Europe’s Carbon Border Adjustment Mechanism: Time to Go Back to the Drawing Board

Published By: Fredrik Erixon

Subjects: Energy European Union

Summary

This Policy Brief takes stock of the global and European trade and carbon-emission effects from CBAM. It argues that the current design of the CBAM is not good enough and, ultimately, that there are risks that it will dent the positive effects on global carbon emissions that come from a lower cap on carbon emissions in Europe. These effects will happen through trade and the reallocation of production – and from retaliatory responses from countries that will be negatively affected by the CBAM.

This Policy Brief provides recommendations on what the EU could do to improve the CBAM. First, it should respond better to concerns about WTO compatibility. No one knows if CBAM would stand up in a WTO dispute, or if the issue of WTO compatibility is of relevance at all. What we do know, however, is that the EU is going a bit off-piste with CBAM, and it knows it. It’s better to address these issues directly than to pretend that they don’t exist. It could, for instance, pre-empt problems by offering compensatory concessions for affected countries. Moreover, the revenues raised by CBAM fees could be paid out to the origin country for the exports. There will be a price for the EU to pay and the more front-footed it is, the more choices it will have in deciding what political currency to use for the payment.

Second, the EU should address development problems that will arise from CBAM. The genie is already out of the bottle since development concerns have been raised by the European Parliament and EU member states. Something will have to be done to avoid that CBAM makes it harder for poor countries to improve their welfare.

Third, the EU should provide workable ideas for how CBAM could be anchored in trade and climate agreements. If more economies go off-piste in their climate policies (e.g. in subsidies and procurement), the EU is going to be harmed. Hence, the EU has a strong interest to establish an example and provide international rules for how other countries should act in the future when they take measures that ‘beggar-thy-neighbour’.

Fourth, the EU should provide a realistic assessment of what retaliatory strategies that other countries will use against the EU, and get a much better understanding of the dynamic or second-order actions that CBAM will prompt. These actions can have a very bad impact on both EU growth and its efforts to decarbonise the economy. It is just decadent to avoid dealing with them pre-emptively.

Finally, and more ambitiously, the EU should consider how it can avoid that CBAM (not the ETS) provokes carbon leakage through both imports and exports. In its current shape, the CBAM provides an incentive to move imports up the value-chain and reallocate imports to goods with embodied carbon. Moreover, the CBAM will reduce the external competitiveness of EU exports, leading to a reduction in foreign sales. Both effects will move the global production of CBAM goods to countries with lower carbon costs and higher carbon intensity in the production. [1]

[1] One section in this paper draws on a forthcoming study to which colleagues have contributed, especially Vanika Sharma and Oscar Guinea.

1. Introduction

The European Commission has recently proposed that Europe should unilaterally introduce a Carbon-Border Adjustment Mechanism (CBAM).[1] There is a simple economic logic behind the proposal – and one that also makes sense in the larger context. As part of the programme to cut carbon emissions, the EU will reduce the amount of carbon allowances that companies can buy in its Emissions Trading System (ETS). In other words, the EU’s cap on total emissions will go down and the price for permits will go up – just as it should.

Along with a new and lower cap, the EU also proposes to reduce the number of free ETS allowances that selected energy-intensive firms have received (and are still receiving) to protect their global competitiveness and, more generally, to avoid carbon leakage. Obviously, these changes will affect production costs for firms and change their relative competitiveness: they will have to pay more to continue with their current carbon emissions. And in this scenario, the risk is that users of these products – those who buy the products from emitting companies – will substitute their European suppliers with non-European suppliers that don’t have to pay carbon fees in Europe. If that happens, the new emissions cap could drive production out of Europe without achieving the stated goal of reducing carbon emissions in that production. The carbon will just be emitted elsewhere.

While this economic logic is straightforward, it is still only a partial aspect of the complete logic behind the relations between the geography of production and the geography of carbon emissions, and how individual countries relate to global production, trade, and carbon emissions. As a basis for CBAM, this logic is incomplete. Several other aspects need to be considered if CBAM is actually going to reduce global carbon emissions and better reflect the economics and politics of cross-border exchange.

For starters, CBAM would have been a far more logical and consequential approach if it had been an all-encompassing system and not, as now, one that only applies to mostly commodity import in five sectors: aluminium, cement, electrical energy, fertilisers, and iron and steel. While there are some downstream metals products covered in CBAM, most of the traded goods that use these commodities aren’t included in the CBAM list of goods, which means that users in Europe could shift their imports to a refined or downstream version of the product (to products that have the CBAM-covered goods embedded in them) without having to pay a CBAM fee for the imports. In that scenario, CBAM (and not ETS) could provoke carbon leakage by the reallocation of carbon emissions and value added away from Europe.

Second, CBAM only border-adjust in one direction: it only puts a surcharge on imports but don’t (as in a full border adjustment system) reimburse the ETS allowances cost when a European company exports. There are reasons for this design: full border adjustment would stand in opposition to the objective of reducing carbon emissions in European production. It could also sit uncomfortably with the rules of the World Trade Organisation (WTO). However, a CBAM that only applies to imports will still make European exports less competitive. Therefore, to fully understand the consequences of the ETS and CBAM on global carbon emissions, it is important to account for the effects on global emissions when European sales in the third market are substituted by non-European output. In other words, there is another form of carbon leakage than the leakage that CBAM aims to prevent, and it happens on the export side of Europe’s carbon emissions. This effect should not be dismissed because, as a rule of thumb, European producers emit substantially less carbon per unit of production than producers elsewhere – especially in commodities.[2] If one of the effects of CBAM or a CBAM-like system is that Europe increasingly produces for itself – that such a system reduces the exports of CBAM-covered goods and the exports of goods that have CBAM products embedded in them – it is unlikely that the net effect on global carbon emissions will be positive.

In this Policy Brief, I will argue that the EU should go back to the drawing board and come back with a better CBAM proposal. It is far more important to get CBAM right than to hurry a bad proposal through. As CBAM is not planned to put any charge on imports until 2026, there is time to work out a better proposal and make the necessary political and diplomatic efforts to avoid CBAM creating unnecessary conflicts with other countries. I will make three arguments.

- First, the logic of the current version of CBAM is further challenged by market-shares analysis – when the shares of production and trade with the EU for CBAM-affected countries are considered. To understand if CBAM has a positive effect on both global carbon emissions and EU competitiveness, the system should be analysed from a global market perspective. The main point with CBAM or a CBAM-like system is to provide an incentive to other countries to improve their own systems of carbon pricing – leading to higher costs for emitters. However, the current CBAM proposal is unlikely to prompt any government to improve its own system for pricing carbon (or introduce one in the first place) – even in the scenario when the CBAM fee will go up over time.[3] The threat of having exports to the EU becoming less competitive because of a CBAM fee is negligible for many countries once their export to the EU is understood in the broader context of their total export and their total Consequently, CBAM is unlikely to provide sufficient economic incentives to other countries to raise the cost of carbon emissions.

- Second, the EU should be far more careful about the diplomatic consequences of CBAM and avoid that the CBAM provokes international trade conflicts and triggers other climate-trade actions that would be harmful. For instance, many countries are considering using unprecedented amounts of subsidies to achieve a reduction in emissions, and it is in the interest of the EU to avoid that new carbon-emissions policies lead to a substantial erosion of global trade rules and make it more expensive to green the economy. CBAM trespasses in a difficult territory as far as the rules of the World Trade Organisation are concerned. Many of the countries whose exports will be affected will likely respond. Some may countervail CBAM; others may retaliate. Regardless of the relevant WTO jurisprudence, the EU could and should do a lot more to show it is acting in good faith and seeking globally positive outcomes, and that it isn’t attempting to introduce a ‘disguised restriction on international trade’. This could be done in several ways. For instance, the EU could offer to transfer the money collected from CBAM fees to the origin country, which also would suppress the suspicion that the measure is introduced in part to raise tax revenues (a motivation that doesn’t stand up well in WTO jurisprudence).[4] Moreover, the EU could ask for a waiver in the WTO and/or offer compensatory concessions to countries whose exports will be negatively affected. Finally, and importantly, the EU should anchor CBAM in global climate and trade talks, and make more efforts to coordinate CBAM and other climate actions with obligations that other countries are accepting in global climate agreements. It is economically reasonable that some form of border adjustment is introduced in the future if big variations in carbon prices for producers will remain, but it should not be disconnected from other principles in climate agreements – like the admission of historic emissions debt and that any agreement is forced to allow economies to choose different methods of achieving emission reductions (what the Paris Agreement refers to as ‘common but differentiated responsibilities’) without undermining the methods of others through beggar-thy-neighbour approaches.

- Third, there are geoeconomic consequences of CBAM that will be hard to stomach, and the EU would be wise to address them before they are activated. For instance, exports from Ukraine will be affected by CBAM, and even if it is impossible to say how Ukraine’s revenues for trading with Europe will be affected, a potential CBAM effect should be seen in the light of Ukraine’s export revenues from trading with Europe already being set to decline because of other policies in Europe, e.g. Nord Stream II. It is a major geopolitical ambition of Europe to offer Ukraine a route to deeper economic integration with Europe: CBAM should not lead to geopolitical costs. Another example is Turkey. While Turkey’s commodity exports to Europe will be affected by CBAM, Turkey is a country that is rich in raw materials that Europe is very keen to get more of because of the region’s decarbonisation and rapid electrification. Relations with Turkey are already poor, and the Turkish government is already applying export controls on some minerals that Europe buy from Turkey. The EU should be more realistic about the downstream retaliatory consequences of CBAM.

The next three chapters will go into greater detail on each of these points. The Policy Brief ends with some concluding comments and recommendations for EU policymakers.

[1] European Commission, 2021, Proposal for a Regulation of the European Parliament and of the European Council Establishing a Carbon Border Adjustment Mechanism. COM (2021) 564 Final.

[2] A good data source on trade and embedded carbon emissions is the OECD. For links to databases, see https://www.oecd.org/sti/ind/carbondioxideemissionsembodiedininternationaltrade.htm. For a country example, see for instance Hana Nielsen and Astrid Kander, 2020, ”Trade in the Carbon-Constrained Future: Exploiting the Comparative Carbon Advantage of Swedish Trade”, Energies, vol. 13:14.

[3] For a significant exporter of a CBAM-covered good to the EU today, CBAM will most likely reduce the exports to the EU relative to exports to the rest of the world.

[4] CBAM or a version thereof forms part of the compromise over the new EU budget. See European Council Conclusions, December 2020, accessed at https://www.consilium.europa.eu/media/45109/210720-euco-final-conclusions-en.pdf

2. Market-share Analysis: Trade, Production, and Trade in Value-added

The case for a carbon border adjustment mechanism is genuinely global: protecting EU competitiveness and reducing the risk of carbon leakage by a CBAM may not necessarily be good for the global reduction of carbon emissions, but if the EU could provide incentives to other countries to increase the cost of carbon, the effects on global carbon emission could be positive and significant. [1] This has been a strong motivation in the past when the EU has discussed introducing a carbon-border tax; it also features in the CBAM proposal.[2] However, the way CBAM is constructed doesn’t conform to that objective.

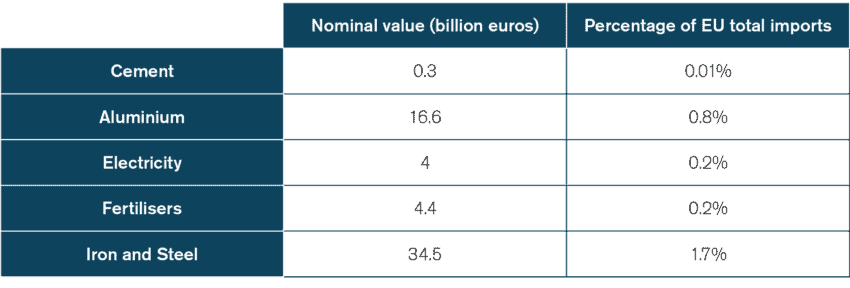

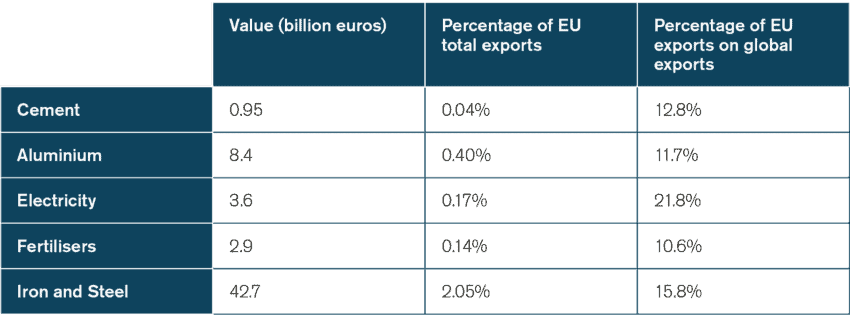

Take the trade consequences of CBAM. The trade amount covered by CBAM is limited: the EU imports that could be subject to the CBAM is around €60 billion, representing 3% of the EU’s total imports in 2019. Among the five sectors included, EU imports of aluminium, and iron and steel, are the largest.

Table 1: EU imports of CBAM-affected goods (2019, billion euros)

Source: UN COMTRADE. Own calculations.

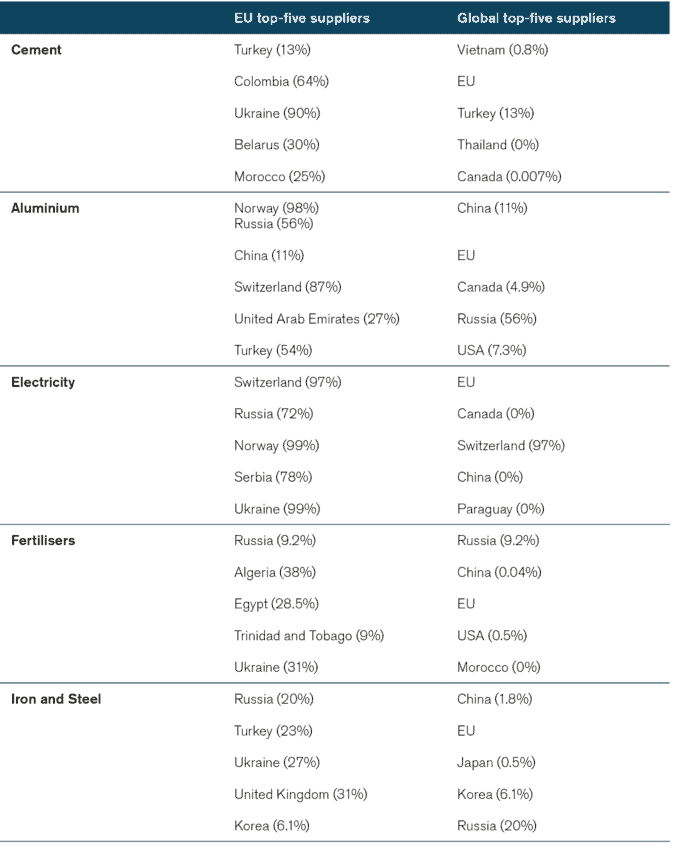

The EU buys these goods from a variety of countries. For cement, Turkey is the largest exporter to the EU (€108 million) followed by Colombia (€26 million). In terms of electricity, Switzerland (€638 million) and Russia (€613 million) are the most important EU suppliers. Russia (€592 million) and Algeria (€421 million) are also the largest exporters of fertiliser to the EU. For iron and steel, Russia and Turkey are the top two EU suppliers (Russia exported €3.3 billion and Turkey exported €2.6 billion). Meanwhile, Norway was the largest exporter of aluminium to the EU (€ 3 billion) followed by Russia (€2.7 billion). Imports from many other countries such as Ukraine, South Korea, India, UAE, Mozambique, Egypt, Brazil, Belarus, and the UK will also be subject to the CBAM.[3]

The EU is one of the largest global importers of cement (3% of global imports), electricity (14% of global imports), fertilisers (10% of global imports), iron and steel (9% of global imports) and aluminium (17% of global imports). Altogether, if the EU were to implement CBAM, 11% of global imports of all these products will be affected. This would be significant: the EU could use its importing power to move production elsewhere to pay for their greenhouse gas emissions.

However, the economic logic is more complex. For instance, many countries only export a small portion of what they produce, and it is not an attractive proposition to raise the cost for all production to make it easier to export to the EU. Hence, direct trade shares may not be a good yardstick to measure the importance of these goods on the economy. This is reinforced by the product selection in CBAM: many of these products are produced for domestic consumption within national borders. For example, due to its weight, in the case of cement, or its physical properties, in the case of electricity, EU member states produce and consume many of these goods domestically. For instance, in 2019, only 20% of the quantity of EU’s domestic consumption of cement came from outside the EU. For similar reasons, the five largest foreign suppliers to the EU of cement and electricity only represent one-tenth of EU total imports of these products, when the EU internal market is taken into account. On the other hand, for fertilisers, aluminium, and iron and steel, the top-five non-EU suppliers to the EU account for a significant 46%, 25% and 18% of EU total imports of these products[4]. In the case of aluminium, for which comparative production data is available, 57% of the quantity of aluminium consumed within the EU was imported from abroad.

However, the suppliers to the EU of these goods are not necessarily the largest global exporters. When the EU imports these goods from abroad, it is mostly from neighbouring countries such as Turkey, Norway, the UK, and Russia. This is an important caveat as one of the drivers of the ETS and CBAM is to lower greenhouse gas emissions while the largest producers of these goods are in many cases not the EU’s largest suppliers.

Table 2 below shows that most of the EU’s top-five suppliers are within its vicinity. Only a few countries outside the EU’s neighbourhood stand out, such as Colombia, China, the UAE, and Korea. Moreover, the EU’s top-five suppliers are rarely the top-five global exporters. Except for some cases where one of the EU’s top-five suppliers is also a global supplier (for example, Turkey for cement, China for aluminium, Russia for fertilisers), the share of exports of the top global suppliers to the EU is minuscule. An even when a top global supplier is also a top-five EU supplier, the share of its total exports that goes to the EU is relatively small.

For instance, in the case of cement, Turkey – which is a top global supplier and an EU top-five supplier – sells 13% of its total exports of cement to the EU. And this figure does not account for Turkey’s cement production used in the Turkish economy: exports to the EU as a share of Turkey’s total cement production is very small. For the same product, the combined percentage of Vietnam, Thailand, and Canada’s exports to the EU of their global exports in cement is only 0.38%. Therefore, even though most top global cement suppliers export to the EU, the EU is not a particularly large market for them, and this is also the case for the other four products.

Table 2: EU top-five suppliers and top-five global suppliers (2019)

Source: UN COMTRADE, Own calculations.

Note: Iceland, Norway, Liechtenstein, and Switzerland are part of the EU ETS and will not be covered by the CBAM. Electricity is traded through physical interconnectors and therefore limited by geography.

2.1 CBAM impact on EU’s suppliers

Some countries will be directly impacted by the CBAM. As mentioned earlier, Turkey sells 13% of its cement to the EU. Similarly, there are also other countries that export a significant share of their goods to the EU. For example, Russia (56%) and United Arab Emirates (27%) in aluminium, Serbia (51%) for electricity, Russia (9%) for fertilisers, or Russia (19%), Turkey (18%), and the UK (31%) for iron and steel. All these countries’ exports will be impacted by the CBAM.

But how would these countries react to the CBAM? The imposition of the CBAM obligation on EU importers will indirectly increase costs for non-EU exporters, who may decide to export elsewhere or sell more domestically to avoid the CBAM fee. If they decide to export to the EU and pay the CBAM fee, the extra cost will be shared between foreign producers and EU consumers depending on the bargaining power each of them holds and the availability of alternative suppliers and buyers.

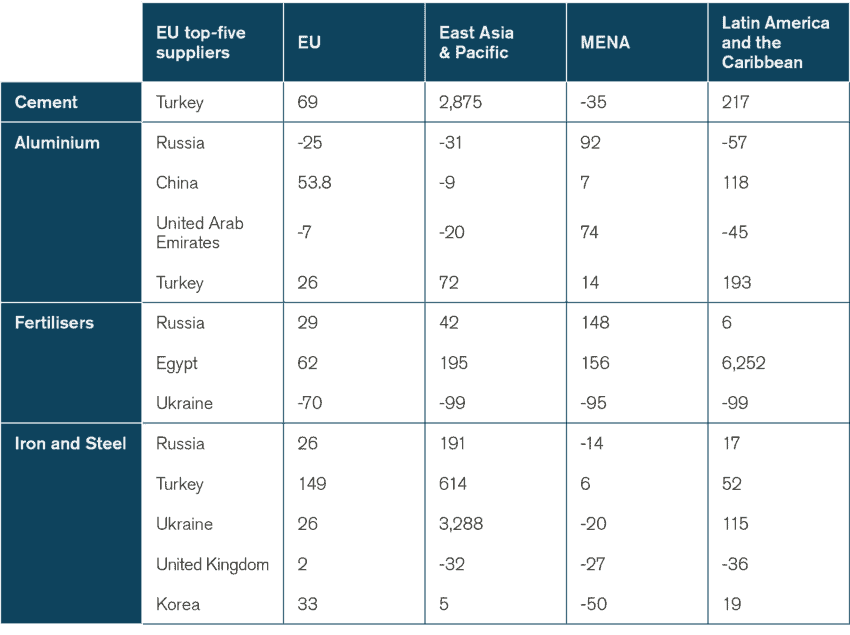

Foreign producers may decide to incur the CBAM’s cost and pass-on part of this cost to their EU consumers. Non-EU countries may decide to compensate their domestic producers for the additional cost of the CBAM or set-up an alternative scheme to demonstrate that their firms must pay a carbon price similar to EU’s firms – just to make sure that they, and not the EU, will get the ‘CBAM revenue’.[5] Whether the EU will succeed or not in convincing other countries to tax carbon emissions will depend on the degree of dependencies that these countries have on the EU’s single market. This market dynamic will be further dictated, not only by EU’s economic size but also by EU’s future demand for these products. Unfortunately for the EU, the centre of gravity of the global economy is shifting away from the EU and towards emerging and middle-income countries. The following table shows the growth in exports of cement, aluminium, fertilisers, iron and steel from EU’s top suppliers to the EU, East Asia and Pacific, Middle East and North Africa (MENA), and Latin America and the Caribbean. Electricity has been excluded as this product is traded through physical interconnectors and therefore limited by geography.

Table 3: Export growth (%, 2015 – 2019) of cement, aluminium, fertilisers, iron and steel from EU’s main suppliers

Source: UN COMTRADE, Authors’ calculations. Note: Iceland, Norway, Liechtenstein, and Switzerland are part of the EU ETS and will not be covered by the CBAM.

As can be seen from the table, for cement, the increase in Turkish exports over the 5-year period has been 40 times greater in East Asia compared to the EU. Turkey’s exports of cement to Latin America have also grown much faster than those of the EU. Even though the exports to the EU have grown for most of the countries, the growth has been larger for one or more of the three other regions. For instance, Egypt’s exports of fertilisers grew by 62% to the EU. But during the same time, they grew by 195% to East Asia, 156% to the Middle East and North Africa, and by 6,252% to Latin America (albeit starting from a low base).

In a similar fashion, China’s exports of aluminium to the EU have grown at a rate of 54% (larger than that to East Asia and MENA), but the growth of exports in aluminium to Latin America have grown even faster reaching 118%. With the exceptions of Ukraine’s exports of fertilisers, and the UK and Korea’s exports of iron and steel, for all other countries, the importance of the EU as the primary market has been replaced by one of the other three regions. This is important when considering the likely reaction to CBAM from EU’s trade partners as most of its top suppliers have alternative markets that they can supply too, and which have already overtaken the EU as their most important foreign market.

2.2 CBAM and EU’s supply chains

Goods affected by the CBAM are inputs used in the production of other goods produced and consumed in Europe: fertilisers for agriculture, iron and steel for e.g. cars, cement for construction, aluminium for infrastructure, and electricity for any manufacturing process. Because the CBAM aims at equalising the cost of carbon emissions across countries, it is bound to make EU imports more expensive. Therefore, to assess the potential impact of the CBAM on the EU’s competitiveness, it is important to understand the role that EU’s imports play in the EU’s own production and exports. For example, imports of basic metals and fabricated metal products – which include aluminium, and iron and steel – contribute €50 billion to EU’s final demand[6] and €28.6 billion to EU’s exports.

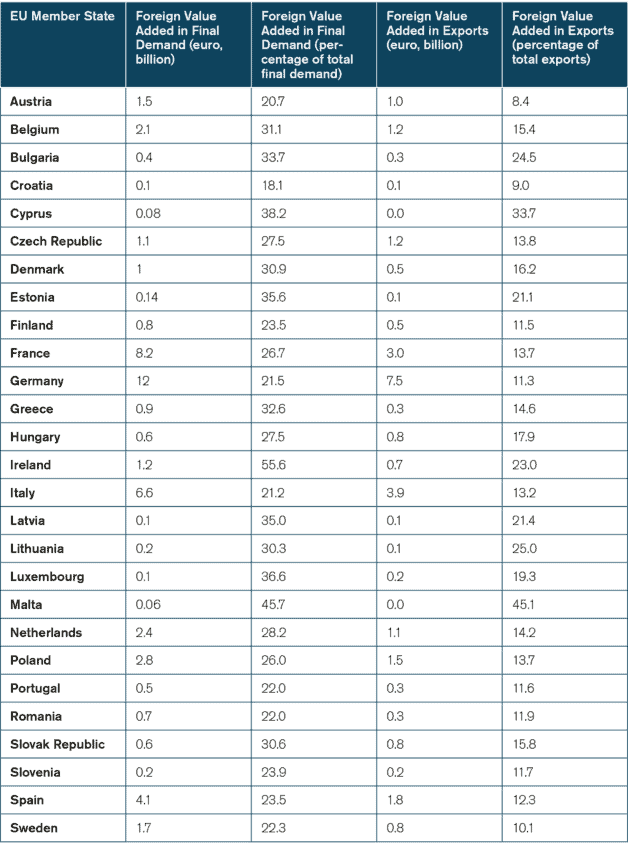

Table 4 shows the contributions of foreign aluminium, steel and iron inputs into the total final demand of EU member states. Economically larger member states such as Germany, France, and Italy receive close to €12 billion, €8 billion, and €6 billion in foreign value added on their final demand whilst as a percentage of their total demand, Ireland and Malta come on top. In terms of foreign value-added to EU exports, the competitiveness of Germany and Italy is the most dependent on foreign inputs whilst as a percentage of total value-added on the value of their exports, Malta and Cyprus are the most reliant on basic metals bought from outside the EU. Therefore, given the amounts of foreign inputs of aluminium, iron and steel embedded into the EU’s final demand and exports, CBAM will be more costly for the EU economies which are more integrated with the rest of the world. It is likely that their foreign sales will decline and be substituted by production elsewhere in the world.

Table 2.4: Contribution of Foreign Aluminium, Iron and Steel into EU MS Final Demand

Source: Author’s Calculations, OECD Trade in Value Added (TiVA) database.

[1] This section draws on a forthcoming ECIPE study of EU defensive measures.

[2] For instance, the CBAM proposal states: ‘While the objective of the CBAM is to prevent the risk of carbon leakage, this Regulation would also encourage the use of more GHG emissions-efficient technologies by producers from third countries, so that less emissions per unit of output are generated’. European Commission, 2021, Proposal for a Regulation of the European Parliament and of the European Council Establishing a Carbon Border Adjustment Mechanism. COM (2021) 564 Final, page 17.

[3] Note that some of these imports are from countries that won’t be covered by CBAM (e.g. Switzerland and Norway).

[4] These figures over-represent the importance of trade on the consumption of these products as domestic consumption of domestic production is not taken into account.

[5] CBAM intends to take account of the carbon cost that exporters pay in other countries. Hence, if an exporter pays a carbon fee in other jurisdictions, that should be discounted from the CBAM fee in Europe – leading to no CBAM fee in Europe if there is equivalence.

[6] Author’s calculations from OECD Trade in Value Added (TiVA) database.

3. Trade Rules and Retaliation

There has been an intensive discussion about CBAM and its compatibility with the rules of the World Trade Organisation. The European Commission and some others believe they are compatible; others don’t. It is an important discussion. However, it would have been far more important if the dispute settlement system at the WTO had maintained its integrity and respect. Now the system is rather dysfunctional and notable members of the WTO (including the EU) are using the absence of a functional dispute-settlement mechanism to pursue justice by other means – including retaliation. This should be the context also for any analysis of the WTO compliance of CBAM: does this really matter or isn’t it more likely that other countries will respond to CBAM without going to the WTO first?

3.1 The WTO issue – will it really be about CBAM?

It is safe to say that it is a close call if a CBAM-like system would be compatible with WTO rules, or not. Good legal minds have analysed the issue, and there is no consensus. I have nothing to add to the body of existing CBAM-specific legal analysis, but there are three attendant points that are important but neglected.

First, countries that will be affected by CBAM may not just go after CBAM if they take the issue to the WTO; if they are clever, they would also include the EU ETS. Since the EU now makes a direct link between the ETS and CBAM, the design, performance, and history of ETS becomes relevant in a WTO case. As the ETS allocates allowances for free and has done so since its inception, there are actionable concerns about subsidies – like the claims that the EU has made against third countries that have used systems of internal allocations to give some producers a better position than others. Furthermore, during the three past phases of the ETS, firms have also been allowed to sell their free ETS permits if they didn’t need them – leading to a subsidy of these firms that is also actionable under WTO rules.

The system of free allowances has been substantial. In the ETS regulation between 2013 and 2020, 57% of all allowances were auctioned and the rest could be allocated for free.[1] The explicit motivation for the free allocation was, logically, that the EU didn’t want to raise costs for producers that were exposed to potential carbon leakage. In phase 4 of the ETS, between 2021 and 2030, there will still be free allocations: in addition to the already set free allocations, the Commission has reserved a buffer of 450 million allowances so that “Europe’s industrial competitiveness [can] be safeguarded”.[2] The new proposal on the ETS will amend some of these rules for this period, but it won’t amend all. Under current EU rules, EU member states are also allowed to take compensatory actions, within state-aid rules, to firms for indirect carbon costs. The EU Innovation Fund will also use revenues from the ETS permits to subsidise industries to reduce their carbon costs through technology. All these subsidies are open to challenge under WTO. Some of these ETS policies may be changed even more as the European Parliament and member states peel into the Green New Deal, but since there will still be indirect subsidies after the introduction of the CBAM, a dispute that includes the entirety of the ETS should be expected. Exacerbating this issue is the price-equivalence effect of the CBAM proposal: it won’t just put a fee corresponding to the increased cost of carbon after the current reform of the ETS, the fee will reflect the entire development of the carbon cost in the EU since the introduction of the ETS.

Second, how is it technically possible to prove that a certain border adjustment is necessary for the avoidance of carbon leakage – especially in light of the main indicators of carbon leakage being basically trade-performance indicators? For instance, the EU has recently agreed on the revised benchmarks for the system of free allocations to installations.[3] This is a highly technical area, but it is important for Europe’s relation to other countries in the context of WTO jurisprudence. And it relates to a critical question: how can correct levels of carbon leakage be evidenced without using trade and competitiveness benchmarks that would be indistinguishable for actions that would have a direct protectionist intent? For leakage to happen, current or future production needs to shift from Europe to territories with lower carbon costs. But all extra costs for carbon in Europe don’t lead to a shift in current production from Europe to other parts of the world: in fact, only a small part of increased carbon costs seem to have that effect.[4]

Some estimates suggest that there is no evidence at all of the carbon leakage from the ETS when trade flows of embodied carbon are modelled.[5] Just as with other mandated cost increases for firms (e.g. compliance with other environmental regulations), firms will manage them differently depending on their competitiveness and the technological capacity for greenhouse gas efficiency. Some firms will do very little about their capital and technological structure; other firms will address these carbon efficiency problems as part of their overall capital strategy and reduce their carbon intensity.[6] In fact, the annexes to the updated methodology on free allowances to installations still show there is a significant difference among Europe’s installations in their greenhouse gas efficiency. The effect of increasing carbon cost for one installation isn’t the same as for the other, meaning that the potential size of leakage is surely a factor of firm-specific and not just cost-specific effects.[7] These firm-specific effects could be amplified by the market structure, especially the market share held by firms that can reallocate their supply across various factories around the world. Hence, the linkage between increasing carbon costs and carbon leakage is far more complex than presumed. So how will the EU prove that it is necessary for the CBAM fee to correspond with the full ETS cost for equivalent firms to avoid carbon leakage? And how could it defend that CBAM will make the relative competitiveness of foreign sellers on the EU market worse than it is now – before the introduction of CBAM? So far, the EU is not providing specific answers that are credible; the CBAM proposal is rather constructed to avoid having to respond to them.

Third, there are development effects of CBAM that the EU presumably would like to avoid: it simply is not fair if the EU imposes a CBAM fee on the exports from all countries that sell the CBAM-covered goods to the EU. After all, some of the countries that will be affected are subject to the EU’s General System of Preferences (GSP) exactly because the EU wants to encourage their economic development. This point shouldn’t be exaggerated, but the EU needs to find an answer to it because the current silence from Brussels on the distributional consequences of CBAM for the Less and the Least Developed Countries will land the EU in greater problems.

Climate negotiations and agreements exacerbate this point. The EU has been steadfast in its defence of the principle that poor countries with low historic emissions should be allowed to escape most of the costs of reducing carbon emissions: it isn’t their fault that the climate is changing. It is the task of developed economies and big emerging markets to make the heavy lifting. CBAM works on a different principle: a cost will be allocated to all exporters of CBAM-covered goods, regardless of their level of economic development. This is already causing irritation in many developing countries, and the risk is that continued silence from the EU on how it plans to address negative consequences on development will spark greater opposition to better global coordination of climate policies.

The problem with CBAM is that exemptions cannot be done under the WTO’s Enabling Clause – the vehicle used by the EU to legitimise its system of preferences to help poor countries develop through trade. The Enabling Clause offers two ways to give a preference. The first is a tariff preference based on the GSP and, hence, the tariff schedule. This is not a way forward because the CBAM fee is not presented as a tariff. The other route to differential treatment is to classify the measure as a non-tariff measure, but the Enabling Clause allows for that only for instruments that have been negotiated under GATT. And the CBAM hasn’t been subject to any negotiation and doesn’t form part of any trade agreement. In other words, the EU would violate its WTO obligations if it were to offer ‘preferences’ in the CBAM fee to developing countries.[8] So how is the EU planning to address the development dimension?

3.2 The Process of Tit-for-Tat Retaliation

Let us go back to the issue of retaliation. The EU’s trade partners that are negatively affected by the CBAM may retaliate. Those who think that Ankara, Beijing, Brasilia, Moscow, Washington, DC and other major capitals are going to accept CBAM without a response have another thing coming. Since the WTO Appellate Body is not functioning, the EU’s trade partners would potentially retaliate directly by imposing trade costs that are of similar value to the cost of CBAM on foreign producers. In past trade disputes, trade partners have often imposed trade barriers on like-for-like products. Assuming that this like-for-like retaliation also holds for the CBAM, EU exports of cement, electricity, aluminium, fertilisers, and iron and steel may face new trade barriers in the form of tariffs and non-tariff barriers, or may have to comply with similar climate-related trade restrictions set up by the EU’s trading partners.

Even though the EU’s exports of CBAM products only account for 2.8% (€58.7 bn) of the EU’s total exports, the EU holds a significant market share in the global exports of many of these goods. Table 5 presents the value of EU exports of these goods and its share in the EU’s total exports and world total exports. The EU is the third largest global exporter of fertilisers, the second largest for cement, iron and steel, and aluminium, and the largest exporter of electricity.

Table 5: EU exports of CBAM affected goods (2019, billion euros)

Source: UN COMTRADE, Authors’ calculations.

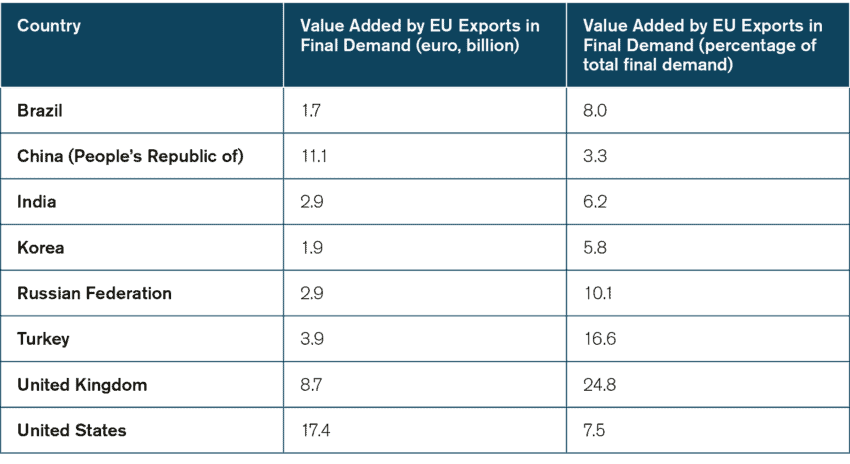

If EU’s trade partners retaliate against the CBAM by imposing trade barriers to EU exports of CBAM related products, they will make their imports more expensive. Table 6 is the mirror image of Table 4 as it shows the value added of EU exports of aluminium, and iron and steel – proxied by basic metals and fabricated metal products – into the final demand of some of EU’s trade partners that will be impacted by the CBAM. In absolute terms, the value-added of EU exports of aluminium, and iron and steel was the largest in the US, China, and the UK. For other countries such as Russia and Brazil, even though EU value-added was relatively small in absolute level, its contribution as a percentage of these countries’ final demand was significant. Therefore, as the CBAM will make EU’s imports more expensive, retaliating against the EU will also make other countries worst-off.

Table 6: Contributions of EU aluminium, iron and steel to the final demand of partner countries

Source: Author’s Calculations, OECD Trade in Value Added (TiVA).

3.3 Raw Materials, Geoeconomics and Retaliation

There is a geoeconomics dimension to the issue of retaliation: the response to CBAM from some countries may not go for a like-for-like retaliation but could hit the EU where it would hurt more. For instance, they could restrict EU access to commodities. As the EU repeatedly observes, China represents the vast part of the EU demand for rare earths. Turkey, to take another example, is the major supplier of borate – a mineral that is critical for greening the economy (borate is used in electric vehicles and clean energy, for instance) and that rarely exists in large and economically viable deposits. The major alternative supplier to the EU of borate is Serbia – another country that will feel the consequences of CBAM the most.

Many of the non-metallic materials that are critical for the economy and that EU imports from abroad are already subject to export restrictions. The Commission’s own review of strategic vulnerabilities estimated that 78 percent of the global cobalt production are already subject to restrictions. For tungsten, another key mineral for decarbonisation, the equivalent figure is 92 percent.[9] EU demand for lithium, cobalt, graphite and other important raw materials, says the Commission, are expected to triple in the period up to 2050 – and the increasing supply is unlikely to come from EU. In the EU production of wind turbines, electric traction motors and Li-on batteries, the EU only produces 1 percent or less of some specific raw materials that are used. The major exporting countries to the EU of lithium and cobalt are also countries that will be most affected by CBAM (Russia, the US, China, Chile, et cetera). If they behave irrationally and intends to retaliate, wouldn’t they go for export restrictions to the EU in these sectors and sharpen the geopolitics of raw materials?

[1] See https://ec.europa.eu/clima/policies/ets/allowances_en#tab-0-0

[2] European Commission, 2017, Questions and answers on the provisional agreement to revise the EU Emissions Trading System (EU ETS). Accessed at https://ec.europa.eu/clima/sites/default/files/ets/revision/docs/high_level_qa_en.pdf

[3] European Commission, Implementing Regulation (EU) 2021/447. Accessed at https://eur-lex.europa.eu/eli/reg_impl/2021/447. See also on benchmarks and competitiveness methodologies European Commission, 2015, Ex-post investigation of cost pass-through in the EU ETS. Accessed at https://ec.europa.eu/clima/sites/default/files/ets/allowances/docs/ex-post_investigation_of_cost_en.pdf

[4] Antoine Dechezleprêtre et. al., 2019, Searching for Carbon Leakage in Multinational Companies. Centre for Climate Change Economics and Policy Working Paper No. 187.

[5] See for example Helene Naegele and Aleksandar Zaklan, 2019, “Does the EU ETS Cause Carbon Leakage in European Manufacturing?”, Journal of Environmental Economics and Management, vol. 93, pages 125-147.

[6] Over the lifetime of the ETS, there has been very many simulations suggesting significant carbon leakage from heavy industries like steel and cement. Ex-post studies, however, has shown most of them to be wrong. See for instance Julia Reinaud, 2008, Issues Behind Competitiveness and Carbon Leakage: Focus on Heavy Industry. International Energy Agency, and Jane Ellis, Daniel Nachtigall and Frank Venmans, 2019, Carbon Pricing and Competitiveness: Are they at Odds? OECD Environment Working Paper No. 152.

[7] Shon Ferguson and Mark Sanctuary, 2014, Firm Productivity and Carbon Leakage: A Study of Swedish Manufacturing Firms. IFN Working Paper No. 1035.

[8] A case can be made that the EU system of preferences already has a difficult relationship with the enabling Clause. See for instance Lorand Bartels, 2008, ‘The WTO Legality of the EU’s GSP Arrangement’, Journal of International Economic Law, vol 10:4.

[9] European Commission, 2021, Strategic Dependencies and Capacities. SWD (2021) 352 final, page 54. Accessed at https://ec.europa.eu/info/sites/default/files/strategic-dependencies-capacities.pdf

4. Conclusion

For CBAM to work out in practice and avoid becoming a source of carbon leakage, or a source of global market dysfunctions that will negatively impact the cost and pace of global carbon emissions, the EU should go back to the drawing board and come up with a revised proposal. The current proposal is too abstract and doesn’t respond to very specific issues and concerns. Ideally, the new proposal should:

- Better respond to concerns about WTO compatibility. No one knows if CBAM would stand up in a WTO dispute, or if the issue of WTO compatibility is of relevance at all. What we do know, however, is that the EU is going a bit off-piste with CBAM, and it knows it. It’s better to address these issues directly than to pretend that they don’t exist. It could, for instance, pre-empt problems by offering compensatory concessions for affected countries. There will be a price for the EU to pay and the more front-footed it is, the more choices it will have in deciding what political currency to use for the payment.

- As part of protecting the EU’s long-term economic interests in climate policies, the EU should be front-footed and make offers to affected countries that will compensate them for trade-revenue and market-access losses. For instance, the revenues raised by CBAM fees could be paid out to the origin country for the exports.

- Address development problems that will arise from CBAM. The genie is already out of the bottle since development concerns have been raised by the European Parliament and EU member states. Something will have to be done. Come up with a proposal and show that you aren’t dismissive of development concerns!

- Provide workable ideas for how CBAM could be anchored in trade and climate agreements. If more economies go off-piste in their climate policies (e.g. in subsidies and procurement), the EU is going to be harmed. Hence, the EU has a strong interest to establish an example of how other countries should act in the future when they take measures that beggar-thy-neighbour.

- Provide a realistic assessment of what retaliatory strategies that other countries will use against the EU, and get a much better understanding of the dynamic or second-order actions that CBAM will prompt. These actions can have a very bad impact on both the EU economy and its efforts to decarbonise the economy. It is just decadent to avoid dealing with them pre-emptively.

- Finally, and more ambitiously, the EU should consider how it can avoid that CBAM (not the ETS) provokes carbon leakage through both imports and exports. In its current shape, the CBAM provides an incentive to move imports up the value-chain and reallocate imports to goods with embodied carbon. Moreover, the CBAM will reduce the external competitiveness of EU exports, leading to a reduction in foreign sales. Both effects will move global production of CBAM goods to countries with lower carbon costs and higher carbon intensity in the production.