Building Value: The Role of Trademarks for Economic Development

Published By: Fredrik Erixon

Subjects: European Union North-America WTO and Globalisation

Summary

Investment in brands drives the allocation of resources in our economy. It increases competition, pushes firms to innovate, and decreases asymmetries in the market leading to a higher level of economic development.

Investment in brands and intangibles has seen an increase in the last fifteen years, especially in advanced economies such as the EU and the US. The US is a pioneer when we talk about investment in brands, whereas the EU is still investing a higher share of GDP in tangible assets. Differences within the European Union are also significant. Size seems to matter. Larger economies usually invest less in brands, whereas relatively smaller economies invest more. Moreover, smaller economies tend to “spend” more on branding compared to bigger ones.

However, on average, the economies taken in our sample (EU27 plus Norway and US) show that they correlate positively with investment in brands. The econometric results show a positive and significant correlation between investment in brands and GDP per capita.

Nonetheless, each country’s economic characteristics influence the role that brands play in the economy. Examples analysed in this policy brief are Germany and Sweden, where GDP per capita and investment in brands are negatively correlated, and Norway and the US, where correlation between the variables is rather positive.

1. Introduction

Brands are central to the way the modern economy works. The brand is a unique design, symbol or trademark that distinguishes one firm’s product from another. It is a firm’s intangible asset, perhaps the most valuable asset a company possesses, and should be the one that is most difficult to copy or reproduce by competitors. The brand equity embeds the strategy that a firm utilises to construct its reputation, to develop trustable relations with business partners and consumers, and to have a competitive advantage on the market. According to Urwin et al (2008), branding is defined as a “reputational asset” which has been “developed over time so as to embrace a set of values and attribute”[1] of a company.

Investment in intangible assets has increased significantly over the last 15 years. Companies have understood the value of knowledge creation in the economy and the long-term return on investment that it generates. According to the academic literature, investment in intangible assets and in brand has a positive and significant influence on economic development.

From an organisational perspective, branding is central to the company strategy. Although it is not tangible, it represents the personality of the company and is the interface for direct contact with consumers. It is the company’s façade and it embeds the company’s culture and strategies to achieve a certain reputation in the market. Brands communicate a message to consumers. They create the perception that consumers have of a company or of its product. Consumers associate a company name to a higher quality product therefore they will rely on that perception for future purchases.

Investments in brand create more competition in the market, forcing firms to use their resources more efficiently to produce larger quantities for a cheaper price. It pushes firms to take more risks to launch an innovative product in the market, boosting innovation. It eliminates asymmetric information that can arise between consumers’ needs and the firms’ trying to fulfil those needs.

Investment in intangibles and in brands drives the allocation of resources in the economy creating new competitors in the market. A continuous re-allocation of resources in the market is key for a well-functioning market economy. According to the OCED, on average, about 15-20% of all firms and more than 20% of jobs are created or destroyed each year (OECD, 2012). This can occur thanks to firms entering and leaving the market, and a shift in resources across firms or within firms. In the market, only the more efficient firms survive over a long period of time.

The value of brands and corporate brand strategies extend beyond companies. They are increasingly a source of economic development therefore shaping economies in different ways. Investment in brands is a large portion of investment in intangibles and it influences directly and indirectly investment in other categories. Equally important, investment in brands and in intangibles generally contributes to an efficient allocation of resources in the economy, since capital and labour are re-distributed in the sectors where they are more needed.

Although investment in intangibles has on average largely increased in the past fifteen years, not all countries have invested the same resources in the matter, or have experienced a larger return on investment from it. The economic results of investment in brands and intangible assets also vary between countries. For this reason, we deepen the analysis on investment in brands and economic development, taking into consideration a country’s economic features. In our study we analysed four countries – Germany, Sweden, Norway and the United States, which each have a different understanding and give a different importance to investment in brands.

[1] Urwin, Karuk, Hedges, Auton (2008). Valuing brands in the UK Economy, Westminster Business School University of Westminster.

2. The evolution of investment in brands and intangible assets

Western economies are increasingly dependent on assets that are not physical and the value those assets generate. Throughout economic history, investment in tangible assets like equipment and machinery has been an important source of growth for economies. The level of tangible investment has set the pathway for the economy’s ability to grow and generate income thanks to an efficient allocation of resources, such as capital and labour.

Investment in tangibles still matters, but what has become important for developed economies is their generation of intangible assets. Intangible assets allocate resources efficiently in the economy, increasing capital and labour productivity. They support a greater generation of economic output thanks to economies of scale, creation of innovation, and diffusion of spill over effects. Intangible assets are equally important as tangible assets today in determining the future trajectory of an economy – in short, its future path of economic development.

Although investment in intangible assets has increased in past years, investment trends differ across economies depending on how they value knowledge creation. In Figure 1 below, the graph on the left hand side shows the evolution of investment in intangible assets as a percentage of GDP in the EU and the US over fifteen years. In other words, we can see how much the two economies are “spending” on intangible assets. Both economies have increased their investment in intangibles, however the US has devoted a larger amount of resources to it.

The chart on the right hand side explains the argument in more detail. While the US has clearly focused on intangible assets, the EU economy’s allocation of resources is still driven by tangible assets. About 8,5 % of GDP is invested in tangible assets, compared to 4,5% of GDP for intangibles. In the US, 5% of GDP is dedicated to tangibles whereas 11% of GDP is dedicated to intangibles.

Those numbers show how resources are mainly allocated in both economies. In the EU, a large amount of capital and labour is employed in sectors where tangible assets such as machinery and equipment, e.g. heavy industries, still play an important role. In comparison, US economy seems to be driven by a knowledge-based approach. However, the economic outcome and the level of development in the EU and the US are not necessarily better than one another. As we are well aware, economic development in both economies is high. Investments in different types of assets depend on the country’s economic characteristics, which consequently determine the country’s productivity level and economic output.

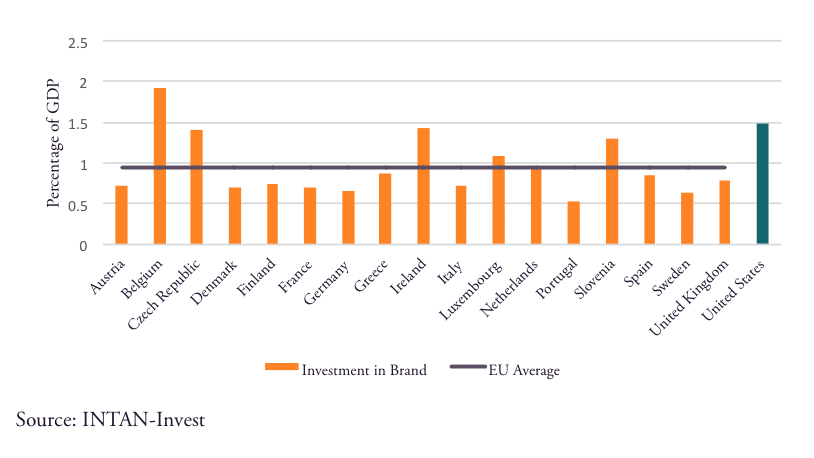

In fact, some of the richest countries in the EU have comparatively low levels of investment in intangible while countries with a lower GDP level have a larger share of their investment dedicated to intangibles. Supporting this argument is Figure 2, where the countries with the highest share of investment in brands are Czech Republic, Greece and Slovenia, which have a lower GDP per capita compared to Germany and Sweden, which are characterised by the lowest share of investment in brands but a higher GDP per capita.

Moreover, the same figure shows another trend. In the EU, smaller countries, in population terms, such as Belgium and Ireland, tend to have a higher share of investment in brands compared to bigger countries such as Italy and Spain. Smaller countries are generally knowledge based whereas bigger countries rely more on an industry-based economy.

Figure 1. Investment in intangible assets in the EU and the US.

Figure 2. Investment in brand by country in 2010

3. Correlation effect between investment in brands and economic development

Measuring investment in brands and intangibles is challenging. Due to their nature, intangibles are difficult to capitalise, especially compared to tangible assets. The latter are usually reported in the national account, which is why observations about tangible assets are easy to identify. The same does not occur for brand investment and intangibles in general. Usually they are not registered in the national account as investment but as expenses.

In recent years, there have been new ways to shed more light on the level and growth of investment in intangibles. The European Union, through the European Community’s Seventh Framework Program, funded the COINVEST and INNODRIVE projects which focus on measuring intangible assets and evaluating the effect of investment in intangibles on economic growth. Moreover, Corrado, Hulten and Sichel (2006)[1] developed a theoretical model in which they explain economic growth by intangible assets, tangible assets and capital deepening. The models consider brand investment as function of spending in adverting and market research. Corrado and Hao (2013) improved the definition of brands, also including R&D and the number of people working in brand development.

To get a better understanding of the relationship between investment in brands and economic output we have estimated the correlation effect following the model of Corrado and Hao (2013). Due to limited data availability, we use the same definition as Corrado, Huten and Sichel (2006) for investment in brands, which is a function of spending in advertising and market research.

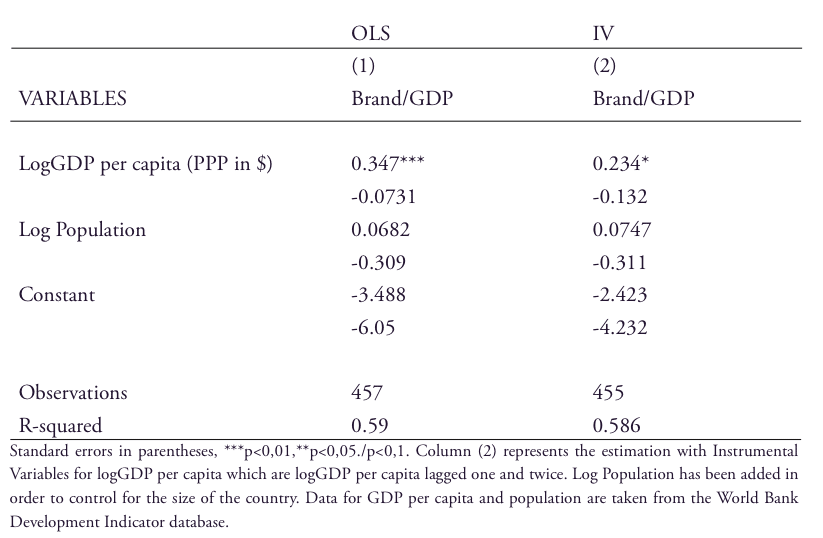

We use the EU-27 countries plus Norway and the United States from 1995 to 2010 as a sample. Data are gathered from the INTAN-Invest database[2]. That data continues until 2005. From 2005 to 2010, data for some European Countries[3] are missing but they have been interpolated by standard econometric methods. We have chosen to analyse a sample of advanced economies where knowledge creation is highly valued and understood to have a positive effect on economic development. The results show that the correlation between investment in brands and GDP per capita is positive and significant. Table 1 represents the estimation of the correlation effect between our variables. The model we use to estimate the correlation is simple and straightforward. We have the main variables, which are investment in brand and GDP per capita in PPP as a proxy for economic development. We also added population in order to account for the size of a country, hence to ensure that the size of a country would not influence the final effect.

As we briefly already mentioned, investment in brand and economic output have a positive relation and they are two variables, which can influence each other. This double relation can offset the real effect. In order to solve this issue, we use a different technique to evaluate the results, reported in Column (2) of Table 1. Throughout the analysis, the results remain positive and significant. The coefficient remains positive throughout the different estimations, confirming that investment in brands and GDP per capita are correlated.

Table 1. Estimation of the effect of brand investments on GDP

Generally, advanced economies are influenced positively by investment in brands. Figure 3 shows the relation between investment in brands and economic development. The trend line in the graph is positive and facing upward. Nonetheless, countries have different economies and give different importance to investment in brand. Each single country’s GDP can be correlated positively or negatively to investment in brand, depending on the country’s economic characteristics. Figure 4 gives an insight on how economies respond to brand investments in different ways. For Sweden and Germany, correlation between GDP and branding is actually negative while for Norway and the US it is positive. For Germany and Sweden, as the level of economic development increases, the percentage of investment in brands actually decreases meaning that those two countries allocate resources differently compared to Norway and the United States.

The results are not surprising. Germany and Sweden are economies with a significant economic dependence on industrial output, and both economies show low shares of investment in brands and intangible investments. Traditionally these economies have worked in markets where brands play less significance. In industrial markets, where consumers are usually other industrial businesses, companies cannot affect competition through brands in the same way as they can in other markets. Furthermore, in industrial markets, investment in brands is less correlated with other types of value-generating investments (e.g. R&D) than in other markets. The US economy, on the other hand, has a greater diversity in its profile of production. Norway’s economy has a small base of industrial output and its non-hydrocarbon economy is more focused on markets where brands are important.

However, the results also map the difficulties economies of adjusting to new patterns of production and output in a global economy. Countries with a strong industrial profile – e.g. Germany and Sweden – are increasingly dependent on sources of output outside their traditional spheres of production. Their sectors of growth are increasingly those that are dependent on brands, or where brands are a competitive factor. Those economies, however, have not managed to build structures of production in which exports and competition on foreign markets are significant sources of output growth. On the contrary, the growth of non-industrial production is particularly strong in less-tradable sectors. That result can also be described the other way around, non-industrial growth is particularly strong in markets that are comparatively “local”.

Figure 3. Correlation between GDP per capita (PPP) and investment in brands

Figure 4. Correlation between investment in brands and economic growth

[1] Corrado. C, Hulten C., Sichel D., (2006). Intangible Capital and Economic Growth. Working Paper 11948. National Bureau of Economic Research.

[2] http://www.intan-invest.net/ INTAN-Invest estimates are the authors’ own elaboration of work they previously conducted under three projects: two funded by the European Commission 7th Framework Program and an ongoing effort of the Conference Board

[3] Data are missing from 2005 to 2010 for Bulgaria, Cyprus, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, Slovakia and Norway.

4. Concluding comments

Brands shape the economy in different ways. Brands drive product quality in the economy. In particular, they push firms to innovate and compete, therefore leading to better resource allocation and growth. Econometric studies show that there is a positive relation between investment in brands and economic development. Most studies also suggest that the structural shifts in the global economy will lead to an increasing role for brands in generating economic growth. What are the key determinants behind that development?

The past decades have seen an increasing role of fragmented and globalized value chains. This trend will accelerate in the future, especially as it moves into new sectors that were previously less affected by globalisation. While the fragmentation of supply chains was particularly strong in the past decades, increasingly sophisticated patterns of value chains will dominate the next decades of global competition.

Fragmented value chains change the nature of competition and the type of factors that determine the local profile of production. Economies that are large and have liquid markets will naturally build up production that is specific to local preferences and demand. Smaller economies, however, will have a less natural role in the choice of location of certain types of production. Size does not speak to their advantage. When the global economy was more reliant on industrial output, countries were less dependent on the location factor. Nowadays, the location factor is important for market growth in other markets, especially the service one.

While performance is ultimately the determining factor of competition, fragmented value chains promote a type of competition that puts the emphasis on proximity to producers, firm boundaries, and ownership advantages. While any firm can use global cost and comparative advantages for their supply of inputs, the value-generation of an economy increasingly moves closer to the market and the consumer. The ability to compete close to the end-consumer has already grown in importance over the last two decades, but it is likely to do so even more in future. And that competition is often based on brands and the output that can be generated by investment in intangibles.

Economies are, therefore, going to become more reliant on the output generated at the end of the value chain and are determined by their relation to firm boundaries and market position. Smaller economies will have a greater challenge to facilitate such a progression in their economy than bigger economies, and this is what existing data already shows. While countries like Sweden have seen a shrinking reliance on traditional sources of output, the new sources of output have more often been internal and less capable of being marketable abroad. With low levels of investments in brands and intangible assets, it is difficult to generate significant economic output as a consequence of those investments in the first place. When those investments are more dependent on local rather than international markets, it is difficult to build up a return on such investments.

References

Andrews, D. and A. de Serres (2012), “Intangible Assets, Resource Allocation and Growth: A Framework for Analysis”, OECD Economics Department Working Papers, No. 989, OECD Publishing. http://dx.doi.org/10.1787/5k92s63w14wb-en

Corrado, C, et al. (2012). Intangible Capital and Growth in Advanced Economies: Measurement Methods and Comparative Results. IINTAN-Invest.

Corrado, C. and Hao, Janet (2013). Brands as productive assets: Concepts, measurement and global trends. Economic Research Working Paper No. 13. World Intellectual Property Organization (WIPO).

Corrado A.C., Hulten C.R. and Sichel D.E. (2006). Intangible Capital and Economic Growth. Working Paper 11948, National Bureau of Economic Research.

Jona-Lasinio, C. et al (2011). Intangible capital and Productive Growth in European Countries. INNODRIVE Working Paper No 10.

Smith, P. and Amos, J. (2004). Brands, Innovation and Growth. Evidence on the contribution from branded consumer businesses to economic growth. A report for AIM- the European Brands Association.

Urwin, P. et al. (2008). Valuing Brands in the UK Economy. Westminster Business School University of Westminster. London, NW1 5LS. Commissioned by the British Brands Group.