Globalisation Isn’t in Decline: It’s Changing

Published By: Erik van der Marel

Research Areas: New Globalisation WTO and Globalisation

Summary

Globalisation isn’t in decline; it is simply changing. Although the COVID-19 crisis has seen a dramatic decline in goods trade, investments and the movement of people, a new type of globalisation is emerging. This “new globalisation” is based on digital services, research and development, data, ideas, and other intangibles. This development has been going on for a while and has evolved more rapidly after the previous global financial crisis (GFC) in 2008-9. For instance, the GFC caused digital services trade to significantly “de-link” from goods-related services trade. This pattern illustrates that the COVID-19 crisis will likely mark another break in trade patterns and that future growth in globalisation will depend crucially on digital trade and cross-border exchange in intangibles.

1. Introduction

Globalisation is in trouble and some predict that the world is now entering a period of rapid de-globalisation. And several observations give some support to that view. Global trade, for instance, had slowed down already before the COVID-19 crisis. Since the global financial crisis (GFC) in 2008-9, merchandise trade has been unable to return to its previous trend of growth.

Meanwhile, the US and China have ramped up their tariff rates to reduce imports. Supply chains have stagnated, and investments growth – which drives much of the supply chain activity – has lost pace. Real trade liberalization hasn’t happened for a long time. If we want gloom forecasts about globalisation, we don’t need to look any further than the World Trade Organization (WTO): this high church of global trade predicts goods trade to drop by 13-32 percent because of the COVID-19 crisis (WTO, 2020a).

However, we’re missing the big picture if we only look at the developments in goods trade. Globalisation covers more than physical goods and commodities, and there is a new and different kind of globalisation that is dawning. Services, ideas, data, information, and R&D are increasingly setting the tone of global commerce. Even though the global share of these non-physical flows is still relatively small, their activities have substantially internationalized in recent years.

Services trade now represents 20-25 percent of total trade – and it has been growing faster than goods trade for several years. Knowledge diffusion has grown by a factor of 1.4 since the GFC, and multinational firms are dramatically expanding their efforts to build new R&D hubs around the world.[1] Global data flows have grown exponentially, and trade in information services – albeit still small – is now also reaching the developing world. The world is still growing many cross-border connections, but it is doing it in different ways than before.

In the policy brief, we will demonstrate that globalisation is undergoing a remarkable shift by becoming more immaterial, non-physical and digital. Economies aren’t entirely de-globalizing: they are deepening global economic integration in new ways.

In our view, looking only at goods trade is therefore misleading. While protectionism is growing in goods trade – and in other forms of global exchange too – the reality is that the force of economic globalisation is likely to remain vitally strong. It’s important to counter protectionism wherever it grows, but it is equally important to avoid pessimistic visions of de-globalisation today.

[1] Knowledge diffusion follows the WIPO’s definition of intellectual property receipts, which are computed as the charges for use of intellectual property i.e., receipts as a percentage of total goods and services trade.

2. Towards an Intangible Globalisation

For a long time, goods trade grew faster than domestic production. This simple indicator to measure globalisation therefore showed an upward trend: countries did not have to rely on domestic producers only for the stuff they required. Instead, countries produced and exported those goods in which they were globally competitive and opened their borders to import the rest they needed.

This led countries to become ever-finely specialized in producing a stage, part or even task of the production chain. Other countries followed suit, producing another part of this supply chain whilst the rest was traded. All this produced a sharp growth in goods trade, causing the trade-to-production ratio to rise for decades.

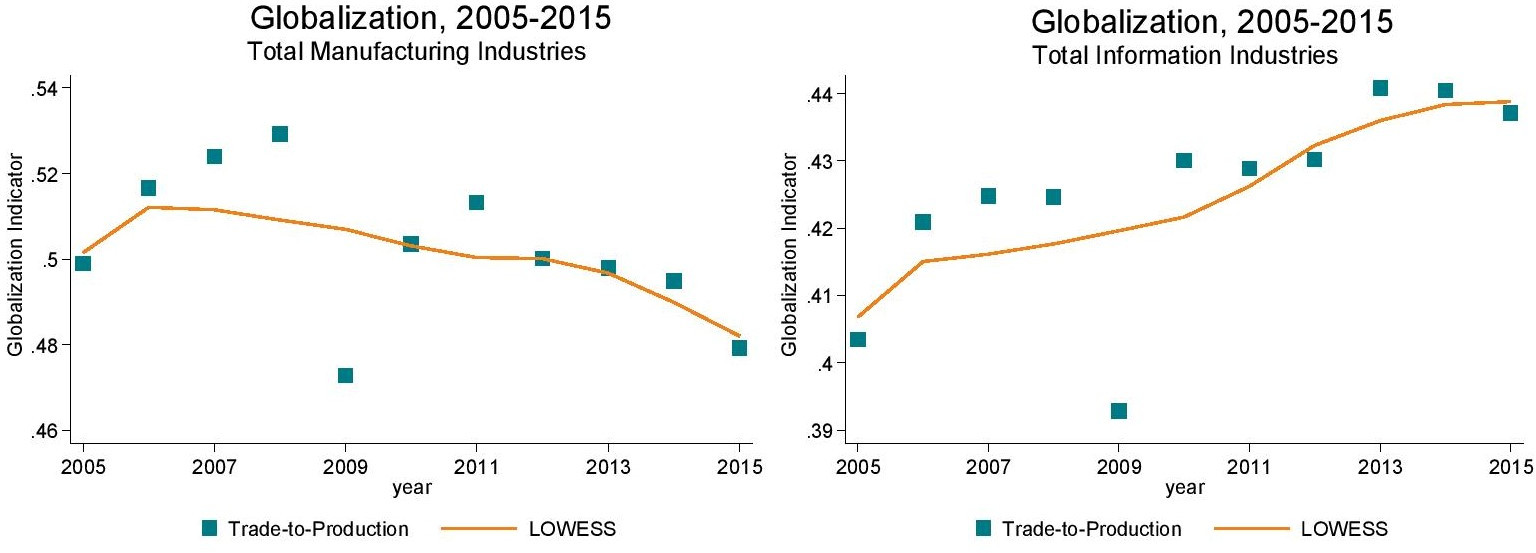

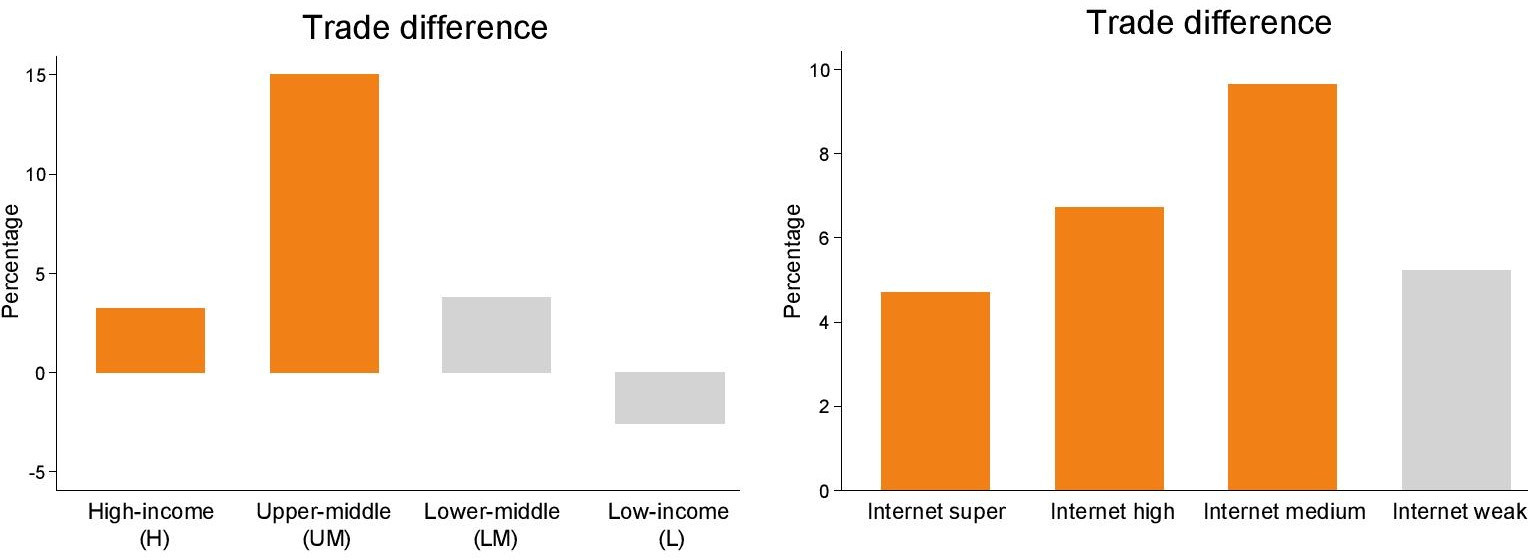

That part of globalisation, however, is in decline (Figure 1, left-hand panel). China’s integration to the world economy has matured and Eastern Europe’s integration into the European Union (EU) economy isn’t growing at past rates. These two trade integrations were important drivers for the growth in goods trade because China and Eastern Europe were the most popular outsourcing destinations. Meanwhile, many countries have become hesitant about the idea of further liberalizing international markets, and the slow-down in actual liberalization has weighed down trade growth too.

But as Figure 1 illustrates, that side of globalisation is in large part based on goods. While total manufacturing globalisation declined, a new kind of international exchange emerged. This other side of globalisation, what the OECD calls “information industries”, are highly digital, in large part intangible, and not seldom work in combination with others as they are non-storable. Publishing services, audio-visuals, IT consultancy, as well as ideas and information, and even some related products, have started to become globalized (Figure 1, right-hand panel).[1]

Figure 1: Changing Nature of Globalisation: Old and New (2005-2015)

Source: author’s calculations using OECD TiVA.

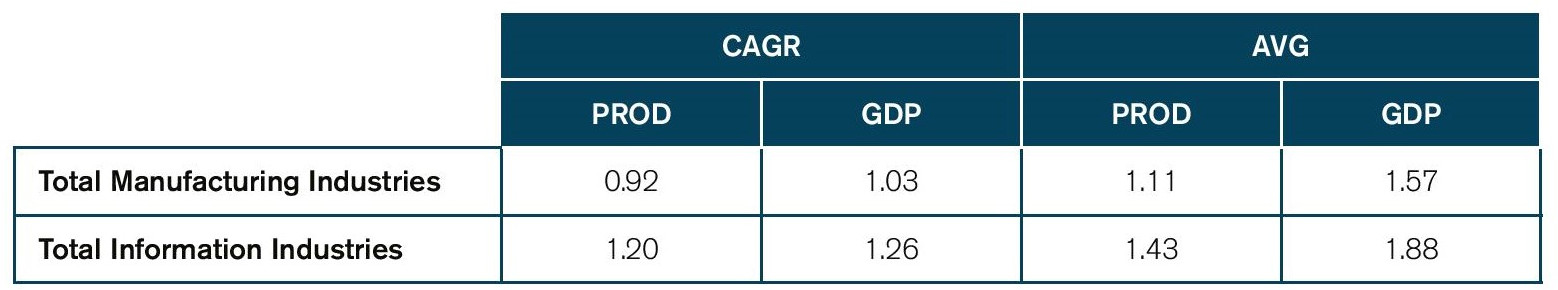

Furthermore, the speed with which these sectors expand globally is also faster compared to goods sectors. Trade economists like to compute so-called trade elasticities, which are the same trade-to-production ratios but expressed in growth terms. This indicator points out whether the growth rate of trade has been increasing more rapidly than income growth. Typically, this trade-to-income relationship is more volatile (Figure A1, bottom panels, in the Annex), but long-term patterns reveal a similar conclusion: the growth of trade has on average increased faster than the growth of production for the information industries (Table 1), indicating dynamic patterns for this new face of globalisation.

Table 1: Long-run Trade Elasticities (2005-2015)

Source: author’s calculations using OECD TiVA. Note: long-run trade elasticities are computed in two ways, namely by computing the compound annual growth rate (CAGR) of trade and production or GDP separately and taking the ratio; or by computing the simple average of the yearly growth rate of the trade-to-income growth ratio. For each method, trade elasticities are computed using production (PROD) and GDP (VALU) as the denominator. Results deviate from standard long-run trade elasticities (which is usually set at 1.4 for goods) due to the use of TiVA data and alternative time periods.

True, the scale of trade in these immaterial activities, including international R&D and ideas, are still low. Likewise, international firms have taken years to build up their supply chains and therefore goods trade won’t disappear. But during the time when trade in goods slowed down, intangible activities found their way to international exchange. The opposite directions of trade flows these two groups experience are a good representation of the changing nature of globalisation.

[1] Total Information Industries are defined following the OECD TiVA definition of “DINFO” which covers ISIC Rev. 4 sectors 58 to 60 (Publishing, audio-visual and broadcasting activities), 61 (Telecommunications), 62 (Computer and IT services), 63 (Information services), and 26 (Computer, electronic and optical products).

3. The Nature of Services is Changing Too

However, the new face of globalisation is not a story of goods versus services, but transcends such a dichotomy. Figure 1 already defined information businesses in a wider sense: it covers the many input-commodities needed to enable these intangible sectors to thrive (see footnote 2). But there are more structural factors that defy the oft-mentioned story that physical and intangible trade are opposites apart.

For starters, newly globalized activities are often highly digital and came into existence in the first place with the help of ICT technologies. As a result, they consume an extreme amount of data, which in themselves have formed an exponential flow across borders in recent years (Cisco, 2016). These new businesses are also mostly intangible (but not always). Their products are also difficult to store, which requires their production to be a continuous stream, frequently based on cross-border collaborations.

Yet more important is the fact that these sectors are also able to turn their required face-to-face interactions into an unbundled series of tasks. That is key, because for that to happen trade costs must be low, which in turn opens the way to become globalized. Obviously, advanced software technologies and the Internet enable firms in these sectors to exploit these global opportunities for international trade.

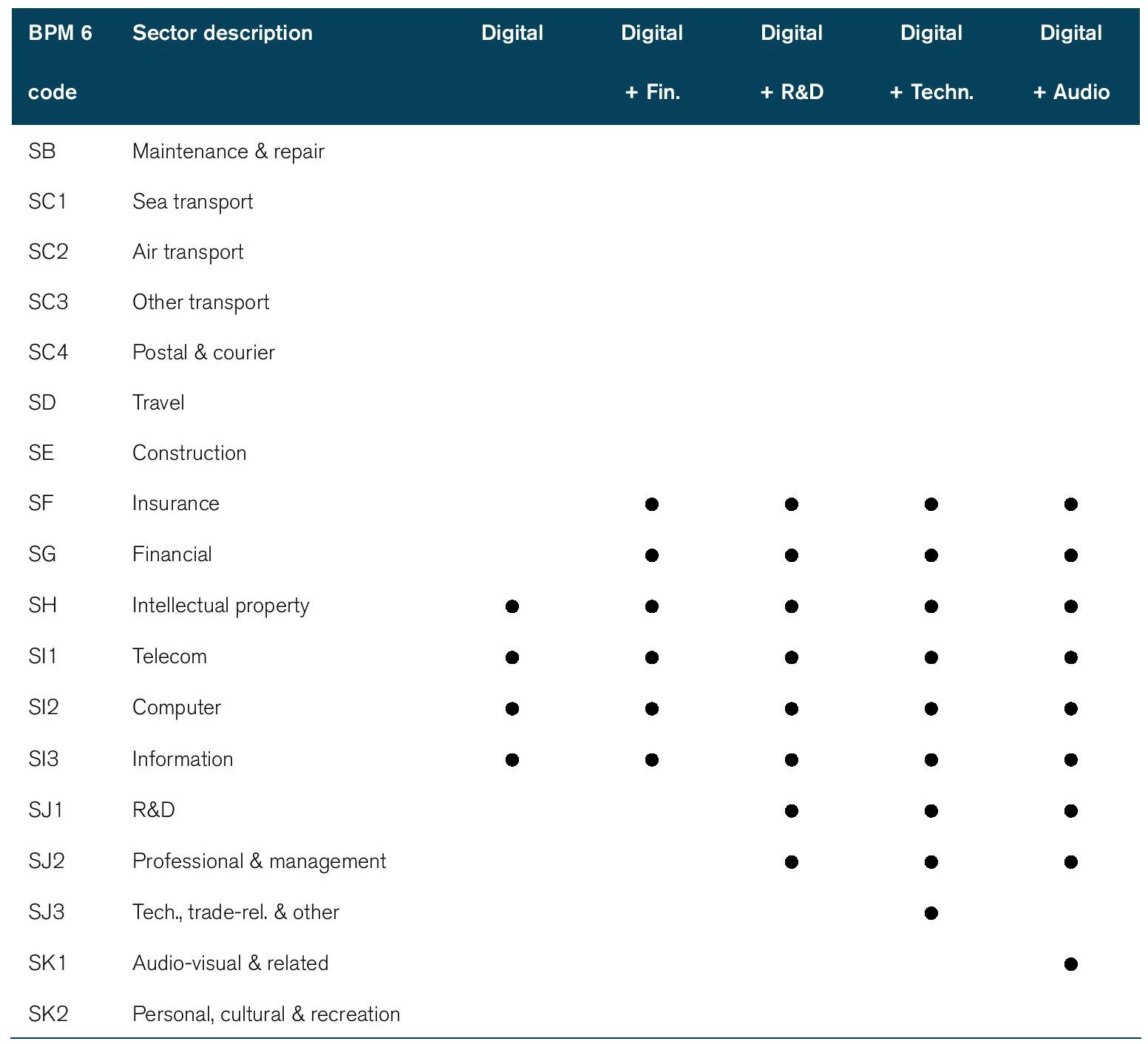

Parts of the services economy itself nicely illustrate this split between conventional and newly developed segments of globalized trade. Many of these modern intangible sectors employ a high amount of advanced software technologies, especially compared to another essential ingredient for economic production, namely labour. By comparing both, Table A1 in the Annex identifies the sectors that qualify as a newly intangible activity.

In doing so, and depending on the threshold defining these high software ratios, it becomes clear that many service activities such as R&D, management, the selling of ideas enshrined in intellectual property rights (IPRs) and information businesses, together form a different basket of commerce that sets itself apart from other more traditional services, let alone many traditional goods.

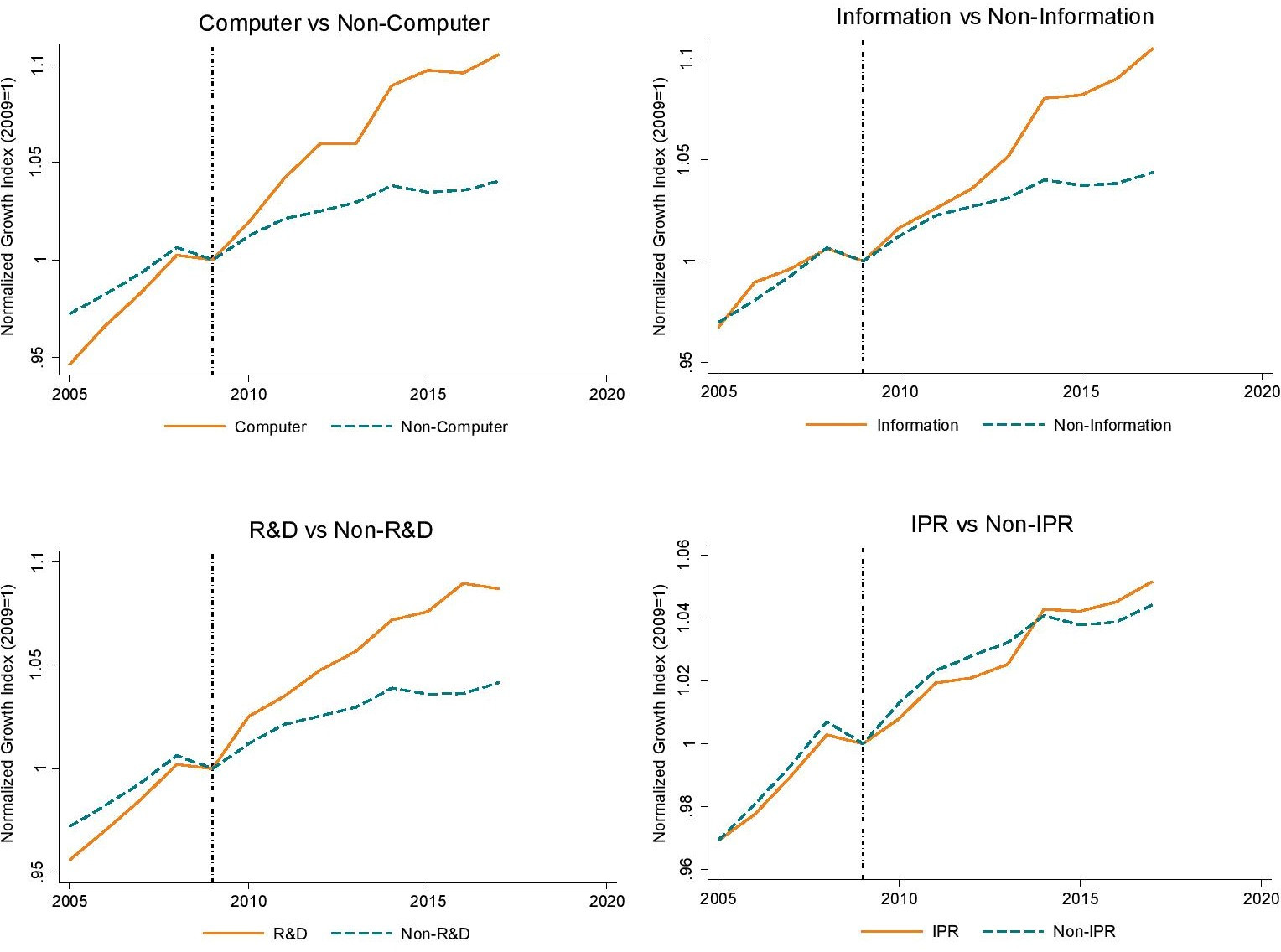

These sectors shape activities in their own right. They are less sensitive to developments in merchandise trade than, for instance, distribution and transport services. They also form a source of positive productivity developments, which is sometimes even higher than in manufacturing industries (IMF, 2018). And even though trade in these fields are still being eclipsed by goods trade, their global participation has experienced a stronger rise compared to any of their traditional equivalents, particularly in the aftermath of the GFC (Figure 2).

Figure 2: Exports of New Intangibles are Growing Faster than Other Services

Source: Author’s calculations using WTO-UNCTAD-ITC data.

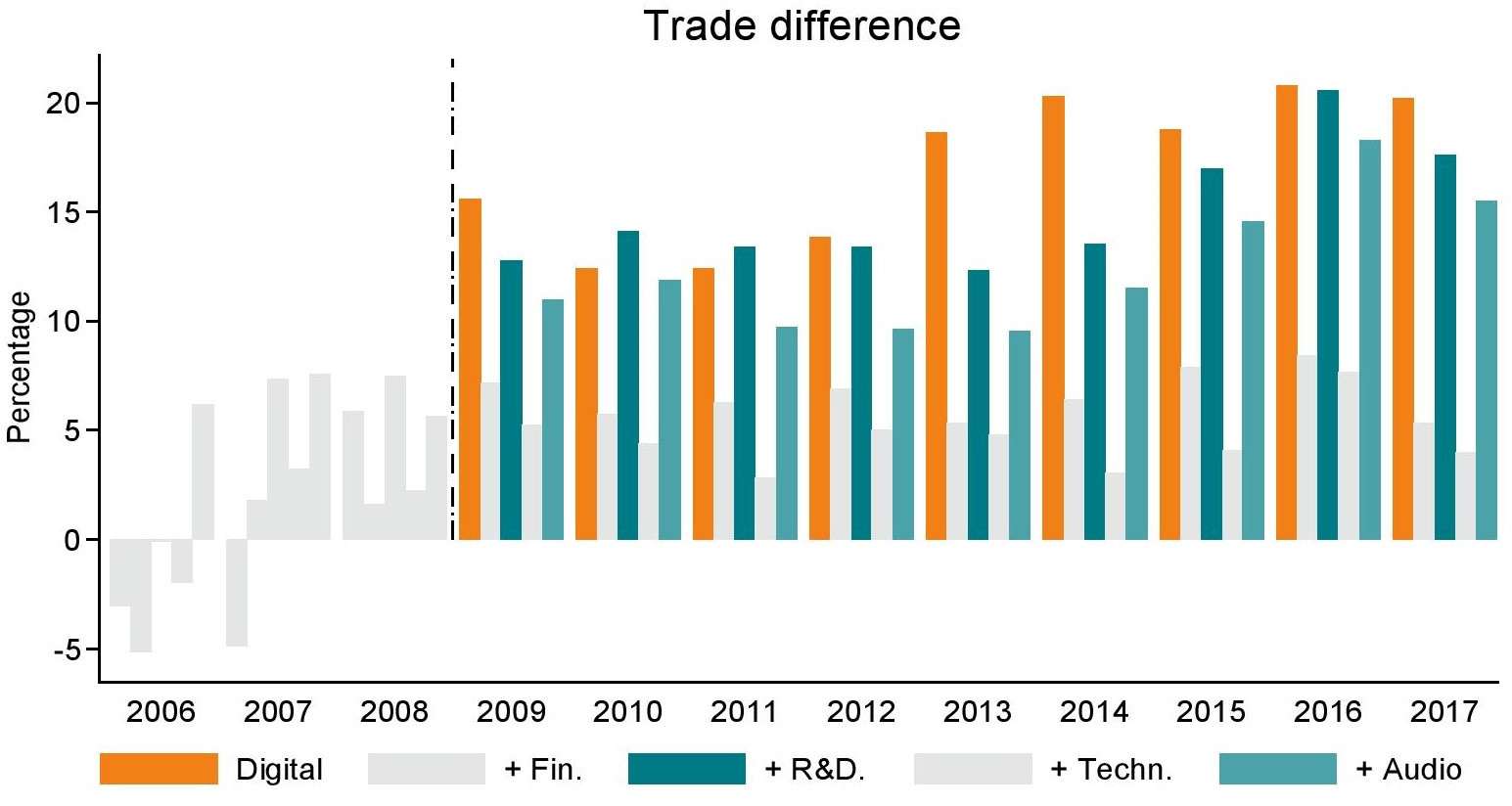

ECIPE research shows that this change in trade patterns started to materialize most probably right after the GFC of 2008, although signs are there that trend had started already somewhat before. Using an econometric method, van der Marel (2020) shows that around that period, trade in R&D, information, and management consultants, started to depart significantly from the rest of the services sector.[1]

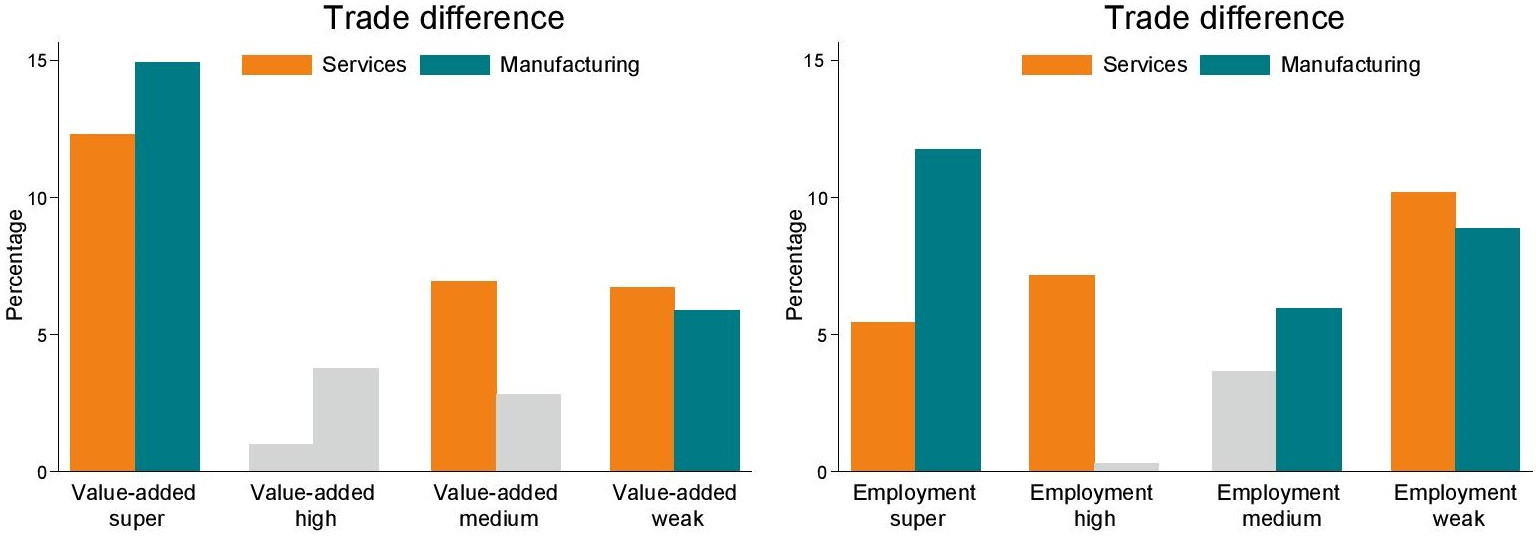

Figure 3 demonstrates this diverging trend. For the various definitions of newly digitalized intangibles, the bar chart measures the trade difference in growth pre and post 2008 to illustrate this trade gap. Not only is the difference in trade growth of digitalized services more important after 2009, as shown by the higher bars; this development also became significant compared to the previous period, as shown by the coloured bars.

Interestingly, when gradually adding other services to this intangible basket, the positive difference in trade between pre- and post-crisis remains. In contrast, by adding technical and business services, finance, or even distribution to this list – sectors that the WTO (2019) incidentally map as requiring face-to-face proximity – this trade divergence disappears.

Figure 3: The GFC of 2008 is a Significant Turning Point for Growth in Intangible Trade

Source: van der Marel (2020)

[1] Given that trade in goods started to decline already since a longer time, and because the entire services sector exhibited growth patterns markedly different compared to goods, testing for the changing composition of services within this sector presented a more interesting research question that making a comparison between goods and services only. Hence, goods trade has been excluded in van der Marel (2020).

4. Who Stands to Gain?

Obviously, some countries profit more than others from these new developments in trade. But it’s hard to predict the future, and even harder to foresee who will be the likely winners and losers from this new trade trend. In any event, much depends on fundamental structures of economies, and whether underlying country endowments match the requirements for this new intangible trade.

Still, given that newly intangible services really took off after the previous crisis in 2008, some conclusive answers from this historical trade event may provide the basis for predicting future developments. Which type of countries gained most from the post-2008 new services take-off? How do these countries behave? And is it true that mainly the richer part of the word experienced most of the trade gains in these newly invisible activities? Some of the answers we found may contradict expectations.

For starters, it is not only developed OECD countries that have gained from the previous trade wave in digitalized services. They did profit, for sure, but the relative increase for the next group of countries on the income ladder, namely upper-middle income countries, was in fact higher (Figure 4, left-hand panel). Countries like Costa Rica, Romania, Bulgaria, Argentina and to some extent South Africa all profited from the increased digitalized services trade.

Interestingly, this group of countries do not naturally come to mind when thinking about advanced internet technologies. Nor are these countries the location for new data hubs. That said, they do have decent digital infrastructures (Figure 5, right-hand panel), and in combination with their low labour costs, firms found it attractive to outsource parts of the digital supply chain to them.

Figure 4: Trade in newly digitalized services was strong for upper-middle income countries

Source: van der Marel (2020)

It may also speak to the fact that many upper-middle income countries are witnessing high urbanization rates, which favours the development of services more generally. Moreover, these countries often have a young population with an entrepreneurial spirit, eager to get their digital hands dirty. All these factors may explain why some smaller open economies, such as Bulgaria and Romania, have profited a lot post-GFC.

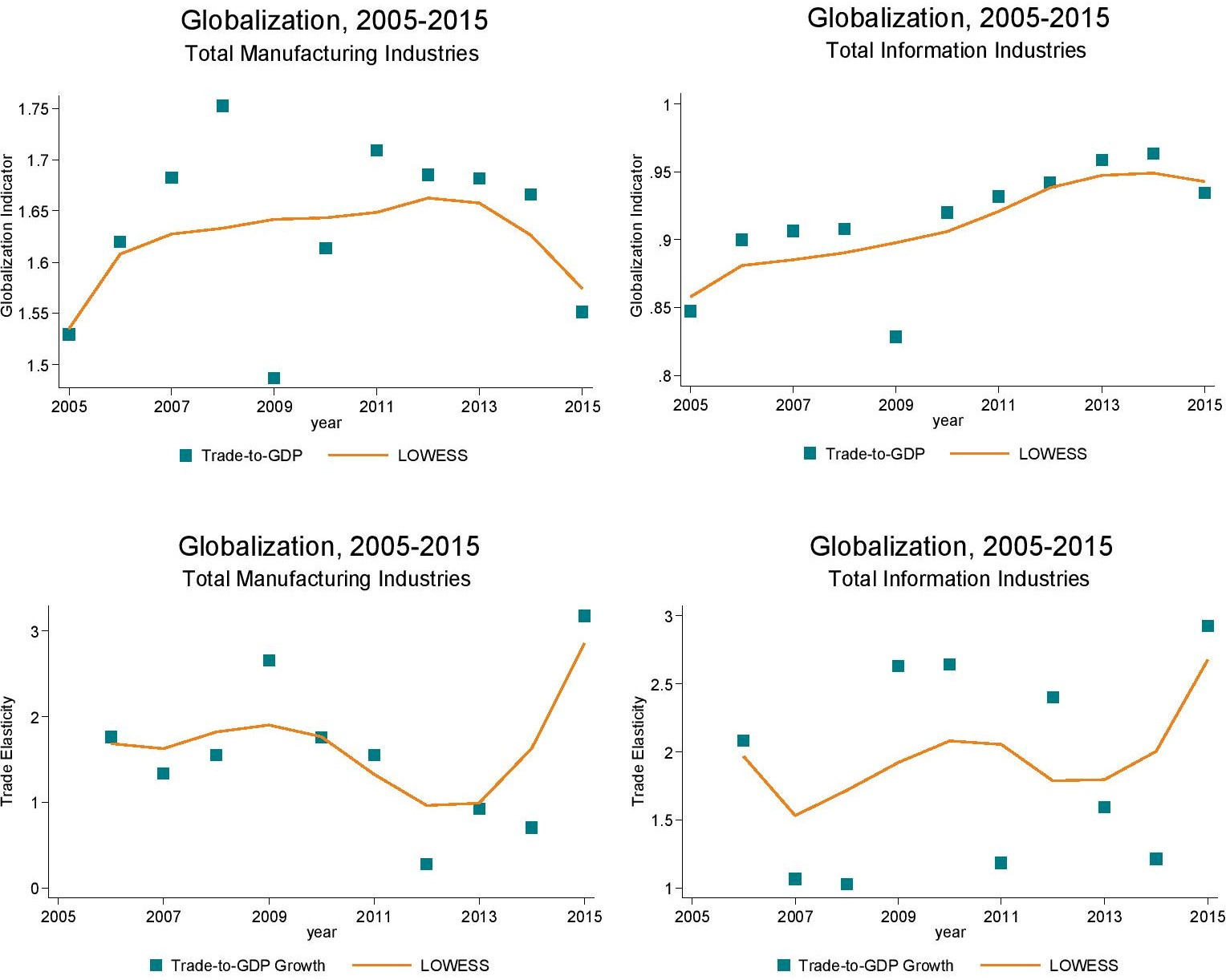

Consequently, it is wrong to presume that countries that already have a strong services edge are the ones that will profit the most from new services developments post-COVID-2019. In fact, looking at the pattern so far, it is actually the highly industrialized nations that has shared most of the modern digital trade benefits (Figure 5). Countries whose economies generated most value-added and employment in manufacturing also witnessed greater disconnect of trade in favour of modern services.

Figure 5: Trade in Newly Digitalized Services was also Strong in Manufacturing Economies

Source: van der Marel (2020)

That should be good news for those obsessed with manufacturing. If, for instance, Industry 4.0, and the Internet-of-Things are really kicking off, industry-based economies are likely to benefit most from further expanded exports in R&D, ideas, information and other future-related digital services.

5. Conclusion

Globalisation isn’t dying: it’s actually prospering albeit in different ways. It’s true that new protectionism has had a negative effect on global trade – and there are obvious risks that there will be more restrictive trade measures introduced in the next few years when governments are trying to protect their economies. However, a more critical trend is that global trade for more than a decade has started to shift into a new direction. Old trade – trade in goods – isn’t growing so fast anymore. The factors that pushed the rapid growth in goods trade in the 1990s and the 2000s are no longer the lading vectors of globalisation. Now it is rather ideas, data, and intangible services – often traded digitally – that are expanding cross-border global integration.

This “new globalisation” grows on the back of technological changes and innovation – not least digitalization. It will also continue to grow as more sectors are getting digitalized. Therefore, there’s still a huge potential for economic gains by expanding trade, investment and other intangible connections across borders. True, governments are also taking measures that are making new globalisation more costly and cumbersome. Still, the underlying economic forces of economic collaboration and specialization in these sectors are very strong. And there will be huge economic costs to any economy who shields itself from this new global economic exchange.

References

Van der Marel (2020) “Shifting into Digital Services: Does a Crisis Matter and for Who?”, ECIPE Working Paper Series No. 01/2020, European Centre for International Political Economy, Brussels.

WTO (2019) “The Future of Services Trade”, World Trade Report 2019, World Trade Organization, Geneva.

WTO (2020) “Trade Set to Plunge as COVID-19 Pandemic Upends Global Economy, WTO 855 Press Release, World Trade Organization, Geneva.

Annex

Figure A1: Changing Nature of Globalisation: old and new (2005-2015)

Source: author’s calculations using OECD TiVA.

Table A2: Software-intensive sectors using the WTO-UNCTAD-ITC classification

Source: van der Marel (2020).