German Industrial Competitiveness and the Metaverse

Published By: Hosuk Lee-Makiyama Robin Baker

Subjects: Digital Economy European Union

Summary

The metaverse is the next iteration of the internet as an immersive, 3D, virtual, shared world where activities can be carried out with the help of extended reality services.

But it is much more than headsets and virtual games. The metaverse is increasingly conceptualised in tandem with other advanced technologies, including AI, IoT, automation, and blockchain. Combined, these Industrie 4.0 innovations will be at the centre of German productivity growth over the next decade.

The IMF and the OECD both expect Germany to be the worst-performing leading economy in the world in 2023. Beyond recent shocks, German competitiveness is being “steadily eroded” by structural factors like “rising labour costs and a lack of digitisation” (Arnold, 2023).

In this context of sclerotic growth, immersive technologies show much promise. The economic dimension of the new Digital Strategy should be guided by three simple “I’s” – immersive, industrial productivity, and internationalisation of German technologies.

Specifically, the metaverse is driving productivity gains in manufacturing, engineering, financial services and retail – it could add €71 billion to German GDP by 2035. As well as enhancing the productivity of existing operations, immersive technologies and smart factories can enable the reshoring of profitable activities back to the German economy, particularly in technology and engineering.

But these economic gains are not inevitable. Neglecting immersive technologies would have a significant effect on Germany’s remaining competitive advantages. For example, late adoption of the metaverse and digital twins by the German auto industry would lead to a 10% loss in exports, equating to more than €12 billion each year.

The costs of late adoption are only underscored by the current salience of global competition. US firms have a strong track record of successfully integrating internet products into industry, while China and its own technology giants are developing strategic initiatives to capitalise on the metaverse.

While much of the metaverse remains under development, companies are already showcasing a range of commercial partnerships and innovative use cases. German companies like Siemens are at the forefront of digital twins which allow automakers and other manufactures to replicate their physical facilities in virtual worlds, drawing on real-time data and simulations to optimise their operations.

In insurance, the same digital twins are facilitating underwriting and expedited claims via remote monitoring. Meanwhile, in medical devices and healthcare, a metaverse of medical technology and AI (MeTAI) is facilitating the refinement of AI-based medical practices. This is the future of medical imaging technology, diagnosis, and therapy.

Ultimately, the metaverse is an industrial technology that has a fundamental impact on German competitiveness. The strategic promotion of innovation and adoption represents an opportunity to better compete with Chinese and US manufacturing. This is why Germany should:

- Adopt a Digital Strategy that mirrors EU strategy by carefully considering the centrality of metaverse, especially given in its impact on Industrie 4.0

- Address the overall funding gap for technology while directing federal funding towards commercialisation of German technologies that are critical for the metaverse (such as optics, IoT, microLED, and EDGE). Incentivise investments and roll-out of digital twin technologies to boost Mittelstand and manufacturing sector productivity.

- Intensify national and EU standard-setting work. Boost German industry participation in international SDOs to extend German and EU influence.

- Advocate for the removal of tariffs and other trade barriers against the export of German technologies that are essential for building the metaverse.

- Incorporate immersive technologies into the curriculum of engineering and technical degrees to rapidly upskill the German industry.

- Acknowledge the assumption of the European Commission that all existing EU and German laws that protect consumers, vulnerable groups and personal data already apply to the metaverse. Therefore, a separate “Metaverse act” might dilute or contradict existing rights online.

The Metaverse Matters for the German Industry

What is the industrial metaverse?

There is ongoing debate on a precise definition of the metaverse, but it can be understood as a set of digital spaces, including immersive 3D experiences, that are interconnected and powered by AR/VR technologies (Mckinsey, 2022).

Technically, the precise form and full potential of this nascent ecosystem will become clearer with the development of underlying components and governance protocols. But it is broadly composed of three distinct layers:

- Hardware, protocols, and standards, including network infrastructure to enable connectivity, data hosting and transfer, as well as multi-sensory peripherals like headsets, glasses, and gloves.

- Platforms and networks, where products, such as avatar accessories, virtual history lessons and digital twin factories, will be created and marketed.

- Experiences, allowing end users to immerse themselves in manufacturing visualisations, real-time supply chain simulations and 3D imaging-guided medical diagnosis and therapy.

The metaverse is increasingly recognised as the next evolution of the web, and conceptualised in view of other next generation technologies that include advanced networks and an internet of things (IoT), blockchain and non-fungible tokens (NFTs), and artificial intelligence (AI).

For example, a Platform Industrie 4.0 Working Group report (2023) outlines how the metaverse is increasingly finding its way into German industry. There are no limits to the wide variety of industrial simulations with virtual model production, maintenance and logistics processes, or the enabling of immersive training. This will provide a much-needed increase to German efficiency and productivity through “promising application possibilities for digital twins, virtual design, augmented reality, and smart contracts.”

Real objects, services or processes are accurately modelled where material properties can be reproduced in detail through IoT and measurement technologies. Combined with the metaverse, these Industrie 4.0 innovations will be at the very centre of smart factories and productivity growth in advanced economies during the next decade and beyond.

The economic promise of immersive technologies

The IMF and the OECD both expect Germany to be the worst-performing leading economy in the world in 2023. It has suffered disproportionately from energy inflation and a global downturn in manufacturing but underperformance has been evident since 2017. German competitiveness is being “steadily eroded” by structural factors that include “rising labour costs” and “a lack of digitisation” (Arnold, 2023).

In this context of stagnation, the metaverse can enhance total factor productivity and drive growth in tandem with existing industrial strengths in manufacturing, retail, financial services, and the sciences. According to some industry estimates, the metaverse could add €71 billion to German GDP by 2035 (Meta, 2023).

As well as enhancing the productivity of existing operations within Germany, the metaverse and other Industrie 4.0. technologies can facilitate reshoring of profitable jobs and activities from overseas. Due to disparate labour costs, the financial viability of local manufacturing investment is often dependent on German employees being many times more productive than their counterparts in low-cost locations. Survey data suggests that smart factory adopters enjoy increased labour productivity of up to 12% (Deloitte, 2019). In other words, an average metaverse-enabled worker generates 12% higher revenues than a worker that does not benefit from the same technology. The productivity premium for German industrial workers is likely to be much higher.

Altering operations can be highly complex and some initiatives have run into difficulties. Adidas’ “speedfactory”, which opened in Ansbach in 2016, closed just four year later with production moved closer to suppliers in China and Vietnam (Ziady, 2019). But there are also success stories. Sennheiser has leveraged high-tech manufacturing to reshore some of its Chinese manufacturing to Europe, and similar initiatives will only become more viable as the labour share in value-added declines (fDi Intelligence, 2019). According to the academic research, reshoring is most successful in German offensive interests like advanced machinery, pharmaceuticals, and automobiles (Kolev & Obst, 2022).

Unfulfilled potential for German industry

The much-needed economic gains associated with the metaverse are not inevitable. Instead, they are contingent on the strategic development of a vibrant ecosystem with high rates of technological adoption across the economy.

The Federal Government is beginning to recognise the potential of the metaverse. BMDV is engaging with XR experts as it attempts to make Germany “the best location for new technologies” (BMDV, 2023). Elsewhere, the BMWK is supporting content creators and launching a new three-year dual occupation and training course on design for immersive media (BMWK, 2023; Takahashi, 2023).

At the EU-level, the European Commission has adopted a new strategy on Web 4.0 and virtual worlds. This highlights the metaverse as a major driver of the technological transition, bringing a seamlessly interconnected, intelligent and immersive world.

There are also shortcomings to existing strategies. The Federal Government’s “Future Strategy” (led by BMBF) failed to adequately address the potential of immersive technologies, and it remains to be seen whether immersive technologies will receive appropriate recognition in the forthcoming “Digital Strategy” (Deutscher Bundestag, 2023).

Germany does have its strengths that include an established network infrastructure, IoT market leaders, digital content producers and forward-thinking manufacturers that have started to leverage immersive technologies.

But if Germany is to realise the full potential of the metaverse, it will need to nurture these strengths and properly address its weaknesses. A shortage of venture capital has long been cited as a deficiency in developing European technology start-ups. While French technology companies are now collecting more capital than their German counterparts in absolute terms – and even growing aggressively, at 63% between 2021 and 2022 – funding of German tech companies declined 20% in the same period (EY, 2022). This continues to harm prospects for the development of local ecosystems.

Elsewhere, Germany has a skills gap, with a particular shortage of skills in digital and sustainable sectors (WEF, 2022). For example, 49% of the German population have “at least basic” digital skills, compared to an EU average of 54% (European Commission, 2022). Furthermore, just 19% of the German population possess “above basic” digital skills, compared with an EU-wide average of 26%. This hinders industrial adoption, as European businesses report employee resistance towards XR solutions as a significant impediment to successful implementation initiatives (Cottereau, 2021).

Late adoption harms industrial competitiveness

The price of failing to adopt immersive technologies would be significant. Commercial rivals are already embracing the metaverse and complementary tools to reap significant productivity gains. Where German firms fail to keep up, the relative costs of non-adoption threaten remaining competitive advantages. This is particularly true in price elastic export markets.

To illustrate the potential costs of neglecting immersive technologies, preliminary data from automotive manufacturing is considered. According to industry estimates, the implementation of digital twin technology is associated with an increase in profit margins of 54% (Challenge Advisory, 2019). Assuming that industry average margins remain consistent in the long run, we can estimate the ad valorem equivalent cost of non-metaverse adoption. This is then modelled in an import demand equitation with country-specific elasticities to calculate the potential impact on German autos exports. A full description of the methodology is available in the annex. Summary results are displayed in Table 1.

As can be observed, the hypothetical cost of delayed metaverse adoption is significant. A relative rise in the price of German autos would lead to an estimated decrease in world exports of nearly 10%. This equates to more than €12 billion each year.

Further to reduced exports, the effect on corporate profits would be more severe, as margins are typically higher in overseas markets. Moreover, German manufacturers would likely lose a significant share of their domestic market to an influx of relatively affordable imports.

Table 1: The cost of late metaverse adoption on German autos exports

Source: Own analysis based on computable general equilibrium models using assumptions from Challenge Advisory, EU Eurostat, and industry annual reports

Source: Own analysis based on computable general equilibrium models using assumptions from Challenge Advisory, EU Eurostat, and industry annual reports

Assumptions behind this model is outlined in the technical annex.

China is challenging the German leadership

The importance of a successful strategy to promote the metaverse and other Industrie 4.0 technologies is only underscored by the current salience of geopolitics. It is no coincidence that the proliferation of first-generation digital technologies has coincided with a widening of the productivity gap between the US and Europe (ITIF, 2014). In the US, private and public sector executives have demonstrated an understanding of the importance of key technological advances, including the metaverse. As such, they continue to prioritise their integration in long-term organisational strategy (Accenture, 2022).

Elsewhere, the Chinese government has recognised importance of the metaverse in sustaining global competitiveness. For example, the Chinese Ministry of Industry and Information Technology (MIIT) has published a plan to develop XR with an emphasis on its industrial applications in sectors like manufacturing. Specifically, the plan aims to cultivate “backbone enterprises”, pilot cities and industrial parks to showcase industrial integration of XR technologies.

In tandem with the outlined industrial policy, China has been a lead contributor to the ITU’s metaverse focus group – the main standards setting forum for an immersive internet. China’s main mobile operators have also formed the metaverse industry committee to strengthen innovation and synergies among virtual worlds builders. Meanwhile, Chinese tech companies like Alibaba, Baidu, NetEase and Bytedance have also announced their own virtual world initiatives (European Commission, 2023).

In other words, China is already mobilising its industrial policy and diplomatic leverage to challenge Germany as the current leader of the industrial metaverse. As commercial and geopolitical rivals begin to leverage the productivity gains associated with the immersive internet, it is imperative that Germany leads the EU into an offensive agenda to avoid prolonged stagnation and further existing competitive advantages.

Building the Metaverse Is an Industrial Opportunity

Foundation technologies are already facilitating innovative use-cases economy wide. However, further advances across selected components will be necessary to fulfil the true potential of the metaverse and maximise productivity growth.

Hardware, protocols, and standards

Ubiquitous high-speed networks are essential to support real-time communication, data streaming, and seamless interactions across virtual spaces. The majority of XR content is consumed over fixed networks. As a ‘once in a generation’ investment, existing fibre deployments already support speeds of 2.4 gigabits-per-second, latency lower than 20 ms, with prospective upgrades yielding speeds of up to 50 gigabits per-second on the same underlying fibre (Salvadori & Martin, 2023). For mobile networks, 5G can support speeds of up to 1 gigabit-per-second. Put simply, existing network architecture has ample potential to address demand for the metaverse and other internet services for decades to come.

Building on high-quality network infrastructure, the metaverse will require additional computational power (Carlini, 2022). Advances in cloud computing are necessary for processing capacity and storage, while edge computing will relocate applications and data closer to the end-user to facilitate a more seamless experience. Looking further ahead, high performance computing (HPC) and quantum computing may be needed to support ever-more-real interactions, simulations, and renderings (European Commission, 2023).

Connective devices have enjoyed spectacular advances in recent year. In particular, headsets and smart glasses have exhibited impressive improvements in processing and sensory technology. Minor issues persist, but these devices are already facilitating immersive 3D experiences. Haptic technologies have also made strides from alerts and vibrations to mimicking the feel of natural materials and interactions (Haseltine, 2023). With that said, gloves and other wearables remain confined to experimental use cases, with technical limitations inhibiting mass adoption.

Aside from personal devices, the Internet of Things (IoT) is proving central to the metaverse as a means of real-time mapping and control, particularly in terms of its industrial applications. Manufacturers are already leveraging IoT devices with immersive technologies for enhanced monitoring, diagnostics, and simulations. For example, combining metaverse with IoT allows maintenance teams to locate and solve anomalies virtually before dispatching a team in the physical world. Uptake of the IoT is forecast to proliferate with access to advanced computing, data processing and analytics, including Edge AI chips which are relocating decision-making and other capabilities from the network core towards the device (European Commission, 2023).

Indeed, electronics and photonics are integral to progress on connective devices. Next generation chipsets will further enhance processing power and reduce energy usage. Meanwhile, energy harvesting and self-generated sensors and actuators are increasingly adopted as an alternative to battery power (Shi, 2020). In photonics, developments like micro-LED displays, waveguides, metasurfaces and liquid lenses offer low power means to improve user visualisation.

Protocols and standards can be overlooked as a foundation of the metaverse, but they are essential to businesses and consumer certainty. Standards on hardware, software, communication protocols, and security mechanisms will help to promote transparency and reduce development costs. Governments, established standardisation development organisations (SDOs) and other initiatives, including the metaverse Standards Forum, are already engaged in pre-standardisation activities for the next iteration of cyberspace.

Platforms and content

The establishment and maturation of platforms will be fundamental to immersive synergies and the creation, delivery, and accessibility of high-quality content. Existing platforms allow stakeholders to build and share specific XR content and “assets”, but a synchronous and ambient metaverse remains nascent. It’s realisation is contingent on the continued development of scalable and modular solutions, ideally within the context of clear standards which can facilitate compatibility as hardware advances (Deloitte Insights, 2023).

Building on platforms and systems, user-generated content and experiences are a cornerstone of the metaverse. The creation of XR content generally entails technical development and design, and businesses and consumers are already leveraging tools to produce and share their own XR content.

One of the best examples of existing user-generated content has been the proliferation of digital twins in manufacturing, logistics and other sectors. Highly accurate digital simulations are drawing on a wealth of IoT data for process optimisation. Digital twins have demonstrated their value in product design, supply chain management, quality assurance, and predictive maintenance.

In fact, Germany already has an industrial association in digital twinning. Industrial Digital Twin Association (IDTA) gathers the key players of the German industry and was founded by BMWK’s Platform Industrie 4.0, VDMA and ZWEI. The association does not just act as a point of contact, but also develops an Asset Administration Shell (AAS) with standardized digital representation of various assets and submodels for industrial digital twins.

While 3D modelling has mandated specialist equipment and expertise in the past, but recent progress in LiDAR (light detection and ranging) and photogrammetry software have heightened accessibility (European Commission, 2023), and developments in spatial computing can enhance the creation of content and experiences. Meanwhile, generative AI can create content and experiences without needing technical development or design where virtual environments can be created from human prompts or from existing content.

The German ecosystem has strengths and areas for cooperation

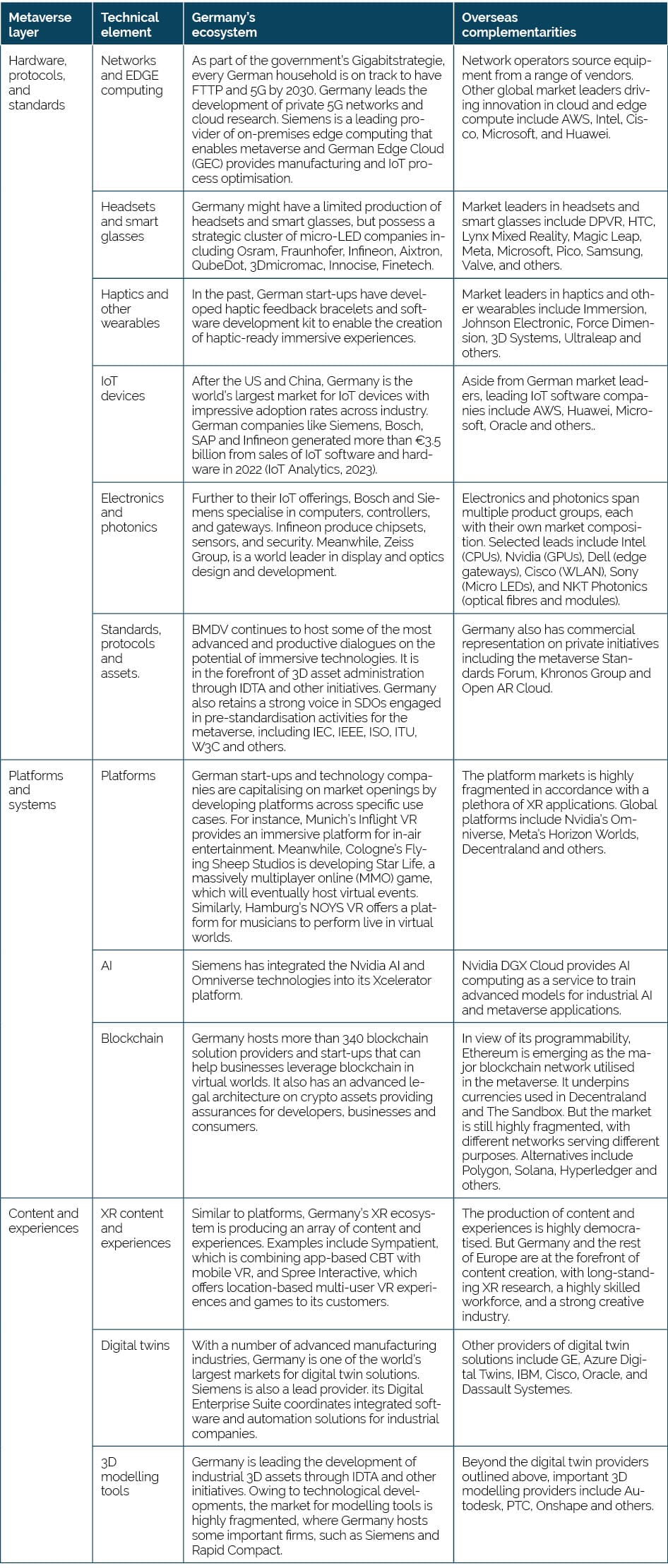

The ongoing development of technical foundations represents a commercial opportunity. This applies not only to German technology firms, but also for other businesses to develop their own use-cases economy wide. Table 2 provides a stocktake on the current health of Germany’s metaverse ecosystem. It also highlights important commercial partnerships as adoption rates continue to grow.

Table 2: The current health of Germany’s metaverse ecosystem

The German industrial interest

The German industrial interest

A stocktake of Germany’s metaverse ecosystem highlights numerous competitive advantages across the value-chain.

On the hardware side, Germany will reap commercial success as the metaverse takes off thanks to its indispensable role in micro-LED, and EDGE/on-premise networks with companies like Carl Zeiss, Siemens, Bosch, or Infineon. Furthermore, Germany is in the forefront of both development and adoption of the platforms and systems associated with enterprise metaverse and digital twins, which translates to a unique agenda and standard-setting power for the next iteration of the internet.

Prospective interventions should complement business activity in harnessing existing strengths. For instance, hardware companies may need incentives to commercialise their technologies for metaverse applications against other more short-term business priorities.

Elsewhere, international cooperation will be necessary to maximise other technical elements. Here, government initiatives should focus on balancing regulatory priorities with open interoperability and a business environment that allows German industry to acquire and integrate foreign technologies.

The Metaverse Transforms the Economy

New commercial partnerships

While much of the metaverse remains under development, companies are already developing a range of commercial partnerships and innovative use cases.

The web of technological components outlined above indicates how Business-to-Business (B2B) models will underpin the metaverse. For instance, Siemens’ open digital business platform is currently reliant on partnerships with NVIDIA for immersive digital twin development, and AWS Cloud for enhanced processing capacity, data storage, and security. Elsewhere Sympatient’s app-based CBT therapy is being accessed on handsets produced by Apple, Samsung and Xiaomi.

As a vibrant digital ecosystem, the metaverse is enabling B2B partnerships as well. Following previous iterations of cyberspace, businesses are creating their digital economies, trading with other companies, and forming commercial relationships in different ways.

Finally, the metaverse is enabling revolutionary Business-to-Consumer (B2C) interactions. Immersive marketplaces are creating novel ways to discover and explore products, while virtual worlds are fostering different forms of consumption. Put simply, the metaverse is “once-in-a-generation opportunity to reinvent the consumer experience” (Purdy, 2023).

Innovative industrial use-cases

Synchronous with these partnerships, the metaverse is already facilitating a plethora of use-cases that span key verticals driving Germany’s economy.

In manufacturing and industry, digital twin factories enable firms to replicate their physical facilities in the metaverse, drawing on real-time data and simulations to optimise their operations. For instance, Swedish appliance manufacturer, Electrolux, have leveraged Siemens digital industries software to provide a strategic overview of end-to-end production processes (Siemens, 2023). Using data created in a digital twin model, they were able to identify and eliminate bottlenecks in their production line, saving millions of euros each year.

In automotives, manufacturers are increasingly relying on 3D models to reduce production costs. For instance, BMW and its specialist subsidiary, Idealworks, are simulating factory layouts to train mobile robots tasked with moving parts and assemblies around the factory floor (BMW, 2022). As well as generating efficiency gains, simulation-enabled reconfigurations allow for greater flexibility. Each of BMWs factory lines can produce as many as ten different cars with a range of options for customisation. BMW and other manufacturers are also utilising digital twins to mitigate the costs of the transition to electric vehicle (EV) production.

In medical devices and healthcare, a metaverse of “medical technology and AI” (MeTAI) can facilitate the development, prototyping, regulation, and refinement of AI-based medical practices, especially imaging-guided diagnosis, and therapy (Wang et al., 2022). VR, multi-sensory presentation, voice and gesture control, 3D printing, and haptic feedback is already in use to provide practitioners with new ways of interacting with large data masses like human tissue and its properties (Tampere University, 2019). One Siemens senior expert calls a future for medical technology without XR “unthinkable” – while Varjo has already developed a VR headset for specialised medical professionals with true-to-life XR/VR for challenging real-life scenarios.

In banking and insurance, metaverse use cases are still emerging. Avatars can be utilised for training and customer support; while digital twins can facilitate underwriting and expedited claims via remote monitoring (PwC, 2023). Major insurers are already embracing immersive technologies. For instance, Allianz is using AR and VR to increase customer awareness of specific risks to their property and providing appropriate insurance services.

In architecture, construction, and town planning, the metaverse allows for 3D models of buildings, streets, and entire cityscapes. This makes it easier to visualise and adjust designs in a collaborative manner. According to a survey by CGarchitect (2016), a number of Europe’s major architectural firms are already using head-mounted displays (HMDs) for client presentations and concept formulations. Beyond product design and marketing, the metaverse can be used as a tool for project management and worker training by simulating virtual replicas of construction sites.

In education and training, lessons and content can be more engaging when delivered or demonstrated interactively in the metaverse. Research by PwC (2022) suggests that VR learners were four times faster to train in the classroom and three times more confident in applying skills learned after training. Nürnberg’s “Spree Interactive” is a pioneer in the field of virtual reality developing technologies and products for location based virtual reality systems for children from 6 years on.

In media, creative and cultural sectors, the metaverse provides a platform for creating and experiencing new forms of art and entertainment. Users can play immersive games, attend virtual concerts and exhibits, and experience and participate in cultural events from around the world. Some of Europe’s most famous cultural institutions are now offering virtual tours, including Deutsche Museum München and Pergamonmuseum Berlin.

In retail and marketing, the metaverse is hosting cyber stores, personalised shopping experiences and new forms of brand engagement, including virtual events and avatar influencers. In addition to novel marketing opportunities, the metaverse offers scope for entirely new revenue streams via the sale of virtual goods and services. In collaboration with NFT creators, Adidas recently launched its “Into the metaverse NFT collection” providing customers with access to digital and physical wearables across a phased immersive experience (Adidas, 2023)

Finally, in transport and logistics, the metaverse can facilitate immersive interaction with transport networks and supply chains via digital twin systems. This is revolutionising operations management by allowing suppliers and other stakeholders to make highly informed decisions in real time (Dwivedi et al., 2022). Companies such as DHL are already using the metaverse for supply chain simulations, allowing them to optimise their logistics processes and reduce costs (DHL, 2019).

These emerging business models and use cases demonstrate that the metaverse is already fostering vital efficiency gains across Germany’s existing industrial strengths. In this sense, the strategic promotion of innovation and adoption represents an opportunity to bolster stagnating growth by capitalizing on new markets and furthering existing competitive advantages.

Federal Action Plan for a Metaverse-Led Industrialisation

The ongoing erosion of Germany’s competitiveness underscores the necessity of a federal action plan for metaverse-led industrialisation. As with all general-purpose technologies, public policy plays an inevitable role in setting the stage for deployment of smart factories and undisrupted German leadership in manufacturing. Similar to historical predecessors like electricity or the internet, the society-wide adoption of general-purpose technologies depend on publicly financed infrastructure and sustained support for education and innovation.

So far, Federal support has focused on fostering a content layer within Germany, including business promotion through the Federal gaming promotion programme. Whilst such programs show promise, ambitious cross-cutting economic policies are needed.

In the light of the current productivity and competitiveness challenge facing the nation, the industrial dimensions of the Digital Strategy will be critical. While the previous Federal “Future Strategy” could not yet foresee the convergence of metaverse and Industrie 4.0 technologies like AI and IoT, more recent initiatives like the EU strategy on Web.40 and virtual worlds already set out the broader societal importance of immersive technologies.

As a point of departure, this strategy gap on the national level must be addressed in the government’s Digital Strategy that is pending this year. In the light of the productivity challenge, the economic dimension of the strategy should be guided by three simple “I’s”: immersive, industrial productivity, and internationalisation of German technologies. And this creation of a thriving metaverse for the German industry requires coordinated fiscal, industrial and trade policies.

Fiscal policy

The government must address the funding gap given the shortage of funding for both start-ups and SMEs for immersive technologies. The German funding deficit is not just against competitors like the US and China – but even against regional competitor like France, which continues to harm future German standard-setting powers in Web 4.0.

At the EU-level, the European Commission recently announced its “Strategy on Web 4.0 and virtual worlds” where several existing sources of EU-funding have been redirected to the metaverse. However, EU funds are often accused of being administratively cumbersome; work is organized into EU-wide consortiums where funding and the results generated is often shared among competitors. National funding on the metaverse will always supplement EU funding, especially for applied research.

In this regard, BMBF has already launched funds aimed at SMEs to bring Industrie 4.0 to their factory floors. Such funding should promote the adoption of digital twin and other immersive, productivity-boosting technologies. Increased adoption within Germany does not just provide scale efficiencies for German engineering companies that are in the forefront of the technologies, but leads also towards federated digital twins that collect and analyse the information from various domains and deliver better solutions.

But as we have seen, immersive technologies present a major commercial opportunity for the German industry. We must now decide whether we want to remain a world-leader on critical technologies associated with the metaverse, including optics (such as combiners, ancillary lenses), displays (micro-LEDs), sensory and network technologies. However, the R&D budgets of the companies engaged in these fields are often too overstretched to focus on the metaverse. Here is where the emerging economic powers see an opportunity to outpace German companies.

Such upstream R&D clusters are necessary for a viable ecosystem that build competitive downstream applications such as digital twin engineering, smart factory platforms and industrial enterprise applications.

In conclusion, we recommend BMF and BMBF to:

- Address the overall funding gap for technology companies in Germany, at least above regional benchmarks like France.

- Incentivise investments and roll-out of digital twin technologies to boost manufacturing sector and Mittelstand productivity that will also supporting economic scale and federated twins.

- Direct the national funding towards rapid commercialisation of German upstream technologies, e.g., optics, microLED, IoT, next-generation network technologies that are required for the industrial metaverse and Industrie 4.0.

Industrial and trade policies

Industry 4.0 is still in developmental stage where the concept needs further standardisation and implementation guidelines to unleash the power of private investments. However, Germany cannot wait for the establishment of global Industrie 4.0 standards, it must carefully consider maintaining interoperability for its own future expansion. This is particularly true as the metaverse will cut across multiple technology domains. All players in the global market will have gaps in their value-chains and Germany is not an exception: Gaps will be filled by international partnerships that will also provide reciprocal opportunities for German firms.

Open and market-led standards (such as 3GPP for mobile networks, or ECE for motor vehicles) were led by German and European industries have proven to be key for successful German internationalisation. Hence, global developments towards an open, market-led and interoperable standards for the metaverse and other Industrie 4.0 technologies is key – but German industrial policy must intensify national standardisation work, increase participation of the German firms in international SDOs (especially in the light of increasing Chinese activities), and activate Federal diplomatic and EU-support for open standards to retain the influence of the German and European industry.

Germany and Europe must develop an offensive “standards diplomacy”. But securing German technology exports will also depend on market access: Duties and technical barriers to trade must be reciprocally removed for technologies for that are essential for building the industrial metaverse. The next update of the WTO IT agreement (ITA-3) is already discussed in the backrooms of APEC, which will eventually be reach Brussels and Geneva for consideration. should encompass European interests to build effective partnerships and coalitions to export German technologies that realise Industrie 4.0.

In conclusion, we recommend BMWK and AA to:

- Intensify the national standard-setting work and encourage foreign participation in these for a to boost the relevance of German work, aligning the national standards work with EU SDOs such as ETSI and CEN-Cenelec in the following step.

- Boost German and EU industry participation in international SDOs, including IEC, IEEE, ISO, ITU, W3C and new open forums like web3D and Metaverse Standards Forum to extend German and EU influence.

- BMWK should express its support for launching ITA-3 through the European Commission’s DG Trade, with the objective of expanding duty-free treatment for IoT, optical and sensory technologies made in Germany.

Skills and training

The national skills gap – where the German population lags behind the EU average on basic digital skills – have led to employee resistance towards digital tools and significant impediment to industrial productivity. Understandably, addressing such systemic challenge like the upskilling of the national workforce will require a nation-wide and bottom-up effort across the entire educational system and attracting foreign talents that is perhaps beyond the scope of this paper.

But with regards to the web and immersive technologies, Germany has so far focused on fostering skillsets within the content layer. For example, BMWK has recently announced an “immersive media design programme” as one of the first publicly supported efforts for digital literacy necessary for Web 4.0. While these measures are ground-breaking and laudable, a productivity-focused deployment of e-skills could also focus on the immediate need for industrial adoption. In addition to creating separate silos of “metaverse”-educational degrees, existing engineering and technical degrees should also be well-traversed in the data-driven and immersive future of engineering.

We therefore recommend BMBF to:

- Making digital twins, immersive technologies (together with AI and other Industrie 4.0 domains) becoming integral part of the educational curriculum for civil engineers, architects, and other technical degrees.

Tackling regulatory questions

European Commission (2023) draws the conclusion that the EU already has a robust, future-oriented legislative framework for Web 4.0 and the metaverse. It cites DSA, DMA, GDPR, Markets in Crypto-Assets (MiCA) Regulation, Directive on Copyright in the Digital Single Market, Regulation on the EU Trade Mark, and the Directive on the Protection of Trade Secrets that apply generally to virtual worlds.

While Germany and the EU should constantly look at its existing regulations to ensure that they are future-proof, the European Commission has a valid point that a specific ex-ante law (i.e. a “Metaverse Act”) is not necessary for the broad range of use-cases we envisage in the metaverse. A metaverse-specific regulation will, on the contrary, create legal divergences between the current Web 3.0 and the immersive 4.0, which may be exploited by dominant actors with abundant resources for regulatory compliance.

Moreover, existing laws on consumer protection, protection of minors and vulnerable groups, IPRs, antitrust and services provision must apply equally to the current iteration of the internet as well as the next one. If there is cause for regulation due to market failures that are specific to the metaverse which we cannot predict today – then new regulation should be proportionate and precise to address the problem and avoid creating more market failures.

Sandboxing – where innovators are allowed to trial new technologies in a real-world environment under close regulatory monitoring – is one alternative that allows both the innovator and regulator to understand future impact. Similarly, far less complicated use-cases in the German industries and enterprises will come before any mass markets uses and provide useful experiences on how to govern the metaverse.

In other words, the belief in a human-centric metaverse comes first. For the same reasons that it is too early to say we need to de-regulate, it is also too early to say whether we anticipate more regulation of immersive technologies.

Technical Annex

Estimating the cost of non-adoption on German autos exports

The average profit margin for auto manufacturers was reported at 18.5% in 2022, as per data from NYU Stern. Challenge Advisory (2019) estimate that the implementation of digital twin technology is associated with a reduction in production prices, and a subsequent increase in profit margins of 54%.

It is assumed that all non-German manufactures adopt immersive technologies and enjoy an initial production price that is approximately 8.4% lower, in line with the forecast increase in profit margins.

Eventually, widespread adoption leads to industry convergence and a like reduction in sale prices for non-German manufactures. Margins return to 18.5%.

By contrast, German manufactures continue to operate at the initial sale price and the initial production price. Therefore, it is estimated that non-metaverse adoption is associated with an ad valorem equivalent premium of 8.4% on German exports.

To assess the effects of this premium on German exports to different markets, country-specific import demand elasticities are derived from Ghodsi (2016). Data on Germany’s existing autos exports (HS 8703 in 2022) is derived from UN Comtrade.

To estimate the effects of non-metaverse adoption on German autos exports to the top ten markets, and worldwide, these figures are inputted into the following import demand equation: Predicted exports = Existing exports * ( (Elasiticty*0.084) +1).

References

Accenture. (2022). Federal technology vision 2022. https://www.accenture.com/us-en/insightsnew/us-federal-government/technology-vision-2022

Adidas. (2023). Into the metaverse. https://www.adidas.co.uk/metaverse

Arnold, M. (2023, August 20). Can Germany fix its economy? Financial Times. https://www.ft.com/content/28d22761-d81f-4402-bd56-7329fd6d18b0

BMDV. (2023). Federal minister for digital discusses possible areas of application for immersive technologies with 100 experts. https://bmdv.bund.de/SharedDocs/EN/PressRelease/2023/072-wissing-metaverse-dialogue.html

BMW. (2022). This is how digital the BMW iFactory is. BMW Group. https://www.bmwgroup.com/en/news/general/2022/bmw-ifactory-digital.html

BMWK. (2023, April 20). In virtuelle Welten eintauchen – BMWK schafft neuen Ausbildungsberuf „Gestalterinnen und Gestalter fur immersive Medien“. Bundesministerium für Wirtschaft und Klimaschutz. https://www.bmwk.de/Redaktion/DE/Pressemitteilungen/2023/04/20230413-in-virtuelle-welten-eintauchen.html#:~:text=Gestalter%2F%2Dinnen%20f%C3%BCr%20immersive,f%C3%BCr%20die%20Auszubildende%20qualifiziert%20werden

Bozorgzadeh, A. (2018, March 17). Europe needs to halt its startup brain drain to the U.S. VentureBeat. https://venturebeat.com/entrepreneur/europe-needs-to-halt-its-startup-brain-drain-to-the-u-s/

Carlini, S. (2022). How Edge Computing Will Power The Metaverse. Forbes. https://www.forbes.com/sites/forbestechcouncil/2022/05/18/how-edge-computing-will-power-the-metaverse/?sh=7b5850d3630d

CGarchitect. (2016). Survey results: VR usage in arch viz. https://www.cgarchitect.com/features/articles/919b2174-survey-results-vr-usage-in-arch-viz

Challenge Advisory. (2019, April 5). Case study on digital twin in the manufacturing industry – 54% more ROI. https://www.challenge.org/case-studies/digital-twin-case-study/

Cottereau, T. (2021). Reducing resistance to AR adoption: Four ideas for change management. Field Technologies Online. https://www.fieldtechnologiesonline.com/doc/reducing-resistance-to-ar-adoption-four-ideas-for-change-management-0001

Damar, M. (2021). Metaverse Shape of Your Life for Future: A bibliometric snapshot. Journal of Metaverse. https://dergipark.org.tr/en/pub/jmv/issue/67581/1051371

Deloitte Insights. (2023, February 20). What does it take to run a metaverse? https://www2.deloitte.com/us/en/insights/industry/technology/metaverse-infrastructure.html

Deloitte. (2019). Manufacturing goes digital: Smart factories have the potential to spark labor productivity. Deloitte Insights. https://www2.deloitte.com/us/en/insights/industry/manufacturing/driving-value-smart-factory-technologies.html

Deutscher Bundestag. (2023). Zukunftsstrategie Forschung und Innovation. Deutscher Bundestag – Startseite. https://dserver.bundestag.de/btd/20/057/2005710.pdf

DHL. (2019). DHL Trend Report: Implementation of digital twins to significantly improve logistics operations. https://www.dpdhl.com/en/media-relations/press-releases/2019/dhl-trend-report-implementation-digital-twins-significantly-improve-logistics-operations.html

Euractiv. (2023, January 13). Tech brief: Germany’s AI reservations, fair share moves in the metaverse. www.euractiv.com. https://www.euractiv.com/section/digital/news/tech-brief-germanys-ai-reservations-fair-share-moves-in-the-metaverse/

European Commission. (2022). The digital economy and society index (DESI). Shaping Europe’s digital future. https://digital-strategy.ec.europa.eu/en/policies/desi

European Commission. (2023). An EU initiative on Web 4.0 and virtual worlds: a head start in the next technological transition. https://digital-strategy.ec.europa.eu/en/library/eu-initiative-virtual-worlds-head-start-next-technological-transition

EY. (2022, July 18). Baromètre EY du capital-risque: 1er semestre 2022. https://www.ey.com/fr_fr/fast-growing-companies/barometre-ey-du-capital-risque-1er-semestre-2022

fDi Intelligence. (2019). On the move: Manufacturing’s return to the developed world. fDi Intelligence – Your source for foreign direct investment information – fDiIntelligence.com. https://www.fdiintelligence.com/content/feature/on-the-move-manufacturings-return-to-the-developed-world-74569

Haseltine, W. (2023). The Whole World In Your Hand: Major Advances In Haptic Technology. Forbes. https://www.forbes.com/sites/williamhaseltine/2023/01/21/the-whole-world-in-your-hand-major-advances-in-haptic-technology/?sh=165fec481012

IoT Analytics. (2023, July 4). IoT in Germany – Market size, industries, vendors, use cases. https://iot-analytics.com/iot-in-germany/

ITIF. (2014, June). Raising European Productivity Growth Through ICT. https://www2.itif.org/2014-raising-eu-productivity-growth-ict.pdf

Jalo, H., Pirkkalainen, H., Torro, O., Pessot, E., & Zangiacomi, A. (2022, June). Extended reality technologies in small and medium-sized European industrial companies: level of awareness, diffusion and enablers of adoption. Virtual Reality. https://link.springer.com/article/10.1007/s10055-022-00662-2

Jiang, Y. (2023, April 25). China’s Metaverse is all about work. Wired. https://www.wired.co.uk/article/china-metaverse-work-health-care

Johnston, A. (2023). Blockchain and the metaverse, Part 2: Challenges. S&P Global. https://www.spglobal.com/marketintelligence/en/news-insights/research/blockchain-and-the-metaverse-part-2-challenges

Kolev, G., & Obst, T. (2022). Global value chains of the EU member states. Institut der deutschen Wirtschaft (IW). https://www.iwkoeln.de/fileadmin/user_upload/Studien/Report/PDF/2022/IW-Report_2022-Global-value-chains.pdf

McKinsey. (2022, July 15). What is the metaverse? McKinsey & Company. https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-the-metaverse

Meta. (2023). The metaverse and the opportunity for the European Union.

OECD. (2020). SMEs Going Digital: Policy challenges and recommendations. https://goingdigital.oecd.org/data/notes/No15_ToolkitNote_DigitalSMEs.pdf

Pileggi, P. (2021, April). Overcoming Digital Twin barriers for manufacturing SMEs. Change2Twin Project. https://www.change2twin.eu/wp-content/uploads/2021/04/Change2Twin_Position-Paper_Overcoming-9-Digital-Twin-Barriers-for-manufacturing-SMEs-.pdf

Purdy, M. (2023, April 3). Building a great customer experience in the Metaverse. Harvard Business Review. https://hbr.org/2023/04/building-a-great-customer-experience-in-the-metaverse#:~:text=The%20metaverse%20can%20help%20put,brands%20through%20AI%2Dpowered%20bots

PwC. (2023). The metaverse and insurance: A new frontier in user experience and risk coverage. https://www.pwc.com/us/en/tech-effect/emerging-tech/the-metaverse-and-insurance.html

PwC. (2022, September). How virtual reality is redefining soft skills training. https://www.pwc.com/us/en/tech-effect/emerging-tech/virtual-reality-study.html

Rodriguez, S. (2022, September 2). Meta acquires Berlin startup to boost virtual-reality ambitions. WSJ. https://www.wsj.com/articles/meta-acquires-berlin-startup-to-boost-virtual-reality-ambitions-11662147631

Salvadori, K., & Martin, B. (2023, March 23). Network fee proposals are based on a false premise. Meta. https://about.fb.com/news/2023/03/network-fee-proposals-are-based-on-a-false-premise/

Siemens. (2023). Electrolux implements worldwide 3D factory and material flow planning. https://www.simsol.co.uk/wp-content/uploads/2019/09/Siemens-PLM-Electrolux-Case-Study.pdf

Shi, Q. (2020). Progress in wearable electronics/photonics—Moving toward the era of artificial intelligence and internet of things. InfoMat. https://onlinelibrary.wiley.com/doi/full/10.1002/inf2.12122

Takahashi, D. (2023, March 20). Flying sheep studios gets $1.2M in German government funding for metaverse game. VentureBeat. https://venturebeat.com/games/flying-sheep-studios-gets-german-government-funding-for-metaverse-game/

Tampere University. (2019). Tampere University is revolutionising medical imaging with the help of virtual reality and AI. https://www.tuni.fi/en/news/tampere-university-revolutionising-medical-imaging-help-virtual-reality-and-ai

VR/AR Industrial Coalition. (2022). VR/AR industrial coalition: Strategic paper. Publications Office of the EU. https://op.europa.eu/en/publication-detail/-/publication/9aaef6fd-28db-11ed-8fa0-01aa75ed71a1

Wang, G., Badal, A., Jia, X., Maltz, J., & Mueller, K. (2022). Development of metaverse for intelligent healthcare. Nature machine intelligence, 4, 922-929. https://www.nature.com/articles/s42256-022-00549-6

WIK Consult. (2018). The Benefits of Ultrafast Broadband Deployment. Ofcom. https://www.ofcom.org.uk/__data/assets/pdf_file/0016/111481/WIK-Consult-report-The-Benefits-of-Ultrafast-Broadband-Deployment.pdf

World Economic Forum. (2022, April 25). Here’s how Germany is bridging its growing skills gap. https://www.weforum.org/agenda/2022/04/germany-growing-skills-gap/

XR4europe. (2023, April 4). About. XR4EUROPE. https://xr4europe.eu/about-us/

Ziady, H. (2019, November 12). Adidas is closing Hi-tech sneaker factories in Germany and the US | CNN business. CNN. https://edition.cnn.com/2019/11/12/business/adidas-speedfactory-plants-closing/index.html