From SMEs to Unicorns: What Role for Trade, Standards and New Tech?

Published By: Lucian Cernat

Research Areas: European Union Sectors

Summary

The global economy has been shaped by important, disruptive technological changes in recent years. Many of these technologies have been instrumental in our global COVID-19 response and will become the new normal. Some of these technologies have been introduced by small firms, which grew spectacularly to become ‘unicorns’, with very high market value and global reach, setting new technological standards in their sectors. The future competitiveness of the EU economy depends on the interplay between firm size, technological progress and ability to use the opportunities offered by global markets. This paper looks at the role of trade policy in influencing this complex interplay and offers a few tentative conclusions and recommendations.

The views expressed herein are those of the author and do not reflect the official position of the European Commission.

1. On Viral, Disruptive Technologies: What Can the Past Teach Us?

There is an interesting parallel between viruses and the great ideas behind ground-breaking technological innovations. And not just the fact that great ideas can go “viral”. The most distinct characteristic of a virus is its capacity to mutate rapidly and interact with an existing organism. Similarly, almost every great idea is a mutation of other ideas or technologies that existed already. Just as viruses need a body to thrive, good ideas need to be embodied in a new product or service, in order to become new tech. Therefore, new technological innovations require a successful mutation and a new and innovative combination of existing products or materials that were already in use.

Take surgical gloves for instance, a life-saving product for the frontline medical staff fighting the COVID-19 pandemic. Few would guess that rubber gloves are at the origin of a technological “mutation” that brought us the modern pneumatic tyre, a major invention that changed the world forever. Yet, John Dunlop – a Scottish veterinarian – reinvented the pneumatic tyre[1], based on his familiarity with rubber-based listening tubes of stethoscopes, and the use of rubber gloves in medicine. Dunlop not only reinvented the wheel, he also reinvented transportation, leading to the widespread use of bicycles and automobiles. In today’s world, John Dunlop would be a start-up entrepreneur in search for a venture capitalist who would invest in his brilliant idea to create a ‘unicorn company’ (i.e. a rapidly expanding, recent start-up that is valued at more than 1 billion dollars) based on his disruptive technology. In the late 19th century, things worked out differently. John Dunlop did not make a great fortune out of his invention. Instead of becoming part of one of the most successful tyre manufacturers that dominated global markets for decades, he decided to remain a small company owner, returning to his veterinary practice.

Why is this parallel relevant for our topic? The answer becomes clearer once we turn our attention to the trade policy rules in place when the Dunlop rubber company tried to expand into foreign markets at the end of the 19th century. At the time, the United States, France and Germany were witnessing a large demand for bicycles and the market was booming. The most obvious strategy for Dunlop would have been to export tyres to those markets. Yet, the trade policy at the time made Dunlop’s export activities very difficult and fundamentally changed Dunlop’s corporate decision, forcing it to become a multinational company. As Jones (1984) documented, government policies were the second most important influence on the company’s decision-making in international markets.[2] For instance, patent legislation in France and Germany imposed “local production requirements” to qualify for patent protection under the domestic legislation. Just relying on exports would have exposed Dunlop to the risk of other companies (e.g. Michelin) copying its cutting-edge tyre technology.[3] Other countries maintained steep tariffs on imported tyres. The US McKinley Act of 1890 increased the ad valorem duties on imported cycles and parts (including tyres) from 35% to 45%.

Because of these trade policy measures, instead of remaining an export-oriented British company, Dunlop was forced to invest in third countries in order to protect its technological advantage and market share from growing competition with other tyre producers, like Michelin and Goodyear. To counter such protectionist trade policies abroad, Dunlop was forced to open local production plants (several of them unprofitable) in France, Germany, the US, Canada, Ireland, South Africa, India, etc.[4] As a result of these multiple factors, Dunlop became over time a multinational company, a very different company than if it had pursued a “Stay British” strategy focussed only on profitable UK domestic production, where they maintained a strong leadership position, coupled with a global export strategy.

[1] The original inventor of the first pneumatic tyre was actually Robert William Thomson, who filed a patent several years earlier, but his invention was little known and did not have any commercial success.

[2] The historical examples of Dunlop’s international corporate strategy are based on Jones (1984).

[3] In Germany, for instance, in late 1890s, the German patent law required that tyre valves should be manufactured locally to grant patent protection for Dunlop tyres.

[4] According to Jones (1984), Dunlop’s decision to open a plant in India was strongly influenced by the Indian government’s preference for giving public contracts to Indian-registered companies. A large proportion of Dunlop’s business relied on access to government procurement markets.

2. The Importance of Firm Size in Tech Development: What to Expect in the Future?

The Dunlop story clearly illustrates that firm size and structure, technological innovation and trade policy have been closely linked for more than a century. It also shows that the wheels of global business are often unpredictable. Dunlop soon discovered that being a large multinational is not a guarantee for economic success. In some cases, foreign affiliates made losses or were forced to buy locally-made intermediate goods. In others, even when making a profit, government regulations prevented Dunlop from repatriating profits. At the same time, the sector became fiercely competitive and Dunlop lost its technological advantage as other players introduced innovative, superior products. Dunlop’s major European rivals (Michelin in France and Continental in Germany) grew rapidly and this growth was based on rapid responsiveness to changing market conditions and technical innovations, which the British firm was slow to emulate.

What was true in early 20th century is also true in the 21st century. The relationship between firm size and technological supremacy is not guaranteed. In sectors like traditional manufacturing, large firms have a competitive advantage in their ability to devote larger amount to R&D investment and produce innovative products. In other sectors, there is little evidence in support of the Schumpeterian hypothesis that market power and large firms stimulate innovations. For instance, in knowledge-intensive industries, smaller firms can be lead innovators. For instance, thanks to BioNTech’s innovations in mRNA technology, the pharmaceutical giant Pfizer was able to produce COVID-19 vaccines that have saved the lives of millions of people. This is a well-known example but there are many others of innovative small- and medium-sized enterprises (SMEs) punching above their weight in the fight to produce innovative products (EPO, 2017). With respect to firm size and age, in contrast to the manufacturing sector, start-ups and young firms in knowledge-intensive services sectors are more likely to engage in innovative activities and, even more importantly, are more likely to successfully turn innovation into a new service than larger firms (Audretsch, Kritikos, Schiersch, 2020). Also, smaller firms can be more agile in dealing with disruptive technologies. Large manufacturers have path dependency on their technological choices, while SMEs having a shorter lifespan are not so hampered by the sunk costs of previous innovation. Let’s take the car industry as an example. Research shows that car manufacturers that have innovated more on combustion engines in the past are more likely to continue to innovate in combustion engines in the present, finding it more difficult to shift their R&D towards alternative technologies needed for electric cars (Aghion et al., 2016).

Without entering further in a discussion about this complex relationship, for the purposes of this short policy brief, it is important to note that “large can be beautiful, but not always”.[1] However, as we have seen in the case of Dunlop, trade policy can affect firm size and corporate strategy, as well as global technological leadership. Forced localisation and technological requirements, as well as high tariffs, forced Dunlop to take suboptimal decisions that eventually affected the company’s future and its competitiveness.

[1] For a comprehensive literature review on the relationship between firm size and technological innovation, see for instance Symeonidis (1996).

3. The Interplay Between Firm Size and Trade Policy: It’s Complicated!

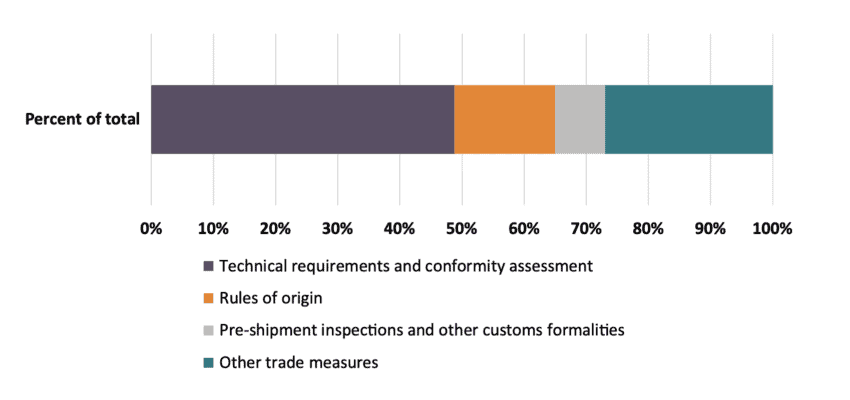

When looking at the interplay between firm size and technology, one should not disregard the role and impact of today’s trade policy. In many respects, world trade has changed considerably during the last century. Nowadays, unlike the late 19th century, local production is no longer a requirement to guarantee patent protection. Thanks to the WTO rules contained in the TRIPS and TRIMS agreements, such measures are prohibited. However, even if such trade barriers have disappeared, it does not mean that we live in a free trade world. Tariffs still exist, although at a much lower level than the double-digit tariffs faced by Dunlop tyres. More importantly, today virtually all products are subject to regulatory requirements. Regulations are there for good reasons but, when designed with a trade discriminatory purpose in mind, such regulatory requirements become costly non-tariff barriers (NTBs). NTBs are nowadays the most important trade barriers for companies, irrespective of their size. Among NTBs, technical barriers to trade (TBTs) are the most prevalent (Figure 1).

Figure 1: The incidence of non-tariff barriers reported by EU exporters by main type Source: Cernat and Boucher (2021).

Source: Cernat and Boucher (2021).

This is one example where trade policy and firm size interact strongly. While NTBs are costly for all firms, they are costlier for smaller firms. The primary reason for this effect is the fact that, unlike tariffs, these non-tariff barriers impose a fixed cost. These fixed, NTB-induced transactions costs impact both small firms and large firms, but not proportionally. Large firms can afford more easily to assign resources to address NTBs, and these costs can be spread over larger trade values, making them easier to absorb. SMEs tend to have limited resources or insufficient information about such non-tariff barriers and even when they invest resources in overcoming them, the fixed cost is spread over lower trade values, making NTBs overall more costly for SMEs.

This leads us to a simple but powerful first conclusion: trade policy is not firm-size neutral and the current prevalence of non-tariff barriers makes it more difficult for SMEs to engage in international trade.

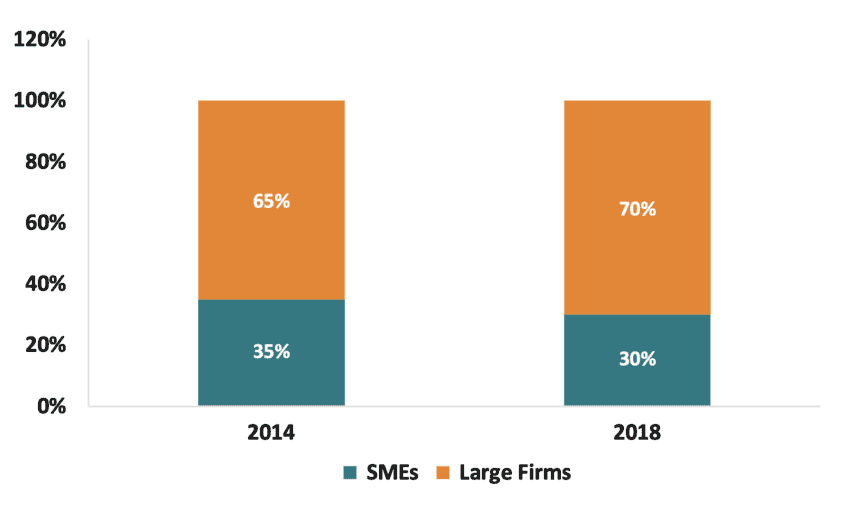

Despite these obstacles, many EU SMEs are very competitive in international markets. Over 615,000 EU SMEs are direct exporters, with clients around the world. EU SMEs also generate a sizable share of total EU exports. However, there are signs that things might get trickier in the coming years. One important factor is the potential impact of the COVID crisis. Post-COVID trade figures broken down by firm size are not yet available but business surveys indicate that SMEs have been more severely affected by the COVID-related global economic downturn than larger firms. For instance, the COVID crisis strongly or moderately affected three out of four SMEs, forcing them to deal with supply chain disruptions, employee absences and temporary shutdowns (Mergen, 2021). Already before the COVID crisis, EU SMEs had experienced a decline in their relative trade performance (Figure 2). Between 2014 and 2018, the share of EU SMEs in total extra-EU merchandise exports declined by 5 percentage points.

Moreover, participation in international supply chains is correlated with the ability to innovate. There is evidence that both R&D spending and trade exposure are complementary. Based on a sample of Norwegian firms, Moxnes et al. (2012) found that virtually all firms that invest in R&D are also importing more than non-innovative firms. Hence, if imports are closely linked with innovation, supply chain disruptions – such as the ones experience by many SMEs due to COVID-19 – and less exposure to international sourcing may indirectly affect the ability of firms to innovate.

Figure 2: Share of EU SMEs in total EU exports Source: Author’s calculations, based on Eurostat Trade by Enterprise Characteristics database.

Source: Author’s calculations, based on Eurostat Trade by Enterprise Characteristics database.

As a result, the corollary of the old adagio that “trade policy affects competition and competition affects trade performance” is that different trade policy instruments affect firm size, competition and technological innovation in different ways. While tariffs are firm-size neutral, non-tariff measures (e.g. TBTs, SPS, IPRs, norms, standards) and other specific trade provisions that generate a fixed cost of compliance, affect small firms in a disproportionate manner.

At a more general level, the economic theory also raises a number of important questions when it comes to trade, technology, and firm size. Contrary to the usual temptation to adopt a simple textbook economics approach to this complex interaction, recent analyses provide a more nuanced picture. For instance, Nocco, Ottaviano and Salto (2019) argue that, in a world in which countries differ in terms of market access and technology, and firms with market power differ in terms of productivity, the design of optimal trade policy is not as straightforward as one might think. In an ideal world, free trade is the best multilateral trade policy and there is no room for welfare improvements from targeted policy interventions. In the real world, where multiple trade frictions and economic imperfections are at play, Nocco and co-authors argue that free trade allocation of resources may be inefficient in terms of products available and their characteristics, and that the extent of inefficiency varies across countries depending on market size, state of technology, and geography. In this new light, a “strategic trade policy” is not just a new and misguided political interference with free trade principles. If well calibrated, trade policy interventions may actually provide solutions to some longstanding problems affecting global trade.

Beyond theory, the practical implications of all these complex interactions are that some start-ups may forever remain SMEs, unable to build a virtuous circle between trade and technology. Others, in contrast, can evolve into “SMEs on steroids” and become unicorns: innovative companies that may be the next market leader in their sector.

4. In Search of European Unicorns: Where are They?

Unicorns are a fascinating economic animal, both for business and policy makers. The generally accepted definition of a unicorn is that of a privately held start-up company which is valued at over $1 billion. What used to be a rather exceptional occurrence, to rapidly evolve from a garage company to a multi-billion dollar company, is nowadays more and more common, especially in the United States and China.

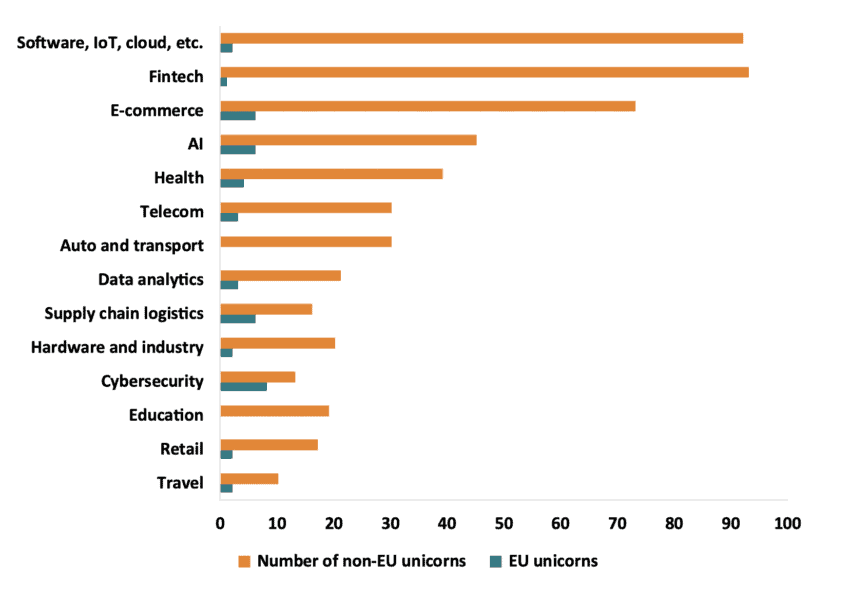

The question is all the more important since unicorns tend to emerge in sectors considered to be of strategic importance or with a highly disruptive potential for future global competitiveness of many sectors (Figure 3). For instance, there are almost 100 unicorns specialised on IoT and related software worldwide and around 50 unicorns offering leading solutions based on artificial intelligence. Unicorns are important for the future development of a sector, as they may be the drivers not only of new innovative solutions but also of future industry standards.

A number of these emerging technologies will fundamentally change how international trade is conducted. Such technologies may also change comparative advantages and national competitiveness across sectors, including the ability of EU SMEs to remain competitive worldwide. From Internet of Things and blockchain to 3D printing, many so-called #TradeTech applications developed by global unicorns will redefine manufacturing, supply chains, and trade customs procedures.

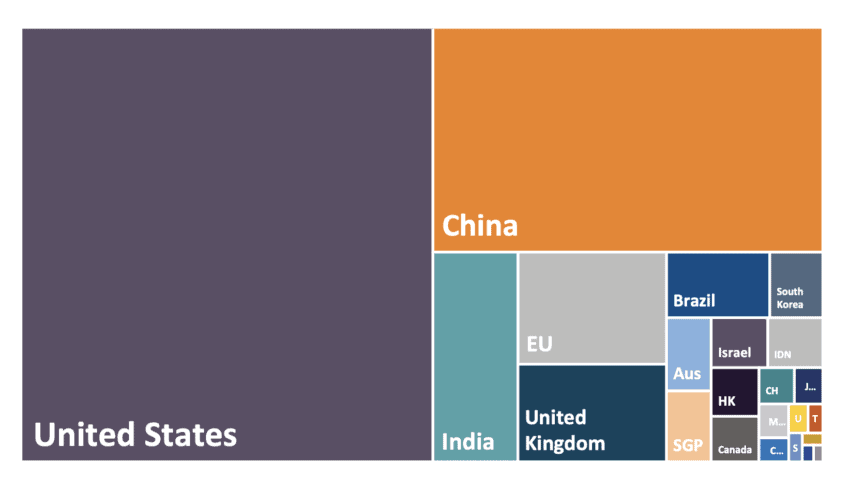

Surprisingly perhaps, the EU is not well placed in the global unicorn ranking (Figure 4). The EU is home to only 8% of the total number of unicorns worldwide. EU based unicorns are not just fewer than expected, they are also smaller in value than the average unicorn. Since EU unicorns account only for 5% of the total market valuation of all unicorns worldwide, this lower “lower in value than in number” share of EU unicorns vis-a-vis non-EU unicorns indicates the existence of a double challenge. The EU is behind both the US and China, and even behind India, in terms of the number and value of unicorn companies headquartered across all EU Member States. In terms of number of unicorns, Germany and France lead in Europe (accounting for 60% of the total), followed at a distance by Sweden, the Netherlands, and Spain. A handful of other Member States (Ireland, Lithuania, Estonia, Croatia, Belgium, Finland, Austria) also appear to have at least one unicorn company. Analysing the possible factors that may be behind this “anomaly” goes beyond the focus of this short paper. However, while the most likely reasons are not related to trade policy aspects, exploring potential linkages would nonetheless be a worthwhile endeavour.[1]

For instance, unicorns are quickly becoming in many cases the de facto standard-setters in their niche markets.[2] Beyond such de facto standard-setting examples, the empirical literature found that “the most decisive factor for participation in the standardization process is the company size” (Blind and Thumm, 2004). If this is a systematic trend, in a world where unicorns set standards, EU SMEs will be standard takers, instead of standard makers. Therefore, an important question for the post-COVID future is: can EU SME-exporters compete as successfully as before with non-European unicorns?

The answer is not necessarily gloomy, but it is not straightforward either. Unicorns are important as a source of new technology, and new technology creates new ecosystems where many small firms can thrive as valuable partners in the supply chain of larger companies. The answer also depends on the ability of each economy to stimulate technological diffusion within such ecosystems, from large to smaller companies. This is sometimes easier said than done, but there are successful examples.[3] The sectoral distribution of unicorns also indicates that they are very often found in sectors that are the drivers of digitalisation, which is another important objective for several EU policies. A successful presence in global markets for EU exporting SMEs therefore depends to a large extent on improving the links between trade and other EU policies aimed at promoting the internationalisation and digitalisation of EU SMEs.

Figure 3: Number of unicorns worldwide by sector

Source: Author’s elaboration, based on the CB Insights database. Accessed online in July 2021.

Source: Author’s elaboration, based on the CB Insights database. Accessed online in July 2021.

Figure 4: Geographical distribution of unicorn companies, by market value

Source: Author’s elaboration, based on the CB Insights database. Accessed online in July 2021.

Source: Author’s elaboration, based on the CB Insights database. Accessed online in July 2021.

The latest post-COVID data seems to suggest that Europe is shifting up a gear in terms of unicorn formation, catching up with other regions. In the last year, there seems to be a rapid growth in the number of EU unicorns, triggered by a strong interest from US investors in EU tech start-ups (Hodgson, 2021). The newly created EU-US Trade and Technology Council offers additional guarantees that there is also a strong political interest in forging such transatlantic ties. Beyond EU-US cooperation, a successful EU trade policy that remains in sync with business realities will require a more global, systematic focus on the growing links between trade and technology (Cernat, 2021).

[1] For an assessment of some of the potential underlying reasons for the EU’s underperformance in certain economic areas, see for instance, Erixon (2021).

[2] For some cases studies of unicorns becoming de facto standard-setters in their business, see for instance Simon (2016).

[3] For one such example of fostering the scaling-up of SMEs as part of EU policies, see for instance the EU UNICORN project (unicorn-project.eu).

5. What Role for Trade Policy and the “Brussels Effect”?

Since new and potentially disruptive technologies might be the “make or break” ingredients of global success for EU companies, what role can trade policy play in the overall policy response? One clear answer is found in business surveys. Companies interested in operating in various international markets indicate that having to comply with different regulations across countries on #TradeTech is the biggest perceived barrier for the majority of respondents (WEF, 2020). Translating this into policy priorities would indicate a strong role for regulatory cooperation in the EU trade policy toolbox. Indeed, reducing regulatory divergence on the basis of the famous “Brussels effect” and advocating the merits of EU regulatory approaches to other jurisdictions can offer a considerable advantage to EU SMEs, but also to companies in our trading partners that crucially depend on the EU market for their exports. The “Brussels effect” may even promote trade between third countries, if compliance with EU norms and standards is seen as a guarantee of quality in terms of product characteristics, data privacy, consumer safety or environmental protection.

Another clear conclusion is that there are things trade policy can never do. Unicorns cannot easily be engineered via any single policy, let alone trade policy. The question is then: how can EU trade policy connect EU SMEs to leading unicorns around the world, irrespective of their origin? One limitation of current trade rules is that they do not really distinguish between companies based on firm size. Yet, in a world of fixed costs and large firm size disparities, EU SMEs would probably be at a loss if competing for the same market segment against a unicorn. For instance, OECD research shows that cross-border service exports by SMEs face the equivalent of an additional 12% trade costs, compared to large firms (OECD, 2018).

While SMEs will rarely be global standard-setters, policy makers can use the potential offered by the “Brussels effect” to create a level playing-field for companies of all sizes. One such example is provided by initiatives aimed at supporting EU SMEs to cope with diverse regulations and standards worldwide. Recently, the #Access2Markets portal created by DG TRADE primarily for SMEs has been voted as one of the best examples of good public policy support for SMEs. The Access2Markets portal is available to both EU and non-EU firms and aims to be one of the best trade information tools available worldwide, covering a growing range of trade policy formalities (tariffs, non-tariff barriers, services, public procurement, etc.). Having a trade “one stop shop” in Brussels instead of 27 trade portals across EU Member States clearly offers economies of scale.

As in the business world, good ideas and new trade policy initiatives often rely on existing elements that just need some tweaking. One pertinent example relates to the potential adoption of disruptive blockchain technologies in trade policy making. According to the World Economic Forum, the reduction of trade costs thanks to blockchain solutions could result in more than 1 trillion dollars of new trade in the next decade. In 2018 the European Parliament adopted a resolution encouraging the adoption of blockchain solutions for trade policy. Blockchain becomes highly relevant in the COVID-19 crisis when electronic (trade) documents were the only way to ensure business continuity in a lockdown and social distancing environment. As a result of these potential trade applications for blockchain technologies, DG TRADE has recently launched an #EUBlockchain4Trade pilot project to explore the efficiencies that can be reaped across various trade policy areas The areas where blockchain can make a difference are incidentally also those where SMEs are looking for cost-effective, digital solutions for their export operations, e.g. trade facilitation, rules of origin, compliance with technical standards, conformity assessment, certification, etc. (Cernat, 2020).

The #Access2Market and #Blockchain4Trade are only two examples of how practical and tangible trade policy initiatives work towards lowering the fixed cost of trade procedures and formalities that will have a positive effect on SMEs. The good news is that we do not need to reinvent the wheel to ensure EU SMEs remain globally competitive in the future. But we might need to think creatively about some existing trade rules. Just as companies invent and adopt new disruptive technologies, so should trade policy.

References

Aghion, P., A. Dechezleprêtre, D. Hémous, R. Martin, and J. Van Reenen (2016) “Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry,” Journal of Political Economy 124(1): 1–51.

Audretsch, D. B., A. S. Kritikos, A. Schiersch (2020) “Microfirms and innovation in the service sector”, Small Business Economics 55: 997–1018.

Blind, K. and N. Thumm (2004) “Interrelation between patenting and standardisation strategies: Empirical evidence and policy implications,” Research Policy 33(10): 1583–1598.

CB Insights (2021) The Complete List of Unicorn Companies. Available online at: https://www.cbinsights.com/research-unicorn-companies

Cernat, L. and D. Boucher (2021) Multilateral cooperation behind the trade war headlines: How much trade is freed up?, CEPS Policy Insights No. PI2021-03, Centre for European Policy Studies, Brussels.

Cernat, L. (2020) Blockchain for Trade: the next gold standard or the fool’s gold?, ECIPE Blog, 20 October.

EPO (2017) Unlocking untapped value: EPO SME case studies on IP strategy and IP management, European Patent Office, Munich.

Erixon, F. (2021) Time for a New Industrial Policy, ECIPE Blog. Available online at: https://ecipe.org/blog/time-for-a-new-industrial-policy/

European Parliament (2018) Blockchain: a forward-looking trade policy, European Parliament Resolution of 13 December 2018, 2018/2085(INI).

Hodgson, L. (2021) Europe’s unicorn herd grows bigger and faster in 2021, PitchBook, 14 June. Available online at: https://pitchbook.com/news/articles/europes-unicorn-herd-grows-bigger-and-faster-in-2021

Jones, G. (1984) “The Growth and Performance of British Multinational Firms before 1939: The Case of Dunlop”, The Economic History Review 37(1): 35-53.

Mergen, J. P. (2021) SME survey on supply chain disruption in Europe due to COVID 19, European Enterprise Network. Available online at: https://www.brusselsnetwork.be/fr/sme-survey-on-supply-chain-disruption-in-europe-due-to-covid-19/

Moxnes, A., K. H. Ulltveit-Moe, and E. A. Bøler (2012) Why trade policy matters for firms’ R&D investment, VoxEU, 18 July. Available online at: https://voxeu.org/article/why-trade-policy-matters-firms-rd-investment

Nocco, A., G. Ottaviano and M. Salto (2019) “Geography, competition, and optimal multilateral trade policy,” Journal of International Economics 120: 145-161.

OECD (2018) Fostering greater SME participation in a globally integrated economy, OECD Discussion Paper for the SME Ministerial Conference, 22-23 February, Mexico City.

Simon, J. P. (2016) How to Catch a Unicorn: Case Studies, Joint Research Centre Technical Report EUR 27822. Luxembourg: Publications Office of the European Union.

Symeonidis, G. (1996), “Innovation, Firm Size and Market Structure: Schumpeterian Hypotheses and Some New Themes”, OECD Economics Department Working Papers, No. 161, OECD Publishing, Paris, https://doi.org/10.1787/603802238336

WEF (2020) Mapping TradeTech: Trade in the Fourth Industrial Revolution, December 2020, World Economic Forum, Geneva.