If the EU was a State in the United States: Comparing Economic Growth between EU and US States

Published By: Fredrik Erixon Oscar Guinea Oscar du Roy

Subjects: European Union North-America

Summary

This Policy Brief is a warning call about Europe’s poor economic growth and its consequences for prosperity. The long-term trend of Gross Domestic Product per capita is crucially important but not always easy to grasp. While it’s common to compare levels of growth between countries in a single year, the reality is that it is the long-term trend that matters. An economy that grows at 3 percent per year will double in 24 years but an economy that grows at 1 percent per year will double only in 48 years. For a long time now, the average growth rate in mature and developed European economies has been closer to 1 than 3 percent.

The EU has had positive economic growth but it has been slow in comparison with other developed economies. If European countries were states in the United States, many of them would belong to the group of poorest countries. In this Policy Brief, we rank GDP per capita in EU countries and US states, and the result is dispiriting. The ranking of GDP per capita in 14 EU member states, which together represented 89 percent of EU GDP, was lower in 2021 than in 2000. For instance, France and Germany were as rich as the 36th and the 31st US states in 2000, but twenty-one years later, French GDP per capita was lower than the 48th poorest US state, Arkansas, while German GDP per capita had fallen to become as prosperous as the 38th US state, Oklahoma. GDP per capita in Central and Eastern European countries have grown considerably but their relatively small size and lower starting point stop them from reverting the trend of relative European economic decline. The result of this economic divergence between EU member states and US states is a growing wedge of GDP per capita between the EU and the US, which in 2021 was as large as 82 percent. If the trend continues, the prosperity gap between the average European and American in 2035 will be as big as between the average European and Indian today.

This Policy Brief tells a story about the EU’s unfulfilled economic potential but also offers a ray of hope. If the US states have managed to sustain robust rates of economic growth, the EU member states can do it too. However, to do so the EU must bring back economic growth and competitiveness to the centre of its economic policy. If Europe is to face the challenges presented by climate change and the digital transition, the growing burden of an aging society and defence budgets, higher economic growth is not an option but a necessity.

1. Introduction

Albert Einstein is said to have called compound interest the “8th wonder of the world”. The quote may be an urban legend, but its essence is profound: few significant and basic concepts in economics are as under-appreciated as compound interest. A 1-percent rate of growth on your savings or Gross Domestic Product (GDP) may not sound much different from a 2-percent rate of growth. In the next two years, the difference in outcome of the two scenarios is not going to be all that big. However, if you scale the difference for twenty years, or even longer, the difference in outcomes will be stark. The savings or the economy that grow by one percentage point more than the other, will end up with much more economic value.

This is how relative prosperity evolves. Countries don’t get richer or poorer than others in an instant: it happens over time. An economy that grows at 3 percent will double in 24 years while an economy that grows by 2 percent will need an extra twelve years to double. This basic numeracy of economic growth is often lost on many political leaders. Many would think the difference between 2 percent growth and 3 percent growth is 1 percent – but the actual difference is 50 percent.

This Policy Brief is a warning call about Europe’s economic development. In many parts of Europe – and especially in the mature economies – rates of economic growth have been poor for a long time. The consequences of low growth are also increasingly visible. And yet, the European economic discourse is strangely distant from the ambition to get back to high rates of economic growth. Many will feel as if we have been in a permanent economic crisis since 2008, and perhaps attrition has kicked in. Calls for making necessary changes to grow the economy faster have worn people thin, and perhaps there has been a gradual acceptance of the rough reality of living in low-growth economies. However, it is of paramount importance – for prosperity, welfare, opportunity, geopolitical power, and the green transition – that Europe raises its levels of growth.

Economies that do not grow at a healthy clip tend to reduce economic opportunity for large groups – especially the young – and people need to sharpen their elbows for political fights over money and resources. Views get short-sighted and many lose the visionary generosity that is stronger in healthy economies – the sentiment that I may not get as much this time but in an economy of plenty there will be improvements also for me, if not now, so next year. It is true that growth and GDP is not everything, and that good and sustainable living conditions include so much more than what is recorded in the national accounts. But a healthy and growing economy is the basis for many material ambitions we have as individuals and societies. For most of the challenges that Europe confront – for instance, climate change, older populations, and debt overhangs – higher rates of economic growth are necessary parts of the solution.

This Policy Brief looks at traditional and novel ways of comparing Europe’s economic development. The centrepiece is a comparison between GDP per capita in the EU and the US states, and how the economic rankings have changed over the last 20 years. In other words, if big economies like France and Italy were states in the United States, how would they fare vis-à-vis other states like Alabama, California, Mississippi, and Texas? The result is dispiriting. Regardless of the measure used for comparing levels of GDP and economic growth, the difference in prosperity between the EU and the US has grown substantially. If the trend continues, the prosperity gap between the average American and European in 2035 will be as big as between the average European and Indian today.

Some readers will say that these comparisons are of little value: America and Europe are different, and the lower levels of prosperity in Europe is a result of conscious decisions to promote a better work-life balance and have social security systems that care for all. Such observations are valid, but only up to a point. Americans do work longer hours than Europeans, but while this difference has existed for a long time it has not changed in the past 20 years – the period we are studying. If anything, the two sides seem rather to become more similar. Nor are higher welfare-state ambitions a motivation for lower economic growth. In fact, an important argument for the welfare state is that equal or better access to education, healthcare, childcare, and social insurances promote more economic activity and a better workforce.

The structure of the Policy Brief is as follows. The next chapter looks at some orthodox measures of economic growth and dynamism. Chapter 3 compares GDP per capita between the EU member states and the US states. Chapter 4 concludes the paper.

2. Growth in the EU and the US

Europe is a diverse economic region. It includes advanced economies that are at the frontier of competitiveness, innovation, and productivity – and economies that are still catching up. Hence, the European Union is not a single economy with equal rates of economic performance throughout its membership. A general trend of the past 20 years is that economic growth has been fast in Central and Eastern European countries that joined the EU during this period, but that rates of growth have been slow especially in continental economies. The consequence is that the economic gap between these groups of countries has been closing fast.

Economic growth in the Euro Area, a region that is comparable with the US, has been deeply disappointing: the region has been falling behind the US since the 1980s, lowering the EU’s overall economic performance rates as a result.[1] There are many structural explanations behind the lagging rates of growth. For instance, market churn in the EU and especially the Euro Area countries is low – and behind comparable economies like the US. Hence, the entry and exit of firms in European markets are held back, leading to lower dynamism and resource misallocation.[2] Small companies are not growing as fast as they could and too many incumbents are not facing enough competition, creating markets that are less susceptible to firm and product innovation – a lack of what the Austrian economist Joseph A. Schumpeter once called ‘the perennial gale of creative destruction’. Moreover, investments in infrastructure have been comparably low and many key infrastructure services have low exposure to competition. Secular trends like population decline and rising energy costs have impacted on the cost structure of many European firms.[3] The combination of these and many other factors have contributed to falling rates of economic growth.

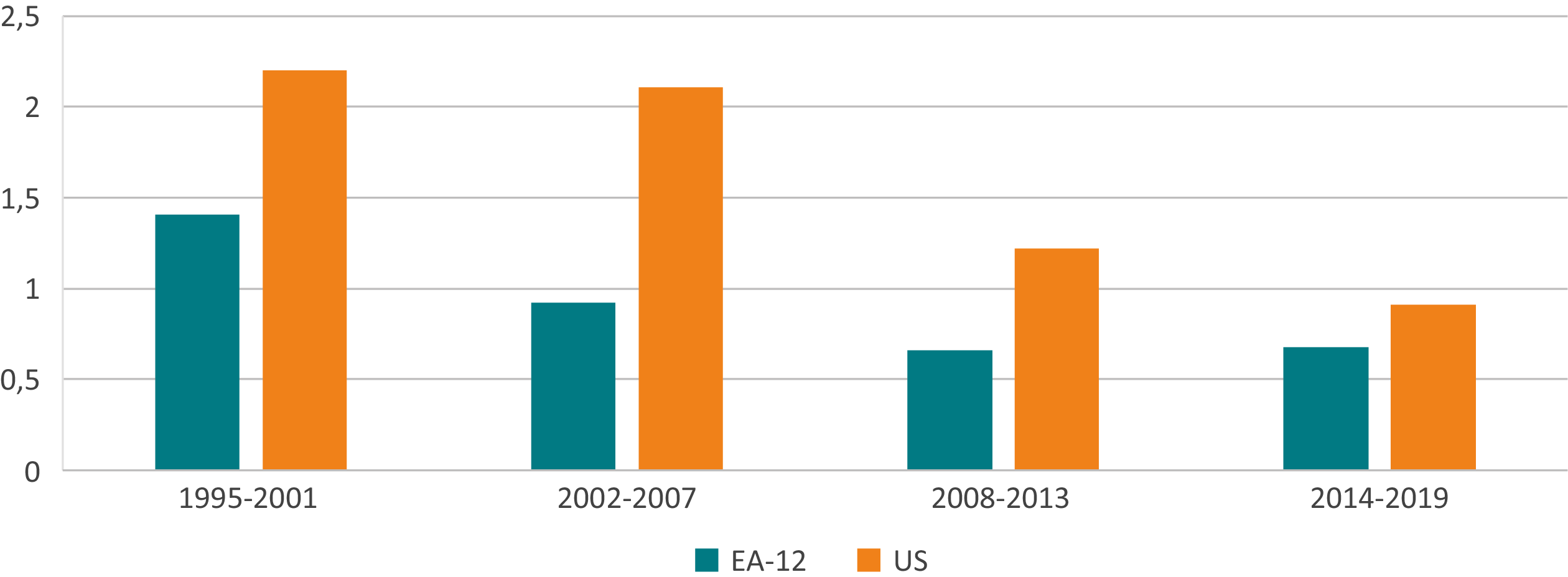

Productivity is the keystone of prosperity, growth, and a flourishing society. Over time, labour productivity has also grown faster in the US than in the Euro Area (see Figure 1), and we are a long way from the time when the differential between the US and many prosperous states was explained by Americans working longer hours. In fact the gap in working hours between Europe and the US widened until 1995, but then the trend reversed.[4] Even though the entire EU has grown labour productivity at a faster clip – especially after the enlargement – it is notable that differences in growth rates between Euro Area countries and the US persist.

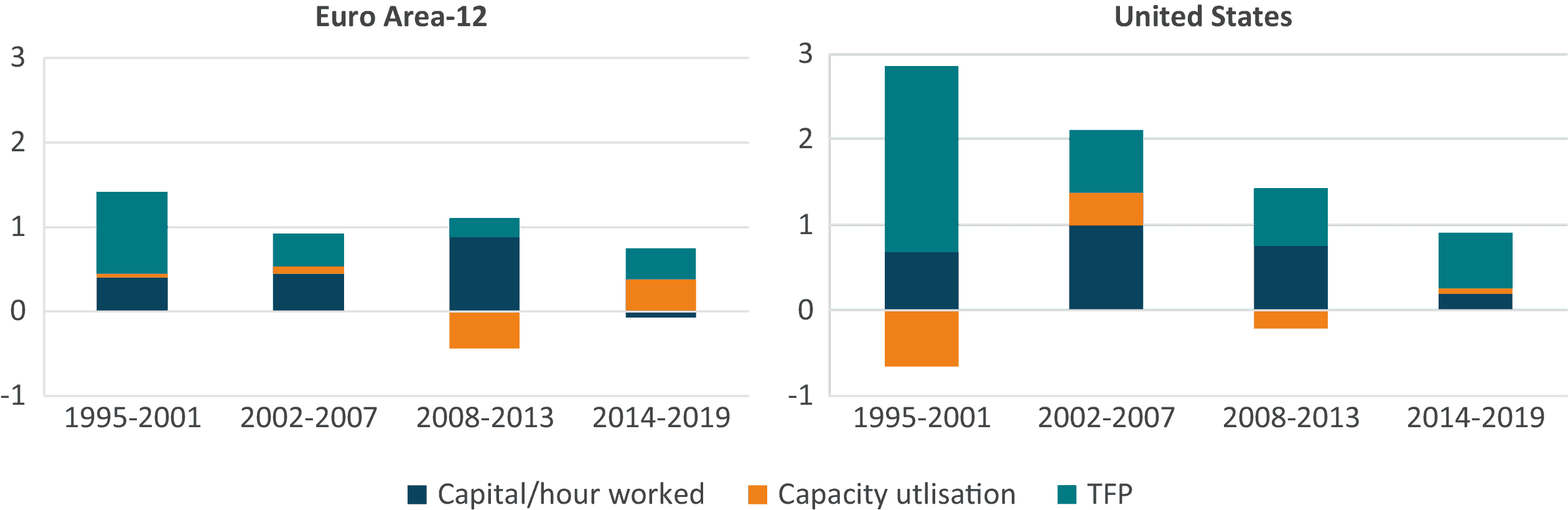

Focusing on the components in productivity growth reveal some interesting patterns in economic behaviour. In Figure 2, which decomposes productivity growth, we find that Europe’s productivity growth – especially in the last 20 years – has been substantially driven by capital deepening, meaning that the amount of capital per worker has increased. However, Total Factor Productivity (TFP) growth in the EU, which can be seen as a benchmark for the rate of technology and innovation growth in the economy, was stronger in the 1990s even if it has somewhat picked up again after 2015.

The Euro Area’s slowdown in productivity growth does not seem to be driven by large structural shifts in the economy – for instance, the secular trend of the services sector taking up a larger share of total output in Europe. In fact, such shifts seem to have had a positive effect on the employment composition, leading to higher levels of productivity. The big factor behind the decline happens within rather than across sectors. Notably, in the manufacturing sector, where the productivity slowdown has also happened across all firm sizes and for all parts in the productivity distribution. Even the frontier firms – the 5-percent most productive firms – in the manufacturing sector have reduced their productivity growth rates markedly. The services sector shows a different performance: frontier services firms have accelerated productivity growth over the past 15 years.[5]

In the US, the relative shares of factors driving economic growth are somewhat similar, but what stands out is that the contribution of capital deepening and TFP growth is substantially bigger than in the Euro Area. While the US TFP rate has declined from the high levels in the 1990s – levels that were pushed by technological change through the information and communication technology (ICT) revolution after a sharp increase in ICT capital expenditure – TFP growth remains much higher than in the Euro Area group.

FIGURE 1: GROWTH IN GDP PER HOUR WORKED Source: Eurostat and Federal Reserve Bank of the United States

Source: Eurostat and Federal Reserve Bank of the United States

FIGURE 2: CONTRIBUTIONS TO GROWTH IN GDP/HOUR WORKED Source: European Central Bank, Eurostat, Reserve Bank of the United States.

Source: European Central Bank, Eurostat, Reserve Bank of the United States.

Growth in TFP is critical for sustained economic growth. It is partly driven by a higher pace of research, technology, and innovation – more generally the contribution to economic growth that comes from individuals, firms and markets adopting new technologies and business practices in a competitive and dynamic environment. Technological change is an important part of it – but high rates of innovation and TFP growth also require dynamic and competitive markets that reward companies that drive productive change. This is also a critical part of productivity growth now because R&D, innovation and rewards for productive market change permeate all industries as we are moving into significant technological and business-model shifts. In other words, it is now key to expand growth by diffusing new technology and innovation into the production of goods and services without adding new capital and labour to the economy.

It is also an aspect that adds urgency to Europe’s need to focus on its economic growth. Comparing the EU and the US at the firm-level (and not the full economy), there is a significant productivity gap – and that gap extends to input factors like corporate-level spending on R&D as well as output factors like corporate profitability. Between 2014 and 2019, European firms grew on average 40 percent slower than their US peers and spent 40 percent less on R&D.[6] As a consequence, the gap between the EU and the US in stock market valuations has increased. This is also reflected in the generation of new knowledge and technologies. The US outperforms Europe in all classes of transversal or cutting-edge technology – technologies that break a new path for the economy. It not only generates more patents than Europe in computing and AI – technologies known to be strong for the US – but also in materials technology and cleantech, classes of technology where Europe traditionally has had strong competitiveness and outperformed the US in the past. The EU is still ahead of China in most technology categories, but it is notable how other countries in Asia have grown their role as sources of new technology and innovation.[7]

[1] Erixon, F., Guinea, O., Lamprecht, P., Sharma, V., Sisto, E., van der Marel, E. (2022). A Compass to Guide EU Policy in Support of Business Competitiveness. Report, ECIPE. Brussels, occ. Paper 6/2022, 82p.

[2] Lopez-Garcia, Paloma. (2021). Key factors behind productivity trends in EU countries. ECB Strategy Review.

[3] Ari. A. et. al. (2022). Surging energy prices in Europe in the aftermath of the war: How to support the vulnerable and speed up the transition away from fossil fuels. IMF Working Paper No. 2022/162.

[4] Bick, A., Brüggemann, B., & Fuchs-Schündeln, N. (2019). Hours worked in Europe and the US: New data, new evidence. The Scandinavian Journal of Economics, 1381-1416.

[5] European Central Bank (2017). The slowdown in Euro area productivity in a global context. ECB Economic Bulletin, Issue 3, 2017.

[6] McKinsey Global Institute (2022). Securing Europe’s Competitiveness: Addressing its Technology Gap.

[7] Patents as an indicator of innovation suffers from certain limitations as demonstrated by Griliches, Z. (1998). Conclusions on the relative position of countries in the innovation race based on patent data should take account of these limitations.

3. If EU Countries were States in the United States

The success of a country cannot be measured only through its GDP. The level of individual achievement or happiness in a country is not necessarily a consequence or a reflection of its ability to generate output. In many dimensions outside pure economic considerations, the EU exceeds the US. For instance, life expectancy in the EU (80 years at birth[1]) is higher than in the US (77 years[2]), partly because lower rates of drug-related and violent deaths[3] but also because the EU achieves better health outcomes than the US – despite spending a lower share of its GDP in healthcare.[4]

It’s also the case that the EU distributes its resources more equally than the US and has more generous welfare policies. In the EU, the richest 10 percent hold 36 percent of pre-tax national income and the bottom half hold 19 percent. In the US, these numbers were 45 percent for the richest 10 percent and 13 percent for the poorest half.[5] Nonetheless, during the last years the US has become more European, closing its gap on social spending with the EU. Between 2000 and 2019, the difference in social spending as a share of GDP between the EU and the US went from 6 to 4 percentage points.[6] At the same time the differences in the Gini coefficient between the EU and the US have been kept relatively stable over time.[7] Similarly, and as it was mentioned earlier, other structural differences between the EU and the US economy such as the amount of working hours have also been narrowing over time. Therefore, the growing gap in economic performance between the EU and the US in recent decades cannot be explained by the differences in social contracts.

This gap in economic performance matters. GDP per capita may be different from productivity, technological progress, or well-being but it is correlated with these measures. This chapter unpacks the growing gap between EU and US economic growth by looking at the EU member states and the US states GDP per capita over time. It presents a steady fall in Europe’s economic prosperity vis-à-vis the US states. However, everyone who cares about EU’s economic growth should interpret this exercise constructively. Using US states as the unit analysis proves that fully developed economies, comparable to the EU member states, can sustain higher rates of economic growth.

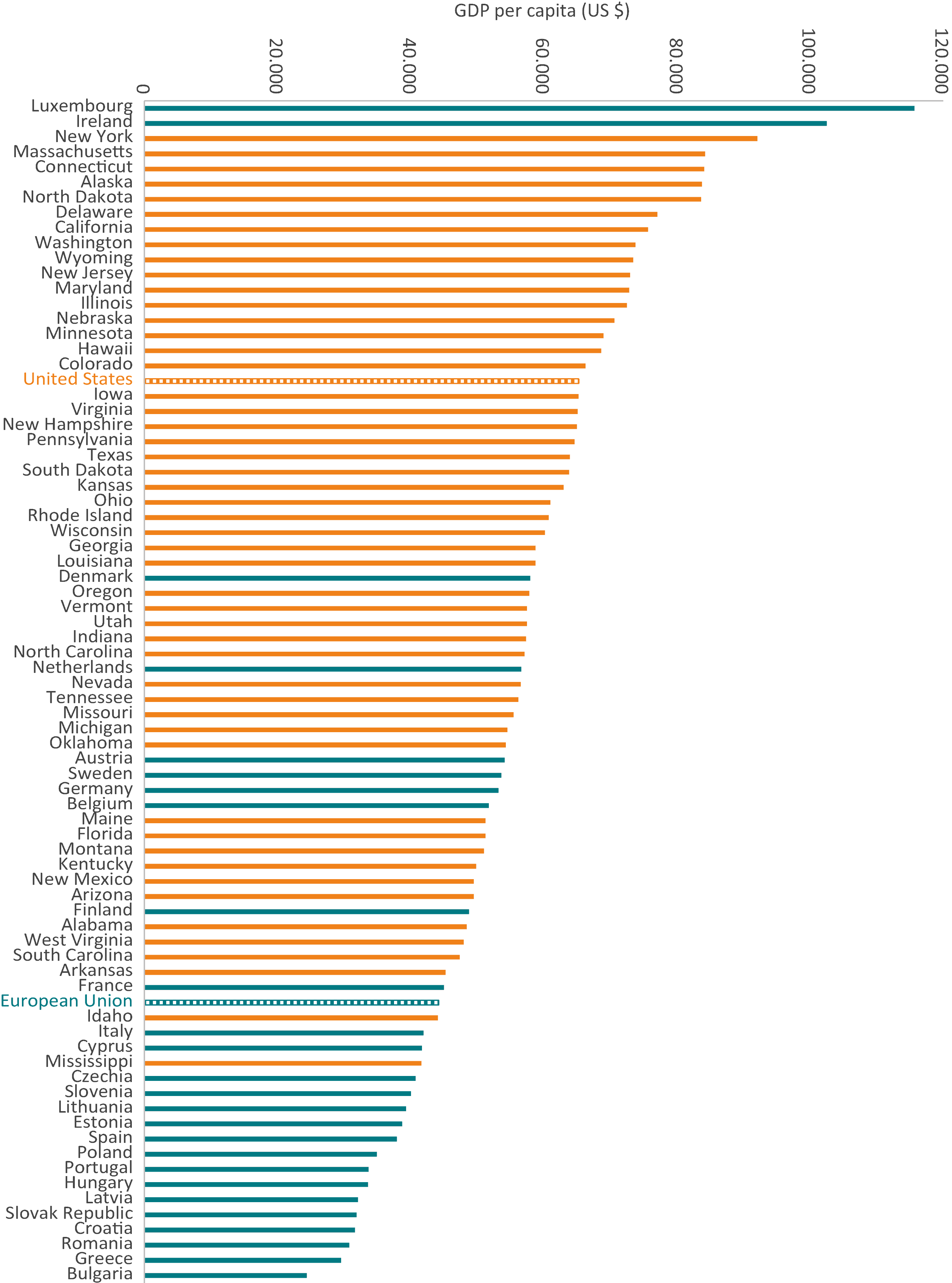

3.1 EU Member States versus US States

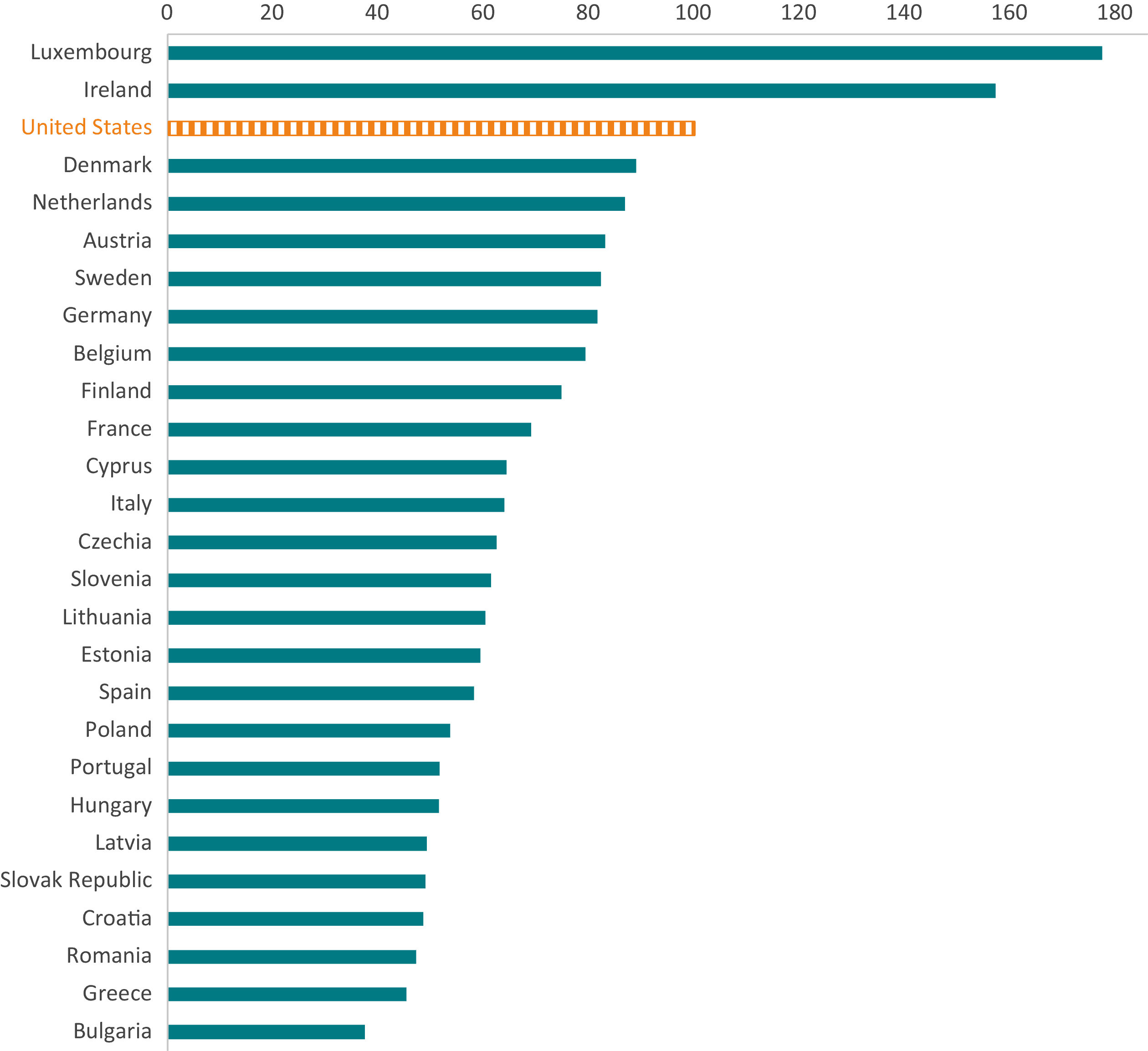

Figure 3 presents US states and European member states GDP per capita in US dollar, from the highest to the lowest. The figure clearly shows that US states are far more represented in the upper part of the ranking than the EU member states. This translates into EU and US average that differ considerably, with the US average sitting in the 19th position and the EU average at a mere 60th place. At the bottom of the table are Central, Eastern and Baltic EU member states which started the 2000s with a relatively low income per person and southern EU member states like Greece, Portugal, Spain, and Italy.[8]

Luxembourg and Ireland are ranked first and second respectively. This can be partly explained because their GDP per capita overestimates their level of prosperity. In Ireland, GDP is boosted by large foreign pharmaceutical and IT multinationals based in the country which, while producing goods and services in Ireland, record a significant proportion of their global profits within Ireland. The Central Bank of Ireland estimated that Ireland should instead rank between the 8th and 12th position in the EU if the relevant parts of per capita income are considered.[9] For Luxembourg the story is slightly different. High GDP per capita is mainly due to the cross-border flows of workers in total employment, as they contribute to overall GDP but are not residents of the country.[10] Mathematically speaking, in the GDP per capita expression the numerator is inflated relative to the denominator.

FIGURE 3: US STATES AND EU MEMBER STATES GDP PER CAPITA (2021) Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.  Figure 4 provides a similar reading as the one above, but it focuses on the EU member states. It shows the ranking of EU member states in 2021 relative to the US average, expressed in terms of an index with the US equal to 100. It shows that almost all EU member states stand below the US average and 11 EU member states presented a GDP per capita lower than 60 percent of the US.

Figure 4 provides a similar reading as the one above, but it focuses on the EU member states. It shows the ranking of EU member states in 2021 relative to the US average, expressed in terms of an index with the US equal to 100. It shows that almost all EU member states stand below the US average and 11 EU member states presented a GDP per capita lower than 60 percent of the US.

FIGURE 4: RANKING OF EU MEMBER STATES RELATIVE TO THE US (US equal to 100, 2021) Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

3.2 Going Down

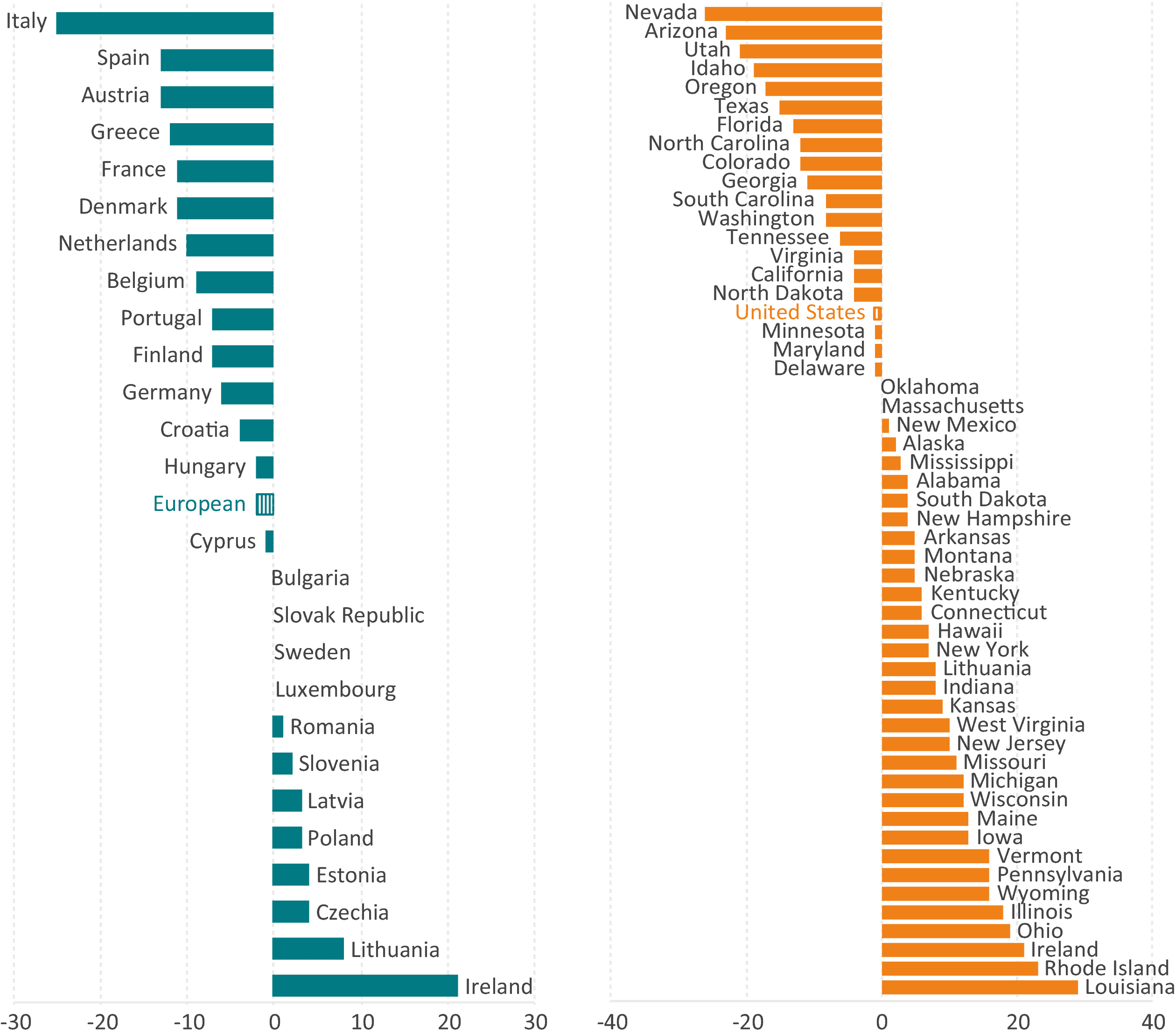

While the comparison between EU member states and US states GDP per capita is striking, the evolution over the last twenty years is staggering. Figure 5 shows the change in the ranking of each EU member state and US state between 2000 and 2021. A positive value means that a EU member state or US state has climbed up in the ranking while a negative value means that its ranking was higher in the year 2000 than in 2021.

In this period, only eight EU member states went up in the ranking while 31 US states gained at least one position. Conversely, the ranking of 14 EU member states, that together represented 89 percent of EU GDP, went down. Among them were France and Germany that lost 11 and 6 places respectively and whose economic growth and size underpins EU figures. On the other hand, a number of EU countries that joined the EU in 2004 such as Romania, Slovenia, Latvia, Poland, Estonia, the Czech Republic, and Lithuania climbed up in the ranking. The rise of these countries, however, was not enough to narrow the gap in GDP per capita between EU and US.

FIGURE 5: CHANGE IN RANKING BETWEEN 2000-2021 Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

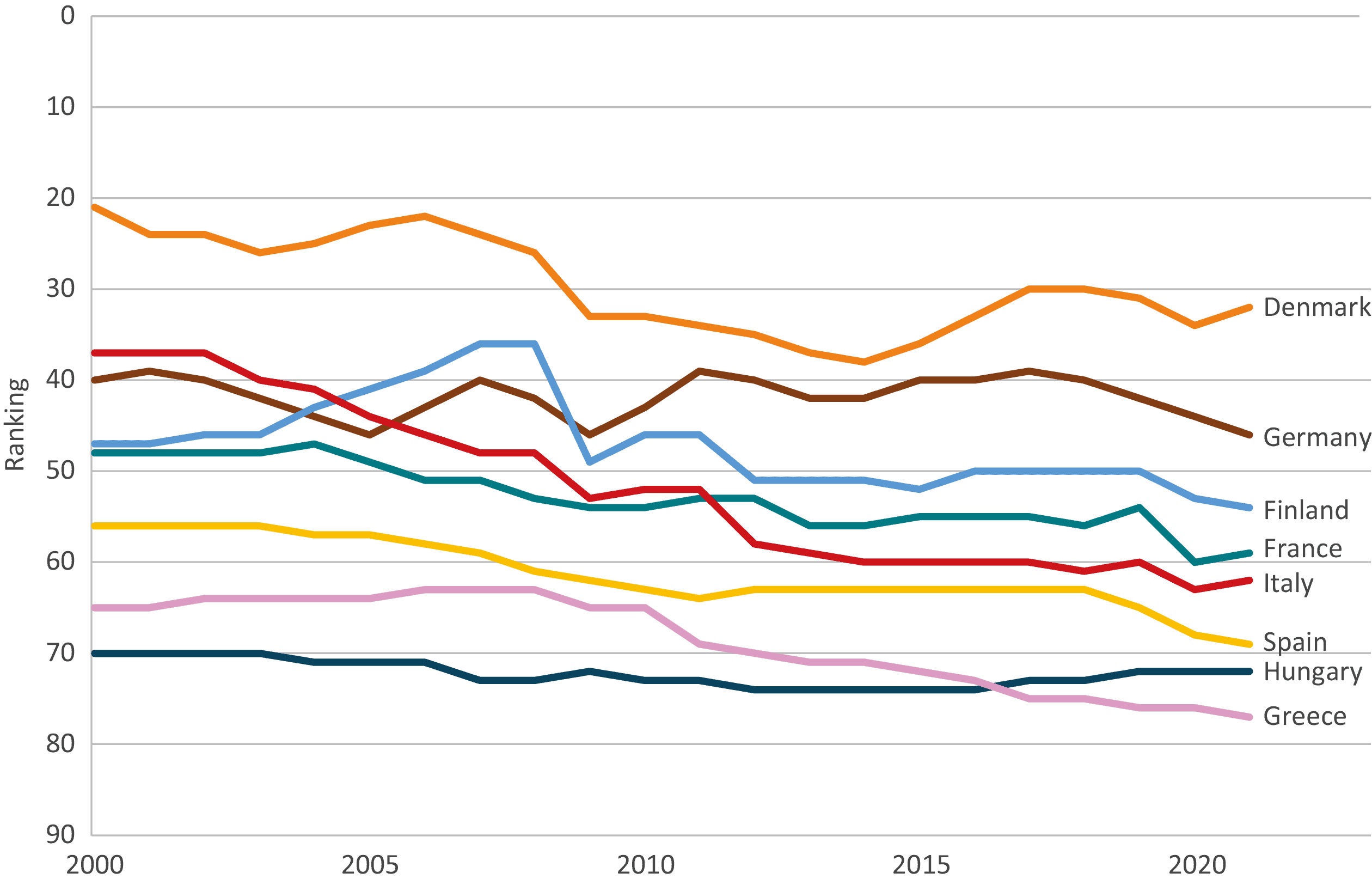

Figure 6 complements the previous one by presenting 8 of the 14 EU member states which have been falling in the ranking of GDP per capita. The figure shows that not all countries have experienced the same pattern of decline. Some, like Italy that lost 25 places, but also France, Spain, and Greece have seen a steady fall in the ranking. Others, like Finland, illustrate a story of mixed successes: a steady growth until 2008, when the financial crisis brought the country 13 positions down, effectively wiping out all previous gains in the space of a year. The figure also illustrates the effects of the pandemic in 2019, with countries like France and Italy hit relatively harder than the rest.

FIGURE 6: RELATIVE DECLINE IN GDP PER CAPITA OF SELECTED EU MEMBER STATES (2000 – 2021)

Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

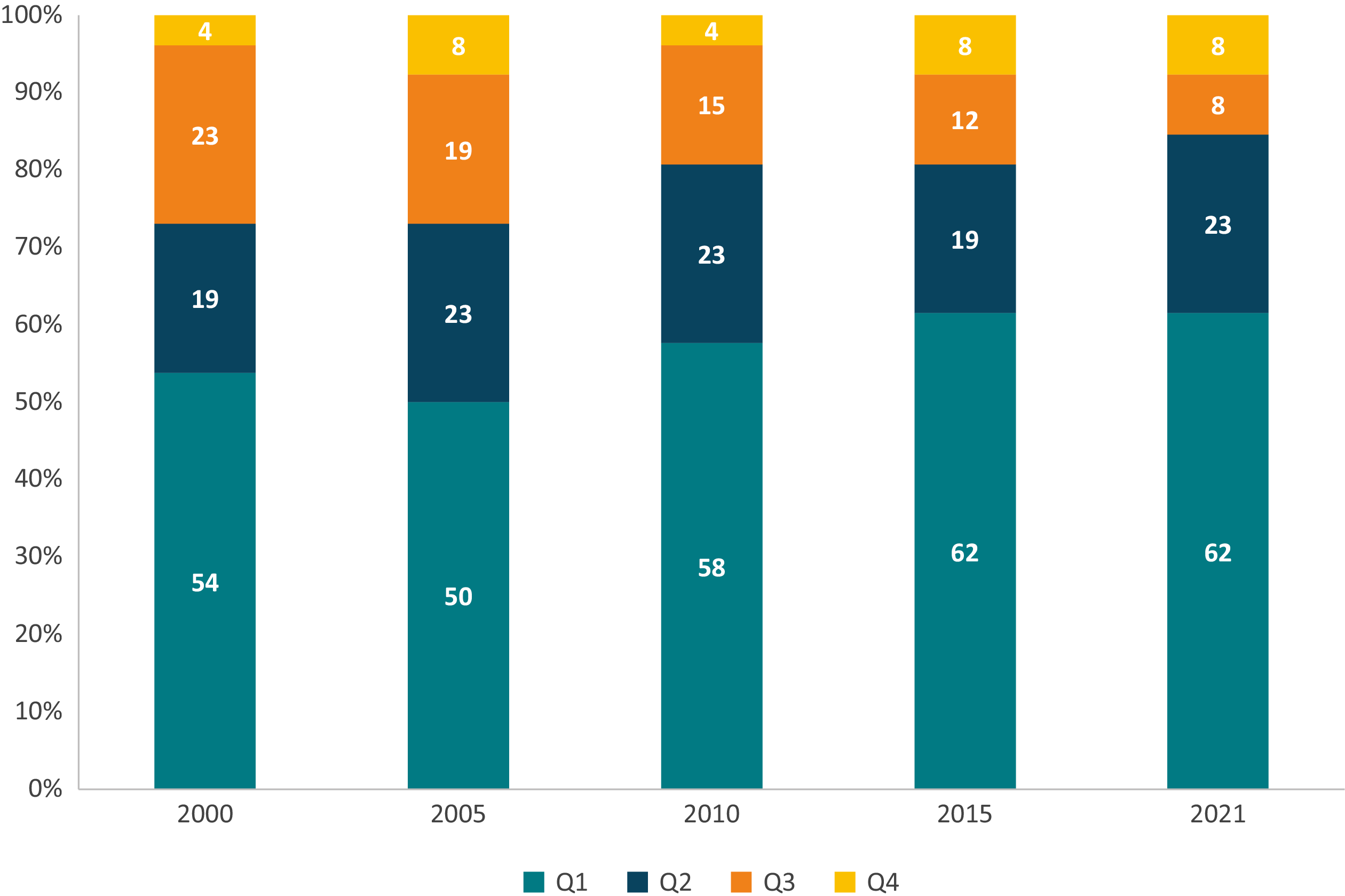

Another way to illustrate the relative fall of EU member states is to display the number of EU member states in the shared distribution of GDP per capita over time. In other words, if we rank the US and EU economies from the highest to the lowest GDP per capita, how many member states in Europe would be in the bottom part of the distribution? Figure 7 answers that question and shows that the proportion of EU member states that fall below the median, which is the sum of the first and second quartile, went up. In 2000, 73 percent of EU member states were in the bottom half of the combined distribution of EU member states and US states GDP per capita, and in 2021 this figure was 85 percent. At the same time, the proportion of EU member states above the middle of the distribution, represented by the sum of the third and fourth quartiles, went down. In 2000, 27 percent of EU member states were in the top half of the combined distribution, but in 2021 only 16 percent, i.e., Luxembourg, Ireland, Denmark and the Netherlands, belong to either of the two top quartiles.

FIGURE 7: PERCENTAGE OF EU MEMBER STATES IN EACH QUARTILE OF THE EU MEMBER STATES AND US STATES GDP PER CAPITA DISTRIBUTION Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

Source: World Bank, US Census Bureau, US Bureau of Economic Analysis, author’s calculations.

3.3 The Difference Between 2 Percent and 3 Percent Growth Is Not 1 Percent, It Is 50 Percent

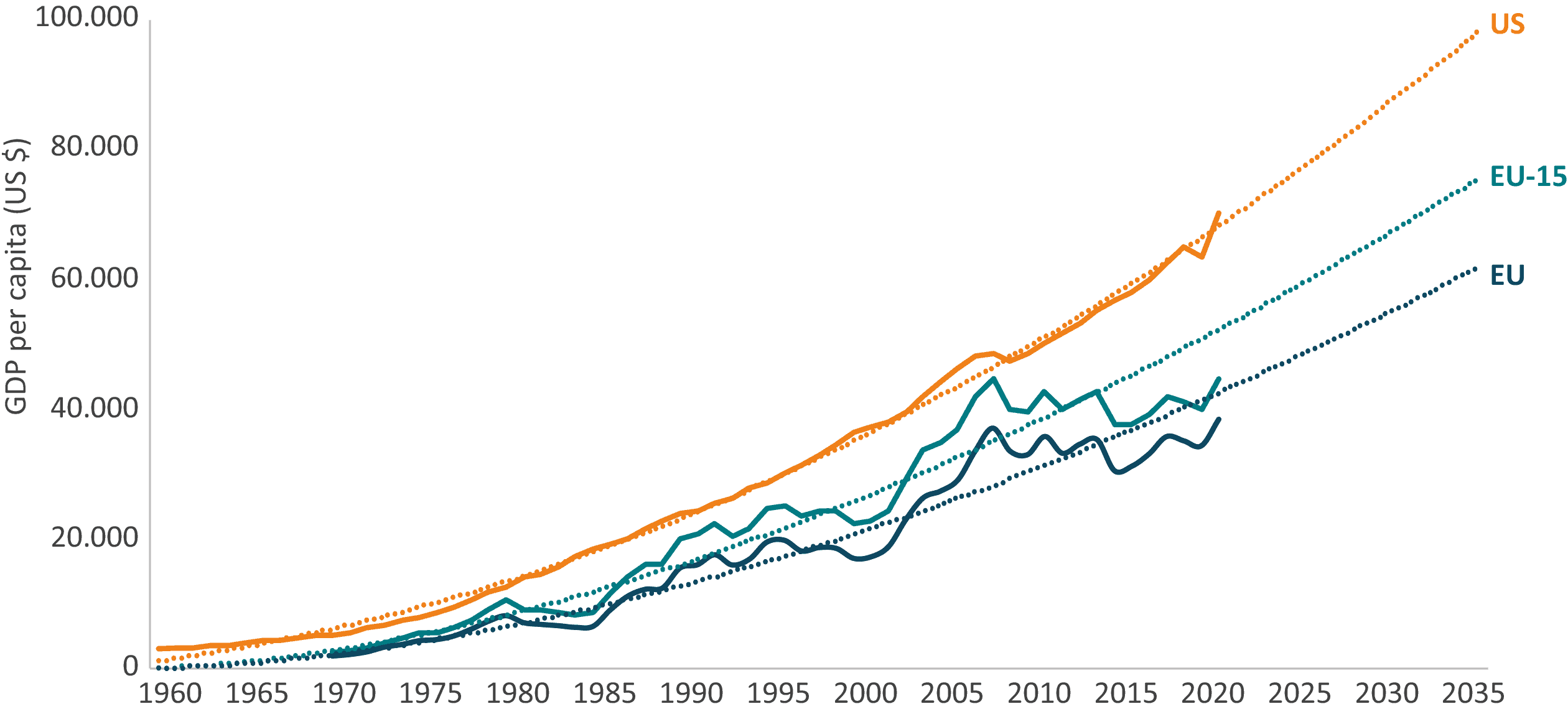

Figure 8 aggregates the individual US states and EU member states into their national figures. It presents GDP per capita in current US dollars for the US and the EU and the projections to 2035 based on historical data. It includes EU-15[11] countries because they reflect the more advanced countries in Europe which, for historical reasons and due to the structure of their economies, are more comparable to the US.

EU and US GDP per capita behaved similarly until 2000 when the gap between both lines started to widen visibly. The path of divergence continued and became particularly acute from 2010 onwards when US GDP per capita grew at an average of 3.4 percent while EU GDP per capita increased by 1.6 percent on average. Such a sustained difference matters a lot: in 2010 US GDP per capita was 47 percent larger than the EU while in 2021 this gap increased to 82 percent. If the current trend of GDP per capita carries forward, in 2035, the average GDP per capita in the US will be $96,000 while the average EU GDP per capita will be $60,000. This is the same difference in GDP per capita as between Japan and Ecuador today. And even though the difference in levels between the US and the EU-15 is smaller, the trend and the widening gap are very similar.

FIGURE 8: DEVELOPMENT OF EU AND US GDP PER CAPITA Source: World Bank, author’s calculations.

Source: World Bank, author’s calculations.

The growing gap in GDP per capita between the EU and the US is also visible in other variables that can be understood as proxies for material well-being such as private consumption, which has been consistently higher in the US than in the EU for the last four decades. Household spending on goods and services as a proportion of total GDP grew slightly in the US but has fallen in the EU. This divergence has led to lower levels of private consumption which is confirmed by a higher share of retail sales in the private economy in the US than in the EU (6.5 versus 4.4 percent respectively in 2020).[12] [13]

These figures should offer policymakers pause for thought. At the current growth rates, it will take 20 years for output per person to double in the US, while in the EU it would take 43 years! However, the EU is not doomed to low-growth rates. The power of compound interests can also play in Europe’s favour if it manages to sustain small GDP increases over time, for instance by raising Europe’s competitiveness.[14] If the EU would increase its growth rate by just 0.5 percent, the economy will double in 33 years – instead of 43 under current growth rate.

As mentioned before, GDP per capita is not the end-all-be-all of economic policy and there are many aspects that are critical for a good life in which the EU outperforms the US. However, it is also certain that the ability of a country to face the environmental, demographic, and geopolitical challenges of the coming decades will improve with higher levels of economic growth. The comparison with US states shows that developed economies, like EU member states, are able to sustain robust growth rates of GDP per capita.

[1] European Commission. (2023, March). Mortality and life expectancy statistics. Retrieved from Eurostat: https://ec.europa.eu/eurostat

[2] Arias, E., Tejada-Vera, B., Kochanek, K. D., & Ahmad, F. B. (2022). Provisional life expectancy estimates for 2021. Centers for Disease Control and Prevention.

[3] The Economist (2023, April 13). America’s economic outperformance is a marvel to behold. The Economist, Retrieved from https://www.economist.com

[4] World Bank. (2023, April 7). Current health expenditure (% of GDP). Retrieved from The World Bank: https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS

[5] World Inequality Lab. (2023, May 13). Data. Retrieved from World Inequality Database: https://wid.world/data/

[6] OECD (2023), Social spending (indicator). doi: 10.1787/7497563b-en (Accessed on 02 June 2023)

[7] World Bank. (2023, May 15). Gini Index. Retrieved from The World Bank: https://data.worldbank.org

[8] The results of our analysis do not change when we use GDP per capita in dollars without the PPP dollar conversion. In other words, when we do not take into account the differences in cost of living across countries, the relative rankings between EU member states and US states stay almost identical. The distribution of EU member states and US states at the upper and bottom end are the same regardless of the definition of GDP per capita, which validates our analysis. The only difference lies in the magnitude of ranking changes over time that is more pronounced when no PPP conversion is used.

[9] Honohan, P. (2021). Is Ireland really the most prosperous country? Central Bank of Ireland.

[10] European Commission. (2021, December 15). Highest AIC levels in Luxembourg, Germany and Denmark. Retrieved from Eurostat: https://ec.europa.eu/eurostat

[11] The EU-15 comprises Belgium, Denmark, Germany, Finland, France, Greece, Ireland, Italy, Luxembourg, Netherlands, Austria, Portugal, Spain, the United Kingdom, and Sweden. They are often referred to as the “original Member States”, those in the EU before the 1995 enlargement.

[12] U.S. Bureau of Economic Analysis. (2023, June 5). Interactive Access to Industry Economic Accounts Data. Retrieved from U.S. Bureau of Economic Analysis.

[13] European Commission. (2023, June 5). National accounts aggregated by industry (up to NACE A*64). Retrieved from Eurostat: https://ec.europa.eu/eurostat

[14] Erixon, F., Guinea, O., Lamprecht, P., Sisto, E., & van der Marel, E. (2023). The economic dividend of competitiveness. Report, ECIPE, Brussels, Policy Brief 02/2023, 36 p.

4. Conclusions

The US economy has clearly outperformed the EU. This disparity in economic outputs has been sustained over a long period of time and, thanks to the power of compound interest, resulted in an 82 percent GDP per capita gap in favour of the US in 2021. While the grass is always greener on the other side of the fence, and the EU performs better than the US in other areas that matter for the quality of life such as health, the gap in GDP per capita between the EU and the US has become too big to ignore.

There are many reasons behind this variation in economic outcomes. The EU’s Total Factor Productivity (TFP), a proxy for technological change, has been significantly lower than the US. The EU economy experienced lower economic dynamism, R&D spending, and higher energy costs than the US. As a result, EU GDP per capita, particularly for the Euro Area, has been consistently lower than the US.

The EU’s relatively disappointing economic performance vis-à-vis the US is a well-known economic fact. However, it becomes more striking when the EU and US averages are broken down by its constituent parts, namely the EU member states and the US states. The resulting picture should be a cause for concern for the EU policy-makers. When EU member states and US states GDP per capita is ordered from the highest to the lowest only two EU member states, Luxembourg and Ireland, have a GDP per capita higher than the US average. The next in the line is Denmark, whose GDP per capita is still lower than 28 US states. Since 2000, 14 EU member states, including Germany, France, and Italy which historically have been the drivers of European economic activity, have fallen in this ranking. While GDP per capita in Central and Eastern European countries has grown considerably, their relatively small size and lower starting point, stop them from reverting the trend of relative EU economic decline.

However, every cloud has a silver lining. This Policy Brief offers a glimpse of hope for Europe. The EU is not destined to a future of economic stagnation. The example of the US states, which are comparable to the EU member states in their economic development, proves that achieving higher rates of economic growth is possible and, given the current challenge in the EU’s energy, defence, demography and public finance, desirable.

References

Ari, A., Arregui, N., Black, S., Celasun, O., Iakova, D. M., Mineshima, A., and Zhunussova, K. (2022). Surging Energy Prices in Europe in the Aftermath of the War: How to Support the Vulnerable and Speed up the Transition Away from Fossil Fuels. IMF Working Papers, 2022/152.

Arias, E., Tejada-Vera, B., Kochanek, K. D., & Ahmad, F. B. (2022). Provisional life expectancy estimates for 2021. Centers for Disease Control and Prevention.

Bick, A., Brüggemann, B., & Fuchs-Schündeln, N. (2019). Hours worked in Europe and the US: New data, new answers. The Scandinavian Journal of Economics, 1381-1416.

Erixon, F., Guinea, O., Lamprecht, P., Sharma, V., Sisto, E., van der Marel, E. (2022). A Compass to Guide EU Policy in Support of Business Competitiveness. Report, ECIPE. Brussels, occ. Paper 6/2022, 82p.

Erixon, F., Guinea, O., Lamprecht, P., Sisto, E., & van der Marel, E. (2023). The economic dividend of competitiveness. Report, ECIPE, Brussels, Policy Brief 02/2023, 36 p.

European Central Bank. (2017). The slowdown in euro area productivity in a global. ECB Economic Bulletin(3).

European Commission. (2021, December 15). Highest AIC levels in Luxembourg, Germany and Denmark. Retrieved from Eurostat: https://ec.europa.eu/eurostat

European Commission. (2023, March). Mortality and life expectancy statistics. Retrieved from Eurostat: https://ec.europa.eu/eurostat

European Commission. (2023, June 5). National accounts aggregated by industry (up to NACE A*64). Retrieved from Eurostat: https://ec.europa.eu/eurostat

Honohan, P. (2021). Is Ireland really the most prosperous country? Central Bank of Ireland.

Lopez-Garcia, Paloma. (2021). Key factors behind productivity trends in EU countries. ECB Strategy Review.

McKinsey Global Institute. (2022). Securing Europe’s competitiveness: Addressing its technology gap. McKinsey.

OECD (2023), Social spending (indicator). doi: 10.1787/7497563b-en (Accessed on 02 June 2023)

The Economist (2023, April 13). America’s economic outperformance is a marvel to behold. The Economist, Retrieved from https://www.economist.com

U.S. Bureau of Economic Analysis. (2023, June 5). Interactive Access to Industry Economic Accounts Data. Retrieved from U.S. Bureau of Economic Analysis.

World Bank. (2023, April 7). Current health expenditure (% of GDP). Retrieved from The World Bank: https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS

World Bank. (2023, May 15). Gini Index. Retrieved from The World Bank: https://data.worldbank.org/indicator/SI.POV.GINI?end=2022&start=1968&view=chart

World Inequality Lab. (2023, May 13). Data. Retrieved from World Inequality Database: https://wid.world/data/