Has Globalisation Really Peaked for Europe?

Published By: Lucian Cernat

Subjects: European Union WTO and Globalisation

Summary

This paper builds on the recent arguments put forward by Richard Baldwin and others debunking the myth that we enter a period of de-globalisation. The paper argues that globalisation is a complex phenomenon that requires detailed, firm-level indicators going beyond simple aggregate metrics. When using such indicators, the picture is much more nuanced and, in the case of Europe, the role of global trade is as important as ever for hundreds of thousands of companies and millions of jobs supported by global trade flows. A strong participation in the “new globalisation” is also key for the future EU competitiveness in technology-driven sectors.

The views expressed herein are those of the author and do not reflect the official position of the European Commission. I would like to thank Oscar Guinea for his valuable suggestions and useful comments that improved the content of this policy brief.

1. Debunking globalisation: Where do we stand?

Globalisation is a complicated phenomenon that is often oversimplified. The common conception is that the world has entered a period of reduced trade activity as countries have closed themselves off to trading with other markets. However, Baldwin (2022) examined the common indicators that are used to make these distinctions. He makes a number of interesting and nuanced claims, which could probably best be summarised by paraphrasing Mark Twain’s famous quip: the reports about the death of globalisation are greatly exaggerated.

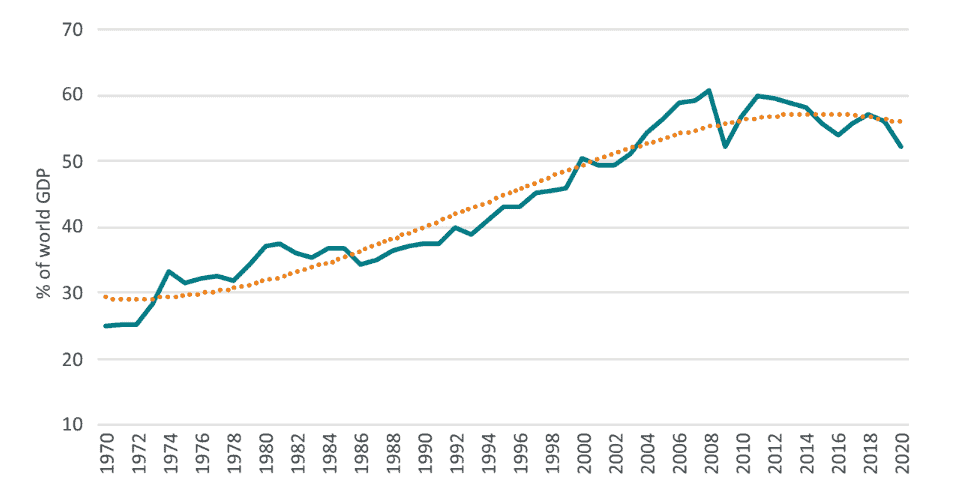

One of the key indicators referred to as evidence of “de-globalisation” or “slowbalisation” is the declining share of trade in global GDP.

Figure 1: World trade in goods and services, as a share in world GDP (1970-2020)

Source: World Bank, World Development Indicators.

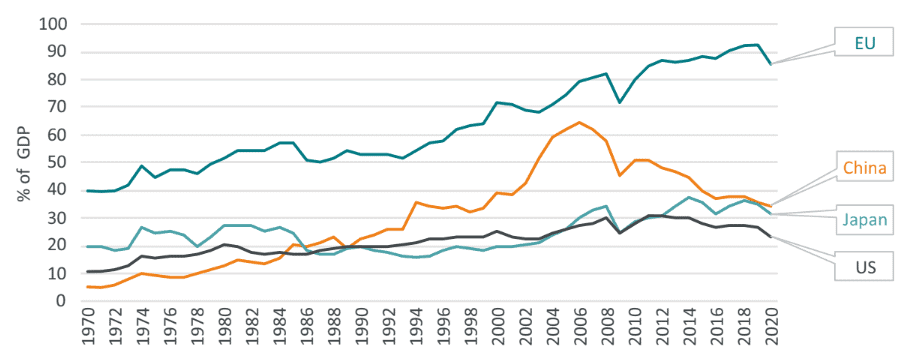

Baldwin (2022) calls this “slowbalisation” argument, which is based on very aggregate global trade flows and world GDP, a “lazy” peak globalisation narrative. He argues convincingly that globalisation is a complex trade phenomenon that needs to be unpacked and looked at through the lens of more disaggregated indicators. For instance, it is enough to simply plot the evolution of trade as a percentage of GDP for each of the top trading partners (e.g., the EU, US, China, Japan) and the de-globalisation story becomes more nuanced. The evolution of trade over GDP looks rather different for the EU compared to the other major trading nations.

Figure 2: Trade in goods and services as a percentage of GDP

Source: World Bank, World Development Indicators. EU trade date includes intra-EU trade.

Other earlier analyses pointed to similar conclusions. For instance, van der Marel (2020) argues that globalisation is not in decline. Instead, a new “intangible globalisation” is emerging that is based on growing global influx of digital services, research and development, data, ideas, and other exchanges that are not always captured in traditional trade statistics. Three important conclusions come out of these analyses. First, as Baldwin (2022) clearly shows, the EU trade over GDP metric of globalisation has not really peaked. Second, to have a correct understanding of recent developments, one needs to use more disaggregated trade metrics than simple trade over GDP ratios. Third, globalisation is a multi-dimensional process and must be measured across a wider range of economic indicators.

2. Measuring globalisation: Using “Trade Policy 2.0” firm-level indicators

One way to measure the extent to which globalisation is shaping trade and economic relations is to rely on more disaggregated indicators, ideally firm-level trade indicators. As it is now generally accepted in economics, nations do not trade while firms do. Having a good grasp of trade policy realities would also require such good firm-level trade indicators, leading to a “Trade Policy 2.0” approach (Cernat, 2014).

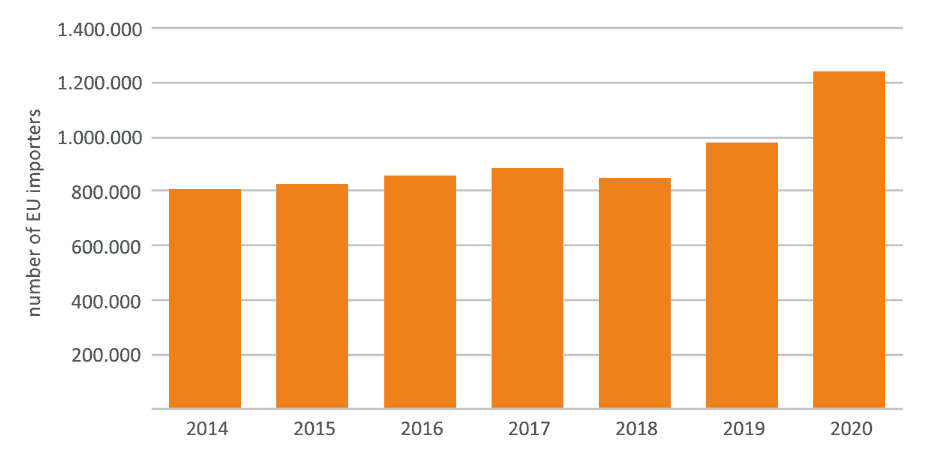

How would globalisation look like, particularly the EU’s global position in international trade, when using such firm-level, disaggregate indicators? While comprehensive trade flow information at firm-level across the EU remains limited, there are a handful of indicators that allow us to zoom in and have a more detailed view at the recent evolution of “Global Europe” that go beyond the total value of exports. One such detailed indicator that can capture the extent to which the EU has become more integrated into the global economy is the number of firms in Europe that engage in trade, notably the number of EU firms that rely on imported products for their economic activities. As can be seen in Figure 3, the number of EU importing firms kept growing, surpassing the symbolic milestone of 1’000’000 firms in 2019 and reaching a new record of more than 1.2 million firms in 2020.

Figure 3: Number of EU importing firms Source: Author’s elaboration based on Eurostat (2022a).

Source: Author’s elaboration based on Eurostat (2022a).

This finding is quite remarkable if one thinks of the unprecedented shocks that global supply chains suffered in recent years and the massive decline in trade witnessed globally as a result of the COVID-19 pandemic and other trade shocks (e.g., the semiconductors crisis crippling automotive production lines, the blockage of the Suez Canal, geopolitical tensions, high shipping costs and port congestions, etc.) At the same time, this positive trend is in line with the economic literature indicating that a significant share of the recent decline in trade was at the intensive margin (reduction in the volume of trade flows) rather than the extensive margin (a reduction in the number of companies engaged in trade). Beyond this EU trend, more in-depth firm-level analyses for some EU countries confirm that a large share of trade adjustment took place via a decrease in exports and imports (either in terms of volume or product varieties) and not so much via a reduction in the number of firms engaged in trade (see Bricogne et al. (2012) for a firm-level analysis of French exporters and Behrens et al. (2014) for an in-depth analysis based on Belgian firm-level trade data).

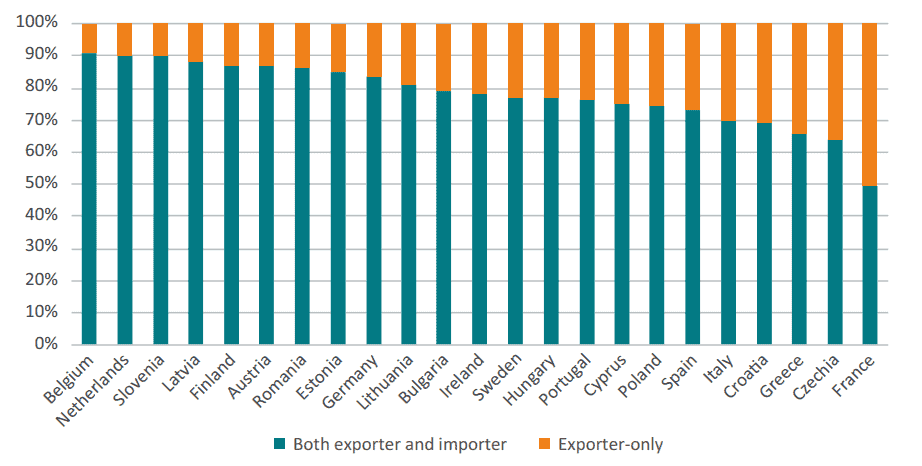

Another way to measure globalisation is to look at the extent to which “Global Europe” requires well-functioning, diversified supply chains. There are two detailed indicators that can shed light on this aspect. The first one captures the importance of imports for EU exporters. As seen in Figure 4, for the vast majority of EU Member states, more than 70% of exporters are also importers. A second detailed indicator to gauge the complexity and the diversity of global sourcing patterns for EU trade is to look at the number of suppliers for every imported product in the EU at a very disaggregated product levels (Figure 5).

Figure 4: The importance of imports for EU exporters, 2020 (Percentage of two-way traders in total number of EU exporters)

Source: Author’s elaboration based on Eurostat (2022a).

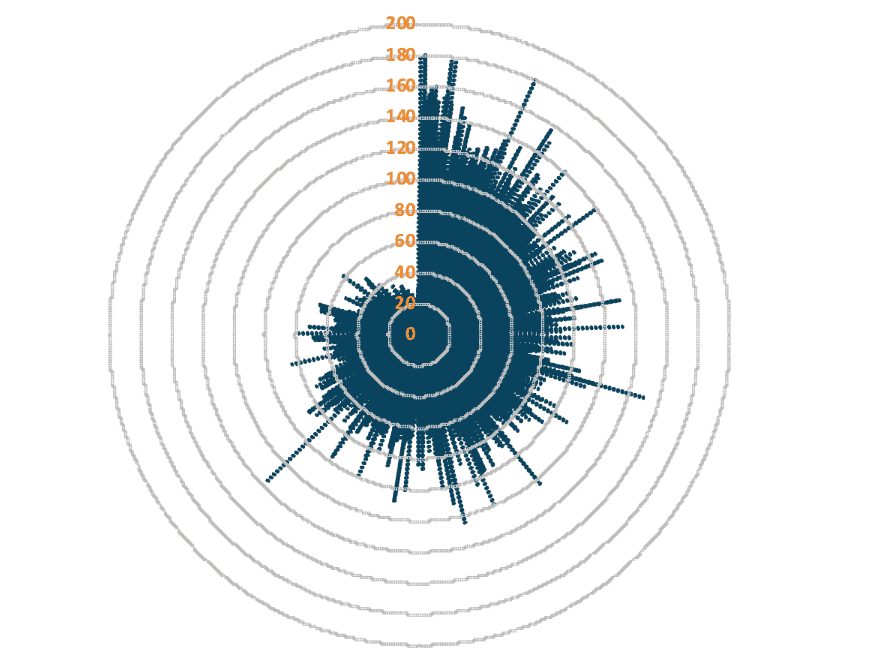

Figure 5: Number of extra-EU suppliers Legend: Author’s elaboration based on official 2019 EU import statistics. The chart depicts over 9000 products defined at 8-digit level, ranked by EU import value and the number of supplying countries.

Legend: Author’s elaboration based on official 2019 EU import statistics. The chart depicts over 9000 products defined at 8-digit level, ranked by EU import value and the number of supplying countries.

Even when looking at one of the most disaggregated product levels of EU imports (8-digit product codes), the complexity and diversity of EU supply chains is staggering. EU imports come from a wide range of suppliers. Out of the over 9000 individual products that are imported in the EU, many of them come from over 100 non-EU countries. In fact, the average number of foreign suppliers for EU imports across the total range of imported products is 68 countries. In addition, it is safe to assume that, in the vast majority of cases the diversity of EU import sources at firm-level is even greater, since each country usually has more than one individual exporting firm for each of these products.

3. When trade means jobs: How much employment depends on “Global Europe”?

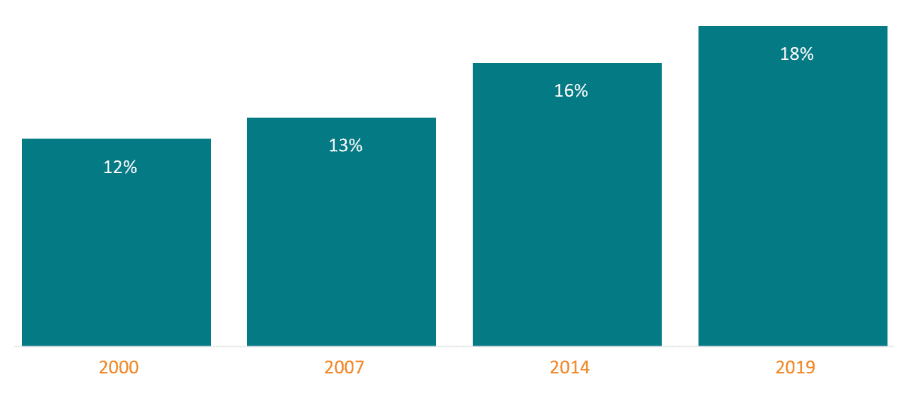

Global trade flows are not just important for over 1.2 million EU importing firms, they are also a major source of economic activity for around 675’000 direct exporters, 94% of which are small and medium enterprises (Eurostat, 2022a). Beyond these direct exporters, many other EU (and non-EU) firms that are suppliers of intermediate goods and services for these EU direct exporters benefit as well from the “Global Europe” effect along global supply chains. Such participation in global supply chains has a positive effect on jobs and wages for the employees of these firms. The share of trade-related EU employment in total EU employment increased from less than 12% in 2000 to more than 18% in 2019 (Figure 6). Export-related jobs in the EU are, on average, 12% better paid than other jobs. The export wage premium ranges from 5% to 14%, depending on workers’ skill level and occupational profile (Kutlina-Dimitrova and Rueda-Cantuche, 2021).

Figure 6: Share of total EU employment supported by extra-EU exports

Source: Based on Kutlina-Dimitrova and Rueda-Cantuche (2021)

The “Global Europe” effect has a positive trade and jobs nexus in third-countries as well. As indicated earlier, the 1.2 million EU importers rely on complex and diversified supply chains. A significant share of these products is further exported from the EU to the rest of the world, generating growing, positive jobs effects around the world.

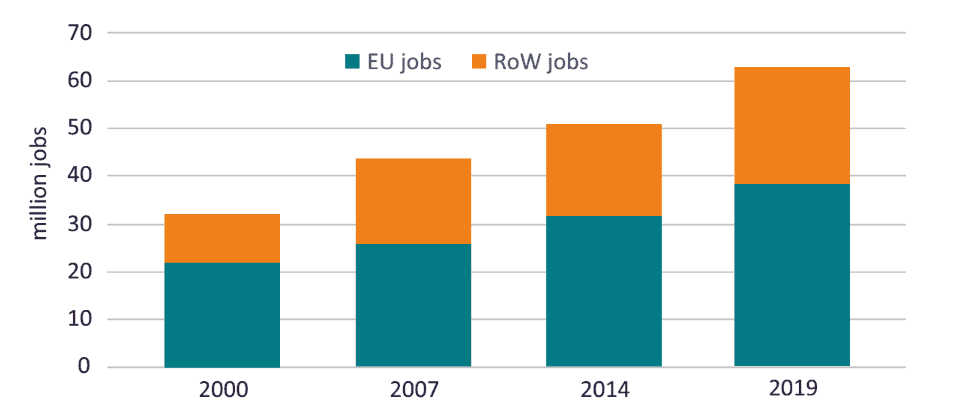

In 2000, for instance, extra-EU exports supported almost 22 million EU jobs and 11 million jobs in the rest of the world. By 2019, EU jobs supported by trade increased to 38 million and the number of non-EU jobs more than doubled to 24 million jobs (Figure 7). Hence, so far, the importance of globalisation for job creation did not peak, at least until 2019.

Figure 7: EU exports supported jobs at home and abroad

Source: Based on Kutlina-Dimitrova and Rueda-Cantuche (2021). RoW stands for “rest of the world”.

As pointed out by other analyses, services have a growing importance not only in global trade but also in the number of jobs supported by trade flows. In the EU, when accounting for both direct services exports (under GATS rules) and the “embedded services” exported as part of goods (mode 5 services), the number of services jobs represents 58% of all the total trade-supported jobs in Europe (Kutlina-Dimitrova and Rueda Cantuche, 2021). Many of the trade-supported jobs in Europe are found in small and medium enterprises (SMEs) that are successfully engaged in global supply chains; over 13 million jobs in Europe depend on EU SME exports (Cernat, Jakubiak, Preillon, 2020).

4. The importance of globalisation for Europe: What do people really think?

In Europe, globalisation (especially in its trade and investment elements) did not always get good press. While certain societal groups can be well organised and very vocal in expressing their views against globalisation, it is always useful to look at the “big picture” and see what society at large thinks about globalisation or the importance of trade for Europe. One good source of such views are the regular thematic Eurobarometer surveys that cover these issues. For instance, a 2010 Eurobarometer found at the time that 44% of Europeans think they have benefitted from trade, while almost 20% of them did not know if they were positively or negatively affected by trade (European Commission, 2010).

Fast forward almost a decade later and, in 2019, another Eurobarometer survey found that 60% of respondents felt they personally benefit from international trade, primarily through a wider choice of products and lower prices. This is a significant increase (16 percentage points) on the previous poll in 2010. The 2019 survey also reveals that 71% of respondents believed the EU as common trade bloc is more effective at defending their country’s trade interests than any of the 27 EU Member States acting alone (European Commission, 2019).

Moving from opinions to trade statistics, the consumers’ “love of variety” is also reflected in the importance of globalisation measured by the share of imports in overall household consumption. Imports of non-EU origin accounted in 1996 for only 6.5% of total EU household expenditures. In 2016, this share almost doubled reaching around 11% (Cernat et al, 2018). While the importance of trade in our every day’s life needs no statistical proof, it is revealing that despite the “hyper-globalisation” claims, the share of imports in total household expenditure remains fairly small.

5. The future of globalisation: Some open-ended questions

So far, we have seen that globalisation has not really peaked for Europe and one can only hope that past indicators of globalisation are a good indication for the future. However, globalisation is shaped by many powerful and unpredictable forces, and one should recognise that there is also a possibility that globalisation might peak in the future. When faced with so many uncertainties, an educated guess is often the only option.

What educated guesses can we make about the future forces that will shape globalisation, and the future of “Global Europe”? Some forces will work against globalisation, others will keep pushing towards more global economic integration. Take for instance the consumers’ “love of variety”, mentioned earlier. If globalisation would satisfy this human need for greater (including imported) varieties, trade in consumer goods will not fade away. One good indication is perhaps the rapid increase in global e-commerce. In 2010, only around 4% of EU consumers engaged in online purchases from non-EU sellers. In 2021, 12% of EU consumers did so, buying a wide range of products online from foreign (non-EU) sellers (Eurostat, 2022b). Moreover, trade has also been a major driver of development and poverty reduction. With such positive income effects for millions of people around the developing world comes an increase demand for quality products which are often imported and more “love of variety” for a growing middle-class in the developing world.

Another factor that might lead to an increase in the “Global Europe” effect is climate change. Climate change will increase food insecurity in many parts of the world and hence the need for more agrifood trade. This is because climate change will lead to extreme weather events which may ruin harvests but not all harvests at the same time, everywhere. Hence, the need for international agricultural trade will likely increase. The EU continent is well placed to maintain a leading role in food production and trade. Moreover, to fight climate change we need both domestic and imported new technologies that would make our economies more resilient. Since not all countries will be lead innovators in climate-critical technologies, global trade will remain part of the climate change solution.

Given the growing impetus to adopt technological change, this may increase the reliance of many countries on raw materials located elsewhere in the world. Think about the exponential increase in the demand for electric batteries, for instance, and the need for critical raw materials that tend to be highly concentrated around the globe. Therefore, the expansion of such new technologies would require more rare metals and chemical elements that are concentrated in a handful of places in the world, thus requiring an increase in trade flows.

New technological disruptions will have an ambivalent impact on trade flows: robots will reduce some trade flows but 3D printing, for instance, increased trade flows somewhat counterintuitively (Freund et al, 2019). In general, the disruptive technological changes unfolding under our eyes combined with the climate and digital transition will require more capital goods, in both the developed and the developing world. Even if robots will replace labour, and hence erode one of the comparative advantages that led historically to impressive global trade flows, not all countries will produce robots. Machinery is nowadays one of the most important categories of international trade. Trade in robots might be the new “machinery” sector.

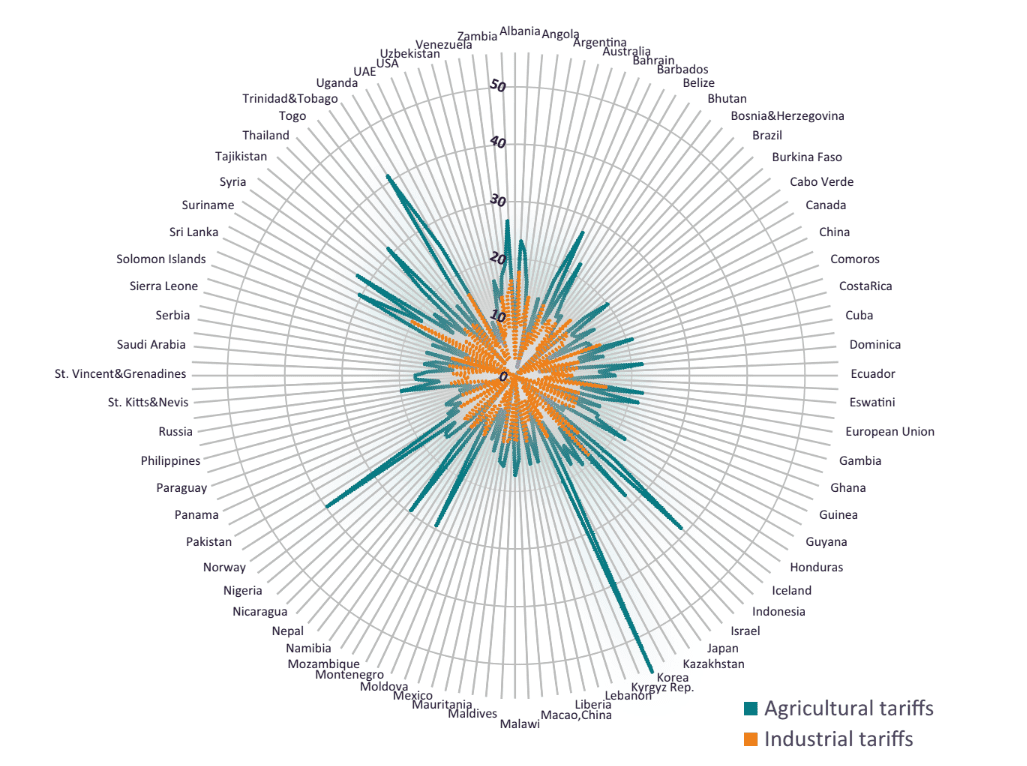

Even if trade policy is not the main driver of trade flows, trade policy has not run its course. While it’s common to consider that the current level of trade flows has been also the result of major trade liberalisation initiatives (e.g., multilateral rounds, free trade agreements), industrial tariffs around the world can still be pretty high (Figure 8). Add then agrifood tariffs and you realise that there is plenty of scope for trade initiatives that will increase global trade in goods in the future. If tariff peaks are not convincing enough, add then other trade distortions and protectionism measures (e.g., technical barriers to trade, buy local policies affecting large segments of public procurement markets) which can be even more trade-restrictive than regular tariffs and the scope for higher global trade flows becomes apparent. Given that, by definition, trade barriers in services are non-tariff regulatory measures, if services become the new driver of globalisation, then this requires a renewed effort on promoting global regulatory cooperation as one of the most important areas for the future.

Figure 8. Agriculture and industrial tariffs for goods (MFN applied tariffs (%), simple averages)  Source: Author’s elaboration based on the WTO World Trade Profiles 2022.

Source: Author’s elaboration based on the WTO World Trade Profiles 2022.

The distinction between goods and services will continue to become less and less relevant, given the growing interdependence between trade and technology. A whole range of new technologies (big data, AI, 3D printing, IoT, robotics, machine learning, etc.) will affect both the manufacturing process and the type of functionalities that “smart” products will possess. Even products considered “simple” will continue to acquire smart functionalities in the near future. Digital technologies will continue to “eat” into the share of manufactured goods (from cars to pacemakers) and companies engaged in such activities will remain global players. Apple, for instance, uses more than 170 direct suppliers (located in 30 different countries worldwide) for the parts and components used in their products. Now consider the number of services suppliers that are part of the Apple iOS App store. In 2017, there were almost 500’000 active mobile app developers registered with Apple and over 700’000 app developers registered in Google Play (Ceci, 2022). Like hardware suppliers, software and app developers are also scattered around the world, in the United States, China, India, Brazil, Japan, Ukraine, or Romania. Our lifestyle will continue to increase digital trade flows, since software applications have virtually no physical limitations, except perhaps the memory of your iPhone.

Global trade is not an environment where only big firms thrive. The vast majority of EU exporters and importers (over 80%) are small and medium enterprises (SMEs). EU SMEs participating in global supply chain are well placed to remain well connected in the future. Many SMEs are competitive in digitally intensive goods. Some EU SMEs mature and grow to become successful unicorns. EU SMEs are also specialised in products with lower CO2 emissions than average levels: 70% of EU SME exports belong to low and medium-low CO2 emission intensity.

All in all, there are many reasons to remain cautiously optimistic about the future. But with so many competing forces affecting the prospects of globalisation, it is not surprising that the jury is still out, and opinions differ. If the future remains hard to predict, especially for major societal trends, it is fair to assume that humanity will keep some of its fundamental traits. If the future is hard to predict, our past is not. Archaeological evidence indicates that from the early days of humanity trade played a critical role in ensuring the well-being of societies. As The Economist put it, “free trade and division of labour might be responsible for the very existence of humanity” (The Economist, 2005). One may therefore say that Homo Sapiens was born as Homo Mercatus. This helps putting things into the longer-term perspective: whether we trade more or less in the short-term, or in any given year, becomes less relevant. What really matters for the prospects of globalisation in the longer term is that trade is part of our DNA.

References

Baldwin, Richard (2022) The peak globalisation myth: Part 1, CEPR VoxEU column, 31 August 2022. Available online at https://cepr.org/voxeu/columns/peak-globalisation-myth-part-1

Behrens, K., Corcos, G., and Mion, G. (2013), Trade Crisis? What Trade Crisis?, Review of Economics and Statistics 95, no. 2: pp. 702-709.

Bernard, A. B., Bradford Jensen, J., Redding, S. J. and Schott, P. K. (2007) Firms in International Trade, The Journal of Economic Perspectives Vol. 21 (3), pp. 105-130.

Bricongne, J.C., Fontagné, L., Gaulier, G., Taglioni, D., and Vicard, V. (2012), “Firms and the Global Crisis: French Exports in the Turmoil, Journal of International Economics 87, no.1: pp. 134-146.

Ceci, L. (2022) Number of developers per app store worldwide 2017, Statista. Available online at: https://www.statista.com/statistics/276437/developers-per-appstore/

Cernat, L (2014) Towards “Trade Policy Analysis 2.0”: From National Comparative Advantage to Firm-Level Trade Data, Chief Economist Noted 4/2014, DG TRADE, Brussels.

Cernat, L., Gerard. D., Guinea, O., and Isella, L. (2018) Consumer benefits from EU trade liberalisation: How much did we save since the Uruguay Round?, Chief Economist Note 1/2018, DG TRADE, Brussels.

Cernat, L. (2020) Blockchain for Trade: the next gold standard or the fool’s gold?, ECIPE Blog, October 2020. Available online at https://ecipe.org/blog/blockchain-for-trade/

The Economist (2005), “Homo economicus?” available at http://www.economist.com/node/3839749

European Commission (2010), “International Trade Report”, Eurobarometer, available at http://ec.europa.eu/commfrontoffice/publicopinion/archives/ebs/ebs_357_en.pdf,

European Commission (2019) Europeans’ attitudes on Trade and EU trade policy, Special Eurobarometer 491, November 2019.

Eurostat (2022a) Trade in goods by enterprise characteristics, available online at https://ec.europa.eu/eurostat/web/international-trade-in-goods/data/focus-on-enterprise-characteristics-tec

Eurostat (2022b) Internet purchases by individuals database, available online at https://ec.europa.eu/eurostat/web/digital-economy-and-society/data/database

Freund, C., Mulabdic, A., and Ruta, M. (2019) Is 3D Printing a Threat to Global Trade? The Trade Effects You Didn’t Hear About, World Bank Policy Research Working Paper No. 9024, Washington.

Kutlina-Dimitrova, Z. and Rueda-Cantuche, J.M (2021) More important than ever: employment content in extra-EU exports, Chief Economist Note 2/2021, DG TRADE, Brussels.

van der Marel, E. (2020) Globalisation Isn’t in Decline: It’s Changing, ECIPE Policy Brief 6/2020, Brussels.

WTO (2022) World Tariff Profiles 2022, World Trade Organisation, International Trade Centre, UNCTAD, Geneva.