Published

China’s Expanding Influence in the Western Balkans: Why Montenegro Matters

By: Philipp Lamprecht Bernd Christoph Ströhm

Subjects: Far-East Regions Russia & Eurasia

In recent years, powers such as Russia and China increased their economic and political presence in the Western Balkans. It is evident that the EU is currently under pressure to find a solution on how to mitigate the activities of those actors in the region. The Eurozone crisis, along with the global financial depression in 2008, has diverted the focus of the EU. As a result, the EU bloc’s overall enlargement process got stalled.

Historically, European banks had played a prominent role in its neighbourhood, providing capital for business investments, and acting as intermediaries for financial services. For example, they have been essential as correspondent banks, facilitating the trade finance necessary for international trade. However, following the financial crisis, the EU reformed its financial services regulations, weakening these relationships. European banks have since withdrawn from the EU’s eastern rim and reduced their exposure in neighbouring countries.

At the same time, other non-EU actors, particularly China, successfully managed to get a foothold on the region, as bilateral creditor first and foreign direct investor second. The Chinese “Belt and Road Initiative” (BRI), seeking to improve international trading and infrastructural connectivity, is a crucial part of China’s investment strategy in the Western Balkans. The Western Balkans region finally became a target region for Chinese investment owing to the region’s geostrategic position and due to the need for investment in infrastructure development programs since 2008.

Montenegro in a Chinese dept-trap?

Montenegro, the smallest country in the Western Balkans, easily gets overlooked. Nevertheless, even though small, Montenegro remains important to the region. Its geography and economy capture global attention and international investments. Particularly China as creditor and investor caught attention in recent years owing to the concept of “debt-trap diplomacy”. This concept suggests that China actively loans money to nations which are subsequently unable to service the debt. This grants China political and economic influence. Montenegro’s loan for the construction of the “Bar-Boljare Motorway” project is such an example – the debt to GDP ratio of the loan is colossal in the economy of Montenegro.

China and Montenegro’s Bar-Boljare Motorway Project

The Bar-Boljare motorway project can be regarded as a Montenegrin “prestige-project” – it is the largest infrastructure project in Montenegro since the country’s independence in 2006. The project’s construction is additionally a vivid example of China’s investment strategy in the Western Balkans. The Montenegrin government secured an USD944 million loan from the Chinese Exim Bank in 2014, at a two percent interest rate, to facilitate the Bar-Boljare motorway’s construction. The motorway construction was launched to connect Montenegro’s seaport city of Bar with the capital of Belgrade, Serbia.

The project was also designed to boost Montenegro’s economic development and to support the country’s tourism sector. However, it has been plagued by various issues since its conception. Two feasibility studies declared the highway financially infeasible. Nonetheless, Montenegro proceeded with the loan, raising the debt-to-GDP ratio of Montenegro to astronomical levels.

The Montenegrin economy was further negatively struck by the COVID-19 pandemic, whose worst effects were felt by the country’s tourism-dependent economy. The US State Department in 2023 finally ranked Montenegro among the most indebted Western Balkan countries based on the skyrocketing public debt-to-GDP ratio. Excessive spending and project cost have also triggered political tensions in Montenegro, with accusations of corruption and inefficiency fuelling public disillusionment and criticism of government.

Back in 2021, Montenegro was feeling the squeeze from its massive public debt, which it why the country had issues to properly service its debt to China. In July of that year, with a helping hand from the EU, Montenegro struck a hedging deal with France’s Société Générale, Germany’s Deutsche Bank, and the US-based Merrill Lynch International and Goldman Sachs International. This 14-year agreement essentially swapped their dollar debts for euros, as a measure to protect Montenegro’s public finances from risks due to changes in the euro-dollar exchange rate, which directly affected the amount of debt. Montenegro successfully renegotiated the hedging arrangement in January 2024, safeguarding the entire credit arrangement for the Bar-Boljare motorway until the complete repayment of the debt to the Chinese Exim Bank.

The first section of the Bar-Boljare highway (some 41 kilometers long) was eventually completed by the Chinese China Road and Bridge Corporation (CRBC) in 2022. The construction overall took seven years. During that time, reports emerged that the construction process itself was accompanied by lack of transparency, fiscal and environmental problems. Non-governmental organizations also pointed out that the project was poorly contracted and that the state did not adequately protect itself through contractual arrangements. Despite those issues in the construction of the Bar-Boljare highway, there is still great interest from the CRBC, and other international companies, in continuing the construction of the second section of the highway. To facilitate the construction of the highway’s second section, the European Commission is willing to finance a third of the section’s construction cost, with EUR100 million in grants.

Other Chinese Projects in Montenegro and Montenegro’s External Debt

Apart from the Bar-Boljare highway project, there are a number of other Chinese projects and investments in the transport sector of Montenegro. Chinese companies have provided more than just financial support in the improvement of the transport infrastructure. The Port of Bar, also the main port of Montenegro, has been significantly modernized through investments from the Chinese side. About ten years ago, Montenegrin maritime companies additionally purchased ships from Chinese companies with subsequent financing by a Chinese bank loan. Chinese companies also continued to improve rail infrastructure and were involved in various road construction projects in southern Montenegro in 2023.

Furthermore, another important area of cooperation between Montenegro and China is the renewable energy sector. Chinese companies have been engaged in building up wind power plants and solar power projects. A Chinese company is also involved in the ecological rebuilding of the Thermal Power Plant in Pljevlja. Those projects allow Montenegro to fulfil certain renewable energy goals, aimed at limiting the country’s fossil fuel dependency.

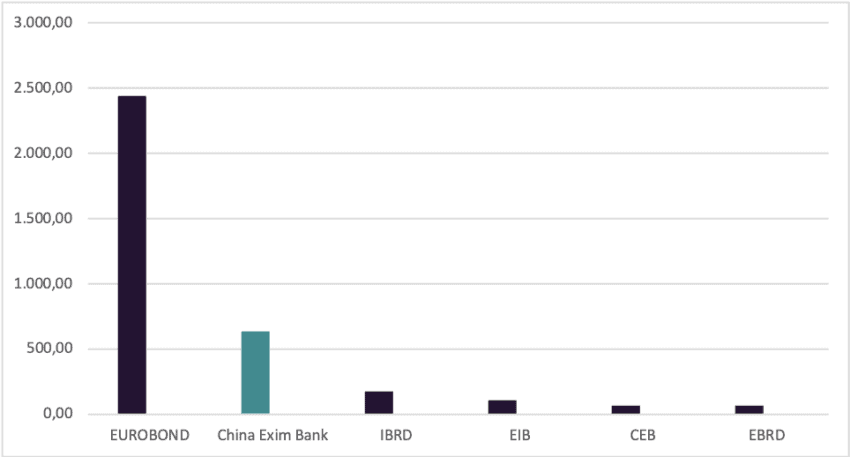

As of Q3 2024, Montenegro’s external debt continues to be substantially tied to the Chinese Exim Bank. The country is still repaying a substantial loan from the Chinese Exim Bank, originally taken out for the Bar-Boljare highway project. This loan has been a significant part of Montenegro’s external debt for several years. In addition, Montenegro also has considerable obligations through Eurobonds. These bonds have been vital to refinance public debt and manage the country’s financial stability. In the third quarter of 2024, the Chinese Exim Bank’s total foreign debt amounted to EUR633 million, representing 15,6% of Montenegro’s total external debt and 8,5% of the country’s state debt. China also emerged as one of the most important importing countries to Montenegro, next to Serbia, and the most important country in the import of machinery and transport equipment.

Figure: External debt Montenegro in mn/creditor, Q3 2024

Source: Government of Montenegro

China’s investments and bilateral loans increased its geo-economic influence across the entire Western Balkan region. It is also involved in establishing the strategic infrastructure in Montenegro, like the Port of Bar, and continues undertaking large-scale road and railway construction in the region.

The task to offset this influence so that the EU could protect its strategic interests within the Western Balkans seems apparent. It is crucial to note that financial stability for Montenegro is equally important for the future integration of Montenegro into the EU and that Chinese loans, while useful in providing a temporary reprieve, have rendered the debt-to-GDP ratio quite uninviting. China has great economic interests in Montenegro, and therefore the EU should work strategically to increase its economic presence within the country to provide the much-needed balance.

The EU should focus on making it easier for businesses in the region to get their hands on both public and private capital. EU funding opportunities are vital – they shape what kind of financial products and services businesses in the Western Balkans can access. Also, regulatory cooperation, information exchange, and capacity building should be strengthened between the EU and countries in the Western Balkan region. In addition, through special provisions included in some EU financial regulations, the European Commission has the authority to designate parts of a third country’s regulatory framework as EU-equivalent. This is intended to facilitate cross-border compliance and increase financial services trade. Expanding such adequacy in neighbourhood countries should also be a key priority. Finally, the EU’s trade agreements with countries in the region need to be modernised and enhanced in these areas.