Securing Europe’s Future: Strengthening ICT Competitiveness for Economic and National Security

Published By: Fredrik Erixon Oscar Guinea Dyuti Pandya

Research Areas: Digital Economy EU Trade Agreements European Union Services Trade Defence

Summary

Europe’s Information and Communication Technology (ICT) sector, including ICT manufacturing such as telecom equipment and electronic components, as well as ICT services such as software, telecommunication services, and data processing, is no longer merely an economic pillar but a strategic asset essential for national security and defence capabilities. This paper identifies two concerns linking technology and national security: the exploitation of ICT as a gateway to critical infrastructure and the weaponisation of trade and technological dependencies in ICT by foreign nations. Addressing these two challenges requires tailored approaches, as they involve distinct nations and contexts.

First, the EU should reduce its reliance on Chinese telecom equipment within its networks and accelerate the deployment of 5G. While phasing out Chinese telecom equipment will take years, a faster rollout of 5G can be achieved in the short term. To accomplish this, the EU should promote the scale and profitability of its telecom operators.

Secondly, the EU relies heavily on US companies for a substantial share of its cloud-based online services. However, it is unlikely that the US would impose restrictions on these exports to the EU. Furthermore, replicating the infrastructure needed to deliver cloud-based online services would entail significant costs. To achieve technological leadership, the EU must prioritise emerging technologies such as 6G, XG, AI, quantum computing, and edge and hybrid computing, which will form the foundation of future commercial and military innovations.

Thirdly, the EU should strengthen its leadership position in the development of technologies for advanced mobile communication, including 5G, 6G, and XG. Through significant effort and investment in R&D, European companies have secured a leading role in developing technical standards for cellular communication and telecom equipment. Large European firms such as Ericsson and Nokia, as well as EU SMEs that are champions in their fields, are among the most significant contributors to the technological standards. This hard-won position is one that EU policymakers must do their utmost to protect and develop.

However, complacency is a recipe for disaster. The EU has the potential to foster companies that could lead in the technologies of tomorrow. It possesses the necessary fundamentals to drive technological innovation in the ICT sector, including high levels of human capital, firms operating at the technological frontier, and a market economy underpinned by strong institutions, the rule of law, and robust intellectual property protections. These constitute Europe’s comparative advantages, and the EU must adopt policies that recognise and reinforce them, rather than undermine them.

1. Introduction

Traditionally, the ICT sector have concerned national security experts for two reasons: the use of ICT technology as a gateway to critical infrastructure and the weaponisation of trade and technological dependencies in ICT by foreign countries. However, a third reason has gained relevance in recent years: ICT has become an essential input for military equipment and broader statecraft. Consequently, having companies that operate at the technological frontier of the commercial ICT space is now a vital component of national security and defence capabilities.

As a result, the competitiveness of the EU ICT sector must be at the heart of any EU framework for national security, and national governments and EU institutions now need to wake up to the fact that big ICT companies are pondering moving to the US because of bad market and policy conditions in Europe. Policymakers should implement policies that ensure the EU ICT sector not only remains at the technological frontier but also continues to push this frontier further. This is both an economic imperative and a national security priority.

Chapter Two explores the two traditional pillars linking technology and national security: access to critical infrastructure and the weaponisation of ICT dependencies by foreign countries. These two issues involve the world’s two most powerful countries: China and the US. However, they must be approached differently. Unlike China, the US is a market economy where state intervention is limited and broadly comparable to EU rules.

Moreover, while access to critical infrastructure and the weaponisation of trade and economic dependencies are genuine risks, the EU must recognise another blind spot. The competitiveness of its ICT sector, which includes the rollout of 5G, should be an economic and security priority. In these efforts, the EU should also look to the next wave of ICT developments, including AI, 6G, XG, quantum technology, and edge and hybrid computing. Having companies operating at the forefront of these technologies will provide the EU with a significant geopolitical and military advantage.

Chapter Three demonstrates that the EU ICT sector is well positioned to achieve these goals. The EU is a leader in some areas of the ICT sector such as advanced mobile communication and it can lead in many other fields in the future. Chapter Four argues that the EU should focus on its comparative advantages and design policies that recognise and nurture them: high levels of human capital, a diverse ecosystem of companies operating at the technological frontier, and a market economy supported by strong institutions, the rule of law, and robust intellectual property rights are the EU’s key strengths.

2. Technology and National Security

2.1 5G Networks and China

Economic, security and political tensions between the EU and China have been on the rise. Among other factors, these tensions have been fuelled by security issues related to 5G technology. This is not a secret. In 2023, the European Commission identified significant concerns about Chinese telecom equipment which could compromise the security of EU’s infrastructure[1] and enable Chinese cyber-espionage targeting confidential information from firms, governments, and the military.[2]

Chinese-made telecom equipment represents a significant share of the total network in several European countries. In Finland, the home country of the European Commission’s Executive Vice-President for Tech Sovereignty, Security, and Democracy, Henna Virkkunen, 41 percent of the 5G Radio Access Network (RAN) relies on Chinese inputs. The same can be said about other European countries such as Netherlands (72 percent), Austria (61 percent), Germany (59 percent), Italy (51 percent), Spain (38 percent), Poland (38 percent), and Portugal (34 percent), which rely heavily on Chinese suppliers for 5G equipment.[3] EU countries have implemented measures to reduce or eliminate Chinese telecom equipment form their 4G and 5G networks, but this is a process that will take years.

The prominence of Chinese suppliers in EU 4G and 5G networks is not due to a shortage of EU companies producing telecom equipment. Ericsson and Nokia, two of the world’s largest suppliers of these goods and services, are European companies. However, over the years, their market share in both the EU and global telecom markets has declined due to intense competition from Chinese providers, such as Huawei and ZTE.

Another critical risk to national security related to the deployment of 5G, which is often overlooked, is its slow rollout. Numerous mergers have been either rejected or altered by regulators, leading to a lack of consolidation among EU Member States.[4] The pace of establishing 5G networks is widely seen as a marker of a nation’s advancing technological capacity. 5G is not only providing access to digital services at much greater speeds – potentially 100 times faster than the 4G mobile network we currently use[5] – but is also paving the way for new innovations.

This is critical. Without a timely roll-out of the 5G network, the EU’s technological leadership in cellular technology and telecom equipment will be at risk, and EU companies could face disadvantages when competing in AI, 6G, XG, quantum technology, edge and hybrid computing, automated vehicles, or IoT, all of which require a modern network infrastructure. These advancements are crucial not only for the competitiveness of the EU economy but also for its defence capabilities.[6]

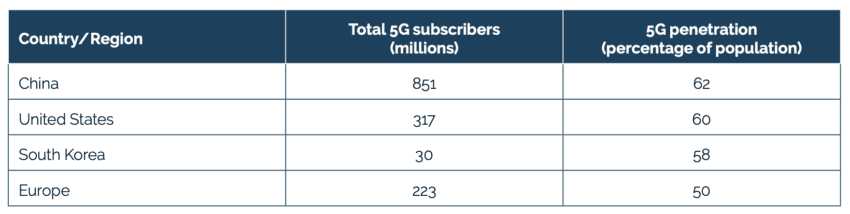

Recent reports from the European 5G Observatory[7] and Ericsson[8] highlight that the EU lags behind China and the US in the absolute number of 5G subscribers. Additionally, when considering the percentage of the population with 5G subscriptions, the EU also trails behind South Korea.

Table 1: Total 5G subscribers (millions) and 5G penetration (percentage of population) Source: European 5G Observatory; Table: Comparison of 5G rollout in international markets. Note: The US total number of 5G subscribers and as percentage of population also includes all of North America; 5G Subscriber data in EU includes all of Western and Eastern Europe.

Source: European 5G Observatory; Table: Comparison of 5G rollout in international markets. Note: The US total number of 5G subscribers and as percentage of population also includes all of North America; 5G Subscriber data in EU includes all of Western and Eastern Europe.

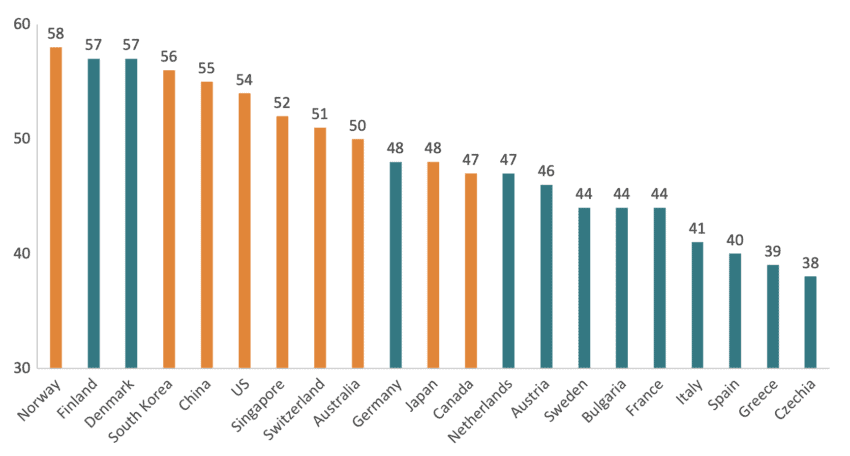

A similar analysis that considers not only the number of subscribers but also 5G infrastructure and services paints a comparable picture. GSMA Intelligence, a consultancy specialising in mobile market information, produced an index that ranked countries based on 17 indicators measuring the infrastructure that enables 5G connectivity and the adoption and usage of 5G by consumers and firms. Figure 1 presents the results of this index for EU countries and comparable economies outside the EU. While some EU countries, such as Finland and Denmark, performed well in this index, the majority of EU member states lagged behind advanced economies such as South Korea, China, and the US.

Figure 1: 5G Connectivity Index

Source: GSMA Intelligence.

The realisation that the EU has fallen behind the US and China in the deployment of 5G has placed the telecom sector at the heart of the EU’s competitiveness debate. High-speed, high-capacity broadband networks were among the few sectors identified by Mario Draghi as priorities for revitalising Europe’s competitiveness.[9] The report highlights the sector’s well-known weaknesses. Firstly, market fragmentation and a large number of telecom operators have led to insufficient scale and profitability, undermining the substantial infrastructure investments needed for fibre and 5G broadband. One data point is worth a thousand words: returns on capital in the EU telecom sector have consistently fallen below the weighted average cost of capital. In other words, companies in the EU telecom sector are not generating sufficient profits from their investments to offset the costs of raising capital through loans or investors. This makes it hard for telecom operators to get funding for future projects such as upgrading networks or rolling out new technologies.

Secondly, spectrum policies in the EU remain inconsistent across member states and are primarily focused on maximising the pricing of frequencies. EU spectrum auctions have been designed to prioritise high prices for 3G, 4G, and 5G, placing minimal emphasis on investment commitments or fostering innovation. This approach restricts the availability and duration of frequency bands for existing operators. In contrast, the US benefits from permanent spectrum ownership and flexible auction policies, allowing telecom operators to use spectrum more efficiently. Furthermore, the US has a varied high-band allocation, enabling high-speed deployments for new ICT applications in urban areas and industrial purposes. Meanwhile, the EU uses the 26 GHz band for high-speed applications, which aligns with global trends but is less ambitious than the US.[10]

Thirdly, the EU’s telecom regulatory framework is characterised by a dual emphasis on both “services competition” and “infrastructure competition.” These conflicting objectives create a scenario where growing demand for digital services is met with falling prices, yet without a corresponding rise in investment levels to meet the increased demand. Telecommunication services are affordable in the EU, but the lack of investment is beginning to affect consumer satisfaction, as consumers care not only about price but also about speed and coverage. The Draghi report notes that gigabit connectivity reaches only 56 percent of households across Europe, while 50 percent of rural households lack access to advanced digital network infrastructure.

2.2 Cloud Computing and the US

A second national security risk associated with technology concerns economic and trade dependencies. When one country relies heavily on another for critical products such as raw materials, medicines, or semiconductors the supplier may exploit this dependency for political leverage.

The EU relies heavily on US companies, such as Microsoft, Google, and Amazon, for a significant share of its cloud-based online services. However, it is unlikely that the US would impose restrictions on these exports to EU companies. Moreover, not all dependencies are equal, and the US functions as a market economy, where state intervention in exports is limited and broadly similar to the rules followed in the EU. If anything, it is the EU that has imposed regulatory barriers affecting the delivery of these services from abroad. For example, Apple and Meta have delayed the introduction of their latest AI models and systems in the EU due to concerns about EU regulations.[11]

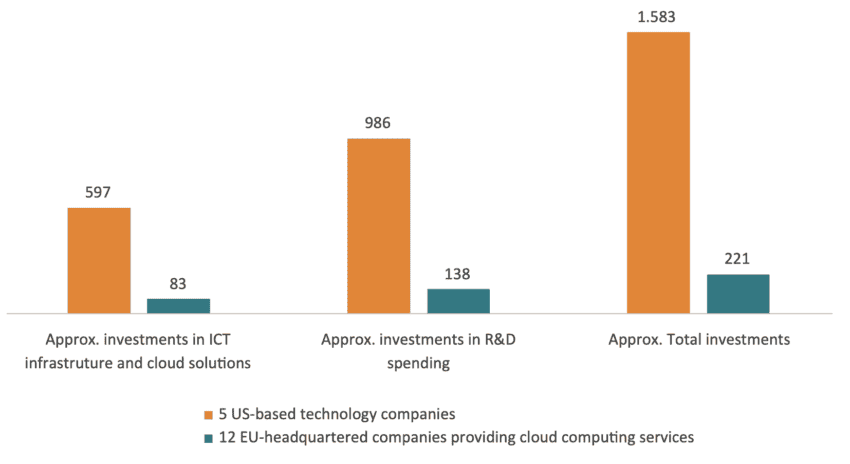

Moreover, replicating the infrastructure needed to deliver cloud-based online services would entail extraordinary costs. Between 2005 and 2022, the top five US companies by capital expenditure invested €1.6 trillion in developing the technology and infrastructure required for these services. By comparison, during the same period, the top twelve EU companies by capital expenditure spent €221 billion on similar activities, leaving an unbridgeable gap of €1.36 trillion. Allocating scarce public and private R&D resources to duplicating infrastructure that is already established and functioning effectively would be unwise. Figure 2 presents overall investment by the top five US-based technology companies and 12 EU-headquartered companies which provide various cloud computing services.[12]

Figure 2: Total ICT and cloud-related investments, 5 US-headquartered technology companies vs. 12 EU-headquartered companies providing cloud computing services, 2005 to 2022, in USD billion

Source: Bauer, M., Erixon, F., and Pandya, D. (2024).

Source: Bauer, M., Erixon, F., and Pandya, D. (2024).

To achieve technological leadership, the EU must prioritise future technologies over existing ones, such as cloud computing. Technologies such as 6G, XG, AI, quantum computing, and edge and hybrid computing will form the foundation of future commercial and military innovations. The war in Ukraine has shown that drones, satellites, and AI are as critical as tanks and artillery. 6G will enable autonomous networks that integrate aerial, terrestrial, and underwater systems, providing limitless and continuous wireless connectivity, alongside the speed and low latency needed for autonomous military weapons. Machine learning and AI will analyse vast amounts of data and power real-time targeting, while some of the first practical applications of quantum technologies focus on encryption and cybersecurity.

The EU should focus on the future, not the past. The good news is that it has the right fundamentals to drive technological change in the ICT sector, including high levels of human capital, companies operating at the technological frontier, and a market economy supported by strong institutions, the rule of law, and robust intellectual property rights. These are Europe’s comparative advantages, and the EU must recognise and nurture them.

[1] The report said “The unavailability of communication sector services caused by ransomware and destructive malware carries large potential for spillover harm into other sectors. Moreover, the risk of disruption is heightened in areas where a telecommunications operator is the sole provider for critical entities or in a particular region.” See: NIS Cooperation Group. (2023). EU cybersecurity risk evaluation and scenarios for the telecommunications and electricity sectors. Prepared at the request of the Council by services of the European Commission and the NIS Cooperation Group

[2] European Parliament. (2019). 5G in the EU and Chinese telecoms suppliers. Available at: https://www.europarl.europa.eu/RegData/etudes/ATAG/2019/637912/EPRS_ATA(2019)637912_EN.pdf

[3] Strand Consult. (2024). The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries Strategic Reports.

[4] See: Copenhagen Economics. (2024). 4-to-3, back to 4? A time of reckoning for the EU telecoms industry. Copenhagen Economics; White & Case LLP. (2023). EU Court of Justice in CK Telecoms sides with the European Commission’s approach to mergers. White & Case LLP; and European Commission. (2024). Commission statement on IP/24/928. Retrieved November 28, 2024. Available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_24_928

[5] Thales. (September 26, 2024). 5G technology and networks (speed, use cases, rollout). Available at: https://www.thalesgroup.com/en/markets/digital-identity-and-security/mobile/inspired/5G

[6] Abd EL-Latif, A. A., Abd-El-Atty, B., Venegas-Andraca, S. E., & Mazurczyk, W. (2019). Efficient quantum-based security protocols for information sharing and data protection in 5G networks. Future generation computer systems, 100, 893-906.

[7] European 5G Observatory. (2024). European 5G Scoreboard. Available at: https://5gobservatory.eu/observatory-overview/interactive-5g-scoreboard/#5G-spectrum-chart

[8] Ericsson. (2024). Ericsson Mobility Report 2024. Available at: https://www.ericsson.com/49ed78/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-june-2024.pdf

[9] EU competitiveness: Looking ahead. Available at: https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en

[10] European 5G Observatory. (2024). (see note: 5)

[11] Stolton, S. and Gurman, M. (June 22, 2024). Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-06-21/apple-won-t-roll-out-ai-tech-in-eu-market-over-regulatory-concerns?embedded-checkout=true ; Kroet, C. (July 18, 2024). Meta stops EU roll-out of AI model due to regulatory concerns. Euro News. Available at: https://www.euronews.com/next/2024/07/18/meta-stops-eu-roll-out-of-ai-model-due-to-regulatory-concerns

[12] These companies are SAP, ATOS, Capgemini, Dassault, Amadeus, Koninklijke, Deutsche Telekom, Telefónica, Nokia, Orange, Telecom Italia, and OVH. For more information on the methodology see Bauer, M., Erixon, F., and Pandya, D. (2024). The EU’s Trillion Dollar Gap in ICT and Cloud Computing Capacities: The Case for a New Approach to Cloud Policy. Report, ECIPE, Brussels, occ. paper 3/2024, 32 p.

3. The Competitive Edge of the EU ICT Sector

In 2022, Europe’s ICT sector[1] comprises of 1.2 million firms, of which 96 per cent were small and medium-sized enterprises (SMEs) scattered across all EU member states. Together, they generate a net turnover of €2.3 trillion, making the ICT sector much larger than any manufacturing sector within the EU. Importantly, the ICT sector is highly dynamic and offers above-average wages. Compared with the overall manufacturing sector, its value added grew 10 percentage points faster during the last four years and in 2022 enjoyed average salaries 40 percent higher than those in manufacturing.[2]

The EU ICT sector is also highly competitive. In 2020, the EU’s benefited from a positive trade balance in ICT services – such as telecommunications, computer programming, and information services – measured in value-added terms, of $32 billion. That year, EU ICT services exports reached $127 billion – the highest on record – close to doubling EU ICT services exports from a decade earlier. These trends persist even when excluding Ireland from the statistics, where many US ICT multinationals are headquartered.[3]

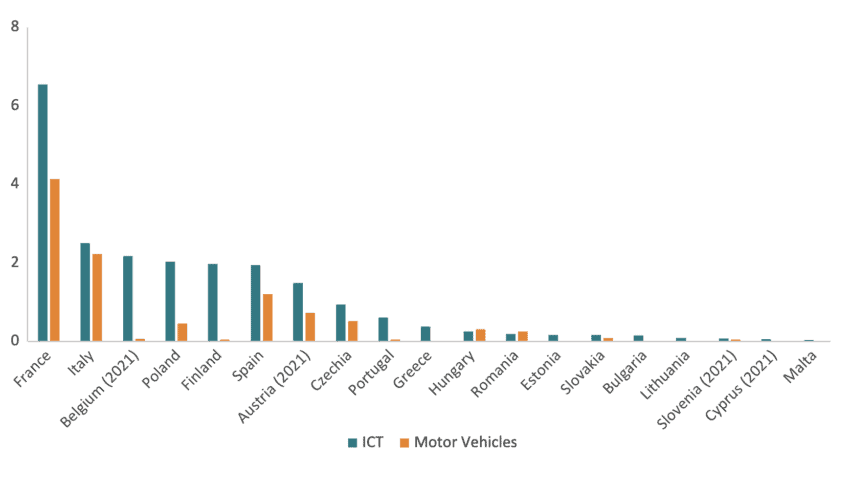

The sector’s competitiveness is also evident in its Research and Development (R&D) investment. The EU’s largest sector for business R&D spending is the automotive industry, which invested €36 billion in R&D in 2022. The ICT sector ranked second, with an investment of €34 billion. However, excluding Germany’s R&D investment, which is skewed towards automotives, the ICT sector becomes the EU’s largest investor in R&D. Moreover, companies in the motor vehicle sector are spending an increasing share of their R&D budget on ICT related innovations such as vehicle connectivity. Figure 3 illustrates that, in most EU countries, business R&D spending in the ICT sector is higher than in motor vehicles.[4]

Figure 3: Business spending on R&D across ICT and motor vehicles in 2022, in Euros billion Source: Authors’ calculations. Eurostat.

Source: Authors’ calculations. Eurostat.

Many of these European companies making R&D investments in the ICT sector work at the knowledge frontier. Some of these such as Nokia, Ericsson, Siemens, and Philipps are large corporations, but many others are SMEs such as Fractus in Spain, Transatel in France, or TICRA in Denmark. The contribution of these companies is evident not only in the business metrics like turnover and exports presented earlier but also in their active participation in standardisation bodies that set protocols for mobile telecommunications, such as the European Telecommunications Standards Institute (ETSI) and the 3rd Generation Partnership Project (3GPP). In 2023, EU companies accounted for 52 and 28 per cent of the total firms in ETSI and 3GPP, respectively – a significantly higher proportion than that of the US and China.

These figures underscore the EU’s leadership in crucial areas of the ICT sector. European companies were pioneers in cellular technology, and that leadership remains strong today. This is excellent news for the EU, as advanced mobile communication has become a critical component for the competitiveness of other sectors, including automotive and industrial applications, as well as defence. It is no coincidence that 6G featured prominently in the EU-US Trade and Technology Council[5], that several European countries issued a joint statement with the US, Japan, South Korea, and Australia emphasising the importance of secure 6G technologies built on global standards that respect intellectual property rights (IPRs)[6], or that Sweden and the US identified 6G as critical infrastructure and committed to cooperating on its development.[7]

This leadership position has been achieved through significant investments in R&D, enabling European companies to remain at the forefront of innovation and lead in developing new technology standards. Technological leadership in standards is determined by the quality of the companies’ technological contributions, not by the number of participants, chairperson positions, or contributions to a standards development organisation[8]. Increased R&D leads to more innovation, which positions a company to take the lead in the development of a standard.

The importance of EU ICT companies as key contributors to R&D spending and as technological leaders in their respective fields is also critical for national security. Many of the new defence capabilities transforming modern warfare originate from the commercial ICT sector. Assuming that 2025 chips and AI technologies will outperform their 2024 counterparts on the battlefield, it is more likely these technologies will emerge first from the commercial ICT sector rather than from traditional defence suppliers. Therefore, a thriving EU ICT sector, capable of producing and integrating digital technologies into its goods, services, and defence systems is one of the Europe’s best security guarantees.

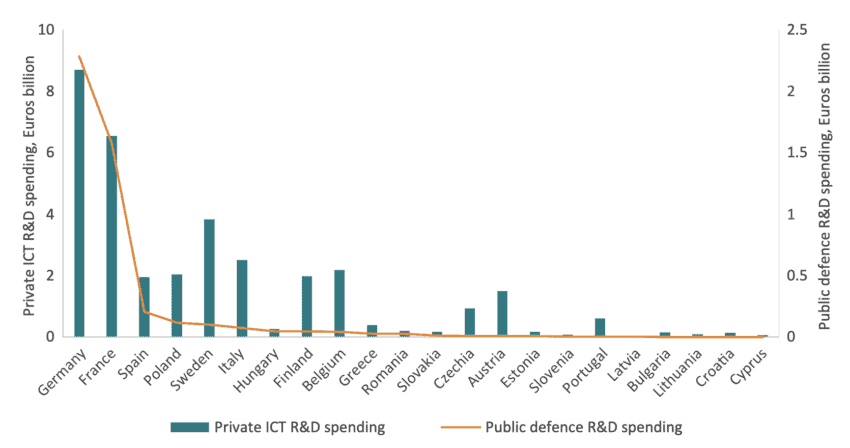

Furthermore, the commercial ICT sector is not only faster at developing new technologies but also significantly larger. In 2022, the total public defence R&D spending across the EU amounted to €4.6 billion[9]. By comparison, as noted earlier, EU private ICT R&D spending was seven and a half times larger, amounting to €34 billion. These R&D investments are reflected in the number of patents. In 2018, the ICT sector was the leader in patent applications to the European Patent Office (EPO) with more than nine thousand patents filed.[10]

Figure 4 compares EU ICT R&D spending with defence R&D spending across EU member states. First, it shows that larger EU countries invest more in private ICT R&D and defence R&D than smaller ones. Second, it demonstrates that private ICT R&D spending significantly outweighs public defence R&D spending. For instance, private ICT R&D spending in Germany, France, Spain, and Poland, the four EU countries with the highest public R&D spending on defence, totalled €19 billion, compared to €4 billion spent on defence R&D by these same countries.

Figure 4: EU ICT spending on R&D and defence by EU member states, in Euros billion Source: Authors’ calculations. Eurostat. Note: ICT R&D spending for Germany, Sweden, Austria and Cyprus corresponds to 2021.

Source: Authors’ calculations. Eurostat. Note: ICT R&D spending for Germany, Sweden, Austria and Cyprus corresponds to 2021.

[1] ICT sector includes ICT manufacturing and ICT services. Following Eurostat and OECD Guidelines, the ICT sector is defined with the following NACE codes: ICT manufacturing: NACE groups [26.1 – 26.4] + 26.8; ICT services: 46.5 + 58.2 + 61 + 62 + 63.1 + 95.1.

[2] Data sourced from Eurostat. In 2022, average employee benefits expense were 44 percent higher in ICT than in manufacturing; labour cost per employee FTE was 43 percent higher in ICT than in manufacturing.

[3] Data source from the OECD Trade in Value-Added. ICT services included the following codes: J61 Telecommunications; and J62_63 computer programming, consultancy and information services activities.

[4] Sectors included: ICT sector (ICT manufacturing and services) and manufacture of motor vehicles, trailers and semi-trailers (NACE Code C29). Data sourced from Eurostat. Eurostat BERD By NACE activity suffers from missing values across countries, sectors, and years. The calculations of total business R&D spending used 2022 data and 2021 when 2022 data was missing.

[5] White House. (April 5, 2024). U.S-EU Joint Statement of the Trade and Technology Council. Available at: https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/05/u-s-eu-joint-statement-of-the-trade-and-technology-council-3/

[6] White House (February 26, 2024). Joint Statement Endorsing Principles for 6G: Secure, Open, and Resilient by Design. Available at: https://www.whitehouse.gov/briefing-room/statements-releases/2024/02/26/joint-statement-endorsing-principles-for-6g-secure-open-and-resilient-by-design/

[7] US Department of State. (August 6, 2024). Joint Statement of the United States of America and the Kingdom of Sweden on Cooperation in Advanced Wireless Technologies. Available at: https://www.state.gov/joint-statement-of-the-united-states-of-america-and-the-kingdom-of-sweden-on-cooperation-in-advanced-wireless-technologies/

[8] National Security Telecommunications Advisory Committee. (2022). Letter to the President on standards. Cybersecurity and Infrastructure Security Agency. Available at: https://www.cisa.gov/sites/default/files/publications/NSTAC%20Letter%20to%20the%20President%20on%20Standards%20%285-24-22%29_508.pdf

[9] Eurostat, General government expenditure by function. Available at: https://ec.europa.eu/eurostat/databrowser/view/gov_10a_exp/default/table?lang=en

[10] Bauer, M., Erixon, F. Guinea, O. and Sharma, V. (2023). In Support of Market-Driven Standards. ECIPE. occ. Paper 1/2023. 12 p

4. Policies to Support a Thriving EU ICT Sector

For years, the EU’s discourse on technology was primarily centred on the concept of technological sovereignty. The essence of this concept was encapsulated by former EU Commissioner for the Internal Market, Thierry Breton, when he defined its three pillars: “computing power, control over our data, and secure connectivity.”[1] The prevailing assumption was that, in the realm of digital technology, Europe needed to develop its own champions to reduce its dependence on hardware and software from third countries.

This is wrong. It presents an imaginary version of the EU that contradicts Europe’s economic structure and comparative advantages. The EU ICT sector can be characterised as a rich and varied ecosystem of companies. While they may not dominate vast swathes of the digital world, they are champions in their respective fields. This diversity is a strength. As in nature, a rich ecosystem of firms of different sizes tends to be more resilient to external events than one dominated by a single corporation. Moreover, Europe’s SMEs are not mere bystanders to technological change. As mentioned earlier, many of them play a significant role in developing the latest technological standards.

This economic structure does not fall from the heavens. It is the result of a market underpinned by technical standards developed through an open, consensus-based, and industry-led voluntary process that has brought interoperability and compatibility. In turn, this interoperability and compatibility enabled the emergence of a market for technology which supported the diverse ecosystem of ICT companies that the EU has today.

Thanks to standards, companies can specialise in what they do best and invest in innovation because they can rely on a system of compatible solutions protected by IPRs and Standard Essential Patents (SEPs). This is a crucial point to understand Europe’s strengths in ICT. Selling a product that incorporates an innovation is an obvious way for the innovator to be rewarded for his or her efforts. However, it is not the only way. If the innovation itself can be traded – through technology licensing – then innovators do not also need to be manufacturers.

Europe’s industry structure would be fundamentally different if innovators typically produce and sell their own products than if they licence the technology underlying them. In the first case, innovation and production would be based in vertically integrated firms. In the second case, licensing of technology allows a more varied industry structure with competition between innovators in the upstream side of the market. This is the case of European companies like Nokia, Siemens, and Ericsson which in their corporate strategies have shifted their focus towards their core activities, producing innovations used by other businesses (like consumer-oriented ICT companies or telecom companies).

A critical by-product of this system is the emergence of more specialised R&D firms. This kind of company emerges because innovations can be licensed, and their technologies can be applied to many downstream firms and products. While it is true that companies like Microsoft and Apple – owners of proprietary standards – are highly innovative, an ecosystem supported by voluntary technical standards also sustains substantial amounts of aggregate R&D spending – that is, R&D spending by the entire ecosystem. Indeed, empirical data shows that there is a positive correlation between the pace of technology deployment and market structures, with quicker deployment being associated with more competitive markets.[2]

Specialisation is also the result of openness. A larger demand for innovation is a powerful incentive for researchers and engineers to innovate. Technical standards offer a platform to ensure that the agreed solution is compatible while IPRs and SEPs ensure that their efforts are protected and rewarded. The European ICT manufacturing sector has a much higher level of trade intensity, measured as the sum of imports and exports as a proportion of turnover, than other manufacturing sectors such as machinery and motor vehicles, where the use of technical standards and SEPs is not as prevalent.

Firm-level data confirms the global nature of the ICT sector. In 2021, there were 37,000 firms working in the European ICT manufacturing sector[3] and almost seven out of ten were involved in export and import activities outside the EU.[4] In comparison, only 22 percent of EU manufacturing firms exported goods to other countries or bought their inputs from abroad. Moreover, EU companies received significant revenues from exporting their technologies. Europe’s strength lies in R&D activities rather than in production, which brings tangible benefits in the form of royalties and licensing payments. In 2016, it was estimated that the mobile telecommunication industry generated patent royalty of USD 14.2 billion.[5]

Against this background, which aligns with the reality in which the EU ICT sector has flourished, the EU has wrongly implemented policies aimed at achieving political control over technical standards and reducing the influence of SEPs. Regulatory changes in the EU Standardisation Strategy risk politicising the standard-making process and jeopardising the global appeal and adoption of European technical standards.[6] Similarly, proposed changes to SEPs could affect how the industry evolves and the outcomes it delivers, particularly in terms of innovation, potentially leading to a slowdown in technological progress.

Finally, the EU telecom market urgently requires higher levels of investment. The EU lags behind the US and China in the number of 5G subscribers. This is concerning not only because 5G offers much greater speeds but also because it enables new ICT applications. Therefore, if the EU wants to lead in ICT technology, it requires a comprehensive rollout of 5G infrastructure. To encourage such investments, EU telecom market require market consolidation and scale, particularly at the national and regional levels, to spread investment costs across a larger customer base. Furthermore, investment-friendly spectrum policies, including streamlined licence renewals, will facilitate 5G deployment, whereas delays and cumbersome processes from national regulators in issuing licences will discourage market consolidation.

[1] Concordia (2022). Work Package 4: Policy and the European Dimension Deliverable D4.4: Cybersecurity Roadmap for Europe. Horizon 2020 Program (2014-2020). Available at: https://www.concordia-h2020.eu/wp-content/uploads/2021/10/CONCORDIA_Roadmap.pdf

[2] Shelanski, H. A. (2000). Competition and Deployment of New Technology in US Telecommunications. U. Chi. Legal F., 85.

[3] Eurostat. Enterprise statistics by size class and NACE Rev.2 activity (from 2021 onwards). The ICT manufacturing sector is approximated as C26 Manufacture of computer, electronic and optical products.

[4] Eurostat. Enterprise statistics by size class and NACE Rev.2 activity (from 2021 onwards). The ICT manufacturing sector is approximated as C26 Manufacture of computer, electronic and optical products.

[5] Galetovic, A., Haber, S., & Zaretzki, L. (2018). An estimate of the average cumulative royalty yield in the world mobile phone industry: Theory, measurement and results. Telecommunications Policy, 42(3), 263-276.

[6] For an extended discussion on the impacts of the EU Standardisation Strategy see Bauer, M., Erixon, F. Guinea, O. and Sharma, V. (2023). (see note: 18).

References

Abd EL-Latif, A. A., Abd-El-Atty, B., Venegas-Andraca, S. E., & Mazurczyk, W. (2019). Efficient quantum-based security protocols for information sharing and data protection in 5G networks. Future generation computer systems, 100, 893-906.

Bauer, M., Erixon, F., and Pandya, D. (2024). The EU’s Trillion Dollar Gap in ICT and Cloud Computing Capacities: The Case for a New Approach to Cloud Policy. Report, ECIPE, Brussels, occ. paper 3/2024, 32 p.

Bauer, M., Erixon, F. Guinea, O. and Sharma, V. (2023). In Support of Market-Driven Standards. ECIPE. occ. Paper 1/2023, 12 p

Concordia (2022). Work Package 4: Policy and the European Dimension Deliverable D4.4: Cybersecurity Roadmap for Europe. Horizon 2020 Program (2014-2020). Available at: https://www.concordia-h2020.eu/wp-content/uploads/2021/10/CONCORDIA_Roadmap.pdf

Copenhagen Economics. (2024). 4-to-3, back to 4? A time of reckoning for the EU telecoms industry. Copenhagen Economics.

Deloitte. (2023). Decision time for Europe’s telcos. Deloitte.

Ericsson. (2024). Ericsson Mobility Report 2024. Available at: https://www.ericsson.com/49ed78/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-june-2024.pdf

European Commission. (2024). Commission statement on IP/24/928. Retrieved November 28, 2024. Available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_24_928

European Commission. (2024). EU competitiveness: Looking ahead. Available at: https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en

European 5G Observatory. (2024). European 5G Scoreboard. Available at: https://5gobservatory.eu/observatory-overview/interactive-5g-scoreboard/#5G-spectrum-chart

European Parliament. (2019). 5G in the EU and Chinese telecoms suppliers. Available at: https://www.europarl.europa.eu/RegData/etudes/ATAG/2019/637912/EPRS_ATA(2019)637912_EN.pdf

Galetovic, A., Haber, S., & Zaretzki, L. (2018). An estimate of the average cumulative royalty yield in the world mobile phone industry: Theory, measurement and results. Telecommunications Policy, 42(3), 263-276.

Kroet, C. (July 18, 2024). Meta stops EU roll-out of AI model due to regulatory concerns. Euro News. Available at: https://www.euronews.com/next/2024/07/18/meta-stops-eu-roll-out-of-ai-model-due-to-regulatory-concerns

National Security Telecommunications Advisory Committee. (2022). Letter to the President on standards. Cybersecurity and Infrastructure Security Agency. Available at: https://www.cisa.gov/sites/default/files/publications/NSTAC%20Letter%20to%20the%20President%20on%20Standards%20%285-24-22%29_508.pdf

Shelanski, H. A. (2000). Competition and Deployment of New Technology in US Telecommunications. U. Chi. Legal F., 85.

Stolton, S. and Gurman, M. (June 22, 2024). Apple Won’t Roll Out AI Tech In EU Market Over Regulatory Concerns. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2024-06-21/apple-won-t-roll-out-ai-tech-in-eu-market-over-regulatory-concerns?embedded-checkout=true

Strand Consult. (2024). The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries Strategic Reports

Thales. (September 26, 2024). 5G technology and networks (speed, use cases, rollout). Available at: https://www.thalesgroup.com/en/markets/digital-identity-and-security/mobile/inspired/5G

US Department of State. (August 6, 2024). Joint Statement of the United States of America and the Kingdom of Sweden on Cooperation in Advanced Wireless Technologies. Available at: https://www.state.gov/joint-statement-of-the-united-states-of-america-and-the-kingdom-of-sweden-on-cooperation-in-advanced-wireless-technologies/

White House. (April 5, 2024). U.S-EU Joint Statement of the Trade and Technology Council. Available at: https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/05/u-s-eu-joint-statement-of-the-trade-and-technology-council-3/

White House (February 26, 2024). Joint Statement Endorsing Principles for 6G: Secure, Open, and Resilient by Design. Available at: https://www.whitehouse.gov/briefing-room/statements-releases/2024/02/26/joint-statement-endorsing-principles-for-6g-secure-open-and-resilient-by-design/

White & Case LLP. (2023). EU Court of Justice in CK Telecoms sides with the European Commission’s approach to mergers. White & Case LLP.