What is Wrong with the Single Market?

Published By: Fredrik Erixon

Subjects: EU Single Market Five Freedoms

Summary

Europe’s Single Market is in many ways an illusion – it exists only nominally. There are substantial barriers to cross-border exchange and the Single Market is riddled with uncertainty. The EU has again set itself the target to advance the Single Market and it is thus important to consider what factors made Europe resistant to more Single Market reforms in the past, and what this resistance has entailed.

In this paper we will explore what we mean by a Single Market, and what the possible reasons for its failure to meet its goals are. While the nature and profile of the Single Market, and its regulations, have changed over the years, they often have focused on the wrong issues, or on factors that would not change the nature of markets as such. The piecemeal approach to reform, followed until now, has created a complex web of regulations, administrative rules, national discretion, and partial freedoms. Fractional and incomplete liberalization have reduced the potential gains.

Although many problems are endogenous to the Single Market there are others that are a result of external structural shocks. The European economy has undergone profound structural changes, and as the economy has shifted profile, it has moved further into sectors and areas where there is very little of the Single market. The more Europe’s economy grows dependent on services and the digital sector, the less Single Market there will be in Europe. It is evident that the improvements that can be made in Europe’s integration is less about classic Single Market reforms and more about building adequate market institutions and advance structural reform.

1. Introduction

What is wrong with Europe’s single market? In a way, there is a simple, short and pithy answer to that question: it does not really exist. The single market is in many ways an illusion. Many observers assume it exists because it is talked about to such a length and intensity that it simply appears implausible that it would not exist. The reality though is that the Single Market in Europe exists only nominally and that there are substantial barriers to cross-border exchange – more so in some sectors than others – that depress the capacity of the European economy to grow on the back of economic integration.

Today’s European Union is a good distance from its founding freedom – the freedom of goods, services, capital and people to cross borders. A recent study by the European Parliament’s Research Service puts the “cost of non-Europe”, or the potential benefits from advancing the Single Market, to 1.6 trillion euro.[i] Obviously, such potential benefits would not exist in an economy that had eliminated most of the existing barriers to cross-border integration.

The obvious example of the incompleteness or the “un-singleness” of the Single Market is the services sector. Europe’s services sector is fragmented along national lines and there are far too many restrictions that hold it back. There is a direct cost to Europe from its failure to build a better framework for services integration, and it is represented in basic indicators about the health and competitiveness of the services sector. But the costs of a non-existing Single Market for services do not only affect the services sector; they spread widely through the economy and reduce the general pace of and benefits from structural market change. The European economy is embedded in a global economy, and periods of rapid structural change affect Europe, but the shape and profile of those changes are often determined by policies at home and what instructions they give for economic behavior.

Now that the EU again has set itself the target to advance the Single Market – partly through general programmes, partly though separate or sector initiatives like the Digital Single Market – it is important to consider what factors made Europe resistant to more Single Market reforms in the past, and what that resistance has entailed. Furthermore, it is critical for the success of new initiatives to understand what structural problems these new initiatives may entail – and how they can reinforce the political roadblocks that previously have prevented ambitions for a better Single Market to become real.

In this paper we will discuss these issues on the basis of a couple of hypotheses.

- Single Market reforms have become victims of the piecemeal approach to reform. Ever since the launch of the Single Market Programme in the 1980s, there have been so many new initiatives and efforts at reform that their history would make up a very thick volume. Some of these piecemeal reforms have opened up markets; others have not. What they have created, however, is such a complex web of regulations, administrative rules, national discretion, and partial freedoms to cross-border exchange that the Single Market itself is not possible to grasp and that it is riddled with uncertainty. Europe’s Single Market now has, to borrow a term from Jacques Pelkmans, a “non-design”.[ii] Furthermore, that approach has reinforced the perception of Single Market reforms as a give-and-get haggling about trade opportunities between countries as if the Single Market were just a glorified version of a global trade agreement whose properties could be adjusted in regular or – as is the case in today’s trade policy – irregular rounds of negotiation. But building a market is different from constructing trade agreements, even if the two worlds obviously could borrow from each other. While the main subject of the latter is to exchange trade opportunities with each other, the former is about building institutions and, ideally, reducing market distortions.

- Europe’s Single Market history of partial liberalisation has reduced the potential gains from its own reforms. While partial liberalisation of cross-border exchange was – and is – politically feasible, it is not an economic strategy with good payoffs in markets that are going through periods of structural change because of technology, globalisation, education and other important factors. In fact, relative degrees of openness may incentivize companies, capital and labour to employ their assets in a way that does not go with the flow of natural structural changes. If the chances to cross-border commercialization in Europe are far better in traditional industry than in advanced services and digital services, there will be obstacles of re-deploying Europe’s economic assets to the latter sectors because the gains from cross-border commercialization are easier to capture in traditional industry. Most likely, the partial and selective nature of Europe’s Single Market has been one reason behind why Europe’s is a laggard in advanced services and digital services.

- When the quest is about building markets, the Single Market has to step behind the borders and focus on structural reforms and building institutions that are compatible with a well-functioning market. While the nature and profile of the Single Market, and its regulations, have changed over the years, they often have focused on the wrong issues, or factors that will not change the nature of markets much. As we are stepping closer to Single Market reforms in services, this becomes even more obvious. To build a Single Market reform in energy, for instance, requires a completely different focus than building a Single Market for transistor chips. The actual barriers to cross-border integration are different and, consequently, the reforms that could change the conditions for cross-border integration will also be different than a standard, off-the-rack Single Market project. Again, the quest is much more about building markets than building bridges across borders.

This paper is structured as follows. Chapter two discusses various flaws in the current Single Market. Chapter 3 discusses the Single Market and structural change, especially with regard to services and the digital economy. Chapter 4 concludes the paper.

[i] Dunne (2015): Dunne, Joseph, “Mapping the Cost of Non-Europe, 2014-19”, European Parliamentary Research Service, European Parliament, PE 536.364, April 2015

[ii] Pelkmans (2016): Pelkmans, Jacques, “What strategy for a genuine single market?”, CEPS, No. 126 / January 2016

2. What is Wrong with the Single Market?

Europe’s Single Market was created with the intention to improve Europe’s economic performance by enabling a better and more efficient allocation of resources – labour, capital and investment. Its implementation has been a long and sometimes charged process of abolishing trade and non-trade barriers between EU member states, but it has undoubtedly brought real economic and political benefits to European citizens, businesses, and governments.

However, the Single Market Program (SMP) as presently framed has failed to materialise many of the goals for general economic growth and employment, and the project remains unfinished business. By the European Commission’s own admission, the Single Market remains an “ongoing project”.[i] Naturally, it has become not an end per se but a means to reach economic and political objectives, but the question is what direction, if any, there is for the ongoing project.

There is a dearth of attention about what the underlying problems of the single market are, and what remains to be done in the long term before there is a truly single market in Europe. The focus rather tends to be on stepwise changes in the regulations that guide the single market, and what partial reforms could generate. However, without taking the larger view, and understanding the underlying problems of the market, it is difficult to arrive at a better understanding of what remains to be done. In this chapter we aim to define and explain these problems. Have there been flaws in the design or the implementation of the Single Market? Are there different kinds of stumbling blocks, such as problems not attributable to weaknesses in the program itself? We will explore what we mean by a Single Market, and what are the possible reasons for its failure to meet its goals.

According to institutions such as the International Monetary Fund (IMF) and the Organization for Economic Co-operation and Development (OECD), the fundamental causes of the Single Market failure are the absence of sufficient structural reform and the weakness in the functioning of services, capital, and labor markets[ii]. Undoubtedly, the contribution of these factors is significant, but they are not the only culprits. Many problems are endogenous to the Single Market. Others are a result of external structural shocks. Some, if not many, are the creation of national governments.

The EU is an amalgam of numerous cultures. The market is, therefore, quite diverse culturally, linguistically, and follow general divisions between policy and government in Europe. Consumer and voter attitudes and expectations among the Member States are reflected in the policy approaches taken by the national governments, and they are sometimes difficult to succumb.[iii] Some Member States’ policies are protective of their businesses and do not necessarily support the Single Market. Their policies may occasionally, if not often, hamper the outcome of the SMP in situations where barriers have been removed.

The Economic Perspective: Expected Benefits and Delivered Results

Because the Single Market is a moving policy project, representing a growing pool of regulations and a complex form of economic integration, it is difficult to measure its performance. Nevertheless, despite its many and strong benefits, there is broad consensus among economists that the Single Market has not been transformative for Europe’s general economic performance when its effects have been distinguished from other and non-related structural changes in Europe’s economy. It has been an instrument to promote more economic integration in Europe but it failed to achieve its potential as a source of large macro-economic benefits though increased competition within the EU.

The Single Market has both medium and long-term effects on the economy and works through a variety of channels, such as commercial integration, increased competition and productivity, and improved investment attractiveness. They, in turn, lead to an increase in GDP and employment. By removing barriers hindering trade, and enabling free movement of production factors within the EU, the SMP aims to increase spur classic “Smithian” economic gains of specialisation and reduce costs, prices, profits and mark-ups. There is a plethora of studies showing Gross Domestic Product to have been raised by the Single Market, and there are studies showing significant GDP effects to have been generated in those countries that joined the EU at a later stage. For instance, a study comparing deep integration in the EU with the counterfactual scenario of not joining the club, concludes that EU membership has raised GDP by 12 percent in average for new members.[iv]

Many studies have attempted to quantify the channels of the benefits created by the Single Market, and they help to understand what has worked well and what has not. They include gains related to direct cost reductions resulting from an abolition of trade barriers; indirect cost reductions associated with economies of scale and learning; reduction in prices due to stiffer competition; and indirect dynamic growth effects resulting from increased innovation and organizational change in the economy. While the evidence generally suggests these channels to have worked, there is also mixed results from these studies, with a fairly substantial body of them being skeptical about the extent to which some of these channels have worked. Depending on the nature of the study, the methodology, and the time period covered, analyses on Single Market performance vary from highly optimistic expectations to results showing that the actual verifiable impact of the Single Market has grossly fallen short of the forecast.

The Commission’s own work on the “Costs of non-Europe” – the so-called Cecchini-Report in 1988 – estimated general economic gains of 4.25-6.5% of GDP[v]. These effects were supposed to result directly from shifts in the competitive regime in previously protected industries. Stronger competition would in turn lead to a drop in prices and in mark-ups. They comprise standard allocative efficiency gains. Also, stronger competition would also lead to an increase in productivity, translating into a fall in the production costs, spurring both static and dynamic efficiency gains. Therefore, it would lead to a further increase in trade volumes.

The European Commission has followed-up with annual reports, which has been complemented by numerous working papers and conference volumes. But in terms of allocative efficiency gains, the one concerned with the distribution and allocation of resources in society, economic analysis shows no clear evidence for decreased mark-ups and for specialization based on comparative advantage. Mark-ups or price-cost margins are often used as indicators of the degree of competition because an increase in competition translates into a reduction in the monopolistic behavior of firms and then into a fall in prices and mark-ups. Other studies confirmed that firms’ mark-ups decreased over the first half of the 1990s[vi]. However, they recovered in the second half of the 1990s, possibly because better access to strategies of reducing production costs, and there does not seem to have been broad economy-wide effects since then associated with the Single Market.

Furthermore, a study on cross-section data from EU 12 carried out by London Economics in 1996 casts some doubts about the causality of the estimated fall of price-costs ratios across European countries. It reveals, however, that the relative decline in margins triggered by the SMP has been particularly important both in manufacturing sectors sensitive to Single Market reforms and in sectors which were not particularly affected by it, suggesting that other factors have been at play and that the partial reforms that happened during the Single Marker program had more widespread effects in the economy, at least initially.[vii]

With regard to the productive gains, related to specialization in production from agglomeration and economies of scale, the main indicators to consider are trade flows and price convergence. Obviously, trade flows in Europe have increased, and the growth of internal trade has been faster than general trade growth. The composition of trade has generally remained pretty stable. A good part of internal trade in the EU, however, is connected to external trade and the accelerating “division of labour” in the global economy, impacting the European economy and its value chains significantly.[viii] Consequently, the internal trade that the Single Market has helped to create is increasingly connected to Europe’s external trade. Price convergence, however, is harder to measure because it is influenced by complex factors such as differences in purchasing power parity, quality variations, and particular characteristics of local demand.[ix] From an economic point of view, however, in a functioning market, the price of a given good should not differ significantly depending on the geographic location of the good, beyond what can be expected due to transport costs, tax differences, and demand variations.

However, there remain significant differences in prices between countries. The European Commission has pointed to a couple of interesting examples. In postal services there are huge differences in price of sending a package from, say, Austria to Italy compared with sending it from Italy to Austria. In fact, it is 80 percent more expensive sending that package from Italy rather than Austria. Yet in Austria, the cost of sending the package to nearby Italy than a longer distance within the country is three times higher.[x]

Thevenot (2005)[xi] demonstrates at an aggregate level that prices, even within the Eurozone, remain dispersed. In the beginning of the SMP prices rapidly began converging but then the pace significantly slowed down until around 1999 when convergence stalled.[xii] During this process there were two forces leading to price convergence: the catch-up effect, leading to a rise in price levels in the countries with lower standard of living, and increased competition, leading to lower price levels due to lower markups of prices over marginal costs. Analysis at country level shows signals of convergence, especially in the early part of the SMP, but quite the opposite seems to be true when scholars review data at a regional level. There are consistent indications that the poorest EU regions not only missed the “catch-up” opportunity, but even fell further behind.[xiii]

It is unrealistic to expect stiffer competition in the Single Market alone to cause complete price convergence. Inarguably, not all of the persistent price dispersion are a consequence of the lack of a Single Market. After all, companies mostly do not compete on price alone, which can be shown by the lack of absolute convergence in prices even in what should be a relatively integrated EU market like cars. On the other hand, there are sectors where huge price differences continue to exist that cannot be explained by product or geographic differentiation, let alone prosperity and national demand. One example is network industries, such as electricity, gas and telecommunications where there are huge price dispersions.[xiv]

An increasing price convergence is a good proxy for assessing the Single Market’s economic performance and how much of a market that the Single Market has become. Price convergence is in several ways attributable to the integration process, both in Europe and with the rest of the world, and it gives clear signals about the health of markets. And it does not require much imagination to see that a key reason behind the incomplete and stalled process of price convergence is because the European market is fractured and far from a single unit. Europe’s policy is diverse and, judging by the standards of national policy, presents a wide range of preferences, interests and characteristics. Member States continue to compete with one another, often seeking their own interests and the interests of their domestic producers. Depending on how national governments allocate the gains and the costs that arise from the integration, they also indirectly affect the larger economic outcomes of integration and, therefore, the success of the Single Market.

The United States is often cited as the closest example of a perfect Single Market and, even if that is not exactly true, the country serves as a valuable point of reference. For example, trade between individual U.S. states accounts for nearly 40% of GDP, whereas in the EU-27 the figure is just 20%. Furthermore, the trade volume within a U.S. state is 2.6 times higher than that between U.S. states, but in the EU it is no less than 7.5 times higher. In the EU there are some significant obstacles to full economic integration that persist and are less related to policy, such language barriers and cultural differences. In other words, there is an excessive “home bias”.[xv]

However, it is surprising that home bias in goods and services has barely changed in recent years. This might indicate that past approaches to integration policies have not been effective. In 2007, for example, a group of scholars noted that trade integration lost momentum in the 2000s[xvi] and its impact was limited to a 5-10 percent increase in trade[xvii]. In other words, trade creation and trade integration did not perform as expected.

Conversely, the OECD Economic Survey from 2012 argues that EU economies gain from a high degree of integration in terms of cross-border trade. A large majority of EU trade occurs within the EU itself. Intra-EU exports account for around 26% of EU GDP compared with 15% for extra-EU exports.[xviii] Currently, much of the increase in intra-regional trade in the EU takes the form of intra-industry trade (the exchange of similar products such as Renault cars for Mercedes cars between France and Germany) rather than the classical inter-industry trade (such as the exchange of cars for wine between Germany and Portugal), and that follows general trends in trade. In the machinery and equipment sector, around half of all intermediate and final consumption of goods is sourced from other EU countries with only a tenth from outside the EU.[xix] Trade in intermediate goods is a useful indicator of how integrated production processes are across borders. At the same time, when it is not combined with stronger integration in other parts of production and trade, it helps to explain why end markets remains less integrated than expected and why prices have nit converged more than they have.

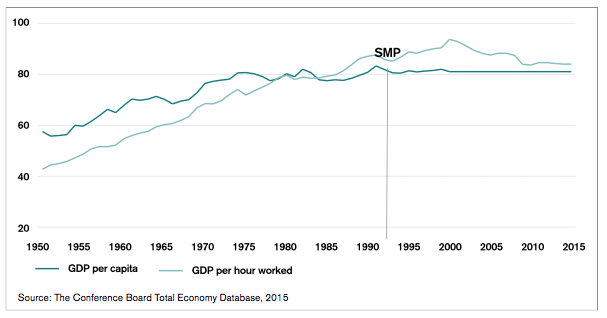

Figure 1: Productivity level and GDP per capita, EU15 as % of US

Source: The Conference Board Total Economy Database, 2015

The relationship between the Single Market, innovation and productivity also remains ambiguous. The Single Market and lower barriers to trade mean that firms face more competition, which encourages innovation and productivity. Increased interaction between competitors and easier exchange of ideas and methods should also promote innovation. In a recent paper a group of Bruegel scholars tried to find empirical evidence of the Single Market’s positive impact on productivity. According to them, EU GDP per capita and EU GDP per hour worked, measured in relation to the U.S. performance, did not show any significant change as a result of implementation of the Single Market.[xx]

Admittedly, the period of implementation of the Single Market Program starts when several EU countries are in recession, making it difficult to draw macro conclusions about the impact of the Program in its initial phase. Cross-sectoral and cross-national comparisons of growth, however, show that in 1992-93, SMP-sensitive sectors grew faster than the non-sensitive sectors. Interestingly, the results from the EU were more pronounced than the results from the U.S. and Japan. Thus, the evidence suggests that the SMP has generated a positive productivity effect in EU countries during this period. Moreover, productivity in SMP sensitive sectors increased by approximately 2% in 1992 and 1993.[xxi] Moving further into period since the launch of the Single Market, the gap between productivity growth in SMP-sensitive and non-sensitive sectors has remained and, for several sectors, business productivity has shown signs of greater variation.[xxii] Business areas that have been subject to more Single Market integration have recorded faster productivity growth than sectors with less or little Single Market integration.

By way of conclusion, there is evidence of general positive economic effects of the Single Market, but those effects seem to have waned over time and it has been especially difficult to nail the specific channels and intermediaries between increased economic integration and macroeconomic benefits. The changing economic structure in Europe may provide a partial explanation because economies of scale are far more significant for the manufacturing sector than for services. This explanation, however, is not sufficient to explain the whole difference. Yet another challenge comes from incomplete expansion of the Single Market to new sectors in order to accompany a fast changing economy.

In a study, the European Commission[xxiii] found little or no empirical evidence to support the claim that the Single Market made it possible to exploit previously untapped economies of scale. Cross border mergers can indeed point at the effectiveness of the Single Market, but as firms agglomerate to reap the benefits of scale and specialization, many products and services are still largely provided along national lines. As a result, some countries have experienced poor growth performance.

The economics of the Single Market has been intensively researched. To know how well the market is performing economists employ a wide range of ex-ante and ex-post evaluations, indexes, and economic indicators measuring job creation, wealth generation and consumer choice. The evaluation of the effects of the SMP is a challenging task for several reasons. First, the SMP has been implemented at varying speed and intensity in different sectors and different Member States. Second, the period that has elapsed since the beginning of SMP is relatively short and many of the measures were put in place recently. Last but not least, numerous complexities related to faster structural changes in the global economy need to be considered and distinguished from the effects of the Single Market.

Regulatory Perspective: Excessive, Complex and Inconsistent legislation

Regulation is a central plank of the single market, but it is clear that in large parts of the economy, the single market has brought neither convergence of regulation nor regulation that supports reduction of border barriers. There are several reasons behind this patchy development, but it adds up to a single market that remains incomplete and that does not work as a market.

Naturally, the partial nature of the Single Market, and the significant variation in regulation across countries, is best shown in the services sector, where the incompleteness of the single market is alarmingly high. Despite efforts to introduce legislation to create a Single Market that covers services and that uses the basic rule of regulatory recognition, that ambition has been “honoured in the breach rather than its observance”, to put it in the language of William Shakespeare.

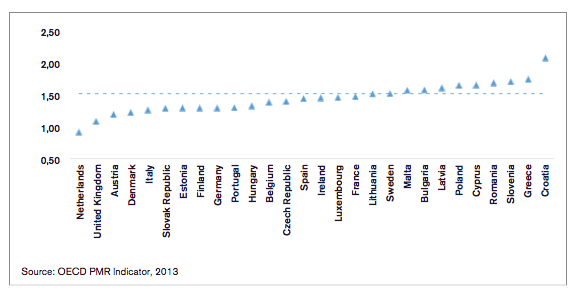

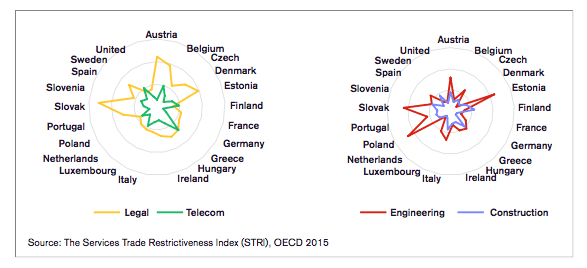

OECD Indexes clearly show the discrepancies in European market regulations for services. Its Services Trade Restrictiveness Index, covering 18 sectors within 40 countries and 80% of global services trade, monitors relevant domestic regulations and helps to identify which policy measures restrict trade. Another OECD indicator is Product Market Regulation (PMR). It signals that, in some aspects and sectors, the average regulatory barriers in EU countries are high by OECD comparison, which means the costs of doing business across borders remain high.[xxiv] Similarly, World Bank’s Doing Business Indicator tracks the effectiveness of regulatory inputs, processes and outputs that are applicable to companies across their life cycle. It allows testing whether Single Market policies deliver tangible results to businesses and, therefore, to consumers. The latter also helps to understand the differences between EU countries.

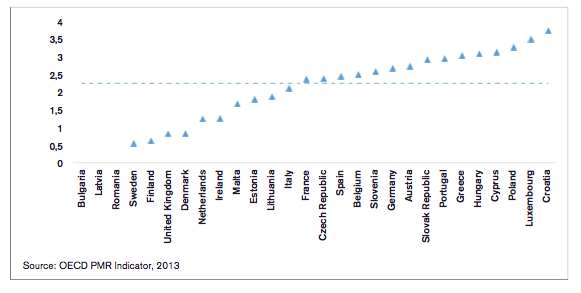

To illustrate the difference between Member States regulation we use first the OECD Product Market Regulation (PMR) Indicator. The index scale is from 0 to 6 – from least to most restrictive regulation. The figure below, however, shows there is a significant difference in Member States’ market regulation. The disparity is evident on an economy-wide level, but it is even more pronounced when regulations of professional services are compared.

Figure 2: Economy-wide PMR score in 2013

Figure 3: Regulation of professional services

While the PMR indicators do not exactly represent the profile of market barriers in the services markets that are relevant from the viewpoint of the Single Market, it requires a great deal of will power to see an emerging Single Market in these OECD indicators. Judging by the politics around especially efforts to liberalise the services markets in Europe, there is not much of a commitment to deepen the Single Market. National governments are unwilling to conform their national legislation to basic Single Market rules. Member states, without any exceptions, still retain many protectionists and discriminatory provisions. Likewise, EU policy-makers enact legislation that contradicts the Single Market Program (which we will cover later) and quite often fail to propose reforms that conform to the basic design of a market.

The OECD Services Trade Restrictiveness Index (STRI) also shows great variation in the level of barriers. The figure below shows the variation in four services sectors. It takes values from 0 to 1, where 0 is completely open and 1 is completely closed.

Figure 4: Services trade restrictiveness in four sectors

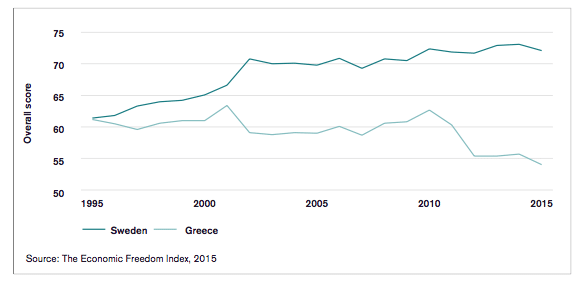

Another way to look at market regulations, and the general conditions for advancing the Single Market, is through the prism of economic freedom. The Economic Freedom Index compares the overall levels of economic freedom, including freedom of trade, tax policy, and business regulation. EU countries have great variation in their index ratings, reinforcing the image of a union where policy diversity has been too low in order to support a much better Single Market.[xxv] Not only do Member States fail to converge, but groups of countries are actually moving further apart from each other. For example, Greece and Sweden scored almost identically in 1995. Nowadays the difference between them is striking: Sweden improved its score, while Greece has fallen behind.

Figure 5: Economic Freedom in Greece and Sweden

The past pattern of partial market deregulation affected the allocation of European business activity. Reforms that increased competition helped productivity growth.[xxvi] However, the effects of partial market reforms “at home” cannot be disentangled from other general regulatory trends pointing in the same direction – e.g. the effects on trade, investment and globalisation emerging from economic reforms “abroad”. Nor can the slow-down of business growth be explained with precision by a separation between the end of the market liberalisation wave and the end of fast globalisation (measured as growth in trade and investment volumes). They both hang together – and, as sources of growth of competition, are showing signs of exhaustion.

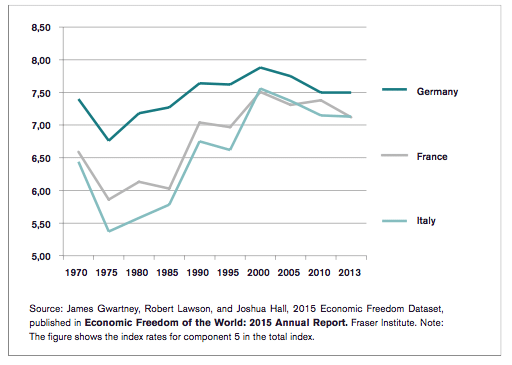

However, market reforms no longer power the economy in the same way they did from the 1980s and two decades onward. In fact, market reforms have not just stalled but regulators have in several ways returned to old regulatory habits. There is no longer a general trend of greater market liberalisation and there has not been one in European economies for at least a decade. Figure 6 shows this trend for three selected countries by using data from the particular category of regulatory performance in the Fraser Institute’s ranking of economic freedom in the world. Economic regulations of credit, labour, and business were reduced or eliminated in most of these countries from the late 1970s up to the early 2000s – leading to a higher index rate – but in the past 10-15 years regulations have again become more stringent. And that trend did not come hard on the heels of the financial crisis and the all the new financial regulations that subsequently came as a response. The trend of declining regulatory freedom started several years before the crisis and covers far more areas of regulation than finance.

Figure 6: Regulatory freedom in selected European economies

The European Commission has recognized the burdensome nature of many European and national regulations and their negative impact on economic growth. It has, therefore, put in place policy actions that focus on market monitoring, targeted regulatory intervention, simplification and reduction of compliance costs. For example, in 2008 the European Commission launched the “EU Pilot” project, which aims to clarify or resolve problems before formal proceedings are undertaken.[xxvii] Its recent effort to promote “Better Regulation” is another case in point.

That is a good strategy, but it does not address the big variation in regulation between Member States, nor does it do much about the general trend of increasing market regulation in Europe. And both these factors have eroded efforts to deepen the Single Market or to build a European market. Big variation in market regulation and a trend of more restrictive regulation simply do not sit easily with European ambitions.

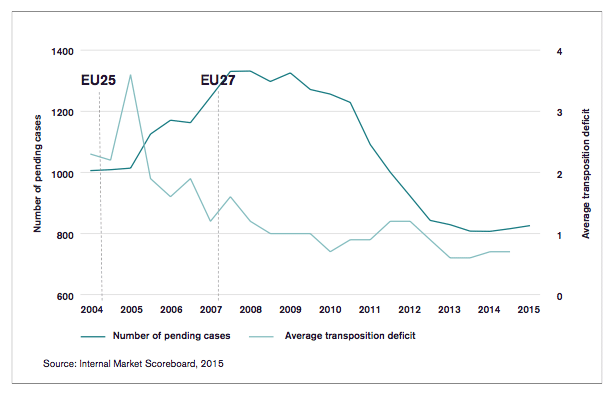

The transposition deficit

The regulations that guide the Single Market have to be implemented (or “transposed”) into national law in order to take full effect. When EU law is incorrectly transposed or applied, the Commission can launch formal legal proceedings against the Member State concerned. The rulings of the European Court of Justice almost always concern very specific cases, but the principles and interpretations underlying them have to be respected throughout the EU. Thus, the structure of regulation and enforcement of the Single Market leads to considerable complication and co-ordination problems that affect the functioning of the Single Market.

The Single Market Scoreboard is the chief monitoring tool for evaluating the compliance of Member States with Single Market obligations. It is often criticized that, as a ratio of transposition deficit versus total number of directives related to the Single Market, it exaggerates the legal integration. There are two reasons behind it: first, it accords the same weight to the transposition of critical directives, such as Services Directive, as to less important directives; and second, the total number of directives grew much faster than the transposition deficit declined. It, therefore, provides a false signal of improvement.[xxviii] Consequently, the figure over the transposition deficit is not a good tool for understanding actual implementation and enforcement.

Figure 7: Transposition Development and Infringement Cases

The number of Single Market Directives has increased from 1291 in 1995 to 1521 in 2010. During the same time frame the average transposition deficit has declined from over 20% per Member State in 1992 to just over 2% in 2002. In 2014, the total number of Member States achieving the 1% transposition deficit target increased from 18 to 20 Member States.[xxix] The peak in 2004-2005 is due to the EU enlargement and the time that new members needed to adjust their national regulation to the EU acquis.

Moreover, it is not only matter of transposition but also of the quality of implementation. Transposition concerns only directives and does not account for regulations that have recently gained more prominence; 976 regulations relate to the various Single Market policy areas.[xxx] When a Member State fails to transpose a Directive or to follow regulation an infringement procedure might be enacted. It is the main legal and administrative recourse to enforce correct application of EU law. Despite the slow, costly and difficult process they entail, the number of open infringement cases is significant, reaching almost 1000 pending cases in 2014. It takes on average 30 months to resolve an infringement case.

The downturn after 2010 can be explained both by the burdensome nature of initiating a procedure and the efforts by the European Commission to reduce the rate and frequency of non-compliance. In general, infringement proceedings in case of non-compliance are a measure of last resort. Often, organized industry groups, such as trade associations, are not permitted to file for infringements. Individuals and companies that are allowed to file complaints often lack the necessary knowledge.[xxxi]

Complex and conflicting regulation

Together with weaknesses in enforcement and compliance, complex and conflicting regulations are another considerable impediment in the quest to improve the Single Market. There are numerous complaints that the EU is pursuing policies that are overly complex or conflict with other regulations, let alone the core four freedoms that underpin the Single Market. As a result, they cause economic and political uncertainty.

Examples of complex or conflicting regulations can be found in almost any area relevant to the Single Market. For example, two directives relevant to free movement of labour pose considerable confusion among Member States with regard to the scope of the derogation. The Services Directive governs reserved activities and another Directive on the Mutual Recognition of Professional Qualifications governs professional competences. Alas, the two Directives do not fit together, and the lack of clarity and compatibility drives up uncertainty and the transactions costs for those that want to engage across borders.

Or take the example of genetically modified organisms (GMOs), a glaring example of both a complex regulation and one that contradicts with basic Single Market principles. The European Union recently adopted new legislation that allows EU Member States to restrict or ban crops containing GMOs on their own territory, even if they have been approved at the EU level. In other words, the Single Market is fractured, and one particular product that is allowed in one country will not be able to enter another country. According to the new regulation, EU member states will be allowed to ban these imports to their territories if there are “compelling grounds” to do so, but that criteria is sufficiently vague that it encompasses a broad range of non-scientific reasons.

This piece of legislation directly contradicts the EU core principles of free movement of goods. It shakes the foundation of the Single Market and sets a dangerous precedent for other “sensitive” products and technologies. It has be labeled a “voter friendly compromise”[xxxii], but in reality it is an anti-Single market legislation. Accordingly, countries may ban products, for example muesli, arguing that they may contain traces of GMOs.

Or take the so-called ILUC Directive, or indirect land-use change, that oddly attempts to add more layers of complex regulation to an already thorny piece of legislation that no one really understands what it entails for cross-border trade in Europe. While the intention of the regulation is clear, it complicates the business of biofuels production to such a degree that a producer in one EU country cannot tell for sure what is necessary in order to get access to another EU country, or what protection that basic Single Market rules give. Already under past biofuels regulations, effective market access has come down to a question about standards and what different national standards mean and to what extent they are compatible with each other. The new ILUC Directive introduces a requirement for mandatory reporting by fuel producers of the indirect land-use change that could possibly result from their production. But ILUC is neither observed nor measured. In fact, no regulator can say exactly what it is or in what situations it occurs. Yet producers have to report it.

Another complexity arises from the absence of clearly superior norms, especially in sectors mostly covered by the harmonization approach, such as the EU car industry. A case in point is the banned air coolant R134a by the EU Directive 2006/40/EC on the basis of its pollution level. It was replaced with a less polluting alternative, which turned up to be much more flammable than the old one. For safety reasons, a German car producer kept producing Mercedes cars using the old coolant R134a. Their decision was backed up by the German Federal Office in charge of the car safety but resulted in their cars being banned in France. Only after the ban had been introduced, and a charged dispute between EU, French and German regulators, could the market access be restored.

The problem of complex and conflicting regulation amplifies when regulations are increasingly excessive and prescriptive. For the Single Market to be advanced, especially under the current framework of substantial national discretion, it is necessary that new EU regulations are not excessive and market distortive. As the amount of EU regulation has grown – from around 26500 legal acts in 2009 to 35000 today – there are also clear signs that regulation increasingly errs on the excessive side and new EU regulation adds new layer of regulations rather than substitutes national ones.

Take again the case of services. The Directive’s mutual evaluation program, performed in 2011, highlighted that restrictive regulatory frameworks are particularly prevalent among regulated professions. Member States retained nearly 3000 regulatory requirements, specifically for professionals and business services, which inhibit access to the single market, shield sectors from competition and undermine growth.[xxxiii] The requirements include fixed tariffs and minimum price for lawyers, architects, certified translators and building surveyors to geographic restrictions. In total, over 800 different occupations in the service sector are subject to state regulation in the EU[xxxiv] and in the economy writ large there are about 5000 regulated professions.[xxxv] The wide variety in the number and profile of regulated professions across the EU depresses the entire service economy. Furthermore, given that 25% of regulated professions are only regulated in one Member State there is significant potential to cut the number of regulated professions and generally make the system simpler. At the least, in those cases when there are harmonized systems established at the EU level, they should replace national ones, not just add another layer of bureaucracy.

All these developments in the field of regulation suggest to us that there is a political design flaw in the Single Market. It is based on the notion, no doubt politically convenient, that progress in advancing the Single Market has to be step-wise. However, every new step tends to create their own complexities, and they will have to respond to new opinions and preferences that have emerged in Member States. The result is all too often that new Single Market reforms builds on new regulations that have been advanced since the past reform, and that it adds a new layer of regulation above Member State regulation. Building a market in a region with great diversity requires, just like in the United States (when U.S. regulation works well, we should add), that regulations on internal exchange are proscriptive rather than prescriptive. Europe has followed a different track and created a Single Market system that is fraught with inconsistencies and where new reforms do not achieve all that much in terms of taking away existing barriers within the European market. Arguably, the system is becoming politically unmanageable.

[i] EC (2013a): European Commission, Single Market News # 67, 2013 ISSN 1830-5210

[ii] Canoy (2009): Canoy, Marcel et al., “The Single Market: Yesterday and Tomorrow”, Bureau of European Policy Advisers (BEPA), European Commission, October 2009

[iii] Pelkmans (2011): Pelkmans, Jacques, et all., “The European Single Market – How Far from Complete Is It or How Complete Can It Ever Be?”, Intereconomics, 2011

[iv] Campos (2014): Campos, Nauro F., et all. “Economic Growth and Political Integration: Estimating the Benefits from Membership in the European Union Using the Synthetic Counterfactuals Method”, IZA DP No. 8162, April 2014

[v] Pataki (2014): Pataki, Zsolt, ‘The Cost of Non- Europe in the Single Market, ‘Cecchini Revisited’: An overview of the potential economic gains from further completion of the European Single Market”, EPRS | European Parliamentary Research Service, PE 510.981, September 2014

[vi] Sauner-Leroy (2003): Sauner-Leroy, Jacques-Bernard, “The impact of the implementation of the Single Market Programme on productive efficiency and on mark-ups in the European Union manufacturing industry”, European Commission Directorate-General for Economic and Financial Affairs, Economic Papers, No 192, 2003

[vii] Notaro (2011): Notaro, Giovanni, “European Integration and Productivity: Exploring the Gains of the Single Market”, Journal of Common Market Studies, Volume 49, Issue 4, pages 845–869, July 2011

[viii] Di Mauro (2013): Di Mauro, Filippo, et all. “Global Value Chains: A Case for Europe to Cheer Up”, COMPNET Policy Brief 03/2013, August 2013

[ix] EP (2014): European Parliament, Directorate-General for Internal Policies, Indicators for Measuring the Performance of the Single Market – Building the Single Market Pillar of the European Semester, Study for the IMCO Committee, 2014, IP/A/IMCO/2014-03, PE 518.750, September 2014

[x] Brunsden (2015): Brunsden, Jim, “Brussels to crack down on cross-border postal prices”, Financial Times, December 2015

[xi] Thévenot (2005): Thévenot, Celine, “Convergence des niveaux de prix à la consommation et intégration de la zone monétaire européenne”, Institut National de la Statistique et des Études Économiques, December 2005

[xii] Canoy (2009)

[xiii] EP (2014)

[xiv] Vetter (2013): Vetter, Stefan, “The Single European Market: 20 Years on. Achievements, unfulfilled expectations & further potential”, DB Research, October 2013

[xv] Vetter (2013)

[xvi] Ilzkovitz (2007): Ilzkovitz, F., A. Dierx, V. Kovacs, and N. Sousa, “Steps towards a Deeper Economic Integration: The Internal Market in the 21st Century”, European Economy Economic Papers No.271, European Commission, Brussels, 2007

[xvii] Baldwin (2006): Baldwin, Richard, “The Euro’s Trade Effects”, ECB Working Paper No. 594, March 2006

[xviii] OECD (2014): OECD, OECD Economic Surveys European Union, April 2014

[xix] OECD (2014)

[xx] Taylor (2015): Taylor, Timothy, “What about the EU Single Market?”, Conversable Economist, April 22, 2015

[xxi] Notaro (2011): Notaro, Giovanni, “European Integration and Productivity: Exploring the Gains of the Single Market”, Journal of Common Market Studies, Volume 49, Issue 4, pages 845–869, July 2011

[xxii] EC (2015b): European Commission, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, European Commission, “Single Market Integration and Competitiveness in the EU and its Member States”, Staff Working Document SWD(2015) 203, October 2015

[xxiii] EC (1996): European Commission, “The 1996 Single Market Review Background Information for the Report to the Council and European Parliament”, Commission Staff Working Paper SEC (96) 2378, Brussels, December 1996

[xxiv] Taylor (2015)

[xxv] Blix (2014): Blix, Gustav, “Economic Freedom in the EU: Mediocre Today – World Leader Tomorrow?”, Timbro, May 2014

[xxvi] Arnold (2011): Arnold, Jens Matthias, “Does Anti-Competitive Regulation Matter for Productivity? Evidence from European Firms”, IZA DP No. 5511, February 2011

[xxvii] EC (2013b): European Commission, Single Market Scoreboard, The European Single Market, European Commission, Reporting period: 01/2013 – 12/2013

[xxviii] Saltelli (2014): Saltelli, Andrea, “Indicators for the internal market? An unfinished business”, JRC scientific and policy reports, 2014

[xxix] EC (2011c): European Commission, Single Market Scoreboard, “Internal Market Scoreboard: Member States improved”, European Commission, August 2011

[xxx] Monti (2010): Monti, Mario, “A New Startegy for the Single Market: At the Service of Europe’s Economy and Society”, Report to the President of the European Commission Jose Manuel Barroso, 9 May 2010

[xxxi] OECD (2014)

[xxxii] Spiegel (2015): Spiegel, Peter, “EU proposal on genetically modified crops satisfies no one”, Financial Times, April 22, 2015

[xxxiii] BIS (2011): BIS/Department for Business, Innovation & Skills, European Commission Consultation on the Single Market Act, UK Government Response, February 2011

[xxxiv] Vetter (2013)

[xxxv] EC (2015a): European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, “Upgrading the Single Market: more opportunities for people and business”, COM/2015/0550 final

3. Structural Change: an External Shock to the Single Market

The Single Market is incomplete, and the more European economies have been exposed to natural structural change, the bigger the problems associated with the incompleteness get. In fact, the absence of a proper market for advanced and digital services in Europe is a key contributor to Europe’s laggard status in these areas. Markets in Europe have not adjusted as fast as other comparable regions to natural structural change, and the change, therefore, has not generated the same amount of benefits as it has for other countries. Importantly, as the services and digital sectors are important input producers to industry, the laggard status of the former sectors affects the latter sector.

In that way, the partial and selective nature of Single Market openness change relative prices and the relative relation between different sectors. It is easier for more tradable sectors compared to less tradable sectors to attract investment and accelerate capital deepening because they can easier benefit from scale and specialization. Take the example of Europe’s services sector and some stylized facts about its performance and relation to macroeconomic results.

First, artificial barriers to services trade (internal and external) prevent countries from reaping the direct gains from trade. Potential export gains will be untapped in the sectors a country – or a region like the EU – has comparative or absolute advantages and are competitive. Potential import gains will also go unexploited, often affecting welfare as consumers get saddled with a service that is more expensive than the potentially imported substitute. The healthcare sector illustrates these losses. Many healthcare services cannot be traded, but most of them (in different ways) could be subject to cross-border exchange. Many European countries have comparative advantages in the healthcare sector. Production in healthcare also tends to have a high value-added, leaving considerable contribution to GDP. All European countries also struggle with containing costs in the healthcare sector as expenditures grow faster than fiscal revenues. Potential savings through import of healthcare services thus are not exploited. Overall, the non-tradable structure of healthcare prevents greater economic specialization in healthcare. Organizationally, the healthcare sector lacks one strong inspiration to increased natural efficiency: trade.

Second, artificial barriers to services trade distort the choice of consumption and depress demand for services. This may sounds counterintuitive, but one effect of non-tradability is that the consumption tends to be held back. Let us take an example based on German price data. In 1995 the price of a big flatscreen TV equaled the cost for a hip replacement. In 2005, one could get 5 flat TV’s of the same size for the price of a hip replacement. In 2008, the ratio was 8:1. Few, if any, desire eight big flatscreen TV’s, but despite falling prices for goods that are traded and an overall increase in salaried income, people do not use increasing purchasing power to buy significantly more hip replacements. Nor do they increase consumption to a significant degree of other non-tradable services. Services such as personal legal services and personal financial services have stagnated across Europe in the past decade. The shoe-repair sector is contracting, as are other repairing-oriented sectors. People tend to buy a new pair of shoes rather than taking the current ones to repair. People are less likely to take a broken TV to a repair shop than they were a decade ago; they rather buy a new one. One could consider the environmental effect of a trading system that favours goods over services, but equally important is to understand the economic basis for consumption biases: the magic of the relative price (the price of a product measured in another product). Few desire eight flat TV’s, but rather than spending money on non-tradable services the typical consumer will increase goods consumption as he or she will get more ‘bang for the buck’. Rather than paying for regular treatments of a bad back, the typical consumer will buy a new TV couch and a new car with more comfortable seating. Hence, the non-tradability of a service increases the consumer price and depresses the consumption of it.

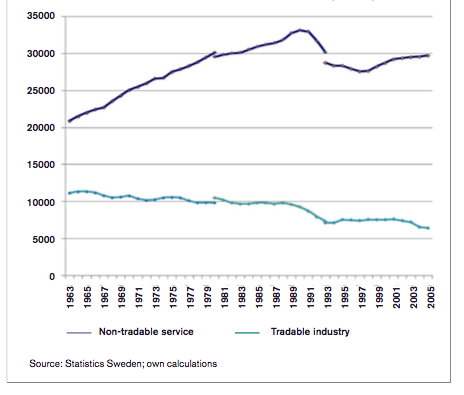

Third, the shift in employment and economic structure from tradable industries to non-tradable services changes the texture of productivity and wages. Figure 7 maps this development for Sweden. While the tradable industries have been the sector in an economy that mostly has fostered increased productivity and determined wages (directly or indirectly), non-tradable services have lagged behind other sectors in terms of productivity. As a consequence, the increase in total labour compensation per unit labour has relatively declined in the non-tradable service sector. The tradable sectors have also been outward-oriented and less inclined towards protectionist mentalities. But the material base for this structure is eroding as the non-tradable sectors grow and tradable industries decline.

Figure 8: Average number of employed 1963-2005 in Sweden (in 100’s)

Services and the Digital Economy

The declining importance of the manufacturing sector and the soaring role of services in the European economy were underway already when the SMP was launched. While services have become more important, the industrial share of value added has fallen continually since the 1990s. In the last decade, the EU economic structure has been smoothly changing the weight of the manufacturing and services sectors. The services sector is thus crucially important for European economies. Not only have services been trending in foreign direct investment but also account for over two-thirds of EU GDP and employment. While manufacturing has been reducing its share in employment, the services sector increased its share in overall employment to 70%.[i]

Furthermore, services have also driven general growth. Between 1998 and 2008, the average annual growth of the European economy was 2.1% while the services sector grew on average by 2.8% per annum. Employment in this sector increased by 2% per annum, compared with 1% for the economy as a whole.[ii] At the same time, services sectors have many linkages with the rest of the economy. About 75% of services trade concerns the supply of services to other businesses in almost any sector of the European economy, but particularly industry.[iii]

Some services are difficult to measure and are not directly recorded in trade statistics. For example, they can be sold in a package with a good and hence registered as goods trade in official statistics. Cross-border trade can also be substituted with foreign direct investment. Often, services are delivered to customers abroad by means other than cross-border trade, for example by establishing offices in different countries.

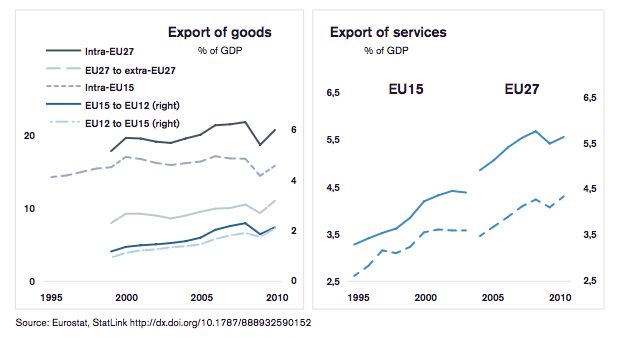

Figure 9: Exports of goods and services as share of GDP

Services are increasingly important both as inputs and as outputs of manufacturing. Manufacturing and services have become intertwined and many traditional goods producers are today service companies when revenues or value added are measured. A study of 80 multinational manufacturing companies showed that services in 2006 represented on average 25 percent of revenues, but as much as 46 percent of profits for the companies.[iv]

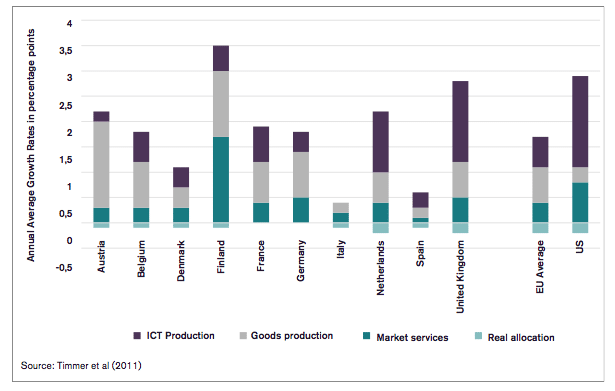

Benchmarking the EU with the United States, which has a similar balance between manufacturing and services in its economy, it becomes clear that European services have trailed productivity growth U.S. services. The McKinsey Global institute has estimated the productivity gap in business services between the EU and US to be as high as 43%.[v] Figure 8 below is taken from Timmer (2011) and shows the contributions of major industrial sectors to aggregate productivity growth in the U.S. and the EU. The difference between market service contributions is striking: 0.6 for the EU against 1.8 for the US.[vi] The difference between the EU and the U.S. in the contribution from ICT production is equally notable.

Figure 10: Major Sector Contributions to Labor Productivity Growth in the Market Economy, Selected EU economies and the United States, 1995-2007

Services that could be covered by the Single Market, including utilities and construction, make up around 60% of GDP. The 2006 Services Directive intended to free trade in these sectors up, and it did have a noticeable effect on some services that have been subject to liberalization, e.g. telecommunications. However, many services remain outside the scope of the Single Market, and those that have been partially liberalised have seen some horizontal changes but with no big reforms removing unjustified barriers.

Europe’s digital economy has a problem equal to the services sector; it is only subject to partial liberalisation of internal trade, and a plethora of complex regulation makes it difficult for EU authorities to make the Single Market work better. A recent study on legal barriers to the digital single market (DSM) in Europe identified 100 issues spanning areas such as privacy and data protection, content and copyright, liability of online intermediaries, e-payments, and electronic contracts.[vii] Existing barriers can be grouped in three broad categories. The first group has its source in varied consumer preferences; the second group includes issues related to consumer protection to boost the consumer trust; and the third, and maybe the most important, take account of fragmentation of the EU legal system.

Limitations on liability of Internet providers in the e-Commerce Directive are a case in point. The limitations on liability are established in a horizontal manner in the Directive, i.e. they apply to clearly limited activities carried out by Internet intermediaries rather than to categories of service providers or types of information. Furthermore, not all Member States have transposed the Directive into their national laws in an adequate fashion, which splits the market additionally. That problem builds on substantial divergences in national legislation, often differences between countries but, surprisingly, sometimes also differences within one country. Consequently, online service providers face many legal regimes, which creates uncertainty for them.[viii]

Recognizing the importance of scale, the European Commission has focused on fixing the lack of a digital single market. In early 2015 it proposed vast regulatory reforms that could affect everything from sales taxes and e-privacy to Internet searches and big data. However, the main problem with the plan is that it hardly deregulates but adds new layer of bureaucracy and costs, and that it continues the time-honored strategy of piecemeal changes. Furthermore, it neglects critical issues for the transfer of data across countries in the EU – and opens up for new platform regulations that, judging by the arguments used by the supporters of platform regulations, would slow down the diffusion of digital services and handicap real integration.

Nor are current strategies on the single market well connected with each other. There are, for example, significant non-digital barriers to the growth of Europe’s economy, and to achieve a better economic payoff from the DSM, there has to be significant reforms of other market regulations.[ix] However, the chief non-digital policy barriers to a better digital economy in Europe are invariably neglected in other Single Market strategies, primarily because Member States are not willing to consider them.

[i] Vetter (2013)

[ii] CEPR (2012): CEPR, Twenty Years On: The UK and the Future of the Single Market, October 2012

[iii] EC (2011a): European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Towards a better functioning Single Market for services – building on the results of the mutual evaluation process of the Services Directive, COM (2011) 20 final

[iv] NBT (2012): National Board of Trade, “Everybody is in Services – The Impact of Servicification in Manufacturing on Trade and Trade Policy”, November 2012 – First Edition. ISBN: 978-91-86575-50-2

[v] BIS (2011

[vi] Timmer (2011): Timmer, Marcel P. and Robert Inklaar, “Productivity and Economic Growth in Europe: A Comparative Industry Perspective”, International Productivity Monitor, Number 21, Spring 2011

[vii] EPC (2010): European Policy Centre – EPC, “The Economic Impact of a European Digital Single Market”. Final Report, March 2010

[viii] EC (2011b): European Commission, Digital Agenda for Europe, “Legal analysis of a Single Market for the Information Society”, (SMART 2007/0037), 30 May 2011

[ix] Van der Marel (2015): Van der Marel, Erik, “The Importance of Complementary Policy for ICT in the EU”, ECIPE OCCASIONAL PAPER, August 2015

4. Concluding Comments

New initiatives to reform the Single Market are often presented as initiatives to “complete the Single Market”. However, they have all fallen substantially short on that ambition, and Europe is far away from having a Single Market. In fact, it is problem further away from it now than ten years ago. The European economy has undergone profound structural changes, and as the economy has shifted profile, it has moved further into sectors and areas where there is very little of the Single Market. The more Europe’s economy grows dependent on services and the digital sector, the less Single Market there will be in Europe.

Arguably, the piecemeal approach has prevented Europe from reaping the gains of structural change, and the relative policy conditions between sectors have damaged Europe’s desire to grow faster on the back of new sectors and services. The failings of Europe’s Single Market are becoming ever more evident and, left unaddressed, will cause real economic disintegration in Europe and depress the rates of productivity and economic growth.

Furthermore, given the vast complexity of regulations in Europe, and the increasing layers of bureaucracy they entail, it is difficult to see how improvements could be made without a vast overhaul of the structure of regulations and the design of the Single Market. And such a reform has to start from a completely different proposition: Europe’s ambition should not be to continue building its Singe Market, it should be to create a European market. As reforms are moving closer to areas like digital services, energy, and advanced business services, it is evident that the improvements that can be made in Europe’s integration is less about classic Single Market reforms and more about building adequate market institutions and advance structural reform.

Bibliography

Arnold (2011): Arnold, Jens Matthias, “Does Anti-Competitive Regulation Matter for Productivity? Evidence from European Firms”, IZA DP No. 5511, February 2011 [http://ftp.iza.org/dp5511.pdf]

Baldwin (2006): Baldwin, Richard, “The Euro’s Trade Effects”, ECB Working Paper No. 594, March 2006 [https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp594.pdf]

BIS (2011): BIS/Department for Business, Innovation & Skills, European Commission Consultation on the Single Market Act, UK Government Response, February 2011 [https://www.gov.uk/government/publications/single-market-consultation-response-to-the-european-commission]

Blix (2014): Blix, Gustav, “Economic Freedom in the EU: Mediocre Today – World Leader Tomorrow?”, Timbro, May 2014 [http://timbro.se/en/reports/economic-freedom-in-the-eu-mediocre-today-world-leader-tomorrow]

Brunsden (2015): Brunsden, Jim, “Brussels to crack down on cross-border postal prices”, Financial Times, December 2015 [http://www.ft.com/intl/cms/s/0/e939fb2a-a7c3-11e5-955c-1e1d6de94879.html#axzz40bt55c1h]

Campos (2014): Campos, Nauro F., et all. “Economic Growth and Political Integration: Estimating the Benefits from Membership in the European Union Using the Synthetic Counterfactuals Method”, IZA DP No. 8162, April 2014 [http://anon-ftp.iza.org/dp8162.pdf]

Canoy (2009): Canoy, Marcel et al., “The Single Market: Yesterday and Tomorrow”, Bureau of European Policy Advisers (BEPA), European Commission, October 2009 [http://ec.europa.eu/dgs/policy_advisers/publications/docs/single_market_yesterday_and_tmorrow_en.pdf]

CEPR (2012): CEPR, Twenty Years On: The UK and the Future of the Single Market, October 2012 [http://cepr.org/content/twenty-years-uk-and-future-single-market-0]

Di Mauro (2013): Di Mauro, Filippo, et all. “Global Value Chains: A Case for Europe to Cheer Up”, COMPNET Policy Brief 03/2013, August 2013 [https://www.ecb.europa.eu/home/pdf/research/compnet/policy_brief_3_global_value_chains.pdf?fcccc5651bee912e1698e1019c8b3969]

Dunne (2015): Dunne, Joseph, “Mapping the Cost of Non-Europe, 2014-19”, European Parliamentary Research Service, European Parliament, PE 536.364, April 2015 [http://www.europarl.europa.eu/EPRS/EPRS_STUD_536364_Mapping_Cost_of_Non_Europe_201504_third_edition.pdf]

EC (1996): European Commission, “The 1996 Single Market Review Background Information for the Report to the Council and European Parliament”, Commission Staff Working Paper SEC (96) 2378, Brussels, December 1996 [http://ec.europa.eu/internal_market/economic-reports/docs/bkground_en.pdf]

EC (2011a): European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Towards a better functioning Single Market for services – building on the results of the mutual evaluation process of the Services Directive, COM (2011) 20 final [http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2011:0020:FIN:FR:PDF]

EC (2011b): European Commission, Digital Agenda for Europe, “Legal analysis of a Single Market for the Information Society”, (SMART 2007/0037), 30 May 2011 [http://ec.europa.eu/digital-agenda/en/news/legal-analysis-single-market-information-society-smart-20070037]

EC (2011c): European Commission, Single Market Scoreboard, “Internal Market Scoreboard: Member States improved”, European Commission, August 2011 [http://ec.europa.eu/internal_market/smn/smn60/docs/scoreboard_en.pdf]

EC (2013a): European Commission, Single Market News # 67, 2013 ISSN 1830-5210 [http://ec.europa.eu/internal_market/smn/smn67/docs/smn67web_en.pdf]

EC (2013b): European Commission, Single Market Scoreboard, The European Single Market, European Commission, Reporting period: 01/2013 – 12/2013 [http://ec.europa.eu/internal_market/scoreboard/performance_by_governance_tool/eu_pilot/index_en.htm#maincontentSec1]

EC (2015a): European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, “Upgrading the Single Market: more opportunities for people and business”, COM/2015/0550 final [http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2015:550:FIN]

EC (2015b): European Commission, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, European Commission, “Single Market Integration and Competitiveness in the EU and its Member States”, Staff Working Document SWD(2015) 203, October 2015 [http://data.consilium.europa.eu/doc/document/ST-13370-2015-ADD-3/en/pdf]

EP (2014): European Parliament, Directorate-General for Internal Policies, Indicators for Measuring the Performance of the Single Market – Building the Single Market Pillar of the European Semester, Study for the IMCO Committee, 2014, IP/A/IMCO/2014-03, PE 518.750, September 2014 [http://www.europarl.europa.eu/RegData/etudes/STUD/2014/518750/IPOL_STU(2014)518750_EN.pdf]

EPC (2010): European Policy Centre – EPC, “The Economic Impact of a European Digital Single Market”. Final Report, March 2010 [http://www.epc.eu/dsm/2/Study_by_Copenhagen.pdf]

Ilzkovitz (2007): Ilzkovitz, F., A. Dierx, V. Kovacs, and N. Sousa, “Steps towards a Deeper Economic Integration: The Internal Market in the 21st Century”, European Economy Economic Papers No.271, European Commission, Brussels, 2007 [http://ec.europa.eu/economy_finance/publications/publication784_en.pdf]

Monti (2010): Monti, Mario, “A New Startegy for the Single Market: At the Service of Europe’s Economy and Society”, Report to the President of the European Commission Jose Manuel Barroso, 9 May 2010 [http://ec.europa.eu/internal_market/strategy/docs/monti_report_final_10_05_2010_en.pdf]

NBT (2012): National Board of Trade, “Everybody is in Services – The Impact of Servicification in Manufacturing on Trade and Trade Policy”, November 2012 – First Edition. ISBN: 978-91-86575-50-2 [http://www.kommers.se/Documents/dokumentarkiv/publikationer/2012/skriftserien/report-everybody-is-in-services.pdf]

Notaro (2011): Notaro, Giovanni, “European Integration and Productivity: Exploring the Gains of the Single Market”, Journal of Common Market Studies, Volume 49, Issue 4, pages 845–869, July 2011

OECD (2014): OECD, OECD Economic Surveys European Union, April 2014 [http://www.oecd.org/eco/surveys/economic-survey-european-union.htm]

Pataki (2014): Pataki, Zsolt, ‘The Cost of Non- Europe in the Single Market, ‘Cecchini Revisited’: An overview of the potential economic gains from further completion of the European Single Market”, EPRS | European Parliamentary Research Service, PE 510.981, September 2014 [http://www.europarl.europa.eu/RegData/etudes/STUD/2014/510981/EPRS_STU(2014)510981_REV1_EN.pdf]

Pelkmans (2011): Pelkmans, Jacques, et all., “The European Single Market – How Far from Complete Is It or How Complete Can It Ever Be?”, Intereconomics 2011 [http://archive.intereconomics.eu/year/2011/2/the-european-single-market-how-far-from-completion/]

Pelkmans (2016): Pelkmans, Jacques, “What strategy for a genuine single market?”, CEPS, No. 126 / January 2016 [https://www.ceps.eu/system/files/CEPS_SR%20No%20126%20JP%20Genuine%20Single%20Market.pdf]

Saltelli (2014): Saltelli, Andrea, “Indicators for the internal market? An unfinished business”, JRC scientific and policy reports, 2014 [https://ec.europa.eu/jrc/en/publication/eur-scientific-and-technical-research-reports/indicators-internal-market-unfinished-business]

Sauner-Leroy (2003): Sauner-Leroy, Jacques-Bernard, “The impact of the implementation of the Single Market Programme on productive efficiency and on mark-ups in the European Union manufacturing industry”, European Commission Directorate-General for Economic and Financial Affairs, Economic Papers, No 192, 2003 [http://ec.europa.eu/economy_finance/publications/publication_summary849_en.htm]

Spiegel (2015): Spiegel, Peter, “EU proposal on genetically modified crops satisfies no one”, Financial Times, April 22, 2015 [http://www.ft.com/intl/cms/s/0/4fc96106-e8fb-11e4-87fe-00144feab7de.html#axzz40dlwLS4a]

Taylor (2015): Taylor, Timothy, “What about the EU Single Market?”, Conversable Economist, April 22, 2015 [http://conversableeconomist.blogspot.be/2015/04/what-about-eu-single-market.html]

Thévenot (2005): Thévenot, Celine, “Convergence des niveaux de prix à la consommation et intégration de la zone monétaire européenne”, Institut National de la Statistique et des Études Économiques, December 2005 [http://www.insee.fr/fr/publications-et-services/docs_doc_travail/e0507.pdf]

Timmer (2011): Timmer, Marcel P. and Robert Inklaar, “Productivity and Economic Growth in Europe: A Comparative Industry Perspective”, International Productivity Monitor, Number 21, Spring 2011 [https://ideas.repec.org/a/sls/ipmsls/v21y20111.html]

Van der Marel (2015): Van der Marel, Erik, “The Importance of Complementary Policy for ICT in the EU”, ECIPE OCCASIONAL PAPER, August 2015 [//ecipe.org/wp-content/uploads/2015/12/The-importance-of-complementary-policy-for-ICT-in-the-EU-version-2.pdf]

Vetter (2013): Vetter, Stefan, “The Single European Market: 20 Years on. Achievements, unfulfilled expectations & further potential”, DB Research, October 2013 [https://www.dbresearch.com/PROD/DBR_INTERNET_EN-PROD/PROD0000000000322897/The+Single+European+Market+20+years+on%3A+Achievements,+unfulfilled+expectations+%26+further+potential.pdf]