Cooperation in Europe’s Digital Economy: How do Countries Position Themselves?

Published By: Fredrik Erixon Philipp Lamprecht

Subjects: Digital Economy European Union Five Freedoms

Summary

Members of the European Union have different positions on matters of digital openness, and those differences typically reflect how the digital sector sit in national economies and the relative size of digital endowments. In this paper, we work with three groups of countries – digital managerialists, digital frontrunners, and digital convergers. These groups have gradually emerged over time and they think differently about the politics of reforms to open the digital economcy to faster change. This paper lays a focus on their stances on digital-policy reform and on their own understanding of the costs and benefits of the growth of the digital economy. The paper also suggests new ways for countries to cooperate in current or new constellations, which will allow them to profit from other countries’ experiences, and to fully develop their own policy preferences as well as a clear understanding of appropriate digital reforms for them.

Digitisation has the potential to support growth in many different sectors and the growing digital economy will make positive contributions to the productivity of non-ICT sectors as well. This is especially true for the services sector. However, countries with smaller digital endowments (e.g. digital infrastructure like networks) often believes that they do not stand to profit as much from digitization as countries with bigger endowments. That is a profound misconception. Here, it is crucial to note that economic success in the digital economy is actually not merely the absolute level of digital endowments, but rather the way in which these endowments are effectively employed.

Reaping the rewards in the digital economy is based on an exchange that exploits the comparative advantages of countries and here, digital frontrunners, but also digital convergers, are performing well. Digital convergers are well established in international value chains and they create significant output from their digital endowments. They have an interest in improved regulatory conditions as a result of their trade and economic integration that is shared with frontier economies.

The future task for digital convergers lies in both increasing their output from accumulated digital capital via climbing the value chains of the digital economy, as well as increasing their digital endowments. In order to do so, digital convergers require better market conditions and increased investment in digital capacities and skills. The ability of digital convergers to profit from digital value chains also depends on their trading partners and on their proximity to these frontier economies. Digital convergers can thus profit from a more rapid pace of digital economy growth by tying themselves closer to frontrunner economies.

In addition, they can profit from the experience of digital frontrunners in developing their digital economies both for benefiting from lessons learned in their process of doing so, but also for further identifying and clarifying their own policy needs and position. Accordingly, this paper suggests that digital convergers could join more closely in cooperation with digital frontrunners and potentially form a D16 group to articulate their policies and priorities, and to devise strategies to shape EU digital policy.

Introduction

In this paper, we will examine how various countries in the European Union performs in various benchmarks of digital readiness and performance, and how groups of countries typically position themselves on issues regarding digital policy reform. There is a long history of analysis about why countries tend be more or less open to reforms that increases trade and competition. While there is a pattern throughout history that smaller countries generally are more open than larger countries, it is equally clear that the size of a country’s “endowments” – in this case, the relative size of digital endowments like digital infrastructure or digital human capital – informs choices of policy. In stylized terms, positions of openness tend to favour those factors of production that are in abundance – and harm production of factors that are scarce, and vice versa (Rogowski 1990). Following that logic, if data and digital endowments are considered factors of production, it should be natural that countries where the relative size of these factors are abundant (vis-à-vis other factors of production) are more open to digital competition and, in Europe, reforms that knock down barriers to a digital single market.

This approach holds in comparisons of how countries in Europe weigh up the costs and benefits of digital openness – although with some nuances. There is three categories of countries in the EU, and the positions of these groups often reflect which sectors that are influential in the respective economies, the policy tradition of economic openness, the relative size of their digital endowments. In this paper, we will work with these three groups: digital managerialists, digital frontrunners, and digital convergers. The focus is particularly on the latter two.

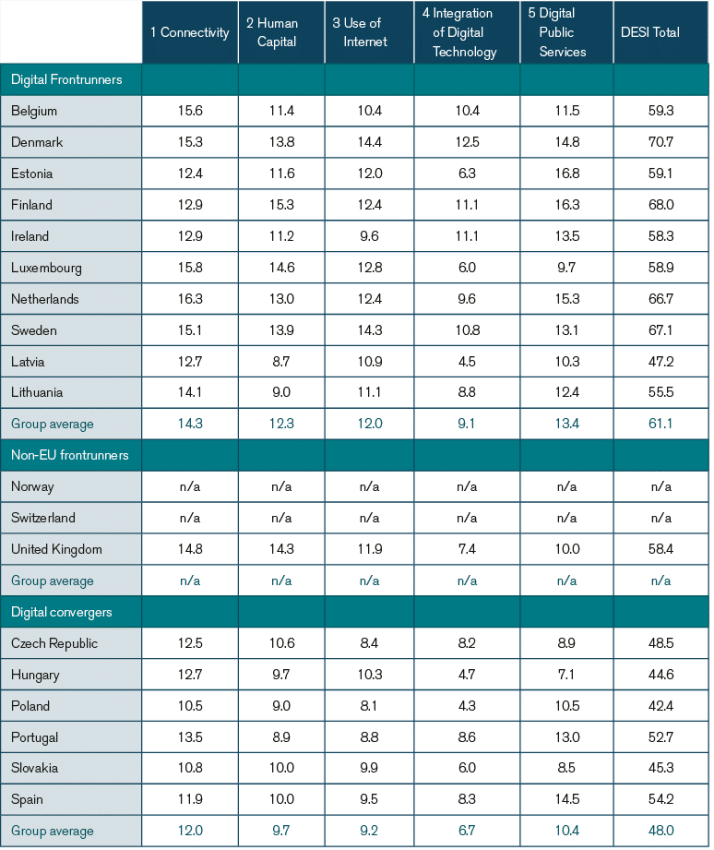

Table 1: Digital Frontrunners, Managerialists and Convergers in the Digital Economy and Society Index (DESI)

Source: European Commission

The first group, digital managerialists, is defined by its desire to balance a positive attitude to digital opportunities for societies with defensive economic interests that fear the competition that digitization encourage. Their digital endowments are comparably small. In addition, both attitudes are wrapped up in digital dirigisme, a general disposition and temperament supporting more rather than less regulation of the digital economy.

Members of the second group, digital frontrunners, are generally small and open economies that rely heavily on trade and that have high digital readiness, or endowments, defined by ICT infrastructure, digital skills, and digital use. This group tends to be on the side of the argument that favours deregulation rather than regulation of the digital economy – partly because of own economic interests; partly because of a political culture in those countries that embrace openness to new ideas, technology and societal change.

Finally, countries in the last group – digital convergers – are catching up on other EU members, in terms of both economic prosperity and digital performance. While their ICT infrastructure is generally good, these countries are still trailing others in digital skills – and, with substantial digital inequality, broad-based economic benefits from digitization are held back. Furthermore, a good part of their economy is based on the production of parts, components and services to multinational firms – and many digital convergers are uncertain about where in the digital value chain they stand and if greater openness to growth, competition and experimentation in the digital economy can allow them to climb that value chain at a faster rate.

While the policy character of these groups has gradually been articulated, it is less clear what two of the groups – the digital frontrunners and digital convergers – actually want to achieve in EU policy on the digital economy. It is obvious to any observer of digital politics where the source of resistance can be found and how the digital managerialists have maneuvered to slow down the pace of policy change.[1] It is equally obvious why some of the countries in this group feel that things should slow down: they are articulating the politics of defensive corporate interests that want more time to adjust to new technologies and patterns of digital competition, and their economies have smaller digital endowments.

However, it less obvious what the digital frontrunners are trying to achieve, other than a general stance in favour of openness. While they are clearly supportive of a policy that releases the forces of growth in the digital economy, they are seldom taking positions that stake out future ambitions or set a path for where Europe’s digital economy should go. Until recently, they have been somewhat hesitant to seek coalitions with other countries. Generally, their strategy seems to have been focused at supporting most initiatives launched by the European Commission. Similarly, it is unclear what the convergers want to achieve, other than general ambitions to expand their ICT capacity. On matters of EU-based market and regulatory policy for the digital economy, they are often sitting on the fence, without a clear idea of where their own economic interest lies. While they often go along with soft digital reforms, they do not seem to have a policy for how they want to use EU policy to support their digital growth. It is true that, as of late, several digital convergers have been warming up to the frontrunners, but it is not at all clear if this is a lasting development.

The purpose of the paper is to put light on the politics, economics and political economy of digital-economy reform in Europe – and to delineate what should be the policy positions of various groups of countries. The paper will consider their stances on digital-policy reform and suggest various ways for countries to work with each other in current or new constellations – all with the purpose of reinforcing the understanding of their costs and benefits of the growth of the digital economy, and what should be appropriate digital reforms for them.

While it gradually has become clear what digital managerialists fear, it is less obvious what digital frontrunners and digital convergers desire – or what they want from new policy at the European level. Frontrunners usually give their support to efforts by the European Commission to cut the barriers to digitization and digital commerce in Europe, but they seem to take for granted that most proposals conform to that agenda and that there is not a need to raise the level of ambition for what the EU should aim for and at what speed. Moreover, few of the frontrunners seem to have an idea of what defines a Digital Single Market and how current proposals score in that context. Importantly, digital frontrunners do not carry an idea for how their group could expand – and how they could join forces with digital convergers that aspire to become frontrunners.

In the next two chapters, we will examine how countries define (or not) their policy strategy and form coalitions in matters related to digital policy. While digital managerialists can exercise influence by virtue of their economic size (and voting power), digital frontrunners and digital convergers do not come with the same economic and political power, and consequently have a greater need for policy collaboration. The question is – are they acknowledging that need for greater collaboration and, if not, what should they do about it?

These chapters address two essential questions. First, they aim at answering why certain countries form coalitions in matters related to digital policy? What is the purpose of forming such coalitions for the countries involved in them? Second, they address the question of how different groups of countries can make use of such coalitions and related initiatives to exert influence and to promote their interests regarding digital policy. These questions are relevant both for the group of digital frontrunners as well as for the digital convergers. The analysis of these questions for both of these groups is structured in two parts: narrative and initiative. It firstly focuses on the narrative of the country groups, how they are positioned within the digital economy of Europe and how they could benefit from greater integration in and openness towards it. Secondly, it drafts ideas for specific initiatives and forms of collaboration going forward.

[1] Digital managerialists have, for example, supported platform regulation and the breakup of US tech firms, and they have been skeptical of – if not hostile to – digital single-market reforms like the free flow of data. They are also hesitant about creating a single market for services in Europe that would allow for more digital competition in non-digital sectors.

Endowments and Performance by Convergers and Frontrunners

Let us start by looking closer at endowments. There is one aspect where digital convergers differ from frontrunners: their digital endowments are smaller. Consequently, a key ambition for increasing the growth potential of the digital economy in converging countries is to expand their network capacity and their digital human capital. However, lower levels of endowments do not mean that the economic benefits of digitization are in doubt. Their lower level of digital endowments is often translated, also within the countries in question themselves, into a perception that they have a low ability to profit from opening up to the digital economy. Smaller endowments are often seen as reducing the competitiveness of these economies – and a reason to be hesitant about promises of growth to follow on the heels of digitization. However, that is a misreading of the economics of the digital economy. Endowments are only one side to the equation. What is key for economic success in the digital economy is actually not the total amount of digital endowments, but rather how the endowments are employed in the economy. Or to put it in different terms: how countries are using their comparative advantages.

Obviously, all countries cannot be at the top at the same time, but just because endowments are smaller does not mean that countries do not stand to benefit from new digital opportunities. Just like the entire economy, the patterns of rewards in the digital economy are based on exchange that exploits the comparative advantages of countries. And by that standard, both digital frontrunners and convergers are actually doing pretty well. To see how – and what different countries can do to improve their relative performance – let us consider the two different charts below.

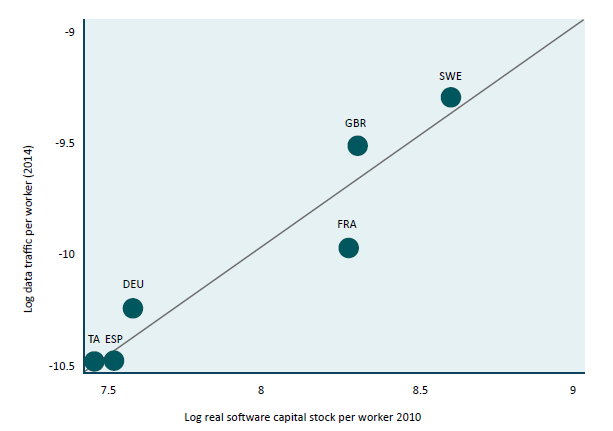

The first chart shows that countries do not need to be equally endowed with a stock of digital investments and capacities in order to reap positive economic benefits: what is more important is how the stock of endowments, in this case measured by software capital per worker, is used in order to generate output. Some countries have built up a very large stock of data or computerized information – in the digital economy, this is a good benchmark of digital endowments – and, as can be seen, frontrunner countries like Sweden and the United Kingdom are well ahead of other countries. The size of the endowment – measured on the x-axis – does not say anything about whether Sweden and the UK are performing well, if they are utilizing that endowment or if there is a lot of underemployed capacities in the economy. The important metric is how close they are to the mean or fitted-values line, which measures how they – relative to other countries – are embedding their data endowment in the economy, in this case a measure of output like data traffic per worker (the y-axis). The conclusion is that countries above the line are, relative to others, using their digital endowments more and that for every unit of software capital added to the endowments, more data traffic is generated than in other countries. Just like with other investments in endowments, output is not generated just by adding more endowments – and the real key to economic success is to improve the utilization of the stock of capital that exists.

Chart 1: Real Software Stock per Worker (2010) and Data Traffic per Worker (2014)

Source: ECIPE calculations based on van der Marel (2016). Data does not exist for other EU countries.

Source: ECIPE calculations based on van der Marel (2016). Data does not exist for other EU countries.

Using the same concept of performance relative to others, is there a way to get a sense of what factors that are preventing countries from better exploiting their digital endowments? France and Germany are the two leading digital managerialists in Europe. What sets them apart from the rest of the EU is not poor digital endowments – but the restrictions that hold back the exploitation of the endowment. In Germany, for example, policy initiatives are currently lacking a focus on removing obstacles and creating incentives for businesses to make use of these endowments. However, such increased usage of digital endowments by businesses would be crucial for increasing the competitiveness of Germany’s economy in the future (Deringer, Erixon, Lamprecht and Van der Marel, 2017).

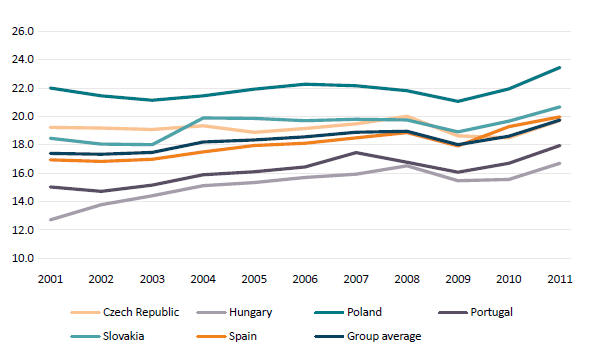

Another way of illustrating the same conclusion is to look at factors such as the position of countries within the value chains of the digital economy. In view of their endowments, digital convergers perform rather well as many of them are already plugged into the value chains of ICT manufacturing or ICT services such as back-office operations. Forward linkages, i.e. the domestic value added embodied in foreign exports, can be seen as a measure of integration into international supply chains. Chart 2 shows these linkages in international supply chains of digital convergers from 2001 to 2011. While their contributions to forward linkages were already significant in 2001, they have further increased in the case of all digital convergers. This shows that many of the convergers are generally creating more value-added in their economies by connecting their economies to the arteries of the value and supply chains of foreign companies. In other words, even if many countries in this group have few multinational companies that trade directly from their home country with the world, the countries have prospered by a smart use of endowments in international value chains. The same logic also applies to digital value chains.

Chart 2: Domestic Value Added Embodied in Foreign Exports as Share of Gross Exports for Digital Convergers, 2001 – 2011 (%)

Source: OECD

Digital convergers are already established in international value chains and, even if their endowments remain distant from the frontrunners, the output they create from current digital endowments is significant and contributes substantially to their economies. They are in competition with other economies in the world that have similar positions in international value chains and they are on a trend of fast acceleration of their digital competitiveness. This is illustrated, for example, by the fact that the digital economy has contributed to the centre of economic gravity shifting away from Europe to Southeast Asia in recent years. This trend is estimated to continue with the centre of economic gravity further shifting to the Asia-Pacific region in the next decades (Erixon, 2017).

Their shared interest in improved regulatory conditions for the digital economy is based on trade and economic integration, especially with frontier economies that have reasons to worry about regulations that are restricting output. In that way, the ability of many convergers to prosper in the digital value chain depends on the countries they trade with and their proximity to these frontier economies. Hence, it becomes clear that digital convergers can profit from a faster pace of digital economy growth by tying themselves closer to frontrunner economies. And in that way, the future shape of the digital economy in this group hangs together with the future of digital frontrunners: the more the latter group expands their digital economy, the greater the benefit will be for convergers that are integrated with them.

The integration of digital convergers into international value chains has further contributed to the openness of their economies. Their economies show a significant degree of openness which is comparable to that of digital frontrunners. As chart 3 below points out, the trade ratio of digital convergers is comparable with that of almost all digital frontrunners, and their average trade ratio is even higher than that of non-EU digital frontrunners. In other words, these are already economies for whom openness and linkages to other economies are crucially important. In that way, they are similar to the digital frontrunners. They are both damaged by digital restrictions that prevent these linkages to operate fully.

Chart 3: Trade ratio (Trade/GDP) of Digital Frontrunners (blue), non-EU Frontrunners (light blue) and Digital Convergers (yellow), 2015 (%)

The future task for digital convergers lies in both generating more output from their accumulated digital capital, through climbing the value chains of the digital economy, and expanding their digital endowments. To do so, they need better market conditions for the digital economy and more investment in digital capacities and skills. Better market conditions will enable them to exploit their comparative advantage in the sectors in which they are specialized. Indeed, better conditions are necessary for the efficient use of these countries’ accumulated digital capital, which in turn also incentivizes more investments.

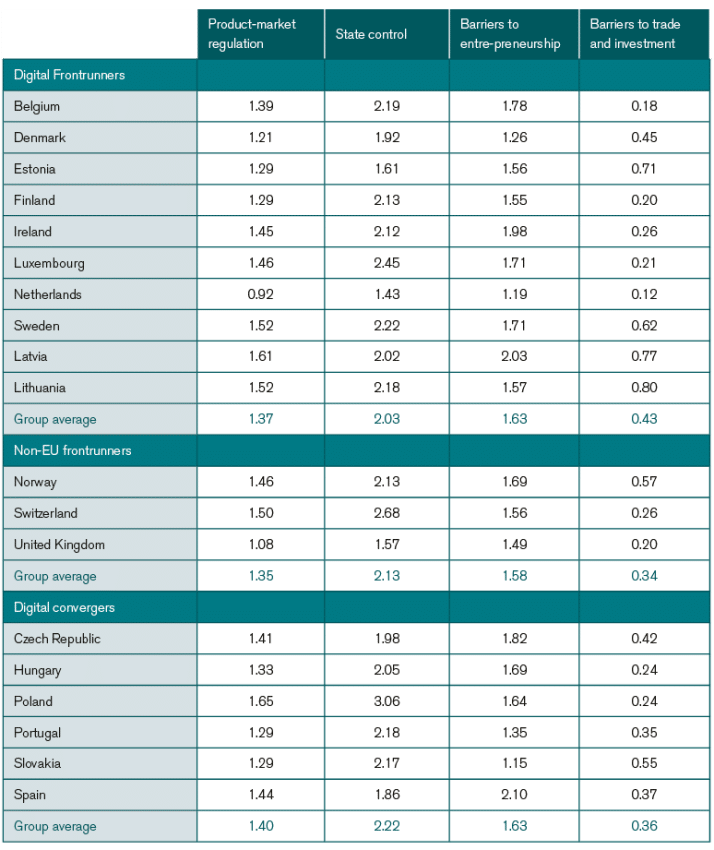

For digital frontrunners, the future challenge is more skewed towards improving market and regulatory conditions to allow for more output on the back of their digital endowments. Different aspects are important for achieving such improved market conditions. The overall reduction of the total number of product market regulations as well as reducing the restrictiveness of existing regulations are effective policy measures. Heterogeneous product market regulations across the economy prevent competition in the economy (Bauer & Erixon, 2016). This is especially true when it comes to the crucial role of non-digital sectors for the growth potential of the overall economy. Product market regulations prevent the use of ICT from entering into non-digital sectors, where it can especially result in efficiency gains and contribute to enhanced economic growth.

Table 2 outlines the product market regulation index with different indicators for digital frontrunners and digital convergers. Considering the overall product market regulation index value, the restrictions of digital convergers are on average still higher (index value of 1.4) than those of digital frontrunners (1.37) and non-EU frontrunners (1.35). This is especially true for the indicator of state control, where digital convergers on average score higher (2.22) than the group of digital frontrunners (2.03) and non-EU digital frontrunners (2.13). These stronger existing barriers again illustrate the potential for digital convergers not only to profit from further openness to the digital economy in the future, but indeed to profit from it to a larger extent and at a faster rate than digital frontrunners.

Table 2: Product Market Regulation Index, 2013

Existing product-market regulations prevent competition from improving the use of ICT into these non-digital sectors. This is particularly true for the services sectors. For example, especially digital-intensive services such as telecommunications and computer services, but also business services, are important input services for industries. They are crucial for generating productivity and increasing competitiveness. Both direct and indirect value added of such digital services plays an important role for exports, for example in the manufacturing industry (Deringer, Erixon, Lamprecht and Van der Marel, 2017).

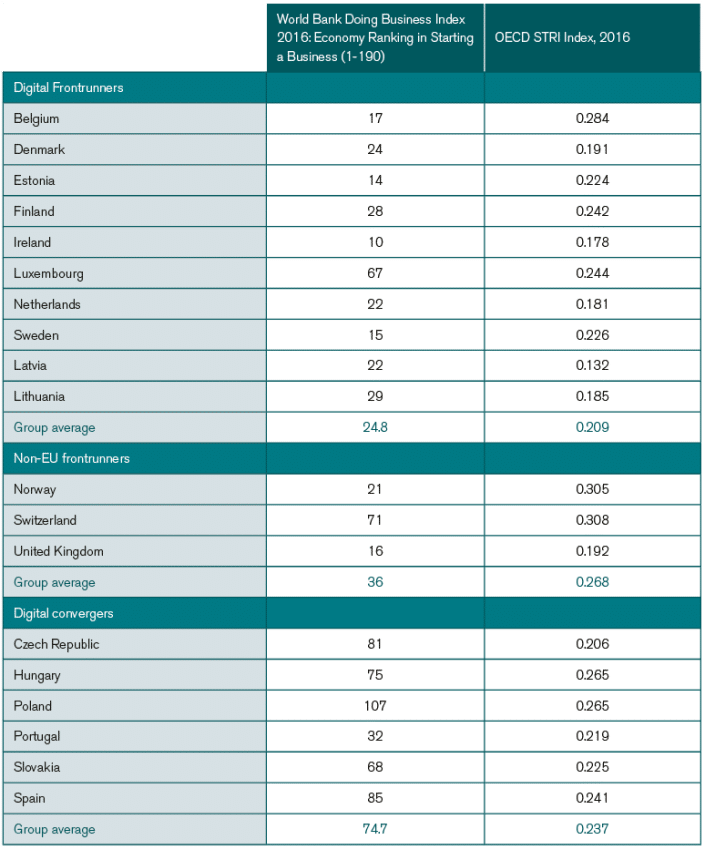

As indicated by the OECD’s Services Trade Restrictiveness Index, services restrictions among the digital convergers are relatively higher than those in the frontrunners group. Further reduction of the amount of regulations and of the restrictiveness of existing regulations would allow these countries to profit from increased efficiency gains, as well as resulting economic competitiveness and growth. However, their level of restriction is still broadly comparable to those of the frontrunners and is even lower than the average level of restriction among the non-EU frontrunners. Note that the level of restrictiveness of Lithuania and especially Latvia is below the average of digital frontrunners, further justifying their inclusion in this group.

Other crucial elements for achieving improved market conditions are high employment protection, private credit provision, patent application open to non-residents as well as high R&D expenditure (Van der Marel, 2016). In addition, policies supporting the entrepreneurial spirit is a key element for taking and further developing comparative advantage. Support for start-ups especially in non-digital sectors is key, as start-ups rely heavily on the use of software and ICT for their business models also in these sectors. Companies have to adapt to modern forms of operation due to technological change, which can be described as the process of digital business transformation (Forbes, 2017). In order to remain competitive and to withstand digital disruption, companies have to be able to develop their digital business agility. Environmental factors, such as policy intervention, are a crucial factor for this process, especially for SMEs and start-ups.

Reduced product market regulations in these sectors are an important factor for attracting investment and increasing economic growth. According to the World Bank’s Doing Business database, digital convergers could still improve their position in this area. Their average position in the ranking from 1 – 190 is only 74.7, which is behind the average of the digital frontrunners with a score of 24.8 and of the non-EU frontrunners with a score of 36. Also, note again that Lithuania and especially Latvia have rankings that are fully in line with the digital frontrunner average, again confirming that they can be considered to be part of this group (see the table below).

Table 3: Ranking in Starting a Business and Services Trade Restrictiveness Index

New Initiatives of Policy Collaboration for the Digital Economy

Both digital frontrunners and convergers have strong reason to initiate new forms of policy collaboration inside those groups – and between them. While the profile of these two groups are somewhat different – especially as far as digital endowments are concerned – it is also clear that there is variation in endowments and digital performance inside the groups, not just between them. Finding initiatives that help countries to converge to the best standard could have a strong economic payoff for countries.

Equally important, both groups of countries need to find ways to better articulate their policy interests – in the short as well as the long term – and to build alliances with the purpose of impacting the future policy direction. While there have been some step-wise improvements of digital policy in Europe over the years, the reality is that both frontrunners and convergers have digital economic interests that have not been responded to by policy decisions at the EU level.

For example, the Digital Single Market initiative has yet to provide a policy of substantial liberalization. New regulations have sought to complicate data flows with countries like Australia, Korea and Japan – countries with high-standard protection of data privacy – simply because their data regulations are not identical with those in Europe. New companies like WhatsApp, challenging incumbents in the telecom sector and bringing new services to people with constrained high-quality access, are exposed to overly burdensome regulations. In member states, if not the EU, new platforms have been rejected rather than embraced – some of them are deemed to be anti-competitive despite bringing substantial improvements in markets and competition to a great number of sectors. The list goes on – and leads to a depressing account of current policy: it reflects the interests of less open economies with fewer instincts for competition rather than those economies that are heavily plugged into the world economy.

What can various country groups do to change this trend of policy? In this chapter, we will look at some initiatives that can be taken by digital frontrunners as well as digital convergers in order to build coalitions for policies that would support faster growth of the digital economy and improve the positive economic impact of digitization.

Initiatives for Digital Frontrunners

Initiatives to foster better collaboration between digital frontrunners is not a novel idea. Countries in that group already meet – together with other EU member states – to discuss and coordinate positions in Brussels. A more exclusive group of frontrunners have established the so-called Digital9, or D9, initiative with the purpose of fostering a stronger policy coalition. There are also various combinations of individual countries that meet in other fora to charge new ground for the development of the digital economy. One such initiative is the Nordic Council, a very established forum of government-to-government cooperation, with a Council of Ministers and a secretariat, that also includes non-EU countries like Norway and Iceland. Earlier this year they met to discuss the concept of the “Digital North” and adopted a political declaration stating that “The Nordic-Baltic region is well-positioned to show the way for digitalization in Europe”. At a June meeting this year, a new cross-sectional Council of Ministers was established to work specifically on matters of the digital economy between 2018 and 2020, and it has been equipped with a budget that is tied to developing policies for the Digital Single Market.

Box 1: Nordic Council initiative

The Nordic Council is an inter-parliamentary forum founded in 1953 by Sweden, Norway, Iceland, Denmark, and Finland, and includes several observer and associate countries as well[1]. On the 25th of April 2017, at a Digital North conference, the members of the Nordic Council signed a declaration, affirming their commitment to intensifying their digitalization efforts both domestically and on a cross-border level[2].

The declaration has three focus areas, the first of which concerns bolstering digitalization both in government and society, namely through a common platform for cross-border public sector services to increase their effectiveness and reduce the administrative burden of enterprises. The Council’s priorities in this regard involve cooperation on the following items: cross-border digital infrastructure and removing technical and legal barriers, particularly through more cross-border integration of electronic authentication (eID) systems; improvements on the re-use and free movement of data; enhancing public procurement practices; and guaranteeing information security and personal data protection in all digitalization efforts.

The second priority of the Council involves: improving competitiveness of enterprises, through initiatives on innovation; liberalizing digital markets through flexible regulation; assisting digitalization of SMEs; efforts to market the region’s strengths as a digital hub; develop ICT capacities by improving freedom of movement and skills accreditation procedures; promoting 5G and technological interoperability; and safeguarding workers’ protection and conditions through labour standards.

Finally, the Council aims to enhance the DSM in the Nordic-Baltic region through: developing solutions and sharing good practices with regards to disruptive business models and the new sharing economy; strengthening the voice of members of the council within the EU/EEA area, especially concerning early legislative phases and regarding national implementation of DSM policy; cooperate to abolish obstacles to the full functioning of the DSM, namely unjustified data localization policies and other regulatory barriers.

According to DG Connect’s Digital Economy and Society Index (DESI), Denmark, Norway, Finland, and Sweden are the most digitized economies of Europe[3]. Regarding connectivity, Finland, with 97% 4G coverage, is the only one of the four countries not to have 100% coverage, and all four countries have some of the cheapest broadband in Europe, with subscriptions being on average <1% of income. Regarding human capital, Finland has the most ICT specialists per capita (6.5%), with Sweden being second (6.1%). Concerning internet use, Finland is also the country where people use online banking the most (92%), while people use video on demand the most in Denmark (49%), and people use the internet for music, videos and games most in Sweden and Finland (91%). Denmark ranks best overall in terms of integration of digital technology, as 27% of SMEs sell online, and 64% of companies use eInvoices, although it is Finland which ranks first in terms of use of cloud computing in enterprises (40%). Regarding digital public services, Denmark and Finland are also the countries with the most eGovernment users (73% and 64% respectively).

Undoubtedly, this is a promising initiative. Nordic countries are at the global frontier of the digital economy and many of the countries in the region top global rankings over digital readiness and technological capacity. In other words, they have substantial digital endowments. They can also provide examples – positive and negative – to other countries about reforms and investments that support a rapid expansion of the digital economy and redouble the positive economic impact of digitization. The sharing of these lessons between countries in the group will be helpful to all participating countries. If they can also take them to countries outside of the Nordic Council, the impact can be much larger.

Observers of the discussions held at these meetings, or the initial discussions over the D9-initiative, will however find that there is another obvious task for these group initiatives: to articulate an idea for what digital frontrunners want to achieve in EU policy over the medium term and draw conclusions for what that idea entails in the short term. Discussions between digital frontrunners still remain weak on substance and all-too-often becomes an exercise responding to adverse events and policy trends in the short term. There are only fragmented thoughts about the medium and long-term agenda, for instance what the Digital Single Market actually should become and what policies that stand in the way for actually having one.

Box 2: The D9 Initiative

The Digital Nine (D9) group began forming and determining its priorities only recently, in September 2016. It comprises ministers from Belgium, Denmark, Estonia, Finland, Ireland, the Netherlands, Sweden and the UK, and has so far focused discussions on the free-flow of data, geo-blocking and business taxes[4]. Another focus of the group also includes the possibility of creating a separate digital single market for its member countries, so as to better be able to take advantage of their advancements, and to facilitate cooperation.

Together, these 9 countries are the most digitized in Europe, according to DG Connect’s Digital Economy and Society Index (DESI). Belgium has the most subscriptions to fast broadband in the EU (81%), and comes second in terms of use of electronic information sharing by enterprises (50%) and percentage of SMEs engaging in cross-border online sales (13.1%). The Netherlands is second in terms of enterprise use of social media (38%) (although it was first in 2016), and second in terms of fixed Broadband take-up (95%) and fixed broadband coverage (100%). In this regard, it is the UK which is first (40%), and it is also the country with the most online shoppers (87%). As for Luxembourg, it is the country with the most households with fixed broadband take-up (96%), the most internet users (97%), and the most individuals with digital skills that are at least basic (86%). Finally, Ireland has the most STEM graduates (25 per 1000) and has the most SMEs selling online domestically (30%) and cross-border (16.2%), and the most eCommerce turnover in SMEs (21.8%).

This is not surprising. Even if the digital economy has been a central feature of the economy for a long time now, it is one that constantly has raised new types of issues and increasingly prompted new considerations about what policies that actually will drive its expansion. It is only recently that it has become a clear concept in policymaking that the digital economy is not one sector that will be supported or stymied only by digital-specific policies, but that its real potential is the degree to which digital technologies can be embodied in non-digital sectors.

But the fragmented notions about how digital frontrunners want to progress policy over a longer period of time point to a very clear task for new initiatives: while day-to-day policymaking always will occupy the minds of ministers and governments, it is important for the success of policy that the same actors invest time and thought in developing what policy initiatives that should come next and what they would want from new initiatives for the Digital Single Market. In the EU, this is only work that can be done by the frontrunners, and it is work that will be useful in the short term as well. All too often, frontrunners end up in an awkward situation in Brussels’ discussions where they have to rally all their support behind an initiative from the Commission in order to avoid it being diluted by other member states. But in the transactional and compromise-based policy culture of the EU, supporting the Commission means that the Commission position becomes one of the extreme positions, and one that will not be the basis for an EU agreement. The task of the frontrunners should rather be to stake out a position that goes much further than what the Commission proposes. For that to happen, however, these countries need to know where they want to go, and that remains an idea that has not been articulated, let alone thought through by governments.

In that way, the new forms of collaboration that are established should aim to establish policies that are exclusively in the interest of the frontrunners. Given that many of these issues are not EU-specific issues, but involve domestic policies as well as global policies, governments do not need new forms of cooperation in addition to EU membership and EU policy. They can rather allow a larger degree of flexibility and base cooperation on the participation of governments and ministers that have ambitions and want to see them materialize.

Box 3: Why it’s important to keep the UK in Europe’s digital loop

As a recent report by Frontier Economics demonstrates, digital services and goods make up a significant portion of the UK’s economy[5]. Indeed, digital industries are responsible for 16% of domestic output, 24% of exports, and three million jobs. This not only makes the UK a key player in global digital markets, but an important asset for the EU’s long-term digitalization efforts. In that policy sphere, the UK has been an important proponent of cross-border e-commerce, consumer protection, e-identificaton, clearer copyright frameworks[6], and an open and flexible digital market, regardless of its exit from the EU[7]. Indeed, there are certain areas where losing the UK’s input would be a great cost to the EU.

This is especially true in the field of connectivity and data, as the UK’s cross-border data flows account for 11.5% of global transfers in 2015[8]. Unsurprisingly, 75% of those data flows are with other EU countries. The infrastructure characteristics of the UK’s data industry are a primary reason why it has been a leading player in this field. This is especially due to London which is one of the leading centres in the world in this respect[9]. Brexit is likely to have a significant impact on this part of the UK’s digital economy, primarily through the EU’s General Data Protection Regulation (GDPR)[10], which goes into effect in May 2018. Even if the UK maintains a data protection regime similar to the GDPR, a change of the UK’s status would require the EU Commission to review its adequacy to determine whether it matches the requirements of EU law. Were it to deem the UK’s data protection regime inadequate, the EU Commission would force localization or redirection of data, with dire consequences for UK and EU partners. Uncertainty would lead firms to restrict flows with regards to amount and type, thus harming the services the UK exports to the EU. Although relocation would likely balance out short-term losses in output created by legal uncertainty, this would also mean that the UK would be lost as a proponent of free data flows, with its ability to contribute to innovation in terms of technology and policy lost as well.

Similarly, although much of the UK’s finance industry is likely to relocate in some form to continental Europe[11], the EU would nonetheless suffer the loss of the UK’s capabilities in financial innovation provided by its flexible regulatory system[12]. Indeed, regulations such as the Financial Services and Markets Act[13] and its principles based (rather than rules-based) approach have provided investors with room to fund new technologies and innovative start-ups. Additionally, Project Innovate (2014)[14] has provided support to innovators, namely through a ‘regulatory sandbox’ allowing new products to be tested with real consumers. This, combined with the UK’s large capital markets[15], attractive research systems, and focus on exports of medium & tech goods and knowledge-intensive services[16], means that the UK is one of the top 3 most innovative economies in the world according to a report by WIPO[17] and the world’s leading fintech hub in terms of market size[18]. Although much of the UK’s fintech industry may be exported in the event of relocations following Brexit, the same cannot be done so easily with the flexible regulatory system in which it strived. Were the EU to lose such an important player and promoter of liberal regulation, its overall efforts at financial regulation would be severely hampered.

For the D9 group of countries, there should be some new thoughts given to countries that should participate in addition to current members. For example, there are good reasons to consider the membership of some non-EU countries like Norway and a country that soon is about to leave the EU – the United Kingdom – but whose policy instincts in matters of the digital economy should remain in the European domain. There are other candidates as well to consider, but the key point is that the D9 group of countries is not attractive because the ranking of these countries in digital indexes but for its ambitions and capacity to build a policy idea that goes widely beyond current policy debates. While an obvious target for new policy ideas developed in that group will be the European Union, they should not condition the participation on the exact form of relation to the EU. After all, EU as well as non-EU countries have a big stake in developing a digital economy with few restrictions to cross-border integration and that can easily embody new technological innovation in the future.

However, the exclusive role of the D9 group of countries arguably rules out the participation by countries that are distant from the digital frontier and hesitate about a policy of greater digital openness. The task of that group, therefore, should not be to build an inclusive agenda involving other countries with less digital capacity or that comes with an interest to focus the agenda on matters that are not about moving the goalpost for the future and developing the concepts and ideas of policy that will guide how policy evolves over the next decades.

There is a role for forms of cooperation that builds support for ambitious policies in the short term and that can better serve as a “docking station” for countries that want EU policies to become better suited for the digital economy. The role of such initiatives is neither to come up with bold ideas nor to be a hub for frontrunners but to build a coalition for a digital economy in Europe that is open and supports the economic integration that many countries have already achieved. There will be a role for bilateral and region-to-region cooperation in that space. Often, the capacity to build political coalitions depends upon the personal chemistry between ministers and heads of governments, and the degree to which there is a good rapport between them on specific issues. An example of this is how the personal relation between the former Swedish Foreign Minister, Carl Bildt, and the former Polish Foreign Minister, Radek Sikorski, became the basis for the launch of the Eastern Partnership initiative.

Such developments are also underway for the digital economy. The digital economy is now front and centre in many bilateral relations between governments in Europe and there is also an increasing need to find areas where there can be a good atmosphere of cooperation. Countries in the Benelux and Visegrad have already started to schedule meetings at high political levels to discuss how they see the future of EU cooperation, and it makes sense to give the digital economy a central role in these discussions because it is an area where these regions are converging. Likewise, Nordic countries have been engaging with Visegrad countries and the geographical proximity between some of these countries, along with their shared interest in encouraging faster digital growth, is a good platform for policy oriented discussions related to EU policy.

However, bilateral relations can only move policy cooperation a bit – and they are no substitute for more structured cooperation when the purpose is to build new coalitions. They are the glue that can make more institutionalized forms of cooperation work smoothly and be fed with new ideas, but there is an important role now to make sure that there is a platform of digital frontrunners and digital convergers to regularly meet with the purpose of establishing a coalition for positive policy change.

That platform can be a Friends of the Digital Economy Group that will gather frontrunners and convergers that are members of the EU. By our calculation, that would be the “D16 group of countries” – a group of 16 members that have comparatively high degree of economic openness and that is committed to building a Digital Single Market in the EU that reduces barriers to digital integration and enterprise at a fast rate. The agenda of that group should follow the EU policy cycle, but allow for the entire group to take initiatives in the EU. Apart from encouraging bolder steps for building the Digital Single Market, this group should put a lot of emphasis on the competitiveness agenda for Europe. Despite some variation between countries in their economic and domestic policies, they share a pretty liberal view on the economy that includes expanding entrepreneurship and improving the conditions for SMEs to grow. They are not supportive of digital dirigisme – nor do they take the view that there should be a defensive industrial policy for the digital economy that protects incumbents against new competition from digital entrepreneurs.

For the D16 initiative to leverage policy it should build a virtual infrastructure around it that ensures that it is given high political attention. An annual summit for heads of governments would help to give it political weight. A schedule of regular meetings of relevant ministers would force attention given to the agenda. A D16 Business Group attached to it would use the energy of businesses and help to shape an agenda that reflects real market problems. A separate chairperson tasked to manage the agenda would ensure continuity and that agreed priorities and positions are delivered.

Initiatives for Digital Convergers

Digital convergers share a similar degree of openness with digital frontrunners when it comes to openness to trade and regulatory freedom, for example with regard to product market regulations or services trade restrictiveness. However, digital convergers are behind digital frontrunners in their digital endowments, and hence the forms of cooperation that digital convergers should encourage need to be based on two components: setting the right type of market regulations for the digital economy to grow and supporting investment in digital endowments.

Generally, digital convergers have strong economic interests to associate themselves with the digital frontrunners. They can import digital endowments and policy experience from them. Importantly, they both have companies focused at exploiting their comparative advantages in value chains and frontrunners have examples to show convergers how they faster can climb these value chains. Given their tight economic integration with the European and global economy, digital convergers have an interest in ensuring digital success for countries that are closer than them to the digital frontier, or that actually is at the frontier.

However, digital convergers can start closer to home. There is a clear role for greater regional cooperation between countries – cooperation that seek to build regional coalitions and share experiences of what has worked well in regulatory policy and the investment in digital endowments. Existing groups such as the “Visegrad Group” or “V4” can therefore be expanded and be given a clearer purpose in matters of the digital economy. Digitization is already today a key component in the V4 and, as an example, in March 2017 the Prime Ministers of the Visegrad countries adopted the “Warsaw Declaration” stressing their intent to cooperate in innovation and digital affairs. That is a promising development, and one that now needs to be backed up by substance and good initiatives. Likewise, there is substantial bilateral cooperation between Spain and Portugal, two other convergers, and there should now be more attention given to the digital economy in that relation.

Box 4: Visegrad’s digital cooperation

One of the main contributions of the V4 to the DSM includes their promotion of the Directive establishing the European Electronic Communications code[19], and the subsequent adoption of their associated common paper on the 6th of February 2017 by V4 regulatory agencies[20]. This directive[21] recasts the four directives currently regulating the European electronic communications market through: more effective spectrum management at the European level (although the V4 is opposed to measures which would hamper national competences in this matter); a peer review mechanism; improvements to market access and infrastructure competition; and improvements to the universal service regime, among other issues.

In November 2016, at the Budapest Regional Digital Summit, the V4 signed the “Memorandum of Understanding for Regional Cooperation in the Areas of Innovation and Startups”, which aimed to make cooperation easier with regards to promoting the expansion of start-ups[22]. Its main activities include the introduction of “We4Startups”, a tool to facilitate matchmaking between startups, policy makers and investors. Additionally, the V4 committed to organizing various events, including pitching events. One of such events was the V4 Startups and Scale-ups 2016, which took place in the Netherlands[23]. It included panels with policy makers and representatives from startups. The Memorandum expanded the role of the V4 Innovation Task Force, which was originally launched in November 2014, and which acts as a platform to share information, develop innovation and funding strategies, identify joint interests, and organize events with the aim of improving networking and raising awareness. The regional startup platform was later also joined by Slovenia[24].

The Warsaw declaration[25], signed at the Central Eastern Europe Innovators Summit in March 2017, was another initiative exemplifying the V4’s drive to promote their digital economies. Among other things, the declaration expressed the V4’s commitment in the following areas: promoting innovation, preparing for next generation mobile services (5G), facilitating joint research, supporting SMEs, increasing ICT and digital skills at all educational levels, improving cyber security, support regional Industry 4.0 projects, act against unjustified barriers to the free flow of data, and develop policies to improve data privacy and protection. Additionally, the declaration announced that a special budget line would be dedicated within the International Visegrad Fund for R&D&I, so that grants would be more available to the business and scientific community[26]. The priorities of these strategic grants include regional cooperation for competitiveness and connectivity, security and stability, and general promotion of the V4.

Such new and intensified forms of cooperation within the group of digital convergers should focus on the regional level, including regions within countries. Digital convergers have high levels of digital inequality and there are regions with little capacity to build an economy in the back of digital endowments. These countries are not unique: regions within other countries also have very different endowments and perform differently in the digital economy. Still, the problem of digital inequality is a more important matter for many convergers because the lack of skill and ICT capacity prevents digitization to ripple through the entire economy and lift productivity.

For these reasons, digital convergers could reinforce their region-to-region collaboration. This new form of cooperation does not have to be limited to the national level alone. An increased cooperation between strong regions within the group of digital convergers can also lead to a better understanding of the policy needs and goals of the entire group – or parts of it such as the V4 – and to make sure that good experiences are shared across regions in different countries. There are already plenty of such exercises in other policy matters – and it is surprising that digital policy and development have not taken a more central role. That underlies the point that an initiative that involves more countries can be a better conduit for engaging in policy discussions that are seldom squeezed out from the agenda.

As part of regional initiatives like the V4, digital convergers should also intensify their collaboration with other open economies that have managed to increase their digital endowments. Here, existing groups of countries such as the Nordic Council represent recurrent opportunities for different forms of cooperation. As previously mentioned, the group of Benelux countries are also good partners from which ideas and experiences can be imported. Cooperation with these groups can also involve areas that are not on the level of influencing EU policy, as digital convergers have the potential to profit from experiences in these countries with regard to their process of increasing digital endowments.

Digital convergers should also embrace initiatives like the “D16 group”. Digital frontrunners have gone through a process of increasing their digital endowments and have established a cooperation that helped to identify their own domestic digital goals. For digital convergers, close contacts with frontrunners will help to shape their own domestic agendas. In such a forum, they could build on the efforts by other countries to improve market conditions, for example through competition-enhancing reforms including digital sectors. Digital convergers share the interest of frontrunners to reduce heterogeneous product market regulations – especially services regulations – and boost efficiency gains through the increased use of ICT especially in non-digital sectors. Moreover, they have shared interests in economic issues that are important for the growth of the digital economy, such as employment protection adapted to the modern economy, credit provision, patent application, and R&D cooperation.

However, a more relevant ambition for digital convergers in a D16 initiative is to anchor their own policy in a larger group that share many of the policy aspirations to foster greater digital entrepreneurship and increasing their role in digital value chains. Just like digital frontrunners, convergers need a new context to articulate their policies and priorities, and to draw up strategies for how their demands will be responded to by EU policy. Many of the current policy initiatives are new to every government, and there is not a sure way for governments to manage them in a way that is compatible with their own economic interests. A plurilateral initiative like D16 would help to steer work by national governments and to streamline it in accordance with policies and positions that are debated more openly with other countries. Such transparency on issues is important for every government – but it is accentuated in economies where there is still a need to develop a general narrative about where the country stands in digital value chains and how the digital economy can improve the performance of the economy. Like in other countries, digital convergers have no shortage of visions and aspirations, but there is a gap between these visions and the general perception about where they are positioned now.

[1] http://www.norden.org/

[2] https://www.regjeringen.no/contentassets/5ed83530b83c4e4ba85338c29eb50c63/ministerial-declaration.pdf

[3] https://ec.europa.eu/digital-single-market/en/desi

[4] http://www.politico.com/tipsheets/morning-trade/2016/11/green-goods-talks-at-a-breaking-point-217601

[5] http://www.techuk.org/insights/news/item/10086-the-uk-digital-sectors-after-brexit:%20techUK_FINAL_2017-01-24.pdf

[6] https://www.gov.uk/government/speeches/vision-for-a-digital-single-market

[7] https://www.parliament.uk/business/committees/committees-a-z/commons-select/european-scrutiny-committee/news-parliament-20151/digital-market-access-report-published-16-17/

[8] ibid

[9] https://www.cbre.co.uk/-/media/files/gws/gws%20thought%20leadership%20and%20collateral/2016%20q4%20european%20data%20centre%20marketview.pdf

[10] http://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A32016R0679

[11] https://www.ft.com/content/a3a92744-3a52-11e6-9a05-82a9b15a8ee7?mhq5j=e2

[12] http://www.ey.com/Publication/vwLUAssets/EY-UK-FinTech-On-the-cutting-edge/%24FILE/EY-UK-FinTech-On-the-cutting-edge.pdf

[13] http://www.legislation.gov.uk/ukpga/2000/8/contents

[14] https://www.fca.org.uk/firms/fca-innovate

[15] https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp72.pdf?d842aa7a507a87bcba7bb32abeea088a

[16] http://ec.europa.eu/growth/industry/innovation/facts-figures/scoreboards_en

[17] http://www.wipo.int/pressroom/en/articles/2016/article_0008.html

[18] https://www.weforum.org/agenda/2016/08/these-are-the-worlds-fintech-hubs/

[19] http://www.visegradgroup.eu/calendar/selected-events-in-2017-170203/joint-declaration-of

[20] http://www.politico.eu/wp-content/uploads/2017/02/V4-paper.pdf

[21] http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=comnat:COM_2016_0590_FIN

[22] http://www.visegradgroup.eu/calendar/2015/memorandum-of

[23] https://www.axsmarkets.com/v4startups/

[24] http://www.podim.org/en-us/News/62

[25] http://www.visegradgroup.eu/calendar/selected-events-in-2017-170203/joint-declaration-of

[26] http://visegradfund.org/grants/strategic-grants/

Concluding comments

All European economies stand to benefit from policy reforms that accelerate the pace of technological and digital change, and that help to diffuse the benefits of these changes to the wider economy. Many such reforms can be done domestically; others need to be part of European Union policy, and they typically concern the wider conditions for commercial exchange across borders. Unquestionably, the difference across the world between those countries that are speeding up change and those that are slowing it down is increasing and gradually having a stronger impact on relative economic performance. For many European countries – not just those that in this paper have been called digital convergers – the next couple of years will have to feature a substantial focus on creating better conditions for the digital economy to flourish.

Cooperation in digitally-focused economic and regulatory policy should improve in Europe. In the first place, all countries can learn from others and forms of cooperation that intend to share best-practices can have a good economic payoff. In the second place, there is a growing need for many countries to articulate a policy vision and agenda for what should happen with digital policy in the European Union. The point of this paper has been to zoom in on the relations between countries at the digital frontier and countries catching up with the digital frontier. Many of them are fundamentally linked up with each other through commercial value chains and they tend to broadly align with a view of economic policy that favours less regulation rather than more regulation.

Countries in Europe cooperate in many different ways, and the EU features several old and new forms of selective groups that for one reason or the other discuss exclusively among themselves about what they want to do with EU policy. In areas of fiscal and macroeconomic policy, there are new groups – like the “Hansa”-inspired group of countries in Europe’s Northern rim – that now aims to complement the old axis of Franco-German leadership. There have been “coalitions of the willing” in areas of international trade policy and the Single Market for services. There are proposals to move EU policy among a selected group under the enhanced cooperation clause. None of these forms of cooperation seek to undermine unity in Europe; they rather reflect that fact that countries and governments have different views about some policy matters and that some feel more strongly than others about the need to chart a certain policy direction for the EU.

In digital policy, there is now new experimentation with how countries can collaborate in more selective groups. This period of experimentation needs to continue and should ideally be intensified. What exact forms of cooperation that will work is less clear, but successful collaboration will have to start with a shared understanding about what new policies that could benefit individual countries and help them to improve the economic payoff from digitization.

References

Accenture (2016) “Unlocking the Digital Potential of Industries Across Europe”, Accenture Strategy

Arnold, M. and Noonan, L. (2016) “Banks Begin Moving Some Operations Out of Britain”. Available at: https://www.ft.com/content/a3a92744-3a52-11e6-9a05-82a9b15a8ee7?mhq5j=e5

Bauer, M. and Erixon, F. (2016) “Competition, Growth and Regulatory Heterogeneity in Europe’s Digital Economy”, Five Freedoms Project at ECIPE Working Paper No. 2, Brussels: ECIPE.

Behsudi, A. (2016) “Green Goods Talks at a Breaking Point”. Available at: http://www.politico.com/tipsheets/morning-trade/2016/11/green-goods-talks-at-a-breaking-point-217601

CBRE (2016) “European Data Centres MarketView Q4 2016”. Available at: https://www.cbre.co.uk/-/media/files/gws/gws%20thought%20leadership%20and%20collateral/2016%20q4%20european%20data%20centre%20marketview.pdf

Deringer, H., Erixon, F., Lamprecht, P. and van der Marel, E. (2017) “Boosting Services Trade in the Age of Digitalization: What is the Potential, What are the Obstacles?”, Bertelsmann Stiftung, Gütersloh.

Derrington, G. (2017) “The UK Digital Sectors After Brexit” Available at: http://www.techuk.org/insights/news/item/10086-the-uk-digital-sectors-after-brexit

Erixon (2017) “Embracing Innovation and Economic Development: A Policy Perspective for the Asia-Pacific Region”, Available at: https://ecipe.org/publications/embracing-innovation-and-economic-development/

European Central Bank (2017) “Moving to the Frontier: Promoting the Diffusion of Innovation”. Available at: https://www.ecb.europa.eu/press/key/date/2017/html/sp170313_1.en.html

European Commission (2015) “Digital Entrepreneurship Scoreboard, 2015”. Available at: http://ec.europa.eu/growth/tools-databases/newsroom/cf/itemdetail.cfm?item_id=8778

European Commission (2016) “Corrigendum Document COM(2016) 590 Final/2”. Available at: http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=comnat:COM_2016_0590_FIN

European Commission (2017a) “The Digital Economy and Society Index (DESI)” Available at: https://ec.europa.eu/digital-single-market/en/desi

European Commission (2017b) “European Innovation Scoreboard”. Available at: http://ec.europa.eu/growth/industry/innovation/facts-figures/scoreboards_en

European Parliament and Council of the European Union (2016) “Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the Protection of Natural Persons with Regard to the Processing of Personal Data and on the Free Movement of such Data, and Repealing Directive 95/46/EC). Available at: http://eur-lex.europa.eu/legal-content/en/ALL/?uri=CELEX:32016R0679

Ernst & Young (2016) “UK FinTech on the Cutting Edge- An Evaluation of the International FinTech Sector”. Available at: http://www.ey.com/Publication/vwLUAssets/EY-UK-FinTech-On-the-cutting-edge/%24FILE/EY-UK-FinTech-On-the-cutting-edge.pdf

Financial Conduct Authority (2017) “FCA Innovate”. Available at: https://www.fca.org.uk/firms/fca-innovate

Financial Services and Markets Act 2000 (UK). Available at: http://www.legislation.gov.uk/ukpga/2000/8/pdfs/ukpga_20000008_en.pdf

Forbes (2017) “Digital Transformation and Innovation in Today’s Business World”, Available at https://www.forbes.com/sites/brianrashid/2017/06/13/digital-transformation-and-innovation-in-todays-business-world/#3ed51bd49052.

Hartmann, P., Heider, F., Papaioannou, E. and Lo Duca, M. (2007) “The Role of Financial Markets and Innovation in Productivity and Growth in Europe”. Available at: https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp72.pdf?d842aa7a507a87bcba7bb32abeea088a

Herszenhorn, D. and Plucinska, J. (2017) “Europe’s ‘E-believers’ Brave Skepticism in Estonia”. Available at: http://www.politico.eu/article/europes-e-believers-brave-skepticism-in-estonia-digital-tech-summit-tallinn-eu/

Kelly, J. and Jones, H. (2016) “These are the World’s FinTech Hubs”. Available at: https://www.weforum.org/agenda/2016/08/these-are-the-worlds-fintech-hubs/

Nelson, P. (2015) “McKinsey Names Industries That are Falling Behind in Digitization”. Available at: https://www.networkworld.com/article/3017204/leadership-management/mckinsey-names-industries-most-lacking-in-digitization.html

Neville-Rolfe (2015) “Speech about the United Kingdom’s Vision for Digital Single Market” EU in a Digital Age Conference. Available at: https://www.gov.uk/government/speeches/vision-for-a-digital-single-market

Nordic Co-operation. Available at: http://www.norden.org/

Norwegian Ministry of Local Government and Modernisation & Nordic Co-operation (2017) “Ministerial Declaration”, Digital North, Nordic-Baltic Ministerial Conference on Digitalisation. Available at: https://www.regjeringen.no/contentassets/5ed83530b83c4e4ba85338c29eb50c63/ministerial-declaration.pdf

Office of the Prime Minister (NOR) (2017) “Norway to Host Informal Nordic Prime Ministers’ Meeting”. Available at: https://www.regjeringen.no/en/aktuelt/norway-to-host-informal-nordic-prime-ministers-meeting/id2553244/?utm_source=POLITICO.EU&utm_campaign=4be7ebdb71-EMAIL_CAMPAIGN_2017_05_15&utm_medium=email&utm_term=0_10959edeb5-4be7ebdb71-189028485

Parliament UK, European Scrutiny Committee (2017) “Clarity Needed on UK Access to Digital Single Market post-Brexit”. Available at: https://www.parliament.uk/business/committees/committees-a-z/commons-select/european-scrutiny-committee/news-parliament-20151/digital-market-access-report-published-16-17/

PODIM (2007) “Start:up Slovenia Joined the Visgrad Partnership for Building a Collective Regional Startup Platform”. Available at: http://www.podim.org/en-us/News/62

Reck, J. (2017) “The Next German Government’s Greatest Challenge: Building the Framework for a Digital Revolution”. Available at: http://tech.eu/features/17306/next-german-governments-greatest-challenge-building-framework-digital-revolution/

Van der Marel (2016) “Digital Investments, Data and Growth in Europe: A Framework for Analysis”, Five Freedoms Project at ECIPE Policy Brief No. 2, Brussels: ECIPE.

Visegrad Grants (2017) “Grants”. Available at: http://visegradfund.org/grants/visegrad-grants/

Visgrad Group (2017b) “Common Paper of the Visegrad Group on the Commission Proposal for the European Electronic Communications Code”. Available at: http://www.politico.eu/wp-content/uploads/2017/02/V4-paper.pdf

Visegrad Group (2017a) “Joint Declaration of Intent of Prime Ministers of the Visegrad Group on Mutual Co-operation in Innovation and Digital Affairs”. Available at: http://www.visegradgroup.eu/calendar/selected-events-in-2017-170203/joint-declaration-of

Visegrad Group (2016) “Memorandum of Understanding for Regional Cooperation in the areas of Innovation and Startups”. Available at: http://www.visegradgroup.eu/calendar/2015/memorandum-of

WIPO, Cornell University, INSEAD, Confederation of Indian Industry, du and A.T. Kearney (2016) “Global Innovation Index 2016: Switzerland, Sweden, UK, U.S., Finalnd, Singapore Lead: China Joins Top 25”. Available at: http://www.wipo.int/pressroom/en/articles/2016/article_0008.html