The Economic Losses from Ending the WTO Moratorium on Electronic Transmissions

Published By: Hosuk Lee-Makiyama Badri Narayanan Gopalakrishnan

Subjects: Africa Digital Economy Far-East Regions South Asia & Oceania WTO and Globalisation

Summary

This paper is co-authored with Badri Narayanan, PhD, Associate Professor at University of Washington, Consultant at McKinsey Global Institute, UN ESCWA, FAO, Commonwealth Secretariat and GTAP Research Centre.

Background

- Since 1998, the WTO Members have applied a moratorium against tariffs on international electronic transmissions (commonly referred to as the WTO ‘E-Commerce’ Moratorium). However, some WTO Members have recently debated whether the moratorium remains in their economic interest, given the potential revenues that might be generated by imposing tariffs on electronic transmissions. The study examines the impact on India, Indonesia, South Africa and China (and the general case for developing countries) and concludes that imposing such tariffs would be fiscally counter-productive.

- Putting aside any legal questions, a country that opted out of the moratorium may apply tariffs affecting a wide range of cross-border business activities. Our research shows that if countries ceased to uphold the moratorium and levied import duties on digital goods and services, they would suffer negative economic consequences in the form of higher prices and reduced consumption, which would in turn slow GDP growth and shrink tax revenues. Yet our research indicates that the payoff in tariff revenues would ultimately be minimal relative to the scale of economic damage that would result from import duties on electronic transmissions.

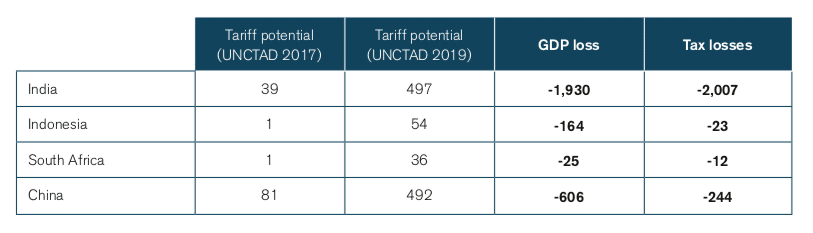

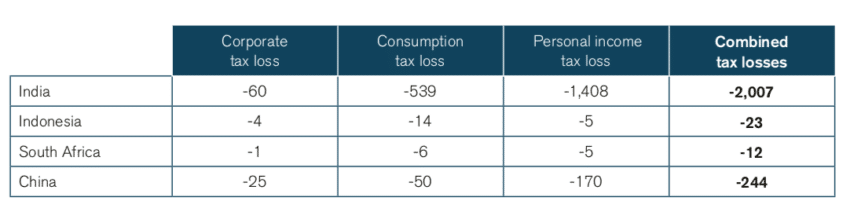

GDP and tax losses based on global imposition of tariffs on electronic transmissions (Scenario 2) on four economies. (in millions of US$) Impact on GDP and the economy

Impact on GDP and the economy

- Each of the four countries examined in our study would lose considerably more in gross domestic product (GDP) than they would gain in tariffs. Assuming a likely scenario in which tariffs imposed by one country gave way to widespread reciprocal tariffs (Scenario 2), India would lose 49 times more in GDP than it would generate in duty revenues. The figures are even more skewed for Indonesia, which would give up 160 times as much GDP as it would collect in tariffs, while South Africa would lose over 25 times more and China, seven times more.

Impact on tax revenues

- Likewise, if the goal is to fill tax coffers, imposing tariffs is a wrong-headed strategy. Duties would take a toll on domestic output that would depress tax collection. The net result for tax authorities is strongly negative. Again assuming a situation of reciprocal tariffs (Scenario 2), the loss of tax revenues is estimated to be 51 times larger than the tariff revenues for India, 23 times for Indonesia, 12 times for South Africa and three times for China. In short, a tariff on electronic transmissions would prove to be a highly inefficient form of tax collection.

Conclusion from the results

- In assessing existing literature on this issue, our study examined the potential tariff revenue losses projected in 2017 and 2019 UNCTAD reports that made a case for ending the moratorium. However, UNCTAD research did not discuss the economic and domestic tax losses that are likely to ensue if duties are implemented – and which we detail further in our own study. UNCTAD reports also did not take into account the significant enforcement and compliance costs involved in implementing electronic tariffs.

- In addition, UNCTADs’ research was based on certain assumptions that we believe merit serious scepticism – including that in the future, virtually all physical media or paper-based products would be digitised and therefore exempt from duties under the moratorium. Finally, those reports substantially overstated the potential of ‘lost’ tariffs due to digitalisation by over-estimating the value of digital trade – despite contrary evidence that the price of digitally-delivered items has tended to decline over time.

- Both UNCTAD reports have sought to argue that the adoption of 3D printing or additive manufacturing would make it harder for developing countries to capture taxes on manufactured goods. We believe the premise of this argument is questionable. It remains the case that, even if the files for 3D manufacturing (e.g. schematics and blueprints) can only be taxed once, the source materials used to manufacture products (the additives, or the thermoplastic ‘ink’ of a 3D printer) will remain subject to tariffs and sales tax. The more items are manufactured, the more states would stand to collect in tariffs and sales tax on 3D ‘ink.’ In short, we see no reason that the advent of 3D printing would undermine the economic logic of maintaining the moratorium.

- Finally, we would draw attention to one of the less-heralded benefits of digital trade, and one that is a boon to tax collection e-commerce forces more transactions into a transparent, trackable and therefore taxable realm. For many developing countries, where tax evasion is a constant challenge, a shift towards digital transactions is likely to help boost domestic tax collection. Far from undermining government sources of revenue, the growth of e-commerce stands to enhance a nation’s tax base, pushing grey market transactions into a taxable space.

The authors gratefully acknowledge support for this study from the members of the Global Services Coalition.

Introduction

Since the 1998 Geneva Ministerial Conference, the WTO Members have upheld a moratorium against tariffs on electronic transmissions that has been extended every two years at each WTO Ministerial. While many bilateral and regional trade agreements have made the moratorium permanent,[1] several WTO Members have recently voiced concerns that the moratorium may result in a loss of potential tariff revenues.

As our research makes clear, however, countries gain far more through the moratorium in terms of broader economic benefits than they would give up in tariff collections. Our study, a comprehensive assessment of the impact of electronic transmissions, bears out the well-known axiom of trade economics that tariffs often end up causing losses inside the economy that are larger than the revenue they generate at the border: indeed, it is well documented that tariffs distort the economy, increase domestic prices, reduce productivity and end up reducing government income from other taxes.[2]

We take a comprehensive approach in calculating the net impact of tariffs, considering how reduced economic growth would affect consumption, corporate and personal income taxes. The results are striking: in one scenario involving India, we find that the moratorium serves to prevent tax erosion of as much as $2 billion.

In fact, the economic losses cited in this study are likely to be understated since this study does not take into account enforcement costs – i.e., that existing customs infrastructure is only designed to collect duties on traditional goods and not services or intangibles. The compliance costs associated with implementing e-commerce tariffs would likely further reduce projected tariff revenues.

In explaining our conclusions, we allude to two studies that have been cited by WTO members sceptical of the value of the moratorium. The studies, both published by UNCTAD (in 2017 and 2019),[3] have advocated for an end to the WTO ‘E-Commerce’ Moratorium. Their authors argue that as increasing volumes of electronic transmissions replace trade in physical goods, countries are losing out in the form of foregone tariffs. The UNCTAD reports suggest that a tariff on electronic transmissions could recoup these lost tariffs.

As we explain below, this perspective ignores the substantial benefits that accrue to national economies from keeping electronic transmissions duty-free, particularly in terms of economic growth (though there is a substantial consumer benefit). As we will argue, the benefits of maintaining duty-free status are far greater than the potential revenues that could be generated through tariffs.

[1] Notably CPTPP, USMCA and EU bilateral agreements have incorporated the WTO ‘E-commerce’ Moratorium without sunset clauses.

[2] See inter alia Why tariffs are bad taxes, the Economist, July 31, 2018.

[3] UNCTAD, Rising Product Digitalisation and Losing Trade Competitiveness, 2017; Growing Trade in Electronic Transmissions: Implications for the South, 2019.

Assumptions behind UNCTAD-estimated tax revenue

Is there a real revenue potential?

UNCTAD’s first report (2017) calculated the impact of zero duties on films, printed matter, media, software and video games, assuming all items under these categories will be digitised and that the tariff revenues will be lost. The foregone revenue for electronically transmitted products (or ‘ET products’) is believed to be US$281 million. Even if this number is accurate, it is extremely modest compared to all goods tariffs collected annually, at US$418 billion per year.[1]

As we are two decades into digitalisation, one could also argue that some of the remaining trade in physical products is less likely to be digitised. Trade statistics also show that the decline of trade in printed matter and media has begun to plateau since 2010.

It is therefore questionable that all printed matter, memory circuits, optical or mechanical media currently traded will be digitised. In other instances, such as printed advertising materials, one could argue that online services did not directly replace traditional marketing materials but rather that it occupies a different role. People communicate, play and disseminate information differently than in the past, and therefore a corporate website is a supplement – and not a replacement – to traditional advertising.

Moreover, there may not be any revenues lost at all. Online equivalents of dutiable goods like CDs, DVDs or software are often based on copyright, which is negotiated and paid for in each jurisdiction. Unlike a physical disc that is shipped, a streaming or download service must license the content it wants to sell in a country and is regularly subject to sales taxes and VAT. Thus, the duties foregone for an imported DVD are perhaps replaced by sales taxes charged on online services that are more affordable or easily accessible.

Exaggeration of trade volumes

The conclusions of the second report by UNCTAD (2019) are even harder to reconcile. That report makes the following assumption: if the internet had never come into existence and imports of physical media had continued to rise at the same pace as they did between 1998–2010, global imports would have reached US$255 billion. UNCTAD (2019) assumes that the gap of US$139 billion between this hypothetical volume and today’s trade in physical media is the global trade in ‘digitisable products.’

Existing industry data seem to disprove these estimates. For example, cross-border trade in music and film accounts for US$25 billion in UNCTAD (2019) projections, whereas the total global sales of digital content (including domestic and cross-border sales) amount to just US$6 billion. Since the majority of online transactions are domestic rather than cross-border sales, UNCTAD (2019) may exaggerate the trade volumes by 10 to 20 times.

Also, much of the digital content is no longer ‘sold’ but provided as a subscription-based service. However, it is not just the business models that have changed. Global competition and new technologies have brought down the prices of applications and content as well. In conclusion, UNCTAD’s trade volumes in ‘digitisable products’ seem exaggerated. Also, the notion that recent innovations (such as the internet or subscription-based services) can be somehow ‘un-invented’, or that the governments should reclaim historical tariffs seems far-fetched. To draw a parallel: would the global trade in candles have continued to rise and continue to generate tariff revenues without the invention of electricity, and should there be tariffs on electricity to compensate this hypothetical tariff loss?

In conclusion, UNCTAD’s trade volumes in ‘digitisable products’ seem exaggerated. Also, the notion that recent innovations (such as the internet or subscription-based services) can be somehow ‘un-invented’, or that the governments should reclaim historical tariffs seems far-fetched. To draw a parallel: would the global trade in candles have continued to rise and continue to generate tariff revenues without the invention of electricity, and should there be tariffs on electricity to compensate this hypothetical tariff loss?

Assessing the impact in two steps

The approach taken by the UNCTAD studies is static, offering one-sided analyses of tariffs at the border that ignore the more profound impact that they may have inside the economy. It is critical to recognise that tariffs lead to higher prices, lower consumption and slower economic growth, in proportion to the scope and severity of the tariffs.

In turn, the slowdown will affect public finances through government receipts on various domestic taxes. For example, government revenue from consumption taxes fluctuates with the total amount of goods and services consumed in society. Meanwhile, the corporate tax depends on overall business performance – i.e., industrial output and profit margins – and personal income taxes depend on employment levels and wages. Economic losses will mount further if other countries impose reciprocal or retaliatory duties.

The benefit of the moratorium is in its ability to prevent these lose-lose scenarios. Measuring this loss requires a computable general equilibrium (CGE) model, which can capture the decline in GDP, welfare and employment caused by the tariffs. In this study, we look at some major developing countries – India, Indonesia, South Africa, China – as well as all developing countries (including the aforementioned countries) as a group.[2] We then determine how these losses compare to the revenue forecasted in the UNCTAD studies.

Scenario 1: Intermediate scenario (without reciprocation by other countries)

In the first instance, we shock the model by using the average tariff rates assumed by UNCTAD (2019) on a Most Favored Nation (MFN) basis.[3] This intermediate scenario merely inserts the tariffs into the CGE model, generating the anticipated effects inside an economy. Each country is assumed to be alone in imposing the electronic transmissions tariffs. In other words, only the country in question imposes a tariff on electronic transmissions and there is no reciprocation by other countries.

Since the term ‘electronic transmissions’ is potentially very broad, it may be used to justify tariffs on the online provision of several goods and services, including at a minimum:[4]

- Online retailing services (e.g. online intermediation)

- Internet publishing, web search portals, directories and information services

- Motion picture and video industries and sound recordings (online portion only)

- Software and programming

- Data hosting, system services and data transfers

- Advertising (online portion only)

For the sake of consistency, tariffs are assumed to apply to all activities above for all the countries included in our analysis.

Scenario 2: The full impact (with other countries also imposing reciprocal tariffs on electronic transmissions)

In the second scenario, we see the full results of the electronic tariffs. We assume that all other countries will retaliate with duties of their own, in line with the tariffs imposed by the respective country in Scenario 1. Scenario 2 comes closest to the likely outcome in the event that the WTO ‘E-commerce’ Moratorium is allowed to expire, since no country should expect to be alone in imposing new tariffs. For the sake of consistency, we assume that the rest of the world will impose the same tariff rate on ‘ET products’ as the country we are examining. In reality however, other countries may respond by imposing a higher-rate tariff or a tariff on different products and services, since each WTO Member will use its policy space in the manner that suits its interests.

For the sake of consistency, we assume that the rest of the world will impose the same tariff rate on ‘ET products’ as the country we are examining. In reality however, other countries may respond by imposing a higher-rate tariff or a tariff on different products and services, since each WTO Member will use its policy space in the manner that suits its interests.

Conservative assumptions in the model

In the CGE modelling exercise, we use the standard Global Trade Analysis Project (GTAP) model described in the Annex. We also make the following assumptions in an effort to create the most realistic scenario for imposing electronic transmissions tariffs.

- We assume that only electronic transmissions are affected. All other trade in goods and services are unaffected.

- We assume that the scope of the analysis is in the short run, and foreign service providers will remain available to the same extent (i.e., no new market access or regulatory restrictions), facing only a tariff paid on imports.

- We also assume that there will be no change in the availability of technology for the country that imposes the tariff. Foreign suppliers will continue to service a country that imposes tariffs, however unlikely such an assumption is. All affected products and services – all content, cloud and online marketing tools – will continue to be available. In other words, the simulation applies no other shocks other than the tariffs stipulated by UNCTAD (e.g., productivity shocks).

- Foreign providers are not immediately replaceable. This also follows naturally from the assumption that there will be tariff revenues: if domestic equivalents were immediately replaced, no tariff revenues would be collected in the first place.

- A standard practice in much GTAP-based research in recent years is to assume that the aggregate employment of unskilled labour is endogenous and not fixed at the full employment level, taking into account the significant unemployment of workers in most economies.

These assumptions further stress that the results are a low-end estimate and no ‘black box’ assumptions were made in this exercise. See also the Technical Annex of this paper, which explains all relevant assumptions.

[1] Based on UN ComTrade 2017; UNCTAD TRAINS 2018.

[2] All countries in the GTAP database that are classified by the World Bank as low- and middle-income countries.

[3] UNCTAD, 2019.

[4] See the technical annex for the weights applied in each GTAP sector. Based on market data, online streaming and downloads proportions are assumed to account for only 17% of the activities, excluding traditional film, broadcasting or licensing activities. Similarly, the online portion of sound recording activities are assumed to be 50%; data transfers are 50-60% of cross-border telecommunications, and online advertising services are 45% of all advertising services.

Scenario 1: Intermediate scenario – without reciprocation by other countries

Impact on economic output

It is well-established economic fact that tariff cuts lead to an increase in economic output (i.e., GDP), and the opposite is also true: a country that imposes tariffs will see a reduction in GDP that is proportionate to the severity of the tariffs.

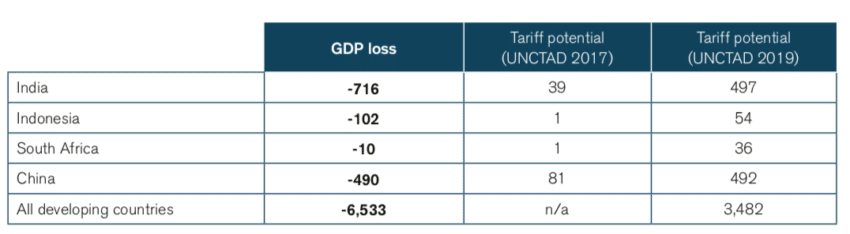

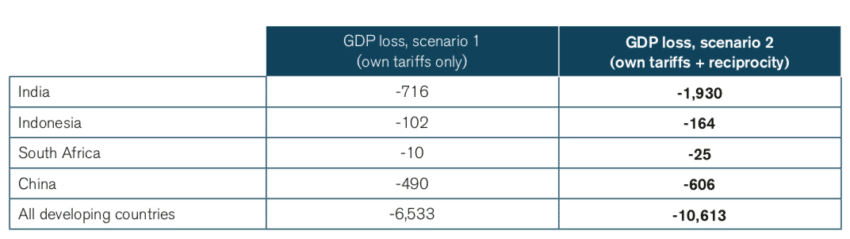

As described in the previous section, the tariff losses estimated by the second UNCTAD study (UNCTAD, 2019) are not actual revenues, but hypothetical revenues based on the premise that the internet never came into existence and prices on software and content remained constant for two decades. Yet, the GDP losses would be larger or on par with (or even significantly larger than) these hypothetical revenues (Figure 1) already in this intermediate scenario.

For example, the GDP losses suffered by the Indian economy in our model would be equivalent to US$716 million. Given that the tariff is expected to generate only US$39 million, the people of India actually would be better off to simply give their government the US$39 million that it wants to collect – and continue to enjoy the remaining US$677 million.

In conclusion, tariffs on electronic transmissions are a highly inefficient means to generate fiscal revenue. The gap between revenues and output losses is likely to be much wider as the UNCTAD revenue estimates do not take into account the technical and organisational costs of implementing a tariff on electronic transmissions.

Figure 1: GDP losses in the intermediate scenario (in million US$) Source: Authors’ analysis based on GTAP 9 and World Bank national accounts data, 2017; UNCTAD, 2017, 2019

Source: Authors’ analysis based on GTAP 9 and World Bank national accounts data, 2017; UNCTAD, 2017, 2019

Impact on investments

An economy would respond proportionately to the negative change in the investment climate (Figure 2). Although the model does not introduce any external shocks on productivity or returns on investment, electronic transmissions are nonetheless carriers for the essential business services and connectivity that are fundamental to managing an efficient business operation. Therefore, investment losses are naturally more pronounced than GDP losses.

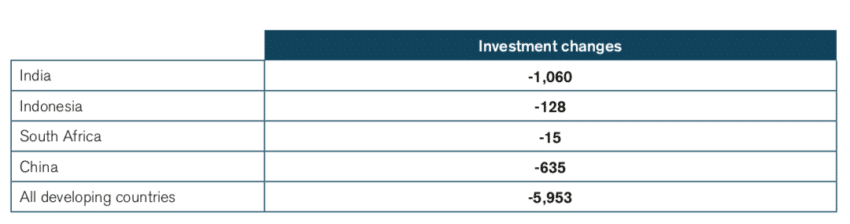

Figure 2: Investment losses in the intermediate scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9

Source: Authors’ analysis based on GTAP 9

In total, the aggregated loss in investments (both domestic and foreign direct investments) for the developing countries would be US$13.7 billion. The decline in investments ranges between US$15 million for South Africa and up to US$1 billion for India. To put these figures into context, the entire federal budget for public cultural programmes in India is US$410 million (2,843 Rs crore),[1] and the investment losses from the ‘ET tariff’ would be twice the impact of removing all federal funding for culture in India.

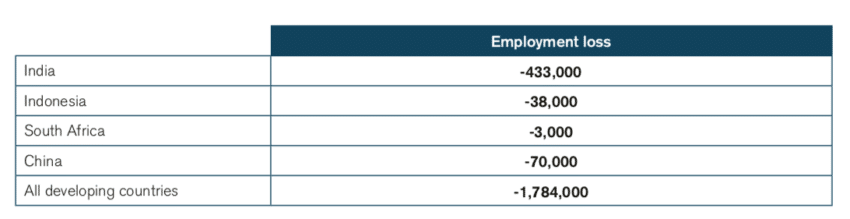

Jobs and welfare losses

When GDP declines, unemployment rises. In the scenario we have modelled, the imposition of duties would result in a loss of 1.8 million jobs in developing countries. The job losses would be significant due to the large populations being impacted and the importance of the services sector in some of the countries of our study, particularly in the case of India (Figure 3).

Figure 3: Employment losses in the intermediate scenario (in numbers of jobs) Source: Authors’ analysis based on GTAP 9 and ILO database and World Bank population estimate, 2018

Source: Authors’ analysis based on GTAP 9 and ILO database and World Bank population estimate, 2018

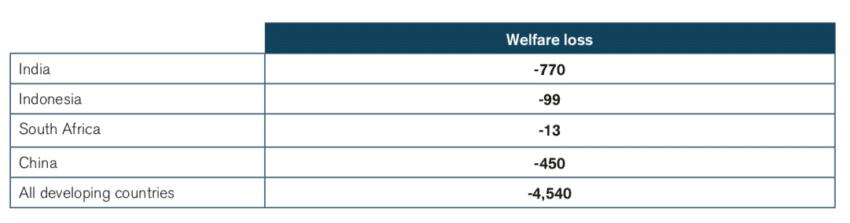

Welfare effects would also be more pronounced than GDP effects, mainly because of the erosion of allocative efficiency and reduced employment. The total welfare losses would be equivalent to US$4.5 billion per year for all developing countries. While effects are still low in South Africa, India is again the major casualty (Figure 4): every rupee in assumed tariff revenue for the government leads to twenty rupees lost in welfare for the Indian people.

Figure 4: Welfare losses in the intermediate scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9

Source: Authors’ analysis based on GTAP 9

[1] Ministry of Culture of India, Budget and Programme 2018-2019 – Transparency audit with respect of compliance under section 4 under the RTI Act, 2018.Source: Authors’ analysis based on GTAP 9

Scenario 2: Full impact – other countries reciprocating the tariffs

If the moratorium was to expire and a few individual countries began to impose tariffs on electronic transmissions, it is a political fallacy to assume that a broader group of WTO Members would not follow suit and begin to consider their own tariffs. Moreover, these tariffs could affect any product or service fitting under the scope of ‘electronic transmissions’ that best serve their own interests and sensitivities.

For consistency, we assume that this reciprocation occurs at the same tariff rate as the original tariff imposed by the country in question. In reality, however, other countries may reciprocate by imposing higher rates, depending on the policies or the bound rates of the respective country.

Impact on economic output and investments

If we take into account reciprocal tariffs, the aggregated GDP losses for the developing countries would increase considerably. The results for all developing countries would be US$10.6 billion in absolute terms – worse by a factor of 1.5 than the previous scenario of unilateral tariffs. These GDP losses are higher than any of the assumed tariff revenue collected in the two UNCTAD studies for each of the countries (Figure 5).

The GDP losses for India would amount to US$1.9 billion – for the sake of collecting a meagre tariff revenue of US$31 million. The loss in GDP would be 49 times larger than the tariff revenues for India, over 160 times larger for Indonesia, over 25 times larger for South Africa and 7 times larger for China. Every country demonstrates strongly negative results that exceed the tariffs revenue by far, which further proves the inefficiency of the ‘ET tariff’ and the poor trade-off between the fiscal revenues for the government and the costs for the general economy.

Figure 5: GDP losses in the full scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9 and World Bank national accounts data, 2017; UNCTAD, 2017; 2019

Source: Authors’ analysis based on GTAP 9 and World Bank national accounts data, 2017; UNCTAD, 2017; 2019

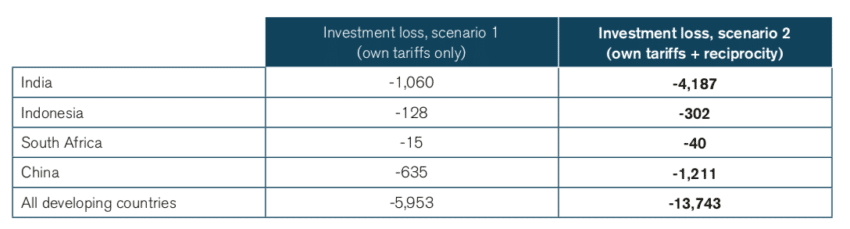

The reciprocation scenario would also lead to further negative impacts on investments. The total collective loss on investments in the developing countries would be US$13.7 billion per year, and the country-specific results (figure 6) show that the investment losses would be magnified by 2 to 4 times when other countries reciprocate in imposing tariffs.

Figure 6: Investment losses in the full scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9 and ILO database and World Bank population estimate, 2018

Source: Authors’ analysis based on GTAP 9 and ILO database and World Bank population estimate, 2018

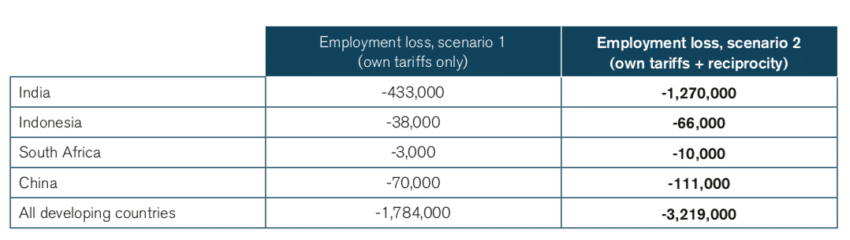

Jobs and welfare losses

The reciprocal imposition of tariffs by multiple countries would result in more than 3.2 million jobs lost in the developing economies, nearly doubling the impact of the first Scenario. The losses would range from 10,000 jobs lost in South Africa to almost 1.3 million jobs in India (Figure 7) once other countries also impose tariffs on electronic transmissions.

Figure 7: Job losses in the full scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9 and ILO 2017

Source: Authors’ analysis based on GTAP 9 and ILO 2017

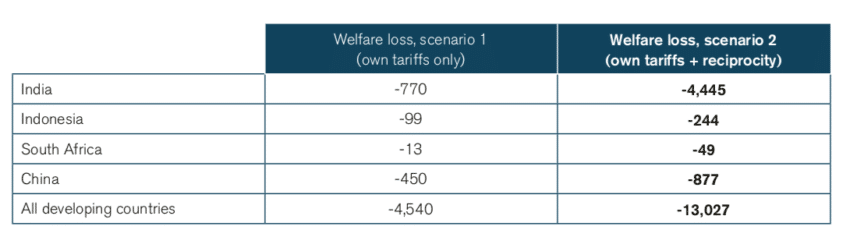

Welfare effects would continue to be more pronounced than GDP effects in this scenario, pointing to a redistribution of wealth from the citizens to the government at a disproportionately high cost. The total welfare loss would be US$13 billion for the developing countries – and the citizens must sacrifice between 12 and 244 times more than the tariffs are assumed to collect in revenues (Figure 8).

Figure 8: Welfare losses in the full scenario (in millions of US$) Source: Authors’ analysis based on GTAP 9

Source: Authors’ analysis based on GTAP 9

How much could be lost in domestic taxes?

The previous chapter suggests that tariffs on electronic transmissions would generate a significant loss for the overall economy of a country (i.e., consumers and businesses) that is disproportionate to the small tariff revenue assumed by the two UNCTAD studies. In this section, we focus on the aggregated fiscal impact, i.e., looking strictly at the impact on government revenues and the bottom line of public finances.

As explained at the onset, even a minor tariff increase would increase domestic prices and the cost of private consumption and industry inputs. In turn, these increases reduce economic output, corporate profits, consumption and employment, and these factors all affect a government’s ability to generate direct and indirect taxes that tend to outweigh the tariff revenues.

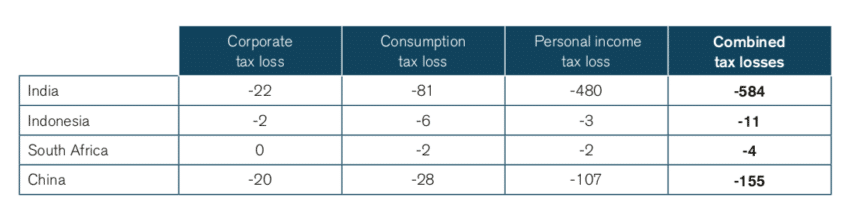

The combined losses in corporate income taxes,[1] consumption or value-added taxes,[2] and personal income tax[3] are illustrated below for Scenario 1 and 2, respectively. To take India as an example, the moratorium prevents a tax erosion between US$584 million (Figure 9) and US$2 billion (Figure 10) depending on the scale of reciprocation and retaliation.

Figure 9: Total tax revenue losses in the intermediate scenario (Scenario 1, in millions of US$) Source: Authors’ analysis based on GTAP 9, Damodaran, A., EY, Deloitte, ILO

Source: Authors’ analysis based on GTAP 9, Damodaran, A., EY, Deloitte, ILO

Figure 10: Total tax losses due in the full scenario (Scenario 2, in millions of US$) Source: Authors’ analysis based on GTAP 9

Source: Authors’ analysis based on GTAP 9

Despite the assumptions behind the revenues from UNCTAD 2017 and 2019, we still take these tariff revenues as comparison benchmarks. In conclusion:

- The combined domestic tax losses under Scenario 2 are much larger than the potential tariff revenues identified in UNCTAD 2017: 51 times larger than the tariffs for India, 23 times larger for Indonesia, 12 times larger for South Africa, and three times larger for China.

- Compared to the potential tariffs assumed in UNCTAD (2019), India’s domestic tax losses are four times larger than the tariff revenues. For the other countries, the domestic tax losses would reduce the projected tariff revenues by 42% for Indonesia and 33% for South Africa and would halve tariff revenues for China.

- Given the considerable costs involved in implementation and collection of a tariff for electronic transmissions, the aggregated result is a net loss for government revenues.

[1] Using statutory corporate income tax rates collected from EY Worldwide Corporate tax guide; average pre-tax lease & R&D adjusted operating income from Damodaran, A., Profit margins, India; China, NYU, 2019 (in the case of Indonesia and South Africa, emerging markets average serves as a proxy) and industrial output in GTAP 9.

[2] Deloitte, Global Indirect Tax rates and demand in GTAP 9.

[3] Average earnings, ILOSTAT, 2015-2018 and GTAP 9, personal income tax (at the average earning rate) collected from the tax authorities and employment in GTAP 9.

Other WTO obligations and linkages

There is an argument that the moratorium binds the WTO Members and limits their commercial and industrial policy space – and the WTO Members must retain that policy space, as new technologies, like 3D printing, are emerging.

It is inarguably true that the moratorium limits the policy space of its members. However, every WTO agreement and international treaty does so to some extent. Such an argument merely supports the notion that a country should leave all WTO agreements and international cooperation for the sake of preserving its autonomy, while the results from the scenario show that the moratorium is reciprocally beneficial for the developing countries.

There are no obvious reasons why WTO Members should act ex ante against new technologies by imposing electronic transmission tariffs. Even if 3D printing could displace more trade and tariff revenues, downloads of data (such as the CAD schematics for a printable item) are a one-time ‘fixed costs.’ Meanwhile, the use of thermoplastic materials (e.g., the ‘ink’ of a 3D printer) increases with each item printed and produced. In other words, it is the ‘ink’ – and not the data – that displaces trade, and that ‘ink’ (along with the printers) must be imported and continue to be subject to tariffs and sales tax.

While this report only takes into account retaliation through reciprocal tariffs with identical scope, the ‘ET tariff’ also has a bearing on other agreements and WTO rules.

Firstly, WTO Members have negotiated the ‘E-commerce’ Moratorium jointly with the Trade Related Aspects of Intellectual Property (TRIPS) moratorium on non-violation and situation complaints (NVCs). By not extending the tariff moratorium, the WTO Members would also be likely to end the TRIPS moratorium, an act that could open the door for WTO disputes against developing and developed country patent systems.

Secondly, many physical goods were not just digitised into intangibles but also transformed into services. Business models have changed from traditional sales (of goods) to subscription-based services. Such tariffs (or any tax only applied on imports) at the border on services would violate the national treatment obligations under the General Agreement on Trade in Services (GATS) XVII, where such commitments exist on data processing, telecom, and audiovisual services.[1]

Thirdly, the General Agreement on Tariffs and Trade (GATT) rules on customs valuation (Article VII) also stipulates that any dutiable item is ‘merchandise’[2] – other words, goods – rather than a service or an intangible. Electronic transmissions or services cannot be made dutiable using any of the accepted valuation methods under GATT rules, which prohibit any use of ‘arbitrary or fictitious values.’

[1] China, South Africa has undertaken commitments on data processing services (CPC843, under which most online services fall under) for Mode 1 and 2, while India remains unbound. Commitments under telecom services for (international) data processing or transmissions also exist for China, South Africa and India (at least for mode 1). China has also taken commitments for audiovisual services.

[2] GATT VII 2.a.

Conclusions

In total, the moratorium prevents a combined economic loss of US$10.6 billion in GDP annually for developing countries – a disproportionately high cost for consumers and businesses to bear for very modest tariff revenues.

The net effect on public finances is also strongly negative as the moratorium prevents tax erosion that could be 51 times larger than the tariffs UNCTAD projects. In the case of Indian tax authorities, government revenues equivalent to US$2 billion would be lost on value-added tax (VAT) as well as corporate and income taxes.

Furthermore, addressing the informal and untaxed economy has remained one of the biggest fiscal policy challenges for decades for developing countries. The proliferation of the internet and e-commerce does not undermine government revenues but actually expands the tax base by transforming the ‘grey’ economy into a tax-paying and formalised sector.

Developing countries may have lost some of their tariff revenues due to technological advancement, but they have also benefited from the lower prices, inclusion and higher levels of overall consumer welfare produced by such advancement. This development (enabled by duty-free access) is essential to the emergence of a vital information and communications technology (ICT) sector, especially for systems development and data hosting services or creative industries in the developing world. History has also shown that developing countries grow out of their dependency on tariffs for fiscal revenues by diversifying into other forms of taxes like consumption taxes that are less distortive.

Collecting duties on electronic transmissions will be costly and technically complex. Currently no customs infrastructures or processes exist to collect tariffs outside of traditional goods, or even correctly (and legally) attribute commercial value to electronic transmissions. Tariffs on electronic transmissions would impose an undue administrative burden on not just producers and consumers but also tax authorities and carriers.

For example, tariffs could potentially be applied to purely domestic transactions, since they are inseparable from foreign imports. Internet Protocol (IP) traffic often gets routed through foreign territories simply because they represent the fastest or cheapest avenues, even when the sender and the recipient are in the same country.

Also, data is regularly transmitted through other countries that are located between the sender and the recipient, for whom transit traffic is also inseparable from dutiable imports. Therefore, the application of tariffs on electronic transmissions would almost certainly force the re-routing of global internet traffic.

In conclusion, the implementation of duties on electronic transmissions will lead to costs or losses that exceed the potential tariff revenues and put the open nature of the internet at risk.

Technical annex: A technical description of the GTAP modelling framework

The modelling framework developed in this paper is an extension of the standard GTAP framework, developed by the Global Trade Analysis Project (GTAP), widely used to study the impacts of changes in trade policy. The framework includes a combination of a state-of-the-art model and dataset, which are used together for a wide range of policy analysis. It is the principal analytical tool used in the vast majority of reports on the economic and climate impact of free trade agreements (FTAs) and regional trade agreements (RTAs). The model is also frequently used by international organisations like UNCTAD, World Bank, WTO and Organisation for Economic Cooperation and Development (OECD) who are also members of the consortium responsible for its development.[1]

The GTAP model is a multiregional, multisector, computable general equilibrium (CGE) model, characterised by perfect competition, constant returns to scale and Armington elasticities.[2] Such a model captures supply-chain effects, macro-economic aspects, economy-wide equilibrium constraints, linkages between different sectors and countries as well as the factor-use effects of various commodities. The model is also able to capture the potential substitution of one sector by another, among other aspects.

We use the most up-to-date and publicly available data from the GTAP 9 database,[3] which contains global trade data for the years 2004, 2007 and, 2011, including input-output tables and currently applied levels of trade protection.

Before applying the tariff shocks to the model according to our scenarios, we extrapolate the GTAP 9 dataset (starting from the 2011 dataset) to the latest available year, 2017, to reflect the ‘best estimate’ of the global economy today. The exogenous variables shocked for extrapolation include the most relevant macroeconomic variables, i.e. population, labour force, GDP, total factor productivity and capital endowment, which are available in the well-recognised database of the French Research Centre in International Economics (CEPII).[4]

International trade

The change in imports of each region from each of the others is determined by three factors, captured by the variable qxskk,r,s,, which is the percent changes of real volumes of exports of commodities (indexed by k), from exporting countries (indexed by r) to the importing countries (indexed by s) (i) substitution among different sources, based on the differential between import prices from specific sources and the sum of import-augmented technical change and aggregate import prices pimkk,s[5], multiplied by the elasticity of substitution of imports between the sources σM,k, which is the Armington elasticity for the sector as in GTAP Data Base; (ii) import-augmenting technical change, amskk,r,s, that lowers the effective price of a good in the destination market; and (iii) the import penetration as captured by change in composite imports of subsector commodity k, qimkk,s

For all sectors k in SECT (all sectors in the model), regions r and s in REG (all regions in the model):

qxskk,r,s = -amskk,r,s + qimkk,s -σM,k * [pmskk,r,s – amskk,r,s – pimkk,s] (1)

Another important aspect of international trade is transport and insurance associated with the shipments exported and imported. The model captures this as global transport margins, which are the wedge between the value of trade exported as Freight on Board (FOB) from the exporting country and the value of trade imported as the Carriage, Insurance and Freight (CIF) shipments in importing country before tariffs are applied. Global transport margins in the standard GTAP model takes into account requiring transport and insurance services as a fixed portion of the volume of goods shipped.

Domestic consumption

There are three broad categories of consumption of products and services manufactured in a country: private households, government and firms. In addition, each of these categories of agents also consumes imports aggregated across exporters in the model. For private households, GTAP assumes CDE (Constant Difference Elasticity) functional form, with linearised expenditure systems (LES) and constant elasticity of substitution (CES) as special cases. CES is the functional form for intermediate inputs used by firms and government consumption. There is also a CES nest between domestic and imported products for each of these agents.

Domestic production

Production function in GTAP involves 3 levels of nests: (1) there is a Leontief function on the topmost part of the production system, wherein intermediate inputs as a composite, single input and primary factors (as another composite, single input) are complements; (2) within the intermediate inputs, there is a CES function; and (3) within the primary factor inputs, there is another CES function. Factors are also mobile across sectors except for land and natural resources (that only move within agricultural and extraction sectors respectively).

Links between production, consumption and international trade

The sub-modules explained above link to each other. The percentage change in sector-level domestic consumption, qdmkk,s, with corresponding price change pmkk,s, substitutes for imported subsector goods, qimkk,s, with corresponding price change pimkk,s. The CES elasticity between these two variables is σD,k, and this substitution takes place based on their respective price differentials from the sector-level domestic prices pdkk,s:

For all k in SECT and s in REG:

qimk(k,s) = qdk(k,s) – σD(k) * [pimk(k,s) – pdk(k,s)] (2)

qdmk(k,s) = qdk(k,s) – σD(k) * [pmk(k,s) – pdk(k,s)] (3)

Domestic market and import price changes are aggregated to domestic price changes by weighting according to their respective shares. VDKk,r is the total value of domestic consumption of goods corresponding to the sub-sector k in the region r, VDMKk,r is the value of domestic consumption of goods produced by the domestic sector k in the region r and VIMKk,s is the value of imports of goods produced by the sub-sector k to the region s.

For all k in SECT and s in REG:

pdkk,s =αDk,s *pmkk,s +αMk,s *pimkk,s (4)

where: αDk,s =VDMKk,s /VDKk,s and αMk,s = VIMKk,s /VDKk,s

Finally, the total changes in supply and demand are equalised to ensure equilibrium, by equating the percentage change in total output qokk,r with the share-weighted sum of exports and domestic consumption for all sectors k in SECT and regions r in REG. When the slack variable tradslackkk,r, is exogenised, this equilibrium condition determines the change in market prices, pmkk,r and output, qokk,r , is determined by equation (5) below.

For all k in SECT and r in REG:

qokk,r = βDk,r * qdmkk,r + ΣsβMk,r,s * qxskk,r,s + tradslackkk,r (5)

Adjustments to the standard model

In this exercise, we make deviations from the standard model in order to effectively incorporate the realities that are important to consider for the policy shocks in this exercise. In every other respect, we use the standard model and its closures.

First, in order to generate a tariff revenue,[6] we need to capture the fact that imports should not be replaced immediately by domestic substitutes. Therefore, we assume no substitution between the domestic and imported services sectors, which corresponds to the domestic-imports Armington substitution elasticity (ESUBD) in the GTAP model.

Second, in order to capture the existence of significant unemployment, we assume that the aggregate employment of labour is endogenous and not fixed at the full employment level. This assumption is a standard practice of GTAP-based research in recent years, given the increasing emphasis on the impact on employment rather than on wages. We thereby fix the real wages of unskilled labour, thereby implying an infinitely elastic unskilled labour supply curve.

Our study aggregates the 141 regions in the GTAP dataset into the following regions: India, Indonesia, South Africa, China, Developing Countries (based on the World Bank thresholds for low and middle-income countries),[7] the US, and the ‘Rest of the World’.

Applied shocks in the model

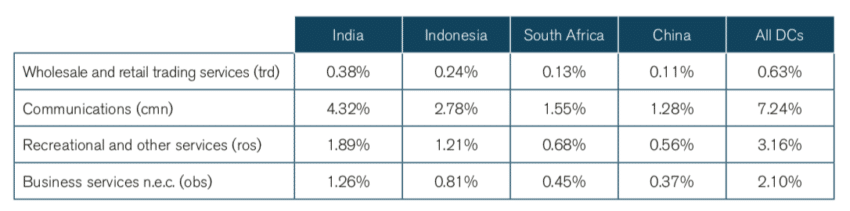

Neither traditional trade statistics nor the GTAP database contains any sectoral data on trade using electronic transmissions isolated from other cross-border activities. Therefore sectoral tariffs are weighted by the share of according to the share the dutiable activities would apply in that sector.

However, the term ‘electronic transmissions’ is also very broad and could incorporate activities falling under several different categories of goods and services.[8] According to the most detailed available input-output (IO) table, at least the following activities could – from a purely economic (rather than legal) perspective – be subject to a tariff:[9]

- Online retailing services, i.e. intermediation by non-store retailers: NAICS 454000 (trd)

- Internet publishing, web search portals, directories and information services: NAICS 5111A0, 519130 (cmn)

- Motion picture and video industries; sound recordings: NAICS 512100, 512200 (ros)

- Software publishing, programming: NAICS 511200, 541511 (obs)

- Data hosting, processing, systems and data communications: NAICS 518200, 541512, 517210, 518200 (obs)

- Advertising: NAICS 541800 (obs)

These activities fall under four sectors in GTAP, namely wholesale and retail trading services (trd), recreational and other services (ros), communications (cmn), and business services n.e.c. (obs).

Two factors weigh the applied tariffs in each sector described in Figure 11. First, we adjust the tariff increases according to the share of dutiable activities in respective GTAP sector. As cross-border transactions in these industrial activities depend on electronic transmissions to a more considerable extent than purely domestic transactions, the use of IO tables as proxies is likely to be underestimations.

In the second step, we account for the fact that some cross-border activities take place online as well as offline. For example, sound recordings are within the scope of ET tariffs but are still delivered online as well as via physical media – and only the former will be affected by the new tariff. As a further precaution against overestimation, the following activities are further adjusted to account for traditional trade available industry data on online revenues:

- Global revenues on digital video (including TV/Video on demand and electronic-sell-through, i.e. downloads) was approximately 17% of total movie production and distribution;[10]

- The global music industry revenues for both streaming and downloads account for 54% of the global sales in sound recordings (Ifpi, 2018);[11]

- Based on the ITU reports on global telecom retail revenues in 2019, data transmissions (i.e. non-voice revenues) are estimated to 60% and 70% of wireline and wireless telecommunications respectively;[12]

- Online advertising accounts for 45% of global advertising expenditure in all media according to Zenith Adspend Forecast (2018).[13]

Finally, some products and services are entirely new and have no offline equivalents that have an applied tariff rate in the schedules. Rather than imposing an arbitrary tariff rate in our scenarios, we impose the same rate assumed by UNCTAD (2019) for the sake of consistency between the two studies. Other countries also reciprocate the same tariff rate in Scenario 2 in respective GTAP sector. The ‘developing country’ (DC) group applies an average rate for developing countries in UNCTAD 2019.

Figure 11: Tariff increases applied in the Scenarios, by sector and country Source: Authors’ analysis and UNCTAD, 2019

Source: Authors’ analysis and UNCTAD, 2019

As we see above, the applied rates are consistently low as we only take into account activities trading via ‘electronic transmissions’ and the share of sales that takes place online. The majority of the tariff imposed on the GTAP sectors in this exercise are below 1%.

[1] Purdue University, GTAP Consortium Members. Accessed at: https://www.gtap.agecon.purdue.edu/about/consortium.asp.

[2] Purdue University, Global Trade Analysis Project (2018). GTAP Models: Current GTAP Model. Accessed at: https://www.gtap.agecon.purdue.edu/models/current.asp.

[3] Aguiar, Narayanan, McDougall, An Overview of the GTAP 9 Data Base, Journal of Global Economic Analysis, 1(1), 181-208, 2016.

[4] Jean Fouré, Agnès Bénassy-Quéré & Lionel Fontagné , 2012. “The Great Shift: Macroeconomic projections for the world economy at the 2050 horizon,” CEPII Working Paper 2012- 03, February 2012, CEPII.

[5] The substitution effect for a particular flow (k,r,s) increases in divergence of import tariff for good k from regions r to s, from the weighted-average tariff of s. Since higher weight means lower divergence, this effect decreases in import-shares of region r in the total imports by region s of the good k.

[6] An increase in tariffs typically would reduce the corresponding imports, if imports and domestic are substitutable. This may potentially reduce tariff revenue despite the increase in tariffs. We avoid such a situation by assuming that imports do not substitute domestic production.

[7] In addition to the four developing economies that are individually represented in the study, the GTAP region includes all the developing countries available in the database, i.e. Mongolia, Cambodia, Lao People’s Democratic Republic, Philippines, Vietnam, Bangladesh, Pakistan, Sri Lanka, Bolivia, Honduras, Nicaragua, El Salvador, Dominican Republic, Jamaica, Puerto Rico, Trinidad and Tobago, Ukraine, Kyrgyzstan, Tajikistan, Georgia, Jordan, Egypt, Morocco, Tunisia, Cameroon, Cote d’Ivoire, Ghana, Nigeria, Kenya and Zambia. The dataset and our analysis include all developing countries through composite regions in the dataset. For example, the regions ‘xsa’ in GTAP denotes ‘Rest of South Asia’, which includes all the remaining countries like Afghanistan, Bhutan and Maldives.

[8] Unlike regulatory restrictions on cross-border data flows (e.g. tariffs are not imposed on goods or services that generate data, for example on motor vehicles or financial services.

[9] US BEA, 2012 Supply Table, 2015.

[10] Based on IBIS, Global Movie Production & Distribution Industry Market Research Report, 2019; Statista Digital Market Outlook – digital video revenue worldwide 2016-2022, by type, 2019.

[11] Ifpi, Global Music Report, 2018.

[12] ITU, Trends in Telecommunication Reform, 2016.

[13] Zenith Adpsend Forecast, 2018; see also Marketing Interactive, Internet advertising tops in global ad spend once again, but growth is slowing, 25 September 2018, accessed at: https://www.marketing-interactive.com/internet-advertising-tops-in-global-ad-spend-once-again-but-growth-is-slowing/.