Processing Trade and Global Supply Chains: Towards a Resilient “GVC 2.0” Approach

Published By: Lucian Cernat

Subjects: European Union Far-East

Summary

In the current global context marked by economic fragility, growing uncertainty and geopolitical conflicts, ensuring the smooth functioning of global supply chains becomes more important than ever. Supply shortages, higher freight costs, higher commodity prices and strong demand increase will trigger inflationary pressures for all economic sectors dependent on global value chains (GVCs). As part of global efforts to enhance the resilience of GVCs, this paper makes the case for a broader discussion about the untapped potential of processing trade, a relatively unknown trade facilitation option available in many countries around the world. Processing trade has been credited with stimulating China’s participation in GVCs, in combination with foreign direct investment (FDI) attraction and industrial upgrading. However, processing trade is not just a Chinese phenomenon. In the EU, significant trade flows (over 200 billion euros in 2021 alone) benefitted from a double-digit trade cost reduction, thanks to the EU processing trade provisions. Different types of processing trade arrangements exist in over 70 countries worldwide (including in the EU), as a way to facilitate the integration of developing countries in global production chains.

However, these unilateral schemes have different requirements and co-exist without any attempt to facilitate their inter-operability along complex global supply chains. This paper argues that there is a pressing need for a global reflection on how best to promote a better integration between these national processing trade schemes. One option is to promote a “GVC 2.0” approach that offers key recommendations and best practices for processing trade along GVCs. Such a coordinated “GVC 2.0” trade facilitation initiative would not only make GVCs more resilient for countries that depend on global sourcing for their critical economic activities, but it will also reduce the inflationary effect generated by the unnecessary trade costs associated with GVC activities.

1. Introduction

Unless you are a high voltage engineer, you have probably never heard of Combinova. Yet the 25-year old Swedish company that is specialised in measuring and testing instruments used in a wide range of industrial sectors made itself known among custom law experts when the European Court of Justice issued an important ruling on Combinova’s use of inward processing trade, a scheme offered under the EU customs rules to companies engaged in global supply chain activities. Combinova challenged a ruling by the Swedish customs with regard to the way in which the company used inward processing.[1] The benefits offered by processing trade were important enough to take matters to court, given that Combinova is a small Swedish enterprise manufacturing and distributing state-of-the-art measuring instruments that are produced in collaboration with many suppliers worldwide and are exported in many countries worldwide, such as Brazil, China, Egypt, Indonesia, Japan, Korea, Singapore, Taiwan, United States, Vietnam[2].

Although processing trade is relevant for many other companies beyond Combinova, few trade experts have inward processing among their favourite topics of discussions, apart from customs lawyers and supply chain specialists. This is not to say that there is no relevant empirical literature on the importance of processing trade provisions in the rapid expansion of global supply chains (see for instance van Assche and van Biesebroeck (2018) and Amador and Cabral (2016) for a review). However, this relative lack of attention is somewhat surprising since processing trade is one of the important trade facilitation initiatives behind the impressive development of global value chains (GVCs) over the last few decades. Processing trade has been credited with stimulating China’s participation in GVCs, via FDI attraction and industrial upgrading (see for instance Kim (2017) and Bai, Hong and Wang (2021)). Processing trade is also quite important for EU export performance: over 200 billion euros (around 72 billion of imports and 148 billion of exports) benefit from the EU processing trade regime. Different types of processing trade arrangements have been adopted by the integration of many small and medium enterprises (SMEs) from developing countries in global production chains. There is also some evidence that other trading partners are re-assessing the benefits of their processing trade national schemes. For instance, the United States launched in December 2021 an assessment of the impact of US free trade zones and an overview of similar schemes operating in Mexico and Canada. This is a clear example that raising awareness about the relevance of processing trade and other similar trade facilitation schemes is important for both policy makers and interested companies.

This paper makes the case for a broader discussion about the untapped potential of processing trade procedures, as part of global efforts to enhance the resilience of GVCs against major shocks like the covid-19 pandemic, climate change or political tensions. In a global context marked by economic fragility, growing uncertainty and geopolitical conflicts, ensuring the smooth functioning of GVCs becomes more important than ever. Supply shortages, higher freight costs, higher commodity prices and strong demand increase could add to the inflationary trend for all economic sectors dependent on GVCs. GVCs account for more than half of global trade and industrial activities rely on a significant share of imported intermediates. Unsurprisingly, strong reliance on imported intermediates combined with supply chain disruptions led to an increase in trade cost and import prices which, in turn, affected domestic prices and added to the existing inflationary factors. Empirical research indicate that global supply chain disruptions during the COVID-19 pandemic played a significant role in US inflation during 2021 (Santacreu and LaBelle, 2022). Against this background, this paper argues that there is a pressing need for a global reflection on how best to promote the inter-operability between processing trade schemes available in over 70 countries around the world. One option is to promote a “GVC 2.0” global trade facilitation framework that offers key recommendations for greater inter-operability across processing trade schemes for GVCs. Such a “GVC 2.0” trade facilitation initiative would not only make GVCs more resilient for countries that depend on global sourcing for their critical economic activities, but it could also reduce the inflationary pressure generated by the unnecessary trade costs associated with GVC activities.

[1] The case involved a preliminary ruling from the European Court of Justice on a dispute between the Swedish customs authorities and Combinova on compliance with the administrative requirements for the EU inward processing trade provided for in Article 256 of the EU Customs Code. Combinova imported goods into Sweden, processed them, and re-exported them later on. It relied on the EU inward processing scheme that exempts such imported products from tariffs and VAT charges. However, Combinova missed the deadline for sending the required documentation to Swedish customs. This led to a customs debt that Combinova successfully challenged in court, on grounds that in fact the imported products have been re-exported. For more details, see for instance Heeren (2020).

[2] Based on the list of distributors that Combinova has around the world, according to the company website (https://combinova.se/distributors).

2. What is processing trade?

Processing trade, generically defined, refers to several schemes that are conceived to facilitate the participation of companies in global supply chains, while keeping standard tariffs in place (see for instance Brandt, Li and Morrow (2021) for an assessment of this form of selective trade liberalisation). Among the many variants, two different types of processing trade schemes are in operation: (i) inward processing trade and (ii) outward processing trade. Special trade regimes making use of processing trade have proliferated around the world, under different underlying ideas and names: export processing zones, free ports, bonded warehouses and factories, etc.[1] The ILO has identified over 100 countries with export processing zones and the WCO has identified over 70 countries that have standard processing trade schemes (WCO, 2017).

In the case of the EU, for instance, inward processing means that non-EU goods can be imported in order to be used by EU-based manufacturing companies in one or more processing operations, prior to their use in exported products. When imported, such goods are not subject to import duties and other taxes related to their import (such as VAT or excises). Moreover, goods imported under the inward processing procedure are not subject to other EU trade policy measures, including a number of otherwise costly trade formalities.

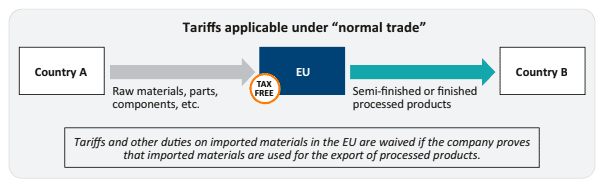

The EU inward processing procedure is designed to give a competitive edge to EU companies involved in GVCs. Graphically one could envisage the operation of processing trade operations in the following manner. Let us start with an example of inward processing trade involving three countries (see Figure 1).

Figure 1. Inward processing scheme: a generic example

Source: Author’s elaboration.

In this example the inward processing scheme operates in the EU and allows the registered companies in this scheme to import various parts and components from country A without paying the “normal” customs duties, provided that these materials are used or incorporated in goods further processed for export to country B. Typically, such inward processing schemes require certain administrative costs (e.g. registration with customs, sharing detailed logistics and production information to guarantee the compliance with the scheme, etc.). In return, participating companies not only save the customs duties that would apply to “normal” imports but it may also benefit from faster clearance times, and additional trade facilitation measures. The extent to which inward processing schemes offer such additional non-tariff advantages is an important point that will be further elaborated upon in the next sections..

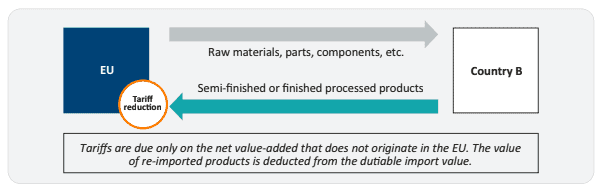

The second generic type of processing trade is called outward processing (see Figure 2). This scheme involves a bilateral trade relation between an EU exporting company of an intermediate component towards a processing country that subsequently re-exports the finished product back to the EU. The outward processing scheme allows the EU importer to deduct the value of the EU components previously exported from the value of the imported product, thus paying customs duties only on the non-EU value added.

Figure 2. Outward processing scheme: a generic example

Source: Author’s elaboration.

The outward processing scheme typically involves a company in the EU that outsources parts of the downstream activity to another country B. If we take the example of automotive supply chains, a complex production process involving many suppliers worldwide, the EU company exports several car parts (e.g. gearbox, electronic components) to a car assembly factory in country B. If the finished car containing the EU car parts is then re-imported into the EU, it will only pay tariffs on the value of the car minus the value of the components originally exported from (and now re-imported into) the EU.

Interestingly, in the case of the outward processing trade, the EU scheme also extends these trade facilitation benefits to mode 5 services, i.e. services exported by EU companies under one of the GATS modes of supply that are embedded in the reimported products (DG TRADE, 2022). The value of EU mode 5 services trade is considerable (Cernat, 2015) and having such services covered under the EU outward processing scheme facilitates the “servicification” of EU manufacturing and the attractiveness of the EU for the types of services that will be essential for the 4th Industrial Revolution (e.g. artificial intelligence, Internet of Things and other industrial software development).

[1] A distinction should be made between processing trade regimes that apply in general to all interested and eligible economic operators and “export processing zones”, which are specific geographical areas with a policy framework different from the rest of the country territory (including special tax and infrastructure incentives to attract foreign investment), in which imported materials undergo some degree of processing before being exported again. (ILO, 2003). The most well-known export processing zones are “maquiladoras” in Mexico, or “special economic zones” in China, or “foreign trade zones” in India or the United Arab Emirates. Duty drawbacks schemes are another variant of such processing trade schemes. In the current paper, the focus is on the standard processing trade regime that is usually available across an entire territory of a trade jurisdiction for all eligible companies.

3. The importance of processing trade: how much trade goes on under these schemes?

Global supply chains are a dominant feature of world trade. Around 70% of international trade today involves global value chains (GVCs), as parts and components cross borders numerous times. Once incorporated into final products, they are shipped to consumers all over the world (OECD, 2020). Although it did not make big headlines, processing trade has been part of the transformative effects of GVCs and the broader globalisation success story. To render abstract GVC concepts more concrete, let us take the example of a car produced along fragmented production chains involving several countries. A modern car has more than 10 000 parts that may cross borders more than eight times in the production and assembly process (Canis, Villarreal, Jones, 2017) and automotive supply chains can involve hundreds of suppliers. Saving double digit tariffs every time such car parts cross borders from one factory to another is the big contribution that processing trade made to the development of GVCs.

The role of processing trade has come to the fore in the context of the rapid integration of China in GVCs. The processing trade facilitation scheme, coupled with special economic zones and the facilities offered to foreign companies interested in assembling various manufactured products in China has been credited with a large role in the impressive export performance of China over the last decades. The success of processing trade was outstanding, at some point reaching over 50% of the total value of Chinese exports. Even though in recent years China has moved away from this heavy reliance on processing trade, it still accounts for a significant share of Chinese exports, representing almost a quarter (24%) of total Chinese exports in 2020 (GAC, 2021).

Processing trade is not only a feature of Chinese trade. Other developing countries have also encouraged their companies to emulate the Chinese success and created various processing trade schemes. A recent survey by the World Customs Organisation indicates that over 70 countries have such schemes in place. While in some smaller developing countries, the participation of exporting firms in such schemes remains limited, the OECD/WTO Trade in Added Value (TiVA) database indicates that many countries have a high share of GVC participation and therefore would benefit greatly from the promotion of processing trade among their exporters and importers.

Processing trade is also an option that EU trade policy offers to interested companies, subject to a specific set of rules and procedures. However, despite its potential benefits, processing trade procedures are not well known by all exporters. While Combinova made good use of the EU processing trading scheme, that is not the case for all EU SMEs engaged in global supply chains. This lack of awareness for the benefits of processing trade is an issue in other countries as well. According to the WCO survey on the use of processing trade in over 70 countries, 33% of respondents identified lack of awareness among potential beneficiaries as the biggest source of under-utilisation of processing trade schemes. Existing evidence suggests that even large companies are not fully aware or not fully utilising these facilities, let alone SMEs. For instance, in 43% of the countries covered in the WCO survey on processing trade schemes, there were less than 100 companies participating in the scheme. The second reason is related to burdensome administrative procedures and formalities required for companies to participate under such schemes, and the need to interact closely with custom authorities. Therefore, in some cases, there may be good economic reasons why companies do not take the additional costs and requirements necessary to become an approved economic operator under such processing trade schemes. The good news is that many, new digital solutions are available to reduce the administrative costs associated with processing trade, such as Customs4Trade (C4T, 2022).

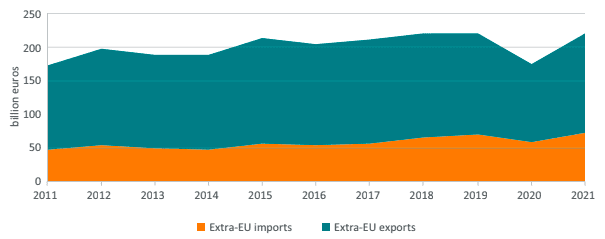

As seen in Figure 3, the importance of EU inward processing trade remains considerable and has been on a positive trend over time, surpassing 200 billion euros in trade value (around 72 billion of imports and 148 billion of EU exports). These figures highlight the importance of inward processing trade, as an important facility for EU companies interested in participating in GVCs. This is even more noteworthy, given that the EU benefits from being one of the most open economies in the world, as around 63% of EU imports enter at zero tariffs (either under MFN zero, FTAs or other preferential schemes). When comparing the value of EU imports under the inward processing (around 72 billion euros in 2020) with the remaining value of EU imports that still pay duties (e.g. MFN, GSP positive, other non-zero preferential access) which totalled almost 400 billion euros in 2020, the EU inward processing trade offers an additional duty-free alternative for around 18% of the dutiable EU imports.

Figure 3 The evolution of EU inward processing trade: exports and imports

Source: Author’s calculations based on official Eurostat trade statistics.

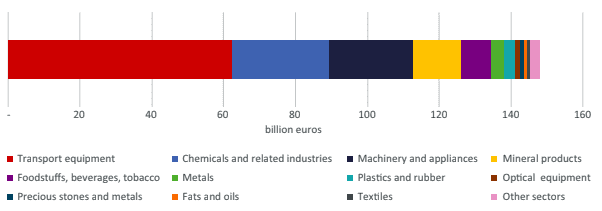

Figure 4. EU exports under inward processing: sectoral breakdown

Source: Author’s calculations based on official Eurostat trade statistics (2021 data).

Figure 3 also offers interesting “value-added” insight. Over the last decade, the value of embedded imports in exports under inward processing has increased slightly, from one quarter in 2014 to one third in 2021. This indicates that EU companies using inward processing are relying more and more on this regime for their participation in GVCs. Although processing trade activities have been sometimes described as low-value participation in GVCs, this is not the case for EU inward processing trade. When comparing the value of exports and imports under the scheme, the data suggests that two thirds of the exported value-added is still generated in the EU. This compares well with the roughly 85-87% of EU domestic value-added in “normal” exports.

Turning to the importance of inward processing trade activities across sectors, we notice that this facility is used in a wide range of economic activities. The sectors that make the most use of processing trade are the automotive and transport sector, followed by chemicals and pharmaceuticals, and in the third place by machinery and appliances (see Figure 4). As previously documented in the case of Europe (Cernat and Pajot, 2012), processing trade is extremely important for a number of sectors and is used intensively between the EU and some major trading partners (e.g. United States, China, Japan, South Korea, Brazil, India).

4. Beyond tariff savings: non-tariff measures and dynamic effects of processing trade

The economic literature devoted considerable attention to processing trade especially on the Chinese experience. A number of in-depth analyses, using firm level trade data, have been carried out to understand the impact of processing trade on participating firms in terms of quality upgrading, productivity and efficiency improvements, and other dynamic effects on firm characteristics stemming from learning-by-exporting such as expanding into new markets and diversifying its exported product portfolios. Bai, Hong and Wang (2021) used a detailed sample of Chinese exporters that participated under China’s processing trade regime and found strong evidence in favour of such dynamic effects. Interestingly, the same companies seem to be engaged in both “normal” trade and processing trade, indicating that there are advantages to be reaped from each trade regime. They found that initial participation in processing trade has improved the ability of Chinese firms to improve their overall export performance, both in terms of the value (intensive margin) and the number of exported products (extensive margin). Processing trade allowed participating companies to benefit from diffuse knowledge that was part of the comparative advantage of leading firms in the supply chain, hence allowing for a very effective strategy for industrial upgrading.

Processing export has been a successful strategy for industrial upgrading and economic growth in many other developing economies, especially in Asia (Auboin and Borino, 2018; van Assche and van Biesebroeck, 2018). Given the widespread existence of such schemes, it is only logical to consider any other steps that could enhance their benefits, especially if only better coordination is required, without any change in existing processing trade schemes required.

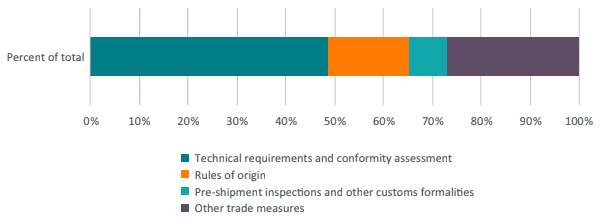

While processing trade arrangements are usually promoted as tariff-saving solutions, the biggest costs in today’s trade are non-tariff measures (NTMs). Econometric evidence and business surveys confirm that the costs of non-tariff measures are typically higher than tariffs. Among non-tariff measures, the most cumbersome and costly barriers are the technical barriers to trade (see Figure 5), i.e., the unnecessary costs of testing and certification across multiple markets and against different standards and technical requirements.

Here processing trade has another important benefit to offer that is not high on the radar screen of trade policy experts. Apart from tariffs, processing trade can also reduce testing and certification costs, by eliminating the need for unnecessary certification of products against mandatory requirements of all the intermediate countries involved in the global supply chain. If an intermediate product is imported under an inward processing trade regime, the imported product will not be released for free circulation in the processing country. Instead, it will be embedded in another product and exported to the next stage of production in a third country. Since they will be re-exported, the intermediate imports would save on unnecessary testing and certification costs that are required for products traded under “normal” trade regime in the transit country. Under processing trade, the products will only need to comply with the technical and safety requirements in the final country of destination.

Figure 5. Incidence of non-tariff measures faced by EU exporters abroad, by type

Source: Cernat and Boucher (2021)

The example of Combinova is also relevant for this additional benefit of inward processing trade related to NTMs. According to the company website, Combinova is specialised in producing and distributing testing and measurement equipment for electric and magnetic fields used in a wide range of industrial applications (e.g. electric vehicles, railways, power lines, heating equipment, etc.). These instruments are used to control the safety limits set out in the relevant national legislation around the world and in line with international standards. If such testing and measuring equipment would be produced and traded by Combinova under the “normal” EU trade regime, it will have to comply with multiple EU norms and regulations, regardless of whether the final customers are in the EU or abroad (e.g. the EU Directive 2014/30 on electromagnetic compatibility or the EU Directive 2013/35 on minimum health and safety requirements arising from electric, magnetic and electromagnetic fields). By using the inward processing regime, Combinova does not have to undertake the unnecessary EU conformity certification procedures for equipment exported to third countries. This equipment will only be tested and certified according to the requirements that are necessary in the final export destination.

Therefore, apart from tariffs and VAT, the processing trade facility can save considerable NTM costs along the supply chain at a time where they are under particular strain. By reducing the unnecessary costs of certification in a “transit” country where intermediate products, parts and components are only processed for further export, processing trade can also contribute to more resilient and diversified GVCs. This positive effect is achieved due to the reduction in non-tariff barriers for suppliers (including SMEs) that would not find it economical to test their products multiple times against multiple requirements under “normal” trade regimes in all the countries involved in the production chain.

5. What else can we do: towards a “GVC 2.0” approach for processing trade

Currently, the smooth functioning of GVCs relies on a large number of disparate processing trade schemes implemented unilaterally by many WTO members. Yet, from a global supply chain perspective, the co-existence of a myriad of unilateral processing trade schemes at national level is suboptimal. The smooth interaction between processing trade schemes across countries, or between processing trade and FTAs should not be taken for granted as there is evidence of instances when this was not the case, with negative implications for the companies involved (European Parliament, 2015).

Let us take the example of the EU outward processing trade outlined in Figure 2 above and let us make the (realistic) assumption that it is used in the automotive sector. An EU car company may consider sending several car parts from the EU to an assembly factory in a third country, under the EU outward processing trade scheme. If the foreign car is reimported in the EU, the car will only have to pay the 10% tariffs in the EU on the value of the car, minus the value of the components that were previously exported under the outward processing trade. This is already a tangible trade facilitation benefit.

However, if the car parts face tariffs in country B, there are additional benefits to be made if the car engine would be imported in country B under its inward processing trade regime. Under the inward processing regime in country B there would be even more trade cost savings to be made, by waiving the need for unnecessary testing and certification of those EU car parts in country B. However, there are no rules to facilitate the inter-operability of one country’s outward processing regime with another country’s inward processing schemes.

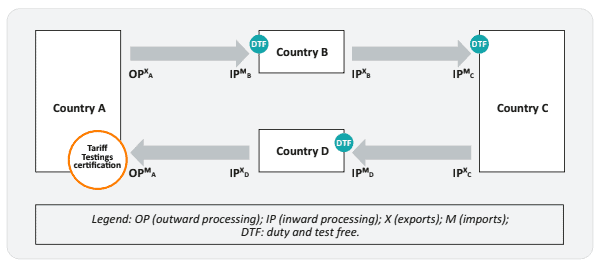

Therefore, a simple way to generate greater global gains from existing national processing trade arrangements would be to ensure a more coordinated approach in their administration and guarantee greater inter-operability. Under a coordinated “GVC 2.0” approach, companies active along the supply chain would be able to “interconnect” the various processing scheme available in each country (Figure 6).

Figure 6. The “GVC 2.0” processing trade framework: a schematic representation

Source: Author’s elaboration.

Compared to “normal trade”, under such a seamless cross-country processing trade regime importers can save on tariffs on intermediate inputs and exporters can save on unnecessary certification costs against product requirements in each transit market.

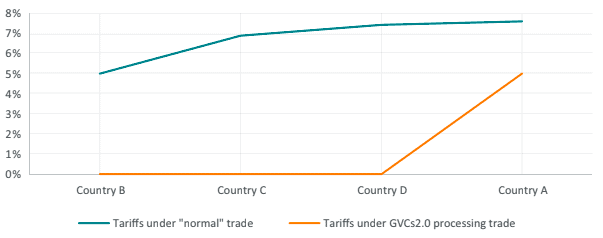

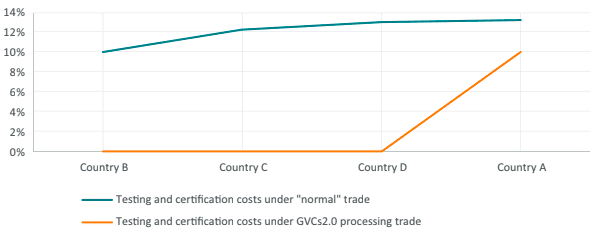

To illustrate with a numerical example such a “GVC 2.0” scheme, let us assume that four countries ensure that their processing trade regimes are interoperable. The company in the country of final destination would make use of outward processing (OP) trade, since the final product will be imported in country A. All the other companies in “transit” countries would make use of their respective inward processing (IP) trade schemes. For simplicity, let us also assume that all countries have a “normal” MFN tariff of 5% on all products. We also need to make an assumption for the cost of conformity assessment testing and certification that are required under “normal” trade each time a product crosses borders. For simplicity again, let us assume that the costs associated with product testing and certification are double the tariff costs (10%).

This assumption is not far from the findings in the empirical literature suggesting that the costs of non-tariff barriers are often in double digits. Ghodsi and Stehrer (2016) estimated that the average ad-valorem tariff equivalent of non-tariff barriers across over 3000 product categories was 10.5%. We also need to assume the ratio of imported intermediates vs domestic value-added at each stage of production. For this parameter we can use the estimate for the EU inward processing trade scheme provided in section 2 above, which indicates roughly a 1:3 ratio between imported and domestic value-added.

With these simple numerical assumptions and the schematic representation of a four-country “GVC 2.0” processing trade arrangements, the trade facilitation effects appear quite considerable. First, the intermediate products save the 5% tariff that would be charged under “normal trade” each time the product crosses the border. Under the “GVC 2.0” processing trade framework, there are no tariffs at the intermediate stages of production. There is a final 5% tariff to be paid on the value added that does not originate in country A. As can be seen from Figure 7, in “normal” trade the tariffs would accumulate over the supply chain as products would pay “tariffs on top of tariffs”, reaching cumulative levels that are higher than the nominal 5% tariff.

Figure 7. “Normal” trade vs “GVC 2.0” processing trade: tariff savings along global supply chains

Source: Author’s calculations.

In addition to the tariff savings, under the “GVC 2.0” processing trade scheme, the intermediate products save also the unnecessary 10% testing and certification costs each time the product crosses borders, compared to a “normal” trade scenario. There is, of course, a testing and certification cost before the final product is placed on the market at the final importation stage in country A where the product will need to be tested and certified as compliant with the prevailing technical norms and regulations in the market (see Figure 8).

Figure 8. “Normal” trade vs. “GVC 2.0”: savings on unnecessary testing and certification costs

Source: Author’s calculations.

While this was just a numerical example, empirical work has found that “tariff escalation” along GVCs was a real issue (Rouzet and Miroudot, 2013). A “GVC 2.0” approach to processing trade schemes clearly illustrates the tariff saving potential and the testing and certification cost savings throughout the intermediate steps in the value chain, while maintaining the tariffs and testing requirements under the outward processing scheme in the final destination.

The “double dividend” of a “GVC 2.0” framework for globally coordinated processing trade come from tariff savings and a reduction in unnecessary non-tariff costs as compared with other trade procedures required under “normal” trade, such as testing and certification of products in markets where these products will never be actually used. This untapped potential should trigger a reflection process on how to interconnect all the processing trade regimes and other similar schemes in a consistent fashion that would allow global companies and SMEs to seamlessly move the intermediate products needed along GVCs with minimal costs. A multilateral approach that would create the conditions for greater inter-operability between these existing processing trade regimes would be clearly something that would ensure greater resilience of GVCs, higher diversification and potentially a significant reduction in trade costs, at a time when inflation risks are mounting.

6. Conclusions

Whether we will see more “de-globalisation” or re-shoring, goods will continue to cross borders several times as part of the production process, before reaching the final consumer. Processing trade offers several ways in which it can support resilient GVCs and trade as an engine for development. While the current unilateral schemes have worked relatively well, a multilateral or plurilateral approach aimed at ensuring inter-operability of such individual processing trade schemes would take these trade facilitation measures to the next level. By saving tariffs and unnecessary testing and certification costs (which remains a very costly component of international trade), it would facilitate tens of billions of euros worth of intermediate trade flows along global supply chains. There is also an opportunity for many developing countries to implement processing trade schemes that could be made compatible with the schemes in major economies like the EU, US, or China.

Placing new issues on the multilateral agenda is not easy and successful conclusion of trade deals is even more difficult. However, such a GVC 2.0 approach to multilateral trade would not require any change in current trade policies and would be in the interest of all countries interested in remaining connected via well-functioning global supply chains. It might also help with supply-chain related inflationary pressure that looms large for the immediate future in many countries.

However, since such a new initiative will take time to materialise, some useful steps can be taken in the meantime. First, we need to elevate the importance of processing trade in trade policy debates. This is particularly important since there is an awareness deficit both among policy makers and among exporting and importing firms about the benefits of existing processing trade schemes. Second, a coordinated global approach towards processing trade arrangements could also identify best practices to reduce the unnecessary costs of such schemes for SMEs. The case of Combinova clearly illustrates that import processing requirements and their implementation can be at times costly. As not all companies are prepared to take matters to court, policy makers need to put in place business-friendly procedures to facilitate trade.

7. References

Amador, J. and Cabral, S. (2016) “Global value chains: a survey of drivers and measures”, Journal of Economic Surveys 30(2): 278-301.

Auboin, M. and Borino, F. (2018) “Recent Trade Dynamics in Asia: Examples from Specific Industries”, CESifo Working Paper No. 7194, Munich.

Bai, X. Hong, S. and Wang, Y. (2021) “Learning from processing trade: Firm evidence from China”, Journal of Comparative Economics 49 (2021), 579–602.

Brandt, L., Li, B. and Morrow, P.M. (2021) “Processing trade and cost of incomplete liberalization: The case of China”, Journal of International Economics vol.131, 103453.

Canis, B., Villarreal, M.A. and Jones, V.C. (2017) “NAFTA and Motor Vehicle Trade”, Congressional Research Service Report R44907, Washington, July 2017.

Cernat, L. and Pajot, M. (2012) “Assembled in Europe”: the role of processing trade in EU export performance, Chief Economist Note 3/2012, DG TRADE, Brussels.

Cernat, L. (2015) “Trade rules and technological change: The case for mode 5 services”, The E15 Initiative, Geneva.

C4T (2022) Customer stories: Honda – Inward Processing Relief. Available online at: https://www.customs4trade.com/customer-stories/honda-inward-processing-relief.

DG TRADE (2020) Access2Markets: Services – Trade in digital services embedded in a product – Frequently Asked Questions.

European Parliament (2015) Parliament approves €3 million in job search aid for redundant Irish and Finnish workers, European Parliament Press Release, 18 December 2016.

GAC (2021) Review of China’s Foreign Trade in 2020, General Administration of Customs, People’s Republic of China, 14 January 2021.

Ghodsi, M. and Stehrer, R. (2016) Non-Tariff Measures Trickling through Global Value Chains, The Vienna Institute for International Economic Studies.

Herren, P. (2020) “The extinguishment of a customs debt incurred through non-compliance: mitigating the impact of formalism in customs”, 20 October, Greenlane. Available online at https://www.greenlane.eu/2020/10/20/analysis-the-extinguishment-of-a-customs-debt-incurred-through-non-compliance-mitigating-the-impact-of-formalism-in-customs/

ILO (2003) “Employment and social policy in respect of export processing zones (EPZs)”, Geneva, March 2003.

Kim, B. (2017) “What has China learned from processing trade?”, Journal of Economic Structures (2017) 6:32.

OECD (2020) “Trade Policy Implications of Global Value Chains”, Trade Policy Brief, February 2020, Paris.

Rouzet, D. and Miroudot, S. (2013) The cumulative impact of trade barriers along the value chain: an empirical assessment using the OECD Inter-Country Input-Output Model, GTAP 16th Annual Conference on Global Economic Analysis, 12-14 June, Shanghai.

Santacreu, A. M. and LaBelle, J. (2022) Global Supply Chain Disruptions and Inflation During the COVID-19 Pandemic, Federal Reserve Bank of St. Louis Review, Vol. 104, No. 2.

Van Assche, A. and Van Biesebroeck, J. (2018) Functional upgrading in China’s export processing sector, China Economic Review 47 (2018) 245-262.

WCO (2017) Handbook on Inward and Outward Processing Procedures, World Customs Organisation, May 2017, Brussels.