Time to Rethink Export Controls for Strengthened US-EU Cooperation and Global Trade Rules

Published By: Matthias Bauer Dyuti Pandya

Subjects: Digital Economy European Union North-America Trade Defence

Summary

The escalation of broad export controls by the US, under the guise of national security and the aim to curb technological transfers to potential adversaries,[1] marks a new epoch of bureaucratic oversight. The US push for broad export controls also underscores a critical juncture in US-EU relations and global trade rules. Broad export restrictions not only challenge the very foundation of free trade but also contribute to the erosion of Western technology leadership.[2] Unilateral export controls may start strong but eventually lose effectiveness and become counterproductive,[3] pushing non-US companies, particularly in the semiconductor sector, to find alternatives to US components.

[1] Lewis, A J., (2023) Rethinking Technology Transfer Policy toward China, CSIS, Available at: https://www.csis.org/analysis/rethinking-technology-transfer-policy-toward-china.

[2] Brown, P. C., (2020) Export Controls: America’s Other National Security Threat, PIIE, Available at: https://www.piie.com/sites/default/files/documents/wp20-8.pdf.

[3] Wolf, K. (2022) Export Controls and An Evolving Understanding of What “National Security” Means. Akin Gump. Available at: https://researchservices.upenn.edu/wp-content/uploads/2022/05/Wolf.AUECO_.Export.Control.Security.pdf

Export Controls and Global Technology Leadership

International trade policy, which serves as both a diplomatic channel and a strategic tool for industrial policy, is at a critical juncture, resulting from broad export controls that risk triggering retaliatory spirals. The US, in its strategic focus on safeguarding high-tech industries, may not fully appreciate the critical importance of global technological collaboration and production networks. The enforcement of broad US export controls risks compromising US companies’ competitive position and prompts both allies and adversaries to consider similar protective actions, highlighting the need for a more nuanced approach to policy formulation in the context of global interconnectivity.[1]

Export controls generally act as a regulatory mechanism for governments to secure their economic interests and national security objectives, aiming to prevent access to pivotal technologies by potential foes. In the US, the Bureau of Industry and Security (BIS) is tasked with regulating both emerging and foundational technologies that are deemed essential for the nation’s security.[2]

On 17 October 2023, the BIS updated its export controls on advanced chips and semiconductor manufacturing equipment (SME), aiming to address technological advancements and previously identified gaps. These updates seek to limit in particular, China’s military capabilities by restricting access to advanced chips and SME necessary for developing large-scale AI systems for military applications. The revised controls expand the criteria for restricted chips, including performance metrics and intended use, and extend the geographic scope to cover additional countries, aiming to limit the diversion of technology through third countries. The expansion now encompasses 43 more countries with AI ties to China, extending controls to regions such as the Middle East, Africa, and Central Asia, and incorporating a broader range of entities under stricter regulations. These measures are designed to ensure that chips and related technology do not contribute to China’s military advancements by requiring licenses for exports to a wider set of destinations. Additionally, BIS introduced new controls based on the headquarters of purchasing entities to prevent circumvention and issued “red flag” guidelines to aid foundries in identifying potential evasion of export controls. This comprehensive approach seeks to tighten the US’ technological security net, ensuring that advancements in chip technology are not misused for military modernization efforts by adversaries.[3]

The US strategy is not merely to retain a competitive edge in crucial technological fields but to secure a leading stance. At the same time, the US government recognises that its own export controls will remain effective only if there is multilateral consensus between partners and commercial incentives for the countries to agree on its policy objectives.[4] This consideration is crucial because businesses in other countries, affected by these US controls, may incur higher operational costs for equipment inputs compared to the US, e.g., in the semiconductor industry, which could erode the resilience of proven value chains.[5] The imposition of broad and overly stringent export controls can also compromise US technological leadership and innovation, curtailing exports, shrinking economies of scale, and slowing down technological advancement.[6] Tight US export controls risk handing market dominance to competitors, especially Chinese firms, who can undercut prices and capture global market share.[7] Such a scenario underscores the need for the US to collaborate closely with international partners to ensure that export controls are both effective and non-detrimental to vital economic policy objectives. A nuanced approach to managing these controls is thus imperative to sustaining global supply chains and maintaining market access, particularly in sectors as critical as semiconductors and advanced software applications.

The 5th Ministerial of the EU-US Trade Technology Council (TTC) in January 2024 highlighted a commitment towards economic security, advocating for the diversification of supply chains and the alignment of export control regimes to deter the exploitation of dual-use technologies.[8] This ongoing dialogue between the US and the EU reflects the intricate balance required to navigate technological dominance and economic autonomy within a globally interconnected framework. But is also underscores the necessity for a collaborative and balanced approach to export controls – one that encourages innovation while safeguarding security interests. [9]

[1] One example for the export control “copycat response” is when Japan threatened export controls on semiconductor materials that its companies ship to South Korea, there is every possibility that Japan could extend the ban on American chipmakers as well, see: Goodman, M. S., Kim, D., and VerWey, J. (2019) The South Korea-Japan Trade Dispute in Context: Semiconductor Manufacturing, Chemicals, and Concentrated Supply Chains, USITC Working Paper ID-062, Available at: https://www.usitc.gov/publications/332/working_papers/the_south_korea-japan_trade_dispute_in_context_semiconductor_manufacturing_chemicals_and_concentrated_supply_chains.pdf, China also drafted its unreliable entity list and placed Lockheed Martin Corporation (Lockheed Martin) and Raytheon Missiles & Defense (Raytheon) on the list. While the impact to placing these two companies will likely be limited, China nevertheless placed them on UEL after 4 years of the UEL introduction, see: Davis Polk, (2023) Chinese Ministry of Commerce places two companies on its Unreliable Entity List for the first time, https://www.davispolk.com/insights/client-update/chinese-ministry-commerce-places-two-companies-its-unreliable-entity-list, The Dutch government is reportedly moving ahead with export restrictions on advanced semiconductor equipment following US political pressure, see: Kharpal, A., and Amaro, S (2023, March 9) The U.S. imposed semiconductor export controls on China. Now a key EU nation is set to follow suit, CNBC, Available at: https://www.cnbc.com/2023/03/09/asml-netherlands-to-restrict-semiconductor-machine-exports-after-us-pressure.html.

[2] The BIS, as per section 1758 of the Export Control Reform Act of 2018 (ECRA), “Section 1758 of the Act authorizes Commerce to establish appropriate controls, including interim controls, on the export, reexport, or transfer (in country) of emerging and foundational technologies. Under the Act, emerging and foundational technologies are those essential to the national security of the United States,” see: Bureau of Industry and Security (2018) Review of Controls for Certain Emerging Technologies, Available at: https://www.federalregister.gov/documents/2018/11/19/2018-25221/review-of-controls-for-certain-emerging-technologies.

[3] CSET (2023). A Bigger Yard, A Higher Fence: Understanding BIS’s Expanded Controls on Advanced Computing Exports. Available at https://cset.georgetown.edu/article/bis-2023-update-explainer/.

[4] See, e.g., SWP (2023). New US Export Controls: Key Policy Choices for Europe. Available at https://www.swp-berlin.org/10.18449/2023C20/. Also see Brown, P. C., (2020) Export Controls: America’s Other National Security Threat, PIIE, Available at: https://www.piie.com/sites/default/files/documents/wp20-8.pdf.

[5] Ibid, Firms from the U.S., Netherlands, and Japan have faced loses from export control measures aimed at Chinese semiconductor companies such as SMIC, YMTC, and CXMT, see: Triolo, P (2024) A New Era for the Chinese Semiconductor Industry: Beijing Responds to Export Controls, 8 (1) American Affairs Journal, Available at: https://americanaffairsjournal.org/2024/02/a-new-era-for-the-chinese-semiconductor-industry-beijing-responds-to-export-controls/ .

[6] “We have become unable to sell more advanced semiconductor chips to one of our largest markets,” Nvidia CEO Jensen Huang expressing his concerns over US export controls and their potential devastating effects for the US technology, Similarly Intel CEO Pat Gelsinger also expressed concerns “China is one of the largest markets in the world and one of Intel’s most important markets,” see: Young-sil, Y (2023, July 19) US Semiconductor Firms Concerned over Additional Controls against China, Business Korea, Available at: https://www.businesskorea.co.kr/news/articleView.html?idxno=118640. The US Semiconductor Industry Association (SIA) which represents 99 percent of US semiconductor industry and two thirds of non-US chip firms also issued a statement, “Allowing the industry to have continued access to the China market, the world’s largest commercial market for commodity semiconductors, is important to avoid undermining the positive impact of this effort. Repeated steps, however, to impose overly broad, ambiguous, and at times unilateral restrictions risk diminishing the U.S. semiconductor industry’s competitiveness, disrupting supply chains, causing significant market uncertainty, and prompting continued escalating retaliation by China,” see: SIA (2023) SIA Statement on Potential Additional Government Restrictions on Semiconductors, Available at: https://www.semiconductors.org/sia-statement-on-potential-additional-government-restrictions-on-semiconductors/; this was followed by an additional statement released in October 2023, “Overly broad, unilateral controls risk harming the US semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere,” see: SIA (2023) SIA Statement on New Export Controls, Available at: https://www.semiconductors.org/sia-statement-on-new-export-controls-2/

[7] Atkinson, D. R., (2023) Export Controls Shrink the Global Markets U.S. Semiconductors Need to Survive, ITIF, Available at: https://itif.org/publications/2023/07/17/export-controls-shrink-global-markets-us-semiconductors-need-to-survive/.

[8] White House. (2024) Readout of U.S.-EU Trade and Technology Council Fifth Ministerial Meeting, Available at: https://www.whitehouse.gov/briefing-room/statements-releases/2024/01/31/readout-of-u-s-eu-trade-and-technology-council-fifth-ministerial-meeting/.

[9] Picula, T. (2023, December 12) EU-US relations: key to geopolitical stability, Social Europe, Available at: https://www.socialeurope.eu/eu-us-relations-key-to-geopolitical-stability.

The Global Reach of US Export Controls

The US FDPR (Foreign Direct Product Rule) extends US export controls to foreign transactions involving American technology, affecting a broad range of products and technologies. The US export control rules thus also impact US allies, affecting European companies heavily reliant on the Chinese market.[1]

For example, restrictions on the sale of advanced lithography machines to China impact companies like ASML, underscoring the geopolitical tensions influencing international trade and technology exchange. Chinese fabs have accounted for 26.3 percent of revenues for ASML in 2023.[2] Export controls from the US government have already restricted ASML sales of advanced deep ultraviolet and extreme ultraviolet lithography machines in China. And further restrictions will harm the company, as highlighted by ASML in its annual report “[g]eopolitical tensions may result in [additional] export control restrictions, trade sanctions, tariffs and more generally international trade regulations which may impact our ability to deliver our systems, technology, and services.”[3]

Another example is Europe’s reliance on China as a source of key raw materials. China’s decision to impose export restrictions on gallium and germanium, key metals used in semiconductor manufacturing, signals a significant escalation in the US-China technology conflict. This move, following US export controls on technology, has prompted urgent discussions among trade officials worldwide, particularly in countries like South Korea, Japan, and Taiwan, which play crucial roles in the global semiconductor industry. These restrictions are expected to have short-term impacts, including price hikes, and could accelerate efforts by these nations to reduce reliance on Chinese supplies of these critical materials. This development further underscores the broader geopolitical battle for technological supremacy, potentially affecting global supply chains, with China demonstrating its capacity to retaliate against US-led technology export controls.[4]

EU and US policymakers need to recognise that the retaliatory consequences of export controls can be significant. In 2021, the IMF already cautioned that a full technological separation (decoupling) between China and the US and their allies could have far-reaching implications for global production and consumption patterns.[5] Should the US persist in maintaining or escalating these measures leading to a potential drop to “0” in US semiconductor sales to China, the American Chamber of Commerce estimated that US companies could suffer an annual loss of USD 83 billion, resulting in the loss of 124,000 jobs.[6]

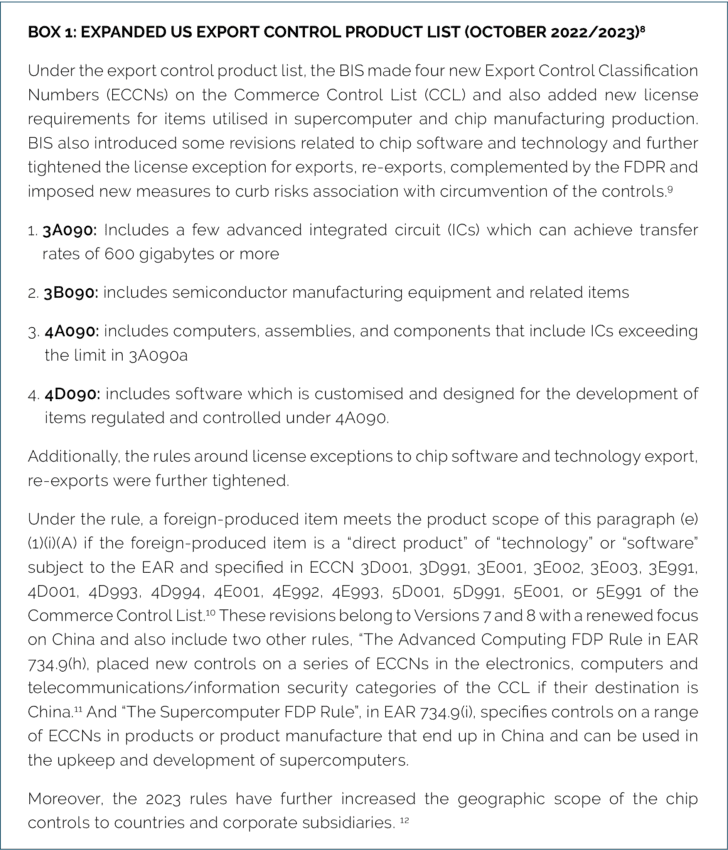

So far, EU has continued to remain passive on the export control debate. However, the state of tension between the two points to the likelihood where the US can impose its “draconian” FDPR rule to extend technology related export controls to transactions between its foreign allies and China. The rule gives the US government the power to stop a product from being sold, including products made in a foreign country if the product was made using American technology.[7] And the list of affected products has recently been expanded to also curb China’s access to advanced computing semiconductors and semiconductor manufacturing equipment (see Box 1).

In addition, the legal and commercial landscape for EU technology companies is also becoming increasingly fraught with Export Administration Regulations (EAR), particularly under § 744.11 of the EAR.[13] These controls impose license requirements on entities that are acting, or are at significant risk of acting, contrary to the national security or foreign policy interests of the US.[14] Several EU-based entities find themselves navigating this challenging regulatory environment (see Table 1 below).

This US policy not only poses significant compliance burdens but also carries the potential for substantial commercial disruptions. The inclusion of companies from, for example, Belgium, Germany, France, and the Netherlands underscores the broad reach of these controls, affecting a range of sectors from technology trading to aerospace and telecommunications. For EU technology firms, navigating these US export controls necessitates a careful assessment of legal risks and commercial strategies to mitigate potential impacts on their operations and international collaborations.

Table 1: § 744.11 License requirements applying to entities in Belgium, Germany, France, and the Netherlands (excerpt)

Importantly, the technology used in semiconductors will continue to grow and mature over time. The effect of expanding controls will very likely continue to disrupt trade and investment decisions. A similar regulatory trend is being observed as countries start to adopt more restrictive laws.[15] Notably, the US Chips Act illustrates this trend, attracting global semiconductor investment to the US and sparking a wave of similar policies worldwide. Governments, including the EU, are increasingly resorting to subsidies and tariffs to shield their industries, as evidenced by the US Inflation Reduction Act (IRA) and its “Buy America” provisions. The EU is concerned about US policies for electric vehicle tax credits which can impact the production in Europe negatively.[16] These developments signal a risk of regulatory spirals, where actions by one nation provoke countermeasures by others, potentially leading to a fragmented global market and further complicating international trade dynamics.

The threats to technology suppliers both from Asia and Europe are material. Export control policies can inadvertently initiate subsidy races between Asia, Europe and US and distort semiconductor market dynamics, reducing global prices and hindering international research collaborations in fields such as quantum computing. By implementing restrictive measures, the US conditions access to crucial technologies on alignment with its export control policies. This approach, exemplified by the ASML case, threatens to exacerbate global technological disparities and skew resource distribution.[17] Simultaneously, expanded US export controls pose significant challenges to EU trade and investment strategies, potentially undermining initiatives like the European Chips Act as companies are forced to realign their operations to adhere to US regulations. This regulatory shift could prompt sectors vital to the EU economy, such as automotive, chemical, and smart manufacturing, to redirect investments toward China, thereby weakening the EU’s strategic autonomy. The situation also endangers joint research efforts between the EU, the US, and China on cutting-edge technologies by making European access to essential US technology contingent on policy compliances. Such actions would exacerbate global technological disparities and resource distribution, impacting the pace and scope of research cooperation and technological advancements worldwide.

To navigate these complexities, there is a pressing need for a nuanced approach that balances national security concerns with the imperative of maintaining a competitive and collaborative global technological landscape. The EU must craft a coherent strategy that not only ensures compliance with international regulations but also safeguards its strategic interests and promotes technological interdependence. Engaging in dialogue with the US and other global partners to harmonise export control measures could mitigate adverse impacts on trade, investment, and research collaboration, thereby preserving the integrity of the global technological ecosystem.[18]

[1] “The Commission is concerned that these export restrictions are unrelated to the need to protect global peace and also stability and the implementation of China’s non-proliferation obligations arising from international treaties,” Commission spokesperson in a briefing, as quoted in Reuters, see: Blenkinsop, P and Van Campenhout, C (2023, July 4) EU concerned over China export controls on metals used in chips, Available at: https://www.reuters.com/technology/eu-concerned-over-china-export-controls-metals-used-chips-2023-07-04/; German chipmaker Infineon CEO Jochen Hanebeckalso expressed concerns against US export controls, “…..we hope that these limitations will be confined to the very few critical areas,”[…] “Complete independence from any country is unimaginable in the semiconductor industry” (2023) as quoted in German media Handelsbatt.

[2] China was the second largest buyer of ASML’s tools on country/region basis, just after Taiwan (which accounted for 29.3%).

[3] “Our ability to deliver technology in certain countries such as China has been and continues to be impacted by our ability to obtain required licenses and approvals. […] The list of Chinese entities impacted by export control restrictions has increased since 2022. […] These and further developments in multilateral and bilateral treaties, national regulation, and trade, national security and investment policies and practices have affected and may further affect our business, and the businesses of our suppliers and customers.” Also see: ASML (2023) Annual Report, Available at: https://www.asml.com/en/investors/annual-report/2023#2023-annual-report. Also see Gooding, M. (2023, January 25) ASML delivers bumper results but new US China sanctions could spell trouble, Available at: https://techmonitor.ai/technology/silicon/asml-us-china-semiconductor-chip-industry. South Korea memory chipmakers are also facing a fundamental threat to their production bases in China, and more export controls will only aggravate the damage and put the supply chain under stress, see: Mark, J. and Tiff Roberts, D. (2023, February 23) United States–China semiconductor standoff: A supply chain under stress, Available at: https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/united-states-china-semiconductor-standoff-a-supply-chain-under-stress/.

[4] Li Gloria, et al., (July 4, 2023). China’s curb on metal exports reverberates across chip sector. Financial Times. Available at https://www.ft.com/content/2fa865a7-176f-4292-8842-38bb6470d732.

[5] Cerdeiro, D. A., Mano, R., Eugster, J., & Peiris, M. S. J. (2021). Sizing up the effects of technological decoupling. International Monetary Fund. Available at: https://www.elibrary.imf.org/view/journals/001/2021/069/article-A001-en.xml, 3.

[6] The report also estimated in the factsheet that the revenue available for research and development will also drop falling by $12 billion annually. See US Chamber of Commerce, “Semiconductors Fact Sheet,” n.d., Available at: https://www.uschamber.com/assets/documents/024001_us-china_decoupling_factsheet_semiconductors_fin.pdf, accessed February 27, 2024.

[7] Lee, L. J. and Nellis, S. (2022, October 7) Explainer-What is ‘FDPR’ and why is the U.S. using it to cripple China’s tech sector? Reuters, Available at: https://www.reuters.com/technology/what-is-fdpr-why-is-us-using-it-cripple-chinas-tech-sector-2022-10-07/ ; under the Revisions to the Unverified List; Clarifications to Activities and Criteria that May Lead to Additions to the Entity List, the BIS has also indicated that entities maybe added in the Commerce entity list if there is a lack of cooperation in activities by the host government (‘the government of the country in which an end-use check is to be conducted’) see: BIS (2022) Revisions to the Unverified List; Clarifications to Activities and Criteria that May Lead to Additions to the Entity List, Docket No. 220930-0205, Available at: https://public-inspection.federalregister.gov/2022-21714.pdf .

[8] Secretary of Commerce Gina M. Raimondo said “As we implement these restrictions, we will keep working to protect our national security by restricting access to critical technologies, vigilantly enforcing our rules, while minimizing any unintended impact on trade flows,” see: BIS (2023) Commerce Strengthens Restrictions on Advanced Computing Semiconductors, Semiconductor Manufacturing Equipment, and Supercomputing Items to Countries of Concern, Available at: https://www.bis.doc.gov/index.php/documents/about-bis/newsroom/press-releases/3355-2023-10-17-bis-press-release-acs-and-sme-rules-final-js/file.

[9] EY (2022) US Implements new technology export controls on China, https://taxnews.ey.com/news/2022-1591-us-implements-new-technology-export-controls-on-china as seen in Reinsch, W., Schleich, M., and Denmiel, T., (2023) Insight into the U.S. Semiconductor Export Controls Update, CSIS, Available at: https://www.csis.org/analysis/insight-us-semiconductor-export-controls-update.

[10]FDPR, Available at: https://www.federalregister.gov/documents/2022/02/03/2022-02302/foreign-direct-product-rules-organization-clarification-and-correction.

[11] For instance, ASML, a global frontrunner in manufacturing equipment for computer chips, is headquartered in the Netherlands but operates globally. It incorporates U.S. technology in the design of certain equipment and chips, potentially making them subject to U.S. export regulations.

[12] CSET (2023). (see note:6)

[13] Supplement No. 4 to Part 744—Entity List, Available at: https://www.ecfr.gov/current/title-15/subtitle-B/chapter-VII/subchapter-C/part-744/appendix-Supplement%20No.%204%20to%20Part%20744.

[14] § 744.11 License requirements that apply to entities acting or at significant risk of acting contrary to the national security or foreign policy interests of the United States; Available at: https://www.ecfr.gov/current/title-15/subtitle-B/chapter-VII/subchapter-C/part-744/section-744.11.

[15] The European Chips Act aims to enhance Europe’s competitiveness by facilitating its digital transition. Regulation (EU) 2023/1781 of the European Parliament and of the Council of 13 September 2023 establishing a framework of measures for strengthening Europe’s semiconductor ecosystem and amending Regulation (EU) 2021/694 (Chips Act) (2021).

[16] The IRA includes tax credits for vehicles assembled in North America, and their components made in the US or other select “free trade partners. Alden, E (2022, December 5) Biden’s ‘America First’ Policies Threaten Rift with Europe, Foreign Affairs, Available at: https://foreignpolicy.com/2022/12/05/biden-ira-chips-act-america-first-europe-eu-cars-ev-economic-policy/.

[17] Gehrke, T., and Ringhof, J. (2023) Caught in the crossfire: Why EU states should discuss strategic export controls, ECFR. Available at: https://ecfr-eu.cdn.ampproject.org/v/s/ecfr.eu/article/caught-in-the-crossfire-why-eu-states-should-discuss-strategic-export-controls/?amp=&_gsa=1&_js_v=a9&usqp=mq331AQIUAKwASCAAgM%3D#amp_tf=From%20%251%24s&aoh=17090394418899&referrer=https%3A%2F%2Fwww.google.com&share=https%3A%2F%2Fecfr.eu%2Farticle%2Fcaught-in-the-crossfire-why-eu-states-should-discuss-strategic-export-controls%2F.

[18] In a European Parliament recommendation concerning US-EU relations, point V of the report specifically highlights, “whereas new technologies such as AI, space capabilities and quantum computing, which present new opportunities for mankind, also create new challenges in defence and foreign policy that require a clear strategy and consensus between the Member States and the US,” contrasting the approaches pursued by each of the governments, see: European Parliament (2023) REPORT on a European Parliament recommendation to the Council, the Commission and the Vice-President of the Commission / High Representative of the Union for Foreign Affairs and Security Policy concerning EU-US relations, Available at: https://www.europarl.europa.eu/doceo/document/A-9-2023-0372_EN.html.

Concluding Remarks

The US’s aggressive stance on export controls, particularly in the semiconductor industry, has catalysed a global response, with countries increasingly adopting protective measures. The US Chips Act and the EU’s concerns over the “Buy America” provisions in the IRA illustrate the emerging subsidy races and the potential for significant disruptions in global trade dynamics. These measures, while aiming to protect national interests, may inadvertently stifle global technological progress and cooperation, especially in critical areas like AI and quantum computing.

The evolving landscape compels a more careful and more collaborative approach to export controls, one that balances national security with the imperative of maintaining open, collaborative international research and development ecosystems. The dialogue between the US and the EU, as seen in the TTC meetings, highlights the importance of aligning strategies to enhance supply chain resilience and counter economic coercion. However, achieving consensus and fostering a cooperative global technological ecosystem remains a complex challenge amidst the divergent policies and geopolitical ambitions. The implications of the US’ export control policies extend beyond mere trade restrictions for US technology, impacting EU technology companies heavily reliant on global markets. Many US and European companies have already felt the sting of these policies, with significant revenue streams at risk due to restrictions on sales to China.

The EU and the US must work together diligently to ensure that measures taken for national security do not inadvertently stifle the global technology diffusion or the functioning of the international rules-based trading system. As we move forward in an ever-evolving global technology environment, it is essential to embrace dialogue, collaboration, and a deep-seated mutual understanding. These are the cornerstones upon which a stable global technological ecosystem can be built, reflecting the enduring values of minimal barriers to commerce and the free exchange of knowledge and technology for the betterment of societies globally.