Digital Futures for Europe

Published By: Guest Author

Subjects: Digital Economy European Union New Globalisation

Summary

By Meelis Kitsing, Professor and Rector, Estonian Business School.

There isn’t one model for success in the digital future; there are many. Europe is now debating what policies that could help to power entrepreneurship and growth in Europe’s economy, and some are arguing that Europe should make itself technologically sovereign – independent from the big platforms from the US. This is not the right approach – partly because there cannot be just one model applied in Europe if it is to become more successful in technology and competitiveness. This briefing paper argues that is far more important for Europe to create a better environment for companies to experiment and discover with new business models, and to learn from the past platform success while they do so. That requires a much greater space for entrepreneurship and that the EU and national governments stay away from excessive regulations that strain new business growth. Europe can be a powerful region that shapes rules and standards globally – “the Brussels effect”. But that isn’t the future for Europe if it ensnares entrepreneurs in red tape – “the Brussels defect”.

He’s the author of the forthcoming book The Political Economy of Digital Ecosystems: Scenario Planning for Alternative Futures (Routledge)

Introduction

Digitalization today looks quite different from the technolibertarian dreams of the 1990s. Then American poet John Perry Barlow (1996) declared “independence of cyberspace” and American technology expert David S. Isenberg (1998) highlighted “the dawn of stupid network.” Internet was supposed to be a decentralized and borderless space where users are in control, not corporations and governments. Barlow wrote to governments: “On behalf of the future, I ask you of the past to leave us alone. You are not welcome among us. You have no sovereignty where we gather.”

In retrospect, the opposite has happened. China has for years prioritized independence of its cyberspace. The United States under President Trump got engaged in technology wars. The debates in Europe increasingly fixate on “technological sovereignty”. Among digital corporations platformization has been most persistent trend for the past decades. The rise of digital platforms has made internet smarter, not stupid, and created virtual gated communities instead of borderless cyberspace. Now that Europe ponders its digital future, it’s important that it learns from the successful platforms rather than trying to shield itself from them.

The rise of platforms

Seven out of ten most valuable public companies in the world by market capitalization were digital platforms on April 30, 2020. Five of them – Microsoft, Apple, Amazon, Alphabet and Facebook- are US companies and two are Chinese – Alibababa and Tencent (Statista, 2021). Apple and Microsoft made it to the top ten in 2010. Twenty years ago only Microsoft made it to the list of top ten companies by market capitalization.

Initially, the digital platforms such as Google and Facebook were seen primarily as delivering significant consumer surplus in making search and social networking easier. This is also evident in the European network neutrality debates a decade ago where the digital platforms were seen as forces for the neutrality while old telecom monopolies represented the vested interests of repression and control of cyberspace (Kitsing, 2011). Let’s recall Deutsche Telecom’s efforts to ban Skype, for instance. Digital platforms won this battle. Who would not want to be for network neutrality – even though the term was coined by and worked in the interest of digital platforms. Nevertheless, some scholars did warn of “googlearchy” back then (Hindman, 2009).

Now the same digital platforms are either monopolies in certain market niches and dominate in oligopolistic markets. It is ironic that in a way the large digital platforms have become more similar to old telecom companies they criticized decades ago. The platformization has made digital networks smarter and centralized, which in Isenberg’s terms is a typical feature of old telephone network. Digital platforms have taken advantage of internet architecture. However, they are not just marketplaces but also rule-makers of digital platform ecosystems.

Platform ecosystems

The use of term “ecosystem” implies that the platformization is not just about digital economy, platform economy or sharing economy. Platformization is not just about dominance of large digital companies within these economies. Through technological lock-ins (Arthur 1989), network effects (Parker and van Alstyne, 2005) and use of long-tail, two- and multisided markets (Rochet and Tirole, 2003; Evans, 2003; Brynjolfsson et al., 2006), digital platforms operate ecosystems which go beyond purely economic trade-offs as cultural, political and social implications play a significant part.

Platforms create ecosystems around their products and services. For instance, the 2014 Alibaba IPO prospectus mentioned the word “ecosystems” 160 times as Michael Jacobides and his co-authors (2018) have highlighted. The ecosystem approach allows to exploit further the network effects as it becomes costly to leave the ecosystem. A decade ago people used different social networking apps in different context. Outside universities MySpace was quite popular. Google affiliated Orkut was heavily used in Brazil, Estonia and India. As it makes sense to be on the same network, then Facebook prevailed as a main social network platform. Certainly, there are many other apps that compete with the Facebook but it is not just about using a different technological solution but embedded benefits of entire ecosystem.

Multisided markets

The network effects are strengthened through two- and multisided markets that characterize platform ecosystems. Initial work on two-sided markets by Jean Tirole, Nobel laureate in Economics, goes back to the pre-digital platform era where he discussed cross-subsidies in the credit card companies such as Visa.

However, it is highly relevant for digital platforms such as Google which offers “free search” subsidized by the advertising income. The old lessons of economics apply that there is no free lunch and no 100-dollar bills left on the sidewalk.

In many ways, subsidizing one business activity with another one is nothing new. Many businesses do it to build complementarities, which can be monetized. For instance, car dealerships may offer cheaper cars in order to compensate it through services and parts later. Universities may use tuition to subsidize research, which, in turn, may increase credentials and serve as an input into teaching.

However, the platform ecosystem strengthens this logic further as ecosystem operates on modularity where different complementary goods can be combined for the benefit of platform. Obviously, some of the corporate profits are shared with ecosystem participants but most of the profits primarily captured by the owners of digital platforms in the center of ecosystem.

Market niches and boundary resources

The digitalization of platform ecosystem allows for use of long tail markets where it is easy for platform to expand into different markets niches. Amazon does not sell only most popular books but also offers books which are relevant for a few academics around the world.

Digital platform ecosystems allow the use of boundary resources through which different participants co-create value in the ecosystem. For instance, third-party developers may develop apps for digital platform. This is strategically critical for the platform as it enables significant value capture.

However, it may lead also to platform-dependent entrepreneurship as Cutolo and Kenney (2019) have highlighted. In many ways the ecosystem serves as a barrier for entry for potential competitors as the build-up takes time.

Born in Silicon Valley

If digital platform design ecosystems around their products and services, then their very emergence stems from the spontaneous developments within larger technology ecosystems. The most famous ecosystem is obviously Silicon Valley where different formal and informal ingredients have produced an extremely vibrant ecosystems for others to envy.

The attempts of learning appropriate lessons and policy transfer experiments with the aim of cloning Silicon Valley have ended usually in failures (Giest, 2017). Linear explanations emphasizing the importance of government investments in technologies and public-private partnerships as articulated by Mazzucato (2013) paint at best only a small part of the picture.

Most importantly, such simplifications focusing on limited set of explanatory variables do not do justice to the understanding of complex evolution of Silicon Valley ecosystem as well as Boston Route 128 as shown by many scholars (Kenney, 2000; Saxenian, 2006 and 1996). Government investments and public-private partnerships may be necessary but it is certainly not sufficient in the evolution of ecosystem. Another factor is time, policies working in the 1960s or 1970s may not do it anymore.

Chinese scholar Kai Jia and California professor Martin Kenney (2021) show in the recent paper how platform business models develop along alternative evolutionary trajectories in different environments. On the basis of Alibaba, Tencent and Trip.com they show how the “platform business group” model in China, focusing on stock market listing of some operations and interfirm cross-investments, is different from the US West Coast model.

To sum it up, policy transfers and lessons from Silicon Valley have limited value at the best – particularly, by factoring in the context specificity and institutional complexity of entrepreneurial ecosystems.

Options for Europe

The European Union does not have any large digital platforms and large digital platform ecosystems. The closest is Spotify but it is not systemically important. Digital ecosystems are not simply created by imposing digital tax here and some regulations there. In addition, focus on regulatory and tax measures generate additional bottlenecks for enhancing cooperation with the United States as well as balkanize common digital market if member states take a lead in an ad hoc fashion.

So what are options for Europe? The scenario planning allows to explore the costs and benefits of various future trajectories. The global financial crisis as well as the current pandemic have highlighted limitations of relying on one vision or forecast. Let’s recall that in the dawn of the global financial crisis, Her Majesty Queen Elizabeth II visited the London School of Economics and Political Science in 2008 to inquire why no one predicted the global financial crisis. In a letter that followed many months later by LSE Professor Tim Besley and eminent historian Peter Hennessy wrote that it was result of “a failure of collective imagination of many bright people” (Stewart, 2009).

Through literature reviews of work done, many foresight organizations the collective imagination of many bright people around the world shows three broad scenarios for the digital ecosystems. The first scenario describes the world where trends prevalent in the last decades shape also future developments – implying that large digital platforms will continue to dominate digital ecosystems. The second scenario insists that governmental activism towards digital platforms grows into unstoppable force. This means greater involvement of governments in digital ecosystems by heavy regulation of private platforms and development in public-private platforms. The third option is the gradual emergence of decentralized ecosystem with multitude of players which challenges both existing large private platforms and encompassing ability of governments to shape the ecosystems (Kitsing, 2020).

Certainly, such scenarios lack perceived precision of forecasts. However, British logician and philosopher Carveth Read (1914) argued already a century ago that “It is better to be vaguely right than exactly wrong.” In addition, assumptions of linear forecasts rely on the house of cards which often fall apart in the world of complexity and uncertainty.

As Schoemaker (2004) has emphasized the conditions of uncertainty and complexity imply that scenario planning should be used instead of forecasting. American economist John Kenneth Galbraith once wrote that “there are two classes of forecasters: those who don’t know, and those who don’t know that they don’t know” (Graham, 1996).

Scenarios for European digital ecosystems

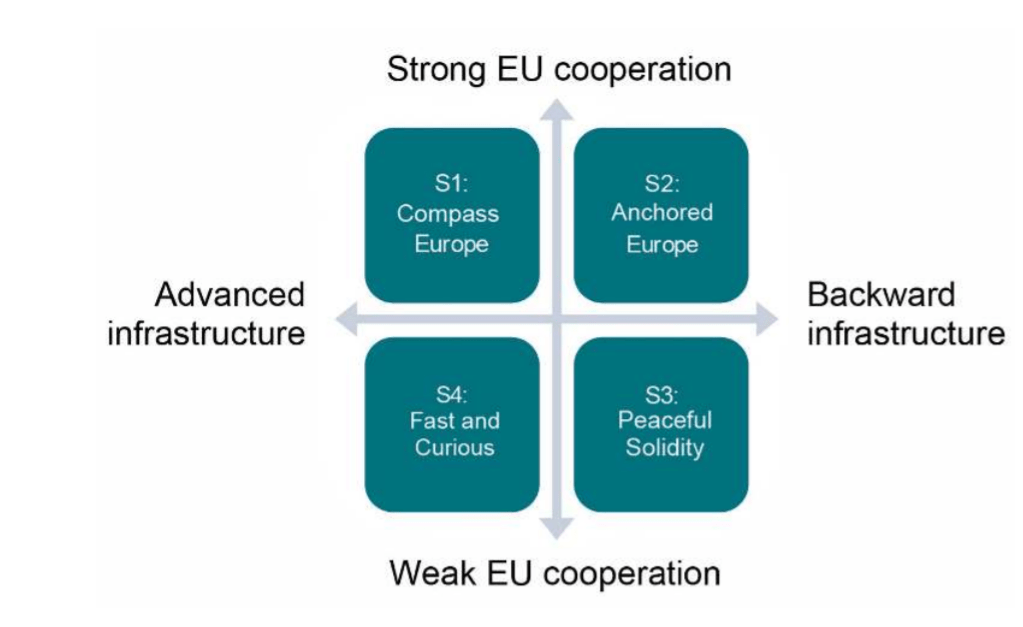

To bring all of it more into specific European context, the Foresight Centre at the Estonian Parliament created four scenarios in 2020 which relied on the insights expressed by national and international experts. By combing two key drivers – the nature of EU cooperation and infrastructure – the expert-led workshop generated four scenarios for understanding alternative future trajectories (Arenguseire Keskus, 2020; Kitsing, 2021).

The EU cooperation may tighten or decrease in the next 15 years. It also an open question whether the cooperation will focus primarily on the single market, economic competitiveness, social affairs, foreign policy or other areas. The development of digital infrastructure is not only about the availability of technology. It concerns also willingness, capability and capacity to implement and manage these technologies. The development of infrastructure is not a simple matter of internal affairs of states, communities and other entities. The network nature of infrastructure makes it important to reach across national, local, regional and other borders.

The scenario “Compass Europe“ describes the world with a strong EU cooperation and digital infrastructure development. The cooperation among EU members will increase and the EU will make substantial investments in the digital infrastructure. Through the so-called “Brussels effect” the EU is quietly leading the world by setting standards and strong complementarities to the global system provided by European governments as well as businesses.

Scenario “Anchored Europe“is about strong EU cooperation in the social sphere but backward digitalization. The EU focuses on expanding social Europe and implementing excessive regulations in the different fields. EU is still an important player in the world but the ability of European digital companies to compete in the world market is seriously deteriorating. Instead of “Brussels effect” the EU is characterized by the “Brussels defect” where EU rule-making is seen as barrier rather than advancement of digitalization.

This scenario ”Peaceful Solidity“ describes the world characterized by weak EU cooperation and backward digital infrastructure, which suffers from fragmentation and social opposition. The limited EU cooperation has also reduced the role of EU in the world. The EU does not have sufficient resources and other global players lack incentives to invest in the European digital infrastructure projects.

Scenarios “Fast and Curious“ implies limited EU cooperation, but development of state of the art infrastructure in Northern Europe. China and US have increased their presence in Europe. Some EU members prefer economic cooperation with China while others prefer United States. The economies of Northern Europe grow considerably faster than Southern Europe. The Northern economies have also integrated more with the United States. As the states have lost their legitimacy, large metropolitan areas such as “Talsinki” (Tallin-Helsinki) and greater Copenhagen as well as multinational companies have become increasingly important.

FIGURE 1: Four Scenarios for the European Digital Ecosystems

Source: Kitsing 2021

Source: Kitsing 2021

Policy implications

Certainly, the four scenarios imply different opportunities and threats for the digital ecosystems in Europe. The long-term strategies of both public, private and civil society organizations have to consider a range of alternatives across the spectrum of imagination instead of relying on one tunnel vision and wishful thinking. These more abstract scenarios allow to play out concrete implications for different organizations and for different fields and stress-test their digital strategies.

Starting with the world characterized with a weak EU cooperation, the scenario “Peaceful Solidity” may seem appealing to some interest groups as it means limited digitalization which can be implemented its own way. New opportunities may emerge for government, private sector, and civil society with variation and diversity. However, it also carries risks of higher transaction costs and thus lower efficiency.

The scenario “Fast and Curious” turns the weak EU cooperation into strength at least in some parts of Europe. European countries can also benefit in a world dominated by large US private platforms as user surplus also emerges from the adoption of digital platforms. The EU countries, regions and companies embodied in old Silicon Valley belief that “the best way to predict the future is to invent it” (Kay, 1989) may reap huge benefits in this scenario.

However, this scenario also implies that it is challenging to resist the efficiency of large global platforms in the domestic platform ecosystem. Both private and public services can be offered by global platforms. However, it may come at the expense of equity and domestic stakeholder engagement which is key in the previous scenario.

The scenario “Fast and Curious” places a huge responsibility on the shoulders of domestic policymakers. If they are not able to manage digitalization processes well in a demanding agile environment, then their constituencies may fall into scenario “Peaceful Solidity”. Technological anxiety, malign populism and not-in-my-back-yard attitudes may turn certain segments into digital Luddites. Particularly, if the benefits of digitalization are perceived to be concentrated in the hands of elites.

If we let our imagination go wild it is not difficult to foresee developments in the scenarios characterized by weak EU cooperation that particularly small players risk becoming “digital rose islands” in the turbulent global political economy. The original Rose Island was built as a platform by young Italian engineers in Adriatic Sea in 1968 and was later blown up by Italian navy.

All of this does not imply that any kind of stronger EU cooperation is better than weak cooperation. The world of scenario “Anchored Europe” shows perils of EU protectionism. Instead of bridging EU digital networks in the broadest sense to the world, policies encourage digital bonding within EU by taking a defensive position against the outside world. The focus on social sphere in this scenario may benefit certain interest groups but carries significant risks of short-termism in the world of malign mercantilism and splinternet.

The scenario “Compass Europe” focuses on the EU cooperation in strategic areas for digital ecosystems. It does not imply that all policy decisions have to be taken on the EU level. However, the cooperation has to focus on the areas where EU creates strength and where sending strong signals to the world is crucial. Stronger EU cooperation offers opportunities collaborate with the United States as a strategic partner. Coordinate regulatory moves that EU and US would not end up in a tit-for-tat protectionism.

As the digital ecosystems are constantly evolving, then this scenario offers also opportunities for different EU platforms to take part in the EU-led global efforts to be global technology leader. This is particularly so because digitalization and platformization will not be limited to the current prominent areas such as social networking, search, ride-sharing and ecommerce. Many different fields will be affected by these developments. Instead of taking offensive stance against US platforms, it is crucial to learn from US experience and use it for building stronger ecosystems in Europe which encourages entrepreneurial discovery.

It is far from certain that end-to-end platforms can dominate in every field. Rather, a multitude of independent platforms may prevail in different ecosystems. Policymakers in the EU should rather think in terms of what kind of policies facilitate entrepreneurship and digitalization in the areas where Europe has a comparative advantage. Such areas could range from agriculture to manufacturing as well as mean, for instance, the use of digitalization in creating platforms in the field of sustainable energy. The focus must be in avoiding “Brussels defect” and leveraging “Brussels effect”.

References

Arenguseire Keskus (2020). Globaalsed jõujooned 2035. Stsenaariumid ja tähendus Eesti jaoks. Tallinn, Estonia: Arenguseire Keskus.

Arthur, W.B., (1989). Competing Technologies, Increasing Returns, and Lock-in by Historical Events. The Economic Journal, 99 (394), pp. 116-131.

Barlow, J. P., (1996) Declaration of the independence of cyberspace. in Electronic Frontier Foundation [database online]. Available at https://projects.eff.org/~barlow/Declaration-Final.html.

Bauer, M. and Erixon, F., (2020). Europe’s Quest for Technological Sovereignty: Opportunities and Pittfalls. ECIPE Occasional Paper No 02/2020. Brussels, Belgium: European Centre for International Political Economy. Available at https://ecipe.org/publications/europes-technology-sovereignty/

Brynjolfsson, E., Hu, Y., and Smith, M.D., (2006). From Niches to Riches: The Anatomy of the Long Tail. MIT Sloan Management Review, 47 (4).

Cutolo, D. and Kenney, M., (2019). The Emergence of Platform-dependent Entrepreneurs: Power Asymmetries, Risks and Uncertainty. SSRN. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3372560

European Commission (2020). The Digital Economy and Society Index. Brussels, Belgium: European Commission. Available at https://ec.europa.eu/digital-single-market/en/digital-economy-and-society-index-desi

Evans, D.S., (2003). The Antitrust Economics of Multi-Sided Platform Markets. Yale Journal of Regulation, 20(2), pp. 325-381.

Graham, J.R., (1996). Is a group of economists better than one? Than None? The Journal of Business, 69(2), pp. 193-232.

Giest, S., (2017). Overcoming the failure of ‘silicon somewhere’: learning in policy transfer processes. Policy and Politics, 45 (1), pp. 39-54.

Isenberg, D. (1998). The Dawn of the Stupid Network. ACM Networker, 2(1), pp. 24-31.

Jacobides, M.G., Cennamo, C. and Gawer, A., (2018). Towards a Theory of Ecosystems. Strategic Management Journal, 39(8), pp. 2255-2276.

Kai, J. and Kenney, M. (2021). The Chinese platform business group: an alternative to the Silicon Valley model?, Journal of Chinese Governance, DOI: 10.1080/23812346.2021.1877446

Kay, A.C., (1989). Predicting the Future. Stanford Engineering, 1 (1), pp. 1-6. Available at http://www.ecotopia.com/webpress/futures.htm

Kenney, M., (2000). Understanding Silicon Valley: The Anatomy of an Entrepreneurial Region. Stanford, CA: Stanford University Press.

Kitsing, M., (2011). Network Neutrality in Europe. ICEGOV ’11: Proceedings of the 5th International Conference on Theory and Practice of Electronic Governance, September, pp. 313–316. https://doi.org/10.1145/2072069.2072126

Kitsing, M., (2020). Alternative Futures for Global Digital Ecosystems. Working Paper. Tallinn, Estonia: Arenguseire Keskus. Available at https://www.riigikogu.ee/en/foresight/global-forces/

Kitsing, M., (2021). The Political Economy of Digital Ecosystems: Scenario Planning for Alternative Futures. London: Routledge.

Mazzucato, M., (2013). The Entrepreneurial State: Debunking Public vs Private Sector Myths. London: Anthem Press.

Read, C., (1914). Logic. Deductive and Inductive. London: Simpkin, Marshall, Hamilton, Kent & Co Ltd.

Saxenian, A., (2006). The new argonauts: Regional advantage in the global Economy Cambridge, MA: Harvard University Press.

Saxenian, A., (1994). Regional advantage: Culture and competition in Silicon Valley and Route 128. Cambridge, MA: Harvard University Press.

Shoemaker, P.J., (2004). Forecasting and Scenario Planning: The Challenges of Uncertainty and Complexity. In D.J. Koehler and N. Harvey (Ed.) Blackwell Handbook of Judgement and Decision Making. Oxford: Blackwell Publishing

Statista, (2021). The 100 companies in the world by market capitalization in 2020. Available at https://www.statista.com/statistics/263264/top-companies-in-the-world-by-market-capitalization/

Stewart, H., (2009). This is how we let the credit crunch happen, Ma’am…Guardian. July 26. Available at https://www.theguardian.com/uk/2009/jul/26/monarchy-credit-crunch