Benchmarking Quantum Technology Performance: Governments, Industry, Academia and their Role in Shaping our Technological Future

Published By: Fredrik Erixon Andrea Dugo Dyuti Pandya Oscar du Roy

Research Areas: Digital Economy

Summary

In this study on the transformative potential of quantum technology in reshaping economies, we present results and evidence drawing on a unique and innovative quantum dataset compiled by ECIPE. This data offers new insights into the current state of quantum advancements. This comprehensive database sheds light on the roles of various actors – governments, industry, and academia – showcasing their contributions to the development of quantum technologies. By grounding the analysis in real data, we provide a clearer understanding of the dynamics at play, enabling stakeholders to assess the sustainability of quantum technology progress and foster an ecosystem that supports both public and private sector involvement.

Our findings provide a picture of the global quantum development, with particular emphasis on the performance of major players:

- Governments: Announced public investments in quantum technology from over 30 countries worldwide have already surpassed USD 40 billion and are projected to increase further over the next decade. China leads in public investment (USD 15 billion), with the EU collectively ranking second (USD 10 billion), primarily driven by Germany’s contributions, while the US ranks a distant third (USD 5 billion).

- Private sector: Funding for quantum companies has grown significantly over the last decade, from USD 59 million in 2012 to USD 2.3 billion in 2021, reaching a cumulative USD 15 billion by 2024. The US leads in investment in the quantum private sector (44% of global funding), followed by the UK, Canada, and Australia (collectively about 20%) and China (17%). The EU as a whole places further behind with just over 12% of the sector’s investment.

- Academia: Different regions exhibit unique research priorities. The US leads in quantum computing research quality (34% of top-cited papers), followed by China (16%) and Germany (4%). China, instead, leads in quantum communications (34%), followed by the US (17%) and Germany (7%). In quantum sensing, the US and China are nearly tied (23.7% and 23.3%), again followed by Germany (8%).

- Patent developments: The three key players – governments, companies, and universities – have all contributed to the rapid acceleration of quantum-related patents since 2017-2019, highlighting the increasing importance of intellectual property in this field. The US dominates the quantum patent landscape, followed by Japan and China. The EU is represented by only two entities from Germany and France in the global top 20 for patent filings.

While there is a tendency in the public debate to view deep tech and quantum development as a Great Power race between China and the US, the data and our research point to a different reality. There is a competition between companies and countries, and broader geopolitical developments have an increasing impact on quantum technology – mostly by motivating more governments to allocate more research funds and design new quantum initiatives. Still, there is also obvious patterns of country-to-country collaboration and knowledge dependency is evolving – just like in other fields of research and emerging technology.

Fundamentally, Europe is also a significant region for quantum technology. It is notable that the major three regions – China, Europe, and the US – have a pattern of development that largely follows their economic structures. There are patterns of specialisation within the broad fields of quantum technology, with for instance the US building a strong position in quantum computing and China in quantum communication. The US has a substantial private quantum sector while the EU performs well in public quantum funding and, generally, has many companies and institutes that participate in the development.

Thanks to Bianca Donati and Jules Borgetto for research support.

1. Introduction

The 21st century can become the quantum century. “There are weeks when decades happen,” Lenin famously said. And in the last months alone, there have been announcements and academic publications of very substantial breakthroughs in quantum computing – which is only one of the areas of quantum technology.[1] More will come as governments, companies, universities, and investors grow the amounts they are spending on development. As we get closer to the commercialisation of quantum technology, significantly more money will be spent on quantum in the next decade. In fact, we are at an inflection point where quantum technologies are set to transition from laboratory research to industry-specific application at an accelerating pace, and revolutionise predicted sectors such as medicine, finance, and logistics, aerospace, among others.[2]

Like many emerging technologies, quantum technology has been subject to significant hype, sometimes leading to inflated expectations. This was evident when shares in quantum computing companies fell after Jensen Huang, Nvidia’s CEO, complained that useful quantum computers were still decades away.[3] A common misconception is that new technologies entirely replace their predecessors. This has led to the mistaken belief that quantum computers will replace classical digital systems. In reality, quantum computing is designed to complement classical computing, solving complex problems that traditional computers cannot while processing vast amounts of data more efficiently.[4] Such unrealistic expectations can create boom-and-bust cycles in investment, where enthusiasm leads to rapid capital inflows followed by disappointment when near-term breakthroughs do not materialise.

Quantum technology carries huge economic potential and has the capacity to change the competitive dynamics of companies, countries, and the world. However, we know very little about the performance of different actors in the quantum race – or how companies and countries compete and collaborate over new technologies. Research and public policy are clearly behind technological development, and even if there have been new interests in the recent years for emerging technologies and deep tech development, much of the discussion is only occupied by security aspects and the prospects of reinforced Great Power competition. Realities on the ground are far less romantic and abstract – and, as in all innovation process, mundane. Governments, the private sector, and academics all play a role. Various entitles have different specialisms and focus on different areas. In the aggregate, however, there are interesting patterns emerging that speak to the future of quantum markets and how they will evolve.

ECIPE’s team of scholars have worked for eight months to collect and process data over quantum performance. There is scant data and research that is easily accessible to the public, and our work has included detailed research at the level of individual actors to learn about what they are doing in quantum technology – and how they are doing it. Therefore, this study is one of the first ever to bring more transparency to the performance of actors in quantum technology. By examining patterns and interactions between these players, this paper draws on ECIPE’s new quantum database to provide an in-depth analysis of quantum developments and performance.

Chapter 2 examines public sector quantum investments in 31 countries as of 2024, using official government sources to ensure accuracy and consistency, rather than relying on potentially conflicting media reports.

Chapter 3 shifts the focus to private sector investment, analysing data from 258 companies across 26 different countries. These companies consist primarily of quantum startups – both privately held and publicly listed on the stock market – with disclosed funding of at least USD 1 million as of 2024, representing 90% of our dataset. The remaining entries include major tech companies and other corporate giants that have publicly disclosed funding for quantum projects.

Chapter 4 provides an academic publication analysis. The paper draws on data for quantum publications between 2019 and 2023 from the Australian Strategic Policy Institute (ASPI)’s Critical Technology Tracker. The analysis identifies which countries – among the US, China, and EU Member States – are producing the largest volume and highest quality of quantum research.

Chapter 5 delves into patent developments. The paper draws on data for quantum technology patents development over the last ten years, primarily from EPO PATSTAT and builds on the rich set of information provided by patent documents. And as such, shows the output side of quantum R&D by private players in the field.

[1] Our recent primer on quantum technology is a good starting point for anyone with an interest in basic quantum science and what experts mean – also for policy – when they are talking about quantum. See ECIPE. (2025). Quantum Technology: A Policy Primer for EU Policymakers. Available at: https://ecipe.org/publications/quantum-technology-eu-policy-primer/

[2] ECIPE forthcoming brief 2025

[3] Berkowitz, B. (2025, January 8). Quantum computing stock bubble pops after Nvidia CEO warning. AXIOS. Available at: https://www.axios.com/2025/01/08/quantum-computing-stock-nvidia-jensen-huang

[4] Ferrie, C. (2024). What You Shouldn’t Know About Quantum Computers.

2. Governments and Quantum Technology Investment

Governments are clearly placing importance on quantum technologies. Of the 33 nations worldwide with active government quantum technology initiatives, over 20 have established formal, coordinated policy frameworks – that is long-term national strategies with dedicated agencies and long-haul investment plans to ensure government efforts are aligned with research and industry ones.[1] Governments globally are expected to invest between USD 40 and 50 billion in public funding for quantum technology over the next decade.[2] Considering the technology is still in the earliest stages of commercialisation, these are substantial investments.[3]

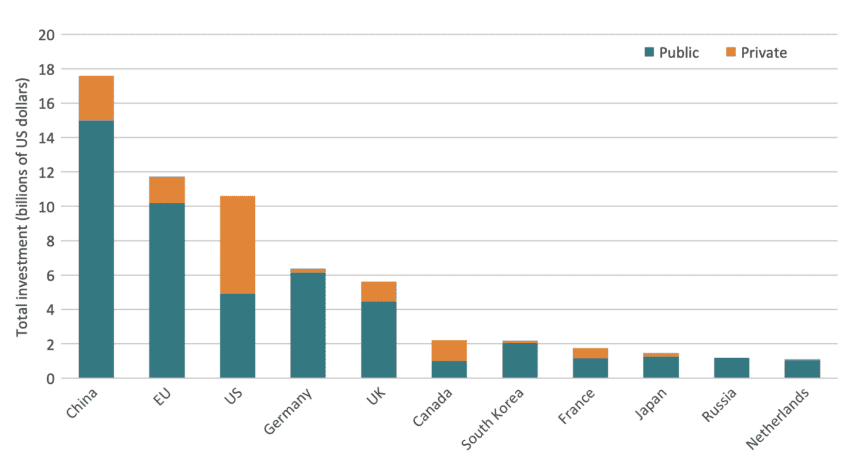

The importance of these investments in quantum technology is further illustrated in Figure 1 below. The chart shows that, as of 2024, announced public investment significantly surpasses private investment as the largest source of funding for quantum technology. According to our calculations, the cumulative announced global public investment in the quantum sector to date is almost three times greater than the total private investment. The private sector has made significantly smaller contributions because quantum technology is still an emerging technology. At present, quantum computing has yet to deliver clear advantages over classical computing in commercial and scientific applications.[4] While there is undoubtedly growing momentum for quantum technology, the market remains small, and the efficiency gains for the private sector are still limited.

Figure 1: Total (announced) public and private investment in quantum technology for selected countries and regions, up to 2024 (billions of US dollars) Source: ECIPE Quantum Database. Note: Only countries and regions with total investments exceeding USD 1 billion are displayed.

Source: ECIPE Quantum Database. Note: Only countries and regions with total investments exceeding USD 1 billion are displayed.

Leading the field by a significant margin is China. With an impressive USD 15 billion public investment, it is outpacing all other nations by far. The EU secures the second spot with total investments exceeding USD 10 billion, a sum that includes both the bloc-wide EUR 1 billion Quantum Flagship initiative as well as public sector contributions by individual Member States.

Remarkably, Germany alone accounts for over 60 per cent of the EU’s collective public investment announced in quantum technology. The substantial funding announced by the German government encompasses both federal budget allocations and contributions from local governments and agencies. Key players in this sector include the Federal Ministry of Education and Research, the Federal Ministry for Economic Affairs and Energy, the German Aerospace Centre (DLR), and the Bavarian government, all spearheading multiple quantum initiatives.[5] The majority of these efforts are concentrated on quantum sensing, the area of quantum technology with the greatest potential for industrial applications.[6]

The case of the US is particularly noteworthy, with public and private investments being nearly on a par around the USD 5 billion mark each. The UK also spends significant resources, having announced over USD 4 billion in government funding. Other notable non-EU players in the quantum space, measured by public sector investment, include South Korea, Japan, Russia, and Canada.

The public-private distribution of funding for quantum technology does not follow the typical pattern for aggregate R&D spending. While in the mid-1960s, business-funded R&D accounted for less than 31% of total R&D spending in the US,[7] today, it makes up for almost 80% of the US total.[8] The unrivalled dominance of corporate R&D is not unique to the US, but is a common trend across virtually all advanced economies.[9] While companies worldwide now arguably count as the largest contributors to innovation spending in the aggregate, this does not apply to quantum. Or at least not yet. As quantum technology matures and moves closer to commercialisation, private R&D funding is expected to grow rapidly.

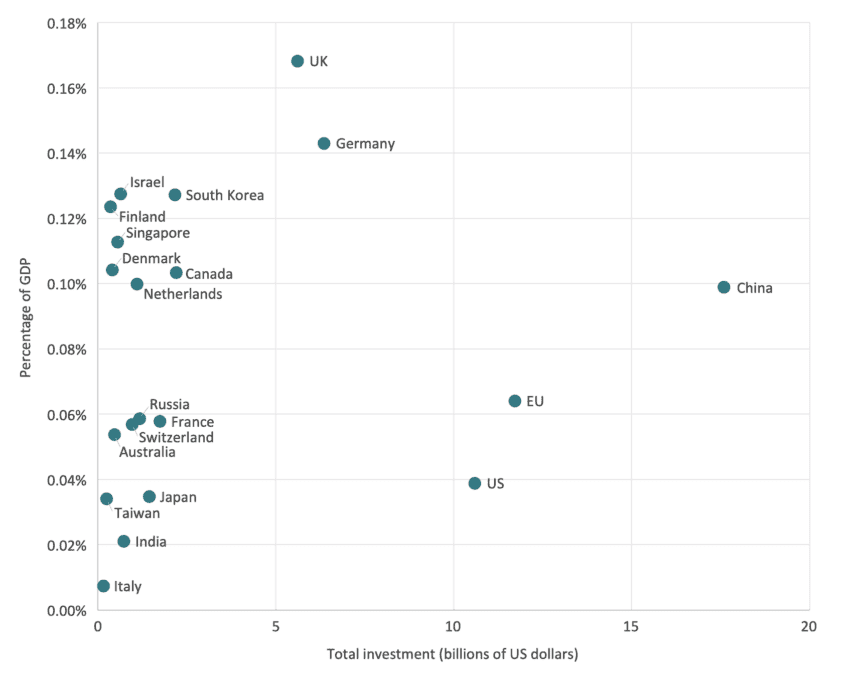

Figure 2 below extends the analysis by comparing total public and private investment in quantum technology relative to GDP. Although China, the EU, and the US account for the largest absolute amounts of total investment, they contribute a smaller share relative to GDP compared to other countries in the sample. This is evident in the Figure, as the three largest quantum players are positioned in the lower right corner of the chart.

China still ranks relatively high in terms of total investment as a share of GDP, having a place in the upper echelon of countries. The EU, albeit to a lesser extent, also performs reasonably well in this regard. Surprisingly, in spite of its vast economy and leading global position in overall government spending on R&D – more than all EU countries combined[10] – the US appears to be punching far below its economic weight when it comes to total quantum investment.

Private sector involvement is crucial for technological innovation in the US, arguably more so than in most other countries. This dynamic extends to the quantum sector as well. As noted earlier, the US has adopted a distinctive approach to funding quantum innovation, striking a balance between public and private investment rather than relying predominantly on government funding, as is common elsewhere. However, Figure 2 indicates that the US’s comparatively lower government expenditure on quantum technology places it at a disadvantage relative to most other nations when total investment is measured as a share of GDP.

Figure 2 also suggests that the ‘Big Three’ – the US, China, and the EU[11] – have an incentive to move closer to the other countries – that is to strike a more optimal balance between their economic capacity and total quantum investment. One way to do this is for major players to seek opportunities to collaborate with smaller yet higher-performing nations. This is particularly important given that quantum technology is inherently collaborative and thrives on international cooperation.

A brief side note is warranted regarding the over-performers in Figure 2 – namely, the group of smaller nations situated in the upper-left tier. These countries, which exhibit high levels of total investment in quantum technology relative to their economic size, are often characterised by strong public as well as private sector investment as a share of GDP. This is particularly true for nations such as the UK, Israel, and Canada.

For EU countries like Germany and the Netherlands, this over-performance is primarily driven by substantial announced public investment. However, their private sector contributions, particularly in venture capital (VC) funding, as will be explained later, remain comparatively weak. Denmark and Finland stand out as exceptions within the EU, more closely resembling the first group. In Denmark, this is largely due to significant corporate investment from one major company (Novo Nordisk). Finland, on the other hand, represents the most flourishing venture market for quantum startups in the EU relative to its size.

Figure 2: Total investment in quantum technology (private and public) relative to GDP for 20 largest contributors, up to 2024 Source: ECIPE Quantum Database.

Source: ECIPE Quantum Database.

Admittedly, estimating the exact scope of government funding for technology development in China is challenging. Government spending is famously difficult to track or verify, as the country frequently makes ambitious funding announcements that often go unrealised. This lack of transparency extends to quantum technology, where conflicting reports about funding levels have raised questions among experts. Some estimates suggest that China’s public investment in quantum technology could be as low as USD 4 billion, bringing it much closer to the US figure, and much lower than the EU figure, than initially believed.[12]

Regardless of the exact amounts invested by individual governments, it is evident that the public sector will play a pivotal role in advancing quantum development in the years ahead. Following a decade of exponential growth in private sector investment in quantum technology, 2023 proved to be an annus horribilis. Private investment in the quantum sector – and in the venture market more broadly – plummeted, nearly halving from over USD 2 billion in 2021 and 2022 to just USD 1.2 billion in 2023.[13]

Although our data for 2024 suggests a rebound in private funding for the quantum sector compared to 2023, similar downturns cannot be ruled out in the near future. Given the still nascent nature of quantum technology, governments may be better positioned to provide patient capital – long-term financial support that helps bridge the gap in funding and absorb the high upfront costs of R&D. This sustained backing is vital for overcoming the significant early-stage expenses associated with quantum technology and fostering its long-term growth. To put it in perspective, if distributed evenly over ten years – USD 4 to 5 billion annually – global government funding commitments to quantum technology would amount to twice the peak VC investment in the sector seen in 2022.[14]

2.1 Public Quantum Technology Strategies in the EU, US, and China

The type of investment also matters. In the US, for instance, government efforts have largely been focused on knowledge creation rather than near-term application of quantum technologies. Among the sub-fields of quantum technology, the government’s role is most evident in quantum computing – a field that, as yet, has limited practical applications.[15] However, in other areas such as quantum sensing and, most notably, quantum communication, American efforts lag behind those of China.[16] This is despite these fields offering far more immediate applications, ranging from precision measurement to quantum key distribution (QKD) for secure communication.

Unlike its historical approach to other emerging information and communication technologies (ICTs) – such as with the early adoption and procurement of integrated circuits – the US federal government has been rather passive in matters of near-term applications.[17] Under the 2018 National Quantum Initiative Act, for example, a substantial portion of funding – USD 625 million – was allocated to the Department of Energy’s national laboratories to support “basic research” in quantum technology. Some experts lament that initiatives of this kind reveal that the US lacks a comprehensive approach that also includes technology transfer and the commercialisation of quantum technologies – not just support to scientific breakthroughs.[18]

China has adopted a diametrically opposed strategy. As early as 2015, at the Fifth Plenum of the 18th Party Congress, President Xi Jinping identified quantum communications as a key scientific and technological initiative, designating it as a priority for significant advancements by 2030, underscoring the technology’s active role in addressing China’s long-term strategic objectives.[19] In 2021, with its 14th Five-Year Plan, China enshrined its quantum strategy by setting out “to unleash indigenous innovation and reduce the country’s reliance on foreign inputs, mostly in high-technology manufactured goods. Efforts will focus on […] quantum computing […], where the country expects to become a global leader in the longer term.”[20]

Since then, China’s government initiatives in the quantum sector have been focused on fostering collaboration between research institutions and industry within national technology clusters, with the explicit aim of driving domestic innovation. China’s approach has consistently prioritised the translation of quantum breakthroughs into tangible products, thereby accelerating the commercialisation of these technologies.[21] This integration strategy has proven successful, as evidenced, for instance, by the emergence of Hefei as a key hub for quantum technology. The city – whose Yunfei Road is often referred to as “Quantum Avenue” – houses a major science and technology university, several quantum research centres and around 20 companies dedicated to advancing quantum technology. The close proximity of these institutions helps speed up the transformation from theoretical research into practical applications, mirroring the dynamic innovation ecosystem seen in the past in areas like the Silicon Valley.[22]

Albeit with a more cross-national take, the EU is also focused on the linkages between government, industry, and universities. The bloc’s Quantum Technologies Flagship initiative is a EUR 1 billion programme that provides financial support to universities, companies, and startups to bridge the gap between theoretical quantum research and commercial applications.[23] Additionally, Member States are using their public financing arms to fund quantum research and incentivise private sector efforts to translate quantum theory into practical solutions, in an attempt to build the world’s “quantum valley” in the Old Continent.[24]

[1] IQM. (2024, January 29). State of Quantum 2024 Report. Press release. Available at: https://www.meetiqm.com/newsroom/press-releases/state-of-quantum-report-2024

[2] Ibid.

[3] We refer to public funding in quantum technology as “investment” rather than “expenditure” as this is the prevailing terminology, particularly in government strategy papers. Governments frame such funding – whether for research, education, training, or workforce development – as investment rather than a mere budgetary cost, as it signals a commitment to building future assets (knowledge, patents, and talent) and driving innovation and competitiveness through quantum advancements.

[4] Bobier, J.-F. et al. (2024, July 18). The Long-Term Forecast for Quantum Computing Still Looks Bright. Boston Consulting Group. Available at: https://www.bcg.com/publications/2024/long-term-forecast-for-quantum-computing-still-looks-bright

[5] Federal Ministry of Education and Research. (2023, April). Handlungskonzept Quantentechnologien der Bundesregierung (Federal Government’s Action Plan for Quantum Technologies). Available at: https://www.bmbf.de/SharedDocs/Downloads/DE/230426-handlungskonzept-quantentechnologien.html

[6] Lea, R. (2023, January 9). Regional spotlight: Quantum sensors in Germany. AZoSensors. Available at: https://www.azosensors.com/article.aspx?ArticleID=2716

[7] National Science Board – Science & Engineering Indicators 2024. (2024, May 21). Research and Development: U.S. Trends and International Comparisons, p. 10. Available at: https://ncses.nsf.gov/pubs/nsb20246/federal-support-for-u-s-r-d

[8] Ibid.

[9] OECD-MSTI. (2022). Gross domestic expenditure on R&D by sector of performance and source of funds – Constant prices, US dollars, PPP converted, Millions, 2015. Available at: https://data-explorer.oecd.org/vis?lc=en&tm=Gross%20domestic%20expenditure%20on%20R%26D%20by%20sector%20of%20performance%20and%20source%20of%20funds&pg=0&snb=1&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_RDS_GERD%40DF_GERD_SOF&df[ag]=OECD.STI.STP&df[vs]=1.0

[10] OECD-MSTI. (2021). GERD financed by government – US dollars, PPP converted, Millions, Current prices. Available at: https://data-explorer.oecd.org/vis?lc=en&tm=msti&snb=1&vw=tb&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_MSTI%40DF_MSTI&df[ag]=OECD.STI.STP&df[vs]=&pd=2021%2C2021&dq=.A.G_FG.USD_PPP.V.&to[TIME_PERIOD]=false

[11] The EU plot point represents the total investment in quantum technology by all EU Member States, divided by the bloc’s overall GDP. This is in addition to the individual plot points for each EU Member State, which represent the investments of specific countries.

[12] Freedberg Jr., S. J. (2024, February 5). China’s investing billions in quantum R&D, but is Beijing making some bad bets?. Breaking Defense. Available at: https://breakingdefense.com/2024/02/chinas-investing-billions-in-quantum-rd-but-is-beijing-making-some-bad-bets/

[13] IQM. (2024, January 29). State of Quantum 2024 Report. Available at: https://cdn.prod.website-files.com/6523f13a748909d3e1bbb657/65e6d35be62d08db2e7b3b71_State-of-Quantum-2024-report.pdf

[14] Ibid.

[15] Quantum Economic Development Consortium – QED-C. (2022, September). Public Private Partnerships in Quantum Computing: The Potential for Accelerating Near-Term Quantum Applications, Arlington, VA. Available at: https://quantumconsortium.org/ppp22/

[16] Omaar, H. and Makaryan, M. (2024, September 9). How Innovative Is China in Quantum?. Information Technology and Innovation Foundation. Available at: https://itif.org/publications/2024/09/09/how-innovative-is-china-in-quantum/

[17] Omaar, H. (2021, April 27). Why the United States Needs to Support Near-Term Quantum Computing Applications. Center for Data Innovation. Available at: https://www2.datainnovation.org/2021-quantum-computing.pdf

[18] Ibid.

[19] Kania, E. B. and Costello, J. K. (2018). Quantum Hegemony? China’s Ambitions and the Challenge to U.S. Innovation Leadership. Center for a New American Security. Available at: https://s3.us-east-1.amazonaws.com/files.cnas.org/hero/documents/CNASReport-Quantum-Tech_FINAL.pdf

[20] People’s Republic of China. (2021). The 14th Five-Year Plan of the People’s Republic of China—Fostering High-Quality Development. Available at: https://www.adb.org/publications/14th-five-year-plan-high-quality-development-prc

[21] Omaar, H. and Makaryan, M. (2024, September 9). How Innovative Is China in Quantum?. Information Technology and Innovation Foundation. Available at: https://itif.org/publications/2024/09/09/how-innovative-is-china-in-quantum/

[22] Ibid.

[23] European Commission. (2023, December 19). Quantum Technologies Flagship. Available at: https://digital-strategy.ec.europa.eu/en/policies/quantum-technologies-flagship

[24] Greenacre, M. (2024, March 26). European industry is yet to embrace the potential of quantum technologies. Science Business. Available at: https://sciencebusiness.net/news/quantum-computing/european-industry-yet-embrace-potential-quantum-technologies#:~:text=Since%202018%2C%20the%20EU%20and,8%20billion%20to%20quantum%20technologies.&text=The%20first%20pillar%20of%20the,both%20public%20and%20private%20investments

3. The Private Sector’s Role in Quantum Technology Investment

Besides government, the importance of firm innovation is also crucial in the realm of quantum technology. Private sector investment in this field has expanded rapidly, driven by the recognition of quantum technology’s transformative market potential. Since the early 2010s, private funding in the quantum space has skyrocketed, soaring from USD 59 million in 2012 to 2.3 billion in 2021 – an almost 40-fold increase in just ten years.[1] Although still a fraction of the global funding committed by governments, our data indicates that, as of 2024, the cumulative disclosed funding received or pledged by companies engaged in quantum technology worldwide has reached the USD 15 billion milestone.[2]

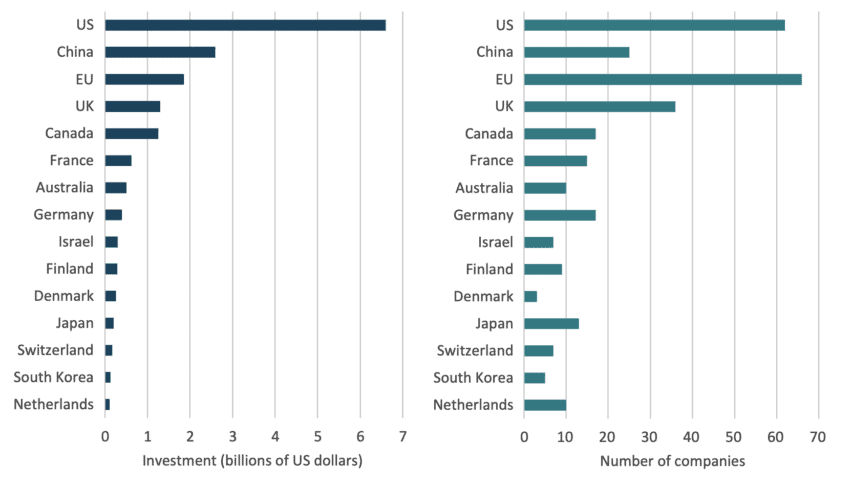

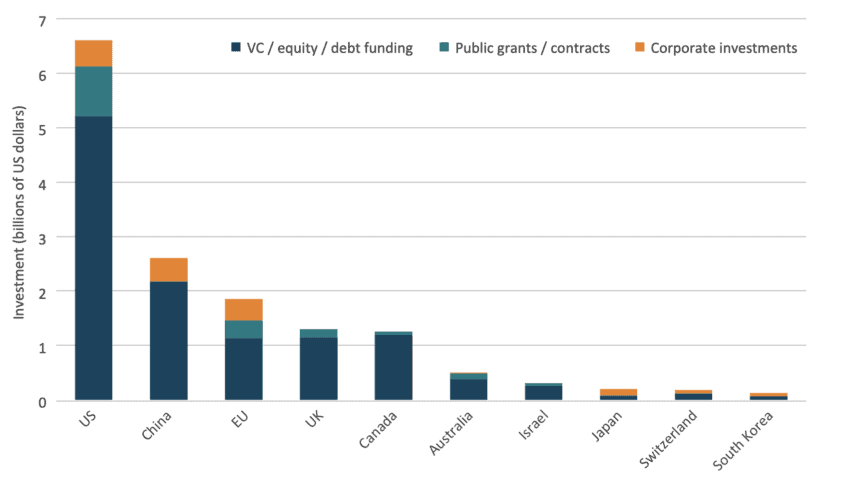

Figures 3a and 3b present findings from ECIPE’s quantum database, and one key observation is that, while the US hosts only 62 of the 258 companies under analysis (about 24% of the total), these companies have received or committed 44% of all funding in the sector to date. Similarly, albeit on a much smaller scale, China, with just 25 companies – 10% of the global total – accounts for around 17% of the total investments in the private quantum space.

Figures 3a and 3b: Total disclosed investments (left) and number of companies active in quantum technology (right) for selected countries and regions, up to 2024 Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed.

Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed.

In contrast, the EU, despite boasting the largest number of companies – 66, or 26% of the total – makes up for just over 12% of the sector’s investments. Other English-speaking countries, including the UK, Canada, and Australia which have established themselves as significant global players, have a better balance. Driven by the strength of their private sectors in the quantum technology space, their 63 companies represent 24% of the global landscape and over 20% of the total funding.

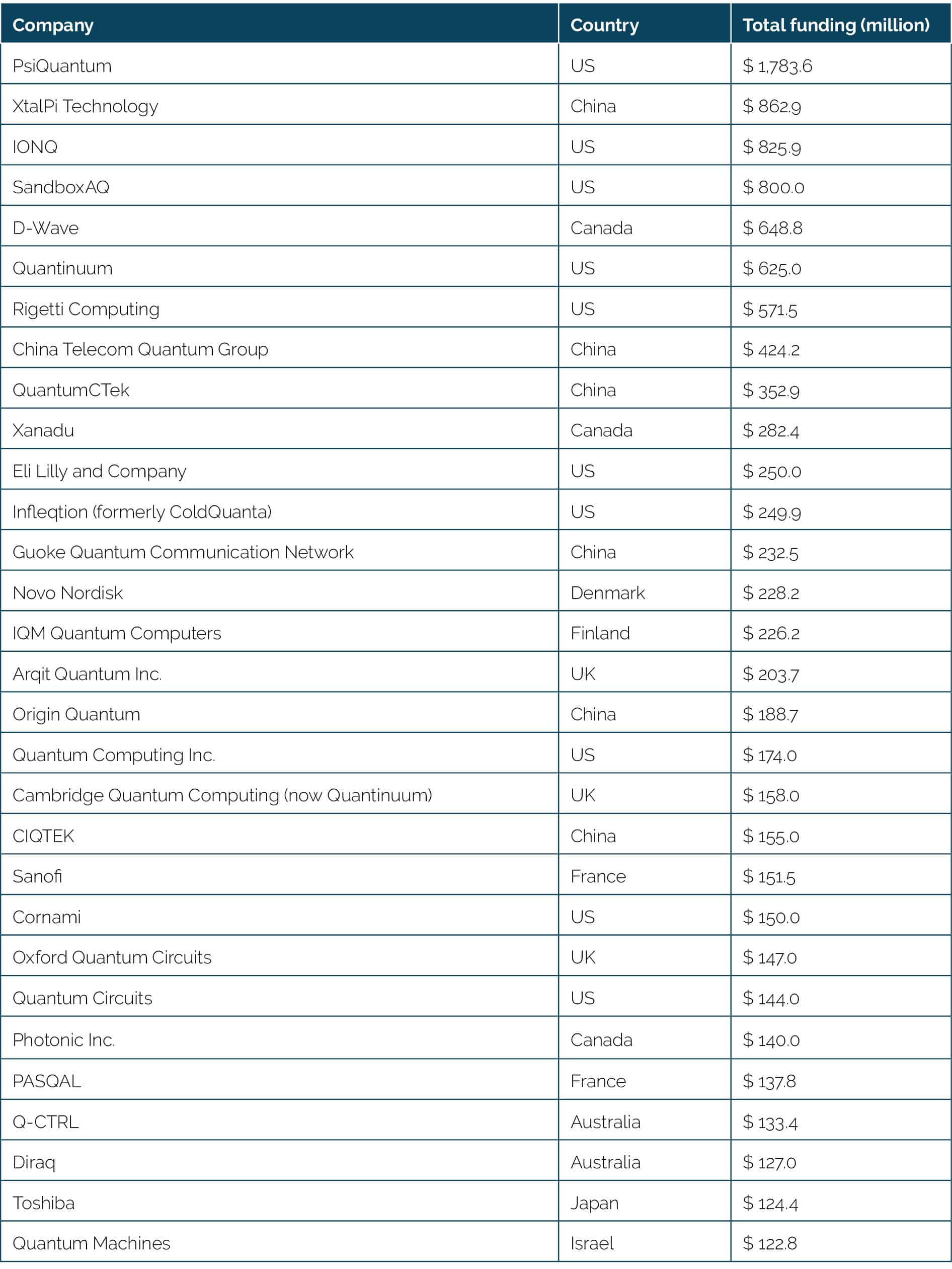

From an international perspective, the EU is not lacking in the number of companies needed to compete in the global quantum space. In fact, according to our data, European quantum firms are the most numerous worldwide. However, when comparing the funding by European quantum companies with their international counterparts, the situation looks far less favourable. Table 1 below shows the 30 largest firms in our dataset based on total funding. Only four are EU-based. What is more, two of these – Novo Nordisk and Sanofi – are large, established pharmaceutical companies rather than startups. The most well-funded EU quantum startup, Finland’s IQM Quantum Computers, ranks 15th overall, with total funding amounting to just one-eighth of the top US quantum startup and one-fourth of the leading Chinese competitor.

Table 1: Top 30 largest companies in the quantum sector by total disclosed funding, received or committed (as of 2024) Source: ECIPE Quantum Database.

Source: ECIPE Quantum Database.

3.1 Dissecting Private Sector Funding for Quantum Technology

While home to over 25% of all quantum companies globally, private sector investment in the EU stands at a mere 12% of the world’s total. A significant barrier to scaling EU quantum startups certainly is their limited access to private capital – a well-documented problem for Europe’s young and fast-growing companies in virtually all innovation sectors. For context, in 2022, European tech startups more generally secured just one-tenth of the venture capital (VC) investments available to their US counterparts.[3]

Equity financing, especially venture capital as an early-stage investment type, plays a crucial role in the emergence of new technologies. It provides capital to companies and startups, enabling them to scale innovative ideas into commercially viable projects while aiming for a return on investment within 5 to 10 years. However, equity financing extends beyond mere capital provision. It also brings strategic management expertise and sector-specific knowledge, helping to navigate the complexities of bringing innovation to market. This form of financing is particularly important for quantum technology, as it helps cover the substantial fixed research costs associated with its development, accelerating progress towards commercialisation.

The connection between technological development and access to private capital is well illustrated by the development of a related technology – generative AI. Much like quantum, AI technologies also require substantial upfront investment, far exceeding that of many non-digital sectors. As a result, they depend on flexible, high-risk financing models such as venture capital. It is therefore no coincidence that over 85 per cent of all VC funding for generative AI to date has been concentrated in the US and that the vast majority of generative AI startups and their Large Language Models (LLMs) originate there.[4]

One might argue that large VC investment is not strictly necessary for driving innovation, pointing to the example of the Chinese AI company DeepSeek, which has gained worldwide attention for its advanced capabilities despite its relatively modest initial investment.[5] However, it is important to note that, although limited, DeepSeek has still received financial backing from private equity, and, most importantly, that this remains an exception so far within the deep-tech startup world. The prevailing consensus is that for a narrow set of high-risk, high-potential technological fields – such as software, biotechnology, AI, and most likely quantum – strong VC funding is closely linked with some of the world’s fastest-growing and most influential companies.[6]

With this in mind, we now turn to an assessment of which countries demonstrate the most vibrant venture markets – an aspect that will be crucial for the success of quantum startups and for driving tangible, near-term innovation in the quantum sector. To do so, we have categorised private sector quantum investment into three main sources of funding:

- VC, equity, and debt financing: funding from venture rounds, equity investments or debt instruments.

- Public grants and contracts: direct public funding or contracts awarded by government agencies.

- Corporate investments: contributions from established corporations to universities, research institutes, or collaborative efforts with other firms.

Figure 4 below presents the funding breakdown for all countries and regions in our dataset where companies collectively raised or committed at least USD 100 million. Unsurprisingly, in most comparable economies, VC, equity, and debt instruments account for at least 75% of the funding pool for quantum technology companies. In contrast, this percentage drops to 61% in the EU and plummets further to 50% in South Korea and 37% in Japan.

Remarkably, the size of the equity market for quantum technology in the UK and Canada alone is bigger than that of the entire EU bloc put together. Remarkably, in the US it is more than four times larger than in the EU. For the EU, public grants and contracts as well as corporate investments represent a significant share of funding for quantum startups with USD 721 million against USD 1.13 billion of VC, equity, and debt financing. This contrasts with most other countries analysed for which public and corporate sources are much more marginal or non-existent altogether.

Figure 4: Total investment in quantum companies by source of funding for selected countries and regions (billions of US dollars) Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed. Individual EU countries surpassing this threshold have not been shown separately; instead, only the EU as a whole is included.

Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed. Individual EU countries surpassing this threshold have not been shown separately; instead, only the EU as a whole is included.

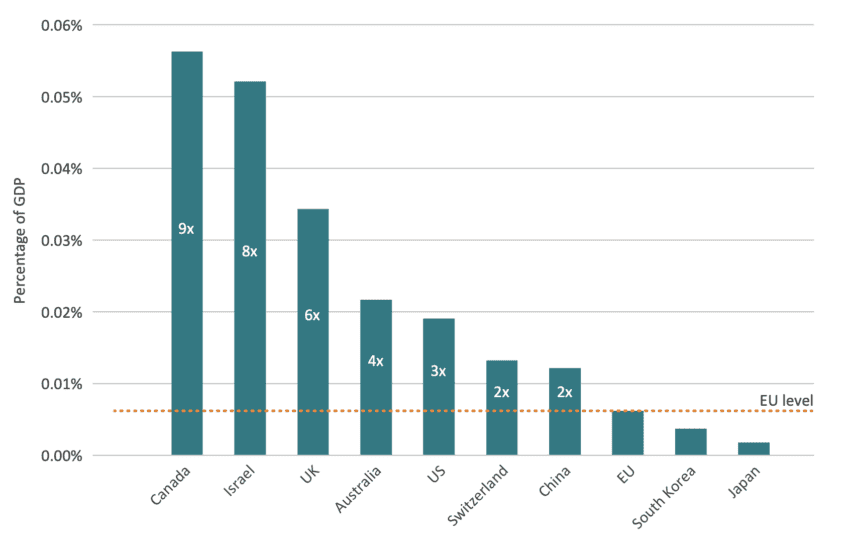

The comparatively small size of the EU venture market in the quantum sector becomes even more striking when measured as a share of GDP, as illustrated in Figure 5 below. Countries are ranked in descending order based on the incidence of VC, equity, or debt funding as a proportion of their GDP, with the dotted line representing the EU’s level.

Unsurprisingly, the total value of VC, equity, or debt funding raised by quantum startups in the EU pales in comparison to other global players: this figure is over nine and eight times larger in Canada and Israel, nearly six and four times greater in the UK and Australia, over three times higher in the US and more than double in China and Switzerland. Among major economies, only Japan and South Korea have a smaller venture market for quantum startups as a proportion of GDP than the EU.

Figure 5: VC, equity, and debt funding in quantum startups relative to GDP for selected countries against the EU benchmark (percentage of GDP) Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed. Individual EU countries surpassing this threshold have not been shown separately; instead, only the EU as a whole is included.

Source: ECIPE Quantum Database. Note: Only countries and regions with investments in quantum companies exceeding USD 100 million are displayed. Individual EU countries surpassing this threshold have not been shown separately; instead, only the EU as a whole is included.

A couple of notable exceptions exist within the EU. First and foremost, Finland. When measured relative to its GDP, venture capital and equity investments in Finnish quantum start-ups are by far the highest among all countries in our dataset, placing Finland ahead of Canada in Figure 5, with funding over one and a half times greater than the North American country relative to GDP. This is certainly a by-product of the country’s smaller economic size compared to some of the giants in the dataset, but it still plays to Finland’s indisputable strength in the field. The second largest EU player is France, with venture funding for its start-ups as a share of GDP slightly lower than the US but higher than Switzerland or China.

However, this is not enough to propel the EU as a whole into the higher ranks of global quantum private sector players. The remaining EU Member States exhibit VC and equity funding levels in their start-ups either around the bloc’s average or much lower. This is true even for otherwise large public investment and corporate players like Germany, the Netherlands and Denmark.

[1] The Quantum Insider. (2023, February). Quantum Technology Investment Update – 2022 Review. Available at: https://thequantuminsider.com/wp-content/uploads/2023/02/Quantum-Technology-Investor-Update_vFF.pdf

[2] It is important to account for both received and committed funding by companies active in quantum technology, as this group primarily consists of startups, which finance themselves through venture or equity markets – thus receiving funding – while larger corporations involved in quantum technology pledge their own funds to quantum initiatives.

[3] Council of the European Union. (2024, June 18). European capital markets. Available at: https://www.consilium.europa.eu/en/policies/european-capital-markets/#:~:text=European%20tech%20start%2Dups%2C%20for,in%20the%20EU%20in%202022.

[4] EY. (2024, December 20). Venture Capital Investment in Generative AI Almost Doubles Globally in 2024 As Momentum Accelerates in Transformative Sector. Press release. Available at: https://www.ey.com/en_ie/newsroom/2024/12/venture-capital-investment-in-generative-ai-almost-doubles-globally-in-2024-as-momentum-accelerates-in-transformative-sector

[5] Soni, A. and Kachwala, Z. (2025, January 29). DeepSeek’s low-cost AI spotlights billions spent by US tech. Reuters. Available at: https://www.reuters.com/technology/artificial-intelligence/big-tech-faces-heat-chinas-deepseek-sows-doubts-billion-dollar-spending-2025-01-27/

[6] Lerner, J. and Nanda, R. (2020). Venture capital’s role in financing innovation: What we know and how much we still need to learn. Working Paper No. 20-131, Harvard Business School. Available at: https://www.hbs.edu/ris/Publication%20Files/20-131_fc73af76-3719-4b5f-abfc-1084df90747d.pdf

4. The Academic Sector’s Role in Quantum Technology Development

Academic communities, in particular universities and research institutes, play a central role in fostering innovation by providing the foundational knowledge and creative insights that fuel product development.[1] Academic publications reveal theoretical breakthroughs. It is important to track trends and priorities in a given research area. A surge in publications on a specific topic would also signal where scientific and financial investments are being concentrated by countries.

Countries with rising publication rates in a field (e.g., China in quantum communications) often indicate strategic national priorities. There are two ways to map this, by exploring the patterns in the quality and quantity of quantum publications. Quantity reflects the level of activity, investment, and interest while quality hinges on the impact and potential for future research in quantum technologies. Universities are key because they often provide basic research and the theoretical development that leads to applied technologies. A quantum ecosystem for publications should therefore combine volume (many researchers tackling diverse challenges) with impact (pioneering papers that redefine the quantum field).

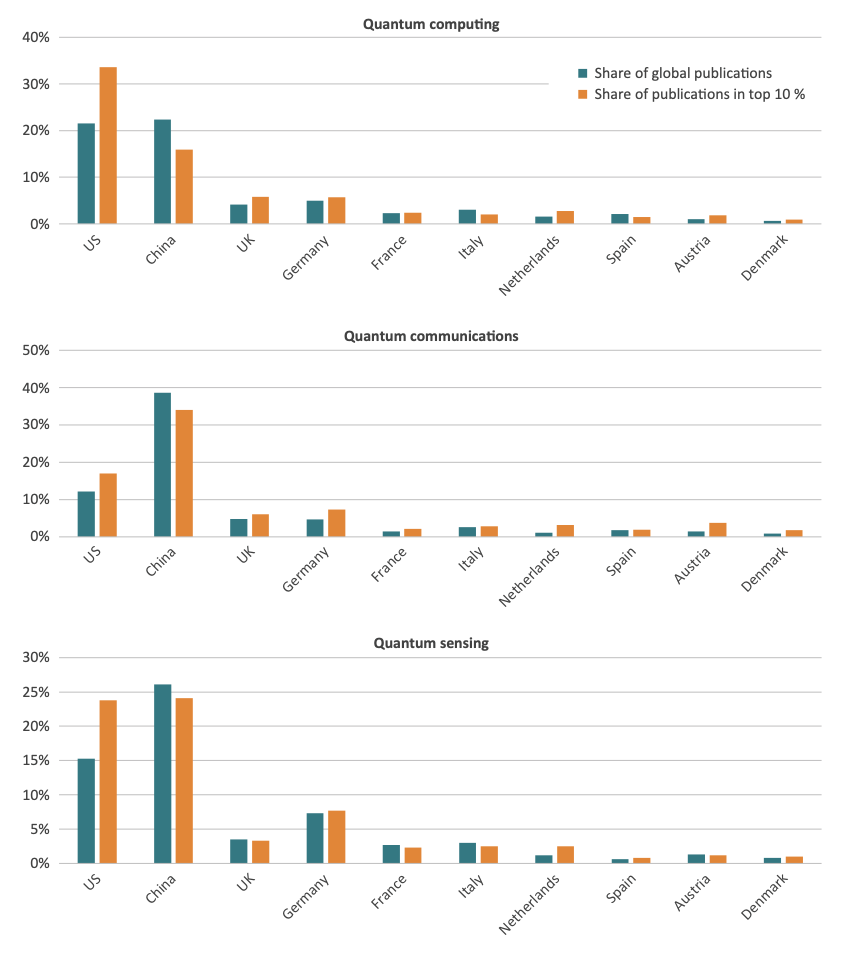

Figure 6a, 6b and 6c below shows the relative publication performance in the fields of quantum computing, quantum communications, and quantum sensing. The total number of publications serves as a useful indicator of the overall research activity in quantum sub-field. Quantity reflects the intensity and breadth of research activities across various domains, while quality signals where breakthroughs are emerging, highlighting the most promising trajectories for quantum developments. Data is derived from the Australian Strategic Policy Institute’s (ASPI) critical emerging technology tracker.[2] ASPI evaluates research output using two key metrics, the total number of publications from 2019 to 2023 and the top 10% of these publications, for assessing the quality. The focus on the top 10% of publication is rooted in the idea that these high-impact papers can often influence future research directions throughout the technology life cycle, often leading to new technological breakthroughs and patent documents.[3] Crucially, however, we argue that patents should not be viewed merely as outputs of innovation but as critical inputs that codify knowledge, incentivise risk-taking in product development, and accelerate cross-sector collaboration.

Our selection of countries is not arbitrary. These countries are highlighted due to their strategic, economic and scientific significance in the quantum ecosystem. All of these countries host some of the most prominent universities and research institutes, each of which have a strategic focus on one of the three quantum fields. The selection reveals a distinct pattern: the US prioritises high-impact research driven by its top tier universities and industry partnerships, China emphasises scale through its state-aligned universities and the EU balances open scientific research from its Member States’ leading universities with the development of specialised, application-driven innovations through cross country collaboration.

The US currently leads in quantum computing, particularly in research quality. While the US and China produce a similar volume of research – accounting for 22.5% and 21.5% of global publications, respectively – the US outperforms China in terms of high-impact work. Specifically, 34% of US publications rank among the top 10% most cited globally, compared to just 16% for China. Among EU Member States, Germany is the top contributor, producing 4% of global quantum computing papers. In terms of research quality, 6% of German publications are among the top 10% most cited worldwide, followed by the remaining EU Member States.

China is the global leader in quantum communications research, accounting for 39% of the world’s publications, significantly ahead of the US, which contributes 12%. China also ranks first in research quality, with 34% of its publications among the top 10% most cited globally, while the US follows with 17% in this category. Among EU Member States, Germany leads in publication volume, contributing 5% of global papers. However, in terms of research quality, 7% of German publications rank in the top 10% worldwide.

In quantum sensing, China leads in research output, accounting for 26% of global publications, while the US follows with 15.4%. However, both countries are nearly tied in research quality, with 23.7% of US publications and 23.3% of Chinese publications ranking among the top 10% most cited globally. Among EU Member States, Germany is the top contributor, producing 7% of global quantum sensing papers, with 8% of its publications ranking in the top 10% for citations.

Figure 6a, 6b and 6c: Quantity and quality of quantum technology academic publications by sub-field for top 10 countries, 2019-2023 (percentage of total) Source: ECIPE analysis based on ASPI Critical Technology Tracker data.

Source: ECIPE analysis based on ASPI Critical Technology Tracker data.

The data reveals that the US has continued to prioritise quantum computing, and this is partly driven by the National Science Foundation’s (NSF) recognition of its interdisciplinary research potential.[4] These efforts align with the National Quantum Initiative Act (2018), which mobilised funding across the Department of Energy (DoE), NSF and National Institute of Science and Technology (NIST) and also brought in partnerships between universities and corporate partners.[5] Universities like MIT, Harvard, and Caltech prioritise “moonshot” innovations rather than incremental progress.[6]

In China, the research centres on quantum communications, reflecting its 2021–2035 S&T priorities, where quantum ranks second among cutting-edge fields.[7] Its publication pattern indicates that it focuses on incremental engineering rather than disruptive theories, its growth in communications also reflects its first mover advantage in satellite-based quantum encryption (Micius) and ground networks.[8]

The US-China parity in quantum sensing, in particular, suggests that both nations view sensing as a critical technology for dual-use applications, which can serve both civilian and military purposes. As such, quantum sensing has become a focal point in national technology assessments, particularly at the R&D level, and is increasingly integrated into international security policy frameworks. This growing significance of quantum sensing has also contributed to the tightening of restrictions on technology transfer, which is a direct outcome of the intensifying Sino-American military competition. In this context, the parity between the US and China indicates that Washington is likely to be in a stronger position, followed by Beijing, to achieve and deploy breakthroughs in quantum sensing for national security purposes.[9]

Meanwhile, the EU is also a notable region in quantum sensing, but its focus is more on applications that cater to civilian industries, such as telecommunications and healthcare, rather than strictly military use. Germany’s emphasis on sensing also highlights its industrial R&D focus on quantum sensors, especially for a sectoral view (e.g. Bosch’s quantum sensors for autonomous systems[10]).

For the EU, the findings reflect a distributed expertise which balances each other via EU-wide quantum programmes (e.g., Quantum Flagship and the European Quantum Communication Infrastructure (EuroQCI) initiative). This distribution avoids duplication and allows for complementary expertise, which creates a sort of “quantum mosaic” – a research ecosystem where diverse specialisations interconnect, making the whole stronger than sum of its part. As a bloc, the EU becomes a strong competitor to China and the US in the quantum technology areas pointed earlier. The prospects of an open science approach encourages more collaboration within the EU, focusing on practical, near-term applications, and allowing other known players, as Austria, Denmark, Spain to contribute to impactful research without needing massive scale. [11]

As the findings reveal, Germany, the Netherlands and Austria outperform the scale of their publication, mirroring the US model of prioritising ground-breaking research over incremental progress. This quality-based edge stems from their ability in adopting new ideas and cutting-edge research methodologies and translating research into breakthroughs, giving them a competitive edge.

Germany already has a strong quantum technology ecosystem. A notable instance is in the Baden-Württemberg region in south-west Germany which hosts a specialist centre formed by Fraunhofer Gesellschaft and IBM: the Quantum Computing Baden-Württember. In 2021, it unveiled one of the most powerful quantum computers ever produced.[12] Similarly, in the Netherlands is the research Institute for quantum computing and quantum internet, founded by Delft University of Technology (TU Delft) and the Netherlands Organisation for Applied Scientific Research (TNO). QuTech is at the forefront of fundamental research and engineering breakthroughs. A team of researchers at TU Delft and Netherlands Organisation for Applied Scientific Research (TNO) were able to establish the first multi-city quantum network, connecting quantum processors in Delft and the Hague.[13] Meanwhile, Austria punches far above its weight in research density. With nearly 70 quantum-focused research groups and the highest concentration of quantum scientists relative to its population,[14] the country fosters a uniquely interdisciplinary research environment. This is notable from the strong quantum technology centres including the Vienna Centre for Quantum Science and Technology (VCQ), a joint initiative of the University of Vienna, the Vienna University of Technology, and the Austrian Academy of Sciences and also notable is the Austrian Institute for Technology.

As quantum development gains further momentum, countries are increasingly prioritising domestic initiatives, paving the way for both more autonomy and silos of specialisation in research,[15] reducing incentives for international research partnerships. While it can lead to innovation in particular niches, this approach limits knowledge sharing and interoperability across different research efforts. A notable instance is US imposing research restrictions on collaborations with Chinese institutions due to concerns over IP theft and military use.[16] Likewise, China’s 2023 Anti-Espionage Law also discourages foreign researchers from accessing sensitive quantum technology projects.[17] Restrictions that hinder international scientific collaboration can slow down the R&D process and disrupt the state of scientific diplomacy.[18] This can also be reinforced by the European Commission’s release of the updated Horizon Europe Strategic Plan for 2025–2027. The new plan elevates ‘open strategic autonomy and ensuring Europe’s leading role in the development and deployment of critical technologies’ from one of four key strategic orientations to an overarching principle, marking a significant shift from the 2021–2024 period.[19]

In this context, we also highlight ASPI’s evaluation of technology monopoly risks, which measures a country’s advantage over its competitors and the concentration of top research institutions in leading countries. By using the top 10% of research output as a leading indicator, ASPI identifies quantum computing as having a medium monopoly risk with a score of 2.26, followed by quantum communications and sensing with low monopoly risk scores of 1.89 and 1.02, respectively. These findings caution against overemphasising a security-first mentality in a field which is still evolving, and reliant on trust and collaboration as its foundation. To mitigate technology monopoly risks, it is important to avoid siloed specialisation and instead foster ecosystems that can balance scientific diplomacy with cross border research interactions.[20]

[1] Biotechnology, nanotechnology, and clean technology sectors have exemplified this trend, see: Jong, S., & Slavova, K. (2014). When publications lead to products: The open science conundrum in new product development. Research Policy, 43(4), 645-654. And quantum technology is now following suit.

[2] ASPI. Critical Technology Tracker. Available at: https://techtracker.aspi.org.au/

[3] Research results from Hicks et al confirms that publications with high scientific quality are likely to be cited in patent documents, and at a higher rate. See: Hicks D., Breitzman A. Sr., Hamilton K., Narin F., Research excellence and patented innovation. Sci. Public Policy 27, 310–320 (2000). Also see: Wong, L., J, Robin, S., and Cave, D. (2024). ASPI’s two-decade Critical Technology Tracker: The rewards of long-term research investment. ASPI. Available at: https://ad-aspi.s3.ap-southeast-2.amazonaws.com/2024-08/ASPIs%20two-decade%20Critical%20Technology%20Tracker_1.pdf?VersionId=1p.Rx9MIuZyK5A5w1SDKIpE2EGNB_H8r

[4] “QIS is first mentioned in the FY2008 budget of what is now the Networking and Information Technology Research and Development Program and has been a component of the program since then.” See: Figiliola, P. M. (2018). Quantum Information Science: Applications, Global Research and Development, and Policy Considerations. Congressional Research Service. Available at: https://crsreports.congress.gov/product/pdf/R/R45409/1

[5] H.R.6227 – National Quantum Initiative Act 115th Congress (2017-2018)

[6] Innovation Institute of MassTech Collaborative. Massachusetts Quantum Computing Ecosystem Study. Available at: https://innovation.masstech.org/sites/default/files/2023-11/MA-Quantum%20Report.pdf

[7] Hmaidi, A. and Groenewegen-Lau, J. (2024). China’s long view on quantum tech has the US and EU playing catch-up. MERICS. Available at: https://merics.org/de/studie/chinas-long-view-quantum-tech-has-us-and-eu-playing-catch; Also see: “国家中长期科学和技术发展规划纲要 (National Medium and Long-term Science and Technology Development Plan Outline)” (2006). from State Council https://web.archive.org/web/20240926153345/https://www.gov.cn/gongbao/content/2006/content_240244.htm

[8] CAS. Beijing-Shanghai Quantum Communication Network Put into Use. Available at: https://english.cas.cn/newsroom/archive/news_archive/nu2017/201703/t20170324_175288.shtml

CAS. Micius Satellite for Quantum Science Experiments. Available at: https://quantum.ustc.edu.cn/web/en/node/351

[9] Austin, G. (2024). Quantum Sensing: Comparing the United States and China. International Institute for Strategic Studies. Available at: https://www.iiss.org/globalassets/media-library—content–migration/files/research-papers/2024/02/iiss_quantum-sensing_022024.pdf

[10] Bosch. Quantum technologies push the boundaries of what is possible. Available at: https://www.bosch.com/research/research-fields/digitalization-and-connectivity/research-on-quantum-technologies/#:~:text=In%20autonomous%20systems%2C%20for%20example,hand%20of%20a%20standard%20clock.

[11] Germany’s findings highlight its engineering expertise and strong collaborative networks such as, Fraunhofer Society, Netherland’s findings reveal its advanced research capacities driven by QuTech’s breakthroughs including quantum internet development, and Austria’s findings unveil its legacy in quantum optics underlying Anton Zeilinger’s Nobel-winning work.

[12] Nature portfolio. (2021). The high-tech German region reshaping the quantum technology race. Available at: https://www.nature.com/articles/d42473-021-00497-6

[13] TU Delft. (2024, October 31). A rudimentary quantum network link between Dutch cities. Available at: https://www.tudelft.nl/en/2024/tu-delft/a-rudimentary-quantum-network-link-between-dutch-cities

[14] Pumhosel, A. (2024, October 8). Austria probably has the highest density of quantum researchers. Available at: https://scilog.fwf.ac.at/en/magazine/oesterreich-hat-wahrscheinlich-die-hoechste-dichte-an-quantenforschenden

[15] In November 2024, Henna Virkkunen announced her intention to present a quantum strategy aimed at fostering a coordinated EU approach. She emphasised that the EU’s technological sovereignty relies on the ambitious Chip Act, which will also encompass additional elements for a quantum chips initiative. “The ambitious Chips Act has enabled us to mobilize over EUR 80 billion in public and private investments. We must do more to achieve our goal of 20% of global production. I will explore further actions related to the Chips Act,” she stated. See: Confirmation Hearing of Henna Virkkunen. Available at: https://hearings.elections.europa.eu/documents/virkkunen/virkkunen_verbatimreporthearing-original.pdf

[16] Mervis, J. (2024, May 13). Senate panel backs funding ban on U.S. researchers in Chinese talent programs. ScienceInsider. Available at: https://www.science.org/content/article/senate-panel-backs-funding-ban-us-researchers-chinese-talent-programs ; Rosenzweig, O. (2022, January 5). U.S. Science Research Has a Foreign Influence Problem. The Regulatory Review. Available at: https://www.theregreview.org/2022/01/05/rosenzweig-us-science-research-foreign-influence/

[17] Goldenziel, J. (2023, July 3). China’s Anti-Espionage Law Raises Foreign Business Risk. Forbes. Available at: https://www.forbes.com/sites/jillgoldenziel/2023/07/03/chinas-anti-espionage-law-raises-foreign-business-risk/

[18] Matthews, K. R., Yang, E., Lewis, S. W., Vaidyanathan, B. R., & Gorman, M. (2020). International scientific collaborative activities and barriers to them in eight societies. Accountability in Research, 27(8), 477-495

[19] European Commission. (2024b). Horizon Europe strategic plan (2025–2027). Publications Office of the European Union, as referenced in Mariotti, S. (2024). “Open strategic autonomy” as an industrial policy compass for the EU competitiveness and growth: The good, the bad, or the ugly? Journal of Industrial and Business Economics, 1-26.

[20] ECIPE’s upcoming paper on quantum clusters will feature a section dedicated to an in-depth analysis of the collaboration patterns between research institutions and universities from 2018 to 2024.

5. Trends in Quantum Computing Patents

Understanding technology development requires looking at both the input side, addressed in the previous sections with amounts of investments, and the output side. That is, how much actual invention result from the investments. By using information from patent documents, we can present some indication of the scale of output.

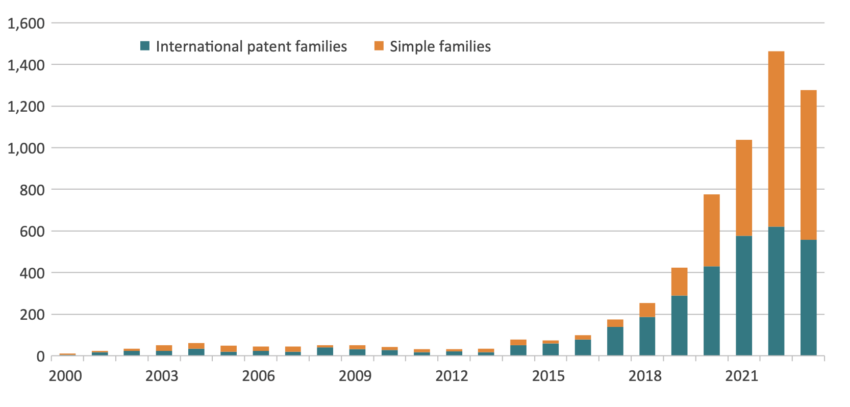

Patenting activity for quantum computing started to accelerate in 2017-2018. As shown in Figure 7, the total number of worldwide inventions, approximated by DOCDB patent families[1], increased from 174 in 2017, to 1.464 in 2022. That is, an average increase every year of 58 per cent.[2] The surge in the number of patent publications related to quantum computing also underscores how important knowledge diffusion is for innovation: when a patent is published, the technical invention becomes publicly available for other inventors/applicants. Also, the surge in quantum inventions in Figure 7 is strongly correlated with private investment efforts highlighted in chapter 3.[3]

Figure 7: Number of quantum computing inventions, approximated by the number of DOCDB patent families, 2000–2023 Source: ECIPE calculations based on EPO PATSTAT.

Source: ECIPE calculations based on EPO PATSTAT.

In addition, Figure 7 makes a distinction between international and simple patent families, as this holds clues on the strategic value of an invention. The process of patenting includes the tying intellectual property rights to a geographical area. Hence it is considered that patent applications filed under several jurisdictions (i.e. international patent families) have greater strategic value because the applicant is seeking a wider geographical protection – also bearing additional costs – before commercialising its invention.

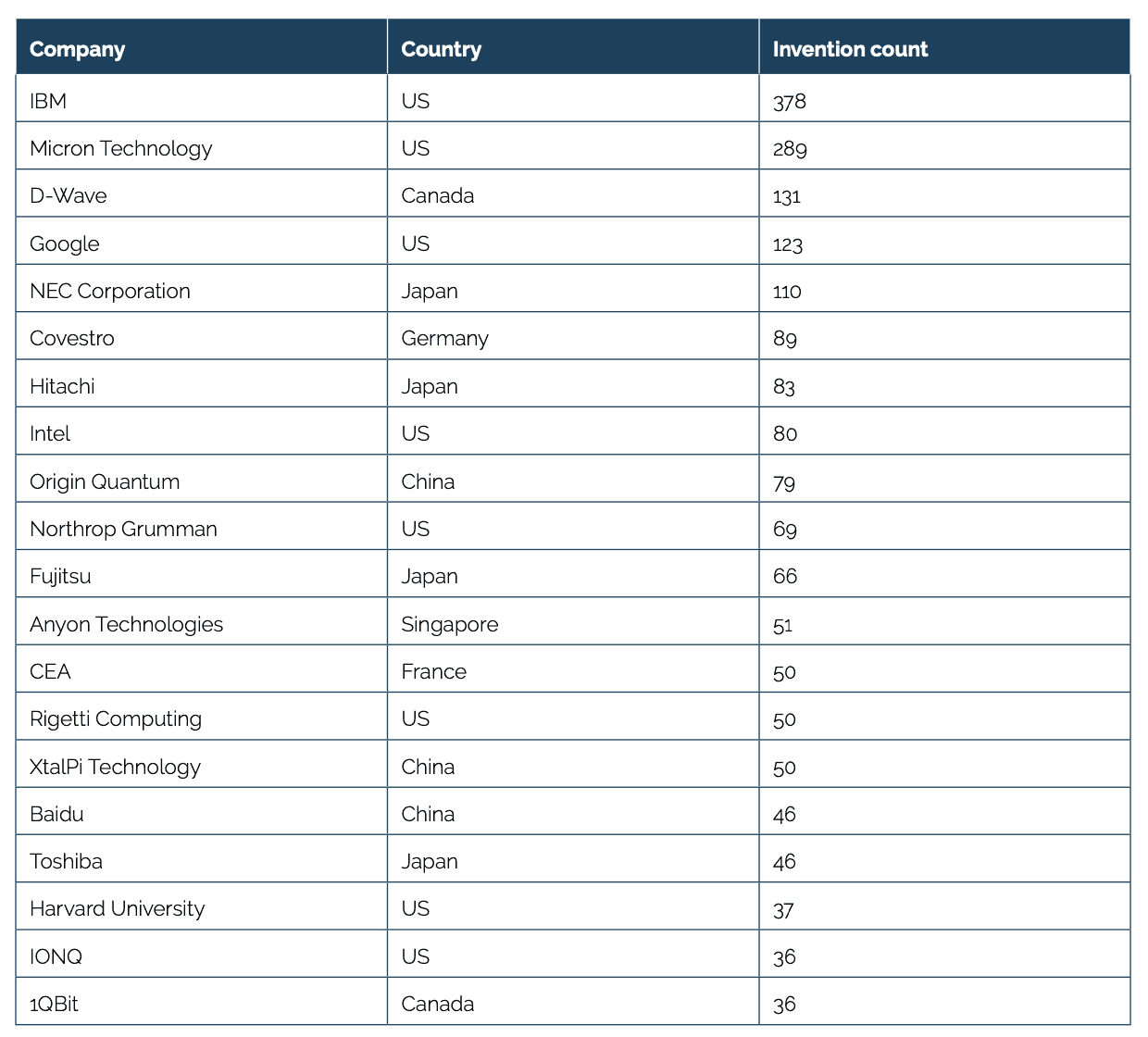

To complete the picture on quantum patenting, Table 2 highlights the distribution of quantum technology inventions among the top 20 companies, using data from international patent families.[4] Since 2010, a substantial share of these inventions has been concentrated to a few key companies: 26% originate from the three leaders – IBM, Micron Technology, and D-Wave Systems. US companies dominate the field, with eight firms among the top 20 applicants, collectively responsible for 1061 inventions. Japan follows with four companies contributing 306 inventions, while China ranks third with three companies producing 176 inventions. The EU is represented in the top 20 by Germany’s chemical company Covestro and the French government agency CEA, which specialises in energy, technology, and defence research. Together, these two EU actors account for 139 quantum computing inventions.

Table 2: Top 20 quantum technology applicants (fractional count of international patent families), 2010–2023 Source: ECIPE calculations based on EPO PATSTAT.

Source: ECIPE calculations based on EPO PATSTAT.

Another notable observation is the role of universities: six US universities rank among the top 50 applicants, compared with only one European university and two government agencies.[5] This raises an important question: what explains the discrepancy between the significant EU public funding highlighted in Chapter 2 and the low patenting output of its universities and government agencies?

One explanation may be different definitions used in various sources of data. When counting inventions by region, the selection of relevant patents for quantum technology is defined according to a specific Cooperative Patent Classification (CPC) code. By contrast, collecting data on quantum investment has a broader definition of quantum technology, and will hence include investments and companies active in quantum technology that are not necessarily included in the CPC classification.

A second explanation is that European universities is less capable of taking academic research into patentable inventions (let alone marketable innovations), despite receiving substantial public funding at both the EU and national levels. This reflects the “European paradox”: European universities are among the most recognised in the world, but generate fewer ground-breaking discoveries that become commercialised when compared to the US, for example. One contributing factor to the lower patenting performance of EU universities is that they often operate independently in their patenting efforts, which reduces the likelihood of them appearing among the world’s top 20 quantum technology inventors. Nevertheless the role of public R&D is central in the wider EU innovation landscape: more than 10 per cent of all patents filed by European applicants at the EPO came from universities in 2019.[6]

[1] The DOCDB patent family is a collection of patent documents covering the same invention and is often used as a proxy for a technical invention. See Box 2 in the Appendix.

[2] The dip in the number of quantum computing inventions after 2022 is due to the lag between the moment a patent is filed and when the patent is published by a patent authority. Typically a patent application is published 18 months after its filing date. See: https://setis.ec.europa.eu/document/download/bb59e826-32d7-4af7-bb15-e564def47337_en?filename=patent_based_indicators.pdf&prefLang=sv

[3] As explained in the appendix, the data collection strategy for this section focuses on quantum computing, and thus omits quantum sensing and communication.

[4] Fractional counting is used to compute invention counts, to avoid double counting.

[5] The only university is Delft University of Technology in the Netherlands, and the two government agencies are France’s Commissariat à l’Energie Atomique (CEA) and the National Centre for Scientific Research (CNRS).

[6] EPO. (2024). The role of European universities in patenting and innovation: A study of academic inventions at the EPO.

6. Conclusion

The current state of quantum development shows that it is too early to identify definitive leaders, predict long-term winners or determine who might fall behind in the race. This is true for any technology, given the constant flux of developments and the rapid pace of progress influenced by geopolitical dynamics. What is clear, however, is that technological success hinges on fostering distributed, decentralised ecosystems rooted in openness, experimentation, and collaboration. Currently, 33 countries are actively building quantum capabilities, with public funding commitments rising sharply. Major players like China, the US and the EU possess the resources to lead. However, the EU faces a unique challenge, its venture capital market for quantum startups lags far behind peers, jeopardising its ability to translate scientific research into commercial and strategic advantage. Despite its considerable economic size, government initiatives, and a substantial number of quantum companies, the EU ranks among the lowest in private-sector investment compared to other major economies in our analysis.

At present, because regulatory constraints have had little to no impact on quantum technology, as the sector remains in its early stages and is yet to be subject to stringent regulations, it is important that the EU resists replicating a self-sufficiency approach. Instead it should continue to broaden its global outlook, and tap into other quantum markets to scale innovations. Funding should prioritise to bridge what some have called the “valley of death” between research and commercialisation. The EU as a bloc is already a strong competitor in the quantum space, demonstrating that the EU and its Member States have the potential to transition from ground-breaking scientific discoveries to developing market-ready applications. In this regard, one should also not characterise patents as mere outputs of innovation but as a crucial factor that drives knowledge diffusion and technological advancement. By bridging the gap between breakthroughs and scalable applications, patents enable iterative cycles of R&D, ensuring that foundational discoveries and research can translate into tangible progress. We recognise that the future of quantum technologies will depend on many factors, many of which extend beyond what we have covered here, but ultimately the regions that will benefit most are those that adopt a multi-faceted approach to innovation, one that balances competition and collaboration.

ANNEX

EPO PATSTAT patent search strategy for quantum computing:[1],[2]

The data collection process for quantum computing inventions uses the EPO Worldwide Patent Statistical Database (PATSTAT). This online repository contains a rich set of bibliographical and legal events for more than 100 million worldwide patents. The search strategy used in this paper relies entirely on the Cooperative Patent Classification (CPC) system. This hierarchical classification groups inventions into close to 250.000 different categories. The field of quantum computing includes all the subclasses within ‘G06 N10’; that is, comprising quantum computing in general, models of quantum computing, physical realisations, quantum algorithms, quantum error corrections, and quantum programming.

The DOCDB patent family number and the earliest publication date are the two most important patent information. A patent family is a set of patent applications filed in several countries which are related to each other by a common priority number. In other words, a patent family contains all patent documents protecting the same invention, hence making it a suitable proxy to count the number of inventions for a given technology. Thus when counting the number of inventions for quantum technology, the invention is counted once, embedding the whole DOCDB patent family ID. The earliest publication date is used to fix the number of inventions across time. Finally, once the appropriate set of patents is compiled into a dataset, a few manipulations are necessary to make applicant names and countries consistent across the observations.

It is worth noting that other works on quantum computing innovations also use text-based search strategies, in patent titles or abstracts, in addition to classification search. Based on specific keywords, such search strategy is at the discretion of the researcher and seeks to improve the coverage of the technology field in patent search results. This explains why, in aggregate, the number of quantum computing inventions differs from other works. The trend over time, however, is equivalent.

[1] USPTO. (2024, August). CPC Scheme. USPTO.Gov. https://www.uspto.gov/web/patents/classification/cpc/html/cpc-G06N.html

[2] OECD. (2009). OECD Patent Statistics Manual. OECD Publishing.