ICT Beyond Borders: The Integral Role of US Tech in Europe’s Digital Economy

Published By: Matthias Bauer Dyuti Pandya

Subjects: Digital Economy European Union North-America

Summary

Contrary to political assertions about the vulnerability of digital services provided by non-EU companies, the strong presence and sunk costs associated with US tech companies’ investments in data centres, skilled workforce development, and research facilities in Europe act as significant barriers to exit, highlighting the inherent symbiosis between US tech investments and Europe’s digital and non-digital sectors. These investments underscore a mutual inter-dependency that strengthens European economies, making the notion of “sudden cessation” of digital services by US companies implausible.

Corporate data show a significant investment gap of approximately USD 1.36 trillion between US and EU ICT companies, attributing a competitive edge to US firms due to their heavy investment in ICT, cloud solutions, and R&D. Forecasted increases in ICT investments by US corporations outline a benchmark beyond reach for EU businesses. The notion of EU firms aligning with this growth path is rather fantastical, as it would call for immense government investment, ultimately draining financial resources from essential public services, such as healthcare, housing, and environmental policies.

Substantial ICT investments across EU Member States together with a long-term commitment to the European market present an opportunity for the EU to leverage US continuous technological advancements, underscoring the potential for transatlantic collaboration to drive the EU’s digital transformation and innovation. EU-US partnerships not only fuel the EU’s digital transformation but also align with shared political values, reinforcing the significance of transatlantic collaboration in shaping a competitive and innovative digital future.

1. Introduction

The symbiosis between the US technology companies and the EU’s digital economy has been instrumental in shaping EU’s technological landscape. This relationship, underscored by significant investments and long-term strategic partnerships, has fostered a robust digital services landscape, driving technology adoption and economic growth across Europe. The smaller size of Europe’s national markets poses challenges for native innovators aiming to achieve the scale seen in the US or China. Europe can only continue drawing on its industrial strength if it stays open to the diffusion of advanced digital technologies across supply chains.[1]

Europe’s reputation as a traditionally open economy serves as a significant strength, making it an attractive destination for foreign direct investment (FDI). This openness not only allows consumers to benefit from high-quality services provided by non-EU companies but also fosters innovation, enhances customer value, and generates increased tax revenues within Europe.

Unfounded political assertions that digital services, provided by non-EU companies, could be shut down in a matter of seconds, overlook several critical factors that make such instantaneous cessations highly unlikely.[2] For US tech companies, the EU is a large market with an affluent consumer base and a strong focus on digital innovation, offering substantial opportunities for revenue growth through collaborations across industries.

Moreover, US tech companies’ “sunk costs” – large-scale investments – of establishing data centres, research facilities, and a skilled workforce act as significant barriers to exit. US companies and Europe’s digital and non-digital world work closely together, making the economy in Europe stronger. This includes big projects like building data centres and research facilities, and training skilled workers. These investments involve substantial time and financial commitments making the US tech companies departure more challenging and complex.

[1] Andrews, D., Criscuolo, C. and Gal, P. (2015). Frontier firms, technology diffusion and public policy: Micro evidence from OECD countries. OECD. Available at: https://www.mckinsey.com/~/media/mckinsey/featured%20insights/innovation/reviving%20innovation%20in%20europe/mgi-innovation-in-europe-discussion-paper-oct2019-vf.ashx.

[2] See, e.g., EU Resilient 2030 report prepared under the Spanish EU Council Presidency. Available at https://futuros.gob.es/sites/default/files/2023-09/RESILIENTEU2030.pdf.

2. ICT Infrastructure in the EU: A Foundation of US-EU Technological Synergies

US tech companies have been pivotal in establishing a sophisticated digital infrastructure within the EU. The investments in data centres and the subsequent development of cloud computing, cloud-based AI applications, and edge services underscore the crucial role these companies play in Europe’s digital economy.

Substantial investments have increasingly solidified the presence of US tech companies in Europe, making the prospect of their withdrawal both unlikely and economically detrimental. For instance, Google’s substantial data centre investments across Europe not only bolster the continent’s digital infrastructure but also significantly contribute to its economy through job creation and economic activity.[1] IBM has recently announced its intention to establish its inaugural quantum data centre in Europe. This strategic move aims to enhance the company’s ability to support its customers within the growing quantum computing landscape across the continent.[2] And Amazon Web Services (AWS) is launching the European Sovereign Cloud to address the specific data security and protection needs of Europe’s public sector and businesses, offering solutions like AWS Outposts and Dedicated Local Zones for data residency and isolation requirements.[3]

Over the past quarter-century, Amazon has markedly impacted economic activity and job creation throughout the EU, reflecting a profound commitment to fostering opportunities across diverse regions. Since its inaugural EU store launch in 1998, the company now employs over 150,000 individuals in 21 Member States, extending its influence beyond urban locales to include rural and post-industrial areas through its widespread presence in 50 cities and over 250 logistics centres, as well as its investments in R&D and ICT. Amazon’s workforce development initiatives, such as delivering over 3.5 million hours of training in 2022, have culminated in recognition as a Top Employer in Europe for 2023. With financial contributions exceeding EUR 150 billion since 2010, including significant investments in sectors like cloud infrastructure and renewable energy, Amazon contributed to European productivity and sustainability, with a notable goal of achieving net-zero carbon by 2040. Furthermore, Amazon has been instrumental in aiding SMEs across the EU to reach broader markets, investing over EUR 20 billion from 2020 to 2022 to support their integration into the Single Market and facilitate international trade, enabling over 125,000 European SMEs to globally sell more than 1.2 billion products, thereby significantly enhancing their sales and global footprint.[4]

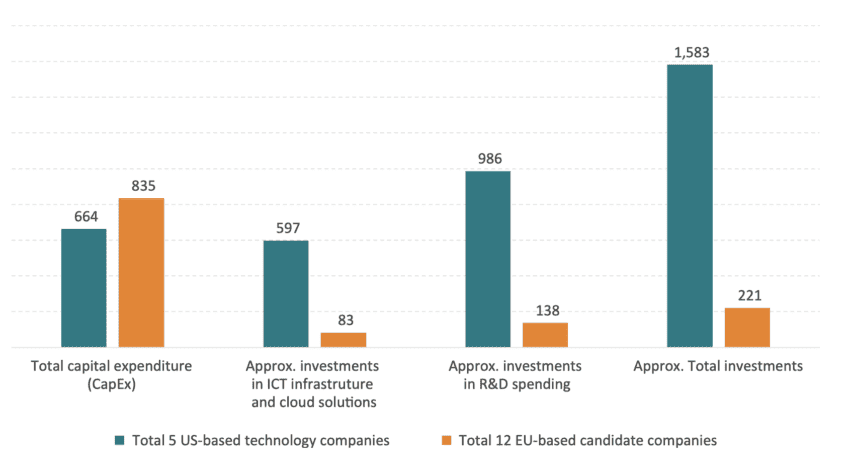

In a rapidly evolving digital economy, strategic partnerships between technology companies have become a cornerstone for fostering innovation, expanding global reach, and addressing complex regulatory environments. These collaborations span a variety of objectives, from enhancing cloud computing capabilities and digital sovereignty to integrating cutting-edge AI into business solutions.

The partnership models between US and EU entities further illustrate the intricate web of interdependencies. Collaborations like AWS and T-Systems, focusing on data protection in Germany[5], or the joint venture between Thales and Google Cloud for a sovereign cloud solution in France[6], highlight a shared commitment to advancing digital transformation while respecting the unique regulatory and sovereignty concerns of European nations.

EU-US partnerships and Joint Ventures in Cloud and Advanced ICT Services

[1] Basalisca, B. (2019) Google’s hyperscale data centers and infrastructure ecosystem in Europe. Available at https://www.copenhageneconomics.com/dyn/resources/Publication/publicationPDF/0/500/1569061077/copenhagen-economics-google-european-dcs-infrastructures-impact-study_september2019.pdf.

[2] NASDAQ (2023). IBM Plans to Develop First Quantum Data Center in Europe. Available at https://www.nasdaq.com/articles/ibm-plans-to-develop-first-quantum-data-center-in-europe.

[3] About Amazon (2023). Amazon Web Services to Launch AWS European Sovereign Cloud. Available at https://press.aboutamazon.com/2023/10/amazon-web-services-to-launch-aws-european-sovereign-cloud.

[4] Amazon (2023). Creating opportunity for Europeans across EU Member States – and employing 150,000 people. Available at https://www.aboutamazon.eu/news/job-creation-and-investment/creating-opportunity-for-europeans-across-eu-member-states-and-employing-150-000-people.

[5] T-Systems. (2020). T-Systems announces Strategic Collaboration Agreement with AWS. Available at: https://www.t-systems.com/de/en/insights/newsroom/news/t-systems-announces-strategic-collaboration-agreement-with-aws-357810.

[6] Thales. (2021). Thales And Google Cloud Announce Strategic Partnership To Jointly Develop A Trusted Cloud Offering In France. Available at: https://www.thalesgroup.com/en/group/investors/press_release/thales-and-google-cloud-announce-strategic-partnership-jointly#:~:text=Thales%20and%20Google%20Cloud%20today,of%20the%20French%20’Trusted%20Cloud.

3. Capitalising on Trade and Investment to Bridge the ICT Investment Divide

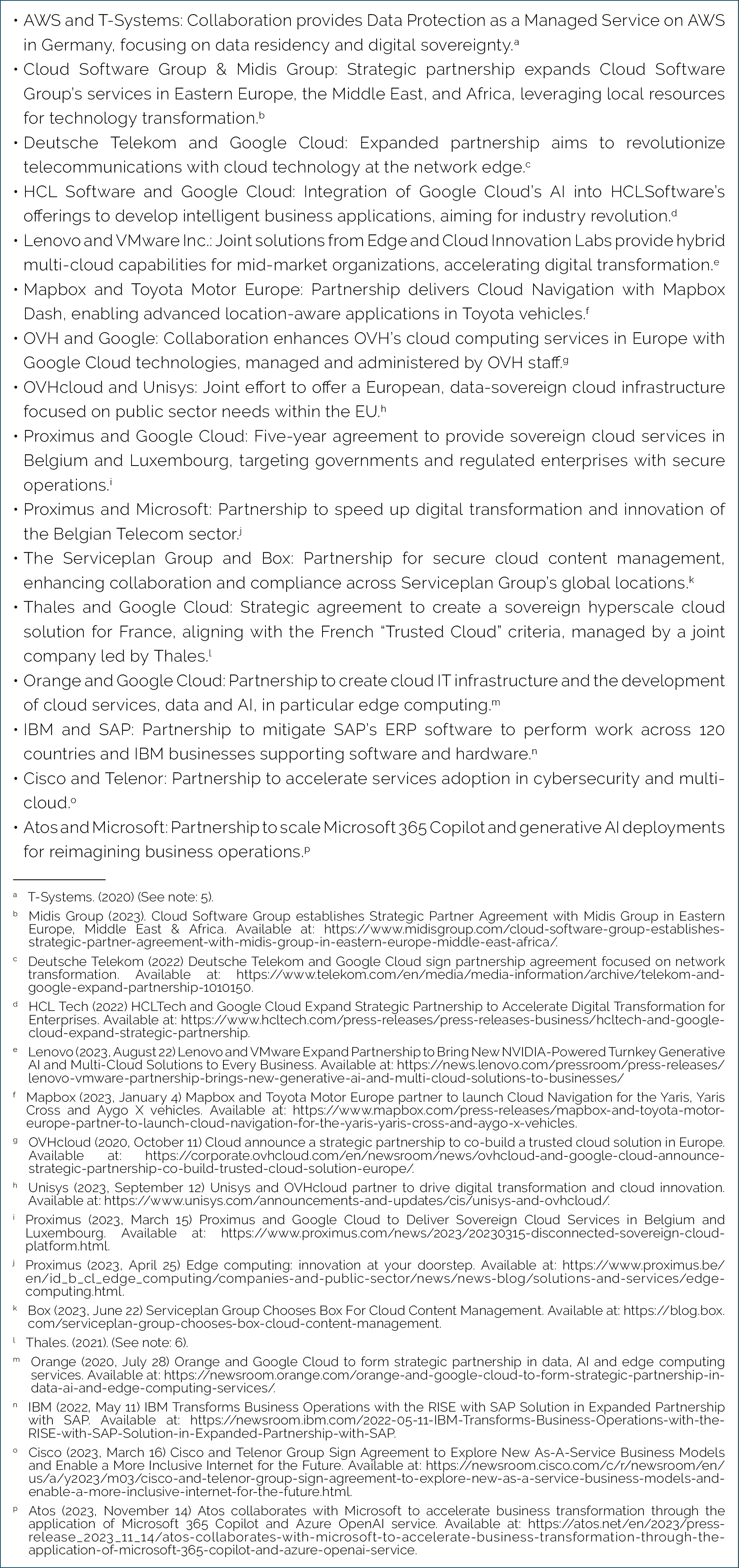

There’s even more to the story. Industry data show that EU-headquartered companies represent a relatively low investment share in key global ICT investments — 8% in technology hardware and equipment and 4% in software and computer services (Figure 1)—highlighting the importance of US technology solutions for Europe’s digital economic transformation. Lacking large-scale “native” investment underscores the need for Europeans to be able to benefit from others outside the EU for digital advancement and economic development.

Figure 1: Share of Capital Expenditure and R&D investments in global investments by leading global technology companies, 2022 Source: European Commission 2023 EU Industrial R&D Investment Scoreboard.

Source: European Commission 2023 EU Industrial R&D Investment Scoreboard.

Moreover, financial data of leading US and EU technology companies highlight the prominent position of US firms in the global ICT and cloud computing markets. This is reflected by considerable differences in capital expenditure, annual revenues, and R&D spending. Notably, the 5 leading US companies have demonstrated an impressive growth trajectory in ICT and cloud-related investments, increasing from USD 15.9 billion in 2005 to an estimated USD 299.4 billion by 2022.[1] This growth indicates a consistent and strategic emphasis on innovation and expansion within the sector, with a significant surge observed from 2017 to 2022, nearly tripling the investment volume. In contrast, “EU candidate cloud services providers” have shown a much more modest pattern of investment over the same period, with figures predominantly hovering around the USD 11 to USD 13 billion mark, slightly peaking at USD 16 billion in 2022.

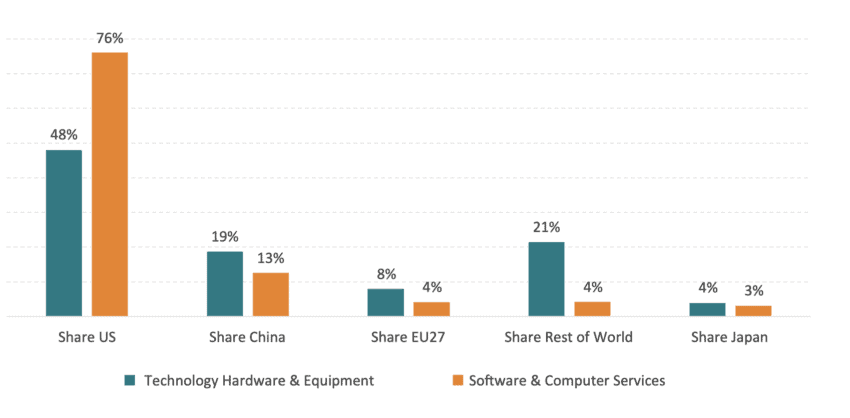

The total capital expenditure for the period from 2005 to 2022 further emphasises the strategic investment priorities of US versus EU firms. While EU companies exhibit a higher total CapEx of USD 835 billion compared to the USD 664 billion of US companies, the allocation towards ICT infrastructure and cloud solutions reveals a stark contrast. US firms have channelled a substantial USD 597 billion towards these areas, significantly overshadowing the EU’s USD 83 billion investment. This discrepancy is mirrored in R&D spending, where US companies have invested a staggering USD 986 billion, vastly surpassing the EU’s USD 138 billion. The overall investments amount to approximately USD 1,583 billion for US companies, markedly eclipsing the USD 221 billion invested by EU candidate companies. These figures not only underscore the US’s strategic focus on ICT and cloud infrastructure but also indicate a profound investment gap and differing priorities between US and EU technology firms.

This analysis underscores a considerable investment gap between US and EU companies, estimated at approximately USD 1.36 trillion (USD 1,362 billion) for the period from 2005 to 2022. This gap reflects the cumulative effect of strategic investment decisions and underscores the competitive advantage US companies have established through their prioritisation of ICT and advanced cloud solutions, as well as R&D spending in and beyond these areas, with investment and innovation resulting in leading positions in the global market.

Figure 2: Development of total ICT- and cloud-related investments, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022, in USD billion Source: own calculations based on companies’ annual reports. Company composition and source outlined in Footnote 25.

Source: own calculations based on companies’ annual reports. Company composition and source outlined in Footnote 25.

Looking forward, assuming a continued growth at the 2005-2022 Compound Annual Growth Rate (CAGR) of 19 percent, US companies’ investments are projected to grow to approximately USD 4.5 trillion by 2030, USD 25.6 trillion by 2040, and an astonishing USD 145.8 trillion by 2050. For EU companies to catch up with this projected trajectory, they would need to significantly increase their investments in ICT and cloud-related infrastructure and R&D. Ideas by EU officials to significantly ramp up EU companies’ investments in the technology sector to maintain competitiveness remain unrealistic.[2] The scale of government spending required would be so immense that it would inevitably divert essential resources away from crucial public sectors, undermining social policy objectives, healthcare provision, and climate change initiatives.

Accordingly, the present situation, far from being a mere dependency, presents an opportunity for the EU to adopt the most technologically advanced technologies and digital services. With significant investments from world-leading US tech companies in Europe, the EU is well-positioned to accelerate its own digital transformation by leveraging these top-tier technologies. This approach not only propels the EU’s digital economy forward but also highlights the importance of transatlantic collaboration – based on shared political values – in shaping a competitive and innovative digital future.

[1] We compare the group of five leading US cloud services providers with 12 EU-headquartered technology companies which all provide various cloud computing services. The composition of US-headquartered companies is based on recent market intelligence about their share in global and EU cloud services markets. The list of 12 EU-headquartered companies is based on industry reports, market intelligence, and annual reports. We label these companies “EU candidate cloud services providers” because of the size of their total business operations and revenues respectively, and the fact that they already offer cloud services with different purposes and functionalities. Companies included in this analysis are: Amazon (United States), Microsoft (United States), Alphabet (United States), IBM (United States), Oracle (United States), SAP (Germany), ATOS (France), Capgemini (France), Dassault (France), Amadeus (Spain), Koninklijke (Netherlands), Deutsche Telekom (Germany), Telefónica (Spain), Nokia (Finland), Orange (France), Telecom Italia (Italy), OVH (France). See ECIPE (2024, forthcoming). The EU’s Trillion Dollar Gap in ICT and Cloud Computing Capacities. By Matthias Bauer, Fredrik, Erixon, and Dyuti Pandya. Made available at www.ecipe.org.

[2] For estimates abound EU government funding going into ICT industries, see, e.g., Capstone (2023). EU Big Tech Policy Rising: Why European Policymakers Will Ramp Up Regional Autonomy; European Parliament (2023). A STEP towards supporting EU competitiveness and resilience in strategic sectors. Available at https://www.europarl.europa.eu/news/en/press-room/20231009IPR06729/a-step-towards-supporting-eu-competitiveness-and-resilience-in-strategic-sectors; European Commission (2023). Investment and funding needs for the Digital Decade connectivity targets. Available at https://digital-strategy.ec.europa.eu/en/library/investment-and-funding-needs-digital-decade-connectivity-targets. Taking all of these estimates into account, it becomes clear that government-sponsored investments in the European ICT sector are not in the least sufficient to noticeably increase private investment, which stems primarily from the most technologically advanced and most competitive US corporations.

4. The Synergistic Relationship Between US Technology and the European Digital Market

The relationship between US tech companies and the European digital economy is marked by mutual dependencies. This interdependence is crucial for mastering the future challenges and opportunities in the global tech landscape. As the EU strives to enhance its digital sovereignty and reduce dependency on non-European cloud services that are not considered trustworthy, the role of US tech investments becomes even more significant. Concerns regarding data sovereignty, potential government surveillance, and the legal frameworks governing data access and privacy in China indeed have a significant impact on the perception of trustworthiness in the EU when it comes to using Chinese cloud services and ICT products.

Large-scale investments are a formidable barrier to exit, challenging theories that primarily views sunk costs as a deterrent to market entry.

US technology investments and collaborations not only demonstrate a commitment to the technological advancement of the EU but also reflect the strategic importance of the European market to US tech companies. US tech investments are not merely short-term expenses but signify a long-term strategic commitment to the European market. The sunk costs of establishing data centres, research facilities, and a skilled workforce act as significant barriers to exit, challenging the traditional view that sunk costs primarily deter market entry.

The economic rationale behind these costs or investments provides a compelling argument for the sustained presence of US tech companies in Europe. Investments in R&D, infrastructure, and local talent development embed these companies deeply within the European technological ecosystem. These are not short-term expenditures but are demonstrative of a long-term strategic commitment. While issues may also arise about potential disruptions in data access and economic ties, the substantial investments by the US tech companies in the EU in fact serve as a stabilizing factor.

The investments in research facilities, manufacturing plants, and employee bases contribute to the mutual dependency between the US and EU in the technological domain. Certain sectors, like cloud computing, even pharmaceuticals, and semiconductors, exhibit even deeper interdependence due to common technology standards, shared infrastructure, and collaborative research.[1] Decoupling from the investments would mean losing access to a sizeable and lucrative customer base which can further harm a long-term growth prospect.

Traditionally, sunk costs/investments have been perceived as a hindrance to entering markets due to the risk of non-recovery. However, in the context of US tech investments in Europe, these sunk costs have evolved into barriers to exit. Generally, the more a company invests in a foreign market, the more committed it becomes to its success in that market. The rationale is straightforward: having invested heavily in the market, companies are inclined to see through the fruition of these investments rather than abandon them. This is particularly true for the tech industry, where the gestation period for R&D and the maturation of technological investments can be lengthy.

The long-term commitment of US tech firms to the European market is not solely based on the anticipation of future recovery and growth. It also considers the economic detriment that would ensue from withdrawal. Withdrawing from the European market would not only result in the forfeiture of the investments made but also in the loss of substantial future revenue streams that these investments are expected to generate. Moreover, such a move would damage relationships with European and non-European stakeholders, including governments, businesses, and consumers, further exacerbating the economic fallout.

[1] Combs, V. (2019, August 11) Pharma companies are counting on cloud computing and AI to make drug development faster and cheaper. ZDNET. Available at: https://www.zdnet.com/article/pharma-companies-are-counting-on-cloud-computing-and-ai-to-make-drug-development-faster-and-cheaper/.

5. Conclusions on The Integral Role of US Tech in Europe’s Technological Sovereignty

The ongoing evolution of Europe’s digital economy necessitates a balance between fostering innovation, ensuring competition, and safeguarding digital sovereignty. The strategic partnerships and investments by US tech in Europe are integral to achieving this balance. They provide a foundation for continued growth and innovation, enabling the EU to leverage technological advancements while pursuing its digital autonomy.

The integral role of US technology investments in Europe’s digital economy is undeniable. US tech investments have not only propelled technological advancement and economic growth but have also created a landscape of mutual dependencies that underpin the relationship between the US and the EU in the digital domain.

As Europe advances towards digital sovereignty, its collaboration with US tech companies remains vital, embodying a strategic balance between asserting autonomy and leveraging the innovation and infrastructure these partnerships offer. The symbiotic relationship between US tech and the European digital economy is a testament to the interconnected nature of global technology markets, highlighting the importance of cross-border collaborations in driving forward the digital future.