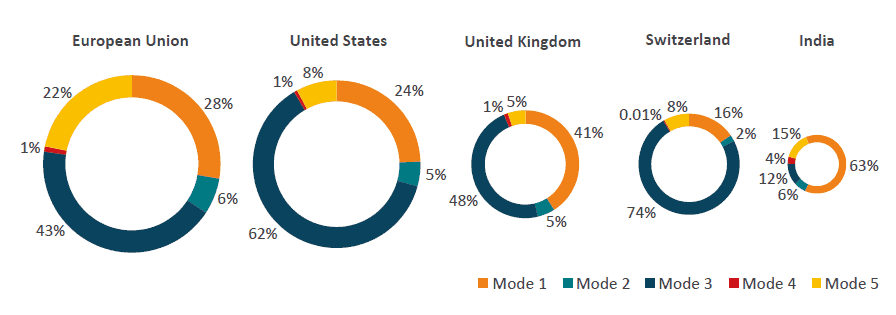

While at world level mode 3 is the dominant mode of supply, when looking at the breakdown of services exports by modes of supply at country level, the reality is very different. Take, for instance, a handful of major players in global services trade: the European Union, United States, United Kingdom, Switzerland, and India (Figure 2).

Figure 2. Services by modes of supply: a tale of five WTO members

Source: Author’s calculations based on the TISMOS and TiVA databases. Data for 2021. The size of the charts is proportionate to the total value of services exports.

Whereas the EU comes fairly close in its structure of services exports to the world averages, the other countries differ widely. In the United States and Switzerland, mode 3 (FDI-driven) accounts for a much bigger share than the world average (62 percent of total services exports and 74 percent, respectively). At the same time, mode 3 only generate 12 percent of India’s services exports, which are dominated by mode 1 services (63 percent). Mode 1 also has a very large share in UK services exports, accounting for 41 percent compared to the world average of 25 percent.

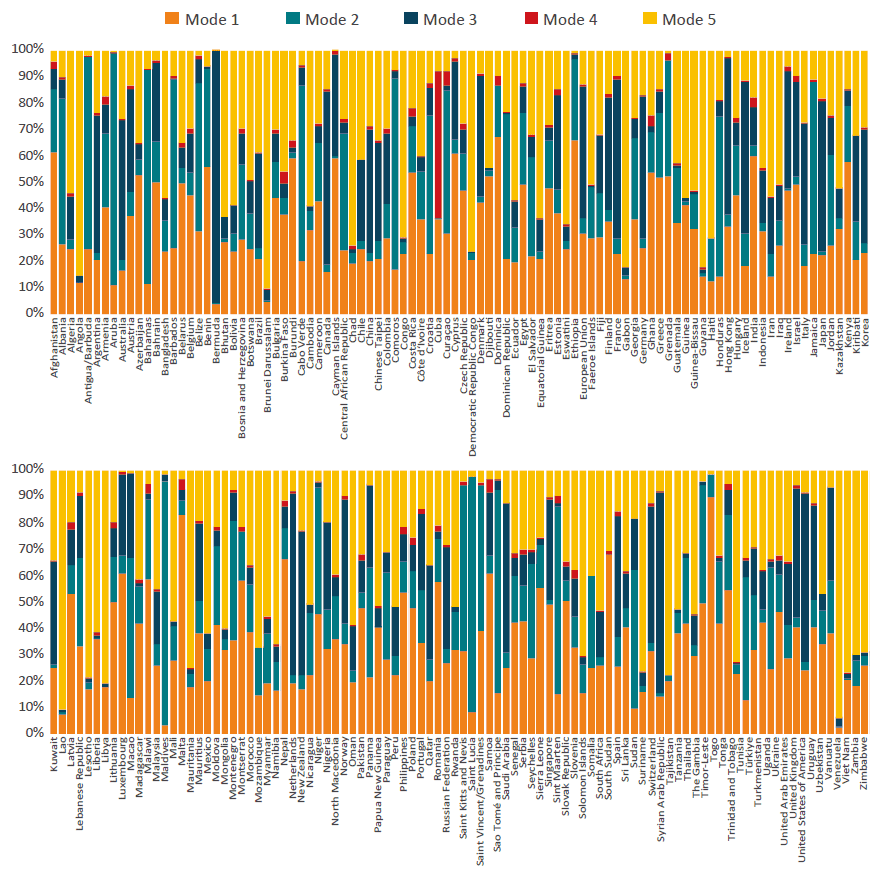

The wide diversity of services trade patterns becomes clearer when we plot the country-by-country services exports broken down by modes of supply (Figure 3). In reality, mode 3 is the dominant mode of supply for only a minority of country, mostly developed or major emerging economies. Instead, while at global level mode 2 services exports where rather marginal, accounting for 6 percent of global services exports, Figure 3 indicates that mode 2 services, like tourism, are the most important mode for many countries, notably developing countries. Another insight that can be derived from Figure 3 is the overwhelming number of countries that rely on mode 5 services, as their main vehicle for services exports. Mode 1 (essentially transport and digital services) remain important for many countries around the world. Above all, what Figure 3 reveals is an extraordinary diversity across countries in their services trade structure, that would otherwise remain hidden behind world averages.

Figure 3. The breakdown of services trade by modes of supply at country level (percentage of total services exports)

Source: Author’s calculations based on the TISMOS and TiVA databases. Data for 2021. Mode 5 estimates are based on the value of embedded services in manufacturing exports.

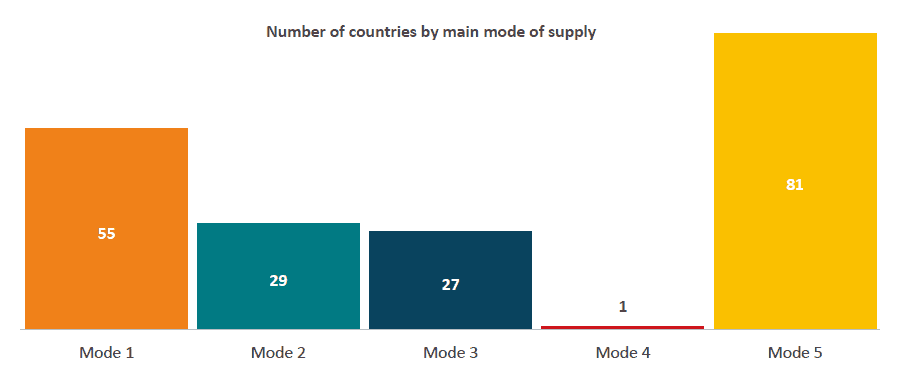

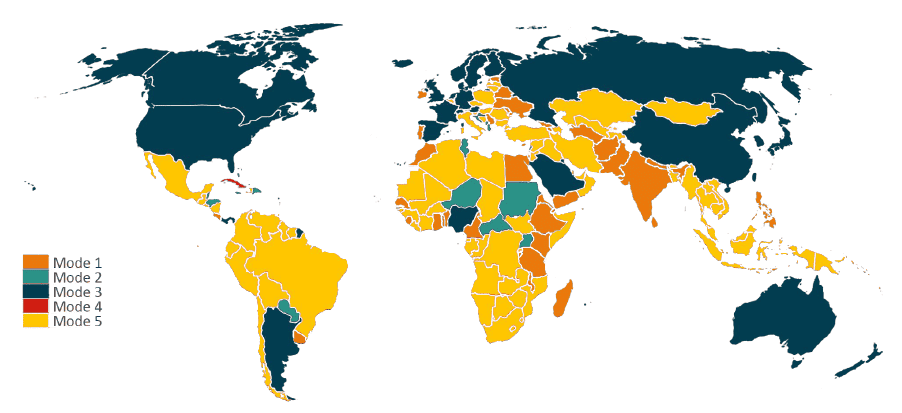

Figure 4 summarises this wide heterogeneity found across countries into a simple comparison, whereby countries are clustered in five groups based on the most important mode of supply. It turns out that, whereas in value terms mode 3 is the most important mode of supply worldwide accounting for 40 percent of the global trade in services, at individual country level this is no longer the case. Instead, for 81 countries the most important mode of supply is mode 5 services, followed by mode 1 (55 countries), and mode 2 (29 countries). The only country that relies on mode 4 as the main mode of services exports is Cuba.

Figure 4. The distribution of countries by main mode of supply

Source: Author’s calculations.

The geography of the most important mode of supply at world level is also quite revealing (Figure 5). We observe that mode 1 is the main mode of supply for a very diverse set of countries including EU member states (Ireland, Portugal), as well as several developing countries in Africa (Morocco, Cameroon, Kenya) and Asia (India, Pakistan, Philippines). In contrast, mode 3 is the main mode of supply mainly for OECD countries and several developing and emerging economies (China, Argentina, Saudi Arabia).

Figure 5. Mapping the main mode of supply for services exports

Source: Author’s elaboration based on data from the TISMOS and TiVA databases. Data for 2021.

Figure 5 also clearly shows that Mode 5 is the most important services mode of supply for a large number of countries across all continents. It is especially important for most Latin and Central American countries, for a large number of African countries and for the ASEAN region. The next section takes a closer look at the implications of this specific mode of supply, which typically receives less attention compared to the GATS modes of supply.

5. Mode 5 services: are they the future drivers of global competitiveness?

As many other analyses have shown, mode 5 services (like engineering, design, banking, software and logistics) play an increasingly important role in global trade flows, as a direct contributor to the value-added incorporated in goods products (see, for instance, Baldwin et al. 2023 and Blazquez et al. 2020). Several authors have also suggested that mode 5 service affect firms’ export capabilities positively and that buying more such intermediate services is linked to higher firm-level export intensity (Lodefalk 2014) as well as to total factor productivity growth, especially in the high-skilled intensive industries (Wolfmayr 2008).

Several mode 5 services (such as product design, R&D, engineering and IT services) are high-value added and intrinsically linked to new technologies. Such new technologies are now adopted on a large scale not only in manufacturing activities but also in agriculture or mining, two sectors that have a sizeable economic footprint in many developing countries. Mining companies use advanced sensors and Internet of Things (IoT) functionalities to reduce the maintenance cost of their equipment. Running earth-moving machines in remote and harsh environments is costly if such equipment breaks down often and in unpredictable ways, making the repair process long and difficult. Introducing remote sensors and IoT technology in mining equipment, combined with predictive software analytics, allows mining activities to be much more efficient (Zvarivadza et al, 2024). Agriculture is also using such technologies and is set to increase its mode 5 services content, notably in terms of digital technologies. There are plenty of examples, from the ‘internet of wine’ (Martinez, 2014) to the “internet of bananas” (Rajak et al, 2023), showing the significant potential offered by new technologies and associated mode 5 services for agricultural exporters.

Therefore, against this background, the fact that mode 5 is the most important mode of supply worldwide is not that surprising, given that for the vast majority of developing countries merchandise exports are still more important than GATS services exports. Even for India, a country that turned services trade in a powerful development tool, the value of merchandise exports is larger than services exports. This fact invites for a more in-depth reflection from policymakers interested in using trade as an engine for development. As Antimiani and Cernat (2018) have argued, liberalising mode 5 services worldwide would hold great promise for the integration of developing countries exports in global supply chains, and global trade could increase by over $500 billion. In terms of development gains from mode 5 liberalisation, among the key beneficiaries would be African countries (notably LDCs), India and ASEAN countries.

6. Conclusions

Based on the current trade data, it seems that the future of global trade is already in services, as their total value (under GATS and via mode 5 combined) exceeds the value of world merchandise trade. However, for many developing countries, it would be premature to put all eggs in the GATS services trade basket, even though as The Economist recently documented, there are examples of developing countries making great strides in certain services areas (e.g. tourism, audiovisual, computer and telecommunication services). Yet, for the overwhelming majority of developing countries, the present is still defined by trade in goods. That means that mode 5 services are a safe bet for a dual track development strategy relying on both current trade in goods and future services trade.

Having said that, given the significant role played by mode 1 (digital) services for a growing number of developing countries, it would make perfect sense for them to get more actively involved in global supply chains and in digital trade negotiations, either as part of the recently concluded plurilateral E-commerce Agreement at the WTO (European Commission, 2024) or as part of bilateral FTAs and other trade “mini-deals”. Putting in place trade facilitation measures and moving away from paper-based procedures to digital trade tools may also create opportunities for both trade in goods and services to play their developmental role. Finally, for countries that have a comparative advantage in mode 2 services (tourism) the challenge is to ensure that the sector remains resilient and sustainable in the future. A good place to start would be to adopt the key performance indicators contained in the Sustainable Tourism Benchmarking Tool (Cernat and Gourdon, 2012).

To conclude, services trade is already more important than most people think when looking only at the usual trade statistics. Hence, to get an accurate picture of the ongoing trade realities and the trade policy priorities, one needs to go beyond official statistics and rely on other databases such as TISMOS and TIVA. The good news is that such data is now more readily available and allows policy makers to get a complete “cartography” of their national competitive advantage in services by mode of supply, and calibrate their trade policy priorities accordingly.

References

Antimiani, A. and Cernat, L. (2018) Liberalizing Global Trade in Mode 5 Services: How Much Is It Worth?, Journal of World Trade 52(1): 65 – 83.

Baldwin, R., Freeman, R. and Theodorakopoulos, A. (2024) Deconstructing Deglobalization: The Future of Trade is in Intermediate Services, Asian Economic Policy Review 19(1):18-37.

Blazquez L, Diaz-Mora C. and Gonzalez-Diaz, B. (2020) The role of services content for manufacturing competitiveness: A network analysis. PLoS ONE 15(1), January.

Cernat, L. and Kutlina-Dimitrova, Z. (2014) Thinking in a box: A “mode 5” approach to services trade, Journal of World Trade 48(6):1109 – 1126.

Cernat, L. and Gourdon, J. (2012) Paths to success: Benchmarking cross-country sustainable tourism, Tourism Management 33(5): 1044-1056.

The Economist (2024) Will services make the world rich? American fried chicken can now be served from the Philippines.

European Commission (2024) Commission welcomes text of global E-Commerce Agreement negotiated at the WTO. Available online at: https://ec.europa.eu/commission/presscorner/detail/en/ip_24_4022.

Lodefalk, M. (2014) The Role of Services for Manufacturing Firm Exports, Review of World Economics 150: 59–82.

National Board of Trade (2012) Everybody is in Services – The Impact of Servicification in Manufacturing on Trade and Trade Policy, National Board of Trade, Sweden.

OECD (2024), “Trade in value added”, OECD Statistics on Trade in Value Added (database), https://doi.org/10.1787/data-00648-en (accessed on 01 July 2024).

Pellen, G. (2023) Brancusi v. United States: Modern Art on Trial. France-Amerique, November 2023. Available online at: https://france-amerique.com/brancusi-v-united-states-modern-art-on-trial/

Rajak, P., Ganguly, A. Adhikary, S. and Bhattacharya, S. (2023) Internet of Things and smart sensors in agriculture: Scopes and challenges, Journal of Agriculture and Food Research 14.

Wolfmayr, Y. (2008) Producer Services and Competitiveness of Manufacturing Exports, FIW Research Report no. 9, Vienna: Austrian Institute for Economic Research (WIFO).

WTO (2022) World Trade Statistical Review 2022. World Trade Organisation: Geneva.

WTO (2024) Trade in Services by Mode of Supply (TISMOS) database. Available online at: https://www.wto.org/english/res_e/statis_e/trade_datasets_e.htm.

Zvarivadza, T., Onifade, M., Dayo-Olupona, O., Said, K. O., Githiria, J. M., Genc, B., & Celik, T. (2024). On the impact of Industrial Internet of Things (IIoT) – mining sector perspectives. International Journal of Mining, Reclamation and Environment, 1–39.