What is Wrong with the German Economy? The Case for Openness to Technology and Human Capital

Published By: Philipp Lamprecht

Subjects: Digital Economy European Union New Globalisation

Summary

Advanced economies like Germany need to focus more on attracting foreign high-skilled labour and become better at importing foreign technology and business models. This might not sit well with current thinking of economic sovereignty in Berlin, but it is a necessary step for improving technology-penetration, competitiveness and productivity. Supply of high-skilled labour is getting more difficult to obtain and the cost of generating and adopting new ideas is increasing.

Policymakers need to create the right conditions to open their markets to foreign technology and high-skilled labour. But openness alone is only a necessary condition – not a sufficient one. Policymakers also need to focus on creating the right environment domestically to attract a specialised and highly-skilled labour force, despite fierce competition from around the globe. The crucial question is to what extent companies make use of innovation capacities that can be obtained from international recruitment.

Our analysis focuses on what German policymakers can do to increase openness for, and its attractiveness to, the high-skilled labour. Germany’s policy framework should focus on public policy initiatives aimed at increasing the incentives and removing obstacles for firms to attract the global high-skilled labour force. To stay attractive, Germany’s policies should also target issues of bottleneck regulation to facilitate field-testing new technologies and to support innovation sandbox processes of companies. And German policies should focus on the regulatory environment, notably the type of regulations that policymakers pursue. Many current regulations in Germany do not sufficiently allow for experimentation of technologies and ideas.

Introduction

Things are not always what they seem. For two decades now, the German economy has been the locomotive of the European economy – pulling many other countries into the value chains of German companies and thus helping them to access markets abroad. Several new books have been published in the last years arguing that “Germans do it better”, suggesting that other countries have more to learn from Germany than vice versa. Dull economic performance in the 1990s made Germany the sick man of Europe but a series of domestic structural reforms and benign global economic weather conditions injected some new life in the economy. Just before the Covid-19 pandemic started, German unemployment was as low as 4.9 percent.[1] What’s not to like with the German economy?

However, beyond the surface, structural economic problems are not just visible but growing. Some of them concern demography, technological skills and the slow pace of economic modernisation – an economy increasingly stuck in a rut. The German economy has been powered by high volumes of exports: in fact, the German trade surplus, standing at close to 8 percent of GDP, is one of the biggest in the world.[2] But the trade surplus isn’t just about competitive German companies that have made a success out of globalisation. It also reflects demographic changes with an increasing average age and big cohorts of people that need to save for their impending retirement. The more a population needs to save, the less it can consume – and the trade surplus is very much a factor of low German consumption leading to low imports.

Productivity growth is another underlying weakness in the German economy – one, of course, that it shares with many other developed economies. One factor behind Germany’s productivity slowdown are the successful labour market reforms. While successful integration of less-qualified workers into the German labour market has led to an increase in employment, there has at the same time been a decline in average productivity per employed person (i.e. a composition effect on average labour productivity) which has contributed to a strong slowdown of productivity growth in manufacturing in Germany. However, it isn’t just an issue about labour productivity. Growth in total factor productivity has slowed down remarkably and now stands at -0.33 percent – compared with 2.46 percent in 2011.[3]

Nor has digitalisation come to the rescue. Many observers have noted that there have not been enough productivity-enhancing impulses coming from the ICT-intensive sectors. One reason is that Germany performs poorly when it comes to digital infrastructural issues such as mobile broadband subscription and internet bandwidth. But a bigger problem is that firms are not successful enough in using ICT-technologies efficiently in their operations and get workforces to adjust to new ways of organisational performance, especially in services.

What are the possible remedies? One of them is surely to focus on education and training, and especially the teaching of necessary IT-skills. But this is not enough. It is going to be ever more important for Germany – and Europe – to import ideas, technology and human capital from abroad and become better at using these scarce resources. In a world where shifting relative economic powers mean a lot more of technology and innovation will come from other countries, it is increasingly important to be open to those other countries. Economic development in recent decades has been accompanied by a global process of generating new ideas and technologies, with a growing importance of innovation and a greater role for new ideas in the global economy. One of Germany’s prime economic challenges is to better tap into this new economic modernisation.

This policy brief argues that advanced economies like Germany need to focus more on attracting foreign high-skilled labour and become better at importing foreign technology and business models. While this might not sit well with current thinking in Berlin, which rather moves in the direction of economic sovereignty, it is a necessary step for improving technology-penetration, competitiveness and productivity. The age of easy supply of high-skilled labour is over and the cost of generating and adopting new ideas is increasing. That should lead to more economic openness, not to more of Germany’s traditional “we-do-it-better-here”-attitude.

Policymakers need to create the right conditions to open their markets to foreign technology and high-skilled labour. But openness alone is only a necessary condition – not a sufficient one. Policymakers also need to focus on creating the right environment domestically to attract this specialised and highly-skilled labour force, despite fierce competition from around the globe. Our analysis focuses on the situation in Germany and what German policymakers can do to increase openness for, and its attractiveness to, the high-skilled labour.

[1] Destatis (2021). Unemployment Rate Germany. Available at: https://www.destatis.de/EN/Themes/Economy/Short-Term-Indicators/Labour-Market/arb210a.html

[2] https://www.ceicdata.com/en/indicator/germany/current-account-balance–of-nominal-gdp

[3] Source: OECD.

The situation in Germany: A frontier analysis

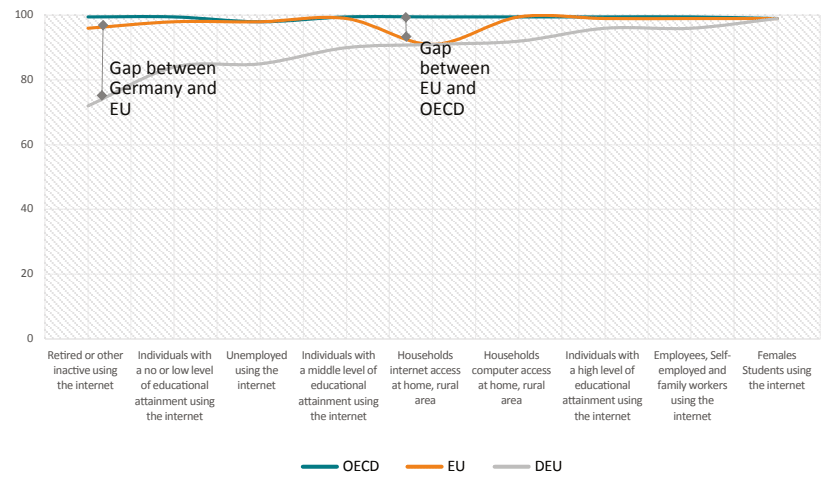

Germany isn’t a digital economic powerhouse. Let’s look at Germany’s performance in several pretty basic digital-adoption indicators and compare that performance with the leading countries of the EU and OECD. This frontier analysis covers two dimensions, namely the individual/consumer and business performance in the digital economy which are respectively shown in Figures 1 and 2.[1]

Figure 1: Closing the Digital Consumer Absorbing Gap (Index Rescaled from 0–100) Source: OECD; authors’ calculations.

Source: OECD; authors’ calculations.

Figure 1 indicates that Germany approaches the digital frontier to a very high extent on many of the personal ICT usage dimensions. For instance, although there is still a gap in the extent to which retired or other “inactive” persons use the internet, this gap is relatively small compared to the business performance of digital items (see figure 2). Note that the EU itself is on many dimensions also the frontier performer when compared with other OECD economies.

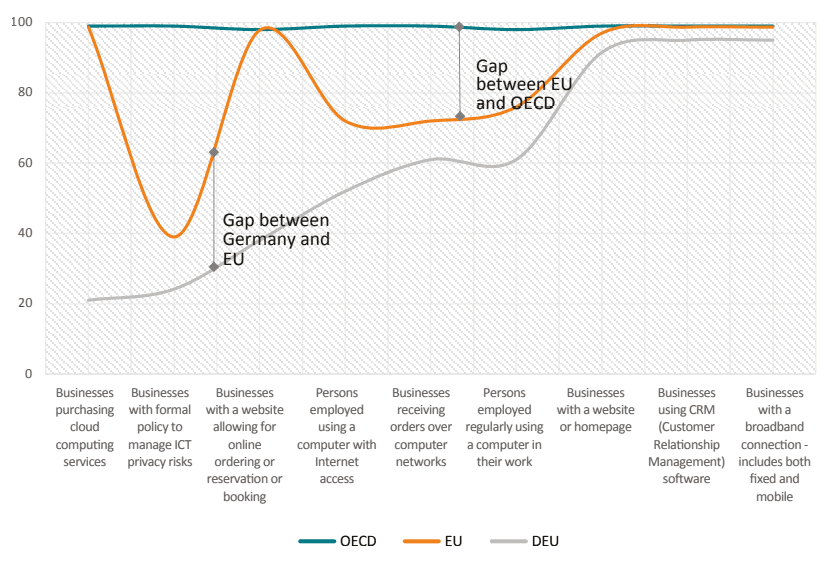

Figure 2: Closing the Digital Business Absorbing Gap (Index Rescaled from 0–100) Source: OECD; authors’ calculations.

Source: OECD; authors’ calculations.

In contrast, figure 2 shows that Germany is distant from the frontier of the digital economy in most of the business performance indicators. Note that the diffusion gap between Germany and the frontier is relatively small on the final three – broadband connection, businesses using customer relation software and business with a website. The gap is relatively large on all other items, including areas of cloud computing, ICT privacy risks or businesses with a website for orderings and customer management. The frontrunners in the EU tend to show a similar trend as Germany, although they perform much better than Germany regarding online ordering and cloud computing (in these cases Finland and Sweden, respectively).

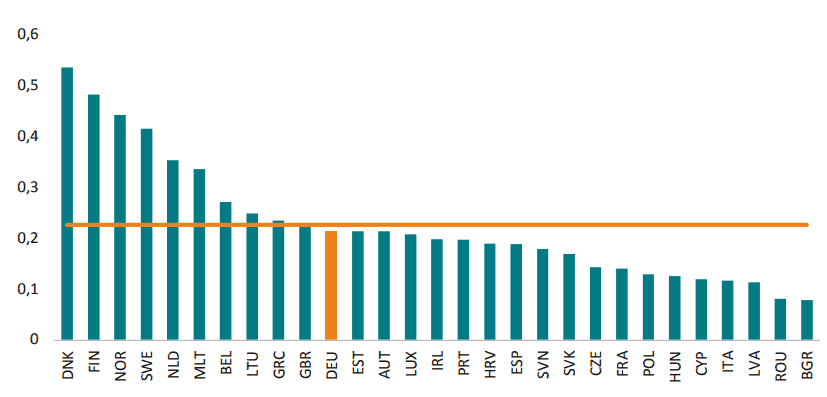

The general view is that Germany performs relatively poorly with regard to business usage.[2] Germany’s policy initiatives need to specifically focus on increasing business usage of existing digital endowments. This is also illustrated by the low digital intensity of firms as Germany ranks below the EU average when it comes to enterprises with high levels of digital intensity (see figure 3).[3]

Figure 3: Enterprises with High Levels of Digital Intensity (Index) Source: European Commission; authors’ calculations

Source: European Commission; authors’ calculations

[1] Bertelsmann Stiftung (2017). Boosting Trade in Services in the Digitalisation Era. Potentials and Obstacles. Available at Erahttps://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/GrauePublikationen/NW_Study_Trade_in_Services_Digitalisation_01.pdf

[2] Germany appears to have low scores in the following specific areas: Businesses purchasing cloud computing services; businesses with a website allowing for online ordering or reservation or booking; business with formal policy to manage ICT privacy risks; persons employed using a computer with internet access; use of PCT patents; ICT use for business-to-business transactions; extent of staff training; and B2C internet use.

[3] Bertelsmann Stiftung (2017). Boosting Trade in Services in the Digitalisation Era. Potentials and Obstacles. Available at Erahttps://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/GrauePublikationen/NW_Study_Trade_in_Services_Digitalisation_01.pdf

What are the reasons for this situation in Germany?

There are many reasons why Germany isn’t at the frontier. Starting with business-environment factors, the process of businesses adopting increasingly modern types of operation is known as digital transformation or digital business transformation. It is important for firms to develop their digital business agility, which also increases their ability to respond to digital disruption, i.e. technological change that companies need to embrace in order to stay successful.

Policymakers could help this process of digital business transformation by improving the necessary environmental conditions. Digital business transformation is driven by a number of different factors, such as technology itself, consumer behaviour, markets, and also environmental factors.[1]

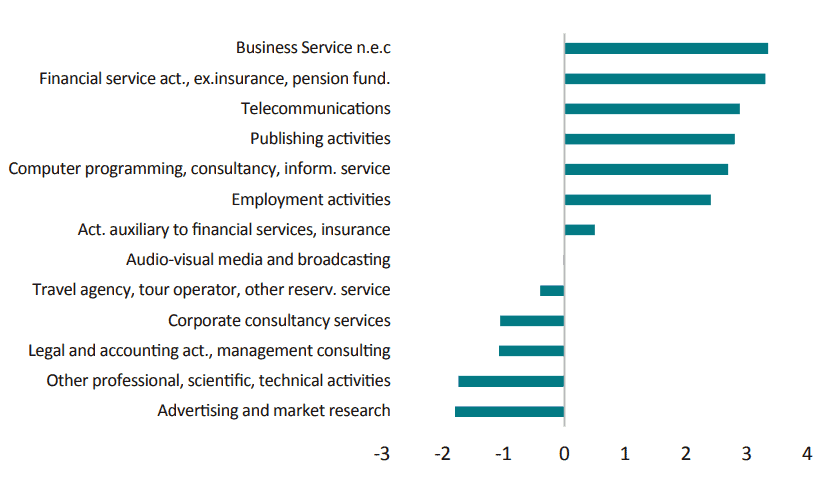

Note that these factors are crucial especially for non-digital sectors. Productivity growth in key services such as corporate consultancy services, legal and accounting/management consulting, other professional, scientific, technical activities, as well as advertising and market research has been declining for long in Germany (see figure 4). These are crucial support services for companies active in non-digital sectors and they are key for their competitiveness as well as their ability to trade internationally.

For example, productivity growth in administrative and support services in Bavaria has been relatively low compared to other regions of Germany, despite Bavaria being a regional powerhouse for the German car industry.[2] There is also business-environment factors that takes down the general atmosphere of innovation and experimenting with new technologies. Take the case of biotechnology. BASF has focused much of its biotechnological research and development in Germany into GMOs but had to move that abroad because of hostile regulations and a climate of innovation scepticism. In combination with too strong regulation of labour and goods markets, such environmental factors can seriously affect the climate of openness to new ideas, people and technologies.

Figure 4: Average Annual Growth Rate of Productivity, 2000-2014 (%) Source: Federal Statistical Office of Germany; authors’ calculations. Note: productivity is defined as output per worker. The annual average growth rate is computed.

Source: Federal Statistical Office of Germany; authors’ calculations. Note: productivity is defined as output per worker. The annual average growth rate is computed.

This is where policy comes in. Recent research has identified a range of specific areas in which governments can facilitate the process of digital business transformation with concrete policy initiatives. They include investments in digital human capital and engineering – especially for labour with too poor digital skills; boosting business investment in knowledge capital and research; improving competition in the digital-intense sectors; facilitating access to finance, especially for SMEs; removing inadequate regulation, for example regarding product market regulation, employment protection regulation and ICT regulation; and addressing relevant tax problems.[3]

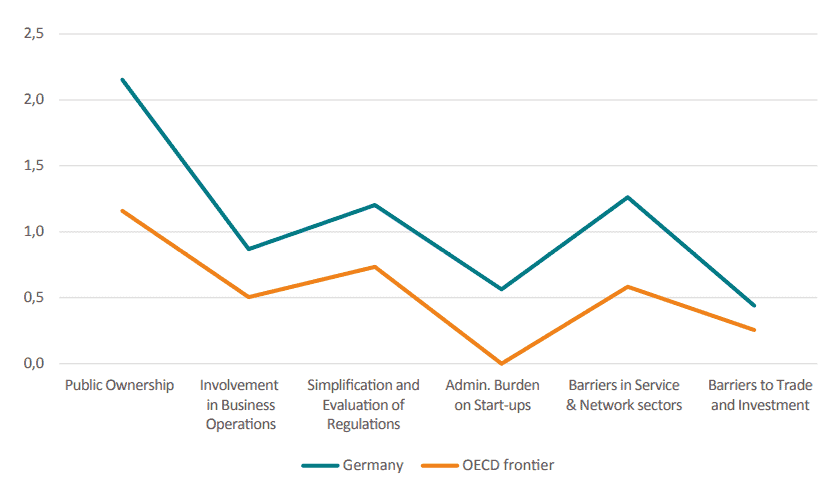

Figure 5 presents a frontier analysis comparing Germany’s product market regulations (PMR) with top-OECD performers for six different PMR indicators. The PMR indicators range from 0 to 6, from the most (0) to the least (6) competition friendly regime and are based on latest data available. Overall, Germany is better in almost all areas than the OECD average (with the only exception of public ownership where Germany is doing least well). However, Germany’s PMRs severely lag behind the OECD frontier.

Figure 5: Economy-wide Product Market Regulation Indicators, 2018 Source: OECD.

Source: OECD.

Culture plays a role as well, as the process of digital business transformation goes beyond mere absorption of new technologies. It also includes a change of “thought and organization culture”.[4] The cultural factor is relevant in Germany, where the attitude of many companies towards changing business models to meet digitalisation often remains one of caution.

Industrial structure is important: 99% of German business can be attributed to the so-called Mittelstand. These Mittelstand companies are small and medium-sized enterprises (SMEs) which have less than 500 employees and annual revenues of less than 50 million Euro. They form the backbone of the German economy and are export-orientated. 70% of them are located in rural areas or smaller cities.

The ownership and culture of Mittelstand companies are often family-based and decisions within the company are long-term focused. This is a strength, but there are also weaknesses. One consequence of the long-term focus is the investment of Mittelstand companies into their workforce. They are focused on the continuity of employees, leading to 44% of employees staying with the company for 10 years or longer. This is an exceptionally high rate. Employees are highly committed to the company and identify themselves with it, leading to employee turnover as low as 3.2% a year. And Mittelstand companies are actively supporting this, with 80% offering incentives for employees to contribute to new ideas, and many having initiatives such as quality circles or profit-sharing programs.[5] This environment can be difficult to fit with a model that requires more openness to foreign high-skilled labour – who may only want to come a stay for a few years. When access to new human capital becomes critical, it takes long time for the Mittelstand-type of firms to move and make themselves attractive workplaces. Too few of them are actively pursuing a high turnover of changing international high-skilled experts from abroad, adjusted to the latest needs for innovation that the company in question faces.

[1] Forbes (2017). Digital Transformation and Innovation in Today’s Business World. Available at https://www.forbes.com/sites/brianrashid/2017/06/13/digital-transformation-and-innovation-in-todays-business-world/#3ed51bd49052

[2] Bertelsmann Stiftung (2017). Boosting Trade in Services in the Digitalisation Era. Potentials and Obstacles. Available at Erahttps://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/GrauePublikationen/NW_Study_Trade_in_Services_Digitalisation_01.pdf

[3] OECD (2017). Going Digital: Making the Transformation Work for Growth and Well-Being. Available at: https://www.oecd.org/mcm/documents/C-MIN-2017-4%20EN.pdf

[4] Forbes (2017). Digital Transformation and Innovation in Today’s Business World. Available at https://www.forbes.com/sites/brianrashid/2017/06/13/digital-transformation-and-innovation-in-todays-business-world/#3ed51bd49052

[5] Parella, J. F., Hernandez, G. C. (2018). The German Business Model: The Role of the Mittelstand. Journal of Management Policies and Practices. June2018, Vol. 6, No. 1, pp. 10-16.

Attracting foreign skills and human capital

It is obvious that Germany needs to attract foreign skills in order to improve digital human capital and productivity. There is very strong evidence supporting the claim that managers with good international experience play a critical role on fostering technological changes within firms and that they bring experience and best practices. For example, recent studies find that differences in management practices account for about 30% of total factor productivity differences between countries, and within countries across firms.[1] Many of the big German multinationals have for many decades internationalised their leadership – even if many of them still have a surprisingly strong German representation in executive and supervisory boards. It is still difficult for a foreign executive to get a top-level position in Germany’s A-list companies.

However, the difficulties are small compared to the international penetration of Mittelstand firms. Many of them are struggling to internationalise their labour force – even if they have become ever more skilled at following big German multinationals into foreign markets. There is generally also a skills gap in corporate Germany – between the multinationals and the Mittelstand. Obviously, SMEs struggle to keep up with the big firms in attracting highly skilled labour.

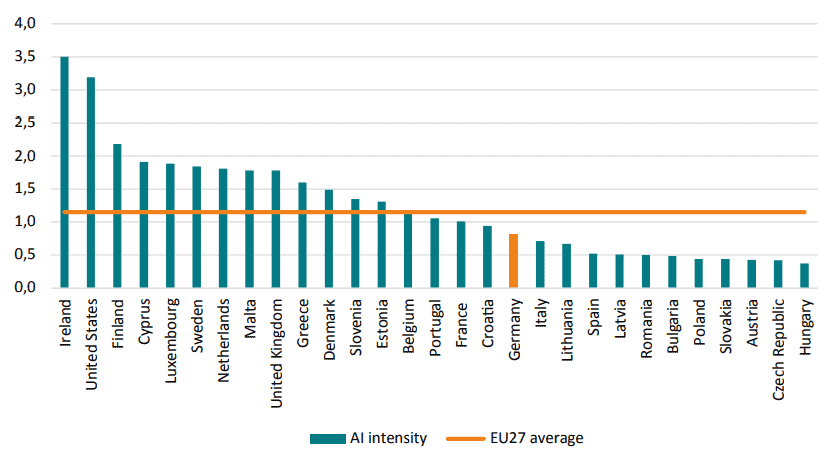

Overshadowing that gap is a general shortage in Germany of skilled labour. In order to understand to what extent countries are able to develop or attract AI talent, figure 6 provides an international comparison of Germany’s AI intensity. AI intensity is the ratio of the number of AI workers compared to the size of the active population in each country. The figure shows that in particular Ireland and Finland are leading the EU in attracting or developing AI talent. It also becomes clear that two non-EU countries, the United Kingdom and in particular the United States, have a strong AI intensity. In contrast, Germany does not compare to either of them, and does not even make the top 10 of the EU. With a value of 0.81, it is well below the EU average of 1.15.

Figure 6: Germany’s AI intensity in international comparison, 2019 Source: LinkedIn Economic Graph.[2]

Source: LinkedIn Economic Graph.[2]

And the problem here is that demand for IT specialists has been growing rapidly for long in Germany. Figure 7 shows the vacant posts for IT specialists from 2009 to 2019, indicating that unfilled vacancies reached a record high of 124000 in 2019. This is a 51% increase compared to the year before (82000 vacancies). And it illustrates that the number of unfilled vacancies has doubled over the last two years (55000 vacancies in 2017). Also the time that an IT post remains vacant has been getting longer. It currently takes German companies six months on average to fill an IT specialist vacancy. And this is a problem as well, as innovation cycles in the IT sector tend to be much shorter than in other sectors. Half a year of vacancies can severely affect the competitiveness of companies, or lead to outsourcing of projects abroad.[3]

Figure 7: Germany’s growing gap of supply and demand for IT specialists, 2009 – 2019 Source: Bitkom Research.

Source: Bitkom Research.

The shortage of skilled labour is exacerbated by Germany’s demographic development. The main reason is the ageing population as projections of future labour force potential suggest. Without migration or participation effects, Germany’s labour force potential is estimated to decline by 7.5 million people or 16% until 2035, taking 2017 as a baseline. The striking point here is that even with migration effects the decline could be postponed, but not stopped. In a more realistic scenario of assuming 200,000 net migration per year Germany’s labour force potential is still estimated to decrease by 2.7 million or 6% from 2017 to 2035. [4]

Demographic developments will keep shrinking Germany’s labour force and the situation is not going to get better any time soon. According to recent statistics the smallest cohorts are in retirement age at the moment, while the largest will get there in about 10 to 15 years. And this shortage of skilled labour will translate into a need to become more open to foreign labour and technology. If Germany’s workforce offers fewer staff to produce what it needs, then Germany is bound to become more dependent on foreign technology in the future if it does not adjust its policies.

[1] See: https://www.nber.org/papers/w22327

[2]See:https://economicgraph.linkedin.com/content/dam/me/economicgraph/en-us/reference-cards/research/2019/LinkedIn-AI-Talent-in-the-European-Labour-Market.pdf

[3]https://www.bitkom.org/Presse/Presseinformation/Erstmals-mehr-als-100000-unbesetzte-Stellen-fuer-IT-Experten

[4] See: https://www.iab-forum.de/en/effects-of-population-changes-on-the-labour-market-in-germany/

Concluding remarks: How to make progress?

Germany’s policy framework should focus on public policy initiatives aimed at increasing the incentives and removing obstacles for firms to attract the global high-skilled labour force. It is crucial to keep in mind that the actors responsible for trade activity are companies and Germany’s policy framework should focus on incentivising openness towards new recruitment. The crucial question for increased trade, and for Germany’s economy and labour force to be able to benefit from it, is to what extent companies make use of innovation capacities that can be obtained from international recruitment.

But openness alone is not enough. Many countries are now competing for high-skilled international labour, which is increasingly becoming a scarce resource. Germany faces fierce competition from other advanced economies in obtaining it. This competition is not only decided by financial incentives for future international employees. High-skilled experts in niche areas such as AI programming are not only interested in high salaries, but also in environmental factors such as the location of their workplace, the network and spill-over effects that it comes with, and opportunities to stay competitive and advance their future career. It takes more than money to attract top-level engineers, and especially to make them move across the globe, often together with their families.

This is particularly important for Germany considering two key developments observed in a recent survey on global mobility with respondents in 190 countries. First, the willingness of global talent to move abroad has been on the decline consistently in recent years, already before the Corona pandemic. While 63.8% of respondents were willing to work abroad in 2014 according to the survey, this figure rapidly decreased to 57.1% in 2018, and to only 50.4% in 2020. Second, according to the same survey results, Germany has fallen in the rankings of top destinations for global talent in recent years (down to fourth rank globally in 2020). [1]

To stay attractive, Germany’s policies should target issues of bottleneck regulation to facilitate field-testing new technologies and to support innovation sandbox processes of companies. This should also be aimed at promoting testbeds and experimental zones for data-driven innovation in cities to enable and encourage innovation aimed at self-driving vehicles, drones, robots or other focus areas where highly-skilled workforce is missing. Cities are especially important because they concentrate both physical and digital interactions and exchanges, but this approach could also include other places. This gives different zones comparative advantages and thus attracts entrepreneurs and innovators across borders to utilise them.

German policies should also focus on the regulatory environment, notably the type of regulations that policymakers pursue. Many current regulations in Germany do not sufficiently allow for experimentation of technologies and ideas. Consider the difference between proscriptive and prescriptive types of regulation. Prescriptive regulations are focused on what actors should do, while proscriptive regulations define what actors cannot do. Conceptually, Germany should focus on the setting of proscriptive rules, as the alternative implies coping with a much higher degree of regulatory complexity.

Such policies are key, not only to remove obstacles and incentivise German companies to become more open, but equally importantly for rendering Germany a more attractive environment. Indeed, it is inevitable to do so. We live in a world where more countries have the ability to search for new and great ideas, and in which there is an ever higher demand and ever stronger competition for the global high-skilled labour force.

[1] Kovács-Ondrejkovic, O. et al. (2021). Decoding Global Talent, Onsite and Virtual. Available at: https://web-assets.bcg.com/1a/34/e225c29448f68d2d979434d1439b/bcg-decoding-global-talent-onsite-and-virtual-mar-2021-r.pdf