The EU’s Trillion Dollar Gap in ICT and Cloud Computing Capacities: The Case for a New Approach to Cloud Policy

Published By: Matthias Bauer Fredrik Erixon Dyuti Pandya

Subjects: Digital Economy European Union

Summary

An inward-looking EU approach to cloud computing and data policies risks stifling innovation and competitiveness by promoting domestic champions at the expense of accessing global cloud capabilities. Limiting market diversity and access to best-in-breed solutions could hinder digital transformation across sectors, raising costs and constraining growth opportunities. By contrast, a free trade approach to cloud offer guardrails and security but champions non-discriminatory cross-border and regulatory policies, yielding economic advantages by stimulating investments, fostering innovation, and enhancing competition.

Unfortunately, some EU policymakers envision Europe building an independent ICT infrastructure, exemplified by initiatives like the European Alliance on Industrial Data, Edge and Cloud. This approach prioritises technological sovereignty, aiming not just to maintain European control over critical infrastructure and data but favouring localisation policies, including in AI and quantum computing. However, the approach is simply not going to work because the amount of resources that are needed for “pure-EU firms” to rise up as significant competitors to global leaders is so large that it would drain other sectors of investments and human capital.

The investment gap between the EU and the US in ICT and cloud-related sectors, totalling some USD 1.36 trillion, presents a significant challenge for native European companies. To catch up by 2030, 2040, and 2050, European technology companies would need to substantially increase annual investments, ranging from approximately USD 157 billion to USD 1.2 trillion annually, representing 0.8 percent to 6.4 percent of the EU’s GDP. This would – hypothetically – require a significant commitment of resources. Despite recent efforts such as state aid for R&D in cloud and edge computing, the scale of investment needed far exceeds the current levels, underscoring the urgency for an open and non-discriminatory EU policy approach to bolster Europe’s position in the rapidly growing and technologically changing digital landscape.

There are different components to a successful cloud policy, including policies to spur adoption and cross-border cloud integration in the EU, and more investment in R&D. EU policymakers should adopt a dynamic perspective rather than fixating on static market shares, and pursue policies that prioritise innovation and technological advancement over merely seeking to catch up on current technologies. The cloud market and the broader Internet market are going through rapid changes, leading to new services and new competition. A future-oriented approach to cloud policy advocates for policies that foster competition, drive technological progress, and enable interoperability, all of which align with the dynamic nature of cloud services and global markets.

Introduction: What Model for the EU Cloud Strategy?

European policymakers are rightly concerned about Europe’s performance in cloud and the world of computing and services that run on the cloud. However, all too often these concerns manifest themselves in a knee-jerk defensiveness over the market shares held by foreign cloud suppliers or an attitude suggesting that EU cloud users rely too heavily on those from the US and China.[1] The competitiveness of especially large US cloud suppliers have made it difficult for suppliers with an EU birth certificate to build-up or maintain a strong market position, and cloud users (including the public sector) rarely find competitive offers from suppliers that are “purely European”. While some national security concerns and risks related to the on-off legal framework of the Transatlantic cross-border portability of personal data are acknowledged in many arguments for EU cloud policy, the distinguishing feature of the “sovereigntist” approach is that Europe – through a combination of restrictive and discriminatory policies – should aim to cut the wings of foreign, especially US, cloud suppliers.[2]

Some policymakers and industrialists in Europe go further and articulate a vision for Europe that involves building an independent ICT infrastructure and services offerings that resonate with European values. In 2020, EU member states signed a joint declaration which pledged public money to power the cloud sector and establish the “European Alliance on Industrial Data and Cloud.” The declaration addresses the broader concerns of the economic and security risks associated with outsourcing data and the long-term implications of dependency on external technology platforms.[3] This ongoing debate underlines a political ambition to assert technological sovereignty by maintaining more secure and potentially better performing European technological alternatives in cloud services – and, further, in AI and quantum computing.

1.1 European Cloud Policy Requires a Dynamic View Rather Than Focusing on Market Shares

The sovereigntist view is misguided and economically harmful to Europe. Fortunately, it is not the only existing or possible approach to a European cloud policy and strategy. A workable and successful cloud policy should not be obsessed with the market share of current suppliers but needs to centrally feature policies for adoption and encourage dynamic technological and market changes that inevitably will change the hierarchy of suppliers. Taking measures that allow for faster diffusion of cloud services in Europe is beneficial for the EU economy but will also help to create more competition. A faster-growing market will create spaces for a larger variety of services and for new technology to accelerate. Such market development is far better for stimulating new competition.

Moreover, many other countries are also wrestling with finding the balance between market openness and maintaining agency to control security concerns – between realising technology efficiency gains and maintaining sovereignty over systems and data. The need to maintain control over sensitive and strategic data underpins many policy developments in key markets where cloud services are considered critical digital infrastructure assets. For instance, the US government’s “Clean Network” proposal is aimed at removing all Chinese influences from the country’s internet ecosystem (including specifically cloud services, represented as the “Clean Cloud”).[4] Such approaches aim to address explicit concerns and tailor policies to specific services or suppliers, including connections to foreign and potentially hostile governments. However, there exists a significant risk of divergence between a company’s aspiration to remain competitive and the regulatory structure overseeing cloud services. While the preference for a functioning cloud service should rely on markets and private sectors, there is an on-going trend to approach cloud by infusing its functioning with industrial policy and protectionist motivations.

Importantly, the approach of EU policymakers to create new EU-based competitors is to accelerate technological change and make sure that EU firms have the incentives to invest in such change. The cloud market is already undergoing technological transitions, and the changes will only accelerate with more cloud-specific developments and changes in ICT technology. A key development is the maturation and widespread adoption of next-generation data security and privacy-enhancing technologies like homomorphic encryption, secure enclaves, differential privacy, and self-sovereign identity solutions.[5] These innovations have the potential to enable secure computation on encrypted data without decryption, while also preventing unauthorised data access and empowering users with control over their personal data. As these capabilities become more engrained across cloud stacks, the perceived risks around data exposure and the need for strict sovereigntist or localisation policies could diminish substantially. This could help establish a global framework for next-generation telecom and cloud services that fosters both development and security. Ensuring technology and commercial openness in the policies governing this framework would set the stage for healthy competition in the cloud sector and create opportunities for all stakeholders.

In parallel, the standardisation and potential deployment of quantum-resistant cryptography algorithms will also become critical to safeguarding data transmitted across cloud environments from future quantum computing threats to encryption.[6] This could increase confidence in the security of data privacy of cross-border data flows and shared cloud models across jurisdictions. Additionally, emergence of governance frameworks for ethical, transparent and accountable AI/ML services hosted on cloud platforms could help alleviate concerns around surrendering advanced AI capabilities to foreign providers on verified grounds.

1.2 Cloud and Related ICT Developments Are Not Taking a Pause

The resurgence of new globalisation and decentralised supply chains will further interconnect markets and open digital ecosystems. This could catalyse the formation of regional or plurilateral “cloud blocs” with harmonised cloud policies enabling frictionless data and service mobility across trusted cloud ecosystems. Intensifying competitive pressures could further drive enterprises to demand barrier-free cloud capabilities that power innovation and responsiveness, without being hampered by data sovereignty bottlenecks. The market-driven approach – rather than a Brussels-centric or, for that matter, a Washington-centric approach – will likely re-emerge as a model for cloud governance and will be a key factor in determining how countries can maximise their economic returns from cloud and computing investments. Telecommunications and the Internet were never based on a government-led strategy; they were products of commercial and technological initiatives and market forces which generated new applications and innovation.[7] And this development is not taking a pause.

With the advent of 5G and 6G, which blends with AI and cloud computing, new services and products are now being enabled to meet the growing demand of creating data and knowledge fast to support a digital and interconnected economy in a secure way.[8] The future development of 6G/xG will further transform distributing data and computing to edge cloud. These networks will potentially be architected on the grounds of a decentralised, software-defined infrastructure closely integrated with Multi-Access Edge Computing (MEC) capabilities.[9] Being built on the principles of, for instance, network slicing allows the partitioning of physical network to serve different service requirements and multi-tenancy models,[10] which can potentially be utilised to lay the foundation for decentralised edge cloud deployment across the same telecom network infrastructure. Such a policy model will allow data to not remain centralised in any single provider’s cloud but be processed closest to its point of origin. It will facilitate data sharing and aggregation through the use of privacy-preserving technologies across virtualised multi-cloud environment.

The market-driven model for cloud policy is a good starting point for the EU. Cloud, ICT, and services markets will change with new technology and new models for data distribution and commerce. The developments will also bring a change in competition between companies. The EU could support these changes and hasten development and experimentation by setting interoperability standards and governing the ethical, secure operation of this decentralised cloud-edge-network stack. For instance, in the biomedical sector, a number of cloud platforms are supporting scientific research. This points to the increasing need for supporting cross-platform interoperability for managing and analysing data.[11] There have been attempts for interoperating cloud platforms for biomedical data by the GA4GH organisation and European Open Science Cloud (EOSC) Interoperability Task Force of the FAIR Working Group. The underlying basis of these framework is to make data in the cloud platforms findable, accessible, interoperable and reusable (FAIR).[12] Following a diffusion of cloud computing innovation, there will be a potential shift towards a more decentralised framework. This will inevitably move the policy rhetoric away from localising data and towards enabling cross-provider and cross-border harmonisation of shared cloud services, which will be utilised across various sectors.

The future direction of EU cloud policies should necessitate striking a careful balance between advancing cloud innovation and capabilities versus the present imperative for sovereignty and digital autonomy. Overreliance on technology sovereignty will ultimately hamper EU competitiveness and future economic prospects and force a reallocation of EU resources to services delivered today rather than services delivered in the future. Insulating the EU cloud market from non-EU players will stifle innovation. It will deter foreign investment and also lead to a brain drain of top cloud computing talent.

1.3 The EU’s Inward-Looking Approach to Promoting Domestic Cloud Champions Is Poised to Fail

The insular approach risks technology isolation of the EU and prevents productive exchange of ideas and cross exchange of frontier R&D. Adopting overly stringent data localisation mandates aimed at reducing dependencies on US providers risks hampering the on-going digital progress and dampening future cloud-driven growth opportunities. Current models in Europe based on industrial, resource-constrained approaches – centred on promoting domestic cloud champions through an exclusionary framework – have inherent limitations. There is already a lack of hyperscale players, semiconductor supply chain gaps, human capital shortages, and a highly fragmented digital (and non-digital) internal market which abates the EU ambition of achieving comprehensive cloud self-sufficiency in the short-to-medium term.

Yet, this paradigm refuses to die. An inward-looking policy singularly fixated on reducing foreign cloud reliance could increase economic harm by depriving EU businesses and citizen’s access to best-in-breed global cloud capabilities. This incumbency preference for nascent EU providers over established companies risks the EU to not scale up based on the modern enterprise needs. Recent survey findings indicate a growing trend towards cloud adoption across companies. Two out of three companies have already established a cloud foundation, while one out of every two companies is currently undertaking large-scale migration initiatives or building new applications and capabilities in the cloud. Notably, approximately 65 percent of surveyed companies have more than 20 percent of their workloads running on cloud platforms.[13] In total, 43 percent of EU enterprises have brought cloud computing services in 2023.[14] Restricting the operation of foreign cloud providers in EU will likely result in higher costs for consumers, while also deter the adoption and integration of cloud technologies across different sectors to enable digital transformation initiatives.

1.4 The Sovereignty Narrative Will Create More Problems Than It Pretends to Solve

The narrative around technological sovereignty in Europe is further enriched by discussions on the practical challenges and potential solutions for achieving this goal. Actors like OVHcloud and other policy documents call for a concerted European effort,[15] highlighting the need for collaboration among European nations and private companies to invest in and develop the continent’s digital infrastructure.[16] This includes addressing the complexities of integrating international companies within European projects like Gaia-X, and Catena-X while ensuring that European sovereignty is preserved.[17] The French government’s active role in the European Union Cybersecurity Certification Scheme (EUCS) negotiations reveals a political strategy that, while championing European technological sovereignty, also raises concerns over France’s attempt to skew the market in favour of its own cloud services.[18] Jean-Noël Barrot, the former French Minister for Digital Transition and Telecommunications, underscored this ambition by advocating for exclusionary requirements that surpass public authorities and Operators of Vital Importance (OVIs), aiming to model the EU’s entire digital security framework on France’s SecNumCloud certification.[19]

Thus, by pushing for the adoption of cybersecurity standards akin to France’s SecNumCloud or even Germany’s C5,[20] there seems to be an underlying ambition to artificially inflate demand for French/German cloud regulatory solutions across the EU. These approaches invite scrutiny over their potential to limit market diversity and access to the best cloud services solutions available on global markets. Such tactics, while enhancing the stature of France’s and Germany’s cloud industry, will likely inadvertently stifle competition and innovation within the European cloud services market, contradicting the broader EU principles of fair competition and technological neutrality.[21]

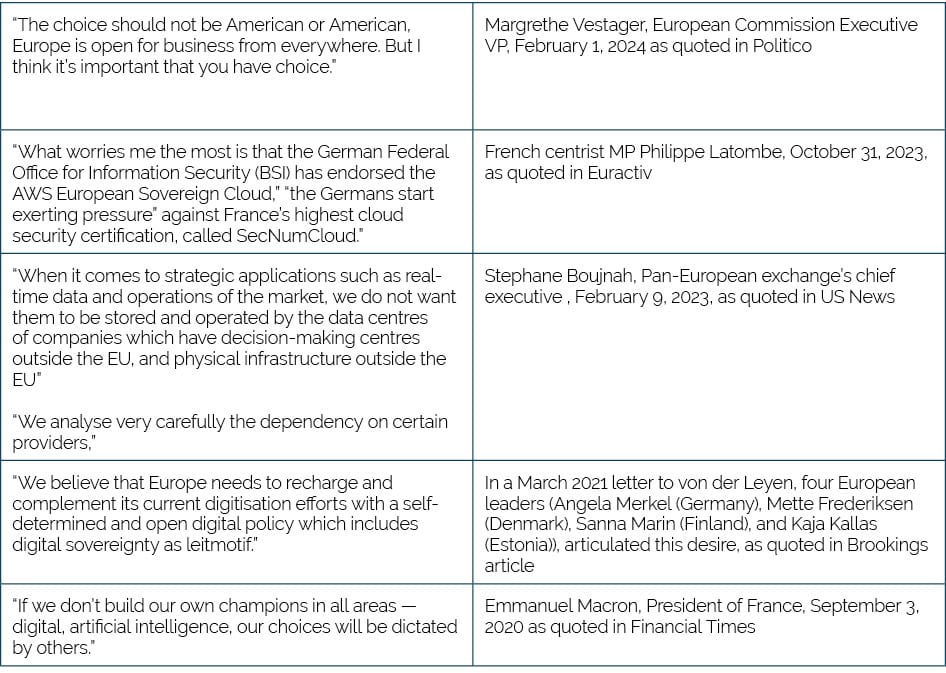

Table 1: Sovereigntist views on EU cloud policy

The advent of protecting sovereignty is appealing in Europe, and while EU policymakers may strive to make their cloud computing infrastructure competitive, the reality is that EU providers are not competitive enough to supplant American and Asian rivals. The draft Cybersecurity Certification Scheme for Cloud Services (EUCS) included several sovereignty requirements.[22] While data localisation aims to enhance data sovereignty and security, it comes with economic implications for both the host nation and the cloud service provider. It imposes higher costs through local data centre investments, as well as constrained scalability and functional capabilities, thereby limiting broader cloud adoption. The evolving and complex sovereignty landscape across the EU, with its patchwork of data residency requirements, increases regulatory compliance burdens and scrutiny over operational autonomy for cloud customers across EU. Accommodating these localisation requirements necessitates EU member states to establish and maintain robust local data centre infrastructure through substantial capital outlays and operational expenses to meet regulations.

For major US cloud providers like AWS, Google, and Microsoft,[23] offering controlled public cloud services that adhere to EU’s sovereignty principles involves massive investments in dedicated local capacity, regulatory compliance processes, and sovereign control capabilities. This resource-intensive overhaul is a critical factor governing their presence in the cloud sovereignty battle in Europe. Customers will likely face heightened governance and auditing obligations to verify data localisation, residency, and authorised cross-border transfers – adding to the complex web of resource demands stemming from the EU’s pursuit of controlled cloud sovereignty while aiming to enable innovation and maintain cyber security requirements. This is an extremely resource demanding approach.

From the perspective of cloud service providers, adhering to data localisation requirements can be cumbersome and expensive. These providers often leverage economies of scale by centralising their operations and infrastructure, allowing them to offer cost-effective services globally. Data localisation mandates, however, disrupt this by requiring the establishment of multiple data centres across various regions or countries. This fragmentation can also undermine global cybersecurity frameworks and likely affect 13 out of 14 controls in the international standards for the information and cybersecurity sector (ISO/IEC 27002),[24] while also potentially undermining the new Transatlantic Data Privacy Framework (TDPF).[25] It is important for technology firms to have market access and availability of data flows in instances where there will be a potential cyber-attack or threat.

In essence, a good point here is to also refer to the security practice between the US FedRAMP and the EU SecNumCloud (the French policy approach) and EUCS sovereignty requirements. FedRAMP primarily focuses on the technical aspects of cloud cybersecurity rather than considering the ownership structure of the firm providing the services. This has allowed many foreign firms to obtain the FedRAMP certification, reflecting the program’s emphasis on evaluating the security capabilities of cloud services. By not discriminating based on the ownership or nationality of the cloud service provider, FedRAMP creates a level playing field for both domestic and foreign companies to compete in the U.S. market. The technical cybersecurity standards employed by FedRAMP are established by the U.S. National Institute of Standards and Technology (NIST) through an open and transparent process. In contrast, the standards for the EUCS are developed by the European Union Agency for Cybersecurity (ENISA) through a politically influenced and closed approach.[26]

Sovereignty requirements that fragment or disconnect a provider’s ICT infrastructure from their global cloud can severely hamper their ability to respond promptly and comprehensively to security incidents.[27] Moreover, joint incident analysis and coordinated response efforts between government agencies and technology firms become exceedingly difficult, if not impossible, when foreign companies are excluded from specific markets. Collaborative threat intelligence sharing and collective defence mechanisms are critical in today’s interconnected cyber landscape. Isolationist policies or data localisation measures could potentially create security blind spots, leaving cloud infrastructure more vulnerable to attacks that could originate from anywhere in the world. EU policymakers must recognise that ensuring the resilience and security of cloud services necessitates a collaborative, globally integrated approach that empowers technology firms to respond swiftly and comprehensively to emerging threats, irrespective of geographic boundaries.

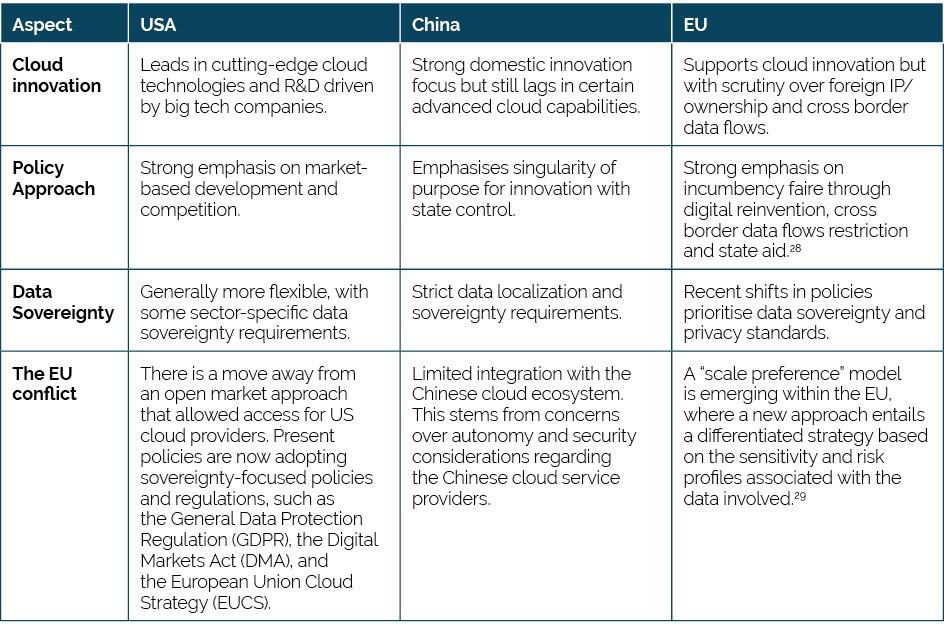

Table 2: Policy Approach followed by China, USA and EU (Excerpt)

1.5 Consideration of a “Cloud Free Trade” Approach

The optimal policy approach for cloud technologies should facilitate cross-border data flows while striking a balance between sovereign control over resources and the economic benefits of openness and connectivity at scale. This particular model aims to create an environment that fosters investments and the diffusion of cloud technologies across borders. One could call it the “cloud free trade” approach that intends to promote free flow of data across borders as well as more foreign direct investments (FDI) in cloud capacity. Such a policy approach will focus on maintaining market access commitments for foreign clouds and harmonise cloud standards and certifications. The underlying economic value and driver of cloud development patterns is the ability to rapidly experiment with prototype and scale frontier technology applications without upfront fixed costs or regulatory constraints. An attempt underlying this approach was launched by HPE through its Cloud28+ aggregator program in 2015, which aimed to link customers with a global, open ecosystem of independent cloud service providers.[30] It was originally dedicated to the European market, but now operates globally. The initiative points to the increase in affinity of collaboration and knowledge sharing across a common ecosystem. For instance, the Helix Nebula project aimed to pave the development and exploitation of high performance computing through a global network and cloud computing infrastructure. A single IT company would not be able to deliver this architecture. But the consortium and community of partner providers through Cloud28+ were able to provide a tailored answer through a hybrid cloud strategy. [31]

Free movement of data and resources across borders can unlock the full potential of cloud technologies, enabling businesses to leverage global infrastructure and new services. This openness promotes scalability, cost-efficiency, and the ability to access cutting-edge cloud services from anywhere in the world. Further moving away from a data localised model will allow domestic and foreign companies to invest in business expansion and innovation. The success of non-EU companies in providing high-value cloud services through imports does not necessarily mean a failure for EU countries. It should not be viewed as a zero-sum game – the achievements of non-EU firms should not be seen as a loss for the EU. Instead, it can present opportunities for collaboration, innovation, and mutual growth, rather than being perceived as a win-lose situation. Europe’s level of competitiveness and growth is reliant on opportunities for investment attractiveness, cross-border exchange, and competition and technology diffusion. Access to high-quality cloud services make European firms more competitive, whilst international trade exposes domestic cloud services firms to competition, requiring constant innovation and productivity improvements to succeed in the market.[32] The promotion of multi-cloud strategies which combines EU and non-EU providers enables strong economic benefits and competitiveness. A protectionist EU cloud approach will undermine the transatlantic digital trade and also make the digital privacy framework irrelevant.[33]

The reality is that the EU will not achieve self-sufficiency across all cloud domains anytime soon, and a comprehensive policy to that end would be very resource demanding. But policies that pragmatically embrace foreign player participation, under the appropriate guardrails, and that spurs increasing adoption and faster technological change will deliver strong benefits to Europe and create new opportunities for European ICT companies to grow. There is no point trying to substitute existing US companies with their state of technology and services now: it is the future technology that can invite EU companies back to the frontier of ICT, especially as the boundary between hardware and software will further break down.

Below we demonstrate the inherent shortcomings of the EU “sovereigntist” approach to cloud resulting from a substantial lack of cumulated investments by European technology companies in ICT technology in the past and the ongoing growth and technological innovation in the industry globally. We will review the investment challenges that EU ICT companies face in their quest to catch up with their non-EU counterparts, specifically focusing on the sectors with advanced cloud services (including AI development). Our analysis will explore the broader ramifications of these challenges for European technological sovereignty and economic interdependence. In particular, we delve into the disparity in investments in infrastructure capacities and research and development (R&D) efforts. Our analysis considers the impact of regulatory frameworks, market access barriers, and the strategic manoeuvres of EU member states. By examining these factors, we aim to provide a comprehensive understanding of the challenges EU ICT companies face and the feasibility of overcoming these obstacles to achieve parity with global technology leaders. The overall results fit into the picture of the EU digital policy that has weakened the competitiveness of the EU industries.

Section 2 draws on the European Commission’s R&D Scoreboard and corporate data to outline investment trends and patterns in the global ICT hardware and software industry. In Section 3, we broadly quantify the EU’s technology investment gap in ICT and advanced cloud computing services and capacities, using firm-level data and looking at the market hierarchy of investment and R&D expenditures. Section 4 continues the policy discussion from the introduction and concludes with policy recommendations.

[1] “Today, we are launching collective risk assessments, together with our Member States, in four technology areas critical for our economic security. Technology is currently at the heart of geopolitical competition and the EU wants to be a player, and not a playground. And to be a player, we need a united EU position, based on a common assessment of the risks. With this approach we will remain an open and predictable global partner, but one who nurtures its technological edge and addresses its dependencies. Our single market will only get stronger as a result in all its parts.” – Vice President Věra Jourová, see: European Commission. (2023, October 3) Commission recommends carrying out risk assessments on four critical technology areas: advanced semiconductors, artificial intelligence, quantum, biotechnologies. Press Release. Available at: https://defence-industry-space.ec.europa.eu/commission-recommends-carrying-out-risk-assessments-four-critical-technology-areas-advanced-2023-10-03_en ; also see: Komaitis, K., and Sherman, J., (2021, May 11) US and EU tech strategy aren’t as aligned as you think. Brookings Institution. Available at: https://www.brookings.edu/articles/us-and-eu-tech-strategy-arent-as-aligned-as-you-think/

[2] Reale, R., (2023, May 26) Towards Sovereignty in AI: A 7-Tier Strategy for Europe’s Technological Independence in Generative Artificial Intelligence. European AI Alliance. Available at: https://futurium.ec.europa.eu/en/european-ai-alliance/blog/towards-sovereignty-ai-7-tier-strategy-europes-technological-independence-generative-artificial

[3] Madiega, T., (2020). Digital sovereignty for Europe. EPRS Ideas Paper Towards a more resilient EU. Available at: https://www.europarl.europa.eu/RegData/etudes/BRIE/2020/651992/EPRS_BRI(2020)651992_EN.pdf, also see: European Financial Services Round Table. (2020). EFR Paper on Cloud Outsourcing. Available at: https://www.efr.be/media/2xblnmf0/131-1-efr-paper-on-cloud-outsourcing.pdf

[4] Pompeo, R, M. (2020, August 5). Announcing the Expansion of the Clean Network to Safeguard America’s Assets. U.S. Department of State, https://www.state.gov/announcing-the-expansion-of-the-clean-network-to-safeguard-americas-assets/

[5] Amorim, I., Maia, E., Barbosa, P., & Praça, I. (2023). Data Privacy with Homomorphic Encryption in Neural Networks Training and Inference. In International Symposium on Distributed Computing and Artificial Intelligence (pp. 365-374). Cham: Springer Nature Switzerland; AWS (2024, April 10) How differential privacy helps unlock insights without revealing data at the individual-level. Available at: https://aws.amazon.com/blogs/industries/how-differential-privacy-helps-unlock-insights-without-revealing-data-at-the-individual-level/ ; AWS. Guidance for Trusted Secure Enclaves on AWS. Available at: https://d1.awsstatic.com/solutions/guidance/architecture-diagrams/trusted-secure-enclaves-on-aws.pdf ; IAPP (2022) White Paper – Self-sovereign identity as future privacy by design solution in digital identity? Available at: https://iapp.org/resources/article/white-paper-self-sovereign-identity/

[6] NIST (2023, August 24) NIST to Standardize Encryption Algorithms That Can Resist Attack by Quantum Computers. Available at: https://www.nist.gov/news-events/news/2023/08/nist-standardize-encryption-algorithms-can-resist-attack-quantum-computers , Mattsson, J. P., Smeets, B., & Thormarker, E. (2021). Quantum-resistant cryptography. arXiv preprint arXiv:2112.00399.

[7] CSIS (2021) Accelerating 5G in the United States. Available at: https://www.csis.org/analysis/accelerating-5g-united-states

[8] Ibid

[9] Microsoft Azure (2024, April 26) What is Azure private multi-access edge compute? Available at: https://learn.microsoft.com/en-us/azure/private-multi-access-edge-compute-mec/overview

[10] Ericsson. The art of 5G network slicing explained. Available at: https://www.ericsson.com/en/blog/2021/2/the-art-of-5g-network-slicing-explained

[11] Grossman, R.L., Boyles, R.R., Davis-Dusenbery, B.N. et al. A Framework for the Interoperability of Cloud Platforms: Towards FAIR Data in SAFE Environments. Sci Data 11, 241 (2024). https://doi.org/10.1038/s41597-024-03041-5

[12] Rehm, H. L. et al., GA4GH: International policies and standards for data sharing across genomic research and healthcare, Cell Genomics, vol. 1, no. 2, p. 100029, https://doi.org/10.1016/j.xgen.2021.100029 (Nov. 2021). Wilkinson, M. D. et al., The FAIR Guiding Principles for scientific data management and stewardship, Sci. Data, vol. 3, no. 1, p. 160018, https://doi.org/10.1038/sdata.2016.18 (Dec. 2016).

[13] McKinsey (2024) The state of cloud computing in Europe: Increasing adoption, low returns, huge potential. Available at: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-state-of-cloud-computing-in-europe-increasing-adoption-low-returns-huge-potential

[14] Eurostat (2023) Cloud computing – statistics on the use by enterprises. Available at: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Cloud_computing_-_statistics_on_the_use_by_enterprises

[15] The head of Italian defence and electronics firm Leonardo said that Italy and other European countries need a government controlled cloud services to store sensitive data. Reuters (2023) Italy, Europe Need State-Controlled Cloud Services – Leonardo Chief. Available at: https://www.reuters.com/world/europe/italy-europe-need-state-controlled-cloud-services-leonardo-chief-2023-10-25/

[16] OVH Cloud. (2024, January 17) OVHcloud presents its strategic plan, Shaping the Future, and new financial targets for FY2026. Press Release. https://corporate.ovhcloud.com/sites/default/files/2024-01/2024-01-17-ovhcloud-shaping-the-future-veng-vdef.pdf

[17] McKay (2021, April 21) What is GAIA-X and Why Are AWS, Google, and Azure Involved? How To Geek Available at: https://www.howtogeek.com/devops/what-is-gaia-x-and-why-are-aws-google-and-azure-involved/. However, it is not the first time a European Cloud has been discussed. In 2009, on a €150 million state-funded budget, Cloudwatt was launched, an initiative of Project Andromède, France’s attempts at localising the computer industry. see: INPLP (2020) GAIA-X: European Sovereign Cloud Guidelines Unveiled. Available at: https://inplp.com/latest-news/article/gaia-x-european-sovereign-cloud-guidelines-unveiled/;

Similar to GAIA-X, the Fraunhofer Society launched the International Data Spaces (IDS) project, formerly known as the Industrial Data Space, in October 2015. This initiative, funded by the German Federal Ministry of Education and Research, focuses on standardising data exchange and sharing while ensuring participants retain sovereignty over their data. Supported by IDSA, the project includes 117 members worldwide from various industries, collectively defining the IDS standard for data sovereignty, akin to GAIA-X., see: IDSA (2021) GAIA-X and IDS. Position Paper. https://internationaldataspaces.org/wp-content/uploads/dlm_uploads/IDSA-Position-Paper-GAIA-X-and-IDS.pdf , also see: Catena-X aims to create a standard for data exchange along the entire automotive value chain. see: Wilkes, W. (2020). BMW and SAP Join Forces to Build German Auto Data Alliance – Siemens, Deutsche Telekom also join the cloud data group. Bloomberg. Available at: https://www.bloomberg.com/news/articles/2020-12-01/bmw-and-sap-join-forces-to-build-german-auto-data-alliance?embedded-checkout=true

[18] Guillaume Poupard, the Director General of ANSSI, voiced strong support for these new requirements, emphasising their role in advancing digital sovereignty. He said, “Europe needs a rule that only European law is applicable on cloud products certified in Europe,”…. “This is about…having the courage to say that we don’t want non-European law to apply to these services,”…… “If we’re not capable to say this, the notion of European sovereignty doesn’t make sense.” Cerulus, L., (2021, September 13) France wants cyber rule to curb US access to EU data. Politico. Available at: https://www.politico.eu/article/france-wants-cyber-rules-to-stop-us-data-access-in-europe/ ; Anne Le Hénanff, a member of the French Parliament from centre-right Horizons, who is the rappporter for the bill, “We aim to regulate while supporting French cloud providers, enabling them to grow in Europe, and fostering the creation of French cloud champions,” see: Hartmann, T. (2023, October 3) France set to regulate cloud market more than EU. Euractiv. Available at: https://www.euractiv.com/section/competition/news/france-set-to-regulate-cloud-market-more-than-eu/?utm_source=Euractiv&utm_campaign=e1e24c4590-; also see: Cory, N. (2022, May 10) France’s “Sovereignty Requirements” for Cybersecurity Services Violate WTO Trade Law and Undermine Transatlantic Digital Trade and Cybersecurity Cooperation. ITIF. Available at: https://itif.org/publications/2022/05/10/france-sovereignty-requirements-cybersecurity-services-violate-wto-trade/

[19] Government of France (2021) Communique De Presse: Le Gouvernement annonce sa stratégie nationale pour le Cloud. Available at: https://minefi.hosting.augure.com/Augure_Minefi/r/ContenuEnLigne/Download?id=B32CFA9B-74D2-411D-A501-82041939FC67&filename=1002%20-%20Le%20Gouvernement%20annonce%20sa%20strat%C3%A9gie%20nationale%20pour%20le%20Cloud.pdf;

Economy Minister Bruno Le Maire, “There is no political sovereignty without technological sovereignty. You cannot claim sovereignty if your 5G networks are Chinese, if your satellites are American, if your launchers are Russian and if all the products are imported from outside,” ….following this, Jean-Paul Smets, founder of Nexedi and member of the Euclidia organisation, “We are being asked to participate in something special through intermediaries who are promoters of American technology,” Pollet, M. (2021, December 14) France to prioritise digital regulation, tech sovereignty during EU Council presidency. Euractiv. Available at: https://www.euractiv.com/section/digital/news/france-to-prioritise-digital-regulation-tech-sovereignty-during-eu-council-presidency/

[20] Federal Office for Information Security. C5. Available at: https://www.bsi.bund.de/EN/Themen/Unternehmen-und-Organisationen/Informationen-und-Empfehlungen/Empfehlungen-nach-Angriffszielen/Cloud-Computing/Kriterienkatalog-C5/C5_Einfuehrung/C5_Einfuehrung_node.html

[21] Bauer, M. (2023) Building Resilience? The Cybersecurity, Economic & Trade Impacts of Cloud Immunity Requirements. ECIPE. https://ecipe.org/wp-content/uploads/2023/02/ECI_23_PolicyBrief_01-2023_LY07.pdf ; Bauer, M., and Lamprecht, P., (2023) The Economic Impacts of the Proposed EUCS Exclusionary Requirements Estimates for EU Member States. https://ecipe.org/wp-content/uploads/2023/10/ECI_23_OccasionalPaper_04-2023_LY06.pdf

[22] ENISA. EUCS Cloud Service Scheme. Available at: https://www.enisa.europa.eu/publications/eucs-cloud-service-scheme

[23] AWS. Digital Sovereignty. Available at: https://aws.amazon.com/compliance/digital-sovereignty/ , Microsoft. Cloud for Sovereignty. Available at: https://blogs.microsoft.com/blog/2022/07/19/microsoft-cloud-for-sovereignty-the-most-flexible-and-comprehensive-solution-for-digital-sovereignty/ , Google. Cloud on Europe’s Terms. Available at: https://cloud.google.com/blog/products/identity-security/advancing-digital-sovereignty-on-europes-terms/

[24] Swire, P., & Kennedy-Mayo, D. (2023). The Effects of Data Localisation on Cybersecurity-Organizational Effects. Georgia Tech Scheller College of Business Research Paper, (4030905).

[25] Transatlantic Data Privacy Framework. Available at: https://ec.europa.eu/commission/presscorner/api/files/attachment/872132/Trans-Atlantic%20Data%20Privacy%20Framework.pdf.pdf

[26] Cory, N., (2023) Europe’s Cloud Security Regime Should Focus on Technology, Not Nationality. Available at: https://itif.org/publications/2023/03/27/europes-cloud-security-regime-should-focus-on-technology-not-nationality/

[27] Ibid

[28] The term “incumbency faire” refers to the recent cloud policy focus on giving preferential treatment or advantages to the existing, established EU cloud computing firms. The rationale behind this approach is to prevent these incumbent EU companies from losing ground and to also reduce the EU dependencies on US cloud companies as part of its objective of fulfilling strategic autonomy goals.

[29] The EU now exhibits a preference for relying on domestic cloud providers, aiming to maintain control and ensure stringent data protection measures within its sovereign boundaries

[30] Cloud 28+ connects the reseller, the service provider, the systems integrator and the software vendors. see: HPE. (2016, November 29). HPE Expands Cloud28 Community. Available at: https://www.hpe.com/us/en/newsroom/blog-post/2017/03/hpe-expands-cloud28-community.html ; also see: CERN (2013, January 24) Helix Nebula project passes proof-of-concept. Available at: https://science.cern/news/news/computing/helix-nebula-project-passes-proof-concept

[31] The Global Vice President Service Providers, Colocation Providers Xavier Poisson Gouyou Beauchamps said, “Cloud28+ operates essentially as a large service center, a platform for organizations to leverage cloud services. But it also functions as a promotion center for the vendors and service providers that are members, providing opportunities for participants to promote their offerings to customers,”

[32] Bauer, M. and Lamprecht, P. (2023) The Economic Impacts of the Proposed EUCS Exclusionary Requirements Estimates for EU Member States. Available at: https://ecipe.org/wp-content/uploads/2023/10/ECI_23_OccasionalPaper_04-2023_LY06.pdf

[33] Cory, N., (2023) (see note: 25)

2. The EU’s Corporate Gap in R&D-Intensive ICT Industries

In the rapidly evolving landscape of global ICT technology innovation, the distribution and scale of investments in research and development (R&D) and capital expenditures (CapEx) serve as key indicators of a country’s or region’s or firm’s competitive edge and future growth potential. Below we delve into the intricate dynamics of technological investment across various nations, highlighting the strategic commitments made by companies towards fostering innovation, enhancing infrastructure, and securing a leading position in the international market.

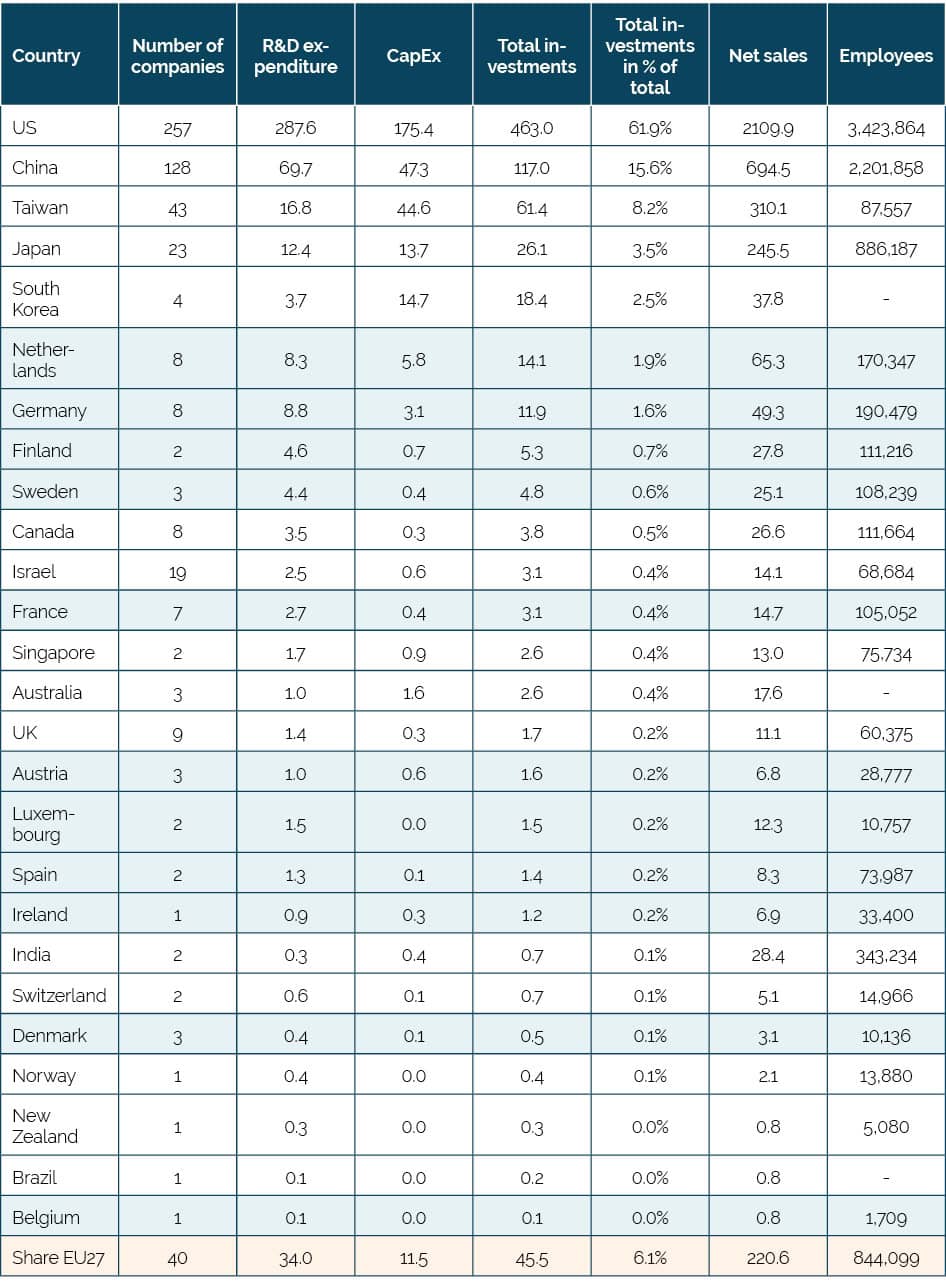

By examining data on the world’s 2,500 most research-intensive companies, their R&D and CapEx investments, total investments (R&D plus CapEx), and their contributions to the global total, alongside net sales and employment figures, we gain insightful perspectives on the global distribution of technological prowess and industrial capacity. US-headquartered ICT companies, operating in the “Technology Hardware & Equipment” and “Software & Computer Services” industries, lead significantly in all aspects, with 257 companies having invested a total of EUR 463 billion in 2022 (latest year for which data is available across industries), accounting for 62 percent of the total global investments listed in the “Technology Hardware & Equipment” and “Software & Computer Services”.

This massive investment reflects the US corporations’ dominant position in global ICT innovation and infrastructure development, with net sales of EUR 2,110 billion and over 3.4 million employees across these companies (see Table 3). China follows as a distant second, with 128 companies making total investments of EUR 117.0 billion (16 percent of the total), showing its growing but still developing technological sector. Taiwan, Japan, and South Korea also show strong investment in technology and infrastructure, though on a smaller scale compared to the US and China, indicating their roles as significant players in specific technological niches or industries.[1]

The data also sheds light on the investment landscape within the EU, where 40 companies have made total investments of EUR 46 billion representing 6.1 percent of the global total. This figure, whilst significant, also highlights the substantial gap between the EU and the top investing countries, underscoring potential areas for growth and increased competitiveness in the global market. Notably, the distribution of investments across different countries within the EU and other regions underscores the varying levels of technological development and industrial focus, with countries like Germany, the Netherlands, and Finland making noteworthy contributions in R&D and CapEx. The global distribution of investments and the concentration of technological development efforts reflect the strategic economic and industrial priorities of each region, with implications for future competitiveness and innovation capacity.

Table 3: Number and financial indicators of world’s most research-intensive ICT companies, in 2022, EUR billion

Source: European Commission 2023 R&D Scoreboard. Industry-ICB3 sectors: “Technology Hardware & Equipment” and “Software & Computer Services”.

The EU27 list (see Table 4) is led by SAP from Germany, a software and computer services giant with significant R&D and CapEx investments of 6.14 and 0.87 billion EUR, respectively, and employing over 111,000 people. Other notable companies include NOKIA from Finland and ERICSSON from Sweden, both specialising in technology hardware and equipment, with substantial investments in R&D, reflecting their commitment to innovation. Dutch technology hardware company ASML HOLDING also stands out with sizeable R&D and CapEx investments, indicative of its role in the semiconductor industry. The list includes a mix of software and hardware companies, underscoring the diverse technological expertise within Europe. Companies like France’s DASSAULT SYSTEMES and Spain’s AMADEUS focus on software services, while others like ASM INTERNATIONAL in the Netherlands and Germany’s INFINEON TECHNOLOGIES are involved in hardware. The range of R&D investments from these companies, many investing over a billion USD, alongside CapEx outlays, demonstrates a robust commitment to technological advancement. The number of employees varies widely, from giants like ERICSSON employing over 100,000 individuals to smaller, specialised firms like Luxembourg’s SUSE or Sweden’s MYCRONIC employing over 2000 individuals, showing the breadth of the European tech industry’s influence and reach.

Table 4: Number and financial indicators of EU-headquartered companies in world’s most research-intensive ICT companies, in 2022, EUR billion

Source: European Commission 2023 R&D Scoreboard. *Ranking by annual R&D expenditure in 2022.

[1] Economics of Industrial Research and Innovation. (2023) The 2023 EU Industrial R&D Investment Scoreboard. Available at: https://iri.jrc.ec.europa.eu/scoreboard

3. Quantifying the EU’s Technology Gap in Corporate ICT and Advanced Cloud Computing Services

Infrastructure (largely CapEx) and R&D investments are vital for companies in the ICT and cloud computing sector to stay competitive, innovate, meet regulatory and customer demands, and achieve sustainability goals.[1] These investments enable companies to not only sustain growth but also shape the future of technology and its applications across various industries.

There is a need to move the traditional ICT infrastructure given the ongoing rapid technological evolution. CapEx investments in new hardware, infrastructure, and technology are essential to stay competitive.[2] This includes scaling operations: expanding the geographic reach of data centres to reduce latency for end users,[3] increasing servers, scaling the networking equipment, and other hardware that underpin cloud services. Without continual CapEx investment, a company’s technology can quickly become obsolete, leading to decreased performance and competitiveness. Furthermore, R&D investments drive innovation in these sectors, leading to the development of new technologies, services, and improvements in efficiency and performance. The fast pace of technological change means that companies must invest in R&D to keep up with or lead in the development of new technologies, such as artificial intelligence, machine learning, and next-generation networking technologies like 5G and 6G.[4] It allows companies to explore new business models, improve user experience, and offer cutting-edge solutions that meet the evolving needs of customers. There exists a need to deepen the understanding on technology issues, and shape the state of technology investments.

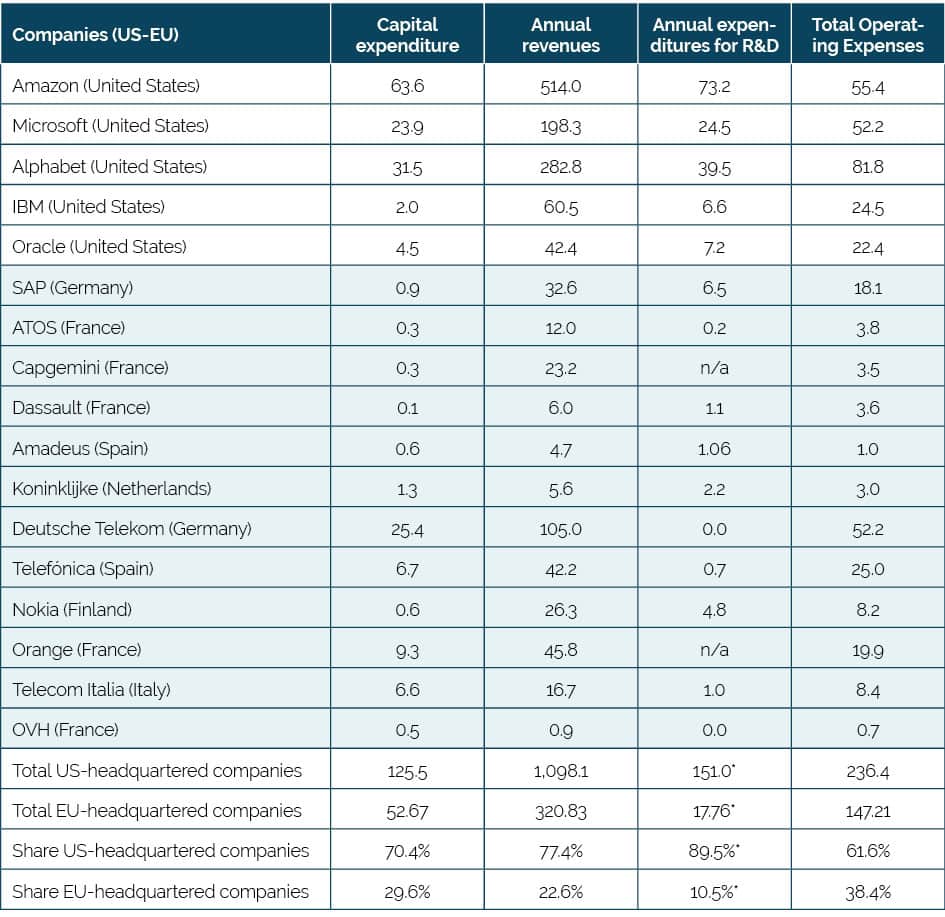

Below, we compare the group of five leading US cloud services providers with 12 EU-headquartered technology companies which all provide various cloud computing services. The composition of US-headquartered companies is based on recent market intelligence about their share in global and EU cloud services markets. The list of 12 EU-headquartered companies is based on industry reports, market intelligence, and annual reports. We label these companies “EU candidate cloud services providers” because of the size of their total business operations and revenues respectively, and the fact that they already offer cloud services with different purposes and functionalities.

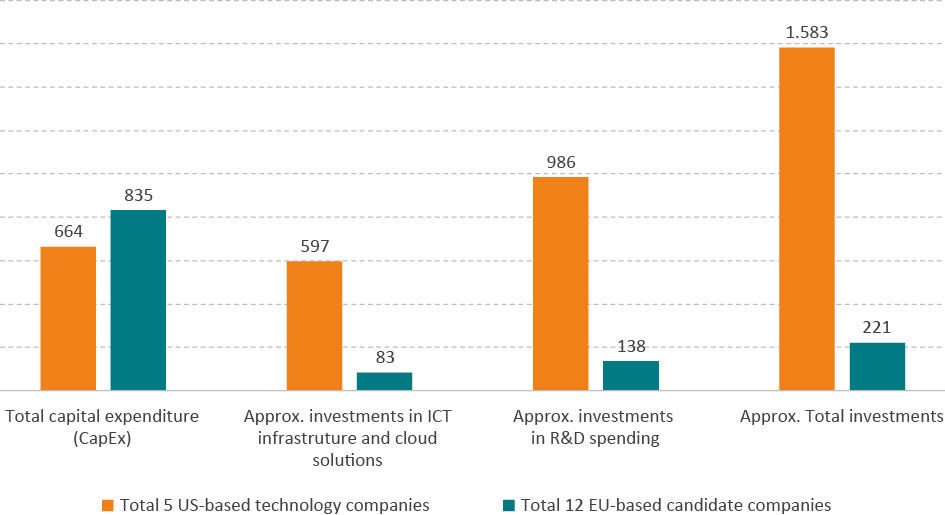

The comparative analysis between 5 leading US cloud services providers and 12 EU-headquartered technology companies illuminates the profound financial and operational divide within the cloud computing industry across the Atlantic (see 4). American entities markedly outstrip European technology companies in critical financial metrics, including capital expenditure, annual revenues, research, and development (R&D) spending, and total operating costs. This dominance evidences their more substantial infrastructure investments, pronounced market presence, and a more profound commitment to innovation.

Importantly, the financial robustness of a company stands as a pivotal determinant of its capacity for technological innovation, primarily emanating from organic growth and investment dynamics, as well as the adeptness in procuring funds from financial markets. US corporations exhibit superior performance in capital expenditure, annual revenues, and R&D expenditure, thereby creating a virtuous cycle of heightened investments in infrastructure, formidable market positioning, and a tendency towards pioneering innovation endeavours.

The analysis also highlights the disparity in R&D investment, with 5 leading US companies allocating a combined USD 151 billion towards innovation in 2022, nearly tenfold the expenditure of the EU-12 group, which stands at a mere USD 15 billion. This discrepancy underscores the US firms’ heightened focus on technological advancement and product innovation, essential for staying competitive in the rapidly evolving cloud services market. Furthermore, the figures for operating expenses and capital expenditure suggest that US firms are not merely investing in their current operations but are also strategically gearing up for future growth and market leadership.

Table 5: Financial indicators 5 leading US-headquartered cloud services providers versus. EU-headquartered candidate companies, in USD billion, 2022

Source: Annual reports and 2023 R&D scoreboard. *Excluding Capgemini (France) and Orange (France).

This juxtaposition paints a broader picture of the technological and economic variances between US and European firms in the cloud computing sphere. The significant lead of US providers highlights a considerable gap in market penetration, innovation capacity, and global ICT capacity investment. Despite the EU’s endeavours to foster a competitive ICT and cloud services ecosystem, the supremacy of US companies is pronounced, indicating a potential necessity for European firms to bolster their technology and innovation investments to improve their standing and offerings in the international cloud services market.

3.1 The Uptake of Advanced Cloud Computing Services

The uptake of cloud computing services can be traced to the late 2000s and early 2010s when the technology began to garner mainstream attention and utilisation.[5] This trend was propelled by several key developments, including the widespread availability of high-speed internet, the emergence of smartphones and mobile computing, advancements in data centre technology, and significant enhancements in virtualisation and distributed computing technologies.

- 2006-2008: The Introduction of Amazon Web Services (AWS) made its debut in 2006,[6] offering solutions like Elastic Compute Cloud (EC2)[7] and Simple Storage Service (S3)[8], marking a pivotal moment for cloud computing by providing scalable, pay-as-you-go compute and storage services. Later, Google App Engine, launched in 2008, further expanded the market by offering a platform for developing and hosting web applications in Google-managed data centres.[9]

- From 2010: Maturation and Widespread Adoption. By 2010, the cloud computing market was rapidly expanding, with Microsoft, IBM, and other technology giants entering the fray.[10] This period saw a significant rise in the adoption of cloud services across various sectors, driven by the flexibility, scalability, and cost-efficiency of cloud computing. Enterprises began migrating more critical applications to the cloud, and the proliferation of Software as a Service (SaaS) applications[11] like Salesforce, Dropbox, and Office 365 made cloud computing more accessible to a wider audience.

- 2010s: Expansion of Cloud Infrastructure and Platform Services. The development of Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) offerings,[12] such as Microsoft Azure (launched in 2010) and Google Cloud Platform,[13] contributed to the swift adoption by providing more options for building, deploying, and managing applications and services in the cloud.

The adoption of cloud computing was also influenced by evolving data protection and privacy regulations, which necessitated companies to adopt compliant IT solutions.[14] Cloud providers began offering region-specific services and compliance certifications, making it easier for companies to trust and adopt cloud solutions. In addition, continuous advancements in technology, including faster internet speeds, more powerful mobile devices, and improvements in virtualisation and automation, have made cloud services more efficient, reliable, and cost-effective. The advent of edge computing and the increasing application of artificial intelligence and machine learning in cloud platforms have further accelerated adoption. The Covid-19 pandemic, starting in late 2019 and continuing into the early 2020s, significantly accelerated the adoption of cloud computing as businesses and educational institutions shifted to remote work and learning, necessitating reliable, scalable, and accessible computing resources.[15] Following the rapid technological up scaling and transition during the pandemic, D-Wave Systems Inc., announced the immediate availability of free access to its quantum systems via the Leap quantum cloud service for projects as a means to respond to the COVID-19 crisis.[16] [17] In utilising quantum cloud, a code is employed to operate on a cloud-accessible quantum computer, typically following a “circuit-based” approach. This process involves passing the data through a predetermined sequence of quantum operations, culminating in a final quantum measurement to produce the output.[18]

3.2 The Rise of Cloud Based Quantum

Quantum computing in cloud integrates the power of quantum computing with the accessibility and scalability of cloud computing. Users through the cloud can access quantum resources and run algorithms without using specialised hardware. And these operations allow the incorporation of transformation of quantum information during computation.[19] Cloud-based quantum computing expands the reach of advanced technology to a wider audience. Various platforms such as AWS Quantum Computing, Google Quantum Computing, IBM Quantum Experience[20], and Microsoft Azure Quantum have started to commercialise the quantum cloud services and offer user-friendly interfaces and infrastructure, enabling experimentation with quantum algorithms and the execution of quantum simulations. This adoption enables researchers, developers, and businesses to delve into the possibilities of quantum computing without the need for significant investments in hardware and infrastructure.[21] Quantum computing thus represents a significant leap forward in computational capabilities, offering the potential to solve complex problems far beyond the reach of traditional computers.

The EU has a lot of catching up to do. The distribution of total global investment in the quantum industry from 2019 to 2023 shows that the US and China are the major nations engaged in quantum technology collectively constituting two-thirds of the total global financing (65 percent and 9 percent respectively). Within the EU, France stands out with 6 percent of global quantum investments, and the remaining EU countries collectively account for only 11 percent of global quantum investments with rest of the world excluding Switzerland and UK.[22] Several US cloud-based services mentioned above have emerged as a pivotal solution, allowing individuals and businesses to harness the power of quantum computing without direct physical access to quantum hardware. The driving force behind the US leading the race are the investments by private investors. Instead of adopting sovereigntist attitude, the EU can in collaboration with US tech giants establish quantum R&D centres which will allow for knowledge transfer, skill development and innovation. Further, gaining access to the US cloud-based quantum computing resources will allow EU to build expertise and explore practical applications without the need for substantial upfront investments in quantum infrastructure.

- IBM Quantum Experience: IBM provides access to their quantum computers through the cloud. With IBM Quantum Experience, users can program quantum computers using a graphical interface or through Qiskit, a Python framework for quantum computing.[23]

- Microsoft Quantum Azure: Microsoft’s Azure platform offers quantum computing as part of their cloud services. Users can experiment and develop algorithms using the Quantum Development Kit (QDK) and the Q# programming language.[24]

- Amazon Braket: Amazon Braket is a fully managed quantum computing service that makes it easy for scientists, researchers, and developers to experiment with computers from multiple quantum hardware providers, including D-Wave, IonQ, and Rigetti.[25]

- Google Quantum AI: Google also provides access to quantum computing resources, mainly for research and development projects. Their Cirq platform is a Python framework designed for creating, simulating, and running quantum circuits on Google Quantum processors.[26]

3.3 The Growth of Cloud-Based AI

AI techniques are increasingly utilised on cloud computing platforms to provide additional value. SaaS companies have integrated AI technologies into comprehensive software packages to enhance functionality for end-users.[27] In 2019, a study projected an uptick in the adoption of cloud-based AI software and services by companies. It anticipated that among AI adopters, 70 percent would acquire AI capabilities through cloud-based enterprise software, while 65 percent would develop AI applications using cloud-based development services.[28] The study suggested that the cloud would propel more comprehensive AI implementations, improved return on investment (ROI) from AI initiatives, and increased spending on AI. AI’s initial expansion has come through many large American and Chinese technology companies (Alphabet (Google), Alibaba, Amazon, Baidu, Facebook, Microsoft, Netflix, and Tencent) who already had the required technical expertise, strong IT infrastructure, and deep pockets to acquire scarce and costly data science skills. Moreover, large investments have also gone into infrastructure, including massive data centres and specialised processors.[29] The incorporation of AI in cloud computing thus represents a merger between cloud computing capabilities and artificial intelligence systems, which allows for enabling intuitive, interconnected experiences for applications and operations.[30]

To understand cloud as an AI component, we highlight a few cloud-based services that have emerged as leads to incorporate AI in software applications:

- Azure AI: Microsoft has designed this platform to create intelligent, cutting edge and market ready applications with APIs and models (natural language processing, monitoring, decision making). [31]

- AWS AI Services: The platform allows the integration of applications through deep learning technology and machine learning services.[32]

- Google Cloud AI: Google has unified its UI and APIS under the Vertex AI banner and launched TensorFlow to integrate with other Google services and allow the testing of new models and applications.[33]

- IBM Watson Studio: The applications run on IBM Cloud Pak for data to provide range of AI and ML services, and SaaS and on-premise configurations.[34]

- Oracle Cloud Infrastructure AI Services – The platform includes OCI Generative AI, and services with prebuilt machine learning models to apply AI to business operations and applications.[35]

It seems clear that US-based companies’ early and substantial investments in digital infrastructure, alongside a strong commitment to research and development, have set the stage for their current leadership positions. The foundation laid by these investments has not only fostered an environment conducive to innovation but has also created a momentum that is difficult for competitors to match. This has been further supported by the US’s large, unified market and a regulatory environment that has traditionally favoured technological innovation and entrepreneurship, cementing the country’s position at the forefront of the global ICT industry.

By contrast, the investment by European companies and governments have been comparatively smaller. Despite notable strengths in certain technology sectors and regions within Europe, the early and comprehensive push by US firms into cloud services, backed by significant R&D spending and supportive ecosystems in Silicon Valley and beyond, has given them a considerable edge. Accounting for path dependencies in investments in the ICT industry, we analyse the amount of annual capital expenditure investments and R&D expenditure for the period 2005 to 2022 (the most recent year in our dataset).

We consider the proportion of capital dedicated to ICT and cloud solutions, and the intensity of investments across different R&D categories. Several assumptions regarding the allocation of CapEx to advanced ICT and cloud infrastructure, as well as the calculation of R&D spending as a multiple of CapEx, underpin our comparative analysis. As concerns R&D spending over the period 2005 to 2022, companies do not always report the amount of R&D made in a certain period. To get a rough insight into the size of R&D expenditure across companies, we calculated the percentage share of R&D spending in total capital expenditure derived from observations in our data set. For the total average of observations, average R&D spending is 161 percent of CapEx. This means that on average, the companies in our dataset are spending significantly more on R&D than on CapEx.[36] Based on this share, we estimate the investments in R&D and the companies’ total investment.

Moreover, US-5 companies are assumed to have channelled 90 percent of their CapEx into ICT infrastructure and cloud solutions, amounting to USD 597 billion.[37] Conversely, EU-12 companies are assumed to have allocated only 10 percent of their CapEx to ICT and cloud infrastructure and solutions, totalling USD 83 billion.[38] This stark difference highlights the greater emphasis US technology companies’ place on ICT and cloud infrastructure.

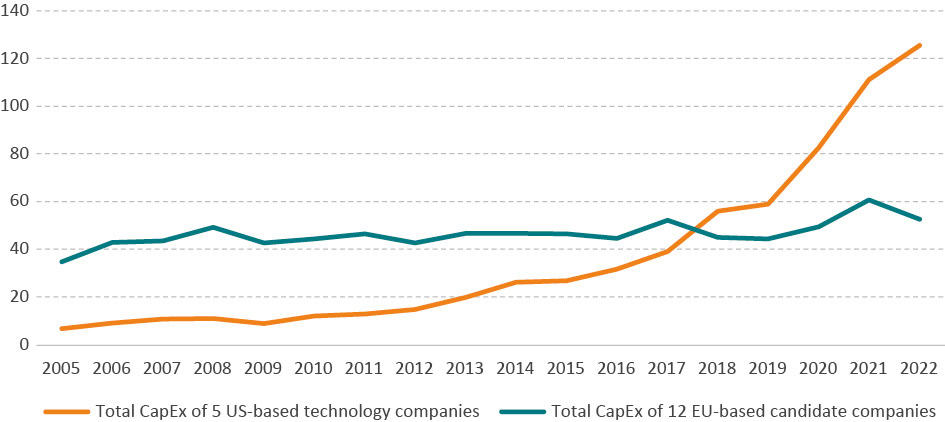

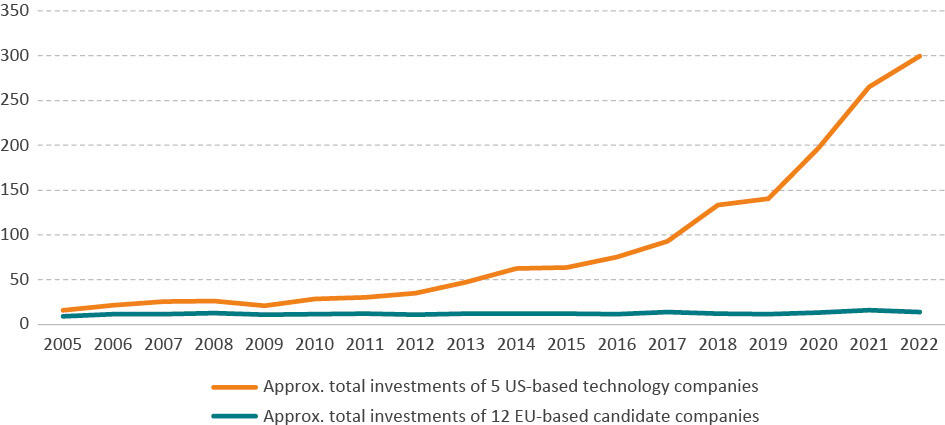

Over the period 2005 to 2022, CapEx infrastructure investments of the 5 US-headquartered technology companies have demonstrated a pronounced growth from USD 6.7 billion in 2005 to an impressive USD 126 billion in 2022, showcasing a consistent and notable upward trajectory (see Figure 1).[39] On the other hand, the 12 EU-headquartered candidate companies commenced with a significantly higher CapEx of USD 35 billion in 2005, but their investment levels have shown relative stagnation, with periodic fluctuations and a decline to USD 53 billion in 2022. It is particularly noteworthy that the CapEx for EU firms was greater than that of their US counterparts until 2016, after which the US companies rapidly surged ahead, surpassing the EU group by a considerable margin. This divergence indicates vastly differing approaches in investment strategies, emphasis on innovation, or disparities in capital accessibility, potentially impacting their competitive standing within the international technology market.

Figure 1: Development of CapEx investments, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022

Source: own calculations based on annual reports.

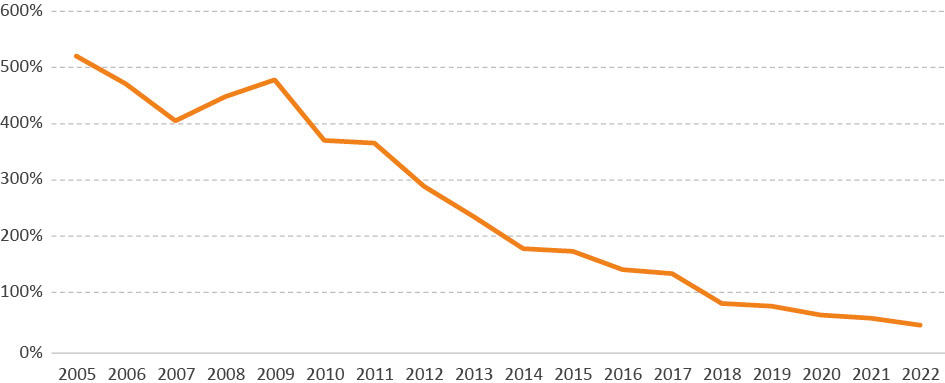

In 2005, the EU-12’s CapEx was 520 percent of the US-5’s CapEx, indicating that the EU technology companies were initially investing significantly more in capital expenditures than their US counterparts (see Figure 2). However, there has been a steady and sharp decline in this ratio over the years. By 2022, the EU-12’s share in US-5 capital expenditure had dropped to just 42 percent of the US-5’s CapEx. This decline from a dominant position to less than half of the US-5’s expenditure demonstrates the widening gap in the capacity for innovation and expansion between the two groups, which on aggregate impacted the EU’s ability to compete in the global ICT market.

Figure 2: Development of relative share in total CapEx investments, 12 EU-headquartered candidate companies in 5 US-headquartered technology companies, 2005 to 2022

Source: own calculations based on annual reports.

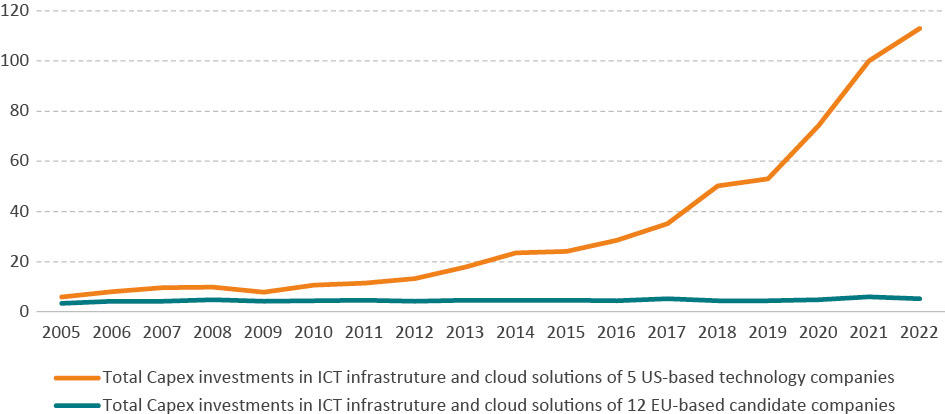

As concerns the estimated CapEx in ICT infrastructure and cloud solutions, the US-based companies have shown a robust growth from USD 6 billion in 2005 to a peak of USD 113 billion in 2022 (see Figure 3). This represents a near nineteen-fold increase, with particularly steep growth from 2018 onwards.[40] Conversely, EU-based companies’ estimated CapEx investments in ICT infrastructure and cloud solutions have remained relatively flat, starting at an estimated USD 3.5 billion in 2005 and showing a slight increase to USD 5.3 billion by 2022.

These estimates underscore the vast divergence in investment magnitude and growth trends between the US and EU companies, with the US showing substantial investment in ICT infrastructure and cloud solutions, while EU investments have been comparatively low, indicating different investment priorities and potential challenges for EU companies in matching the scale and growth of US companies in these technological sectors.

Figure 3: Development of estimated CapEx in ICT infrastructure and cloud solutions, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022, in USD billion

Source: own calculations based on annual reports. Note: US companies are assumed to have channelled 90 percent of their CapEx into ICT infrastructure and cloud solutions, based on information in annual reports. Conversely, EU companies are estimated to allocate only 10 percent of their CapEx to these areas, based on an EU market share approximation.

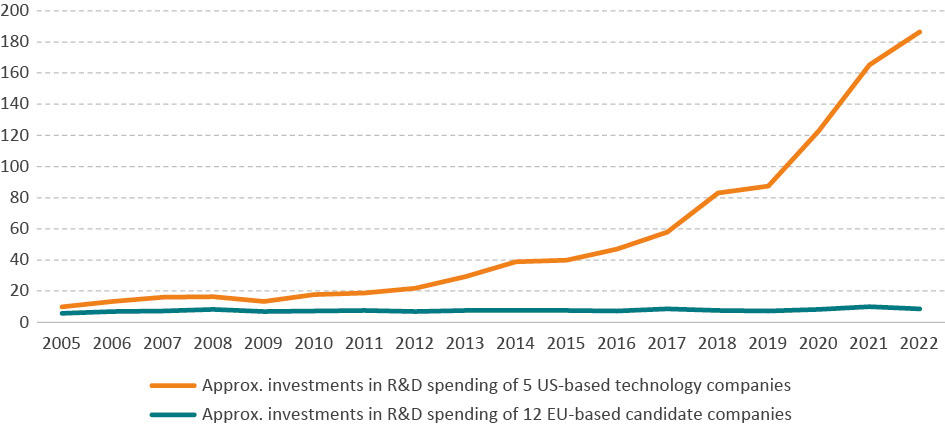

As concerns ICT and cloud related R&D spending, the US-5 companies show a clear upward trend in R&D spending (see Figure 4). This increase is especially notable from 2013 onwards, where investments more than doubled in less than a decade. In contrast, the EU-12 candidate companies show a relatively stable trend in R&D spending. There is no significant growth pattern observed, indicating a more consistent but limited investment in R&D compared to the US-5 companies. The stark difference between the two groups suggests a more aggressive R&D investment strategy by the 5 technology companies, which may reflect a sector that is rapidly innovating and expanding compared to the 12 EU-based companies.

Figure 4: Development of estimated ICT- and cloud-related R&D spending, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022, in USD billion

Source: own estimations based on annual reports. Note: we calculated the percentage share of R&D spending in total capital expenditure derived from the total of observations in our data set. The applied average R&D spending is 165 percent of CapEx.

For the 5 US-based companies, there is a significant upward trajectory in total estimated ICT- and cloud-related investments, starting at USD 16 billion in 2005 and escalating to an estimated USD 299 billion by 2022 (the actual reported amount is USD 277 billion for 2022). The growth is relatively steady, with a notable surge from USD 93 billion in 2017 to nearly three-times the amount in 2022. In contrast, the EU-based companies demonstrate a much more modest investment pattern over the same period. Beginning at USD 9.2 billion, the investments hover around the USD 11 to USD 13 billion mark for most of the observed period, with a slight peak at USD 16 billion in 2022 (see Figure 5).

Figure 5: Development of total ICT- and cloud-related investments, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022, in USD billion

Source: own estimations based on annual reports. Note: For the share of R&D spending in total investments, we calculated the percentage share of R&D spending in total capital expenditure derived from the total of observations in our data set. The applied average R&D spending is 165 percent of CapEx.

For the overall period 2005 to 2022, the total capital expenditure for the 5 US-based companies is at USD 664 billion, while for the EU-based companies, it is significantly higher at USD 835 billion. However, when we look at the estimated investments in ICT infrastructure and cloud solutions, the US-based companies have invested a substantial USD 597 billion, compared to only USD 83 billion by the EU-based companies. A similar trend is observed in R&D spending, with the US companies investing USD 986 billion, which is vastly greater than the USD 138 billion invested by the EU companies.

Overall, the total approximate investments of the US-5 companies amount to USD 1,583 billion, which dwarfs the USD 221 billion invested by the EU-12 companies. This data suggests that while many EU technology companies have a higher capital expenditure, the leading US ICT and cloud services companies have heavily prioritised investments in ICT and cloud solutions, as well as R&D, which reflects the strategic focus on ICT innovation and technology development.

The overall amount of investment over the period of 2005 to 2022 underscores the considerable difference in investment priorities between US-based and EU-based tech companies, with the US firms showing a heavier investment in both ICT infrastructure and ICT-related R&D. It should be noted that the assumptions applied in the analysis lead to differences in total ICT investments and investments in cloud solutions of differing magnitude. Total investment estimates are affected by the R&D multipliers derived from historical data, which may not accurately represent the companies’ future strategic directions or adaptability to market changes.

Figure 6: Development of total ICT- and cloud-related investments, 5 US-headquartered technology companies vs. 12 EU-headquartered candidate companies, 2005 to 2022, in USD billion

Source: own calculations based on companies’ annual reports.

The comparison of historical investment gaps between the EU and the US from 2005 to 2022 highlights a substantial disadvantage for European companies, with a deficit of USD 1.36 trillion in ICT and cloud-related investments compared to their US counterparts. This gap poses a significant challenge for European entities aiming to catch up, particularly considering the substantial advantage enjoyed by US companies, which continue to grow rapidly.

To bridge this gap by 2030, 2040, and 2050, European companies would need to significantly increase their investments annually. Considering the EU’s GDP at approximately USD 19.35 trillion and the global GDP around USD 88 trillion, the EU’s share of the global market stands at roughly 22 percent based on GDP. Applying this proportion to the projected US investments to serve the global market, we can roughly estimate the adjusted investment needs for EU companies to adequately serve the EU market. The underlying estimations are explained in Annex I.

By 2030, EU companies would need to increase investments by approximately USD 157 billion annually. By 2040, this would rise to around USD 349 billion, and by 2050, it would reach approximately USD 1.2 trillion. Expressed as percentages of the EU’s GDP, these adjusted annual increases in investments by “native” EU companies would need to be approximately 0.8 percent by 2030, 1.8 percent by 2040, and 6.4 percent by 2050.

These percentages indicate the substantial allocation of resources required annually to match the scale of US companies’ investments, adjusted for the EU’s share of the global market. Comparing these investment needs to sectors like knowledge-intensive manufacturing or tech-intensive services, even a 0.8 percent GDP annual investment can be significant. By 2050, the higher figure of 6.4 percent would represent a substantial increase, surpassing current investment levels in key sectors within the EU.

Considering the EU’s comparatively low starting point and the ongoing growth of US companies, catching up becomes even more challenging. EU companies would need to make substantial investments just to serve the EU market adequately, with annual increases ranging from approximately USD 157 billion to USD 1.2 trillion.

It should be noted that in December 2023, the European Commission approved – only – up to EUR 1.2 billion of state aid over the period of eight years to support R&D in cloud and edge computing.[41] However, as per a recent study, this is equal to about 4 percent of Amazon Web Services’ total investments in 2022 alone.[42]

[1] European Commission. Investing in Cloud, Edge and the Internet of Things. Available at: https://digital-strategy.ec.europa.eu/en/policies/iot-investing; Gartner (2023, November 9) Gartner Forecasts IT Spending in Europe to Record 9% Growth in 2024. Available at: https://www.gartner.com/en/newsroom/press-releases/2023-11-09-gartner-forecasts-it-spending-in-europe-to-record-9-percent-growth-in-2024

[2] Hodgson, C. (2023, November 5) Tech giants pour billions into cloud capacity in AI push. Financial Times. https://www.ft.com/content/f01529ad-88ca-456e-ad41-d6b7d449a409

[3] Evans, P. I., (2021) Hosted Edge vs Cloud: the battle for latency and security. CloudNative. Available at: https://www.cncf.io/blog/2021/12/08/hosted-edge-vs-cloud-the-battle-for-latency-and-security/

[4] White House. Research and Development. Available at: https://www.whitehouse.gov/wp-content/uploads/2022/04/ap_18_research_fy2023.pdf

[5] Bigelow, J. S. and Marko, K. (2022, November 15) The history of cloud computing explained. Techtarget. Available at: https://www.techtarget.com/whatis/feature/The-history-of-cloud-computing-explained

[6] AWS (2023, September 28) Overview of Amazon Web Services. Available at: https://docs.aws.amazon.com/whitepapers/latest/aws-overview/introduction.html

[7] Geeksforgeeks. What is Elastic Compute Cloud. Available at: https://www.geeksforgeeks.org/what-is-elastic-compute-cloud-ec2/

[8] GeeksforGeeks. Introduction to AWS Simple Storage. Available at: https://www.geeksforgeeks.org/introduction-to-aws-simple-storage-service-aws-s3/

[9] McDonald, P. (2008, April 7) Introducing Google App Engine + our new blog. Google. Available at: https://googleappengine.blogspot.com/2008/04/introducing-google-app-engine-our-new.html

[10] McAfee, A. (2010, December 15) 2010: The Year the Cloud Rolled In. HBR. Available at: https://hbr.org/2010/12/2010-the-year-the-cloud-rolled

[11] AWS. What is SaaS. Available at: https://aws.amazon.com/what-is/saas/

[12] Azure. What is IaaS. Available at: https://azure.microsoft.com/en-us/resources/cloud-computing-dictionary/what-is-iaas/; also see: Azure. What is PaaS. Available at: https://azure.microsoft.com/en-us/resources/cloud-computing-dictionary/what-is-paas/

[13] Google cloud. The new way to cloud starts here. Available at: https://cloud.google.com/

[14] Levite, E. A., and Kalwani, G. (2020) Cloud Governance Challenges: A Survey of Policy and Regulatory Issues. Available at: https://carnegieendowment.org/files/Levite_Kalwani_Cloud_Governance.pdf

[15] https://www.weforum.org/agenda/2021/04/future-remote-working-digital-learning-covid-19/

[16] Leap2 introduced a hybrid solver service designed to bring classical and quantum resources to enable rapid and accurate solve complex problems involving 10, 000 connected variables.

[17] D wave (2020, March 31) D-Wave Provides Free Quantum Cloud Access for Global Response to COVID-19. Available at: https://www.dwavesys.com/company/newsroom/press-release/d-wave-provides-free-quantum-cloud-access-for-global-response-to-covid-19/

[18] Brooks, M. (2023, January 6) What’s next for quantum computing. MIT Technology Review. Available at: https://www.technologyreview.com/2023/01/06/1066317/whats-next-for-quantum-computing/

[19] Sengupta, P. (2023, September 18) How does quantum computing in the cloud work? TechUK. Available at: https://www.techuk.org/resource/how-does-quantum-computing-in-the-cloud-work.html

[20] Mandelbaum, R. (2021, May 4) Five years ago today, we put the first quantum computer on the cloud. Here’s how we did it. IBM. Available at: https://research.ibm.com/blog/quantum-five-years

[21] Lawton, G. (2020, April 17) The future of quantum computing in the cloud. TechTarget. Available at: https://www.techtarget.com/searchcloudcomputing/tip/The-future-of-quantum-computing-in-the-cloud

[22] ICV TA&K (2024) A comparative analysis of Quantum Industry. available at: https://www.icvtank.com/newsinfo/908752.html

[23] IBM. What’s Next in Quantum is quantum-centric supercomputing. Available at: https://research.ibm.com/quantum-computing; IBM. Qiskit is the open-source toolkit for useful quantum. Available at: https://www.ibm.com/quantum/qiskit

[24] Azure. Azure Quantum Cloud Service. Available at: https://azure.microsoft.com/en-in/products/quantum#:~:text=Azure%20is%20the%20richest%20cloud,Send%20native%20circuits%20to%20QPUs.