The Future of EU Leadership in the Car Industry: Still Global

Published By: David Henig Hosuk Lee-Makiyama

Subjects: European Union Sectors WTO and Globalisation

Summary

- Automotive is Europe’s key export industry, an important contributor to the EU economy, from balance of payments to employment, and a manufacturing base to global and European brands;

- Balancing the EU’s climate ambitions (and its implied economic transformation) with a successful EU car industry is therefore crucially important. The car industry is at the forefront of new initiatives to tackle the climate emergency, shaped by these new regulations its products and infrastructure will be radically different in just a few years;

- Proposals within EU frameworks such as Green Deal, Fit for 55, and Next Generation EU are about reducing emissions and reshaping industry. Yet, the policy mix also leans towards increased regulatory costs and loss of competitiveness that can only be partially offset by climate subsidies and import substitution;

- This cumulation of measures also carries significant risk of retaliation from our key export markets for the car industry. In particular, attempts to apply green regulation extraterritorially are seen as provocative by third countries and unlikely to be accepted without response;

- Since the EU is the world’s largest exporter of passenger cars, it has most to lose if the global economy regresses into protected markets. Open global supply chains also enable EU manufacturing to retain competitiveness, and has also helped to keep the component and services portion of the industry going despite a relative decline of demand in motor vehicles in the EU;

- Consumer support for Green Deal initiatives will be lost if there are no affordable and sustainable alternatives for personal mobility – which also requires open markets. Thus, cars play a significant role in sustaining both EU macroeconomic stability and support for the Green Deal;

- The Green Deal and an open economy must not become a binary choice for Europe. The automotive industry is today global, digitised and electrified by default. The EU cannot mass-produce locally unless it can also compete globally – which entails facilitating industry transition, minimising retaliatory risks and understanding the biggest transition the industry is facing since Henry Ford’s invention of the assembly line.

The authors acknowledge assistance from Anna Guildea.

1. Introduction

This study considers how best to maintain a globally thriving EU car sector in the face of several interrelated challenges. The climate emergency necessitates a dramatic reduction in emissions to net-zero impacting across the economy, which leads to a fundamental shift in automotive products and therefore manufacturing, given electrification and digitalisation. Moreover, there is a greater emphasis on the need of preserving and restructuring the auto industry in the face of increased competition from the emerging markets, not least China and India. In trade policy, Europe feels the need for a more assertive and autonomous trade policy to protect against perceived imbalances in the current models of globalisation.

Much has been written about the individual building blocks of each of these points. Our aim is to consider the cumulative impact of the initiatives, the risks they may entail, and how these can best be managed, on a single industry that is often at the nexus of climate, trade and industry policy debates.

While individual policy areas will be scrutinised, they must also be considered as a package in terms of their combined impacts. The EU car industry is the most important manufacturing sector in terms of export revenues, and it is not clear whether those revenue streams will be ‘sustainable’ in both meanings of the word.

Current objections to openness will likely be supercharged by the overarching objective of carbon net zero in the medium term at very high costs, where the necessary private and public investments in infrastructure and the energy transition is still missing.[1] Meanwhile, there are worries about post-pandemic recovery in the short term. This leads to the question: How can the EU auto industry remain Europe’s most important source of export revenues in the long term?

The rest of this study is structured as follows. Section 2 discusses the EU car sector, and its importance to the EU; Section 3 summarises the risks to its future including key current EU initiatives affecting the sector; Section 4 concludes by considering how these risks can best be managed.

[1] https://ecipe.org/publications/eu-green-deal

2. A Globalised Industry

A trade surplus critical to the EU economy

The motor vehicle industry (including passenger cars, commercial vehicles and parts and associated industries) accounts for over 8% of EU economic output.[1] It provides direct and indirect employment for around 13 million EU citizens[2], including around 8.5% of total EU manufacturing employment. With nearly 20% of the world’s motor vehicles produced in Europe, we have become accustomed to being the host of a vibrant, competitive and export-led car industry.

Strong, globally recognisable brands and centralised production inside Europe created conditions for extreme economies of scale and export orientation that maintained production despite demand contraction within the EU. The passenger car (PC) segment – or the car industry – is an inseparable part of a competitive motor vehicle sector that covers its high fixed costs. The volume-driven car industry is the driver of R&D, accounting for 28% of the entire EU spending on R&D (€62 billion in 2019). In fact, the vehicle and mobility industry would not be able to support the vast supply chain network of component and machinery suppliers that exists in Europe without the car industry.

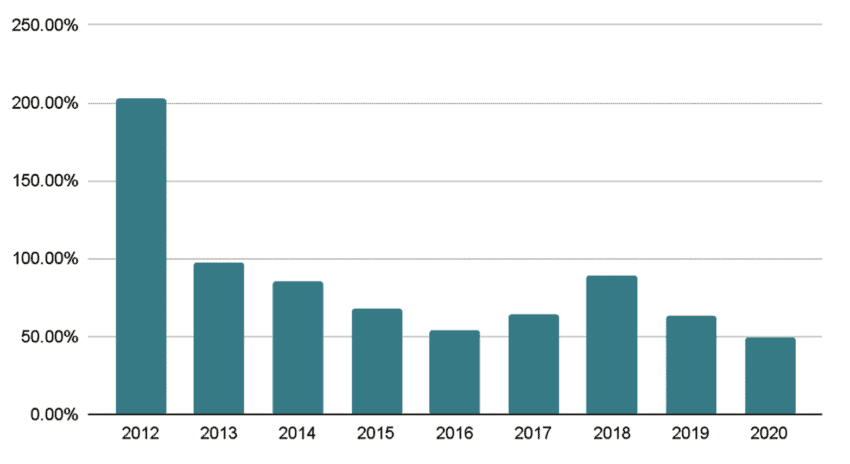

Figure 1: EU does not run a trade surplus, its auto industry does (Auto industry share of EU trade surplus in goods).

Even during a time of severe production difficulties – the EU motor vehicle industry exported 2.4 more times than what it imported – and despite having concluded major FTAs with other large auto exporting countries, including Japan and Korea, while the US has imposed new tariff barriers, which still remain in place. Over the past ten years, the motor vehicle industry (parts, passenger cars and commercial vehicles) has accounted for somewhere between 50-203% of the EU-27 trade surplus on goods (figure 1). The motor vehicle industry is not only by far our largest trade surplus – it is also the world’s largest trade surplus by value – which also accounts for one-fifth of the EU balance of payment surplus. In other words, not just European jobs, but also EU macroeconomic stability, could depend on a sustainable and export-oriented car industry.

While workers, shareholders and tax revenues are some obvious beneficiaries of the EU car industry’s success, the same can be said of consumers who benefit from a degree of choice at competitive price-points. This is a clear benefit of the competitiveness of the EU car sector, with the success of exports and current production methods allowing a greater range of choice of both locally produced foreign and domestic brands, as well as a strong presence of imports, despite the declining share of EU demand as a global share.

EU manufacturing facing headwinds

The widespread assumption is that car industry will always be a mainstay in the EU’s industrial structure. However, this cannot be taken for granted. As the households delayed their capital purchases in the economic slump caused by the pandemic, EU passenger car production contracted in 2020 by over 3 million units compared to the previous year. At the start of the pandemic in April 2020 1.1 million auto industry jobs were affected as the labour force was reassigned to short-term contracts.

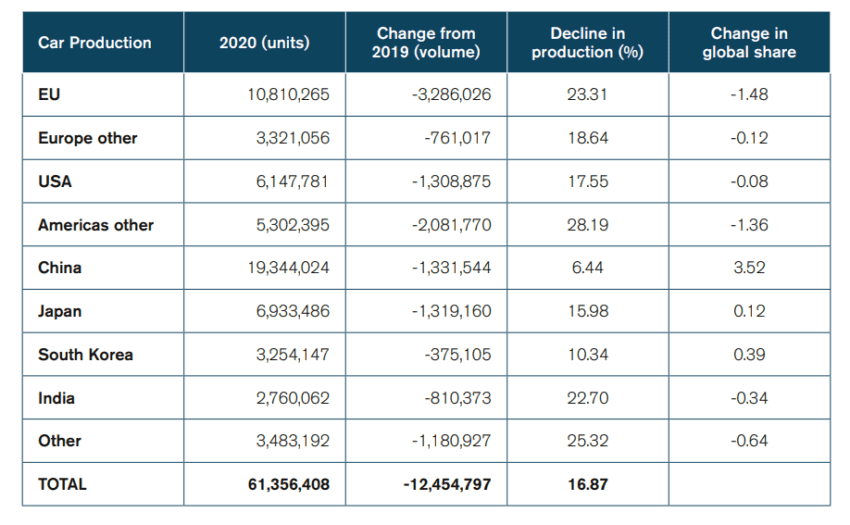

Figure 2: Pandemic induced market contraction Source: IHSMarkit

Source: IHSMarkit

As we can see in figure 2, the EU took the heaviest brunt of the contraction between 2020 and 2019, as the annual EU-based production shrank more than any other region – by over 3 million units or 23%. The EU continued to be an important production centre, yet nearly half of the world’s cars were made in East Asia in 2020. Notably, China has firmly established itself as the world’s largest producer of cars, thanks to its strong inner demand and relocation from Europe and other places. There is no doubt there are significant technological and competitive challenges to be overcome for EU producers, with the Chinese seemingly having a clear lead in the production and sale of electric vehicles. It has been estimated that China will be making over eight million electric cars a year by 2028, with Europe producing 5.7 million by comparison.[3]

Although these adjustments are likely to be permanent, this is a development that began long before the pandemic. The emerging markets are growing faster than Europe for structural reasons that are inevitable, which has a particular impact on the auto industry. The purchase of capital durable goods are closely tied to a few factors, such as economic growth, income increases and demographics – indicators that had in the EU plateaued relative to the rest of the world even before the pandemic. The European car industry also suffered heavily long-term structural overcapacities.[4] EU capacity utilisation rate hit its lowest point during the global financial crisis in 2009 (when it was as low as 65%), it was then restored and reached full utilisation in the two years before the pandemic. It reached a new nadir in 2020, with the EU industry muddling along in half-speed (with the EU average utilisation rate falling as low as 50%), only to reach full capacity utilisation again in 2021.

European and East Asian brands with global appeal produce their latest models in modern and large-scale plants in Central Europe. Foreign brands from recent FTA partners (notably from Korea or Japan) have also invested heavily in producing cars in France, Spain, Poland, Czechia, Slovakia, Portugal and Hungary, and set up R&D and design centres in Germany, France, Italy and Belgium. European premium brands and foreign-branded cars have outperformed local, non-exporting brands whose production is often dispersed among several smaller, older and less cost-efficient plants. Competitiveness correlates also very strongly with the share of production that is sold overseas, and to this day, there are approximately 186 assembly and production plants across the EU. This is both a testament to the importance of the car industry in the EU, as well as a sign that the streamlining is yet to be completed.

Other sectoral vulnerabilities became evident in 2020. The shortage of semiconductors has created issues for cars and commercial vehicles,[5] despite the fact that the auto industry is not a user of the smallest and most advanced chipsets. The Suez canal blockage (which lasted less than a fortnight) was enough to empty the production component stock in Europe which should have normally lasted two months. Lockdowns disrupted ongoing R&D projects inside Europe that were critical for transition into connected and autonomous vehicles (CAVs), batteries and other key strategic processes for electrification. Since East Asia and many other regions fared arguably better in their pandemic response than the EU did, the European OEMs fell behind in their attempts to catch up against Korean and Chinese competitors.

Increasingly globalised markets

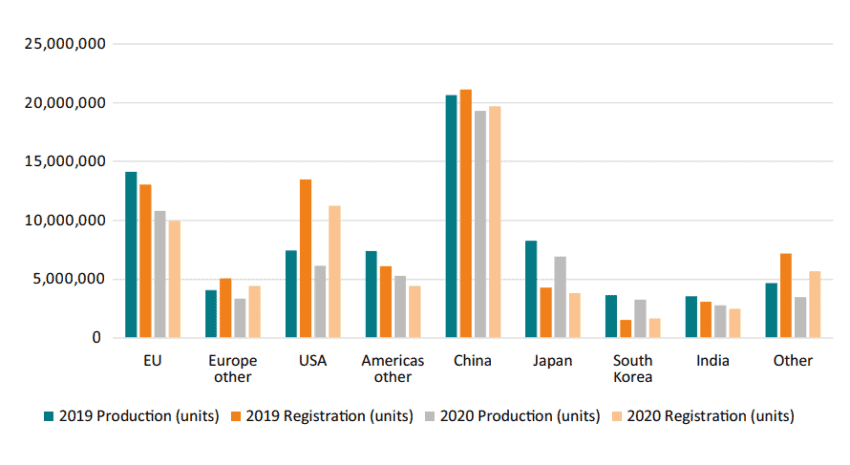

Recent years have shown that the car industry is not just volatile, but also how the EU car industry is sensitive to oversupply and cannot thrive on local demand alone. Close to half of the EU production in 2020 of 10.8 million vehicles was exported – to both nearby regions and further away. Therefore, a considerable number of the 9.9 million vehicles registered were imported. In some cases, this was to and from nearby markets like Turkey and the UK, but there is also considerable trade with the US and China. It should equally be noted that the major market with the greatest misalignment between production and consumption, the US, seeks to change that position, by continuing to impose tariffs against the EU.

Figure 3: Global production and consumer demand of passenger vehicles 2019-2020 Source: IHS Market / ACEA / author calculations

Source: IHS Market / ACEA / author calculations

The home market is clearly not enough to sustain a vibrant car industry. The motorisation rate in Europe (car ownership per thousand inhabitants) increased by just 16 vehicles per thousand people in the past five years (reaching 569 vehicles per thousand people). During the same period, the Chinese market grew by 100 vehicles per thousand inhabitants. This development is likely to continue during the post-pandemic recovery as consumer demand in Europe typically recovers much slower than overall GDP – the income elasticity (the speed demand grows in relation to the rest of the economy) for the car market is remarkably low – at 0.4 – meaning car sales will recover at less than half the rate of the EU economy on average.

Manufacturers typically maintain production facilities inside (or very close to) major markets, to support choice and price cognisant of shipping costs involved in the sector, while the Chinese market is now twice the size of the Single Market. The EU must compete for new investments in production, R&D and consumer attention with the US and China – where Europe can only compete with its advanced and efficient business environment. Furthermore, any attempts to localise production into the EU or to close our markets will harm competitiveness, consumer choice and affordability.

So far the EU Single Market is an extremely attractive production base for auto manufacturing thanks to the EU FTA network that has slashed tariffs for producers who want to import critical manufacturer-specific components into their factories in the EU, while the rules of origin and duty drawback provisions benefit those who use the Single Market as a production base.

The integrated nature of car supply chains means that inward and outward trade and investment are all important. Foreign OEMs work with EU subcontractors from virtually every Member State. Equally, cars made in recent FTA countries (Korea, Japan, Canada) contain between 10-50% of value-added created overseas (parts, design, engineering services and intangibles, many from the EU), in addition to the value that is created in distribution and after-servicess when they arrive in the Single Market. However, as has been suggested throughout this section, the automotive sector is changing due to economic fundamentals.

[1] https://ec.europa.eu/growth/sectors/automotive-industry_en

[2] https://www.acea.auto/figure/manufacturing-jobs-in-eu-automotive-sector/

[3] https://www.nytimes.com/2021/05/04/business/china-electric-cars.html

[4] Lee-Makiyama 2011

[5] https://www.eulerhermes.com/en_global/news-insights/economic-insights/Chip-shortages-to-boost-carmakers-pricing-power-in-Europe.html

3. Future Risks for the EU Car Industry

Decarbonisation, autonomy and retaliation

New car market entrants from the US and China are based around innovative technologies, especially in digitalisation and electrification. Those new technologies, responding to climate change, are going to fundamentally change the product of the automotive sector. A cut-throat competition for innovation may mean further market exits by EU brands if they lag behind.

We are in the realm of fundamental change even before we consider the wider policy landscape and such a picture in such a crucial industry should lead policymakers to careful consideration at any time. Coming at the same time as a dramatic change in the general policy landscape, driven by the same climate factors, should only increase the concern.

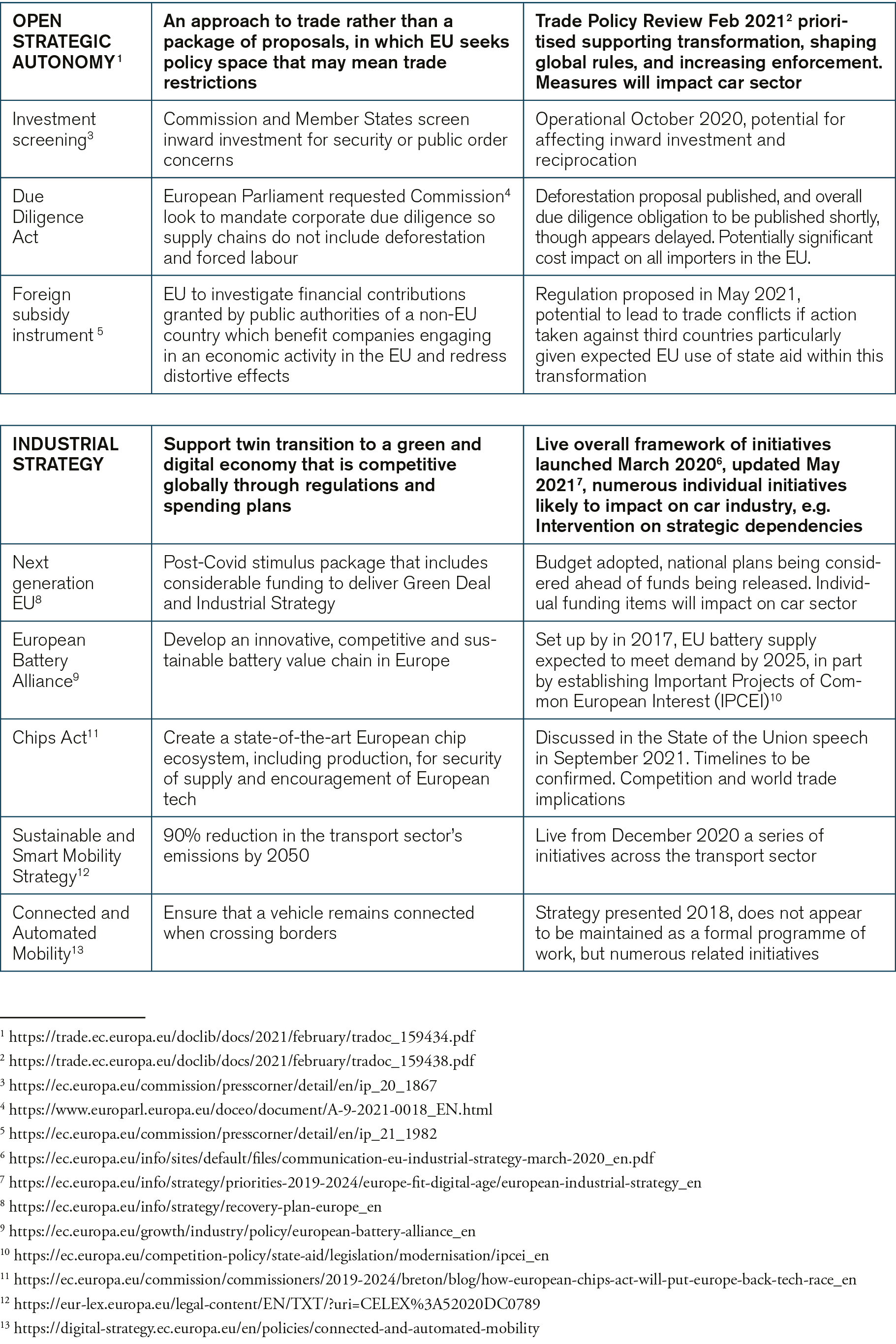

It is normal for the EU to have a busy legislative schedule, various overarching initiatives and individual regulations progressing at any point in time. What is different now is three overlapping transformative visions on decarbonisation, trade assertiveness and industrial policy enabled through multiple regulations and initiatives underpinning all other reforms. At the end of this impressive journey, the EU will, if successful, have a different industrial structure delivering the same economic benefits despite significant transitional costs.

The car industry is at the nexus of these transformations on top of its own. Firstly, a carbon-neutral economy by 2050 imposes direct costs, including costlier inputs through border adjustment and government-mandated phase-out of fossil-based technologies with high transition costs. Indirectly, costly energy transition will slow down EU GDP growth, with the official impact assessment pointing to a GDP loss of an additional -0.3 to -0.7%, by 2030, relative to the previous level[1] which will also slow down demand. Increasing costs could also price some citizens out of mobility, affecting the domestic market.

Secondly, new trade regulations aiming at more equitable practices and autonomy will mean new compliance costs and bureaucratic red tape that will affect the car industry and similar sectors with complex supply chains. EU hegemony in “top of the food chain” positions in globalised and complex network industries (like automotive) will be more costly to maintain.

Thirdly, attempts at EU-wide industrial policy using different forms of state aid will cover some of these new costs, but subsidies are “one-off”, whereas regulatory costs are constant and permanent. An activist industrial policy might seem a necessity for the EU car industry given there is a cycle of state aid and interventionist measures in both capitalist and state-capitalist economies, but could easily backfire: Subsidised and protected producers are less incentivised to innovate, while competitors have deeper pockets and stronger fiscal firepower than all the EU economies combined. If the EU casts the first stone – through public initiatives on batteries and other areas – they might end up legitimising far more market distortive initiatives abroad, with risks of public funding and/or retaliatory spirals.

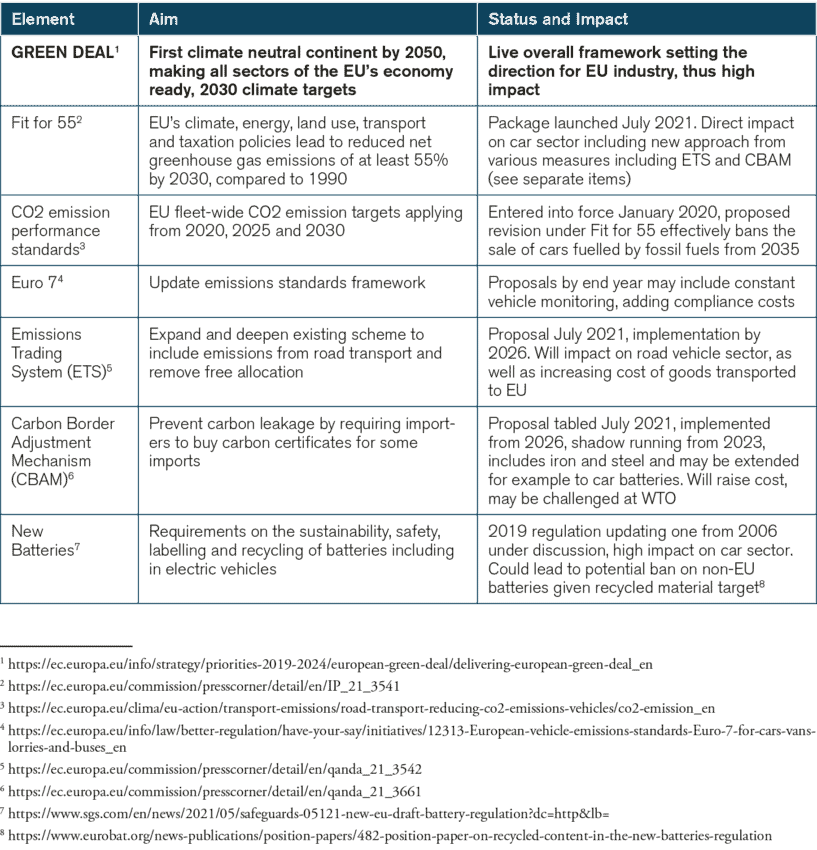

Policies with cumulative impact

When we consider EU plans collectively, the cumulative impact of numerous individual packages and regulations is a high-cost, radical transformation. As the EU does not exist in a vacuum, the success of these climate, industrial and trade plans depends on the response of EU and global industry – and most of all, the reaction from both friendly and hostile trading partners and competitors who will naturally attempt to mitigate EU initiatives.

It is within and between them that the right balance of regulatory cost against international competitiveness, state aid against international competitors, open versus autonomous with risk of retaliation, and state direction or private sector leadership, must be found. Such balances will be challenging given this extensive programme as shown below.

Figure 4: Key EU initiatives impacting automotive sector

Achieving strategic autonomy

The days of cars, or indeed most other complex products, being entirely sourced and manufactured in one country are long gone, overtaken by the development, particularly between 1990 and 2010, of the supply chains that now dominate international trade. These are global and regional in nature, though predominantly the latter particularly when it comes to component goods. They have also been supported by international investment, such that the major carmakers typically have facilities across different countries and continents, supported by networks of suppliers, as we discussed in Section 2.

Such a development does not match popular beliefs in which a car made in the US or South Africa that is branded with a European name is deemed more “European” than a car designed and made in Europe, and branded with a foreign name. Similarly, a foreign car that has considerable amounts of European parts and intangible inputs that is assembled in Asia will if imported to the EU be seen as problematic.It is clear that car brands occupy a symbolic place in our economies and appeal to our nationalist sentiments, possibly all the more so as the one major consumer product still seen to be massproduced in Europe.

The backlash against modern trade is particularly focused in its stories in so-called ‘left behind’ regions which were formerly manufacturing centres. Moreover, the pandemic and US-China bifurcation has spawned a new buzzword in trade policy, namely ‘resilience’ – the thinking (despite evidence to the contrary) that the covid pandemic would have been better handled if all production was local. There is also seen to be a risk that soon all manufacturing will be lost from developed countries making fighting future pandemics more difficult, even if in fact output actually continues to rise[2].

Yet, the current transformation in the car industry means that Europe’s current specialisation (in a powertrain built on combustion engines, exhausts and pumps) has become obsolete in the EU. The largest exporters also specialise in high-end or large-sized (above 1000 cc) segments, which may be a poor fit for certain emerging markets. The electric vehicle powertrain is much simpler – consisting just of a battery and an electric motor. Electrification in the EU means that component manufacturers, and those working for them, must turn to export markets. There are differing estimates as to how many may be affected,[3] but few doubt the scale of the change. Conversely, the industrial transformation also means the EU (or all regions) will rely on cross-regional collaboration for the years to come.

Hence, strategic autonomy and self-reliance in the auto sector is a pipe dream. The clash between national manufacturing with particular car industry symbolism and global trade realities generates a potential clash in which a desire for greater local manufacturing actually renders production uneconomic, except in a scenario of protectionism and higher costs. Such a challenge is common to the EU, US, and to an extent China, but of these only the EU simultaneously has a major green transformation programme adding significant cost.

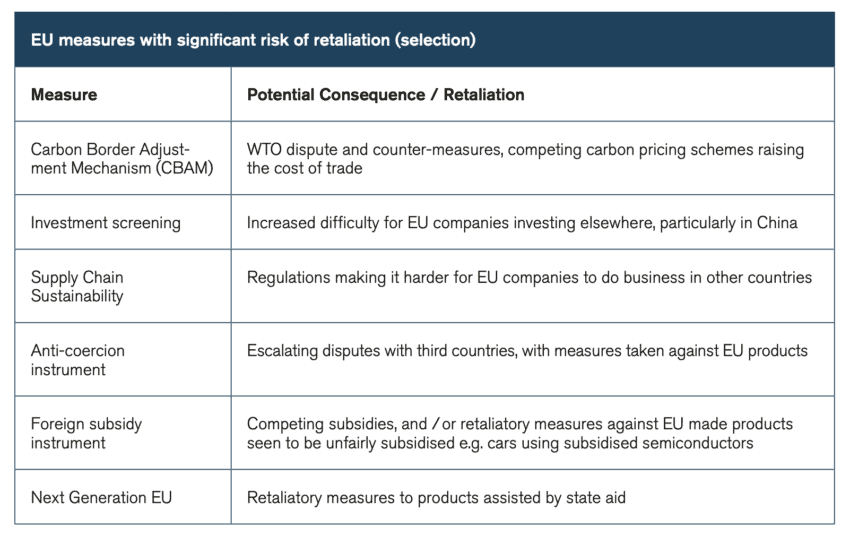

Retaliatory and reciprocal actions

Recalling the EU trade policy approach of open strategic autonomy, currently proposed measures lean heavily towards the latter. The number of such initiatives and importance of the EU as a leading trade policy player mean challenges and reciprocal behaviour should be expected, with those likely to do so shown in Figure 5 below.

Figure 5: EU measures with significant risk of retaliation

There is already considerable debate as to whether CBAM is legal under WTO rules[4]. Notwithstanding EU assurances to the contrary, it seems almost certain that a dispute will be raised – not by countries that are heavy polluters, but by like-minded economies with lower carbon footprints than EU that are nonetheless hit by CBAM. There are particular concerns that charging different tariffs for what is ostensibly the same product is incompatible with MFN principles, and exceptions do not sufficiently cover this scenario.

Right or wrong, there is no global consensus that the climate change emergency is of sufficient importance as to require a new take on the existing WTO rules. But the argument becomes weaker given the presence of other measures such as overt subsidies[5]. In terms of incentivising behaviour change, it should be said that industries most significantly affected by decarbonisation – heavy manufacturing, extractives, transports and agriculture – are typically not those embracing foreign competition in the first place. Thus, we cannot assume the principal assumed benefit for CBAM, of encouraging other economies to step up their climate ambitions on par with Europe’s. It may instead provoke a race of subsidies and other initiatives similar to those proposed by the EU.

As we have noted, the EU’s agenda is similar to the approaches of comparable economies, with the US, UK, and China also pursuing government intervention with a view to maintain or renew globally competitive manufacturing, while reducing carbon emissions. Such ‘competitive interventionism’ does not lend itself to reliable international cooperation and open markets. Particularly at a time of growing intervention, there is every possibility that actions are seen as hostile by others, risking countermeasures damaging the EU economy and particularly the car sector.

The regulatory agenda could be a particular agenda where it has designs to set new global norms. The ‘Brussels Effect’ is often cited as evidence for the EU’s regulatory power was market-led and thus hard to resist, but a more deliberate approach to gain advantage through regulation with extra-territorial impact is not likely to simply be accepted by competitors. Even a specific EU regulatory measure such as the New Batteries regulation could see reciprocal measures from others if deemed to disadvantage their products.

Thus, while understandable that the EU feels new instruments are required to sustain support for open markets, their design and use needs to be considered very carefully to avoid escalation into a damaging spiral of exactly the opposite. There is a level of tacit understanding of a new interventionism at least between the US and EU, but this may not protect the most exposed sectors, of which cars, with its symbolic importance, will be one. That is a dangerous risk to an EU so dependent on the sector.

[1] https://ecipe.org/publications/eu-green-deal/

[2] https://www.cato.org/publications/policy-analysis/manufactured-crisis-deindustrialization-free-markets-national-security

[3] See p32 of https://www.europarl.europa.eu/RegData/etudes/STUD/2021/695457/IPOL_STU(2021)695457_EN.pdf

[4] https://www.gmfus.org/news/eus-triangular-dilemma-climate-and-trade

[5] https://ec.europa.eu/commission/presscorner/detail/en/IP_21_226

4. Conclusions

Openness is always reciprocal

We introduced this study by establishing that the auto industry accounts for Europe’s (or actually the world’s) largest trade surplus by category. This is a testament to the competitiveness of the EU industry. But by the same token, it also reveals that the revenues and jobs that the car industry generates are dependent on access to other markets. Especially the emerging markets are central, given the demographic limitations of the EU market.

All major economies, not just Europe but also the US, China and Brazil, are increasingly looking inward. Since Europe is the world’s largest exporter of passenger cars, it also has most to lose if the global economy regresses into protected markets. The truism of the past decade has been that the sectoral growth in demand is largely outside of Europe[1], a fact that still remains true in 2021.

Therefore, Europe has to incorporate into its objectives the retention of open markets around the world, which cannot be done without the EU also being open. As we do not exist in a vacuum, an autonomy-seeking policy will always generate a response and reciprocation: One euro paid in selective public subsidies to EU battery technologies only creates twice the same amount paid out in subsidies to Chinese and US companies, or import substitution measures against EU producers. Alternatively, they end in WTO disputes, countervailing duties, or both.

Inevitably, attempts to use EU regulation and state aid to level the playing field are seen by third countries as provocative, and tilting away from an open EU towards protectionism despite our best intentions. We have also seen that trade retaliation could also be asymmetrical, where the counterpart imposes an unrelated instrument against a sector where the EU is particularly vulnerable, such as cars, foods or textiles.

Recent developments across Europe have also proven that socio-economic groups will not accept to be “left behind” by technical or economic developments. Recent months have shown that the same clusters of citizens refuse to see their mobility restricted by fuel costs or pandemic decrees. Politically, consumer welfare is crucial, and the markets must supply mobility solutions at all price points. Foreign manufacturers who export to the Single Market are necessary for this political imperative. They also establish service centres and distribution networks, making them net positive contributors to the EU economy.

A false binary choice between climate change and industrial leadership

The EU pursuit to mitigate climate change or deliver value-based trade are not necessarily protectionist constructs. The basic premise of the EU Green Deal – namely to “delink resource use and economic growth” – is sound, but still utopian given the technology we have available. The EU must transform itself into a new low carbon economy via leveraged public funding, direct subsidies and green regulations. But some aspects deliberately force up costs in other markets, underpinned by threats to future access to the EU market. Such a strategy might be a feasible path for basic commodities like steel and basic materials. However, the case might be different for companies with heavily fragmented supply chains, especially if their home markets only cover the fixed costs.

The regulatory package that is proposed will further add cumulative transitional and regulatory costs that raise the costs of EU production considerably compared to competitor regions. With many of the measures yet to be finalised (or still under negotiation) it is important when doing so to consider the cumulative effects. For the export industry – and the car industry in particular – openness cannot be a contradiction of autonomy and sustainability. Especially if the policies change underlying demand or factor market conditions in such a way that may make investments into green EU production less profitable. Squaring this circle often implies working with market incentives instead of punitive measures or unilateral measures.

But given the strong regional competition for investments, we should not assume that the next big investment in a plant or R&D by an European (or Asian) OEM will happen in Europe by default. The EU also needs the right mechanisms to attract FDIs into production, retail and R&D; and tax regimes that allow EU multinationals to repatriate overseas profits back into our tax systems. Otherwise, EU industrial policy could only accelerate the pace of “de-industrialisation”, with domestic and global capital abandoning European equities to seek out alternative markets overseas that offer higher dividends, profit margins, or more effective environmental policies.

A successful green industrial policy require balance and adaptability

Europe will continue to “lock in” climate goals to avoid the US and emerging markets exploiting their energy or cost advantages to outcompete EU companies in third markets. However, it is not in the power of Europe (or anyone) to define how people of other countries and regions will reach their climate goals in the most climate-efficient manner. Under such a scenario, the best way forward is continued commitment to global cooperation and keeping faith in EU bilateral trade agreements. The EU must also make credible efforts to discuss carbon measures and due diligence issues as a multilaterally negotiated scheme rather than unilaterally.

The EU must let its multinationals and workers reap the benefits of exports, interoperable standards with UNECE, and foreign investments that once produced the EU industrial leadership. It also starts from a strong position. There is wide support from different groups of stakeholders for the EU’s aims on climate change, trade and industrial policy at a programmatic level.

That however will be difficult to sustain through individual files, as we have already begun to see from the recent difficult conversations around the Council on rising energy costs. In particular, we increasingly see calls to toughen measures or exempt certain sectors from measures in ways liable to further concern third countries. Given the absence of financially realistic alternatives for carbon-free transportation, climate change could become a class issue. All of this in turn reduces support for the low-carbon and industrial transformation, potentially slowing or blocking progress to both.

With third countries keeping a close watch on the EU, there will need to be careful balance between different aims, stakeholders, and industries, with particular reference to the car sector as such a key player in the overall economy. At the moment that does not appear to be the case, with the risk of a spiral towards more closed markets, coming at cost to EU producers and consumers.

[1] https://trade.ec.europa.eu/doclib/docs/2016/march/tradoc_154340.pdf