Openness as Strength: The Win-Win in EU-US Digital Services Trade

Published By: Matthias Bauer Dyuti Pandya Oscar du Roy

Subjects: Digital Economy European Union North-America Regions Services

Summary

The discourse surrounding the EU’s supposed over-reliance on digital services imports from non-EU countries, particularly the US, has been a recurrent topic among some political circles. However, this viewpoint tends to oversimplify and misrepresent the nuanced and complex reality of the EU’s status within the global Information and Communication Technology (ICT) sector and digitally enabled trade.

A thorough analysis of trade data and trends clearly illustrates that the EU’s engagement with foreign (non-EU) digital services, notably from the US, represents a strategic economic advantage, bolstering Europe’s competitiveness and fostering productivity growth. Below we underline the critical importance of openness to foreign innovation and technology diffusion for the EU’s economic future.

Analysis

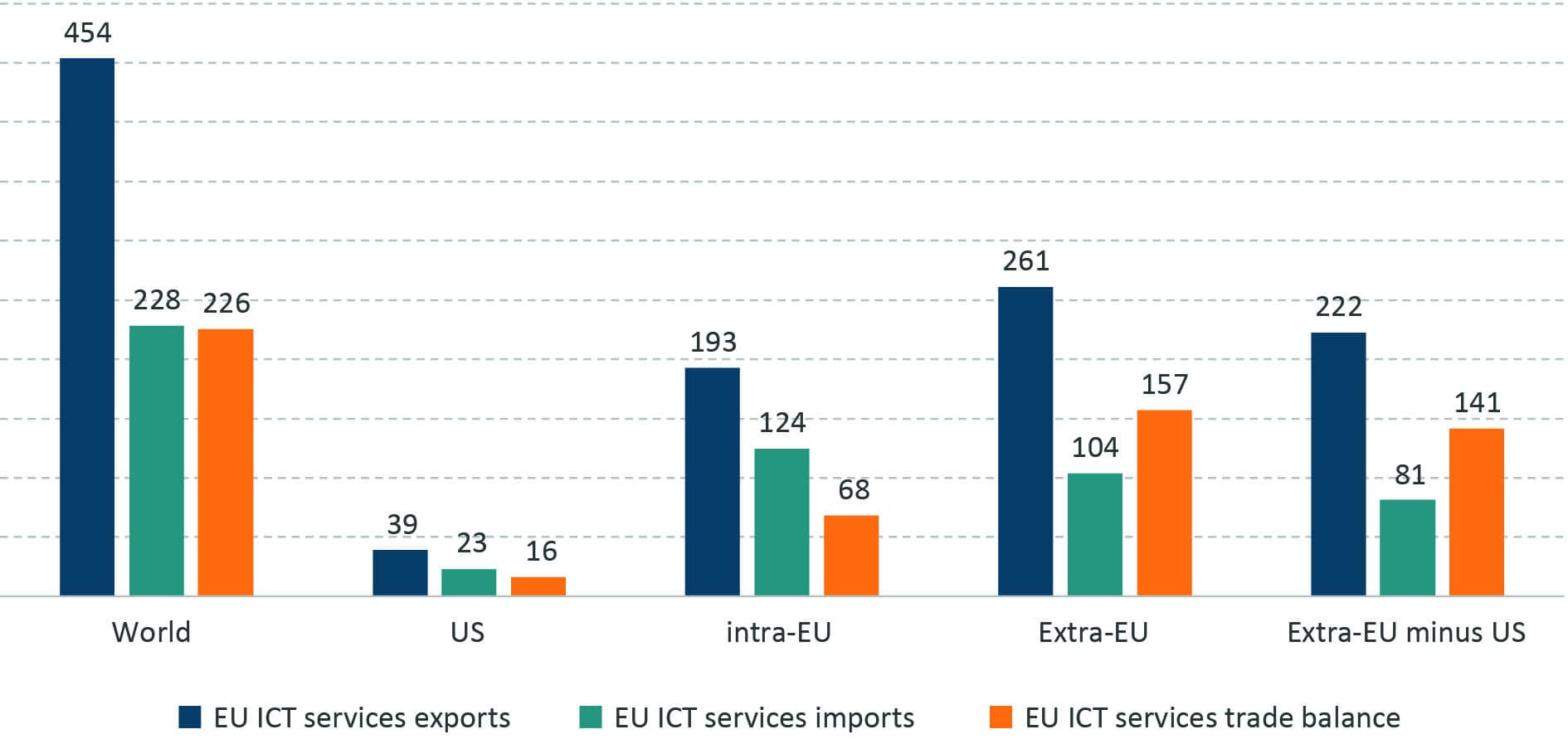

Firstly, the overall trade patterns in the ICT sector highlight the EU’s strength and resilience. In 2021, the EU’s total ICT trade was approximately US$682 billion, with the US contributing $59.6 billion (see Figure 1). Significantly, European businesses exported US$453.5 billion of ICT services globally, juxtaposed with importing close to US$228 billion worth of US ICT services. This positive trade balance in the ICT services sector exemplifies the EU’s capability not only to absorb but also to innovate and compete on a global scale. It dismantles the argument that the EU is overly dependent on digital services imports; rather, it showcases the EU as a pivotal player in the global digital economy.

Figure 1: EU ICT services trade by partner region in 2021, in billion USD

Source: UNCTAD. ICT services: telecommunications, computer, and information services.

The export of ICT and software services is a significant activity undertaken by companies of varying sizes across the EU. Data from large EU-based corporations vividly illustrates this reality, showcasing their extensive involvement in the global market. These enterprises span a diverse range of specialties, from advanced software solutions and digital infrastructure to cutting-edge telecommunications and cloud services. They operate in a vast array of countries outside the EU, indicating not only their competitive edge in the international arena but also their critical role in driving forward the digital transformation worldwide.

Table 1 exemplarily illustrates the global outreach of globally operating EU-headquartered companies in the ICT and software services sector, highlighting their expansive export operations to non-EU jurisdictions. For example, SAP SE from Germany leads with a wide array of software solutions including enterprise resource planning (ERP) systems, customer relationship management (CRM), supply chain management (SCM), business intelligence (BI), and various other applications, catering to a diverse clientele across countries including India, US, China, and many others. In the same manner, ASML Holding NV, based in the Netherlands, specialises in advanced lithography equipment designed for semiconductor manufacturing. They provide software and metrology and inspection products and EUV/DUV lithography systems to key markets in East Asia, while also extending support operations to the Middle East and Africa.

Companies like Ericsson AB from Sweden and Nokia Corporation from Finland focus on telecommunications, providing a range of network solutions, cloud services, and 5G technologies to countries including the USA, Brazil, Saudi Arabia, and China, among others. This international presence underlines the EU’s significant role in the global digital infrastructure, facilitating advancements in telecommunications and information technology worldwide. Furthermore, companies like Telefónica SA and Amadeus IT Group SA from Spain, Dassault Systèmes SE, and Thales Group from France also extend their services in digital communication, travel and transportation software solutions, and security solutions respectively, to various corners of the globe, thereby not only expanding their market reach but also contributing to the digital transformation and connectivity across different sectors.

It should be noted that many EU-based companies actively also engage in long-term partnerships with non-EU technology companies. Recent strategic partnerships between leading tech companies and cloud service providers illustrate a concerted effort to expand digital transformation capabilities across various regions. These collaborations are set to enhance cloud computing, AI integration, and telecommunications, thereby facilitating industry-wide innovation. Notable partnerships include the strategic alliance between Cloud Software Group & Midis Group,[1] and Deutsche Telekom’s expansion with Google Cloud[2] to revolutionise telecommunications through cloud technology. Furthermore, HCL Software’s integration with Google Cloud AI[3] aims to develop intelligent business applications, while Lenovo and VMware Inc.[4] focus on providing hybrid multi-cloud capabilities to mid-market organisations. The partnership between Mapbox and Toyota Motor Europe introduces advanced cloud navigation in vehicles, and collaborations involving OVH with Google,[5] as well as OVHcloud with Unisys,[6] emphasise the enhancement and security of cloud computing services. Proximus engaged in an agreement with both Google Cloud to advance digital transformation in Belgium and Luxembourg,[7] targeting secure cloud operations for government and regulated industries. Additionally, collaborations such as The Serviceplan Group with Box,[8] Thales with Google Cloud for a sovereign hyperscale cloud solution in France,[9] and partnerships between Orange and Google Cloud,[10] IBM and SAP[11], Cisco and Telenor,[12] and Atos and Microsoft,[13] each underscore the growing emphasis on leveraging cloud IT infrastructure, cybersecurity, multi-cloud services, and generative AI deployments to reimagine business operations and accelerate the adoption of digital innovations across various sectors.

Table 1: ICT and software solutions and products exports by companies headquartered in the EU[14]

Moreover, it is crucial to recognise the robust growth and dynamic evolution of the EU’s ICT sector. Between 2009 and 2020, EU exports of ICT services[29] grew at an impressive average annual rate of 7 percent, in tandem with a 5 percent increase in EU imports of US ICT services. In 2020, despite global challenges, US firms remained the leading providers of ICT services to the EU, accounting for 30 percent of total imports, markedly ahead of other suppliers. This development indicates a strategic integration into the global digital economy, where European businesses actively seek and utilise the most competitive global inputs to refine their offerings.

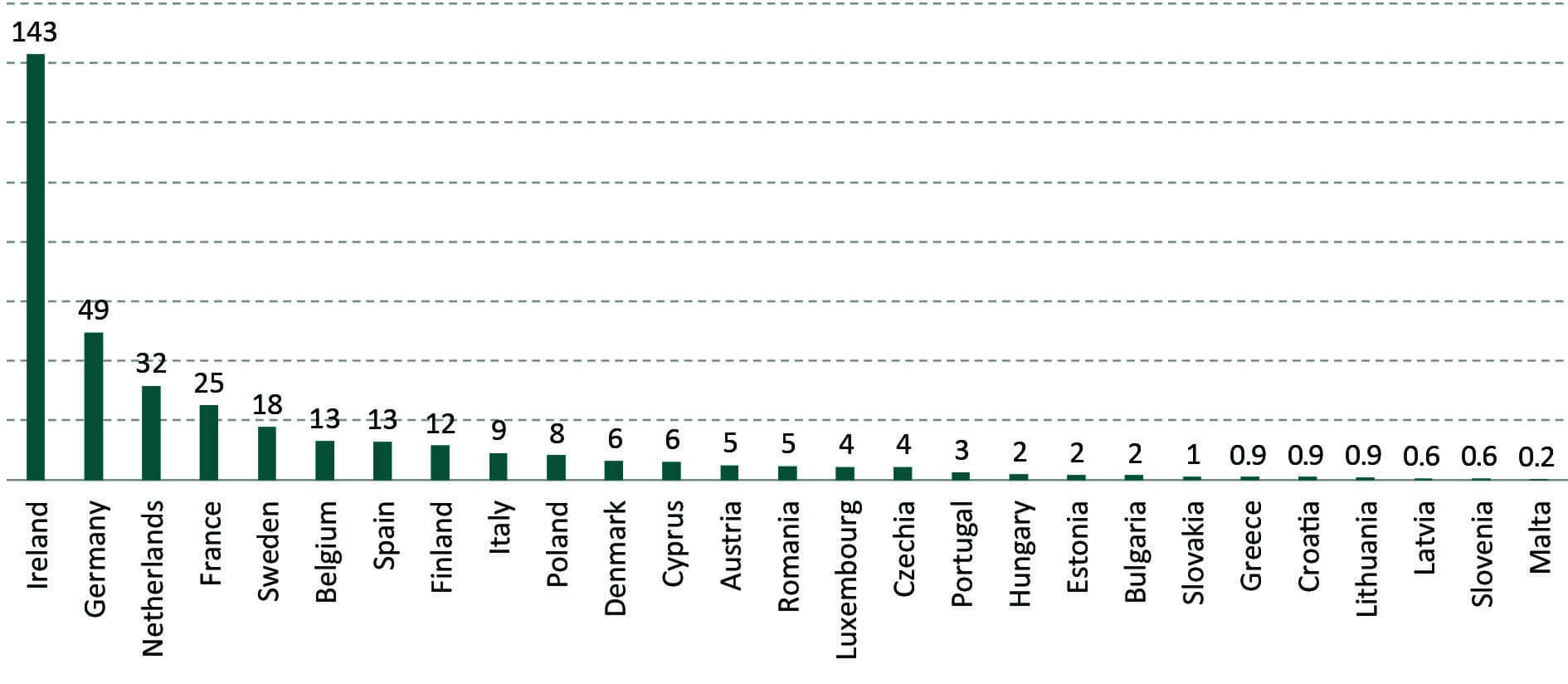

Country-by-country reporting demonstrates a vibrant landscape of ICT services trade within the EU, with some smaller economies showing remarkable growth, suggesting rapid development and investment in the ICT sector. These trends are critical as they demonstrate not dependence but a strategic expansion of capability and engagement in the global digital services market (see Figure 2). The robust growth rates across various EU countries indicate a thriving trade in ICT services, fuelled by both large economies like Germany and Ireland and smaller, rapidly developing ones like Estonia and Lithuania. This paints a picture of an EU that is not only open to importing innovation but is also increasingly contributing to and competing within the global digital economy.

Figure 2: Extra-EU ICT services trade by EU Member State in 2021, in billion USD

Source: UNCTAD. ICT services: telecommunications, computer, and information services.

The strategic significance of maintaining openness to foreign innovation cannot be overstated. The case of the EU’s ICT sector exemplifies how leveraging global competencies, especially from technologically advanced partners like the US, is crucial for sustaining and enhancing competitiveness. The global leadership of US ICT companies and their role as suppliers to the EU should not be viewed as a vulnerability but as an asset, enabling European businesses to integrate cutting-edge technologies and services into their operations and product offerings. And this is demonstrated by the EU’s sectoral digital trade patterns.

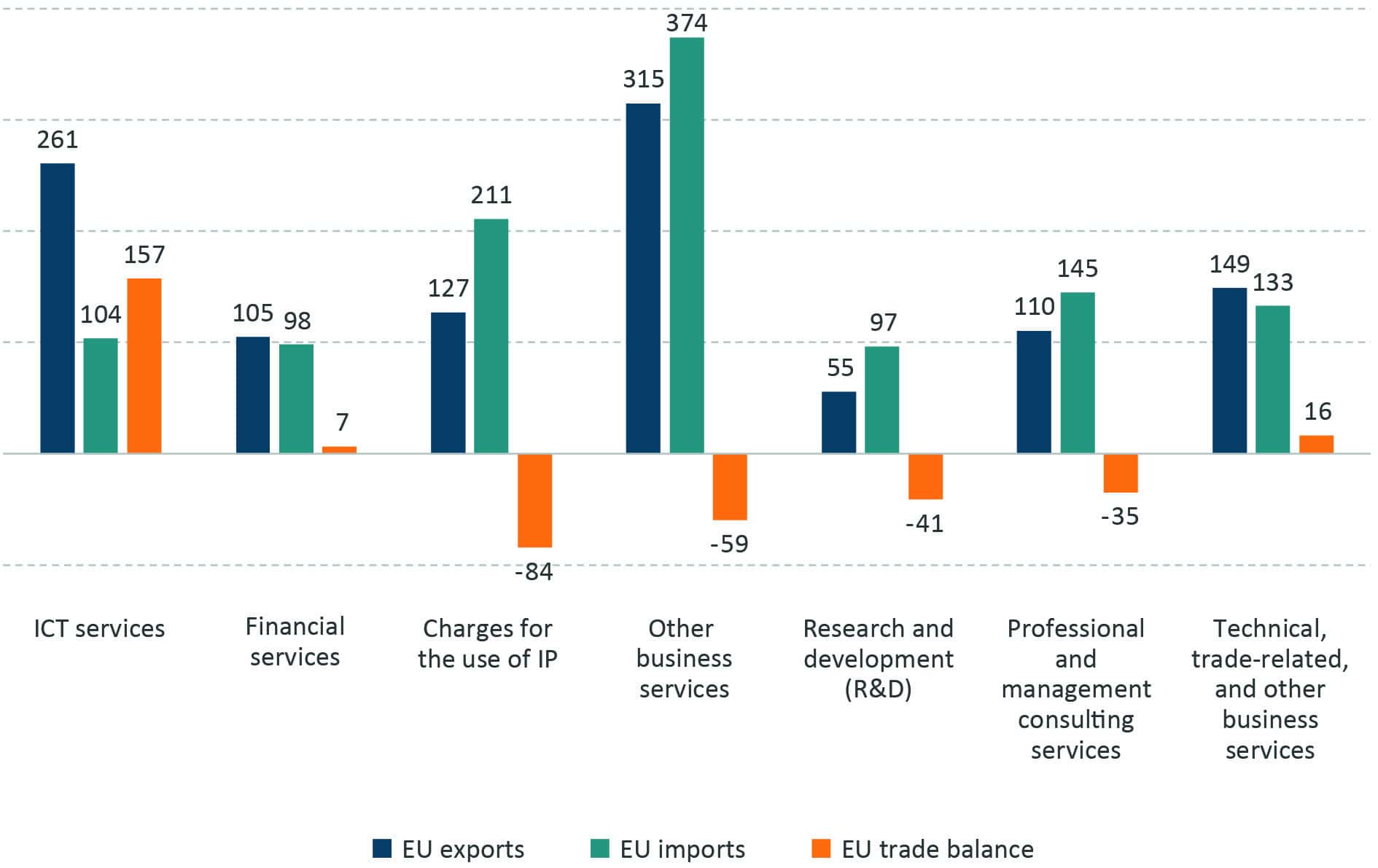

Data for digitally enabled services illustrates a nuanced trade landscape, characterised by both trade surpluses and deficits when considering extra-EU exports and imports (see Figure 3):

- ICT Services: The EU has a robust positive trade balance, reflecting its strong capabilities and global competitiveness in exporting ICT services. The surplus persists even when considering trade beyond the EU, underscoring the EU’s influential role in the global ICT marketplace.

- Financial Services: A positive trade balance is also seen in financial services, signalling the EU’s proficiency in this sector. However, the surplus is less pronounced when looking at the figures excluding the US, which highlights the significant role of the transatlantic financial exchange.

- Intellectual Property (IP): A trade deficit is observed in IP charges, particularly marked in transactions with the US. This indicates the EU’s strategic procurement of US IP, which is an asset for the EU’s innovative capacity and technological progress.

- Other Business Services: The EU experiences a negative trade balance, importing more than exporting in this category, and this deficit is more accentuated when the US is not included in the calculations.

- R&D, Professional and Management Consulting Services: These sectors also present a trade deficit, with the EU importing more than it exports, reflecting the EU’s investment in external expertise and innovation.

- Technical, Trade-related, and Other Business Services: Conversely, a positive trade balance is reported, suggesting the EU’s competitive advantage and success in exporting these services to markets outside of the EU.

Understanding that a negative trade balance is not inherently detrimental is crucial. Such deficits, particularly in high-value sectors like IP, R&D, and professional services, underscore the EU’s strategic engagement with the global marketplace. They represent the Union’s commitment to sourcing top-tier knowledge, expertise, and technology from around the world. This approach is in line with the EU’s broader economic strategy of embracing the use of the most productive international inputs, facilitating knowledge exchange, and promoting global technology diffusion.

These trade patterns, even where deficits occur, are opportunities that enable the EU to benefit from the global diffusion of innovation, ultimately enhancing the EU’s competitiveness and productivity. By welcoming the import of high-quality services, the EU integrates global innovation, which stimulate domestic sectors, drive economic growth, and maintain its position as a leading economy in an interconnected world.

Figure 3: Extra-EU ICT and digital services trade in 2021, in billion USD

Source: UNCTAD.

The significant growth rates of intra-EU trade and the diversification of the EU’s external trade relations beyond the US demonstrate the internal robustness and external reach of the EU’s digital services market. Lithuania, Portugal, and Finland for instance show average growth rates of ICT trade above 15 percent over the last five years. Germany’s role as a leading European trading partner, along with the remarkable growth experienced by smaller EU countries in extra-EU ICT services trade, exemplifies the diverse and dynamic nature of the EU’s digital economy.

Finally, for US companies investing in the European ICT industry means gaining access to a large and sophisticated market, which can provide American firms with a diverse and sustained consumer base, robust industrial partnerships, and collaborative innovation opportunities. US firms already leverage the EU’s strong ICT infrastructure, skilled workforce, and innovative ecosystems to enhance their clients’ global competitiveness. Furthermore, such investments can act as a catalyst for the global diffusion of technology, ensuring that both European and US firms stay at the forefront of technological advancements by integrating and adapting to the needs and innovations that emerge from both markets.

In conclusion, portraying the EU as overly dependent on digital services imports from the US misconstrues the strategic and symbiotic nature of this relationship. The EU’s engagement with US digital services reflects its openness to global innovation, a strategy that has proven indispensable for competitiveness and productivity growth. Far from being a sign of weakness, this openness is a strength that positions the EU at the forefront of the digital revolution. It is vitally important for the EU to continue embracing foreign innovation and technology diffusion to propel its competitiveness and productivity growth forward. The data and trends from the ICT sector provide compelling evidence that the EU’s current path of strategic engagement and openness is not only beneficial but essential for its economic vitality and global leadership in the digital age.

[1] Midis Group (2023, June 14). Cloud Software Group establishes Strategic Partner Agreement with Midis Group in Eastern Europe, Middle East & Africa. Available at: https://www.midisgroup.com/cloud-software-group-establishes-strategic-partner-agreement-with-midis-group-in-eastern-europe-middle-east-africa/

[2] Deutsche Telekom (2022, July 12). Deutsche Telekom and Google Cloud sign partnership agreement focused on network transformation. Available at: https://www.telekom.com/en/media/media-information/archive/telekom-and-google-expand-partnership-1010150

[3] HCL Tech (2023, June 14). HCLTech and Google Cloud expand partnership to boost innovation and adoption of generative AI. Available at: https://www.hcltech.com/press-releases/hcltech-and-google-cloud-expand-partnership-boost-innovation-and-adoption-generative

[4] vmware (2023, August 22). Lenovo and VMware Expand Partnership to Bring New NVIDIA-Powered Turnkey Generative AI and Multi-Cloud Solutions to Every Business. Available at: https://news.vmware.com/releases/vmware-lenovo-partnership

[5] OVHcloud. (2020, November 10) OVHcloud and Google Cloud announce a strategic partnership to co-build a trusted cloud solution in Europe. Available at: https://corporate.ovhcloud.com/en/newsroom/news/ovhcloud-and-google-cloud-announce-strategic-partnership-co-build-trusted-cloud-solution-europe/

[6] OVHcloud. (2023, July 12) OVHcloud and Unisys form partnership for data-sovereign cloud offerings. Available at: https://corporate.ovhcloud.com/en-in/newsroom/partnerannouncementunisys/

[7] Proximus (2023, March 15). Proximus and Google Cloud to Deliver Sovereign Cloud Services in Belgium and Luxembourg. Available at: https://www.proximus.com/news/2023/20230315-disconnected-sovereign-cloud-platform.html

[8] Box, Inc. (2023, June 22). The Serviceplan Group, Europe’s Largest Independent and Partner-Managed Agency Group, Chooses Box for Cloud Content Management. Available at: https://www.boxinvestorrelations.com/news-and-media/news/press-release-details/2023/The-Serviceplan-Group-Europes-Largest-Independent-and-Partner-Managed-Agency-Group-Chooses-Box-for-Cloud-Content-Management/default.aspx

[9] Thales. (2021, October 6). Thales And Google Cloud Announce Strategic Partnership To Jointly Develop A Trusted Cloud Offering In France. Available at: https://www.thalesgroup.com/en/group/investors/press_release/thales-and-google-cloud-announce-strategic-partnership-jointly#:~:text=Thales%20and%20Google%20Cloud%20today,of%20the%20French%20’Trusted%20Cloud.

[10] Orange. (2020, July 28). Orange and Google Cloud to form strategic partnership in data, AI and edge computing services. Available at: https://www.orange-business.com/en/press/orange-and-google-cloud-form-strategic-partnership-data-ai-and-edge-computing-services

[11] IBM Newsroom. (2024, January 11). IBM Collaborates with SAP To Develop New AI Solutions for the Consumer Packaged Goods and Retail Industries. Available at: https://newsroom.ibm.com/2024-01-11-IBM-Collaborates-with-SAP-To-Develop-New-AI-Solutions-for-the-Consumer-Packaged-Goods-and-Retail-Industries

[12] Telenor. (2023, March 16). Cisco and Telenor Group Sign Agreement to Explore New As-A-Service Business Models and Enable a More Inclusive Internet for the Future. Available: https://www.telenor.com/media/newsroom/announcement/cisco-and-telenor-group-sign-agreement/

[13] Atos. (2023, November 14). Atos collaborates with Microsoft to accelerate business transformation through the application of Microsoft 365 Copilot and Azure OpenAI service. Available at: https://atos.net/en/2023/press-release_2023_11_14/atos-collaborates-with-microsoft-to-accelerate-business-transformation-through-the-application-of-microsoft-365-copilot-and-azure-openai-service

[14] Note: This is a non-exhaustive list of EU ICT companies, which provides an overview of companies who provide product capabilities, solutions, and services to customers and businesses outside the EU as well

[15] SAP. Available at: https://www.sap.com/india/index.html?url_id=auto_hp_redirect_india ; also see: SAP (2023) SAP Integrated Report, Available at: https://www.sap.com/integrated-reports/2023/en.html?pdf-asset=5234b263-ad7e-0010-bca6-c68f7e60039b&page=1.

[16] ASML. Available at: https://www.asml.com/en ; also see: ASML (2023) ASML Annual Report, Available at: https://www.asml.com/en/investors/annual-report/2023.

[17] Examples include: Mass producing leading-edge microchips, EXE systems,

[18] Ericsson. Available at: https://www.ericsson.com/en ; also see: Ericsson (2022) Ericsson Annual Report, Available at: https://www.ericsson.com/493d1d/assets/local/investors/documents/2022/annual-report-2022-en.pdf.

[19] Nokia. Available at: https://www.nokia.com/ ; also see Nokia (2023) Nokia in 2023, Available at: https://www.nokia.com/system/files/2024-03/nokia-annual-report-2023.pdf.

[20] Telefónica. Available at: https://www.telefonica.com/en/ ; also see: Telefónica. (2023) Annual Accounts, Available at: https://www.telefonica.com/en/shareholders-investors/financial-reports/annual-report/.

[21] Amadeus (2022) Annual Reports, Available at: https://corporate.amadeus.com/en/annual-reports/amadeus-annual-report-2022.

[22] Amadeus. Available at: https://corporate.amadeus.com/en/about-us

[23] Dassault Systemes, Office Locations, Available at: https://www.3ds.com/about/company/office-locations.

[24] STMicroelectronics N.V. (2023) Annual Report, Available at: https://investors.st.com/static-files/9087e0c3-0d9e-4cad-80d8-5b8f633b7fa6

[25] Thales, Available at: https://www.thalesgroup.com/en.

[26] Infineon, Available at: https://www.infineon.com/cms/en/.

[27] Atos, Available at: https://atos.net/en/.

[28] NXP. Available at: https://www.nxp.com/

[29] ICT services: telecommunications, computer, and information services.