We Need to Talk Trade and Technology!

Published By: Lucian Cernat

Subjects: Digital Economy European Union

Summary

“It’s May 3, 2021. Don’t forget to upgrade the embedded software in your shoes before you go for a run!”

This may sound like a commercial for the 1986 Puma Smart Sneaker[1], the first running shoe with embedded sensors and software in its heel. It could also be an opening line from an old sci-fi movie describing a distant point in the future. Sci-fi movies have a great track record of predicting the future, from video calls[2] to self-driving cars[3]. The former is a dominant part of our daily professional routine these days. The latter is no longer science fiction[4]. So, what if the growing interplay between goods and services is not about the future but a good description of the present? Nowadays we live in a world of connected objects that rely on sophisticated embedded software. Recently, the Volkswagen’s CEO[5] admitted that the only way for VW to remain a successful car manufacturer is to become a successful software company. And while he may be the latest CEO to recognise the business irrelevance of such a goods-services distinction, he certainly is not the only one. Apple understood it well before many other companies when designing mobile phones and their underlying software ecosystem without having any production facilities. Now Apple wants to produce cars[6]. And so do several Chinese telecom giants, like ZTE[7] or Huawei[8]. And the list is longer: Amazon, Tencent, Google, Baidu. All these corporate announcements are another way of saying that mode 5 services[9] are going to be one of the most important ingredients of global competitiveness in many sectors.

Car companies are right to get interested in software. Future autonomous and electric vehicles are primarily software-driven products compared to traditional cars. Already in 2010, the General Motors’ Volt car[10] was dubbed as one of the most sophisticated IT products, with over 10 million lines of software code and its own IP address. So, in the future, car manufacturers might need to do software in order to produce cars successfully. Surely, along complex global supply chains with many suppliers scattered around the world.

These headline announcements from global manufacturing companies entering the software market and vice-versa, confirm a simple truth: in order to stay competitive, companies can no longer see themselves just as a manufacturing firm, or a services firm. And this simple truth goes beyond the automotive sector. Underpinning this radical shift is a series of digital disruptive technologies, affecting everything from product standards, industrial design, intellectual property, and investment decisions. Such technological developments are game changers for many traditional manufacturing sectors.

The views expressed herein are those of the author and do not necessarily reflect the views of the European Commission. The author would like to thank Christophe Kiener, Oscar Guinea and Marina Foltea, for their useful suggestions and valuable additional insights.

[1] Moscaritolo, A. (2018, December 13). Puma Revives RS-Computer Smart Sneaker From 1986. PC Magazine. Accessed at https://in.pcmag.com/news/127497/puma-revives-rs-computer-smart-sneaker-from-1986

[2] Lang, F. (Director). (1927). Metropolis [Motion Picture]

[3] Verhoeven, P. (Director). (1990). Total Recall [Motion Picture].

[4] Miller, B. (2021, February 26). No driver needed: Waymo rolls out fully autonomous vehicles in Chandler, Tempe, Mesa areas. Fox 10 Pheonix. Accessed at: https://www.fox10phoenix.com/news/no-driver-needed-waymo-rolls-out-fully-autonomous-vehicles-in-chandler-tempe-mesa-areas

[5] Klender, J. (2021, March 13). Let’s talk about Volkswagen and Software. Teslarati. Accessed at https://www.teslarati.com/volkswagen-software-issues-id-3/

[6] Nellis, S., Shirouzu, N., & Lienert, P. (2020, December 22). EXCLUSIVE: Apple targets car production by 2024 and eyes ‘next level’ battery technology -sources. Reuters. Accessed at https://www.reuters.com/business/autos-transportation/exclusive-apple-targets-car-production-by-2024-eyes-next-level-battery-2020-12-21/

[7] Reuters. (2021, March 4). ZTE Preparing Electric Vehicle Product Line, Company Confirms. Gadgets360. Accessed at https://gadgets.ndtv.com/transportation/news/zte-electric-vehicle-car-confirm-preparing-product-line-baidu-dji-2383340

[8] Reuters. (2021, February 26). Huawei Said to Foray Into Electric Vehicles, May Launch Some Cars This Year . Retrieved from Gadgets360: https://gadgets.ndtv.com/transportation/news/huawei-electric-vehicles-cars-launch-this-year-2021-sources-internally-design-manufacture-produce-china-2379113

[9] Cernat, L. (2015, November). Trade rules and technological change: The case for mode 5 services. The E15 Initiative

[10] Paur, J. (2017, June 4). Chevy Volt: King of (Software) Cars. Wired. Accessed at https://www.wired.com/2010/11/chevy-volt-king-of-software-cars/

What About Trade Policy in all This?

In trade policy, this new reality is well understood. Take for instance the latest EU trade strategy[1] launched at the beginning of 2021. The importance of trade and technology is clearly understood and features prominently among the top keywords defining the EU trade policy priorities (Figure 1). Global regulatory standards and digital technologies are seen as key ingredients to ensure that EU companies can compete fairly along GVCs. However, the underlying structure of the global trading system relies on a set of global trade rules written in late 1990s, to use the digital jargon, either on an electric typewriter or on a monochrome computer screen using MS-DOS word processing programmes.

Figure 1: The latest EU Trade Policy Review: main keywords

Source: Author’s elaboration, based on the European Commission “Trade Policy Review – An Open, Sustainable and Assertive Trade Policy” Communication.

The creation of the WTO in mid-1990, was accompanied by a realisation that the Internet revolution will affect the future. The WTO members adopted a work programme on electronic commerce[2] as early as 1998. The work programme was very ambitious and correctly identified that digital technologies will cut across both GATT rules (customs valuation issues, standards, rules of origin, HS classification) and GATS (domestic regulation, privacy, competition issues, etc).

The work programme on electronic commerce has been ongoing since 1998, but without much progress. There is hope that the current e-commerce negotiations will address some important gaps in global trade rules. The EU and several other WTO members had been trying for years to start negotiations on digital trade under the multilateral work programme on e-commerce, unfortunately to no avail. Therefore, plurilateral talks are now well underway on many issues that matter for global businesses, in the context of the Joint Statement Initiative negotiations on e-commerce. The extension of the moratorium on customs duties on electronic transmissions until June 2021 is also encouraging, although far from ideal from the viewpoint of stable, predictable trade rules. The good news is that most EU FTAs contain a permanent prohibition of customs duties on electronic transmissions

While trade negotiators have been working hard on new trade rules, many things happened in the real world since 1990s. We are no longer using monochrome screens and WordPerfect. Several technological disruptions are nowadays the source of future global competitiveness (e.g. 5G and cloud computing, Internet of Things, blockchain, 3D printing, remote sensors, artificial intelligence, big data, cybersecurity, telematics, robotics, e-health etc.) and these digital technologies are subject to exponential evolution.

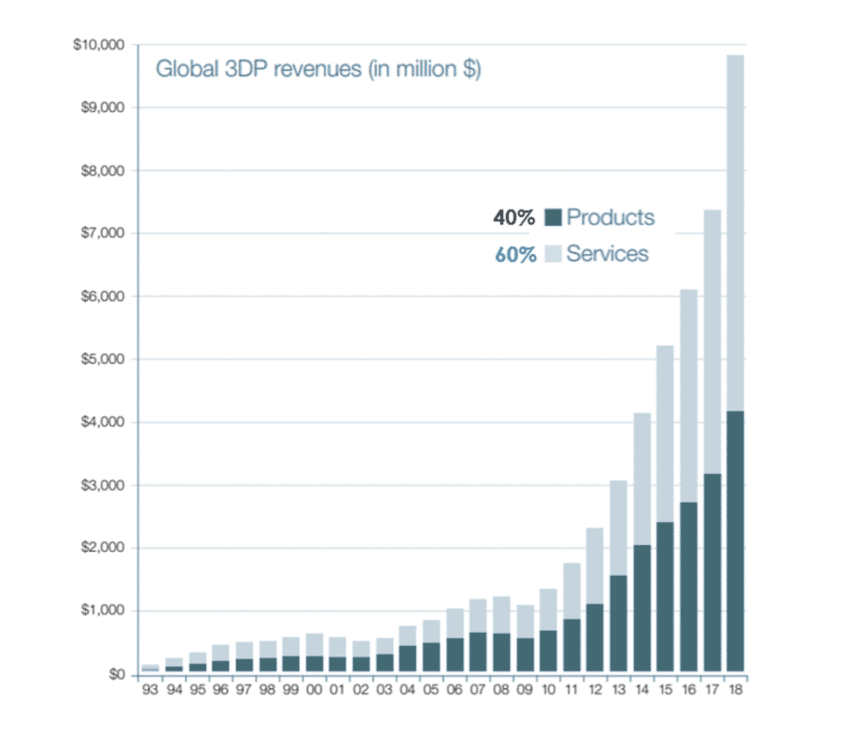

Figure 2: Global 3D printing activities and its evolution over time

Source: Wohler Associates, cited in World Economic Forum (2020), 3D Printing: A Guide for Decision-Makers.

Source: Wohler Associates, cited in World Economic Forum (2020), 3D Printing: A Guide for Decision-Makers.

The precise estimates of the exact number IoT “smart devices” that have the embedded software varies but it surpassed 20 billion IoT devices[3] already in 2018. Their number is forecasted to more than double in the next years. Or take, for instance, 3D printing. Although still marginal as a share of total manufacturing, 3D printing has been recently on an exponential curve, and it has made headlines as a life-saving technology[4] during the covid19 health crisis. Figure 2 also shows that 3D printing is predominantly about embedded services (60% of the total 3D printing revenues worldwide), not the material value of the inks used in additive manufacturing. Yet, 3D printing is one of the new tech areas that may be caught in between the gaps between various trade rules in GATT, GATS, or TRIPS. In trade policy, things are still governed by different rules focussed on different key elements. In the area of goods, although tariffs are still important, non-tariff regulatory barriers are the most important barrier for manufacturing businesses[5].

In the area of services, it is all about GATS modes of supply[6]. The same services can be affected by different trade barriers, under each mode of supply (ranging from domestic regulations, licensing, certification, etc). Although we knew GATS modes of supply are critical for services trade, until recently, we did not have a clear picture of their relative importance across total EU export performance. Trade in services suffered from major statistical setbacks and sometimes was completely ignored in public debates (see for instance the misperception that China has become the largest trading partner for the EU[7]). One recent conceptual development that blurred the classical distinction between trade in goods and services is the so-called “mode 5 services”[8], i.e. services that are embedded in products (e.g. innovative eco-design or software functionalities). Nowadays manufacturing activities have a growing share of such embedded services and therefore trade in goods and services are part of a continuum.

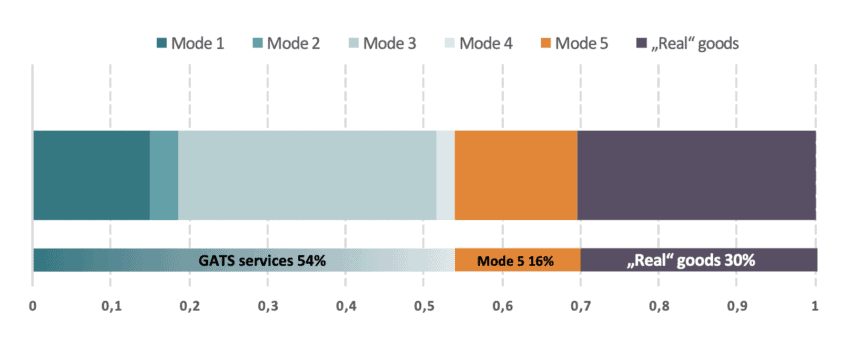

Figure 3: Distribution of EU exports in 2017: services by modes of supply and goods trade

Source: Author’s calculation based on Eurostat data and WTO-OECD WIOD database.

Source: Author’s calculation based on Eurostat data and WTO-OECD WIOD database.

In reality, when all GATS modes of supply are taken into account, EU services trade accounts for 54% of total EU exports, which makes EU services trade bigger than goods trade. This is often ignored, even among trade policy experts, due to the way in which services trade statistics are compiled[9]. Now, add mode 5 services to it and “real” goods exports represent only about 30% of EU total exports (Figure 3).

Where does all this lead us? As the 2017 trade data shows, services accounted for a majority of EU exports, and mode 3 (FDI-driven) services were dominant. However, with the technological disruptions that have been accelerated by the covid19 global crisis, the relative structure of different modes of supply is bound to change considerably. FDI data indicates that there was already a downward trend in global FDI inflows[10] even before the covid19 crisis.

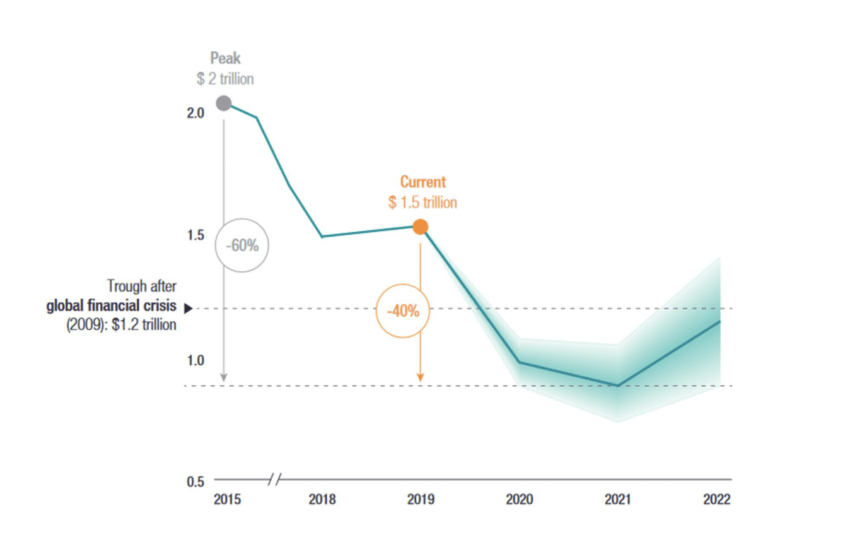

Figure 4: Global FDI inflows: before and after the covid-19 pandemic (USD trillions)

Source: UNCTAD, World Investment Report 2020.

Source: UNCTAD, World Investment Report 2020.

The recovery in FDI levels may take years, and it may never reach the previous peak levels. Digitalisation will lead to a substantial increase in mode 1 services trade as part of post-covid globalisation[11], both in addition and at the expense of other modes of supply. Mode 2 services (tourism) has nosedived. And so did Mode 4 services (cross-border individual professional service providers). The latter however reinvented itself as tele-migration using online conferencing platforms, whose activity reached the sky. So much so that, in October 2020, one online conference platform was more valuable than the top 7 US airlines combined[12].

Not only mode 1 services will increase in relative importance. The value of “mode 5 services” will also increase, both in absolute value and share in EU trade. It is very likely that the share of mode 5 is greater today than in 2017. Take for instance the case of electric or autonomous vehicles, which are described nowadays as “computers on wheels”. The car of tomorrow is becoming a software-enabled, cloud-connected device[13]. Beyond Volkswagen’s plans to become a software company and Apple’s to become an automotive company, the sector is on a rapid path of servicification and digitalisation. The clearest evidence is that the sector is in the midst of a rapid transformation is the fact that car production has been slowed down due to a shortage of computer chips[14]. Computer chips need software to run, which indicates that the importance of embedded software will continue to increase. This trend does not affect only cars. We can see it everywhere, primarily driven by the Internet of Things and RFID sensors, controlling many industrial processes. They also play a crucial role in international trade. The need for real time traceability along global supply chains led to the introduction of RFID sensors in maritime container. Tens of millions of containers are going back and forth across the seas, all connected via various digital platforms, increasingly using blockchain technology[15], as part of trade facilitation and compliance requirements. And, for any product with a high mode 5 services content, cross-border data flows will be crucial.

Another critical services sector that will continue to lead in terms of digital intensity is health services. The trend was already there, with many medical devices being highly depended on software and digital features. The 2017 EU Medical Device Regulation[16], for instance, had already introduced new rules for software as a medical device and the current pandemic has clearly demonstrated the importance of digital health[17]. The covid19 pandemic has also accelerated not only vaccine production but also promoted the development of potentially lifesaving connected medical wearables[18], and the benefits of performing remote, robotic surgeries. The Lindbergh operation[19], the first transatlantic robotic surgery performed two decades ago announced already how the future will look like. With 5G technology, combined with advancements in robotics, such developments may boost the share of mode 1 (digital) e-health solutions, leading to technological diffusion and increase the health benefits for patients worldwide, reducing the need for medical tourism under mode 2 or top “high-flying surgeons” to criss-cross the world, under mode 4 services.

There are several ways for trade rules to embrace these new technological developments. One avenue available for trade rules to be in sync with current technologies, is unilateral reform. Many countries have understood the importance of the services-goods continuum and are trying to put in place new trade rules that promote technological progress via domestic reforms. One such example concerns customs rules and indirect taxation. For instance, some developing countries are contemplating adopting a “duty drawback” for services. The EU exporters have already several options available for the treatment of embedded services, under the European Union Customs Code. For instance, the outward processing regime provided for under art. 259 of the Union Customs Code allows for EU embedded software to be exempted from import duties[20] when they are part of processed products traded under this specific customs procedure. This is one example about trade rules to facilitate trade and technology developments, for products that nowadays are essentially “computers on wheels”.

A second option is to bolster bilateral cooperation on trade and technology with key partners[21], as recently proposed by the EU. Rapid technological developments are and will remain ahead of trade rule making. But, sooner or later, rules are put in place by national regulators in charge of critical areas such as cybersecurity, artificial intelligence, data protection, product standardisation and consumer safety. Ex-ante regulatory cooperation with key partners is a promising avenue to avoid future trade barriers, before they are introduced as part of domestic regulation. This is extremely important in the area of services, but given their deeply rooted regulatory nature, removing services trade barriers is inherently more difficult than removing certain barriers affecting trade in goods. For instance, in 2019, there was only one services barrier that the European Commission managed to solve[22], out of 40 barriers worldwide.

The third option is regulatory cooperation on trade and technology in a multilateral setting that breaks the “legal silos” of various WTO treaties and adopts “best practices” from one trade area to another. For instance, the WTO has a well-functioning system of addressing technical barriers to trade[23] that cause “specific trade concerns” for goods trade. Dialogue and cooperation between WTO members in the TBT Committee under this mechanism led to significant results[24]. Identifying such best practices, improving transparency as part of the work in the regular WTO councils and committees could reinforce the effectiveness of WTO rules[25]. WTO members could also try to modernise certain specific trade provisions that potentially hamper the adoption of such new technologies along global supply chains. The WTO Customs Valuation agreement is a prime example, and proposals[26] with significant development gains and potential to boost the global post-covid19 recovery exist.

So, it’s time to discuss trade and technology!

[1] European Commission, (2021). Trade Policy Review – An Open, Sustainable and Assertive Trade Policy.

[2] World Trade Organization,(1998). Work Programme on Electronic Commerce. Accessed at https://trade.ec.europa.eu/doclib/docs/2021/february/tradoc_159438.pdf

[3] Vailshery, L. S. (2019, May). Number of internet of things (IoT) connected devices worldwide in 2018, 2025 and 2030. Statista. Accessed at: https://www.statista.com/statistics/802690/worldwide-connected-devices-by-access-technology/

[4] Kleinman, Z. (2020, March 16). Coronavirus: 3D printers save hospital with valves. BBC News. Accessed at https://www.bbc.com/news/technology-51911070

[5] European Commission and International Trade Centre, (2016). Navigating Non-Tariff Measures: Insights from a Business Survey in the European Union.

[6] World Trade Organization, The General Agreement on Trade in Services (GATS): objectives, coverage and disciplines

[7] Hamilton, D. S. (2021, February 19). No, China is not the EU’s top trading partner. Politico. Accessed at https://www.politico.eu/article/china-not-eu-top-trade-partner-us-is/

[8] Cernat, L. & Kutlina-Dimitrova, Z., (2014). Thinking In A Box: A ‘Mode 5’ Approach To Service Trade. DG TRADE Chief Economist Note

[9] Rueda-Cantuche, José M., Kerner, Riina, Cernat, Lucian, Ritola, Veijo, (2016). Trade In Services By Gats Modes Of Supply: Statistical Concepts And First EU Estimates. DG TRADE Chief Economist Note

[10] UNCTAD, (2020). World Investment Report 2020 International Production Beyond The Pandemic.

[11] Van der Marel, E., & Guinea, O. (2020). Globalisation after COVID-19. ECIPE Blog.

[12] Update: Video conferencing is eating (business) travel. (2020, October). TNMT. Accessed at https://tnmt.com/infographics/video-conferencing-vs-business-travel/

[13] Shirokinskiy, K. (2021). Time to shift gear? A new role for Tier 1 automotive suppliers in software-enabled vehicles. Roland Berger

[14] Kailath, R. (2021, February 12). A Global Shortage In Computer Chips Hits Auto Industry. What Industries Are Next?. NPR. Accessed at https://www.npr.org/2021/02/12/967458767/a-global-shortage-in-computer-chips-hits-auto-industry-what-industries-are-next?t=1615798685970

[15] Cernat, L. (2020). Blockchain for Trade: the next gold standard or the fool’s gold?. ECIPE Blog

[16] European Commission, Medical Devices – Sector. Accessed at: https://ec.europa.eu/health/md_sector/overview_en

[17] McNeil Jr., D. G. (2020, March 18). Can Smart Thermometers Track the Spread of the Coronavirus?. The New York Times. Accessed at https://www.nytimes.com/2020/03/18/health/coronavirus-fever-thermometers.html

[18] Labios, L. (2021, February 15). New Skin Patch Brings Us Closer to Wearable, All-In-One Health Monitor. UC San Diego News Centre. Accessed at https://ucsdnews.ucsd.edu/pressrelease/new-skin-patch-brings-us-closer-to-wearable-all-in-one-health-monitor?fbclid=IwAR0_SCqGeeSh_StO5ZX8HGtj69qf7GqSwPubYVL1o2teGgt0eHzoXZpN1kw

[19] Wikipedia, Lindbergh Operation, Accessed at https://en.wikipedia.org/wiki/Lindbergh_operation

[20] European Commission, SPECIAL PROCEDURES – Title VII UCC/ “Guidance for MSs and Trade”. DG Taxation and Customs Union. Accessed at https://ec.europa.eu/taxation_customs/sites/taxation/files/docs/body/guidance_special_procedures_en.pdf

[21] European Commission, (2020), EU-US: A new transatlantic agenda for global change. Press Release. Accessed at https://ec.europa.eu/commission/presscorner/detail/en/ip_20_2279

[22] EU Commission, (2019), Report from the Commission to the Parliament and the Council on Trade and Investment Barriers. 1st January 2019 – 31st December 2019.

[23] World Trade Organization, 2020, WTO members intensify work on technical barriers to trade. Accessed at https://www.wto.org/english/news_e/news20_e/tbt_24sep20_e.htm

[24] Cernat, L., & Boucher, D. (2021). Multilateral cooperation behind the trade war headlines. CEPS

[25] European Commission, 2021, Annex to the Trade Policy Review – An Open, Sustainable and Assertive Trade Policy.

[26] Antimiani, A. & Cernat, L., 2017, Liberalizing Global Trade in ‘Mode 5’ Services: How Much is it Worth?. DG TRADE Chief Economist Note