How Huawei Weathered the Storm: Resilience, Market Conditions or Failed Sanctions?

Published By: Hosuk Lee-Makiyama Robin Baker

Subjects: Digital Economy Far-East North-America

Summary

Huawei is exhibiting stoic resilience in the face of US sanctions, economic downturns, and the slow pace of 5G investments. There is a narrative that the company has been propped up by the Chinese government, but the key to Huawei’s resilience is multifaceted. Through pre-emptive stockpiling and ingenuity, the company has continued to fulfil its base station orders and defend its market shares abroad.

Concurrently, Huawei has made an autonomous business decision to reinvest its earnings and intensify R&D to secure its supply chains against political risks and diversify into new business areas. Successful forays into semiconductors, cloud services and energy grids have also been facilitated by a capital structure that lends itself to long-term planning.

Huawei’s survival is not necessarily a lesson in the futility of sanctions to stifle technological progress. However, it does show that muddled political objectives and inconsistent implementation will yield potentially contrary outcomes. At the same time, factors that contribute to Huawei’s resilience also highlight the infighting and vulnerabilities of listed firms like Mavenir, Ericsson and Nokia.

Introduction: Sanctions and Downturns

Since 2018, successive US administrations have exercised a range of policy levers to penalise Huawei as a national security threat. Within the US, the FBI has warned against the purchase of Huawei smartphones citing their capacity to facilitate ‘undetected espionage’. Although Chinese kit vendors have been de facto banned from the US’ major wireless and fixed-line infrastructure since 2012, the FCC has allocated more than $5 billion to replace Chinese equipment.

Needless to say, these “rip and replace” funds have not come to much use – as there was almost no equipment to replace. Beyond its own borders, the US government initially expended significant political capital on persuading third countries against the deployment of Chinese 5G equipment – before turning its focus on its own entry into the 5G market.

Most significantly, the Commerce Department added Huawei and its subsidiaries to the Entity List in May 2019. Under this designation, Huawei’s purchases of US components or licensing US software and IPs – notably on virtualisation software and middleware – remain subject to a government-issued waiver. However, successive administrations have granted waivers to many of Huawei’s suppliers and the wider Chinese tech industry.

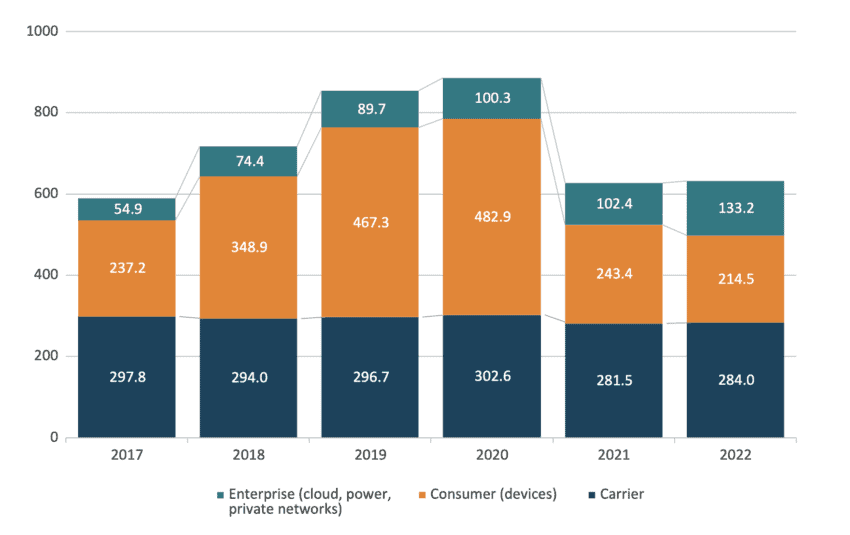

Nevertheless, trade restrictions have had some impact on Huawei’s handset operations than its base station business. In particular, BIS Entity List designation has hampered its consumer business group, which manufactures handsets and devices, and relies on an abundance of sub-7nm chipsets and Google’s Android ecosystem. In November 2020, Huawei was forced to offload its mass-market device brand, Honor, to a state-owned consortium due to the ‘persistent unavailability of technical elements’. While the sale provided some temporary reprieve, consumer group revenues fell by 50% in 2021, underscoring a 29% decline in total annual revenues during the same year.

Figure 1: Huawei annual revenue by business group (CNY billion) Source: Huawei financial accounts.

Source: Huawei financial accounts.

Although many have questioned Huawei’s ability to survive, it has exhibited remarkable resilience in the face of high-risk vendor designations and extensive export controls. Huawei’s carrier division (i.e. telecom equipment) has been a bedrock, while the decline in consumer group revenues has been largely arrested by the development of indigenous alternatives to US technology. Finally, its highly profitable Enterprise Business Group – including cloud, IoT, and private networks – has burgeoned, with sales growing by 140% in just five years.

Over the first half of 2023, Huawei generated CNY310.9 billion in revenue, representing a year-on-year increase of 3.1%. Net profit margins also climbed to 15% during the same period. Income remains down in pre-sanctions years, but Huawei’s rotating chair has declared a return to “business as usual”, with US trade wars simply representing “a new normal”.

At first glance, Huawei’s relative stability seems even more remarkable in the context of a stuttering network equipment market. In response to poor uptake and rising interest rates, Western operators have curtailed their 5G investments, with Huawei’s principal competitors issuing profit warnings to shareholders. In response to ongoing market uncertainty, Nokia has also announced plans to slash around 16% of its workforce from 2024, with Ericsson likely to follow suit.

It is tempting to assume that Huawei’s survival is solely attributable to massive state subsidies. However, the reality is more nuanced with fiscal policy complemented by research, development, and diversification, as well as the indecisive application of US sanctions.

Anticipating Supply-chain Constraints

As we see, Huawei’s financial reports and market data suggest stable revenues from Huawei’s carrier division have been central to its survival. The Trump administration began legislative action against Huawei in May 2018 but was not designated to the Entity Listed for another twelve months. Furthermore, a Temporary General License continued to permit limited transactions with Huawei until August 2020, provided those transactions related to certain critical activities, including “those necessary for the continued operations of existing networks and equipment”.

This twenty-seven-month window afforded Huawei time to source alternatives for the supply of components unlikely to be covered by an export waiver. By the end of 2019, Huawei was able to produce its 5G base stations without US parts. Where components still relied upon some US IP during the production process, Huawei was free to amass significant stockpiles. For instance, the company placed enormous orders for its 7 nm Tiangang core chips, a self-designed application-specific integrated circuit (ASIC) generally manufactured by TSMC of Taiwan, using US wafer fabrication equipment (WFE). TSMC continued to fulfil these orders until the expiration of the Temporary General License and shipped more than two million units in total. Benefitting from the lengthy product cycles associated with 5G network equipment, Huawei accumulated stockpiles sufficient for several years’ worth of orders.

Aside from selected cutting-edge inputs, Huawei has also enjoyed relatively unfettered access to components. Even in 2023, the company continued to rely on US semiconductor firms for inputs for its long-range base stations. The likes of Texas Instruments, Broadcom and Onsemi have helped to supply Huawei with high-end FGPAs (reprogrammable ICs), power devices, and digital signal processing (DSP) chips for its macro-cells (Caijing, 2023).

As for the supply chain challenges, it would be oversimplistic to say that US sanctions have had no effect on Huawei’s carrier division – but it is clear that US export controls affected the device business – which is an unprofitable side business – rather than its core business in carrier equipment.

Nonetheless, Huawei’s carrier business would unveil new baseband cards every six months prior to the imposition of restrictions. Chipsets were continuously upgraded to boost the transceivers on its high-performance antennas (so-called “massive MIMOs”). But with limited access to Taiwanese and Korean foundries, Huawei has retained the same baseband card for nearly four years – a design built around Balong 5000 chipset, a 7 nm ASIC that Huawei first introduced in January 2019.

While Ericsson and Nokia have moved on to more power-efficient 5 nm ASICs and beginning to leverage new 3 nm nodes, Huawei is packing more chips onto each card to keep pace on mMIMOs. Its power performance is suffering, but Huawei offset these gaps by adjusting its prices to compensate for the higher electricity bills for its customers

A Profitable Home Market

Instead, it is appropriate to conclude that lengthy product cycles and the gradual and misfired punitive measures have offered Huawei some breathing space in sourcing critical inputs to fulfil orders. Crucially, the Chinese vendor has been able to service China’s gargantuan 5G market. As Ericsson and Nokia have been side-lined in retaliation for the West’s crackdown, Huawei has retained a 60% share of the Chinese market that accounted for around 40 to 55% of the global total between 2019 and 2022.

As China’s leading supplier, Huawei is expanding abroad with a chunk of the global market already in its pocket, where it is positioned as a premium vendor with pricing above its European competitors. Therefore, it is in a unique position to recoup the extremely high fixed costs associated with this industry and act more aggressively when it exports abroad. By contrast, the European 5G vendors are likely to draw as much as two-thirds of their profits from the US market, which is both smaller and more fragmented than the Chinese market.

Huawei’s attractiveness is further enhanced by Chinese export credits issued by the China Development Bank and China Ex-Im Bank. These institutions are progressively expanding their project financing and export credits to match the more sophisticated structured financing options offered by the US and Nordic governments. In addition, Chinese infrastructure vendors benefit greatly from being a part of the Digital Silk Road, which operates under the Belt and Road Initiative (BRI). This global infrastructure initiative – widely recognised as the world’s largest – combines overseas development aid, technical assistance and industrial cooperation, which the EU’s Global Gateway or the Quad cannot match.

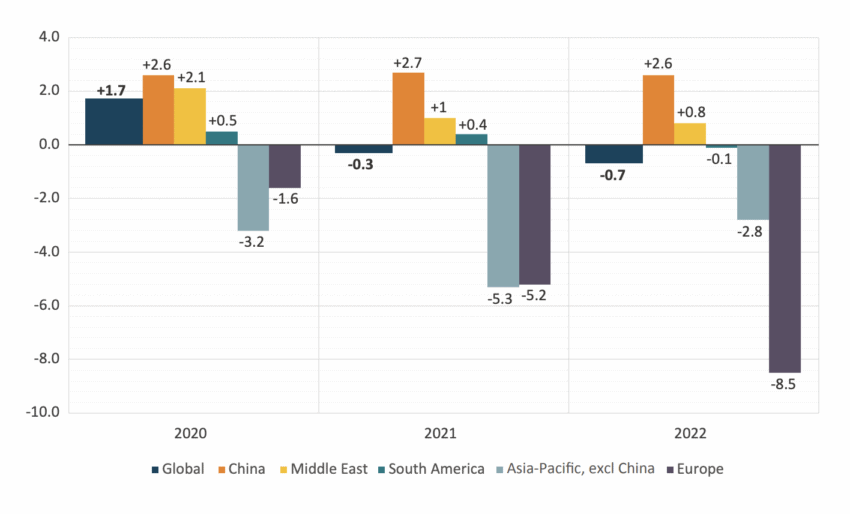

By having the right home market, Huawei’s global market shares have remained remarkably stable. Restrictions were limited to relatively small markets (e.g., the UK, Scandinavia, Japan or Australia), accounting for less than 4% of the global market. Germany, the largest European market, has also refrained from excluding any Chinese vendors, further softening the decline. In sum, any decline in European low-margin markets was offset in absolute terms by China and the emerging economies, including major 5G contracts in Brazil and Saudi Arabia that helped Huawei to retain its RAN market share.

Figure 2: Approximate changes in Huawei’s share of mobile RAN markets vs 2019 Source: Dell’Oro, 2020; own analysis

Source: Dell’Oro, 2020; own analysis

Avoiding Unnecessary Distractions

Looking ahead, Huawei’s focus on relevant research and standardisation work has only enhanced its resilience as a network vendor. At the behest of telecom operators and Big Tech lobbyists, Ericson and Nokia have committed significant time and resources to the development of Open RAN. Contrary to single-vendor solutions, this industry concept aims to disaggregate the RAN portion of a mobile network by combining hardware and software components from different companies via open interfaces, virtualisation, and cloud computing.

The leading open product development initiative is taking place within the O-RAN Alliance – a consortium controlled by telecom operators, Chinese state-owned enterprises and US cloud businesses. The Biden administration is directing a minimum of US$1.5 billion in direct subsidies towards this endeavour, hoping to cultivate a U.S. alternative. Despite these efforts, O-RAN has not achieved a complete commercial 5G deployment, and O-RAN-based market entrants (such as Mavenir) are projected to represent less than 1% of 5G mobile sites by 2025.

Unlike Ericsson, Samsung and Nokia, Huawei refused to jump on the Open RAN bandwagon – and had many good reasons to do so. To begin, Huawei may have foreseen the obstacles against mass adoption and profitability, given its many performance constraints.

Rightly, the O-RAN code and designs are likely to eventually catch up in the coming years, and integrated vendor solutions have so far proven to be superior to O-RAN designs on security, performance and total cost of ownership. Also, very few operators can afford the overheads associated with managing more than one vendor. Most operators – not least among Huawei’s customers in emerging countries with electricity shortages – have little to gain from assembling a power-hungry O-RAN network from parts. Other customers may not be keen to swap Huawei for a dependency that relies on the dominant US players in cloud or virtualisation.

However, non-commercial factors may have played a bigger role in Huawei’s decision to shun O-RAN. The Chinese contingent of the O-RAN Alliance is led by its domestic rival (and state-owned) ZTE, who was unlikely to welcome Huawei into the consortium. Also, O-RAN specifications are based on surplus stocks of Intel’s standard PC (x86) chipsets, and the chipmaker’s license to supply Huawei is rumoured to have expired in 2021.

Regardless of its motivations, Huawei did not divert its R&D resources into a concept with limited commercial viability during the current cycle. Seen from Huawei’s perspective, the current market is not only distinguished by the witch-hunt against itself – but also by a conflict between the Biden administration and Europe ever since the O-RAN Alliance was mis-sold to the Biden administration as an “American alternative to Huawei”.

This view also explains why the US diplomacy may have misfired: Given that Western vendors are unable to grow their market shares in China where Huawei and ZTE are enjoying reasonable profits, the shift in US strategy – from promoting “trusted vendors” to trying to spawn a US alternative – only resulted in eroded profitability for the European vendors, or market shares swapping hands among Western vendors. To take a recent example, in December 2023, AT&T took the decision to replace its brand-new Nokia 5G equipment with an O-RAN-compliant network delivered by Ericsson.

Development of Its Own Chipsets

In tandem with efforts to build 5G base stations without US inputs, Huawei is working with indigenous suppliers to produce accessible semiconductors as it resurrects its consumer division. Specifically, Huawei is investing considerable resources to secure foundries for its chipset designs.

Huawei and Chinese wafer-fabrication equipment (WFE) manufacturers are making progress on foundry, and HiSilicon (a Huawei subsidiary) recently unveiled its Kirin 9000S 7 nm system on a chip (SoC) that meets the bandwidth and power requirements for high-end 5G handsets.

The new SoC is produced by Shanghai’s Semiconductor Manufacturing International Corporation (SMIC), another Entity Listed firm. Many of the tools required were US technologies, and SMIC’s success arguably provides further evidence for limitations to export controls. In some instances, SMIC procured WFE via proxies that received an export waiver from BIS. In other instances, it is alleged that US lobbyists drafted export controls in a deliberately vague and circumventable manner (Fuller, 2023). Elsewhere, SMIC was also able to purchase Deep Ultraviolet (DUV) lithography machines and other equipment from Dutch and Japanese firms during a grace period before these countries began to enforce their own export controls.

SMIC’s 7nm process may be sub-par in that it produces much lower yields compared to TSMC and Samsung’s EUV-based foundries. But through innovation and creativity, Huawei is now sourcing the inputs required to compete in current generation smartphones and other connected devices. Drawing on Kirin 9000S chips and HarmonyOS, Huawei launched the Mate 60 Pro – its first post-sanctions smartphone with 5G capabilities – in August 2023. Despite direct competition from Apple’s iPhone 15, handset sales exceeded 1.2 million units during the first six weeks. As domestic chip production increases, Huawei is aiming to double its smartphone sales to 70 million units in 2024. This represents considerable progress in a market that relies on access to chipsets, even if it is somewhat short of the 240 million units shipped by the company in 2019.

In conclusion, the US export controls may have graced Apple’s iPhone from a competing product from Huawei for three years but achieved little else: Instead, the measures provided strong commercial and political incentives for China’s indigenous sub-7nm and EUV capabilities.

R&D Towards Diversification

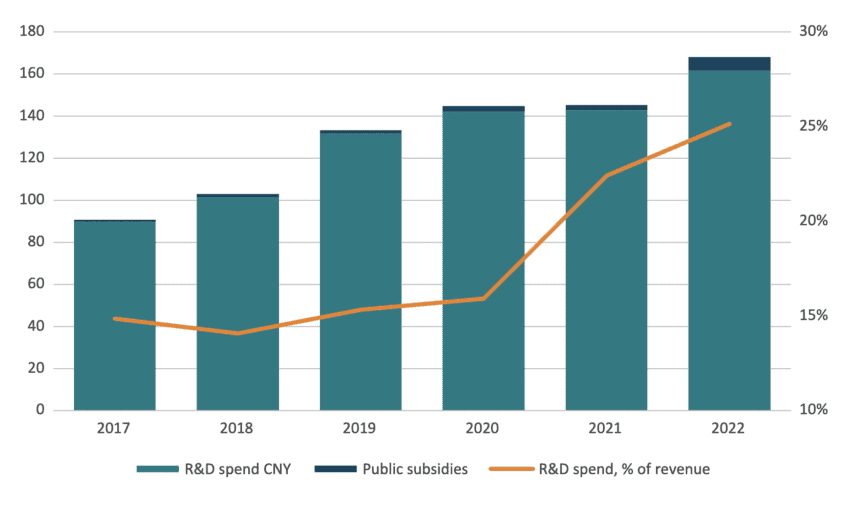

Rather than uncertain concepts like Open RAN, returns from Huawei’s core business interests have been reinvested in a massive R&D budget that is central to the firm’s long-term survival strategy. In 2022, Huawei’s R&D budget reached 161.5 billion RMB and was surpassed only by Amazon, Meta, Alphabet and Apple. Huawei’s intensification of R&D is even more evident when expenditure is considered as a proportion of its sales. Huawei spent a quarter of its revenue on R&D In 2022, compared with 17% for Ericson, 10% for Alphabet, and just 7% for Apple.

Huawei’s R&D is far more diversified and spread across more business areas than its direct competitors, and productivity and scalability vary between industry cultures. For example, Apple’s R&D budget for its devices is as large as the entire global turnover for the network equipment industry taken together. Nonetheless, relative to its nearest competitors, Huawei has spent a relatively large portion of its revenues on innovation and commercialisation. This plays a key factor in its survival.

While a small and growing proportion of Huawei’s R&D expenditure comes in the form of government subsidies, criticisms of an overreliance on direct incentives appear unfair. In 2022, government subsidies amounted to just 4% of Huawei’s R&D budget. Rather, the company has made an autonomous business decision to intensify its R&D to develop alternatives to Western components and diversify into new business areas.

Figure 3: Huawei research and development budget (CNY billion) Source: Financial Times, 2023

Source: Financial Times, 2023

For instance, Huawei has purposefully heightened its concentration on more lucrative non-hardware domains such as cloud computing, database software, operating systems, AI development, and virtualisation. In these domains, Huawei is presently surpassing cloud behemoths like Microsoft in terms of absolute expenditure. While its competitors are compelled to allocate R&D funds to revamp their existing product portfolios to meet the expectations of the Biden administration, Huawei is reconfiguring its supply chains and applications to enhance the synergy between its hardware and software. Consequently, it is well-positioned to capitalise on enterprise services and the ongoing convergence of cloud computing, private networks, and edge computing.

This evolution typifies diversification through Huawei’s enterprise division, which has accounted for much of the company’s top-line growth post-sanctions. Ironically, the enterprise division remained peripheral until US restrictions forced the company to prioritise profitable products with more accessible inputs. Initially, Intel received an export waiver to continue supplying Huawei with x86 CPUs for its cloud servers. As sanctions tightened, Huawei developed its own Kunpeng CPUs based on ARM-based architecture, which does not rely upon US IPRs. For all eventualities, Huawei is also investing in R&D in RISC-V architecture, which is open source-based.

Due to Huawei’s relatively late entry, its cloud products may lack some of the advanced features offered by industry leaders. Nonetheless, public contracts have helped to grow Huawei’s domestic market share to 19% by 2022, eclipsing Inspur, Kingsoft, Baidu and Tencent and is second only to Alibaba. Huawei Cloud is also expanding abroad, providing cloud infrastructure and e-services to governments and state-owned enterprises in 41 countries (Hillman & McCalpin, 2021). Whereas US advocacy against Chinese vendors home in on mobile RAN, they are much less stringent on cloud infrastructure or services.

Huawei has also made forays into energy infrastructure. The company has long hosted relevant expertise in power optimisation, as energy consumption is a decisive factor in its telecom tenders. With US export controls as a catalyst, Huawei created a digital energy business under its enterprise division in June 2021. As well as focusing on the smart management of energy infrastructure, Huawei’s digital energy business provides solutions in photovoltaics, EV charging and energy infrastructure for both home use and digital industries that build on its innovations in telecoms. This ingenious segue has had plenty of initial success as it seeks to capitalise on the green transition and the scale of China’s clean energy policies. Notably, Huawei is already the world’s largest producer of inverters, also used in solar panel installations.

In a similar fashion, albeit on a much smaller scale, Huawei launched its own enterprise resource planning (ERP) developed as a consequence of its entity listing. It is not farfetched to see how Huawei’s MetaERP could come to fill an important commercial gap for Chinese multinationals in the future.

Finally, Huawei has diversified into intelligent automotive solutions (IAS) in 2019. The founder, Ren Zhengfei, encouraged any employee who believed Huawei should make electric cars to leave the company immediately. Perhaps by foreseeing the current overcapacities in the Chinese EV industry and the pending crunch, the company is building a competitor to AppleCar and GoogleCar that expands the market for Harmony OS and Kirin chipsets rather than building the cars themselves.

However, Huawei has struggled to gain a foothold as an automotive supplier, and IAS was its only loss-making business unit in 2022. In particular, the Chinese auto industry has been reluctant to purchase Huawei’s components due to concerns over lock-in effects and an uncertain future. As a proven solution, Huawei recently spun off its IAS business in September 2023 – after just four years. It is hoped that the move will allow deeper cooperation with Chinese car makers and secure fresh financing for independent development.

However, on balance, the intensification of R&D is paying dividends for Huawei. The company has developed a number of alternatives to Western components and has arrested the decline of its consumer businesses group. Elsewhere, successful diversification initiatives have contributed to significant revenue growth for its enterprise business group – not least by focusing on commercialising existing innovations in non-telecom areas.

Benefits of Being a Non-publicly Traded Company

Huawei’s ownership structure has been key in fostering the decision-making space required for business resilience. There has been much debate over the nature of Huawei’s ownership. Huawei claims it is employee-owned, but others argue that Huawei’s employee participation scheme has nothing to do with financing or control and is purely a profit-sharing incentive. In either case, Huawei is a private unlisted company that is not held hostage to quarterly returns and annual dividends.

Compared to its publicly traded competitors, Huawei’s capital structure offers some strategic advantages, particularly when it comes to weathering adverse market conditions and long-term viability. A publicly listed Huawei would have endured untold volatility in its share price as a consequence of US measures. Even collaterally affected firms have suffered in the wake of US restrictions. In October 2022, US export controls prompted a 20% decline in the share price of certain American semiconductor equipment manufacturers.

In the face of the revenue losses endured by Huawei, a public company would be forced to take extraordinary measures to defend its share price. Following sustained losses in market capitalisation, EU network operators have conducted share buybacks, inflated dividend payments, and cut staff. By contrast, Huawei has been able to reinvest its remaining earnings in business strengths. Contrary to lay-offs among its competitors, the intensification of R&D meant that Huawei actually increased its headcount by 20,000 workers between 2019 and 2022.

This kind of long-term-ism seems particularly valuable in the network equipment market, where sales and development costs are asynchronous. Intermittent rollouts of next-generation networks (that peak once per decade) naturally lend themselves to volatile revenues. However, market leadership is the product of sustained R&D and standardisation work during intermittent periods. Huawei’s ability to shoulder longer slumps is a key factor behind its remarkable demonstration of resilience.

The Questionable Objectives of US Sanctions

Finally, Huawei’s resilience must be viewed in the context of a muddled export control regime and public diplomacy efforts, where the US has made limited progress in lobbying third countries against the deployment of Huawei equipment. Although it has enjoyed some success in relatively minor markets, it has faced resistance elsewhere. Partial implementation of export controls afforded Huawei time to stockpile critical components and seek synergies with alternative suppliers, not least among China’s state-owned foundries.

Meanwhile, prospective allies have been dissuaded or bemused by US propositions to deploy premature O-RAN designs instead of Ericsson, Samsung or Nokia. But criticising US policy is difficult in the absence of a clearly stated strategic objective. Officially, Huawei was entity listed for “engaging in activities that are contrary to U.S. national security or foreign policy interests”, including “alleged violations of the International Emergency Economic Powers Act (IEEPA)… by providing prohibited financial services to Iran”. Beyond this pretext, it is generally accepted that US measures are the product of concerns over spying and backdoor access to mobile networks in the US and third countries.

Finally, there are those who view US actions against Huawei as an attempt to “kill the company” as “an opening shot” in the broader battle with China for technological supremacy. However, such notions neglect how ZTE – Huawei’s smaller rival and a self-admitted state-owned entity with military origins – was exempt from US sanctions and entity listing, and allowed to participate in the O-RAN Alliance. ZTE is also the primary beneficiary of the displacement of European vendors in China and state financing on third markets – a glaring omission that warrants an analysis of its own.

The extent to which US policy has achieved any of these inferred objectives is up for debate – and some even question whether 5G infrastructure was a target at all – or at least secondary to the objective of slowing down China’s SoC capabilities. In any case, US measures have certainly yielded some unintended consequences: As Huawei has started to produce its own inputs, it has developed expertise that is now undermining US efforts to suppress China’s technological capabilities in other areas. For example, Baidu and others are using Huawei-designed, SMIC-manufactured 910B Ascend AI chips as an alternative to controlled designs from Nvidia.

Moreover, Huawei has diversified into new product areas that pose additional headaches for geopolitical adversaries. Public and private enterprises store and process data via Huawei’s cloud offerings, while Huawei Digital Power is underpinning an ever-greater proportion of the world’s energy infrastructure. The Biden administration itself is likely unsure whether a series of partial victories was fair currency for unforeseen and contrary outcomes that are still developing.

What Huawei’s Resilience Tells Us About the State of The Industry

As Huawei continues to defy US efforts, there is a temptation to claim that the company is cheating in its reliance on the Chinese state. However, the reality of its survival is decidedly more complex and explained by market factors rather than geopolitics.

Huawei Founder Ren Zhengfei is rumoured to have said to his executives during the early days of the Trump administration that the stormy years ahead will determine whether the company is strong enough to “sail the seven seas” or must seek a safe harbour as a local supplier in China. The last three years have shown how these two scenarios were not mutually exclusive. Benefiting from a sizeable home market and a capital structure that facilitates long-term planning, Huawei has been able to reinvest its past earnings into R&D and intensify its attempts to catch up. Huawei’s R&D focuses on quickly commercialising new products, including a digital energy infrastructure offering where it has already become a global leader. Ironically, these areas also pose bigger headaches for those who saw Huawei’s presence in critical infrastructure as a national security risk.

But the deciding factors behind Huawei’s survival say just as much about its competitors and the 5G industry as a whole. While Chinese operators accept reasonable equipment costs against healthy development of user revenues, most EU operators seek to minimise infrastructure investments to compensate for disproportionately large dividend payouts. And where Chinese industrial policy incentivises Huawei to integrate its supply chains, improve profit margins and seek new markets – the Biden administration betted on a concept designed to lower industry margins.

Much of US efforts also came too late: The announced US-led Partnership for Global Infrastructure and Investments (PGII) pledged $600 that is yet to be allocated, though all major 5G supplier decisions are already taken – whereas BRI has already moved a trillion dollars of Chinese capital surplus and equipment into third markets. The EU has also repackaged several existing funds into a €300 billion investment vehicle, the Global Gateway Investment Agenda, that co-finances overseas subsidiaries of EU operators (who often select ZTE in developing countries).

Ultimately, the situation warrants the question: If European equipment vendors cannot thrive on “Western” markets alone – at the peak time of digitalisation and rollout of a whole new generation of access networks – will they ever be? Unless Ericsson and Nokia are provided with reasonable market access to the Chinese market – i.e. the healthier half of the world market – the 5G equipment business must find alternative ways of scaling their businesses, re-examine how the industry is organised, or perhaps find more sustainable ownership.

In the long-term, this severe imbalance between China and the European or US markets in terms of commercial potential provides a valuable lesson on fragmentation, reciprocal access, and transatlantic policies. On the one hand, seen from a firm-level perspective, the past four years have positioned Huawei better for the next 6G challenge than many of its competitors. On the other hand, it may also be less prepared than its rivals for virtualised RAN and vulnerable to closer standardisation efforts between the US and the EU standards development organisations.

References

Caijing. (2023, February). 美国政府考虑彻底断供华为,影响几何? https://mp.weixin.qq.com/s/0myMl_LDFWMO13g5AoAAeg

Financial Times. (2023, May 3). ‘We have survived’: China’s Huawei goes local in response to US sanctions. https://www.ft.com/content/32f40217-dc3e-4e02-9433-0c20ae3d7d79

Fuller, D. (2023, October 4). U.S. regulators made Huawei’s chip ‘breakthrough’ possible. Nikkei Asia. https://asia.nikkei.com/Opinion/U.S.-regulators-made-Huawei-s-chip-breakthrough-possible

Hillman, J. E., & McCalpin, M. (2021, October 19). Huawei’s global cloud strategy. Reconnecting Asia. https://reconasia.csis.org/huawei-global-cloud-strategy/

Strand Consult. (2023, November 8). Are Huawei’s customers facing supply chain challenges? https://strandconsult.dk/are-huaweis-customers-facing-supply-chain-challenges/

Zhang, I. (2023, February 7). China reacts to export controls: Huawei + multilateral push with Japanese and Dutch. ChinaTalk. https://www.chinatalk.media/p/china-reacts-to-export-controls-japan