Online Platform Regulation and Investment Attractiveness: A Look at the EU, the UK and Impacts on Small Open Economies

Published By: Matthias Bauer Vanika Sharma Oscar du Roy

Research Areas: Digital Economy European Union UK Project

Summary

Small trade- and investment-oriented economies like the United Kingdom (UK) should carefully consider whether to regulate online platform services based on presumptions rather than evidence that consumers are being harmed. Flimsily enforced platform regulation can have a chilling effect on investments in business expansion and innovation, particularly in technology-adopting industries.

Several countries around the world are designing new competition policies that specifically target large digital platforms. The theory behind these policies is grey. There are political concerns about the impact of various aspects of platforms on society, especially regarding the collection and safety of data. However, practices that harm consumers – traditionally a key motivation of competition enforcement – are very rare. Indeed, the success stories of large tech platforms demonstrate that they offer strong benefits and conveniences to millions of business users across a wide range of industries. Marginal costs of supply, high-quality services, continuous technological advancements, and platforms’ ability to drive productivity growth have enabled especially small businesses to thrive and compete in domestic and international markets. Against this background, it is highly questionable why some governments, with the backing of power-seeking competition regulators, are aiming to legally interfere in services provided by large technology companies.

An important consequence that has so far received little attention from policymakers and competition authorities is the impact of platform regulation on a country’s investment attractiveness. It is obvious that bans and restrictions on corporate conduct cause regulated companies to abstain from investments and establish new business elsewhere. What is less clear is the effect of regulation on investments by companies that extensively adopt platform services to reduce costs, speed-up innovation, and expand market opportunities.

In this policy brief, we argue that access to integrated and internationally traded platform services is increasingly important for a country’s investment attractiveness, even more so for smaller countries. Access to advanced technologies and the utilisation of network effects create a virtuous cycle of economic opportunities, investments, value creation, and trade. Discretionary and presumption-based competition enforcement, as adopted in the EU, risks hurting smaller countries in particular. The EU has chosen the path of proscriptive and protective policymaking with the DMA to achieve industrial and trade policy goals rather than defending competition in the Single Market. UK competition policy risks being driven by institutional interests and ideological considerations, which could potentially lead to the adoption of a regulatory landscape that is even more restrictive than that of the EU, undermining Britain’s ambitions for economic and innovation leadership.

1. Introduction

Europe’s investment climate has not improved in recent years.[1] Policymakers in the EU and the UK are concerned about US economic and technological superiority, China’s economic rise, and the erosion of international competitiveness of their domestic industries.[2] Within the paradigm of Open Strategic Autonomy, Brussels is trying to strengthen the resilience and future competitiveness of the EU. However, many new EU policies tend to have a deterrent effect on technology companies willing to strategically invest in Europe. These include discriminatory provisions of online platform regulation, and a fragmented EU competition policy that pays too little attention to innovation and consumer welfare.[3]

Following Brexit, the UK is hoping to revive its economy, seeking a regulatory landscape that is conducive to business and investment activity. The current UK government is looking for new approaches to trade and foreign policy that can mitigate the economic losses arising from leaving the EU’s Single Market. However, Global Britain has not yet delivered in line with the hopes expressed by supporters of leaving the EU.[4] New regulatory developments, such as the proposed Digital Markets, Competition and Consumers Bill[5], and potential overenforcement of merger control risk undermining the UK’s future investment attractiveness.[6]

This policy brief focuses on how online platform-targeted competition regulation affects countries’ investment attractiveness. Section 2 begins with a critical discussion of theoretical considerations and the motivation of policymakers to enact new regulation for services with strong network effects. Section 3 discusses the beneficial effects of platform services on business activity and productivity. Section 4 discusses the relationship between network effects, interfering regulation, and investment attractiveness.

[1] See, e.g., core indicators of the OECD FDI Regulatory Restrictiveness Index. Available at https://www.oecd.org/investment/fdiindex.htm. Also see OECD Indicators of Product Market Regulation. Available at https://www.oecd.org/economy/reform/indicators-of-product-market-regulation/.

[2] Key indicators of the EU’s Investment Scoreboard indicates that China and the US have surpassed many European industries in private sector R&D investment. See European Commission (2022). The 2022 EU Industrial R&D Investment Scoreboard. Available at https://iri.jrc.ec.europa.eu/scoreboard/2022-eu-industrial-rd-investment-scoreboard#field_reportscoreboard.

[3] ECIPE (2022). The Impacts of EU Strategy Autonomy Policies – A Primer for Member States. Available at https://ecipe.org/publications/eu-strategy-autonomy-policies-impact/. Also see ECIPE (2023). What is Wrong with Europe’s Shattered Single Market? – Lessons from Policy Fragmentation and Misdirected Approaches to EU Competition Policy. Available at https://ecipe.org/wp-content/uploads/2023/04/PR-OP-22023.pdf.

[4] ECIPE (2023). Building a Mature UK Trade Policy. Available at https://ecipe.org/wp-content/uploads/2023/03/ECI_23_PolicyBrief_03-2023_LY04.pdf.

[5] See UK Parliament (2023). Digital Markets, Competition and Consumers Bill. Government Bill. Originated in the House of Commons, Session 2022-23. Last updated: 21 July 2023. Available at https://bills.parliament.uk/bills/3453.

[6] Digiday (2023). What the divergent EU and U.K. rulings say about the future of the Microsoft–Activision Blizzard merger. 19 May 2023. Available at https://digiday.com/marketing/what-the-divergent-eu-and-u-k-rulings-say-about-the-future-of-the-microsoft-activision-blizzard-merger/. Also see CPI (2023). UK Regulator Throws Lifeline To Microsoft-Activision Blizzard Deal. 12 July 2023. Available at https://www.competitionpolicyinternational.com/uk-regulator-throws-lifeline-to-microsoft-activision-blizzard-deal/.

2. The Grey Theory of Online Platform Regulation

Policymakers’ ambitions to regulate large technology platforms are driven by concerns related to various aspects of their influence and impact on society.[1] Antitrust concerns about large tech companies mainly relate to market dominance. Based on remarkable commercial success stories, several large platform operators have indeed achieved significant market shares in their respective domains, ranging from online advertisement to retail and advanced cloud computing services. Competition authorities have sounded alarm bells claiming some big tech companies engage or may engage in anti-competitive practices by using their strong market positions to drive out smaller rivals and potential entrants.[2] In addition, it is argued, that the level of control over vast amounts of user data, can stifle competition, deter potential competition, and hinder the growth of smaller businesses.[3]

The theory of platform-specific regulation remains grey.

A common notion of policymakers is that traditional tools of competition policy have failed to address business practices that are specific to multi-sided digital markets. Digital platforms are extremely heterogeneous in terms of business models, the type of services provided, and how they engage with users. Typically, they serve as an intermediary space that connects individuals and/or firms with each other. Large user groups generally allow for network effects. That is, the user group’s value of participating on the platform increases as more users of the same group join the platform (direct effect), or if more users of the other group join the platform (indirect effect). Network effects can imply that consumers on, for example, a retail or cloud computing platform can benefit from much more choice or much lower costs due to network effects.

There may indeed be circumstances that favour anti-competitive behaviour, such as, the ability to do so in monopolistic situations.[4] Harm theory in competition economics commonly refers to practices associated with dominant positions on digital platforms which include input foreclosure, tying, killer acquisition, self-preferencing, and predatory pricing. Academics, civil society, and authorities have increasingly expressed criticism of the collection of data in connection with market power. As more users join the platform and an increasing number of transactions allow for personalised data collection, the platform can allow for increased differentiation (through targeted ads) and thus larger revenues.[5] Tipping, the point from which the platform that shows significant network effects, can also discourage future platform entry in the market, and is viewed as anti-competitive in competition theory.[6]

These theories have undoubtedly shaped EU competition policy, including the EU Digital Markets Act (DMA), and they have a bearing on how the UK’s Competition and Markets Authority (CMA) wishes to regulate large technology companies in the future. However, clear evidence of significant consumer harm is scarce. Competition policy in the EU therefore has prioritised concerns about market contestability, or “fair” competition within the market, over evidence of consumer harm and competition for the market.[7] EU competition regulators have been largely ignorant to the fact that even the biggest technology firms are exposed to severe competitive pressures urging them to continuously leverage new technologies to create innovative services in response to the ever-changing preferences of businesses and consumers. Moreover, claims and assumptions regarding tipping are vague and have not been subjected to adequate analysis. Since platform markets are constantly changing and difficult to predict, determining which markets and which platforms will reach a tipping point and the features of a potential tipping candidate presents a significant challenge. Accordingly, the notion of platform maturity remains more theoretical than proven through empirical evidence. The transition from business growth to tipping lacks clear theoretical and empirical understanding, as numerous efforts by major platforms to enter new services either fail or succeed without translating into increased dominance. Further research and empirical data are necessary to differentiate “tipped” or “mature” platforms from smaller ones in terms of value and competitive impact. Google+ stands as a prominent case illustrating the unsuccessful attempt of a major platform operator to expand into the realm of social media, while Apple Music serves as an instance of expansion that did not lead to achieving dominant status.[8]

Platform-specific competition regulations are prone to being interpreted through a political lens.

It is the combination of relatively new and untested competition theories, in particular vague notions of contestability and the subordination of real consumer harm, that have shaped EU’s platform regulation. Inspired by the EU DMA, some countries are now also considering implementing “ex-ante” interfering regulation targeted at platform services. Competition regulators in these countries have come up with their very own regulatory templates on how to regulate platform business models: Germany has implemented Section 19a of German Competition Law (GWB10). The UK has recently proposed the UK Competition Bill, and US legislators have proposed several individual laws, which are intended to address specific political concerns.[9]

There are many concerns about the lack of clarity regarding how these regulations will be enforced and how companies can comply with diverging obligations in cross-border contexts.[10] The DMA and Germany’s GWB10 have faced criticism for their divergent nature, which increases the risk of fragmenting the EU Single Market.[11] The DMA and the UK Competition Bill share some common criticisms, particularly regarding their interference in business models with strong positive network effects. Both aim to regulate companies proactively rather than reactively (ex-post) in cases of perceived harm. Criticism was also raised about the rule of law, especially the right to object: the UK Competition Bill allows for only very limited appeals under its judicial review standard, while the EU DMA grants EU courts the authority to fully review European Commission actions.

Despite common theories, countries’ approaches to regulating online platforms differ in objectives and scope.

The DMA aims to improve fairness and contestability in digital markets by imposing pre- and proscriptive obligations on operators of platform services. Fairness and contestability are given a higher priority than innovation and consumer protection.[12] The EU’s DMA is also prejudiced as it contains a list of do’s and don’ts that apply universally to all designated gatekeepers.[13] The UK competition bill appears to be more rooted in traditional competition policy, relying on case-by-case analysis of patterns of competition, consumer benefits, and innovation.[14] UK competition regulators seem to have taken a broader and more careful view on policy objectives and trade-offs. They intend to focus only activities where the risk of harm is greatest.[15] However, the UK Bill would grant the CMA and its Digital Market Unit (DMU) significant leeway in determining which sectors of the economy to regulate, which firms to subject to regulation, and the specific rules to impose, without substantial checks or limitations. Firms might be required to obtain approval from the CMA before they can innovate or introduce new technology or products in the UK market.

Compared to the EU DMA and the UK Bill, US proposals are generally much narrower in scope.[16] By contrast, Germany’s recent amendment to competition law also target digital platforms with a distinct set of provisions to prevent abusive practices by companies that have market-dominant positions. Like the DMA, these are much broader than the US regulations.[17]

The (proposed) regulations differ in how they single out harmful platform operators.

Depending on how selection criteria are defined and interpreted, the list of companies covered will become longer or shorter and, as in the case of the DMA, result in a carve-out of large domestic platform businesses.[18] Under the DMA, online platforms are designated as gatekeepers based on their size. It sets quantitative thresholds including turnover and the number of users and does not focus on more traditional competition policy definitions such as market power. The US proposals lack clarity in their conceptual definitions for a gatekeeper.[19] By contrast, Germany’s GWB10 goes beyond size thresholds and requires market investigations based on several criteria that need to be considered for a platform to have market dominance. This is similar to the UK Bill, where the CMA would have significant discretion to determine whether a company has Strategic Market Status in a given digital activity based on quantitative and qualitative thresholds. The CMA would be vested with the power to decide which sectors to investigate, which firms fall under those sectors, and the particular rules that will apply to them. Importantly, the CMA is not obligated to demonstrate any actual or potential consumer harm as a condition for intervening, nor does it need to prove that its intervention will not adversely affect competition or consumers.

The DMA is broadly a self-executing regulation, meaning that its obligations are immediately applicable. It has a clear list of do’s and don’ts that need to be followed by the digital platform. If they are not followed, structural or behavioural remedies can be applied. Like the DMA, the US proposals by and large entail self-executing obligations and do not require market investigations before intervention. In contrast, Germany’s GWB10 does not provide for self-executing obligations. It requires Germany’s competition authority to investigate markets, corporate conduct and its impact. The UK proposal does not rely on self-executing obligations. Instead, the CMA would aim to enforce requirements on the basis of knowledge of market characteristics and evidence of abusive or anti-competitive practises by large platforms. The CMA would have broad discretion to design and implement targeted pro-competitive interventions (PCIs), such as to enforce interoperability or, in certain circumstances, to implement ownership separation remedies.

[1] The EU Digital Services Act, for example, seeks to enhance user safety and trust in online platforms and services. It addresses concerns related to illegal content, harmful products, and misleading information by holding digital services more accountable for the content that appears on their platforms.

[2] A list of recent antitrust cases against large online platform providers is available at https://qz.com/antitrust-cases-big-tech-2023-guide-1849995493.

[3] See, e.g., recitals 2, 3 and 32 of the EU Digital Markets Act (DMA). Available at https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32022R1925. Similar issues have been debated in US policy circles. For a discussion of several proposals see, e.g., ECIPE (2022). The EU Digital Markets Act: Assessing the Quality of Regulation . Available at https://ecipe.org/wp-content/uploads/2022/01/ECI_22_PolicyBrief-TheEuDigital_02_2022_LY03.pdf?_gl=1*1rib2hd*_up*MQ..*_ga*NjYyNjg3Mjg4LjE2ODk1ODY3MjQ.*_ga_T9CCK5HNCL*MTY4OTU4ODYxNS4yLjEuMTY4OTU4ODYzMy4wLjAuMA.

[4] Oxera (2021). Tipping: should regulators intervene before or after? A policy dilemma. Available at https://www.oxera.com/insights/agenda/articles/tipping-should-regulators-intervene-before-or-after-a-policy-dilemma/.

[5] CERRE (2020). Digital markets and online platforms: new perspectives on regulation and competition law. Available at https://cerre.eu/publications/digital-markets-online-platforms-new-regulation-competition-law/.

[6] Note that market tipping can be the result of an efficient process, and the emergence of a dominant firm is not necessarily conducive to abuse of dominance. For instance, some market structures are bound to have only a few and potentially large firms operating profitably (e.g., because the initial set up costs are so large that they require sufficient economies of scale and therefore only large firms can stay in the market). See, e.g., Jullien and Sand-Zantman (2021). The economics of platforms: A theory guide for competition policy. Available at https://www.sciencedirect.com/science/article/abs/pii/S0167624520301244.

[7] In the European Commission’s case against Google over self-preferencing the company was found to have artificially favoured its own services over rival Comparison-Shopping Services (CSS). In the Google’s Android case, competition regulators were concerned about the practice to offer Google Play Store for free to Original Equipment Manufacturers (OEMs) in exchange for having Google Search being a pre-installed feature on the mobile devices. And in the EU’s case against Microsoft provides a prime example of competition issues related to interoperability. A list of recent antitrust cases against large online platform providers is available at https://qz.com/antitrust-cases-big-tech-2023-guide-1849995493.

[8] See, e.g., Garces, Eliana (2023). Eliana Garces: “Regulation and Competition in Digital Ecosystems: Some Missing Pieces”. Available at https://www.networklawreview.org/digital-ecosytems-missing-pieces/.

[9] These include the recent Bennet proposal to establish a US body overseeing digital platforms, US Bill HR3816 – ‘‘American Choice and Innovation Online Act’’, US Bill – HR3849 – ‘‘Access Act of 2021”, and US Bill – HR3825 – ‘‘Ending Platform Monopolies Act’’.

[10] See, e.g., Akman (2022). Regulating Competition in Digital Platform Markets: A Critical Assessment of the Framework and Approach of the EU Digital Markets Act. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3978625.

[11] See, e.g., ECIPE (2023). What is Wrong with Europe’s Shattered Single Market? – Lessons from Policy Fragmentation and Misdirected Approaches to EU Competition Policy. Available at https://ecipe.org/wp-content/uploads/2023/04/PR-OP-22023.pdf.

[12] For a discussion of several proposals see, e.g., ECIPE (2022). The EU Digital Markets Act: Assessing the Quality of Regulation . Available at https://ecipe.org/wp-content/uploads/2022/01/ECI_22_PolicyBrief-TheEuDigital_02_2022_LY03.pdf?_gl=1*1rib2hd*_up*MQ..*_ga*NjYyNjg3Mjg4LjE2ODk1ODY3MjQ.*_ga_T9CCK5HNCL*MTY4OTU4ODYxNS4yLjEuMTY4OTU4ODYzMy4wLjAuMA. Also see Akman (2022). Regulating Competition in Digital Platform Markets: A Critical Assessment of the Framework and Approach of the EU Digital Markets Act. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3978625.

[13] See Articles 5 and 6 of the DMA. For a comparison, see, e.g. Sidley (2023). New UK Digital Markets Regime: Key Differences With the EU Digital Markets Act. Available at https://www.sidley.com/en/insights/newsupdates/2023/04/new-uk-digital-markets-regime-key-differences-with-the-eu-digital-markets-act.

[14] Contrary to the DMA, the UK Digital Markets Unit (DMU) allows for more flexibility on the side of companies to adjust certain business practices. According to the UK proposal, the DMU would draft an individual code of conduct for each “Strategic Market Status” Firm (UK designation for what is referred to “gatekeeper” in the DMA) that would specifically address particular dangers to competition associated with that firm’s activities.

[15] UK Secretary of State for Digital, Culture, Media & Sport and the Secretary of State for Business, Energy and Industrial Strategy (2021). A new pro-competition regime for digital markets. July 2021. Available at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1003913/Digital_Competition_Consultation_v2.pdf.

[16] The US Access Act of 2021, for example, aims to foster competition through obligations on interoperability and lower switching costs for consumers. The Digital Platform Commission Act of 2022 (often referred to as the Bennet proposal) is also a narrowly defined legislation focusing on enforcement of interoperability and transparency through the establishment of a Federal Digital Platforms Commission. See Bennet (2022). Digital Platform Commission Act of 2022 Section-by-Section Summary. Available at https://www.bennet.senate.gov/public/_cache/files/a/8/a886bcf6-9a00-4920-a7e2-c5bddd578770/6EC160206FFBB3BDA4F652DE8283CFF7.05.09.21—bennet-digital-platform-commission-act—final-section-by-section-summary.pdf.

[17] See Gesetz gegen Wettbewerbsbeschränkungen (GWB), sometimes referred to as the German Digitalisation Act and the 10th amendment of the GWB (GWB10).

[18] See, e.g., Peterson Institute (2022). The European Union renews its offensive against US technology firms. Available at https://www.piie.com/publications/policy-briefs/european-union-renews-its-offensive-against-us-technology-firms. Also see European Commission (2023). Remarks by Commissioner Breton: Here are the first 7 potential “Gatekeepers” under the EU Digital Markets Act. 4 July 2023. Available at https://ec.europa.eu/commission/presscorner/detail/en/statement_23_3674.

[19] For instance, the Bennet proposal primarily uses qualitative definitions to designate a platform as a systemically important digital platform. However, the use of these attributes is also left to the discretion of the Commission. The “American Choice and Innovation Online Act” proposal provides a list of conduct that is by default considered discriminatory and thus unlawful.

[20] See, e.g., Garces, Eliana (2023). Eliana Garces: “Regulation and Competition in Digital Ecosystems: Some Missing Pieces”. Available at https://www.networklawreview.org/digital-ecosytems-missing-pieces/.

3. The Economic Importance of Online Platforms

The value created by large online platforms and their contributors as well as the continuous pressure to innovate reveal that the rationale for regulation does not fit the facts. Recent interventions by regulators in the EU and, potentially, the UK are aimed at addressing perceived harms and ensuring fair competition in platform services. Regulators thereby treat platforms as infrastructure and try to disintegrate them into separate services. However, this approach is too narrow. It overlooks the complexity of digital platforms as ecosystems, where joint value generation and interdependence among participants play crucial roles. Two key aspects are overlooked in the “platform as infrastructure” approach:[1]

- Value Generation and Innovation: While platforms reduce costs and improve efficiency, their primary efficiency comes from fostering innovation by sharing and recombining digital resources. The generative potential of digital ecosystems is significant, as platforms actively contribute to the creation of new services and processes.

- Dynamic Nature and Evolution: The regulatory framework tends to view large platforms as statically dominant, potentially causing harm when expanding into new markets. However, platforms are evolving entities that continuously enter new areas and engage in competitive dynamics with other platforms, often challenging each other in unexpected ways.

These considerations call for a more comprehensive view of platforms as ecosystems where value is jointly produced by a very diverse set of participants. The way platform owners control contributors and maintain alignment within the ecosystem is crucial for maintaining the platform’s viability. Moreover, the competitive landscape involves platforms challenging each other and entering risky spaces, which the current regulatory framework might not fully consider. In essence, an “ecosystem view” of platforms – rather than treating platforms as static infrastructure providers – is more adequate in order to understand their roles in value creation, innovation, and competition over time. Regulators should acknowledge these aspects and incorporate them into the assessment of platform behaviour and impact.

The joint creation of value and interdependent relationships among participants yield outcomes that deserve greater recognition from regulatory authorities. Companies across industries benefit significantly from using online platform services. Online platforms offer a wide range of tools and resources that can enhance business operations, help companies reach a broader customer base, and drive business growth. Large online platforms offer cost-effective advertising and marketing solutions, enabling companies to promote their products and services to a targeted audience without the need for a large marketing budget. Platforms help level the playing field for new and smaller firms in terms of their exposure to potential customers, thereby “democratising” domestic and international markets”.[2] Large online platforms with e-commerce functionalities allow business users to set up online stores and sell products directly to consumers. They open new sales channels and simplify the buying process for customers. Many large online platforms offer highly valuable additional tools and integrations that streamline business operations, such as inventory management, payment processing, and order fulfilment services. Platform services can therefore substantially reduce operational costs and improve firm-level productivity.

In aggregate, online platforms spur commerce and investments in business innovation across a broad range of use cases. The largest online platforms are known to heavily invest in technological R&D, creating new technologies. By using their services, business users gain early access to solutions that can give them a competitive edge, e.g., advanced cloud services featuring data-driven sales, resources, and process management. Platforms have also created opportunities for small businesses to better access finance from institutional lenders and non-traditional sources. Data analytics thereby help platform operators to readily assess credit risks of online vendors using the platform with the help of extensive data collection. Digital application marketplaces provide an infrastructure for small developers to rapidly expand their user-base.

The enormous positive economic impacts of online services have been confirmed in numerous surveys and studies.[3] Numerous studies find that SMEs use online platforms to sell products and services internationally because they ease entry barriers in a foreign market. For example, the OECD finds that SMEs tend to leverage the services of external technology providers to compensate for weak internal capacities. Online platforms provide significant scope to optimise certain operations at very low cost.[4] With respect to cross-border trade, another OECD study finds that around 300,000 SMEs registered in Amazon’s marketplace in the US were exporting to another country in 2017.[5] For the UK, a recent survey shows that 67% of small businesses are using free platform services, 60% rely on paid digital advertising, and half declared that the Covid-19 pandemic made platform services even more important for their businesses.[6] Accounting for the continuous penetration of advanced platform services, recent work by the OECD finds that their dissemination in the domestic economy positively affects the productivity of platform users. Overall, platform development is found to increase businesses’ productivity and to stimulate labour reallocation towards the most productive amongst them.[7] Research also shows that, by reducing asymmetric information, platforms significantly contribute to creating a more level playing field between small businesses and larger corporations, as well as in narrowing disparities in firm productivity and competitiveness respectively.[8]

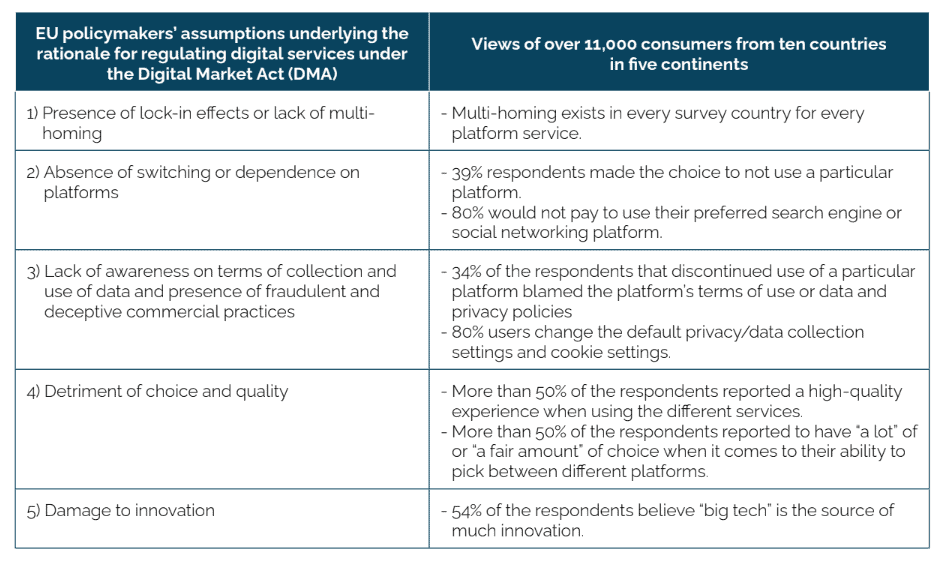

As concerns consumer harm, data reveals that regulators’ assumptions about market dominance and abuse by large digital companies do not align with consumers’ actual experiences. Indeed, market concentration in digital services markets in the EU is not as harmful as policymakers claim when justifying behavioural regulation. The DMA, for example, lists several features that characterise a gatekeeper company and a certain service to rationalise the need for the prescriptive and proscriptive regulation. However, these features are not empirically proven and are instead based on general assumptions regarding the presence of these features in digital markets. A recent study, which is based on large-scale empirical survey data of over 11,000 consumers from ten countries in five continents, challenges many of the reasonings inciting the need for EU regulation of large technology platforms (see Table 1).[9] Of course, there may be individual cases of abuse of power in narrow markets, e.g., self-preferencing (which can also be beneficial for consumers[10]). However, it is highly questionable whether the few known alleged cases of market abuse justify excessive interventions in platform business models and digital solutions that undeniably bring so many benefits to businesses and consumers.

Much points to the fact that EU has indeed chosen the path of proscriptive and protective policymaking with the DMA to achieve industrial and trade policy goals rather than defending competition in the Single Market.[11] Accordingly, as concerns developments in the UK, the question arises to what extent UK competition policy will be driven by institutional interests and ideological concerns in the future, which could result in a regulatory landscape that is even more restrictive than that of the EU.

Table 1: Contrasting views of EU policymakers and European consumers of advanced digital services Source: Recitals of the EU Digital Market Act and Akman (2022).[12]

Source: Recitals of the EU Digital Market Act and Akman (2022).[12]

[1] See, e.g., Garces, Eliana (2023). Eliana Garces: “Regulation and Competition in Digital Ecosystems: Some Missing Pieces”. Available at https://www.networklawreview.org/digital-ecosytems-missing-pieces/.

[2] See, e.g., World Economic Forum. (2019). Competition policy in globalized, digitalized economy. Geneva: World Economic Forum.

[3] See, e.g., OECD. (2021). SMEs in the online platform economy. Available at: https://www.oecd-ilibrary.org/sites/1386638a-en/index.html?itemId=/content/component/1386638a-en#abstract-d1e15424. Troise et al. (2023). How can SMEs use crowdfunding platforms to internationalize? The role of equity and reward crowdfunding. Management International Review, 117-159. Also see OECD (2018). Exploring the Impact of Digital Platforms on SME Internationalization: New Zealand SMEs Use of the Alibaba Platform for Chinese Market Entry. Journal of Asia-Pacific Business, 72-95.

[4] OECD (2021). The Digital Transformation of SMEs. Available at https://www.oecd.org/industry/smes/PH-SME-Digitalisation-final.pdf.

[5] OECD (2021). SMEs in the online platform economy. Available at: https://www.oecd-ilibrary.org/sites/1386638a-en/index.html?itemId=/content/component/1386638a-en#abstract-d1e15424.

[6] See IAB. (2022, May 24). Digital advertising crucial to SMEs’ recovery. Available at https://www.iabuk.com/news-article/digital-advertising-crucial-smes-recovery.

[7] Rivares et al. (2019). Like it or not? The impact of online platforms on the productivity of incumbent service providers. OECD Economics Department Working Papers.

[8] Costa et al. (2021). Are online platforms killing the offline star? Platform diffusion and the productivity of traditional firms. OECD Economics Department Working Papers.

[9] Akman, P. (2022). A Web of Paradoxes. Empirical Evidence on Platform Users and Implications for Competition and Regulation in Digital Markets. 16 (2) Virginia Law and Business Review 217 (2022). Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3835280.

[10] See, e.g., Dubé, J.-P. (2022). Amazon Private Brands: Self-Preferencing vs Traditional Retailing. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4205988.

[11] See, e.g., discussion of the broader factors behind the emergence of technology sovereignty as a desirable political ambition in ECIPE (2020). Europe’s Quest for Technology Sovereignty: Opportunities and Pitfalls. Available at https://ecipe.org/wp-content/uploads/2020/05/ECI_20_OccPaper_02_2020_Technology_LY02.pdf.

[12] See, e.g., recitals of the DMA and See Akman, P. (2022). A Web of Paradoxes. Empirical Evidence on Platform Users and Implications for Competition and Regulation in Digital Markets. 16 (2) Virginia Law and Business Review 217 (2022). Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3835280.

4. The Impact of Online Platform Regulation on Investment Attractiveness

By far the largest share of the economic value of an innovation is not created where the innovation originated, but where it is adopted. Policymakers need to acknowledge that the economic benefits from new technologies can only be reaped where they can be adopted. Access to innovative and typically integrated platform services is particularly important for small trade-oriented economies, which lack the resources and gravity of larger countries.

It is too early to quantify the economic effects of restrictive online platform regulation on a country’s investment attractiveness. However, some informed assessments can be made about platform regulation’s effects on corporate behaviour including platform operators and business adopting platform services. At the same time, the overall (macro-)economic effects of a decline in investments must be assessed intertemporally taking into account other jurisdictions’ approaches to platform regulation and how these policies impact economic opportunities and economic activity respectively.

Essentially, there are two main channels through which restrictive platform policies can influence investment activity:

- The direct effect: Large online platforms themselves adjust their investment strategies in response to evolving legal frameworks within the economies in which they operate. Restrictive platform regulation can significantly reduce network effects and the value-added provided by integrated platform services. For example, restrictions to share platform user data across several platform services could undermine the economic viability of existing services and new business models. Data may no longer be used for research, analytical or (cyber-)security purposes, or the ban on data sharing threatens a platform’s monetisation strategy so that cross-subsidisation of platform services and development activities could no longer take place. Restrictions on intra-platform data sharing and the tying of services could therefore result in large online platforms no longer offering major services to maintain the platform’s value proposition in the regulating jurisdiction.[1] In other words, platforms would either discontinue offerings provided from abroad, stop investing in new business opportunities or divest in the regulating jurisdiction. Recent examples include Meta’s announcement to not to roll out Threads, a potential rival to Twitter, in the EU.[2] Similarly, Google put on halt the launch of its AI-based chatbot Bard in the EU over concerns about compliance with EU privacy regulation.[3]

- The indirect effect: By far the largest share of the economic value of an innovation is not created where the innovation originated, but where it is adopted. Users would only be able to attain value from platform services if those services remained accessible within the regulated economy. The adverse economic impacts from less supply and limited portfolios can be significant for business users. Popular and widely adopted services might no longer be provided to their fullest extent, e.g., in advertising, online intermediation, and cloud-based productivity solutions. Online platforms and the use of advanced technology services are known to have an enormous economic multiplier effect.[4] If platform services are no longer available with the best features, companies will no longer be able to benefit from them and may themselves have to scale down operations, reflected by declining business and investment activity.[5]

The EU’s DMA has been criticised for being disproportionate and overly interventionist. However, it is a novel and untested regulation. As concerns its direct effects on platforms’ corporate behaviour, it is too early to assess the extent to which platform companies have limited or entirely discontinued certain services offerings. The overall magnitude of the changing investment behaviour of platforms needs to be assessed in light of whether and how other countries regulate platform services in the future. The scale of divestment in the platform services portfolio can be expected to be more significant if other countries, especially those with similar economic gravity and institutional characteristics (e.g., regulatory quality, taxation, R&D support, etc.), do not enforce equally restrictive regulations. Furthermore, in anticipation of regulatory intervention, domestic platform firms that are nearing critical thresholds in terms of size and network effects as outlined in the criteria for classifying them as major platforms might respond in a similar manner. This trend is observable in the ongoing contest over the designation of gatekeepers under the EU DMA.[6]

As concerns indirect effects on investment activity, there are important aspects that deserve policymakers’ attention. While platform regulations, such as the DMA and the proposed UK Bill, do not explicitly aim to reduce network effects, restrictions and obligations imposed on business conduct would have the indirect effect of reducing some of the major advantages that platform services provide to businesses using these services. It is important to understand that, unlike traditional sector-specific regulation (e.g., telecoms and electricity), platform regulations apply to a broad spectrum of technology-driven companies that span across various markets and supply chains but may not have competitive or commercial relations with one another.[7] The potential economic impacts of reduced network effects and the quality of services can be significant given the industry-wide reach of many platform services.

Restrictive platform regulation can have a particularly strong impact on knowledge- and technology-intensive businesses. Tech-intensive businesses are particularly dependent on cutting-edge tech solutions of which many are provided by the world’s largest technology companies. Data analytics and cloud services solutions from some of the world’s largest online platforms are, for example, boosting healthcare services and pharmaceutical development.[8] Utilising their software development and cloud computing expertise, the largest platforms are also supporting carmakers and automotive suppliers in enhancing connectivity, advancing sustainability, and addressing the complexities of autonomous driving.[9] Advanced platform-based cloud services also enable farmers to enhance crop yields by saving water, agrochemicals, labour, and energy, minimising farmers ecological footprint.[10] If innovative and very powerful services disappear, many users could migrate to regions with a more conducive regulatory environment. Ambitious start- and scale-ups could look for more technology-friendly regions to grow more rapidly and more successfully. This effect will be stronger the smaller the regulating economy is, simply because smaller countries lack the economic gravity of a large market.

Policymakers, particularly in smaller nations, should pay specific attention to the global technology and investment landscape and the major pulling factors that incite companies to invest in a certain jurisdiction. Market size is just one of the factors that start-ups, scale-ups, and technology-intensive companies consider when deciding to move to a certain country. Technology companies, small and large, tend to prefer investing in locations that offer a combination of favourable factors to support their operations and business growth strategies. Restrictive platform regulation can have a significant negative impact on knowledge- and technology-intensive businesses. Platform services’ adopters in these sectors are particularly dependent on cutting-edge tech solutions of which many are provided by the world’s largest technology companies. Data analytics and cloud services solutions from some of the world’s largest online platforms are, for example, advancing healthcare services and pharmaceutical development. Utilising their software and cloud computing expertise, the largest platforms are also supporting carmakers and automotive suppliers in enhancing connectivity, advancing sustainability, and addressing the complexities of autonomous driving. Advanced platform services also enable farmers to enhance crop yields by saving water, agrochemicals, labour, and energy, minimising farmers ecological footprint. If innovative high value services become inaccessible, many users could migrate to regions with a more conducive regulatory environment. Ambitious start- and scale-ups could look for more technology-friendly regions to grow more rapidly and more successfully. This effect will be stronger the smaller the regulating economy is, simply because smaller countries lack the economic gravity of a large market.

In the event that the UK were to implement highly stringent platform regulations, technology-oriented companies from Britain might opt to relocate, quite possibly to the US due to the absence of language barriers and a greater inclination of US politics towards embracing technology. As demonstrated by Kearney’s 2023 FDI Confidence Index, investors generally prioritise transparency of government regulation as well as technological and innovation capabilities in making investment decisions. For the 11th year, the US is ranking first on the index.[11] Tech-driven companies primarily invest in the US for a combination of compelling reasons that make it an attractive destination for their investments: access to a large market, access to talent, access to capital, and business-friendly regulatory framework and favourable tax policies at US state level. The US is also home to renowned research hubs and innovation clusters, which foster collaboration, knowledge exchange, and access to cutting-edge research and developments.

Many success stories point to the fact that the US has a substantial structural advantage in providing all these resources and market opportunities. The fact that the US does not regulate platform-driven business models beyond traditional competition policy implies that the US will very likely continue to be the preferred investment location for growing innovative businesses compared to European countries. It is precisely this point that should give politicians and competition authorities in the EU and the UK cause for concern, taking into account important developments of the past decade:

- A recent estimate shows that total economic output of the US tech industry is about half the size of the entire German economy.[12] S&P Dow Jones Indices show that US-based companies make up almost three-quarters of the global IT market — including 86% of the software market.[13]

- While Europe tends to have a tech talent cost advantage compared to the US (e.g., the US Bay area), Europe is not a single market, which has profound effects on start-ups. Internationalisation is unavoidable for start-ups to achieve valuations typical of US start-ups. For a European start-up to serve a market that is similar in size to that of the US, it would need to enter 27 (plus the UK) heterogeneous countries. It has also been more difficult for European companies to raise large funding rounds due to a lower supply of late-stage capital. Also, “Superhubs”, such as Silicon Valley and New York City, which have a high concentration of entrepreneurs, tech talent, and investors, have played a very important role in the success of the US start-up ecosystem.[14]

- OECD data show that US investments in start-up and early-stage companies are more than 11 times higher than France, Germany and the UK combined. In fact, they are many times higher than all other OECD countries combined.[15]

- Between 2008-2014, almost two-thirds (59%) of European start-ups expanded, or moved entirely, to the US ahead of Series A funding rounds. Between 2015-2019, this number decreased to a third (33%). European corporates invest three-quarters (76%) less than their US counterparts on software, and European investments are typically on compliance rather than innovation. This implies that many European start-ups may continue to move to the US.[16]

- Zendesk and MySQL are prominent examples of European-born companies that moved over in their entirety at Series A, and continued to build their companies successfully from there. Recent data indicate that European start-ups are now further along in terms of scaling at the point they expand to the US, and the primarily reason for their move to the US is access to a huge customer base. At the same time, European corporations tend to be too conservative when it comes to innovative technology. They invest less in technology, and when they do, it is too often focused on compliance, rather than on business transformation. European software companies selling B2B are therefore drawn to the US, before they are given the chance to do so in Europe. As long as this situation remains unchanged, European businesses can be expected to keep moving the to the US to scale their software companies and seek listings. Global competitiveness of European corporations will likely continue to decline.[17]

Small and open economies should carefully assess the effects of platform regulation on domestic economic activity, business growth, and innovation.

The investment attractiveness of a country is influenced by a wide range of factors impacting the desirability of businesses to invest in that jurisdiction. Determinants of investment attractiveness include political stability, regulatory quality and the rule of law, prospects for economic growth, and market size.[18] Larger countries such as the US by default offer more significant growth opportunities due to a large customer base. Small countries, by contrast, face several challenges that make it relatively more difficult for them to attract investments compared to larger countries. Small countries typically have smaller markets, limiting the scale of potential operations for businesses. This has a deterrent effect on investors as domestic demand may not be sufficient to support robust economic growth and business expansion.

To achieve economies of scale and access a larger customer base, companies from small countries rely heavily on open markets.

An open trade and investment framework also enables businesses in smaller countries to access advanced technologies, knowledge, and expertise that may not be locally available. Trade and investment are also key drivers of domestic productivity growth and competitiveness in the global market. Indeed, as concerns platform services, research demonstrates that reducing restrictions on online platforms increases the contribution of advanced ICT technology to overall productivity growth. Sectors that benefit the most are those that make wider use of online platforms and, generally, the Internet.[19]

Several small countries have been successful in attracting foreign investment due to various factors that make them attractive destinations for businesses investors. For example, despite its small size, Switzerland has been successful in attracting FDI in high-value-added industries due to its trade-oriented economy, a highly skilled workforce, a competitive tax system, and a strong financial services sector. Ireland has become a significant destination for foreign investors particularly in the technology-driven sectors such as ICT and pharmaceuticals. Low corporate tax rates and strong research and development capabilities have made Ireland a preferred location for many multinational companies. Estonia’s success in attracting foreign investment can be attributed to its digital innovation, e-governance initiatives, a tech-savvy workforce, and a favourable regulatory environment for start-ups. One thing all these countries have in common is that they have refrained from excessive regulation in key industries. This also applies to the regulation of competition. With regard to the DMA, businesses in smaller EU countries in particular have been very critical of the European Commission’s plans to regulate services of large online platforms, calling for “proportionate and sound obligations”.[20]

Unhampered access to integrated platform services with strong network effects is particularly important for small and open economies.

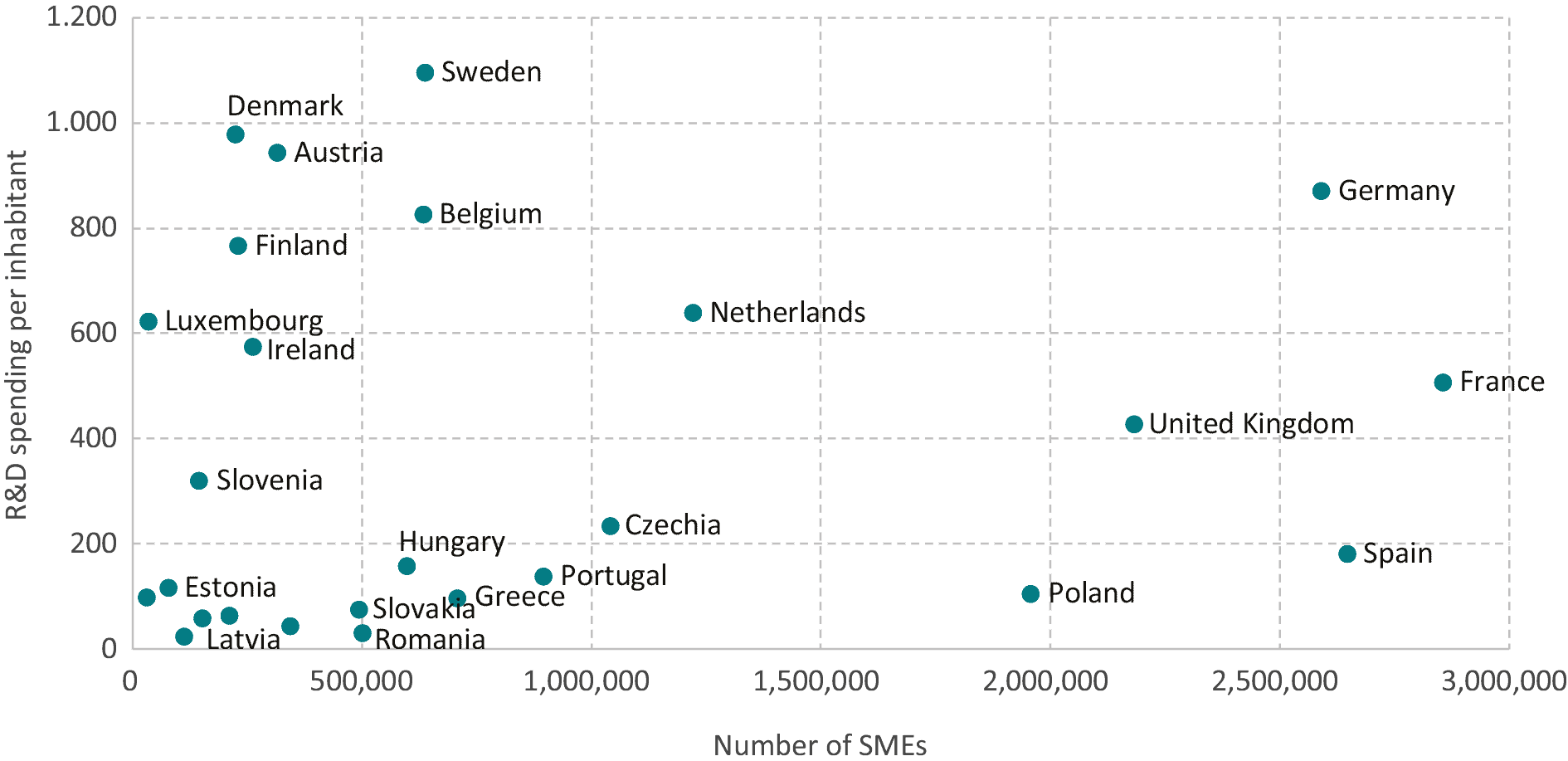

For the path of economic development – which is a function of investments in the domestic economy – it is important that businesses and final customers have free and predictable access to international technology solutions. Small countries, whose economies are characterised by relatively high spending on research and innovation, could on aggregate be worse off than countries with relatively low spending on R&D and innovation. The difference lies in the height of the fall. Businesses in economically more developed countries, of which many are known for significant investments in a broad spectrum of R&D activities (see Figure 1), may face difficulties in leveraging their investments due to restricted access to advanced platform services. On the other hand, while restrictive platform regulation would on the aggregate have a smaller impact on less R&D-intensive countries, limited access to platform services would slow-down the process of technological development and economic renewal. Larger countries tend to have more diversified economies. Accordingly, restrictive platform regulations would have a more moderate impact on larger countries. Nevertheless, owing to their significant dependence on integrated platform services, it is the small businesses that would experience the most pronounced repercussions, even within larger economies.

Figure 1: Domestic R&D spending per capita vs. total number of SMEs in 2021, by country Source: Eurostat. Note: UK data are from 2018.

Source: Eurostat. Note: UK data are from 2018.

Policymakers need to acknowledge that the economic benefits from new technologies are reaped where they can be adopted.

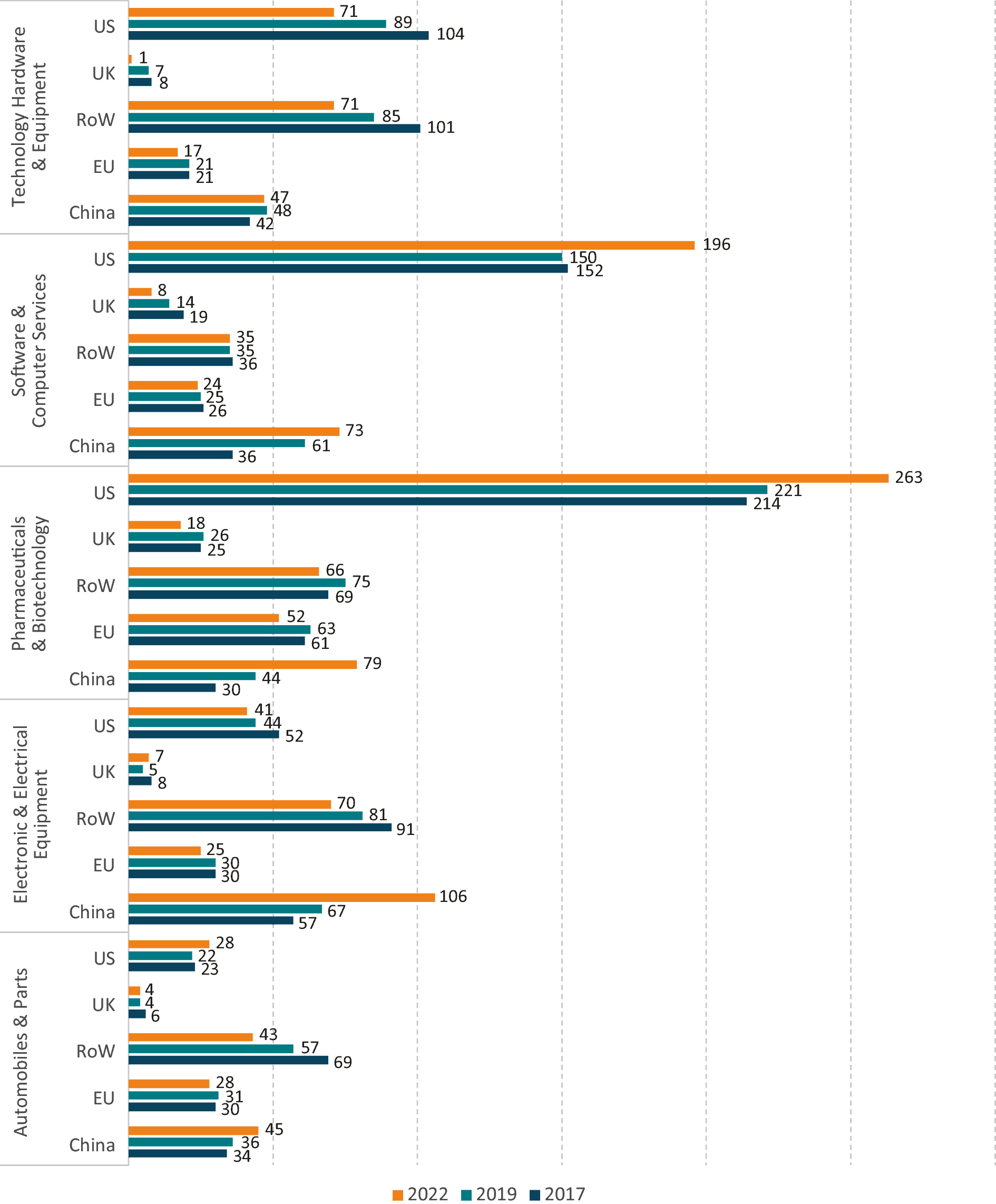

Another important development that policymakers should take into consideration is global technology competition. As outlined by Figure 2, the share of EU and British companies among the world’s most research-intensive companies has been substantially declining in many important sectors. Global economic developments suggest that governments in the EU and the UK should have strong interests to collaborate with others. Until 2050, the EU and the UK will steadily lose ground to the rising economies, especially China. The share of EU27 GDP in global GDP, for example, will fall to some 9% in 2050.[21] Against this background, and contrary to common political interpretations, policymakers should recognise that the economic benefits of innovative technology and platform services are much more evenly spread across economies, and even more so in the future. Approaching a 9% share in the global economy, businesses in the EU and the UK will become increasingly dependent on other parts of the world in the provision of frontier technology and integrated platform services.

Figure 2: Number of companies by country and sector that invested the largest sums in R&D worldwide Source: European Commission 2022 EU Industrial R&D Investment Scoreboard.

Source: European Commission 2022 EU Industrial R&D Investment Scoreboard.

[1] Examples in the EU’s DMA include requiring user consent for data integration across services (Article 5.2), prohibiting the bundling of core services (Article 5.8), disallowing unified logins for diverse core platform services (Article 5.2), and mandating user selection for default complementary services available on operating systems, personal assistants, or web browsers (Article 6.3).

[2] See, e.g., Politico (2023). Meta’s Twitter rival Threads not yet launching in the EU. 5 July 2023. Available at https://www.politico.eu/article/metas-twitter-rival-threads-not-yet-launching-in-europe/.

[3] See, e.g., Politico (2023). Google forced to postpone Bard chatbot’s EU launch over privacy concerns. 13 June 2023. Available at https://www.politico.eu/article/google-postpone-bard-chatbot-eu-launch-privacy-concern/ .

[4] For a discussion of effects from the adoption of advanced sales technology tools, personalised marketing, the use of third-party marketplaces, and own marketplace use, see, e.g., McKinsey (2023). The multiplier effect: How B2B winners grow. Available at https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-multiplier-effect-how-b2b-winners-grow.

[5] There are also concerns that platforms could strategically react by raising prices on their core platforms instead of increasing price in adjacent markets. It is argued that platforms could raise the price for those users that are least price sensitive, namely (small) business users. Taking the example of e-commerce and online advertisement, platforms would demand higher prices from businesses do not have viable alternatives to sell their products online. Ultimately, it may be more likely that those businesses invest less or sell products to end users at higher prices than stop using the platform, resulting in less business and investment respectively. See, e.g., CEG (2023). Strategic reactions to the DMA: will prices rise? Available at: https://www.ceg-global.com/insights/strategic-reactions-to-the-dma-will-prices-rise.

[6] See, e.g., Euractiv (2023). Zalando files suit against Commission over very large platform designation. Available at https://www.euractiv.com/section/platforms/news/zalando-files-suit-against-commission-over-very-large-platform-designation/. Also see Politico (2021). EU struggles with tech crackdown dilemma: How much to rein in European companies? Available at https://www.politico.eu/article/eu-dma-zalando-silicon-valley-european-tech-vestager/.

[7] Akman (2022). Regulating Competition in Digital Platform Markets: A Critical Assessment of the Framework and Approach of the EU Digital Markets Act. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3978625.

[8] See, e.g., Business Today (2023). Amazon Web Services, Google, Microsoft cloud: How cloud services are boosting the pharma sector. 16 April 2023. Available at https://www.businesstoday.in/magazine/deep-dive/story/amazon-web-services-google-microsoft-cloud-how-cloud-services-are-boosting-the-pharma-sector-376113-2023-04-05.

[9] See, e.g., CB Insights (2022). The Big Tech in Auto & Mobility Report: How Google, Amazon, Microsoft, and Apple are changing the automotive industry. 3 November 2022. Available at https://www.cbinsights.com/research/report/big-tech-auto-mobility/.

[10] Amazon (2023). How an agriculture company uses AWS Cloud computing to increase sustainability and feed more people. 17 January 2023. Available at https://www.aboutamazon.com/news/aws/how-cropx-uses-aws-cloud-computing-for-farming.

[11] Kearney (2023). The 2023 FDI Confidence Index. Available at https://www.kearney.com/documents/291362523/296971621/Cautious+optimism-2023+FDI+Confidence+Index.pdf/659bfe08-10c8-a19f-a543-cfc4920b417b?t=1685719955000.

[12] CompTIA (2020). Cyberstates – The definitive guide to the U.S. tech industry and tech workforce. Available

[13] WEF (2020). These two charts show U.S. dominance of global markets. Available at https://www.weforum.org/agenda/2020/02/dominance-american-companies-global-markets-industry/.

[14] McKinsey (2020). Europe’s start-up ecosystem: Heating up, but still facing challenges. Available at https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/europes-start-up-ecosystem-heating-up-but-still-facing-challenges.

[15] OECD (2023). Database on venture capital investments. Available at https://stats.oecd.org/Index.aspx?DataSetCode=VC_INVEST.

[16] TechCrunch (2020). New research shows European start-ups are spending drastically less on a US launch, for the same gains. Available at https://techcrunch.com/2020/09/23/new-research-shows-european-startups-are-spending-drastically-less-on-a-us-launch-for-the-same-gains/.

[17] IndexVenture (2020). Expanding to the US – The guide for European entrepreneurs. Available at https://www.indexventures.com/us-expansion/.

[18] The OECD’s FDI Regulatory Restrictiveness Index captures key legal determinants of FDI, including the

foreign equity limitations, screening or approval mechanisms, restrictions on the employment of foreigners as key personnel, and operational restrictions, e.g. restrictions on branching and on capital repatriation or on land ownership. The index is available at https://www.oecd.org/investment/fdiindex.htm.

[19] Ferracane and van der Marel (2020). Patterns of trade restrictiveness in online platforms: A first look. Available at https://onlinelibrary.wiley.com/doi/abs/10.1111/twec.13030.

[20] See Joint statement to the 27 May Competitiveness Council on The Digital Markets Act (DMA). 25 May 2021. Available at https://zpp.net.pl/wp-content/uploads/2021/07/25-05-DMA-Joint-statement-27May-Compet-Final.pdf.

[21] PWC (2017). The World in 2050. The long view: how will the global economic order change by 2050? Available at https://www.pwc.com/gx/en/issues/economy/the-world-in-2050.html.

5. Concluding Remarks

The regulation of online platforms remains a complex and evolving area, with different countries adopting diverse approaches to address concerns about anti-competitive behaviour. Traditional tools of competition policy are perceived to have fallen short in addressing business practices specific to multi-sided digital markets. The theory of platform-specific regulation remains ambiguous and subject to interpretation by policymakers. Platform-specific regulations have shaped EU competition policy, leading to the EU DMA and to the similar though in many respects different regulations in other countries like Germany’s GWB10 and the UK Competition Bill. Clear evidence of significant consumer harm is very limited, if any, which is why the focus has been on market contestability and “fair” competition rather than consumer welfare and competition for the market.

Digital platforms vary greatly in their business models and services. Network effects, where the value of participating on the platform increases with more users, play a crucial role in these markets. Online platforms offer a wide range of tools and resources that enormously benefit companies by enhancing business operations, reaching a broader customer base, and driving growth domestically and internationally. The world’s largest platforms provide cost-effective advertising, sales and advanced cloud services solutions, levelling the playing field for new and smaller firms, and enabling them to set up online stores and access valuable additional tools, leading to improved productivity. On aggregate, as demonstrated by ample evidence, large online platforms stimulate commerce and investment in business innovation, offer early access to cutting-edge technologies, and create economic opportunities especially for small businesses.

The EU’s approach with the DMA prioritises pre- and proscriptive rules to achieve industrial and trade policy goals, potentially at the expense of competition in the Single Market. It remains uncertain to what extent UK competition policy will be influenced by like-minded institutional interests or ideological concerns on the side of the CMA. The proposed UK Competition Bill, as it stands, could lead to a regulatory landscape even more restrictive than the EU.

Though it is too early to assess and quantify the full economic effects of ex-ante platform regulation, some important qualitative assessments can be made. Restrictive platform regulation can directly impact investment activity of large online platforms and smaller domestic ones, as compliance with changing legal frameworks may affect their services and network effects. Indirectly, the regulation can impact business users’ access to valuable services, leading to reduced investment and potential migration of technology-driven companies to more technology-friendly regions.

Several small countries have successfully attracted foreign investment by leveraging various factors such as a trade-oriented economy, skilled workforce, competitive tax systems, and strong financial services sectors. Switzerland, Ireland, and Estonia are examples of such countries that have become preferred destinations for foreign investors, particularly in high-value-added industries and technology-driven sectors. These countries have refrained from excessive regulation in key industries, including competition regulation. Access to integrated innovative platform services with strong network effects is crucial for small and open economies, impacting their economic development and the ability of businesses to leverage investments in research and development. Restrictive platform regulation would have a significant impact on small businesses.

To remain attractive to investors, policymakers in the EU and the UK need to pay attention to critical economic impacts and legal uncertainties from competition policy, which ultimately impact strategic investment decisions. These include venture capital investments, investments in start- and scale-ups, and investments by larger technology companies in opportunities to innovate and grow across borders.