Published

Time to Resist Dovish Temptations?

Subjects: North-America

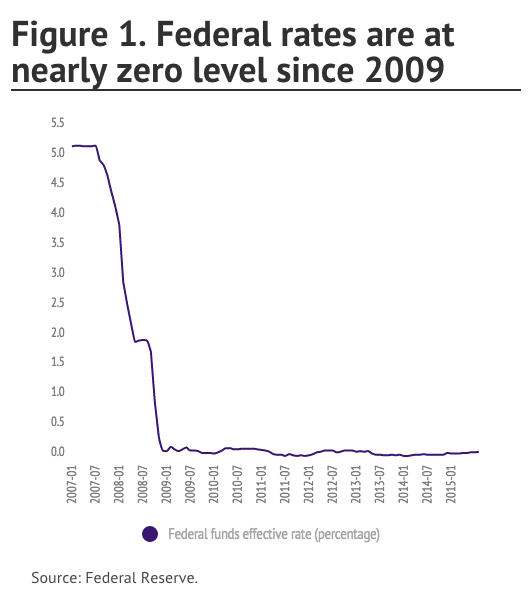

On Thursday, the Federal Reserve might raise interest rates for the first time in nine years (figure 1). However, this decision is still surrounded by uncertainty. On one hand, the US economy has shown clear signs of recovery and, given the time lag with which monetary policy works, the Fed has solid domestic reasons to raise rates already this week. In fact, although inflation is still far from the 2% target, unemployment is down to 5.1% (sooner than expected) and wage-inflation pressure might pick up soon. Moreover, there is a growing concern over the prolonged disconnect between financial markets and fundamentals (figure 2 and figure 3).

On the other hand, mounting financial volatility in the Chinese market – and consequently in other emerging economies – has brought the IMF and World Bank to warn against the destabilizing effects that might result from a normalization of US monetary policy and have called for postponing the first increase in the federal rates. Yet, some emerging markets seem to disagree with this prescription and have asked the Fed to lift rates in order to end the uncertainty which has surrounded their economies for too long.

Whether or not the Fed will decide to test its capacity to pull the brakes on its unprecedented experiment of ultra-loose monetary policy, it remains clear that what lays ahead is the loosest tightening cycle in modern history. In the emerging world, Brazil, China and Russia are experiencing great troubles to respond to financial instability. At the same time, Europe and Japan are struggling to support their real economy while also fearing serious distortions in the assets market.

The Fed’s decision is an extremely thorny one. However, given the domestic developments in the US market and the mounting expectations of a rate increase, excuses to resist dovish temptations are running out.