European Economic Security and Access to Critical Raw Materials: Trade, Diversification, and the Role of Mercosur

Published By: Oscar Guinea Vanika Sharma

Research Areas: EU Trade Agreements EU-Mercosur Project European Union

Summary

Access to secure and stable supply of critical raw materials (CRMs) is vital for Europe’s economic security. These raw materials, which are indispensable inputs for Europe’s modernisation, are supplied by a handful of countries. Among them, China and Russia are two of the most important European suppliers of CRMs. This dependency leaves the EU exposed to Chinese and Russian policies that may harm Europe’s economic and political interests.

The European Commission has recently proposed a Critical Raw Materials Act with the objective of increasing domestic production of strategic raw materials (SRMs) – a subset of CRMs vital for the energy and digital transitions. However well-intentioned, most of the policies in the Act – which aim at producing more SRMs in Europe – are a red herring. While the EU needs to reduce its vulnerable dependence on some countries, the politics about the supply of CRMs have become hostage to manufacturing fetish, import-substitution ideas, and companies who want governments to subsidise their investments and growth. In reality, getting substantial amounts of Europe-produced SRMs to market will take years – if not decades – and new mines will face significant legal and environmental resistance. It is simply not realistic to expect that higher domestic production in the EU will reduce Europe’s current dependency on imported SRMs anytime soon. If it is economic security and reduced vulnerabilities that Europe wants, a different strategy is needed.

There is a better alternative. Trade dependencies of CRMs can only be fought with more trade. One option exist already: the EU could diversify its supplies of CRMs away from China and Russia by trading more with other exporters of CRMs. Mercosur is an obvious partner to achieve this goal. Brazil, a member of Mercosur, is the largest supplier of SRMs to the EU by volume and the Mercosur countries are democratic market economies that are seeking deeper relations with Europe.

To encourage trade and investment in CRMs across both regions, the EU-Mercosur Association Agreement includes binding provisions that will place the bilateral trade and investment relations under a more certain institutional arrangement. Other policies, such as those included in the EU’s CRM Act, can only complement but not substitute for a trade-oriented strategy to improve the structure of SRM supply.

1. Introduction

There are technological and trade risks that make the EU vulnerable to the whims – or, worse, the malicious abuse – of third countries. In a recent Economic Security Strategy[1], the European Commission identified trade dependencies and the weaponization of these dependencies as one of the most substantial risks. These risks are not just theoretical. Russia’s war on Ukraine is proof of the dangers of over relying on a single country with divergent values and interests for the supply of crucial goods such as hydrocarbons. Other and less dramatic examples of dependence on supply from countries that do not wish Europe well can be found: chemicals like red phosphorus from Kazakhstan or silicon wafers[2] and certain active pharmaceutical ingredients from China[3], for instance.

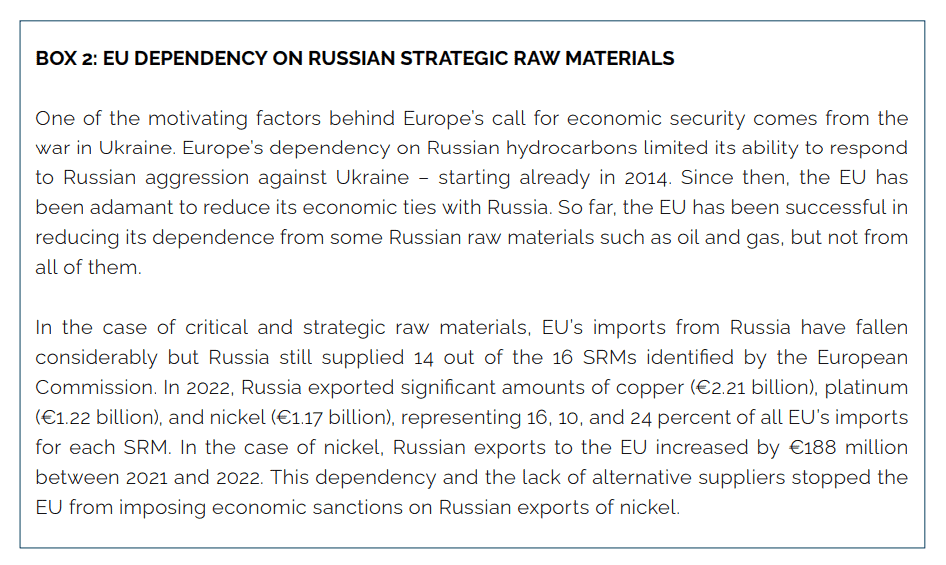

Europe’s dependencies on third countries extend to critical raw materials (CRMs), which are vital ingredients for industries such as defence as well as the economic sectors behind the green and digital transitions. A practical example of the political implications of these dependencies is Europe’s inability to include palladium and nickel as part of the package of economic sanctions against Russia due to the lack of alternative sources for these CRMs[4]. China, a country with which the EU wants to de-risk its economic ties, is also a major global producer of many CRMs.

As a result, the supply of CRMs has become a huge political issue, and not just in the EU. Countries around the world are hatching up plans to secure the delivery of these raw materials: the U.S., the UK, Japan, South Korea, Australia and Canada have implemented policies and regulations to monitor the availability of CRMs and support domestic production. This is not just because of its criticality for strategic industries but also because the demand for CRMs is only going to increase.

For instance, meeting the REPowerEU’s objective of tripling wind power capacities by 2030 will require five times more rare earth permanent magnets[5]. In 2030, for electric-vehicles batteries and energy storage alone, the EU will need up to 18 times more lithium and 5 times more cobalt[6]. At the global level, the International Energy Agency (IEA) predicts that demand for lithium will increase up to 42 times between 2020 and 2040, while annual demand for nickel and cobalt in that period is projected to be two and five times higher than the levels seen between 2010 and 2020[7].

Securing a stable and diversified supply of CRMs is anything but simple. First, CRMs are concentrated in a few countries: 60 percent of global cobalt production is in the Democratic Republic of Congo; South Africa accounts for 77 percent of global palladium production; Russia holds 83 percent of platinum production; Brazil is responsible for 88 percent of the international production of niobium; and Australia and Chile together produced 81 percent of lithium[8]. In Europe, China provides 98 percent of the EU’s supply of rare earth elements and Turkey provides 98 percent of the EU’s supply of borate[9]. Second, for some CRMs like lithium, magnesium, or germanium, market concentration in the processing stage is even higher than in mining, which in the case of many CRMs, takes place mostly in China.

This market concentration in the mining and processing of CRMs makes their provision susceptible to price surges, scarcity and geopolitical disruptions – something that has materialised in the past. In September 2010, in the context of a territorial dispute with Japan over the Senkaku islands, China halted all exports of rare earth elements to Japan triggering a significant price spike on global markets[10]. Also in 2010, China reduced its export quota of rare earth to the U.S. and since 2022 China has included all rare earth elements in its export control measures[11]. Most recently, China has also imposed export curbs, in the form of licenses, on gallium and germanium which are essential for the production of semiconductors. Applications for export licenses will need to identify importers and end users and explain what these CRMs will be used for[12].

It is in this context that the European Commission published its proposal for the Critical Raw Materials (CRM) Act. Based on an established methodology, the EU identified 34 CRMs[13] and a subset of 16 strategic raw materials (SRMs)[14], which are vital for the green and digital transition, as well as defence and space applications (see Box 1). The Act contains provisions for the monitoring, circularity and sustainability of all CRMs, although specific attention is given to SRMs by setting targets for their extraction, processing, recycling and diversification of supply. The Act also includes public subsidies – in the form of favourable access to finance – to meet these targets. By 2030, the EU should be able to extract at least 10 percent, process at least 40 percent, and recycle at least 15 percent of its annual consumption of SRMs. These three targets will support the achievement of a fourth one which aims to reduce EU’s reliance on the extraction and processing of SRMs from third countries to no more than 65 percent of the EU’s annual consumption by 2030. Achieving these targets will not be easy. Extraction capacity depends on whether the SRMs can be found in Europe’s soil with sufficient concentration for mining to be commercially viable. Nor is it a given that SRM mining and processing can get started for political reasons. In the first place, public support for these activities is underwhelming[15]. Moreover, building new mines in Europe takes a long time – only getting all necessary approvals take years and years. Therefore, despite Europe’s efforts to increase domestic production, there will be significant delays before any newly mined European SRMs can reach the EU market.

Achieving these targets will not be easy. Extraction capacity depends on whether the SRMs can be found in Europe’s soil with sufficient concentration for mining to be commercially viable. Nor is it a given that SRM mining and processing can get started for political reasons. In the first place, public support for these activities is underwhelming[15]. Moreover, building new mines in Europe takes a long time – only getting all necessary approvals take years and years. Therefore, despite Europe’s efforts to increase domestic production, there will be significant delays before any newly mined European SRMs can reach the EU market.

The contrast between future demand and supply for CRMs points to the obvious need to increase production of CRMs, in the EU and worldwide. However, it is simply unrealistic to assume that the EU can substantially meet its own demands for CRMs and lower its dependency on CRMs from China and Russia in the short and medium term by substituting imports from these countries with its own production. Spending public resources to increase domestic production will not make a difference in lowering these trade dependencies. Using public subsidies to increase domestic production of SRMs in the EU seeks the reindustrialisation of the EU, not lowering EU’s CRMs dependencies from China and Russia. This policy is unnecessary. The share of EU’s manufacturing sector over its GDP has not fallen and the EU is particularly strong in the manufacturing of green and digital technologies whose share of global production is, on average, 28 percent[16]. Public subsidies will not solve the problem of trade dependence because the barrier behind Europe’s low levels of production of CRMs is not access to finance but a strict and slow regulatory system for the extraction and processing of CRMs. If the EU wants to become less vulnerable to Chinese and Russian interests, it needs to reduce its regulatory burden and trade more with other countries rather than handing over subsidies.

The EU’s CRM Act acknowledges the need for trade diversification. However, there is a glaring omission in the partners identified by the EU for cooperation. There is no mention of Mercosur, its constituent countries (i.e., Argentina, Brazil, Paraguay, and Uruguay) and the EU-Mercosur Association Agreement. This is a fundamental mistake. Argentina is one of the largest global producers of borate and lithium, and Brazil of bauxite, copper, iron ore, manganese, natural graphite, niobium, silicon metal, and tantalum[17]. Importantly, the EU has negotiated an Association Agreement with Mercosur, which includes the binding legal provisions and institutional structures that the EU’s CRM Act aims to construct. If the EU could ratify this agreement, it would create great opportunities to diversify imports of raw materials and improve its own economic security.

The EU’s proposal for a CRM Act lays out a plan for the creation of Strategic Partnerships, Strategic Projects – where public subsidies will be channelled to stimulate higher production of SRM in the EU and abroad – and the Critical Raw Materials Club. These actions contribute towards increased production of SRMs and the diversification of the EU’s supply. However, they are a poor substitute for the binding commitments given by the EU-Mercosur Association Agreements. These commitments are essential to create the conditions for a reliable and stable supply of CRMs from Mercosur to the EU and for the required investments if the EU wants to encourage increased production of CRMs in Mercosur.

This Policy Brief makes the case in favour of the EU-Mercosur Association Agreement as a crucial tool to achieve EU’s economic security by diversifying EU’s imports of SRMs away from China and Russia. Achieving these objectives also contributes to the creation of higher value-added activities within the Mercosur’s mining industry, supporting the industrialisation of the region. The next chapter of this Policy Brief presents the EU demand for SRMs, sources of supply and the risk of dependency on China and Russia. The third chapter shows Mercosur supply of SRMs. In particular, it presents Brazil exports of SRMs over time, as well as the potential for Brazil to replace Chinese and Russian SRMs. The final chapter shows that the EU-Mercosur Association Agreement is the best tool to support further integration of the supply chains of CRMs across both regions, placing the exchange of CRMs under a more certain and secure institutional arrangement.

[1] European Commission (2023). Joint Communication to the European Parliament, the European Council, and the Council on “European Economic Security Strategy”. Brussels, 20 June 2023. JOIN(2023) 20 final.

[2] Arjona, R, W Connell and C Herghelegiu (2023). An enhanced methodology to monitor the EU’s strategic dependencies and vulnerabilities. Single Market Economy Papers WP2023/14.

[3] European Commission (2021), Strategic dependencies and capacities. Staff Working Document SWD(2021)352 final.

[4] OECD (2022). The supply of critical raw materials endangered by Russia’s war on Ukraine. OECD. Gehrke, T. (2022). Securing EU critical raw material supplies after Russia’s war. Encompass.

[5] JRC (2022). Supply chain challenges: Wind Turbines and magnets. Science for Policy Brief.

[6] JRC (2018). Cobalt: demand-supply balances in the transition to electric mobility.

[7] IEA (2021). The Role of Critical Minerals in Clean Energy Transitions.

[8] Sancho Calvino, A., (2022). What makes “critical materials” critical? Zeitgeist Series Briefing 5. Global Trade Alert.

[9] European Commission (2020). Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability. COM (2020) 474 final.

[10] Pitron, G. (2022). The Geopolitics of the rare-metals race. The Washington Quarterly, 45(1), 135-150.

[11] Government of China (2023). Situation and Policies of China’s Rare Earth Industry. Retrieved from http://english.www.gov.cn/archive/white_paper/2014/08/23/content_281474983043156.htm

[12] Financial Times (2023). China imposes export curbs on chipmaking metals. Retrieved from: https://www.ft.com/content/6dca353c-70d8-4d38-a368-b342a6450d95

[13] These CRMs are: antimony; arsenic; bauxite; baryte; beryllium; bismuth; boron; cobalt; coking coal; copper; feldspar; fluorspar; gallium; germanium; hafnium; helium; heavy rare earth elements; light rare earth elements; lithium; magnesium; manganese; natural graphite; nickel – battery grade; niobium; phosphate rock; phosphorus; platinum group metals; scandium; silicon metal; strontium; tantalum; titanium metal; tungsten; vanadium. The list can be found in the Annex to the proposal.

[14] These SRMs are: bismuth; boron – metallurgy grade; cobalt; copper; gallium; germanium; lithium – battery grade; magnesium metal; manganese – battery grade; natural graphite – battery grade; nickel – battery grade; platinum group metals; rare earth elements for magnets (Nd, Pr, Tb, Dy, Gd, Sm, and Ce); silicon metal; titanium metal; tungsten. The list can be found in the Annex to the proposal.

[15] In the EU public consultation that informed the Act, more than six in ten respondents agreed that limited public acceptance for new CRMs projects in the EU was driving away investment in the sector. Source: SWD(2023) 161 final.

[16] JRC (2023). Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study. European Commission. EUR 31437 EN.

[17] JRC (2021). Raw Materials Scoreboard 2021, Indicator 9: Geographical concentration and governance.

2. EU’s Demand of Strategic Raw Materials

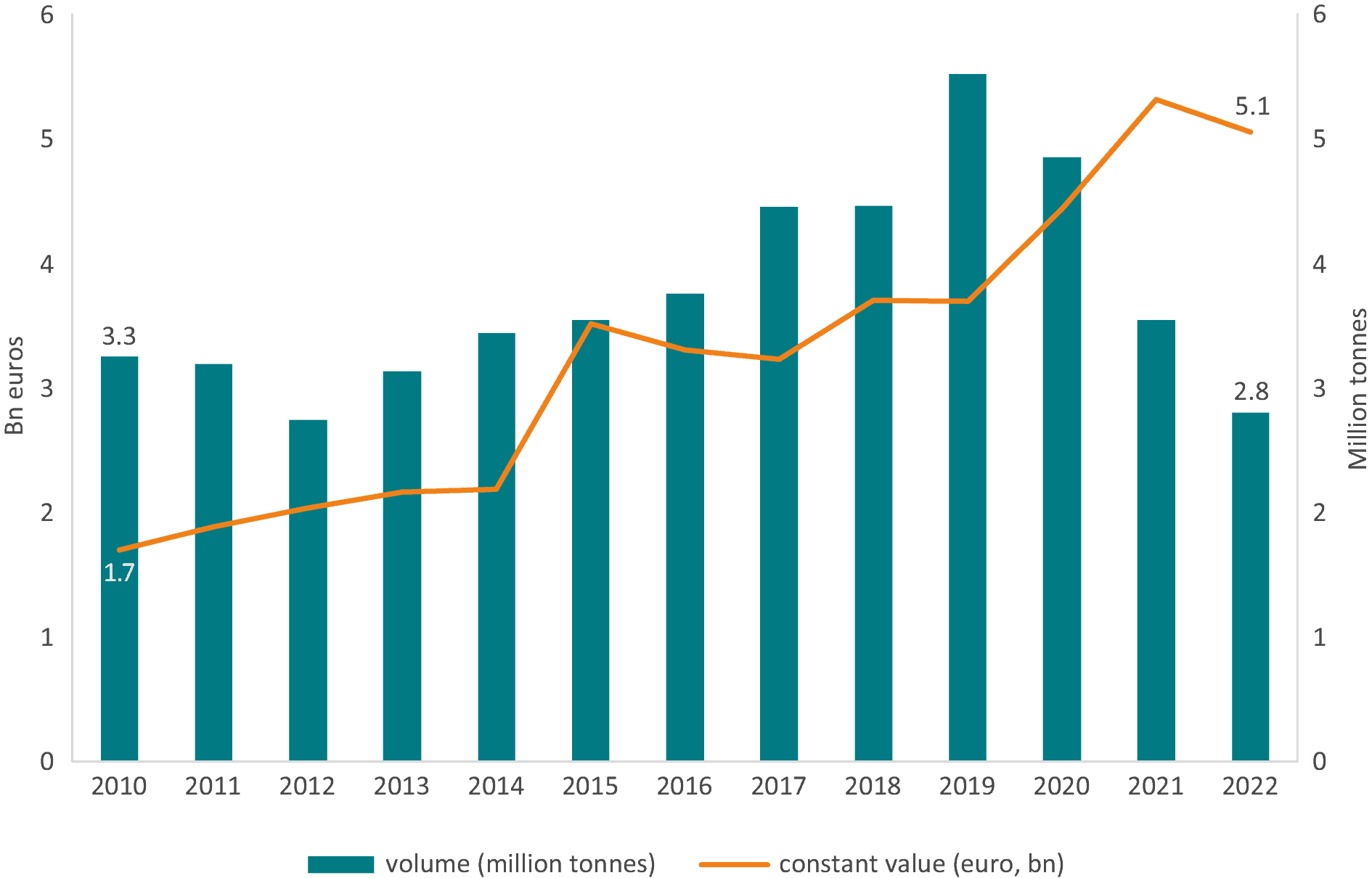

The EU’s share in the global production of CRMs used in the digital, defence, aerospace and green energy sectors is lower than 7 percent[1]. The vast majority of Europe’s consumption of CRMs was supplied by foreign producers. In the case of SRMs, the value of EU’s imports of SRMs has increased significantly during the last years[2]. In 2022, the EU imported €36 bn[3] of SRMs, which represents a 65 percent increase since 2010. By volume, however, the EU imported 9.3 million tonnes in 2022, a 5 percent fall from what it bought from abroad in 2010. The increase in value and fall in volume indicates a raise in SRMs unit prices (from 2.2 euros per kg in 2010 to 3.9 euros per kg in 2022). This is the result of two factors. First, many SRMs have become more expensive: unit value prices of 13 out of 15 SRMs went up between 2010 and 2022. Second, the EU has imported increasing amounts of the most expensive SRMs such as platinum metals or gallium.

Figure 1: Extra-EU imports of SRMs by value and volume (2010 – 2022) Source: Eurostat, Author’s calculations

Source: Eurostat, Author’s calculations

Across all SRMs, copper, platinum, and nickel were the SRMs that the EU imported from outside the EU in the highest value representing 39, 33 and 13 percent of EU total value of imports in 2022. By volume, the SRMs that had the highest share were copper, titanium, and manganese with 52, 16, and 12 percent of EU total volume of imports during the same year. The SRMs that experienced the fastest growth between 2010 and 2022 were lithium in value terms and platinum in volume terms. And while platinum was the most expensive SRM per kg, lithium was the SRM that experienced the biggest increase in its unit value during this period.

The EU’s demand for SRMs was met by a small number of countries. In 2022, the five largest EU suppliers provided almost half of EU’s total demand for SRMs by value and 38 percent by volume. The figure below shows that Russia, U.S., South Africa, Chile, Brazil, Norway and Turkey were the EU’s top suppliers of many SRMs either by value or volume. For instance, Brazil was one of the EU’s largest suppliers by value and volume of copper, battery grade nickel, and silicon metal; Chile supplied copper and lithium; South Africa was the main EU supplier of platinum group metals, and Russia was the largest EU’s provider of nickel by value.

Figure 2: Largest EU suppliers per SRMs by value and volume (2022) Source: Eurostat, Author’s calculations

Source: Eurostat, Author’s calculations

The fact that China was not Europe’s main supplier of SRMs but appears in everything but name in the EU’s Economic Security Strategy and as one of the main motivations behind the EU’s CRM Act demonstrates that not all dependencies are created equal. The institutional arrangements and economic integration that the EU has with Norway dramatically lowers the risk of any SRMs interruption as a result of a political disagreement. A similar argument can be made about other countries like the U.S., Chile and Brazil, which are market-based economies underpinned by democratic political systems.

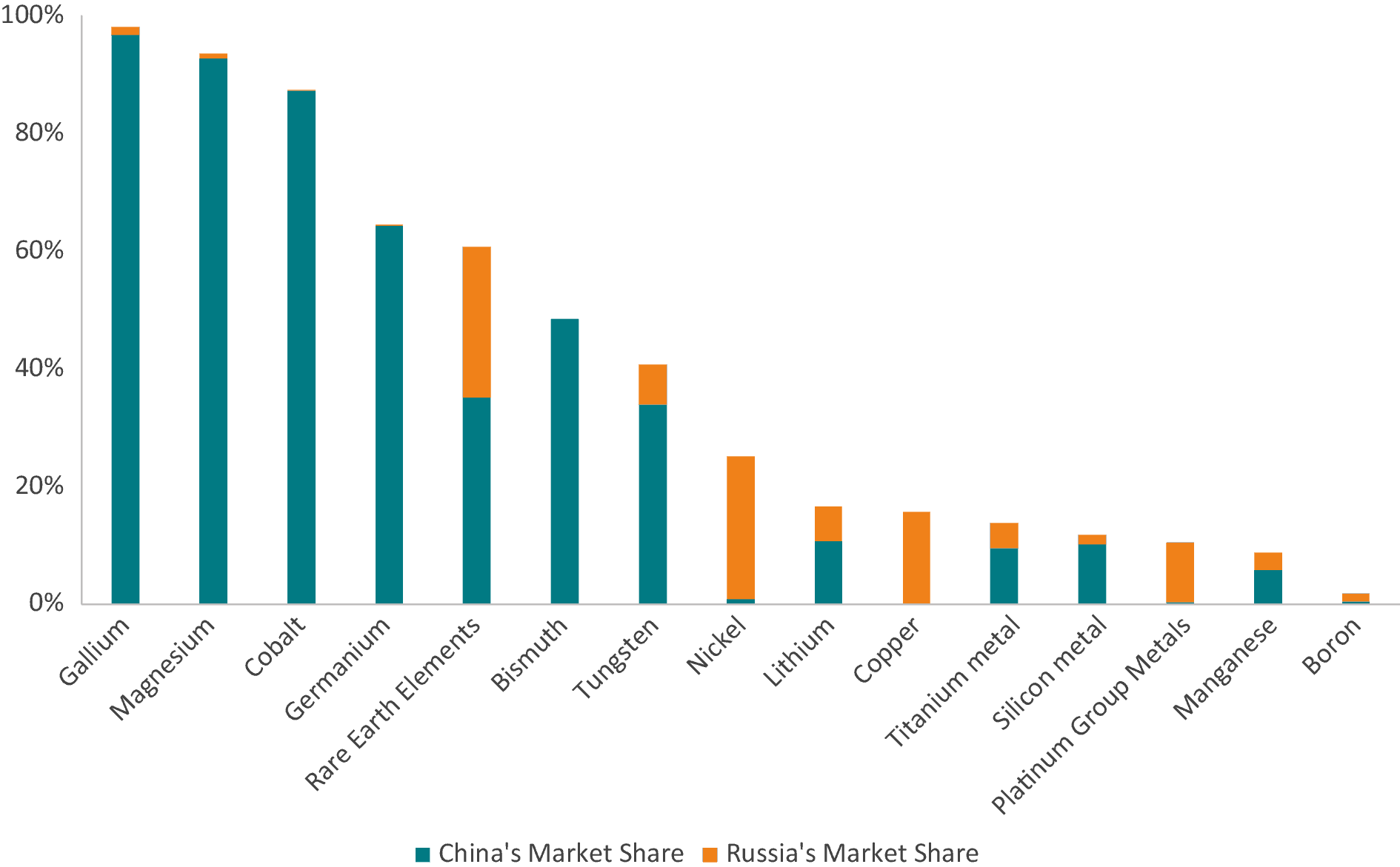

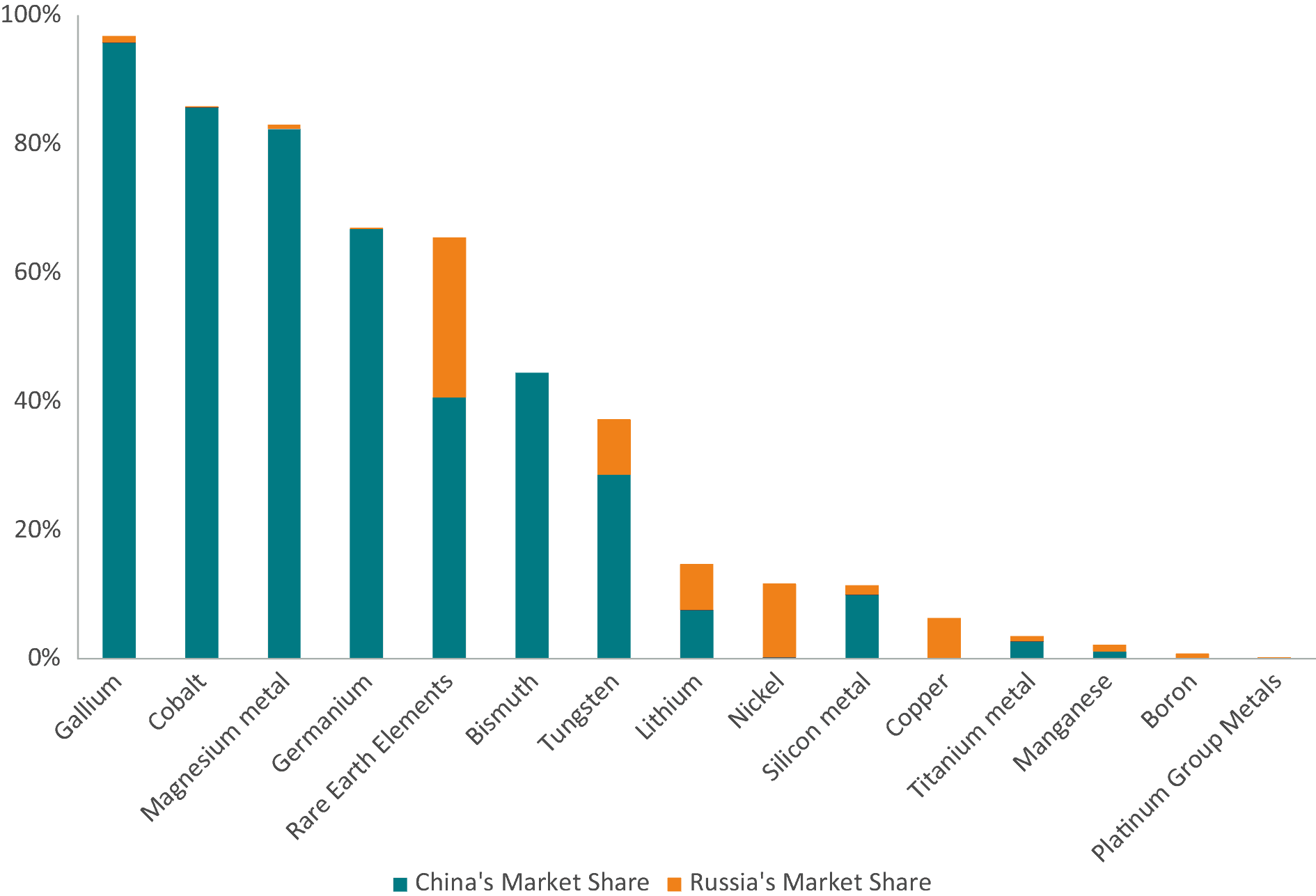

In the case of China and Russia, however, EU’s dependency is much more problematic. China was the largest EU supplier of seven out of the 15 SRMs, which were bismuth, cobalt, gallium, germanium, magnesium, rare earths, and tungsten. As can be seen in Figure 3 and 4, this dependency was particularly problematic for cobalt, gallium, and magnesium for which China’s share of EU’s total imports was larger than 80 percent in value and volume. Russia supplied more than 10 percent of EU’s import of rare earth elements, nickel, platinum, and copper in value and nickel and rare earth metals in volume.

Figure 3: China and Russia market share of SRMs in the EU by value (2022) Source: Eurostat, Author’s calculations

Source: Eurostat, Author’s calculations

Figure 4: China and Russia market share of SRMs in the EU by volume (2022) Source: Eurostat, Author’s calculations

Source: Eurostat, Author’s calculations

The figures show acute trade dependencies on SRMs from China and Russia. EU member states produce some of these SRMs – e.g., Germany is a producer of gallium and Finland of cobalt[4]. However, the size of Chinese imports demonstrates the scale of the challenge of any policy seeking import substitution. Trade diversification and not subsidising Europe’s domestic production is the EU’s most honest and reasonable answer to the issue of trade dependency. Even for the SRMs in which China is the major supplier, the EU also buys from other countries. In the case of germanium and rare earth, the EU bought from companies based in 18 and 15 different countries. In the case of gallium, cobalt and magnesium – where China is overwhelmingly the most important EU supplier, the EU acquired these SRMs from 3, 12, and 36 different countries apart from China including US, Canada, Korea, Japan, Israel, Turkey, Morocco or Brazil.

[1] JRC (2023). Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study. European Commission. EUR 31437 EN.

[2] The EU published individual factsheets for each of the SRM included in the EU Critical Raw Materials Act, with the exception of natural graphite (battery grade). These factsheets include the corresponding trade codes for each of the SRM. Annex I presents the list of the codes for the corresponding SRM, which were used in this analysis. Source: SCRREEN (2023). Factsheets – CRMS 2023. Retrieve from https://scrreen.eu/crms-2023/

[3] All prices in this Policy Brief are presented as constant prices with 2016 as the base year. Prices were deflated using GDP figures from the IMF.

[4] See Figure 5: Geographical concentration of global product and supply to the EU. European Commission (2023). SWD (2023) 161 final. pp. 29 – 31.

3. Mercosur's Supply of Strategic Raw Materials

Undoubtedly, the EU will need to engage with resource-rich countries to secure and diversify the supply of critical raw materials. And Mercosur has a large role to play if the EU wants to achieve this objective. In 2022, EU imports of SRMs from Mercosur amounted to €2.5 bn and 0.9 million tonnes representing 7 percent and 10 percent of EU’s imports of SRMs by value and volume. The majority of this share (99 percent in value and 99 percent in volume) was supplied from Brazil.

These figures demonstrate the importance of Mercosur as a supplier of SRMs to the EU. However, Mercosur also exports SRMs to many other countries. Using publicly available data from the Brazilian Government , we estimate Brazil’s total exports of the SRMs identified in the EU CRM Act. In 2022, Brazil exported €5 bn of SRMs amounting to 2.8 million tonnes. Over time, this represented a 160 percent increase from 2010 in value and a 14 percent decrease in volume. Similar to EU’s imports, the increase in the average price of Brazilian exports of SRMs is the result of Brazilian SRMs becoming pricier and an increase in Brazilian exports of the more expensive SRMs. Brazilian exports in volume of some of the most expensive SRMs such as platinum increased by close to 160 percent between 2010 and 2022. Brazil also started exporting lithium (another expensive SRM) which reached export volumes of 0.1 million kg in 2022.

Figure 5: Brazil’s exports of SRMs by value and volume (2010 – 2022) Source: Brazilian Government. Author’s calculations

Source: Brazilian Government. Author’s calculations

Copper is the primary export of Brazil in terms of value and accounted for 51 percent of Brazil’s total exports of SRMs in 2022. This is followed by nickel and silicon, responsible for 26 percent and 15 percent respectively. In terms of volume, manganese was the leading Brazilian export of SRMs, accounting for 41 percent in 2022, followed by copper and nickel representing 38 percent and 12 percent. Over time, the SRM that experienced the fastest growth between 2010 and 2022 was nickel in both value and volume terms.

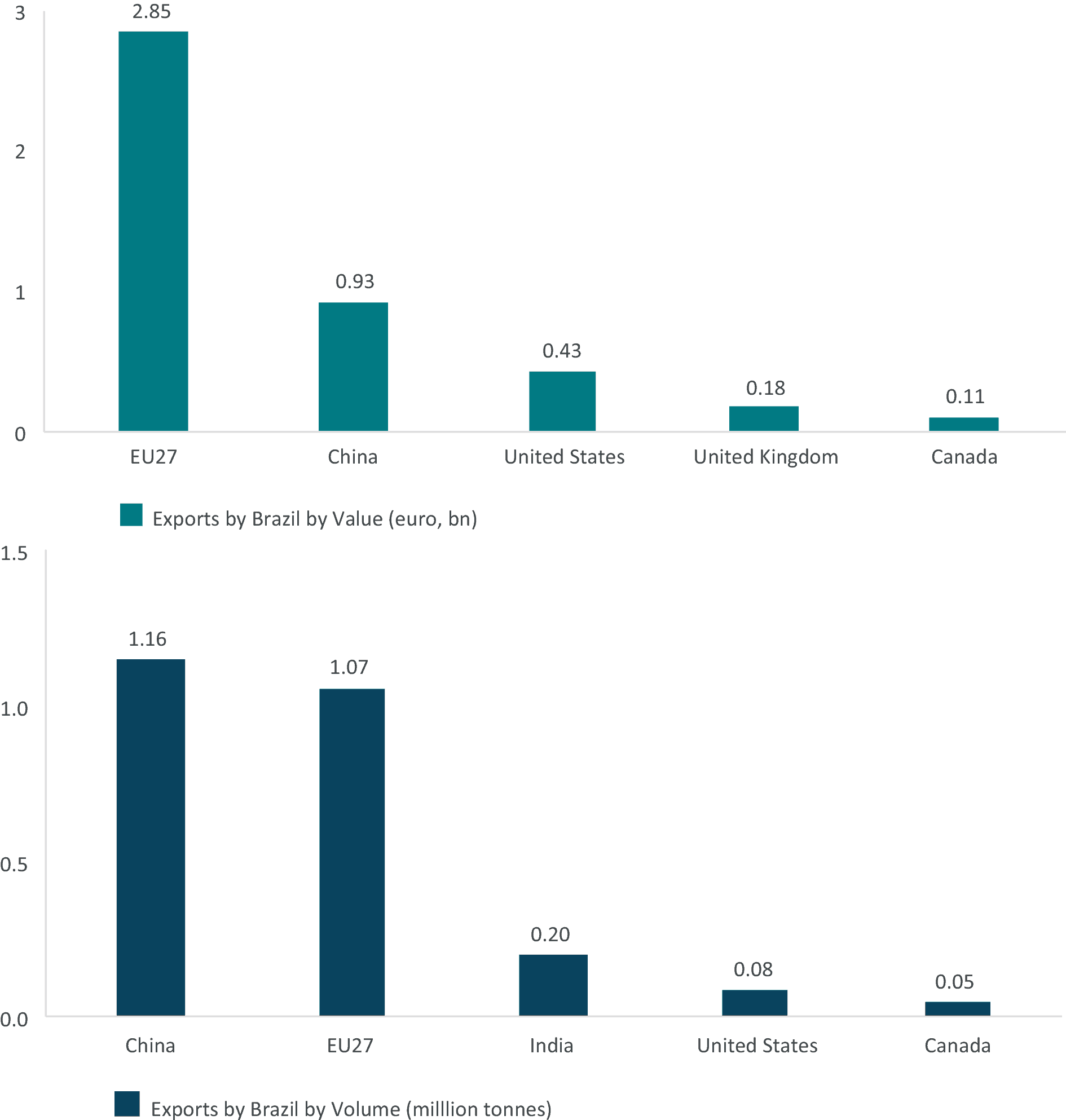

The EU is one of the main buyers of Brazilian SRMs. In 2022, the EU was Brazil’s most important trading partner in SRMs in value (56 percent) and the second (38 percent) most important after China in volume. The reason why China was Brazil’s largest buyer of SRMs in volume terms is because of its purchases of Brazilian manganese, copper, and nickel, which have a relatively lower unit price compared to imports of titanium and lithium, that China imports from Brazil in smaller volumes. In comparison, the EU imported from Brazil some of the more expensive SRMs such as platinum group metals and boron, that China did not import at all.

Figure 6: Brazil’s exports of SRMs by trade partner and value and volume (2022) Source: Brazilian Government. Author’s calculations

Source: Brazilian Government. Author’s calculations

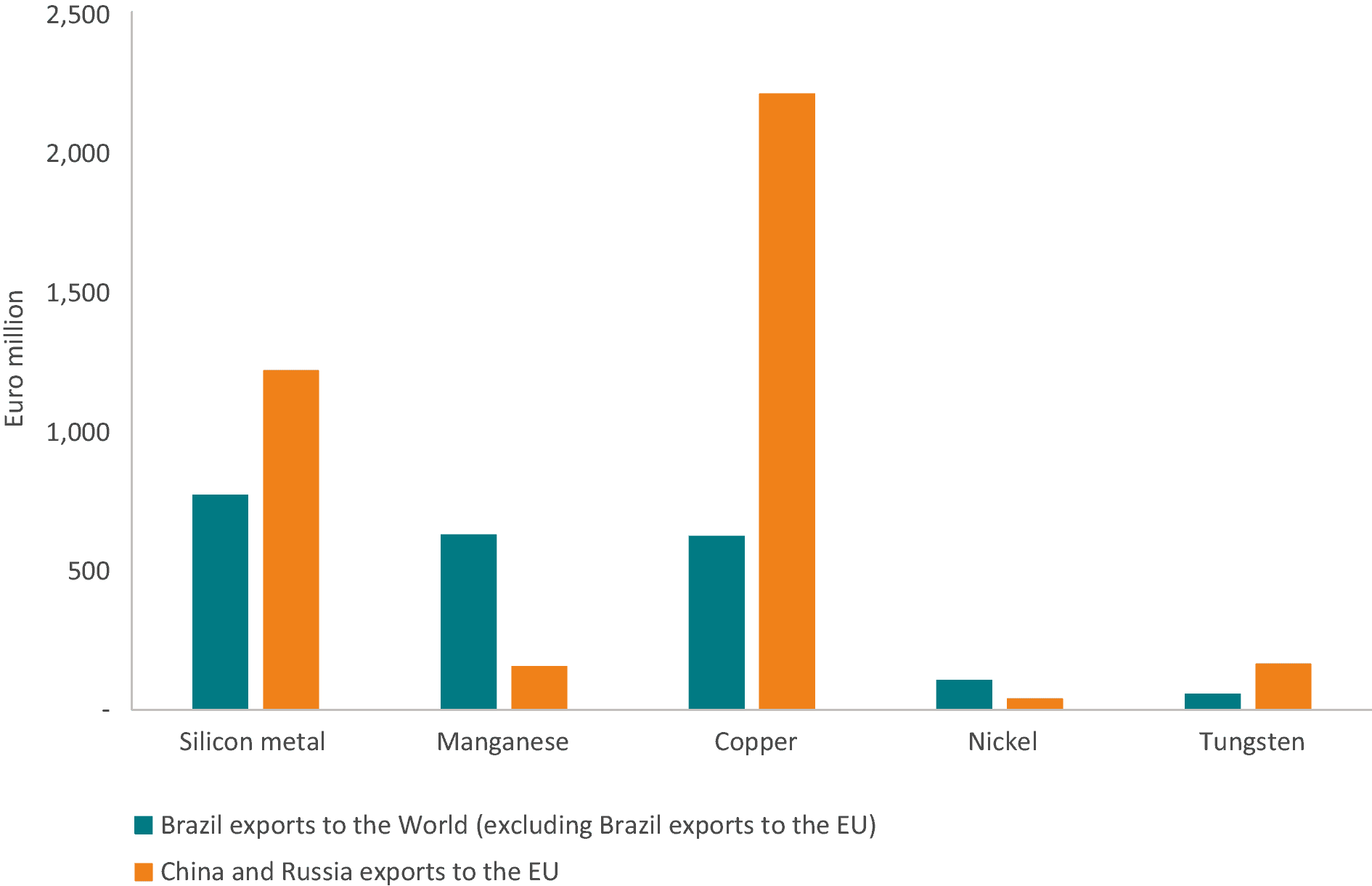

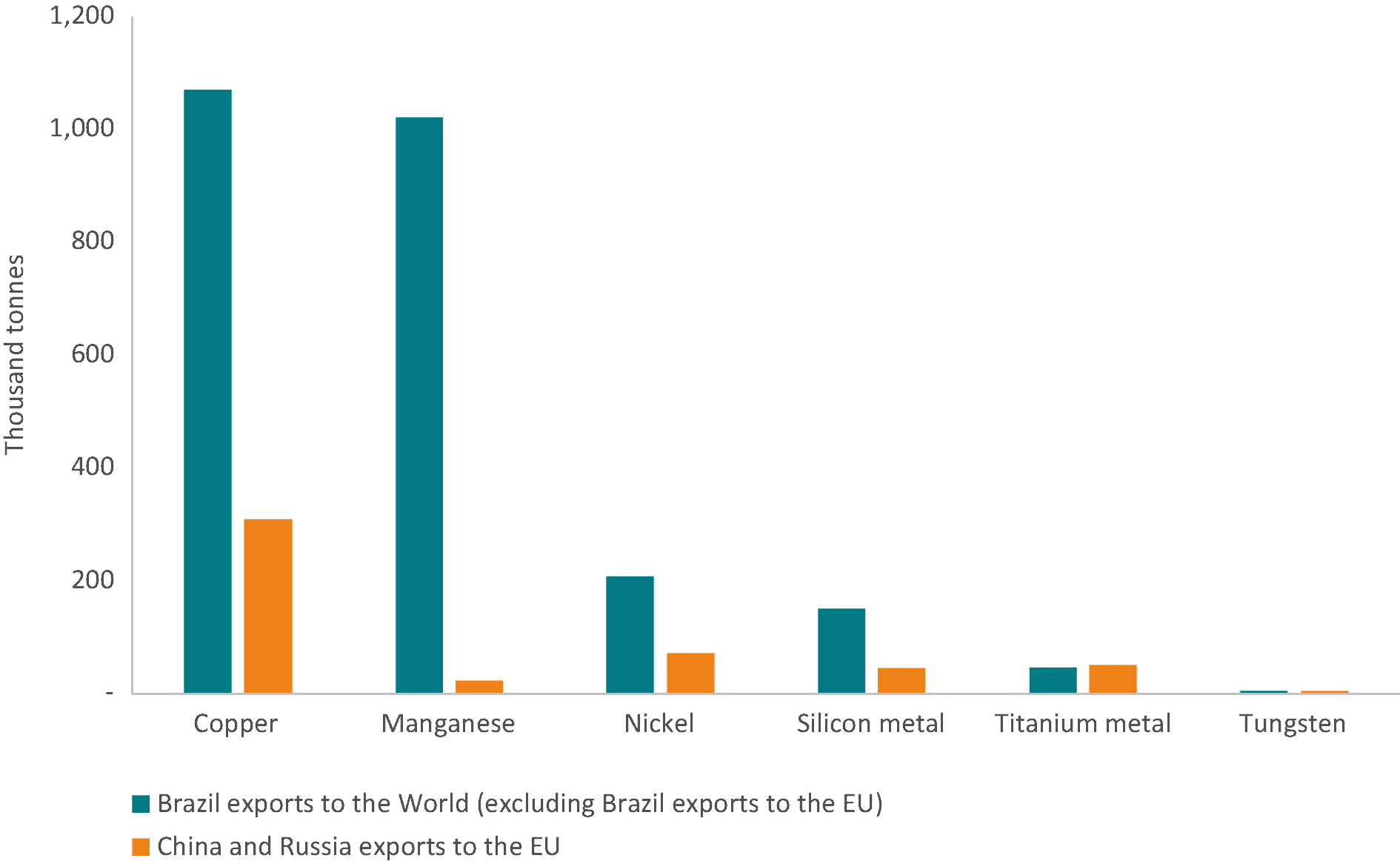

Brazil can play a critical part in reducing EU dependencies on Chinese and Russian SRMs. Europe’s radical departure from Russian hydrocarbons shows that dependencies can be broken if there is sufficient political will. Comparing Brazilian exports of SRMs to the World (excluding Brazil’s exports to the EU) with EU imports of SRMs from China and Russia indicates clear opportunities for diversification. Figure 7 shows that Brazilian exports of manganese and nickel could substitute all EU imports of these two SRMs coming from China and Russia in value terms. This is important. If the EU is serious about de-risking its economy from China and decoupling from Russia, buying more of these SRMs from Brazil is an obvious starting point. Brazil’s untapped potential as a lever to lower EU dependence on China and Russia is also clear when looking at Brazilian exports of silicon, copper and tungsten to non-EU countries which represented 63, 28, and 35 percent of EU imports of these SRMs from China and Russia. In volume terms (Figure 8), Brazilian exports of copper, manganese, nickel, and silicon were larger than the sum of Chinese and Russian exports to the EU of these SRMs and slightly lower for titanium and tungsten .

Figure 7: Brazil exports of SRMs (excluding Brazil exports to the EU) and EU imports from China and Russia of SRMs (value, 2022) Source: Brazilian Government; Eurostat. Author’s calculations

Source: Brazilian Government; Eurostat. Author’s calculations

Figure 8: Brazil exports of SRMs (excluding Brazil exports to the EU) and EU imports from China and Russia of SRMs (volume, 2022) Source: Brazilian Government; Eurostat. Author’s calculations

Source: Brazilian Government; Eurostat. Author’s calculations

Some of the SRMs that Europe buys from abroad can be found on Europe’s soil. However, it is much more realistic and will lower EU’s dependencies on China and Russia faster to start buying more SRMs from other countries. It is true that Brazil is not a major exporter of gallium, cobalt, magnesium, germanium or rare earth – some of the SRMs in which the EU’s dependence on China was more pronounced. However, China is not the only exporter of these SRMs, which were exported by, on average, four other non-EU countries including the U.S., India, Japan, Norway, Israel, Turkey, Australia, or Canada[1]. Promoting trade with Brazil – and other resource-rich countries – is a must if the EU is serious about increasing global supply of SRMs and reducing its dependence on Chinese and Russian SRMs. The dramatic rise in the production of rare earth outside China since 2015 shows that markets are not static, production can be diversified and the leverage of the main supplier will decline[2]. In order to achieve these objectives, the EU and Mercosur should establish policies and norms that support long-term trade and investment in SRMs. The EU-Mercosur Association Agreement is the best tool at its disposal.

[1] The availability of suppliers across CRMs was documented in Evenett, S. and Fritz, J (2023).

[2] Evenett, S. and Fritz, J (2023). The Scramble for Critical Raw Materials: Time to Take Stock? Global Trade Alert.

4. The EU-Mercosur Association Agreement and the EU’S Search for Strategic Raw Materials

There is a role for governments to reduce trade dependencies. Firms trade, not countries, but countries can establish rules and incentives that change relative prices and encourage commerce with firms from certain places and not from others. Free Trade Agreements (FTAs) do exactly this by reducing import tariffs and changing relative prices between exporters. Crucially for CRMs, FTAs offer a stable legal framework which supports long-term business relationships, which is important for trade and vital for investment. Firms need to be assured that the rules and regulations underpinning a business case can withstand political turmoil – even more when it takes years before any new production of CRMs goes to market. This is the reason why the EU-Mercosur Association Agreement is important for Europe’s economic security since it establishes a better institutional arrangement that provides safer conditions for trade and investment in CRMs between the EU and Mercosur.

The proposal for the CRM Act identifies the relevance of rules and incentives to reduce the EU’s dependency on Chinese and Russian SRMs. The CRM Act lays out bilateral Strategic Partnerships on raw materials in order to integrate the EU and third countries CRMs’ value chains. These Partnerships can be complemented with Strategic Projects in which the EU will offer public funding for the extraction, processing or recycling of SRMs in the EU and in non-EU countries to increase the supply of SRMs. At the same time, the CRM Act wants to counter the weaponization of CRMs with the creation of the CRM Club that will bring together consuming and resource-rich countries to monitor market developments and maintain a regulatory dialogue.

The Strategic Partnerships, the Strategic Projects and the Critical Raw Materials Club can complement the EU-Mercosur Association Agreement but they are not a substitute for it. The Association Agreement will not only eliminate import tariffs – which is not that relevant for most CRMs since the vast majority of them already enter the EU duty free[1]– but will establish a level playing field and reduce regulatory barriers with the elimination of export restrictions, taxes and licensing[2], offering undistorted trade and investment conditions for EU firms in Mercosur. Moreover, the Association Agreement offers legal commitments in the fields of labour, human and environmental rights across the economy and not just for SRMs[3].

As a tool to lower EU’s dependence on Chinese and Russian SRMs, the EU-Mercosur Association Agreement offers better value-for-money than channelling public funds to businesses to increase production of SRMs. In the same way as the EU CRM Act eases the burden of regulation to facilitate investment in the extraction and processing of SRMs in the EU, the EU-Mercosur Association Agreement establish better norms that reduce trade cost and uncertainties to encourage more bilateral trade and investment in SRMs. Given the growing demand for CRMs during the next decades and the increase in unit prices experienced across most CRMs, supply-side policies that facilitate business operations will make a more substantial difference than handing over money to companies for investments that they are likely to do anyway.

In addition, the EU-Mercosur Association Agreement will deliver binding legal provisions while the Critical Raw Materials Club, the Strategic Partnerships and the Strategic Projects will do not. This is another reason why the Association Agreement is a much better tool to achieve a secure, predictable and resilient value chain in CRMs between the EU and Mercosur than the EU CRM Act. For example, countries’ participation in the CRM Club is a poor substitute for the binding commitments and regulatory cooperation established in the EU-Mercosur Association Agreement that can actually limit the policy space of any government willing to weaponize CRMs for its geopolitical gains. The same argument can be made about the Strategic Partnerships, which have grand ambitions[4], but lack the right institutional framework to support long-term investments that the Association Agreement provides. This is why, as the European Commission acknowledges[5], the activities presented in the EU’s CRM Act are a complement not a substitute for the market access and binding regulatory commitments achieved in FTAs like the EU-Mercosur Association Agreement.

[1] Some CRMs do pay import duties. For example, the EU most-favoured nation (MFN) tariffs for unprocessed magnesium is 5 percent and for processed gallium is 3 percent. Source: COM(2023) 165 final.

[2] European Commission. EU-Mercosur Agreement Documents: Trade in Goods. Accessed at: https://circabc.europa.eu/ui/group/09242a36-a438-40fd-a7af-fe32e36cbd0e/library/52c860b0-c1f2-43fb-97c0-8be8f0a591dc/details

[3] European Commission. EU-Mercosur Agreement Documents: Trade and Sustainable Development. Accessed at: https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/mercosur/eu-mercosur-agreement/documents_en

[4] “Although the ultimate objective of the partnerships is about integration of the raw materials value chains between the partner country and the EU, they are comprehensive, and cover aspects such as research and innovation and leverage of ESG (environmental, social and governance) standards”. European Commission (2023). SWD (2023) 161 final. pp. 29 – 31.

[5] “To date strategic partnerships have been agreed with countries with whom the EU has negotiated or concluded a trade and investment agreement. Such agreements and strategic partnerships are in fact complementary, offering a political framework and concrete bilateral cooperation in the specific field of CRMs. For countries that do not have trade and investment agreements with the EU in force, the Commission will promote the objective of undistorted trade and investment when negotiating the memorandum of understanding establishing the partnership.” European Commission (2023). COM (2023) 165 final. p. 11.

5. Conclusion

Access to critical raw materials (CRMs) is a question of strategic security. If Europe wants to achieve its digital and energy transition, it has to secure an uninterrupted supply of these raw materials. Unfortunately, the defining feature of CRMs is its geographical concentration. This concentration is problematic since supply disruptions due to idiosyncratic risks such as natural disasters are always more severe than when production is distributed in several places. This concentration becomes particularly challenging when a large number of CRMs are supplied by less reliable partners such as China and Russia, which makes the supply of CRMs and strategic raw materials (SRMs) vulnerable to geopolitical risks.

To counter this, the EU has published a proposal for the Critical Raw Materials Act which sets out targets, lowers the regulatory burden and provides public resources to increase production of SRMs. While some of the policies behind the EU’s CRMs Act are well-intentioned, it is unrealistic to believe that increasing European production of CRMs in the future will reduce China and Russia’s grip on the extraction and processing of CRMs now. The most likely scenario is that public resources in the form of favourable financial conditions to increase domestic production of SRMs will not make a difference since access to finance is not the issue that stops domestic production of SRMs in the EU.

Europe’s economic security is inextricably tied to its ability to diversify its trade of CRMs away from Russia and China by trading more with other countries. Moreover, if given a choice, the EU should partner with like-minded countries that share the values of open and free trade. Mercosur (Argentina, Brazil, Paraguay, and Uruguay) stands out as such a trade partner. Brazil – which supplies the vast majority of the SRMs that Mercosur sells to the EU – is not only the EU’s largest supplier of SRMs in volume terms but it has the capacity to substitute large amounts of SRMs such as silicon, manganese, copper, nickel, tungsten and titanium coming from China and Russia.

The EU must assist its firms in the process of reducing their dependence on Chinese and Russian CRMs. EU’s assistance does not require public subsidies but less burdensome rules in the EU and the establishment of shared rules and regulations that facilitate trade and investment in CRMs between the EU and Mercosur. The EU-Mercosur Association Agreement is the best tool to place bilateral trade in CRMs in a more secure and certain institutional arrangement. Afterwards, growing investments in the production of CRMs will follow.

The EU’s CRMs Act outlines Strategic Partnership, Strategic Projects and the Critical Raw Materials Club as actions to diversify EU’s trade and increased production of SRMs. These initiatives are a good complement to the EU-Mercosur Association Agreement but they are not a substitute for it. The Strategic Partnership, the Strategic Projects and the Critical Raw Materials Club lack commitment. Participating countries can always leave if they want to, which does little to reduce the geopolitical uncertainty associated with trade and investment in CRMs. In contrast, the EU-Mercosur Association Agreement establishes binding provisions that contribute towards building a common regulatory framework, stopping both parties from setting up export restrictions, and incentivising the integration of EU and Mercosur supply chains of CRMs.

References

Arjona, R, W Connell and C Herghelegiu (2023). An enhanced methodology to monitor the EU’s strategic dependencies and vulnerabilities. Single Market Economy Papers WP2023/14.

European Commission (2021), Strategic dependencies and capacities. Staff Working Document SWD(2021)352 final.

BBC (2023, 21 January). Chinese firm Catl to develop huge Bolivian lithium deposit. BBC, Retrieved from https://www.bbc.com/news/world-latin-america-64355970

Bloomberg NEF (2020, September 16). China Dominates the Lithium-ion Battery Supply Chain, but Europe Is on the Rise. BloombergNEF, Retrieved from https://about.bnef.com/blog/china-dominates-the-lithium-ion-battery-supply-chain-but-europe-is-on-the-rise/

Dempsey, H. (2022. December 6). Electric car battery prices rise for first time in more than a decade. Financial Times, Retrieved from https://www.ft.com/

European Commission (2020). Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability. COM (2020) 474 final.

European Commission (2020). Study on the EU’s list of Critical Raw Materials. Final Report.

European Commission (2021), Strategic dependencies and capacities. Staff Working Document SWD(2021)352 final.

European Commission (2022, September 14). 2022 State of the Union Address by President von der Leyen. European Commission, Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/speech_22_5493

European Commission (2022, September 14). Critical Raw Materials Act: securing the new gas & oil at the heart of our economy I Blog of Commissioner Thierry Breton. European Commission – Statement, Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_22_5523

European Commission (2023). A secure and sustainable supply of critical raw materials in support of the twin transition. COM(2023) 165 final.

European Commission (2023). Annexes to the Proposal for a Regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020. COM(2023) 160 final. ANNEXES 1 to 6.

European Commission (2023). Commission Staff Working Document. Accompanying the document Proposal for a Regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020. SWD(2023) 160 final.

European Commission (2023). Commission Staff Working Document. Impact Assessment Report. Accompanying the document Proposal for a Regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020. SWD(2023) 161 final.

European Commission (2023). Proposal for a Regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/1020. COM(2023) 160 final.

European Commission (2023). Questions and Answers on the European Critical Raw Materials Act. Brussels, 16 March 2023.

European Commission (2023). Joint Communication to the European Parliament, the European Council, and the Council on “European Economic Security Strategy”. Brussels, 20 June 2023. JOIN(2023) 20 final.

Evenett, S. and Fritz, J (2023). The Scramble for Critical Raw Materials: Time to Take Stock? Global Trade Alert.

Financial Times (2023). China imposes export curbs on chipmaking metals. Retrieved from: https://www.ft.com/content/6dca353c-70d8-4d38-a368-b342a6450d95

Gehrke, T. (2022). Securing EU critical raw material supplies after Russia’s war. Encompass.

Government of China (2023). Situation and Policies of China’s Rare Earth Industry. Retrieved from http://english.www.gov.cn/archive/white_paper/2014/08/23/content_281474983043156.htm

Guinea, O., & Sharma, V. (2022). Should the EU pursue a strategic ginseng policy? Trade Dependency in the Brave New World of Geopolitics. Report, ECIPE, Brussels, Policy Brief No. 05/2022, 29 p.

Hendrix, C. S. (2022). Building downstream capacity for critical minerals in Africa: Challenges and opportunities. Peterson Institute for International Economics Policy Brief, (22-16).

IEA (2021). The Role of Critical Minerals in Clean Energy Transitions. IEA.

Jacobs, J. (2022, November 30). Rising prices and supply chain risks threaten Europe’s renewable aims. Financial Times, Retrieved from https://www.ft.com/

JRC (2016). Raw materials in the European defence industry. Retrieved from https://setis.ec.europa.eu/system/files/2021-02/raw_materials_in_the_european_defence_industry.pdf

JRC (2018). Cobalt: demand-supply balances in the transition to electric mobility. Retrieved from https://publications.jrc.ec.europa.eu/repository/bitstream/JRC112285/jrc112285_cobalt.pdf

JRC (2021). Raw Materials Scoreboard 2021, Indicator 9: Geographical concentration and governance.

JRC (2021b). Raw Materials Scoreboard 2021, Indicator 10: Export restrictions.

JRC (2022). Supply chain challenges: Wind Turbines and magnets. Science for Policy Brief.

JRC (2023). Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study. European Commission. EUR 31437 EN.

KU Leuven/Eurometaux (2022): Metals for Clean Energy. Metals Clean Energy. Eurometaux.eu.

Leruth, L., Mazarei, A., Régibeau, P., & Renneboog, L. (2022). Green energy depends on critical minerals. Who controls the supply chains? Peterson Institute for International Economics Working Paper, (22-12).

Mining.com (2021, October 8). Cobalt Supply Chain: China and DRC to Maintain Dominance, Growth Potential in Australia—Report, Retrieved from https://www.mining.com/cobalt-supply-chain-china-and-drc-to-maintain-dominance-australia-holds-growth-potential-report/

OECD (2022). The supply of critical raw materials endangered by Russia’s war on Ukraine. OECD.

Pitron, G. (2022). The Geopolitics of the rare-metals race. The Washington Quarterly, 45(1), 135-150.

Sancho Calvino, A., (2022). What makes “critical materials” critical? Zeitgeist Series Briefing 5. Global Trade Alert.

SCRREEN (2023). Factsheets – CRMS 2023. Retrieve from https://scrreen.eu/crms-2023/

Sharma, V., & Zilli, R. (2023). EU and Russia: A year in trade numbers. Blog, ECIPE.

United Nations ECLAC. (2020). La Inversión Extranjera Directa en América Latina y el Caribe 2020.

US Geological Service (2022). Mineral Commodity Summaries. Washington: Department of the Interior.

World Bank Group (2017). The growing role of minerals and metals for a low carbon future. World Bank.

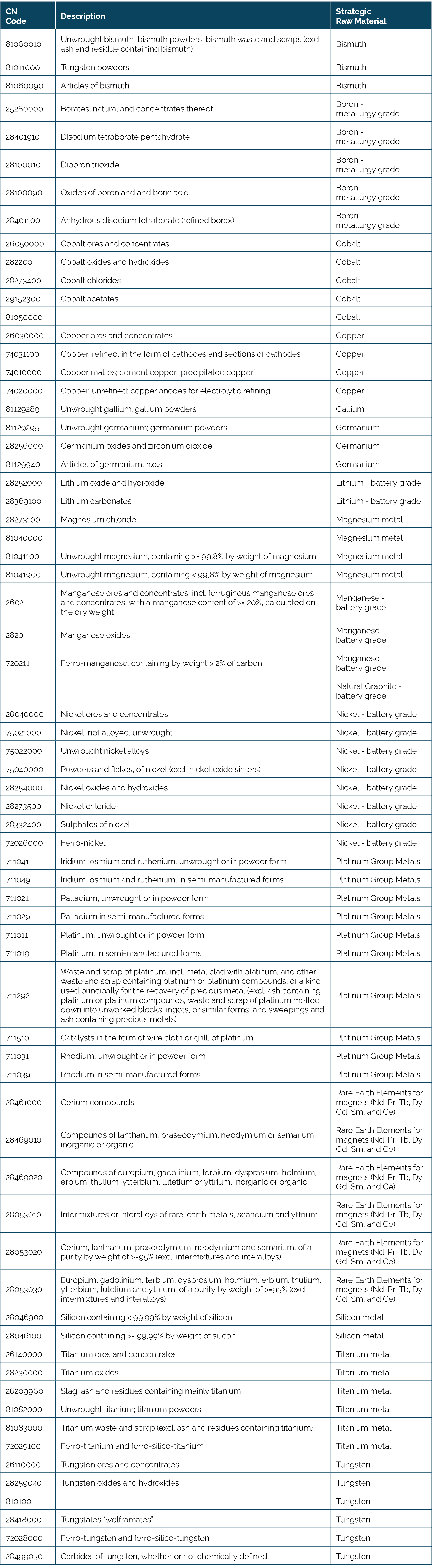

Annex I

Table 1: List of CN codes for each SRMs

Annex II.

Table 1: SRMs concordance of Eurostat CN codes and Mercosur’s common

Nomenclature (NCM) codes