The Future of European Digital Competitiveness

Published By: Oscar Guinea Vanika Sharma

Research Areas: Digital Economy EU Single Market European Union Services

Summary

Former Italian prime minister Mario Draghi’s recent report on Europe’s competitiveness lays bare the negative effects of overregulation in the EU economy and the underperformance of its digital sector. However, Draghi failed to draw connections between these two phenomena.

The future of Europe’s competitiveness is inextricably linked to the future of its digital economy. Unfortunately, the economic contribution of Europe’s Information and Communication Technology (ICT) sector remains significantly smaller than that of the US ICT sector to the US economy. There are well-known reasons behind this divergence. Chief among them is the lack of sufficient investment in Europe’s intangible and tangible assets.

Regulation, particularly those regulations governing the digital economy, has emerged as a key factor that restricts Europe’s usage of digital technologies and hinders subsequent productivity growth. The EU now has nearly 100 tech-focused laws, comprising thousands of pages, provisions, and restrictions.

This must change. The EU should develop a joint plan for digitalisation and competitiveness. This plan should build upon Europe’s comparative advantages: openness, strong institutions, the rule of law, robust intellectual property protections, and high levels of human capital. Above all, the EU must recognise that, while protecting consumer rights, EU policies and regulations must also prioritise the competitiveness of Europe’s ICT sector and promote the widespread adoption of digital technologies across the entire EU economy.

The five policy recommendations that underpin this joint plan for digitalisation and competitiveness are:

- Embrace digital trade: an open digital trade strategy will secure market access for EU digital services and facilitate access to digital technologies and skills from outside the EU.

- Boost R&D investment: new policies and innovative approaches are required to incentivise higher levels of R&D spending by European businesses.

- Invest in digital infrastructure: tangible capital, particularly digital infrastructure, is essential for competitiveness. The EU must accelerate the rollout of 5G, where it lags behind the US and China.

- Enable digital economy growth: capital for business expansion within the EU should be readily available, with measures to make such investments comparatively more attractive and profitable.

- Improve the quality of digital regulations: EU regulation should be benchmarked against global leaders, with the goal of creating a significantly more attractive environment for digital business development and growth than its competitors.

1. Introduction

The future of Europe’s competitiveness is closely intertwined with the future of its digital economy. Digital technologies are among the key drivers of productivity growth, helping companies improve business processes, advertise their products and services and develop new ones. Moreover, digital sectors spend heavily in Research and Development (R&D) activities, pushing the technology frontier further and diffusing innovations throughout the economy.

The EU enjoys a leadership position in some areas of digital economy, such as advanced mobile communication. This leading role did not come out of thin air; it was hard-won by investing significant resources in R&D. Looking forward, the EU has the potential to lead in technologies such as 6G, XG, AI, quantum computing, and edge and hybrid computing, which will form the foundation of future commercial and military innovations. However, in the meantime, the EU is committed to achieving the objectives of the Digital Decade, which include widespread use of digital technologies by most EU companies.

Yet, the economic contribution of Europe’s Information and Communication Technology (ICT) sector is smaller than that of the same sector in comparable economies, such as the US. Several factors account for this difference. Among them is the lack of investment in intangibles, such as databases, software programmes, and AI, as well as tangible capital, such as computers, data storage facilities, and telecom networks. This shortfall is strongly associated with lower levels of overall productivity.

The future of European digital competitiveness requires a new course of action. These words have been chosen deliberately. They refer to the title of Mario Draghi’s Competitiveness Report, a widely praised document that analyses Europe’s weak economic performance and suggests measures to improve its competitiveness. For instance, Draghi argues that “Europe must confront some fundamental choices about how to pursue its decarbonisation path while preserving the competitive position of its industry”.[1] Others have written in favour of similar actions as part of a proposed Clean Industrial Deal.[2]

Surprisingly, there have been no comparable plans or deals for the EU’s digital economy. While it is true that the EU’s digital economy is less affected by rising energy prices than traditional energy-intensive industries, it faces other economic woes, also highlighted in the Draghi’s report, perhaps even more acutely than other sectors.

To maintain the necessary balance, this Policy Brief argues for a joint plan for digitalisation and competitiveness. This joint plan builds on Europe’s comparative advantages as it focuses on trade, R&D, investment, technology, and a supportive regulatory environment.

The Policy Brief is structured as follows: Chapter Two describes the factors that have resulted in an EU ICT sector making a much more modest contribution to Europe’s value-added growth compared to the contribution of the US ICT sector to the US economy. Chapter Three examines the relationship between digital technologies and productivity across EU countries, sectors, and firms of different sizes. It demonstrates that higher usage of digital technologies is associated with higher productivity in firms. Chapter Four goes beyond industry and firm characteristics, exploring the role of regulation in the adoption of digital technologies and examining to what extent the volume and restrictiveness of EU digital regulation may shift the EU’s comparative advantage away from digital activities. Finally, Chapter Five presents a plan for digitalisation and competitiveness, comprising five policy recommendations aimed at accelerating the diffusion of digital technologies and fostering an environment in which EU companies in the ICT sector can flourish and thrive.

[1] Draghi, M. (2024). The future of European competitiveness: A competitiveness strategy for Europe. European Commission. p. 37.

[2] Pisani-Ferry, J., Tagliapietra, S., & Tubiana, L. (2024). The EU needs a strong and clean industrial deal. Bruegel.

2. EU’s ICT Contribution to EU’s Economy

The productivity divergence between the EU and the US was a key plunk for policy action in Mario Draghi’s competitiveness report. In 1990, labour productivity in the EU and the US was very similar, with each worker’s annual output averaging close to US$ 53 per hour. However, a gap has since emerged – and it continues to grow – with US labour productivity now nearly US$ 15 higher than the EU.[1]

Underneath the EU-US productivity gap hides significant variations across economic sectors. In fact, the average EU productivity growth between 2000 and 2019 was faster than the US in many areas of the economy such as wholesale and retail, manufacturing of transport equipment, or public administration. Yet, there was a sector where the US clearly outperformed the EU: ICT[2]. In the words of Mario Draghi itself: “The EU has less activity in sectors in which much of the productivity growth has originated in recent years, notably the ICT sector and the exploitation of large-scale digital services. Due to slow technology diffusion within industries, the EU’s productivity growth gap compared to the US was particularly pronounced in these industries with very high productivity growth”.[3]

A crucial factor explaining the EU’s relatively poorer performance in ICT is its lack of investments in intangible and tangible capital. Between 1995 and 2020, the share of investments in intangible capital over Gross Value Added (GVA) was, on average, 5 percentage points higher in the US than in the EU[4]. Many of these intangibles relate to ICT such as databases, AI and software programmes. These investments are strongly related to Total Factor Productivity (TFP) growth, which measures how efficiently an economy is producing goods and services. Studies estimate that one-fifth of intangible capital growth translates into gains in TFP. In other words, when a firm raises its investments in intangible capital by one percent, the knowledge spillovers that it generates translate into a 0.2 percent increase in TFP. [5]

The EU and the US also diverge in their levels of investment in tangible ICT infrastructure: physical assets such as computers, cables, and data storage facilities. During the 1995-1999 period, both the EU-12[6] and the US invested between 4 and 5 percent of non-residential capital into ICT equipment. However, by 2015-2020, this number increased by almost 16 percentage points in the US, while it went up by just 3 percentage points in Europe. This relatively poor performance extends to the latest advances in telecommunication infrastructure such as 5G, which not only provides access to digital services at much greater speeds – potentially 100 times faster than the 4G mobile network currently in use[7] – but will also pave the way for further investment in 6G and XG technologies, as well as new applications for AI, automated vehicles, and IoT. Recent reports from the European 5G Observatory[8] and Ericsson[9] highlight that the EU lags behind the US and China in the absolute number of 5G subscribers, featuring 223 million 5G subscribers in comparison with 317 in the US and 851 in China.

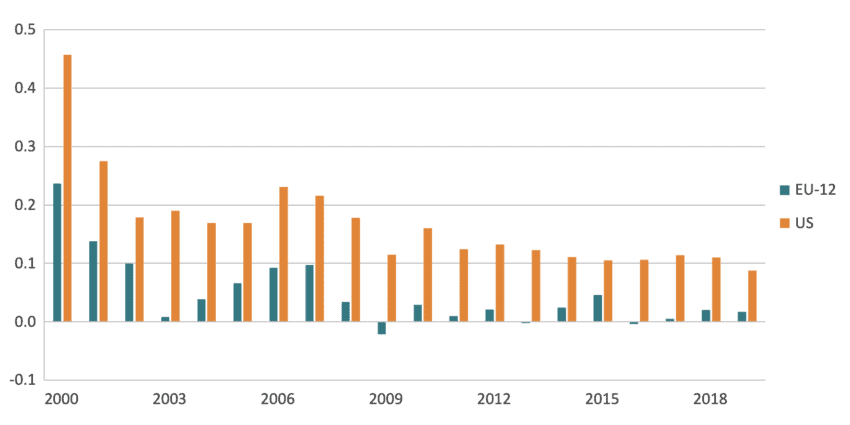

The EU’s sluggish investment in ICT intangible capital and digital infrastructure has resulted in an EU ICT sector that makes a much more modest contribution to Europe’s value-added growth than what the US ICT sector does to the US economy. Figure 1 shows the contribution of ICT services to value-added growth for EU-12 countries and the US. Though both regions follow a similar downward trend, US ICT services contributed, on average, six times more to value-added growth than in the EU-12 (omitting years of negative contribution).

Figure 1: Contribution of ICT services to value-added growth (percentage points, 2000-2019) Source: EU KLEMS – INTANProd

Source: EU KLEMS – INTANProd

As identified in the Draghi report, this is a drag on the overall EU economy. First, it dampens the productivity gains from the diffusion of ICT technologies. Second, it undermines future productivity growth in the EU that could come from the next generation of intangible-related innovations, such as AI. Third, it hampers the potential growth of EU R&D spending, since the scarcity of successful digital businesses in Europe explains the marked difference in R&D between the EU and the US[10]. Fourth, it slows down Europe’s digital transformation.

[1] Erixon, F., Guinea, O., & du Roy, O. (2024b), Keeping Up with the US: Why Europe’s Productivity Is Falling Behind, ECIPE.

[2] Nikolov, P., Simons, W., Turrini, A., & Voigt, P. forthcoming.

[3] Draghi, M. (2024). The future of European competitiveness: A competitiveness strategy for Europe. European Commission, page 23.

[4] Erixon, F., Guinea, O., & du Roy, O. (2024a), “The EU’s Productivity Performance: Falling Behind the Curve”, EconPol Forum 25(3), 23–27.

[5] Corrado, C., Haskel, J., Jona-Lasinio, C., & Iommi, M. (2022). Intangible Capital and Modern Economies. Journal of Economic Perspectives, 36(3), pages 3-28.

[6] EU-12 countries include: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, and Spain.

[7] Thales. (2024). 5G technology and networks (speed, use cases, rollout). Available at: https://www.thalesgroup.com/en/markets/digital-identity-and-security/mobile/inspired/5G

[8] European 5G Observatory. (2024). European 5G Scoreboard. Available at: https://5gobservatory.eu/observatory-overview/interactive-5g-scoreboard/#5G-spectrum-chart

[9] Ericsson. (2024). Ericsson Mobility Report 2024. Available at: https://www.ericsson.com/49ed78/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-june-2024.pdf

[10] Coatanlem, Y., & Coste, O. (2024). Cost of Failure and Competitiveness in Disruptive Innovation. IEP@ BU Policy Brief.

3. Digital Technology and Productivity

A crucial word in the quote from the Draghi’s report mentioned earlier is “diffusion”. Productivity gains from technology are not automatic or guaranteed, but instead hinge on the adoption of new technologies, not just by a few innovative companies, but also across all sectors, particularly labour-intensive ones.

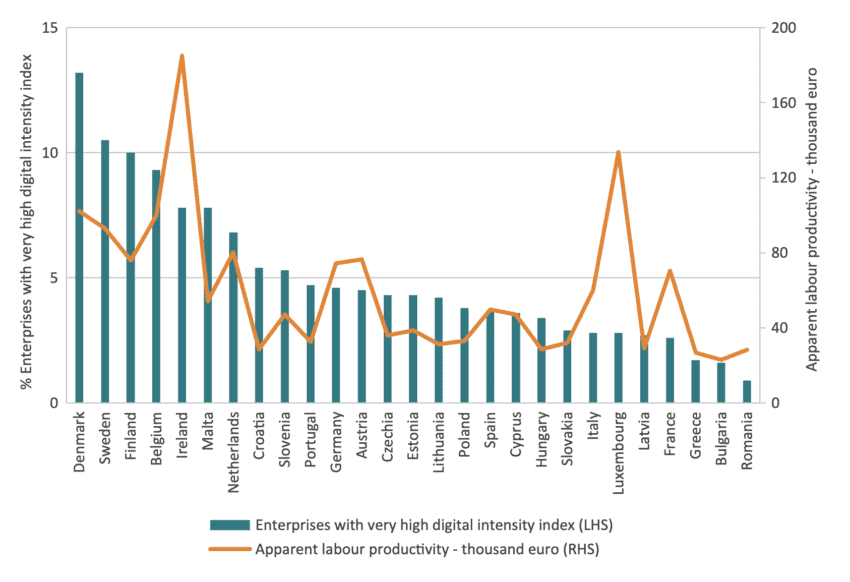

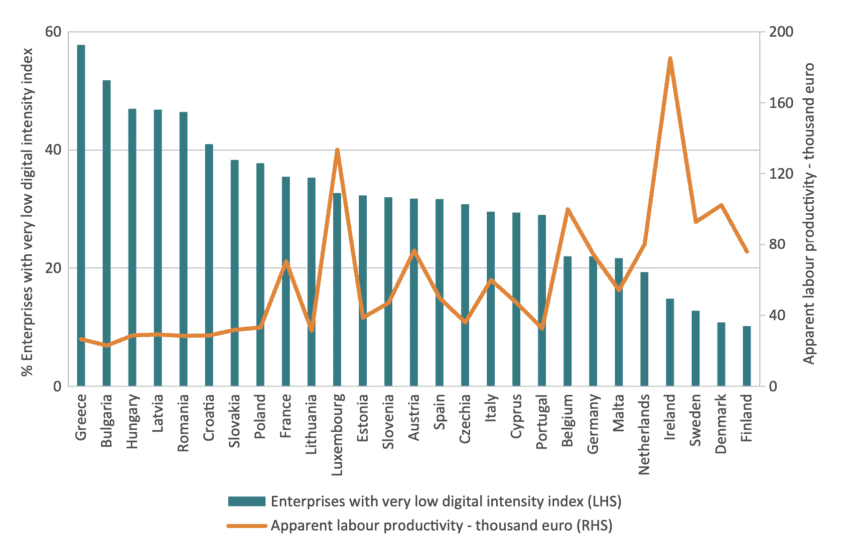

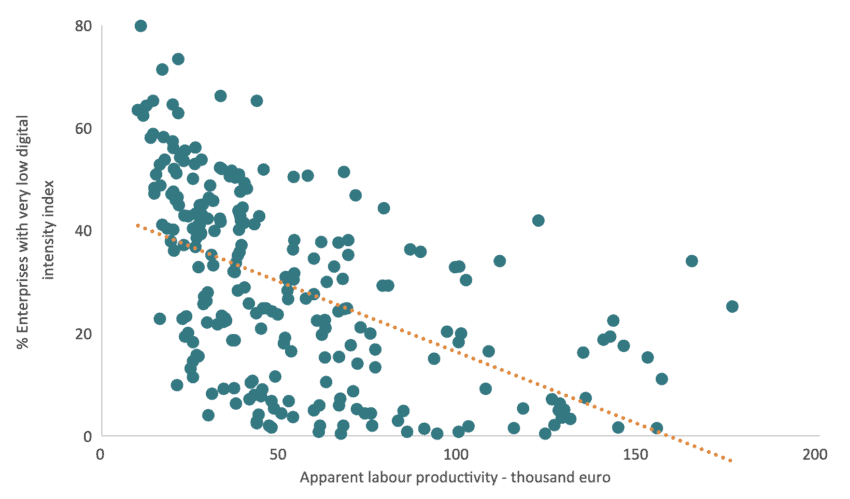

The EU developed the Digital Intensity Index (DII) as an indicator to measure the adoption of digital technology among EU firms. It evaluates the use of 12 specific digital technologies[1] within businesses, assigning one point for each technology used. The total score, ranging from 0 to 12, classifies firms into four levels of digital intensity: very low (0-3 points); low (4-6 points); high (7-9 points); and very high (10-12 points). The next two figures present the percentage of firms with very high and very low digital intensity across EU member states, alongside their respective levels of labour productivity.[2] Figure 2 indicates that, in general, EU member states with a higher proportion of firms exhibiting very high digital intensity tend to display higher levels of labour productivity. In contrast, Figure 3 shows that EU member states with a larger share of firms exhibiting very low digital intensity tend to experience lower levels of labour productivity.

Figure 2: Percentage of firms with very high digital intensity and apparent labour productivity across EU countries, 2022 Source: Authors’ calculations based on Eurostat.

Source: Authors’ calculations based on Eurostat.

Figure 3: Percentage of firms with very low digital intensity and apparent labour productivity across EU countries, 2022 Source: Authors’ calculations based on Eurostat.

Source: Authors’ calculations based on Eurostat.

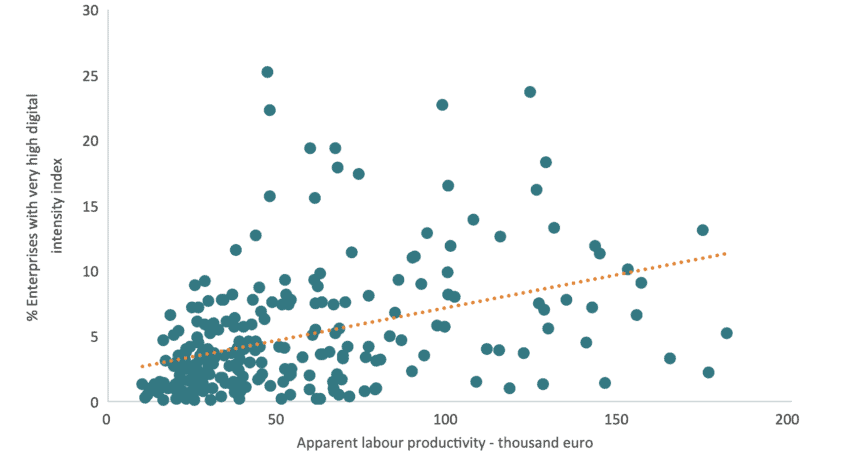

The next two figures show the percentage of firms with very high digital intensity, very low digital intensity, and their respective labour productivity across economic sectors for each EU member state in 2022.[3] It shows a similar relationship to that presented across countries. Figure 4 demonstrates that economic sectors with a higher percentage of firms with very high digital intensity tend to achieve higher levels of labour productivity. For instance, digital advertising enables companies, especially Small and Medium-sized Enterprises (SMEs), to connect with customers more effectively by reaching both domestic and international markets. This enhanced connectivity drives higher sales supporting firm growth and business specialisation, which in turn leads to higher productivity levels. Conversely, Figure 5 indicates that economic sectors with a higher percentage of firms with very low digital intensity tend to experience lower levels of labour productivity. Variation exists across countries and sectors, with manufacturing showing the strongest relationship between higher (lower) digital intensity and higher (lower) productivity levels.

Figure 4: Percentage of firms with very high digital intensity and apparent labour productivity across economic sectors, 2022 Source: Authors’ calculations based on Eurostat. Note: Apparent labour productivity values capped to 200 to eliminate outliers. 9 data points were deleted from the figure.

Source: Authors’ calculations based on Eurostat. Note: Apparent labour productivity values capped to 200 to eliminate outliers. 9 data points were deleted from the figure.

Figure 5: Percentage of firms with very low digital intensity and apparent labour productivity across economic sectors, 2022 Source: Authors’ calculations based on Eurostat. Note: Apparent labour productivity values capped to 200 to eliminate outliers. 7 data points were deleted from the figure.

Source: Authors’ calculations based on Eurostat. Note: Apparent labour productivity values capped to 200 to eliminate outliers. 7 data points were deleted from the figure.

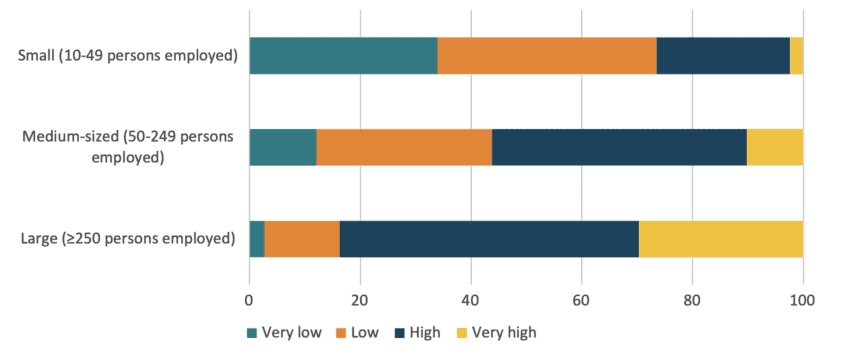

Another important aspect is the spread of digital technologies across firms of different sizes. In principle, large companies possess greater financial and human resources to invest in ICT, allowing them to spread the fixed costs of digital investments across a larger volume of production. The reverse is true for smaller firms. Therefore, larger companies tend to use more digital technologies and employ them more intensively in their production processes. Figure 6 reveals that, in 2022, only 4 percent of SMEs achieved very high levels of digitalisation compared to 30 percent of large firms. These statistics are crucial for the EU’s competitiveness and productivity because SMEs constitute the backbone of the EU economy: they account for 99 percent of European businesses, provided close to 85 million jobs across Europe, and accounted for more than half the value added in EU’s GDP.[4]

Figure 6: Digital intensity of enterprise across firms of different sizes, 2022 Source: Authors’ calculations based on Eurostat.

Source: Authors’ calculations based on Eurostat.

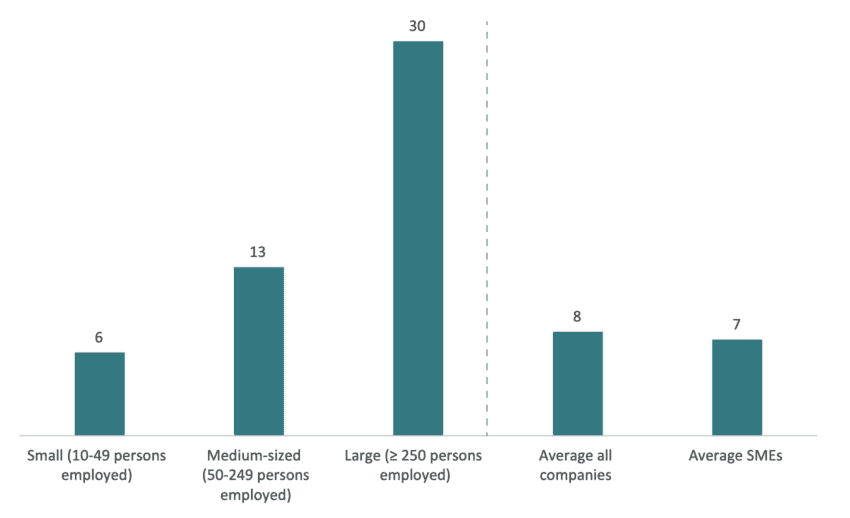

These findings align with a recently released Eurostat survey on AI usage across EU firms.[5] AI enhances firm productivity by improving processes, automating tasks, and helping to develop new products and services. However, the extent of its impact varies depending on firm characteristics. Figure shows that AI usage varies significantly across firms of different sizes: the larger the firm, the higher the percentage of firms using AI. In 2023, 30 percent of large EU firms used AI, compared to only 7 percent of SMEs.

Companies with very low levels of digital intensity are caught in a catch-22: their minimal use of digital tools, such as websites, e-commerce, or online advertising, significantly limits their growth potential. At the same time, their small size and limited resources make it difficult to invest in advanced digital technologies like big data analytics, hiring ICT specialists, or adopting AI applications, perpetuating their low digital intensity and limited growth.

Figure 7: Percentage of firms using AI across firms of different sizes, 2023 Source: Authors’ calculations based on Eurostat.

Source: Authors’ calculations based on Eurostat.

[1] The 12 digital technologies assessed by the DII include: (1) Internet access for more than 50 percent of employees; (2) Employment of ICT specialists; (3) Use of fast broadband (≥30 Mbps); (4) Provision of portable devices with mobile internet for over 20 percent of employees; (5) Having a website; (6) Website with sophisticated functionalities (e.g., online ordering, tracking); (7) Use of 3D printing; (8) Purchase of medium-high cloud computing services; (9) Sending invoices suitable for automated processing; (10) Use of industrial or service robots; (11) E-commerce sales accounting for at least 1 percent of total turnover; and (12) Analysis of big data internally or externally. For more information on the DDI see: https://ec.europa.eu/eurostat/web/interactive-publications/digitalisation-2024

[2] Labour productivity is measured using the Eurostat indicator apparent labour productivity. Apparent labour productivity is defined as value added at factor costs divided by the number of persons employed. This ratio is generally presented in thousands of euros per person employed. Eurostat Glossary.

[3] The following sectors were included: C: Manufacturing; D35: Electricity, gas, steam and air conditioning supply; E: Water supply; sewerage, waste management and remediation activities; F: Construction; G: Wholesale and retail trade; repair of motor vehicles and motorcycles; H: Transportation and storage; I: Accommodation and food service activities; J: Information and communication; L68: Real estate activities; M: Professional, scientific and technical activities; and N: Administrative and support service activities. Figure 4 includes 237 data points and Figure 5 includes 246 data points.

[4] European Commission. (2023). Annual Report on European SMEs. https://single-market-economy.ec.europa.eu/document/download/b7d8f71f-4784-4537-8ecf-7f4b53d5fe24_en?filename=Annual%20Report%20on%20European%20SMEs%202023_FINAL.pdf

[5] Eurostat. Artificial intelligence by size class of enterprise.

4. EU Digital Regulation

Industry and firm characteristics explain part of the productivity differences but not everything, there are other cross-cutting factors that matter[1]. One of these factors is regulation.

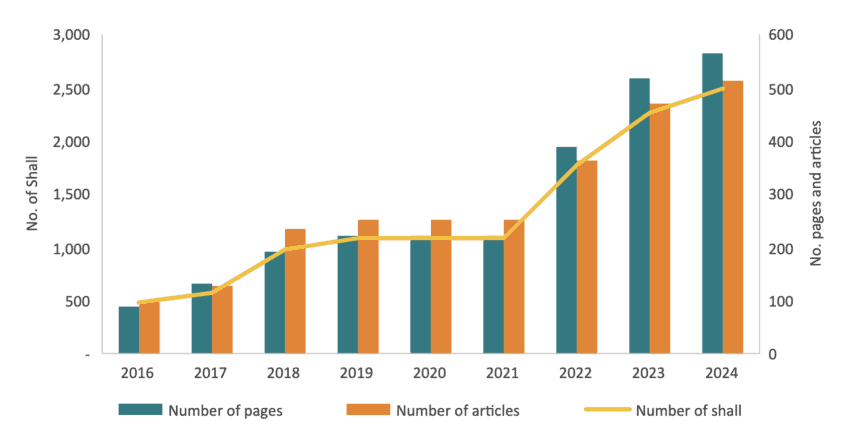

The European Union now has almost 100 tech-focused laws[2]. Individually, each of the regulations may not represent much in terms of the administrative burden and limitations imposed on firms, but together they are a force to be reckoned with. As an example, in the case of EU Data and Privacy and E-commerce and Consumer Protection regulation shown in Figure 8, the number of pages and articles, which can be understood as proxies for regulatory complexity, increased by 833 (pages) and 758 (articles); while the count of the number of times the word “shall” appeared in the regulation, which can be used as a proxy for restrictiveness, grew by 3,673.

Figure 8: Data & Privacy regulation, cumulative number of pages, articles and the word shall between 2016 and 2024 Note: The following regulations are included General Data Protection Regulation (2016); ePrivacy Directive (2017); Regulation to protect personal data processed by EU institutions, bodies offices and agencies (2018); Regulation on the free flow of non-personal data (2018); Open Data Directive (2019); Data Governance Act (2022); (Proposal) European Health Data Space (2022); European Statistics (2023); European Data Act (2023); (Proposal) Harmonisation of GDPR enforcement procedures (2023); Interoperable Europe Act (2024); Regulation on data collection for short-term rental (2024). The data is presented cumulatively: the number of pages, articles and the word shall in one regulation is added to the pages, articles and “shall” from the previous regulations.

Note: The following regulations are included General Data Protection Regulation (2016); ePrivacy Directive (2017); Regulation to protect personal data processed by EU institutions, bodies offices and agencies (2018); Regulation on the free flow of non-personal data (2018); Open Data Directive (2019); Data Governance Act (2022); (Proposal) European Health Data Space (2022); European Statistics (2023); European Data Act (2023); (Proposal) Harmonisation of GDPR enforcement procedures (2023); Interoperable Europe Act (2024); Regulation on data collection for short-term rental (2024). The data is presented cumulatively: the number of pages, articles and the word shall in one regulation is added to the pages, articles and “shall” from the previous regulations.

The volume and restrictiveness of regulation affects the extent to which firms can adopt digital technologies, for instance by limiting access to these technologies; decreasing firm’s ability to use ICT-related intangible capital; or disincentive firm growth which hinders the adoption of digital technologies.

The most direct effects, however, relate to the regulation of digital markets and technologies. EU digital regulations, such as the General Data Protection Regulation (GDPR), the Digital Markets Act (DMA), the Digital Services Act (DSA), and the Artificial Intelligence Act (AI Act), cover many different aspects of the digital economy. These comprehensive regulations combine features of product regulation, market access regulation, and regulations governing firms’ behaviour, concepts traditionally used in competition policy to prevent abuse of market dominance.

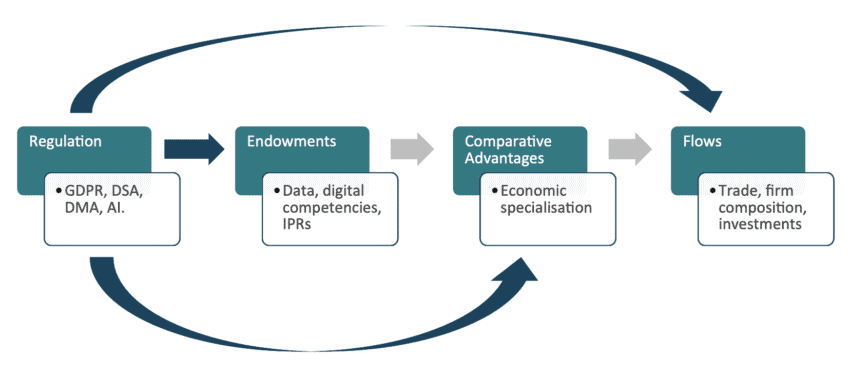

These regulations have a profound effect on economic endowments. Historically, economists studied three key endowments: land, labour, and capital. Countries with abundant land, for example, often specialised in agriculture. By contrast, those with less land but an abundance of labour focused on labour-intensive industries, like manufacturing. As the economy modernised, some endowments (such as land) have become less significant, while modern endowments, such as data and digital competencies, have emerged.

These digital endowments (many of them tangible and intangible ICT-related capital) are exploited by firms to create different comparative advantages within the economy. However, regulations play a crucial role in the ability of firms to transform these endowments into advantages. For instance, if digital regulations restrict access to endowments like data, firms may import goods and services with these endowments embedded – provided it is allowed. In such cases, downstream services can still function, but the regulation limits sectors and firms to specific segments of the supply chain.

Regulations do not only influence advantages but also the flows that result from these advantages. For example, a regulation can affect the portability of data between countries, which impacts their ability to export digital services. Digital regulations can also affect the relative balance between firms that are old or young, or big or small. For instance, digital regulations can limit access to endowments, such as data, through restrictions on intermediate services, making it more expensive for firms to access these endowments through the market. Indirectly, these regulatory restrictions benefit large companies, with access to in-house data processing, and penalise young and smaller ones which are more dependent on the market to access these endowments, making it harder for them to grow, thereby lowering their productivity and inhibiting their innovations. This has negative knock-on effects on the economy.[3]

Figure 9 presents this conceptual framework. It describes how regulations impact modern endowments, advantages and flows. At the same time, only by limiting access to endowments, regulations shape the way firms create different comparative advantages and specialisations, which ultimately lead to specific economic flows such as trade, changes in firm demographics, and investments.

Figure 9: Model for Understanding the Behavioural Effects of Regulation These effects have been identified empirically in the case of the GDPR. Article 5 of the GDPR limits firms’ ability to combine data for purposes other than those originally intended. These limitations on endowments affect Europe’s comparative advantage. For example, EU firms had to destroy substantial amounts of data upon the entry of the GDPR. Forward data endowment creation was also damaged: EU firms stored 26 percent less data on average than US firms two years after the GDPR, and reduced computation relative to US firms by 15 percent.[4]. Ultimately, GDPR also contributed to changes in flows such as innovation, with new app[5] entries falling by half, and firm demographics in favour of old and larger companies.[6]

These effects have been identified empirically in the case of the GDPR. Article 5 of the GDPR limits firms’ ability to combine data for purposes other than those originally intended. These limitations on endowments affect Europe’s comparative advantage. For example, EU firms had to destroy substantial amounts of data upon the entry of the GDPR. Forward data endowment creation was also damaged: EU firms stored 26 percent less data on average than US firms two years after the GDPR, and reduced computation relative to US firms by 15 percent.[4]. Ultimately, GDPR also contributed to changes in flows such as innovation, with new app[5] entries falling by half, and firm demographics in favour of old and larger companies.[6]

The DSA, DMA, and AI Act have been approved too recently for empirical evidence to emerge. However, since these regulations are also all-encompassing, the conceptual framework in Figure 9 helps us foresee some of the potential impacts on economic endowments, comparative advantages, and flows.

The DMA builds on the assumption that the combination of endowments or assets should be prevented when pursued by gatekeeping platforms. A core aspect of the DMA has the explicit intention of making it more difficult for firms to combine different sets of data. The obvious result is that gatekeeping firms will have to reduce the usefulness and competitiveness of the services they provide or could potentially offer in the future, impacting advantages and flows for EU firms. This is one of the reasons why some US firms have decided to pause the introduction of new data and AI services in the EU.

Endowments and advantages may also be impacted by the DMA with regard to scale. First, the threshold defining the designation of gatekeepers could incentivise digital firms to self-impose limitations on scale to avoid burdensome regulatory obligations. Second, the DMA is likely to reduce the incentives for outsourcing business activities to third parties. Finally, the AI Act defines the degree of regulatory restrictions based on the ethical risks associated with certain types of AI development. This approach tends to discourage offshoring and favours corporate solutions that make business activities indivisible, favouring large and established companies over younger and smaller ones which are more dependent of intermediate services to buy the endowments the require for their products.

Finally, these regulations also have significant compliance costs. For example, businesses under the European Tech Alliance (EUTA) umbrella reckon that 30 percent of their resources may be taken up by regulatory compliance.[7] Another study projects that the DMA and DSA will increase costs for European businesses from €43 billion to €71 billion per year, with nearly half of these costs incurred by European SMEs[8]. Moreover, regulatory barriers and uncertainty can deter new digital products from reaching EU consumers and firms. Google removed search features for flights, hotels, and local businesses, preventing users from directly accessing information about carriers, flight times, and prices[9]; and Apple and Meta have delayed the introduction of their latest AI models and systems in the EU due to concerns about EU regulations.[10]

[1] Syverson, C. (2011). What determines productivity?. Journal of Economic literature, 49(2), 326-365.

[2] Bruegel. A dataset on EU legislation for the digital world. Retrieved November 28, 2024. Available at: https://www.bruegel.org/dataset/dataset-eu-legislation-digital-world

[3] See Barone, G., and Cingano, F. (2011). Service Regulation and Growth: Evidence from OECD Countries, Economic Journal 121, 931–957; Ferracane, M. and van der Marel, E. (2021). Do Data Flows Restrictions Inhibit Trade in Services?, Review of World Economics, Vol. 157, No. 4, pages 727-776; Ferracane, M. & van der Marel, E. (2020b). Patterns of Trade Restrictiveness in Online Platforms: A First Look, The World Economy, Vol. 43, Issue 11, Special Issue: The Effects of Services Trade Policies, pages 2932-2959; Ferracane, M., Kren, J., & van der Marel, E. (2020a). Do Data Policy Restrictions Impact the Productivity Performance of Firms and Industries?, Review of International Economics, Vol. 28, No. 3, pages 676-722.

[4] See Demirer, M., et al. (2024). Data, privacy laws and firm production: Evidence from the GDPR (National Bureau of Economic Research Working Paper No. 32146). National Bureau of Economic Research.

[5] See Janßen, R. et al. (2022). GDPR and the lost generation of innovative apps. National Bureau of Economic Research.

[6] See Chen, C. et al. (2022). Privacy Regulation and Firm Performance: Estimating the GDPR Effect Globally. The Oxford Martin Working Paper Series 22(1).

[7] European Tech Alliance. (2023), European tech companies face an overwhelming amount of rules.

[8] Suominen, K. (2022). Implications of the European Union’s Digital Regulations on U.S. and EU Economic and Strategic Interests. CSIS.

[9] Walker, K. (2023). New competition rules come with trade-offs. Google. Available at: https://blog.google/around-the-globe/google-europe/new-competition-rules-come-with-trade-offs/

[10] Stolton, S. & Gurman, M. (2024). Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-06-21/apple-won-t-roll-out-ai-tech-in-eu-market-over-regulatory-concerns?embedded-checkout=true ; Kroet, C. (2024). Meta stops EU roll-out of AI model due to regulatory concerns. Euro News. Available at: https://www.euronews.com/next/2024/07/18/meta-stops-eu-roll-out-of-ai-model-due-to-regulatory-concerns

5. A Joint Plan for Digitalisation and Competitiveness

The future of the EU digital economy is in Europe’s hands. In recent years, the EU has passed policies and regulations that, while protecting and upgrading consumers’ rights, have also hampered the contribution of Europe’s ICT sector to the economy. It is high time to recognise these trade-offs and implement policies that support the production and diffusion of digital technologies in the EU. In turn, these policies will enhance Europe’s competitiveness and prosperity.

The EU has the inherent strengths to lead in digital technologies and capitalise on their economic potential. It has high levels of human capital, firms operating at the technological frontier, and a market economy underpinned by strong institutions, the rule of law, and robust intellectual property protections. These are Europe’s strengths compared to other countries and regions. The five policy recommendations that form this joint plan for digitalisation and competitiveness build on what Europe does best.

1. Embrace digital trade

Digital trade has become a key determinant of competitiveness, providing more opportunities for growth, innovation, and increased trade to companies of all sizes. EU trade agreements are increasingly including self-standing chapters on digital trade. However, the EU is behind other advanced economies in digital trade agreements and remains overly defensive. An open digital trade strategy can grant Europe access to markets where new technology is being developed, which is essential to ensuring that the EU does not lag behind technologically and remains competitive.

The EU could play an active role in multilateral rulemaking by taking the lead in negotiations on cross-border digital trade rules at the WTO. The EU can also negotiate and sign Digital Economy Agreements. Above all, the EU should avoid erecting regulatory barriers that prevent new digital products from entering the EU.

2. Boost R&D investment

Europe’s private ICT sector is one of the largest investors in R&D. However, the current levels of spending are below its potential and significantly lower than what the US ICT sector spends on R&D.

The EU should focus on incentivising European businesses to increase their R&D. Firstly, it should remove barriers to the commercialisation of innovations developed at universities and support efforts to make European universities global leaders. Secondly, it should work with member states to facilitate international labour migration into the EU and make the EU an attractive destination for high-skilled foreign workers. Thirdly, it needs to maintain strong and effective IPRs, as well as other forms of innovation protection, so that investments in innovation are incentivised and innovators are rewarded. Lastly, it should prioritise R&D in its budget, significantly increasing the share allocated to R&D.

3. Invest in digital infrastructure

Digital infrastructure is essential for competitiveness. It can raise the productivity of all factors of production, broadening the productive capacity of the economy as a whole. Without the latest digital infrastructure, the EU’s technological leadership in cellular technology and telecom equipment could be at risk, and EU companies may face disadvantages when competing in AI, 6G, XG, quantum technology, edge and hybrid computing, automated vehicles, or IoT – all of which require a modern network infrastructure.

A clear case for action relates to 5G deployment, where the EU has fallen behind the US and China. To encourage investments in network infrastructure, the EU telecom markets require market consolidation and scale, particularly at the national and regional levels, to spread investment costs across a larger customer base. Furthermore, investment-friendly spectrum policies, including streamlined licence renewals, will facilitate 5G deployment, whereas delays and cumbersome processes from national regulators in issuing licences will discourage market consolidation.

4. Enable digital economy growth

Europe lags behind the US and China in supporting new digital companies with venture capital and growth equity. For technological start-ups to scale up and bring their ideas to fruition, access to capital is essential. The EU needs policies to channel savings into a vibrant corporate market. This can be done, for instance, by encouraging pension funds across the EU to invest in venture capital funds or by making investments in assets that support corporate growth comparatively more profitable.

In addition, EU digital regulation needs to change. The most impactful elements of EU digital regulations are not their compliance costs but the behavioural and downstream economic effects triggered by their implementation. These regulations reduce the profitability of investing in digital technologies and prompt firms and markets to adjust their current and future behaviour. These changes manifest in how firms access resources, identify their comparative advantages, and create specific flows where some digital activities are penalised. Consequently, the EU economy remains dominated by non-digital activities, hindering its performance.

5. Improve the quality of digital regulations

Digital regulations should support competitiveness and growth. Europe’s digital regulations are often clumsy and overly heavy-handed, increasing costs and unpredictability for businesses. This uncertainty over what a firm is permitted and not permitted to do depresses investment in Europe’s digital economy. The risk of persisting with this approach is that it could widen Europe’s ongoing investment gap compared to the US and increasingly China, which is already evident in AI, and, as a consequence, further undermine Europe’s ambitions for technology leadership.

In contrast, digital regulation in the EU over the last decade has focused on constraining perceived risks, leading to a regulatory environment that is increasingly complex and costly, particularly for European SMEs. The EU needs to simplify and streamline digital regulations and avoid regulatory burdens that harm competitiveness and the adoption of new technology and new ways of doing business. Europe’s regulatory environment should be benchmarked against global frontrunners, with the ambition of offering a much more attractive environment for digital business development and growth than its competitors.

References

Barone, G. and F. Cingano (2011). Service Regulation and Growth: Evidence from OECD Countries, Economic Journal 121, 931–957.

Chen, C., Frey, C. B. and Presidente, G. (2022). Privacy Regulation and Firm Performance: Estimating the GDPR Effect Globally. The Oxford Martin Working Paper Series 22(1).

Coatanlem, Y., & Coste, O. (2024). Cost of Failure and Competitiveness in Disruptive Innovation. IEP@ BU Policy Brief.

Corrado, C., Haskel, J., Jona-Lasinio, C., & Iommi, M. (2022). Intangible Capital and Modern Economies. Journal of Economic Perspectives, 36(3), pages 3-28.

Demirer, M., Jiménez-Hernández, D. J., Li, D., & Peng, S. (2024). Data, privacy laws and firm production: Evidence from the GDPR (National Bureau of Economic Research Working Paper No. 32146). National Bureau of Economic Research.

Draghi, M. (2024). The future of European competitiveness: A competitiveness strategy for Europe. European Commission.

Ericsson. (2024). Ericsson Mobility Report 2024. Available at: https://www.ericsson.com/49ed78/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-june-2024.pdf

Erixon, F., Guinea, O., & du Roy, O. (2024a). The EU’s Productivity Performance: Falling Behind the Curve. In EconPol Forum (Vol. 25, No. 03, pp. 23-27). CESifo.

Erixon, F., Guinea, O., & du Roy, O. (2024b). Keeping up with the US: Why Europe’s productivity is falling behind. ECIPE.

European Commission. (2023). Annual Report on European SMEs. https://single-market-economy.ec.europa.eu/document/download/b7d8f71f-4784-4537-8ecf-7f4b53d5fe24_en?filename=Annual%20Report%20on%20European%20SMEs%202023_FINAL.pdf

European Commission (2023). European Media Industry Outlook. Available at: https://digital-strategy.ec.europa.eu/en/library/european-media-industry-outlook

European Tech Alliance. (2023), European tech companies face an overwhelming amount of rules.

Ferracane, M., Kren, J., & van der Marel, E. (2020a). Do Data Policy Restrictions Impact the Productivity Performance of Firms and Industries?, Review of International Economics, Vol. 28, No. 3, pages 676-722.

Ferracane, M. & van der Marel, E. (2020b). Patterns of Trade Restrictiveness in Online Platforms: A First Look, The World Economy, Vol. 43, Issue 11, Special Issue: The Effects of Services Trade Policies, pages 2932-2959.

Ferracane, M. & van der Marel, E. (2021). Do Data Flows Restrictions Inhibit Trade in Services?, Review of World Economics, Vol. 157, No. 4, pages 727-776.

Janßen, R., Kesler, R., Kummer, M. E., & Waldfogel, J. (2022). GDPR and the lost generation of innovative apps. National Bureau of Economic Research.

Johnson, G. A., Shriver, S. K., and Du, S. (2020). Consumer privacy choice in online advertising: Who opts out and at what cost to industry?. Marketing Science 39(1): 33-51. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3020503

Kroet, C. (2024). Meta stops EU roll-out of AI model due to regulatory concerns. Euro News. Available at: https://www.euronews.com/next/2024/07/18/meta-stops-eu-roll-out-of-ai-model-due-to-regulatory-concerns

Nikolov, P., Simons, W., Turrini, A., & Voigt, P. forthcoming.

Pisani-Ferry, J., Tagliapietra, S., & Tubiana, L. (2024). The EU needs a strong and clean industrial deal. Bruegel.

Stolton, S. & Gurman, M. (2024). Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-06-21/apple-won-t-roll-out-ai-tech-in-eu-market-over-regulatory-concerns?embedded-checkout=true

Suominen, K. (2022). Implications of the European Union’s Digital Regulations on U.S. and EU Economic and Strategic Interests. CSIS.

Syverson, C. (2011). What determines productivity?. Journal of Economic literature, 49(2), 326-365.

Thales. (2024). 5G technology and networks (speed, use cases, rollout). Available at: https://www.thalesgroup.com/en/markets/digital-identity-and-security/mobile/inspired/5G

Walker, K. (2023). New competition rules come with trade-offs. Google. Available at: https://blog.google/around-the-globe/google-europe/new-competition-rules-come-with-trade-offs/