Reforming Standard Essential Patents: Trade, Specialisation, and International Jurisprudence

Published By: Fredrik Erixon Oscar Guinea

Subjects: European Union Trade and IP

Summary

The European Commission is considering a radical overhaul of the system governing Standard Essential Patents (SEPs). A leaked proposal suggests that the Commission wants to take control over the registration of SEPs, take efforts to regulate their essentiality, and intervene in negotiations over royalty rates if parties do not come to an agreement. The underlying assumption is that such a system will benefit SEP implementers and the European economy, and that the common holders of SEPs will be cut down a size or two.

The logic behind this policy is that, since there are more SEP implementers than holders, any change in favour of implementers will have a net positive effect on the EU economy. However, this is doubtful. The EU is a R&D powerhouse for many of the technologies protected under SEPs and since most of the global production of the goods using these technologies is done outside Europe, the EU is a net exporter of innovation and a receiver of revenues from the licensing of these technologies. Using data on trade, specialisation, and market revenues, this paper comes to a different conclusion: the EU economy is likely to be a net loser if the balance between holders and implementers is changed. Moreover, there is a general and fundamental interest for Europe to preserve a system of standards and SEPs that allows it to punch above its weight in international policies and practices in standards and patents.

1. Introduction

The European Commission is about to present a radical overhaul of the institutions and markets for Standard Essential Patents (SEPs). A leaked version of a forthcoming Commission proposal surfaced in late March and has already prompted strong reactions. Among other things, the European Commission wants the EU Intellectual Property Office (EUIPO) to take control over the process of registering patents and review their essentiality. In the Commission’s view, this would help to reduce obscurity about which patents are really essential to a standard and the “over-declaration” of patents by holders of SEPs.

Furthermore, the Commission is setting out an additional role for the EUIPO as a quasi-price regulator. Ultimately, when price negotiations between holder and implementer break down, there should be a mandatory (yet non-binding) reconciliation between parties, managed by the EUIPO, to establish the royalty rate that conform to FRAND principles.[1] According to this line of argument, an administrative body could help resolve disputes over price for accessing technology and thus avoid costly litigation in courts – something which has not guaranteed a resolution since courts have not (or rarely) been willing to establish a royalty rate. All in all, transparency and predictability would increase, suggests the Commission, and transaction costs would go down. Moreover, the market for SEPs would become more attentive to the needs and demands of the implementers, or the licensees.

There is much to discuss in the Commission’s proposal, and one of the authors of this paper has already shared his doubts about it.[2] For instance, the proposal is messy and work with unclear terminology and concepts, and pay far too little attention to how the SEPs market has evolved over the years and how courts and competition authorities have helped to reduce the problems. Strangely, the Commission’s proposal comes on the eve of the establishment of the Unified Patent Court (UPC) in Europe, and foresees a division of labour between the EUIPO and the UPC that is likely to cause rather than mitigate delays and uncertainty. Moreover, the underlying assumption seems to be that SEP holders have too much market power and that they are using it to the detriment of SEP implementers: the reforms necessary now, therefore, are about cutting down the size of these holders a notch or two. At best, this is a one-sided view of observed problems in the SEP system and reforms to that effect may do irreparable harm to the delicate balance between holder and implementer interests in SEPs.

Once the final proposal is out, there can be a more specific discussion about claims and propositions in the proposal, and how they stack up with markets, realities, and policies. There is a case for improving SEPs and the market for them, and some of the broad objectives in the proposal are valid. However, if the leaked proposal is what the Commission will present, it is going to miss an opportunity to achieve important changes.[3]

In this paper, we want to draw attention to some international aspects of SEPs and the market for standardised technologies, that provide an important context for any reform effort. In chapter 2, we will discuss some international political economy aspects of SEPs – especially the institutions governing or underpinning them – and review how the Commission’s proposal relates to the global market for standards and patents. In chapter 3, we will look closer at patterns of trade and specialisation, and international market shares and revenues for technology. Chapter 4 concludes the paper.

[1] FRAND stands for “Fair, Reasonable and Non-Discriminatory” conditions for licensing.

[2] Fredrik Erixon (2023) Go Back to the Drawing Board! The Commission’s Leaked Patent Reform would be Bad for Technological Development and for Europe. ECIPE Blog, April 11, 2023, https://ecipe.org/blog/commission-leaked-patent-reform/

[3] Matthias Bauer and Fredrik Erixon (2017) Standard essential Patents and the Quest for Faster Technology Diffusion. ECIPE Policy Brief No. 2/2017.

2. The International Political Economy of SEPs

There is an underlying logic in the proposal that builds on some basic claims of political economy. In the past, market competition reduced the amount of downstream cellular production (mobile phones/smartphones) in Europe. When Ericsson and Nokia departed the handset market, or the broader downstream devices market, and became more pure upstream technology contributors, Europe had an interest to maintain a system that was beneficial both to SEP holders and implementers. The balance was needed to preserve the integrity of the SEP system. This happened around the time when the FRAND concept took shape in the SEP system and complemented the rules that initially gave strong weight to ensuring technology contributors to get a “fair deal” if they contributed to a standard and declared their key standards-related patents to be essential.

Now, however, digitalisation is creating new downstream production and growing demand for upstream and innovative ICT technology. The developments of connected vehicles and the Internet-of-Things (IoT) have created a new class of implementers, and their production in Europe is now receiving strong political support. Therefore, several stakeholders in Europe have proposed reforms that reallocate the balance in the system in favour of SEP implementers at the expense of SEP holders. With this new producer environment, it is argued that such a rebalancing would benefit the European economy. In the Impact Assessment to the leaked proposal, the Commission implicitly makes the point that changing the balance will support output and jobs in the EU.

Is this really a correct representation of Europe’s “interest” in the SEPs market? We suggest the answer is No. A first approach is to review the profitability of firms whose market positions are in different parts of the ICT value chain, and the obvious conclusion is that firms that are specialised downstream have higher rates of profitability and return on investment (RoI) than firms that are specialised upstream.[1] Of course, several factors explain this category variation, but it sits awkwardly with the notion that aggregate license revenues to SEP holders are too big and that SEPs reward their innovation too much. In the past, analyses and proposals commissioned by the European Commission have sketched the idea of a RoI approach to guide how royalty rates under FRAND should be set.[2] If this had become the reality there could be a case for a top-down increase of royalty rates.

Obviously, the political economy of SEPs is far more complex than a crude and simplistic review of output and jobs – or revenues and profits in different parts of the value chain. In the first place, it is in the interest of both holders and implementers that the SEP market work efficiently and reward upstream innovation adequately at the same time as it presents downstream implementers with access, competitive technology markets, and prices that drive towards integrated and interoperable markets. Arguably, this is the key and overarching objective that should guide any effort to change the SEP system: preserving the system and strengthening its integrity are incredibly important for markets, technological development, and the end consumers.

If that objective is not observed, there is a clear risk that patent holders are going to declare fewer patents as essential to a standard, and the value of the standard will then go down. Without SEPs, implementers will have to negotiate about access to the license on different terms and in a different institutional context. The balance between SEPs and non-SEPs in the patent portfolio of big technology contributors will change, and it is not far-fetched to assume that implementers will have to pay more for their aggregate licenses in such a scenario. SEPs licenses are built on FRAND principles and the underlying logic is that SEPs licenses should cost less than a standard patent license because the SEP holder gets a chance to sell more. In the jargon, the SEP holder “commits” to a “FRAND price” or “FRAND royalty rate” – in some methodological assumptions, a price based on the value of the technology before it became a standard. The essence of SEPs is that a holder reduces margins in return for more sales: technology becomes a volumes market rather than a margins market.

Moreover, the international aspects of SEPs cast more doubts on the argument that SEPs revenues can go down without reducing the incentives for technology contributors to invest in innovation. First, the SEPs market is a global market. The Commission’s proposal can only deal with policies in the EU: it cannot establish a policy or practice that other jurisdictions must follow. However, actual policies and practices have over the years become more integrated globally. While there is a foundation of international law in the SEP system, it also has the features of an “emergent order” – a system that has been “designed without a designer”.

Europe has played a critical role in this development. The combination of a good culture of technical regulation and competent bodies like the European Telecommunications Standards Institute (ETSI) have made Europe a central hub for developing standards. Despite profound market change in the past 20 years, which has reduced the market importance of Europe and the role of European firms, Europe has maintained its unique role in the process of developing new standards. At the moment, Europe punches above its weight.

In its standardisation strategy, the European Commission has proposed changes that likely will disempower Europe. In a recent paper, we have documented these changes and analysed how they relate to the nature of the SEP system.[3] The conclusion we (and several others) have reached is that there is a very clear risk that these proposed changes will reduce the centrality of the European standardisation system in the global technology market.[4] Europe’s voice in the world – a key component of the EU’s ambition to build strategic autonomy – will be muted.

Next to these institutional foundations is the role of the courts. Because of Europe’s unique institutional system of market-driven standards, its legacy of being a pioneering region for cellular technology, and competent judges, Europe has also been the key region for SEPs litigation. European courts have strongly contributed to developing an international jurisprudence on SEPs and have been the go-to place for international and non-European disputes. This is a very strong advantage for Europe. Obviously, other central actors for standards and technology, especially China, want to change it.

For instance, a 2015 landmark ruling in the Court of Justice of the European Union (CJEU) on FRAND concerned the companies Huawei and ZTE. Why did the case, first filed in the Düsseldorf court, go to the CJEU when it concerned two Chinese companies and was not first and foremost connected to the European market? That is the question that Chinese officials asked at the time, and they concluded that they want to claim back the power to deal with a mostly intra-Chinese dispute themselves. However, the answer is simple: the litigation concerned European patents (too) and SEPs declared at ETSI, and the ETSI Rules of Procedure were the guiding “policies” for how to deal with the dispute – even if it did not concern Europe-specific friction. This is part of the background to Beijing making it a priority to make China a central place for standards in the future.[5] Following this development, and the policy development around the China Standards 2035 strategy, Chinese courts have started to make more “political” decisions to prohibit anti-suit injunctions, give more sovereignty to Chinese courts, and disregard international jurisprudence. The EU is now challenging this practice in the World Trade Organisation (WTO).[6]

The gravitational pull of the world economy will naturally reduce the centrality of Europe in standard setting. However, reforms that undermine the integrity of standards and the SEPs system will accelerate this development and work against Europe’s interest. A new system of SEPs based on the EUIPO and the development of new policy and practice by a direct EU agency is likely going to invite some distrust. The role of ETSI will be undermined – as will be the role of the Unified Patent Court in Europe, that soon will be up and running. It takes a long time to build up expertise to manage SEPs, their essentiality, and litigation, and courts will still have to be involved because of the underlying patent rights, even if the Commission wants to sidestep them.

[1] Matthias Bauer (2023, forthcoming).

[2] See for instance Joint Research Centre (2015), Fair, Reasonable and Non-Discriminatory (FRAND) Licensing Terms – Research Analysis of a Controversial Concept, JRC Science and Policy Report, European Commission, Joint Research Centre, Institute for Prospective Technological Studies.

[3] Bauer, M., Erixon, F., Guinea, O., Sharma, V. (2023). In Support of Market-Driven Standards. ECIPE Occasional paper, No. 1/2023.

[4] Obviously, there is already a process of “politization” in standard-setting but it is best responded to by making it harder for those who want to politically control the outcome of the standard-setting process, not by exacerbating the problem with more political control.

[5] For an overview of the China Standards 2035 strategy and related developments, see Tim Nicholas Rühlig (2020) Technical Standards, China and the Future International Order: A European Perspective. Heinrich Böll Stiftung, and Julia Voo and Rogier Creemers (2021) China’s Role in Digital Standards for Emerging Technologies – Impacts on the Netherlands and Europe. Leiden Asia Centre.

[6] European Commission (2022) EU Challenges China at the WTO to Defend its High-tech Sector. Press Release, February 18.

3. Trade, Specialisation, and Market Revenues

The Commission’s proposal describes a conflict between European SEP holders and European implementers. Companies like Nokia, Ericsson, Philips, and Siemens are the major SEP holders, while other European companies like Orange, KPN, Deutsche Telekom, Telia, Telecom Italia, T-Mobile, Alcatel, and research institutions such as Fraunhofer Gesellschaft also own SEPs. The users of information and communication technology and implementers of SEP includes companies within the ICT sector. Importantly, these implementers are now also featured in the automotive and IoT sectors.

However, despite the characterisation of the SEP proposal as a European issue, the reality is that the development of new technology, as well as the agreements on technological standards and the SEPs that protect and reward innovators, is a global enterprise. In reality, it is impossible to think that one market alone could run its own policy, separate from other major markets, without incurring costs. This is partly because of the success achieved by technical standards, which have helped to spur a market development in which companies can access a larger market and expand their businesses. For example, 5G technical standards in the cellular industry allow companies to sell the same product across countries, without having to make adjustments, because 5G phones work all over the world.

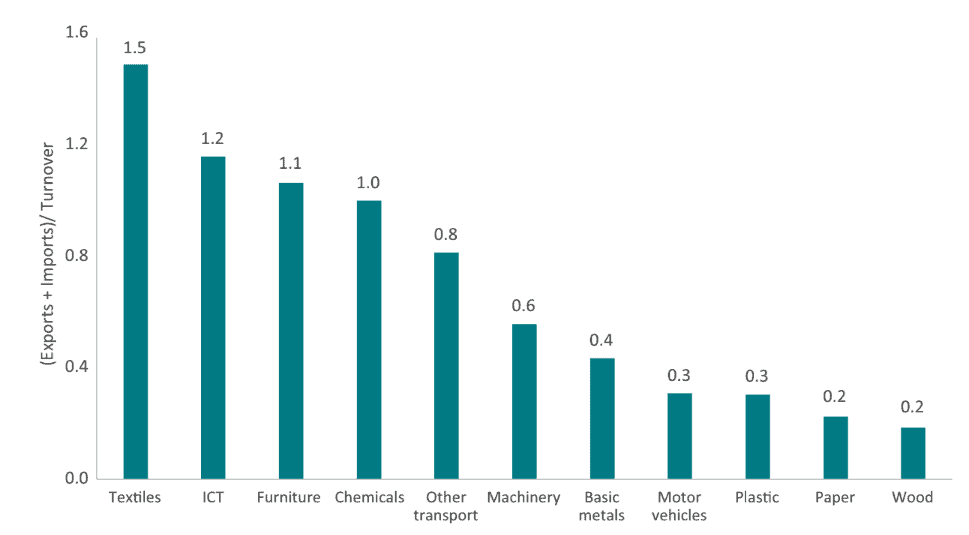

The global reach of ICT is not an abstract argument but something that is reflected in the data. Figure 1 shows that the European ICT manufacturing sector has a much higher level of trade intensity than other manufacturing sectors, where the use of technical standards and SEPs is not as prevalent. This higher level of trade intensity, measured as the sum of imports and exports as a proportion of turnover, is the result of the global ICT market in which EU ICT manufacturing is embedded. The ratio for the ICT sector is 1.2. In other important manufacturing sectors, like machinery and motor vehicles, the ratio is much lower, which means that trade (and the pattern of specialisation it reflects) is not as intensive. For instance, the trade ratio for the automotive sector is about a quarter of the ratio for the ICT sector.

Figure 1: Exports and Imports over Total Turnover Across European Economic Sectors in 2019 Source: Eurostat. Author’s calculations.

Source: Eurostat. Author’s calculations.

Firm-level data confirms the global nature of the ICT sector. In 2021, there were 37,000 firms working in the European ICT manufacturing sector[1] and almost seven out of ten were involved in export and import activities outside the EU[2]. In comparison, only 22 percent of EU manufacturing firms exported goods to other countries or bought their inputs from abroad. Hence, there is something unique about the ICT market that makes it much trade oriented and that allows for more participants in international trade.

A global market for innovation is a powerful incentive for researchers and engineers to innovate. Traditionally, large companies would integrate innovation and production in an “equity strategy” – inserting their own new technology into their own downstream products (see Box 1) or outsource their R&D activities to specialised firms that deliver new technologies mostly or exclusively to them. This is, by and large, how the ICT sector worked in the past and, of course, how many other sectors work today. However, the combination of technical standards and SEPs have spurred new patterns of production and specialisation in the value chain, and enabled a distinct way of meeting extra demand for innovations: a highly sophisticated market for technology. Companies do not need to go for an equity strategy to compete: they can license key technologies on the market and allocate resources in a way that conforms to their market positions. Hence, a market for technology supports a diverse ecosystem of companies with multiple business relations, with the added advantage of competition between innovators in the upstream side of the market.

In other words, because of market developments and the SEP system, companies can work at arm’s length rather than having to integrate different activities within the firm. For instance, nowadays, it is impossible for a single firm to produce each and every component of a mobile phone. Thanks to technical standards, a producer of cellular technology does not need to master every component and a user does not need to fully control every technology inserted into its products. Moreover, producers of technology know that, if the technical standard is successful and implementers adopt it, its work will be protected and rewarded, which incentivises them to continue participating in Standard Development Organisations (SDOs).

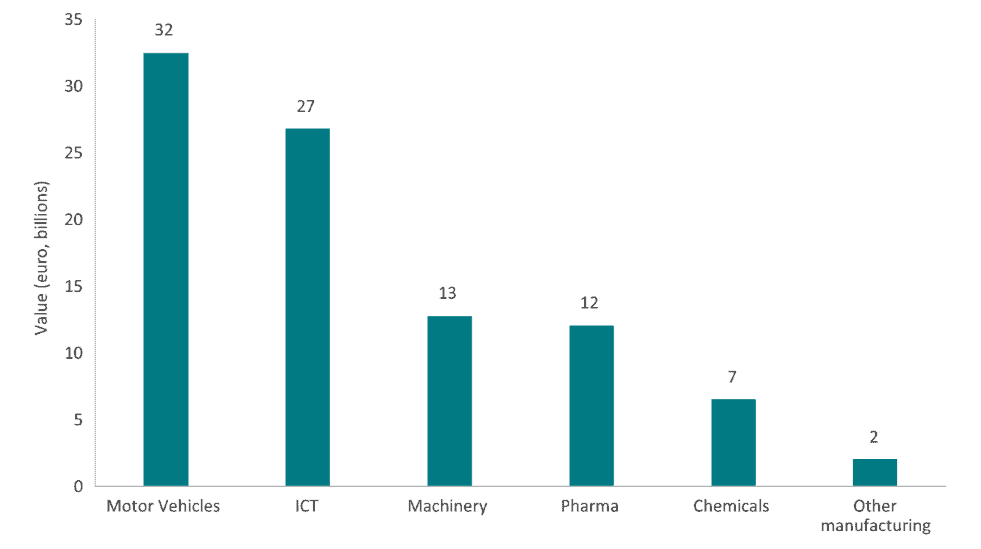

This is incredibly important for the performance of the sector. A critical effect of this system is the emergence of more specialised R&D firms. This kind of company emerges because innovations can be licensed, and their technologies can be applied to many downstream firms and products. For instance, the European ICT sector was the second largest source of R&D spending in the EU (Figure 2) – even if many of the big companies no longer compete in the downstream market. The ICT sector is the biggest R&D investor in all EU countries but Belgium, Denmark, Germany, and Romania, where it is the second biggest. This is because markets for technology in ICT support a more uniform distribution of R&D activities in which firms, across all the EU, can participate.

Figure 2: Business Spending on R&D Across European Economic Sectors in 2019 Source: Eurostat, Author’s Calculations. France, Estonia, Cyprus, Latvia, Lithuania, Luxembourg, Netherlands, Poland, Slovakia, Sweden not included due to missing data.

Source: Eurostat, Author’s Calculations. France, Estonia, Cyprus, Latvia, Lithuania, Luxembourg, Netherlands, Poland, Slovakia, Sweden not included due to missing data.

The changes proposed by the European Commission for SEPs will have impacts on how the industry is shaped and the outcomes that it delivers, particularly the amount of innovation. Initially, the cost of these changes will predominantly fall on SEP holders. The European Commission believes that, on balance, the benefits of the proposal clearly outweigh the cost because there are many more European implementers than innovators. Yet, as explained before and indicated in Figure 1, the EU ICT sector is more globally oriented than other European economic sectors. For instance, in the global market of ICT and IoT, the EU is clearly an innovator rather than an implementer.

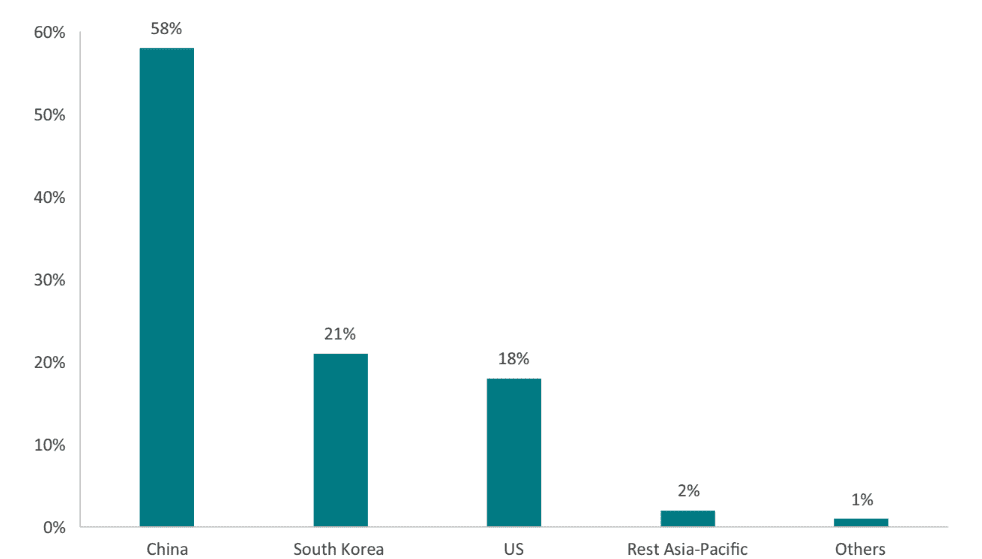

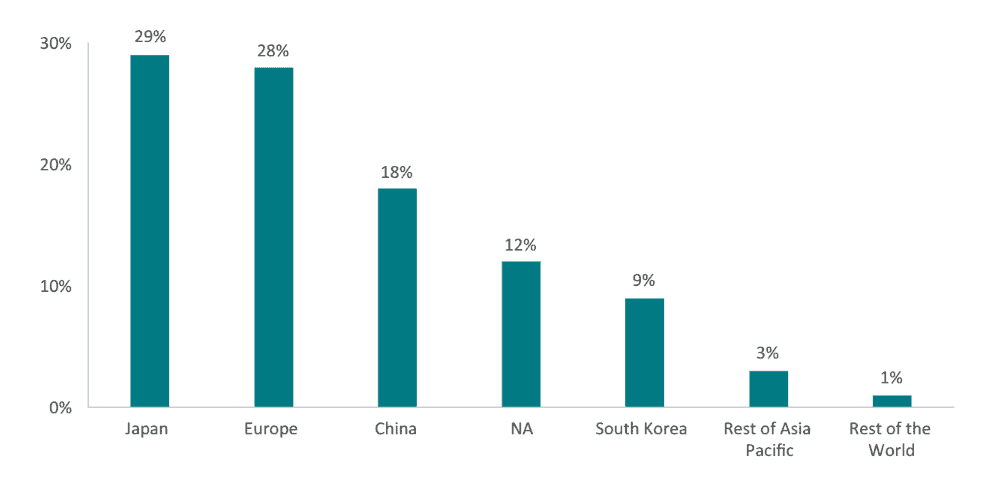

The developing market structure is important for understanding the political economy of the Commission’s proposed reforms. Predominantly, implementers are still outside the EU while the holders are still important investors and firms in the EU. This is obvious in cellular and smartphone markets. Figure 3 shows that nearly all smartphones’ sales – which are, by far, the largest implementers of SEPs – are made by companies headquartered in the Asia-Pacific. Out of the top ten mobile/smartphone manufacturers, none are headquartered in the EU. Moreover, the big implementers have very little production and assembly in the EU. Therefore, with respect to smartphones, Europe is a net exporter of upstream innovation and an importer of downstream products.

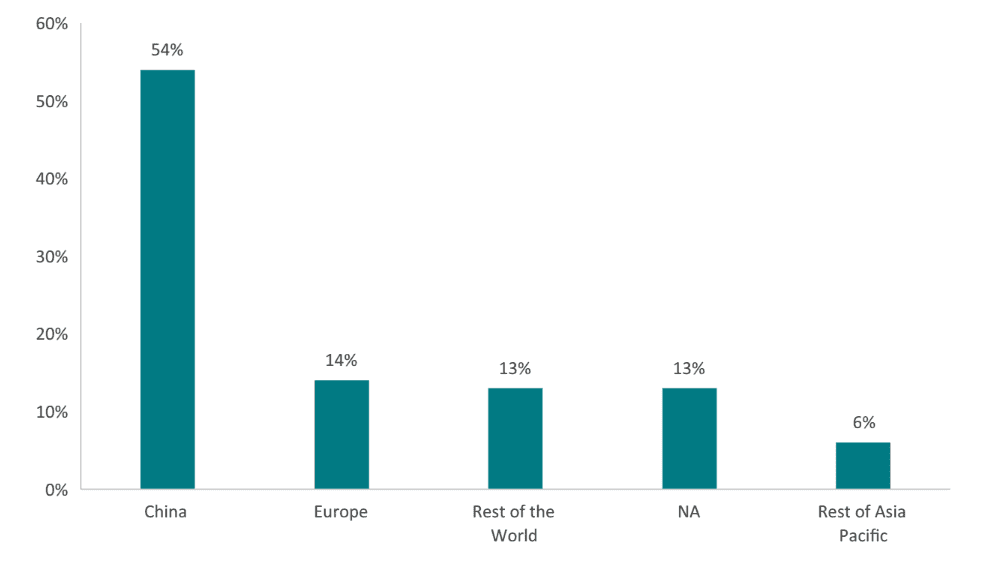

In fact, a similar argument can be made for IoT devices. It is now argued that the advent of IoT will reverse the balance of revenues, leading to more downstream income for Europe – also on the export side. This is partly true, but the argument still does not stack up. Only 14 percent of IoT modules are made by companies headquartered within Europe while 54 percent of shipments were made by companies headquartered in China (Figure 4). Even if European firms develop and innovate in the IoT space, it is still not attractive to produce in Europe and most customers will still be in the large Asia-Pacific region.

The same can be said about the almighty European automotive manufacturing sector. Figure 5 shows that even if car production in Europe remains important globally when it is compared to other regions, it represents only 28 percent of global car shipments while the Asia-Pacific region produces 59 percent of all the cars. Moreover, Europe’s share is in decline.

Figure 3: Global Smartphone Shipments Share by Region (2022) Source: IDC Mobile Phone Tracker.

Source: IDC Mobile Phone Tracker.

Figure 4: Global Cellular IoT Module Shipments (2022 Q2) Source: Counterpoint Global Cellular IoT Module and Chipset Tracker.

Source: Counterpoint Global Cellular IoT Module and Chipset Tracker.

Figure 5: Global Auto Original Equipment Manufacturer Shipments (2022) Source: Strategy Analytics.

Source: Strategy Analytics.

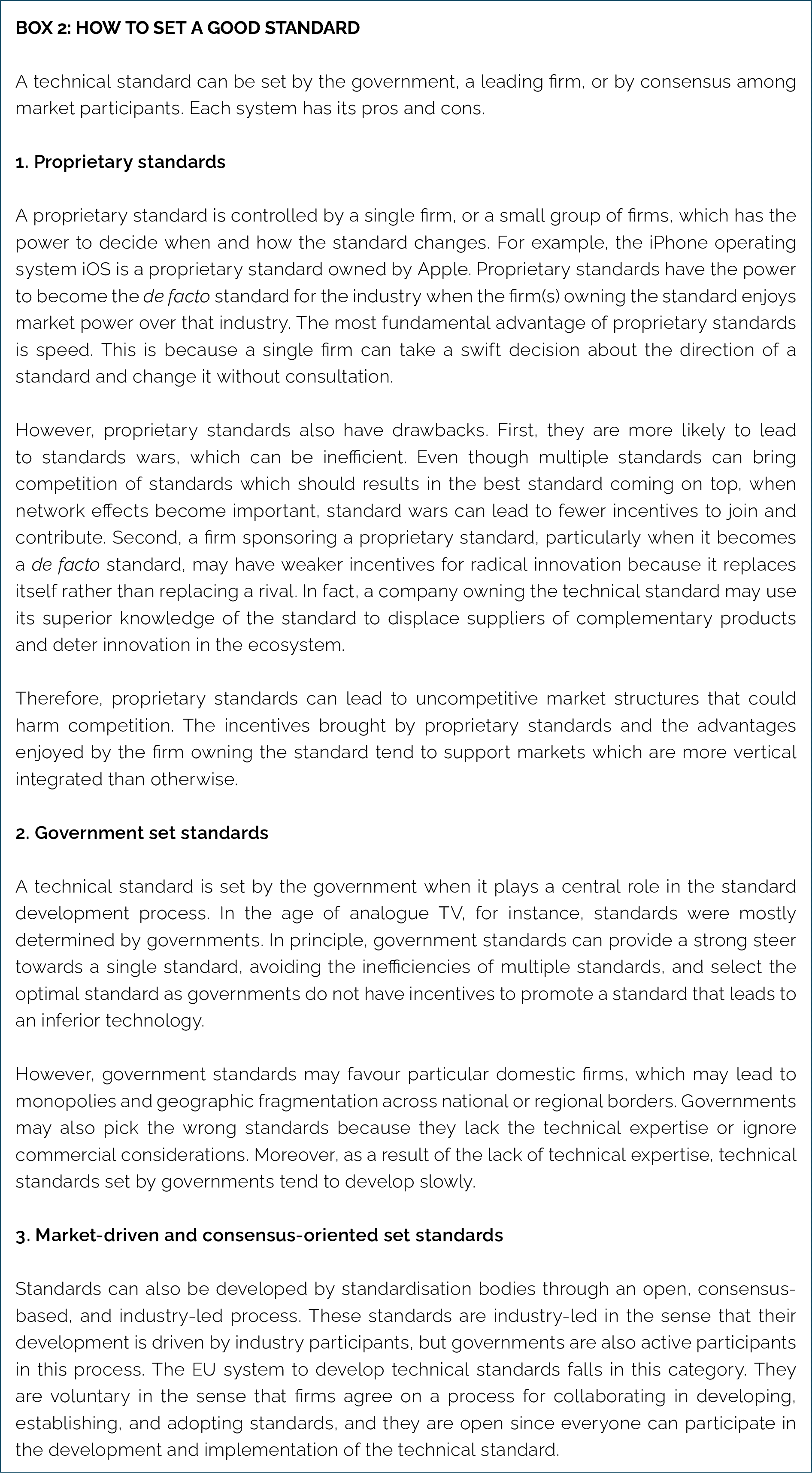

It is notoriously difficult to estimate the distribution of different incomes within a sector, but the data clearly suggest that in the value-chain of these ICT goods, Europe’s strength lies in R&D activities rather than in production, which brings tangible benefits in the form of royalties and licensing payments. In 2016, it was estimated that the mobile telecommunication industry generated patent royalty of USD 14.2 billion[3]. Equally important, this market specialisation delivers a sustained amount of innovations that benefit firms and consumers across the EU and worldwide. The most important risk associated with the new proposal is that innovators reduce their spending on R&D and move away from market-driven and consensus-oriented technical standards (see Box 2).

[1] Eurostat. Enterprise statistics by size class and NACE Rev.2 activity (from 2021 onwards). The ICT manufacturing sector is approximated as C26 Manufacture of computer, electronic and optical products.

[2] Eurostat Trade by Enterprise Characteristics (TEC) database. Data for 2020.

[3] Galetovic, A., Haber, S., & Zaretzki, L. (2018). An estimate of the average cumulative royalty yield in the world mobile phone industry: Theory, measurement and results. Telecommunications Policy, 42(3), 263-276.

4. Concluding Comments

The core argument of this paper is that the international context of SEPs must be considered in a full analysis of what should constitute Europe’s economic interest as it mulls reforms of the SEP system. Obviously, Europe has a strong interest in preserving the centrality and integrity of the Europe-led SEP system that holders and implementers know they can trust and contribute to, and that there is a good reward when using it. Furthermore, the way the market has evolved, and is likely to evolve in the future, will follow patterns of specialisation that will focus European parts of the value chain to R&D and innovation. Europe benefits from a system that is open to value-chain specialisation and fragmentation.

The risk with the Commission’s proposal is that, by taking matters out of ETSI and courts, they are likely to discourage companies from providing the technical expertise to participate in SDOs, ultimately lowering the appeal and adoption of technical standards, including European technical standards, across the globe. The European Commission proposal is a radical departure from the previous norms and institutions that have guided the SEP system. Even if some of the objectives behind the proposal are valid (for instance, more efforts to improve transparency and essentiality checks), the creation of an EU administrative agency for these matters risks undermining the trust and the incentives that are foundational to an efficient technology market.

5. References

Bauer, M., and Erixon, F. (2017) Standard essential Patents and the Quest for Faster Technology Diffusion. ECIPE Policy Brief No. 2/2017.

Bauer, M., Erixon, F., Guinea, O., Sharma, V. (2023). In Support of Market-Driven Standards. ECIPE Occasional paper, No. 1/2023.

Counterpoint (2023). Global Cellular IoT Module and Chipset Tracker: Q4 2022. Retrieved from https://report.counterpointresearch.com/posts/report_view/iot/3751

CRA, De Coninck, R., von Muellern, C., Zimmermann, S., and Mueller, K., (2022). SEP Royalties, Investment Incentives and Total Welfare, 2022, pp. 3-5

Erixon, F. (2023) Go Back to the Drawing Board! The Commission’s Leaked Patent Reform would be Bad for Technological Development and for Europe. ECIPE Blog, April 11, 2023, https://ecipe.org/blog/commission-leaked-patent-reform/

European Commission (2022). EU Challenges China at the WTO to Defend its High-tech Sector. Press Release, February 18.

European Commission. Unpublished. European Commission Impact Assessment Report Accompanying the document Proposal for Regulation of the European Parliament and of the Council establishing a framework for transparent licensing of standard essential patents.

European Commission. Unpublished. Proposal for Regulation of the European Parliament and of the Council establishing a framework for transparent licensing of standard essential patents.

Galetovic, A., Haber, S., & Zaretzki, L. (2018). An estimate of the average cumulative royalty yield in the world mobile phone industry: Theory, measurement and results. Telecommunications Policy, 42(3), 263-276.

IDC Tracker (2023). Worldwide Quarterly Mobile Phone Tracker. Retrieved from https://www.idc.com/getdoc.jsp?containerId=IDC_P8397

Joint Research Centre (2015). Fair, Reasonable and Non-Discriminatory (FRAND) Licensing Terms – Research Analysis of a Controversial Concept, JRC Science and Policy Report, European Commission, Joint Research Centre, Institute for Prospective Technological Studies.

Kapner (2001). Ericsson plans to stop manufacturing mobile phones. NY Times. Retrieved from https://www.nytimes.com/2001/01/26/business/ericsson-plans-to-stop-manufacturing-mobile-phones.html

O’Brien (2005). Asian Rival takes over Siemen’s cellphones. NY Times. Retrieved from https://www.nytimes.com/2005/06/08/technology/asian-rival-takes-over-siemens-cellphones.html

Rühlig, T. N. (2020). Technical standardisation, China and the future international order. A European perspective. Heinrich Böll Stiftung, Brussels, European Union.

Strategy Analytics (2022). Automotive Infotainment & Telematics – Vendor Market Shares & OEM Features Q3 2022 – Spreadsheet. Retrieved from https://www.strategyanalytics.com/access-services/automotive/infotainment-and-telematics/market-data/report-detail/automotive-infotainment-telematics—vendor-market-shares-oem-features-q3-2022—spreadsheet

Voo, J., & Creemers, R. J. E. H. (2021). China’s Role in Digital Standards for Emerging Technologies-Impacts on the Netherlands and Europe. Leiden Asia Centre.