EU Export of Regulatory Overreach: The Case of the Digital Markets Act (DMA)

Published By: Matthias Bauer Dyuti Pandya Vanika Sharma

Subjects: Digital Economy European Union

Summary

The EU’s Digital Markets Act (DMA) exemplifies the “Brussels Effect,” extending the EU’s regulatory influence beyond its borders and shaping global digital competition policies. While intended to curb the market power of large technology platforms and promote fair competition, its broad, rigid, and pre-emptive approach risks stifling technological development, deterring investment, and creating legal uncertainty, particularly in emerging markets still building digital infrastructure and seeking to attract foreign investment.

Large technology firms play a pivotal role in global economic development, driving innovation, infrastructure upgrading, and consumer welfare. However, increasing regulatory scrutiny, particularly under DMA-like frameworks, could inadvertently harm the very markets they help grow by imposing compliance burdens that hinder business expansion and technology diffusion. Countries with weaker institutions and regulatory capacity – such as India, Brazil, South Africa, and other emerging market and developing economies (EMDEs) like Indonesia – could face greater risks of regulatory capture, corruption, and enforcement challenges if they replicate the EU’s approach without adapting it to their economic realities (Section 2).

A key concern with the DMA is the departure from traditional case-by-case enforcement in competition policy, instead relying on broad, pre-emptive obligations based on ambiguous concepts such as fairness and contestability. This shift reduces legal certainty, increases the risk of inconsistent enforcement, and may inhibit dynamic competition, which is essential for innovation-driven sectors like fintech, e-commerce, ICT, and edtech. By prioritising static over dynamic competition, the DMA could impede technological progress, limiting consumer choice and long-term economic benefits (Section 3).

The global adoption of DMA-like regulations risks further regulatory fragmentation and may create unintended consequences, particularly in emerging economies where regulatory frameworks, institutional quality, and market structures differ significantly from the EU. Broad prohibitions on business practices, such as self-preferencing and data-sharing, could limit opportunities for local firms to scale internationally, weaken cybersecurity protections, and reduce incentives for large technology firms to invest in these regions (Section 4).

To ensure proportionate and effective competition enforcement, governments outside the EU should prioritise regulatory flexibility and case-by-case assessments over broad, static restrictions. OECD best practices on competition policy emphasise clear objectives, legal certainty, and regulatory proportionality, ensuring that competition enforcement supports, rather than stifles, innovation and investment (Section 5).

Moreover, the risks of corruption and regulatory overreach in developing countries make broad ex-ante regulations especially problematic. Excessive discretionary power granted to local authorities could increase the risk of politically motivated enforcement, deter foreign investment, and undermine long-term economic growth. A more effective approach would be to strengthen institutional frameworks, enhance transparency, and adopt supply-side policies that support technology neutrality, free trade, and economic freedom.

Key Policy Recommendations

To mitigate these risks, a smarter approach to digital market regulation is needed, balancing competition enforcement with innovation incentives.

- EU regulators should reassess the DMA’s rigid approach, reverting to case-by-case competition enforcement and aligning with OECD best practices to avoid legal uncertainty and overregulation.

- Globally, “outside-of-EU” regulators should adapt regulations to local market conditions, avoiding one-size-fits-all EU-style competition policies that may be ill-suited to emerging economies with different enforcement capabilities.

- Businesses should proactively engage in policy debates, highlighting their role in fostering innovation, economic growth, and technology diffusion while advocating for evidence-based competition policies.

- Civil society should promote regulatory transparency, supporting consumer welfare-driven policies and helping governments navigate competition enforcement without stifling market innovation. Civil society organisations should assist competition authorities by providing market knowledge, empirical research on consumer harm, and expert insights to improve regulatory decision-making.

By maintaining proportionate, targeted, and innovation-friendly competition policies, competition regulators can foster dynamic competition, ensure technological progress, and create a digital economy that benefits both businesses, consumers, and overall economic development.

1. The EU Digital Markets Act and the Risk of Global Regulatory Overreach

Over the past decade, large technology companies such as Alphabet (Google), Amazon, Meta, Apple, Microsoft, and Booking.com have significantly reshaped traditional markets by expanding their presence across multiple sectors.[1] These companies have played a pivotal role in democratising traditional industries, broadening consumer choices, and reducing operational costs. Their innovations have fostered a more competitive environment that benefits not only consumers but also the broader economy, driving growth and efficiency across various economic activities.

The Rising Influence of Major Technology Firms

As technology companies have grown, so too has their influence on the global economy. They now serve as crucial gateways to consumers, whereby third-party business can leverage new digital technologies to expand their reach and impact. However, this unprecedented growth has raised concerns among regulators and policymakers, who worry about the potential for these firms to exploit their dominant market positions.

Critics argue that the dominance of these firms could lead to anti-competitive behaviours, such as predatory pricing, exclusive agreements, and the elimination of rivals.[2] Companies may bundle innovative products across ecosystems, encouraging consumers to engage in multiple markets. Cross-market exclusivity agreements can further entrench users and developers, strengthening dominance across hardware, software, and services simultaneously. Regulators are particularly concerned about the extensive control these companies have over user data, which they fear could give firms an unfair advantage by allowing them to personalise services and target ads more effectively[3] than smaller businesses. Platforms often aggregate user data from one market (search/social media) to expand others (advertising, AI, or VR). This could create insurmountable barriers for new entrants lacking similar data troves and this data advantage, they argue, could deter competition and obstruct innovation.[4]

Myths and Realities of Market Disruption

While there is a growing political narrative that traditional industries are under threat from emerging technology companies, with disruptions occurring at an unprecedented pace, the reality is more nuanced. In 2020, 198 companies from the 1995 Fortune 500 list remained while 256 dropped off. Most of those that dropped off did so due to mergers, asset sales, or failing to meet size criteria – rather than being primarily impacted by digital disruption. Additionally, many of today’s leading tech giants, including Meta, Google, Netflix, and Tesla, were founded after 1995, underscoring that market shifts are driven by innovation and competition rather than disruption alone.[5] Meanwhile, new information technology solutions have boosted productivity in traditional industries, reshaping operations and competitiveness.[6]

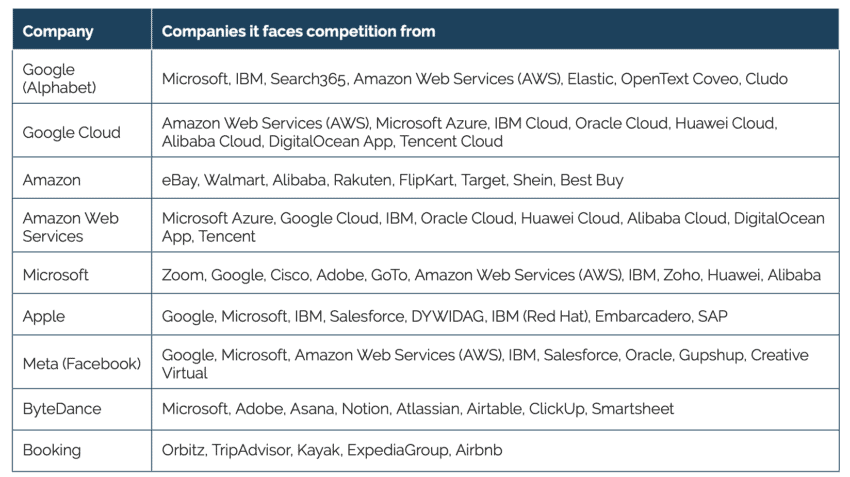

Disruption plays a crucial role in driving innovation in shaping industries, but rather than being a force that simply displaces established players, it acts as a catalyst for adaptation and growth, it actively challenges established norms, fostering competition and accelerates progress. Yet, even the largest digital companies must continuously develop long-term assets to stay ahead amid strong competition from both established firms and new entrants (see Table 1). Companies can respond to disruption by expanding their operations, pursuing acquisitions, or forming joint ventures, and the best strategies are either to counter it or leverage existing strengths. [7] [8] Regulatory concerns amid this often arise when these competitive advantages suggest imbalances that may put local competitors at a disadvantage, further shaping the evolving business landscape.

Table 1: “Gatekeeper companies”,[9] and potential competitors[10] Source: Gartner Peer Insights

Source: Gartner Peer Insights

Regulatory Responses and the Impact of the Digital Markets Act (DMA)

The EU, in response, has taken a proactive role in regulating competition within the digital sector. The EU introduced the Digital Markets Act (DMA),[11] a legislative framework designed to limit the dominance of large technology companies and promote fair competition. The DMA imposes specific obligations and prohibitions on a selected number of designated “gatekeeper” companies, aiming to prevent anti-competitive practices and ensure a level playing field.

The influence of the DMA has also extended beyond Europe, inspiring similar regulatory actions worldwide. Germany, for example, has integrated elements of the DMA into its national competition law through the German Digitalisation Act, also known as the tenth amendment of the GWB.[12] Similarly, the UK has launched the Digital Markets, Competition and Consumers Act (DMCC),[13] empowering the Competition and Markets Authority to oversee and regulate large tech platforms to ensure fair competition. In the US, lawmakers have proposed several legislative bills to address the dominance of large technology companies, including the American Innovation and Choice Online Act, Open Markets Act, State Antitrust Enforcement Venue Act of 2021, and the Ending Platform Monopolies Act.[14]

Global Influence and Risks of Regulatory Overreach

The EU frequently positions itself as a global leader in regulation, often claiming to set standards that inspire other jurisdictions to follow. However, the DMA’s interventionist approach – coupled with a static rather than dynamic view of competition and innovation – has set a precedent and encouraged other governments to adopt similarly restrictive policies.[15] These new regulations often target some of the world’s most innovative companies. Unfortunately, many of these restrictions are rooted in a populist rhetoric, tapping into the public sentiment that is increasingly afraid of free global trade and the operations of large foreign corporations.

Ex-ante competition regulation, exemplified by the DMA, risks being overly broad and heavy-handed, stifling innovation in rapidly changing tech markets.[16] By attempting to pre-empt corporate misbehaviour, policymakers assume a static view of competition, overlooking the dynamic and unpredictable nature of these markets. This approach risks imposing rigid regulatory burdens that may limit companies’ ability to innovate and adapt, which could ultimately harm the competitive landscape they aim to protect. Predicting future market behaviour in fast-evolving sectors is fraught with uncertainty, and the DMA’s sweeping measures could inadvertently stifle the very competition it seeks to foster.

Arguably, if a regulation is poorly designed and too restrictive, it will have a negative impact and harm economic activity in the domestic economy. Since digital innovation has set a positive precedent and benefited industries and productivity, governments must carefully balance ensuring competition and encouraging innovation and economic growth, especially in less developed economies.

In the following sections, we focus on aspects related to the quality of DMA (ex-ante) competition regulation and how poorly designed policies restricting the economic freedom of large technology companies can affect technology adoption and economic development.

Section 2 discusses the critical role of large technology companies in driving economic development and technological advancement. It explores how these companies influence markets, innovation, and consumer choice.

Section 3 delves into the EU’s DMA, examining the political motivations behind its creation and the quality of its regulatory design. It assesses how the DMA aims to address market dominance and promote fair competition.

Section 4 explores the global influence of the EU’s DMA. Many developing countries have implemented DMA-like regulation, while others are designing similar frameworks.

Section 5 offers concluding remarks, emphasising the importance of tailored regulatory approaches that balance market growth and innovation with robust and evidence-based competition enforcement.

[1] For example, Microsoft is supporting Epic in tackling healthcare industry challenges by implementing co-pilot solutions powered by Azure OpenAI services. Additionally, Microsoft is assisting Mercado Libre in streamlining code development using GitHub Copilot, aiming to expand access to e-commerce in Latin America. See: Microsoft (2023) Annual Report 2023. Available at: https://www.microsoft.com/investor/reports/ar23/; Likewise, Google is strengthening its presence in healthcare with innovations such as the Med-PaLM model and a new AI-powered search tool tailored for medical professionals. See: The Medical Futurist (2023) Google’s Masterplan for Healthcare. Available at: https://medicalfuturist.com/googles-masterplan-for-healthcare/

[2] Recital 46 of the European Parliament’s annual competition policy report, released by the Economic Affairs Committee, expresses concern that gatekeepers with a data advantage over competitors can achieve significant economies of scale, further distorting competition in digital markets and hindering innovation. See: European Parliament resolution of 16 January 2024 on competition policy – annual report 2023 (2023/2077(INI)). Available at: https://www.europarl.europa.eu/doceo/document/TA-9-2024-0011_EN.html.

[3] Ibid, MEPs, in their annual competition policy report, Recital 38, referenced the Meta v. Bundeskartellamt case, which confirms that national competition authorities can enforce data protection rules under antitrust law. The CJEU ruling highlights that personal data protection is a key factor in assessing abuse of dominance and imposes restrictions on the use of personal data for targeted advertising. Recital 39 of the report highlights the Bundeskartellamt v. Alphabet Inc. case, which led to improved data processing choices for Google users. It emphasises that EU consumers should have the right to decide whether their personal data is aggregated and processed across services. The report encourages the Commission to enhance coordination with national competition authorities to ensure effective enforcement of competition law alongside the DMA, particularly regarding its “further obligations.”

[4] Some argue that companies extract value from European consumers’ data while their business operations remain within the EU, effectively shifting value creation abroad. However, this claim is largely political rather than economically persuasive. Many EU industries—such as automotive, healthcare, pharmaceuticals, aerospace, and semiconductors—generate substantial value from activities outside the EU, while profits are often recorded at EU-based headquarters (and vice versa). This dynamic is not unique to the digital economy and does not necessarily underine European value creation.

[5] Birkinshaw, J. (2022, January) How Incumbents Survive and Thrive. Available at: https://hbr.org/2022/01/how-incumbents-survive-and-thrive.

[6] A McKinsey analysis shows high-performing IT operations drive 35% higher revenue growth and 10% higher profit margins. Many traditional firms enhance efficiency by leveraging external IT services, cloud adoption, and AI-driven automation. Companies prioritising cross-functional IT teams, low vendor reliance, and scalable cloud solutions outperform peers, proving technology is an enabler, not a disruptor. McKinsey (2024). How high performers optimize IT productivity for revenue growth: A leader’s guide. Available at https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/how-high-performers-optimize-it-productivity-for-revenue-growth-a-leaders-guide

[7] Between 2007 and 2018, Microsoft acquired aQuantive (2007), Skype (2011), Nokia’s mobile division (2014), LinkedIn (2016) and GitHub (2018), similarly, between 2006 and 2014, Google acquired YouTube (2006), DoubleClick (2008), Motorola Mobility (2012), and Nest Labs (2014). Additionally, Google acquired Looker later in 2019. See: Jones, K. (2019, October 11). The Big Five: Largest Acquisitions by Tech Company. Visual Capitalist. Available at: https://www.visualcapitalist.com/the-big-five-largest-acquisitions-by-tech-company/#google_vignette

[8] For example, IBM was once the leading manufacturer of computing machines, equipment, and mainframes. However, in the 1990s, it shifted its focus away from hardware, transitioning to software, IT consulting services, and computing research. see: CO. 13 Hugely Successful Companies That Reinvented Their Business. Available at: https://www.uschamber.com/co/good-company/growth-studio/successful-companies-that-reinvented-their-business

[9] The European Commission designated six gatekeepers – Alphabet, Amazon, Apple, ByteDance, Meta, Microsoft – under the Digital Markets Act (DMA). See: Gatekeepers. Available at: https://digital-markets-act.ec.europa.eu/gatekeepers_en

[10] Gartner. Google Alternatives. Available at: https://www.gartner.com/reviews/market/insight-engines/vendor/google?marketSeoName=insight-engines&vendorSeoName=google ; Gartner. Google Cloud Platform Alternatives. Available at: https://www.gartner.com/reviews/market/strategic-cloud-platform-services/vendor/google/product/google-cloud-platform/alternatives; AMZ Scout. Top Amazon Competitors You Need To Know About. Available at: https://amzscout.net/blog/amazon-competitors/; Gartner. Microsoft Alternatives: https://www.gartner.com/reviews/market/meeting-solutions/vendor/microsoft/alternatives; Gartner. Microsoft Azure Alternatives. Available at: https://www.gartner.com/reviews/market/strategic-cloud-platform-services/vendor/microsoft/product/azure/alternatives; Gartner. Apple Alternatives. Available at: https://www.gartner.com/reviews/market/application-development-integration-and-management-others/vendor/apple/alternatives; Gartner. Bytedance Alternatives. Available at: https://www.gartner.com/reviews/market/collaborative-work-management/vendor/bytedance/alternatives?marketSeoName=collaborative-work-management&vendorSeoName=bytedance ; Gartner. Facebook Alternatives. Available at: https://www.gartner.com/reviews/market/enterprise-conversational-ai-platforms/vendor/meta/alternatives; Craft. Bookings Alternatives. Available at: https://craft.co/bookingcom/competitors

[11] Regulation (EU) 2022/1925 of the European Parliament and of the Council of 14 September 2022 on contestable and fair markets in the digital sector and amending Directives (EU) 2019/1937 and (EU) 2020/1828 (Digital Markets Act).

[12] Bundeskartellamt (2021) Amendment of the German Act against Restraints of Competition. Available at: https://www.bundeskartellamt.de/SharedDocs/Meldung/EN/Pressemitteilungen/2021/19_01_2021_GWB%20Novelle.html.

[13] Digital Markets, Competition and Consumers Act 2024. Available at: https://www.legislation.gov.uk/ukpga/2024/13/pdfs/ukpga_20240013_en.pdf

[14] S.2992 – American Innovation and Choice Online Act 117th Congress (2021-2022); H.R.3825 – Ending Platform Monopolies Act117th Congress (2021-2022); H.R.3826 – Platform Competition and Opportunity Act of 2021117th Congress (2021-2022), S.2710 – Open App Markets Act 117th Congress (2021-2022), S.1787 – State Antitrust Enforcement Venue Act of 2021, and H.R.3849 – ACCESS Act of 2021117th Congress (2021-2022); also see: CRS. (2025). Technology Regulation: CRS Legal Products for the 119th Congress. Available at: https://crsreports.congress.gov/product/pdf/LSB/LSB11266

[15] ITIF (2021). The Digital Markets Act: European Precautionary Antitrust. Available at https://itif.org/publications/2021/05/24/digital-markets-act-european-precautionary-antitrust/. Also see ITIF (2022). Two meanings of dynamic competition. Available at https://itif.org/publications/2021/12/23/two-meanings-dynamic-competition/.

[16] ITIF. (2022). The Digital Markets Act: A Triumph of Regulation Over Innovation. Available at: https://itif.org/publications/2022/08/24/digital-markets-act-a-triumph-of-regulation-over-innovation/

2. The Role of Large Technology Companies in Economic Development

The growing influence of large technology firms, transforming the digital landscape is driven by three key factors: research and development (R&D), human capital, and infrastructure development. These elements collectively facilitate the integration of new technologies and the diffusion of innovation into the economy. By connecting people across markets, these companies not only innovate but also enhance social networking capabilities, streamline information flow, manage supply chains, and support knowledge production.[1] These contributions significantly amplify the value these firms create.[2]

The expansion of these companies into various sectors has further spurred innovation and increased consumer choices.[3] Their role can be understood within the broader context of societal shifts, where technology is increasingly seen as a solution to social, economic, political, and environmental challenges. This “technocratic power” is legitimised through two main principles: (a) the belief that technology is inherently democratic and supports individual autonomy, and (b) the mutually reinforcing relationship between platform economies and “neoliberal” economic logic. These factors have elevated the perceived legitimacy of large technology firms as critical actors in policymaking.[4]

Opportunities and Challenges in Less Economically Developed Countries

In economically less developed economies, rapid urbanisation and significant infrastructure and consumer spending present unique opportunities and challenges. While large technology companies can tap into these markets, they must navigate complex political and business environments often characterised by high volatility, corruption, bureaucratic inefficiencies, and interventionist regulations.

Developing countries face a significant technology gap, driven by unequal internet access, low patent registrations, and disparities in STEM education rankings.[5] Large multinational companies can play a crucial role in bridging this gap by providing cutting-edge technologies and enabling national firms in these countries to adopt and integrate these innovations, fostering technological advancement and reducing inequality. Large technology companies and the solutions they offer, e.g., online platforms, act as enablers, providing infrastructure, visibility, and access to large customer bases. According to the EU impact assessment (IA) study on the DMA, more than 50 percent of goods sold on marketplace platforms come from third-party sellers. Additionally, there are 26.4 million software developers who rely on these platforms for infrastructure and distribution of their apps (Recital 60 of the DMA IA). Large technology firms’ strong market positions allow them to create different ecosystems which are data-driven, allowing them to cross-subsidise on services with data or revenues from the other, and build a new corporate structure (Recital 35 of the DMA IA).[6]

Risks of Overregulation and the Importance of Maintaining Contestable Markets

Large technology companies, with an established online platform presence, have also emerged as significant economic players, boosting efficiency and increasing innovation through the development of new business models (Recital 25 of the DMA IA). These firms often reduce prices by scaling, innovating, and investing in digital technology, making it more accessible and affordable for adopting businesses and consumers alike.[7] Amazon serves as a prime example. While it has faced scrutiny for allegedly leveraging its dominance to disadvantage smaller sellers—a key competition concern—its vast marketplace has simultaneously expanded consumer choice by offering an unprecedented variety of products from numerous sellers. This illustrates the dual impact of scale: it can create substantial consumer value while also prompting regulatory debates over market fairness and competitive dynamics.

In economically less advanced countries, economic growth and structural economic renewal is often driven by increased scale and capital investment, which can lead to higher economic profits. Firms with high market shares, often referred to as “superstar” companies, particularly in high-value sectors, contribute significantly to economic growth.[8] These firms typically cluster in urban centres, creating competitive environments for high-skilled workers and generating substantial wealth for investors and property owners. This concentrated success often allows these companies to scale operations in other cities, building better infrastructure and enhancing connectivity.[9]

Setting specific thresholds to classify firms as dominant can have unintended consequences, potentially impacting domestically-led companies and their operations. Like in a small country, a domestic company might have a high market share locally but is small compared to international players. If the threshold is based on local market share, they get flagged as dominant and face regulations, which can impede their expansion and investments. Another possible angle is that stricter thresholds mean more companies have to comply with regulations which could come with significant administrative costs. Domestic companies especially in developing economies will not have the resources to handle, and this will lead to reduced competitiveness or even exiting the market. Thresholds might also not account for industry specifics, for example, tech companies vs. more traditional manufacturing industries. Domestic industries that are capital-intensive might be unfairly targeted. There is in fact little evidence which highlights that large technology firms are using market power to reduce output to achieve larger product returns. Evidence, however, suggests that large technology firms are typically more productive and innovative, investing in R&D and long-term strategies that maximise value. Therefore, the critical policy concern should not solely be the regulation of current market power, but also the need to maintain contestable markets that foster the creation of independent technologies in the future.[10]

[1] Nentwich, M.,& König, R. (2014). Academia goes Facebook? The potential of social network sites in the scholarly realm. Opening science: The evolving guide on how the internet is changing research, collaboration and scholarly publishing, 107-124.

[2] Kenney, M., & Zysman, J. (2019). “Work and value creation in the platform economy”. In Work and labor in the digital age (Vol. 33, pp. 13-41). Emerald Publishing Limited.

[3] ECIPE (2024). Enhancing Technology Diffusion in the EU amid Tough Structural Challenges. Available at https://ecipe.org/publications/enhancing-technology-diffusion-in-the-eu/.

[4] Sharon, T., & Gellert, R. (2023). Regulating Big Tech expansionism? Sphere transgressions and the limits of Europe’s digital regulatory strategy. Information, Communication & Society, 1–18. https://doi.org/10.1080/1369118X.2023.2246526. Also see: Ulnicane, I., & Erkkila, T. ̈ (2023). Politics and policy of Artifcial Intelligence. Review of Policy Research, 40(5), 612–625. https://doi.org/10.1111/ropr.12574

[5] See, e.g., ERIA (2022). The Technology Gap in the Developing World and the G20:

An Empirical Profile. Available at https://www.eria.org/uploads/media/Books/2022-G20-New-Normal-New-Technology-New-Financing/12_Ch.8-Technology-Gap-in-Developing-World-and-G20-NEW.pdf.

[6] European Commission. (2020). Impact Assessment Report Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on contestable and fair markets in the digital sector (Digital Markets Act) {COM (2020) 842 final} – {SEC(2020) 437 final} – {SWD(2020) 364 final} (Part 1).

[7] Conversable Economist. (2022). Some Economics of Dominant Superstar Firms. Available at: https://conversableeconomist.com/2022/11/23/some-economics-of-dominant-superstar-firms/.

[8] Note that superstar companies can include GAFAM and other firms with dominant market positions. The digital sector in each country is shaped by increasing returns to scale and network effects, leading competition policies to define gatekeepers differently. While GAFAM is often included, other firms may also fall under this designation, depending on the specific market dynamics and regulatory framework.

[9] Mckinsey (2018) What’s driving superstar companies, industries, and cities. Available at: https://www.mckinsey.com/mgi/overview/in-the-news/whats-driving-superstar-companies-industries-and-cities.

[10] Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2024). The rise of star firms: Intangible capital and competition. The Review of Financial Studies, 37(3), 882-949.

3. The EU DMA and the Quality of Regulatory Design

The regulation of online platforms remains a complex and evolving area, with different countries adopting diverse approaches to address political concerns about (alleged) anti-competitive behaviour.[1] The EU’s DMA represents a significant shift in how the European Commission and Member State authorities approach digital market regulation. Its broad scope, lack of clear definitions, and potential for overregulation raises concerns about its effectiveness and impact on innovation. It also risks misallocating regulatory resources and creating more legal uncertainty. It also risks misallocating regulatory resources and creating more legal uncertainty. To avoid unintended consequences, regulation must be clear, proportionate, and focused on genuinely improving market outcomes without stifling the dynamic competition that drives technological progress.

The DMA was designed to address market developments in the Europe, and its applicability in other jurisdictions remains untested. The digital landscape varies significantly across regions, and regulations that may suit the European market could obstruct competition in developing economies. Fragmentation in global competition policy and inconsistent regulatory approaches and interpretations will ultimately create legal uncertainties and barriers, harming both large technology firms and smaller platforms aspiring to scale towards international competitiveness and consumers who have become accustomed to the convenience and increased choices in products and services.[2]

While the DMA aims to enhance competition, concerns arise over its political motivations, deviation from case-by-case enforcement, and reliance on vague concepts like fairness and contestability, which may lead to inconsistent application. Its static approach may also hinder the dynamic competition that drives technological progress, raising questions about its long-term effectiveness. This section further explores these concerns and the broader implications of the DMA’s design on innovation, market contestability, and global regulatory trends.

Political Motivations behind the DMA

While the DMA is presented as a regulatory framework aimed at fostering fair competition and protecting consumer welfare, it is also driven by significant political motivations. For example, the reasoning outlined in the preamble illustrates that the push for regulations like the DMA is not purely about promoting fair competition and protecting consumers, but also about asserting political influence and control over global digital markets. Such motivations may lead to regulations that, while politically expedient, could impose unintended consequences on innovation, competition, and economic growth, particularly in regions outside of Europe where the digital landscape is markedly different.

The DMA represents a significant shift from traditional competition policy’s case-by-case approach to a broader, more pre-emptive regulatory framework. This change lowers the threshold for regulatory intervention by assessing the reasonableness of actions rather than requiring definitive proof of consumer harm. The DMA frequently uses terms like “fairness” and “market contestability,” but these concepts are often left vague, leading to potential overregulation and market distortion.

For instance, France’s digital specialist Philippe Latombe has explicitly stated, “France wants to move quickly. The faster we move, the less the US giants will be able to lobby,”[3] highlighting a clear intention to outpace the influence of large American technology companies rather than solely focusing on the merits of the regulation itself. This sentiment is echoed by France’s President Emmanuel Macron, who remarked, “When we know how to organise ourselves, we create standards on an international scale,”[4] indicating a strategic ambition for the EU to set global standards, potentially as a counterbalance to US dominance in the digital sector. Moreover, France’s economy minister Bruno Le Maire has characterised these large technology companies as “rivals of the states that do not respect our economic rules, which must therefore be regulated.”[5] This framing indicates that the DMA is not just seen as a tool for competition, but as a means of asserting political sovereignty over multinational digital firms.

Similarly, Germany’s State Secretary in charge of competition policy at the economy ministry, Sven Giegold, has called for additional resources for the European Commission, stating, “[t]he Commission needs additional resources for enforcement.”[6] This call underscores the political drive to strengthen the EU’s regulatory apparatus, ensuring that it has the capacity to enforce these new rules against powerful global tech firms.

Political Narrative vs. Consumer Perception

Despite the political and media rhetoric portraying large technology companies as harmful, many consumers perceive these companies more favourably and trust them.[7] Additionally, the critique of the Chicago School’s approach to antitrust, known as the “Chicago trap,” highlights how competition regimes can sometimes obscure the real needs of end users. While the Chicago School focuses on consumer welfare, this concept often becomes ambiguous, leading to a regulatory focus that supports business interests under the guise of promoting competition. Effective regulation, however, should assess how business practices impact consumer welfare, particularly in terms of prices, choices, and availability.[8]

Traditionally, competition regulation prioritised outcomes that benefits consumers by preserving competition among existing market players, and intervention was warranted when actions were identified that could significantly reduce competition. The shift from this approach has led to a broader more pre-emptive regulatory approach where instead of targeting specific actions, EU regulators are now setting industry wide standards and expectations. This approach changes the regulatory threshold, increasing regulatory discretion. Instead of requiring definitive proof of consumer harm, regulators are assessing the reasonableness of actions taken by companies, which lowers the original threshold and allows for more frequent regulatory intervention based on perceived risks than consumer harm. This expanded discretion introduces significant legal uncertainty, as companies face ambiguous compliance benchmarks and unpredictable enforcement timelines.

The EU’s impact assessment of the DMA states that high market concentration harms consumers by limiting choice and raising costs, citing lock-in effects and a lack of innovative alternatives (Recital 70 of the DMA IA).[9] However, the assessment does not provide empirical data to demonstrate these claims across different platform services. Competition can be improved when regulators focus on actual consumer experiences rather than preconceived assumptions about market dynamics.[10]

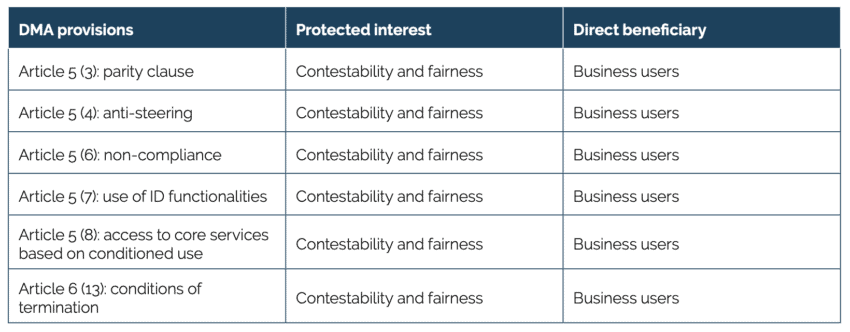

Overlap between Contestability and Fairness

The DMA frequently invokes the concepts of “fairness” and “contestability” as central justifications for its provisions. However, these terms are often used interchangeably and without clear definitions, leading to potential overlaps and ambiguities in the regulation’s application. Table 1 illustrates how various DMA provisions cite both “fairness” and “contestability” as protected interests, yet without distinguishing between the two or clarifying their specific relevance to different stakeholders. This overlap highlights the lack of precision in the regulatory language, which could result in inconsistent enforcement and unintended consequences for market dynamics.

The DMA links the concepts of contestability and fairness without clearly defining either. This lack of clarity can justify extensive regulatory intervention, potentially disrupting everyday business practices. The regulation presumes that the existing market outcomes are inherently unfair and seeks to rectify this through broad behavioural regulations on gatekeepers, which may not always align with the nuances of the digital economy.[11]

Table 2: Overlap of contestability and fairness in DMA Source: Colangelo, G. (2023).

Source: Colangelo, G. (2023).

Dynamic vs. Static Competition

Innovation fuels competition just as much as competition drives innovation – a dynamic the DMA risks overlooking by focusing too narrowly on static market conditions. By “static,” competition theory refers to policies that prioritise short-term welfare maximisation through pricing, output adjustments, and fixed-capacity strategies. It largely assumes that firms compete within established production frameworks, i.e., market stability and limited disruptive investment. This approach to competition treats innovation as an exception rather than the norm. In contrast, dynamic competition drives long-term market transformation through technological innovation. Firms do not merely compete for existing market share but seek to redefine markets entirely. Success depends on R&D, rapid iteration, and the ability to scale new ideas. Crucially, dynamic competition reshapes market leadership over time. Empirical studies show that tech-driven sectors experience faster turnover among dominant firms than traditional industries, underscoring the importance of innovation-led disruption.[12]

Digital platforms operate in a realm of dynamic competition, where technological advancements change production patterns and markets over time. Large technology companies often excel by introducing new products, services, and processes, contributing to a competitive landscape that is constantly evolving.[13] However, the DMA’s focus on static competition risks stifling the innovation that underpins the success of these platforms.

The dynamic approach to competition recognises efficiency not just in cost reductions but in “those contributions to consumer welfare which arise from the conception and introduction of new products, new services, and variations of products and services.”[14] The DMA’s static framework risks locking digital markets into their current state, prioritising short-term fairness and protecting smaller players at the cost of future breakthroughs. A truly dynamic competition policy would strike a reasonable balance – ensuring regulation fosters, rather than stifles, the creative destruction that fuels economic and technological progress. Policymakers, in the EU and elsewhere, should this ask themselves: Are we optimising for yesterday’s market or cultivating tomorrow’s?

Principles of Good Regulation

For regulation to be effective, it must adhere to principles of clarity, proportionality, and reliability. For instance, the OECD has set out new principles that better meet the needs of rapid digitalisation. These principles include measures to improve the quality of evidence, regular stakeholder engagement, international regulatory cooperation, and to help innovators navigate regulatory environments. They also stress the importance of outcome-focused measures to enable innovation and opportunities offered by digital technologies and data.[15] A similar set of recommendations have been developed by the World Economic Forum (WEF), making clear that “adapt and learn mechanisms” are centrally important for regulations to improve and avoid being a source of economic harm.[16] Essentially, the key factors that make a good regulation are clear policy objectives that solve a factual well-identified issue, clear compliance requirements, and proportionality and reliability.[17]

These principles are further outlined below:

Clear Objectives

Building on these principles, effective regulation must start with a clear and well-defined objective. Take, for example, the DMA’s Article 6(2), which vaguely prohibits gatekeepers from “using non-public data” without specifying what qualifies as non-public data, outlining exceptions for legitimate use, or clarifying how to distinguish between competing products. Such ambiguity weakens regulatory effectiveness and creates legal uncertainty.[18]

For regulation to achieve its intended goals, its objectives must be precise, actionable, and free of internal contradictions. A crucial distinction must be made between goals and objectives: goals are broad, long-term aspirations – such as protecting consumer choice in digital markets – while objectives are the specific, measurable steps required to achieve them. Without this clarity, regulatory measures risk being ineffective or even counterproductive.

The EU’s DMA has multiple objectives as well as numerous vague considerations, which can act as guidelines but lack specificity. They are also less rooted in traditional competition policy. For example, the DMA designates platforms as gatekeepers based on qualitative criteria like an “entrenched and durable position” (Recital 21 of the DMA IA), yet the standard method relies on quantitative metrics such as user numbers and turnover. This approach assumes that large digital platforms inherently possess concentrated market power and potential for abuse, which may not always be the case.[19] Pointed earlier in Table 1, even large platforms face fierce competition in specific segments or regions that can limit their abilities.[20] Amazon is strong in e-commerce in many countries globally but struggles in Southeast Asia (where Shopee/Lazada lead) and faces competition in cloud services (Microsoft Azure, Google Cloud). It is the case that platform dominance in one market does not guarantee power in another. DMA therefore risks oversimplifying by treating gatekeepers as monolithic entities.

The objective of fairness could be much better defined and the adequacy of intervention to foster competition as well as concepts and meanings of contestability in different contexts could be defined more precisely (Recital 31 of the DMA IA). Unless objectives can be given a clear meaning in a regulation, they are often not helpful for assessing the adequacy of the intervention and quality of a regulation. In the case of the DMA, its intervention is not explicitly linked to the specific market dynamics of digital platforms. As a result, there is a disconnect between the regulation’s stated objectives and its ability to effectively achieve them. This misalignment increases the risk of unintended consequences, such as overregulation, reduced innovation, or legal uncertainty for businesses.

Clear Compliance Requirements

For regulations to be effective, they must be clear and actionable. Ambiguity can lead to unintended economic harm, as businesses may hesitate to adopt new technologies or business models. While the DMA is broadly self-executing, its self-enforcing rules lack precision. For example, self-preferencing obligations are relatively clear when addressing the favourable ranking of a gatekeeper’s own product over third-party offerings. However, the broader application of “fair and non-discriminatory conditions” in rankings remains vague. Similarly, obligations related to data access, interoperability, and the regulation of emerging dominant platforms are unclear, leaving businesses uncertain about compliance.

Additionally, the rules also appear vague with respect to the obligation to “provide to any third-party providers of online search engines, upon their request, with access on fair, reasonable and non-discriminatory terms to ranking, query, click and view data in relation to free and paid search.” Other obligations that are not clear in scope include broad rules for the processing and combination of data, measures related to interoperability of ancillary services and switching, and measures imposed on platforms that are not gatekeepers but “risk” developing towards an “entrenched and durable position” in the market that could make them relevant for the DMA. It is not always clear to which products these obligations apply and how broad or narrow they are to be construed. The DMA, therefore, lacks guidance on how gatekeepers should comply with their obligations.

Proportionality and Unintended Consumer Harm

Regulation must be proportional and reliable to avoid stifling competitiveness and innovation.[21] The DMA imposes obligations that may be disproportionate, with costs that outweigh the benefits achieved. The lack of clarity on how remedies relate to abusive practices or consumer harm further complicates compliance.

Articles 5 and 6 of the DMA outline gatekeeper obligations, but these may be overly burdensome, potentially violating the principle of proportionality. Advocate General Giovanni Pitruzzella, for example, has expressed concerns about the DMA’s rigid approach, warning that it could hinder efficiency and impose undue limitations on business freedom.[22] A more balanced, case-by-case approach, as suggested by recent advice from the UK’s Digital Taskforce, could better serve the goals of competition and innovation.

One recent example of unintended consequences is the conflict between the DMA’s competition rules and cybersecurity protections. The requirement for mobile operating systems to allow unregulated external links (Article 5(4)) could undermine existing security frameworks, exposing users to increased malware risks. Recent enforcement actions have already led Apple to withhold certain AI-powered features and enhanced app security tools from the EU market, citing regulatory uncertainty. Similarly, Google’s (potentially) DMA-imposed compliance measures for Play Store link-outs would weaken its security protections, increasing risks for consumers and app developers. Apple also withheld new AI features in Europe, citing concerns that the DMA’s interoperability requirements could force compromises in user privacy and security. These cases highlight how the DMA’s one-size-fits-all approach to competition could create vulnerabilities in areas where security safeguards are essential. Ensuring regulatory proportionality means balancing competition objectives with broader policy priorities, including cybersecurity and consumer protection.[23]

[1] ICLE. (2024). Digital Competition Regulations Around the World. Available at: https://laweconcenter.org/spotlights/digital-competition-regulations-around-the-world/

[2] The impact assessment (Recital 66) acknowledges that gatekeepers benefit consumers by offering convenience and a wider selection of free online products and services. However, it also argues that this may ultimately reduce consumer choice by limiting the number of competing platforms. This presents an inherent contradiction: consumers prioritize efficiency, speed, and ease of use, making them more likely to trust and rely on established services. Additionally, transitioning away from an integrated ecosystem is costly and time-consuming, further incentivising consumers to stick with familiar platforms rather than seeking alternatives.

[3] Pollet, M. (2021) France to prioritise digital regulation, tech sovereignty during EU Council presidency. Euractiv. Available at: https://www.euractiv.com/section/digital/news/france-to-prioritise-digital-regulation-tech-sovereignty-during-eu-council-presidency/

[4] Ibid.

[5] Ibid.

[6] Chee, Y. F. (2024) Germany wants Big Tech to pay towards compliance costs of new digital law. Reuters. Available at: https://www.reuters.com/technology/germany-wants-big-tech-pay-towards-compliance-costs-new-digital-law-2024-02-29/.

[7] Houalla, H. (2023). Big Tech’s Free Online Services Aren’t Costing Consumers Their Privacy. ITIF. Available at: https://itif.org/publications/2023/09/20/big-techs-free-online-services-arent-costing-consumers-their-privacy/.

[8] Cseres, K. J. (2005). Competition law and consumer protection.

[9] European Commission. (2020). Impact Assessment Report Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on contestable and fair markets in the digital sector (Digital Markets Act) {COM(2020) 842 final} – {SEC(2020) 437 final} – {SWD(2020) 364 final} (Part 1).

[10] Akman, P. (2021). A web of paradoxes: empirical evidence on online platform users and implications for competition and regulation in digital markets. Va. L. & Bus. Rev., 16, 217.

[11] See, e.g., Colangelo, G. (2023). In Fairness We (Should Not) Trust: The Duplicity of the EU Competition Policy Mantra in Digital Markets. The Antitrust Bulletin, 68(4), 618-640. Note: The DMA incorporates the terms “fairness” and “market contestability” in its title, and both are frequently referenced throughout the text. According to Recital 16, the Commission attributes a lack of contestability to the unfair practices of gatekeepers. The DMA’s core objective is to ensure that markets dominated by large firms remain fair and contestable. However, the concept of fairness is inherently subjective, shaped by varying political, economic, and legal perspectives. This ambiguity allows for broad regulatory interpretations, potentially leading to increased market intervention that could disrupt standard business practices. Moreover, the distinction between fairness and contestability is often unclear, with significant overlap in their definitions.

[12] Petit, N., Schrepel, T., & Heiden, B. (2024). Situating The Dynamic Competition Approach. Dynamic Competition Initiative (DCI) Working Paper, 1-2024.

[13] Petit, N., & Teece, D. J. (2021). Innovating big tech firms and competition policy: favoring dynamic over static competition. Industrial and Corporate Change, 30(5), 1168-1198.

[14] Bork, R.H., 1978. The Antitrust Paradox. 1st ed. New York: Basic Books

[15] OECD (2021). Organisation for Economic Co-operation and Development, Recommendation of the Council for Agile Regulatory Governance to Harness Innovation, October 2021, https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0464.

[16] WEF (2021). Agile Regulation for the Fourth Industrial Revolution A Toolkit for Regulators, December 2020

[17] ECIPE (2022) The EU Digital Markets Act: Assessing the Quality of Regulation. Available at: https://ecipe.org/wp-content/uploads/2022/01/ECI_22_PolicyBrief-TheEuDigital_02_2022_LY03.pdf

[18] OECD (2012a). Organisation for Economic Co-operation and Development, “Recommendation of the Council on Regulatory Policy and Governance”, 2012, http:// www.oecd.org/gov/regulatory-policy/49990817.pdf; OECD (2021)(see note: 40) and WEF (2021) (see note: 41)

[19] ECIPE (2022) The EU Digital Markets Act: Assessing the Quality of Regulation. Available at: https://ecipe.org/wp-content/uploads/2022/01/ECI_22_PolicyBrief-TheEuDigital_02_2022_LY03.pdf. Akman, P. (2022). Regulating Competition in Digital Platform Markets: A Critical Assessment of the Framework and Approach of the EU Digital Markets Act. Available at https://eprints.whiterose.ac.uk/181328/7/Akman%2C%20DMA%2C%20ELR%201-12-21%2C%20SSRN.pdf. Also see Koerber, T. (2021). Lessons from the hare and the tortoise: Legally imposed self- regulation, proportionality and the right to defence under the DMA. NZKart 2021.

[20] HBR. (2022). Can Big Tech Be Disrupted? Available at: https://hbr.org/2022/01/can-big-tech-be-disrupted

[21] Butenko, A., & Larouche, P. (2015). Regulation for innovativeness or regulation of innovation? Law, Innovation and Technology, 7(1), 52-82.

[22] “Normally, in competition law, presumptions are rebuttable, and the party can also use the efficiency defence. Doing so, it is possible to strike a balance between the need of certainty and saving time in the administrative activity (which pushes in favour of the use of presumptions) and the need to avoid false positives in antitrust enforcement and undue limitations of fundamental rights (which pushes in favour of a case-by-case approach). At a first reading, the proposal of Regulation does not allow this kind of limitations in the use of the listed presumptions. The system is more rigid than the one envisaged in the recent advice published the 8th of December 2020 by the Digital Taskforce appointed by the CMA. I wonder whether too much rigidity could hinder efficiency and introduce a disproportioned limitation on the freedom to conduct a business” See Concurrences (2021).” Digital antitrust reforms in the EU and the US; What role for the courts?” Interview with Giovanni Pitruzzella (Advocate General, CJEU) by Jacquelyn MacLennan (Partner, White & Case), March 9, 2021, https://www.concurrences.com/IMG/pdf/_concurrences_interview_210309_ag_pitruzzella_.pdf?6653 1/05635b78f885ad338e6fc097642443b3f2d61a39.

[23] ECIPE (2025). The EU’s Digital Markets Act: A Gift to Hackers – and a Threat to Competition? Available at https://ecipe.org/blog/dma-gift-to-hackers-threat-to-competition/.

4. Global Influence of the EU Digital Markets Act: Adaptations outside the EU

The EU’s DMA has set a precedent in regulating large technology platforms, designating a broad range of large globally operating technology companies as gatekeepers.[1] These firms, along with their core platform services, are subject to very broad stringent regulations under the DMA.

The trend toward DMA-like regulations outside the EU reflects a shift from case-by-case antitrust enforcement to more sweeping, pre-emptive rules. However, these regulations may not be well-suited to the unique challenges and opportunities in these markets. Instead, government outside the EU should carefully evaluate the suitability of such regulatory models and consider alternative approaches that better align with their specific economic circumstances.

The Spread of DMA-Inspired Regulations

The influence of the DMA has extended far beyond Europe, prompting countries like India, South Africa, Brazil, and Indonesia to introduce or consider similar digital competition legislation. These emerging market economies, however, face unique challenges compared to their Western counterparts. Unlike mature economies, they are still striving to attract significant investments from technology firms, which are crucial for building the necessary infrastructure to support digital transformation.

Regulations modelled after the DMA could deter such investment, potentially weakening local firms and limiting their ability to compete against foreign tech giants. Previous estimates suggest that the DMA and Digital Services Act (DSA) alone can impose an additional EUR 71 billion (USD 75.9 billion) costs for businesses in Europe, and USD 97 billion in the US, assuming the DMA and DSA leads a 5 percent increase in technology spending by business customers of major digital service providers.[2] The global spread of competition policies modeled after the EU’s DMA has raised concerns that the DMA disproportionately targets the world’s leading US tech firms, potentially creating discriminatory effects.[3] This could inadvertently benefit Chinese tech giants such as Tencent, Alibaba, Huawei, Baidu, and Xiaomi, raising both economic and national security concerns.[4]

For example, South Africa plans to regulate its digital market, and may even end up targeting companies like Amazon, which has yet to fully enter the country.[5] The assumption that Amazon could disrupt local firms may discourage its entry, limiting consumer benefits. While these regulations may boost competition, they risk stifling innovation and investment. Beyond individual companies, stringent digital rules can deter broader market growth, especially in regions with less regulatory expertise. For example, India’s 2018 regulation requiring local storage of financial data shifted start-ups like Paytm and Razorpay away from disruptive technologies like blockchain, prioritising safer, incremental innovations instead. Overly strict enforcement can have a chilling effect on competition, discouraging firms from pursuing high market shares and dominant positions. This regulatory burden may ultimately shift business strategies toward safer, small-scale optimisations rather than bold, disruptive advancements.[6]

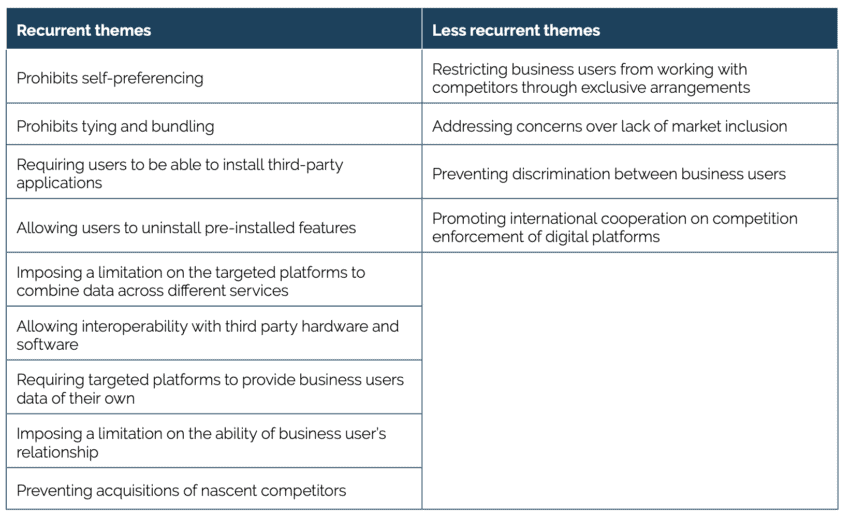

The Broader Implications of DMA-Like Regulations

The trend towards adopting DMA-like regulations outside the EU is indicative of a significant shift from traditional antitrust goals, which focus on maximising consumer welfare and protecting the competitive process. Table 1 outlines the key themes in DMA-like competition policies, showing that common measures include prohibiting self-preferencing, restricting tying and bundling, and requiring platforms to allow third-party applications and uninstalling pre-installed features. These policies also focus on data limitations, interoperability, and providing business users with their own data, alongside preventing early-stage acquisitions and imposing strict fines. Less common themes involve exclusive arrangements, inclusion concerns, discrimination between business users, and international cooperation on enforcement, which are addressed less frequently across different regulatory frameworks.

Table 3: Recurrent and less recurrent themes between DMA and DMA like proposed regulations Source: Suominen (2024).[7]

Source: Suominen (2024).[7]

Countries like India, which has already launched investigations against large digital firms like Amazon and Walmart’s Flipkart, illustrate further challenges of applying DMA-like regulations. These investigations, often motivated by the desire to protect local retailers, risk making the e-commerce market less efficient and more costly for consumers. The restrictions imposed on large e-commerce players, such as limitations on holding inventories and direct sales to customers, could result in a less dynamic and competitive market.[8]

Outside the EU, the proposed laws, initiatives and enquiries are also not clear in the definition of unallowed activities which may leave gaps for subjective determinations. These regulations, for example, impose data-sharing requirements on targeted firms, which raises concerns about data privacy. Ensuring that data-sharing practices align with existing data protection laws is crucial to maintain consumer trust and prevent potential misuse of personal information. These laws commonly seek to prevent platforms from favouring their own products, bundling services, and restricting users from uninstalling apps. They also often require platforms to support third-party apps and ensure compatibility with third-party hardware and software. While these regulations aim to foster fair competition, their broad scope and significant compliance requirements could present challenges, especially for developing economies that are selected for this study in particularly India, Brazil, and South Africa.

For instance, India’s draft Digital Competition Act (2024) identifies Systemically Significant Digital Enterprises (SSDEs) – those with a global turnover of at least USD 30 billion over three years. It prohibits self-preferencing, bundling, and mandates data-sharing.[9] The DCA’s objectives diverge from the traditional principles of competition law and consumer benefits. Divulging digital competition regulation from consumer interests is problematic, as it may create opportunities for regulatory rent-seeking, contrary to public expectations. Given the existing legal framework, digital platforms are already governed by competition law and sector-specific regulations. The Competition Commission of India (CCI) has already launched investigations against Google, Meta, and Apple for antitrust concerns, and with the introduction of the DCA, these companies now face the risk of overlapping or conflicting enforcement.[10]

In Brazil, a draft bill defines large digital platforms as those controlling essential access to users and earning at least R$70 million (USD 14 million) annually, with regulatory oversight by the National Telecommunications Agency. The bill’s minimum revenue threshold – is a mere R$70 million (approximately USD 14 million), making it applicable not only to major tech companies but also to companies with low revenues. Additionally, the legislation grants broad regulatory powers to Brazil’s National Telecommunications Agency (Anatel), allowing it to impose measures based on vague objectives.[11] Brazil’s existing Competition Law already provides effective tools for regulating digital markets, including commitments, competition remedies, and preventive measures to address potential issues and avoid market disruptions. Rather than introducing a new bill that increases costs for businesses, these existing mechanisms could be refined and strengthened.

South Africa has also initiated the Online Intermediation Platforms Market Inquiry, which classifies dominant platforms in their respective markets. The South African Competition Commission (SACC) takes its approach a step further by requiring targeted companies to support struggling competitors through product redesigns, free ad space, and training. This suggests that the SACC views large platforms as an inherent threat and believes pre-emptive regulations are necessary.[12]

Similarly, during a discussion in Jakarta, Indonesia’s Deputy Minister of Communication and Informatics emphasised the importance of the DMA and DSA as key references for shaping the country’s digital regulations. The Minister of Communication and Information had also stated that Indonesia had adopted parts of these frameworks into its approach to digital governance. In line with this, Indonesia’s antitrust agency recently fined Google USD 12.4 million for unfair practices related to the Play Store payment system. This action shows Indonesia’s commitment to regulating big tech, following the approach of other emerging economies. [13] It is also crucial to point that in these markets, enforcement capacity, digital infrastructure, and business resources are still much more limited compared to more economically developed countries, making compliance disproportionately burdensome. A careful, context-sensitive approach is essential to avoid placing undue strain on companies operating across multiple jurisdictions.

[1] European Commission (2024). Gatekeeper Designations. Available at https://digital-markets-act.ec.europa.eu/gatekeepers_en.

[2] Suominen. (2022). Implications of the European Union’s Digital Regulations on U.S. and EU Economic and Strategic Interests. Available at: https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/221122_EU_DigitalRegulations.pdf

[3] Suominen. (2024). The Spread of DMA-Like Competition Policies around the World. CSIS. Available at https://www.csis.org/analysis/spread-dma-competition-policies-around-world

[4] Ibid

[5] South Africa’s online intermediary inquiry states, “During the Inquiry rumours have persisted about the entry of Amazon. Whilst it has not entered South Africa, were it or any other large eCommerce player to do so, they will similarly be expected to comply with similar provisions as set out for Takealot.” See: Competition Commission. (2023). Online Intermediation Platforms Market Inquiry. Available at: https://www.compcom.co.za/wp-content/uploads/2023/07/CC_OIPMI-Final-Report.pdf

[6] Levine, R., Lin, C., Wei, L., & Xie, W. (2020). Competition laws and corporate innovation (No. w27253). National Bureau of Economic Research.

[7] Suominen (2024). The Spread of DMA-Like Competition Policies around the World. CSIS. Available at https://www.csis.org/analysis/spread-dma-competition-policies-around-world.

[8] Economic Times (2021). Inside Amazon’s secret strategy to dodge India e-commerce regulations. Available at: https://economictimes.indiatimes.com/tech/technology/amazon-documents-reveal-its-secret-strategy-to-dodge-india-regulators/articleshow/81059533.cms.

[9] Ministry of Corporate Affairs Government of India. (2024). Report of the Committee on Digital Competition Law. Annexure IV – Draft Digital Competition Bill 2024. Available at: https://www.mca.gov.in/bin/dms/getdocument?mds=gzGtvSkE3zIVhAuBe2pbow%253D%253D&type=open

[10] Auer, D., et al. (2024, April 22). ICLE Comments on India’s Draft Digital Competition Act. ICLE. Available at: https://laweconcenter.org/resources/icle-comments-on-indias-draft-digital-competition-act/; Press Release, (2022, October 20). CCI Imposes a Monetary Penalty of Rs.1337.76 Crore on Google for Anti-Competitive Practices in Relation to Android Mobile Devices, Competition Commission of India, Available at: https://www.cci.gov.in/antitrust/press-release/details/261/0; ET Staff Writer. (2022, September 28). HC Dismisses Facebook India’s Plea Challenging CCI Probe into Whatsapp’s 2021 Privacy Policy, The Economic Times. Available at: https://economictimes.indiatimes.com/tech/technology/women-participation-in-tech-roles-in-non-tech-sectors-to-grow-by-24-3-by-2027-report/articleshow/109374509.cms; Case No. 24 of 2021, Competition Commission of India, (Dec. 31, 2021), https://www.cci.gov.in/antitrust/orders/details/32/0

[11] Broadbent, M. and Strezewski, J. (2024, May 9). Brazil Considering New Digital Competition Legislation. CSIS. Available at; https://www.csis.org/analysis/brazil-considering-new-digital-competition-legislation; PL 2768/2022 of the Bill. Available at: https://www.camara.leg.br/proposicoesWeb/fichadetramitacao?idProposicao=2337417

[12] Competition Commission South Africa. (2022). Online intermediation platforms market inquiry. Available at: https://www.compcom.co.za/wp-content/uploads/2022/07/OIPMI-Provisional-Summary-Report.pdf; Radic, L and Manne, G. A. (2023, August 15). South Africa’s Competition Proposal Takes Europe’s DMA Model to the Extreme. Truth on the Market, Available at: https://truthonthemarket.com/2023/08/15/south-africas-competition-proposal-takes-europes-dma-model-to-the-extreme/

[13] Dharmaraj, S. (2024, October 10). Digital Governance: Indonesia Considers EU’s Regulatory Framework. OpenGov. Available at: https://opengovasia.com/2024/10/10/digital-governance-indonesia-considers-eus-regulatory-framework/#:~:text=He%20noted%20that%20Indonesia’s%20regulatory,and%20preparing%20for%20future%20challenges.; Reuters. (2025, January 22). Indonesia fines Google $12.4 million for unfair business practices. Available at: https://www.reuters.com/technology/indonesia-fines-google-12-million-unfair-business-practices-2025-01-21/

5. Implications for Digital Market Regulation outside the EU

The EU’s DMA exemplifies the “Brussels Effect,” where the EU extends its regulatory influence beyond its borders, setting a global benchmark that other jurisdictions may feel compelled to follow. By prioritising static market interventions over case-by-case enforcement, the DMA-like policies risk stifling innovation and deterring investment, potentially hindering the economic and technological development of emerging markets that rely on digital expansion and foreign investment.

Key Concerns with the DMA and Its Global Impact

Studies indicate that while competition enforcement can promote innovation, the strength of a jurisdiction’s enforcement of “abuse of dominance” rules does not necessarily correlate with increased innovation.[1] Overly strict enforcement may discourage firms from pursuing dominant positions, which are often necessary for achieving economies of scale and driving breakthrough innovation.[2] By imposing rigid constraints, regulators risk creating an environment where companies focus on compliance rather than technological advancements, ultimately slowing progress in digital markets.

Emerging markets face structural barriers that amplify the risks of transplanting EU-style regulatory frameworks, particularly those requiring complex enforcement mechanisms. Countries like India (63rd), South Africa (95th), and Brazil (124th) already ranked relatively low in the World Bank’s Ease of Doing Business Index 2020.[3] These countries operate in challenging institutional environments and the low rankings reflect systemic pain points such as bureaucratic inefficiencies, fragmented compliance systems, and limited administrative capacity.

Imposing expansive digital market regulations, onto these countries compounds two critical challenges. First, regulatory overload, imposing ex ante rules atop overburdened institutions could slow down decision-making and increase compliance costs disproportionately for smaller firms. Second, investment disincentives following these regulations create ambiguous regulatory thresholds and discretionary enforcement heightening perceived risk premiums. Overly prescriptive frameworks risk creating a compliance-centric ecosystem where domestic businesses are made to prioritise bureaucratic box-ticking over market-driven scaling – a dynamic at odds with the rapid iteration needed to compete in digital markets.

The above-mentioned challenges are further compounded by systemic vulnerabilities to regulatory capture and corruption. Emerging economies like India (96th on Competition Perception Index -CPI), South Africa (82nd), and Brazil (107th) exhibit weak institutional oversight, as reflected in their Corruption Perceptions Index rankings.[4] When layered atop pre-existing bureaucratic inefficiencies – evidenced by their Ease of Doing Business rankings DMA-style frameworks risk creating a perilous feedback loop. Granting discretionary powers to agencies invites two mutually reinforcing distortions. First, authority exploitation where ambiguities in ex-ante rules can be utilised for selective enforcement, privileging politically connected firms or foreign entities willing to pay compliance bribes. Second, market distrust, where businesses can face uncertainty and be forced to navigate opaque regulatory decisions, raising compliance costs. This cycle directly undermines the stated goals of competition policy: instead of levelling the playing field, arbitrary enforcement entrenches incumbents, deters scalability-focused investment, and diverts resources from innovation to rent-seeking.

When enforcement becomes discretionary rather than rules-based, large businesses can be deterred from entering or expanding in emerging economies, with negative consequences for the diffusion of technologies that are urgently needed in developing countries. Without sustained investment and technological transfer, these markets may struggle to develop critical digital infrastructure, limiting access to innovation-driven growth and reinforcing economic disparities. Introducing additional layers of rigid regulation may not enhance competition but instead reduce consumer welfare and distort market outcomes. Rather than imposing pre-emptive restrictions, policymakers should focus on refining existing competition laws through a case-by-case approach that balances enforcement with economic growth and innovation.

Recommendations

To foster truly competitive digital markets, regulation must be targeted, flexible, and evidence-based, rather than pre-emptive and rigid. Competition enforcement should be grounded in a case-by-case approach, allowing regulators to assess specific market dynamics, business practices, and potential consumer harm before imposing restrictions.

For lawmakers and competition regulators, a fundamental question remains: Are we fostering competition, or merely constraining the very companies that drive technology diffusion and adoption? The answer will shape the future of national economies, determining whether they continue to thrive as adopters of technological innovation or stagnate under potentially excessive competition policies.

As global discussions around digital market regulation evolve, different stakeholders – policymakers, regulators, businesses, and civil society – must take responsibility for ensuring that competition policies encourage innovation while addressing legitimate concerns about market power. Below, we provide specific recommendations for EU regulators, third-country regulators, businesses, and civil society on how to craft smarter, more effective competition policies.

For EU Regulators: Reassess the DMA’s Approach

- Shift back to case-by-case competition enforcement, rather than imposing vague ex-ante prescriptive or proscriptive rules that lack flexibility and hinder market adaptation.

- Ensure evidence-based intervention by allowing regulators to assess market dynamics on a case-by-case basis, rather than relying on blanket prohibitions.

- Strengthen institutional capacity for competition authorities and courts, e.g., units specialised on competition in technology markets, to conduct thorough investigations rather than applying rigid, pre-emptive regulations.

- Ensure alignment with OECD regulatory principles, focusing on proportionality, legal certainty, and economic impact assessments before imposing broad market restrictions. For example, self-preferencing bans should apply only if demonstrable harm to competitors exceeds a defined revenue threshold, preventing unnecessary regulatory burdens while maintaining fair competition.

For Outside-of-EU Regulators: Adapt Regulations to Local Market Realities

- Avoid copying the EU’s competition rulebook without considering local economic structures, enforcement capacity, and digital market maturity.

- Recognise the role of large technology companies in driving investment, fostering innovation, and developing digital infrastructure that might not otherwise emerge. Their scale and network effects typically enhance market efficiency, expand access to digital services, and boost productivity across industries.

- Improve legal conditions for investments in critical infrastructure (e.g., undersea cables, cloud clusters) to offset regulatory compliance costs – such as reporting, auditing, and operational adjustments – through investment credits or fee reductions, incentivising continued private-sector contributions to digital growth and economic competitiveness.

- Focus primarily on case-by-case enforcement rather than broad ex-ante regulatory mandates, ensuring that interventions are targeted, proportionate, and evidence-based.

- Improve regulatory efficiency by streamlining bureaucratic processes and ensuring transparent enforcement mechanisms to reduce risks of corruption and arbitrary decisions

For Businesses: Engage Proactively in Policy Debates

- Assist competition authorities by providing market knowledge, empirical research, and expert insights to improve regulatory decision-making.

- Advocate for consumer welfare-focused policies, ensuring that regulatory measures do not inadvertently lead to reduced access to services, higher costs, or slower innovation cycles.

- Push for greater regulatory transparency and accountability, reducing risks of regulatory capture and corruption, particularly in markets with weaker governance structures. Adopt ISO 37001 Anti-Bribery Certifications and require companies to disclose all government interactions in annual ESG reports, ensuring oversight and reinforcing ethical business practices.

For Civil Society: Support Evidence-Based Competition Enforcement

- Assist competition authorities by providing market knowledge, empirical research, and expert insights to improve regulatory decision-making.

- Assist competition authorities by providing market knowledge, empirical research, and expert insights to improve regulatory decision-making.

- Advocate for consumer welfare-focused policies, ensuring that regulatory measures do not inadvertently lead to reduced access to services, higher costs, or slower innovation cycles.

- Push for greater regulatory transparency and accountability, reducing risks of regulatory capture and corruption, particularly in markets with weaker governance structures.

[1] Levine, R., Lin, C., Wei, L., & Xie, W. (2020). Competition laws and corporate innovation (No. w27253). National Bureau of Economic Research.

[2] Shapiro, C., 2012. Competition and innovation: Did arrow hit the bull’s eye? In: Lerner J & Stern S (eds.) The rate and direction of inventive activity revisited. University of Chicago Press, pp. 361-404.

[3] World Bank. (2020). Doing Business Comparing Business Regulation in 190 Economies 2020. Available at: https://documents1.worldbank.org/curated/fr/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf

[4] Transparency International. Corruption Perceptions Index. Available at: https://www.transparency.org/en/cpi/2023

References

Auer, D., et al. (2024, April 22). ICLE Comments on India’s Draft Digital Competition Act. ICLE. Available at: https://laweconcenter.org/resources/icle-comments-on-indias-draft-digital-competition-act/

Akman, P. (2021). A web of paradoxes: empirical evidence on online platform users and implications for competition and regulation in digital markets. Va. L. & Bus. Rev., 16, 217

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2024). The rise of star firms: Intangible capital and competition. The Review of Financial Studies, 37(3), 882-949

AMZ Scout. Top Amazon Competitors You Need To Know About. Available at: https://amzscout.net/blog/amazon-competitors/

Birkinshaw, J. (2022, January) How Incumbents Survive and Thrive. Available at: https://hbr.org/2022/01/how-incumbents-survive-and-thrive.